When the global housing bubbles collapse like a row of dominoes – Canadian housing bubble at apex. Real estate markets from Australia, UK, Italy, and Ireland now into correction phases.

Never in the history of our modern economic system have we had coordinated housing bubbles rage across the world like some sort of financial plague. The proliferation of boiler plate media and the ubiquitous spreading of banking debt made the real estate religion spread quicker than any time in the past. The way real estate was being played up in the media was like some sort of spiritual revival. I remember a colleague showing me a clip of a real estate seminar in California at the peak of the bubble where people looked as if they were in some sort of glorified peyote induced trance. At the core of any mania is human psychology and herd behavior.  People never want to believe that their special niche market is not in some sort of bubble. On January 15 we discussed the Canadian housing bubble and many people fell off their rockers as if this was some sort of spectacular revelation. Reading through the comments on the Canadian bubble post is very reminiscent of 2007 in California where the “not in my back yard†arguments dominated the discussion. The nature of this housing bubble is global and the collapse of markets across the globe will have wide ranging impacts that are yet to be felt.

Global home values

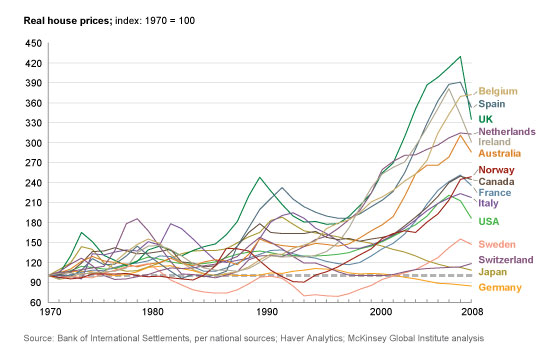

One of the stunning aspects of the global housing bubble is the synchronicity in which prices jumped:

In the late 1990s to early 2000s all prices began soaring almost in unison. At the core is the proliferation of easy access to debt and the financial system going fully into a mania with their addiction to derivatives and black box techniques of stealing from the public. If you look at the chart most bubbles are already in decline. The US market has been falling for five years now. Canada is just starting to turn.

Canada real estate bubble

It was interesting to see the responses that came from the article looking at the obvious Canadian housing bubble. Arguments ranged from:

-Our banks are not as crazy as American banks

-They aren’t making any more land!

-Uncle money bags from China is buying every piece of property

-It’s different here! Really! Trust me.

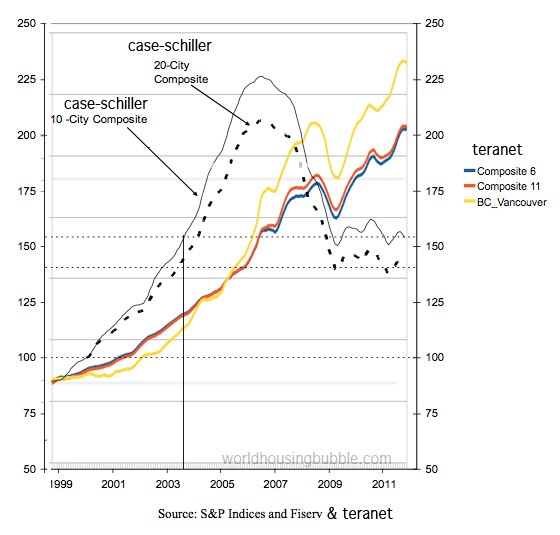

Others acknowledged a correction and many others saw the crash approaching. Take a look at this chart for Vancouver for example:

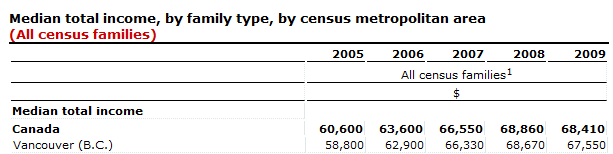

And then examine the typical household income:

The big push is coming from hot money from abroad, specifically China. These are temporary surges. This is reminiscent of pocket markets in California and Hawaii when Japan had their incredible run. These runs are always temporary in nature. They do correct. The question is how bad will the hit be when it does correct. It warrants looking at an updated chart regarding these markets:

