Real distressed properties of Corona del Mar – Most expensive zip code in Orange County lists 2 foreclosures on MLS but has 28 properties in the shadow inventory. How to lose a million dollars in Corona del Mar.

There is an interesting trend in prime California markets regarding distressed properties. These markets have the slimmest amount of viewable distressed inventory yet when we examine the shadow inventory we realize that there are many people simply not making any payments on their properties or banks are simply moving at a snail’s pace to list these homes. We have seen this pattern play out in Beverly Hills over the last few years. According to LPS Applied Analytics nearly 40% of homeowners in default have not made a payment in at least two years. The typical foreclosure now takes 674 days. It is one thing to talk about some middle class family in a $150,000 home struggling to get by because of a job loss or illness. But what about squatters sitting in million dollar homes in prime locations? Today we’ll examine the prime area of Corona del Mar in Orange County.

Corona del Mar has distressed inventory as well

Contrary to what is visible on the surface some of the more expensive cities have some sizeable distressed inventory. Let us take a look at the beachside community of Corona del Mar in Orange County:

7 MUIR BEACH CIR Corona Del Mar, CA 92625

5 bedroom, 6 bathroom, 1 partial bath, 5,629 square feet, SFR

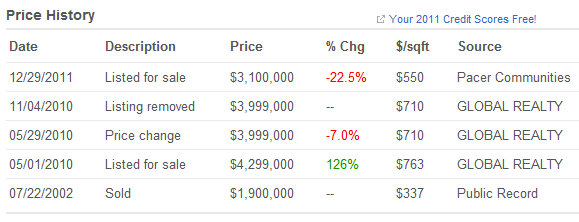

A very nice home in the exclusive 92625 zip code of Orange County. This home has been on the MLS a few times and was listed in May of 2010 for $4,299,000. No takers. The price was adjusted to $3,999,000 later in that month but nothing bit. The listing was finally removed in November of 2010. This has been the action more recently:

Some interesting information here. This is a very recent listing and the current price is $3,100,000 which is over $1 million lower than the May 2010 list price. This is how out of whack prices are thrown around in these prime markets. Of course it appears there was some lack of motivation in moving the price lower before the current movement. Digging deep into the shadow data we find that it was taken over as REO on October of 2011:

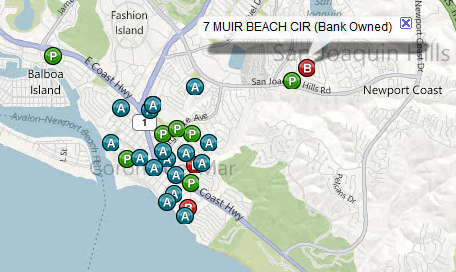

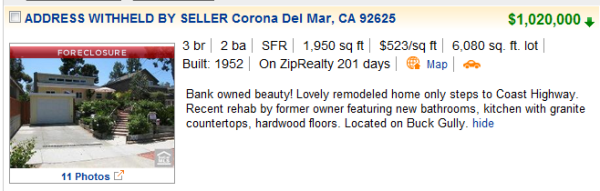

Hard to tell the final figures here but it looks like the winning bid came in at slightly higher than $2.4 million. And as you might have noticed, there are many more properties in this prime zip code outside of the two listed on the MLS. The other listing on the MLS is this one:

One of the most prime zip codes in Orange County has 28 distressed properties. The average loan balance on the 28 distressed properties? $1.39 million. Some of the listed shadow inventory barely has a notice of default filed and there has been no payment for over a year! So much for the notion that everyone is being kicked out equally or that the “rich†are making more payments on their underwater homes. In fact, it appears that only the poor and middle class are being foreclosed on while some of these million dollar shadow properties linger for ages.

I was looking at all zip code in Orange County and as it turns out, the 92625 area is the most expensive coming in with a median price of $1,767,500. It appears that there are more distressed properties than people would think in the exclusive Corona del Mar enclave.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

34 Responses to “Real distressed properties of Corona del Mar – Most expensive zip code in Orange County lists 2 foreclosures on MLS but has 28 properties in the shadow inventory. How to lose a million dollars in Corona del Mar.”

The same is true for high-end listings in my zip code (81507). Banks don’t want to force a sale that will expose the true value and further depress the prices on their remaining properties. One extreme case locally, a brand new 4600 SF home listed for $1.2M in ’07, sat unoccupied for three years after the builder walked, and was eventually sold for $365K. When I looked at the property in late ‘09, weather and lack of maintenance had already taken a toll and a buyer would have to spend quite a bit to fix it up. And this is in an arid climate – I can only imagine the REO horrors that are sitting vacant and moldering in humid climes like Florida. A proper valuation of many bank-owned properties would likely show they are worth only the land value minus demolition costs.

