What would it look like if you were able to see the entire shadow inventory for Beverly Hills with actual loan balances? The myth that foreclosures only occur in poor neighborhoods.

I think an ingrained misconception that still permeates the market like believing the world is flat is that foreclosures only happen to poor people. Nothing can be further from the truth and in places like California foreclosures are hitting every single market. Even the infamous Beverly Hills is filled with foreclosures except these are well buried in the shadow inventory. I figured that I would spend some time today examining every single active foreclosure in Beverly Hills and try to shine a light on the ill-conceived notion that only poor areas are impacted by foreclosures. Most Americans already understand this since it is likely their own home has been hit because of the housing bubble bursting. But how much do we know about what is going on behind the scenes in a prime market like Beverly Hills? The data might be shocking to you especially if your knowledge of the area is only what is promoted on the media and from folks shopping on Rodeo Drive.

Examining distressed inventory in Beverly Hills by loan balance

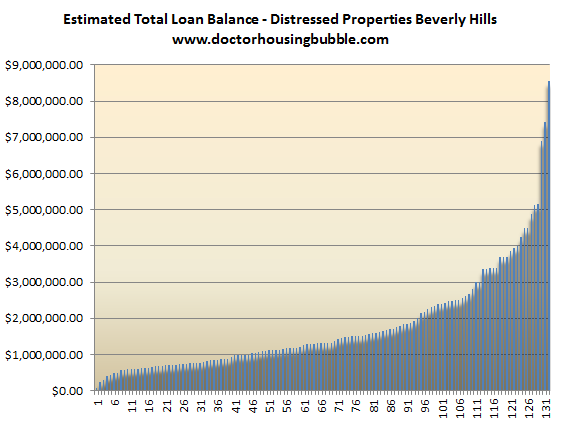

I dug deep into the data today and figured that it would be fascinating to see every shadow inventory property based on the outstanding loan balance. After all, if one home is inflated by $2, $3, or even $4 million this is the equivalent of 50 to 100 foreclosures in the Inland Empire when it comes to dollar amount hit to the lender. Hard to believe but take a look at the outstanding loan balance on homes that are in some stage of foreclosure:

In total 142 homes in Beverly Hills have the following:

-A notice of default filed

-Scheduled for auction

-Bank owned

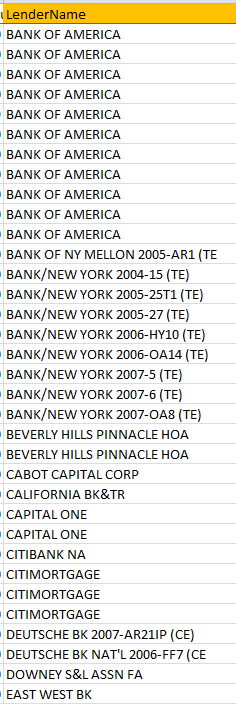

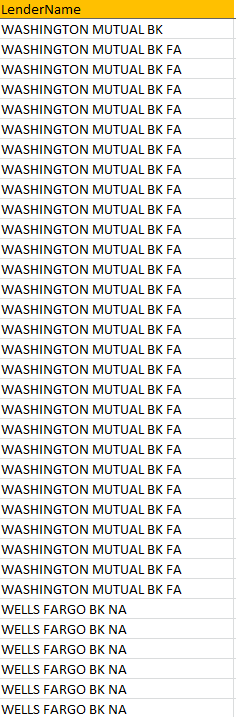

Interestingly enough only 6 homes show up on the MLS search when you look for active Beverly Hills foreclosures. By looking at the primary lender we realize that some of these places have some common names that were front and center during the bubble peak in California:

A very common list no doubt for those tracking the California housing market. But to look at the first chart more closely, 91 of the 142 homes have a loan balance greater than $1 million. 39 have a loan balance greater than $2 million. This is certainly a far cry from the misperception that foreclosures only happen in poor areas. Beverly Hills is one of the prime areas of the nation and it is plastered with homes in distress. I’m sure many Americans are happy that their bailouts are going to people living in these places and staying put without making a mortgage or house loan payment yet enjoying the amenities of a million dollar housing. I’m sure this goes over well with people living in moderately priced states (aka 90 percent of the country). This is why raising caps on FHA loans to $729,000+ made absolutely no sense. How about we cap all government backed loans at the median price of a home nationwide? Banks can then decide if they want to take on jumbo loans and vet borrowers carefully. Then again, look at the financial system we currently have.