Source: World Housing Bubble Â

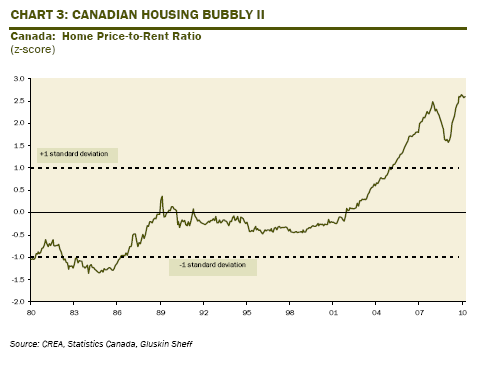

The bubble is rather obvious. Household incomes across Canada are levered with debt just like their American counterparts. One early indicator of price dislocation is with rents and home prices. This was evident here in the US in the early days of the bubble:

This bubble is ripe for popping and hot money is like any infatuation. It clouds all judgment in the short-term but has an inevitable end. Economically it is unsustainable. Folks need to do some background reading on the history of bubbles.

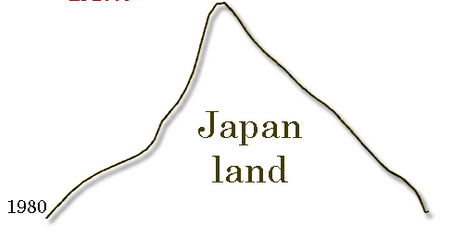

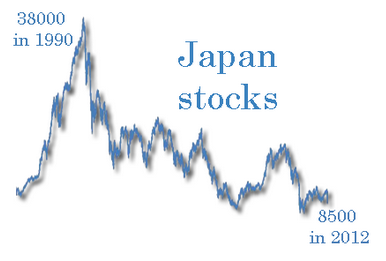

Japan stocks and land values

For those who can remember Japan’s major bubbles and how it impacted California this chart is very apt:

Japan is well into two lost decades for their economy. The hot money from Japan flowed into markets in California and Hawaii. At the time many thought the run would go on forever. It was different this time remember? Of course it wasn’t and the pop was deep:

When the hot money stops, you have to rely on your own financial merits especially for housing. This is why you are seeing major pricing action in places like Beverly Hills, Bel-Air, and San Marino. Ultra prime locations that are now facing price drops. There are shacks and condos in Vancouver that are insanely priced and bring back memories of Real Homes of Genius.

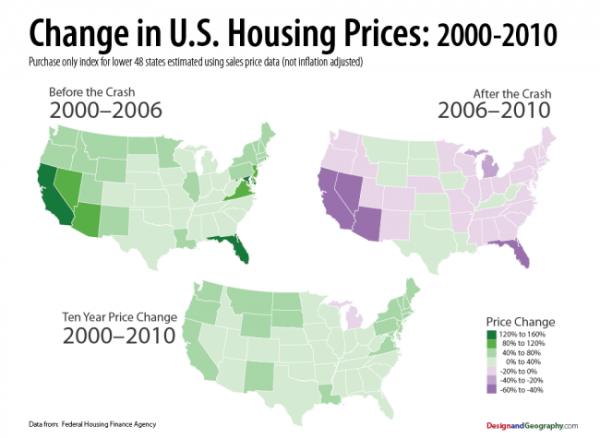

US home values

Bubbles can go on for well over a decade. When they pop, the tide goes out and much is revealed:

Source:Â DesignandGeography

From 2000 to 2006 home prices went nuts on the coastal regions. California and Florida went into full mania mode by having price changes of 120 to 160 percent. Then the correction came and slammed prices back down. The above chart highlights the progression of how bubbles correct. The lesson? The higher you go the harder you fall especially when you don’t have substantive real household gains with income. Leverage or no leverage, when hot money enters a market you must prepare for the inevitable ebb when it runs low or drops to a trickle.

Global housing bubbles are in various stages of correction. When each bubble pops, this will undoubtedly bring pain to local banks and force regional governments and central banks to continue on the bailout path. There are few things that unite this world but our love affair with real estate seems to be a very common one.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

44 Responses to “When the global housing bubbles collapse like a row of dominoes – Canadian housing bubble at apex. Real estate markets from Australia, UK, Italy, and Ireland now into correction phases.”