So what is the end game? I suspect BAC, WFC and other major banks are holding these properties in anticipation of a bailout where the ultimate dumb buyer, taxpayers, pay full price for a sack of dog squeeze. All for the greater good of course…

Jon,

You are absolutely correct – this unfortunate reality is actually increasing the number of infill redevelopment opportunities – these properties have become teardowns by default – literally.

“So what is the end game? I suspect BAC, WFC and other major banks are holding these properties in anticipation of a bailout where the ultimate dumb buyer, taxpayers, pay full price for a sack of dog squeeze. All for the greater good of course”

Sadly I’m thinking you may have a point. Maybe that is what it’s about.

i think (hope) people have wised up to the bailouts and it’s not as politically feasible now. back when the bailouts happened we were told they were necessary to save the economy. no one really understood what was happening, even folks who are fiscally responsible shrugged their shoulders and went along with it because we were told it was necessary. if bailouts happen again it could send citizens into the streets – and not the occupy losers. people who have something to lose could be fed up enough to act.

I fear they have already prepared for the possibility of people in the streets. :\

There are two important accounting terms at work here: “unrealized earnings/losses” and “realized earnings/losses”, i.e. paper earnings/losses versus real earnings/losses.

Mark-to-market requires “unrealized earnings/losses” (paper earnings/losses) to be recorded as they happen. Banks would have to adjust their cash reserves to accommodate for the loss. Suspension of mark-to-market means that when a foreclosure happens, no unrealized loss is taken since the property is still in the hands of the bank. Selling the property forces the bank to take a “realized loss/gain” as the property would no longer be carried on their books.

Since all mortgages are repackaged as bonds and/or securitized, selling off the shadow inventory would require bond/securities holders to take immediate hair cuts (losses). These bond/securities holders are pension funds, mutual funds, sovereign funds, hedge funds, etc. Interest rates on bonds would blow through the ceiling.

There in a nut shell is why banks are holding on to shadow inventory.

Thanks for a bit of insight on why banks are holding back on these properties. My only rebuttal is that I hope the taxing authorities are making the banks pay property taxes on these inflated values that the banks seem to think the properties are still worth. I suspect that banks are begging for a lower assessed value while holding out for a lesser mark-to-market hit. When I hear some of the games that banks are playing to avoid taxes on foreclosed home it grossly disappoints me!

How come no one here knows about an alternative solution to fight against Foreclosure?

If done properly and lawfully, there is a process that can settle the entire debt obligation and then have the bank agree to re-convey the property to the borrower’s benefit.

OK, I will bite – exactly what ‘solution’ are you referring to?

No surprise here…I think the logic is that you can foreclose on many lower-class homes in place of one uber-million dollar estate. Its a numbers game on the bank balance sheet. Wonder what the taxes will readjust to?

Check out the listings in Arcadia, CA. Prices are being lowered in this predominantly asian district with a “great school system” and mostly “small business owners flushed with cash”. Haven’t we heard those two arguments before ad nauseum from the trolls? I’m seeing a lot of homes being listed as “first time on the market”. Looks like the baby boomers are trying to get out ASAP! Good luck with that. This summer should be brutal.

My brother just bought a foreclosed house in Laguna Beach for 2.5 mil- had been listed at 3+

Note that my brother had to completely redo the place- some rich people have ridiculous tastes.

No- the original owner wasn’t squatting- not there anyway- they had several properties- all up for sale.

Maybe banks think that the wealthier squatters are just having cash flow problems and will eventually make good? Maybe the rich are better negotiators?

Or maybe the banks know that you can’t flip a $3 million dollar house in a month- especially when the previous owners decorated in an obscene faux-Persian style.

Of course the higher-priced properties linger, those would be bigger hits against the mortgage holders’ capital ratios, and probably lead to bankrupcies. As long as the Fed and attorneys general allow these holders to keep this junk on their books marked to fantasy they won’t move, and the economic stagnation and decay they cause will continue to fester.

Hope and Change!!

Exactly right, the losses on some of these ultra high end properties are similar to 10 losses in middle class neighborhoods. With mark to fantasy, why would the banks be in any hurry to realize these big losses that adversely affect their capital ratios.

Another reason why these high end places take so long to turnover is that the “owners” are probably a little more financially or should I say “sheister” savy. They can get an attorney to intervene with the lender which just leads to delaying the inevitable. That’s a small price to pay to live the highlife for free for a few years.

