Housing Apocalypse Tomorrow – 675,000 homes in foreclosure have made no payment in over two years. The never ending pipeline of troubled real estate.

There will be no sustainable housing recovery until the shadow inventory is cleared out. As of April with the latest data close to 6.4 million loans are delinquent or in foreclosure. This is a massive number of homes. What is downright disturbing of the 2.2 million homes in foreclosure you have 675,000 homes (31 percent of the pool) that have not made a payment in over two years. That is right, two full years. Apparently one-third of the bank’s strategy in dealing with foreclosures is simply to ignore missed payments. Glad it took them giant bailouts and four years to figure that one out. The housing crisis strategy is really a banking-centric one and that is why nothing has really been resolved since the crisis started. Banks are dictating the movement going forward so the idea of keeping prices inflated is simply one to protect banking interests. Since the market has very little desire for inflated real estate, banks just slip it under the rug for another day. Keep in mind that many Americans are seeing lower wages so lower home prices are actually good for their bottom line since it eats away less of their hard earned income. Plus, one-third own their home outright and another 30 percent rent. So this idea of keeping home prices high just for the sake of keeping them high is a ploy that comes out of the suspension of mark-to-market logic. Do people finally get that home prices have to fall to reflect local area incomes?

The state of distress in U.S. housing

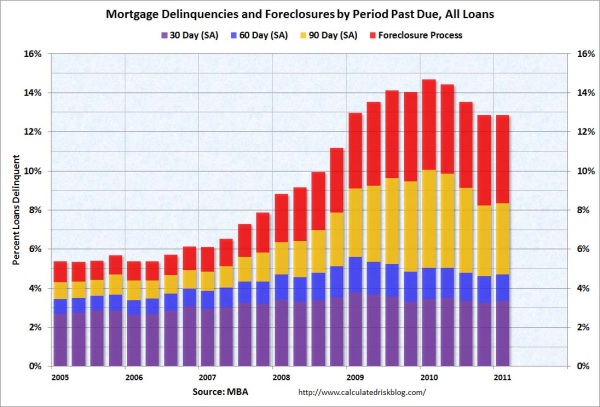

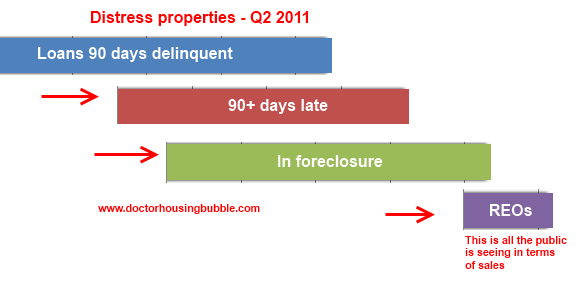

First, it is probably useful to get a sense of the entire potential shadow inventory out in the market:

Source:Â Calculated Risk

According to CR we have the following:

-2.24 million loans less than 90 days delinquent.

-1.96 million loans 90+ days delinquent.

-2.18 million loans in foreclosure process.-For a total of 6.39 million loans delinquent or in foreclosure in April.

That is a large number of homes. Now keep in mind many foreclosures are now starting to make their way onto the MLS since banks are actually taking full possession of the homes (although the reality that 675,000 people have not made a single payment in two years tells you where things stand). Think about the above data; you have roughly 600,000 to 800,000 as current REOs (all the way through the foreclosure process) but you also have 675,000+ people in foreclosure who haven’t made a payment in two years:

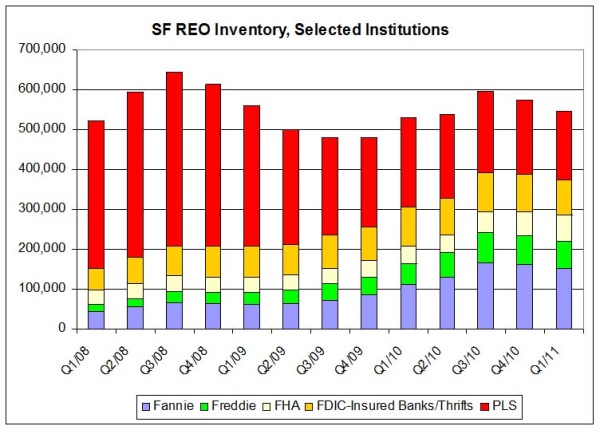

I’ve seen some pundits argue that many of these loans will cure. We know for a hardcore fact that if you are behind on your payments for two years it is likely that your home is going to move from the shadow inventory into the REO pipeline. This also doesn’t examine the fact that we have close to 2.2 million homes in foreclosure. How many have made no payment in one year? Keep in mind we are only looking at the foreclosure category so far. So the entire U.S. banking system is being overwhelmed with 600,000 to 800,000 active REOs yet we have that many in foreclosure without two years of payments. Here is a good estimate of REO data in the U.S.

Source:Â Tom Lawler via Calcualted Risk

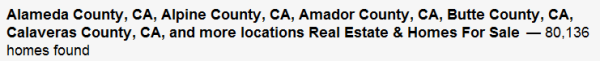

The above doesn’t cover the entire universe of REOs but does a good job. I went ahead and took a quick look at active foreclosures in the state of California and found the following:

Depending on what data source you look at California has roughly 80,000 to 89,000 homes that are REOs and ready for sale. That still leaves another 600,000 to 700,000 REOs across the country that need to be sold. You also have to wonder of the 675,000 foreclosures with two years of missed payments how many are in massively overpriced bubble states like California or New York? Well I can tell you that California currently has 157,000 homes in the foreclosure process that have yet to go REO. The bottom line is you have a massive pipeline of distressed properties waiting to make their entrance on the MLS stage.

And the foreclosures will work through the system like a rabbit filtering through a python. We have another 4.2 million homes delinquent where the foreclosure process hasn’t even started (1.96 million of the loans 90+ days late). Don’t fool yourself because many of these will end up as REOs at some point (could be years down the road given the absurd timeline we are experiencing). It can’t be stated enough that keeping the process slow and providing banks with trillions of dollars of bailout money is simply a method of clogging the financial pipes so the FIRE economy can figure out what other sector to gut and inflate into a bubble. In the end it is the taxpayer that will foot the bill unless something radical changes.

I wanted to draw the current distress universe to show how little of the shadow inventory is being shown to the public:

The bars are drawn to scale to show actual magnitude relative to other buckets. The only homes the public is viewing are those in the purple box above. But look at what we have coming down the pipeline. Things don’t seem to be changing so it is looking more and more likely that we will witness a Japan like real estate market with zombie banks walking the Earth in search of easy capital brains.

It is extremely troubling that we have so much money being lobbed at the banks with such horrible results. But what do you expect? Someone was going to pay for this decade long orgy in real estate. As it turns out it is the prudent public and middle class. The people living rent free are simply the other side of the coin to the morally bankrupt financial sector. We have to go back to watching archived films to remember a time when banking and finance actually carried a positive connotation.

