Public-Private Investment Program for Dummies: How does the new Treasury Plan Impact Housing and the Market? Poorly Planned Investment Program (PPIP).

The much-awaited Public-Private Investment Program, curiously labeled “PPIP” was released on Monday creating a massive rally on Wall Street. Initially we were getting glimpses of the plan through cracks in the financial wall over the weekend and what I was seeing was disappointing. The confirmation was made when the plan was made public early on Monday.  The public has a right to be outraged. Not so much for the bonuses to A.I.G., which are disturbing but the fact that our political system seems to be an extension of the Wall Street and banking elite. I remember when the $700 billion Troubled Asset Relief Program was released back in the fall on the pretense that it was going to buy toxic assets. Remember the storm that created? The public was appalled and that initial gut reaction was proven to be right. Ultimately the first $350 billion of the TARP went directly to banks as capital injections and did absolutely nothing for the health of our economy and ultimately was a major safety net for the banks. Yet the bad assets remained. No credit lending to average Americans. Bad assets still there. TARP 1 was a gift to banks and Wall Street. Which brings us to the PPIP.

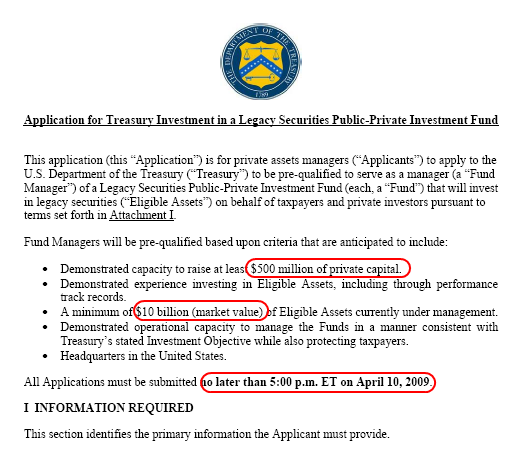

The problem with the PPIP is that it is designed to provide a major subsidy to so-called private investors to buy up toxic assets. This is a misnomer. Why is that? Language is important in any legislation and especially when presenting a money grab like this one. First, there is very little about this plan that encourages the “private sector” in buying these toxic assets. At least it isn’t private in the sense that you and 95 percent of Americans would like to think of it as private. That is to say, if you had some capital laying around and wanted to buy up some toxic assets yourself, you would not be able to do so? Why? Well let us take a look at the application for this PPIP on the Financial Stability website:

I’ll get into the details of the plan later in this article but this application pretty much sums up everything that is wrong with this program. First, participating institutions must have the capacity to raise $500 million of private capital. This is great for bailout participants that are deemed too big to fail since they’ll have that money easily accessible. Next, they’ll need a minimum of $10 billion in market value assets under management. This is important to keep out the riff raff of “small time investors” since only the big boys know how to mange money. Finally, the deadline for the PPIP application is get this, April 10, 2009 at 5:00pm Eastern Time. Bwahahaha! They already know who is going to get the bids! So much for that “open” market place notion. They spent such a long time devising this plan and now they expect solid plans to come out in a little over 2 weeks? The Treasury already has an idea who is going to play in this game on taxpayer funds and it is the same institutions that created this mess.

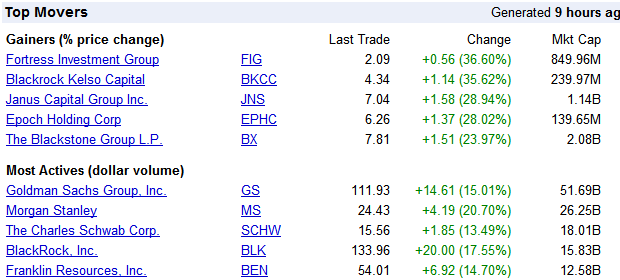

If you want a sense of who stands to benefit just look who posted massive rallies today:

Even though the market posted a “broad” 7 percent rally, many of these firms tripled that in the same day. And don’t think this rally was somehow spurred by the retail investor sitting on the sideline. You mean the unemployed ran back in to gamble in the stock market? You mean to tell me that 50 percent of those in our country that are 1 or 2 paychecks away from financial trouble knew to invest in these firms that stand to benefit the most from this poorly planned investment program (the real PPIP)? Amazing isn’t it? This was a major gift to Wall Street.

This plan was being built over time while Americans were kept in the dark. Remember on March 6 when word was spreading that the FDIC was going to go to the Senate for $500 billion?

“WASHINGTON — Senate Banking Committee Chairman Christopher Dodd is moving to allow the Federal Deposit Insurance Corp. to temporarily borrow as much as $500 billion from the Treasury Department.

