American Savings: Americans Save an Average of $392 Per Year. Total Consumer Debt is over $2.5 Trillion. The Dark Knight of Debt.

I’m going to tell you something that you probably already know. Americans are horrible savers. In fact, this trait has provided the perfect breeding ground for credit products that provide the illusion of real wealth. I’ve been hammering away in article after article going after the big players on Wall Street and also going after unscrupulous lenders that have been the pushers of the credit products for this past decade that have led us to this current economic cliff. Yet there is sufficient blame to go around and one is the psychology of the American consumer.

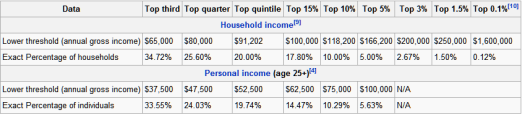

As of 2008, the average household debt is $117,951 and this includes credit cards, installment loans, home equity loans, and mortgages. The New York Times has an excellent series regarding the “Debt Trap” and below is a graph that I will be talking about in great detail. If you are interested, click on the image to go to the New York Times interactive chart:

All in all Americans have over $2.5 trillion in consumer debt. This number is staggering. That is why during the first signs of any economic problems the first thing that came to mind to our financial politician wizards was an economic stimulus package. Of course the majority didn’t ask where the money came from but you can now thank higher consumer inflation for the byproduct of this action.

Yet this mentality is still guiding much of our economic and political policies. People have become addicted to credit as if it were some form of drug. Recently, many lenders especially those with high concentration loan portfolios in California have started closing off many consumers’ home equity line of credits. The reaction is very telling since it gives us an insight into how people view credit.

Many believe that this home equity line was similar to you having access to your regular savings account. That is, whenever you needed the money it would be there for you. This was one of the inventions that started in the 1990s and has exploded recently. As you can see in the interactive chart above, home equity loans really had no place in the market prior to the 1990s. The concept was that the equity was your ultimate safety net, not some modified credit card that would put your biggest asset at risk. Recently with the run-up in the housing bubble, American consumers with their lack of savings decided to tap into this resource to continue spending. So when many people realized that their home equity lines have been shut down, they felt as if they had their savings stripped away. This idea that access to debt is equivalent to access to wealth demonstrates the profound lack of financial knowledge from many in our country.

Why would people be so willing to spend money that they don’t have? This is where the discussion veers off from economics and begins to look at consumer behavior and psychology. People want to be loved and accepted. Just watch MTV or VH-1 for a few hours and you’ll see this for yourself through their advertising. What you’ll see are ads about looking a certain way or buying a certain fragrance and with this simple act, you will be loved or accepted (normally by a very attractive member of the opposite sex). Of course you’ll have to spend money on a certain product which is probably over priced.

You also see this in many of the local clubs and night spots here in Southern California. Pick anytime, if you go out on a single night, you’ll typically see a guy trying to impress his friends with a round of the most expensive spirits not because of the taste, but because of the price of the drink. The group like a Pavlovian experiment responds as, “wow, you are the [best, greatest, coolest, hottest, funniest] person alive!” So the condition is imprinted on the mind. That is, if you spend on an expensive item you will get recognition from the group. The fact that many of these clubs accept credit cards is a perfect place to watch this social experiment unfold. Watch how many people use cash.

Now carry this psychology over to home purchases and automobile purchases which are the two largest consumer debt items around. Buying that home was about being secure and having a place for your family. After all, who doesn’t want this? It’s not like someone is going to respond, “no, I actually don’t want my family to be secure and rather live under the San Gabriel River.” So many either feel the pressure directly from family and friends or indirectly from media campaigns and those in the industry. The idea of owning a home is deeply imbedded in the American psyche. It is a cultural archetype that even as a kid, many start drawing a home with a picket white fence and a dog as a reference to what home is.

Those in advertising produced excellent (meaning they got people to do a desired action) marketing campaigns that exploited this insecurity which many carry deeply. Some of you may have seen this Century 21 ad where a couple is debating over real estate:

*Click to watch full ad on YouTube (warning, you may become financially ill)

Think about what this ad is telling us. What does your gut tell you when you watch this? Try finding an ad that has a more financially prudent debate where the couple is sitting down with their accountant and going over the ratios on a conventional 30 year fixed mortgage. We didn’t see any of this because the entire industry would have halted! Hello! $397 average savings per year and people were going zero down on $500,000 starter homes? No wonder why our economy has placed a multi-year debt albatross that is slowly drowning us.

