Eclipsing a terrible milestone as home prices fall harder than the 1928 through 1933 Great Depression Collapse: Lessons from the Great Depression Part 32. Housing prices continue to fall as other costs eat up disposable income.

Multiple sets of indicators are clearly showing that the housing market is entering a second winter. Home prices are inching closer to cycle lows and indicators of housing distress are rampant throughout the country. Home prices during the troubling five years of 1928 through 1933 saw a decline of 25.9 percent nationwide and this was during the Great Depression. The latest Case-Shiller data shows that home prices in the 20 City and 10 City composite measures are down by 32 percent from their 2006 peak. This is now nominally the worst housing correction since the Great Depression. The continuing correction in housing is economically challenging middle class households in ways vastly different from those during the Great Depression. What is troubling about the new cycle lows is that the liquidity injected into the banking system by the Federal Reserve simply delayed the inevitable while diverting precious resources to a broken financial system. The painful lesson of the new reality is that household income, the gas in the engine, is simply too low to support prices even at today’s new lower levels.

This is part 32 in our Lessons from the Great Depression series:

27. Current Net Worth Drop of $13.8 Trillion Equivalent to 21 Percent Drop.

28. The Gospel of Economic Prosperity

29.  New home sales fell 80 percent from 1929 to 1932 and fell 82 percent from 2005 to 2011.

30.  Economic déjà vu from the 1937-38 recession

31. When government and financial institutions become one.

The Great Housing Crash of 2006

Source:Â Economist

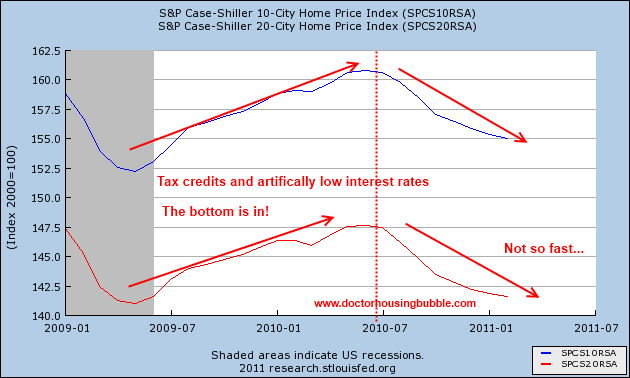

Many were early to call a bottom in the housing market last year. It all varied on what data you were looking at. It was true that the home buyer tax credits and the Federal Reserve pushing mortgage rates lower created an artificial stimulus that did revive the market briefly. You should ask yourself what these actions covered. The home buyer tax credits and the Fed intervening made home buying cheaper only because an artificial floor was temporarily placed. Home prices for many years have not been dictated by the market in the sense of an open transparent market where sellers and buyers compete for goods in a somewhat balanced system. Home prices have so many artificial carrots and glistening bells and whistles that the real price is hard to ascertain. Imagine the government stepping in and offering a giant tax credit for buying SUVs. It is logical to assume that at least initially, sales will increase as the real price of the vehicle is pushed lower. Yet in the end market prices have to reflect more steady measures. As the tax credit evaporated and the Federal Reserve’s mortgage buying spree ended, the reality was American households simply do not have the income to support current prices. You can see the recent up and down here:

Home prices have been falling steadily since the summer of 2010. The fact that we still have close to 7,000,000 homes in the shadow inventory tells us that we still have a long way to go before any normal housing market is restored. This by far is the worst housing collapse ever and it is still ongoing. This isn’t some closed chapter in our history books. We are still experiencing the actual correction. You can see from the above charts and gather a sense of how deep this correction is. Or maybe this chart can help:

Source:Â Economy.com

Keep in mind the above chart is inflation adjusted while the 25.9 percent correction is based on nominal levels. No matter how you slice this correction it is the worst on record. To get closer to the baseline prices would need to fall 43 percent from the 2006 peak. A number that seemed preposterous only a few years ago is now within touching distance.

Homeownership increase causes housing correction more widespread pain

Source:Â Census

When the Great Depression hit roughly 46 percent of Americans owned their home. Most of the mortgage debt was modest although on much shorter balloon payment deadlines that were exacerbated by the collapse. When the bubble unfolded in our current crisis nearly 70 percent of Americans were homeowners with massive amounts of mortgage debt. Most Americans derive their net worth from their home. So a collapse in housing values has sent a ripple through the balance sheets of the vast majority of Americans. Even if you are part of the one-third of homeowners with no mortgage your home values just cratered 32 percent on a nationwide basis. Depending on where you live this could be much worse or better. However it is likely you have lost a good amount of housing equity.

The problem itself isn’t so much that homeownership shot up to 70 percent but how it was financed. As many of you are well aware in the last decade U.S. median household growth was non-existent. Families are earning what they did going back to the late 1990s. Yet the cost of a gallon of gas is now up over $4 in many areas, local and state governments are raising taxes for dwindling budgets, medical care costs are soaring, and the cost to feed your family is also sky high. So the fact that home prices rose in light of all of this is a stunning reflection of the mania we have lived through. There will be books written on the insanity that is the U.S. housing market and history will not look favorably on many of our actions but the truth is history is still being written.

The adjustment in the housing market is still fluid and dynamic. I recall reading an article in the summer of 2009 showing some prescient insight into the market. In the article this chart was produced:

Source: Moody’s

“(Moody’s) A number of indicators of housing have bottomed, and there are tantalizing signs that the descent in house prices is at least moderating. When all is said and done, this housing correction, easily the worst on record for the U.S., will see the national Case-Shiller® house price index fall nearly 40% from its 2006 peak. The correction will be not only deep but also lengthy, with the U.S. price index bottoming in the second quarter of 2010. The national price level will not regain its 2006 high until 2020, a peak-to-peak housing cycle of 14 years. Regions will vary substantially, however, with areas that saw prices rise most taking the longest to return.â€

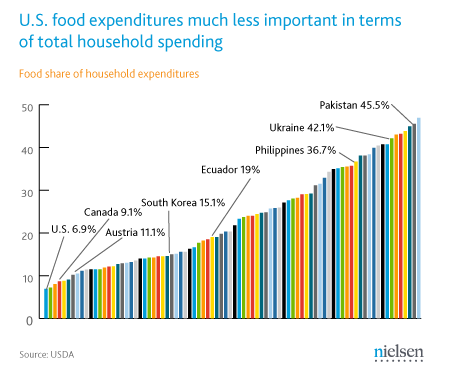

What is interesting is that the market did hit a bottom early in 2010. Yet what wasn’t accounted for was the double-dip in the housing market which is what we are now clearly in. The enormous backlog of shadow inventory will keep a steady stream of lower priced properties for years to come. I also find it interesting that the above chart is able to predict 12 years out and that California will see peak levels again in 2023. Frankly, I think projections going out more than 3 years for housing prices in this current market is similar to flipping a coin since all we can say with certainty is that home prices cannot go up with no significant income changes. People keep asking about certain financial ratios about when it would make sense to buy. Unfortunately we now live in a much more challenging financial world.  The metrics now have to change completely. We are used to paying very little for food and fuel in relation to total household income. Other countries are used to paying more:

As we all know the cost of food is and has been going up yet income has remained stagnant or has dropped. The amount that can be spent on housing by default decreases. The Fed has essentially focused on the borrowing side of the equation by trying to lower rates to adjust to this new lower income world. Ironically this artificial intervention by the Federal Reserve has harmed most Americans while favoring investment banks around the country who really are the only sector who benefit from inflated housing costs. Lower home prices are actually beneficial to the one-third that rent. The one-third that own but have no mortgage are likely to not change their spending habits. It is the two-third that own and have a mortgage that are largely in play. If people purchase carefully and actually treat a home as a place to live, then if prices dipped another 20 percent it would not matter. The narrative that home prices need support is largely a banking propaganda piece trying to keep inflated balance sheets propped up.