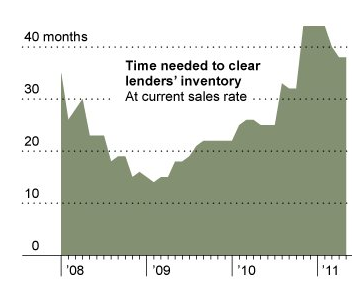

I’m curious to know how many people are living in million dollar homes rent free. We’ve seen homes in foreclosure in Beverly Hills so it is certainly happening and readers have sent over confirmation of this in their own neighborhoods. Talk about a giant mess. The New York Times had an interesting graph showing how long it would take to move 872,000 foreclosures:

Source:Â New York Times

It would take roughly 40 months to clear the current foreclosure inventory (aka the tiny purple rectangle in our earlier chart). And more will be coming into the pipeline but banks are trying to make their speculative gains in other bubbles to soften the blow here. After all, they wouldn’t want to spoil the trillions in loot they have stolen from Americans.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

110 Responses to “Housing Apocalypse Tomorrow – 675,000 homes in foreclosure have made no payment in over two years. The never ending pipeline of troubled real estate.”

So tell me.

If the debtor hasn’t made a payment for a year, the bank hasn’t issued a NOD, shouldn’t there be another category of shadow inventory that isn’t accounted for?

Oh…and has anybody else noticed that CR has become more and more of a “MSM” sellout?

I don’t think CR is a MSM sellout at all. I’ve discussed things with him directly, and he’s just very much a numbers guy. He and I disagreed twice on specific economic issues. Both times I felt he was too optimistic, that he sounded too much like the MSM cheerleaders, and both times he turned out to be exactly right. Lesson learned.

H

“I don’t think CR is a MSM sellout at all. I’ve discussed things with him directly, and he’s just very much a numbers guy. He and I disagreed twice on specific economic issues. Both times I felt he was too optimistic, that he sounded too much like the MSM cheerleaders, and both times he turned out to be exactly right. Lesson learned.

H”

Wow, that is amazing, “exactly right” eh? Specifics, please. Thank you. “F”

I would say that Calculated Risk certain borders on the “MSM sellout” side, by repeating propaganda without delving into the real data; or highlighting the downside of the report.

Take any of the Government data releases and compare the coverage to that done by CR, Karl Denninger, Reggie Middleton or Zerohedge in general. CR usually comes out looking like a fluff piece. I’m not a fan of Denninger, but he does get to the meat of the matter and has a minimum of BS about it.

At best, I take CR with a very large grain of salt. Often I dismiss them altogether.

My sentiments exactly.

Tanta was the one keeping it real on CR.

After she passed away, I’ve been on that site about three times.

Not worth my time anymore.

~Misstrial

CR has been right on the money every time. Ignoring his sight is not wise.

CR a ‘sellout”??? ANd what drugs are you takiing?

Numbers are numbers and that is what he usese. CR and I correspond a LOT discussing the underalying data.

I knew thirty years ago that something was badly wrong with this economy. I worked with a building contractor and part of my job was to assist in the materials purchase. I saw materials back then to purchase 2000 square feet houses in nice communities selling for twenty thousand dollars. My basic logic suggested that the legitimate price for the constructed home should have been forty thousand dollars….2 X materials…right? Do you honestly believe that the constructed home sold for that much? When I inquired with my supervisor he told me one hundred and thirty thousand dollars! That is a mark up of over six times, just in case you have missed it. I call it false value inflation, and that it why this economy is in a tail spin. I observed the same false value inflation in the grocery and retail business, where the values there are marked up more than ten times the purchase value..All of that is fine and dandy when the economy has more secure thirty year career jobs than people out there looking, but such is just not the case any more. Now one is lucky to be employed in a position for five years, and then with no benefits or pay raises…The system will be forced to adjust downward to accommodate this new reality, if we are ever going to have a recovery. False value inflation will have to go with the passing wind!

Your logic is correct but your multiplier is way off because you’re not accounting for labor or the risk associated with being in construction. If you want to use a multiplier go with 3-4x cost of materials because you have to account for a host of other direct costs as well as insulate yourself against all the risks and headaches that go along with construction…injury, stolen materials, mistakes and omissions during estimating, subcontractors who fail, etc, etc. This is why people who don’t own businesses have no business judging those who own businesses. Its easy to sit on the sidelines and make up numbers that “prove” whatever you’re out to prove.

Subject: Re: Quote by Thomas Jefferson “If a Central Bank is ever created in America-

Through Inflation and Deflation the “Bankers” will Rob The Americans”

****B of A to own Countrywide Mtg.(B of A will by itself control close to

40% of ALL USA Mortgages) with Countrywide

alone not counting the two below.

JP Morgan to own EMC Mtg.—Merrill Lynch to own Saxon Mtg.

(Talk about a Monarchies)

Subject: Quote by Thomas Jefferson “Is a Central Bank is ever created in America-

Through Inflation and Deflation the “Bankers” will Rob The “Americans”

This is the Truth-The Bankers created the S&L crisis and eliminated the competition and They created the Sub-prime crisis (The Banks create the product not the Loan-Brokers) and will eliminate the Loan Brokers.And have already procured the Treasury-and Federal Reserves’ approval and the Supreme court confirmation to go into Real Estate and as The now deceased “George Thatcher” ( Thatcher who started Sterling S&L and build it into Union bank and sold it to Barclays -Who sold it to a Japanese Financial concern) told me – The Bankers tried this in the depression. As the “Movie” ” A Wonderful Life” with Jimmy Stewart depicts” only this time the “Jimmy Stewarts of America” lose. Due to a ignorant Senate / Congress /and Public all to willing to buy the (BS) -That the Loan Brokers did it. And this way (With only the Banks left) the Public will save money with No competition (Wrong). Further the Late Senator “Henry Hyde” of Utah and “Henry Gonzales” of Texas held the Bankers at bay till “Henry Hyde’s” apprentice turned on him after he died and “Sold” out to the Bankers.

Lets start a petition and have everyone from the Homeowners’ losing their Homes to the Loan Brokers to the Real Estate community sign under this and get millions of signatures and STOP the Bankers before it is to late to save the “America” created by our Founders OR will we become like the “Serfs of Europe” in the 1300-1600s controlled by the Central Bankers as Slaves.

The plan is for a ALL powerful Federal-Central government to eliminate the States, And then , Run “America” Thru the Federal Reserve and its main Bankers .Example: B of A will control 22% of ALL Home Loans on the buy out of Countrywide. This means B of A will control more than 1 out of 5 Home

Loans. Remember the “Magna Carta” & the “Bill of Rights & The Sons of Liberty & Thomas Paine’s “Common Sense” & the Laws against Monopolies.

The Truth is the Loan Brokers (were pawns) and for the most part made a living and sold their Loans to the big Banks who were not at this point controlled by Respa and resold the Loans at Multiple profits to the (GSEs). Compare the Loan-Brokers commissions with the Bankers.” The BANKERS HAD THEIR HIGHEST PROFIT in HISTORY” from 1999-2006 who. and now are crying “Wolf” .

Our founders refused to have a Central Bank– until the Traitor- Wilson “SOLD” out with J.P. Morgan’s”

Help creating the “Federal Reserve”

We had absolutely no national debt, had the largest middle class in the world, and Mom stayed home to raise the kids.

