We’re All Homeowners Now: 10 Reasons to be Cautious About This Housing Rescue Plan for Motherland USA.

“I’m shocked, shocked to find that gambling is going on in here!” -Captain Renault, Casablanca

Many of our elected officials were “shocked” and astounded to realize that the entire economy has turned into a glorified casino. Ironically, the quote above comes from Casablanca which translated into English means Whitehouse. How appropriate given the circumstances. How the economy can go from fundamentally sound earlier in the week to flat out meltdown mode where Hank Paulson had to not only use his bazooka, but also had to use his rocket propelled grenade with a nuke tip while jumping out of a window launching ninja stars and slapping the markets with brass knuckles is really amazing. This goes to show how quickly we can adapt our thinking. Remember long ago on the weekend of September 6th and 7th 2008 when most Americans were only coming to terms with the largest bailout known to humankind of Fannie Mae and Freddie Mac? As it turns out, it only took 2 weeks before we ended up pushing the easy button:

Well as it turns out, we’re all homeowners now. We went overnight from a tough stance of no bailouts letting Lehman Brothers go into bankruptcy this weekend to the biggest socialist intervention into the markets on Thursday. I’m just calling what occurred by its true name. This was the biggest socialistic move into the markets ever and will put the U.S. taxpayer at risk to the tune of probably $1 trillion. It makes the $30 billion pumped into Bear Stearns look like pocket change. Sure makes the $100 billion in proposed healthcare spending look like a bargain! We all will need healthcare after people realize the magnitude of this market intervention.

I understand that the politics of the situation forced both parties to concede to the current moment. They really had no choice and given that this is an election year, I have already braced myself for such a move. Think about it for a second. The ad hoc bailouts were simply not solving the problem and Americans were seeing their home prices fall off a cliff. The systemic risks were not being addressed. That is, until the United States decided to go socialistic. In fact, it was a tumultuous week all over the world. In Russia, the Micex and RTS exchanges were closed on Wednesday and Thursday after epic losses. That is right. Russia flat out decided to shut down the market. They also decided to inject liquidity into the market since they had fallen by 55% from their May peak. Yet we do things bigger here.

In conjunctions with the massive new bailout which I will discuss in detail later, the SEC also decided to ban short sellers on 799 financial stocks. Looking at the list is like looking at a FBI Wanted List of the most responsible for the housing mess. My take on the strategy of all this is as follows:

(a) The government allowed Lehman Brothers to fail as the sacrificial lamb. This allowed the “no bailout” stance.

(b)Â The no bailout stance only lasted until we bailed out AIG a few days later.

(c)Â The market wasn’t buying this so they called in the big guns

(d) Short selling and the U.S. Motherland bailout hit rumor mills late in the trading day on Thursday making stocks soar. Keep in mind stocks opened much lower on Thursday and turned around to have a late 1 hour massive rally.

(e)Â Word is out that we are going to have the bailouts

(f) It just happened that this Friday was triple witching day. A day when stock index futures, stock index options, and stock options all expire on the same day. This happens once every 3 months.

(g)Â Massive short squeeze rally.

(h)Â Currently the short ban is only for a couple of weeks just coincidentally enough time to piece together some legislation for the new U.S. Motherland “bad bank” to be created to off load toxic debt.

I’ve been getting a ton of e-mail of people here in California thinking this is somehow going to boost housing prices in the state. They are going to be in for the shock of their life. If they haven’t noticed already, the Hope Now Alliance, FHA Secure, the lifting of jumbo loan caps to $729,500, and the Housing and Economic Recovery Act of 2008 did nothing for prices here because these bailouts are for the cronies! In addition, many of these programs are voluntary so no bank is going to voluntarily modify a loan out of good will. Why do this when you can call on your comrades and have them bail you out? And there is a little thing called employment and income that isn’t so good here. We just went into the stratosphere hitting a statewide 7.7% unemployment rate.

10 Reasons to Be Cautious About Rescuing the Motherland

Reason #1 – The Fundamentals are not Sound

Whenever someone starts arguing that the fundamentals are sound you can rest assured something is horrible and unsound. But make no mistake, we have been in this situation before. Have you noticed that all of a sudden people are referencing the Great Depression over and over? How can we be teetering near an economic depression if we aren’t even in a recession!? Here are some quotes from the Great Depression from The Great Crash by John Kenneth Galbraith:

“On Tuesday [October 22, 1929], Charles E. Mitchell dropped anchor in New York with the observation that “the decline had gone too far.” (Time and sundry congressional and court proceedings were to show that Mr. Mitchell had strong personal reasons for feeling that way.) He added that conditions were “fundamentally sound,” said again that too much attention had been paid to the large volume of brokers’ loans, and concluded that the situation was one which would correct itself if left alone. However, antoher jarring suggestion came from Babson. He recommended selling stocks and buying gold.”

“Eugene M. Stevens, the President of the Continental Illionois Bank, said, “There is nothing in the business situation to justify nervousness.” Walter Teagle said there had been no “fundamental change” in the oil business to justify concern; Charles M. Schwab said that the steel business had been making “fundamental progress” toward stability and added that this “fundamentally sound condition” was responsible for the prosperity of the industry; Samuel Vauclain, Chairman of the Baldwin Locomotive Works, declared that “fundamentals are sound”; President Hoover said that “the fundamental business of the country, that is production and distribution of commodities, is on a sound and prosperous basis.” President Hoover was asked to say something more specific about the market – for example, that stocks were now cheap – but he refused.”

A reason to be cautious about the bill is the fundamentals of our economy are not sound. Here are a few reasons:

-The housing market is still falling and inventory in housing is still high

-Unemployment is still growing

-Large entitlement programs will start coming due for baby boomers soon

-We have incredibly large deficits

-There has been nearly $5 trillion housing equity destroyed and $4 trillion in stock market value has evaporated since this correction started

Do those look like good fundamentals?

Reasons #2 – A New RTC?