As more and more disposable income is taken up by items outside of housing the amount of money Americans can finance for purchasing a home dwindles. This is why the demand for lower priced homes is healthy while markets where jumbo loans are needed are basically groveling at the feet of the government for more subsidies to keep prices inflated. Why would these supposedly rich areas need subsidies? What is it to the rich family to pay a little more from their healthy income to a house payment? The answer is that these markets are largely giant shell games where cars are leased and jumbo mortgages reign supreme. No doubt there are very wealthy enclaves with real solid incomes but you have other areas like Culver City or Pasadena where much of the economy is a paper tiger. You have households making $100,000 to $150,000 a year living as if they made $300,000 and above.

What can we learn from the Great Depression housing market and the one we are currently living in? First, many of the safety nets absent from the Great Depression like giant handouts to banks, food stamps, unemployment insurance, the FDIC, and stronger government intervention have made things look much better. Yet this is like a storm ravaging your property and you being happy that you have insurance. Sure, the place is covered but someone is still going to pay for the cost. I have few qualms about unemployment insurance or even food assistance since these keep people from absolute destitute situations and in terms of costs, are relatively low. For example $64 billion was paid out in 2010 to 40,000,000 families through food assistance. This money is spent back into the economy immediately. To put this in perspective look at the absolute failure of the home buyer tax credit:

“(WSJ) The credit wasn’t great for taxpayers, either. IRS says it paid $26 billion in home buyer credits in 2009 and 2010, enough to cover the maximum $8,000 credit for more than 3 million buyers. (It says at least $513 million went for fraudulent claims. Some claimants hadn’t bought houses. Some filed twice. Some were under age 18 or incarcerated.)â€

Let us not forget about the multi-trillion dollar elephant in the room regarding the bailouts to the unworthy and financially broken financial system. The fact that most Americans have their wealth in housing and this was turned into a speculative casino by Wall Street is incredibly irresponsible. The reality of the new home price lows should tell you really who the bailouts were targeted for.

In the end home prices will continue to decline simply because no income growth has shown up in over a decade. Even if we do see income growth, we have to measure this with other rising costs like food and fuel. In the end, you can’t eat your house and maybe this is why the American Dream is now being redefined.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

101 Responses to “Eclipsing a terrible milestone as home prices fall harder than the 1928 through 1933 Great Depression Collapse: Lessons from the Great Depression Part 32. Housing prices continue to fall as other costs eat up disposable income.”

Another year or two of this and housing will be looked upon negatively by the general public.

That will be the time to buy.

I think the time to buy will be when ratios are much closer to long term historical levels. Like a home costing 2 or 3 times annual income. Home prices are a reflection of incomes and mortgage rates. Both have to be at a level that makes mortgage payments sustainable and reasonable. I think we’re still a ways from this in many areas.

Anyone keeping track of what’s going on with retirees who may opt for “none of the above” and move into an RV or sailboat? Everything requires an acronym these days so will submit my contribution for it….MDS. Mobile downsizing? Maybe it’s not a big factor, but considering where we’re headed demographically and economically, the states who offer advantages tax-wise or climate wise might see some impact?

SIlly idea – N O T G O N N A H A P P E N

(1) RVs that you can live in cost the bloody earth and depreciate faster than snowflakes in July. FIgure minimum $100,000 for a 4 season RV that is large enough to live in (35 ft and up.)

Then there is the fuel to get from one place to another……..

We did the fulltime RV thing for 2 -3 years for fun. Not a good idea permanently for all but the upper income (top 10%) unless totally desperate and willing to work for $7-8 an hour at campgrounds in exchange for a site.

(2) Obviously you don’t know a lot about boats. I grew up on them and can handle up to a 49 footer by myself. Again a very very expensive option. TO get one that is suitable for live-aboard – and not in need of $100,000 of work or likely to sink or blow an engine – you will START at over $250,000.

And then there are the dock fees…. year round figure $325 or more per foot of boat, ie a 50 footer costs over $18000 to dock year round… And the maintenance – figure length of boat x $500…… And fuel as living on a sailboat is far far less space than the same length power boat and even if you can suck it up on the lack of space, you can’t count on the wind….

ANd then you have to figure out how to get to the grocery store with no car from some marina and where does the mail go and you can’t even get a driver’s license without a real street address….

There are plenty of RV residences in SoCal where people are living rent free, most of the time (you just gotta know where to park and for how long).

Personally, this doesn’t appeal to me, I’m not into the vagabond lifestyle, but it appears to be an emerging trend – Guess you haven’t been in Venice lately 😉

And yes, living on a boat isn’t for everyone, but I do have a friend that loves living on his 36′ Catalina in Alamitos Bay (uses his Mom’s street address btw) and has saved quite a bit of mula doing so for the last 7+ years.

Sometimes thinking outside of the box (like me selling my home in Sept. 2005 and telling everyone in my family to do the same) can have its benefits too.

In the summer my friend spends almost every weekend sailing, and sometimes gives lessons to those that can afford it 😉

Nonsense. People can, and do, buy liveaboard sailboats for much, much less. $250,000 is completely silly. People buy sailboats for much, much cheaper than that, and are quite comfortable on them. So much so, that they sail around the world on them. Try a tenth to a third of that cost.

The more money, the greater the comfort, certainly. And the newer the boat. But to suggest that you need a quarter of a million for an adequate sailboat is absurd.

And $325 per foot!?! Honestly, I don’t know where you are keeping your boat, but again quite adequate docking can be had for 1/10th the cost. Assuming you choose to tie up. This is just plain silly.

Gee Questor since you know so bloody much why don’t you come to my house, walk 500 feet down to the harbor and try to rent a slip year round for under that cost? Then we can travel the 2000+ miles of coast here and guess what – it will BE MORE for a year round slip than I quoted. And don’t even talk about trying to find anything under that price for the warm weather sites like FLorida or the Carolinas….

