The Truth about Option ARMs, Pick-a-Pay Mortgages, and Alt-A Loans: Looking at Wells Fargo, Bank of America, and JP Morgan. We are in the Eye of the $469 Billion Toxic Mortgage Hurricane and Silence is not Golden.

Let me be abundantly clear. We still have a Pay Option ARM and Alt-A mortgage problem. This will hit in full force in 2010 and we are already seeing many mortgage holders having trouble with actual recasts brought on by negative amortization. Yet there is a crew of people saying that Alt-A mortgage products will not bring any trouble because of the low interest rate environment. Unfortunately the low rate misses the bigger issue. Low rates are helping but the problem that we will be seeing is the massive onslaught of recasts, not resets that will be occurring over the next few years. This is a big reason why we won’t see a housing bottom in California until 2011 at the earliest. Many of these loans were made to supposedly better qualified borrowers in mid to upper priced areas. These areas will begin to crack like an egg dropped on the floor late in 2009. The Notice of Default tsunami will guarantee this much.

I’m am stunned that some people are actually saying that Alt-A mortgages or Pay Option ARMs will create little problems in the market. Okay. Then how about we remove the public-private investment program that conveniently has a cap with the FDIC of $500 billion? After all, if there isn’t any problem with toxic mortgages why should we have a toxic mortgage program that has the design to eat up $1 trillion in loans. Exactly. Let me break down the latest figures from data by none other than the Federal Reserve:

California

At the end of March 2009

Subprime loans active:Â $119 billion

Alt-A loans active:Â Â Â Â Â Â Â Â Â Â Â $288 billion

U.S.

Alt-A active:Â Â Â Â Â Â $469 billion

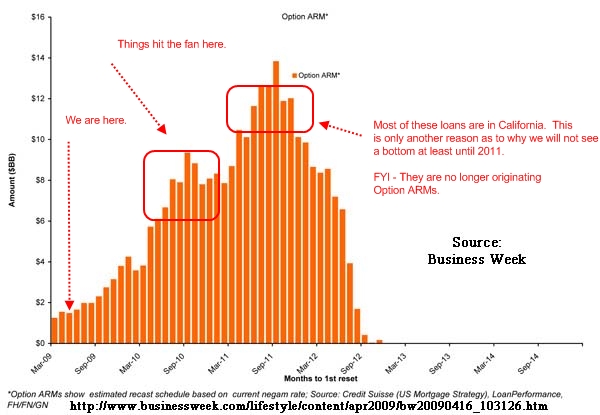

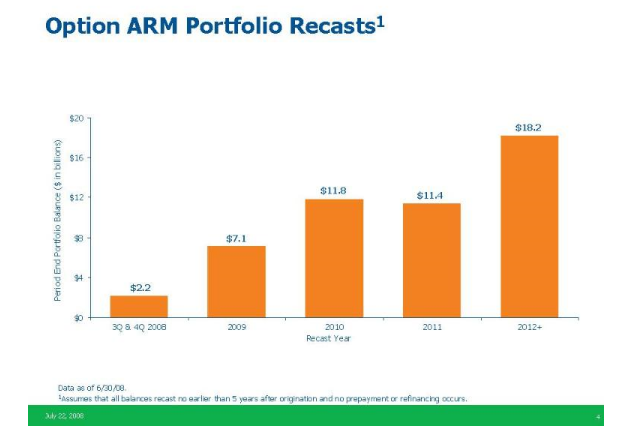

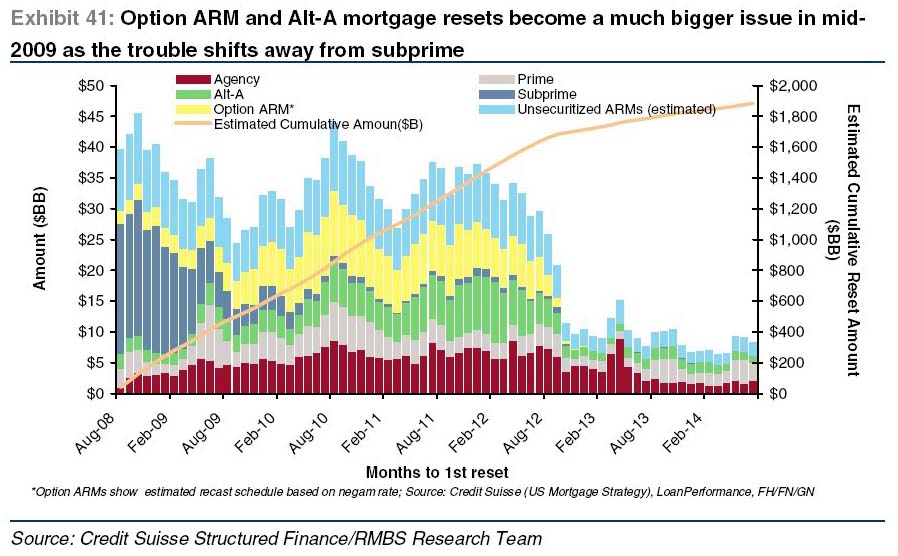

When we talk about the $500 billion in Alt-A mortgages this is what we are talking about. Last time I checked $469 billion does not mean the problem has gone away. Businessweek came out with a chart only last month showing how Pay Option ARMs will be recasting over the next few years:

Click for sharper image

I’ve added a reference point for all those people who seem to think that Option ARMs and Alt-A loans have somehow disappeared from the market. The game is just starting. Currently, we are seeing less than $2 billion per month of these loans recasting. However, in 2010 we are going to start seeing $8 to $10 billion per month recast, nearly 5 times the current rate. The chart states “months to 1st reset” but they are referring to recasts brought on by negative amortization. And as you will see, since the majority of these loans are in California the bulk are underwater Jacque Cousteau style.

