IndyMac: IndyMac History and Collapse. The Saga of the Second Largest Bank Failure in History, here in Sunny Southern California.

It is rather appropriate that the second largest savings and loan failure in history that of IndyMac Bank occurs here in Southern California. IndyMac is based out of Pasadena California, an upper-middle class city within the concrete jungle of the 88-city metropolis.

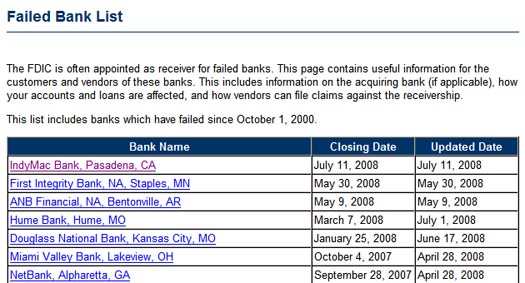

With a stunning $32 billion in assets, this is by far one of the largest failure in decades. And of course, the FDIC with their usual dark suit posse swooped in after the market had closed on Friday to not spook the sheep in the public. Add this one to the list as the fifth bank failure of the year:

Source: FDIC

Just to put this into perspective in relation to the other failures this year:

Douglas National Bank: $7.3 million in assets

Hume Bank: $11.2 million in assets

ANB Financial: $2.1 billion in assets

First Integrity Bank: $35.8 million in assets

IndyMac Bank: $32 billion in assets

That is how large this closure is. They also have $19.06 billion in total deposits with approximately $1 billion that does not fall within the $100,000 FDIC insured prevue.

It is important to understand the history and how this institution was bred to take us through memory lane of the now defunct savings and loan.

IndyMac Spawn of Countrywide

Countrywide Mortgage Investment was founded in 1985 as a dumping ground for loans that were too big from the original mortgage sausage maker, Countrywide Financial. Ironically, these were the loans that were too big to be sold to big brother Fannie Mae and Freddie Mac which have their own obscure and fascinating history. In 1997, Countrywide Financial decided to spin the company off as an independent unit which is (was) the beloved IndyMac Bank.

IndyMac Bank profited handsomely during the decade long housing and credit bubble. They expanded their services by acquiring Financial Freedom in 2004 who were experts in the reverse mortgage business. The only problem with having reverse mortgages is you have to have equity in your home which of course is now becoming rarer with the housing collapse. As the FDIC sorts through the mess, I’m sure this piece of the pie will be bought off since there is a legitimate viable market with the many baby boomers that will be retiring soon. In the midst of all the mortgage mess it is easy to forget that housing for the most part is a good investment. Approximately one-third of those who own their home have no mortgage. Many of these are facing retirement soon. So we’ll see how the vultures divvy up the $32 billion in assets.

IndyMac like many alternative lenders was simply another casualty of the housing Ponzi scheme. During the boom days, IndyMac soared to peak share price of $50 during the peak in 2006. In fact, in September of 2006 CEO Michael Perry went on CNBC to give this brief interview:

*Click on picture to watch 3 minute video

Some lovable quotes from the video:

“only a quarter in option arms…”

You mean the $500 billion in Pay Option ARMs that are now collapsing? What about those Alt-A toxic loans that are now falling apart like sub-prime mortgages?

“the borrowers have very strong credit…”

The ultimate misnomer of the Alt-A phony baloney bubble. Just because you have a 700 credit score and make $100,000 a year does not mean you can afford a $900,000 mortgage on a home. Especially now that the home is worth $600,000 and your $100,000 income came from an industry tied to real estate. Whoops.

“borrowers know what they are getting into…”

Yes sir they did! So much so that your institution was taken over 1 year and 10 months from this interview.

“half of our business is owners accessing the equity in their homes…”

Hard to access money from a home that is now down 35% and you are in a negative equity situation.

The point being is that the model was completely flawed and the only reason institutions like IndyMac lasted as long as they did was the false pretense that somehow credit worthy borrowers knew what they were doing when they took out Alt-A and Pay Option ARMs on over priced homes. The lender like the borrower on these uber priced homes both were speculating and playing into this Ponzi housing game. Like any Ponzi scheme, those that can get in early usually make out very well. It is those that get in late who stand to lose the most.

