AIG Bailout: Federal Reserve Bails AIG out with $85 Billion – World’s Foreclosing Balance Sheet: The Myth of Decoupling, Moral Hazard, and American Dream Disappearing.

AIG is the next in line for the Federal Reserve food stamp program. As the Federal Reserve decided to stand steady on rates, the markets did an unusual move. It actually moved up on a no move when everyone around the world was expecting a cut. Now, it is obvious why the market dipped by triple digits briefly after the Fed announced the no cut and ended triple digits higher. The market was extremely volatile today given the Lehman Brothers bankruptcy over the weekend and the unknown factor with insurance giant AIG – well as it turned out it was only unknown to the vast public since the Fed was getting ready to put more taxpayer money at risk.

For the past decade, we have become accustomed to the market having a brief rally after every Fed rate cut. This became a Pavlovian conditioned response to a society addicted to easy credit. Our society needs a major 12-step program on how to get off debt and given the current market conditions, this is going to prove extremely difficult simply because Americans are saddled with enormous amounts of debt. Paulson just this weekend supposedly drew the line about allowing firms to fail. That line was barely drawn and the Fed was back to their usual antics. AIG will get a loan of $85 billion from the Fed. Another firm that is supposedly too big to fail. Haven’t we heard this story already? Moral hazard to the next dimension folks:

“(New York Times)Â With time running out after A.I.G. failed to get a bank loan to avoid bankruptcy, Treasury Secretary Henry M. Paulson Jr. and the Fed chairman, Ben S. Bernanke, convened a meeting with House and Senate leaders on Capitol Hill about 6:30 p.m. Tuesday to explain the rescue plan. They emerged just after 7:30 p.m. with Mr. Paulson and Mr. Bernanke looking grim, but with top lawmakers initially expressing support for the plan. But the bailout is likely to prove controversial, because it effectively puts taxpayer money at risk while protecting bad investments made by A.I.G. and other institutions it does business with.” [emphasis added]

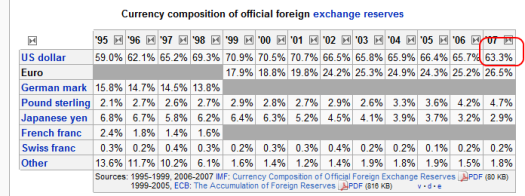

We have hundreds of pieces moving currently and much of what is going in the economy is fluid. Recently the U.S. Dollar has been rallying against other currencies. Many claim this is an anomaly and the dollar will once again continue declining. You have to put this in perspective first. The U.S. Dollar was falling because all eyes were on the U.S. and our current economic problems which are very large indeed. Yet the idea that somehow the world was going to do well in light that many of the other large economies ran on similar economic systems is mind boggling. In addition, the U.S. Dollar is still a reserve currency and takes up 63.3% of all exchange reserves:

Now the myth that was floating around for many years was that the United States was going to go into its own abyss while the world somehow boomed on its own. According to many of these people, the United States was contained. Did Ben Bernanke give them his early 2007 speech about the subprime market being contained? The recent turn of events are as follows:

(a)Â U.S. Dollar rally

(b)Â Commodities falling

(c)Â Inflation moderating

(d)Â Housing still declining

These events are occurring because the world has not decoupled. That is, we are still very much intertwined and when the larger economies sneeze, the smaller economies get a severe flu. In fact, in places like the U.K., Spain, Ireland, and Australia they have housing bubbles that are comparable or even larger in size. Many of these countries are simply one or two years behind the United States so if we are in the third inning to use the baseball analogy these countries are barely seeing the players take the field. This reality has taken the market over and many people are returning back to the perceived safety of the U.S. Dollar which is still by far the world’s reserve currency. Decoupling is a myth.