Aside from the massive cost of the program let us examine the logistics. First, there has been comparison to the Resolution Trust Corporation (RTC), which was used during the S & L Crisis to liquidate assets from failed institutions. Between 1989 and 1995 the RTC closed or resolved the accounts of 747 thrifts with assets amounting to $394 billion. The major difference with this current program and we’ll write more when we get the full details is they are planning to purchase bad debt from current solvent intuitions to liquidate.  The RTC for the vast majority of institutions simply dealt with liquidating the books once the thrift was taken over and had already failed.

With that said, many institutions in order to participate will need to take a steep discount on their debt. This may in fact turn currently solvent institutions insolvent. For example, an institution with Pay Option ARMs with a buyer currently paying $1,500 a month but is looking at a recast in 2 years where his payment will jump to $3,000, is actually a massive asset on the book of the institution. Yet we all know from current data that once the recast hits, they will very likely default. Thus if an institution wants to participate, they will be forced to realize a loss and bring it on the books. Yet how can they bring a loan like this on the books if the buyer is technically still current? With $500 billion of Pay Option ARMs out there, will the new bad bank program allow such loans on their books? That is yet to be seen.

I’m not sure how this will resemble the RTC since they are going to be dealing with live institutions. Which institutions you ask? Try looking at the 799 financials on the short ban list and you’ll get a good idea.

Reason #3 – Flood of new Inventory

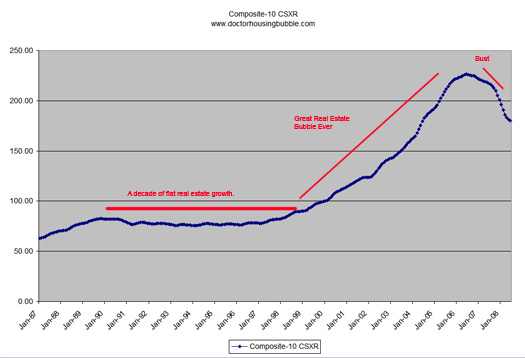

In the early 90s we had a declining housing market across the country. Take a look at the Case Shiller Index chart:

As you can see, in the early part of the 90s prices slightly went lower. Some even argued that the RTC pushed prices lower because they added much more housing inventory on the market. As anyone knows, more supply with the same demand will lower prices. Another problem with this new plan is that we already have record amounts of inventory. How are they going to avoid flooding the market with more inventory? Keep in mind that the longer they hold these properties and assuming housing prices still continue lower, the bigger the taxpayer expense gets. After all, we’re all homeowners now and there are only 2 ways we make money when we own homes. We either flip it for a profit or rent it out. Somehow I doubt the government is going to become a landlord.

Reason #4 – You Can’t Force People to Buy

Even assuming that we dump every single piece of toxic waste into this new bad bank, you still have a populace with growing unemployment and weak income. Unless Fannie Mae and Freddie Mac are planning to go no-doc and bring back NINJA loans there are now standards. In fact, one of the reasons the market has slowed down is there are so few qualified buyers out there. Did they somehow disappear over night? Absolutely not. We simply added a touch of standards and the market came to a grinding halt.

In addition, how are you going to convince people that are watching this current mess and are psychologically hit to buy? That multi-generation mantra of “real estate never goes down” has been destroyed for a generation of Americans. You cannot bring that back with legislation. People are going to be more cautious and selective when buying a home. In addition, a weak economy normally causes people to hold off on large purchases. Unlike the government, people do not have an unlimited line of credit to the Treasury. Even though it is their money, they are not part of the crony circle which makes up 2% of the population.

Reason #5 – Wolf in Sheep’s Clothing

You’ll be surprised as the months go along who was short this market. The flavor for the next few days is the idea that short sellers caused this mess. Forget about the shady mortgage brokers, fast talking real estate agents, the rampant fraud, eager flippers, the Wall Street greed of securitization, and incestuous crony capitalism that went on for a decade unimpeded. As it will turn out, you are going to realize that many of these investment banks and hedge funds were the largest beneficiaries of the short market. Now, there will be plenty of ammunition against these folks. This isn’t a new phenomenon. Let us take a trip down memory lane:

“The bankers met twice on the 29th (October 29, 1929) – at noon and again in the evening. There was no suggestion that they were philosophical. This was hardly remarkable because, during the day, an appaling rumor has swept the Exchange. It was that the bankers’ pool, so far from stabilizing the market, was actually selling stocks! The prestige of the bankers had in truth been falling even more rapidly than the market. After the evening session, Mr. Lamont met the press with the disenchanting task of denying that they had been liquidating securities – or participating in a bear raid. After explaining again, somewhat redundantly in view of the day’s events, that it was not the purpose of the bankers to maintain a particular level of prices, he concluded: “The group has continued and will continue in a co-operative way to support the market and has not been a seller of stocks.” In fact, as later intelligence revealed, Albert H. Wiggin of the Chase was personally short at the time to the tune of some millions. His co-operative support, which if successful would have cost him heavily, must have had an interesting element of ambivalence.”

There are now reports that certain hedge funds, investment banks, and institutional investors will be brought to testify regarding their trades. Oh what a tangled web we weave.

Reason # 6 – We are not Unique in Bailouts

Bailouts are nothing new and are practiced all over the world. The Chinese government put in about $350 billion into the largest banks in China over the past decade. Many of these banks were largely insolvent because they were lending under political pressure and throwing money at declining industries.

European banks only provide insurance up to 20,000 Euros in comparison to our $100,000 per FDIC insured account (by the way, another bank failed this Friday). Denmark, Norway, Finland, and Sweden during the 1980s had much of their banking system nationalized. Taxpayers initially took a hit but in the slow end, may have even turned a profit. Given the absolute magnitude of this bailout, there will be MAJOR losses. For someone to say we may turn a profit with a straight face has not looked at any Real Homes of Genius properties and their accompanying mortgages.

Many on the street clamoring for bailouts need to be careful for what they wish for. Let us look at what happened to a few of the recent bailouts:

Bear Stearns shareholders got $10 per share. People need to be careful what they wish for. To make this even remotely palatable to the American public, any institution participating in this program will take a major hit and may likely put themselves up for insolvency. It will be an expensive proposition. In fact, this may simply be a preemptive move to create a major garbage dump for all the impending bank failures that will be happening over the next few years. Out of 8,430 8,429 commercial banks it is estimated only half will survive after all is said and done.

