Reinventing Japan’s economic lost decades in the United States: Seven charts tracking the parallels between the lost decades in Japan and our approach to a first lost decade. Young adults moving back at home reflecting societal changes experienced in Japan.

Five years of falling home prices have caused societal shifts in the perception of housing. We need to remember that psychologically this is the first generation where a prolonged and severe crash in home values has occurred since the Great Depression. We are hard pressed to even use the Great Depression as an example since this crisis in housing has impacted virtually every American city from coast to coast. Japan is one decade ahead of us in a post-housing bubble economy. You have unique trends that are emerging in America where young adults are moving back home with the descriptive title of being called boomerang children. Japan has an apparently harsher term called “parasite single†for young adults that move back home and draw on parent resources. Yet the overall dynamic is troubling because it causes fractions between generations. Many older boomers are realizing their faux home equity and stock portfolios will not support lavish lifestyles while many of their children unable to find good paying jobs move back into the depreciating nest. As it turns out, the United States recession is starting to look like the lost decades of Japan in more ways than one.

The post bubble markets of Japan and the United States

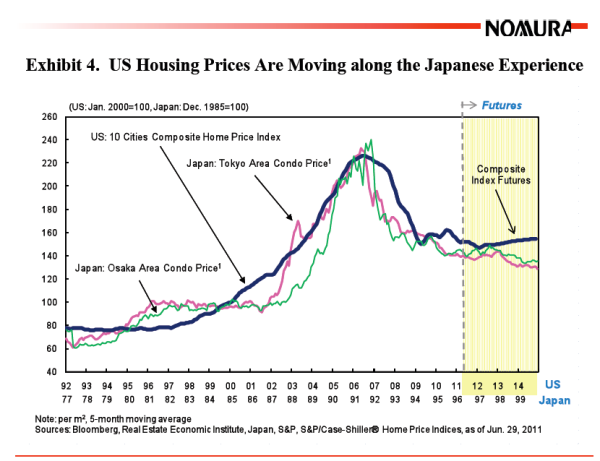

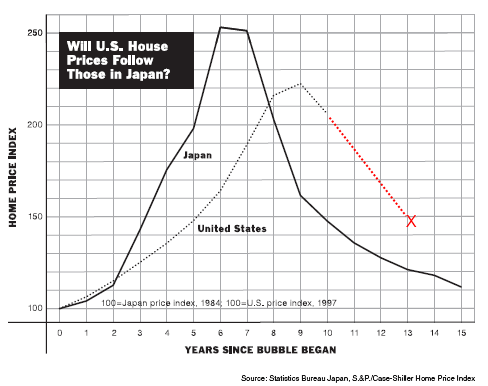

Japan had a tremendous bubble in real estate followed by a crash that is lingering to this day. If we overlap the trajectory of both real estate crashes we find a similar pattern:

Source:Â Richard Koo

Home values continue to fall in the United States and the Case-Shiller Index is reflecting a year-over-year fall yet again. Part of this push to lower prices stems from millions of properties in the shadow inventory combined with the desire for lower priced homes by young households and investors. Home prices in the U.S. are quickly approaching a lost decade in nominal terms. There is no doubt that we will have a lost decade but will home prices rebound anytime soon? The growing ranks of the part-time workforce bring similar parallels to the large part-time workforce in Japan. Is it any wonder why so many young Americans are moving back home?

The young come back to the home only to find lost equity

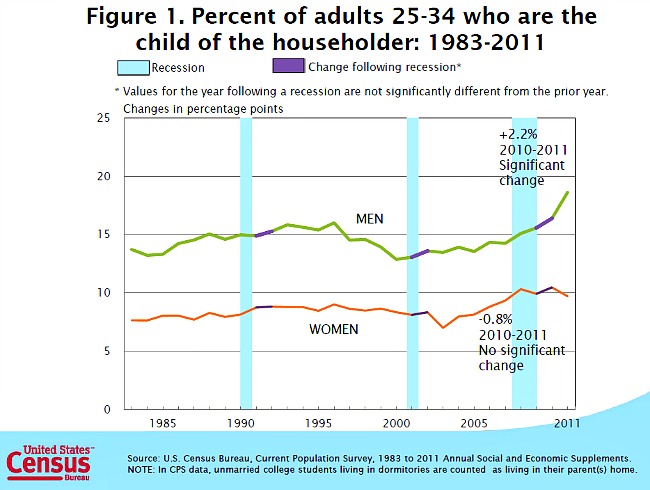

Census data shows a solid number of younger adults moving back home:

The above amounts to a few million young adults living at home that would otherwise be in independent households. A large part of this has to do with the recession and weak job market but also the reality that some areas still have inflated home values. It is hard to figure out exactly what each reason for this trend is but in Japan, you have some clear reasons for the move back home:

“As the unemployment rate soared in the 1990s, the number of unemployed went up sharply not only among middle-aged and older workers but among young people, as did the number of young people known as “freeters” who do not work as full-time employees but move from one part-time to another. The increase in these two groups was seen as the result of a change in attitudes toward work among young Japanese. Young adults who continue to live at home with their parents were labeled “parasite singles” and ridiculed as symbols of a weaking sense of self-reliance among Japanese youth, or a growing dependence on their parents. What lies behind the change in Japanese young people’s behavior, however, is not simply a change in the work ethic or a rise in dependence. Rather, these are the by-products of the confusion in the Japanese employment system, which is unable to deal adequately with the new age. Japanese companies still lack the flexibility to adjust employment, and this defect has manifested itself as a reduction in job opportunities for young people. Reduced to the status of social underdogs, Japanese young people have had no alternative but to become economically dependent on their parents.”