The Connecticut Democrat’s effort — which comes in response to urging from FDIC Chairman Sheila Bair, Federal Reserve Chairman Ben Bernanke and Treasury Secretary Timothy Geithner — would give the FDIC access to more money to rebuild its fund that insures consumers’ deposits, which have been hard hit by a string of bank failures.

Ms. Bair said a change in the law would give the FDIC more options to determine the best way to rebuild its depleted fund. In an interview, she stressed that all insured deposits were already backed by the “full faith and credit of the United States government.”

Scammed again! The subtle pretext here of course was that the funds were going to be used to protect consumer deposits, which of course, is something most Americans would back and did. Instead, that $500 billion which is now the amount the FDIC will insure is the amount we will be backing for Tim and Ben’s excellent adventure into converting the United States into a mega hedge fund. So this fund was being beefed up for the PPIP that was released on Monday.

Okay, let us start digging into the details of the PPIP:

“Despite these efforts, the financial system is still working against economic recovery. One major reason is the problem of “legacy assets” – both real estate loans held directly on the books of banks (“legacy loans”) and securities backed by loan portfolios (“legacy securities”). These assets create uncertainty around the balance sheets of these financial institutions, compromising their ability to raise capital and their willingness to increase lending.”

Now you may be wondering, what in the world is a “legacy loan” or a “legacy security?” Frankly it wasn’t going to sell if they called it “toxic-ninja-fog-a-mirror-no-pulse-zero-down-subprime-non-prime-alt-a-okay-smoldering-junk-pile” loan program. Didn’t have a nice ring like legacy loans. Using the word legacy tries to give this program some mythical powers. Calling this a legacy loan is tantamount to calling a pimple a beauty mark. So right off the bat, this is disingenuous. Also, the reason banks can’t raise capital or lend is because their business models were based on selling “legacy loans” in the first place! Let us read more:

“Creation of a Negative Economic Cycle: As a result, a negative cycle has developed where

declining asset prices have triggered further deleveraging, which has in turn led to further price

declines. The excessive discounts embedded in some legacy asset prices are now straining the

capital of U.S. financial institutions, limiting their ability to lend and increasing the cost of credit

throughout the financial system. The lack of clarity about the value of these legacy assets has also

made it difficult for some financial institutions to raise new private capital on their own.”

Believe it or not, the declining asset prices are the markets way of popping the bubble and trying to find a bottom. The assumption above is that these assets are now marked with “excessive discounts” and that assumption in fact is incorrect. As we have seen with over a hundred homes profiled here in Southern California, some loans are actually worthless. It is very possible that some mortgage portfolios are only worth 20 or 30 cents on the dollar. Is that so hard to believe with the rampant systemic fraud in the system? It is only hard to believe if you live in a Wall Street world so disconnected from Main Street that they forget how it really is to work for a living and the massive surges with unemployment are only a ticker on a Bloomberg Terminal. They forget that what is inconvenient in their models is many people are simply unable to pay these loans. There are now many sub-divisions that boomed that have no economic viability or sustainability. That is, we will see some areas become ghost towns. Now how much are those loans worth? There is “clarity” on these legacy loans just not the clarity Wall Street or banks would like to see.

Think like a bank for a minute. We’ll call you Bank X. You’ve made a ton of horrible Pay Option Adjustable Rate Mortgages during the boom. You have $1 billion of these bad loans. Yet many of them are still paying because they are set to recast in the next few years. Yet you know once they recast, they will start defaulting (you are already seeing signs of this). You also have a portfolio of $1 billion of fixed prime mortgages. These are paying like clockwork. You have another portfolio of Alt-A loans on fixed terms paying on time as well but defaults are rising. Take a wild guess which bundle is going to be put up for auction? It’ll be the $1 billion in Pay Option ARMs. You would be insane as a bank to let go of any of the actual good loans. So right off the bat the incentive is to get rid of the worst loans.

This was my entire point with temporarily nationalizing the banks. Banks are not going to lend until the bad assets are off their books. Someone is going to pay. If we nationalized, at least we shared on the upside potential. Plus, we get to eliminate management, wipe out shareholders, and spend the actual cash on getting lending going again with a new model. We are already paying through the nose but we are basically nationalizing the profits for the banks and “private partners” while socializing the massive losses. Is it any wonder that in a recent poll 41 percent of Americans are now saying, “let the banks fail” and are outraged? Philosophically the plan is horrible for the taxpayer as you can see but let us keep on reading:

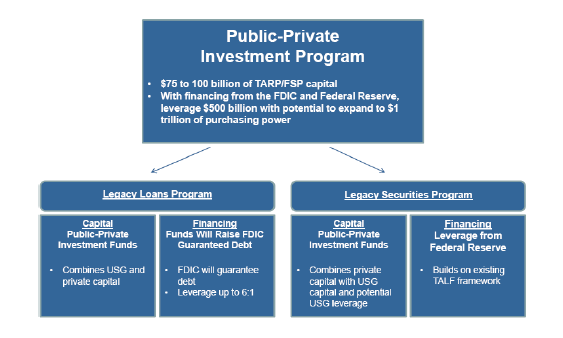

“Three Basic Principles: Using $75 to $100 billion in TARP capital and capital from private investors, the Public-Private Investment Program will generate $500 billion in purchasing power to buy legacy assets – with the potential to expand to $1 trillion over time. The Public-Private Investment Program will be designed around three basic principles:

Maximizing the Impact of Each Taxpayer Dollar: First, by using government financing in

partnership with the FDIC and Federal Reserve and co-investment with private sector investors,

substantial purchasing power will be created, making the most of taxpayer resources.