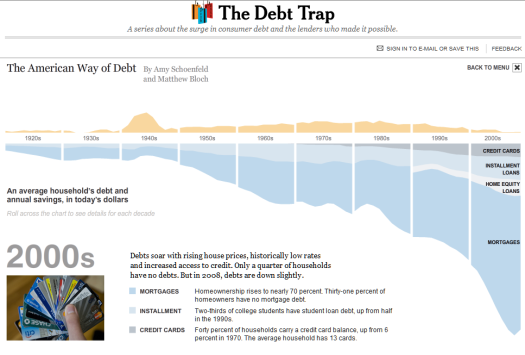

Amazingly, six in 10 Americans oppose Wall Street Bailouts but the majority do support the government keeping people in their homes:

*Source: Gallup

So why did the Bear Stearns bailout go through so quickly without going to the public? The answer is, many people simply do not care enough to cause an uproar about what occurred. They rather focus on saving 10 cents a gallon on oil while their mortgage payment just went up $500, $1,000, or even $2,000. The talking heads told us that if Bear Stearns wasn’t bailed out, the dark clouds of financial ruin would sweep over the nation and cover us in fire and brimstone. Guess what? We still ended up flying into a bear market and people are still losing their homes. We are getting this same rhetoric with Fannie Mae and Freddie Mac. A quick solution is nationalize the entities, split them up, and let the shareholders eat their risk. Enough with this implicit guarantee when we all know the taxpayer is on the hook.

The problem with Wall Street and bailing certain institutions out and this uttering of a second stimulus from politicians is they still believe that we are living in a world where people are willing to sacrifice their lives to go deeper into debt. They miscalculated on how people view housing. When the archetype dream of a picket white fence home came with a $4,000 a month mortgage payment, the sudden reality hit and many realized that the dream wasn’t worth the actual price tag. That is why the zero down craze was so utterly incompetent. Buyers had no skin in the game.

In places like California, buyers were effectively given a put option. The mortgage itself is non-recourse, meaning if there is a foreclosure the home goes back to the lender or bank and the buyer walks away with a foreclosure on their record. Many are electing to go down this route. Some by choice and many because they cannot afford the recasting payment or have seen a decrease in their income. Amazingly, the person that rents with a zero net worth now has a stronger financial position than the person that bought at peak levels and actually has a negative net worth of $100,000 or even $200,000.

The obsession with credit and the ultimate sign of debt the McMansion is now crumbling on its weak edifice. Our economy has been so dependent on debt and real estate for the past decade that we have fallen behind in many crucial areas like biotechnology and engineering because much of our capital and resources were diverted to non-productive sectors like building bigger and bigger homes accompanied by cars that are bigger and less fuel efficient. Slowly this is changing at least with the auto industry.

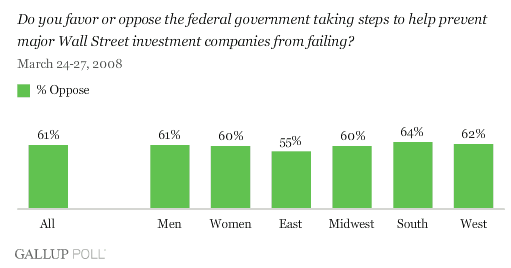

Many rational Americans looked around their neighborhood and saw what was a once in a lifetime spending binge. A boat, Hummer, and McMansion for all. The only problem is, it was on a temporary lease. The problem with this is that 70 percent of Americans were living like the top 1%:

*Source: Wikipedia

Many had to deal with cognitive dissonance of knowing incomes didn’t justify the spending they were seeing in the real world. The majority however decided to capitulate and get into unbelievable amounts of debt. It was a façade. The government is simply feeding into this cultural delusion that all the consumption items of debt reflected the actual income of our country but it did not as you can clearly see. No politician has the courage to say what needs to be said, “my fellow Americans, we have spent way beyond our means and need to change the way we live our lives.” Not during an election year. They will keep feeding into this myth that you can save nothing and sacrifice little and enjoy everything today even if you don’t actually have the savings to pay for it. Until we see some CEOs doing the perp walk instead of going to them for advice on saving the housing market (much of the problems created by them), then we will know that times are changing at the top. People need to demand this from their government or at the minimum, not buy into this financial myth.

