3 Captivating Housing Stories: Trouble in the 90210: When Beverly Hills Isn’t Prime. Vote yes for Multiple Foreclosures. The Coming Bank Failues.

The bigger they are, the harder they fall. That mantra is now being witnessed first hand by many prime areas of Los Angeles County. Luxury properties have a very specific and niche based market. They cater to a very unique audience that usually resides outside the confines of the average American. The story making the rounds this week is the foreclosure of Ed McMahon. He is in arrears by an eye popping $644,000 on his $4.8 million dollar home in Beverly Hills. The loan is brought to you by no other than Countrywide Financial. The problem that is now occurring with these big daddy mortgages is that once they fail, they fail big. For example, let assume in Ohio 10 bad mortgages were made and each constituted a $10,000 loss for the bank. So on that deal, the bank is out $100,000. With this one single deal, Countrywide and many other similar lenders are facing the same financial destruction as having 100 median priced homes in other parts of the country.

Aside from the celebrity theatre, this is big news because this isn’t the only home in the 90210 area code that is having difficulty. In fact, Ed McMahon’s home has been on the market for 2 years according to the Wall Street Journal. The case study this home is providing is also that once these big homes go down, the amount to catch the loan is simply eye stunning and exponentially hits the bottom line of the lenders like a ton of bricks. Unbelievably this home also has a $300,000 home equity line of credit.

According to the WSJ, Countrywide and Ed McMahon are in talks about what to do. My first observation is that there may not be much to talk about. There are two simple solutions. Either modify the home loan to a manageable size (which given the size of arrears seems that the mortgage has been behind for sometime) or sell the home in a market that already has the 90210 area code down by a stunning 12.8 percent on a yearly basis. Since the home has been on the market for 2 years, my simple observation is that trying to keep up with a loan that has a PITI of approximately $30,000 to $35,000 per month, trouble has been occurring for a long time. Ed McMahon sadly was injured about 18 months ago as reported in the Wall Street Journal and this just strikes at the heart of the issue; no matter how large your income it is always important to have a buffer zone.

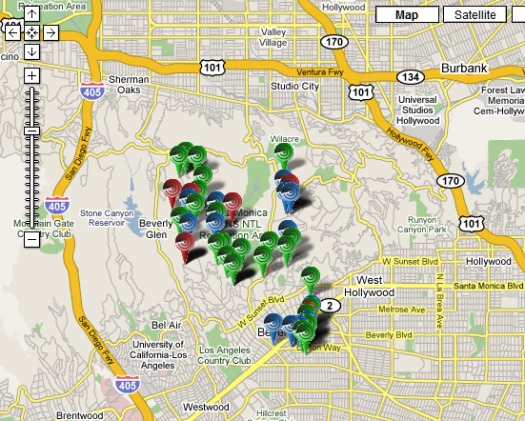

Just take a look at a map showing foreclosures, preforeclosures, and auction sales in the 90210 area code:

As you can quickly tell, Ed McMahon is not the only one person in this area that is facing hard times.

We The People Elect Foreclosures

In light of these defaults even in prime areas, that is why the zero down payment market has been just a sad state of affairs for the housing market. Life happens as we all know. Divorce. Job transfers. Health issues. Some of these things are in our control like choosing to over pay for a home and some are not like coming down with an illness. We also know about the case of a Long Beach Congresswoman that has a clear pattern of not paying her mortgage on time:

“(LA Times) “I understand that these homeownership issues are a reflection of what many Americans are going through as they fight to keep their homes and to remain financially stable,” she said in a news release.

But while the foreclosure of the two-story Sacramento home she bought shortly after being elected to the Assembly in 2006 may have been the first time she lost a house, it was not the first time Richardson had fallen behind on her payments. It continued a pattern started eight years ago.

Since then, the homes she still owns in San Pedro, where her mother lives, and Long Beach have fallen into default six times. The amount she owed ranged from $5,742 to almost $20,000, according to documents on file with Los Angeles County.

“She has this habit of missing payments and then trying to catch up instead of doing it monthly,” said Verla Saylor, who sold Richardson the Long Beach house and carried a second mortgage.

The defaults have come at a quick pace lately, five in the last 13 months and the most recent March 28. The five defaults totaled nearly $71,000. During much of that time, Richardson was bankrolling her political career, lending her campaigns for Congress and Assembly a total of $177,500.”

Looking at the data most Americans are diligent about paying their obligations. About one-third of Americans own their home free and clear. Approximately 23 percent rent. And the vast majority of those with mortgages are actually making their payments on time. The problem is that a small subset of people have swallowed so much toxic waste that it is going to impact the majority. They have made a colossal financial faux pas in cahoots with a corrupt Wall Street culture.