Shared Risk and Profits With Private Sector Participants: Second, the Public-Private

Investment Program ensures that private sector participants invest alongside the taxpayer, with

the private sector investors standing to lose their entire investment in a downside scenario and the

taxpayer sharing in profitable returns.

Private Sector Price Discovery: Third, to reduce the likelihood that the government will overpay

for these assets, private sector investors competing with one another will establish the price of the

loans and securities purchased under the program.”

Now we’re getting to the nuts and bolts of this thing. I’ve gotten a few e-mails of people asking, “well they still have to pass this right?” Nope. Remember that $500 billion FDIC bait and switch above? That money is good to go. The other $100 billion is coming from the craptastic TARP. There is a Monty Python skit in the fact that the TARP is funding the PPIP, which will get loans from the FDIC. Let us go through these three so-called basic principles. First, you are not maximizing each taxpayer dollar. The notion that we are sharing risk with private sector participants is absurd because they are hedged to the max as we will soon see. Finally, this price discovery notion is insane. By default we ARE GOING TO OVERPAY! That is the entire point of this exercise. The market has already discovered the price. It is 20 cents or 30 cents for each dollar. That doesn’t work for Wall Street or banks so therefore they need to juice up the game by subsidizing the adventure of more hedge funds, banks, or others that actually created this crony model of investing.

The irony here is that nationalization would have discovered the prices much quicker. And this would have been the truly private-public model. Why? Remember the notion of portfolios? Once the toxic assets were isolated, they would be sold off to the private market. I assure you that there are many private investors licking their chops to buy loans at 40 or 50 cents on the dollar. Remember we are already losing money here with the PPIP. And this would have been a much more open market because guess what? You already have the system in place to sell these loans. In fact, the FDIC could have then used the money to loan out to private investors, both big or small. That is truly opening it up to the market. Instead, we are setting up a system where large middlemen are going to buy these loans and then what? That is right, SELL THEM TO INVESTORS! Haven’t we learned that a toxic loan is a toxic loan no matter what you do or call it?

You have to love this logic:

“The Merits of This Approach: This approach is superior to the alternatives of either hoping for banks to gradually work these assets off their books or of the government purchasing the assets directly. Simply hoping for banks to work legacy assets off over time risks prolonging a financial crisis, as in the case of the Japanese experience. But if the government acts alone in directly purchasing legacy assets, taxpayers will take on all the risk of such purchases – along with the additional risk that taxpayers will overpay if government employees are setting the price for those assets.”

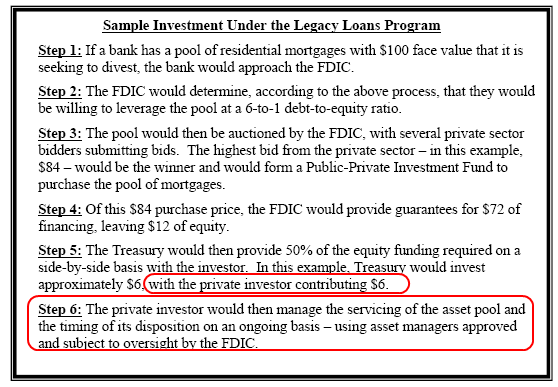

Bwahaha! By subsidizing large private investors we are already guaranteeing that we’ll be overpaying for these assets. By the way, as we’ll discuss soon, these private investors are only going to be putting in $6 for control of $84 which is basically leveraging up to 14 freaking times! Here we are beating up on banks and Wall Street for leveraging up 12:1 or 20:1 and we are designing a program with 14:1 leverage! And the downside is minimal for investors. All they risk is $6. 14 times on the upside and 1 time on the downside? Did Geithner consult with Mozilo for this plan? The premise of “the government will overpay if we take over” and the boogeyman of nationalization creeping to socialism has kept any sensible plan from being implemented. Now, we are assured a massive overpayment for these toxic assets. Geithner is right that we are not going to have a Japanese experience. Japan zombified banks. With this plan we just zombified the taxpayer. Here is the breakdown of the program:

It isn’t true that the leverage will be 6:1. It is looking more like 14:1. What they are assuming via the 6:1 ratio is they are counting the Treasury matching funds as actual equity and only looking at the FDIC loan as debt. That isn’t the case. Those Treasury funds are coming from the taxpayer TARP! Since when did the TARP become a private hedge fund?