We have $500 billion in Pay Option ARMs that are set to recast in the next few months. These are the absolute most toxic mortgages out there. I would put them on the same level as subprime loans and we are going to quickly realize that they too will be defaulting in high rates. Banks and lenders are artificially counting that these loans will still remain current once they do recast. If you look at their bottom line, they are actually counting much of the deferred interest as income. Many are current but not for long. They are betting that owners will exercise their put option but many will simply allow it to expire worthless.

I notice that parts of our cultural consumer psychology are changing. There was one commercial this weekend on a show that was targeted to the teen crowd that had a girl fixing up her dorm room. The room looked trendy and had all the knacks that someone could possibly need for college. She looks at the camera and tells us, “I got this all for a discount. After all, I am a math major.” It will now be cool to save if not for any other reason then there is no other option. There was also a segment on a show poking fun at those who waited in lines for the new iPhone. One of the actors was showing a new feature of, “using the phone to navigate for places for cheaper rent since I can’t afford my current place with this phone.” Time for the wake up call folks. Things are not going back to how they were.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

31 Responses to “American Savings: Americans Save an Average of $392 Per Year. Total Consumer Debt is over $2.5 Trillion. The Dark Knight of Debt.”

The consumer panic will begin when credit cards start getting shut off or reduced to useless levels. I actually had Chase call me because they were concerned I wasn’t using their credit card. They offered to lower the interest rate from 20.9% to 7.9% and double my limit. Even though I won’t use it much I said sure why the hell not?

As for stimulus packages, I really think there will be at least two more. One emergency package before Christmas and another early spring. Each one being larger than the last.

It was over a decade ago when I heard a news report covering Sears fiscal year. The part that stuck in my mind was that the financing division made more than the retail division for the first time. This fact caught my attention and got me thinking. The profits from the financing are coming out of their customers pocket. At that moment I swore off consumer credit (though I didn’t know that was the term for it at the time.)

Since then I realized the game that wall street was playing with us. They desire to get us into as much debt as possible, without us going bankrupt. The more interest they collect from us the more they maximize profits without actually providing any product or service. Advertising and easy credit were their tools to encourage the behaviour they wanted. It’s finally gone too far. People have fallen over the bankruptcy cliff (or at least the default cliff for mortgages) and wall street is finally feeling the effects of the path they wanted for us.

Eric,

No offense intended, but “stimulus packages”? Like the last one we all got? Hello….that is just more debt.

The dollar is effectively becoming worthless because of the idiot policies of our so called “leaders”. Maybe you’re right, instead of getting $600.00 per person, let’s make it six million dollars per person! What’s the difference, right? It’s just paper that gets printed up and gets thrown out the door.

Everyone will be happy for about 30 seconds, and maybe the rabble in the streets will quiet down, go back to their beer and football games, and leave Marie Antoinette and the other fine people in peace.

I had a credit card cancelled earlier this year after paying it off and not using it for 5 months. That has never happened to me before. The lenders will be displeased when I am free of CC debt forever (and 1 of 2 car payments) by the end of this year.

$392 per year is pathetic.

I’m not sure if anyone has covered the fact that retirement savings has also dropped during this time period. I had some friends and acquaintances that raided their retirement accounts and IRA’s to try and keep their homes. It was sad to see people close out their accounts to try and keep the monthly payments on their home so that they could stay a little longer…they eventually foreclosed on their homes. With their retirement savings of the past 5 years and the compounding effect destroyed, I’m not sure if these same people would have even remotely the same retirement as someone who was more prudent with their savings.

I three things with my “stimulus” check that the government yokels hoped I wouldn’t do: First, I bought gold and silver on ebay and used my credit card. Second, I deposited the “stimulus” check in my “savings” account (yeah, at 0.2%) till it cleared. Third, I transfered it to my credit card to pay down the debt incurred for the gold and silver. Steeeerike three, yer outta here!

Credit card companies have ended up functioning in much the same way that wall street traders do: they make money on the transactional fees (in this case, monthly interest payments). Hence they are only incentivized to keep the consumer consuming, running up charges and not paying them off, in order to get the monthly fix of interest payments. So the entire edifice of advertising, particularly on teevee, pushes both consumerism its corollary, credit spending, to keep the juggernaut going.

Banks and financial institutions pay out to savers. This costs them money. So why encourage it?