This realization has also pushed down commodities as many investors unwind previous trades. The meteoric rise of oil this year was simply stunning. When oil hit $145.29 the entire conversation in America seemed to revolve around oil. “Hey man, did you see that gas hit $4.25? It cost me $140 to fill up my Hummer with spinners. I think I might have to ride with only one spinning rim and sell the rest off for fuel.” Now that oil is back under $100 a barrel and the subsequent Lehman Brothers debacle, the focus is now shifting to Wall Street. It was fascinating to see that to most Americans, the difference between $4 $3.75 gas and $3.50 was the centerpiece of economic stability. Yes, their home just lost $50,000 in equity but they just paid $15 more at the gas pump so let us focus on those $15. Penny wise and extremely pound foolish. This is more a psychological gimmick because we tend to feel things we interact with on a routine basis. You buy gas often. You shop for food often. You don’t buy and sell homes that often (unless you live in California and ended up flipping houses each time you filled up for gas). If anything, this drop in energy should at least refocus the public’s attention to the main issue of the economy. That is, the suffocating debt of mortgages and the turmoil in the credit markets. Make no mistake that the drop in oil is going to help the bottom line of many Americans but remember that the drop comes because the economy is in disarray. That is, demand is falling and people are buying cheaper more fuel economical cars thus slamming the U.S. automakers into the ground. Many of the big domestic cars were built on a model of $2 gasoline. I’m not sure if we’ll ever see that again.

Back to the decoupling myth, let us first take a look at GDP for the top countries:

*Source:Â Wikipedia

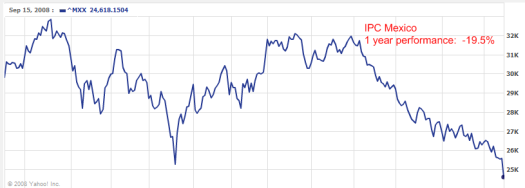

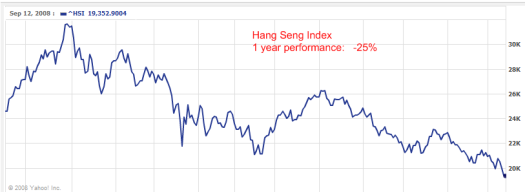

The United States makes up 25% of the world GDP. If we combine the Eurozone and the United States, we then have 56% of the world GDP. Throw in Japan and now we are 64% of world GDP. Japan is in a recession. The U.S. is in a recession. Many countries in Europe are teetering on recession and given many regional housing bubbles, they will also tilt into recession. How can anyone believe in decoupling? But what about China, Australia, Brazil, or Mexico? Let us take a quick rundown of the largest stock exchanges around the world:

In fact, the United States in relation to many of these other markets is fairing better. You need to remember that the credit systems are now global. Let us go back to AIG for a second. AIG currently as of midyear had reported $441 in credit default swaps. More that 75% of these were held by European banks. Is that decoupling? The financial innovations were spread around the world. Fannie Mae and Freddie Mac which seem like wholesome American companies have enormous amounts of their debt floating around the globe. Is it any wonder that China expressed “concern” when it looked like the government wasn’t going to be bailing them out? The fate of the current global economy is at hand and given the amount of debt floating out there, we can only guess what is floating out yonder.

Moral Hazard

The idea that the Fed will now be taking equities in exchange for Treasuries is simply another panic move. The Fed in yet another extraordinary move announced that the “23A Exemption” that limits a 10% passthrough of financing to affiliates will be “temporarily” suspended. Banks can now take stocks to the discount window. This is outrageous given the fact that the Fed’s balance sheet is already badly deteriorated from the ongoing credit crisis:

Source:Â Wikipedia

With AIG getting a cool $85 billion we can only imagine how the above graph is going to look in a few months. Since the Fed introduced the alphabet soup of facilities to exchange Treasuries to battered institutions in late 2007, you can see that the Fed is now in possession of billions of questionable assets. Institutions took them up on this. The fact that they are now willing to accept equities is baffling and against their own rules. But the fact that they aided in orchestrating the Bear Stearns bailout back in March they have been making things up as they go along for a few years. Some would rather not talk about moral hazard but that is avoiding the essence of what got us here. If we don’t address the foundation of the economic philosphy, we are bound to end up in similar situations over and over. These folks are your “but Armageddon will be unleashed if we don’t do [August rate cuts, Bear Stears, Fannie Mae and Freddie Mac, AIG…” crowd while they fail to confront the brutal facts and set the concrete for a better system.