Of course we have similar issues hitting here in the U.S. where baby boomers often berate younger Americans that now have to navigate a debt infused education system that they never had to contend with. Japan also continues to deal with this problem:

“Contrary to the belief that parasite singles enjoy the vested right to live at their parents’ expense, the real parasites are the parents, the generation of middle-aged and older workers on whom society has conferred vested rights and who make their livelihood at the expense of young people.”

We also need to remember that Japan is more tolerant to multi-generational families simply because of cultural reasons. You have to wonder how well some of the baby boomers are going to deal with their young adult children moving back home and dealing with a more fluid workforce. That vision of the future doesn’t coincide with the advertisements of older aged Americans floating carefree in some Caribbean Island. Now we have to include an extra flotation device for an extra family member.

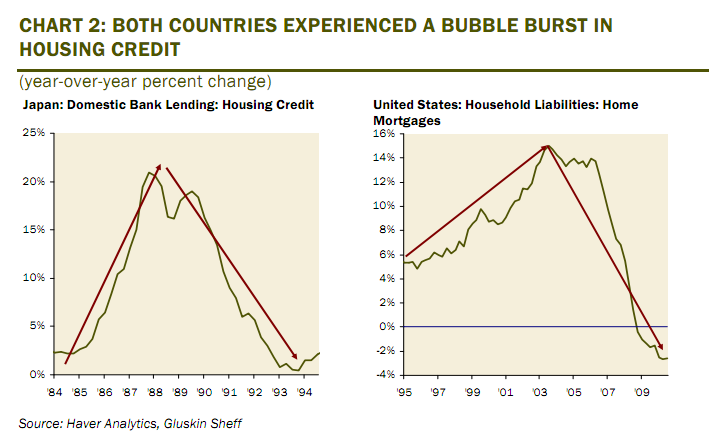

Japan and U.S. have mirror reflection in contraction in lending

Typically the U.S. has been resilient in bouncing back from recession and getting back to “normal†life. That normalcy is not going to come from this recession. The amount of debt floating in the global system is simply unsustainable. Europe is entering into a tipping point. Take an economy like Greece with a GDP of $300 billion or so and debts above $500 billion. There is absolutely no way this will ever be repaid and people are coming to this conclusion. Even Germany is facing struggles in the bond markets. This does not mean the U.S. is out of the woods, it just means the dominoes are starting to fall.

Take a look at the contraction in housing credit:

Source:Â Gluskin Sheff

Now this is fascinating because the contraction in home lending has followed very similar paths. Here in the U.S. even with lower mortgage rates the demand for housing is not really booming. Why? First, it has to do with the contraction in household income but also consumer confidence for the future. A home purchase is a big commitment and if many younger Americans are destined to free floating part-time work, then why many lock down to a location for 30 years? Things change over time and the visions once built into Levittown with fixtures of a community are probably not appropriate to the new generation.

A stagnant stock market

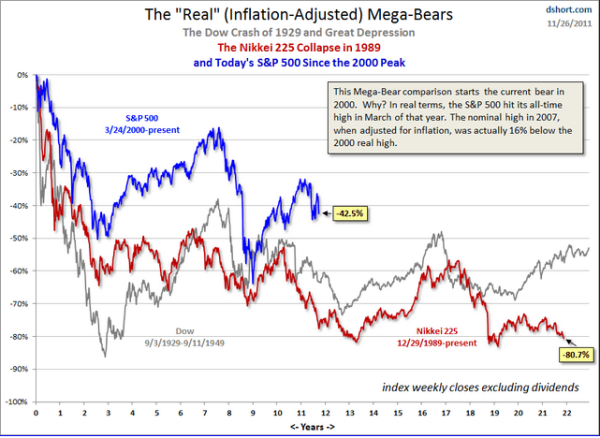

Japan and the U.S. have dealt with stock markets unable to reach previous peaks:

Source:Â Dshort.com

Japan’s Nikkei 225 is down 80 percent from the point reached 22 years ago! The S&P 500 is down 42 percent from the point reached 12 years ago. The perma-growth model of ever-rising home prices and DOW 30,000 are simply unsupportable based on the current economy. What many are starting to realize is that much of the entire global economy was built on debt that would never be repaid. This is the hard to digest reality that is hitting everyone.

