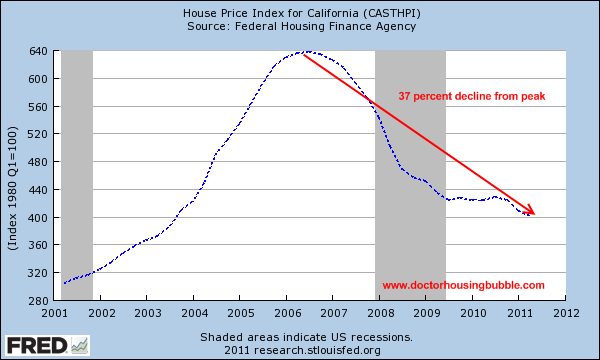

Mark to fantasy model of real estate accounting. California property assessments down only 4 percent from peak but home values are down by 37 percent. FHA default rates surge.

The options are running out in terms of artificially keeping the housing market inflated. Too much time, money, and effort has been funneled to the financial industry over the last five years since the bubble popped and so far, little results have been measured in the market for many Americans. The core of the issue, which ironically is what even drove the no-doc exotic mortgage bonanza, is the stagnant income growth of households. The Federal Reserve has stepped in with artificially low interest rates to keep the game going and it is running on fumes at this point. You also have FHA insured loans stepping in to make up for the low down payment market that is now gone. Right on queue the problems with FHA loans are ballooning. Not like this was foreseeable right? Yet the state even on the property tax front isn’t fully recognizing the changes in assessed values.

Property taxes assessed at a minor correction

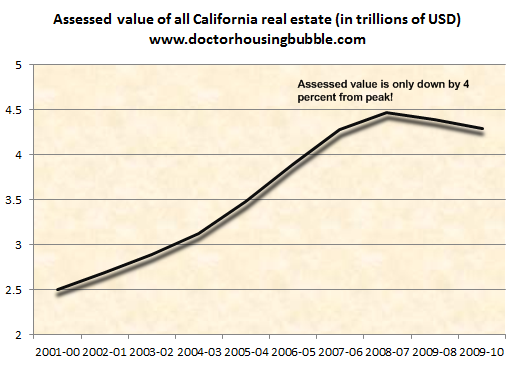

I have yet to see any solid assessment or market analysis on California property taxes. Most of the attention has been given to the general funds budget which is an absolute mess. Yet I put together a chart highlighting the actual assessed value of all California real estate over the last decade:

Source:Â BOE

This chart is fascinating. From 2000-01 to the peak in 2007-08 total assessed property values in California climbed by a whopping 78 percent. To put this into perspective California real estate values surged by $2 trillion in seven years! No wonder why people started looking at real estate as some sort of money tree. This was largely pulled up by over optimistic valuations (aka a bubble). Now of course some of this has come from the increase in housing units but from 2000 to 2010 housing units in California only increased by 12 percent:

Housing units

12,214,549 Â Â Â Â Â Â Â Â Â 2000

13,680,081Â Â Â Â Â Â Â Â Â Â 2010

So based on the latest assessment data California properties are worth $4.3 trillion but this is only a 4 percent drop from the peak when actual real estate values have done this:

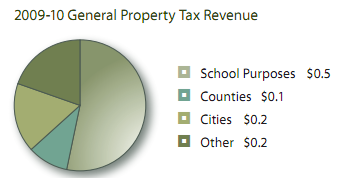

Seems like a disconnect of course but with Prop 13 real estate taxes are already low with a massive burden being placed on those who bought within the last decade. Most of the taxes go to the local community:

I found this information fascinating but also realize that here is another segment of our economy where we have shadow figures. Assessed values are not being mark to market just like the inflated balance sheets of banks with shadow properties.

The dangers of a low rate environment

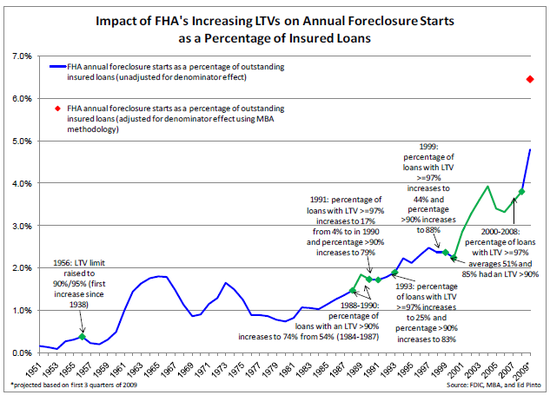

Let us assume we operated in a truly free market (which we don’t) then an interest rate would truly reflect the risk of lending out money to a venture or a securitized asset. Yet in this current market we are largely operating in a distorted netherworld of easy money. Is there really almost no risk in giving a 30 year mortgage to someone in this volatile economy? Absolutely but current mortgage rates reflect an almost risk free bet that the 30 year note will be paid in full. This reminds me of Taleb’s Black Swan where you are right until you are wrong. Home values never went down on a nationwide basis prior to the Great Depression, until they did. This is why problems are now cropping up with FHA insured loans:

FHA defaults are now surging as a percent of the overall mortgage market. Of course this would make sense since FHA loans stepped in largely in 2008 and going forward for the low down payment market. It should be no shock that things are getting bad quickly because a low rate can’t make up for a lost job or low income growth.

