Underwater nation – Over 14 million homeowners now sit in a negative equity position. Bubble markets see faster year over year price declines.

One of the unintended consequences of growing a large shadow inventory is the unfortunate creation of a giant pool of negative equity homeowners. Zillow recently reported that over 28.6 percent of homeowners with a mortgage now sit in a negative equity position. This is up from the 26.8 percent reported only last quarter. It should seem obvious that the process of simply ignoring non-payments by banks to keep balance sheets inflated will reflect in other aspects of housing data. If we look at MLS data the picture is one of declining inventory yet the negative equity position reflects a quite struggle for many homeowners. The shadow inventory looms large. We even have a report out today showing that delinquencies are on the rise again. Let us take a look at some of the housing reports and try to make sense as to what is occurring.

Over 14,000,000 Americans own a home and have negative equity

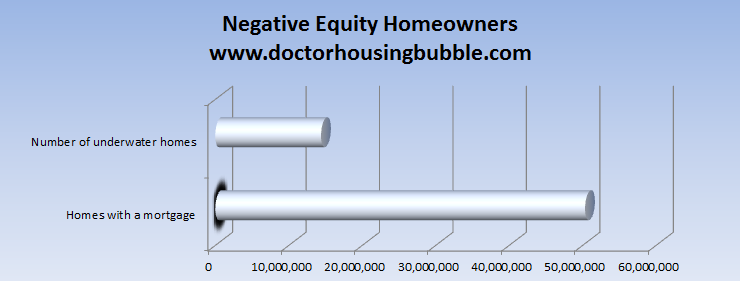

Current information now shows the ranks of those with negative equity have grown once again. The latest Census data shows 50,339,500 homes with a mortgage. If 28.6 percent of these are underwater you have 14.3 million homeowners in a negative equity position:

Source:Â Census, Zillow

This coincides with the large shadow inventory but also the lag in the foreclosure process with banks. It should be apparent that if someone had equity in their home and was falling behind economically that a plausible option would be to sell and scale down. But here you have over 14 million homeowners who would need to come to the table with money if they wanted to sell. Most that encounter problems of course are facing the tough challenges of our economy. The recognition of this is becoming more widespread:

“(USA Today) Another possibility for the bump in the delinquency rate is that a new crop of adjustable mortgages written toward the end of the housing bubble is resetting. Even if their interest rates remain low after the adjustment, payments might have increased, said Darren Blomquist, a Realtytrac spokesman. “We still have the bad loans mixed in that are resetting.”

Although TransUnion still expects the delinquency rate to continue to fall in 2012, the company is now forecasting a few quarters of elevated nonpayment rates due to the uncertain economic outlook. The company doesn’t predict a return to the national peak rate of 6.9%, but said some increase is expected.

“More and more homeowners are likely to struggle,” Martin said. “I’m not sure this is a one-quarter blip.”

That echoes predictions from other sources, like RealtyTrac.

“This isn’t just about bad loans anymore,” said Blomquist. “It’s about a bad economy that’s pushing people into foreclosure.”

This has largely been our argument that low interest rates or other enticements like tax breaks can only go so far when the economy is getting worse or muddling along on the employment front. The approach to solving this crisis was wrong from the beginning because it was banking-centric instead of focusing on shoring up households and looking at the job market. So entering the half decade mark since the crisis hit little has really been done to help middle class American families.

Home prices still declining

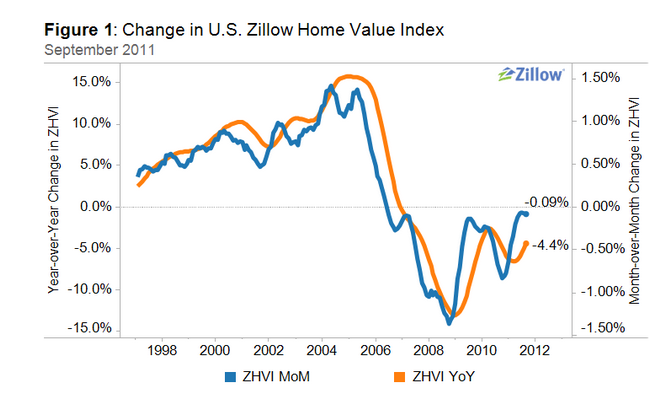

The large shadow inventory will keep pressure on pushing home prices lower. That is why year over year home prices are still falling:

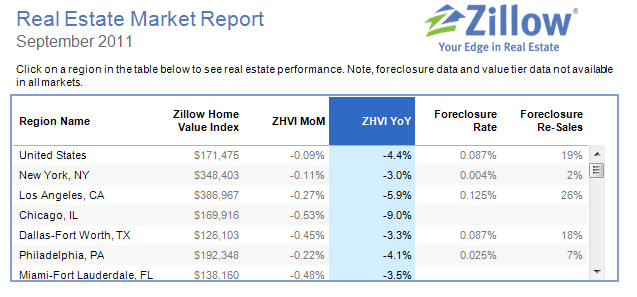

Yet this above data doesn’t really highlight the differences in metro markets. Bubble regions like Los Angeles are seeing more severe contractions in price compared to national trends:

The L.A. market is down 5.9 percent year over year and Chicago is down 9 percent. This is in comparison to the 4.4 percent drop nationwide. We have an interesting market at the moment. You can rest assured that you now have many not buying homes even with low mortgage rates. Call it sticker shock but also household income shock. You have multiple avenues of receiving information and most are becoming more educated especially when it comes to the biggest purchase of their lives. Just because the Fed is artificially pushing rates to 4 percent on mortgages doesn’t mean $500,000 is now somehow chump change. As I have stated before people should take a high interest rate and a lower home price over a high home prices and a low interest rate. With a high rate you have more options (i.e., refi if rates drop, easier all cash sale, add more money to knock mortgage balance lower, etc). The low rate only gives you a low monthly nut.

The trend seems to be clear and that is the shadow inventory backlog is pushing many more homeowners into the negative equity column. The number one predictor for future foreclosure is negative equity (this is the strongest barometer). In other words the years of pushing and hiding properties in bank balance sheets may be causing a new set of problems.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

82 Responses to “Underwater nation – Over 14 million homeowners now sit in a negative equity position. Bubble markets see faster year over year price declines.”

I’m a 1st time buyer on the sidelines in LA, interested in buying a 3bed 2ba in the 90035 or 90019 zip code and I see how much prices have dropped (so far) on some of these nice old craftsman homes sitting on 6,000 sqft. In any case thanks Doc for the reminder and clarity on LA, LA, LAnd. I think I will sit tight at least until spring and watch what happens.

Daniel:

You will be better off if you wait until you see house prices start to rise–don’t guess the market; wait for hard data. I sold all my real estate in LA in late 2005, including a 1300 sf house on the bluffs in Westchester, for more than $1M–I consulkt to hedge funds on real estate–trust me–renting is better–think about job flexibility, etc.

I too am looking for my first home in the 90035/90019 area. I used to dream about a house in the 90036 area- pre-bubble. I check Redfin everyday. I am setting my sights low for a 2×1, below Pico but above Venice, and not within 1-2 houses of a busy street. I curiously walked into an open house that was first time on the market. It needed a lot of work but had a lot of potential. The owner who was retiring to somewhere sunny wanted 650k. It’s pending now for 560k. For something I consider a starter home, it’s way out of my price range. Even the 1000sf 2×1 that’s pending now for 430k. There are two mirror 860sq 2×1’s next to each other for 425k each. Sure if it were 2005 these places would have an extra 200k tacked on, so they are cheaper. But am I crazy to think that these prices today are still too much for a starter home in this area?

No…you are not crazy

I don’t think you are responsible for this person’s retirement. Wait it out.

We decided not to buy due to the large number of negatives in the world right now.

Greece is certainly going to default, probably by Christmas, and no one can predict what effect that will have on the global economy.

Three people on my block have lost jobs in the last year alone, right in the midst of our “recovery”. Hate to think how bad this will get in the next year.

You got to love that all day recovery talk on CNBC. Especially those talking heads that keep reiterating how QE has yet to filter down to the common man and S&P to break out to never before seen highs by early next year. But my favorite is Jim C.’s housing call where he keeps claiming that he called the housing bottom on his show over 2 years ago. I’ve ben looking for a house now for over a year. Every 6 months or so a house I was looking at is 5-10% cheaper. No hurry here. I’ll keep renting. I think the current stock market rally is borrowing from the annual Santa Clause Rally. Time will tell. Took a flyer yesterday and bought some April 2012 WFC puts.