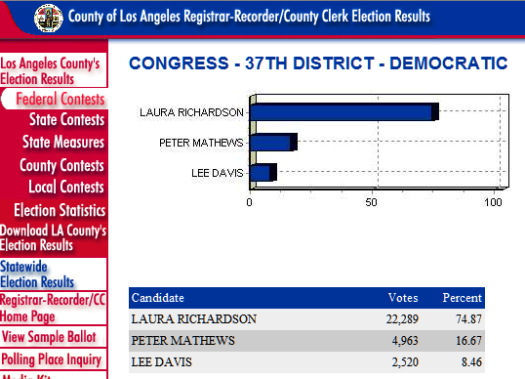

Congresswoman Richardson’s experience is not a reflection of what most Americans are going through. Most Americans do not make a $169,000 congressional salary. And isn’t that the irony? We collectively are paying for her to go out and default on homes that we are going to bailout! Bwahahaha! And this Tuesday she not only won reelection but she won it convincingly with 74 percent of the vote:

Through much of this campaign season one thing has come to mind and that is the majority of Americans hate learning about finances. That is simply a fact. Even though Americans overwhelmingly mention that the economy is the number 1 issue they simply do not back that up with education or action. How else can we attribute the incredibly boneheaded financial moves done by many in our country over this past decade? Sometimes when I talk to folks, they tell me, “I want to go back to school but it is too expensive.” And in the same year, they go out and buy an overpriced SUV which costs more than the education that was supposedly too expensive! In California there is no excuse to not learn. We have community colleges that cost $20 per unit for crying out loud and the California State University system which offers bachelor’s and master’s degrees in practically every field for approximately $3,500 to $4,000 per year.

Education is such an important cornerstone of the success of America. 28 percent of the adult American population has a college degree. You can view this as the highest in the world for which it is, or you can view this as a need to do better. This is not to say that education is needed to make money (heck, just look at GED mortgage brokers yanking in six-figure incomes this past decade) but it does bode well for a population that can think critically to confront the challenges of today. This past decade will probably be viewed as a decade of incredible financial imprudence.

I think the reason that Laura Richardson’s story hits so hard is that she is not a poor American struggling to manage a modest budget and doing everything she can to make ends meet. Â She has an MBA from USC (not a cheap school like a CSU). She is also in the top 10 percent of income earners with multiple mortgages and financially keeps tapping her home equity for her political aspirations. We all have aspirations and I am certain of it. Now wouldn’t you like a $169,000 salary funded by the U.S. taxpayer for studying marine biology in Australia? Or what about going to Europe to study Anthropology on the back of taxpayers? For one, we hope that our politicians reflect the better core of what we are. We hold them to a higher standard because they have decided by their own freewill to carry that challenge. When she tells us that she is a typical American and her challenges are just like your own, all I can do is shake my head. She has failed a basic test of being a worthy politician and that is a shame.

The double whammy of course is the push for the bailout legislation. During these last few months she actually had the funds to pay her mortgages since she is behind by $71,000 according to the L.A. Times but decided to lend her campaign $177,500. Is this personal responsibility? I may have an idea of adding some funds for a bailout and they include slashing a $169,000 salary.

More Bank Failures

Today Fed Vice Chairman Donald Kohn testified regarding the state and condition of the banking system in the United States:

“(Federal Reserve) Consistent with trends in commercial banks overall, conditions at state member banks have weakened over the past year. Problems in residential mortgage, home equity, and loans to home builders have pushed the nonperforming assets ratio at these banks to 1.57 percent, more than twice the level of one year ago and the highest rate since 1993. Loan loss provisions have also accelerated, rising to a high of 1.14 percent of average loans during the first quarter of 2008 in large part reflecting the deterioration in residential real estate-related loan portfolios. Despite this deterioration, state member banks still reported aggregate net income of $3.7 billion and a return on assets of about one percent for the first quarter of 2008. Moreover, more than 98 percent of these banks reported risk-based capital ratios consistent with a “well-capitalized” designation under prompt corrective action standards.

Over the coming months, we expect banking institutions to continue to face deteriorating loan quality. House prices are still declining sharply in many localities and losses related to residential real estate–including loans to builders and developers–are bound to increase further. In addition, weak economic conditions could well extend problems to other segments of lending portfolios including consumer installment or credit card loans, as well as corporate loan portfolios. Moreover, banking organizations must be prepared for the possibility that liquidity conditions become tighter if uncertainties in the capital markets fail to subside or if credit conditions deteriorate significantly. Accordingly, we anticipate that the number of banks with less than satisfactory supervisory ratings will continue to increase from the relatively low levels that have existed in recent years and we are monitoring developments at all supervised institutions closely.”