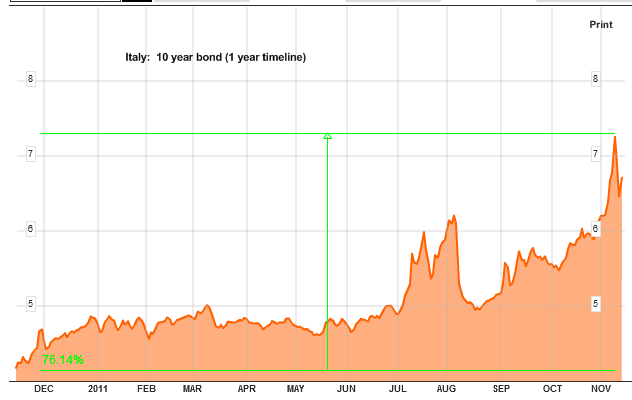

And if you think a central bank can keep rates low forever you are wrong. Greece is too small of country to relate to but take a look at Italy and how quickly things got out of hand once people realized that risk free bets were no longer risk free:

The 10 year Italian bond has surged an incredible 76 percent in one year with most of it coming since August. Italy is not a small country with a $2 trillion GDP, almost on par with California. So keep that in mind when you look at longer term market projections.

For anyone buying today you need to be willing to stay put for a decade or more. If you buy with an FHA insured loan only 3.5 percent is required as a down payment. The going fees associated with selling are easily 5 to 6 percent. So right off the bat you are underwater. If home values even tick lower by 5 or 10 percent which is feasible given the uncertainty with the economy, you will have a large surge in underwater homeowners (we are already at 25 to 30 percent of all mortgage holders in a negative equity position).

When people are shocked why low rates, FHA loans, and all these incentives fail to jump start housing you need only look at household incomes. As always, home values should be driven by a healthy economy and not the other way around. You would think that this lesson would be learned five years after the bubble has burst.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

92 Responses to “Mark to fantasy model of real estate accounting. California property assessments down only 4 percent from peak but home values are down by 37 percent. FHA default rates surge.”

I have recently thought that the housing bubble WAS and CONTINUES TO BE a massive wealth transfer mechanism. Huge property valuations turn out to be HUGE CHECKS TO THE BANKS, and HUGE BILLS FOR PROPERTY TAX. It was a brilliant scheme by banks and governments. It is a scheme for massive TRANSFER OF WEALTH. The banks have made, and continue to make hundereds of billions. All the while millions of chumps vastly overpaid for their homes, making themselves considerably poorer.

Miso said, “……..the housing bubble WAS and CONTINUES TO BE a massive wealth transfer mechanism.”

That would appear to be the case. However, some of their so-called ‘wealth’ that the top 1% are accumulating might be ephemeral. A large chunk of their ‘wealth’ is bonds. How is that working out for holders of Greek bonds, lol?

Or, to use your example, the banks can foreclose America out of their homes, but how solid of an asset is a foreclosed home? What will they do with these ‘assets’, sell them or rent them, and to who, at what price?

And they own a lot of stock in America’s corporations, but that has significant value only as long as those corporations pay dividends or are growing their businesses. Right now, corporations can borrow money at low rates for capital projects, or other corporate purposes. But as Dr. Housing pointed out in this piece, rates can explode higher without warning.

So to summarize, on paper (pun intended), it looks like vast wealth accumulation by the top 1%, but let’s check back in few years and see how they are doing.

You are fabricating a world view to service wishful schadenfreude.

Nearly all bond issuing institutions are solvent. Corporations are making record profits. Really! They are at 2007 levels. I am sure that in general stock and bond holders will come out okay. A few will get seriously bruised on dubious investments in poorly researched and/or maliciously constructed paper. The large risks are really that we are in a bond and gold valuation bubble currently, as people unnecessarily dive to safety. (Thereby making those instruments unsafe.) This problem can and will hit middle income people too. There are probably a bunch of misdirected seniors who are 100% in gold and bonds right now. They will get seriously hammered when that asset bubble deflates.

The reason the rich will be doing better than fine is that the Bush tax cuts remain in place. As long as that is true, wealthy individuals will pay a smaller percentage of their income to the government than you do, and as a consequence will continue to pull away and leave the bourgeoisie behind. The playing table isn’t level and hasn’t been for decades.

Ian, you said, “Nearly all bond issuing institutions are solvent.”

Define ‘solvent’, lol. Using GAAP accounting, the USA government is not solvent. Their debt plus unfunded liabilities are around $100 trillion, and they are adding $5 to $7 trillion to their underwater position each year.

You make the invalid assumption that since their check kiting partner, the Federal Reserve Bank, can create money out of thin air, they will never default. Alan Greenspan said it best, as I paraphrase-‘we can guarantee that all future retirees will receive their social security payments. We just can’t guarantee the purchasing power thereof.’ The same is true for bond holders.

Naive bond holders like yourself are vastly underestimating the coming tsunami of inflation. The only question is how much devastation is unleashed before the inflation finally spills over to the housing market? Quite a bit, I think, since wages must rise first, and that isn’t happening.

Ian — yessiree, record profits, thanks to record levels of corporate welfare, corporate bailouts, wage arbitrage, etc.

For clarity, I don’t hold any bonds, except perhaps indirectly where my brokerage uses them to provide some yield for cash sitting in my account. I think they are currently overvalued and like gold in bubble. I certainly am not keen to lock myself into a 2% yield in a dollar denominated account. I think we have some latent inflation coming.

No. I was just replying to the ridiculousness of assertion that the wealth of the rich will collapse under its own weight and leave the common man unscathed. Rather, for this downturn at least, I subscribe to the theory that you don’t have to outrun the bear, just your fellow hiker. In this regard, the wealthy are in far, far better shape than the 99%. They have a tax policy tail wind in their favor to boot. When the tough times come, which they have, it will be the modest means majority that suffers disproportionately.

Not to worry. When the banks lose money on their European bonds or the American houses they foreclose on, they can just get into the taxpayers to make it up. That’s what they’ve done so far… that’s why they can take home multimillion dollar bonuses while the rest of us fall through the floor due to their malfeasance and lunatic risk-taking.

It’s great to take risk when you only get the upside and the taxpayers take the losing side. Heads they win, tails we lose.

This is the root of the grievances being expressed by the OWS crowd. Unfortunately, the OWS people are so chaotic, confused, inarticulate, and possessed of a welfare entitlement mentality, that they are failing to get at the root of the problem and are alienating the very people they need to win to their side.