ANd yeah if you want a boat that is NOT gonna have problems or need work, you WILL pay that much. They are not cheap — unless of course you don’t mind squashing into a 28 ft cuddy cabinet with a porta-potty. A marine diesel engine starts at a cool $6000 plus installation costs… and the propane refrigerators kick off at over $1000…… fixing a propellor will start at over $500 for jsut the millwork (hit one piece of flotsam and watch the bills pile up for hauling the boat, pulling the prop, sending it into be repaired…..)

Newsboy I can guarantee if they are ‘parking for free’ they do NOT have electric hook ups or water hookup or sewer hookups — and probably get rousted by the cops every couple days. Good plan – get busted for parking violations, trespass, polluting by dumping the grey water and black water tanks, vagrancy…….

Campground are NOT cheap. Monthly rates are less than weekly but they will still hit you for $460 -and even $1200 or more a month depending upon where you are and the season.

Yes, just google “stealth camping” and see how much comes up. There’s a growing community of people in the US that have figured out how to live without paying rent. It makes sense as housing is still the biggest expense most people face on a monthly basis. But living on boats or in vans and campers, etc… is a growing trend. Not for everyone, but necessity is the mother of invention.

Uh….spent a decade orbiting the country in an RV and own 3 boats…..one has a pole in the middle. 3 years does not impress me. Sorry, but I’m not inclined to put much weight in what you’ve said until you have some long term success at it instead of the obvious frustration.

Most of what you have to say assumes ignorance, incompetence, lack of common sense, lack of mechanical and technical skills and ability, not to mention financial fooishness on the part of the potential RVer or sailor. Just a guess, but I’d say someone with those qualities probably wouldn’t last out there more than…….oh….say 36 months?

Sorry, AnnS. You’re just full of crap. You don’t know whatsoever of what you’re talking about. And you’ve got ZERO experience with cruising.

I’ll let the readers decide here with some real, current numbers. Here’s what the market is like for what some would consider the minimum size, 32-35′

http://latitude38.com/classifieds/classy_display.lasso?cat=32

The Westsail, which has an extensive circumnavigation record, is going for $43,000. Needs a little work, but not near $100,000. Maybe $10k is my guess.

At the “upper” end of your experience is here:

http://latitude38.com/classifieds/classy_display.lasso?cat=40

Well under $100,000. And again, you don’t need $100,000 worth of work.

For slips, here you go:

http://latitude38.com/classifieds/classy_display.lasso?cat=Berths

Morro Bay, $11/ft per month. SF Bay, lowest is $4/ft per month if you’re a member. Or you can outright buy a place at Pier 39 for $8,000. Of course, there are tradeoffs for all of these. But yes, it can well be done.

But I’ll tell you what, AnnS. I think you are just plain full of BS and don’t know what you’re talking about. How about you take your claim straight to the acknowledged experts at Latitude 38 and publish your statement there?

You’ll be laughed straight back onto your land lubbing sofa. But I dare you to prove me wrong.

Ouch!!! You guys are ruthless, give AnnS a break, she is just posting from her perspective. I’m sure some people could log on here and give us the finer instructions of living for free using cardboard appliance boxes as housing but hey, to each his own.

To the posters who have lived in a RV, thanks, I have been contemplating doing justthat in a few years, and I like hearing the feedback from that lifestyle.

@Swiller: Yes, AnnS’s elitist snobbery attitude just pissed me off. In one swoop, she managed to insult a very large fraction of current cruisers. Not everyone can afford a gold plated miniature version of the Queen Elizabeth II.

To say nothing of the people who are having a really tough time of making it and need a place to live. Cruising opens up a great lifestyle. It’s not for everyone. And yes, there are maintenance and living issues. The best way to get familiar with it is to start reading about it. Latitude 38 is a great beginning there. But there’s no comparison with just doing it. Start small and see if it works for you.

For me, it’s a superb plan B, should plan A fail. YMMV.

Nice job with the boat stats, Questor… I’ve been reading DHB for the past few years, and I’ve noticed posters like AnnS (and especially CompassRose) make out like they’re experts on everything from boating and the law to esoteric pursuits like home canning and horse breeding.

AnnS is obviously smart, but her condescending attitude that she breaks out after people post things that she doesn’t agree with is annoying as shit. I’m glad you put her in her place.

Questor:

Many thanks for posting info regarding affordable options for boats & slips.

Folks like you make reading this site worthwhile.

As a frequent traveler by car through southern Cali (Imperial County) to Tuscon, AZ on the 8 freeway, all I can state is that a fair number of people still RV to places such as the Coachella, Winterhaven, CA and Yuma & Tucson, AZ for the winter months.

During the past 3 years, I have noticed quite a few empty spaces in RV parks that snowbirds and other road gypsies tend to have occupied in the past 5 years.

Although I do not know what the space rent for these places would be, my guess is that space rent has dropped due to many parks’ readily available spaces.

Best!

And I agree with chubbuni13. I get tired of the “total answerism” from those two posters. These two do not add anything of substance to this board other than arrogance and hubris.

~Misstrial

Just read Swiller’s post and wanted to add that in the summertime, its RV parks in Colorado, St. George, UT, Reno, Flagstaff, AZ, and parking alongside Hwy 1 in Ventura County adj to the beach.

http://portal.countyofventura.org/portal/page/portal/GSA/parks_department_-_Directory/Beach_Front_Parks/Rincon_Parkway

http://www.rvparkreviews.com

Just make sure you have really good medical and dental insurance should anything happen on the road.

~Misstrial

@Chubbuni13 and Misstrial.

Thanks. I appreciate knowing that some one found it useful. These times are hard enough, and going to be harder still, without having to deal with people giving out bad advice that may impact lives.

Your mobile downsizing has been going on for years, but, the “homes” aren’t so “mobile” – trailer parks full of seniors. The trailer parks in Florida are actually pretty nice, though. Most of them.

I am 57 years old and lost everything in this collapse: including my marriage recently. I plan of buying a trailer and living off-the-grid from now on. The cost of staying at campgrounds on BLM land is zero to $8, national forest is $12 to $20 per night. Walmart lets RVers to stay in their parting lots for free (one night). One a week pull into an RV park ($50/night in Anaheim, CA): pump down holding tanks, do laundry.

The future of the Boomers!

It is really hard to think of a good policy path to take at this point. If you close the barn door after the cows get out, those few cows that might want to wander back in, can’t get in.

If they were to let the thing collapse in one big thud, without further intervention, we could form a bottom fairly quickly. That wouldn’t be too popular with the voting public, however. Also, if new home starts dropped further, say to half current levels, or even lower, that would put many home bulders out of business.

As Ludwick Von Mises says, there is no easy way out of a post peak speculative bubble situation. One partial solution is to attempt to inflate away the problem. However, in the present globalization case, wages can’t rise here without leading to a massive exportation of jobs, so it is actually counterproductive.