Ever wonder why midday teevee shows are called ‘soap operas’? It’s because they are there to SELL SOAP. Detergent for ‘labor saving devices’ like washing machines and dishwashers, and devices themselves like (pick your favorite tchotchke). I mean QVC doesn’t even bother cloaking its intention -and it gets tons of viewers! It just sells stuff – crap, if you will – and you have to use a credit card to buy the stuff. Astonishing.

The first step towards reversing this cliff diving trend shown in the chart?

Burn your television. No 84″ flat screen. Try reading a book, or taking a walk.

Well color me different from everyone else. I am saving $18K per year, have no credit cards, but I do have $128K left on my 15 year mortgage @ 4.875%. It sure is hard swimming upstream. I would like to have the latest cool gadget, but it is more important to me live beneath my means.

I do question the average $117,951 in debt figure. Since I have a $128K mortgage, it looks like I am hugely in debt, even more so than the average consumer with the average $117,951 in debt. In short, the average debt figure makes things look worse than they really are. Many people can afford their mortgages and did not buy into the OptionARMs, &c. craziness.

Of course, many people did buy into the craziness, which is one of the reasons the country is in the mess it is in.

This wave is worse than subprime. With pay option the banks like IndyMAC recorded $6,000 in earnings when someone only paid the minimum $2,000 payment. These banks will have massive earnings restatements coming with the jingle mail.

Hey Exit,

Keep in mind that the average includes households that don’t have mortgages, either because they are renting or have paid off their mortgage. If they only included households with mortgage debt the average would be much higher. Your mortgage looks like a good one; stay the course

Does anyone now what the average net worth of an American though is?

Dr H.

Long time reader, first time commenter. On your comment about the people waiting in line for the iPhone I thought of an idea for a political cartoon.

Since I can’t draw, imagine the sun about to rise over Pasadena CA with two massive lines formed in front of two buildings off in the distance. People have been camped out with sleeping bags and blankets visible down the row. A twenty-something year old approaches the end of the line and asks if this it the line for the new 3G iPhone. A man with his family barks back “no, we are waiting to get our life savings out of the bank” and points to the other line. In the last frame we see that we have an Apple store right next to an IndyMac branch.

I think it shows how far apart some people are from priorities. Some people are just trying to get by and others are camped out to buy more c*@p. Do you really need to be the first with an iPhone? Do they realize that Apple sold 1 million in the first weekend? They aren’t that unique. Also this is version two of the phone.

David

I am a renter(rent control). I also believe in living below your means. Out of 52 paychecks per year, 12 go to rent and living expenses. 12 go towards groceries and whatnot. The remainder go towards 401k, IRA and savings(covers large purchases). I finally paid off my student loans(30,000 interest on 21,000). I now feel that debt is for the “other” folks, I won’t have any more of it. I spent the last 8 years counting every dollar spent and tracking my expenses. My FICO is bumping 850 and I have no desire to exercise it. Prudence in financial matters seems to become a horrible addiction. I plan on paying cash for a house when it is the right time($75/sq ft).

I is truly difficult to find sympathy for those who spent with reckless abandon. I have paid my piper, so should they.

I enjoy these articles Doc! Keep them coming.

Car, house and education debt- fine, if they are within your means.

Everything else, ca$h. If you don’t have the money, you don’t need it.

Pretty simple, America.

Doc, this is interesting, but it leaves me with some questions you’ve usually got answers for. I looked up this $2.5 trillion figure. I didn’t easily get a primary source for it, but there were a lot of articles mentioning that number. I read in the Detroit Free Press that, “Ten years ago, consumer debt in the United States, excluding home mortgages, totaled $1.24 trillion. Today, Americans have roughly doubled the amount of non-mortgage debt they carry, to $2.5 trillion, or $8,300 for every man, woman and child in the country.”

So, I have some questions about how one might research the distribution of that debt. My biggest question is how much of that represents outstanding medical bills, of if that outstanding debt even includes medical bill debt. Do you have any idea?

