The New Ownership Society: Federal Reserve Bank, U.S. Treasury, and the FDIC – FYI, We Already Own More Than you Think.

If you are expecting a miracle from Davos Switzerland, think again. All we are seeing is bread and circuses while Putin tells Michael Dell to basically shove it and other countries using the economic forum to dish out political discourse. The last post discussing the paradox of thrift generated a lot of commentary on both sides. I am still stunned at how many people actually still believe that we live in a purely free-market capitalistic system. We do not. Many people simply assume that the Federal Reserve System because it has the word “Federal” means that it is owned by the people, it is not. The Federal Reserve also known as the Fed is the central bank of the United States and has been a key partner in this global credit crisis. The Fed was brought to our country in 1913 by the Federal Reserve Act. The Fed is a quasi-public entity with private components.

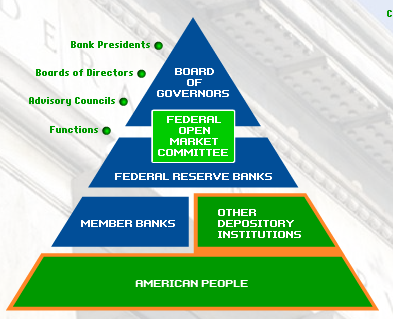

This may stun many people since many think that the Fed is completely independent from the banking powers of the country but it is not. Yet the way they interact with our government, it gives the impression that they are fully part of the government. The Fed breaks down as follows:

(1)Â Board of Governors in Washington D.C.

(2)Â Federal Open Market Committee

(3)Â 12 regional Federal Reserve Banks

(4)Â Numerous U.S. private banks

(5)Â Advisory Councils

The Fed in many regards has failed in its mission and with Ben Bernanke telling us he is willing to drop dollars from “helicopters” we must gear up for inflation down the road. That is another point I want to bring up. In a fiat regime, inflation or deflation is a matter of policy will. That is, the Fed always has tried to keep inflation at a moderate level purposefully and has successfully done so since the Great Depression. Yet now, it is having a harder time with rates reaching the zero bound and may have to resort to literally dropping money from helicopters.

I love this graphic from the Federal Reserve’s own website on Fed 101. It pretty much sums up the structure of our banking system (guess who’s on the bottom?):

So if you are wondering why some banks seem to have more lives than others, only 38 percent of the 8,039 commercial banks in the United States are part of the Federal Reserve System.

Don’t think that the Fed came into being on easy street. With the Panic of 1907, the stage was set for the money trusts in the big Eastern cities to push for a centralized bank yet progressives fought against this plan. You also have to go back to the time and general sentiment was rising for a central bank amongst the public. Yet the public doesn’t always get it right and all we need to look at is Real Homes of Genius and Option ARMs to realize the public can be wrong many times as well.

The Federal Reserve Act was signed on December 23, 1913 only a few days before Christmas which was perfect timing to jam something through Congress. Now you have to wonder about the timing and history many times tries to make it seem that it was a bill that was passed with support from the public and flew right through politically. It did not, this was years in the making and frankly, it is hard to say how many politicians really understood that they have signed over the keys to the country to the Lords of Creation.