Read what Pres. Andrew Jackson Pres. Thomas Jefferson and Pres. George Washington thought of the Central Bankers.

The Treasury Department’s plan to revamp regulation of the nation’s banks, thrifts and investment banking firms is (so we hear) going nowhere fast. The blueprint – among other things – would eliminate state banking charters. As we all know, state chartered banks are at the center of the nation’s mortgage crisis because they’re the ones who created all those risky loan programs, securitized subprime mortgages, and sold them overseas in the form of CDOs to foreign investors. Ooops, I’m sorry that’s Wall Street where Treasury secretary Henry Paulson used to work. If I were the head of a community bank trade organization I would attack the monster that created the mess: Wall Street. How best to do that? Answer: resurrect Glass-Steagall which (until it was torn down by Congress last decade) prohibited investment bankers from owning depositories and banks from underwriting securities..

I agree that the banks are, if not intentionally, circumstantially manipulating everything in order to gain control and power in order to gain access to the main artery of money that their parasitic nature desires. Over the course of history, and increasingly so in the modern times, banks have always had their dirty hands in every major problem and have always used power and influence to come out on top and even benefit from their own mistakes or disasters they created purposefully. In an information age like today, banks should essentially be unnecessary, what is money, digits, numbers. Just like the print media used to needs offices, printing presses, fleets of delivery logistics, and deal with excess prints etc. and now are not necessary because digital creation and delivery of information has made all those costs unnecessary; banks have no justification anymore in the form they exist. Loans and deposits should be easy to process and handle and track and manage and administer and cost practically nothing. I know there are other aspects to banking, but there is something seriously foul afoot.

The single most powerful thing people can do to take the power away from Banks, is to live frugally, under ones means, and save the money with a responsible institution.

Our whole economy has been and is being rigged even more by the day. I have a dire suspicion that Americans will not notice it thought until it is far far too late. We just don’t have the history and common sense needed to realize that getting in bed with the mob is a bad idea; always.

And if we live frugally and within our means where do you wish we save our hard earned money and in what form?? Because if it is in a bank as the U.S. dollar created by the private banking monopoly the FED, then we will all lose!

The first chart is very interesting. It shows that the peak for number of homes delinquent or in the foreclosure process was actually in Q1 2010. And it’s been trending down slowly ever since. This runs counter to the idea that the foreclosure problem is getting worse. I mean, it still looks awful, but could it be that things have stopped getting worse and may be even improving slightly?

A question is why is there this slight improvement. According to CR, Fannie and Freddie are now selling foreclosures faster than they receive them. It’s unclear to me whether this is also happening at other financial institutions. In any case, the tsunami does not appear to be getting bigger.

H

My comment above in way means I think the housing market is good or even getting better. it’s clearly still in a disastrous state. And if the banks ever do get busy really clearing out their foreclosure inventory, it would probably crash the market again.

H

As the Doc says, prices will inexorably move toward alignment with income demographics and as prices fall, more will go underwater triggering more walkaways until an equilibrium is found at 3 to 4 times annual income. People who think a “recovery” in prices can happen, simply don’t understand the problem. Forget the Realtor rhetoric from the past; there is no mechanism by which prices can rise without incomes also rising. It’s a full income doc world now. Get used to it.

“The first chart is very interesting. It shows that the peak for number of homes delinquent or in the foreclosure process was actually in Q1 2010. And it’s been trending down slowly ever since. This runs counter to the idea that the foreclosure problem is getting worse. I mean, it still looks awful, but could it be that things have stopped getting worse and may be even improving slightly?”

“My comment above in way means I think the housing market is good or even getting better.”

Huh? Best one keeps one’s trap shut when in ignorance one revels….

It’s not clear from the first chart whether the homes in the “foreclosure process” includes the ones which have been sitting around for years without a NOD. That’s what this article is about. The chart implies that after 90 days things go into NOD. But it doesn’t state that. If the Banks are ignoring missed payments after 90 days, that chart is bogus.

Also keep in mind that the chart is from Calculate Risk. They have a habit of really not digging into the data, and tend to portray things on the optimistic side. Too often, I’ve seen the deeper data, and it doesn’t indicate what CR’s rosy interpretation suggests.

Keep in mind two things:

(1) that Fannie/Freddie are NOT the ones processing the foreclosure. That is done by the loan servicer; and

(2) Fannie/Freddie have been forcing a lot of the underwritinglenders who sold them the loans to take them back. Watched that happen with several foreclosures right here. AAnd then the foreclosure shows up as owned by CHase, BOA or whoever.

Dr. HB

Some would like us to believe that R/E squatting is “good” for the economy in that households that don’t make mortgage payments now have extra cash to spend for consumables or supposedly save up $$ for a downpayment on another piece of R/E.

I call this phenomena “Do it yourself HELOCing”.

Of course, schemes like these whether intentional or not net out to yet another misdirected transfer of wealth.

I have read articles that the [surprising] uptick in consumer spending was a least partially supported by R/E DIY HELOC cash flow.

I wonder if such a scheme could be supported into perpetuity with endless QE* streams of cash from the FED to the banks?

I have had the same idea, but disagree. If all homes were foreclosed on quickly and the market allowed to “crash” then the cost of housing will go down for renters. If the market were allowed to correct maybe I could negotiate a lower rent based on market fundamentals or maybe I could buy a house and lower my monthly cost. You see nothing is “free”, someone will pay. If my neighbor is not making his payment (in fact they haven’t for over a year) and is still in the house then by default I am paying for it in higher rent, because of false valuations in a false economy. Sooner or later it will balance out no matter what the cronies do (gov’t/banksters etc…)

TRUE capitalism does work, but Crony capitalism screws everything UP.

They will try. That’s what the game plan is all about. Unfortunately the Fed doesn’t doesn’t dictate things. They project the illusion that they do, and many people swallow it hook, line and sinker. It’s the Bond Markets which dictate things. The Bond Markets are much, much bigger than any Central Bank, or all of them. They have always eaten Central Bankers for lunch when the Vigilantes come out.

If you have any notions to the contrary, just look at Greece and Europe right now. And basic history for an education.

So, no, they cannot keep this going forever. But they can keep it going for a while. After Europe implodes though, we’ll be one step closer to the end of QE.

“The Bond Markets are much, much bigger than any Central Bank, or all of them. They have always eaten Central Bankers for lunch when the Vigilantes come out.”

I have spent most of my investing life believing that one. With every passing day it is looking more and more like that is the belief of a sucker.

On top of the increasing evidence that the FED does control the long yeild, wouldn’t the FED want everyone to believe……….”If we did anything that was too out of line the bond market would punish us with higer rates”.

Well, the FED has done everything but set Grandma on fire and 30 year rates are near record lows.

Yep, there are plenty of central banks that have had to submit to thewrath of the bond market but I dare say the largest cental bank, the central bank of the worlds reserve currency, is not just another central bank, it is THE Central Bank.