These long slow stagnant growth futures are live lava flowing down to your home down the road. You know it is going to hit but it will take a long time before it arrives. Take a look at another chart of Japanese real estate values compared to U.S. home values:

There is an unmistakable similarity here. And keep in mind the growth of part-time work and low job security are also a new tradition here in the U.S. Now how is a young non-secure workforce going to soak up all that excess demand pushed out by retiring baby boomers? They may afford lower priced homes and we do see home sales doing well at the lower range. But the mega McMansion dreams of many homeowners were built on cozy economic trends that benefitted a generation born at the right time and at the right place.

The debt ceiling debacle and global debt issues

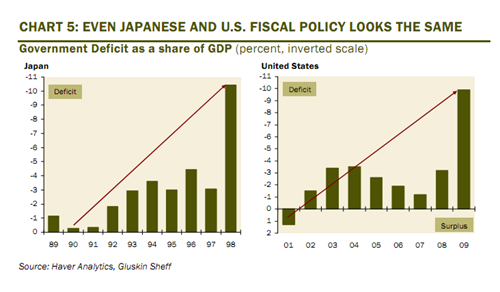

Each economy reaches a breaking point with debt. A few research papers seem to put this number at 10 percent of government debt to GDP before a tipping point is reached. Japan and the U.S. are already there:

Yet borrowing costs at both nations are at historic lows. Why? First, the ratios in Europe look much worse so you have a rush to safe haven nations. Yet this only means that reality is delayed for a few more years in these countries. Plus, you have the Federal Reserve following the same quantitative easing path followed by the Bank of Japan. Why are we to expect any different results here? I have seen a few articles point out that the low borrowing costs in the U.S. somehow reflect our healthy economy. This is absolutely not the case and is simply a reflection of the trillions of dollars put in by the Federal Reserve to keep borrowing costs artificially low and also the rush to a safe haven from the issues being faced in Europe.

The low inflation of Japan

It is fascinating to see the low inflation rate of Japan since their bubbles burst:

For over 20 years it looks like Japan has been battling a low level of deflation. We have had 5 years of falling home prices and over a decade of falling household incomes. It will definitely be an interesting future but Japan does offer some troubling parallels of what may lie ahead for us. The reality that home prices nationwide are falling year-over-year yet again reflects this trajectory.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “Reinventing Japan’s economic lost decades in the United States: Seven charts tracking the parallels between the lost decades in Japan and our approach to a first lost decade. Young adults moving back at home reflecting societal changes experienced in Japan.”

Hello Doc. thanks for the reality-check, I was starting to believe that the US was headed into hyperinflation but then I realize the folks who are espousing hyperinflation are also trying to sell me gold, silver or dehydrated food (‘doomsdayers’). The US following Japan seems logical rather than doomsday.

Dan, hyperinflation is not just really high inflation, but rather the collective loss in confidence in one’s currency. People exchange the currency as quickly as possible in an effort to purchase increasingly higher priced tangible property. We are nowhere close to a hyperinflationary breakdown, but don’t dismiss the goldbugs out of hand.

I look at deflation and hyperinflation as probabilities. And I always return to this quote:

“My friend, debt is the very essence of fiat. As debt defaults, fiat is destroyed. This is where all these deflationists get their direction. Not seeing that hyperinflation is the process of saving debt at all costs, even buying it outright for cash. Deflation is impossible in today’s dollar terms because policy will allow the printing of cash, if necessary, to cover every last bit of debt and dumping it on your front lawn! Worthless dollars, of course, but no deflation in dollar terms!”

Will they attempt to save all debt? Consumer, student, muni bonds, treasury bonds, foreign debt/bonds, pensions, unfunded liabilities (soc sec, medicaire,…), derivatives,…

Has there been any ‘will’ to reduce/balance budgets? Has there been any will to reduce or ELIMINATE the DEBT?

Anyway, this could go either way, but imagine how you’d feel if you had exchanged your paper money for gold and/or silver many years ago. I feel pretty darn good. 🙂 In a few years time, people will look back at $1700 gold and say, “that was cheap”, with or without hyperinflation.

No, sorry, I have to disagree. It can’t go either way. But it can go both. You need to get through the debt destruction first; then you’ll see inflation that few have seen before.

The known amount of derivatives is now over $700 Trillion. The amount which are hidden off balance sheet is unknown. Probably at least as much, but no one knows. When that collapses, then you’ll see the biggest margin call in human history.

One can well argue that they are “printing” up a storm in the derivatives market, with over $100 Trillion created this year. But we’re still not seeing hyperinflation.

With CDS’s no proving to be worthless, half of this House-of-Cards is on very shaky grounds. I’d hold on to your fiat for now. Gold and Silver are good long term bets for excess cash. But note well the “long term”. During margin calls, these do go down.

Of course it can go both ways. USA will experience and already is experiencing hyperinflationary depression. Food prices will continue to skyrocket and soon will take up a large portion of take home wages, wages and benefits continue to be slashed as health care costs continue to skyrocket, high unemployment continues, retail and mall vacancies are very high, and 50 million on food stamps and rapidly growing. Our cowardly leaders in Congress gave the Federal Reserve the green light to devalue our currency as fast as possible. John Williams of Shadowstats.com states that inflation is running at 10% in USA and soon we will hit hyperinflation.