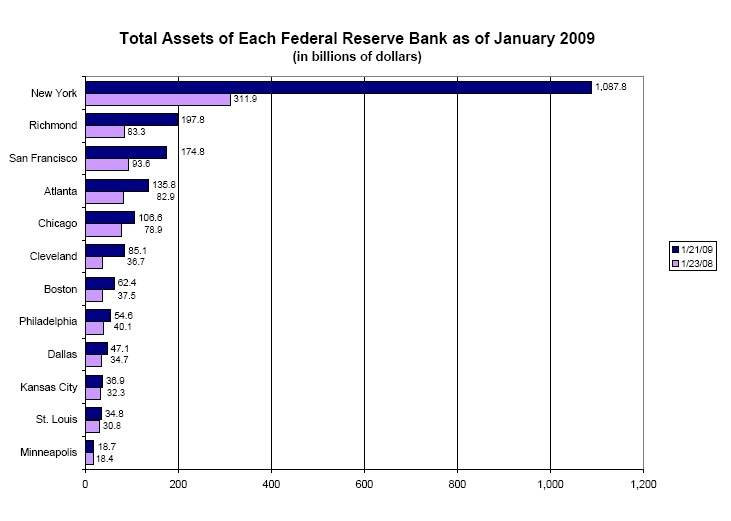

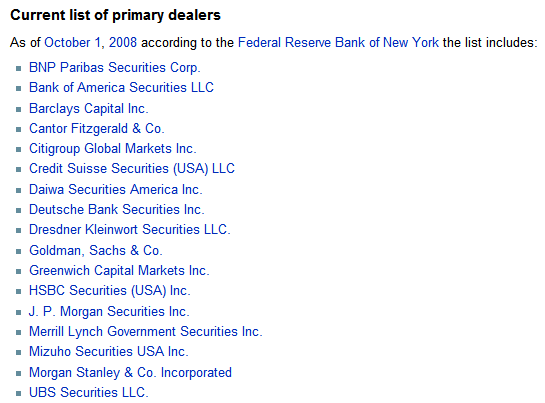

Now you may be thinking this is all a bit far fetched but keep in mind I am getting this research from the Fed itself! And if you have any doubt who has the power right now, it looks like the Eastern money trust is back in the game once again:

I’m not sure there is a clearer picture of who is getting the most action since the crisis has taken place. The New York Fed has seen the most action out of the 12 Regional Banks and the amount of “assets” they have on their books have shot up over $1 trillion. Many people think that only $350 billion has been shoveled off via TARP part 1 but that is separate and distinct since that was money issued via capital injections by the U.S. Treasury. Most of these assets are toxic collateral exchanged to member banks for U.S. Treasuries via the Fed to keep them living one more day and waiting for the government to decide how they are going to unload decades of waste onto the public.

Keep in mind much of the TARP is issued through preferred shares, which almost work as loans to participating organizations. In a way, the system is now setup that we may screw ourselves since we are part of the game. For example, Bank of America already has $45 billion of the TARP funds. This is flat out nuts! Bank of America’s current market cap is only $42 billion:

The above is one part of the problem regarding lending to the public since the preferred shares really don’t do anything to encourage lending. Capital ratios are so horrible at banks that the notion was that the U.S. Treasury would simply buy preferred shares and the market would suddenly bounce back and the shares would be paid back. Consider it a really cheap loan to the banks on the backs of American taxpayers. Yet the market didn’t bounce back and now the shares are there as simply another liability to the banks. So the idea that many of these banks are free and clear is absurd. The public already is knee deep in this stuff. We own a piece of these already whether we want to or not which is unfortunate. That is why people arguing against us getting involved don’t even realize that we are completely involved through TARP, Fed purchase agreements, and the fact that our discount rate is near 0 percent punishing conservative savers who don’t want to play the stock market casino.