Reason #7 – $1,000,000,000,000

Barclays has come out and stated that the U.S. may need to borrow $700 to $1 trillion to fund the biggest rescue of any financial system since, you guessed it, the Great Depression. This sum is so large that it may in fact put our AAA rating as a country at risk. The U.S. National Debt already stands at $9.7 trillion and we have yet to enact the Housing and Economic Recovery Act of 2008 which will probably eat up $200 billion and this current plan will add an additional $700 to $1 trillion in debt. In one month we are looking to increase our national debt ceiling by 10 to 12 percent. Like I said a few months ago, who really believed that $25 billion figure from the CBO? Bwahaha! That figure was probably for the printing and binding budget of the new bad bank legislation.

In the meantime the GSEs will be buying up mortgage backed securities (MBS) as detailed in the Fannie Mae and Freddie Mac bailout plan. With similar authority the U.S. Treasury will also buy mortgage backed securities. We are all now homeowners! The U.S. homeownership rate by the end of this month will be 100%.

Reason #8 – Can we Bailout the American Worker?

Since 1978 worker pay has been lagging behind. Total debt has been growing at such a rapid pace, that total debt now exceeds total employee compensation. I think this graph sums it up nicely:

Source:Â Sudden Debt

Instead of focusing on sustainable and good job creation we have been focused on keeping this debt Ponzi scheme going for way too long. Henry Ford was chastised for raising the wages of his workers but he knew that people with money (not massive debt) would ultimately end up spending. Even though many bought cars on installment plans their debt to income ratios were modest compared to where we are today. Now back then the debt world wasn’t that large. Fast forward to today and you realize that any feeling of real gains was simply a façade being masked by debt. We financed our current “prosperity” completely on debt. The current market correction is simply bringing things back to reality.

In addition, 30%+ of all job creation since 2000 was directly or indirectly related to real estate. Was the apex of our economic system basically selling houses to one another in an endless of orgy of price pyramids? Hard to believe that in such a fiercely competitive world we would dedicate such a large amount of resources to such an unproductive activity. Instead of looking at engineering innovations or biotechnological advances for the well-being of our society, we instead wasted an entire decade figuring out the best way to put granite countertops on a central kitchen island. How funny that a political platform so bent on no new taxes didn’t even “blink” when it came to backing a $1 trillion bailout.

Reason #9 – I Think I’m Turning Japanese, I Really Think So!

An astute reader sent me a link to an October 1998 article talking about the zombification of the Japanese market. I have argued many times that we are going to likely see a deep L shaped recession like Japan’s for a variety of reasons. Just to give you a peak into the future, this experiment has already been done:

“(New York Times October 13, 1998)Â The possibility of a way out of the financial crisis sent stocks surging today, with shares of the nation’s banks jumping an average of 8 percent. The Nikkei index of 225 shares rose 5.24 percent, to 13,555.01, in a big comeback after last week’s plunge. United States markets also rose on optimism about a solution to Japan’s financial problems.”

“The law enacted by Parliament today allows the Government for the first time to deal with large, failing banks by nationalizing them, liquidating them or transforming them into publicly owned ”bridge banks,” which take over the good loans and good borrowers and try to collect on the bad loans. It would establish a public institution to resell the good assets and deal with the bad ones in a process also used by the American Resolution Trust Corporation, which helped clean up the savings-and-loan crisis in the 1990’s.”

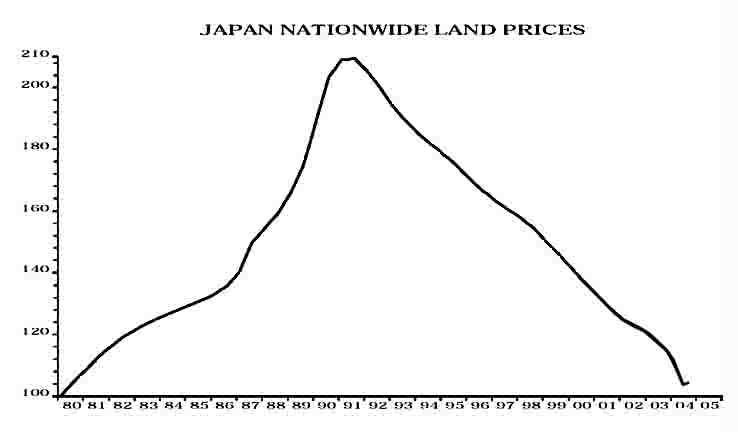

At the time of the above proposal, they were talking about injecting $400 billion into the markets. How did that turn out? Let us take a look:

So what happened in Japan? After a 1 year 7 month bull run, the market shot up from 12,879 in early October of 1998 to 20,434 in April of 2000. This was a stunning increase of 58% in less than 2 years. Well as you can see from the graph, even after 10 years, the market has yet to see prices of a decade ago. What happened to real estate from 1980 to 2005 in Japan?

Scroll up and take a good look at our Case-Shiller graph. Do you notice a resemblance?

Reason #10 – Blame the Wrong People

You know you have reached the absolute peak of madness when you start pointing fingers at the wrong culprits. Blaming short sellers is one. Trying to blame the mainstream media is another. And trying to convince people it is patriotic to buy stocks has got to be the final straw. Even the comedy shows are starting to pick up on this economic mess. Stephen Colbert was asked about diversification and he stated that he was diversified since he had money stuffed under his couch and mattress. Humor at a certain point lightens the mood. Even in the Great Depression humor was used:

“In March 1930, following a flood of optimistic forecasts by his subordinates, Mr. Hoover said that the worst effect of the crash upon unemployment would be ended in sixty days. In May Mr. Hoover said he was convinced “we have now passed the worst and with continued unity of effort shall rapidly recover.” Toward the end of the month he said that business would be normal by fall.

What was perhaps the last word on the policy of reassurance was said by Simeon D. Fess, the Chairman of the Republican National Committee:

“Persons high in Republican circles are beginning to believe that there is some concentrated effort on foot to utilize the stock market as a method of discrediting the Administration. Every time an Administration official gives out an optimistic statement about business conditions, the market immediately drops.”