The fact that the Fed allowed Lehman Brothers to collapse caught so many off guard because they have become used to the new economic philosophy of crony capitalism that is permeating the United States. Before you get too excited that the Fed and the U.S. Treasury are now taking a hard stance, the fact that they are now taking equities should bring you back to this bipolar method of conducting business. There is no rhyme or reason to what they are doing. Why let Lehman Brothers fail but not Bear Stearns? Frankly both should of failed on their own and the government should take on a role to protect the American taxpayer. We are beyond the moral hazard argument. With moral hazard, people that believe they are protected from risk will act differently as if they had no protection and all risk was assumed by the individual. For example, say an accident costs a person $500 but insurance only pays $400 the person has an incentive to avoid the accident. But say the same accident costs $500 but insurance will pay $700 then there may even be an incentive for the person to have an accident.

The housing market is a perfect moral hazard example especially with the innovation of all the toxic mortgage products. Let us run this scenario out to explain. Say you wanted to buy a home in California. All you hear about is $100,000 a year appreciation for doing nothing except flipping homes and cruising on your Hummer while dreams of $1.99 a gallon gas float in your mind. But you are cautious and are weary. You open up your WaMu bank statement and see you only have $50. Your dream initially is dashed. You plop down at the couch and turn on the TV. Low and behold, you see a fancy epilepsy causing mortgage commercial saying you can buy a home with no money down. No money down? You pick up the phone and make a call to setup an appointment with a “certified mortgage loan consultant.”

You meet the broker and find out that yes, it is true that you do not need a penny to buy a home just a willing heart and a quick pen to sign. There is a home on your street going for $500,000 which only last year, was selling for $400,000. Your thought process is such:

Buy?

Plus:Â Maybe $100,000 a year appreciation

Downside: Home goes down and I’ll just let it go since I put nothing down. Cost is zero except for bad credit. What are they going to go after? The $50 in your WaMu account? Bwahaha! WaMu may not be around by that time anyways!

This is better luck than gambling on the lottery. You buy the home and maybe you take in some wicked appreciation. The home reverses, you only lose your credit which given the current market means absolutely nothing. You basically had a call option on your home. If the home went up and you were happy, you sold your option for a nice profit. But what is happening is the price has gone down and as many of you know a large number of options expire worthless. You’re only out maybe the closing cost of the place. Not a big price to pay for tens of thousands in “potential” gains.

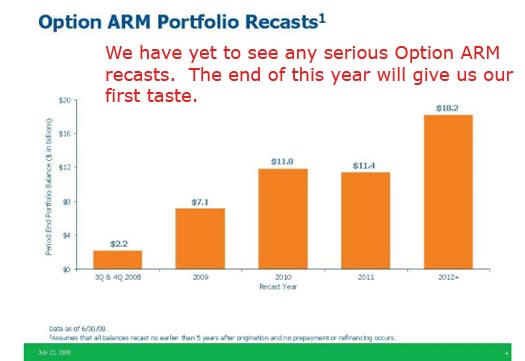

Now take this to the next level. Many of the investment banks where levered 30, 40, or even 50 to 1. This was absolutely insane. Even Fannie Mae and Freddie Mac were levered this high. That is, for every $1 in capital they were able to control in some shape or form $30 in so-called assets. That is why a place like WaMu with a market cap of $3.96 billion can have $309 billion in assets. This is like having $20,000 in the bank but having $2,000,000 in assets and maybe $1,800,000 in debt (i.e., homes, car, etc). Yes, you technically have a lot but you need to finance the monthly payments. And say you are forced to sell which WaMu for example is gong to face with their stunning Pay Option ARM portfolio:

Now, you realize that those $2,000,000 in assets are only worth $1,500,000 yet you have $1,800,000 in debt. You are essentially financially bankrupt if you cannot cover your payments. Talk about a tremendous mess.

The Disappearing American Dream

I know that everyone has their own perception of what the American dream really is. Yet for this past decade the real estate and financial industry captured the dream and turned it into homeownerhip. This became the pinnacle of the dream for most Americans. Since many people think debt and wealth are synonymous, they had no problem leveraging their future for this dream. After all, it was ingrained in the psyche of nearly every American. And let us be honest. Most people do not follow finance. They wouldn’t know the difference between an option ARM and a 15-year fixed mortgage if it bit them on the rear. In fact, simply by looking at the political debate, you would think that all Americans care about is gas, abortion, and no taxes. This simplifies the debate to the most basic and unfortunately most trivial level.