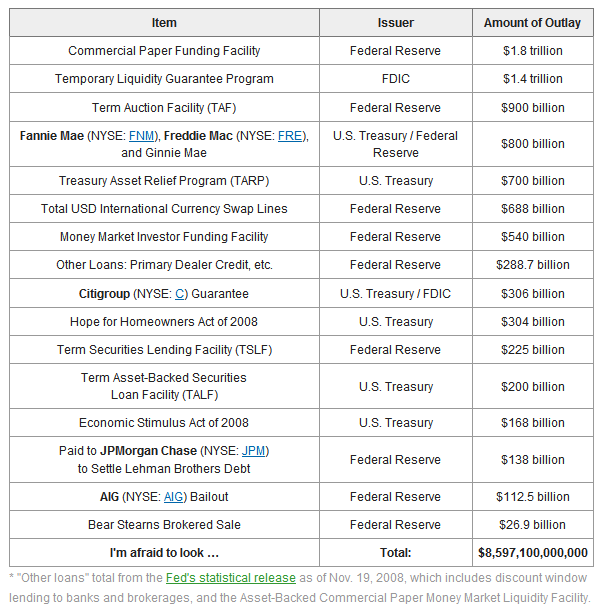

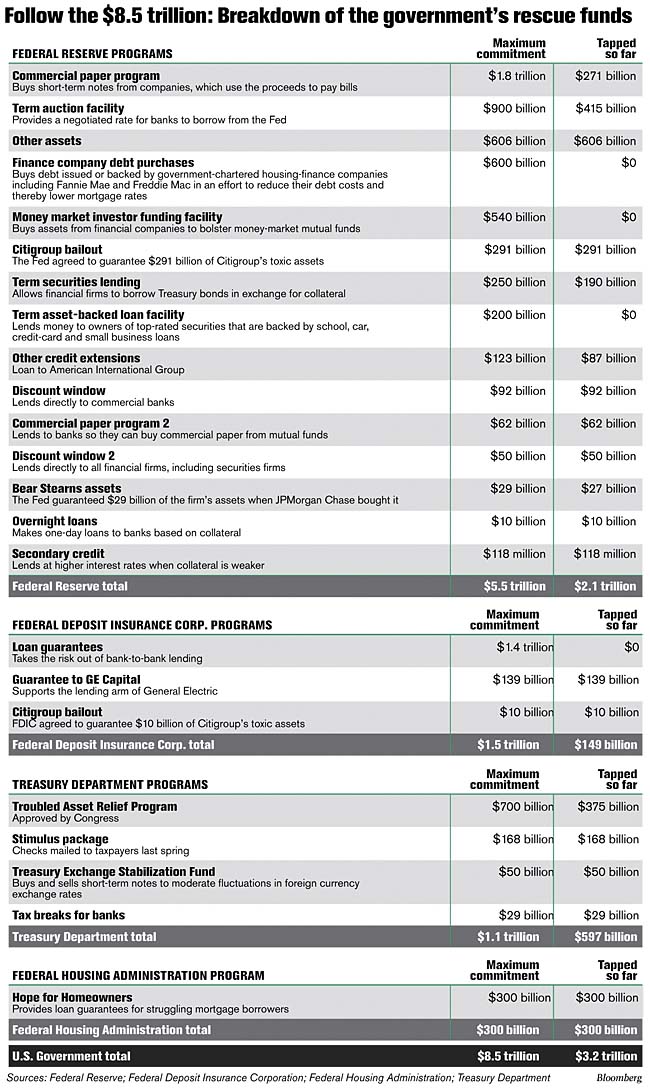

If you want to see how much money is on the table already, take a look at this chart put out back in November of 2008 by the Motley Fool:

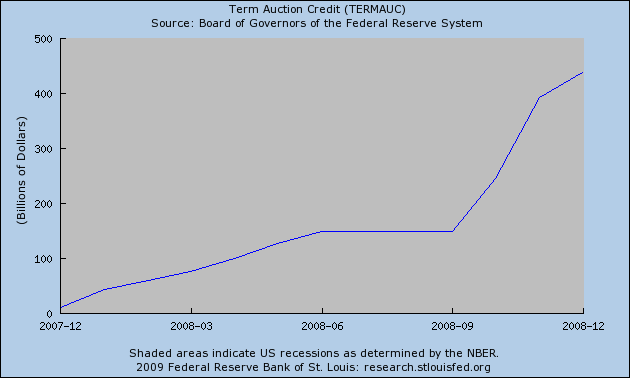

Let us go through the list above and you can see that simply focusing on the $350 billion already allocated by the TARP is chump change to what is riding on this game. We saw in the most recent chart above with the 12 Regional Banks that the Fed already has a ton of questionable assets on its books. Let us look at the term auction mechanism since the crisis started:

The Fed can go up to $900 billion and we are already at $438 billion, a size much larger than the TARP but many people don’t seem to be paying attention to even this program of many. Even looking at the list, that $168 billion Wal-Mart tax rebate voucher from the first half of 2008 now seems like a conservative outlay in the face of what we are now talking about.