Crammer is a turkey who like a broken clock is lucky to be right twice a day. I can still hear him say “Bear Sterns is fine!” one week before they went belly up. Jon Stewart took him to task and he basically admitted he’s a loser. He’s in the entertainment business, not Wall Street, just like all these talking heads, and they should be regarded as such.

Yes waiting like all the rest of my educated friends, with one question…When it finally looks right to buy are we gonna be outbidding each other the wrong way up loser street, or will houses appear to be such a bargain and plentiful like in Vegas that it won’t matter? I like you guys but if you bid me up it’s all yours.

Cramer has loose stools that come out as Ticker symbols. His information is good for at least a day trade 1/2 of the time. He is an excitable shill whose paroxysms are fun to watch but would not build a long portfolio on. One day he is going to have a stroke while filming. Super shill swillage = Cramerica Lightning Round diversified hero or zero rant-a-thon. BUY BUY BUY. SELL SELL SELL.

The media talking heads constant chatter about Greece and Europe is mind numbing. Our media is constantly diverting attention away from the real problems here in the USA. Our media forgets to tell you that the Euro is worth 40% more than US Dollar. They also forget to tell you that Greece represents 2% of the entire Euro GDP. Greece’s debt represents 5% of the entire debt load of Euro zone. If Greece fails it will not cascade into some global meltdown. It is all propaganda to save the Banks.

True. But think of Greece as the canary in the coal mine. Next up….Italy.

Could see the end of the Euro next year, I’m hearing. Paul Krugman is writing some interesting thoughts on his blog about this.

@Matt: “If Greece fails it will not cascade into some global meltdown. It is all propaganda to save the Banks.”

Bullsh*t, at least on the first part. Any one, including you, who says that they know what’s going to happen is either lying, or hasn’t a clue as to what’s going on. The problem isn’t that we’re dealing with debt, the problem is that we’re dealing with hugely leveraged bets on that debt, much of which is off the balance sheets. And so no one can say what’s going to happen.

But there are some excellent analysts out there, who are more interested in the actual numbers rather than the propaganda, and from what they’ve been able to find, contagion is a real issue.

Just look at the European bond markets tonight, especially for France.

But the bottom line remains that no one knows. Not even you. Here’s something for your education:

http://www.zerohedge.com/contributed/mf-global-repo-maturity-and-large-bank-obs-exposures

@Rhiannon: I wouldn’t spend too much time taking Paul Krugman seriously. The man just doesn’t have a clue, as evidenced by his many statements on being able to solve bad debt with more debt. Or maybe how we needed a housing bubble to solve the dot com crash.

hang seng down 900 points tonight. largest municipal bankruptcy in Alabama today. This may be the beginning of the end of life as we know it in the pyramid-scheme modern world.

Questor, excellent comment. I live in England and watch the developing Greek, Italian, Spanish, Irish and even France debt problem assiduously. You are 100% correct that no one knows how this will play out. The banks are leveraged so substantially that even a 5% shock by a Greek default could cause a domino effect and complete meltdown. OTOH, we might just get through it. IMO the chance of a major economic dislocation is greater than 60%. But, we all know what opinions are like, ” … and they all stink” I claim no crystal ball and hope like heck that I am wrong.

Just read this an hour ago:

http://www.cnbc.com/id/45209336

The only CNBC reporter I listen to. Quit a claim, that the number isn’t in the high 20s, it’s ,ore like half of all mortgages.

“On US totals, if you figure average house prices use conforming loan balances, then a repeat buyer has to have roughly 10 percent down to buy in addition to the 6 percent Realtor fee to sell. Thus, the effective negative equity target would be 85%. You also have to factor in secondary financing, which most measures leave out.

Based on that, over 50 percent of all mortgaged households in the US are effectively underwater — unable to sell for enough to pay a Realtor and put a down payment on a new purchase without coming out of pocket. Because repeat buyers have always carried the market as the foundation, this is why demand has not come back. It’s as if half the potential buyers in America died over a two-year period of time.”

Heh, morbid, huh?

I think this is actually a key point and most people have no figured out that this really spells HUGE problems. For 30 years we’ve had a largely up-market with positive demographics and income but what magnified this was leverage and interest rates steadily dropping down from 20% in the early 1980s. What that does is take an incremental salary increase and boost a financed asset value by magnitudes due to simultaneously cheaper debt being offset: Affordability = cost of debt service + principal repayment.