@Questor,

I am confused on your “derivatives†statement. Is your definition of a derivative something like Wikipedia’s? “A derivative instrument is a contract between two parties that specifies conditions—in particular, dates and the resulting values of the underlying variables—under which payments, or payoffs, are to be made between the parties. The term “Derivative” indicates that it has no independent value, i.e. its value is entirely “derived” from the value of the underlying asset.â€

If this is your definition, then who are the two parties and what are the underlying assets?

I chuckled when I got to the end of this video…

Marc Faber Tells Fox Business…

.

What did he say about debt and unfunded liabilities?

@Matt:

We’re in agreement, that both will happen. I note that “Hyperinflationary Depression” is a vague term. There isn’t a good, accepted definition of the term “hyperinflation”, let alone the combination. Even the “faith in the currency” attempt by some is weak. It’s more an after-the-fact characteristic, rather than something which can be used predictively.

Something you say after you’ve been hit by a truck.

I disagree that we’re in Hyperinflation now; just a Depression (I.e. not in a Hyperinfationary Depression).

After the bad credit is gone, then we will most likely see the destruction of the dollar, given what Bernake has been doing.

But the main point is that it doesn’t look like it’s going to be just one or the other, as Tyrone was discussing.

@What?

Yes. Put more simply, a Derivative is simply a bet. That’s what it boils down to.

As for “who” and “what”, you’d have to ask the Bank for International Settlements, as they are the ones who keep track of the known bets, and are doing the reporting.

Daniel said, “The US following Japan seems logical rather than doomsday.”

Not likely. The defining feature of Japan’s (now two) lost decade(s) is the Japanese citizens’ resolve to buy Japanese govt. Treasury debt in sufficient quantity to make Japan self sufficient in this regard. Clearly the USA is not in the same league. That is what QE-1, QE-2, and now ‘Operation Twist’ are all about.

If we were to follow Japan, the American people would have to collectively stop going to spend their money during ‘Black Friday’ and instead buy USA Treasury bonds, currently yielding less than 2%. How do you think that would work out, lol? Not that it will ever happen.

Since the NASDAQ stock bubble burst, in March of 2000, the USA dollar has lost 85% of its buying power with respect to gold. Not hyper inflation, but getting pretty close. And the trend is accelerating, with the dollar weakening at a faster pace in the last year. Almost everyone agrees that the Euro is on the verge of implosion, and yet it buys 33% more than the greenback.

We are screwed and nobody is doing anything to make it better.

well ben bernanke saved us from the great depression.

Certainly appears that the zombies are slowly making their way here. I can’t see any reason to expect different results from similar actions. Of course, Japan’s manufacturing base, high education, diligent work ethic, trade surplus, mass transit systems, and high savings rate would seem to actually make things better there. Not sure why we are expecting a better result…

Because demographically we are nowhere near as top heavy as the Japaneese are.

I agree, this will play out just like Japan.

that is why i think most people should give up on the w side of los angeles. prices will keep going down

They see a neighborhood filled with middle income young families, they see the houses selling for ten times the average family income in the neighborhoods and they think that these young families are struggling to pay the bills.

What the people on this blog ignore is the family money. At least four of the people in my neighborhood who have purchased this year got the house as a gift from either the husband’s family or the wife’s family.

So the people on this blog visit a neighborhood and see people working in the same professions as them, making the same money as them and feel they deserve to live in the neighborhood too.

Bottom line, people on this blog don’t understand multi generational wealth. The people on this blog should throw in the towel on being able to buy in “the promised land” and move to a place they can afford.

I bet many of the folks on this blog desperate and hungry to own in the promised land could move to Boulder or Portland or some other really cool place and live happily ever after. But instead they keep banging their head against the wall, dreaming the impossible dream

Wejones,

Funny,and their parents are still losing money! I live in Pasadena and rent a townhouse which is cheaper then if I actually purchased one. A young couple just recently purchased a unit last summer. I doubt this couple could have afforded the home as one is a post doc in archaeology at UCLA and one works as a secretary at an architectural firm. So most likely parents bought the place or made a large downpayment for them.

Either way the place would go for less then what they paid for it and it’s not going to get any better. Month after month, I keep seeing more and more places go up for sale here. And with the exception of the weather in the summer, Pasadena and it’s surrounding communities (sans-North West Pasadena/Altadena)are much more desirable then West LA ( I Know I lived there)

For me, I can afford to buy, just refuse to pay ridiculous amounts of money for run down junk. Still cheaper to rent.

Generational Wealth does not equal financial smarts.

I do get what you are saying but the fact is that there is plenty of what should be middle income housing (priced as upper-end) being lived in by what are middle income families. Certainly a few houses will move due to buyers flush with multi-generational cash but the reality is that for all intents and purposes these areas are effectively frozen on real price as they can’t support many transactions or a full market.