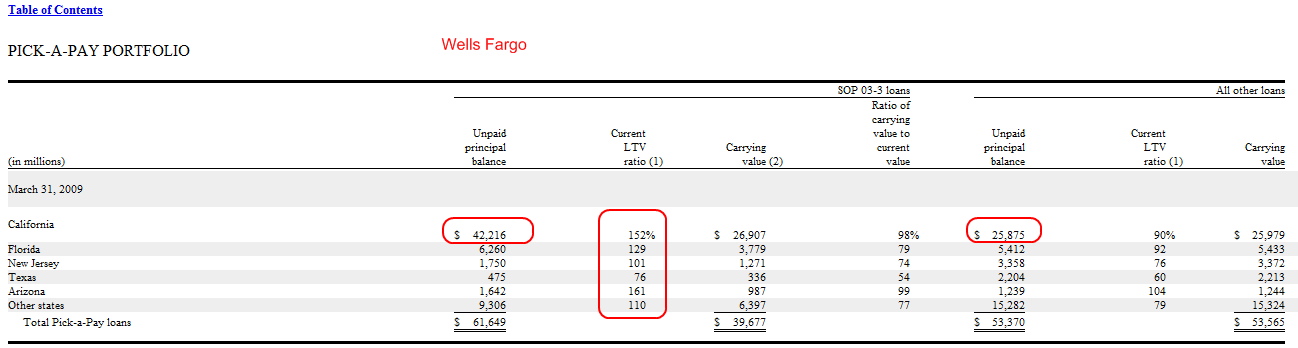

Wachovia in their infinite wisdom swallowed up Golden West at the height of the lending insanity. This cratered the bank which was taken over by Wells Fargo. Just because you eat a bank doesn’t mean the toxic waste suddenly disappears. In fact, there is still well over $100 billion in Pick-A-Pay mortgages in their portfolio. Wells Fargo has written off a portion of the portfolio but there is still a significant amount remaining:

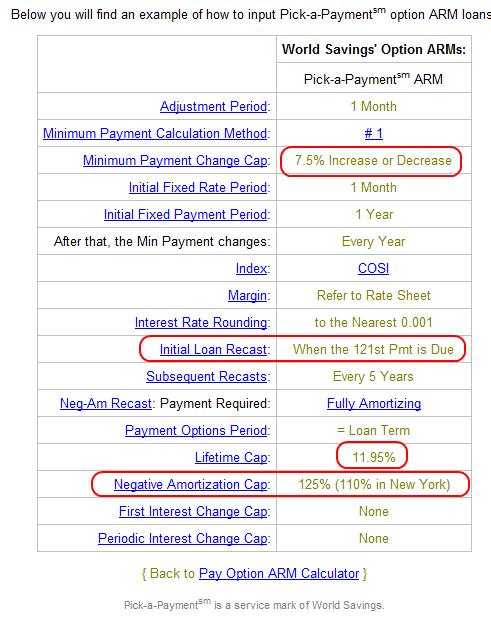

This is from their most recent 10-Q. Wells Fargo alone has $42 billion in unpaid principal linked to Pick-A-Pay mortgages here in California. The Pick-A-Pay was basically the Pay Option ARM World Savings Style. Here were the terms:

Source:Â Mortgage X

These are the crappiest loans in the world. World Savings which was owned by Golden West thought that by simply having a little more collateral and looking at FICO scores that handing out toxic waste would be smart. Some of these insane loans don’t have the first adjustment until 10 years later! Of course, if Wells Fargo had any sense they would look at that absurd 152% LTV and freaking recast the entire lot. Somehow I doubt they are doing this since they are too busy sucking up taxpayer money through the crony bailout and pretending everything is fine through manufactured stress tests. Look at the LTV on some of the toxic foursome. Arizona actually beats California out with a 161% LTV which is astonishing in itself. But again, out of this little section of $61 billion in Pick-A-Pay loans $42 billion are in California, a state that has seen the median price drop by 50% in one year.