The net effect of this was people who bought the ‘starter home’ saw strong steady appreciation in their home (big leveraged equity win) while their income steadily rose. This created the “move up buyer” which basically drove the market with not only wage increases but outsized buying potential as a result of levered equity profits on previous homes.

The point we are at now is that there are NO move up buyers and many of them took a major hit to their equity. A good portion of them played the move up game so far beyond their income and median income levels that they have wiped out their equity (musical chairs and the music stopped). Fundamentals for creating more move up buyers without substantial wage increases are done, that old equity ponzi is finished and people are absorbing the losses. Incomes are no where near pricing and with not only future levered equity gains off the table but the past gains heavily impaired (don’t even bother with tight/real credit and demographic downsizing shifts) – there is no chance of wind in the sails as I see it.

I like your take on this. But, I wouldn’t be so quick to say “don’t even bother with ………… demographic downsizing shifts”. You have basically described the great real estate “move up” game and ponzi like scheme the Boomers, as a majority, have driven since the early eighties, and now a lot, probably most, of them are stuck at the top of that pyramid with nobody out there to buy there overpriced MacMansion. I predict that most of these homes will be inherited and lived in by the only child and sold for true market value in estate sales when more than one child is involved.

LOL – I didn’t mean “don’t bother” as in “it’s unimportant” but rather in the sense of “we don’t even need to account for these other MASSIVE elephant in the room issues as we are screwed on income/price straight from the get go”.

But yes, that point is very valid and honestly there are issues far beyond the kids having a place to live. Maintenance/upkeep/taxes/proximity to gainful employment/energy costs of heating and commute to employment/areas changing. All of this factors in as well and it likely won’t be a slam dunk to pass houses generationally for too many. I know a family who was considering this as a relative passed and I told them to take Prop 13 and several other assumptions out of the analysis completely and see if it worked on base market – otherwise sell it.

You realize that means that every FHA and VA closing automatically creates another negative equity homeowner. The cost of sale is 6% commission + 2% closing costs; if you’re lucky.

If you buy with an FHA loan your upfront mortgage insurance premium is non-refundable and added to your mortgage balance; so you’re at least 6% under right out of the gate and that’s almost twice what the home buyer had to save up for the initial down. What are the odds they’ll be able to save up twice as much as their original down while making their new mortgage payment? They are not homeowners so much as future foreclosur-ites.

– Underwater Nation

And the ones that backstop the VA & FHA driving more nails in the US middle and lower classes. I hate the way Brooksley Born was ridiculed by Greenspan and his Goldman thugs and the fools in congress for trying to get a handle on the banking mafia. All of this is the result of the scorched earth policy of those Manhattan mobsters that chew up the rest of us and spit out the bones. Most of us are sentient beings that would take no pleasure in bringing despair to others for their own gain, but these people are like from another planet. I’m sure Mozilla and Blankfien couldn’t care less about what their machines have done to the world.

This figure only includes people who owe MORE than their houses are worth. But it almost doubles when you factor in closing costs to sell and down payment costs to purchase another house post-sale. With a 6% realtor commission and ~10% down payment, a huge number of people who aren’t officially considered to be in negative equity are just as trapped as those 14 million. Some estimate that the combined total of negative equity and this “effective” negative equity is over 50%! I think this is the reason why nobody’s buying despite the low interest rates. We’ve become a nation with hardly any move-up/lateral move buyers. Half of our mortgage-holders have fallen and they can’t get up!

10% down payment isn’t actually reality though, you can get a house with a much smaller down payment as we all know.

Yep, 3.5% or less I bet.

When you consider that the cost of sales is often 6% or more, negative equity positions are higher than 14.3M mortgages.

New York with its 900 day foreclosure timeline and very slow foreclosure rates/sales has got to be a big problem on the horizon. Outside of high end workers, everyone I talk to there (normal people) is upside down or trying to work out there mortgage. They talk this market up a lot but it appears to be hurting again and all the news about financial layoffs and low bonuses is going to hurt it worse than now – and we’re talking impacts on regular folk not just high flying bankers.

Not me. Just renting and watching. Good news this morning in the NYT that bank bonuses may be down 20-30% or more. Boo Hoo.

Wasn’t there a post on this blog ages ago about how TARP could have paid off every outstanding mortgage in the US?

I’m not sure if this blog mentioned it, but you are correct, TARP could have paid off every mortgage in the US nearly 3x over.

But hasn’t tarp been nearly paid off?