The only real solution is to call a 2nd constitutional convention and start over with a new currency. The present problem isn’t fixable.

Forbes did say we’d be on the Gold Standard within five years….

There are a lot of people under the ridiculous notion that we can simply print money to get us out of this economic mess. For those who have delusional faith in the Federal Reserve, consider this. We’ve spent $4,000,000 to create each new job that’s been created over the past few years. And that hasn’t restored the job market from its current high level of unemployment.

About the only thing which has been restored are Banker bonuses.

Here’s where this number comes from:

http://www.youtube.com/watch?v=VpZtX32sKVE

Note: This video is a must watch for those who remember Dr. H’s recent article about the College bubble, and how it pertains to the educational scam of loading kids up with debt (and thus, they can’t buy houses). The number above comes from the second in the video series, with Gerald Celente.

“The lesson of Socrates was that wisdom begins when a man finds out that he does not know what he thinks he knows… Socrates had died sooner than yield an inch to men who asked no more of him than he should hold his tongue.†~ Francis MacDonald Cornford, The Republic of Plato

Questor, Frontline did an interesting program “College, Inc” about just that issue. All these private universities have popped up all over. Phoenix University, National University, etc. They were recruiting students, many who had no chance at succeeding, and passing around federal loans like candy. These private Unis are not cheap. And a lot of students ended up with a crappy education that didn’t prepare them for anything and tens of thousands in debt. The guys who run the universities have done well, though.

http://www.pbs.org/wgbh/pages/frontline/collegeinc/

The Sperlings who own University of Phoenix live in my general area.

How well are they doing? They have a household staff of about 30 people.

Karen: I agree that this is an excellent show. What I see are people who have no chance of getting a job, so the prospect of “free money” for a couple years while they attend a bogus school seems like a no-brainer. It gets money coming in the door, and can keep them from being homeless. Seems alluring.

What’s sad is that they are forfeiting their future in order to live for today. They’ll be seriously handicapped for a very, very long time.

It’s similar for those who do go to a real University instead of a diploma mill. The elite bankers have managed to set up a scam for serious debt slavery for decades.

One thing I haven’t seen is a discussion about the new generation of Professors. These people are probably in serious debt themselves, and typically with a low paying job. You’d think they’d be the first to try and wake people up, but in general they seem to be in unbelievable denial. And they don’t want to wake up to the fact that they won’t be getting the pension that they are dreaming of.

It’s just plain ugly. And when the education bubble pops, it will get uglier.

And how the many people who got an education from a real university, let’s say a state college, and STILL can’t get jobs?

If you’re staying put, owning a home at a sane fixed interest rate makes perfect sense. Why pay a land lord rent so HE can own the house? That’s worse slavery than paying the banks. So this 50% increase in home ownership is only a bad thing if the income cannot support the agreed on payment or the stay in the house is too short. On the whole the icrease was OK;it was just extended too far and it was the LEVERAGE that did things in. Enough homes were bought overpriced with ARMs that when those loans went bad the fall in values cascaded onto homes that were bought with decent metrics. Dominos

“If you’re staying put, owning a home at a sane fixed interest rate makes perfect sense. Why pay a land lord rent so HE can own the house?”

You really don’t “own” the home.

You’re leasing it from the banksters with a LARGE profit incentive on their part…you’re also leasing the land from the state you’re located in.

When the environment because that of enslavement, is it really wise to volunteer to be shackled?

Personally, I’m 100% liquid in cash & PMs, and I’m looking for a state of like-minded PATRIOTS to pool resources with, build my next business and support the enforcement of the Rule of Natural Law.

I could easily buy a house for cash in SoCal (my familial home) and start my next business there, but why would I support a rapaciously repugnant dystopia?

Why would I volunteer to be enslaved?

Sorry, but that’s an incorrect generalization as it applies to a lot of people. Owning a home which is underwater, or in danger of being so, is a worse situation. When you’re underwater, you are no longer a homeowner, but a renter with the Bank as the landlord. God help you if you have to move, because then you now have to pay the difference to the Bank if you ever refi’d, or took out a second. After next year, the IRS will be after you as well. They’ll still go after you now, if you spend any money on anything other than the house. Not even bankruptcy will save you there.

And with housing going down between 10-20% this year, a lot more than 25% of all Californian homeowners are going to be underwater this time next year.

Owning a home makes a lot of sense if you can really own it. Rather than have a huge debt and taxes. Dont forget that the first 15 years of a 30 year mortgage goes to paying the interest. Not the principle. Taxes and maintenance never goes away, either.

So, if you could go out and pay cash, this would make more sense that getting into big debt. But even after you buy, you’ll have about 1.5% a year to pay in taxes and maintenance in CA.

The Dr. said; “This by far is the worst housing collapse ever and it is still ongoing. This isn’t some closed chapter in our history books. We are still experiencing the actual correction. You can see from the above charts and gather a sense of how deep this correction is. ”

Yep, and I’d say things aren’t even *BAD* yet.

“This is why the demand for lower priced homes is healthy while markets where jumbo loans are needed are basically groveling at the feet of the government for more subsidies to keep prices inflated. Why would these supposedly rich areas need subsidies? What is it to the rich family to pay a little more from their healthy income to a house payment? The answer is that these markets are largely giant shell games where cars are leased and jumbo mortgages reign supreme. No doubt there are very wealthy enclaves with real solid incomes but you have other areas like Culver City or Pasadena where much of the economy is a paper tiger.”

100% spot on. The meme from from the Wall Street/D.C. power elite is to protect the “paper tiger” at all expense!

Even in the face of total collapse of sovereign purchase of U.S. Treasury debt, the politeers & banksters continue to create T-Bills and pass them (with almost no buyers) to the Federal Reserve, in an effort to restart inflation.

They won’t accept a deflationary correction as normal, and are engaged in an economic scorched earth policy.

As wages continue to *FAIL* to inflate, the results will be catastrophic on an ongoing basis, creating a truly feudalist business environment in the near future.

“In the end home prices will continue to decline simply because no income growth has shown up in over a decade. Even if we do see income growth, we have to measure this with other rising costs like food and fuel. In the end, you can’t eat your house and maybe this is why the American Dream is now being redefined.”

The American Dream died when we forgot about enforcing the Rule of Law, from TOP to BOTTOM.

I realize that most of the inhabitants of the 50 United States aren’t AMERICANS, they’re Democrats -or- Republicans, but for those that didn’t know, here’s the LEGAL origin of the American Revolution:

“The state of nature has a law of nature to govern it, which obliges every one: and reason, which is that law, teaches all mankind, who will but consult it, that being all equal and independent, no one ought to harm another in his life, health, liberty, or possessions” ~ John Locke 1690

“Whenever the legislators endeavor to take away and destroy the property of the people, or to reduce them to slavery under arbitrary power, they put themselves into a state of war with the people, who are thereupon absolved from any further obedience.†~ John Locke 1690

Well put. However, and fortunately, I don’t believe our leaders have entered into quite the degree of enslavement of the population that was prevalent (or feared) in the 17th century. Back then absolute monarchs were commonly running the show. Similar situatios do exist today, but mostly in the middle east. Nobody is concerned about a King Obama. He just doesnt wield that much power.