They’re also attacking the wrong people. The “rich” are not the problem. The “1%” is not the problem.

The problem is the satanic union between the powerful, connected, and greedy- and their enablers in Congress and the Obama administration, who have protected them by passing laws that pass our money to their back pockets and protect them from the consequences of their behavior.

The OWS people should make just this one coherent demand: that any officer of any institution or company that is bailed out by the government, walk away penniless. And by “penniless”, I don’t mean just a million dollars vs the $200M he would have made if his bets had made good. I mean BROKE. Anyone whose bank or other financial institution (Fannie, Freddie, et al) has to be “rescued” at the expense of the taxpayers should spend his or her life living in a wire-cage SRO and getting food at the local food bank, with no chance at any job except sweeping the streets or collecting salvage.

+1

Chump Spirits

Irrational Exuberance is no longer the manifestation of bullish spirits. When it comes to the housing market the spirits roaming the RE habitat are the Chumps.

Tax and credit Chumps. Ponzi Chumps. Greek Debt Chumps – (the Germans). Etc.

You’ve said the same thing all along, Doctor. Real estate values will stabilize when either household incomes go up or prices go down….or both. As for property assessments, we all know by now the State plays fast and loose with revenue numbers. When the bond vigilantes finish with Italy and France, they might just give the People’s Republik of Kali a long look.

“For anyone buying today you need to be willing to stay put for a decade or more.”

Oh doctor… Your statement that “you need to stay put for 10 years” if you are buying a home is foolish! Losing a few percent on a $300K home is not going to make it impossible to sell a home…

For instance, I bought a home that before tax deductions… is on part with renting.. if you include my equity I’m making $4K a year better than renting. Let’s assume all my equity is wiped out… over the next 5 years that i’m accruing at a rate of about $7K a year.

Let’s say 5 years from now I want to move… I bought for $400K.. have a $360K mortgage currently… home is appraised currently at $425K.. financed at 3.95%.

In 5 years i want to sell… Let’s say i lose all the equity i put in the next 5 years.. I’m putting in $6k-$7K in equity over the next 5 years… So my home value drops to $372K. That’s close to another 10% price drop… I’ll still be about even when i go to sell… My mortgage will be $327K after 5 years. I’ll sell on redfin for 4.5% or negotiate a lower sale rate with a realtor. (all realtors will have to negotiate if prices drop much more to stay in business.. the days of 6% are OVER!)

On top of this… I’ll be able to sell and buy a better home for cheaper! Since all homes dropped 10%… I’ll need less of a downpayment… And I’m saving about $5K a year currently.. so basically.. Even if i lose 10% in value of my home over the next 5 years…

I’ll be able to sell and buy a better home in 5 years.. even with a 10% drop in my homes value.

Now if we have a 20-30% drop.. then I’ll have to stay put possibly… But we’d have a lot bigger problems if we have another 20-30% price fall in the next 5 years.

First of all I’m going to point to a big WTF in your hypothetical scenario. You buy at 400K and then magically the house is appraised at 425K, am I missing something, are real estate values rising.

The more logical scenario is I bought at 400K and now my house is appraised at 350K or 375K. Now do your calculation again with these numbers and tell us how it comes out.

Regarding selling a house, there are two pages worth of fees that you have to pay (not just realtor commison) that you need to include. When you add all this and the cost of moving, securing a new place…you will greatly exceed 4.5%.

Add all this together and Doctor’s statement of staying put for at least 10 years is not far from the truth!

This is the new, new, new math….

Dr. HB, will you do a follow-up on what Caliowner said that it’s not accurate that if you buy now you have to stay put for 10 years?

Caliowner

I have to assume you have some ghetto home in an area no one but the unemployed hispanics would ever want to buy because nothing in a desirable area goes for less than a million in ca. Based on the fact the you live in a very undesirable area and that only the least qualified buyers would want to live there I would suggest you get over your incredible optimism and realize your home is definitely going to lose another 20 to 30 percent by the end of next year and that doesn’t even take into account the new roof you are going to have to put on the house, the new garage door the house will need to give it some curb appeal and all the other work that will be necessary to sell the property. Basically what I’m saying is you are screwed. Enjoy the coffin you bought because that is basically all it is at this point.

Don’t forget about the 1.25% you lose every year in taxes. Over 5 years, your house would have to appreciate 6% just to break even, assuming you never had to make a repair, or pay a realtor to sell it.

CaliOwner: As I recall, the last time you posted your numbers, you were paying $200 a month over rent, just so you could lose $2,000 a month in equity.

It wasn’t impressive then, and it’s still not impressive now. And I’m being polite.

I have a question for the Dr. Maybe you could do a post about it sometime. In looking at “Recently sold homes” on Trulia, I see many “sales” that are clearly suspicious; that is, they appear to be foreclosures, or homes purchased back at auction by the banks. nevertheless, they end up statistically as sales, and their often inflated values add to the region’s average and median sales prices, as well as the price/sq. ft. Is there a way for us amateurs to sort out which sales are real? This is important, for if there appears to be a 12-month supply of homes based on recent sales, if half or more of those sales are actually foreclosures that will then be added to inventory (counted or shadow), then the situation in those markets is really far more dire than the statistics would suggest. In addition, price comparisons become meaningless, for a property that might bring $90/sq. ft is being compared to a foreclosure nearby based on a 2006 loan that “sold” for $400/sq.ft.

This is true in markets that are still in free fall (Sacramento, for example) and those that have merely lost half the air in their bubble (Santa Barbara); it is also true in markets between the two (Santa Maria).

To repeat my question, how can we tease out the real sales (distressed and organic) from “sales”?

130+ days into the year and CA is $1.5 billion short….and they’re still HELLBENT to build a $98 Billion train..which is TRIPLE what the voters approved…the vig on $135 billion debt is currently $7 billion and will rise to $10 in 2 years out of a shrinking $85 billion in revenue. This train will wreck the state.