And just look at how much was guaranteed to Citigroup. We now backstop $306 billion of their questionable loans through a combination of the U.S. Treasury and FDIC. That is insane for one institution! The amount to AIG? It just keeps growing as time goes on. And we have already tapped well above $3.2 trillion:

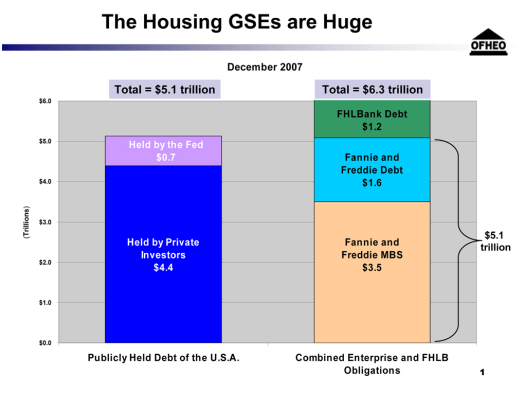

The reason I even uttered the word nationalization in the previous article is that we are already spending money in the trillions whether people realize it or not and we are committed to a much larger amount. No one has really run an analysis showing that nationalization would cost “X” dollars instead of the currently committed $8.5 trillion which seems to be growing as days go by. And don’t think I’m married to this one idea alone. It is simply better than these multiple clandestine nationalization-lite strategies that we are currently employing. Aside from semantics, we already nationalized Fannie Mae and Freddie Mac and they are the primary mortgage players in this country. AIG is virtually nationalized. If you think the amount on the books of Fannie Mae and Freddie Mac is small think again:

Keep in mind the chart above doesn’t include 2008 which saw a jump because Fannie Mae and Freddie Mac were virtually the only game in town. And now with “prime” loans going bad in record numbers, we are on the hook for enormous losses.

The problem I have with the current structure is the U.S. taxpayer is already committed to trillions of downside with very little upside potential. Long time readers know that my stance has always been for the government to stay out of the markets especially when it came to housing prices. Yet one thing I despise even more is using taxpayer money to bailout Wall Street and banks under the umbrella that it is help for the Main Street family. They got their goodies first and now after such a boondoggle, they may want to throw a bone to the public since the masses are getting agitated. In fact, the irony with the TARP funds is they are getting a cheap loan on your back and if things get better, they pay it off and never are held responsible for their actions. What do you get? A pathetically low return if you are lucky to even see the money ever again.

That is the fundamentally troubling sign of the current structure. We are now faced with the option of bringing in say Bank of America or Citigroup that we have billions in preferred shares in these places. Do we wipe ourselves out since we already have billions in them? Talk about a conflict of interest but I think that was the entire purpose of this. Banks knew we would now be committed to the cause since our money is at stake. But is it really? Most people didn’t even want TARP but it was rammed down our throats and look what it has done. Nothing.

So here are the options that we have on our plate:

(a)Â Continue with TARP and the current litany of programs.

-pro: Nothing that I can see. The market improves, banks get away with decades of malfeasance, and taxpayers simply get their money back.

-con: Many things. We are getting screwed on a continued basis and for those who say “stay out” it is already too late. Look at the data. The horse is out of the barn.

(b)Â Go with the Bad Bank.

-pro: Banks have the chance to unload toxic assets and improve their balance sheets. This will increase lending but by how much?

-con: Taxpayers get royally screwed here because we’ll get the worst of the worst. This is already happening (heck, we nationalized Fannie Mae and Freddie Mac, AIG – it isn’t like we nationalized Netflix which is actually doing well). We will have years and years of crap to work through and it isn’t clear how banks will be punished and how we will prevent this from ever happening again.

(c)Â Nationalize

-pro: We own the bank and can wipe out common shareholders, preferred (yes, even us but we already own it anyway), and eliminate management. We tier and spin off the good, the bad, and the ugly on a temporary basis.

-con: It will cost us a lot but everything else is already costing a lot. But the question is, will it cost us more than the above options? Not sure. But look at the Federal Reserve and its quasi-public setup. You cannot serve two masters at once and that is what it is trying to do. Clearly, their number one master right now is Wall Street and the money elite. You need only look at the regional bank assets above. Take a look at the FDIC failed bank list and it will tell you who is connected and who is not.