Welcome to the bad bank era. Get ready for a decade long malaise just in time to go with the 76 million baby boomers who will start to retire in droves. We’ll have to wait to see the final details on this plan to discuss further.

Update Sunday 9/21:

The plan was leaked this weekend and the details are extraordinary:

Under section 8:

“Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.”

In addition, Paulson confirmed on Sunday that this would also aid in foreign institutions:

“Treasury Secretary Henry Paulson said Sunday that foreign banks will be able to unload bad financial assets under a $700 billion U.S. proposal aimed at restoring order during a devastating financial crisis.

“Yes, and they should. Because … if a financial institution has business operations in the United States, hires people in the United States, if they are clogged with illiquid assets, they have the same impact on the American people as any other institution,” Paulson said on ABC television’s “This Week with George Stephanopolous.”

Is there any wonder why they are trying to jam this thing through? This bailout will be on history books for centuries and they want to rush it through in a few days? There is no need to rush it. The toxic assets aren’t going anywhere. The way the plan stands now, it is pushing for dictatorial powers and as a democracy we should always have the power to question certain actions especially when it is the taxpayers’ money on the hook for this bailout! Contact your representative now and let them know that they need to seriously look into this plan before jumping head first:

The plan is going to happen but it does not have to be in the current form. The mainstream media coverage needs to dig deeper into this to shape the public’s perception since it seems the way they are covering it that this is already a done deal in the current form. It is not a done deal and a few representatives are testing the water with dissent as they should.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

48 Responses to “We’re All Homeowners Now: 10 Reasons to be Cautious About This Housing Rescue Plan for Motherland USA.”

baby boomers ready to retire “in droves”?

Notgoing to happen.

Their house has plummeted in value. Their investments likewise. Their city pension was invested in real estate funds and has collapsed. They have no retirement.

4000 illegals each day stream across hte border, of which 98% are ignorant peasants, many of them not even speaking Spanish (500 years aftr Cortez) with at best a second grade education and purely illiterate.

The baby boomers are going to have to feed them, clothe them, and house them and their spawn now that the real estate industry has collapsed.

There is no retirement for baby boomers. They are just now beginning to wake up to that idea. They will spend their retirement taking care of all the little Mexican babies, putting them through school and college and paying for all their expenses.

Great post, Doctor.

“Persons high in Republican circles are beginning to believe that there is some concentrated effort on foot to utilize the stock market as a method of discrediting the Administration. Every time an Administration official gives out an optimistic statement about business conditions, the market immediately drops.â€

That is to be expected as any time Administration official’ mouths move they are lying and the market responds appropriately to lies

The depression will not be so bad. We have come to identify our existence as a function of our possessions and social standing, and have come to value one another as problems. Once the depression bottoms there will be a gradual restoration of real value in life, family and our personal relationships. This year the world changed forever, although most are still oblivious. Some may not choose to participate in the depression, but most of us won’t have a choice. At least we will have our Easter Island statues all around us to remind us of the mass insanity, and hopefully a reminder that “There is nothing new under the sun” and “This time it’s different” are diametrically opposed statements.

It will be like Planet of the Alt-Apes when Charlton Heston see the ruins of the White House. Or when Paulson says: “the problems of three hundred million little people don’t amount to a hill of beans in this crazy world”

This is crazy, I saw this collapse happening years ago. Peter Schiff, If any of you know who he is, SCREAMED this was coming and people dismissed him as a kook.

Well, its here, a complete freee up of the market at the edge of a collapse.

God, wasn’t the housing bubble great?

Watch out what you wish for, you just may get it….

This makes me sick. I’m not sure that I still love this country. I feel cheated. I’ve saved and I still cannot afford a house in SOCA. Why should I have to pay for those crooks? It’s just WRONG. I no longer have any faith in our “leaders.” Both sides of the aisle SUCK. Anyone who is partisan at this point is just stupid, because it’s apparent that big money rules our nation, and not the will of the people. The Dems clamored to sell houses to the poor, and the GOP deregulated, causing the perfect storm of stupid lending that has gotten us here today. I hate both parties equally.

Hey Big Bill,

Like most people, you got it bassackwards.

You have been trained to think like a capitalist and not like a worker. That’s a big part why people have accepted the reasoning which got us into the financial jam in the first place.

“The baby boomers are going to have to feed them, clothe them, and house them and their spawn now that the real estate industry has collapsed”

and

“They will spend their retirement taking care of all the little Mexican babies, putting them through school and college and paying for all their expenses”

So are you suggesting that the boomers will be picking grapes, sewing in sweatshops, working on construction sites, and being nannys wiping the behinds of little Mexican babies?

Or are you saying that all these immigrants will be doing all these tough jobs, but the finance capitalists will not pay then enough to live properly and will tax the boomers to make up the difference?

The fact is that in their retirement, boomers will consume food harvested by, clothes sewn by, live in nursing homes built by, and have their diapers changed by poor immigrants paid a fraction of the value they produce.

I suggest that you do some reading on real economics and focus on the concept of the labor theory of value.

Dear Comrade Housing Bubble (everyone in America will hereby be referred to as comrade),

I would like to add on to the list that Comrade Alan started on the virtues of a depression: it will significantly reduce greenhouse gas emissions thereby saving our planet from certain catastrophe. In addition, recycling will no longer be the domain only of liberals. How about the end of obesity (and the chronic diseases associated with them)?

We are on the same boat here, we make your words our words!

May God Help Us!

Is that Japanese Land Prices graph inflation adjusted?

Read Calculated Risk, especially the comments. Obviously comrade blutown has! The text of the proposal is up over there.

It may not mean much, but try anyways. I did. Write your senators and congressperson, write politely, but express your dismay at the present configuration of the bill.

Section 8 – which to Corporal Klinger from the tv show MASH, meant freedom, means the end of democracy as we know it. It forbids court or congressional oversight.

Sec. 8. Review.

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

http://www.senate.gov/general/contact_information/senators_cfm.cfm

https://forms.house.gov/wyr/welcome.shtml

I wrote that the Congress needs to insert oversight language into the proposal.