Important point you made when talking about high interest rates/ low prices vs high prices low interest rates. The refi and cash sale are obvious but I’m glad you pointed out that you can pay down the mortgage much easier. Tax returns, a small bonus, even wedding money can be a quick 5 percent off the top if you apply directly to principle. On a 200k mortgage that’ve about all the equity you get in 3 or four years. On a 400 k mortgage it’s a drop in the bucket. Throw your tax return each year at a low mortgage principle and you can take years off the payment length. Much harder to play that game with a large mortgage. I’m so sick of the media lying that it’s the best time to buy.

It costs 6% to sell a home. To buy one, the FHA requires a 3% down payment.

Our government is trying to support the housing market by instantly putting people into negative equity, which coincidently is the number one indicator of future foreclosures.

Well, wouldn’t a great way to fix the “underwater” problem be to start a new home sale process that isn’t 6% of the sale price.. But a flat price.

I know realtors would cry foul… But it doesn’t take a rocket scientist to buy and sell a house… I learned so much in my home buying process I feel much better equipped the next time i go to buy. Redfin already lets you sell your home for 4.5%… vs 6%.. I still think it should be easier to have “For Sale By Owner”.

And if home prices drop much further.. I GUARANTEE YOU that you will see a lot of “FOR SALE BY OWNER” homes bypassing real estate agents entirely… Just making deals with a handshake and notary present. That’s $24K savings on a $400K home..

Lets hope, Cali. Lower transaction costs and higher downpayments would be a big step in the right direction.

Yep, we did for sale by owner. An agent found us who offered to list our house on MLS for less than $300, which was cheaper than listing in the newspaper. In the end, I gave the buyers agent 3%. We took a loss on our home, but I think we got off easier than most other sellers on our street. If we would have held on to the house we would have doubled our loss.

I think we are seeing more FSBO out there.

I’d love to see more FSBO – but in Southern Orange County there’s still very few of them – and ALL of them seriously overpriced. It almost seems like around here FSBO is a choice for those stubborn sellers who don’t like the asking prices the realtors suggest…

Another factor is that in many states, maybe nationwide (?), the seller is expected to throw a couple of thousand dollars toward the closing costs of the buyer. That’s how it is in Michigan, any way.

Regardless, there are always tons of closing costs of many types, so add that to the pile of obstacles facing someone that wants to sell and buy another home.

The realtor “6%” collusion needs to be cracked down on.

It occurred to me is that the people that sort of knew that they were doing thinking they’d be long gone from that house in seven years and got 7 year arms during the boom/bubble are starting to reset now.

It will be… THe days of 6% realtor commissions are numbered.. In fact REDFIN already has put pressure on them and lowered it to 4.5% commission.. It will only go lower from here.

Part of the CA real estate agents exam presses the point that the agent should tell the client that the commission rate is completely negotiable. I’ve done deals with agents for 1%.

Consumers also expect rents to rise, and yet a full third still say they would rent their next home rather than buy it. More telling is that 77 percent say the economy is on the wrong track and an all-time high expect their financial situation will stay the same over the next year. http://www.cnbc.com/id/45194097

That’s not a great atmosphere for a surge in home buying.

True rents are high, but in my recent apartment/condo hunting in the East Bay Area I’ve been sensing desperation on the part of landlords & property managers. I don’t think the rental market is hopping for landlords as much as has been reported. I had offers (pleas) to negotiate on the spot. They didn’t bother to ask if I liked the place or could afford the rent, and were very flexible with terms, deposit, pets, etc. I think the shift in families doubling up and adult children moving back in with parents out of necessity is having an effect. I don’t know exactly how the number of households could be quantified, but in the SF Bay Area, subscriptions for all TV providers – cable, satelite and AT&T are down across the board. I doubt people are going without. When 2 or 3 households combine, multiple cable subscriptions becomes 1.

I love this! I think a lot of folks drank the Kool-Aid on this belief in my neighborhood too. I currently rent a house in Southern Santa Cruz County. The average rent for a really nice 3 bedroom was $2300 – $2400 in 2009. Some of these desperate owners are now under the impression that they can get $3000 for these places. I watch the rental market as closely as the RE market and these places sit on the market for months. Then they start lowering to $2800 and then $2600 etc. I think we keep forgetting that rent is paid from income and income in South Santa Cruz County hasn’t grown much in the pasted 2 years…

So almost 30% or loan owners are underwater. I wonder how much that will increase when we see another 5 to 10% decline in house values. Barring the use of a large down payment, you will likely have a decades worth of home buyers trapped in their houses when you factor in the large cost to sell.