When you see the math of this you really get a sense of how absurd this is going to play out:

I love the PR wording in this. Divest instead of dumping this crap onto taxpayers. Legacy loans instead of toxic assets. So the above is a basic scenario. We have a $100 craptastic pool of loans. The highest private bid comes in at $84. It then breaks down as follows:

FDIC: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $72 loan

Treasury:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6

Private Investor:Â Â Â Â Â Â Â Â Â Â $6

Total:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $84

I love step 6 here. For $6, these private investors now fully control the entire pool of mortgages. And one more thing, the loan from the FDIC is NON-RECOURSE. It just doesn’t get better for these private investors and frankly, the banks. Who will suffer? The taxpayer.

What the government is doing is creating a musical chair game once again. The first investor will want to sell this pool off for a premium and who really cares since the loan is non-recourse, creating another phony market. Eventually the last bag holder will realize that indeed, the loans are still crap and the full losses will fall flat on the taxpayer’s shoulders.

Of course this plan is being scrutinized by many people but take a look at this shady scenario. Say I am Bank X again. I have a loan portfolio on my books at $1 billion full of horrible loans. I’m the bank and have full access to documentation and verify that yes, these are some sweet smelling legacy loans. In fact, some preliminary bids are at 20 cents on the dollar and even I think that is overpriced. What do I do? Well say I am a big player and apply for the PPIP. What is to stop me from being a bidder here? After all, if I sell this portfolio on the market I will only get $200 million and recognize a mega loss of $800 million. That would sink my bank. So we get ready and go bidding. Let us assume we use that 84 mark used in the Treasury example:

FDIC:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $720 million loan

Treasury                     $60 million

Private Investor:Â Â Â Â Â Â Â Â Â $60 million

Total:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $840 million

This is a freaking no brainer as the bank! And remember, many of these banks have been sitting on those capital injections since they sure as hell aren’t lending so they have some of our cash stashed away to play with. So as the bank, we can them limit our downside here for a mere $60 million on a $1 billion portfolio. Sure beats an $800 million loss. In fact, we can even overbid:

Face value:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1 billion

FDIC:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,080 million

Treasury:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $90 million

Private investor:Â Â Â Â Â Â Â Â Â $90 million

Total:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1.26 billion

The FDIC better have measures against gaming of this sort. Think about it. As a big bank $90 million for unloading a $1 billion toxic portfolio is worth it. It would be a perfect hedge for these banks. An excellent out. PIMCO and Blackrock must be itching to go for these things.

Bottom line? This is one gigantic put option for private investors. If you lose, so what. You only lose the premium put in since the loan is non-recourse. If you hit the pot of gold, then you make out like a bandit gambling with the taxpayer money. That isn’t going to happen. What is going to happen is short term gaming, Pollyanna thinking, and a stealth cleansing of the books which eventually will zombify the taxpayer. At a certain point these assets will hit the market. Who is going to buy these homes at inflated prices? The only reason home sales are bouncing up recently is because of nearly 50 percent of the homes being sold are foreclosure re-sales at rock bottom prices.

This plan runs along the same vein of the initial Paulson TARP. That somehow, the only reason banks aren’t lending is because of these stubborn toxic loans. That premise is false. The reason banks have pulled back on lending is because there is a limited pool of qualified borrowers. This plan fails to address that. How do you get a qualified pool of borrowers? By having a strong middle class that is employed. Finance should be the grease that keeps the engine going. Yet in our last decade, finance became the actual engine. That is the root of the problem. This kind of inside the box thinking shows how entrenched this mentality is. In fact, there is little room in the plan to acknowledge, “maybe these toxic assets are worth what the current bids are.” No, of course that cannot be. We need to make up all these convoluted programs with acronyms like PPIP, TARP, ABCP, etc and hope the average American blanks out or fails to do the math. 6 months after TARP, we are in a worse position. Where will we be 6 months after PPIP?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

33 Responses to “Public-Private Investment Program for Dummies: How does the new Treasury Plan Impact Housing and the Market? Poorly Planned Investment Program (PPIP).”

First, thank you to the author of this blog. I recently discovered this site, and really appreciate all the information and insights.

As for this new version of the Bad Bank. I am sick of this money laundering, I have friends who are on the verge of losing their jobs. This is no longer the democracy the founding fathers envisioned, how could they justify the govt essentially robbing the US taxpayer to make these crooks whole again.

I have no issue with companies who made good bets, made lots of money, didn’t get messed up with all this subprime junk, let them be as profitable as they wanna be.

But why are taxpayers like me and my family and friends having our money go to people who made bad bets.. and they are taking no losses at all!