The die may already be cast regarding this bill. I’m saddened by the power grab. It literally sickens me. Regardless, what can we do? Complain, yes. Write a probably pointless letter, yes. But don’t forget to be civil to those whose paths you cross. It doesn’t cost anything, and you never know – if there is societal breakdown, having people remember you as a decent person can’t hurt.

Oh, one more thing – we’re all immigrants, don’t forget. The USA is rapidly turning into the kinds of kleptocracy found in central and south America, where the people KNOW they’re getting screwed by the elite, and have no other way to live but to try to find work where it can be had. If we don’t fight to change the power structure, we’ll see slums like you can find in Rio, or Mexico City, or in New Delhi. It won’t be because of the immigrants, either. It will be because we allowed the Wall Street criminals to steal our treasury to bail themselves out.

So Republicans think that there is some conspiracy afoot in the markets to discredit the administration , just because every time the Shrub gets talks, the markets tank?

LMAO!!

If this does not totally discredit the Republican party and ensure defeat for McCain and his Trailer Trash running mate, I don’t know what it takes.

The next big bailout will be for the U.S. Treasury. Do any of our ruling clowns know what the insolvancy of the U.S. Treasury would mean.

It would mean that all the money some folks are stashing in their mattresses and in jars buried in the back yard is worthless. It would mean catastrophic shortages of every commodity we need to exist day-to-day.

Stock up on food staples, blankets, flashlight, medicines- and, if you are so inclined, guns and ammo.

The Japanese stock market was in fact at around 35,000 in the early 90’s (not shown on graph). So a bottom at 12,000 or so in ’98 was pretty severe. I think there was no correlation in yen strength/weakness throughout the period. They’re prolific savers, perhaps their problems were “professionally engineered”.

I kind of chuckle at robin thomas — I figured out 25 years ago that both parties were crooked, both parties lied, and ultimately the lack of leadership and lack of making the hard choices would lead to a country wide disaster. I thought the mess would have arrived sooner, but now it has, and it is a whooper. I hope the areas the enjoyed the benefits of the bubble now suffer the worst consequences. It is a lesson for everyone to learn from. All I can say is I am glad I am not in CA, NV, AZ or FL right now…

Welcome Mexicans! This land is your land too! You want a job? USians like to sit on their asses and dream about getting rich, so there are plenty of jobs. Like changing the diapers of huge, fat Americans who are so obese that they have to live under professional care. It would help if you are very strong, to be able to turn obese Americans giant fat bodies in their beds, since they can no longer turn themselves. Arriba!

Bob N – I cannot find myself chuckling at robin thomas. After all, she lives where I grew up, and where several of my siblings still live. My teacher sister, making almost $50,000 a year could not afford a home. She lived in a series of squalid two-family houses, renting. But then our brother wanted to invest in real estate and being wealthy, he paid cash for a beach house. Our sister gets to live there, and yet it is not really hers. I think she fritters away too much of her own money, spoiled as she is by this arrangement (but one which we might envy and enjoy ourselves — though it is at the pleasure of the brother — and his wife).

I dealt with her frustrations about trying to buy a house — but the strange thing is, she was one of the lucky ones who did not get stuck with a mortgage too much for the current value of the place. She was lifted up by a “deus ex machina” of a brother who got wealthy on what most get wealthy on in SOCA — immigrant labor.

This is not the SOCA of my youth. In some ways it is better, in others it is worse, much more hopeless.

I live in Barney Frank’s district, I paid off my mortgage years ago (against the advice of those who said it would save on taxes), and even though I was poor as a kid, I am much more snug today.

Here’s the deal though: we all have pay for heat (a lot in New England), for gas, and for healthcare. There is no way to escape a tsunami of a debt-ridden society, even if our personal habits are impeccable. One way or another, it will infect and affect us all. Not being a SOCA person anymore, but a little more with a sense of community than prevailed in my Orange County childhood, I know that we live interconnected lives. That is why we have to crack down on our politicians before they rip us off again. Those companies that over-extended — I don’t think they deserve a ‘do-over’, but those who gave it to them — we have to put their feet to fire so that they will explain why.

I think I’ll confront Barney Frank at my earliest convenience.

Great post. I too am bent that I’ve been on the sidelines, didn’t jump in with a ARM mortgage in SoCal… and now, I still have to pay for those that jumped into what they couldn’t afford and the banks behind them saying “the water is fine!”… Sometimes, as hard as it will hurt, we need to hit bottom…. which we will here eventually, we just needed to thrown in a trillion or so taxpayer dollars to try and slow it down… booo to cronism.

There was a time when a man could provide for his family and send his kids to college being a mason, floor refinisher, roofer etc. illegals low bid all those jobs to almost minimum wage status. Its Americas/Americans fault. We should have had a secure border and we shouldn’t have been so damn cheap.

first i would let heads role in the US SENATE and HOUSE

and next when people are living longer why not go from 30 year loans to 40 year loans?

when cars got pricey they did away with the 4 year car loan and went to 5 ,6 and even 7 year loans,heck soon it will be 10 year car loans?

and if the dems get control with the high taxs we will have to go to 2 year payments on the taxes owed in 1 year

I want to thank you Big Bill for clothing, feeding me, and putting a roof over my head, could’t have done it wihout you. By the way, make sure your trailer isn’t in the direct path of a tornado.

wow any one want to trade my house for a big camper? gas won’t be that bad if i can drive to work on monday and just leave it in the parking lot? no house taxes ,no yard to mow ,and if some comes after me i will drive around the the block

Robin Thomas: come out to Borrego Springs in San Diego County, where I can show you a foreclosed 2 BR 1.5 bath duplex for only $82,900, a foreclosed 3 BR SFH for only $89,000, and two similar others I have yet to find out the prices of. They need some work but two new 3 BR SFH sold in this ‘hood recently for about $250k each, so that gives you a lot of room to work with and those four foreclosures are all still habitable to boot. If you really want to own a house in SOCAL, you can. On the other hand, if you are like most people in SOCAL, who cannot stand to be in the hot Borrego weather because it might muss their hair, then you fully deserve to remain a frustrated renter forever. Above all, the truth you need to know before buying any home is this: no one ever said that owning a home was easy, and no one knows that better than me. So just remember: be careful of what you ask for, because you just might get it and end up far more miserable than you are now. Though I am a happy homeowner in SOCAL, it is not easy by any means. So either count your blessings, or else get out here and take a look at what you can already afford. Either way, stop wasting your time blaming distant idiot politicians for the fact that you are not getting out and looking for an affordable house to buy in SOCAL, because they do exist, and they exist in droves. Hopefully I am wrong in this sentence but I have a feeling that after having managed to save some money, you feel entitled to own a million dollar coastal home for $300k or some such thing, but it just ain’t gonna happen….