Martin: What you’re suggesting is that Ponzi schemes are indeed sustainable. Good luck with your investing on that premise. You might try and get Bernie Madeoff to handle your funds.

The Fed has vast influence. Supposedly they haven’t even touched the scheme whereby they keep rates lower via derivatives (as they did back in 2001). That is certainly a lot of power. And it’s also unfortunately the way AIG blew up.

If you are investing without realizing these risks, well, good luck to you. And don’t go whining when it crashes again like in 2008. Just one look at the housing market ought to tell you that they aren’t omnipotent.

At the same time, I wouldn’t ignore their influence at present, by any means. I’ve made good money off of their printing. I intend to again when they start up QE 3.

I also intend to be out when this scheme does come crashing down. That means either not tying up wealth in a house, or being able to live with the losses when they come (which I expect to be substantial).

You sure put a lot of words in my mouth.

The only thing I am suggesting is the Fed has far more control of the bond market than it lets on, but yes, it is manipulation, not the free markets at work. It will come crashing down at some point and the crash will be that much bigger.

I have been 100% in the gold sector since 2002 because of the looming disaster the FEd is setting us up for.

My post was pretty straight forward and I don’t mean anything other than the following words……… The FED has more power over the long yield curve than it lets on.

Everything seems fine on a sinking submarine until the hull caves in. The Manhattan vampires need fresh blood–Totally agree. The financial shadow game goes on but the ratio of tangible output to demand worldwide lies under the surface. There will surely be hell to pay and the only uncertainties are start time, duration, severity and what emerges from the ashes. The next age of enlightenment may be a long way off.

In a part of the country, like Seattle area, that has not experianced a high rate of foreclosures………why would Chase let a loan go with no payments for over two years? Could this indicate some other type of loan problem? Thanks Jerry

Yes. It could indicate that they have lost the note and are no longer able to foreclose. This is extremely common if you’ve been reading the real news (hint: Not CNN).

If only you could get this type of good information out to the mass media and they would publish it, the citizenry would better appreciate what is going on. My local paper, the San Diego Union Tribune, as well as better papers like the WSJ, keep trying to show that everything is just fine in real estate.

Thanks Doc. always on point. I have concern that a large portion of homeowner are active short sales with current payments. Is there a way to track these disstressed homes? also, I believe we will see a large porition of homes that had loan modification with 40 year terms will trend into Short sale or forclosure. Those homeowners are going to realise they are paying 2 times as much princpal/interest over 40 years . meanwhile thier new neighbor just bought a model matching home half the price, 15 year term loan, and lower payment.

I learned last night (5/26/11) that a friend’s deceased parents’ house in tony Palos Verdes, CA, which had not been substantially modified since they bought it in the 50’s, sold for $1.4M inside one week without an open house. It has an ocean view to the west.

I assume it was paid off years ago.

I don’t know what to make of your post, without neighborhood comps, county appraised value, actual address and pics, etc… you sort of imply it’s a “junker” because it hasn’t been “modified” since the 1950s, but, OTOH, there were some VERY chic Mid-Century Modernist (“MiMo” or “MidMod”) houses built in CA in the 50s, and to “modify” them in any noticeable way will actually LOWER their value. It sounds like a primo lot, so perhaps it’s a desirable gem of a house, designed by… Ain?, Eichler?, Koenig?, Neutra?

In any event, it’s a single data point. Foreign/domestic buyer would be interesting add’l data, whether cash/financed, etc.

If your friends no longer live there, why not post the address?… just sayin’…

Enzo mimo – Your posting shows real class… A relative dies…

OK Mr. Somis, aka Conscience of The Free World (self-appointed, nach):

a) “Sensitivity”… it’s not a relative of the POSTER, but a parent of a “friend”, a friend they’re apparently not that close to, given the implied delay of news propagation, and the (again implied) sense that poster did not even know the deceased parent… I could be wrong, it’s only a blog/twitter-thaaang, after all.

b) “Decent Interval, et al”… can’t speak for probate in Cali (without calling a lawyer relative who lives there), but in most states East of The Miss, if the house sold arm’s-length (i.e. to a non-heir, open market), then that parent has been “gone” for at least 2 months, and more likely 3-6 months… depending on how well they “had their affairs in order”.

Sorry if my proposition seemed a bit glib, but the poster is at least twice-removed from the decedent, and some time has passed, and… IT’S ALL A MATTER OF PUBLIC RECORD… we’re not talking about who got the family silverware, nor who was cut out of the Will… ;’)

Cha-Ching! Tough way to earn a living, by inheriting it.

Yep, and they’ll piss it all away in a year, living like rock stars, then spend the rest of their lives talking and obsessing about how they were once “rich”. LOL

No one has seriously mentioned the concept of “cure rates” for over a year now, and that’s because we’ve now crossed a unique “event horizon” for the very first time in American history, i.e. near ZERO cure rate for anything over 90 days deliquent, and guaranteed ZERO cure rate for any prop 180+ days overdue… these rates used to be (IIRC) up in the 40+% and approx. 15% ranges respectively… a big part of this is banksters’ complete lack of incentive (thanks to wads of YOUR $$$) to “cure” anything–and PRINCIPAL REDUCTION was NEVER seriously on the table–but perhaps the even bigger story/sea-change here is the sheeple have lost not only any realistic means (income) of “curing”, but also they’ve (understandably) lost any feeling of MORAL OBLIGATION to “settle up”… as Balzac posited 2 centuries ago to the French aristocracy, why should the plebes be better behaved than their “betters”???

No, you can take “cure rates” out of the equation altogether. I can not find one single case of it anywhere in So-Fla… not from combing online county records, not from RE broker contacts, and not from news sources which would POUNCE on such a “happy shiny all-is-well” story… nada, zip. No, for this Bubble POPping, once it’s in the pipeline, it’s staying there.

Thanks again for another great look into the bank created debacle.

One thing I would like to point out, that nobody has mentioned, is the fact that homes are “living” domiciles. They move, settle, and generally require some annual upkeep.

The banks, in order to keep their inflated home values, are sitting on a considerable amount of inventory already that nobody is maintaining. The longer these houses sit vacant the more they will deteriorate.

How long before that over-inflated asset becomes a condemned pile of building materials?

“How long before that over-inflated asset becomes a condemned pile of building materials?”

Varies greatly, depending on local climate, building materials, and construction methods. Needless to say, the sparsely inspected tract-shacks thrown up circa 2001-2006 will probably not fare well, especially if looters, intent on stripping copper, granite, etc, have left the building’s “envelope” vulnerable to rain and dust intrusion.

MILDEW is a huge issue here in sub-tropical So-Fla, plus we’re facing a more active than average hurricane season. The contaminated CHINESE DRYWALL is now OFFICIALLY (by county prop appraisers) considered to reduce a SFR’s value by a full 50%!!!

So yeah, those 20 cents on the dollar “deals” aren’t always the “steal” they appear to be on paper. At a certain point, a cleared lot is more valuable than a severely degraded house, due to demolition and disposal costs, not to mention lower taxes on the empty lot.

Joe, you are so right.

