Washington Mutual Failure and Collapse: WaMu Largest Savings and Loan Failure in U.S. History. The Rise and Fall of Washington Mutual.

Washington Mutual also known as WaMu, failed Thursday making it the biggest savings and loan failure in the history of our country. What makes this event more astounding that it comes on the heels of stalled bailout talks regarding the absurd and poorly planned $700 billion bailout package. A recent CBS News and New York Times poll shows that only 16 percent of people actually think the plan is a good idea. If that is the case, why are politicians pushing so hard to get this thing rammed down the throats of Americans? Could it actually be that tomorrow is the target adjournment date and many of these politicians simply want to go back to their districts to campaign?

As many of you remember with the collapse of IndyMac Bank on July 11th of this year, all the media headlines had this running as a top story for nearly a week. WaMu fails and it is a footnote on the stalled bailout talks. We are now dealing with multiple fires all at once. Let us first discuss some history of Washington Mutual before we discuss the failure of the S & L.

WaMu – History

WaMu was founded in 1889 and was initially called the Washington National Building Loan and Investment Association. At the time of the formation, Seattle was in tatters after a major fire had nearly destroyed the city and put the economy in a difficult situation. The bank in one respect was setup as an attempt to help the local economy. The first loan made by WaMu was in 1890 and of course happened on the West Coast.

Over time WaMu started to grow. Showing business savvy and ultimate marketing prowess, over the next 50 years WaMu pioneered cash machine networks and telephone banking. In fact, this early start in machines to easily access money served them well when they decided to go nuts and create a virtual ATM which clients were able to attach to their own home and suck every dime and nickel from their home equity. One of the their initial slogans was “The Friend of the Family” which ironically has little to do with toxic pay option mortgages. Â

In 1983 WaMu bought Murphey Favre a brokerage firm and by 1989 its assets had doubled. Purchasing subprime credit issuer Providian in October 2005 for $6.5 billion may have not been such a smart deal especially when they paid prime dollar at the peak of the market insanity.

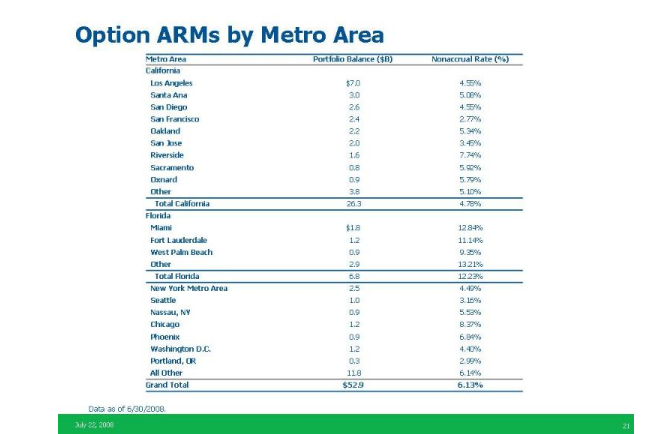

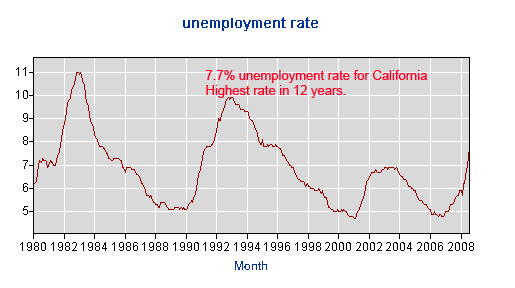

Serious problems started hitting WaMu as the United States housing market started to collapse. Not only was this bad news for WaMu, but it also didn’t help that Washington Mutual made a large amount of pay option ARM loans in California and Florida:

In December of 2007 WaMu closed 160 of their 336 home-loan offices resulting in 2,600 people being laid off. Things only got progressively worse from there. In April 2008 WaMu took a $7 billion cash infusion from TPG Capital out of Texas to stay afloat. How well did that work out? Let us take a look:

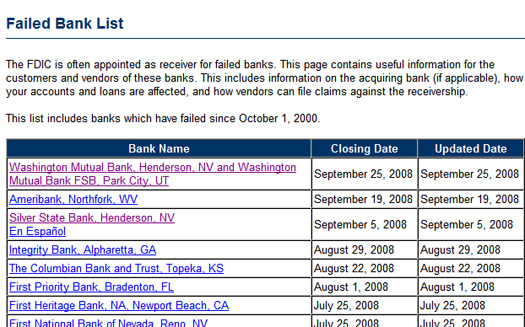

The company went from having a market cap of $62.3 billion to $753 million in one year. That is definitely not a way to run a company. As time went on WaMu could not fend off the issues it had with its loan portfolios. The losses kept on mounting over and over. On September 25 federal regulators took over WaMu’s assets and sold them off to JP Morgan Chase & Company and many of the directors at WaMu were kept in the dark about the announcement. The FDIC made that pretty official on their site:

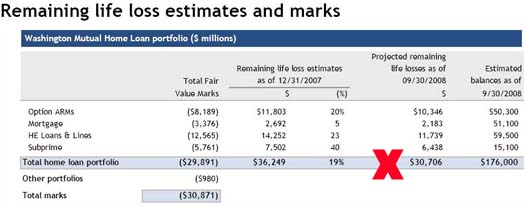

JP Morgan acquired WaMu for $1.9 billion with all assets and retail branches. What is more fascinating about this situation is that JP Morgan released during their press conference their expectation of the toxic loan portfolio and in this information, they gave us a little perspective on the future of the California housing market:

Right off the bat they are expecting to write-down approximately $31 billion in the toxic loan portfolio. Yet they have a few different scenarios that can play out:

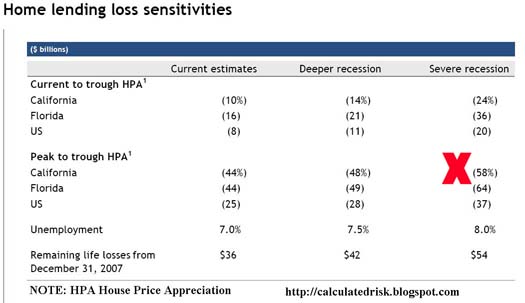

JP Morgan is estimating that California from peak to trough will drop 44%! That is assuming things stay as they are. If we hit a deep recession, they are predicting a drop of 48%. Should we hit a severe recession, the number would jump to 58%! Even Dr. Housing Bubble is surprised by the doom and gloom in those numbers. I don’t rule that out but it is something else hearing JP Morgan come out and publicly make that prediction. Again, the current economic situation in California is horrible. Our unemployment rate is 7.7% and JP Morgan announced a closing of branches which of course will lead to more layoffs in the state:

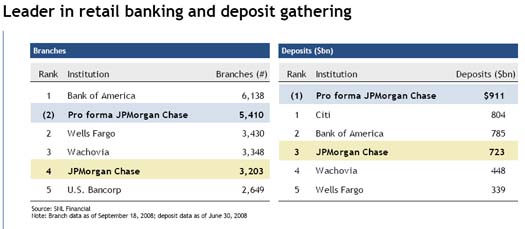

When IndyMac Bank failed, they had no buyers and it ate into the FDIC fund to the tune of $8.9 billion. The FDIC is adamant that no one will lose money here (aside from the shareholders and bondholders). With this one move, JP Morgan Chase WaMu and [insert blank] will now be the 2nd leader in retail banking and number 1 in deposits:

The big are swallowing the small. That is if you can consider WaMu with $309 billion in assets and 44,000+ employees small. This move by JP Morgan is smart. It gives them a major stake in the west coast. I’m not sure who they are going to get money from since many people went broke with toxic WaMu loans. In fact, they now will be one of the large contenders here in California:

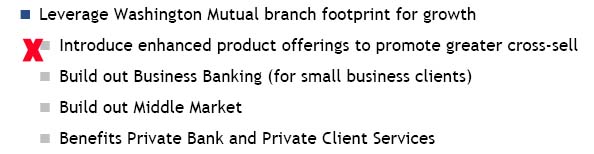

Like Bank of America buying Merrill Lynch to have a stake in the investment banking world, JP Morgan now has a major stake in retail banking. I wonder if they’ll keep that Wooo Hoo campaign going? One thing to consider is that fewer and fewer banks are getting bigger and bigger. In fact, JP Morgan tells us in their presentation that one of their motives for doing this move is “cross selling” more products to customers:

Think of what occurred with Bank of America buying out Countrywide Financial, one of the pioneers in the subprime game. These banks are buying up more and more and it looks like we are going to have 3 or 4 major banks that will provide all services to clients from investments, credit cards, deposits, checking, mortgages, auto loans, and everything debt related. Can you imagine what will happen if one of these 4 gets into a troubled spot? Do you see any conflicts of interest?

WaMu was a sitting duck. They made absurd loans and simply had no sustainable model.  My guess given the current derailment of the $700 billion bailout program in D.C. is that this move is intended to light a fire in Washington. Why not wait until the typical Friday night? After all, every other bank failure this year occurred on a Friday night. Was WaMu in such bad shape it couldn’t wait one more day? Of course not. This feels more like a move to scare the public from that 16% opposition to a more palatable number. I think most Americans are now hyper aware of the shady tactics being employed by those on the hill. They do not want this bailout plan. They do not understand nor do they want it. In fact, some are ready for the unexpected even if we don’t have a plan. Look what happened here with WaMu. A very clean and orderly demise. Heck, it cost the FDIC $0!

Representatives are listening to your calls and letters. Here again are the links to reach your local representative:

If you do not find your representative, contact another one. The majority of Americans do not want this corporate welfare bill. This bill will do nothing to help the average American family.  $700 billion bailout bill and they can’t even explain how the money will be spent. Is it any wonder a 119 year old institution like WaMu, the biggest S & L in the country just went down with a wimper?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

16 Responses to “Washington Mutual Failure and Collapse: WaMu Largest Savings and Loan Failure in U.S. History. The Rise and Fall of Washington Mutual.”

WooooooHooooooooooo!!!!!!!!!!!!!!!!!!!!!!

When does the fire sale begin.

WooooooHooooooooooo!!!!!!!!!!!!!!!!!!!!!!!

I can’t believe that our government using this kind of scare tactic to raid taxpayer money to help the elite bankers. It is so shameful and I hope the masses wake up and smell the roses; we have to keep up the pressure on the congress to block the bail out bill!

How much debt is JPM going to be carrying on it’s books? Oh by the way Wamu also baught Dime savings bank here in New York, giving them a large presence in the northeast. In White Plains where I work Chase has 5 branches in & around the downtown area, now that number goes to 7 with Wamu factored in. I wonder how many of those branches will remain knowing the city council told Chase no more branches would be allowed to be built.

Infact the city is a wash in banks, with more than a dozen different companies with locations downtown from People’s united to CitiBank. I guess the question then becomes, who buys who to survive & what becomes of the real estate under the branches that end up closing. Some can return to retail uses & others , it’s going to be tricky with zoning regulations being near residential areas.

Anyone besides me remember when Wamu’s model was “the buck fifty stops here?” (no fee to use their ATM with your non-WAMU card) That went the way of the dodo as soon as home loans started going bad. They now charge TWO bucks! I guess it’s Sign’o’da’times: Get ready for higher, more frequent banking fees! About a decade ago, I switched to a credit union to get a better deal on a car loan… I’m sure glad I stuck with them… not that CU’s can’t fail, but they are a better deal and just as well insured. BTW, Anyone know where to get information to monitor my CU’s health?