Its not fair! For the first time, I feel like it doesn’t matter who is in power, they both answer to the same master, and they play off one another just to sucker little people like me.

I am thorougly digusted by this money laundering scheme!

(thank you again for this great site!)

Thieves, assholes, and douches…those are the people we have “working for us.”

I sincerely wish that some lone psycho would start picking the bastards off one by one. I’d be glued to the TV for that. I’d skip work to watch it.

What incentive is there for people to work hard, pay their bills, play by the rules, when the douches can behave criminally and get rewarded for it?

America is screwed…

Thanks once again Dr HB for the great breakdown. This stuff seriously makes my head hurt.

Once they’d announced this thing with a Taaadaaah – Drrumroll!!! my first thoughts (other than ‘whaaaa?’) was:

A) How are they going to figure out how much this stuff is worth (the famous Rumsfeld ‘known knowns” phrase comes to mind).

And B) If its such a screamin’ deal – where were the ‘private investors’ beforehand – swooping in to snap up all this undervalued, erm, cra@? What? You mean we have to bribe them with scads of free money to get them to step up? That’s unpossible!

I voted for Obama, and am glad he’s the Prez – but I think he’s being undermined by his Economic Council.

While no human can be on top of everything all the time – and let’s face it the guy has a lot on his plate atm – his Financial Gurus are giving me a case of the Heebie-Jeebies.

While he’s shown himself to be both pragmatic and populist in all other ways, he seems to have a blind side to money matters – and how the average Jane Doe is seeing this.

Someone please talk me down and reassure me that this will work. Please?

And the corporate welfare continues…

Serenity now!

What I worry about is once the government owns millions of foreclosed homes they’ll refuse to list them on the open market, thus creating an artificial scarcity of housing at taxpayers expense. If they sit on the assets for a few years and allow hyper-inflation to work it’s magic eventually they could even turn a “profit”. With that kind of manipulation it’s possible we really could be close to a government induced bottom in housing.

I really hope I’m wrong…. I’d like to own a house someday.

God bless DrHB for getting this information out there so clearly. I hope the public eventually gets it that we’re being fleeced (for generations) and it’s being done in plain view. George Orwell was dead on with 1984, the politicians have taken “newspeak” to its ultimate level…..”legacy loan”? give me a break that kind of lying to the sheeple by using disingenuous words is tantamount to criminal misrepresentation.

I too voted for Obama and seriously thought that he had a better economic team than these jokers. Why isn’t Paul Krugman advising his team? Where’s Paul Volker???

I will be really pissed if Obama squanders all of his political muscle on this banking debacle and fails to fix the healthcare problem in this country.

Just a really well written post about the new PPIP program. Thanks DHB for all of the information; it is proving to be invaluable in this economic meltdown.

Yes and yet the people spend months and months debating the stimulus and yet this cr@p doesn’t have them up in arms. Why?!? Because the stimulus at least was understandable to the average person who has taken high school civics. Government voting to fund things (even if on deficit), yep very simple. But with all the money laundering (I absolutely love the term here, thanks anon1) it’s a whole long trail of following the money to even find out where it came from and these plans are never voted on directly (democracy? what democracy?) And so the stimulus which actually was at least to some extent represented legitimate government spending gets months of debate and this nonsense slips through.

Oh yea they’ll be lots of competition to make sure the government doesn’t over pay. With those barriers to entry competition will be restricted to a few firms, at best you’ll get oligopoly, at worst and more likely you’ll get trust (as opposed to anti-trust) and conspiracy.

So we elect Mr. Changey Change and we continue the economic policy of the previous administration and the foreign policy of the previous administration etc. Some change, brother can you spare a dime?

Long time lurker. Appreciate all you’ve done and the info you provide. I sold my house in LA in early 2007 based on reading this site, Calculated Risk and Market Ticker Forums.

With this program, of course ‘investors’ will game the system and taxpayers will get pasted with the losses. This is a travesty.

Take a look at where banks are carrying these assets.

http://2.bp.blogspot.com/_FM71j6-VkNE/Scka7JcKKeI/AAAAAAAABkA/pS34gaIK1jY/s1600-h/toxic+assets.jpg

I feel that we are losing our country. The hearings today with Ben and Timmay were nauseating. These people are doing everything in their power to bring the US down, IMO.

Bravissimo, DHB.

~

Friends, of COURSE this nation isn’t what the founding fathers imagined. Don’t you see? The whole point of this is to wrest sovereignty out of the hands of nations, and put it with a global elite of bankers.

~

THIS is why Wilson handed the US financial system over to the central banks in 1913.

~

THIS is why only the big boys are allowed to play banker in the New Whirl Odor. (Just as Doc describes.)

~

THIS is why smaller, effective, solvent community banks are being destroyed by the thousands to make way for these huge banking cartels.