There is a house in our neighborhood that has sat vacant for over 2 years. Owner hasn’t paid his HOA fees in 3 years, although I’m not sure how he stands with the bank. The house looks OK from the outside, but the yard is dead. I don’t believe they’ve run the A/C since the last renters moved out (in central Florida!) I’ve seen a couple bank notices on the door, but no other activity. There are zero vacancies and zero properties for sale on our entire street, so this house can’t hide in a herd of distressed properties. Its just a shame that the bank doesn’t take the haircut and put this place on the market.

If the banks release all of the shadow inventory , an other tsunami of walkaway will happen. I know few people will do it, include myself. Then will buy back the same house with cash

LOL… I believe I’ve already uncovered 2 cases of this, but family members acting as straw-buyers were involved. Probably raises less scrutiny if family member has different surname.

I like the stacked bars as a reference. Too bad we can’t also see the short sale inventory.

Probably three more years for the housing market to stablize. Go away and come back in three years. It is like being the captain of the Titanic in the fog. The future is unclear. The world economy is uncertain. Party on.

For the foreseeable future we’re going to have two housing markets – distressed and non-distressed. The distressed market’s a fraud-ridden wild west with colluding all-cash buyers and crooked realtors flipping on the same day for big profits. The non-distressed market will be people who are current or have no mortgages, but who want/need to sell in order to move to another job, upsize or downsize. They’re living in a fantasy version of the past, when a “normal” real estate market existed. These non-distressed sellers — as friends of mine who are in that situation will attest — are in for a big wake-up call when their overpriced homes sit on the market for months and every Sunday becomes another brutal day at home cleaning up for yet another open house that yields no offers.

Dr. HB

***************

additonal thoughts

***************

Is it possible that we will see non-payment of mortgages exceeding 3, 4, 5 or even 10 years?

Certainly we are in uncharted territory.

Do any historical stats exist for non-payments that measure out 3,4,5 years?

Uncharted territory indeed. Except that there are numerous cases of crashing bubbles throughout history. Only this time, the Fed is so smart it knows how to mitigate the crisis, or at least hold the lid on the pot until it explodes. A simple analogy would be to turn the heat down and pull the pot off the stove, but these guys think you need more heat…

And the new report says pending home sales is down. I know, I know … it’s the weather. Though where I live there have only been some unusually cool evenings and a little rain, and in looking around at nice areas I’m seeing homes come down to reasonable levels and still sit on the market. On top of that, I’m seeing a lot of homes over $400,000 advertising that they only need a small downpayment with something like a 560 credit score. 6 years ago homes like that would have been snatched up pretty quickly. I think it’s interesting that many homes are coming down in price, some by %50 or more off the peak. We still have very low interest rates, and they still take much less than a 20% downpayment. And homes are still sitting there waiting for buyers.

I remember posting on this blog 2 years ago that I hadn’t made a payment in 6 months and hadn’t even gotten an NOD and being surprised. I have done nothing to try to slow the process and now its bee 30 months and the process still isn’t done. I’ve been waiting for a DIL to “record” for about 3 months now. Its incredibly difficult to get the bank to foreclose on a home even if you stop making payments and move out. If people trying to get the bank to take back their home can’t even done it imagine the ones that actually put effort into delaying the process. I’m thinking you will have a large number people who haven’t made payments in 5+ years in another couple years that still haven’t been foreclosed on. Banks have some false delusion that if they wait long enough values will come up. How is a loan 2 years delinquent going to cure? I guess if you do a mod you could call it a “cure”, but when you have a 500k loan with 150k in arrears from not paying for 2 years and they give you a 4% mod but tack on all the arrears does it really help the situation? Eventually that home will have to be liquidated.

If the Bank hasn’t changed the ownership on the records, aren’t you still liable for the property taxes? I know there have been stories about people who have moved out and are later surprised that the local government is after them for delinquent taxes.

This might be part of the reason why the banks aren’t moving on some properties. Another one, as I mentioned above, is that they destroyed the note and so they can no longer legally foreclose.

Question for ya, DG. How does the IRS treat the ‘free rent’ or whatever you want to call it when a mortgage payer stops paying? Are there any tax consequences at all, other than the real estate taxes someone mentioned above? As an aside, it is my understanding that real estate taxes are going up in my area, because they conveniently ignore foreclosure sales in determining property values.

It is my understanding that there are tax consequences from exiting foreclosure. For example, if one owes $300,000 on a house and the bank forecloses and sells it for $200,000, then the foreclosed borrower has $100,000 in forgiven debt which is taxable, right? Or is it calculated differently?

Here’s a visual of the housing market fundamentals. I’m serious on this one. It’s not looking good. I guess you could say the housing market is an A-bomb exploding in slow motion….

http://noscope.com/photostream/albums/various/A-bomb.jpg

“Probably three more years for the housing market to stablize.”

With 40 months of backlog _now_? That’s more than three years even if no new ones appear. And if you believe that, I’ve a bridge to sell you, very cheap.

I’ll say no way below 10 years and 20 is probable. The amount of overpriced houses in banks assets is huge: I’ll say that hardly a 1% of it is visible to public.

Just a guess, of course, but mandatory for the banks: If they’d write down their assets (“real estate”) to current value, all of them would be instantly bankrupt. Economical suicide. Thus extend and pretend is the name of the game.

Thanks for touching on the suspension of mark-to-market accounting and falling home prices in relation to falling wages. The Realtor friends I have act like lower prices are the end of the world. Far from it. More people can buy and less of their earnings goes to inflated housing costs.

With Realtor friends who needs enemies?

Who’s paying the property taxes, sewer and water?

One would assume that as long as they keep those bills current, the bank grants them unofficial squatter’s rights. But good question. Crime would soar if all the sheriffs had to spend all day foreclosing houses and condo’s. People would go around without their seat-belts, driving 11 miles over the posted limit, talking on their cellphones–it would be utter chaos.

Has anyone else noticed that mortgage rates are at the lowest for the entire year, and right in the middle of the big Spring selling season. Yet home sales are declining!

We might be in the middle of a phase transition here. I somewhat pity the greedy suckers who are buying right now.

Greedy is probably not the best explanation. I’m sure they are just as much in despair as others that housing is so expensive. It’s no longer a financial investment but people just wanting to go on with their lives. On the surface, there is no plausible explanation for why housing went up so much and why it hasn’t retraced as much as it should. Under the surface is the Manhattan Project, designed to inflate our way out of unserviceable debt, while draining the resources of the American people to support their tiny imperial island. California squealed when Enron was bleeding the state dry, but somehow hasn’t made the connection to Manhattan and what a disembowelment has occurred.

Read some of the Doctor’s previous articles. NPR did a great story explaining the complex derivatives and CDO’s in terms gentiles can understand. Of course they haven’t stopped–as Doc reiterates frequently they are now using FHA to backstop more of the same thing.

For some of the young reader, we had something on a smaller scale in the 70’s and 80’s that ended in the collapse of the S&L business. The US hasn’t even paid for that criminal fiasco yet.

There are lots of aspects to this mess, certainly. But with the FHA doing 90+ % of the mortgages out there, with as little as 3% down, greed on the homeowners part is a big part of it. It’s like nothing has been learned from the 2006 bubble. But this time, housing is going down by 1% a month; there’s no euphoria.