I will keep renting for the time being, but I am keeping a watchful eye on neighborhoods I am interested in. I like using Redfin to map all sales within the last 3 years in a neighborhood, just by doing this you can tell prices are still heading down. The homes currently for sale are definitely less than what people paid for comparable places back in 2009 and 2010…these people are likely underwater also by now.

Keep renting, keep saving that down payment and keep your powder dry!

We are going to continue to rent, perhaps never buying a home again. Have friends that purchased “a great deal” (according to their realtor) last year. Not only are they sitting on negative equity, but there are now 3 foreclosures in their neighborhood. A couple of the properties look abandoned. Our friends also said that their neighbors next door intend to rent out their house in the next several months. Who knows what kind of renters will move in and how well the owners will monitor and maintain the property. Continuous advice from our friends….”Don’t buy, keep renting”. The home our friends purchased is in Coto.

All of this is directly related to the control of finances. Yet ANOTHER reason why the Occupiers are out on the streets. Right now you have people in the streets trying to HELP change the system for everyone, when it gets really bad, you will see people out in the streets for THEMSELVES.

If you have any logical, free thinking left from your upbringing in this “free” society, AND you contemplate the issues, you will know in your heart the Occupiers are correct intheir assessment.

Someone please explain “The trend seems to be clear and that is the shadow inventory backlog is pushing many more homeowners into the negative equity column”. I would think the opposite would be the case. If there was no shadow inventory and all foreclosed houses where on the market wouldn’t that create more supply for the current weak demand which would push values lower? Hence, less shadow inventory and more real inventory would cause more under water homeowners. What am I missing?

The Shadow pushes FUTURE price projections Lower. Current MLS pricing is artificially propped-up cuzz true inventory is “in the shadows” RE is an inefficient market…compared to/for example the commodities market. You pointed-out great example of why it is defined as such.

Wow! That is a new one for me!!! House futures trading! I bet we will see a show on CNBC on this one… Seriously, I still do not see how this works. My understanding is that there is no futures market for housing. I understand the CDS market but that is really not what we are talking about as far as I can see. The only housing that I know of is valuation by comps (i.e. history not future). It is also my understanding that comps do not include “distressed” sales (Short sales and REO’s). Am I missing something? BTW -I will let you sell the housing futures market idea to CNBC or Goldman Sachs!!! 🙂

U ever hear of Mortgage Backed Securites (MBS)? Sorta the same thing, the future is only ever a guess & gamble!!! Funny stuff!

I think CDS’s are more of a representation of the future home price than a mortgage back security. In the end they are just the other side of MBS’s. However, I do not believe that this is important in regards to my original question. Home valuation is always backwards looking from government to banking as far as I know. So, how does shadow inventory have a negative effect on house valuation? I understand between you and me we bake this into our valuation of a possible future purchase. But as far as the housing market, comp sales are used to value a house. I still don’t understand what DHB meant by that quote…

I agree. Seems to me like shadow inventory would tend to keep home/loan owners above water. Were the shadow inventory to become real inventory then the number of underwater home/loan owners would skyrocket due to plummeting prices. Basic supply and demand.

All that QE did was stabilize the banking system by pumping up there reserves. However, banks are sitting on those reserves, requiring much higher loan standards, so in effect, QE has not improved the housing market liquidity. QE was basically a supply side attempt to place more debt on homebuyers’ backs, and stabilize prices. Didn’t work because with high unemployment, income levels have dropped and world economies are buckling under sovereign debt. With interest rates at 50 year lows, some consumers are stepping back in, but until employment and productivity measures improve, they are likely catching a falling knife.

The banks need to step up and work on reducing this negative equity position. Why don’t we demand a program – call it REAP for Regain Equity Add Principle, whereas the banks will match the additional principle the homeowner sends every month with their mortgage payment. Maybe our brilliant congress could write some legislation that would give the banks the option to claim the principle matching as an operation expense. This is just an idea that there needs to be something done with this massive overhang of negative equity.

Sorry Salvatore, we are not responsible for bailing out your bad decisions. You want more equity? Get a second job to pay down your principle. How about that?