Guys, look at this. It was real home of guineas few months ago for $575K if I am not wrong. Now $335K. And this is heavily overpriced, since it is Torrance PO i.e. ghetto.

http://www.realtor.com/search/listingdetail.aspx?ctid=1671&typ=1&sid=c83d7208e4ac4bbdbc946ac48e054105&pg=2&lid=1100468982&lsn=17&srcnt=341#Detail

feel the woooo.

I saw wamu from the inside (and the housing stuff too). Evil mismanaged corporation that deserved to fail, but as noone believes a disgruntled ex-employee who long ago moved on with life and quit working there anyway, I’ll let the facts speak for themselves 😀

But anyway far more important than the fate of wamu, thank you Dr HB, for continuing to urge people to contact their congress people. That isn’t the fate of wamu, but the economic fate of our country at stake. It really matters that the bailout gets defeated.

The WaMu story is big beans here in the PNW. The folks over at Seattle Housing Blog–who up till about fifteen nanoseconds ago were still trumpeting how Seattle’s house prices would never go down–recently awoke to this.

~

My concern is the same as with Bear/Lehman. If you’re big enough, you’ll get bailed out early. Everyone else will have their throats cut. The lifeboats are gone; now there’s just a widely dispersed fleet of ultra yachts.

~

Chris, you can check on your CU’s rating at

http://www.bankrate.com/brm/safesound/ss_home.asp

~

Also Bauer’s online service, though that doesn’t give up much for free.

http://www.bauerfinancial.com

~

Some CUs are privately insured, some to $250,000; see for instance Patelco in California, the old telephone/telecom workers’ CU. Not sure how far they are into liar loans or NINJA finance. They were my main bank when I lived in the Bay Area. I pulled my cash out of there last spring, even though I think they’re a good institution; I’ve got other options locally. My concern for them: they’ll be one of the big solid responsible players taken down in the suckvortices of the Titanics. California unter alles.

~

OTOH, Patelco may be one of the institutions in CA well positioned to ride this out. I note they gobbled up Sterlent CU and CalState 9 in July. Interestingly, with this move, Patelco gets back a lot of AT&T (formerly Pac Bell) employees.

~

Here, Chris…have a ball:

http://www.cutimes.com

~

rose

We now have two institutions that have predicted home depreciation in California:

**

“[The Lehman] base case assumes national home prices drop 32% peak to trough, vs. 18% to date, with California down 50% vs 27% to date.”

Ian T. Lowitt, Lehman CFO

**

“JP Morgan is estimating that California from peak to trough will drop 44%! That is assuming things stay as they are. If we hit a deep recession, they are predicting a drop of 48%. Should we hit a severe recession, the number would jump to 58%!

**

Californians, we have a long way to go before we hit bottom in housing.

**

Tell all your friends and family to hold tight, save your money, and wait for home prices to come to US!

Like most people I have no idea what the $700B will really be used for, but could anyone (Dr, ?) give us a clearer idea of how a bailout will help those borrowers that took on more debt than they could realistically afford when they purchased that $750k home on a $30k salary.

This doesn’t mean that some of those borrowers could have some or any of their debt simply forgiven in any way could it? I don’t mind if they have to give them an 80 yr mortgage, but they should be on the hook for their total or walk away!

I mean I can’t logically imagine that happening and if it does “It’s just not right!” in a capitalist market, but then again will we really have a capitalist economy after this is all said and done? Hopefully our congress has at least a hint of a backbone.

~Just another angry Renter

(and hopeful future home buyer)

The WaMu- JPM Chase deal proves that there are solutions for these large failures other than hitting the taxpayers. This deal cost the taxpayers not a dime, and enabled Chase to pick up assets for a very cheap price, even given that they were bad assets.