The problem we face today is an overly liberal interprtation of the right of free speech (by conservatives no less!) which has resulted in corruption of government. We are not interested in good government, but rather the “best” government money can buy. I’m not sure how we get out of this nonsense.

I really agree and would add that the Locke quotes are precise here in that the government, by failing to regulate–or even think about for that matter–American banking “activities” are equally culpable in this crisis. The baby left the tub a long time ago, let’s throw out the dirty water! I understand why people are starting to practice “strategic default” on their mortgages even though it’s very emotionally and personally devastating to them.

I have to laugh–or at least guffaw–so I don’t cry… or shoot a bankster.

DrHB: One of the few sources that keeps ALL the relevant factors tied together. Keep it up!

OTOH, the narrow, slanted “views” offered by CNBC and related cheerleaders is pathetic. Anyone following Australia’s housing bubble?

I gotta go develop a spreadsheet to track M1/M2/M3 and related global macro capital flows…

Enzo Mimo – I think I love you – you took the words right out of my mouth.

“Wuv, twue wuv…” They say that, and a few tubes of massage oils, (plus a foreclosure purchase at 20% off 1999 prices) can make for a pleasant summer… ;’)

Measure the drop in house values in terms of gold. An even more dramatic drop.

Measure it in Netflix…even scarier and valuation has even less to do with sentiment than gold.

Be very careful of gold, I’m not saying not to own it but it does not always behave as one believes it should. Consider 1980-2000, we had inflation the entire time and many gold bugs would argue that inflation was manipulated to appear lower than it otherwise would be via CPI formula adjustment. Over that period gold depreciated relative to just about everything. It’s important to keep that in mind as the hucksters choose to ignore that period and offer no rational explanation. The answer is simple – price matters (as it always does), people bought too high, and that price included an implied forecast about the future (not just then current) economic and monetary outcomes – that forecast was wrong. Invest like everything in life, moderation and diversification.

From 1980-2000 the public bought the federal debt.

Since 2008 the federal reserve is creating money out of thin air to buy the majority of federal debt. The dollar is eroding because of this scheme. That very debt is rolling over and then the Federal Reserve buys more of the debt. It is a house of cards and charade.

Theoretically, Gold and Silver, will continue to go higher in price because of the dollar being devalued. The propaganda machine and attacks by the federal reserve on the precious metals market, will be temporary, but in the long term, it won’t work.

Well no. It is not a house of cards or a charade. The government legally can and will print as much money as it wants to. How much should they print? They should print enough that the economy stays liquid enough for businesses to operate, expand if they need to, and certainly make payroll. Anything less would result in economic Armageddon. if you haven’t noticed credit has been tight these last few years.

QE2 was well placed. The current hysteria about it, including yours, is because you mistakenly believe that the government needs to balance payments with income, just like the government makes you do. In reality, the government is not legally required to do so, and making it do it (by surrendering it’s sovereignty over the currency, for example by joining the Euro) would likely just open us up to problems like Greece, ireland or Portugal. It is the ability to print money which is going to give us the control over liquidity that we need to get us out of this mess.

The current hysteria about it, including yours, is because you mistakenly believe that the government needs to balance payments with income, just like the government makes you do.

Do you live in the real world? The government does not make me balance payments with my income. What the hell are credit cards for, borrowing money to buy a house, etc.

The Federal operating deficit is $1.6 trillion a year. The national debt is over $14 trillion. A 1% rise in treasury bonds would immediately bankrupt the USA as interest payments would skyrocket.

“A 1% rise in treasury bonds would immediately bankrupt the USA as interest payments would skyrocket.”

And you say that like a bad thing!

When confronted with an addict do you give him more drugs so he never feels any pain?

OMG! Some of you sheeple still have no clue that we’re nearing the end of the debt-based Ponzi!

Here’s a hint: It’s Official: DTS Discloses Total Debt Hit Ceiling Yesterday; Government Draws On $14.3 Billion From Retirement Funds.

https://www.fms.treas.gov/fmsweb/viewDTSFiles?dir=w&fname=11051600.pdf

Good luck getting to the other side…you’re gonna need it.

> Do you live in the real world? The government does not make me balance payments with

> my income. What the hell are credit cards for, borrowing money to buy a house, etc.

It does. You can borrow, but you eventually have to repay all of it, or go bankrupt and turn over your assets, or die. In the latter two cases, someone else ends up paying for it, but no money was created out of thin air. My point was that you can’t literally make money yourself like the government can. The treasury agents see to that. No counterfeiting for you!

@Ian: “Well no. It is not a house of cards or a charade.”

You know, it boggles the mind how anyone can live through the crash of 2008 and still not have clue as to what is going on. To be more blunt, the entire financial system is a Ponzi scheme. Yes, Ian, the Fed selling its debt and buying it back is a charade.

Do enlighten us all please. What specifically has been done since the crash of 2008 to prevent it from happening again?

If you really think you have a clue as to what’s going on, I eagerly await your answer. But personally, I don’t think you do have a clue, and I don’t think you can come up with a good answer.

Until then, the original authors’ point stands quite well.

A prudent investor would diversify their capital into Gold/Silver, not an inflated asset like RE – The U.S. Debt is about to implode, getting to the other side of the abyss is going to require liquid capital and mobility.

Home “owners” sitting on their “ass”ets are going to get destroyed!

Retirement accounts are also no “safe” haven:

Treasury Confirms Debt Ceiling To Be Breached Today; Will Tap Pension Funds

http://www.washingtonpost.com/business/economy/treasury-to-tap-pensions-to-help-fund-government/2011/05/15/AF2fqK4G_story.html?hpid=z1

In legislation just proposed, and I don’t know by whom, nor do I have a number yet, the Dept of Labor has proposed a re-definition of who is a fiduciary, not under the Securities laws, but under ERISA, the law that governs tax advantaged retirement accounts, such as 401K and IRAs and it probably will include all retirement assets, we don’t have a definite direction yet of what they intend to do but it is my guess they want to limit those investments only to US government debt.

http://www.theinternationalforecaster.com/International_Forecaster_Weekly/The_Financial_Powers_That_Be_Are_In_A_Trap_of_Their_Own_Making

The Looting of the Middle Class

http://www.silverbearcafe.com/private/11.10/looting.html

I think i smell blood in the streets! Just like when the DOW hit 6000 and everyone was predicting total collapse… Now we are at close to 13000 dow again… Just wait until people sell those gains and put it in housing… It was a huge transfer of wealth from seniors to twenty somethings who had jobs and started a 401k in early 2009… They made a killing and will be buying homes with their 401l money soon!