Beverly Hills under $1 million

Let us take a look at one of the listed homes for sale:

9549 DALEGROVE DRIVE Beverly Hills, CA 90210

2 bedroom, 2 bathroom, 0 partial bath, 1,655 square feet, SFR

Hard to tell how nice this place is from the photos:

What we do know is that this home is bank owned. From the ad:

“What a price for this beverly hills bank owned home! Only $848,000 for a secluded home that is located up a long private driveway, features: 2 bedrooms, 2 bath, single story w/over 1600+sqft and on very large lot. This property has so much potential and will go fast. (buyer to verify property boundaries and bh address)â€

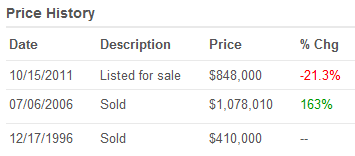

Someone thought this home had a lot of potential a few years ago as well:

Someone paid $1,078,010 five years ago for this property. The place is now listed at $848,000. No low interest rate is going to erase a $230,000 hit to equity even in Beverly Hills. Hard to believe that properties are chasing the market lower in prime cities? Think again and all you need to look is at the above data and the 142 properties sitting in the shadows.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

50 Responses to “What would it look like if you were able to see the entire shadow inventory for Beverly Hills with actual loan balances? The myth that foreclosures only occur in poor neighborhoods.”

A 20% drop doesn’t seem like nearly enough for either West LA or SF – I go back and forth, and parts of LA seem like they’re halfway back to earth but in SF, it’s still very bubblicious, and after waiting for 5 years now, I’m starting to think a slow deflation will leave me unable to buy a reasonable home here in my lifetime. Time to look at leaving the state.

The bigger they are, the harder they fall, eh?

I’m presently looking to buy another place in northern San Diego. Not quite Beverly Hills, but upper middle class, good schools. These neighborhoods were built in 2004-2007. These homes sold for around $900K, and are now going for around $600K, with virtually all of them short sales/REO, and most of them with about $100-$150/month HOA plus $300-550/month Mello Roos (so $400 to $700 per month total).

I keep waiting for a flood of these to hit the market since I’m guessing almost every single person who bought when these homes were built is under-water now. Why would anyone pay a mortgage on a $900K place when it’s worth at most $600K now, and they’re also paying around $550/month in HOA/Mello Roos on top of that. Household incomes here are around $120K to $200K, which makes an $800K mortgage on an upside down home a considerable burden. Cheaper to bail and rent something else, right?

But the strange thing is that there has been NO flood. The market is just frozen. How many of these homeowners are actually making their payments? I have no idea. Gotta think a lot of them are living payment-free, courtesy of Bernanke’s perpetual printing machine holding up the banks and enabling them to avoid foreclosing on people.

JimAtLaw: I ask this with all respect. I am truly curious why your desire to buy a house is so strong, you’ll willing to leave the state to do so. What’s wrong with renting? The financial benefits of owning have been debunked on many levels I wonder what’s the pull?

I would love to have “stability” and the ability to do what I want but not enough I’ll leave CA. (Besides, I’ve been in my apt. for over ten years and have been able to do a lot with the inside so even those factors aren’t as important as you might think.)

You beat me to it! I was going to ask him the same thing..

The financial benefits [i][u]in a bubble market[/u][/i] have been debunked – but in a normal market, owning can be as cheap or cheaper and in the long run, you can retire without a rent payment absorbing a huge percentage of your social security or other retirement income. Heck, here in the Bay Area, if you were to try and retire on social security, rent alone would consume most if not all of your income! And let’s not pretend that inflated housing prices don’t effect rents either.