Not talking about myself -I’ve been paying down my principle since day one – my main goal in life is to stay in my home – love every minute I’m there. I’m talking about the stupid banks who are the main reason for the hyper inflated homes – give a lone to any moron – who cares if they can’t afford it – we will sell the worthless paper anyway. All debt holders are going to have to start taking losses – look at Europe. WRITE DOWN YOUR DEBT – IT WILL DIMINISH IN VALUE ANYWAY. I’m a controller in a Chap 13 bankruptcy office – every filer is wiping out their 2nds and home equity lines of credit – so it is happening

Something will be done. It’s called bankruptcy.

If home prices keep drop another 10-20% over the next 2 years… Whoever gets elected in November 2012.. will have to pass a policy to help homeowners.

If that party wants to get re-elected in 2016…. Otherwise the economy will be far worse in 2016 if home prices drop another 20-50%… We’ll be in a dark depression.

I didn’t know there was wifi access at OWS.

DHB and fellow readers-

I have been following this blog for about the past year. I am in constant awe of the amazing research and analysis that DHB provides. Equally as impressive are the insightful and intelligent comments by the readers. Many people here have a tremendous knowledge about not only real estate, but economics, finance, and investing. I was hoping to tap into that knowledge base….

I am a young professional, just begining in my career. The good doctor has been schooling me in real estate, but I have little to no knowledge in the areas of econimcs, finance, and investing. I was wondering if anyone could point me in the right direct to learn about these subjects….books, websites, etc??? Im trying to arm myself with knowledge as early as I can to prevent future mistakes. Thanks!!!

Paul Krugman’s blog for econ., zero hedge for investing…

DHB is a good site for real estate. Also check out Calculated Risk Blog. Read books by Marc Faber, such as “Tomorrow’s Gold” which is a few years old, but definitely worth it. Also read books by Michael Lewis, who is extremely informative and just plain writes well. There are lots of other economics/finance/investing authors, but many have biases.

Some basic academic education in economics might be useful, but the higher level stuff is actually not that helpful. The big university endowments are NOT managed by university econ departments for a reason (namely they would become small university endowments). Oh, and avoid CNBC, unless you accept that it’s just for entertainment.

Check this website….

http://www.reiclub.com/real-estate-articles.php

I’m sure you’ll get lots of advice. Be aware that most stuff out there is utter BS. As in complete utter BS. Written by people who are incompetent.

If you really want to learn, here’s a filter you can use. Start by ignoring those who “couldn’t see [the crash of 2008] coming”. That was the biggest event of such Economists and Financial “experts” lives, and if they couldn’t see THAT coming, there really is nothing that they can do to help you. If you want to believe in fairy tales, just ignore this advice.

I second that, anybody who didn’t see the entire Ponzi scheme imploding should be put on ignore. I will add one more suggestion, Crash Proof by Peter Schiff. He wrote this in 2006 and was right on the money regarding the housing bubble and the general economic dysfunction going on in the world today. And he was big on buying gold, if you bought 5 years ago you made out like a bandit. His views are pretty extreme but have proven to be correct.

Read, Rich Dad Poor Dad by Robert Kiyosaki and Sharon Lechter.

MISH is the bomb. He takes a very insightful view on economic goings on everyday, and makes it easy for a layperson to understand.

Mike “Mish” Shedlock

MISH’S Global Economic Trend Analysis

http://globaleconomicanalysis.blogspot.com/

@ Carolina, Mish’s is a very good site. +1

Big Picture, Barry Ritholtz’s blog

Naked Capitalism

Calculated Risk

Seeking Alpha

It doesn’t matter on how much the interest rates are lowered but the total cost of the home. To buy property now is akin to purchasing a car that normally sells for $25.000 but with a “special” loan @ 3% you’ll buy it at $45.000. Patience is a virtue!

I believe that most banks are loan servicers and not necessarily holders of the mortgage. Do we know what percentage of shadow inventory (NOD’s + REO’s) are indirectly/directly held by the federal government (GSE’s or MBS’s held by the Fed and Treasury)? I would guess that the percent is growing.

If we assume for arguments sake, that the government was %100 percent owner of all mortgages and all shadow inventory. Would it be possible that the government would hold on to this inventory as yet another method to artificially prop up the housing market?

Maybe this is slowing the pace of the shadow inventory getting to the market. Just a thought, I have no information to back this.

It’s the Fed which owns some MBS’s. Maiden Lane I or II, I forget which. This is published. And they are looking at dumping this ASAP, which is what Obama’s mortgage refinance scheme is all about.

