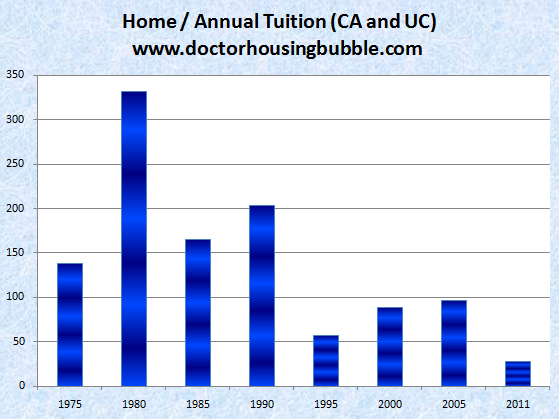

Canceling out a generation of future home buyers because of massive student debt – In 1980 a median priced home in California would purchase 330 years of a UC education. Today it is down to roughly 20 and student loan debt is creating a new class of indentured citizens.

The student debt bubble is going to have long lasting ramifications on the housing market and some fail to make the connection. It now seems that there are countless articles even in the mainstream press discussing the wallet crushing debt that college students are taking in pursuit of higher education. Yet there is little synergy or attempt to connect housing to this (the largest expense of most Americans). It can be taken as a given that college graduates at some point will be potential future home buyers. Yet in the interesting economy that we now live in you have the cost of housing getting cheaper and the cost of college soaring past inflation. This of course isn’t being spurred by wealthier families but the fact that student loan debt is now quickly approaching the $1 trillion mark. Here in California the two public university systems, the California State University (CSU) and University of California (UC) have raised tuitions since the budget crisis hit some five years ago. It would help to measure the cost of an education versus housing since both our heavily leveraged ventures.

The cost of going to college in housing terms

I went ahead and updated the latest California housing figures and also pulled tuition data for the UC going back to 1975. It is helpful to divide the cost of a home by the annual tuition at a UC to get a ratio of this expense:

This is an interesting perspective. The cost of an UC degree was cheapest in 1980 in relation to housing prices. For example, for the cost of the median home in California in 1980 you would have been able to purchase over 330 years of education at the UC. Today the cost of a median priced California home will only get you 22 years of college education.

Better yet, think of it in four year terms since this is the typical time frame for most college degrees. In 1980 the median household income was roughly $21,000 while total tuition for four years at a UC would cost you $1,200. In other words, the typical household with one year of income could pay for 17 degrees at the UC system.

Today the median household income is $60,000 yet four years at a UC will cost you roughly $48,000. In other words, the typical California family can now only afford one full degree when 30 years ago it would purchase 17. No matter how you slice it the cost of a college education has far outpaced the cost of housing and even household income.

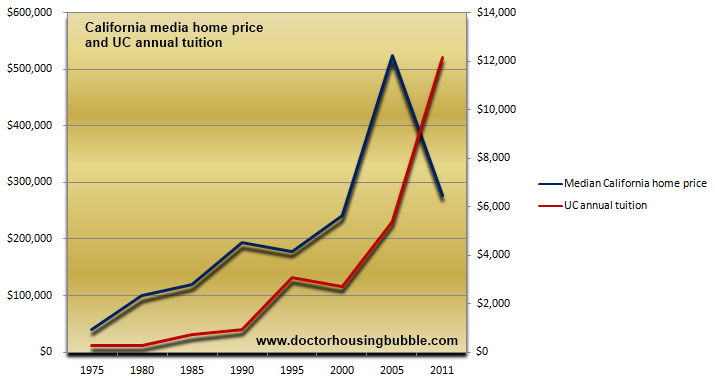

It might be useful to chart this out on a chart:

You’ll notice that housing and education largely tracked each other until 1995. At this point, housing surged higher while education declined for a period of five years. This suddenly changed in 2000. At this point the cost of tuition at a UC aligned with housing prices in the state and quickly made up for lost ground. From 2005 to 2010 tuition doubled. At the same time the cost of the median California home fell almost by half and is still treading lower. The cost of a UC education continues to move higher and higher.

Private schools the option?