IMBALANCE = # of MIDDLE INCOME HOUSES PRICED AT HIGH END INCOME LEVELS > # of FAMILIES WITH HIGH END INCOMES OR MULTI-GENERATIONAL WEALTH

If even 20-30% of that middle income population had to rebuy their current house at market or simply support market level mortgage and taxes, they would explode and default, instantly providing real price discovery (currently being thwarted by shadow inventory management, prop 13, government intervention, and hope). The reality is that this is going to take time as people still have in their heads that ‘good areas never go down’. You just can’t maintain this kind of fundamental dislocation forever and the reality is that truly wealthy people want to live in truly wealthy areas (also consider a lot of CA wealth is built on real estate). Sure they’ll help out their kids but take a look around, by definition wealth is an exception not a median.

@wejones – are you the artist formerly known as weji? I suspect you didn’t mean it to read as such but it sounds like you’re suggesting middle class folks don’t know their place.

@Wejones, way to stereotype and generalize, but since you refrained from using the words “you people”, I guess it can slide. You’re right multi-generational wealth is such a complex and intricate topic most of us wouldn’t understand it. Oh wait, I actually learned in my early 20s not to count other people’s money or to assume that they are in the exact same boat I’m in so I should have what they have. And for the families who are lucky enough to have a family member gift them a house or give them a hefty downpayment, that’s fantastic for them, but that is not a reality for a majority of people. If you look at average income levels overall compared to average housing prices overall, in most SoCal cities things are still way out of whack.

Wejones, just because a few people in YOUR neighborhood got a gift house from mom and dad doesn’t mean that it is happening in EVERY neighborhood. Most people don’t have liquid 700K plus sitting around they can give to junior. There will always be exceptions to the rule, but this is far from common place. Many people will likely get help with a down payment from there parents, making monthly ends meet is up to them.

Say what you will, prices are still coming down. The westside is no exception!

wejones,

Are you the same person posting on westsideremeltdown about supposed family wealth buying up all the properties NOM? On those post you had claimed 9 people you met at a party bought with family money, now there is only 4? Didn’t some guy that actually live there call you out on your bs and you stop posting there?

I once almost purchased a property in Japan a few years ago. Interestingly, new properties there are now properly considered depreciating assets, and like new cars, they instantly lose some value when you purchase them.

When the US market is like that, it will be safe to buy again.

Perhaps. Looking at that chart of inflation, the numbers in Japan have been quite flat for quite some time. Housing prices are generally set by wages which should track with inflation. So if they’re flat and general housing prices track that flatness, new properties have some additional value in their newness and warranties, and that value should fade with time. With inflation constantly pushing everything up, this effect has probably not been as noticeable here.

The primary danger to why I might not entirely agree is that the situation may be a bit worse. If prices do not find support but people resign to pricing flatness, they would still be up for disappointment. It seems a common conception that prices would have to fall 50% from their peak but my my own projections lead me to believe that they need at least about a 70% slide to reach a point where a healthy market would be willing to fund buyers who are capable of affording the loans.

Despite a bubble pop, and prices sliding down 50% over a… lets say 10 year period… If you dont have a large down payment and are at the mercy of interest rates for much of the cost of the price of the mortgage, Buying after 5-6 years on the downhil slide with the current interest rates at below 4%, may save you more money if you are looking at staying in a house/property for at least 10-14 years. If you were to wait another 2-4 years, interest rates may bounce, going up 1% to possibly 4%. Even at 1%, there is a case for paying a little higher price for the property to take advantage of the interest rates. (If you model based off of Japan or Iceland Housing boom and crashes, the down slide did most of its slide in about 5 years, the following 5 years it fell 10-15% to wind up at price levels of 16 years earlier in the early stages of the bubble.) After the 10 year mark, property prices level off, and bounce along the bottom or increase at normal inflationary rates.

Another aspect to consider is the supply and demand component of the market.

With increasing foreclosures from ARM based loans, and people who are underwater and now have less money to pay their bills due to the economy, and the bank takes their house and tries to resell it, given that they already have large quantities of toxic properties on their books that they also need to sell, the median price at each property level could be affected based on the number of properties they need to get rid of/sell to qualified buyers who can pay their bills.

My personal opinion with the bank bailouts, and the economic stimulation that the government is providing is the same as kicking the can down the road. You’ll still have to pick it up, but you can pick it up a little later now.

The major point here is that unless you have enough money sitting in a bank to pay cash for a property, trying to wait for the market to fully bottom out is most likely not the smartest thing to do as you also need to take into consideration the the fluctuating interest rates. Missing out on a 30 year fixed loan at 3.75-4% interest is an opportunity that could impact the amount of house you can afford greatly, and some say there will be 10% slide from here, some say 30% slide in prices from here, and others say we are at the bottom. a 1% increase in the Mortgage rate based on you being able to afford a $1600 a month mortgage payment would buy you $40k less house.

That 10-30% premium you pay for a house now, you will save in the interest rate you can get now as it may not be this low when the market hits the projected bottom in another 3-5 years.

Land will appreciate s there is only a limited amount, but the value of the house on that land should depreciate much like any other property that you own. With renovations, you could increase the value a little here and there, but still, when comparing a new house built in the last year, versus a house built 22 years ago, the new house should be worth more than the older property if they have the same value for the land they are each on. Buying new, and buying used..

A house should not be used for investment purposes unless you are buying land, subdividing, and building new houses on it. It is not an assett, but a liability.