I’m pretty sure it’s financed with private money.. atleast the first leg from Victorville to Las Vegas… (Then the connection from LA transit… that will cost some money).

http://la.curbed.com/archives/2010/03/construction_on_vegas_train_epic_parking_lot_starts_this_year.php

The proposed High Speed Rail for California will be financed by taxpayers, not private lenders.

The train it to be financed in part by a bond measure that was on a ballot a few years ago (in part, yea that is only the first leg of it AND it is now exceeding that estimate!). There is some federal money involved but it’s hardly sufficient by itself. And yes there are all kinds of promises of private investors eventually getting involved which are unlikely to ever materialize. I think public transit is well worth funding, but this train is a BOONDOGGLE!!!! And to think we are cutting classes in our public colleges and still have to fund the train to Bakersfield! Got to love the state bond measures put to popular vote.

The whole thing is being paid by taxpayers. None of the politicians are even talking about the important point of whether it is needed or not. It is a big waste of money. There is no need for high speed rail from LA to SF. We already have it. It’s called Southwest Airlines. It doesn’t cost the taxpayers anything, and a seat on Southwest is certain to be far cheaper than a seat on the train to financial hell.

http://amatha.blogspot.com/2011/11/irvine-housing-blog_14.html

Well, home prices are equal with rentals in IRVINE, CA

Sorry not buying this at all!

The calculations used do not show the full (and true) picture of owning in Irvine:

From the article-

I take 90% of the aggregate rent as a potential loan payment. I calculate the mortgage balance such a payment would service at today’s interest rate. The result is the loan component of rental parity. To the loan balance, I add an appropriate down payment. For conventional buyers, the down payment applied is 20%.

For example, if an area or zip code has an aggregate rent of $2,500 — a common number in Irvine — I will assume $2,250 is available to make a mortgage payment. At 4% interest, a $2,250 payment would service an astounding $471,288. If $471,288 were the loan balance, the down payment would be $117,822. The sum of those two is $589,110 which represents the rental parity equivalent of a $2,250 payment applied to a 4% fixed-rate mortgage using conventional terms.”

What about taxes, insurance, maintenance, repairs? I am pretty familiar with Irvine and for 600k you are not getting a huge house. Maybe 1700-2k sq ft. Oh plus you have to come up with 20% down, so 120k. What about further price drops?

Gotta love taxes. Kinda means you never really own something if they can tax it away from you.

Money for nothing and the chicks for free!!

Very true. “The power to tax is the power to destroy”

And this is a *HUGE* reason not to buy a house here – you don’t really own anything. You are always just renting from the government at rents that are substantial – the property tax alone on a lot of places in the Bay Area is over 25% of what it would it cost to rent the same place, in some places 30% or more.

Excellent article, Doc. Thank you for providing it.

There is one very key thing missing, if I may. You’ll recall the previous news, and your article, about how 50% of all mortgages are now underwater. That’s a key observation, but it again misses the central point.

Namely, that the Federal Government is doing its very best to eliminate people from the housing market, and keep them out, for a very long time to come. At a minimum, 7 years. In reality, much longer.

They do this via the 3% down Federally backed loans. The Government is basically doing 90-95% of the new mortgages out there; and the 3% down probably makes up the Lions’ share. Those people are underwater the day they sign, since it will cost them 6+% to get out. That’s money they have to bring to the table. And if housing keeps going down, they’ll have to cough up more, or declare bankruptcy.

So the Government is working fast and furious to eliminate a huge chunck of potential buyers for many years to come.

Now, contrast that with the huge backlog in Shadow Inventory. And with the Banks now getting disperate enough for cash that it’s starting to appear.

Few buyers and a large number of houses on the market is very negative for prices. And that, folks, is what we’re looking at over the next decade.

Please stop spreading misinformation that it costs 6% to sell a home or that it will cost anything close to that moving forward. Soon agents will be happy to get a free lunch for selling a home if prices and housing ends up as bad as you are predicting. If a real estate agents option is to lower their fee or not sell a house because everyone is underwater…. They will take a pay cut.

Are you delusional… What does the govt get out of more underwater homeowners!?

I definitely agree that govt policies are making things much worse, not better, for housing in the future, altho I tend to doubt that the feds are doing it on purpose. They actually think that its a good idea to have 3% down payments because few buyers now can put up more than that. The effect, of course, will be more and more defaults as these newer buyers find themselves underwater in an economy that is creating essentially no new jobs but has another 100K new job seekers each and every month. On top of this, add millions of 25 – 35 yr olds who have payments on a mountain of student debt that severely curtails their potential for entering the housing market as first time buyers.

We are beginning to look more and more like Japan in 1990, after their crash in 1989. They are now over two decades into their ‘recovery’ and their economy is still almost flat on its back. They too created a mountain of fiat money, reducing interest rates to zero, and it didn’t work, and they tried mountains of ‘stimulus’ spending with a similar result.

We are only a couple of years behind Europe on the slippery slope down into the financial abyss. In Europe, the weaker courtries are defaulting on their debt and begging for bailouts. In the U.S., it will be the weaker states, like California, Illinois and Michigan that will need the bailouts, plus many smaller municipalites, counties and cities which are all already bankrupt by any reasonable accounting standards.

The one economic indicator that most people watch and which has so far held up remarkably well, given the current reality, is the stock market. But, looking behind the curtain, the great Oz will eventually have to tell you that some 70-80% of trading volume is now done by ‘high frequency traders’ computers co-located with the exchanges and the price movements they cause have absolutely no relation to the actual economic values of the stocks. At some point, the curtain will inevitably fall and it will be 1932 again in the stock market.

Cheeers,

Eddie

I don’t follow. I am under the impression that the government is doing everything it can to continue the housing party by paying people to buy houses (%4 in not an interest rate, it is a government give-away). I think the average bozo buys a house based simply on the monthly nut. I think folks like you and I are more interested in the anticipated price deflation/depreciation and income, but I still think we are in the minority. What am I missing?