Banks don’t have to mark to market, and they don’t have to report any of these. They are not even trying to foreclose them. so the prices of these big houses are not really falling as you might expect. The prices will gradually become stable. it will be long time to see a recovery, but it will be stable.

Pete:

Based on what? Hot air and wishful thinking?

Please explain why high end properties are not subject to the same

market forces as the lower and mid tiers.

I know CDM zip 92625 very well.

While in fact many truly wealthy folks live in CDM, I personally know those

who live in some pretty nice homes who don’t have giant incomes.

In an area I track very closely (Harbor View Hills South), a large fraction

of the current homeowners are *original* buyers from late 1968/69

date of construction.

Many homes have been on/off the market for *years*.

Eventually they will have to sell. Who are they going to sell to? Themselves?.

Imaginary FCB’s (Foreign cash buyers), Google zillionaires?, the Space People?

Check out the latest census data for zip 92625. Median household incomes

are nowwhere near large enough to support this market at current fantasy prices.

As Dr. HBB has pointed out endlessly, prices cannot hold at current market

until incomes rise. Even if we have hyperinflation, banks won’t lend. (I think

Dr. HBB had a whole article on this very subject).

I don’t even think the Space People are doing very well these days…

Oct, the current price at any end is 30% below the peak at 2005. The price of low end home now is about 50-60% below peak in certain areas of CA. The reason there is a shadow inventory is because the banks don’t want to put them out there to push the price lower. Banks don’t have to write them down either. Plus all kinds of programs to juice up the banks in the past a few years. The banks will eventually recover, though it may take years.

remember life will go on, people still need to have a place to have sex to form that family. all new home sales, permit and start are at the all time low. The inventory will get digested. If you are looking for a deal, you need to act quickly once you see it. As I saw last year, there were always multiple offers on any good property.

Oct, this is a poor-man’s recession. Wealthy people are doing just fine. The high end of the market can be expected to go up because high end incomes are going up, fast. The stock market is doing fine. Corporations are more profitable than ever. The 1% is really doing fabulously well, as they believe they should, being of course better than you.

In the .com bust, high end housing went down because some of the market was purchased with .com windfall profits. When that dried up the high end collapsed. This time around the screws are to the subprime and alt-A markets and the working man is getting the squeeze.

There are of course exceptions as DHB points out here.

…The high end of the market can be expected to go up because high end incomes are going up, fast….

No question that the “1%” group is doing extremely well.

But here is a major flaw in that line of reasoning:

There are far more “high end” overpriced homes on the market than even the “1%” group can possibly absorb. Probably more than the “5%” group can absorb.

Do you really think the “1%” group each want to own 20 homes? I think not.

That was my point about CDM 92625. Yes, there are some *really* wealthy (and I mean wealthy) folks who live in CDM. But they represent only 1%.

In other words you can’t sustain a mass market unless the masses have *real* incomes to support the market.

Henry Ford understood this principle. Same principle applies to real estate.

As pointed out many times by Dr. HBB, government has made endless pathetic attempts to create the illusion of real income for the other 99% by manufacturing subsides in the form of bogus low interest rates, tax credits, creation of mis-priced mortgages by GSE’s, etc.

@Ian Ollmann

What you wrote is a bunch of nonsense. What you are confusing is real vs. nominal terms. In nominal terms, prices are higher because you have more money (unsterilized printing) chasing goods/services. Just look at M2 and the Fed’s balance sheet.

In real terms, e.g. things priced in gold or oil, you have a TREMENDIUOS decline in purchasing power. That is, real incomes are going DOWN, not up. Look at the S&P500 priced in gold or oil and you see a decline, not an increase.

Housing is falling more rapidly in real terms, than in nominal terms. We have not hit bottom, in either real or nominal terms, in housing.

There will not be any recovery until the banks are restrained, sound money restored, debts cleared (both public and private), and the faith restored of the people.

You failed to mention that this home was in a chapter 7 bankruptcy for months. The bk courts are bogged down and it takes months to get the property out of the bk protection.

How is that relevant? The listing for it in MLS shows a reduction from $4.3 million to $3.1 million in 1 1/2 years. The only relevant point is that someone tried to sell it at 4.3 and has reduced it by 28% since the initial listing.

2007 construction in Brentwood:

SOLD 11/07 for $2,895,000

SOLD 12/11 for $2,050,000

.60% loss per month in the prime of prime areas in LA. This could get ugly in hurry.

http://www.westsideremeltdown.blospot.com

http://www.santamonicameltdownthe90402.blogspot.com

While there are fundamental flaws in the system and a flood of homes backed up as shadow inventory, it seems that prices in various areas in so cal (e.g. la canada, pasadena, etc) are still being stubborn. What’s causing these prices to somewhat stay afloat? Have the wintertime and low sales volume actually slowed down the downward trend (which will be corrected when buying increases in spring/summer), or are we simply facing a long phase of stagnant and marginally decreasing home values from this point on?