Keep in mind when this interview was given, California was still going hot and strong. In fact, at this time Los Angeles had a median priced home of $509,000 that was up from the previous year by 3 percent. The market kept on going strong until August of 2007 when the housing market in Los Angeles peaked at $550,000. Let us take a quick look to see how IndyMac quickly disintegrated once the housing bubble collapsed especially when the market in California started tanking in 2007:

Here is some interesting information:

Peak Price $50 per share

Market Cap at Peak: $5.04 billion

Current share price is 10 cents

Current Market cap: $10 million

Basically the current market cap is enough to buy half of Ed McMahon’s foreclosed home in Beverly Hills. Problems really started happening at IndyMac in 2007. Now we have some of Kudlow’s minions who believe in the psychological recession trying to pinpoint the collapse of IndyMac on letters released by Senator Charles Schumer on June 26, 2008 urging regulatory agencies to take steps to prevent IndyMac’s collapse. Let us look at the chart again with a 1 year horizon:

When the letter was released IndyMac was already trading at 80 cents per share. The only thing the release did was spur a bank run on this shoddy institution that caused a run of $1.3 billion in 11 days. Doesn’t the FDIC tell us in their takeover memo that they have $19 billion in total deposits? Of course. But these folks were treading on such an under capitalized thin margin that $1.3 billion was the coup de grace on this place. Anyone blaming this on Senator Schumer is an absolute moron.

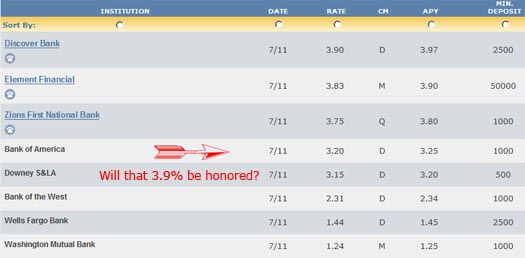

In fact, one of the absurd consequences of a moral hazard is as problems started occurring with IndyMac, they started raising their rates on CDs! This is simply astounding given the nature of their balance sheet but to shore up capital, they had to increase their rates to draw in customers. In fact, take a look of an ad I just spotted today on Bankrate:

For your information there is no longer a Countrywide since they were bought out by 2008 royal problem solver, Bank of America. Since some of these ads are bought on a monthly run, I imagine this was simply on the queue of ads since BofA just finished their takeover a few days ago. Look at that astounding rate! That is flat out beyond any other thing you can get:

This kind of last minute behavior reminds me of the Monty Python Black Knight skit:

*Click to watch persistence in the face of failure

When the market opens on Monday, a bridge bank will be running the show under the name of IndyMac Federal bank, FSB which is now under conservatorship with the FDIC. IndyMac when it was still running announced a job reduction of 60% from an employment base of over 9,000. Now being under this legal restriction, the institution is only operating as a liquidation sale. Given the even larger issues with Fannie Mae and Freddie Mac, I doubt you’ll see any government aid here. IndyMac is the first of many failures this year. During the Great Depression, many small banks failed so we won’t see the sheer size in numbers but keep in mind one IndyMac is the equivalent of 100 small banks.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

21 Responses to “IndyMac: IndyMac History and Collapse. The Saga of the Second Largest Bank Failure in History, here in Sunny Southern California.”

How long will it be for the poison that is Countrywide to place it’s host Bank of America on life support? In medical speak I always thaught the mantra was “do no harm.” I guess that is not the case here, it’s more like suck them dry like Dracula.

Well written, besides informative. I particularly like the sub-title:

“IndyMac Spawn of Countryside”

Sounds like a comic or graphic novel by Alan Moore.

I too am a believer in the CD offered rate as a good indicator of just how stressed a bank is for capital. Wachovia is offering 4.25% for 12 month CD deposits. How this bank ( I think it is America’s 4th largest with assets of $665 billion) can do this and be competitive is something the regulators need to look at.

Problem is should Wachovia do an Indymac the FDIC won’t have the funds to pay off depositors. The Indymac failure is, according to what I’ve seen, expected to cost the FDIC $4-8 billion. It had $52 billion in reserves. This is where it get real ugly. If depositors start losing their money…. well people won’t sit still for that. You won’t have people waiting in lines outside of the bank you’ll have people storming them.

I wonder how Mozillo and his lap dog Perry are sleeping at night? I am sure they are sleeping very soundly with their millions tucked away under their mattresses.

3.9% may seem like a nutso rate but I believe it was in December or January that Countrywide briefly offered a 5.75% rate for a one-year CD.

No, don’t take the rightful blame off of 2-buck-chuck Schumer. He is partially responsible. There was a chance that imb could have survived. His absolutely unnecessary letters yanked the life-support from the patient.

Maybe imb could have survived but we’ll never know now will we?

ARREST SCHUMER NOW!!!!

Chuck Schumer. What a guy.

Does anyone else out there think that people are being manipulated into a panic?