Dr. Housingbubble, I have enjoyed your post for the past couple of years, I am a bit troubled by the anit-Mexican comments that have come to dominate your blog. It seems as though you have recruited all the OC Register’s readers. I would like to know how “Mexican’s” have contributed to this housing mess? I’m Mexican, my whole family is Mexican as of the last time I checked, and none of them have walked away with millions of dollars? As a matter of fact, some, though I tried to convince them not to, got screwed on half million dollar homes in huntington park, city of bell, and south gate. They have managed to stay afloat and continue making mortgage payments as scheduled. I can see how people are angry and frustrated and looking for someone to blame, making it easy to pick on a group of working class individuals who are searching for a way to improve their social class, just as the rest of us are, but I think they are barking up (or down) the wrong tree. It would be beneficial for you to maybe educate your readers about how historically, those with no voice are blamed for large economic problems they have no control over. Thank you for your great posts.

Excellent post, Dr. HB, you’ve comprehensively captured the multiple failures of our current administration, but most interestingly, by noting that this is likely NOT the big-bailout, but a preemptive strike. The mother of all bailouts will occur when the banks begin failing in earnest and/or real bank recapitalization occurs. We have long way down to the bottom of this. And our treasury is simply not large enough to bailout every industry.

If this was a free country with a free press Ron Paul would be the next president and wall street mafia would be shutdown, Bush and Dick would be on trail for war crimes. With courage and people willing to fight there would be a free America for your grand children to live in….. But who cares right? whats on TV!!!….. so this is what you wanted this what you will get……

@Andy –

You’re not entirely getting it. Illegals didn’t design and market poorly crafted cars – GM, Ford, and Chrysler did. They didn’t increase the pay of corporate CEO’s 100 fold compared to the average employee over the past 30 years – corporate boards did. They didn’t stumble upon the greatest waste of time ever invented – television – and then sit in front of it 8 hours a day, watching inane shows which sole purpose is to sell soap and other goods to the viewers. Illegals didn’t start the wars in Iraq and Vietnam, they didn’t de-fund hard science R&D for alternative fuels, and they sure as sthi didn’t vote for the bat rastards in electoral office.

Nope, those were American citizens. Please wake up to the fact that we’ve been sold down the river by the elites. Blaming illegal immigrants deflects attention from where your real animosity should be directed. Divide and conquer… works every time, until and unless we wake up and say…

No more.

If the government would stop saving us from ourselves we could afford to save money. Inflation would be around 0% and we could earn a decent interest rate on savings and would not be taxed a second time on already taxed earnings. We could afford a home, as the price would not rise year to year. Taxes would be minimal, government would be small, retirements never inflated away and our money would not be going broke. Our leaders have destroyed us in under a month with bailouts that will total trillions in the end. This country must stop looking at government as a savior or the end will come soon !!

For those of you attacking immigrants -your foolishness/small mindedness shows.

They would not come if no one would hire them, and that whole retired people wiping mexican babies bottoms thing was just dumb, typical conservative you form your opinion by listening to a fat drug addict

I will never attack a man for trying to better his family’s situation, especially when it is the ruling class of my nation That destroyed the Mexican small plot farmer.

I am a cabinet maker in n. california I see Illegals all the time these are some of the hardest working/most honest people you will ever know.

Your ugly/stupid conservatism is showing so why don’t you go and misinterpret the bible some more and let the adults talk OK!

Tom

Ronnie

While I agree that gov is working counter to our needs, just how does your plan work.

Folks we are the gov-us, you, and me, and this is our fault frankly I blame the conservative mind set-you know venal, selfish, and easily led.

Sorry Ronnie Gov is a necessary evil, you just have to make sure you don’t hire evil people to run it.

All this libertarian who-ha about gov off my back, let the market work crap is just that -crap.

There is no such thing as the free market, don’t argue you’ll just look stupid.

We need a Gov, Taxes are a price to pay for society. My tax dollar is the most effective dollar I spend a day.

Tom

Comrade Dr. Housing Bubble, I have a question for you. I just can’t remember what the cap was during the housing bubble in Califonia. Was the housing cap $417,000 during most of the bubble years in California or not? The plan as I read it was for mortgages that were secured by Fannie and Freddie. If the cap was only $417,000 wouldn’t most of the loans in California not qualify under this plan? I just can’t remember what the cap was and its bugging me. Does anyone know what it was during 2005 & 2006?

Exit I entirely get it now. Thanks

**Many readers know that I have not favored these bailouts from day one not because I oppose bailouts in principle, but because the magnitude of corruption in the housing industry and Wall Street was so rampant. Some doubted the size of the trouble. Well if you want a price tag, now you have it. $700 billion. That’s $700,000,000,000 and that may actually go up.

**At this point, a bailout seems to be inevitable. But the tenacity of the Federal Reserve and U.S. Treasury Sectary to ask for this behemoth of a bailout to pass within a few days is astounding. Now that we are getting snippets of the bill, it is becoming more of an outright joke that will do very little for the average American family and does nothing to safe guard us from this happening again.

**So what would I suggest differently? Excellent question. It is easier to be critical than offer solutions right? Well first, the problem is that there is no market for the toxic waste because why would anyone want to buy this junk? That is the entire purpose of this bailout in the first place. If you were an investor, you are only going to buy something if you felt it was going to turn a profit. Hence, no one in the private sector is purchasing this junk because it would actually lose them money.