At a personal level, I have been forced out of rentals on three separate occasions – once for the owner to move back in, once to move his in-laws in, and once to sell the place. I also have a toddler, and as an army brat who suffered greatly being moved from school to school as a kid, I want to be able to be settled in one place before he is school age. But it may not be in the cards thanks to government policies designed to stab me in the back and give my blood to the banks that fund campaigns.

Property taxes can easily equal rent payments though can’t they? At least rent payements on an apartment which are reasonable in L.A. (though not as cheap as elsewhere of course). True it is possible in CA to hit the prop 13 jackpot, but without that it seems to me property taxes often equal a years rent payments on an apartment.

@JimAtLaw, i am wondering, whether it make sense to buy a home in states where houses are cheap, and till retirement, rent in California. e.g. if I can buy a retirement home for $100k in some other state, I would do that and till I retire I rent in CA, or wherever I enjoy working and living.

Jrs, I suppose they could in theory in a place with high property taxes and cheap rent, but here in the Bay Area it’s not working out that way – for example, I pay $2400/mo and there’s no way my landlord pays even close to $30k in property taxes given that my place would probably sell for $650k at most. (Yes, I could probably rent cheaper in my neighborhood.) Yes, there are maintenance costs too, etc., but it’s still not even close on average – owning outright is MUCH cheaper than renting.

1st-time-buyer, I have actively considered the same possibility and still am. But I’d rather settle down now and then if my boy stays local, be nearby when he has his own brood rather than retiring to somewhere. Grandpa Jim will be a spoiler. 🙂

Well, you could buy a place in Sacramento, only an hour or so from SF. Sonoma County has seen a significant drop, although there is certainly more carnage to come in both markets.

JimAtLaw

Boy, you’re comment about being stabbed in the back from this controlled collapse, we can certainly relate. We sold a long time ago (regular sale) and each month while shopping for a simple home to replace our oversized McMansion, our target house price range jumped $20K a month in So Ca.

Now its been years in a mo to mo Hispanic Tenement, all our stuff in storage, and 5 rents going, including our office. We lived in a 5 bdrm 4,000 sq ft residence. We earned it, nothing given to us, coming from poor backgrounds mind you.

Being frugal, having savings, 825+ FICOs makes us feel like idiots. Meanwhile, the home we DESERVE (responsible human adults here) is being occupied by some deadbeat not paying his mortgage, or is being held hostage in shadow inventory. We’re CASH!

This rigged market set up to make the housing market collapse slowing just pisses us off. Short Sales (paying for someone else’s financial party on OPM) are just overpriced and mostly beat up homes.

This just sucks. We play by all the rules, being responsible citizens (notice I didn’t say consumers) and we all get screwed. If we don’t pay rent, out we go.

OK, rant off. Back to my treadmill.

Dear Speed It Up Please,

So sorry to hear about your “Hispanic Tenement” situation. Are you serenaded by mariachis at night? I hope the Frito Bandito hasn’t stopped in to steal your treadmill. Perhaps you’ve been frugal enough with your money that you can afford to hire Speedy Gonzales to conduct security around your dwelling.

I just strung Xmas lights on my roof this weekend… Was a fun first for me… Also form the looks of my neighborhood… Unless banks are decorating homes with Xmas lights… Our neighborhood still has lots of pride of ownership and not much shadow inventory.

I’m missing something here….this is a ‘Jumbo Loan” hence it reqiured $200000 down on the million buck price….+ 5 years of payments to chisel down mortgage owed. Bank wants $858000 to break even? Make a profit?

Old owner walked because of strategic default? Lost job/bankruptcy? Died?

The war seems like it will never end. Bondholders take no losses and dump it all on the middle class…

What to say? You’ve got a democrat president that still mentions getting prices increasing and availability of loans. Followed by the leading republican, who enabled the mess, apparently as his primary challenger.

Not much hope for a solution at that end.