More, this will help hasten the housing market to total capitulation. JPM Chase has no incentive to keep these loans from WaMU, or the properties underlying them, on its books at the face amount. They have no reason not to foreclose and sell the properties for whatever they will bring, because they will be way ahead no matter what.

Good deal for JPM, for WaMU depositors, and the public alike. I hope that something like this is worked out for Wachovia when the time comes, and for whatever other large institutions are on the verge of failure.

The $700 B tax-funded bailout, on the other hand, will only hasten this country on the road toward the insolvency of our treasury, and the most complete ruin.

I am a single father of 2 boys, living in Fla I have a hom loan thru WAMU but have been behind was served with Foreclosure papers tried working thu this with them but in the end they wanted to raise my payment by 50% & not adjust the intrest rate. I realize I am part to blame, but what does this buy out/ take over mean to me?

Did anyone watch the Mccain/Obama debate? Boring as anything I know. But figures quoted by Obama in the debate basicaly revealed that the cost of the bailout is more than the entire cost of the Iraq war, and it seems to be true!!! (they both seemed to be for the bailout)

http://zfacts.com/p/447.html

There’s a MASSIVE wealth transfer going on at we speak now folks. It may or may not benefit people who bought houses they couldn’t afford. It WILL benefit the banks and investors that financed the whole thing.

What an odd couple – A Republican President (who betrayed his conservative principles) and the Democrat Congress (who was hijacked by the liberals) are using our money (through taxes or borrowing) to help a few fat cats in the Wall Street who made huge profits!

If the majority of the Republican Congressmen (the true conservatives) and a small portion of the Democrat Congressmen (the true conservatives) join together this “taxpayer-support-of-the-fat-cats” bill will never pass.

So call your congressmen and tell to start from zero. Tomorrow is not the end of the world!

P.S. Rep. Nancy Pelosi (D), Sen. Reid (D) and Pres. George Bush (R) – a mighty threesome – who would have thought.

I read yesterday that the bailout amount ($700 B) is just equal to our foreign aid bill for a year.

I had no idea we were so generous, did you? What does it buy us exactly? Certainly not that “respect” that Obama claims would protect us from further terrorist attacks-

We’re suckas.

*Windfall profits tax on Big Finance!!!*

This is a sad day for all of us shareholders and employees of WaMu… we were robbed blind by the feds and no one said or did anything. Chase, like other firms were circling like vultures, waiting for the feds to move in. They all knew what was going on… this was the plan from beginning on the week of the take over…

The run on the bank was caused by the media and not one agency thought of regulating them or to set the record straight… they let the run on the bank happen right in front of their eyes.

Former CEO Kerry Killinger was so selfish and dumb enough not to sell at $8 per share before turning to TPG and investors for money. He was too concerned about his own legacy and income that he forgot what his job functions were and who he wrote his paychecks. Oh and he was paid over $22 million in separation package.

And now Alan Fishman will get paid over $18 million dollars for three weeks of work? humm… since he failed to do his job as a CEO to secure the company… should he be compensated $18 millions?

Oh and Stephen Rotella (President and COO) is getting his $12 million plus package for doing what? Running WaMu into the grounds? This is on top of his millions in bonuses.

Are they serious? We need to stand up… Open up your eyes people… this just doesn’t happen over night.

Everyone in the executive team of WaMu should be held accountable along with the feds who led this take over without any recourse or consideration for the employees’ retirements, public pensions and share holders.

I found an excellent explanation of why the markets are failing.

It is here at the London Review of Books by an economist who explains what all the shenanigans are about.

His explanation is long, but it is imminently worth reading.

http://www.lrb.co.uk/v30/n09/mack01_.html

By the time you are finished you will understand why they are calling it a “liquidity crisis” and why they want someone (anyone!) to rescue them from the hole they have dug.

They have bought a bunch of derivative sh!t based on bizarro mathematical models and have no idea what anything is worth anymore.

Excellent article

Leave a Reply