~

THIS is why we are being pauperized to send money overseas, and to “protect” “our” “global trading” “partners.” I.e., set up China as the Comfort Women–and golden goose–of the bankers.

~

THIS is why China is calling on the IMF to create a global currency to replace the US dollar.

http://www.ft.com/cms/s/0/7851925a-17a2-11de-8c9d-0000779fd2ac.html

~

Don’t you see? The model these bankers value is the hive, and they intend to be the queens. India has the numbers but not the cultural discipline at present. China has both–plus a pre-existing hive culture.

~

The US has only a bunch of high-skilled, high-paid workers, and an increasing underclass of paupers. Some learned the lessons of freedom and liberty in the late 18th century…and refused to forget. Some would sell their own buttholes for hatbands if it preserved for them the illusion that they too might get rich.

~

Let’s be honest. Who DIDN’T buy into this model by buying cheap Chinese crap in the ’90s and ’00s? By re-electing people who let trade imbalances run wild? By re-electing people who voted to kill Glass-Steagall? Now people can’t live without China’s labor-camp largesse, and we don’t have the capacity to make it ourselves…or live without it.

~

I’d say that anyone who wants the American/Enlightenment ideals to move forward had better start brushing up on history in 1939 (particularly the Winter War) and 1949 (particularly the rape of Tibet). But I’m willing to bet that most people reading this would be more likely to try to figure out how to profit from the new Sino-IMF Globo. There’s too much to lose by throwing off the shackles of the central bankers. We might have to start measuring our quality of life in something other than granite countertops and steel appliances!

~

rose

~

1999 roll calls: repealing the Glass-Steagall Act

Senate

http://www.senate.gov/legislative/LIS/roll_call_lists/roll_call_vote_cfm.cfm?congress=106&session=1&vote=00105

House

http://www.govtrack.us/congress/vote.xpd?vote=h1999-570

Great info.. I appreciate the thorough research. I am willing to bet majority of people do not understand these points. I myself did not know the details of the plan until now. Almost at a loss for word, other than wow.. Apparently we are still in a country an elite fraternity. I am glad the markets responded to the news even if it isn’t as good as we would like. Perhaps it will turn out in our favor?

http://utahcribs.wordpress.com/

Great blog and article.

Banks will almost certainly be the primary “private” investors in this scheme. I thought banks trading their junk among themselves to create a bogus market would have been the obvious solution from the start except that none of them trusted each other enough to make it work. Now gov’t involvement has solved that problem and they are free to do their version of the old bogus RE sales then torch it for the insurance scam.

Get rid of mark to market, a few winks from the SEC on accounting practice and now this. Legalized fraud, ain’t it great? I feel so much more confident.

btw I think the constant use of the word “confidence” is totally appropriate because everything that’s being done is a con game. Ponzi schemes and fractional reserve banks are the only businesses that really depend on confidence and both are fraudulent at their core.

Nice and concise. So, what does it look like to have a nation of zombie taxpayers?

This whole deal just seems like the last phase in a terminal disease. Once the same set of crony capitalists that have been running the show all along get all the money, then what? It seems like the parasite will be killing the host.

I just hope the concept of some sort of money survives ‘the great bezzle of the 2000’s’, I don’t wanna have to figure out how many barter items or sexual favors I need to negotiate just to get a frickin beer around here.

Comrades,

Another problem with the PPIP scheme not mentioned is one of scale. It is currently estimated that the toxic crapola amounts to $2.5 trillion and will continue to grow as home prices decline, mortgage holders, credit card holders and auto loan holders increase in their defaults. This scheme will fall far short and then what? We will have exhausted all possible bagholders leaving the Country (and the World) in ruins.

I heard a speaker recently who made an interesting point. She said that the industrial revolution has created a sense of “human exemption” from the forces of nature. The concept is summed up by the saying, “if we can put a man on the moon, we can surely get out of this mess”. Yes, the laws of nature no longer apply to a species that can escape the clutches of gravity and travel at many times the speed of sound! Surely the laws of supply and demand no longer apply to the captains of the financial universe. Comrades, change is coming and will be dictated on nature’s terms, not ours. And when it comes, the bagholders will not be happy!

This was clearly explained, and I must admit that I love the word “craptastic.” I sent it to all my friends. Thanks.

OT:

U.S. renters turn buyers as homes become affordable

http://news.yahoo.com/s/nm/20090325/us_nm/us_usa_economy_housing;_ylt=AhDPMkOtoDkPUqK4Wr96MZmyBhIF

NEW YORK (Reuters) – After six years of renting in San Francisco, Kate Wilusz jumped at the chance to swap her tiny apartment for a roomy four-bedroom Victorian home. But she is paying a mortgage instead of rent — and coming out even.

“I could not be more thrilled,” said Wilusz, a financial planner who recently closed on the dream house with her husband, Charley.