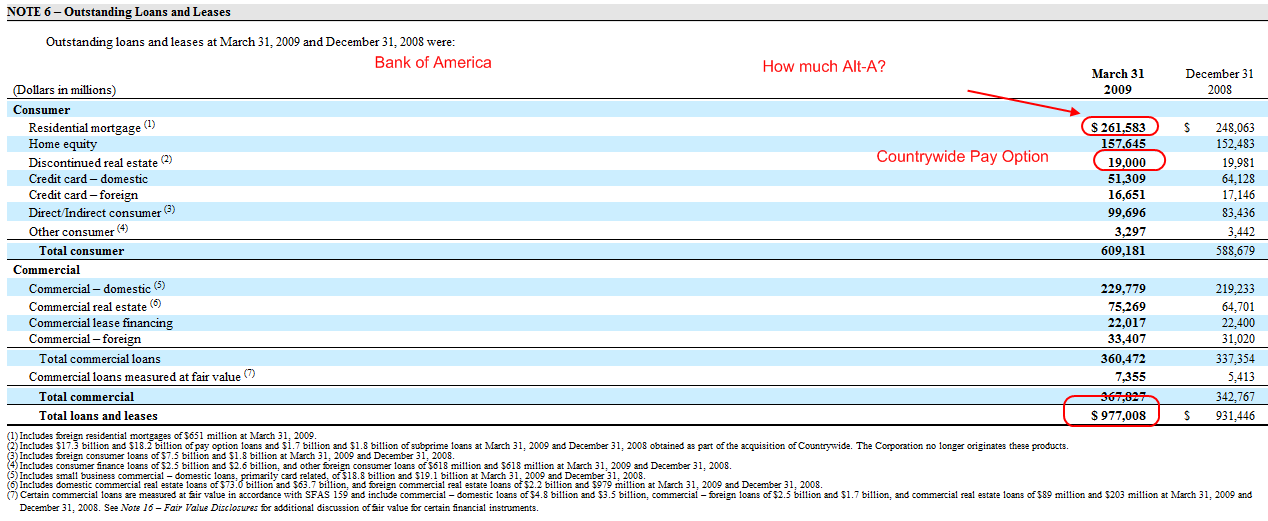

Wells Fargo seems to have the biggest amount of this crap on their books. Yet Bank of America and JP Morgan now have a lot since they acquired toxic mortgage experts Countrywide Financial and WaMu. Let us first look at Bank of America:

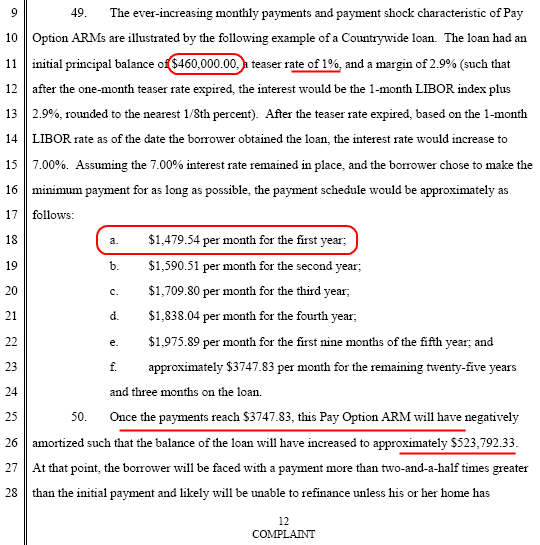

Bank of America has $20 billion in Pay Option ARMs courtesy of Countrywide. But keep in mind Countrywide was a toxic mortgage expert and other Alt-A crap producer. They are the 31-Flavors of toxic waste. We can find some of that junk in the whopping $261 billion residential mortgage portfolio. If you haven’t realized it yet, if you lose your job any mortgage becomes toxic if you are underwater and can’t make the payment. So many of these “prime” loans are equally bad. The only difference is these Pay Option ARMs are monstrosities of epic proportions born in the laboratory of financial meth labs. Take a look at what the California Attorney General shows through one glorious example of a Countrywide Pay Option ARM:

Here we get a firsthand look of a toxic mortgage product in action. This is for a $460,000 loan which is what is sitting in many of those mid to upper priced areas in California. Initially, the first year payment is $1,479 which of course is absurdly low. But by the time we hit the first 5 year adjustment our payment jumps up to $3,747! The payment more than doubles. These craptastic loans were made throughout the bubble from 2004 to 2008 (yes, 2008 with freaking Wachoiva). A large number of these will have major adjustments in 5 years (that is why we are seeing the first batch now) while some like the idiotic Pick-A-Pay loans can go on for 10 years. Like I stated before, I highly doubt that Wells or BofA are going to push to recast many of these loans since they are going to fold the minute they do it. Most people in these loans can’t sell and are basically renters. That is until they hit recast and you will be seeing some massive moonwalking from homes. Yet buyers are walking because they are not building equity (aka, renting). If you bought a place for $500,000 and now know it is worth $250,000, you might make that $1,500 a month payment but are you going to make the payment once it goes up to $3,700? Heck no! You are out. These banks are praying the market will recover. It will not.  At least not under their delusional expectations and V-shaped bubble recovery plans.

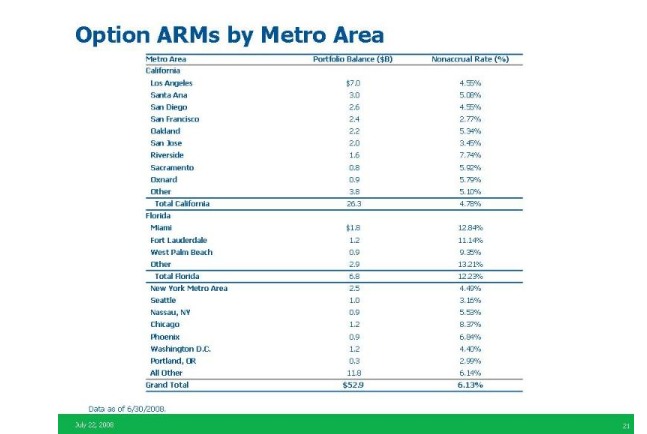

Let us look at JP Morgan who ended up swallowing up WaMu, another Pay Option ARM fanatic. Before WaMu went under like the titanic they had a gigantic amount of Pay Option ARMs:

Right before WaMu bit the banking dust, it had $52 billion in Pay Option ARMs. And where were the bulk of these loans? If you guessed California you win a prize:

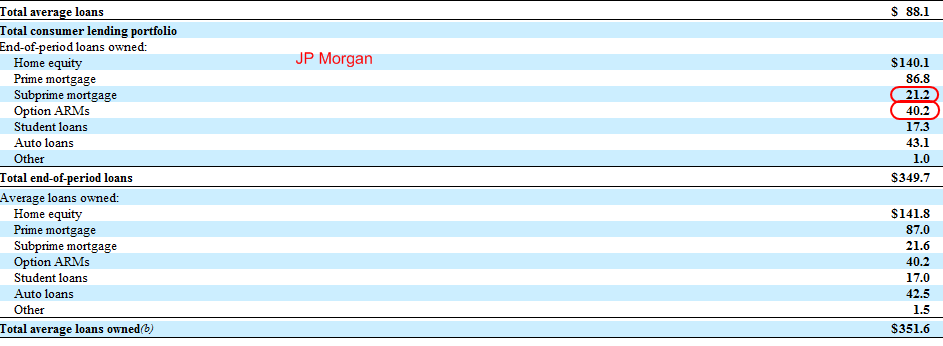

Now JP Morgan wrote down a large part of this portfolio. But how much of it? That is the real question. If we are to take the stress test as any guide, banks are still insanely optimistic of potential losses. Let us pull up the latest 10-Q for JP Morgan:

According to the above, they still have $40.2 billion in Option ARMs and $21 billion in subprime loans. But another major issue that I won’t address here but should be obvious is that massive “home equity” line item. JP Morgan has $140 billion in these loans. Many times, these loans are combined with Pay Option ARMs which makes for a dynamic duo of crap. These loans are secured by home equity which doesn’t even exist anymore! These will implode simultaneously as things get worse with these loans. In the Pick-A-Pay portfolio with Wells, the majority of people make the minimum payment meaning negative amortization. Meaning, the bank most likely will recast the product based on the appraised price at time of sale. Many will say otherwise but this is the only logical conclusion. If we are to appraise those loans in today’s current market, the vast majority of the portfolio would shatter the 110% or 125% (insane) caps and all these mortgages would hit recast oblivion. I doubt that since banks are waiting for the PPIP so the taxpayer can assume the position at the worst time. And that is why this problem hasn’t been solved. I’ve heard a few misguided pundits say that most of these loans have been refinanced. Sorry, the data above doesn’t show that. Most of these are still out there. The only refinancing going on with these toxic mortgages occurs in the foreclosure process.

So why has refinancing activity picked up? Because buyers in no financial trouble have taken advantage of the low mortgage rate environment and this is smart. But don’t think all the activity was because of subprime and Alt-A borrowers running to get new government backed mortgages. They don’t qualify!

I’ll leave you with the most recent graph from Credit Suisse:

The big hit is going to be in 2010.  With 135,000 Notice of Defaults in California for Q1 of 2009, the second half of the year is going to expose the eye of the hurricane we are currently in. The pundits who say these loans have been taken care mistake silence with a problem being solved. The data does not back them up but since when do we expect pundits to pay attention to data?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

51 Responses to “The Truth about Option ARMs, Pick-a-Pay Mortgages, and Alt-A Loans: Looking at Wells Fargo, Bank of America, and JP Morgan. We are in the Eye of the $469 Billion Toxic Mortgage Hurricane and Silence is not Golden.”

Doc, California voters soundly defeated the new tax increases. I’m assuming you’ll be writing about this?

Wells Fargo alone has $42 billion in unpaid principal linked to Pick-A-Pay mortgages here in California.

The disaster is that they’ve been booking that $42b as revenue. Yup, their “assets” are overstated by an equal amount.

THANK YOU for including that example of an option pay mortgage! It is so much clearer to me now why we are the trouble we are. Most people have no idea. It is like one of those zombie movies where no one sees the monsters until it’s too late. Munch.

Dr. Bubble, you’re my hero!!! Please please please keep this great info coming. I’ve been home shopping since late last year and thankfully have been outbid on everything I’ve tried for. Since finding your post it’s giving me the confidence to wait.

Does anyone think the credit card bill will help? I can’t even tell when most things would take effect. And then it has a gun toting allowence law in parks WTF. Everything is too big too fail so all the failures are rewarded. The finance peeps took over the goverment and no one can dislodge them. I know all of this is off the subject but the doctor delivers a good perspecitve.

Once again, thanks for the facts Dr HB ! There seems to be some belief that mid to higher end homeowners are generally more educated and the banks will work with them to avoid foreclosure. On the other hand. I believe the more educated are probably more leveraged as they understand how to play the game. Banks don’t care who you are or how much education you have. Loans are merely financial transactions that banks try to maximize profit from. Once the mid and high level markets begin to crater, they will cut their losses, foreclose and auction off, before losing more value. The real estate market is not coming back for at least 5 years. The last crash in the 90s lasted 7 years and we are barely 2 years into this crash. With a bubble 3xs as big, chances are we drag along the bottom until 2015 – 2017 before we see any appreciation. Just plain common sense.