Just read most of a big regional banks 2nd quarter conference call. Revenue is not doing too badly as they are gouging the hell out of their customers. They brag about it! Depositor ‘fees’ and credit card ‘charges’ are up. Way up. Here’s how one bank is doing it. Customer uses his credit card to pay a parking meter. The meter debits his card $2.00, the bank charges the customer $10 for a cash

advance! Been using that ‘cash back’ service at the supermarket. Make sure you use your debit card if you do because that too could be a ‘cash advance’ if you use a credit card. Another interesting fact from the conference call of this bank. They proudly pointed out they had made provision for all their bad mortgage loans and written them off based on the current valuations of the ‘collateral’. But.. and this is where DHB might have some insight, they don’t define what method they used to value the houses. OFHEO says housing has only declined 4.9% in the last 12 months. Case Schiller says a lot more. It makes a huge difference if you use a 4.9% decline in value or a 25% decline. Also no provision is made for those homes with private mortgage insurance because the loan is presumed to still be worth full value as far as the banks accounting is concerned. But it wasn’t

clear, to me anyway, if the bank has made a claim on the PMI for the mortgage or are simply ‘pretending’ they could make a claim anytime they want and get paid.

The way this is going… by the end of the year the people that are

now using their credit cards to stay afloat will be maxed out.

401-K’s are being tapped right now like never before. So there goes

retirement.

We will end up with a record flood of Bankruptcies and within a couple

of years that whole thing will start again.

The “credit score” system is losing it’s credibility. There is no real

punishment for filing bankruptcy and/or walking away from your mortgage.

Within a year or two after walking away from your house you can start

all over again.

And people like me that refuse to have credit cards and life within our

means have a harder time getting a mortgage because we don’t have

a credit (debt) history.

What gives?

Stevejust I would not think medical bills would be included unless the payment was made via credit card. Hospitals and many other companies carry their accounts on their own books and thus the total amount of debt Americans owe is probably higher. The company I work for ( a gas utility) has over $30 million in bad debt we’ve sent out to collection agencies for last year alone. If there are any medical doctors or dentists reading this I imagine they too can give you chapter and verse on ‘cash customers’ stiffing them.

And then some couples have no credit card debt, drive paid for used cars, save for retirement, and are paying off their 30 year fixed rate mortgage (duplex – other side provides rent!) on an accelerated schedule. And buy an iphone for work. Didn’t have to, but it’s our “play” money.

A lady at work just made her last payment on her car and promptly traded it in for a brand new car. She didn’t want to be nickled and dimed to death on an older car. So now she pays $350+ a month. And will pay $350+ a month for 5 years. It’s the american way… grr. Now please excuse me while I go putz around in the backyard. It’s therapy, it’s looks better each year, it’s excercise, and it’s free!

Love yer column by the way.

We were talking to elder friends about financial headlines when they asked us what was our household budget’s biggest line item. I think they were expecting to hear “mortgage” or “energy” or something. It sure felt nice to be able to say “savings.”

Doc, like ExitStageRight, we have a mortgage that, according to these numbers looks like we’re in huge debt. Being allergic to ANY debt I go back and forth about whether to pay it off. On the surface, it’s a big number…scary big, considering that when my dad died, after 40 years of service to his company, his salary had never been above $24,000.

But how do we interpret it our mortgage, which is, weirdly, almost exactly the “average US household debt”?

Ours is a 15-year note at 5%. We could easily pay it off with savings, it’s less than 1/6 our net worth if we calculate that by valuing our house at what we bought it for in late 2001. Or, 1.5 times our annual gross income, not counting investment/savings returns. We’re young (not yet 50) and we’ll pay it off in 10 at most. We live on the same budget as in 2001. We have banked all raises and promotions since then. We stay in the 15% federal bracket as part of our larger planning.

The big challenge for us is not juggling debt, but where to put savings. Yeah, we have a 401(k) and IRAs and a couple small state pension funds from former jobs. I’m not asking for anyone to cry me a river, for we feel lucky and blessed. I’m just pointing out that the system is not set up to reward savers. It’s set up to get everybody’s money, by whatever means. Now that consumers have been systematically tapped out, that leaves us savers as a mother lode.

I hate debt like a moose hates blackflies…but I have to admit: this feels reasonable. It has flexibility–we are paying ahead, the effective loan rate will be about 2.5 percent. It may be that as the housing markets settle down in the next few years, and if it feels “safe,” I’ll go ahead and pay the mortgage down to zero.

But right now, Doc, I’m not sure where we’d invest another $1,000 a month anyway. Credit Union CDs I guess. We aren’t suffering under our PITI, which is about 55 percent the cost of a similar rental, if such rentals were available, and they aren’t.