Wishful thinking.

Word. By the time the penalties are paid off, you’re talking maybe 4000-8000 dollars those youngsters could apply to a home loan. Unless they’d rather put it toward their student loan principle. Or take a vacation. Or buy car. Or even just lunch. (Seriously, here in the LA area, it’s up to $9-12 for a salad and soda. That’s like $2500/year just in lunches.)

I just read that 85% of college grads are moving back in with the parents because they cannot find any kind of employment. 20 somethings buying houses is probably not going to happen as this new generation is going to be about the lowest paid generation in last 50 years. The recession were now is is not so much cyclical as it is structural. The emerging world is what’s growing, while the developed world is contracting. This re-balancing will be going on for some years yet.

Not too manic, are we? lol

http://www.mercurynews.com/business/ci_18068610

“Battered by the Great Recession, nearly a third of Silicon Valley residents have put their lives on hold — delaying retirement or postponing major decisions such as buying a home or car, according to a survey by a San Jose State research center.”

“Almost a third of those responding to the survey said they are putting

off buying a home; 14 percent of those in their childbearing years say they’re delaying having a baby, and 32 percent are postponing other things such as a vacation, buying a car or enrolling in college. The reluctance to spend on big items suggests that consumer spending here will remain sluggish for a while, slowing recovery, said Stephen Levy of the Center for Continuing Study of the California Economy.”

“Part of the caution may be due to the shadow cast by persistent unemployment, which has more than 90,000 people in the valley still actively trying to find a job.”

The “good” jobs in the Valley have been disproportionately given to foreign nationals on the H1-B visa program.

It’s become so bad that tech firms often receive hundreds, if not thousands of resumes from qualified US citizen applicants, interview none, and bring in a H1-B from India to fill a low level position.

Not everyone in the IT/Tech/Engineering sector is a “connected” superstar that is employable at Facebook, Google, et al. and lots of firms are planning or have already moved out of Kali to places like Utah, Arizona, Texas et al.

Stay liquid and stay mobile, so that you can pursue employment/business opportunities….

WHAT?

Are you saying that retirees sold at the bottom and all the youngsters out there ran down to their human resources department and immediately signed up to start putting 5% into their 401K and in the course of a few months bought all the shares the old folks sold? AND somehow managed to invest all their money at the lows?

How is that even possible?

And after saving 5% for 2 years they now have enough to buy homes in California thanks to being smart stock market investors?

Sorry if I got it wrong but the way I understand what you are saying, it sounds a little wacky.

I hope your post was in jest. NY Post reports 85% of college grads are moving back home with Mom and Dad after graduation…many can’t find full time jobs. What 401K money?

http://www.nypost.com/p/news/business/of_college_grads_return_to_nest_kjMXejGjOymsRom3pz9gaM

EH? Are you kidding? It was only a transfer of wealth if seniors sold their 401ks or cashed them out. Otherwise they got everything back.

Really almost too silly to reply to.

The maximum that can be invested in a 401k a year is 16,500. So that is $33.000. And that is if your are maxing out the 401k. Maybe add an additional $5000 for an IRA. So let’s double the $33,000 + 5000 and say they somehow invested it so it doubled so that’s it is $76,000. Now let’s subtract $6600 for early withdrawal from the 401k and let’s also subtract let’s say 15% for income taxes ($9900) and I won’t even figure in state taxes but in reality they figure in so. $59,500. Ok that will get you a 20% down payment on a house worth $297,500 or so excluding any closing cost. But you still need to be able to make the monthly nut.

So every possible favorable assumption was made for your scenario:

– investing over 20k a year in retirement accounts

– investment somehow doubled (very unrealistic)

– person was willing to raid their own retirement accounts for a downpayment thus stealing from their own future.

– tax bracket was somehow miraculously only 15%

– state taxes were excluded

– closing costs were excluded

– person was able to find a house selling for under 300k (in los angeles it’s a TEAR DOWN!).

– person is still able to make monthly nut, which will be pretty high despite the 20% down.

The problem with the increase in ownership was that it was done by stoking the demand side with easier credit. (Same thing has happened with student loans and the rising cost of education.)

An alternative way would have been to adjust laws to encourage rent-to-own scenarios, co-ops, and other forms of home acquisition. A supply-side approach, of having companies produce too many houses, could also have worked.

Government should demand that parents pass on 2/3 of their wealth to their own kids/offspring not churches or charities. In European countries by law you must take care of your kids you can not just produce a lot of offspring then will your wealth to charity, churches or the like. They pass their homes on to the family generation after generation.

This would reduce our social security /medical crisis and force families to take care of their own..

So true about a requirement to leave property to blood relatives. Treason seems to have become a value system here where we favor foreigners in education and jobs, and non relatives as a badge of honor. In Florida, those late marriages permit generally golddigging women to disinherit sons and daughters. And some have No effing shame about it. This economy was caused by an embracement of anti-Americanism more than by any other factor.

Cool, another rule/law to FORCE behavior. Sounds like oppression and not freedom to me….go trumpet the European fantasy model elsewhere…

I see, another progressive looking for politicos to save us from ourselves!

Here’s a clue; .GOV meddling is how this nightmare was created to begin with…

That really only works for well to do families. In Europe, that might be a significant percentage. Here, the larger rich / poor gap means many or most wont have many assets left by the time they slip away.

The last two Fed Chairmen stated that the last Depression could have been averted by more debt creation and intervention. It should seem obvious now that is not the case. Temporary distortion are certainly possible, but giant cycles like the one we are in now have to run their course. Instead of curing the problem, they have exasperated the problem by further; hence, ushering in the next dark age. This is so bad it will not be corrected within the framework of the current system. The entire current world economy will have to be reorganized before this is over. Lost decade? How about a lost century…

The reality is that it can help. Keynes wasn’t totally off his rocker as many would have you believe. The issue here is that government should increase stimulus/spending in times of need to help buffer cyclical pullbacks or major delevaging events. The other side of this is that the government needs to pull back and deleverage as the economy recovers…but that never happened and we’ve continued to grow the damn government/spending. We now find ourselves at the very limit of where this can work and they are shocked it’s not working. If they had been much more moderate over the past 30 years and not been trying to inflate bubbles all the time (i.e. government played a massive and purposeful roll in housing) it wouldn’t have been so bad and we’d be able to handle it. Instead we are overextended from the consumer, state/local, and Federal level. Oh well.

Keynes, like Marx, looks good on paper. The truth is cheap credit is too good a drug for erstwhile monetary wizards to be objective about.

I still remember Greenspan telling everyone to buy houses using ARMs at the peak of the housing bubble. That man needs to be tarred and feathered everyday.

Not just as prices peaked, but as interest rates bottomed out — the very worst advice for the consumer, but the most profitable for the banks.

That’s when I knew unequivocally that Greenspin was a shill, and craven and stupid to boot.