**So now with $700 billion we have created a market for these securities. Now, you need to remember how the $300 billion Housing and Economic Recovery Act of 2008 works. In fact, this is how this should work as well. First, lenders who want to participate will need to take a 10% reduction off the current appraisal price of a home. Let us use an example in California. Say a lender made a $500,000 loan on a home that is now worth $300,000. The lender, should they wish to participate would only get roughly $270,000 for that loan and take a $230,000 loss. That in fact is acceptable but you’ll notice how little this did to calm the markets especially financial firms because even to do this basic tenet, it would send them off a cliff.

**With this new bill as it stands, we do not know how much the government is going to pay for this crap and they are trying to rush this thing that we may have no protection. The plan should be simple and work like the Housing and Economic Recovery Act of 2008. They say you can’t do tons of loans quickly? Of course you can. Let us say that a lender has a $200 million package of loans in Southern California. The current median price for a home in the area is $330,000 per home so you can do a quick square foot average and offer the lender only 90% of the current median average price. You can even allow private lenders to compete as well since some may like to purchase the assets at this low price. But here is the catch. Lenders will be forced to mark to market. The problem is liquidity in this market. If they become insolvent after this that is their own undoing. The government has already stepped up to protect money market accounts and the FDIC will back up $100,000 of any insured deposit. So it will dwindle out the bad from the market. That is the rightful punishment. How does this help homeowners? Well now that the balance is lower the government can pass the savings on to the consumer. In many case, homeowners will still not be able to afford the reduced fee but at least the government now has a loan at current market values.

**The way the plan is looking right now, it looks as if they are going to pay peak prices for the bad paper! Absurd! Many of these institutions need to fail and the few good firms left standing will be able to provide liquidity to the market. For example, I remember getting a loan with Bank of America during the boom times and they actually had many more checks than other institutions. Was it perfect? No. But they sure did better than other institutions. That is competition and ultimately the current plan does nothing for the American public. How is the government taking a toxic loan from WaMu at face value going to help the homeowner? The homeowner still has to make the same payment now to the government. These are vital issues in this plan. That is why there is no need to rush through this because the foundation is vital. If we do not put the right checks and balances, we will be back here in a few years.

**Unacceptable. You need to remember that even borrowers will take a hit here. Say you have a pay option ARM at $1,500 a month. The recast will send you to $3,000. The government buys the loan as we proposed and puts you on a 30-year fixed government loan. No other crappy loans! Your payment will probably jump up to $2,000 or $2,200 but you get to keep your home. Many will be unable to even afford this. In addition under the Housing and Economic Recovery Act of 2008 which did have some thought put into it, if you were to sell your home for a profit within 5 years you would have to share appreciation with the government. That is how well thought out plans work folks.

Laura,

If you would re-read the comment below:

“What was perhaps the last word on the policy of reassurance was said by Simeon D. Fess, the Chairman of the Republican National Committee”

You might discover that it was made in 1930, not today. You might also notice that virtually all posters now recognize that both parties are deeply flawed and there is more than enough blame to go around for a disaster that has been more than 50 years in the making, through multiple Republican and Democrat administrations and Congresses.

Your visceral reaction and condemnations will do you no good. It will only serve to make you even more angry as you come to realize that there is nothing the government can do to stop deflation or even depression. They will only dig our once-great country into a deeper hole.

If you disagree with a candidate or party, support their opponents. You should ask yourself why you resort to personal attacks on someone you know virtually nothing about?

Robin Thomas,

Go ahead and hate the politicians. They deserve it. But don’t say you don’t know if you still love your country. Average people like us is what our country is made of. We have to do whatever it takes to put our country back on the right track because we do love our country. If we let corrupt politicians destroy our love for our country, we will cease to fight for it.

Laura Louzader,

There are plenty of “clowns” in the Democratic congress to be found so why don’t we all agree that the fault lies at the doors of both parties. Parroting the words of some America-hating Candian journalist, regarding Sarah Palin, is small-minded at best.

The frightening thing here is that if this financial system is unsustainable, what is the next system? We abandoned free market capitalism during the previous depression with Roosevelt’s New Deal. We declared bankruptcy in the Nixon administration and called it ‘Going off the gold standard’. The stock market failed in 1987 and only covert government intervention got the market going again. We already went through a major criminal real-estate bubble deferred by the RTC. God only knows what happened in September of 2001, but the rest of the world is quite aware that we are printing counterfit money to make all our import purchases and we are the ultimate ‘too big to fail’ entity. Fortunately, I suppose, we have the nuclear option: anyone who stops taking paper dollars for tangible goods will soon be in shock and awe…This ain’t your Grandpa’s USA.

Comrade Marxwuzrite now that we have a glut of housing and much reduced construction where is the surplus Mexican labor going to go? Back to Mexico? Suppose they refuse. Then what? We know our government only deports a small fraction of the illegals for show, so the remaining will either go on public assistance or crime. Either way it will cost us.

BTW the hordes of low skilled Mexican migrants are not a net benefit to the American economy. You might get your lawn mowed for less but your taxes will go up. They would be a net benefit if they were unable to draw benefits supplied by the American taxpayer. Do the arithmetic. A Mexican family with 5 children costs the state of California at least $40,000 to educate. Then there is free medicine and a host of other benefits. Suppose both parents work at minimum wage jobs. Their total gross is $28 per and they will pay no taxes on that. How can this family possibly be a net economic benefit?

I feel hopeless because MONTHS ago I wrote hundreds of letters to senators imploring them not to allow any sort of housing bailouts. I sent both emails and regular letters by the ton. Obviously it did no good whatsoever. Now I feel as though my voice means nothing and that the leaders(and I use that term very loosely) are simply not accountable. They do whatever their corporate masters tell them to do. I’ve lost all faith in the process. I’ve never felt this down about anything political. I’ve been sick to my stomach all day.

I just cannot fathom how Paulson has the guts to ask for such a huge sum of money to give to his scumbag buddies (who invented the CDO’s and the SIV’s and all the toxic crap that all of us housing blog people KNEW would spell disaster). It’s like Robin Hood in reverse. I can’t make sense of it.

Let them fail! They made bad loans? Too bad!

If any entity is “too big to fail” then we should not have any companies that big to begin with.

Is there no common sense at all in government?

What do those bastards do all day?

My GOD!