I would argue that the current financial turmoil, the government entitlements, the retiring onslaught of baby boomers, and the failing housing market are the pivotal financial issues for the next 10 years. Yet looking at the current discourse, you wouldn’t know this. In this article I highlighted the difference in the current tax plans of both Senator Obama and Senator McCain. Yet if you listen to the mainstream media, you would get a completely different message. The “no taxes” mantra is a bygone phrase from the Reagan era of supply-side economics. That is old and outdated and simply does not reflect the current economic turmoil. Things go full circle in history. The Glass-Steagall Act of 1933 which appeared during the Great Depression which was designed to control speculation was repealed by the Gramm-Leach-Bliley Act in 1999. The bills compromising the act were introduced by Senator Phil Gramm who said only this year that we are in a “mental recession.” Was the bailout of Fannie Mae and Freddie Mac and the bankruptcy of Lehman Brothers all in your head?

The pendulum today has swung much too far and these free market capitalist have turned out to be nothing more than crony capitalist and welfare recipients who want the government to stay out when they are manipulating the market for profit but when things go sour, want a government handout. The same government handouts they rail against when they say “no taxes” and “cut government waste.” Blatant hypocrisy. Both sides share in the blame but currently one team has many more strikes against them. In the end what is assured if things continue as they are, our overall country will be financially poorer and that is definitely not a sign of progress.

It is unfortunate that the current financial system has been made a mockery out of. Ultimately it is the average American citizen that will suffer. Instead of having political and economic discourse it turns out to become a bread and circus theatre to appease the masses. I think most Americans can feel the American dream slipping away because of the gambling and semi-laissez faire attitude on Wall Street that has raided the taxpayer’s bank account which is already broke to speculate on absurd financial “innovations” which turned out to be snake oil dressed with calculus equations. If we are to find a silver lining it is that the current economic turmoil has once again shifted the economy back as the number one focus for Americans. Not talking about this is not going to solve it. Silence is not golden here.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

16 Responses to “AIG Bailout: Federal Reserve Bails AIG out with $85 Billion – World’s Foreclosing Balance Sheet: The Myth of Decoupling, Moral Hazard, and American Dream Disappearing.”

“It was fascinating to see that to most Americans, the difference between $4 $3.75 gas and $3.50 was the centerpiece of economic stability. Yes, their home just lost $50,000 in equity but they just paid $15 more at the gas pump so let us focus on those $15.”

Most people are not moving anytime soon or do not hit the household ATM like some, so depreciation or appreciation doesn’t matter. Especially if they have been in their home for a while and already have a nice chunk of equity. Their payment, provided they re-fi’ed minimally, is still stuck in many moons ago.

Gas prices hit us now.

Bailouts remind me of silly little history lesson:

Stuck on antique technology which continues to this day, the beloved american motorcycle manufacturer was un-deserving of survival based on the consumer market. Prez Regan couldn’t let an American icon go disapear could he? Harley Davidson was saved by govt while on verge of bankruptcy, and the way the bill was footed came at the expense of the consumer. A tarrif on all bikes over 700cc’s paid for the bailout. Japanese Imports reacted by creating the 600cc class bikes, and the bigger bikes had bigger pricetag (not bigger cost) which fully burdened by consumer. The loan was paid-off, and harley survived. I think the tarriff is still in place? What are they (the govt) doing with that extra money now?? Lee Iacoca made similar “deal” (govt bailout), remember that one? The younger folks prolly dont know WTF I’m talking about. Clue: “Does that thing got a Hemi??”

It would be better if AIG was left to fail. I realize that the implications would be astronomicle, but once it happend the pain would subside quickly vs another bailout wich will put everyone at risk later on. Watch, as the bailouts will have unintended consequenses where the public won’t have the money to put the economic engine back on track for a very long time.

China & other countries are going to demand the monies that were used to buy our bonds & it’s going to get ugly. Meanwhile Washington will tell the american public to eat cake, or are they in not so many words telling us that message right now. That is why the republican presidential campaign was based on “fealings” & not on the facts at hand because they cant deal with them. And in some way or another everyone knows that reguardless who wins in November.

.

Times are going to get tougher, no matter whose fault and no matter who is elected president. While it’s important to want to identify the miscreants, prosecute them, strip them of their ill-gotten gains, and imprison them – all laudable goals – even if this doesn’t happen, what choices will Joe and Jane 6-pack make to their spending habits?

It’s not like we have a choice. It’s not “will we?” It’s “what we will change.”