+1

L.A. suit calls Deutsche Bank a slumlord

Los Angeles prosecutors are calling Deutsche Bank one of the city’s largest slumlords, accusing it of allowing hundreds of properties it owns to fall into disrepair and breed crime.

The Los Angeles city attorney’s office filed a civil lawsuit Wednesday against the world’s fourth-largest bank, seeking hundreds of millions of dollars in penalties and restitution and an injunction forcing it to clean up its foreclosed properties in Los Angeles.

The Frankfurt, Germany-based bank has foreclosed on more than 2,000 homes over the last four years in neighborhoods across the city, according to the suit — many concentrated in the northeast San Fernando Valley, northeast Los Angeles and South Los Angeles.

Los Angeles officials say the bank has been a dreadful landlord and neighbor. Prosecutors say that during a yearlong investigation, they found evidence that Deutsche Bank had illegally evicted some tenants, let others live in squalor and allowed hundreds of unoccupied properties to turn into graffiti-scarred dens for squatters, gang members and other criminals.

Police records show scores of alleged crimes committed on the properties, including vagrancy, possession of drugs for sale and assault with a deadly weapon. In December 2007, police found a dead body at a Deutsche-owned house on West 55th Street. In 2008, they discovered prostitution at a house on Evers Avenue.

Many Deutsche Bank properties have also wound up in a slum housing database, in which tenants pay rent into an escrow program while the city tries to get the properties fixed up.

“This particular bank is … helping to destroy communities,” said Councilman Dennis Zine, one of six members of the Los Angeles City Council who joined City Atty. Carmen Trutanich at a news conference in which they excoriated Deutsche Bank and other banks that have foreclosed on properties in Los Angeles.

they do stuff here that they would never be able to dream of doing back home – whose fault is that – ours!

I have been a bear for 7 years (yep, a little early)

I am 100% in cash. I am not a real estate broker.

I am starting to selectively buy real estate. ( I haven’t bought anything yet, but I am very close )

Why? Because I am inarguably right on a few things:

When everyone is bearish, its time to be bullish.

A 4 5/8 % mortgage is below the REAL inflation rate (free money)

Aside from the lucky, deluded, or dishonest, picking an absolute bottom is IMPOSSIBLE.

I plan to be wrong. I plan to buy more even a little lower. But, IMHO, in 10 years, my average portfolio will look spectacular. I will be using free money to make great returns.

Your planning involves the post WWII Baby Bummer induced inflationary curve.

We’re not in that demographic any longer, even though the politeers and banksters are extending and pretending that we are…

I think most would agree we’re in uncharted waters, no historical situations parallel, except maybe parts of the Great Depression.

Remember what came after that?

Do you think the Global Banking System (U$D Reserve Currency petro-dollar based) will survive intact for another 10 years?

Do you think that’s air you’re breathing now?

Welcome to the desert of the real…

Yes, I believe the Banking Industry will be here in 10 years. BUT, if you are wrong, I pay my mortgages for ten years, and then stop paying. I’ll live for free for the rest of my life, and collect rent from others.

Come to think of it, I like your scenario better!

You are a genius (I hope). I have decided that the home prices have fallen enough that I can decidate some cash and get a steady income stream forever starting now. I’ll be buying houses as fast as I can while these conditions exisit.

“I’ll be buying houses as fast as I can while these conditions exisit.”

Where are you talking about?

Because when I do the math for SoCal a landlord would be operating deep in the red at these prices…

RE still needs to come down 20-30% to be close to profitable in SoCal, and that’s not including growth of expenditures in taxes/insurance et al.

Doc, I’m sick of watching my hard earned savings sit in banks drawing less the 1% … I say it’s time to pick winners. Take, say B of A, that is concidered too big to Fail. Let’s all pull every dollar we have deposited in B of A – out, and place the money in the best, well run of our local Banks to encourage the other “T.B,T.Fail” Banks into behaving like “Banks” again and into making fair loans and paying fair rates, let’s take the premptive strike and hit them where it hurts most.Â

Is this legal? Could it work? I’m tired of waiting and losing the money I had hoped to retire on. So what’s your thoughts Folks?

Individually we’re powerless, but together…? What could it hurt to try?

A single T.B.T.F. Bank each month until they get the message!

Thanks for another great article Doc!

I agree with future price trends & the verdict for the Pasadena’s of SoCal. I was just beginning to get re-acquanted with the Inland Empire housing cycle due to the common sense writing here. Well now, I am totally stumped as I had to go to Santa Barbara county for some business and found that reality is way, way out of proportion in many communities here. We’re talking $500k on up for a shack and the ad always says, “…a great fixer upper”, to start with..

Being very familiar with SB real estate pricing, I can promise you that back in 2007, that $500k shack was going for $1M.

So, progress! Think positively here!

~Misstrial

“So, progress! Think positively here!”

You’re starting to sound like ol’ Jim Da RealTard pumping potential clients on what a genius he is 😉

lol, Newsboy:

Sorry, should have indicated “/sarcasm” after the post.

SB real estate is so overpriced that, imo, it will take ten years just to get to “somewhat” affordable. Presently, not even MD’s can afford to buy in SB. Until recent years, its just been real estate agents and mortgage brokers selling back & forth to one another.

~Misstrial

I agree with most of what you say, but don’t forget that this is the worst crash only because the high was so artificially inflated. If the market had been “normal” and then crashed, the difference wouldn’t be nearly as dramatic.

We were just looked at some open houses in Granite Bay the other day. Finally saw a house that we liked, in a really nice upper-middle class neighborhood, at a price we could afford. I just looked up the stats on this house on Zillow. Someone bought it in 2004 for around $800,000. It sold again in 2010 for about $200,000 less. And now a year later, it’s a short sale for about $50,000 less than it sold last year. Kind of says something about the trend. But it also brings up the question: when the hell are banks going to go back to 20% down? This home is on it’s 2nd distressed sale in about a year. I realize that if they ask for 20% down, there would be fewer qualified buyers, and that would force prices down faster. But there ya go …. now they’ve got another round of new home buyers who will have little personal stake in a home if the house decreases in value or they get hit by personal troubles.

When are banks going to require 20 percent down?

Well, depends on where you get your loan. Traditional lenders want *at least* 20% down and in many cases they want 30% down. Plus assets for each signing party, minimal debt to income ratios, and cash in the bank equivalent to 6-8 months of mortgage payments.

The problem lies with FHA which only requires 3 percent down.

Not sure about Fannie or Freddie loans.

However, in order to service voter populations who want access to cheap mortgage money, its unlikely, unless politicians who have the political will to say “No” are elected.

There are many foundations, activist groups, housing advocates, real estate lobbying firms, politicians who tend to be Democrat, and voters of various demographics who want 3% or even zero-percent down.

What’s that sayin’: “the populace has the government they deserve.”