Canada and Austraila are directly linked to China’s economy. Vancouver gets hot money looking for a safe haven, and the Aussies are reveling in their mining boom as they dig up their earth to send to China. As long as China stays a massive boomtown, they’ll do OK, but, if China crashes for some reason, hoo boy, lookout. One wonders if the real estate bubble represented in China by the empty condo towers in empty cities will bring the rest of the world down. I don’t think that it will, because most of those apartments were bought with cash, and the Chinese banks aren’t as integrated into the world’s financial system to do that much harm.

I’m reminded, as you said, of Hawaii and Vancouver in the late 80s when the Japanese were the invading army of cash rich “investors”. They owned about half of Whistler resort back then. The sushi was killer. Funny, they all skied around in matching one piece suits……strange people.

Red Chinese real estate speculators/ ‘investors’ ARE using leverage.

Their government has pulled away the punch bowl.

Hence even substantial down payments have imploded.

Riots have ensured. (!)

Consumer psychology is key here. The wealth effect grows as the avg consumer’s biggest investment (their home) is going up. The opposite occurs when that asset value is going down. Some consumers will lose their home, others will close their wallets and hunker down waiting tor the storm to pass. Yet others will not be able to buy even when they want to — banks become more restrictive due to the losses from the first group mentioned.

Those dynamics create the domino crash that seems endless. Take it from a U.S. citizen having lived it for five years now, with no firm recovery in sight and no way out.

I have been waiting for Australia/NZ prices to correct for 7 years now, not a happy state of affairs. I have just given up. The governments will do anything to keep house values from falling, and the banks are making 95 to 100% NINJA loans again.

Yes the China bubble is bursting. But, when unemployment soars in China and the riots start, won’t the rich Chinese want to escape to Sydney, Melbourne, and Auckland and set themselves up as landlords?

The hell with it all. Maybe I’ll sail my boat to Thailand and just live on the boat in warm weather and wait to die, hopefully soon.

From what I’ve seen Brisbane is more ripe to for a real estate than LA or San Francisco were 7 years ago.

Prices have fallen across NZ, just not in parts of Auckland. Tauranga, Hamilton, Whangarei… all down by double digits in four years and a lot more with inflation added. Wellington down too last year as civil service cuts bite and more are coming. Prices fell in all of Australia’s eight capital cities last year. Wait till Europe’s recession hits Chinese exports, then Australia, then NZ…

China bubble bursting?!? A bubble is based on leveraged debt. China is a creditor nation with trillions in surplus.

HI Matt-“China is a creditor nation with trillions in surplus.”

Antal Fekete wrote an interesting piece on Japan’s huge hoard of US Treasury bonds. In the late 1970’s/early 80’s, it took almost 300 Yen to equal one US dollar. By the time that Japan desperately needed cash to shore up their tottering banking system, post bubble crash in the mid 1990’s, only 100 Yen were needed to buy a dollar. In other words, 2/3 of Japan’s nest egg vanished into thin air.

So you can see why Congress is so desperate for China to allow their currency to appreciate. It has nothing to do with jobs. It is merely an exercise in semantics, though. We don’t have any money to pay off the Chinese held bonds, except if the Fed does another QE-X. That will be mighty inflationary when they do it, if it hasn’t already started in stealth fashion. That will put downward pressure on the dollar, and cause inflation here and elsewhere.

So China will have the same problem as us: a collapsing housing bubble, and massive inflation in all other sectors.

Hi Matt! Like other observers you make a basic mistake/assumption that the Chinese only have assets no liabilites! Yes, they do have trillions in U.S. Treasuries, but they also have incurred a mountain of debt via building: 1) empty cities; 2) railroads which are to expensive for the average Chinese to ride; 3) roads to nowhere; etc. Check some internet articles written by Jim Chanos the Hedge Fund Manager on China. Over 60% of China’s GDP is driven by real estate – imports is less than 10% of GDP. In the biggest cities, the average rent is over $1200 per month – versus the average wage of $2,000 per year. 800 million Chinese make only a $1 a day. Now are you beginning to understand the real estate and leverage problem of China. When in busts it will be ugly!