(d)Â Do nothing

-I’m stunned some people still believe this is an option still. I didn’t realize $3.2 trillion is doing nothing. Something is already done and it is too late to do nothing since everything is fluid right now and politically how things go, it is now a question what is the best road to travel of the many crappy pothole filled paths.

I always pushed for a hands off approach because if you look at history, anytime we get involved things normally get worse or fly off a cliff. That is just the way things go. But what is worse is many people are snowed into thinking nothing is being done currently. It is. How’s that working for your paycheck? Try getting a loan right now. Do you think you have the same access to the Fed and U.S. Treasury as the connected banks? And don’t fall for the argument that they “know what they are doing” because clearly they do not. You need only look at the CDO, CDS, TARP, ABCP, and every other alphabet soup of junk floating out there to realize things are not going well.

Fundamental changes are coming. I only hope that we look deeply at the structure of the Fed and reexamine whether they deserve the power they currently have. Just look at a brief list of current primary dealers with the Fed:

You don’t see on the list mom and pop regional banks. Heck, the Fed isn’t even following the law:

“Each Federal reserve bank shall keep itself informed of the general character and amount of the loans and investments of its member banks with a view to ascertaining whether undue use is being made of bank credit for the speculative carrying of or trading in securities, real estate, or commodities, or for any other purpose inconsistent with the maintenance of sound credit conditions; and, in determining whether to grant or refuse advances, rediscounts, or other credit accommodations, the Federal reserve bank shall give consideration to such information. The chairman of the Federal reserve bank shall report to the Board of Governors of the Federal Reserve System any such undue use of bank credit by any member bank, together with his recommendation. Whenever, in the judgment of the Board of Governors of the Federal Reserve System, any member bank is making such undue use of bank credit, the Board may, in its discretion, after reasonable notice and an opportunity for a hearing, suspend such bank from the use of the credit facilities of the Federal Reserve System and may terminate such suspension or may renew it from time to time.”

“Whoever knowingly makes any false statement or report, or willfully overvalues any land, property or security, for the purpose of influencing in any way…shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both.”

Yeah right. We are going to have a very long and interesting 2009. It is amazing that as we sit on the verge of another Great Depression, we sit asking an entity that lowered interest rates to the ground, championed adjustable rate mortgages, and saw nothing wrong with derivatives for advice on solving a crisis caused by too much credit, toxic mortgages, and the credit market imploding. Let us ask the thief about his views on justice.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

24 Responses to “The New Ownership Society: Federal Reserve Bank, U.S. Treasury, and the FDIC – FYI, We Already Own More Than you Think.”

How did we let the bankers do this to our children’s futures?

We must change the financial system so this kind of greed by Wall St. can never happen again! God only knows what the next few years will be like us Americans.

Read the Creature From Jekyll Island. The FED was formed in secrecy and has worked in secrecy since the start.

They are THIEVES, pure and simple.

Basically, Wall St. IS the government. We are owned by the FED and Wall St. one and the same. Goldman Sachs runs this country.

People have no idea.

I say nationalize the banking system. Throw the managers and CEO’s out and wipe out the bondholders. If we hadn’t been kissing CEO butt for the past ten years while they championed outsourcing, global wage arbitrage, and creative financing perhaps we wouldn’t be in such a big mess today. With businesses not worrying about their stock prices they can begin to heal and create long term strategy’s for profit rather than worrying only about next quarter. Yeah the government is disorganized but isn’t it better than the thieves who have been running things?

The FED needs to be abolished yesterday, and we need to take back/reverse everything they did to our country over the last few months, if not centuries. The banks should be nationalized, at least temporarily, and every person and institution involved (otherwise known as the elite banksters and politicians who served and supported the government and “quasi” government decisions) in each of the bailouts and heists of the taxpayer’s (i.e. the “common” mans) money, should be divested of their personal assets and earnings and put in a stockade for public viewing, smack dab in the middle of Wall Street, to be pelted with rotten vegetables. Then they should be tar and feathered and sent to jail for the rest of their unnatural lives.