It’s too bad homeowners on the Westside don’t get it. This summer will be their best and last chance to sell, before we see massive loan defaults beginning later this year. By next summer, the Westside will be dead in the water, and we’ll see sellers chasing the market into foreclosure.

http://www.westsideremeltdown.blogspot.com

Thanks Dr.B. You’ve saved me from stupidity countless times over the past three years. I’ll buy when you say it’s safe to buy.

And even more insane Wells assumes only ONE THIRD OF ONE PRECENT of their pick-a-pays will recast before 2012!!! That means virtually all the loans are of the 121 month recast variety and they assume rates are going to stay “flat”.

More here:

http://healdsburgbubble.blogspot.com/2009/05/something-not-adding-up-on-option-arms.html

Even better, people in our neck of the woods (Northern California) are getting letters from WaMu saying they are extending their teaser rate another 5 years on their Option-Arm loan. Push the recasts out and in the meantime the additional negative amortization is REVENUE under GAAP (non-cash of course).

You’re right… this is a time bomb.

I sure wouldn’t be buying a home anywhere, not just California!!!!!

I doubt the credit card bill will help…it will phase in sometime in 2010 and it will then start hitting those who did manage their funds. Those who didn’t run balances, paid off in full, didn’t pay interest – another words, managed their credit well and had the benefits of it. Look for the return of instant-interest on every purchase, card fee’s and high interest rates for those who DID manage their credit, to pay for those who DIDN’T.

We all better be thinking about positioning back into cash or checks for all transactions. Seems like whatever direction you go to save yourself you’re going to be a target.

I really fear for this country. It could just be that despite what the Power Mongers in Washington are going for, it still might collapse and that will be spectacular for everyone. The till is about empty now.

Just think how it could have been if we still lived by the Constitution. These guys could be prosecuted. Unfortunately the congress is who overturned the rules and regulations that restrained these guys. Anybody remember the Glass-Steagall Act? You really have to go back to the masterminds behind the Fed Reserve Act…or the Bible

Great posts as always, regarding neg am and cali loans and the banks that retain them:

has any of the acctg changed, I know one plus for those neg ams, from a balance sheet

perspective was that they could write a full p and i payment collected monthly even though they were

only physically receiving 1-2 percent int payment. So, if that’s still going on then

there’s clearly some inflated numbers there.

I bought a home in Burbank, California in July 2008, and have lost $100,000 so far. Crikey, I wish I had been reading the Doctor before I listened to the whining and pleading of my wife. “It’s just perfect for us. It’s has everything. Stop being so negative. Real Estate always goes up in the long run”. Damn it! Sure it goes up in the long run, but if I had waited two or three years like I told her that we should, I would have been able to pick up an identical home for half the price. Women and their friggin’ nesting instincts! Now I’ve lost a big chunk of my life savings, and the marriage is falling apart anyway because we fight about money all the time. As for you smart renters diligently saving up you wealth in order to buy at the bottom, think for a second about what you are doing. You are trading your time and your life for dollars. Paper dollars, which you think of as a good store of value; as money itself. To repeat myself in the hopes of saving a few from going down the path that I did: The World Almanac shows that in 2008 the total amount of gold mined on planet Earth was 80 million ounces. At $1000 per ounce, all that gold would be worth 80 billion dollars. The US government is printing (borrowing) that many dollars out of thin air every two or three weeks. The US national debt alone already exceeds the value of all the gold and silver ever mined on the planet in the past 5000 years. This is a house of cards that will not long stand. So while you are saving up for a home to purchase at the bottom, save your wealth in real money: gold and silver. In three or four years its nominal value will be much higher in relation to paper money, and you will be able to buy a much nicer home.

“Why buy when you can rent” applies to Women equally well. The rent goes up if you want them whining and pleading 😉

HHB:

WaMu is extending teaser rates? Won’t people be more inclined to stay in their homes then? Wouldn’t that slow the drop in housing prices, too? Or no?

Does anybody have any idea of what the average loan amount for the Option ARM loans were in CA? I know it was a large percentage here, but I can’t seem to find out the loan value range that these were typically in other then people saying the upper end.

Funny how Martha Stewart went to jail and Mozilla could spend five million a year for the rest of his life and still not run out of cash…and I doubt he can even cook…frightening to think where we go from here.

Thanks once again DHB. The data you provide has won me countless arguments with ignorant pessimistic fools who believe housing will recover soon.

I’ve been reading this blog for some time and this is my first post. So I’d first like to say thanks to Dr. HB for the great research and insight. I really enjoy reading your posts.

The biggest question on my mind is where will the market bottom. Today’s post reinforces the point that lower prices are to come, but will it be a sharp decline, a slow trickle like we saw in the early 1990s or some combination? I’d love to here some more thoughts on topic. As a soon-to-be first time home buyer I’d also love to here what signs people are looking for to know it’s time to buy. At some point even a slow trickle down might be more economical then renting…..

According to Wikipedia: Gold reserves (or gold holdings) are held by central banks as a store of value. In 2001, it was estimated that all the gold ever mined totaled 145,000 tonnes. One tonne of gold equated to a value of US$30.27 million as of February 14, 2009 ($941.35/troy ounces). The total value of all gold ever mined would be US$4.39 trillion at that price

The information on this site trumps the ‘green shoots’ baloney every time. thankyou!!!