In some U.S. markets, prices appear to have fallen enough to make buying cheaper than renting. Mix that with mortgage rates that are near record lows and renters who want to become buyers are rejoicing.

“The U.S. government is helping bail out those who bought at the top, but I got my own personal stimulus package through falling home prices and low interest rates on mortgages,” said Wilusz, who works at Ameriprise Financial.

(more at link)

——————————————————————————————————————-

Huh. Home prices aren’t less than renting in my neighborhood yet. Sellers are still asking crazy money. Is it honestly a good time to buy?

I figure about 60 to 70% federal tax rates after the “emergency” of the collapsed dollar. The banksters are simply positioning themselves for the inevitable.

But can they enforce 60-70% tax rates? Let’s just put it this way, I don’t think those kind of tax rates (without loopholes) are enforced anywhere in the world. And they will be even harder to enforce given how little the people are getting from all this spending (a cradle to grave welfare state like Sweden? Nope, merely a banker bailout).

Buying cheaper than renting? Haha. Not in Los Angeles, that one is pretty hilarious. 50% of the people don’t rent in Los Angeles because they like paying more you know ….

I just heard Obama on the news this morning and he has set up a section on the website http://www.whitehouse.gov where you can go and give your opinion(s) on the economy, etc. I just thought this could be a good venting page other than just bitching among ourselves about, “how come my tax dollars have to bail everyone out but I get nothing”. or “Why in the ‘heck’ do you INSIST on keeping house prices artificially inflated when there are so many people that have been doing the responsible thing – saving, managing credit, etc – and we still can’t afford a decent house in a decent hood…” or anything at all that urks you.

All remarks need to be by tomorrow – Thursday 3/26

At the end, the so called “Private Investors” dont have to come up with a cent any way.

The so called Privete Investor’s Capital is an artificial capital accounting figure any way.

The People on the top treat us like a school kids again !

These programs are a joke. The pickup in housing sales was going to happen anyway, just as I said 6-12 months ago in the comments here (at which time I was derided as a bottom-caller, thank you very much perma-bears). This was easily predictable as we have reached the point where the median incomes can support traditional mortgages on the median houses. Or put another way, the median housing prices have fallen below the time-weighted average of housing prices predicted by an inflation-based model projected over long-term historical data. But what do I know? I was just drawing lines on graphs, right? ha. Anyway, now with these crazy programs in effect, we’ll see a solid, strong, short term bull trend on wall street followed by some of the most horrendous inflation imaginible. So now, if the principles of economics remain intact (that is, no armageddon or bolshevik revolution or other form of systemic collapse), 2009 should be an excellent time time to buy. We have a strong dollar, weak housing prices, and a reasonable expectation that the next several years will massively dilute our currency. If you can get approval, get into debt. This is the equivalent of buy low sell high. You will not regret it.

I wish EVERYONE would simply quit paying their mortgage…

So what would it look like if everyone quit paying their mortgage in retaliation?

>In some U.S. markets, prices appear to have fallen enough to make buying cheaper than renting.

People, it’s never “cheaper” to buy than rent. Never.

People who claim that it’s “cheaper to buy” are the same people who got us into this mess to start with.

It’s also the same people who pay Las Vega’s electricity bill by thinking that they know “how to win at the tables”…

Send a letter to your congressman.

Thank you, Dr. HB. You’re doing a great service for your fellow Americans.

And thanks to Moral Hazard and NoHoDolphin, for the inspiration and the link to the White House solicitation of questions, respectively.

FWIW, Here’s the question I posed to our President:

“When did toxic assets become legacy assets? How are responsible taxpayers to trust in leadership which uses disingenuous words tantamount to criminal misrepresentation? Where were private investors before the free $, I mean non-recourse tax $ loans?”

I wish someone in the media had the guts to ask President Obama what does he say to the people that have been saving and waiting for housing to become affordable only to have the government prop up home prices and keep the bubble inflated. What is your take on the housing bubble good Doctor in light of the governments continued intervention? Will we see it deflate or will the bubble be prolonged?

Hey Dr did you see this? HOPE program only prevented 1 foreclosure. What a joke.

http://money.cnn.com/2009/03/25/real_estate/new_hope_plan/index.htm?postversion=2009032512

From Nouriel Roubini’ RGE Monitor Newsletter on PPIP:

—

“Clearly the unfreeze of credit markets would be the first sign of success but we might not see this happening before some time. Some of the banks that choose to sell assets and take a writedown might be in need of additional capital before they can resume lending. Also, for those institutions that are beyond the stage of rescue and effectively insolvent, the plan will likely not be as effective in stimulating lending or participation in the first place.