They aren’t eliminating them from the housing market. They are chaining them to excess inventory!! Those people aren’t going on the housing market, except to sell the house they already have. The easy terms take youthful enthusiasm, chain it to a barge and thereby remove one more house from the market.

Next it will be: “We’ll forgive your college debt if you buy a house valued at 4x the value.” Muahahahaha.

@Caliowner, Fast Eddie, What:

Yes, the mandate of the FHA is to make housing affordable, and in so doing, to support the housing market. It is incredibly ironic that in order to do so for today, they must destroy it for tomorrow.

In simple terms, they are pulling forward the future demand, in order to prop prices up today. But home prices are still going down. Which makes the effort not only futile, but disastrous.

The FHA model only works when prices are stable, or going up. When they are going down, it’s a completely different game.

The concept is pretty simple. The 3% down people won’t be able to buy again for many years to come, if prices remain stable. If prices decrease, today’s buyers won’t be able to buy again unless they declare bankruptcy. That means 7+ years before they can re-enter the market.

Or, in short, the low-down buyers are trapped, and eliminated from the marketplace for the foreseeable future. All due to the Feds easy loan policies. And this is a large part of the market today.

The Feds could tighten up the requirements, by requiring 20% down. But that would be a severe hit to housing prices.

So they pull forward demand. Much like they did with the Housing Tax Credit back in 2009/2010. Sure, they got a bunch of suckers then. But most of those fools are now underwater, and cannot buy now or at any time in the near future.

I hope that’s more clear

This amounts to government theft in the billions.

Yup.

How hard is it to file for an abatement (that’s the term that would be used in towns here in Massachusetts)? If your property taxes are 30% higher than they should be because the city or town is not reflecting actual prices with their official valuations, why would you sit there and pay that?

I’m sure the abatement process is very very understaffed.

Lots of posters (like you) seem to blame “government theft” for the housing debacle, but the truth is that, as non-innocent as FNMA / FHLMC are, they (and the Community Reinvestment Act) are not significant contributing factors in the housing bubble / crash.

One of the best summaries of what I say is here: http://krugman.blogs.nytimes.com/2011/11/16/barney-frank-master-of-disguise/ (follow the links, too).

Executive summary: The bubble was inflated primarily by private, non-regulated lenders, with the collusion of the securitizers on Wall Street. Government neglect, not active theft was the problem. And no, taxes are *not* theft. They are the price we pay for civilization. I doubt you sew your own clothes, much less treat your own water, or vet your own medication, etc.

Government *inaction* remains at the root of the potential for more worse outcomes.

Former S&L regulator William K. Black points out that during the S&L scandal, the largest-in-history political and financial scandal in U.S. history at the time, the Office of Thrift Supervision (OTS) filed 10,000+ referrals for criminal prosecution. The Justice Dept. prosecuted 1,000+ cases with a 90% conviction rate, and politically connected thieves like Michael Millikin and Charles Keating did time.

And this is during the bad ‘ol deregulatory days of Reagan / Bush 41

The current, Bush 43 / Obama crisis is at least 70 times larger. Bailing out a single bank — Angelo Mozilo’s IndyMac — cost more than the entire S&L bailout.

Nevertheless, at present, OTS has filed zero referrals for criminal prosecution, and the Justice Dept. has prosecuted 10 cases.

Unless there are some dramatic changes, the Obama administration, no thanks to Darryl Issa, will go down as literally the most corrupt in history, but Wall Street is where the thieves are.

This all started with cheep money. All that follows would never happen without cheep money…

A lot of Italy’s debt is tied to derivatives/credit default swaps. CDS’s are bankers gambling casino. They seduced Italy with low rates but they were tied to CDS’s.

“Absolutely but current mortgage rates reflect an almost risk free bet that the 30 year note will be paid in full.”

I believe it is worse than the doctor is stating. As I have stated before, anyone who attended a basic econ class knows that interest includes:

Risk (both default risk and interest rate risk) + Anticipated Inflation + the cost of money

If we were in a free market, the anticipated inflation would be higher than the current rate. I believe the government (i.e. the tax payer) has nationalized the risk component and the cost of money component. I am not convinced that the anticipated inflation portion is fully absorbed in the current rate on a FHA %3.5 down, 30 year fixed rate mortgage. I have even joked with colleagues that we will see a time when borrowers will be paid to borrow money. This probably will be done in tax code.

that’s not really true. If you go to a bank to apply for a mortgage, you will need a lot documents to prove you can pay. Not a lot people actually can get a mortgage. Yes, the rate is low, but many don’t qualify. That low rate is not really helping the people who need it. You can try to apply for one. I think colonoscopy is probably better tolerated.

I have no idea what you are talking about. I assume you are not reading my statement correctly. Interest = risk (both default risk and interest rate risk) + anticipated inflation + cost of money. How does the ability to qualify for the low rate change the fact that we have at least 3% inflation today with a high likelihood of going up based on the Fed’s policy over the next 30 years? Hence, inflation cost will most likely be over the 4% rate. There is no room for default risk, interest rate risk or cost of money. Loose versus tight lending standards may shrink the default risk but not to a negative number to offset the other components of interest. I recognize that most of the folks that are getting this rate are current home owners refinancing if they are still above water, but this still causes the same problem. I guess we now have come to believe that money is free…

Ok, money is free, but you are not getting it. that’s the simplest way to say it.

Two of my co-workers just refinanced at this rate… I am not sure that what you say is true…

I am ready to buy! I AM TIRED OF WAITING! Only problem is here in the Santa Clarita Valley 99.8% of homes on the MLS Either have an offer or pending! I am getting so freaking frustrated! If the economy is so bad why houses are selling like hot potatoes? Are they investors who are buying these homes? There’s a lot of them available if you are looking to pay over half of mill but no way in hell we are getting into a home to be slaves to a mortgage! Any advice up there? Thanks…

I think the term you used is very interesting. The normal term is selling like hotcakes. The term hot potato is often used as something you want to get rid of like in the game hot potato. I think you answered your question. You do not want a hot potato you want a hotcake. I suggest you wait for the hotcakes….