Doc – see the dq news out today? I’m guessing you have a post brewing on that…

Even though most people will not move out of their house, have good equity in there homes, and are not foolish in how they use such equity…home prices will decline ALOT from here – everywhere and this is just the very beginning. The new generation of workers have the worst credit score in history. Savings is at an all time low. People can’t trade up easily now (a good majority of home sales) because they will have a hard time unloading there home at a price they will want. Incomes are too low for current home prices in every hood. Prices even in the nicer of zips will need to decline to levels seen in 99, 01. I live in a top zip code – laguna beach and each week I see one more house for sale on some block. Some move, the majority do not. This is just the beginning.

HOW the,,F,,,k is the ussa, going to pay for all of this….? ? ?

CAN some-one make a payment plan for 20-50 years

I doubt if they can keep up with the interest….

So that leaves the…Printing press……

WELL I think the answer just came, GOLD is UP today from

775$ to…865$ + 11% silver + 15%,…in 1 day……….

that is a DEVALUATion…..of the us $

“HOW the,,F,,,k is the ussa, going to pay for all of this….? ? ?

CAN some-one make a payment plan for 20-50 years

I doubt if they can keep up with the interest….

So that leaves the…Printing press……”

There is always a good war to get rid of your creditors (I hope that this is only my sarcasm).

But inflation is a nice way to make debts not that big.

The really funny thing is that all of this “money” is simply made up. There isn’t any real value in any of it. It was created out of thin air and maybe we should just let it disappear like it appeared.

I’m reminded of what Douglas Adams said in Hitchhikers Guide to The Galaxy.

“This planet has – or rather had – a problem, which was this: most of the people on it were unhappy for pretty much of the time. Many solutions were suggested for this problem, but most of these were largely concerned with the movements of small green pieces of paper, which is odd because on the whole it wasn’t the small green pieces of paper that were unhappy.”

I’m filled with a strange mix of dread at what is happening (especially since I knew it was coming) and odd amusement at the absurdity of it all.

Hypocrisy is definately the word of the day. For all of the free market talk in this country, “markets decide outcomes” etc… at the end of the day we are all just going back to the government well. The only stocks that are safe to be in right now, defense, make upwards of 80-90% of their revenue from the federal government. AIG and Bear, Freddie and Fannie all go back to the government when things go bad. The US has no place to talk when it comes to free and open economies given the fact that it is now the worlds largest insurer after what amounts to a buyout of AIG, and the world largest mortgage guarentee shop after Fannie and Freddie.

This whole phony economy is coming unspun. Everyone likes to believe they’re productive, but really their not. Everyone wants security guaranteed by the government or some other entity when in fact theres no such thing. Thats reality.

I worry more about the geopolitical implications of this economic meltdown rather than the actual loss of wealth, which I think this country could muddle through. The broken window fallacy, and the “war stimulates the economy” myth seem to be ingrained in the collective memory banks which would make a bad situation potentially fatal.

We are headed politically for totalitarianism, with complete control of prices, commerce, employment etc. Ironically we’re going to explore the reason why central control doesn’t work.

This all transpired due to easy access to money which didn’t exist in the first place. This IS NOT due to under regulation but rather due to money priced below market because of political concerns. So if people want a culprit, I suggest holding up a mirror and taking a good look, because this fall out will affect EVERYONE in as much as they participated in the fraud. There’s no room for victimhood, its time to go out and fix this farcical situation we’ve been in for 10 plus years.

“There is always a good war to get rid of your creditors (I hope that this is only my sarcasm).”

The Fed has already coughed up US$900 billion to bail out all and sundry (except Lehman Brothers). The central bank is just one good size bailout shy of hitting, as Dr Evil would say pinkie to mouth, ONE TRILLION DOLLARS!!!! Good luck trying to raise cash for that war!

The days of free money are over. It was a glorious time of home appreciation that had no financial basis.

There was a time when you had to put 20% percent down and actually share in the risk with the lender. There was a time when you had to you actually show the lender that you were using only 25% of your gross income to pay your mortgage.

Turn out the lights the party is over. My friends were borrowing 600000 from lenders and to be honest I would not have lent them 60 bucks. Bigger house, bigger car and one paycheck away from the poor house.