Great article. It really highlights the situation.

Had I read it for the first time a year ago it would have meant something to me than it does after reading it today.

Just one year ago 500billion seemed like a big big deal. However, now that the Federal government is literally printing money, tossing money around and doing things that were once considered unthinkable, I can’t be as certain how this will play out.

The Fed has thrown a monkey wrench into what should have occurred several times now and who knows what the future holds from the FED. Today, it seems that if 500 billion is a make or break for the u.s. economy (as goes California, so goes the nation) the FED can easily saw down a couple hundred old growth California Redwoods, add a little special ink, and walaa, 500 billion in freshly printed money to save the day. (actually, today they only need turn on their FED computer and add a few zeros.)

They honestly don’t seem to care about the repercussions since most people in this country (especially the federal government) are debtors.

It seems the only thing that will make this whole economic crisis play out as it should is if the world puts its foot down and says enough! By, ENOUGH, I mean refusing accept the endless pile of freshly printed money.

Currently I am putting my money on the world saying ENOUGH!

Dr. Bubble, why are you using 7% as your interest rate in that example when these loans will recast to 3.21% according to your own facts? You said that loan is using the 1 month LIBOR (currently .31%) and a 2.90% margin. It looks to me like that payment will go down, not double!

Dr. Bubble, why are you using a 7% interest rate on that one loan when your own facts show the rate will be 3.21%? The one month LIBOR is .31% and the margin is 2.90%. That will make that payment go down!

@ Incredulous

There is a cap on the interest rates both high and low, although the high (as I’m sure you can imagine) is much more of a ridiculous number than the low… so when they started their Option ARM when the Libor was at 3% or so, the 6.9% or 7% is as low as it’s gonna get.

I think he hit the head on the nail when he said that no one with the toxic loans is refinancing because they don’t qualify. You can’t qualify for a refi when you owe $200,000 more than your house is worth and thats the boat a large portion of the worst loans are in. This problem will get much worse before it gets better. Inland empire may wildly overshoot even the historical norm due to the fact that we have so many vacant homes out here and 15% unemployment. Wouldn’t be surprised to see the median go under 100k.

Matt: I double checked your figures in all the references available, and your figures seem to be right. All the gold ever mined on Planet Earth is about 145,000 metric tons. At $941.35 per troy ounce, that amounts to 4.39 trillion US dollars. So if you consider that the US debt alone is increasing by two trillion dollars just this year alone, let that figure mean something to you now. Two trillion dollars represents a pile of money that is equivalent to half of all the gold ever mined on Earth in the history of mankind. That is a lot of backbreaking work in the hot sun, by millions and millions of tired, achy ancestors working over centuries and centuries. And miracle of miracles, we can create the equivalent amount of wealth today with a few keystrokes! So save your money in REAL money, and don’t be fooled into accepting fiat money: the soon-to-be-worth-less dollar. And when the good Doctor says it is time to buy, we’ll have solid, valuable money ready to buy physical assets that will eventually rise in value in relation to paper fiat currencies.

Gold Markets are highly manipulated. gold pays no interest. If you don’t know when the big boys are shorting, you’ll get killed. Think all the funny money will bring hyperinflation? It’s not that simple. Read this:

http://www.nytimes.com/2009/05/21/business/global/21reserves.html?_r=1&ref=business

Just stay out of debt. If you’re not in the asset class, don’t act like it. If you work for somebody and make a huge salary, that could all be gone tomorrow. $500k home? Just don’t be p-whipped and buy something you can’t afford, unless you’re just in it for the party.

Alberto – California general obligation bonds are paying 6% tax-free! That MUST mean they are a good investment over time…. Would you rather hold your savings in California bonds paying sky-high interest, or in gold, paying no interest? This is a trick question….

You Tube

“Real Estate Downfall” (Video Parody…. 🙂

http://www.youtube.com/watch?v=bNmcf4Y3lGM

Will make you laugh……..!

The FED and Treasury will keep up this scam at any cost. It will ultimately lead to hyper inflation which is nothing more than a tax on anyone who has savings. Look at Argentina. They hope that we the tax payer keep drinking the Kool Aid and that by the time we realize the extent of the scam it will be too late.

This puts into perspective just how much $1 trillion dollars is and how long it takes to spend it.

If you spent 1 million dollars a day since the birth of Jesus, you still would not have spent all of the money. The would still be enough money for 700 more years.

Data talks that’s how Dr. Housing convenienced us. Thank you so much for all efforts put in this blog.

Quick question for who are reading this blog:

If most of us agree the prices of housing are going down, why the inventory of existing homes on the market have been reducing in SoCal?

I have been shopping for a SFR and found there are less homes to choose from. Your comments are appreciated.

Does anyone know where to find the data by zip code for the outstanding loan distributions by loan type. Before I buy a house I’d really like to know the potential for a micro-bubble to exist within my zip code?

With just a billion we could make big inroads into teaching basic arithmetic skills to all adults…say as a prerequisite to getting a driver’s license. (I was going to add “or buying a lottery ticket,” but lotteries are arithmetic-ignorance taxes. Just as toxic mortgages are. I personally don’t consider ignorance any excuse; grownups should be expected and required to make an effort to understand legal agreements they enter into, and shouldn’t enter into them till they’ve made that effort…but let’s not digress there.)