It also takes two to tango. Without people reaching for the easy cash, the Bankers wouldn’t be making loans.

It will be amusing to see all of those new buyers underwater this time next year. The only good thing that I can is it will tie up the competition for years to come.

You are the greedy one Quest… Like Scrooge sitting on his pile of gold waiting to die with millions in the bank and no fond memories of a home. How is buying a family home to live in greedy… Its my opinion those buying now will be rewarded.

Alot of people on this board need to learn to live a little and stop counting the change in their piggy banks… You will probably die in your 50s anyway… So what are you saving for?

Dr. HB has keenly emphasized the importance of employment and salary levels as keys to the housing market. To get first hand and incredible look see below what a loss of government jobs can do to an area’s real estate. Could this happen in Southern California defense contract punch bowl?

http://www.zillow.com/homes/Titusville,-fl_rb/#/homes/for_sale/Titusville-FL/7433_rid/28.639866,-80.60469,28.479141,-81.091521_rect/11_zm/

Already has. Late 1980’s & throughout 1990’s.

~Misstrial

Agreed Misstrial (my favorite username)

The Military pork is distributed to all 50 states and a bunch of countries. Just like Detroit and much of the rust belt has been dying for decades as the auto industry and others sink into the abyss. I believe Hunter Thompson wrote:

In a nation run by swine, all pigs are upward-mobile and the rest of us are f’ed until we can put our acts together: Not necessarily to Win, but mainly to keep from Losing Completely.

@Jake

That is a disheartening link–lotta red. Just like all those tornado victims aren’t just statistics but real people, all those distressed homes are owned by real people.

I am only interested in one area to buy so how the market is doing for the rest of the country is irrelevant to me.

Unfortunately the area I want to buy has very low inventory and every buyer seems to have the financial means to do it. As a result I am becoming just another frustrated buyer lookin in from the outside.

Oh this area is in a nice area in San Diego. Grrrr

@tbear,

As long as there is the huge military presence in San Diego and the climate and scenery are nice, the prices will be distorted. On top of that, the bubble is still alive and well. Personally, I was born in the desert but I hate it. Obviously, others don’t.

With any luck, the next time there is a raging fire out of control, maybe there will be massive destruction and desirability will drop. Hopefully that is not what you want, so unless you can get on the MI-Complex gravy train, get used to being the boy outside the bubble.

MP:

Its really not the MIL that influences pricing in SD; most military families live on base in military housing.

Its Big Pharma, the medical industry including teaching hospitals, and UCSD. UCSD has a medical school and school of law. When you put both of those together, you get an effect similar to Palo Alto with Stanford U and Menlo Park: high home prices.

~Misstrial

Just to be clear, obviously the soldiers aren’t making the money; but the businesses and contractors that support the bases and the money that flows through and multiplies to the surrounding communities.

Good point Misstrial–lots of places have bases, but none as expensive as San Diego. Used to live in Raleigh, NC. Lots of Glaxo-Merck and all the others. Duke, UNC, lots of pharma-dollars in RTP. Lots of Pharmacy, Nursing, Medicine, Chemistry schools everywhere.

Great article as usual. It is really refreshing to get the straight scoop about RE on this web site. The main stream media is, of course, ignoring the entire issue. Extend and pretend ad nauseam.

Carry on,

Peter

the doctor has rightly pointed out that students with massive debt will not be buying homes. Below the radar is the fact that health care costs are about to explode upward as the bankrupt government will not be able to continue medicare as we know it and consumers will be forced to pay much more out of pocket for quality care. As health care costs rise, less money can me directed to living expenses. I am including this fact in my retirement calculations.

true that drdan.

People think Obama-care is about the gov wanting control of the medical industry. That is simple-minded ignorance. The reason is that Medical costs will bankrupt the nation faster than anything else. US is on the hook for Medicare, medicaid, pensions that will fail first from exponential med costs, states that won’t be able to pay the med obligations, and the list goes on and on.

The Manhattan Project is about creating a debt bomb so large it destroys the third world, including the American Middle class. Housing is just one symptom of this pandemic.

Clark Howard on the TV right now. Couple has 140k in student loans, wants to by a house and Clark gasps! No way these guys buy a house until they work those nuts down. The whole thing is a fairy tale: borrow a zillion dollars, get an MBA, live happily ever after.

Clark made his fortune by saving every other paycheck–50%, then starting a business. Manhattan tells us “for everything else, there’s Master (Slave) card”. Guess who’s the Master when you put it on you card. Guess who’s the master when you take out a second loan. Guess who’s the master when you way over-pay for a home?

I understand. I made stupid decisions when I was young to keep my hottie at home. In the long run, didn’t work anyway. A couple needs cooperative synergy–not a life of serfdom in the Manhattan Projects.

ZINGer!… love the over-arching motive for you username. I assume you face the same frustration as other Dr. HB readers when you try to enlighten family, friends, and neighbors to the truer NON-MSM, NON-NAR picture of what’s going on.

“The housing crisis strategy is really a banking-centric one and that is why nothing has really been resolved since the crisis started. ”

Will add that housing is an asset bubble driven like all bubbles by leverage and liquidity and in this case government tax policies becomes part of the leverage.

In normal markets inventory levels, buyer income levels, location play important roles in defining the market prices but American housing has been in an asset bubble phase for several decades so conventional bench marks don’t provide the predicative roles they should in a normal market.

My stepson’s best friend and his family *finally* got kicked out of “their” home after stopping payments THIRTY MONTHS ago.

And the sad thing is they didn’t save any of that money. Dad got a new truck, Mom got a new car, and now they’re scratching to come up with a the first-last-deposit to rent a place.

What’s wrong with these people???

http://hypertiger.blogspot.com/2011/04/screaming-for-salvation.html

The problem now is that the US Consumer reached maximum potential in 2008.

The lower rates go the greater the volume required…because there is a cost.

The required yield is…not too much…not too little…but always greater than previously.

But something new showed up…Because US consumers have basically reached the point where they have requested their maximum amount of debt to be manufactured by commercial banks…they can’t sustain the volumes required to allow the continuing drop of rates.

The FED was finally forced to use unconventional measures…

So the FED for the first time in decades was forced to build a floor under bonds by buying them…As opposed to the manipulation of Congress into increasing the supply to absorb demand like all the previous times…

Due to the elimination of the consumer from the equation, the FED had to become the consumer, The flow has basically stopped and reversed…yields should have stopped dropping and rocketed up.

The US domestic economy along with the 1944 global trade system should have imploded…It was..still is.

*Game over*

This is the end of the line for the baby boomer ever-inflating economic model.

It broke in July-August 2007 when liquidity froze (which is when I removed the ca$h I hadn’t invested in Ag/Au) and the new normal has yet to be believed or even seen by the general populace…

If you’re buying anything right now you’re a complete and total fool – You’ll also be among the first casualties in the coming new economy.

In exponential growth there comes a point where you are forced to blast off…that’s what the 2008 cave in was…

That point has to be returned to and surpassed in order to recover out of the depression the global economy is headed into.