The Japanese situation is not the same as the US. Japan has an imploding population. The US is above replacement and when the economy cranks up you can expect a follow on boom in immigration – likely from China and Mexico.

Japan’s population is not “imploding.” When a country doesn’t have enough jobs for its population, or enough resources to support them “in the style to which they have become accustomed” that’s a good thing. That we have an increasing population for whom we don’t have jobs…..that’s a bad thing. Having a surplus of unemployed, ill educated people with a poor work ethic and a huge sense of entitlement is not a good thing for a society. We have to get over thinking an increasing population is a good thing. It isn’t.

baby boomers often berate younger Americans that now have to navigate a debt infused education system that they never had to contend with.

.

This article touches on the above point:

http://www.zerohedge.com/news/guest-post-comfortably-numb

I was dumbfounded at the rage directed towards mostly young people who haven’t even begun their working careers and have played no part in the destruction of our economic system underway for the last 30 years. The people making these statements are middle aged, middle class suburbanites. They seem to be just as livid as the OWS protestors, but their ire is being directed towards the only people who have taken a stand against Wall Street greed and Washington D.C. malfeasance. I’m left scratching my head trying to understand their animosity towards people drawing attention to the enormous debt based ponzi scheme that is our country, versus their silent acquiescence to the transfer of trillions in taxpayer dollars to the criminal bankers that have destroyed the worldwide financial system.

.

Watch that debt. Will it ever be repaid? If so, how?

(see my comment that should appear above)

The problem is that the OWS idiots are not taking a stand against Washington malfeasance – they are asking for more of the same from Washington while protesting Wall Street, Main Street, and everything else. They are captives of the DNC narrative that more government is the solution when the government is really the PROBLEM.

@JimAtLaw – That sounds horribly inaccurate. Our government hasn’t been doing it’s job. It’s suppose to be providing services to its citizens, protecting the disadvantaged from the elite, not providing a support system for the wealthy to steal table scraps from the poor like it has been my entire life. OWS has been pretty upfront. They know they’re being lied to, ripped off, and have not been educated well enough to comprehend and articulate how this continues to be accomplished. We can pepper spray them of our doorstep all you like but they’re not goin away until this gets resolved. They have nowhere else to go. They do have lots of energy and anger. We need to focus that on worthwhile endeavors lest we carreen towards ruin.

I think the term “idiot” is best reserved for those who would make sweeping generalizations intent on marginalizing and dismissing millions of fellow country men and women frustrated with inept/corrupt (best case/worst case) policies and institutions along some imaginary black/white party line – especially when they purport to be highly educated. In this case left and right have more in common than a myopic would think: http://southernmanblog.blogspot.com/2011/10/what-tea-party-and-ows-have-in-common.html.

Spoken like a true lawyer. If anyone could strengthen the credibility of OWS it would be criticism from the parasitic group held in near-equivalent esteem with Realtors and investment bankers…

@ Pasaden8r

that chart says it all, and shows why the tea party is so ignorant and why OWS is right.

he government is “owned, run and controlled” by the corporations – and tea-party and Jim at law can’t follow the equation that far… Lol.

Hey Jim, 10,000 lawyers at the bottom of the sea. Good beginning.

Though I obviously disagree with Jim’s take – i.e gross generalizations, etc. (above), many responders are guilty of the same. I am an attorney as well and think I’m a good guy. There are bad apples in EVERY profession, even yours – priest, doctor, coach, teacher, etc, etc. The point of my post was objectivity – give it a try, you might like it.

Wejones,

Funny that you mention Boulder. I consider prices high here, having moved from FL. I have rented since I moved here 3.5 years ago, to the disconcert of my significant other who views renting as a total waste and ownership as the only way to go if you can swing it (which I could with a mortgage).

In retrospect I do wish I had saved the rent, given that housing prices have been only up or down slightly year to year, yet I believe they could drop down from what I consider rather elevated levels.

So I wait, perhaps for a foreclosure, something at least 20 percent below market.

In the meantime I did buy a very cute house in FL that I renting at about break-even with a 75% mortgage. I bought it at about 1995 – 1998 pricing and it is much much nicer than anything I could have bought in Boulder for 1.5 to 2 times the price. Of course time will tell how much lower it might go in FL, but I am more comfortable with that purchase than anything I have seen around here.

I do wish I had the means to buy in CA, but figure I am close to retirement and could spend time there traveling from time to time. And may still look at more remote places still somewhat close to the ocean.

This American notion of “Entitlement” will be broken by economic reality.

Multi generational wealth for the wealthy…yes, for the middle class slug in Culver City, I don’t think so.

I was watching the segment on 60 min. about the huge number of homeless in central Florida and suddenly my rental wasn’t so bad.

Happy Thanksgiving

Remember when people thought the Japanese were going to buy all our property in the 80’s? Now it’s the Chinese. Next, Martians.

Your Martian call gave me a good laugh. I recall the “The Japanese are coming!” warning cry. What is next, after the Martian? Inhabitants from the exoplanets? LOL.

As Voltaire says in his Candide, we have to “make our garden grow”. Industry and the associated jobs is the way to go.