~

Thank you as always, Doc, for your non-partisan, non-ideological, and non-sectarian COMMON SENSE grounded in simple arithmetical facts.

~

rose

WOW! Always good to drop by and get a quick dose of reality after soaking in the happy talk from the MSM and the Government. Perspective comes with knowledge and you always manage to provide the underlying data in a way that makes it quickly apparent.

To all the goldbugs, (I like gold too) it is a tricky business as gold is highly manipulated. The central banks don’t like anyone else holding gold, so they do strange things with the pricing – beware it is best to do long term averaging by buying in increments.

Most folks would do better by first buying 500 to 1000 dollars worth of canned goods and staples and the proper containers in which to store said items. 3 to 6 months of food stores will be much more handy than an ounce or two of gold.

Food stores are great for any disaster, earthquakes, tornado, hurricane, economic depression, bank closures, etc. plus they are convenient and save trips to the store when you don’t want to go, or can’t go.

Housing is the canary in the coalmine, America and the world have so many chronic problems that haven’t been addressed, and all seem to be coming due simultaneously. Until we restructure our energy systems, we cannot repair our economic system, and hence cannot fix employment,savings,housing,retirement,etc.

While I share your concerns on housing, we must try to understand why the economic collapse occured when it did, and not 5 years past or hence. This may reveal innate properties of our government that may prove profound in understanding where they go from here. All our fortunes are tied to the government when it fails(or our currency) all bets are off.

Smart sellers aren’t selling now — they know they won’t get top dollar, AND many of them are underwater, hoping for a rebound in the next year or so so that they avoid foreclosure…so inventory is much less. In my ‘hood in Newport Beach, there are two houses for sale – -they have been on the market a long while. People here KNOW they can’t sell w/o having to pay to get out (they are underwater) so they stay, paying their mortgages.

@Chris

I hear you–but everywhere you look, somebody is trying to chum up the waters with fear and prodding you to hold your cash in gold. Now I’m over 50 and the world’s been coming to an end for 40 years or so. It all might break down soon, but that’s the only time gold is an ‘investment’. It’s really just a hedge against disaster. There are no easy choices for the working class, but if you buy gold out of fear, you’re buying fools gold. If you know the market well and don’t mind taking other people’s money when they’re afraid, by all means. Certainly better than buying a 756 ft/sq RHG with Monet trash cans…

“WaMu is extending teaser rates? Won’t people be more inclined to stay in their homes then? Wouldn’t that slow the drop in housing prices, too? Or no?”

The #1 reason for defaults is negative equity.

Off topic, but FYI:

A twist on New York Times writer’s debt-binge tale

New York Times economics reporter Edmund L. Andrews’ tell-all book about his personal plunge into ruinous debt didn’t quite tell all, blogger Megan McArdle at TheAtlantic.com discovered.

Andrews’ second wife, Patty Barreiro, sought bankruptcy protection in 1998 and again in 2007, McArdle wrote in a post last week.

Barreiro’s bankruptcies weren’t mentioned in Andrews’ book, “Busted: Life Inside the Great Mortgage Meltdown,” or in the widely circulated excerpt that ran in the New York Times Magazine on May 17.

I wrote a post on the excerpt here.

—

Go here for Andrews’ response and for McArdle’s detailed response to his response.

I think her main point is valid enough: The bankruptcies were relevant to the story.

She wrote:

That kind of living up to the edge is, indeed, exactly what Andrews describes happening in his marriage. The bankruptcies suggest that this may be a symptom of a pre-existing problem, rather than the easy credit of the past five years.

— Tom Petruno

Another good post DHB. You seem to be getting quite a following. People like you bring some truth to the scam of cheap credit. Credit pushed by Greenspan and his henchmen. Although I do not condone the behavior of those that got in over their head, they were persuaded by our government to do so. These people were either greedy or not enlightened enough to realize what they were doing. I think they deserve some pity, but a bailout I am uncertain.

My web browser has a tab for most read new stories. When clicked it brings up 30+ articles that are in the main-steam interest. Very, very few are about the impending disaster to befall us regarding mortgage resets or the state of our economy. Is it people are tired of it or that it poses no interest? We are still sticking our collective heads in the sand and await our new savior to rescue. Too bad Britney Spears didn’t have a subprime loan.

Keep up the good work.

I have seen it argued that there was NOT much negative amortization on these loans because low interest rates mean that even the *MINIMUM* payments not only cover ALL monthly interest, but also some of the principal.

Thus, in this ultra-low rate environment, the MINIMUM payment is actually larger than an interest-only payment would have been (had rates remained above historic lows).

Of course, when the mortgages recast, the minimum payment will not longer be available (correct?) and people will have to pay full interest and principal payments. This will be more expensive, but will it be MUCH more expensive? I have heard it argued that on a $500,000 it might amount to $1000 a month and that this is not a large amount, considering most Alt-A Option Arms were aquired by buyers with 20-30% downpayments and decent jobs and credit.

Anyone have any insight as to the above claim that I am repeating?

@ dlazz (or anyone else new to this whole mess that may be confused)

There is absolutely no truth that minimum payments would be higher than the accrued interest. That’s the reason they were called “teaser rates”.