700 BILLION DOLLARS!!!!!!!!!!!!!!!!!!!!!!!!!!

They’re picking our pockets while we watch them do it.

I feel helpless and hopeless.

“focus on the concept of the labor theory of value”

Awesome idea, yet more horseshit Bolshevik nonsense to the rescue.

@Mike,

Anti-illegal immigrant is not the same as anti-Mexican. No doubt there are some out and out racists decrying illegal immigration but most of us can make this distinction. And no it doesn’t have much to do with the housing crisis. Times are about to get harder and the tax burden will likely get heavier. The illegals are bad for the country, especially for the lower/working class. This issue will get increased attention in the near future and deservedly so.

Interesting that Doc’s piece starting with the (completely appropriate) evocation of Louis Renault, in the pan-national, pan-racial freedom haven of Rick’s Cafe Americain, here in the comments got so quickly racialized and politicized.

~

One of the most painful realities I’ve lived through in the past 50 years is how often class issues–or as Nouri Roubini puts it, concentrating wealth while socializing costs–are turned into racial ones.

~

But DHB is talking about economic policy, not racial policy. And immigration most certainly, and by design, designed at the policy level around economics far more than race. That is to say, if Canadians were vastly poorer than US citizens, and Mexicans were richer, we’d have more poutine-slurping, hockey-playing, toque-wearing immigrants from Da Nort.

~

Immigration is hard to talk about because it’s also easier to enter into race-baiting than to face perhaps the hardest issue of all:

~

Should people be entitled to have as many kids as they feel like, at whim and will, with no regard to costs or budgets or balances, or what it will cost others?

~

Given that our nation has apparently established a major precedent that the most reckless get the most rescued, I truly doubt that immigration and population will ever amount to anything other than whizzing matches at the grass roots. We don’t have the verbal and mental equipment to discuss these issues rationally. Focusing on economics is one way that people try to.

~

Thanks, Doc.

~

rose

Dr. HB,

We are pouring taxpayer dollars down the black hole run by Wall Street/US. Govt. It is absolutely clear they are/will be one in the same entity now, if this latest bailout attempt gets rushed through. Talk about a ‘Cram Down”.

So this is what the beginning of a Depression looks like. The only question now is, how many other countries will the US take down with it?

http://www.westsideremeltdown.blogspot.com

Mr. Zarkov: If people stopped hiring them, they would deport themselves. Illegal immigrants aren’t here because they like the view, they’re here because they can make more money here than they can in Mexico. If wages in Canada were 40 times higher than they were in the U.S., I guarantee Americans would be crossing Lake Superior in rowboats if necessary to sneak in.

This is pure supply and demand. As long as there’s a demand for cheap illegal labor, immigrants will find a way to get into the country — no matter how big a fence we build and how many agents we have checking people’s papers at highway roadblocks. The only way to solve this problem is to kill the demand by severely punishing employers who hire illegal aliens.

This bailout business is VERY VERY VERY bad. Not just because it’s a bailout, not just because it’s 700 billion (!), but because there is no congressional oversight! It’s a trashing of the constitution and congressional powers over the purse (in addition to being a financial bankrupting of this country). It’s an invitation to latin american style corruption. That money will be stolen, flushed down the drain, diverted to all sorts of corrupt avenues.

Man the barricades now, or at least do what I plan to: write your congress critters! I know they don’t listen, but write anyway, hope, pray for the “opposition party” FOR ONCE to grow a backbone and actually oppose something. Don’t let Bush put this final nail in the coffin of this country.

All this before we have a REAL crisis (think peak oil etc.). All this for a mortgage backed paper tiger. In case of a real (non paper) crisis how is our infrastructure doing? Yes, I know, don’t make you laugh. We have no money for trains, no money for alternative energy, no money for light rail and public transit, and no manufacturing industries left in this country. And we spent it all bailing out the joke of a FIRE economy.

Hey Mike I wanted to let you know some things that are important not to get confused about.

I do not now nor have I EVER known anyone who was opposed to immigration. Ever. Period. And I’m old and have known a LOT of people.

I HAVE known people who were opposed to Mexicans and/or Hispanics. I’ve always considered them to be racist losers and never taken their opinions to be too worthy of consideration. They are a TINY minority, a fringe really, and I live in SoCal so I know of where I speak.

Many of us are opposed to illegal immgrants for their effect on wages, employment, taxes, housing prices, etc… and it comes mostly from its negative effects on the citizens of this state and this country. Not- ABSOLUTELY NOT- from any “racism” which is a very common accusation thrown at anyone whose opinion the accuser doesn’t like.

Racists are losers, and if people would be much more careful about whether they’re talking about

Mexicans

Hispanics

Immigrants

or

Illegal Immigrants

…we would quit carelessly talking past each other so much and pushing each other’s buttons so needlessly.

The terms are NOT interchangable!!!

We’re all in this leaky boat together folks… we need to work harder to work together.

And I should also point out that anyone blaming all this misery on illegal immigration is an idiot as is anyone who says it is irrelevant.

Doctor this is a wonderful blog and I appreciate your providing it and your insights and I hope you’ll take this and my last post as tokens of my appreciation.

Let’s do better my cocommenters!!! This is too important for anything lees than our best-

This has nothing to do with housing, finance, the economy, the recession, the Depression, or Hank Paulson’s armaments. However. Just for the record, and because, since writing my previous comment in this Doc-ument, I used the term “poutine-slurping” in conversation and someone, um, let’s say got completely the wrong idea…. 😉

~

Poutine is a Canadian…delicacy. A plate of fresh hot fried potatoes, covered with fresh soft cheese curds, and slathered with hot brown gravy.

~

rose

Big Bill

You sound like your looking for someone to blame for what the government has done to all of us, “ignorant peasants” as you call them who can’t defend themselves because they are “purely illiterate”.

I think if baby boomers who own a home and retire, should have their houses paid off, if they were responsible and did not borrow against their equity when house prices where high or if they downsized and paid their house in full, they will be able to live off their retirement. By the way not all baby boomers are ready to retire and not all have worked all their lives, you need to stop generalizing and get some facts.

You who has the ability to read, should do a little more of it.

Leave a Reply