Lucy, I live in SCV also and am as frustrated as you are. What I’ve seen is the inventory is pretty low overall. But most of the houses on the MLS are not in the areas where the people with any money want to buy. Anything decent is $475 and up. When one good house in the right area comes up, everyone who’s been waiting for a good house wants to buy it, and then you’re in a bidding war. Or, a house in a good area comes on the market, but it needs a lot of work. So you pay $450 or more for the house, then you gotta spend another $50-$100 grand to update it. Screw that!

Sorry Lucy but the only option is to wait for the real crash that is coming sometime in the next 24 months and then to wait the three years before everything calms down. Why do you want to buy anyway? Unless you are trying to establish a home for children to grow up in and have a sense of security there is no reason to commit yourself to a depreciating asset.

I’m far from convinced of the inevitability of a SCV crash. Incomes are high here. Tech firms are hiring. I think you need to see a tech crash before any SCV housing crashes hit. Since we already had a recent dot.com crash, it seems unlikely that the sector is ripe for over exuberance.

Some parts of the industry (read: Intel, HP, desktop manufacturers) are ripe for disruption from the bottom. However, we also have new tech like Google, Apple and Facebook here who can likely pick up the pieces and many of the desktop manufacturers are not in SCV.

Ian,

Are you sure that Santa Clarita Valley has a lot of tech? I agree that Santa Clara County (aka San Jose) has a lot of tech. I thought the Santa Clarita Valley was a bedroom community next to Magic Mountain. I am not aware of “a lot of tech†out there.

Ian – I too would be skeptical of anyone saying to wait for the “real crash”. Where I live (east coast) we had homes selling like hot potatoes/hot cakes back in 2009. People on my blog said to wait for the real crash because my area had only fallen 10%.

Well, its now 3 years later and prices have been rising ever since. They are now back at peak. All those who told me to wait for the “real crash” are long gone, except for one delusional guy who was also waiting for the “real crash” back in 1996.

Now, im not saying thats gonna happen here. I am however saying be skeptical and do your own research.

Heh. I’m not familiar with the Santa Clarita valley! I was talking about the San Jose area.

@Talia:

Let me take a wild guess. Hmmm. The only city which is still up, according to Case-Shiller is Washington D.C.. Give us a freaking break. What exactly would you expect to happen there with all the wild spending going on in the party town of the Feds? Sorry, but that crowd isn’t even on the same planet as everyone else, let alone the same Country.

Lucy,

Boy can I relate. We are non-loan contingent, and we can’t believe all these 3% bozos, paying list or getting into a bidding war, knowing darn well, when their down payment is gone, and they are underwater, they can live free until they can’t. I truly understand your frustration. The DOM on an overpriced nice home is 1/2 day sometimes. That’s insane. This isn’t 2005. I think the FHA howmuchamonth crowd (future walkaways) really don’t care about long term planning, they are gaming the system.

I am noticing one story homes are blowing out quicker. Anyone one else noticing the same trend? I find it hard to believe the baby boomers are waking up yet. Most people feel richer in a two-story. Any feedback would be interesting.

“I am noticing one story homes are blowing out quicker. Anyone one else noticing the same trend? I find it hard to believe the baby boomers are waking up yet. Most people feel richer in a two-story.”

single story home are more desirable especially for the elderly who can’t take walking upstairs all the time. What works are multi-story homes where there is at least one bedroom on the first floor, for mom or granny.

Do you really believe people are bidding on houses with the expectation of getting free rent after a loss of 3% down?! I just can’t step up to that level of cynicism. To begin with their credit rating will be trashed making it hard to even rent the next place after their inevitable eviction. Next, 3% of a house ain’t small potatoes! I’m sure it depends on the market, but you’d need at least 15 mo. of free rent to break even around here on that.

Lucy, I’m having the exact same problem in the Northern VA suburb of DC. It’s rare that I find something good in my price range. As soon as I do, it turns into a bidding war that I lose. So, this phenomenon is not unique to California.

The County Assessors are lothe to give back anything. I’m sure their mass appraisals are truely works de arte to the highest degree. Bubble, toil and trouble, witches brew, eyes of gnu, ear of cow and heart of pig. Oh the 110% of highest income retirement plans at 50 and all the other gotta haves for hte spendlingtons in elected office. It’s the same old addage, “I’ll give you all that I don’t have, Ha, It’s yours but I’ll give it away anyway…..don’t care if you’re illegal or not. here take some, now vote for me What, not a citizen, oh we’ll fix your voters card.”

You may not be able to actually cast a witches spell but you sure can run into a flight of fantasy – absolutely zero of what you claim on pensions, voting and illegals is connected to one iota of reality. I suggest you come down from your tower of rage plant your feet on the ground, open your eyes and begin to live in the factual world. You’ll feel a whole lot better and likely function better in quest to own real estate.

You can print a currency. And you can require that taxes be paid in that currency only. You can loan it to foolish people so they can bid against each other forcing up prices to a ridiculous level. It doesn’t mean you have created a viable economy. But it makes a great smokescreen for ‘legal’ money laundering if you are in charge. No expertise required.

And, in fact, if you believe in MMT, this is precisely what the government should do in the name of preserving market liquidity.

After growing up and living in Cali until I was 21, then leaving the state and living in the Pacific Northwest I realize what I was giving up to live in Cali. I was giving up high taxes, overpriced food, overpriced housing and giving up being in traffic. Don’t get me wrong, I still love to visit Cali and even have gone back to live for a year here and there – but I just can’t get my head around a 2500′ home in a good area for $1.25 to $1.5M in a “bad” market. Nuts! I’ll keep my 3500′ home on the golf course for $350K and call it good. I hope the markets get better in So Cal as it is sad to see a lot of my friends really taking it on their homes.