The way these loans were typically structured was a “fully amortizing” payment calculated at 1% interest. Your actual interest rate would be the fully indexed rate of margin plus the 1 mo. LIBOR index (or COFI index or whatever). At the time most of these loans were originated, the fully indexed rate would have been around 7.000 based on a 2.900 margin. The reason it was called an Option ARM was your payment options were as follows(based on a $300,000 loan):

Initial rate: 1.000% payment = $964.92/mo.

True interest only payment (at 7%)= $1750/mo.

30 year amortization payment = $1995.91/mo.

15 year amortization payment = $2696.48/mo.

You would have this payment structure until the loan recast period of 5 years or the negative amortization ceiling, usually 125% of initial principle balance, in the $300,000 example that would be $75,000 in unpaid interest) was reached

It is true that the interest accrued using the current fully indexed rate of 3.125% is less than the teaser rate (but only based on the initial principle amount, not the likely current principle amount), but the loan was originated 5 years ago, and the damage has already been done as far as the negative equity goes, and everyone who had these mortgages is almost certainly still in them because of the loss of value from the date they bought the home because of the failing real estate market, compounded with the fact that they have underpaid their interest accrued for five years.

Chris Durant, I agree with everything you say about the devaluing of our dollar. Don’t fall for the whole economy is recovering speech. We’re putting a tarp over a burnt house hoping that China will buy. Our real estate markets will suffer in direct correlation.

The public at large is becoming a bigger player in the world gold market thanks to GLD. I think it’s now #6 on the world gold holding list and moving up. i.e. there are only 5 central banks ( including IMF) with more gold holdings than GLD.

GLD does not pay interest. But some currencies with stronger antiinflation policies than the US $ do. See FXF etc.

The history of gold as an inflation hedge is spotty. From the 80s to 2000 there was steady inflation but declining gold prices.

Debt deflation is competing with the Fed printing press to keep the US $ from massive inflation. All those assets that get written off are deflationary. Period. The problem for the Fed is T-Bill auctions. They can’t set the rate, and can only buy with printed money to try to keep rates down, which makes other buyers want even higher interest. Next bubble = treasuries. Oh, China!!! come buy our T-Bills! Oh Arabs…. Oh panic stricken investors…. Ohhhhhhhhh………..TBT arrgghh!

I’m not fighting with my wife on the premise of buying now vs later. She wants a new house when nice houses are $500K. Coming soon to a Real Estate office near you….Joe & wife with saved down payment for our retirement dream home. Plenty of women have great money sense.

My comment about my wife got edited wrong. I said she wants a nice new (used) house in Orange when they’re at LT $400K. They’re GT $500 K now. I used the math symbols in my original and maybe they can’t be used in this blog?

Doc, this very topic – in a condensed version – was the focus of Gary Keller’s Vision speech at the Keller Wiliams convention in Orlando this past February. Knowing what’s coming is half the battle.

Navy Chief, Navy Pride

I was a loan officer during the boom and shook my head while my buddies made way more money selling option arms with 3 points rebate…i decided to be morally strong and not sell them, and i thought i was prudent by not buying in an inflated market. Now when i want to buy and try to get a deal, i cant come up with 10-20% down payment, I cant qualify based on my lower income, even tho i have stellar credit…i shouldve been greedy and got into a 800 k home with no money down on stated income, then just have Obama bail me out with a loan mod!

Government has a BIG chunk in shares with GM; 60%

Based on the facts indicated above,now is the time for

Obama to help homeowners to keep their existing homes.

Priority #1 = FAMILIES!!!! – – Please

–Agreed that many waves of recasts/foreclosure to come

–Doubts about the size of shadow indicate, for example, people can’t get loan mods unless they are 90 days late, some lenders are telling borrowers to become late to get the mod.

–Value of money is not based on how much gold is in the world–as far as I can tell our fiat money is based on the ability of the issuing country to tax. I would think about evaluating it just like a personal financial statement…think of money as IOU bonds issued by the country, based on the income-stream of their future tax-payments, enforced by police power. Someone could do a present value of money calculation on this…figure out a P/E ratio for the dollar etc…

Is there any adjustment for Option ARM and Alt-A loans that may have been refinanced into fixed rate or new Option ARM and Alt-As?

I am just wondering if some of the graphs on the number or resets coming up are no longer accurate and may have been deflated by letting off some of the pressure through refinancing.

Pick a Pay loans are just beginning to take investors, home owners and communities apart. Wells Fargo (Wachovia) is only the beginning. Check out U.S. Bank ‘The Bank’ (loans taken over from Downey Savings and Loans). We have leveraged with the use of our financial advisor/loan agent in 2006 and are at 5 years in June 2011 when the loans recast. We have 4 denied loan modifications. The loan began at $1795 about and then will recast August 2011 to $3550. U.S. Bank states that they are community based thinkers, but what I can see, they are just holding onto their assets.

Check out their new adds. Thousands saved on mortgages if you deal in 2011. Why don’t they just modify their current loans about to recast and save consumers homes and investments. Thanks for the opportunity to blast U.S. Bank, they are hiding in the dark and hoping they don’t get hit like Wells Fargo. We are current on the loans but when the payments climb from $1200 to $1700 per loan, we will be done!!

Dr. B, I wish I had found your site in 2006. With regards! R. Birkland

Leave a Reply