Best you can do is starve the beasts, govt and banks. Don’t take out loans. Save your money in a secure place, safe or deposit box (not so safe). Keep transactions under the table as much as possible. Hold some physical gold.

James,

It depends where you buy — whether or not the bubble has burst. Check prices for 1996 or earlier — I want any house I buy to be at that price. Check your area — how much did it inflate? How much has it deflated? If I didn’t have a lot of $$, I definitely would NOT buy a house over $250,000 depending upon location, of course. In the happening urban areas, good luck finding anything at that price, I suspose. Looking at modest houses (1600 sp. ft.) which are estimated around $500 + K, I’m thinking — too much.

Now tell me why you would keep any large cash amount. Do you not fear devaluation of the dollar? Please give reasons, etc. This is my great fear: cash. Or do you want to hold in order to buy bargains as they come up?

LA is still a mess, Hawaii is a still slowly deflating mess. Layoff in aerospace should start denting LA/OC a bit more BUT needs to be deeper cuts. TO the bone there.

This is the long slow grind depression; the fulfillment of our Keynesian legacy.

I predicted a bottom in prices for 2011-2012 but potential that it would drag along for a decade or more. Basically that housing would be a bad investment for the rest of my working years… of course retirement is now a fiction too… and we are doing everything to ensure that happens policy wise.

A good amount of the rest of the country, I believe the bubble is mostly gone. True Doc?

James,

The bubble is not gone. Not even close. Second leg of the drop has commenced. Case Shiller 10 and 20 will see 90 or lower.

http://2.bp.blogspot.com/-1YfOLZjL2Qg/TtTnvQfIuOI/AAAAAAAALcE/inQYK5KhYZE/s1600/CSSept2011.jpg

We have another 30% drop from here.

We are floating around in a sinking ship on a sea of facts. What can we do about it? What is the solution??

Hi Chris, I can’t speak to JimAtLaw leaving the state, but I can tell you my reasons for leaving. Born and raised a So Cal beach kid, left when I was in college to see another part of the country. Came back to So Cal for work, got moved around with various companies all over the USA and then back to So Cal. The older I got (mid 30’s) the less appeal So Cal had with the crazy home prices, taxes, food, energy, entertainment you name it – you pay a premium to live there. A lot of my friends are still there and they are hoping their homes will be their retirement nest egg – I saw my folks get priced out of the market and retire out of state as it was just too much with their fixed income.

I have a house now that is on a golf course, cost me $350K (3500 sq/ft, 4 bed, 3 bth, 3 car) cost of living is around 50% less than LA and I’ve used that extra cash towards my home and retirement fund. So now in my early 40’s I’ll be looking at putting a million dollars more towards my retirement – which means I can retire sooner and where I want to. Do I give up some things? Yes, it gets cold here for about 3 months in winter – little to no snow, otherwise no worries. Great schools, no traffic, little to no crime and all the amenities I could want. Do I miss my childhood stomping grounds? Yes and no – So Cal has changed so much it’s not what I remember – now this is just me and my opinion – but I love to visit So Cal and then come back home to where I live now.

And trust me, growing up I thought I would never live anywhere but So Cal in my lifetime!

Hi Steve, sounds nice, where do you live? – Tom

I was going to ask the same question… 🙂

Now it all makes sense… CaliOwner works in the pretend industry… Throw in a couple of green screens and all is great in the land of make believe…

Rent = mortgage payment does not equal parity.

Rent = mortgage payment, plus maintenance, plus tax, minus tax deduction, plus asset depreciation, plus transaction costs is a closer measure of parity…

Asset depreciation isn’t FOREVER… It’s just as bad to calculate asset depreciation in rental parity as it was to calculate asset appreciation in the bubble years when calculating how much you can afford…

Appreciation/Depreciation isn’t something you can control/predict…

“Appreciation/Depreciation isn’t something you can control/predict…”

Caliowner, current asset depreciation is not that hard to predict when you put all the facts together. I’ll list a few for you, in no specific order:

1. Many areas are still in bubble territory, some more than others.

2. Prices have been falling for the last 5 years despite record low interest rates.

3. The days of fogging the mirror to get a loan are over.

4. Unemployment is the highest it has been in decades.

5. Wages have been stagnant for over a decade.

6. The pool of entry level/move up buyers doesn’t exist anymore.

7. There are millions of homes in the shadow inventory pipeline that need closure.

8. Every city, county in CA is facing massive financial issues for the forseeable future.

9. Energy, food, education, healthcare costs have gone through the roof.

10.The good ole US of A has 15T + in debt with no plans to slow spending/borrowing.