With exponential growth…the longer you move in a direction the quicker you arrive at the logical conclusion.

Whipping an exhausted horse to gallop twice as fast as it just did the past 65 years is not going to work.

The top knows it’s game over – They have known all along that it’s impossible to sustain exponential growth and they have also known all along that demanding a fixed yields year after year is exponential growth – Only fools thinks they’re investing for the future…

All they are doing is slowing down the process as much as possible so you all can adapt without flipping out.

Of course at the bottom it will be very ugly, but that is still a few years away…

I know the topic is on the housing market but I think it becomes moot when applied to the real problems facing the nation. The USS Titanic is sinking, while those in power are rearranging the deck chairs and acting like the iceberg is still ahead, when it has already delivered the fatal blow.

Of course the imbeclilic passengers, not realizing that the unthinkable is happening, will do what they always do in this situation. They will simply decide it’s time to replace the incompetent Captain and crew with another incompetent Captain and crew and the problem will soon be resolved. Sure – works every time.

Bottom line message is stop worrying about one single facet of a much broader and more serious problem. It’s time to man the life boats because the Titanic is going down and it doesn’t make any difference if you were travelling first class or were a stowaway below the deck.

The US has become a nation of feeble-minded, weak-kneed sheeple that are easy prey right there for the taking. Many have lost their jobs and homes, so what’s next? If you don’t have an answer for that question, you’re in worst trouble than you think.

Seems about right, but this is a whole new experiment: Counterfeit your way to prosperity, and carry a big enough stick to beat the crap out of anyone who won’t give you oil, cars and flat-screen TV’s. Maybe this Empire thing will work out just fine, as long you’re OK usurping the wealth of the world to maintain dubious opulence…kin of makes me sad that all the soldiers gave their lives so “…that government of the people, by the people, for the people shall not perish from the earth” Abraham Lincoln

I just hope God’s not up there saying, we’ll I gave them another shot at it…too bad.

A general question.

When will obtaining title by Adverse Possession start to be an issue?

Thanks.

Irvine Renter has a good, short explanation:

“Adverse possession is one way to obtain property, but it is difficult to do. The use of the property has to “open and notorious†meaning the squatter must visibly take possession. Then they must pay the taxes. Most people who own property pay the taxes, so if someone else started doing it, you would find out as an absentee owner and go protect your property rights.

Most cases of adverse possession is by family members who have a sibling that doesn’t pay taxes on an inherited parcel. For instance, Brother Al is an alcoholic who can’t hold a job. Brother Bob is a hard-worker who is responsible. The parents die leaving Al and Bob a property. Al never makes his payments on the property taxes and disappears for 10 years. Brother Bob pays all the taxes and builds a new home on the inherited parcel. Brother Al shows up and demands half of Brother Bob’s house. Brother Bob says the property is mine now due to adverse possession. If it goes to court, Brother Bob should win that claim.”

submitted by ~Misstrial

DH

Alert

Crystal Cathedral selling land to a developer for $46Mil with option to buy back later at only $30Mil

Just negotiated with my landlord to lower my rent on a SFR here in San Gabriel Valley by 12%. I am not in a bad part of town either, with lots of demand for housing here due to the school system. Anyone thinking of buying now is categorically insane as the rent/own cost differential becomes increasingly wider. Prices in South Pas, San Marino, Arcadia, Temple City, Monrovia, are still way overpriced as clearly evidenced by the cost of renting compared to purchasing. Sellers are delusional thinking they can sell at 06 prices.

The crazy thing is that here in So. Pas, houses are selling fast and for over asking. People are nuts. They are hypnotized into buying into the So. Pas school district when it would be cheaper to rent here instead.

So, where am i misreading all this? Your charts sure as heck look like the worst is behind us, and its getting better now. Your foreclosure and REO charts show peaks in 2010, right? Unless I am missing something, you might be convincing me to buy with that info!

@Jeff,

You are kidding right?

1) hundreds of thousands of homes in various stages of foreclosure

2) College grads with so much debt they couldn’t finance TV set, let alone a new house

3) The only recovery is huge bailouts and the Fed buying treasuries to keep mortgage rates artificially low, while mortgaging the economic future of the entire country

4) The only jobs are Walmart, MacDonald s and repo truck drivers.

5) California economy on life support (wait until they close a couple bases like they are all over the country)

Read some dude, don’t just look at the pictures…

Manhattan Project, the typical American still thinks everything is still just a bump in the road or a temporary set-back before the Phoenix rises from the ashes again. Few realize that this is the end game and the hole that has been dug is too deep to crawl out of. That mentality and thinking is one of the major reasons why we are in this mess to begin.

You’re dead on with the reasons why the housing market is nowhere near a bottom or recovery. Pretty much every government program that was going to revive or rescue the housing market has failed and/or ended. Underwriting and loan approvals have tightened, not to mention the ever increasing numbers who are getting behind on mortgage and other debt repayments, killing their credit scores to levels they either don’t qualify for a loan or couldn’t afford the payments/fees. Basically, what we have in the housing market is a log jam, not unlike the situation that plays out daily in DC with our legislatures.

How this plays out is anyone’s guess but I’m not very optimistic as I see nothing but dark days ahead. To me it’s no longer a question of if it hits the fan, it’s now just a question of when.

The problem is that the government claimed to have defused a bomb when all they really did was slow down the pace of the ominous ticking. What happens when the banks come begging again and there is no way to foot the bill because the dollar is in the toilet and nobody will buy our debt? The bankers walk away rich from the smoking wreckage but everybody else learns what their grandparents tried to warn them about when talking about the Depression.

Keep in mind, what Dr. HB is covering here is just residential real estate. THere is also a massive problem in commercial real estate. Got any ghost malls near you? I’ve got one just down the road a few miles. They use it on NCIS a lot because it’s so nice looking but utterly bereft of shoppers. Since it opened three years ago it has had a half dozen tenants come and go, with the only hangers on right now a Subway, a consignment furniture store (perfect business when people are losing their houses and moving into little apartments), and a nail salon. Out of over two dozen retail storefront spaces.

I just found out today my HOA is going to raise rates due tot he number of empty units in this townhouse complex. I know at least four units are in the midst of attempted short sales or in foreclosure. The HOA can hardly ignore upkeep on uninhabited units, especially those attached to inhabited ones, but where will the money come from without it becoming prohibitively expensive for those of us who remain? I’ve no doubt this problem is replicated in hundreds of places in Southern California.

Think about it. Renters who have never missed a payment getting squeezed because there are too few residents to spread out the upkeep costs. You don’t need to have a mortgage to get seriously imperiled by other people’s bad mortgages.

I agree with the majority of your comments here in that we have a ways to go before we start to see the proverbial bottom in RE. I also believe we are seeing a global restructuring or paradigm shift whereby the dollar is being debased/destroyed and no one knows what will replace it.