And they want to put one of the “Keating 5” in the White House. How nice.

ROPE! I NEED ROPE!

IMO, IMB was toast before Schumer opened his yap.. ‘The Letter’ didn’t help but it is certainly not the cause for the bank’s failure.

Scott, it appears you’re right on the % rate thing from Wachovia. From what I’ve read, they are teetering, looking for deposits, and stalling on loan funding.

Looks like we certainly do live in interesting times.

Guys, I have simple question. Do amounts on checking acounts have the same FDIC garanty been paid? Up to what amaount?

where is our congressman Adam Schiff? Has he said/done anything at all to address Schumer’s irresponsible comments that WILL tank the economy in his district.

all I see on his website are travel photos: http://schiff.house.gov/HoR/CA29/

it is outrageous.

@ all those people blaming Shumer –

Read http://www.minyanville.com/articles/fannie-freddie-fnm-fre-GSE-government/index/a/18004, item #5. Math is NOT a rumor. IMB was already drowning in a sea of bad loans before Shumer opened his yap. As of the date of his comments, IMB was already trading under $2 (12 month high was over $30.) So he tossed an anvil and not a preserver – big deal. The problem now is that not enough institutions will be allowed to fail – not that a stupid politician can’t keep a sock in his mouth.

So quit whining about rope and arrests for him and start calling for the people who are truly responsible for the fiasco – he is NOT the one who functioned as CEO, he is not the one who sat on the board of directors, he is not the one who set up the trading programs and loan product matrices that loaded IMB with toxic crap loans. Those are the people who deserve your greatest derision and anger, and who in a just world would be arrested and jailed, and made to pay restitution to their final dollar.

Schumer? Wonder how long it will be before Kudlow and his buddies start trying to blame it all on the Elders of Zion? (I’ll bet the Ron Paul fans can’t wait to get in on that action…)

Now that IndyMac is the first of many banks to fail, I think we’re going to see a lot more banks, not only close for the weekend, but close for good and go bankrupt. Rumors talk about 90+ banks, I think that’s a little exaggerated, but very well possible. I would guesstimate around 30+ banks will close shop.

I’m an investor in the stock market and have started to build a position in Bank of America. One of the few 500 lb. gorillas left in the room. Every dip, I pick up more shares. I don’t think there going anywhere, but you never know. Investments are all risky.

I never thought I would see this happen here in the USA, but here we are….let’s all cross our fingers.

petes2cents.com

I posted this before re: IndyMac Bank…but it bears revisiting in light of recent events: http://alumni.anderson.ucla.edu/content/aw/2007/video/AW_Keynote.htm

This is the same bank and the same guy right? He had no knowledge of his company heading toward the cliff…right? This was done Oct 12, 2007…

Where does the name “IndyMac” come from?

@Eddie

http://en.wikipedia.org/wiki/IndyMac_Bank

um – always a good thing to start with wikipedia or google when asking questions these days

“approximately $1 billion that does not fall within the $100,000 FDIC insured prevue (sic)”

Holy cr@p! That means depositors lost about $500,000 on this failure. That’s a heap of dough. I saw on the NBC news story they showed one guy who had $236,000 in there so he lost $68,000 as they are paying 50% on amounts over the $100K. Ouch!

I heard elsewhere that some 40% of deposits are uninsured. I’m thinking that a lot of people need to wake up and move some of their money so that they are fully insured.

Hey, Folks, its a good time to buy some stock here. And lets get you into a REIT, while we’re at it! Up and at ’em, I always say! Did I mention my money is outside of the United States. Ha! You poor suckers! Oops, I’m being honest.

Ok, now where was I? Oh yes, c’mon America, spend, spend, spend!

No need to save any money here, folks. And don’t pay any attention to that man behind the green (red) curtain. Nothing to see here. Just move on and buy some damn stocks so my bosses will keep paying my salary, which I invest in foreign government bonds. Gosh darn it, there I go again!

So a friend of mine believes this whole economic downturn will bottom out around December and she is planning on putting her money back into the market then. I am a bit worried about her. She is optimistic, so I don’t want to ruin her day, but I also don’t want to see her lose her money. What do you guys think? Safe to jump back in in December? Or is this like the depression where things keep going down for quite some time in dribs and doesn’t get back to the same levels for a long time? And is there any way to help persuade friends to protect their money and not risk it?

Senators shoulf stay away from the financial business. First Mc Cain and the Keating Five and now Schumer.

INDYMAC Bank is like three Gila Monsters following the borrower after one of the Gila Monsters bit the borrower and the rest are waiting for the limping borrower to die before eating him.

Leave a Reply