BizProdigy

I get the feeling you are a mid forties male who has never been with a beautiful woman or driven a sports car and that your main source of food is granola. People want to live in soc Cal because it is sunny year round, loaded with beautiful women and home to the most active nightlife outside of NYC. People live hear because this is where the best of the best are. Please enjoy the pacific northwest because we don’t want people like you here

Well I’m in Calif and I think we don’t want people like you here – that is people who slander others for things that are delusional (beautiful woman), meaningless (sports car) and demeaning (granola). Perhaps he is even a she but if not he may well have the love of a not beautiful but attractive in oh so many ways woman while you have only arrogance, stupidity and loneliness when you the party girl woman says sayanora to you. And don’t forget that every slur you made came entirely from your fetid little brain. If you use that brain you will realize that the American dream of happiness is not synonymous with “California”. The preceding is in no way intended to denigrate the state of California – LA traffic maybe but not California.

Hey Mo – Sure there are beautiful women in So. Cal, but so what? There are beautiful women everywhere. Are there more in So. Cal than in other places? I doubt it – maybe just more women with shorts on and shirts that show a lot of skin due to the hot weather. Just last night, I came upon this link by chance and thought I’d check it out – German farm girls who posed for a calender. There are some absolute babes in the calender! I always had the misconception that many German girls were “homely,” (German mother in army boots), but there are some real gems here, as well as some pretty shots of Bavaria. Maybe I just will move away from California – Bavaria here I come!

http://www.thelocal.de/gallery/culture/1319/

I hope you agree with me that the German girls are beautiful. And they tend to look more wholesome than many So. Cal blond girls you see running around (well maybe not the last girl). Pictures # 1,2,5,6 & 10 are especially nice, I think.

I know this was off the subject of housing, but who the hell wants to get taken to the cleaners by purchasing VASTLY OVERPICED housing right now, just to be close to hot chicks? The hot chicks are going to dump you like a hot potato (not a hot pancake) when all your money is going to a house payment and you can’t even afford to take them to the movies or buy them dinner!

Beautiful Women in Ca? Well, my husband and I have noticed women in So Ca are looking like land whales with tattoos, piercings, and muffin tops hanging out of their undersized clothing. I remember the 70’s in So Ca. We were much more put together, slender, and didn’t have such weird sh*t going on. I’m 54 and 93 lbs, and my neighbors are in their 30’s, all land whales that dress like garage cleaners. It’s not an age thing, it’s really a put together and statement of self thing. Youth is sexy, but not as a land whale. OK, rant off from a cougar. LOL

Overall, women have gotten out of the glamour mode. At any age, dressing like a lady is wonderful. (Pencil Skirts and Tight Sweaters – if you have the body!)

BizProdigy – I too am totally SICK & FED UP with housing prices in California. And I live here, in a coastal town which is expensive. You have to spend a minimun of $400K to buy a house – and that’s for a fixer-upper piece of DOG DOO. Many decent homes go for $600K or more (there are many $1 Million+ homes in the area. What’s sickening is that even homes that sell for $600K usually need a lot of work – many of the homes in this area are over 80 years old.

I know a couple who bought a brand new home in the housing bubble for $1.2 million! The homes in that neighborhood are now selling for about $675K. Talk about losing your shirt!

I am well positioned to buy a house now, BUT I REFUSE TO BUY NOW AND GET TOTALLY RIPPED OFF!!! I REFUSE. Some smaller town in California that are located inland are reasoably priced, but many areas are still insanely high.

$350k for a 3500 sq. ft. home on a golf course sounds nice. Maybe I’ll become your next door neighbor! And don’t listen to Mo – he’s just a dumb stooge (Curly, Larry, Mo).

Oh! I

I hear what you are all saying and obviously I was being sarcastic. I just can’t understand why someone doesn’t understand why a person would pay a lot more to live in los angeles than the pacific northwest. Isn’t it totally obvious! That is like asking why someone would pay more to live in San Diego than temecula. This bizprodigy person is an idiot

I am getting conflicting information on property assessments. First, I hear that distressed sales are not assessed at the actual sales price rather at a price that an assessor determines. Then, I hear that Prop 13 mandates that the house must be assessed at the actual sales price. Which is it? Anyone know?

Is it possible that *both* of those things are true? The problem with the second part is that your city or town sure as hell doesn’t want to have the true price reported. The realtors don’t. The other homeowners don’t. The only people who do are potential buyers and as long as they don’t organize, everyone will ignore the law.

I am not sure the number you referenced is correct. The way the property tax worked in CA is that tax is assessed based on the transaction price, not appraisal price. The transaction (sale price) is significantly lower today, and the property tax revenue from the counties should be a lot lower than before. So, I don’t believe your numbers above is correct. Its easier to bash everything housing. Remember when someone sells their house at the peak, they actually pocket the profit, and move on to something else. That profit will go back to economy one way or another. The banks are holding the bags with their loan books. That’s why a lot banks are gone now. Its easier to really blame the banks today, since they are the bad guys, but in CA, if you buy a million dollar property, and defaulted on your loan, you are the one to blame. 80 yo lady with 20K saving cannot buy a million dollar property no matter what.

The fact is, except for in “fortress areas”, “beach cities”, “top 1% school districts”… Homes are at worst even with rent now if you can buy one. And if you actually do the math on square footage and cost/benefit of having a yard/non-detached home vs. a smaller 2 bedroom apartment… Homes are FAR cheaper than rentals per month.

I think those that are buying now will be rewarded greatly in 10 years…. Maybe the reward will be greater if you wait until 2013… But I don’t think the person that bought Apple stock at $100 a share in 2008.. will be crying in the corner beside the person who bought Apple stock at $90 a share a few months later… Most likely they’ll both be celebrating with champagne together!