“Let us ask the thief about his views on justice.” Love it! The Fed is as federal as Federal Express and has no Reserves other than what it prints out of thin air. The ultimate corruption of our system came via the bankers, as Jefferson warned. We get a wicked deflation first, then the inflation after.

Those who don’t want to play at the stock market “casino” better be pretty damn self-sufficient!

Of that 4.4 Trillion owned by private investors, most of those private investors are government pension funds. So they ain’t private at all. Wiping out these shareholders means another bailout. So the “pro” for nationalization should go into the “con” pile. Which means there is no “pro” at all for nationalization.

I think rather than Tarp, the whole plan should be spelled ‘Trap’. Those that still subscribe to the dogma of the Church of Jekyll Island when faced with logic that cannot be resolved simply chant “The Fed works in mysterious ways…”

It is crucial to understand the rules of the game and this blog is one of a few places where we can discuss what is going on behind the Maelstrom Media’s ruse.

Funny how some that violently oppose Soviet-style central planning have no problem with a central bank. The Ron-Paul Fed critics want it abolished, while the Kramer Kooks complain that the Fed didn’t lower rates fast enough. Well is the fastest, farthest drop in history fast enough? far enough? How’s that been working out Jim? Keep in mind an egomaniac is mostly concerned with impressing his contemporaries.

We’re all looking for a constant in the chaos and a fulcrum in the void. Everything we thought we knew was wrong. All this wisdom from a country that mocked a nuclear engineer president and praised an actor as an economic Einstein.

Schooled again by Comrade HB! Thanks, great post.

~

By thief, I assume you mean former New York Fed president and now Treasury Secretary Geitner??? I think at this point, my expectations are so low that anything short of an Icelandic collapse will be a miracle. Sad.

~

And don’t think there aren’t shenanigans going on it the so-called “stimulus plan”. How about we forward this blog to our Congressmen in the slim chance they might do the right thing? As was discussed last fall on this blog, where’s the outrage and public dissent?

~

Be brave comrades!

When will the American people finally stand up for themselves. Why are we not in the streets and demanding change. Until we stop complaining in the comments section and get mobilized we continue to sit front row and watch our future get ripped away. Get mobilized get active.

As if California wasn’t in enough trouble, it looks like the worst drought in history coming up with snow pack way below normal this year. Also, CNN says:

“NEW YORK (CNNMoney.com) — Running short of cash, California has started delaying $3.5 billion in payments to taxpayers, contractors, counties and social service agencies.”

Next bailout: Municipal obligations nationwide. If Citicorp is too big to fail, I’m sure California is too…

it is interesting that the list of primary dealers brings to my mind the banks with the largest derivatives holdings.. i’ve heard estimates of up to $1 quadrillion in existence, the above group just about has that number covered. i also wouldn’t be surprised if a number of the above banks are owners of the fed, doing bidding for some of the world’s richest, and most powerful. in reference to the statement concerning the disbelief the dr. has with people who still believe in the “free market” capitalistic system. when you read stories about the “robber barons” of over a hundred years ago, and read books such as gustavus myers’ “history of great american fortunes”, it makes me seriously wonder if there was ever such a thing, because there is certainly no such thing today in the usa.

Yes the banks should be nationalized. This is the last thing I want to happen but at this point, taxpayers should not be splitting future proceeds with existing common stock and bond holders, taxpayers deserve the whole future of bailed out banks. Future stock holders need to be more proactive in electing the BOD and understanding their investment. The government can resell the banks at some future point.

As to bonuses, the complaint is that they will lose their good people to other banks. Ok so let another big bank fail, there is far too much excess out there anyway. This will create a larger pool of unemployed bank personnel. Once there is a large pool of unemployed then there is less price pressure on wages. Then bonuses can be cut and there is a ready supply of employees to fill vacated positions from people who “do not like it”. With the government owning the banks, they can set the wage to a more reasonable level, returning the banks to profitability.

And yes the primary dealers are the big players in the derivative market. It is also true that the tarp players are member banks (shareholders of the Fed). The Fed is already responsible for monitoring their member banks and they failed their duty. Giving them more power when they failed with lesser powers obviously does not solve the problem of the failure of the Fed.