11.Baby boomers are starting to retire and many will liquidate CA real estate.

12.How many more days do FHA/Fannie/Freddie have left?

13.Can banks allow squatters to stay in their house indefinitely?

14.Steady employment for many people is a thing of the past, you need to be mobile.

I’m sure I’ve left out many more. Add all these things up and think about them, which way are home prices likely to go?

@CaliOwner

Assets are always depreciated. The land is not. This is basic accounting. Now, if I was an investor, I would take capitol loss/gain very seriously as this tends to be a large part of the return. I admit that anything is possible with green screens behind you…

It will be interesting to see what happens to RE prices when our sunny holiday of record low mortgage rates finally comes to an end. Bernanke thinks he is helping his banker friends with ZIRP, but he’s only digging their grave deeper.

I bought a condo in Brooklyn at the peak, in 2007, 2 months before sales halted to an almost stand still. I have a 6.5% interest rate. I just tried to refinance at a lower rate. It would have cost over $14,000 to do a refi. and since I live in LA I needed a 75% LTV, and the interest rate would have been close to 5%. Although the payments would be lower (If the LTV was 75%) tacking on the almost 5 more years of payments it does not make sense. I am currently losing about $600/month renting it out. That is a drain on the real economy, or on my $$$ going somewhere else. But we rent here in LA, what we can afford minus the money we are losing. I had been watching real estate prices for many years before I bought and knew that even NYC prices had a big drop in the 80’s but got caught up in the mania. Although the place we bought at the time was cheaper than renting (without all the other costs that have been mentioned on this blog.

I live in Atwater village, next to Los Feliz, SilverLake, and Glendale. I can not believe how fast tiny places are going for in my area. $500-$650k places being scooped up in less than a month. And like other have mentioned on this blog, any place that is a steal, it stolen by investors. Those houses are pending the first or second day. The thing that all investors do is put in the ‘trendy’ horizontal slat wood fence and cheap HD stainless steel appliances and flip it for $100k or more, in less than 3 months, once again finding a sucker to buy a place for $500k or more.

The top of the market is caving in and the mid-tier will come down even faster by spring time because all the people who would have gotten a crazy loan for $700-$900k in Los Feliz and SilverLake are not buying over priced places in Atwater Village. This will mean less people buying in the higher priced markets, and so it goes.

im in Los Feliz too. Market has remained resilient. Persons still appear able to pony up 1 mill for the nicer homes south of the blvd.

pretty confident that the majority of buyers in 2011 will be knife catchers in 2012 and beyond.

We have friends who bought in Los Feliz in 1999 for about $350K. Their home is valued around $900k now. A nice home in a good area will always be desirable and people who can afford those houses will be happy to buy them. People who bought in 2005-2007 just paid too much and there isn’t much of a solution for them.

Fantastic amount of work to decipher the Beverly Hills foreclosures. But wouldn’t the majority of distress sales there be either short sales or near-short sales? Is there any way that is shown in the property offerings? As to the rest of the country, it isn’t necessarily any better; Metro Chicago, and that’s a lot of homes, appears to be at a median price in total and all submarkets, at year 2000 prices (before discounting for inflation to boot). I am using Zillow’s values here; but even the high priced areas show a decline to those prices and foreclosures and short sales are everywhere and perhaps will worsen. Look out for false market bottoms, and almost everyone who bought in the last ten years in Chicago, has lost money. By definition, perhaps half to two thirds of Chicago metro buyers in the last ten years, cannot fix up, market, sell and have equity to buy anything else plus pay the closing and moving costs. It isn’t just Beverly Hills that will hurt, or California.