Read Rogoff’s latest book.

There are a lot of similarities between post bubble Japan and post bubble USA. One of most amazing similarities, not shown on the above charts, is the uncanny resemblance between the Japanese Nikkei stock index collapse and our very own NASDAQ index, which crashed in 2000.

However, there is one important difference. The USA is far more reliant of foreign purchases of treasury debt than Japan. Also, there is this oft repeated notion that Japan is ‘muddling through’. Not really. They are just kicking the can down the road to postpone ultimate failure of the Yen. The fact that the dollar and the Euro are significantly weaker means that Japan can kick the can down the road longer before the inevitable currency failure happens. For crying out loud, their debt to GDP is over 200%!!!!!!

None of this debt is ever going to be paid back. When that is acknowledged, that is when the monopoly money is put into the furnace because it is cheaper to burn than firewood.

” Plus, you have the Federal Reserve following the same quantitative easing path followed by the Bank of Japan”

Quantitative easing is a fancy term for theft. The Central Bank simply steals from savers and gifts it to banks. Other acts of thievery include ZIRP, TARP and various other back door bailouts and backstops. However QE is the largest and most blatantly illegal tax in global history.

As for your argument that America now is like Japan 20 years ago, well yes and no. Sure both nations suffered enormous property bubbles based on various ponzi schemes in their financial sectors. But the differences between the two are quite marked.

Japan is and was a homogeneous nation with a culture that places face and societal conformity before anything else. The Japanese people have suffered enormous privations during the past 2 decades. Hidden poverty, unemployment, despair. All borne with a lack of anything approaching social unrest let alone breakdown. Japanese people are also fanatical savers, with a large savings pool that their bankers could raid at will to keep themselves afloat. Japan suffered it’s deflationary bust during a time of global prosperity and growth. However bad the domestic economy they could always rely on their exporters.

To put it mildly none of the applies to the USA. A hopelessly broken, dysfunctional country which has a corrupt governing class who have promised hundreds of trillions in future benefits to their population that will never be paid. I expect America’s descent into a deflationary hole to be far more rapid, further a hyper inflationary event seems far more likely. As the American FSA demands their free em stuff, that cannot be provided. it’s politicians may well push the Fed to print and print and print some more. Hyperinflation is ALWAYS caused by political incompetence and corruption.

Glad we didn’t have kids! Also, both of our sets of parents have passed on, otherwise I’d be really worried right now.

Geez, we gotta pay for your retirement too?

Elaborate, please…troll!

I love your blog, usually agree with you, and did not buy a house 5 years ago because of you. Many thanks. But as a Boomer, I must say: I am really tired of being blamed WRONGLY for ruining every little thing. All of my contemporaries are taking care of aged parents and most of them have kids as well. I don’t know another American generation who had as much of a “sandwich” situation in history. It was our parents’ generation that got all the goodies — and practically for free. Plus they nearly invented the nuclear family and the long vacation-retirement. It all began to change for us. We didn’t change it. WWII changed it, really, and then it slowly crept back to how it was for everybody BUT that “greatest generation”. Only people live much longer now. So, Boomers have parents and kids in a way even the Japanese never knew. By the way, I am married to a Japanese and lived there for 10 years. Believe me, I can see it all in multiple dimensions. I suggest that Boomer bashers start doing the same. History well examined can serve you well.

No other generation had kids and parents?

No other generation had so many years of caretaking for both.

No. The Boomers are the problem. It’s not really their fault. It is their parents’ — they are the ones who caused the population bubble. The problem is the demographic bubble and the supply side strains it causes as the bubble advances though it’s course. It will only wind down when most Boomers are dead. I think many of the unfavorable stereotypes about Boomers (e.g. The “me” generation) might be the natural result of being forced to grow up and scrabble for existence with so many peers doing the same thing at the same time — to th extent that they might be true in small part. Economies work efficiently because we don’t all want the same things at the same time. With population bubbles, that is less so.

WSJ just reported that it’s cheaper to own than rent in 12 metro areas…

In fact — with the average price of a home $242,300 — it is now cheaper to own than rent in 12 metro areas including Atlanta, Chicago, Detroit, Las Vegas, Miami, Orlando and Phoenix.

Now of course Los Angeles and NYC are excluded… But there have been VERY few times in the past 30 years when it was cheaper to own than rent in Los Angeles or NYC.

California home prices have fallen further percentage wise than anywhere else in the united states. If home prices fell another 20-40% in California.. then they would have to fall by an equal amount in all the other metro areas. Otherwise you could live in the much more desired California weather/lifestyle for cheaper than in windy/cold Chicago…

Who really thinks it will be cheaper to live in Chicago than San Francisco/Los Angeles?

I have two words for you: Yobs (misspelling intended) & Taxes.

You are assuming a lot with the statement that housing in CA can only drop the same percentage as other states. One obvious issue is economic growth. An extreme example would be near the oil fields in North Dakota. Who in their right mind would want to live there? Well, folks who want jobs might move there. And it is my understanding that the housing boom is off the charts right now in areas of North Dakota.