Matt, I’m with you. I travel to Asia on jobs a couple times a year. Yes, there are millions of

I can sympathize having rented for years in the US while waiting for the bubble to end. I lived outside the US until early-2004 and, on returning, saw a clear-cut bubble and just rented in spite of my wife’s objections. And yeah, it was very frustrating to watch the gov’t do everything in its power to make housing unaffordable. But I’m soon going to buy a house because things have cooled substantially in my area and I expect you’ll fare similarly, so hang in there.

I agree with Tad. I’ve been renting in SF for 16 years, but in my case quite happily so. Yes, I missed the runup, but because I experienced the crash in LA, I knew eventually this was going to crash all over again, so I stayed out. After buying gold for 10 years, now I am buying depressed real estate in Rockford IL for cash; the price-to-median income ratios are in line. People can get crazy, but they can’t stay crazy. All the data you need to make rational decisions is available to you on the internet, if you can keep emotion out of it.

It’s all about the bank extracting wealth. But they do it because they can as people are weird creatures with their thoughts and actions toward housing. New Zealand Renter: you could look into the underground real estate options in Aussyland in the former opal mines. Nice climate control options given the location.

Hey Doc. Living among the herd is stress. I was wondering if you could hook me up with a peyote induced trance ?

@ronnie

Perhaps even a housing-bubble doctor could write a medicinal MJ prescription, but I don’t think they have anything for Peyote yet. Maybe you could see one of those hypno-therapists like on Office Space…

Took a peek at the Baltic Dry Index, which people pop-poo if it doesn’t align with their financial expectations. When the bubbles were raging, exports were churning out so fast it drove the shipping prices through the roof. There will be 35-miles long of giant cargo ships hitting the market this year and no longer any need for them. The main thing they are used for now is to store commodities so Goldman can manipulate the futures markets and squeeze whatever’s left of the global economy into their vault. This is a huge bubble that is also bursting.

China and India have real-estate bubbles like nothing else. Hot money is always looking for a fast return, and invariably much of it winds up in real-estate speculation. Remember the Asian Crisis of ’98? Sky scrapers never finished and left abandoned. The only thing that changes is the severity of the overshoot.

Don’t you all realize it’s different (insert name of country) here? Sure those RE markets in the USA and the EU crashed and burned, but our markets are invulnerable because we have (insert lame rationalization here) that keeps the price of homes rising.

Whoever things that the Greater Fool is an American is a greater fool than me. There is a sucker born every minute, not just in the USA, but all over the world. Unfortunately every Greater Fool needs an even greater fool to keep the bubble going. Unless we have two suckers born every minute, the worldwide bubble will pop everywhere. Governments all over the world are trying to prevent this; but their actions will only delay the inevitable.

Debt repression will continue until morale improves.

The Fed is holding rates low until the end of 2014, as announced today. Nothing beats telegraphing to the RE markets that buyers will not need to ‘panic buy’ on anticipation of higher rates. So now any rre value movement is going to be solely about pricing. A long period of pricing anguish awaits….Japan style. The commoners are being herded into government bonds…also Japan style.

What the Fed telegraphed was the distinct message that holding US Treasuries and dollars in savings will earn investors ZIP, while Bernanke revs up “QE” driving the dollar down even more…which is their stated goal.

So, whether or not you believe there are actually home buyers on the sidelines holding off purchases because of interest rate fluctuations (I can’t see it), the truth is there are over 10 million homes being held by bankrupt banks on their books at full value (2007 bubble prices)….and waiting for the Fed to buy them too. In other words, shovel more debt with interest on the US taxpayers. They won’t bother using vaseline, either.

That’s the reality…..and it also signaled the PM investors to use this opportunity to stock up: it’s going to be another 2 years of Bull Market heaven. For those still unconvinced…what is Iran selling oil to China and India in exchange for???

Still think gold isn’t money? Real money? China bought 20 tons in August. 20 tons in September. 40 tons in October. 60 tons in November…and 110 tons in December.

Think you’re smarter than a Chinese central banker??? Wiser than an Indian economist? Both countries have more Honor students graduating high school than the US has high school grads…..