We set these numbers carefully, we have backup plans atop backup plans, all of them honest, for various contingencies. (I.e., not flipping houses or juggling credit cards). We have zero other debt. I never borrowed money for a car or education or anything else. We’ve always paid any credit card use off at the end of the month. I didn’t have to borrow for the house, but thought it made more sense to manage the money myself, instead of throwing it into real estate: I was sure there’d be a housing crash in 2003. Didn’t expect Greenspan to go so far to prop it up for so long. Plus we weren’t planning to move for 15 years or longer.

You see, I think we were the kind of people that mortgages were originally made for. Prudently managed debt risk can give people options, but you have to be really disciplined. If we’d had to save 100% before buying (we put 50 percent down), we would have been priced out of anything within 60 miles of here…within 16 weeks of getting our 30-year mortgage in 2001! (We paid it down to 15 in 6 years, then refi’ed according to plan at 1.5% lower.) Our conservative, ancient local bank’s willingness to lend to us let us manage income and debt in a way that we really are coming out ahead in the long run, even, we think, with the worst downturn scenarios. Prices could go down ANOTHER 50 percent before we were at our original purchase price. And 80 percent before we were upside down. We wouldn’t have bought if the numbers hadn’t been this far in our favor.

Of course such a downturn is entirely within the realm of possibility. But we aren’t going anywhere, and we didn’t set things up with the expectation of making easy money and then bailing. This is our house, it’s where we live and do the productive work of life. Like gardening, making stuff with tools, helping others, and turning dry beans, bought wholesale, into French gourmet meals. If we had to sell at a loss, and inflation was at three million percent–well, we’d have much bigger problems. Like what to do with all the SUVs and children people’d give us in return for beans.

As we’ve watched this crash unfold, it still seems to be that, with market drops and inflation eroding income and savings, the unusual location and features of our house/’hood relative to our small city, our moderate climate, and the massive influx of Californians deserting the ship down there, our house seems to be a better bet now than at the height of the speculation, ***when its only value was monetary!***

You see, I wouldn’t have staked EVERYTHING on this house, but it, and its mortgage, are part of a bigger package and approach to life. Which includes saving our butts off, even though we aren’t sure whether that will be worth it in the long run. As part of that larger package, now others can see the value we bought our house for–its energy efficiency, its beauty (forested acreage close in), its ability to grow food, its disengagement from a need to buy fossil fuel AT ALL. A cluster of neighbors who share gardening, bartering, tools, and services. Foot or bike access to nearby employment and transit. Nobody wanted that in 2001, they wanted McMansions and four-car garages. They wanted cathedral ceilings and lawns. They wanted shiny metal kitchens.

That’s why we got this modest, simple, ugly little house for 8 percent under its original listed price. When we bought, we anticipated food and energy inflation, the housing crash, and a tearing long-term bear. We thought like the engineers we are. We have no idea what someone will some day pay us for this house. We could die here, for all we know. In the meantime, the goal is to have a responsible, frugal, creative life. Not make a killing. And hopefully ride out the tsunamis.

And pay down the mortgage as a mature commitment, not a millstone.

I will say that I feel deep compassion for people who succumbed to greed and fear in making their financial decisions. God knows we faced plenty of that when I went around to lenders in ’01. We’re immune to it (stories…we have stories). But it’s kind of sad, to lambaste people for not saving, when the reason they got themselves into debt hell to begin with was they didn’t know how to manage their incomes in the first place, and wanted what they wanted NOW NOW NOW NOW.

And there were people, getting rich off of them by promising to make that possible, and making them fear they’d never ever get it on other terms.

Thanks, Doc. I hope that the conversations can continue. I hope that we can, as a nation, learn to talk about money as adults. This chaos could contain the seeds of a great national healing and test of character…though I’m not betting the farm on it….

Rose

I am just glad I only have house debit and thats at a low fixed rate. I am watching the implosion and realize that the problem is a poor incentive structure and unless things start changing in terms of income/wealth distribution, this pattern will be ongoing for a while. I am just paying more than I have to on the mortgage every month and looking forward to being debit free. Though true freedom is having one’s home paid off, money in the bank and a stock portfolio suficent to fire your employer with no reduction in one’s standard of living.

The total debt amount is kinda misleading without also considering accumulated savings, in my opinion. If everyone paid as much of their debts as they possibly could, this would be a fairly good indicator for overall debt, but since there are tax/investing advantages to certain types of borrowing, the total debt amount can be misleading. For example, I have more debt than 65% of the people in my age/income, but I also have substantial savings, and I’m carrying the debt on purpose. If you subtracted my savings from the debt, it would appear much lower.