What is more likely than just holding things is to buy them up, stick the write downs on the American taxpayer, and then resell these at a loss. That they haven’t done this beyond the refi program says something.

What if anything will force the banks hand? Or, are we to have zombies for the next 10 years while we sink into stagflation like Japan? We would have been out of this mess by now if the gov’t would have let the market clear inventory as usual.

http://www.westsideremeltdown.blogspot.com

Dr. HB has wonderful analysis. Thanks man.

Something a little off-topic, if I may. About Student Loans and Pensions.

First, one thing that I’ve never seen mentioned here about Student Loans is who buys up these things? Well, Pension funds are a large investor in them. They love the guaranteed cash flow from the debt slaves who took these loans out.

Or, in otherwords, we have an absolutely huge transfer of wealth, from one generation to another. The grandparents are eating the grandkids, just to maintain their lifestyle. The next time someone on a Pension sees their grandkids, you might want to think about that.

Second, it has been claimed that some pensions are safe. Maybe they are, but I really don’t think so. Except maybe for Congress. Here are are couple news items supporting my dim view of pensions:

http://www.mercurynews.com/elections/ci_19302567

“From San Francisco to Modesto, California voters Tuesday sent a strong message that they want to cut generous public employee pensions, whose soaring costs are devouring funds for cops, libraries and other services.

…

“It certainly demonstrates solid public support for pension reform,” Reed said Wednesday. “Even in a labor-friendly town like San Francisco, 68 percent said yes.””

And for those idiotic Police Officers who are committing Felonies against the Occupy Wall Street crowd (just like the thugs they are supposed to protect us from), you might want to consider that you’re on the wrong side of the fence and are about to get seriously screwed. Regardless of what the Big Banks are personally contributing to you in order to buy you off:

http://market-ticker.org/akcs-www?post=197329

It’s about a recent Court case, and is entitled:

Police Officers: Wake Up! Your Pensions Are Fooked!

“Public-service employee pensions are not going to be paid. Not only were these people sold unicorn-style rates of return which cannot possibly be sustained the losses that were generated by all the scams and frauds are real and will be recognized — and when they are, you’re going to get a truly ugly surprise.”

”

“

Lets all stop paying our mortgage on 01/01/2012

the “national occupy your home for free” movement

http://caliscreaming.com/2011/11/10/california-free-rent-month-the-occupy-your-house-for-free-movement/

Ok I won’t pay rent that month, take that!!! What is this so called eviction notice they keep sending me all about anyway? Oh I forgot as a renter I actually have to be responsible if I want a roof over my head, and not a total deadbeat like the home debtors.

California, US is circling the drain…I know many 40+ California natives who don’t/won’t work, or hold a menial job, sponge off grandparents, spend the inheritance, live in the home their parents bought decades ago…their teen/twenty something kids live there too having graduated with degrees in poli sci, literature, art history, lots of student loan debt…lucky ones have $10/hr jobs…everyone lives in the family home far into adulthood, many will never leave. Lots of teen/twenty something single moms; WIC, welfare, etc. helps the family pot. A large chunk of Millenials will never buy a CA house, even if they wanted to…only way they can buy is if they leave SoCal…they won’t…they like the weather, friends are here. No point in taking risk when you’re comfortably numb in eternal childhood. Helicopter Boomer parents happy to keep adult kids at home…micromanage their lives forever…

In a few decades when the inheritance (funds from real estate Grandma/Grandpa bought back in the 60’s-80’s) is gone, it will be interesting to see how CA fares. Other countries educational systems stress engineering, science, etc. We stress do what feels good, live the dream. Will be interesting how it all works out.

you are not lying–I personally now two folks that pissed away 7-figure inheritances and are now working one as a sales clerk and the other a handyman. Funny how those super hot chicks quit hanging around after the money’s gone…that’s why the frat boys of Manhattan are pillaging the rest of us–the hot chicks aren’t hanging around cuz you guys are Brad Pitt. No green, no tween.

I am still looking, but how can I find out something about these people? Someone posted that these are all “second homes and flippers who got in too late”, so he sees no problem.

I cannot imagine that 2 million foreclosures are just a bunch of thoughtless wealthy people – are these not mostly families with incomes <$80K?

How can I find out?

Thank you for your work, and the comments. What an amazing site.

Leave a Reply