The other issue is that generalizations almost always get us in trouble. I believe home prices increased percentage wise more in California, Florida, Nevada and Arizona than the US average from 2001 – 2007. I also believe that Nevada, Florida, Arizona and non- coastal California have fallen further percentage wise than the US average. I believe that coastal California areas are still in pre-2007 bubble if you look at a Zillow price chart. This could be justified if wealth/incomes have gone up in these areas as housing increased. I am not convinced that this is the case in coastal California. I believe that there are a lot of “pretendanaires†on the west side alongside a number of trust funders and this does skew the numbers, but I am not convinced that this is sustainable over the long term.

Article today from LAT on Kalifornia’s migration of people in and out of the State.

http://www.latimes.com/news/local/la-me-california-move-20111127,0,5338351.story?source=patrick.net

Yes basically noone is moving here anymore, not from other states, and not even across the border as much. Who is here? Those who were born here. Some might stay because they have financial advantages (inherited property, plus Prop 13). Some stay because they have family ties. Some probably stay because since they were born here it is where their parents house is to move back into!! 🙂 But it’s not a place that keeps people from other states, they come here and discover the quality of life is wanting (the weather is nice, but it’s far outweighted by the harsh economic situation – few jobs and yet everything costs a fortune).

DHB — “You have to wonder how well some of the baby boomers are going to deal with their young adult children moving back home and dealing with a more fluid workforce.”

In fact, as the retirement squeeze disproportionately slams Boomers, as it must, it will be the Boomers moving back in with their kids in a few years in order to cut living expenses. Hopefully, the kids will have found jobs by then. This seems likely. Because there will be realtively few workers per mouth to feed, the ability to do work will be at such a premium, that hopefully youth unemployment will not be a problem.

Who wants to live in North Dakota. Nobody but the desperate. Los Angeles is overpriced & has problems but whatever people say here it is still a desirable place to live. Life is short. You can worry about the pennies all you like but i can honestly say that homeownership has been a big plus despite the extra costs. Will i ever get my money back i can’t say but do i care – not really. My savings make no money, my investments are a roller coast ride but the house is where i live. I have followed this site for years but 18 months ago i bought. I didn’t think we were at the bottom when we bought but i needed to be out of apartment life & I don’t miss it. My costs have gone up compared to what i paid at the apartment but i wouldn’t be able to rent what i have now for any less than what i pay as a mortgage.

Yeah, I wonder if these posters have a clue what 30 below zero feels like. Also, have any of them ever worked in the oil fields?

Here’s all you need to know about work in the oil fields. At the end of your shift, you take your tools and put them in a bucket filled with diesel fuel to clean them. Then, you wash the crude oil off your hands with diesel fuel. Then you wash the diesel fuel off with soap and water.

One day, a new guy (new guys are called ‘worms’, lol) asked, “do we get paid if it rains”? I said, yes, we get paid if it rains. We also work in the rain. So you see, there is a logical reason why jobs are plentiful and housing is relatively cheap in North Dakota.

We Midwesterners also have a saying “40 below keeps out the riff raff.”

I live in Delaware, just south of Philadelphia. We have winter weather here, but it ain’t nothing like North Dakota.

I’m happy with my $78,000 row house and $650/year in property taxes. And no sales tax. =) I could have never owned a home in Los Angeles.

I love how some folks miss the point. The point that seems to be missed is that you cannot take the US average housing price and extrapolate to local bubble communities. What part of my “extreme example†did you not get? I do not remember posting that oil rig work in subzero temperature is great fun, hence the term “extreme exampleâ€. I was simply responding to “If home prices fell another 20-40% in California.. then they would have to fall by an equal amount in all the other metro areasâ€. I do not believe this is a valid statement for the simple reason that most people need to pay for their house with a job. Also most income is taxed and the higher the tax the less money one has available to pay for a house. I would hope that I could get some intelligent feedback if someone has a different point of view versus “I wonder if these posters have a clue what 30 below zero feels like†. You are kidding right?

I like how many die-hard Californians imply that the weather in other states is as bad as it is in North Dakota…and arguably worst of all, that living in a place that requires shoveling snow a couple of times a year is the absolute most awful thing that could ever happen to anyone.

Just keep telling yourselves that.

I’m also amused by the way people in LA act as if snow was some kind of natural disaster…I used to think that too. Born and raised in Culver City, but a few years ago I moved to the Midwest. Friends and family back home still can’t believe that I like it here — “But there’s snow!” they say. Yes, we got a little snow yesterday. But recently I bought a ranch-style duplex condo for $160,000. Three bed two bath, attached two-car garage, 1500 square feet, 20 years old and in great shape in a nice neighborhood. Takes me 10 minutes to get to work and I can get anywhere in town in less than 30. The air quality is excellent, which matters to me, since both my parents died of respiratory disease. Much more relaxed lifestyle, and I don’t feel that constant pressure to buy a better car and get botox and bleach my teeth. Never going back to LA. And the snow is beautiful.

I would love to see a housing price index adjusted for interest rates/credit market health. Imagine where prices would actually be based on such an index… holy sheep sh*t.

Leave a Reply