Anyway, I’m probably an anomalous case, but I just wanted to point out that debt alone is not necessarily a good measure of overall financial health.

I’m just a lowly renter, but I can say this… I save a few times more than the $397 average savings per year…

EVERY WEEK!!

Could someone clarify what is counted as “savings ” in these stats? Does this include retirement funds and stuff like that or just money a person physically moves to a savings account each month.

Other things to do with the stimulus check:

1) Make a donation to Al Qaeda

2) Buy some coke

3) Buy a handgun and use that asset to acquire more wealth

Ok, FBI, I was just kidding, no need to investigate. What I really meant was:

1) Make a donation to the RNC

2) Buy some Coors

3) Buy a shotgun and shoot your buddy in the face

Sorry for any misunderstanding.

Hey all:

One thing that is hidden under the surface is student loan debt.

I went thorugh undergraduate without borrowing anything….I worked, saved, and had generous parents who helped me. HOWEVER, I then went to graduate school for four years. After graduation, I couldn’t find a job. I did work, but seldom made enough to pay anything significant on my student loans. A few years ago, I worked hard, had some luck and started to make a decent living. I have been paying student loans for over 2 years now. My monthly STUDENT LOAN PAYMENT is about $2,100. I paid very little for five years and my debts grew to well over $100k. I now hear stories of people getting out of graduate school with $200K+ in student loan debt. If they mess up like I did for several years, their debt would increase to $350k or so. How is an attorney or doctor going to afford a $4k or $5k a month student loan payment? Remember, student loan interest is NOT DEDUCTIBLE against your income. Also remember that you need to pay for your housing, food, insurance, and other daily expenses. How can you afford to start a family?

I suspect that a LOT OF STUDENTS are getting in WAY OVER THEIR HEADS with student loan debt. Remember, student loans are not dischargeable in bankruptcy. I certainly got in over my head, but I am recovering and getting it paid off.

Roberto

Well you hit the nail on the head Doc. We dont save. But I think the more interesting question is why. The reason is we as an economy aren’t really producing enough in the aggregate to provide for our needs, ergo the lack of savings. Talk to people, are they producing goods that are consumable in this country? Or more importantly in another country to exchange for their goods?

Take a look around your domicile. See anything made in USA? Theres your answer why we don’t save. You need to make something to be able to save it. Most people now-adays are in the services industry which is OK as long as you have goods being produced. You cant eat a service or wear it, you need a balance.

Alot of people have government jobs, are accountants, lawyers, medical professionals. Who are actually paying these peoples salaries if not the innovators, capitalists, industrialists, inventors etc? Our notion at a fundamental level is flawed of what constitutes a successful economy or career.

We right now, are inflating a truly massive credit bubble because of our emphasise on services and the credit to support it. There will be a truly massive contraction of credit to counter-balance the inequity.

Everything makes sense when you evaluate the total sum of the economy, and are not distracted by the “trees versus the forest” ie. property prices which are only part of the total systemic problem.

Asset price deflation needs to occur in the property, bond and stock markets. This will be camouflaged by governments reaction which is to inflate the monetary stock. Only with a significant correction in the aforementioned asset prices, cant you expect a truly cathartic correction. And a normal functioning economy.

I am a secret millionaire living in Malaysia. it took me 30 years of savings to get to the level I am at now. Saving and sacrifice but since I don’t like iphones,new cars, eating out,expensive clothes….it hasn’t been that painful. I drive a 1981 mercedez benz 240D which i restored and now maintain cheaply, when I retire i will have about 3 million in savings and property.

However, I believe if I was living in the USA, my frugality and sacrifice would be much harder to take because of the culture and the “loser” tag for people like me….so i am happy to be not in the USA.

Well done,

Rather than the people thinking your a looser i think the problem is when you have achieved your savings goal and have no debt the others get really angry.

Complain and want to cut you down.

Your so called friends stab you in the back.

Remember or i should say as you already know, 98% of people are not right.

You are one of the 2%.

But now you have to catch the flack of the other 98%.

Good luck.

I know only too well.

It is a hard road.

Screwed if you do screwed if you don’t.

Peter

You all are wrong ang I am right ha ha ha!

Who needs “savings” when you need almost zero down to buy a house these days. Saving for a rainy day is so out of fashion. Defaulting, walking away, deadbeatism compose the New Paradigm.

Leave a Reply