~Misstrial

I have been a real estate investor since 1973. My rule has always been to purchase small rental properties if they are in good condition and if the monthly income is 1% or better than the price. I didn’t purchase many properties for 20 years but now I am purchasing again in the close-in subburbs of Metro-Denver if they are located well.

I agree, a 12% return on your investment isn’t bad. I have an REO in escrow right now, the banks are now letting go of inventory in my hood. This house was at the trustee sale only 2 months ago, for most homes in this area I have been seeing 12 – 14 months between auction and sale.

average income in my area is 55-60k – a decent house, nothing fancy, is still 250-300k – still needs to drop more than 20% to get me to pull the trigger…..

I flew back from Europe on friday last, i watched a film called inside job, wow, what a bunch of slime balls run our country, Remember WMD’s, if your not with us your with the enemy, we all went along with that idiocy. Then Paulson, The sky is falling, to big to fail, we went along with that crap as well. What next, Some future treasury sec, marching out with the President, If we dont re-set the currency IE: Argentina, we are going to be eating dog food by the end of the week. It really scary how passive we have become, still not a crook in jail for this mess?

PS. I just sold my live aboard boat last December, it was a fun 5 years, but not any cheaper than renting a small apartment in real terms. I really think living offshore is my option for a cash happy retirement.

I have the dvd of “Inside Job.”

Thing is, Charles Ferguson interviewed Dominique Strauss-Kahn, IMF Chief – the one who was arrested and charged recently for raping a member of Sofitel Hotel’s household staff and who is currently in jail on Riker’s Island.

Dominique was presented as a “good guy” on Inside Job.

Well, there went that…

~Misstrial

Yes, the IMF head is a serial rapist. A scumbag indeed, but I am not sure the movie was showcasing him for anything but his economic insights. How was he portrayed as a “good guy” and how would his violent criminal behavior change the validity of any economic opinions he gave in the documentary?

RentalLurker:

Strauss-Kahn has a long and established history in France for having problems with women:

http://www.theglobeandmail.com/news/world/with-history-of-sexual-slip-ups-strauss-kahn-arrest-raises-questions/article2026021

Although I agree with the tenor of “Inside Job” its too bad Ferguson could not have found someone else to comment in the place of Strauss-Kahn.

Such as Peter Schiff?

Or Robert Shiller?

Or Mike Morgan?

Jim Rogers?

Eric Sprott?

All of these men have extensive knowledge and experience with global markets and international monetary policies. Any of them would have been a worthy stand-in in lieu of Dominique.

~Misstrial

Dr. HB- We are slipping faster and faster into Depression here in the U.S. All of these stop-gap measures j,do nothing other than dig the hole deeper at the expense of taxpayers. The parasitic bankers, Wall Street and big businesses send us further down the river, as they tout nothing but utter lies, teeping the charade alive. Hard assets will be king, as anything that with perceived value (dollar..) will be proven false. Unfortunately, without jobs and incomes, our real economy and the housing market will remain in the toilet for years to come.

Look for real estate to decline at least another 25% from here.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Well, I’m looking for average wages to decrease by at least that much (if you’re employable), so I concur…

The similarities between perma-bears and perm-bulls are that they both eventually go broke. I’ve been a bear for a while, and although I know that I will never pick an absolute top or bottom, I do know when its time to start nibbling. I wish prices would drop another 25%. I just realized that my desire to see a bigger crash was coloring the reality. I want to buy a 5-plex in Santa Monica for 300k, but it ain’t gonna happen, ever.

Quix, things in this country are not perfect, or even great, but they are a lot better than you perceive them to be. I suggest you be a little bit more open-minded.

My $0.02…

There is a change in the supply/demand curve occurring that is rarely spoken to by the pundits. The greatest generation is dying. Their children–the baby-boomers are also starting to die. As this occurs there is a dilution of net worth that occurs as the assets of each generation are split into halves, thirds or more [depending upon the number of heirs]. As this then progresses over successive generations the net worth of each successive generation is decreasing–leading to a successively smaller demand for high priced homes. E.g., your grandkids will inherit about 1/4 of the assets that you own, assuming that the principal remains untouched.

Apply this to the RE market and one can easily see how the RE market will change because the demand side is decreasing. As the baby-boomer generation attempts to sell their McMansions upon retirement, there will simply not be enough demand to support the market price. This is before the shadow inventory issue enters into the calculations.

Couple that to the job market moving to areas where people and people related costs are lower and the CSI predictions of 2023 for a California recovery appear conservative–as it assumes [falsely] that demand will be consistent with historical figures. However, demand will not be consistent with history–and that is a major flaw.

You are missing a major conclusion from your assumption. Population increases over time. (and also in your example) That increases demand, as there are more people who need/want shelter. In addition, in you example, a baby-boomer dies, and transfers wealth via inheritance. The baby boomer dies with little debt, and transfers the wealth to, as you say, 4 people, or 25% each. Remember, in even the tightest lending environment, a 20% down payment is readily available for home purchase. So, in your example, the death of the baby boomer theoretically quadruples demand. (it’s not that simple, and it actually works out to closer to 2.5x demand, but that is still a big increase)

Jeff, while I agree–in principle–with the population increase and the creation of more demand via inheritance, I disagree with the assertion of LOCAL demand. Real Estate by definition is an asset in a fixed location. So while demand may increase throughout the nation, local demand is subject to local income streams. What I disagree with is the assertion that recovery of local income streams of enough individuals will recover sufficient to create demand in the local SoCal market in numbers great enough to support prices in this decade.

In other words, regardless of the seeming demand created by the redistribution of assets there will simply not be enough genX, genY, etc individuals making incomes required to qualify for (or afford) the loans in the LOCAL market.

So, while I agree with you about the demand increase, I am pessimistic about the demand increase in SoCal.

Thanks for you cogent response.

If the dollar is devaluing so precipitouosly, why do my muni bond funds go up steadily in value nearly every day? People are snapping these up for the yield, which wouldn’t make sense if hard assets were king. Maybe hard assets were King six months ago.

Pricing in QE3. If you backstop Agencies and GSEs, you might as well backstop municipals. What’s another few trillion to ensure state and local solvency?

When hyperinflation comes, you will be thankful that you own your home. Until then, housing looks like a bad investment. Only in a doomsday case of hyperinflation would a house look like a good investment now, along with a good shotgun.

The reality is that the Gov’t massaging of true inflation numbers has masked what it actually costs to build a house today and projections of cost into the future. When the glut of formally overpriced homes is gone that reality will become evident.

Also , the dollar has lost 50% of it’s value since 2000 and the effect of that has been hidden by a deflationary spiral which to a large part has been caused by housing. I am more reminded of the 70’s than the 30’s and anticipate a massive inflationary cycle that will make these now absurdly low fixed income mortgages look like the biggest gifts ever handed out by the banks. If you can qualify for one –take it- and buy a house now.

Leave a Reply to Rob