So much for housing hitting a bottom. We also find in the Federal Funds report released this week that in the first quarter, American household wealth dropped by $1.7 trillion. Things are still difficult and until housing improves, the market will be tenuous in regards to direction. The problem with this relative lull in the market is that it is only calm because every possible measure was used to prop the market up. The Fed with all the term auction facilities, the bailing out of Bear Stearns, potential mortgage bailouts, and other backstops that are putting a bandaid on a broken bone. Take a look at recent bank failures from the FDIC:

Expect this list to increase. We haven’t seen anything yet. The FDIC has tapped into former retired members and has brought them back in preparation for additional bank failures. Now why would the FDIC do this if things were at a bottom? How is the market going to respond to potentially 50 to 300 banks failing in the next few years? If the market is this bad with only 4 relatively small failures this year, what is going to happen when a larger player goes under?

There are many things going on in this market that seem surreal but make no mistake, these stories are only at the vanguard of what is to come.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

10 Responses to “3 Captivating Housing Stories: Trouble in the 90210: When Beverly Hills Isn’t Prime. Vote yes for Multiple Foreclosures. The Coming Bank Failues.”

The following is an interesting story on bank failures at the Wall Street Journal.

Backstage at a Bank Funeral: Feds Swoop In on an Unsuspecting Town

http://online.wsj.com/article/SB121262738508347067-email.html

This reminds me of Duke Cunningham who got booted out on Congress and then San Diegeans in their infinite wisdom voted in one of his good friends to replace him. Well he was a crook so why not another! Makes you wonder about the sanity of the average citizen.

I think part of the reason Americans are so bad at finance is that we don’t talk about it. It’s a big taboo to talk about money, so we don’t learn from our parents, and we don’t learn from the mistakes of our friends and neighbors.

Add Ed McMahon to the list of people who find owning prestige property is expensive. Buying it is only the beginning of the financial drain. As bad as the home mortgage situation is the Construction loan side of things is even worse. There are some bloggers out there, Reggie Middleton being particularly good and an article at the Street today that itemize the various banks exposure to these loans. It ain’t pretty. It is worse than subprime in terms of percentage of loans in default or arrears and they aren’t bungalows, McMansions or even Ed McMahonsions. These are the goliaths of residential finance. Subdivisions, planned communities and luxury condo towers. Banks can’t just put plywood on the windows and write them off. In most cases they have to finish what the builder began. When you look at the charts in the article I just read you can see some of our bigger banks are in real trouble because of these loans. http://www.thestreet.com/story/10419822/1/construction-loans-threaten-some-banks.html

Question: When a home goes into foreclosure, and the bank holds it for a long period of time, do they pay the property tax on it? Does the rate remain at the previous sale or the banks bid if so? Really would appreciate an answer since I had heard someone comment about banks holding off on putting these homes on the market to avoid losing value on other assets in the area.

Mike, you ask “When a home goes into foreclosure, and the bank holds it for a long period of time, do they pay the property tax on it? Does the rate remain at the previous sale or the banks bid if so? ”

*****Answer is, yes, the bank gets the property tax bill. (And if they don’t pay it, the property starts heading down the road of tax foreclosure.) As to whether the rate of the property tax changes the answer is ‘that depends.’ It depends upon (1) Whether the propoerty had a homestead exemption because it really and truly had been owner occupied (2) Whether the assessor picks up on the change of ownership from resident to non-resident owner (3) When the lose of the homestead exemption will actually show up in the taxes and (4) What the taax period is and when the bill goes out for the tax period . On the last item, most jurisdictions send out tax bills in, say, June 2008, for the taxes that accrued in 2007.

****I think you are also asking if the propoerty will be reassessed at what the lender paid for it at auction versus what the prior owner paid. The answer, in most jusrisdictions, will be yes BUT typically that reassessment in 2008 won’t show up in the tax bill until 2009.

Unbelievable:

This Congresswoman should not be sworn in, or allowed to sit in Congress.

If she were an attorney, I doubt she would be allowed to sit for the Bar exam.

Her precarious financial situation is a HUGE potential conflict of interest. What happens when a shady business person comes asking her for access and to get her to introduce a bill, vote a certain way, etc. The temptation for her to take a bribe would be overwhelming. Many average Joe/Janes CAN’T get a job if they have bad/questionable credit.

If this woman sits in Congress, the FBI should be watching her like a hawk!

This woman is also another example why Congress has an 18% approval rating!

Wake up people of California!

Roberto

Mr. Mcman

YOU MAY ALREADY BE A WINNER OF $10,000,000! lol

I wonder if this could help.

@ AnnScott: Thank you.

DTE:

Wake up, indeed! This fool got 74% of the vote? Were the other candidtaes Nazis or something???

Leave a Reply