THe “Estimated Total Loan Balance” chart is just amazing.

Check out the number of loans >> $5mm.

How in God’s green earth is it possible to get such a loan from a bank and be so financially irreponsible / dumb / arrogant to get into arrears?

There have just got be be some interesting Hollywood style stories behind these loans.

Could these back stories be the fodder for yet another reality TV series?

don’t let the other succers draw you in. Housing will drop for at leat 2 more years. Good decisions require patience.

Investors do keep snagging the cheap ones.. we put in an offer on a short sale for $350K in our neighborhood… Never got a response and it foreclosed. Was bought for $328K by an investor or management company.. we went to the open house.. They painted the place, shaved the popcorn ceilings, put some laminate floor on the place… drywalled off one of the baths from the hallway to make a private master bath. And put it back on the market for $420K a month later.

It just sold for $415K… Oh well, it didn’t have nearly as large a lot or privacy as our house and was about 200 sq feet smaller. I’m shocked how many places get bougth for low 300s.. high 200s in our neighborhood.. Show up back on the market a few months later… and sell for low 400s….

Somebodies still making money in real estate…

Welcome to the new California:

http://www.zerohedge.com/contributed/shriveling-middle-class-california

Once again a lot of people that bought a house in Los Angeles in the early 1990s were underwater by 1996… But if the waited out the cyclical downturn the were rewarded with a new bubble period. We are going to have another bubble somewhere in the next decade… Maybe not real estate… But a bubble is always brewing somewhere.

Explain your theory. Over the past 30 years, the Fed has played with interest rates, which causes asset bubbles, to control money supply. But explain how interest rates can go below zero for any extended period of time. I am not clear what economic theory you are basing your next housing bubble on…

The best argument for owning these days is that eventually you’ll own the house free and clear. Whereas rent will just buy you time in the house.

This way of thinking won’t become mainstream for another few years…..when the sheeple realize real estate is toast without high employment.

I think you need to bake a few more items into the ownership argument. First, the average life span of a mortgage it around 7 years. Most move or refinance before the average 30 year mortgage is paid off. In a sense we are all really renting since we can’t take it with us. So the argument would be “it is something to leave to the offspringâ€. Maybe, but there is no guaranty that the “offspring†will not get duped by the banking community, use it as an ATM and lose the house in the end. I am not sure there ever is a “free and clear†with property taxes eating away at your “investmentâ€.

Doc wrote: “How about we cap all government backed loans at the median price of a home nationwide? Banks can then decide if they want to take on jumbo loans and vet borrowers carefully.”

Oh, there you go again. Being prudent, thoughtful, and interested in a banking system that rewards careful borrowers/personal finance managers rather than reckless scammers and lifestyle junkies.

You’d have to rewind California to the days of Hiram Johnson to find many takers for that vision of society–and that includes the remaining middle class people who still think that “owning” a “million dollar home” “in the Hills” is something to aspire to. (Me, I want to live as cheaply as possible in a place that lets me produce things that cast a shadow.)

Or is it? Of those 142 houses, how many are bank owned? How many are the owner occupied primary residences? How many had been owned by Boomers-or-older who bailed out of the bubble and left someone else holding the bag?

So, are you suggesting that the taxpayer give out 0% – 3.5% down, 3.75% rate 30 year mortgages to everyone who “qualifies†for eternity? Do you think this model is economically sustainable? I thought we already saw this move. I think we both know the outcome…

Northern California housing is just about to crash. Hold on tight and ride out the rough tide in 2012.

JimatLaw: I would wait until the middle of 2013 to make a decision about leaving SF. It sounds as though your child hasn’t started school yet. IMO, school changes are no big deal up to about the 3rd or 4th grade, as long as you find out in advance what subjects are covered when, and make sure that your child is on track (for instance, cursive handwriting used to be covered in 2nd grade in some places, and third grade in others — if you moved from one of the latter areas to one of the former, you were “behind.”) Kids make friends pretty easily up to the third or fourth grade, too, especially if the neighborhood has at least SOME population inflow and outflow so that your child isn’t still considered “the new kid” three years after he arrived.