—

The increase in the supply of credit that will come from institutions that are solvent will be important, but will demand be there to do its part? If the real side of the economy continues to deteriorate, it is likely that credit demand might be subdued. Moreover, a further continued deterioration on the real side of the economy would imply new defaults on credit cards, consumer loans, auto loans and mortgages that would result in new toxic assets on the balance sheets of financial institutions recreating an environment where banks would maintain stringent lending standards. Therefore, the success of the plan is a necessary but not sufficient condition to get the economy back on a recovery path. The success of the fiscal stimulus package in sustaining aggregate demand and minimizing job losses and the success in restarting demand in the housing sector will be instrumental to put a stop to the negative feedback loop between the real and the financial side of the economy.

—

Moreover, if the negative feedback loop persists, need for further funding will arise. While it will be very challenging to obtain Congress approval for additional TARP money, we should point out that the government has set aside an additional $750bn in the FY2010 budget in aid for the financial sector.”

—

In other words PPIP is like Life Support, it might stablize the patient but if the patient is terminal, it will be of no use (unless you like zombies). If the patient already has a good prognosis, why does it need PPIP in the first place??? My favorite part is where he rightly points out that the legacy crapola will grow dramatically. There is no hope of off-loading this yet to be realized this sewage on taxpayers because the printing presses can’t keep up. Then what? Our “human exemption” is keeping us in a hyper-delusional state. Be brave Comrades!

PPIP explained with poo poo:

http://www.youtube.com/watch?v=OWLUiT_0ZFw

Thanks Dr. HB, it is a very precise article.

However, I want to point out that we are in this situation and the taxpayer has already been lost. Even if you let all bank bankrupt, the lose in income tax and un-employment services are also huge. My key point is: LOSE ALREADY. Best aim is to have demage control.

PPIP most definitely will cause taxpayer money. But with some control on the numbers, it may become LOSE LESS.

1. Since the government match contribution is already non-recourse, hence FDIC portion of leverage MUST BE RECOURSE.

2. Limit FDIC portion to a maximum of 40% book value.

3. Limit TRAP match portion to a maximum of 10% book value.

Still there are chances that the “investor” may drain some taxpayer’s money; but it is vastly limited. And it is kind of balance out the upside and downside.

With this setup, even the actual value of the toxic is 30 cents for a dollar. Taxpayer may lost 10 cents a dollar. If the bank willing to re-invest in that scale, that 10 cents is a good comprimise for the tax income and un-employment services.

Residential Credit Solutions, which no longer exists, nabbed the plum offering back in 2009. There are several dozen ratings on yelp if you want to know what they were like. Ratings are one person’s 2 out 5 and the rest of the raters’ 1 out of 5. Other loan servicers rated them 1 out of 5. I really don’t think they had the assets needed to qualify. They were acquired by MTGE held onto them for a couple of years, during which they operated at a loss every quarter. MTGE dumped them on ditech, which was owned by an investment company, Walter Associates I think, which promptly became a penny stock. MTGE rallied handsomely the moment they were rid of RCS. Actually they rallied the day before, but who’s counting? That was the end of January 2016. I wonder why MTGE bought them. I assume they were shown cooked books.

RCS had the very lowest rate of loan mod approvals under HAMP. Not just low. Outlier low. About 12%. The next lowest was about 17%. It wasn’t the loans. They were doing it wrong. They were supposed to capitalize the arrearage before doing a certain calculation. The sum of balance plus arrearage is a much bigger number than just the unadorned balance, so it threw off the results to a degree that meant many improper rejections. They also failed to modify any loans by extending the loan term. doing so results in a bad situation for the borrower, who ends up paying far more over life of loan despite lower payment, though for many it can be short term and better than foreclosure by a long chalk.

Financial bloggers were mystified when RCS won the first

PPIP deal, esp. because it didn’t match the criteria for PPIP and should not have been transacted. The bad loans they received were not sold by a functioning bank who needed to unload some bad loans to improve their financial health. They were from a dead bank. No living banks were anxious to dump their bad loans. Go figure. Maybe because each loam was equal to a free house?

In 2010, FDIC sold RCS another batch of loans, those from the deceased amtrust bank. The same lending arrangement, but a separate deal letter granted an extra year for repayment in case certain things happened, including any change in the law that made foreclosures more difficult. meanwhile the contract had rcs’s promise that they’d seek to modify the loans wherever possible. I doubt rcs lived to gloat over the amtrust loans. A widow, Mrs Hammer, who wasnt even foreclosed on, sued them for messing around with forced-placed insurance or some other jive. They kept on messing with her during the trial, angering the judge so much he upped her award to $2,000,000. Their appeal failed.

The CEO of RCS, Dennis G Stowe, had done some contract work for FDIC in the past, related to sorting the assets of post-failure Niagra bank. Maybe he had some pals that greased his crappy company’s route to the two FDIC sweetheart deals that resulted in so many foreclosures. Much of RCS’s staff came from a failure called something like Greentree or Saxon–I forgot which.

Leave a Reply