Not that I think anyone will make 8x their money in housing…. But I’m just saying if you can buy and hold now… You won’t be disappointed come 2020.

zzzzzzzzzzzzzzzzz

Makes sense to me. I bought AAPL at $117 and am quite happy I did!

Can’t say that I’m sure housing is going to explode in the future though. I’m more expecting it to keep up with inflation, ignoring holding costs.

Prices continue to fall and you recommend buying? Homeowners and RE agents are the only ones left thinking buying a home is a good idea.

By the way, the tax bill is sent out yearly, even you purchase the property today with purchase price 50% below the asking price, your tax bill will be the one from last year, with a supplemental bill reflecting the purchase price. Therefore, assessed value may be one year earlier than the real purchase price.

Is it true that banks are required to mark to market their assets (loans) on a monthly basis? If that is true, why is there such thing as “shadow inventory”, i.e. shouldn’t an underwater property be reflected as a write-down of the asset (expense on the income statement), which flows through as a reduction of the capital account on the balance sheet. Are we saying shadow inventory is NOT properly recorded as a write-down? If true, how can banks get away with this if they are properly audited and regulated?

Mark to market has been suspended. I am sure John CPA can tell you the FASB….

Oh yea, I forgot to mention that the banks you refer to most likely are loan servicers not direct owners of the loan. Most loans were sold to the GSE’s (Fanny and Freddie) or MBO’s. The banks do have some of their MBO’s on their B/S but I believe the Fed and US treasury have bought a large portion of them. It ain’t your grandfather’s bank any more…

Whoops!!! Replace MBO with MBS. I have management by objective on the brain… Sorry for the alphabet soup…

I have a secret fantasy that Fanny and Freddie will be getting fabulously rich in the decade to come as the toxic assets turn out to be not so toxic. I’m probably dreaming.

Sadly, since these are only pseudo-government entities, I fear our country would not actually benefit as a result.

So the problem with shadow inventory is Fanny and Freddie not marking to market? Or is still a problem with the remaining inventory that the banks hold not being market?

As to Fannie and Freddie loans being profitable in the long run, perhaps and doubtful, but right now they are asking for yet another taxpayer bailout!

Nobody marks to market as the title of this post suggests…

In the past I posted a question as to how much of the current shadow inventory is directly (GSE’s) or indirectly (MBS’s held by Fed and Treasury) in the control of the Federal government. Nobody responded to my question. This I believe is the missing variable to all of our discussions as to shadow inventory….

My residence was purchased in 1999. Prop 13 keeps the assessed value far below the market value.

Nevertheless, I have the benefit of about a 2% reduction in property taxes. It tooks like the county of LA is reducing everyones assessment slightly rather than reducing those whose assessment is above market value.

Add this to the pot:

http://www.zerohedge.com/news/school-children-rejoice-california-so-broke-it-will-shorten-school-year

Hey Doc, I was shocked to see that Kali has 11 of the top 20 cities in USA for foreclosure filings in Q1 2011. Wow. Ventura county also hits close to LA.

http://realestate.msn.com/article.aspx?cp-documentid=28364347

I have a bone to pick with the top most chart labeled “Assessed Value of all California Real Estate”. I believe your conclusion from that chart is faulty. As we all know assessments in California limited 2% per year by prop 13. Unless the property sells or there a substantial change to the property.

Therefore, the rise in that chart is showing a combination of: 1) property value inflation at sale.

2) inflated values from major remodels. (HELOC $$$)

and most importantly:

3) new construction coming into the system. One hundred new construction homes whether its instant ghetto or not is going to have a LOT higher value than raw scrub land. The number of units statewide is not flat, it is increasing.

That total value chart needs to be normalized the number of units assessed to figure out what is actually going on.

Hahah, check out this classic case of the baby boomer that has lived in a POS house for 40 years and never done any remodeling and now think they can get $599k for it because a REAL-TURD gave them fancy pictures…

http://www.redfin.com/homes-for-sale#!lat=34.00303666148051&long=-118.44649185599042&market=socal&max_price=3000000®ion_id=11203®ion_type=6&sf=1,2&time_on_market_range=7-&uipt=1&v=6&zoomLevel=13

I wouldn’t necessarily call it a POS, though that carpeting needs to go for sure. But that’s not what caught my eye about this. It was that the ad stated that this house:

“would have sold for hundreds of thousands more just a few years ago”

LOL

Yeah, at the height of the bubble maybe?

Who do they think they’re kidding?

Do they think their prospective buyers were born yesterday & nobody told them about the real estate calamity that’s been going on?

I have a solution for correctly assessing property tax. Its called don’t do it. Don’t tax property.

Agree. Don’t tax property. The property tax is the most destructive tax there is. It is brutally regressive, hitting unaffluent property owners much harder than affluent ones and has no relation to the level of service a property owner might get.

Granted that we MUST have taxes and that we must all pay the costs of the civic services and infrastructure we rely upon for our lives, and for the amenities such as libraries, parks, and other cultural facilities that make our cities desirable places to live and do business, there are better ways to tax and other, fairer ways to cover costs than this. How about higher fees for services and licensing, and for street parking, home trash collection, traffic tickets, and towing?

The property tax is not only very regressive (regressive hits poorer people harder, progressive taxes hit people in proportion to their ability to pay), but it encourages bad development and discourages improvements to the property, while making it impossible to really own your property. One of the core reasons to buy is housing security and being able to predict your housing costs. How can you do that when your city can raise your taxes every year with no limit on the amount?

Time to stop giving our local governments unlimited calls on our back pockets and our lives. I have personally seen four families here in the Chicago area rendered homeless by property taxes. Will it be cheaper to house them in government-subsidized housing that cost the taxpayers over $400K a unit to build (like one “affordable” housing complex here in town) than it would be to lower their taxes down to the level they could pay?

Leave a Reply