If you dont understand risk then you risk will bite you and leave a scar. Real estate is heading for another 30% decline. I am not kidding. You will see. Risk now is a dirty word.

to think of all the expense cutting done over the last 10 years and still all costs up…gotta wonder the idea of entitlement given the aspect of forced spending involved as that remains uncut like unfunded mandates

socalwatcher is correct. Until you sell your home, you have not locked in a gain or loss. Therefore home appreciation or depreciation does not hit most people as long as (a) they have a good, steady paying job and (b) they are not mortgaged to the hilt.

In my case, I do have a good paying job, no debt except the mortgage, a 3-month emergency fund, and the 15-yr mortgage is one that I can afford.

Democrats blocked Bush’s Fannie Mae and Freddie Mac Reforms.

”These two entities -Fannie Mae and Freddie Mac – are not facing any kind of financial crisis,” said Representative Barney Frank of Massachusetts, the ranking Democrat on the

Financial Services Committee.

http://strategicthought-charles77.blogspot.com/2008/09/democrats-blocked-bushs-fannie-mae-and.html

Just in at The Economist:

~

http://www.economist.com/finance/displaystory.cfm?story_id=12274078

~

First sentence:

~

“So much for decoupling.”

~

rose

The Financial Crisis and the Federal Reserve

Back in the 18th century, Thomas Jefferson said, “If the American people ever allow private banks to control the issue of their currency, first by inflation then by deflation, the banks and the corporations will grow up around them, will deprive the people of all property until their children wake up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.â€

Jefferson’s words are as valid today as they were in the 18th century. For many years, the American economy has been based on an unsound system of issuing “fiat paper money†printed at will by the Federal Reserve, an organization of large private international banks that Jefferson warned us about. The Fed has kept the economy going by artificially keeping the interest rates low and by selling Treasury Bills to foreign governments like China ($500 billion) which in turn use those securities as leverage to make our government agree to trade and others deals that favor them over American citizens, workers and businesses.

Very rarely is it mentioned that the Federal Reserve is actually a private entity of international bankers who have been given the power to control our monetary system. The Federal Reserve is not accountable to the U.S. Government; and yet the Federal Reserve continues to hold the reins to our monetary system often acting at the behest of large national and international private banks.

Americans have been told for years that our economy was strong and booming. Yet, we find ourselves in the middle of a financial crisis with dire predictions of a possible recession and/or depression coming from leaders in our government, Congress, Wall Street and the big commercial banks. What is the solution these Leaders are proposing behind closed doors? They want to come up with a plan to do the very thing that caused this financial crisis in the first place: they are proposing more government intervention into the free market.

Ever since the Depression, the federal government has involved itself deeply in the national housing market by developing numerous special housing programs to encourage home ownership. Government-sponsored private organizations like Fannie Mae and Freddie Mac were able to obtain a monopoly position in the mortgage market, especially the mortgage-backed securities market, because of the advantages bestowed upon them by the federal government mostly through government loan guarantees. By coincidence, executives from these two organizations routinely made significant bribes, I mean campaign contributions, to many members of congress to keep these advantages.

Some legislation passed by Congress, such as the Community Reinvestment Act that required banks to make loans to previously underserved segments of their communities, changed the way lending institutions approved loans. Under the threat of legal action from the U.S. Attorney General, federal legislation and policy decisions forced banks to lend to people who normally would be rejected as bad credit risks. These governmental measures, combined with manipulation of interest rates by the Federal Reserve, led to an unsustainable housing boom. The magnitude of the real estate bubble that has just exploded would never have happened without the government’s constant interference in the housing market coupled with the Federal Reserve’s actions of injecting a constant stream of easy money and credit into the U.S. economy, for all too many years.

In addition, in the last 14 months alone, the Federal Reserve, a non-government organization of private bankers, has interceded 34 times in the financial markets, primarily by providing fiat money backed by U.S. Treasury securities (government IOU’s) to their friends in investment-banking firms in exchange for getting those companies’ holdings of extremely poorly performing or non-performing mortgage-backed securities.