Wow, so where can we turn? Who in the goverment can save us? (I can’t believe I’m even asking that but who else has the strength and power to decapitate the Creature from Jekyll Island?? I don’t think anyone does…) I’m from the most conservative state (Utah) yet our idiot senators couldn’t vote fast enough for TARP — what a tragedy. They were just so freakin’ coopted! (Remember Mcain rushing back to DC to wrestle with the TARP and the isues involved? I thought he might actually be the maverick he’d bragged about but he suddenly signed it without a word or protest?!?!?!?!? Bizarro. And our man for change? Obama too — just signed it without a word. DESPITE millions of Americans against. Truly bizzare.) Too bad Ron Paul was doomed from the begining. That said we need to one by one gird up for what’s coming — we will have to consider the banks and what they’ve done and what we need to do to throw off that heavy yoke. Not going to be pretty. May God save us all…

CA Drought indeed! Do you think anyone in Government is smart enough to kick some stimulus money down to San Diego and LA to build nuke plants that co-generate electricity and produce heat for desalinization? That would put lots of people to work and provide cheap clean electricity and fresh water.

Might be possible that corruption of our system from the bankers side, already discussion going on about changing the policy of our finance system and also same agree on policy alteration system need to correct our loo false.

You can not get yourself out of a mess by the same means it got you into it, in the first place. The US Treasury and Fed. Reserve are using leverage – or debt – to bail out an economic mess that was created by debt in the first place. The only way to fix a system with too much – or bad – debt is to either pay it off (and that could take years, maybe decades), or to write it off (and that means many people have to take a hit). The power brokers behind the present “solutions” are only making things worse – there will come a depression and it will make the The Great Depression of the ’30’s look like tea party. The point of no return has been well reached and passed, it is only a matter of time now for the implosion. The 1929 market crash on the 29th October didn’t really hit its full potential until four years later. The size of the market today is well over a hundred times bigger and with debts and obligations – if you include the CDS markets – taking leverage to over 100x too (yes that is now in the quadrillion range!). The question is, when is the next 1933?

Back during the last depression at the very least the US was resource rich (oil, power, food, even water), but today, the US is a net importer of all these things (well, maybe not the water, but it is running short in many areas of it). The US is not well placed to deal with the next down turn. Like all Empires, they have to end. And just like all ending empires, they end with much pain, suffering, and self-destruction, viz. Roman Empire. Is this the end of the USA? Personally, I believe when a nation becomes great – or maybe too great – it also becomes too parochial. Blaming Greenspan is to convenient, Greenspan had masters, where were they? No, this is a mess that the whole nation will have to accept, even those who saw all this unfolding and just stood by and just watched, or blogged about it. This is one coming disaster, we all have to pay for. The lessons of history are there, and were repeated many times, yet nothing was done. Human greed and selfishness will be the cause to our penury, all because we refuse to learn. It is not our lack off or misfortune in profit that devalues our wealth and happiness, it is the stubbornness of our ignorance that condemns us to penury and misery. Blaming politicians, economists or bankers is only the symptom. When are we going to learn from the same mistakes we have been doing for centuries!

@alan davis

One of my colleagues told me that LA cleans effluent to potable water, then dumps the water out to sea…that don’t even need de-salinization, they don’t even recycle their fresh water…

Democracy fails when public individuals/corporations can get their hands of the public money. We are in a situation where the big money of big corporations unduly affect the governmental decision making process to the detriment of the people. Few decisions are made by the government now that don’t take the corporate interests into higher account than the people’s interests.

Thanks for the post Doctor and the energy to bring it to us.

~

Good points Galileo. We will all pay. As Americans we like to think of our selves as being in charge of our own destiny. And, when things like this happen, those that were responsible in their spending habits should not have to pay. I think what a crisis like this exposes is that we are not in charge of our own destiny. We have given up personal freedoms for the privilege of shopping at Walmart.

I second Robin Thomas’ recommendation: Read The Creature From Jekyll Island, by G. Edward Griffin, to truly understand the roots of this worldwide economic crisis.