That being said, I currently live and rent in Newport beach, a nice area in OC. I have 10 mos left on this recently signed lease and then I have decisions to make. I am possibly thinking of moving out to the IE. I have an infant and want a house with a large lot and big backyard for him to be able to play and be raised in, and I simply refuse to pay 700-900k for an overpriced home in OC. Also, the wife works mainly in the IE, so we would save a lot on gas. She was also raised there (as i was raised in OC) so thats another reason she is pushing for it.

Overall, I would like to purchase something in the 300k range, put 100k down, get a 30yr fixed and make payments like it’s a 15yr fixed to pay it off quickly.

What do you guys think? Bad move? Good move?

Currently renting a nice 3bed/3bath 1900 sq ft condo for $2500 in NB.

Aside from the 100k down I will and have been putting some $ into PM’s to combat the eroding purchasing power of the dollar.

Would love to hear your guys’ thoughts and any opinions you have of cities in the IE.

Since you have 10 months to go on the lease it’s premature to say whether or not the idea is a good one or not. Many people purchasing a home today will find they should have continued renting as there is still a lot of turbulence in the housing market and it’s not going to end anytime soon.

On a broader scale, for those that think the worst is over on the economic front are in for a rude awakening. 2008 was just a precursor of what is heading our way and once the second wave hits … let’s just say it won’t be pretty.

Of course a 3rd option, which will probably become apparent as your deadline approaches, is to just RENT a great house+lot in the IE. Why put a whopping 33% down in such a (still) declining market? Really limits your options. Most SFRs that are for rent, can be rented for for as long as you like, and modified significantly, so long as mods are seen by owner to add value generally, not just to you.

Totally agree on 15 yr. mortgage over 30–not only are rates lower on the 15, and you’ll pay half or less total, but think of where that “finish line” is in relation to your childrens’ reaching college age… NOT that I’m advocating paying for your kids’ college, but it’s an option… but think of the FREEDOM of not having a mandatory mortgage nut in just a short 15 years. 30 year notes are Yet Another serf-cage of the Master Class.

For the IE, I would not consider any place other than Redlands or Loma Linda. Or up at Arrowhead/Big Bear.

Maybe Corona too. But that’s it. If Corona, then plan on sending the kids to private school or homeschool.

Too much crime and social degradation going on elsewhere in the IE. The public schools are atrocious.

Can you do Yorba Linda or Anaheim Hills or Orange Park Acres?

~Misstrial

Actually for the IE, my wife has been pushing for either Corona or Chino Hills. And yes, Yorba Linda (ya i know it’s the OC), also looks appealing.

I am think that in a year or two, prices in these areas will be an additional 15-25% lower.

Lots of inventory piling up, even in the best neighborhoods. The water is rising everywhere in West Los Angeles. Even Brentwood and Bel Air, are starting to buckle under.

http://www.westsideremeltdown.blogspot.com

People are getting as excited about the downside of housing as they were about the upside in 2005 housing market. Anyone that thinks homes in los angeles in decent areas are going to drop another 20-40% are insane! Does anyone realize this would be equivalent to an apocalypse to our economy? Sure, people on this board could afford homes… If any of you still have jobs, or didnt lose it all in the upcoming stock market crash that would go hand in hand with another 40% drop in home prices.

What is really going to happen is the govt will push interest rates to 2% or lower and we will have massive inflation… Home prices will rise, our debts will be easier to pay off… It will cause a new slew of problems.. But deflation is coming to an end folks… Next stop hyperinflation!

@Kevin: I see you have been training under the Paulson/Geithner fight club. Where the only way to win is to use scare tactics of Armageddon. House prices were much lower not that long ago and the economy was just fine.. Let’s not be over dramatic.

Right, and Kevin, what exactly will inflate and is it material? And, when interest rates rise housing will go back down more. If mortgage rates remain low it would likely only be to try to keep house prices flat for years and years until the banks can sell through their inventory.

I think banks may have profit offsets overseas that the IRS may allow them to bring back onshore to the US to more quickly get the bad real estate off their books….and reinvest in America.

DH any thoughts on that?

You sound like an over-leveraged 20-something (r)ealtor stuck with a bunch of investment condos.

Dogs and cats sleeping together indeed.

Kevin,

Inflation on consumables and deflation in housing is what SoCal has to look forward to for quite a while. I think you missed the point of the article if you have forgotten about local incomes supporting home purchase prices.

No the entire SoCal housing market will not be supported by cash laden foreigners, despite what others have posted under previous Dr. HB articles.

The housing market is on a long and winding road down. A previous poster predicted 10+ years due to the bank’s deathgrip on the shadow inventory. As long as the bank’s balance sheets don’t smell like death everything is ok. Obviously, a write down of residential RE assets would destroy the banks equity and crash the housing market – in other words – a great buying opportunity.

NAR rah rah and wishful thinking won’t make this stuff smell like roses. Keep on dreaming as the ship of fools keeps sinking.

Kevin, you say apocalypse like it’s something can only happen to other people.

It’s quite possible that we’ll have both. The stagflation or hyper-stagflation scenario is entirely possible where the things you need (food, oil, electricity, etc.) skyrocket in price causing you to have no money left over for wants (owning a home, luxury items, expensive cars, boats, etc.), driving their prices down or holding them steady during extreme inflation / money printing induced hyperinflation. But home prices are unlikely to rise much at all (even in nominal terms) during hyperinflation b/c everyone will be so broke from basic needs. There will be too much supply.

Yes, lots of people realize this would be an equivalent to an “apocalypse to our economy”. I believe that it’s already in motion. Protect yourself with PMs. I’ll be looking to buy real estate for cash in about 5-10 years at the earliest, in the meantime I’ll hunker down and rent.

One important question: how can I make money off of the impending collapse?

Inverse ETF’s.

~Misstrial

@Jay Buy Silver!

“massively overpriced bubble states like California or New York?”

In Manhattan 2-bedroom apartments that sold for $2 million at the absolute peak can easily be sold for $1.9 million now. Since the bubble in housing prices in NYC was not fueled by loose loan standards (banks in Manhattan generally defer to coop boards, many coops only permit 40% financing and coops are almost always much more strict on a proposed buyer’s financials than banks are, some buildings require a buyer to demonstrate a liquid net worth of 150% of the apartment’s purchase price) thus the bubble in Manhattan continues almost unabated.

When I was a boy Southern California the sky was clear blue. California had the highest standard of living in the world. The best economy, the Gidget surf life.so the prices kept rising helped by a criminal Fed. However, let’s all be honest the party is long over. Prices will plummet in the next 10 years.

“There will be no sustainable housing recovery until the shadow inventory is cleared out. ”

DHB, why do we perpetuate this fiction? There will be no “housing recovery”, period. You know as well as I do that housing values track inflation over the last 100+ years. As you show dutifully every week or two with Case-Shiller price indices, the bubble has deflated and we are back down to something around where we would have been assuming the usual inflationary increase in housing price, rather than bubble hysteria had happened for the last 10 years. About the best we can hope for in a “recovery” looking forward is that volume will pick up and new home sales will recover. Am I right?

Somebody has to be paying the property taxes on these houses. Why don’t the counties auction them?

As long as Goldman Sucks gets its bonuses this year that’s all that matters.

Leave a Reply