Good luck! Hurry down and buy some more bubble-priced US R.E…….and watch it drop another 20% by 2014. At least 20%, according to Futures markets…farang says 1985 prices…..

1985 prices by 2014? And I thought I was pessimistic. I think we’d have blood in the streets if that happens. Dogs and cats sleeping together. It’d be financial Armageddon. But buying a new house for $90k in Socal does sound nice. I’d just hate to see who my neighbors would be.

Don’t worry people, president Obama is gonna let people refi into lower interest loans and FHA is gonna guarantee those loans (with your tax dollars), so markets will take longer to correct, and when these bailed out “responsible homeowners” default, our tax dollars are gone pay for it. Banks win again. Thanks Mr. President for helping the responsible people.

I’m curious. Can you provide a link supporting these claims, or are you just making stuff up?

My uinderstanding is that only people who are current on their mortgages will qualify for these programs.

However, I agree with what I think to be your implied thought that often the posts on this site show too much caffiene (sp?) and hostility, and not enough thoughtfulness.

Three books which would help support CC’s thinking are: It’s Different This Time by Rogoff, Reckless Endangerment by Morgenson, and All the Devils are Here by McLean.

Fannie Mae and Feddie Mac. in US receivership. Fannie Mae alone needed 7.8 Billion last quarter. FHA – rasied monthly MIP (mortgage insurance to highest it has ever been over double the orginal .50 factor. Sec of HUD said it is concenering and HUD/FHA may need a bailout in the not so distance future. USDA- changed to have a .30 factor monthly MIP for life of the loan. this is concerning that the losses are starting to mount. VA- still running strong becuase the underwriting is based off residual income and inculde child care, were as the other do not. plus thier appraisal system and fees systems are correct.

as you can see the government contorls 90% of the RE loans.

Bruce Krasting on Zero Hedge did a good article on Obama’s FHA refi bluff today.

http://www.zerohedge.com/contributed/obama-bluffs-refi

1. If I had to use one word to describe the direction of the UK housing market…it would be “TIMBER”….

2. Appears to me from that same chart that Germany didn’t take the Bankster housing bait (or they have a real, fiscally conservative banking system)……perhaps a recollection of how they crushed Germany in the 20’s? Driving most Germans into the streets of Munich fist-fighting for Socialism…which they NOW HAVE. Not to mention having the US taxpayer supply their military protection….how’s it feel paying to keep Fritz on the slopes for 6 weeks, Bubba?

Germany: Excellent Socialized medicine…and the strongest economy in the world right now……shared hardships (reduced hours for all workers when conditions require it) instead of some working and some having RIF’s..aka layoffs), and 6 weeks mandatory paid vacations.

Funny how that works…they had a fascist/nationalist strongman promise them Socialism (“national socialism”)…they lose a war of military build up and empire-building…and end up with the Socialism they desired in the first place…..hmmmmm, after suffering devastating FIAT PAPER COLLAPSE…anybody listening?

If we had right thinking leaders (sharing the COMMON WEALTH, minerals, water, trees, wind, while protecting private gains)…maybe we’d skip the losing the empire building and paper collapse phase……and maybe monkeys will fly out of my butt…..

Just get a handle on this: President Gingrich: the best president Israel can buy…..after a difficult tussle with Obama fighting for that title.

Hahahahaha, ya get what ya pay for….

Canada is looking for immigrants who bring business ideas with them. With all that radioactive chinese money flowing it, it’s gotta make you sali…vate. Go northewst young man

If you want to see a real realestate bubble burst! Start refinancing underwater mortgages like Obama wants. Can you imagine the loses that Investors would take on billions of dollars in pre-paid loans. The entire Financial market would once again totally disintegrate and force the World into a worst depression than the 30’s. With that said; No one in their right mind would ever approve such a imbecilic plan. Except Obama, of course. Truly amazing!!!!