Here’s a list of some of the more recent Federal Reserve actions in the financial markets published by Reuters:

The Cost to Taxpayers and the Bailout Type

$ 700 billion+ – Proposed Treasury Department legislation

$ 29 billion – Bear Stearns financing

$ 200 billion – Fannie Mae and Freddie Mac nationalization

$ 85 billion – AIG loan and nationalization

$ 300 billion – Federal Housing Administration housing rescue bill

$4 billion – Mortgage community grants

$87 billion – JPMorgan Chase repayments

$200 billion+ – Loans to banks via Fed’s Term Auction Facility

$ 50 billion – Loans from Depression-era Exchange Stabilization Fund

$144 billion – Purchases of mortgage securities by Fannie Mae and Freddie Mac

TOTAL: $1.8 trillion+

COST PER US HOUSHOLD: $17,064+

The members of the Federal Reserve Board have essentially been bailing out their friends in private business enterprises that pay their employees exorbitant salaries while lowering the value of assets held by ordinary people (via higher inflation) and increasing the tax burden that Americans, their children and grandchildren will need to pay sometime in the future to compensate for the worthless mortgage-backed assets now held by the Fed.

For example, Fannie Mae’s previous CEO was paid a $987,000 salary in 2007, a $2.3 million bonus, and a total compensation (including stock) of $11.6 million. Not to be outdone, Congress decided on July 31, 2008 (via a new housing bill) to provide financial relief to hundreds of thousands of persons who signed mortgage agreements to live in homes that they never could afford in the first place. So the individual American taxpayers who pay their mortgages on time, live within their means and successfully manage their own financial affairs, get stuck with the bill for bailing out those who do not. This particular bill raised the national debt ceiling by $800 billion (to $10.6 trillion) and created risks for current and future taxpayers that are virtually impossible to calculate.

The American taxpayers now own mortgage companies, insurance companies, and if we keep going in this direction, we are going to own a lot more. If the big three American car companies need to be bailed out, rest assured that the Federal Reserve is going to bail them out too, with taxpayers’ money of course.

All of these bailouts have one thing in common: They seek to prevent the quick sale of bad debt and worthless assets at market prices. Instead, the Federal Reserve is trying to artificially prop up those markets and keep those assets trading at prices far in excess of their actual market value. By using trillions of dollars of borrowed taxpayer money to purchase these bad investments, the government is going deeper and deeper into debt and is actually ensuring even greater instability in the financial system in the long term.

The questions to be asked are: (1) What Constitutional authority exists for the U.S. Government or Federal Reserve to use public (taxpayer) funds for definitively private purposes? and (2) What legal authority in the Constitution allows the U.S. Government to directly purchase the distressed assets and contracts of privately owned Wall Street firms for the express purpose of mitigating their private investment risks and losses? The answer to both of these questions is that there is no legal authority in the US Constitution to use taxpayer money for these purposes.

The solution to the problem is to end government meddling in the free market. It is time this process is put to an end, or at the very least, reigned in. The government should sell off the assets of Fannie Mae and Freddie Mac quickly and close down these corrupt organizations. Government must reduce the volume and complexity of regulations it imposes on lending institutions and stop passing social engineering legislation, like the Community Reinvestment Act, that interferes in the free market economy and which has ultimately led to this financial crisis.

History shows us that when the destruction of monetary value becomes rampant, as the actions of our congress and the Fed would indicate, nearly everyone suffers and both the economic and political structure becomes unstable. The Federal Reserve System has been the tool used by the major bankers to allow them to gain control over the smaller regional and local banks. Our current financial crisis is an example of this with J.P. Morgan buying up the competition, sometimes with taxpayers help.

The Fed has also acted as the financing agency for Congress’ unprecedented deficit spending on an ever growing, more intrusive federal bureaucracy and the expansion of the welfare state. Some people believe that the private bankers in the Federal Reserve wield so much power that they can intentionally manipulate the economy in order to influence the results of our presidential elections.

Our government and the American people do not need the help of any private banking cartel to manage our monetary system.

Once we come up with a plan to solve this current crisis, we need to repeal the Federal Reserve Act and return control of our currency to Congress where it belongs, as was the intent of our Founders.

We also need to have a serious national discussion about how real currency reform can be achieved. As long as the private bankers that make up the Federal Reserve Board have control over our nation’s money, Congress’ control of the purse-strings will not have the benefits the country’s Founders intended.

I support legislation introduced by Congressman Ron Paul, of Texas, entitled “Federal Reserve Board Abolition Act (H.R. 2755) that will restore financial stability to America’s economy by abolishing the Federal Reserve Board.

John Wallace

NY Campaign for Liberty

Chatham, New York 12037

http://www.NYCampaignForLiberty.com

Leave a Reply