Prices in Corona Del Mar and Newport Beach areas and other most valuable real estate has declined right along with everything else. Orange county lost some of its “high fliers” who made fortunes (which evaporated) in banking, real estate, finance. Those types of people live hard and expensively when they make big money, and it doesn’t sustain through a bubble. The problem now for studying what is going on, is that the statistics on foreclosures become almost meaningless because of huge numbers of short sales or near short sales, which aren’t clearly visible or disclosed, and that vagueness will only become more so in the next two years. Prices in such areas are supported by new generations of those wanting in to the top areas, and many can’t get out profitably from where they now live, so that’s a huge problem. New pools of rich, hot money buyers aren’t being produced right now. I wonder how the interior decorating business is doing in that area, high end furnishings, endless rehabs of an expensive home into an even more expensive home. If there is one place one can expect slow recovery, it is the high end unless some great new wealth engine appears suddenly. Gimmicks by the Fed don’t help such homes and they aren’t exactly fha qualified for 3% down mortgages.

Any desire to buy property I may have had is pretty much gone. I less want to buy property here and more and more want to flee the country.

Everything that made this country great is gone. A transparent financial system to invest in? They used to argue that was one of the things that made people want to invest in American companies and so on. Well you have got to be kidding me. Instead we just have the giant vampire squid. The rule of law? They just threw that and the bill of rights out the window on New Years Eve when the passed the 2012 NDAA. Property would be nothing but a ball and chain with which to drown in a drowning country without a transparent financial system, without a transparent political system, with little economic future, and without even the rule of law or the bill of rights anymore. There’s still some good people in this country and natural beauty of course, and SoCal is still sunny. But really I want out.

I couldn’t agree more with wantIng out. I am a native southern Californian and make a decent living and all I’m ever reading about and researching is expatriating. And my medical license isn’t good outside of this country and that’s still all I think about. Expatriating.

I’ve been to two countries in my life where I really thought I wanted to move there, if I ever could. One was Germany, the other New Zealand. (Note that in making this assessment, I didn’t take the Germans into consideration.) New Zealand has a points system that favors people with advanced degrees. I’m sure with a MD, you’d have no trouble.

Ian Ollmann Wrote:

“January 5, 2012 at 8:07 pm

I’ve been to two countries in my life where I really thought I wanted to move there, if I ever could. One was Germany, the other New Zealand. (Note that in making this assessment, I didn’t take the Germans into consideration.) New Zealand has a points system that favors people with advanced degrees. I’m sure with a MD, you’d have no trouble.”

Irony of Irony one of those reality tv shows about home buying featured a couple searching for a home in New Zealand for their family who was moving there – Dad was an MD which came out when they noted to the agent that one priority was an easy commute to the Hospital for on- call status.

James Garner Wrote:

January 5, 2012 at 8:25 pm

“Thanks for a bit of insight on why banks are holding back on these properties. My only rebuttal is that I hope the taxing authorities are making the banks pay property taxes on these inflated values that the banks seem to think the properties are still worth. I suspect that banks are begging for a lower assessed value while holding out for a lesser mark-to-market hit. When I hear some of the games that banks are playing to avoid taxes on foreclosed home it grossly disappoints me!”

Off topic but interesting thing I was told during a recent trip to Cuba when I remarked about how the Castro govt seized the properties of foreign companies in Cuba. The reply was that the corporations that owned property in Cuba (think Dole Pineapple) wanted what they claimed was fair market value. Castro and his fellow revolutionaries replied that they were glad to compensate for the properties but that the market value must be what the corporations were claiming was the value in the tax rate they were paying to the Bastita govt. As this was less than the companies told Castro they were worth they declined to take the money.

Simply allow immigrant investors a green card if they purchase a property that is over $500,000. This would stabilize housing prices in a hurry(at least in major metropolitan cities like Los Angeles.

The real problem is the $printing (press’s) makes the $’s in your hand worth less & less

“things” are not worth more ,your money is almost worthless,its another form of taxing

the sheeple.

What you all fail to realize is that everyone in California/Oregon/Washington is moving into Texas/Arkansas/Tennessee…Its squeezing the juices of the first home buyer who can’t compete with a cash offer while at the same time eating up the inventory and they are building ridiculously huge homes.

Leave a Reply