Could you explian were the losses will stem from? from my knowledge, thier are no losses as the prinicaple balance remians the same or even increases with fees. in addition, the yearly terms will strech out even futher. personaly my own tin-hat’ish idea is this is a way to refinance China owned notes back thru the GSE’s. Which will put the weight of those toxic assest back onto the US taxpayers. Another thing to watch out for is incrased home buyer demand post HARP 2.0. many, many homowers will use this program to lower costs then convert the home to a rental and purchase another home for half of the price. from my experiance, that will put a large pool of these so called HARP 2.0 loan at risk of default. your thoughts?

holy christ, Chart 3, huge head and shoulder’s pattern. red flag.

That is what I have been saying for a few months now as well. I see Case Shiller 10 and 20 easily below 100 within 3 years, if not much sooner. My target is 85. Then side-ways action for a decade much like the Nasdaq Comp from 2000.

It’s laughable to read the vitriol from the racist Obama haters! It must fry their brains to worship Limbaugh in the morning, watch FOX News in the afternoon and then come here in the evening pretending to be intelligent. Obama is merely the frontman for the Elite, but at least he can speak in complete sentences with multi-syllable words. Your boy George was in charge when the economy tanked with perfect timing just before the election, knowing that Obama would get the blame for the fubar situation created by the Bush Regime. What an idiot you people re-elected in 2004. Suckers, blaming Obama won’t change the truth.

Who the hell is blaming Obama? Both D’s and R’s are complicit in this theft.

Hey, do you ever come out of the closet?

Please explain why one is labeled a “racist” if you criticize Obama?

Racism in inherent in all of us. How we deal with it is what distinguishes us from animals. Obama is doing the same things all presidents have done, but some parties use the underlying racism in some of us to propagate tirades of political propaganda, as though politicians make the actual decisions in this or any other country. I’m partial to Ron Paul, but I think if so many media goofs hate Obama that much, maybe he’s doing something right. He’s probably just another Goldman drone, but what’s the difference? They all tell us what we want to hear and then do what the Manhattan mob says to.

So all political propaganda is some form of racism, if I follow your proposition.

If I express the reality that I’m not better off since Obama took over,specially after all the flowery promises he made to get elected, does that make me a racist?

If I am fearful that because of the debt ceiling that keeps going up, my children and grandchildren might have a bleaker future than what it is made to look like, does that make me a racist?

If anyone criticizes me for what I honestly feel about the future of this country, would I be correct in calling them racists because they can’t seem to understand my point of view?

I understand your point about political propaganda and the way media, as usual, handles most of the issues to further their agenda or their patron’s agenda. But there are legitimate gripes about the current situation and I don’t think they are coming from a racist mindset.

If you’re interested in more on Canadian real estate Garth Turner, former Canadian Member of Parliament, has been blogging about the coming Canadian real estate correction on his blog Greater Fool (greaterfool.ca) for quite a while.

Interesting stuff. Sounds plausible.

Interesting post response I found explaining why the Canadian bubble burst will be different than in the U.S. I can see that Canadian prices will fall but won’t cause as much turmoil as here in the U.S as this poster explains:

“Banks here in this country have in the past been anything but conservative in their mortgage lending practices. That said though they are NOT at risk from their mortgage lending.

Why you may ask?

And how is that possible?

Well let me explain.

We have a government agency up here. It is called The Canada Mortgage and Housing Corporation (CMHC). It is the Canadian version of Freddie and Fannie but with a few different twists. One of these twists is that this is a Canadian Crown Corporation. It does not issue shares or trade on the wider markets and is not a publicly held entity. It also does not engage in packaging MBS products for sale or distribution as a normal course of it’s business.

Much of it’s inner workings in fact are shielded from public view and so getting substantial up-to-date detailed information on the activities of that organization are something less than “transparent”

CMHC does insure the mortgages of “less than stellar” and some credit-risky customers for the benefit of and on behalf of the Government of Canada. It is the agency whose primary responsibility is to ensure that eligible Canadian home buyers who are unable to secure conventional mortgages are thus enabled to do so through Government backing and insurance.

There is an insurable cost to mortgage consumers who use this service and it allows those who would otherwise be ineligible to secure a mortgage to do so with a minimal down payment.

These have ranged from as little as zero down and 40 year amortizations in the recent past and all the way up to 5% down and 35 year amortizations as they exist now.

So why do our Canadian banks not face significant risks?