To begin the recovery, we the people have to take back the power to make and hold money, from the banking elite, what a century ago was popularly called ‘the money trust’. And to do this, we have to understand what is, and is not, money: The US dollar is an IOU, that is, it is a unit of debt! Who is the debtor? The US citizen and taxpayer. Who is the creditor? The Federal Reserve, which is owned, not by the government, but by a collection of the large banks – the same institutions getting the trillions in bailout funds. What is the collateral for the permanent, revolving line of credit? The entire gold reserve of the US government (“Fort Knox”). How are the interest payments on the borrowed money guaranteed? Through the imposition of the income tax. (Both the income tax and the Federal Reserve were authorized in the same year, 1913.)

So the US dollar is a unit of debt, it is not an asset. Paying someone a dollar to ‘settle a debt’ does not extinguish that debt, it simply transfers it to someone else. That is why our collective debt ever increases…we are trying to pay down debt, by issuing more debt. As a society, we are making payments on our collective ‘credit cards’, with more borrowing! As an ‘environmentalist’ might say: Such an exponentially increasing system is fundamentally unsustainable.

What can pay down debt, by actually neutralizing it? Amazingly enough….money! That’s the essence of money…something of value that can extinguish a debt! But, modern money IS debt. How can this be? How can ‘money’ both be and not be, the same thing…debt!

The answer is: It can’t be! Something can’t both be itself, and be its opposite! Which means, modern ‘money’ isn’t really money. Modern ‘money’ is a store of debt, not a store of value.

What is money? Something of value, that has no debt to anyone else, a thing universally agreed to have value, without corresponding debt. When you give such a thing to someone in payment of a debt, the debt is not merely transferred to someone else… it is extinguished.

You have two guesses as to what such a thing could be.

Mark V: Right on! There were about 80 million ounces of gold mined on the entire planet last year. At $1000 per ounce, that would equate with 80 billion dollars. We print that much money out of thin air (borrow/go into debt) in a month. Good money will always eventually drive out the bad. Buy gold and silver like as if the dollar will one day become worthless….

Were screwed. Plain and simple. Only a matter of time before U.S. Investors bail leaving us nothing but hyperinflation to draw them back. Too bad wages won’t increase enough to keep up. But first, deflation will take a chunk out of current housing prices. Save your money and get ready to buy RE when the time comes.

Westside will have it’s day of reckoning I’m afraid, sooner than most people think.

http://www.westsideremeltdown.blogspot.com

Buy gold and silver; instead of US bonds or bond related funds. They will short circuit soon anyway. Take delivery of the metal; there isn’t as much as is advertised. If no one buys bonds, there is no “money” for goverment. The only way to bring down the current system is to expose it for for what it is; a giant ponzi scheme. Inflation will be exponential, but it is the only way to get back to a value for value economy and a government for the people instead of people for the goverment/bankers/antichrist. Just make sure you have something of value.

p.s. I think it is rather interesting that silver is often used as a shadow or type or representative for blood in the Bible.

The national economy, since 1913, is based upon a Ponzi scheme.

Every “dollar†in circulation is created based upon debt. Congress gives T-securities (bills, bonds, or notes) to the Federal Reserve, and the Fed credits the Treasury’s account with the value of the securities. Voila !!! New fiat money. Congress can spend up to the limit of the account and the Fed will honor the checks.

The problem is that the arrangement obligates the US to pay interest on the principal thus generated. The interest has never been generated. It does not exist. It is impossible to culminate the agreement. The only way the interest can be paid is to generate more principal and pay the interest on the initial securities from the principal on the later securities. It is the classic Ponzi, par excellence.

If a Ponzi scheme does not expand, it totally collapses. Additional expanding at this time merely postpones the inevitable collapse.

Mathematical details on the rip-off by the Fed, including how the Fed obtains the ENTIRE VALUE of ALL issued securities is posted at http://www.scribd.com/doc/43482648/rip-off-by-the-FR

and http://www.scribd.com/doc/43465593/QE2-Rational-Course-of-Action

Leave a Reply