There is a lot of talk about the Euro collapse causing a depression here, and I do think that when interest rates rise at some point, housing will undergo another major slump. Lord Blankfein’s list is very depressing, but it is all true, and the kids getting out of college with no decent job prospects AND colossal student loan debt are going to be living in Mom and Dad’s basement for a long time.

I can’t believe that people are still dumb enough to buy a flipped house with shiny new appliances, but lots of people just cannot do ANY type of repairs or improvements themselves. But I don’t think that any part of California will be exempt from the housing debacle. It is just going that they will be among the last places that the bubble pops.

Laura

If you factor in the broken structure of the economy of the U.S., the effective Ca unemployment rate of 22% (the real UE rate), and have watch the bubble mania (tech, housing/finance, commodities, etc…) we’re already in a Depression. I was at a conference for a sector of the real estate sector, and the speaker (a well respected realist Economist/R E bigshot) was saying the GDP is really 95% govt spending. I personally believe it. Look at all the extend and pretend mortgage programs. I’ve always said I wanted to work for the U S Govt. Dept Of Acronyms. LOL

I call this side of the bubble a controlled collapse. I think R E here is a mirror of Japan’s nightmare. I predict 2-3 lost decades, with the first one behind us. The tech bubble was the start. Housing will trickle down for years.

If the hedge funds and pensions by the REO’s for rentals, we’re all screwed. The conference speakers covered this. Why is it affordable housing to the REIC is about howmuchamonth and section 8, and not about the price and incomes of us J6P?

Any feedback from anyone?

Bad morning for errors. Not enough coffee, I’m stressed, and didn’t proof read. Sorry guys.

I live in NW Arkansas. Depending on which small town or small city you want to talk about, the prices are now reported by Zillow to be dropping 14 to 20 % per year. Who in their right mind would purchase ANYTHING when the prices are dropping at this rate? No matter how good a deal you can get today, you can get a better deal than that three months from now. And if nearly everybody decides to wait for a “bottom” then prices will freefall.

In the town that I live in, there seem to be a lot more executive-style homes than there are families with executive-style incomes. Maybe I’m wrong, but the local area has a lot of little old clapboard cottages that are only suitable as “rentals for the poor” plus a lot of the upscale housing built since the mid 1990s. Lots of people were still building custom houses in this area up until a year ago, and up until a year ago, I don’t think prices were dropping much in this area. I don’t know how the home construction industry is holding up at this point. I don’t think it has fallen off a cliff, but the dropping prices have got to be making a lot of people reconsider their plans to build a Dream Home.

It has already been crashing in south Santa Clara County and south Santa Cruz County. This wild fire is moving north steadily…

It’s not just on the west or east coast. Our business tracks retail customers quite closely by address and not so long ago I googled the address of a customer I believed to by in the decidedly up-market area called Cedar Creek. Low-end houses there are half a million, compared to $200K in your typical well-off KC suburb. High-end is easily $2 million.

Somehow I got bumped into a premium map which displayed all the homes for sale — over 20% — and which allowed me to look at the foreclosures. Oh, my! More than half the houses for sale were foreclosures, but most interestingly, the amounts were profoundly bi-modal.

Roughly half the houses were being foreclosed for amounts in excess of $500K. Obviously the people had bought too much house. The other half were for amounts under $100K — I assume folks who’d lost their jobs. Nevertheless, finding ten percent of the homes in the second wealthiest area of a 3-million population metro region was a bit of a shock. No wonder my sales to that demo are down by 10%.

So Dr. bubble, you are reporting approximately 150 houses in some stage of foreclosure / behind on mortgage / etc. in BevHills, that’s only like 1.5% of the total housing there (population 34,000, assuming average 3 persons per dwelling). 1.5% seems awfully low–what’s the explanation?

Leave a Reply