Here is the reason. The high risk loans given to those with the poorest chances of loan repayment success (high risk loans) are virtually all on the books of CMHC. They are not a risk to the major banks in Canada. They are no longer Bank liabilities.

They are a risk to the general pubic though, to the taxpayer’s who back these loans via CMHC. The risks in other words have been shifted from private to public hands through an ingenious insurance scheme that absolves our banks of usual lender responsibilities, obligations and of course liabilities and risks.

It is a system that has left Canadian taxpayers on the hook for hundreds of billions of dollars in potential obligations related to home acquisition and purchases. But it is also a system that has guaranteed the stability of the Canadian banking and financial system that assures foreign investors and depositors a safe harbor in troubled times.

Like I always like to say though, you can thank Joe Average, (the Canadian taxpayer) for that sweet benefit. It’s about all we can do to keep the world just a little friendlier and more financially stable…..”

The world is now based on virtual money. There is nothing real about money from the Fed. Debt, however, is very real. Only tangible’s like oil have limited supply. Virtual money is infinite. We were broke of real money in the 70’s. If government debt is in virtual money, then who can say with certainty what can and cannot be done. Canadian money is virtual, but their surplus of tangible resources per capita is probably unmatched on this orb. Beach Bum sounds to me like he knows the score.

Another quality post from Dr HB.

I love this this site, I come here for a bit of sunny Californian optimism, amongst all the doom and gloom.

There’s not a lot of happiness around the UK housing market these days either. Prices have been slowly grinding downward, but we’re still only about 15-18% off peak prices, so maybe 30% in real terms. They’re being held up by low volumes, and the foreign buyers in London. ( Every Russian crook, Chinese corrupt beaurocrat and Greek shipping magnate needs his London propery portfolio).

One major difference from other bubble markets though, is that we didn’t have a house BUILDING boom. There’s no real inventory of unsold properties sitting around, dragging prices lower. Plus it’s a small, overpopulated Island, so the hopium addicts can carry on ignoring the economic fundamentals.

I’d say if you want the real ground zero of the worldwide housing mania, look no further than Ireland. Prices there have fallen by a good 45% since 2007, and are still overvalued. House building took up 15% of their economy during the boom era ( 5-7 is normal for a developed country), and they were building for totally imaginary customers. Theres was just no real demand, the only new buyers might have been the Eastern Europeans who moved to Ireland, to work in the ,err, construction industry. At least in Spain, for example, there are millions of potential Northern Europeans who would love to retire out there in the sunshine. No one wants to retire to the only country in the world with worse weather than England. Young guys were quitting university to labour on building sites for 250 Euros a day. They were creating more homes in Irleand than in the UK for a few years, while we have 15 times their population.

There are hundreds, and I mean hundreds, of “Ghost estates” dotted around the Irish countryside, half built, quarter occupied housing developments which are never going to be finished, slowly rotting in the rain. Developers couldn’t even turn them back into agricultural land without spending millions clearing the concrete foundations. They’re worth less than nothing. And it’s not just houses- there are vast numbers of hotels and retail developments that will never make a profit. Irish taxpayers are now on the hook for every penny of the deluded loans that were made to finance them.

It’s tragic, because Ireland had a genuine boom based on software and hi-tech for a decade before the housing insanity properly kicked in, at the start of the last decade. Foreign banks, especially British and German banks, were desperate to get a piece of the action, so they hosed down Irish banks with money, managers of whom were part of a corrupt nexus, along with developers and politicians. None of these guys are in jail, naturally.

You can’t just walk away from a mortgage here or in Ireland, bankruptcy is the only way to get away from a house in negative equity. Stategic default isn’t really an option.

Thanks Paul, very interesting perspective.

I wonder what bursting bubbles mean for super rich who can emigrate at first sign of trouble, especially in developing countries like China. I think “Timber” effects are inevitable after such growth spurts. Call them growing pains, so to speak. Perhaps I missed this point, but the raging effects of collapses worldwide mentioned in the first paragraph were not elucidated in the paragraphs that followed, not to my satisfaction. Who can break all of this hodgepodge down for lay people who haven’t been initiated into jargonistic real estate economic speak?

Leave a Reply