Now even with this quick rise, the annual tuition for a UC degree is $12,000. You can compare this with the $40,000 to $50,000 charged by private institutions. This incredibly fast increase is causing many students to pause and wonder how much debt is too much debt? The issue at hand is that a college education still carries a blanket statement notion that all degrees are created equal. This mentality was highlighted during the housing bubble where even run down homes were selling for incredible prices just because people had the deeply held idea that home values only went up. This vision permeated every aspect of the housing market. The same is now going on with higher education where the cost of every degree is going up equally even though the return on investment is extremely different for various career paths.

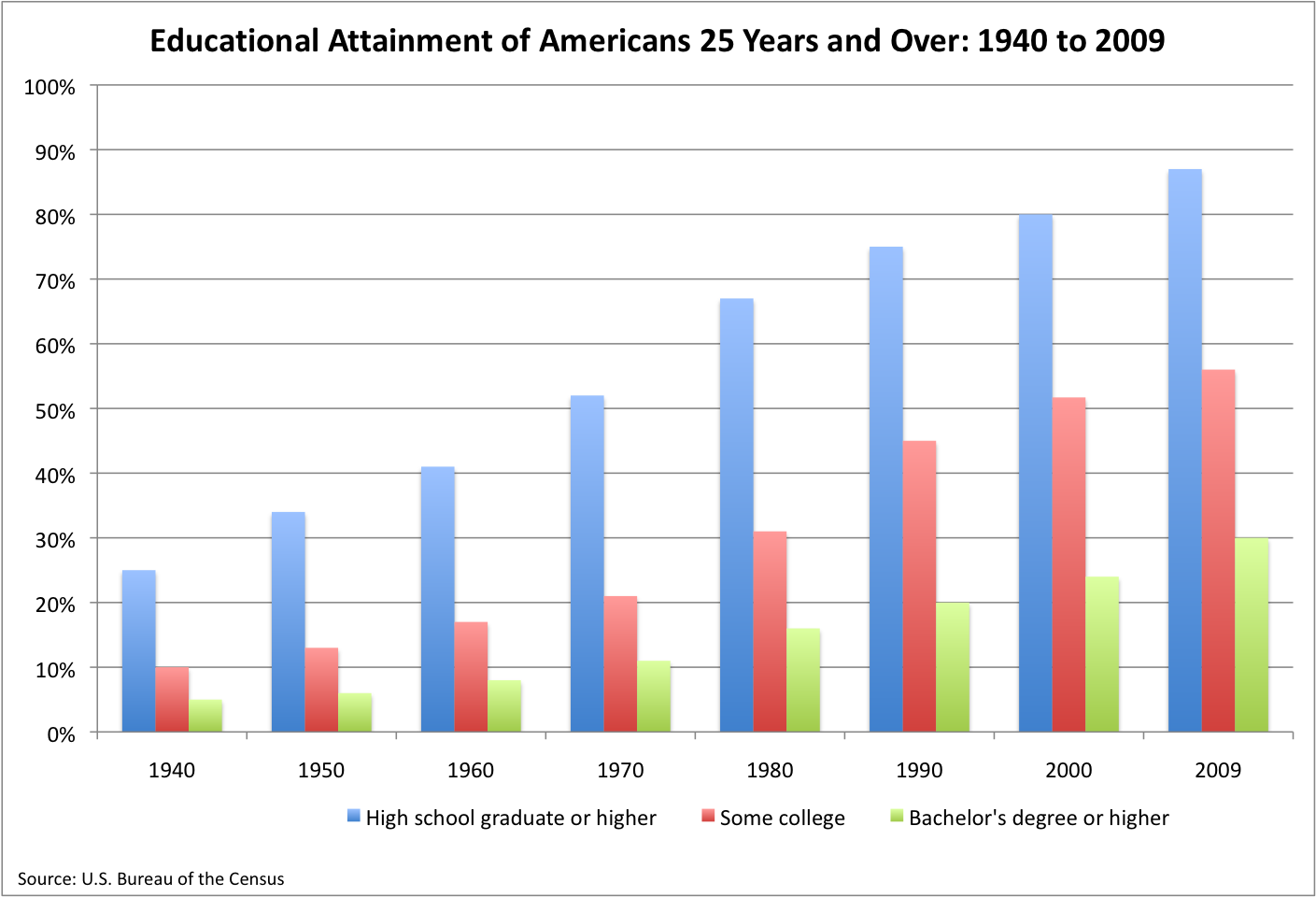

Not everyone will go to college and pursue a four year degree. In fact, most won’t. The official statistics have roughly 30 percent of Americans with a four year degree:

Source:Â Pope Center

This is good only in the sense that students are getting a solid college education. Recent data also has 10 percent of college students enrolled in for-profit institutions many that are largely one step above a paper mill. I can understand that people will point to college attainment as a sort of panacea for economic woes but just look at our current economic dilemma. It isn’t that college is bad; to the contrary an education is very important. I agree with Socrates that the true evil in the world is ignorance. Yet what use is it going into massive debt for a piece of paper from a fly by night subprime college operator?

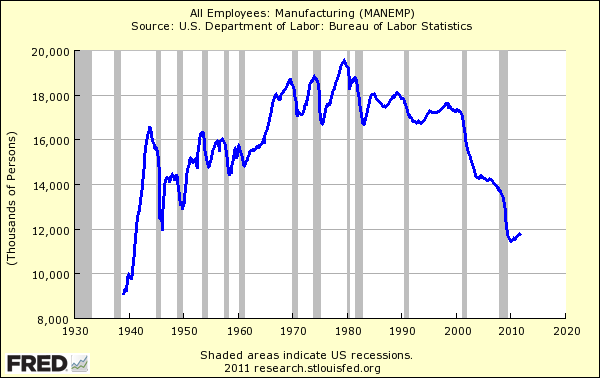

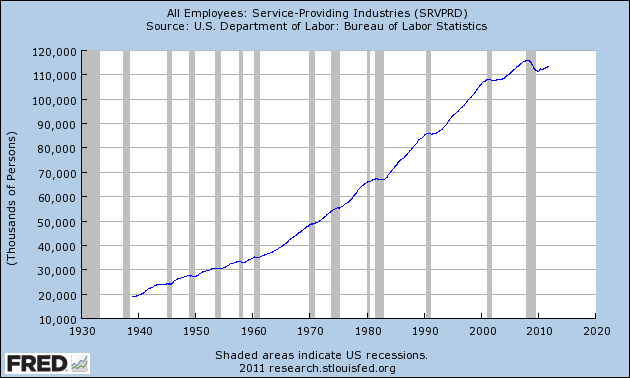

What I do believe is our major change is that many of our new jobs are dominated by the lower paying service sector fields. Jobs in engineering, the sciences, and information technology pay better but we need to produce more to meet market demand. A big change over the last generation is also the typical blue collar worker is going to struggle to buy any sort of home especially in high priced states like California. This is largely due to the major contraction occurring in manufacturing:

While these typically better paying jobs were leaving the nation we have kept on adding more and more service sector positions:

So while these major debt bubbles pop, people are starting to realize that more systematic assessments regarding housing and education need to be made. Just because the standard sticker price is $40,000 to $50,000 a year for a private university does not mean it is worth it. The same applies for housing. Just because someone is willing to lend you $500,000 for a depression built stucco box does not mean it is a solid investment. I’m surprised it took this long to realize but Occam’s razor may be applicable here; there usually is no free lunch and with debt, at some point it will need to be paid back.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

77 Responses to “Canceling out a generation of future home buyers because of massive student debt – In 1980 a median priced home in California would purchase 330 years of a UC education. Today it is down to roughly 20 and student loan debt is creating a new class of indentured citizens.”

Not only is student debt enormous, which is problem enough in itself, but much of it is for study and degrees in liberal arts subject areas which no longer offer much of a leg up in getting a well paying job. Unemployment among engineers is running under 3% nationwide, but, of course, majoring in engineering takes some actual effort and typically results in somewhat lower GPA’s than sleeping one’s way through 4 years of history or poly sci. So, what to do ?? Go on to graduate school and get a law degree or an MBA, both of which now have higher unemployment rates than engineers, not to mention an additional hundred thousand bucks or more to pay for the ‘credential’. The icing on the educational cake is, of course, the recent nationalization (in the healthcare bill, of all places!) of the student loan system and Obama’s recent announcement of a plan to let student debtors pay on their loans for a while and then forgive the balance of the loan due. And to whom is this balance due ?? you and me, the taxpayer, lucky stiffs that we are!

I agree with you that, given the current cost of education, it only makes sense to get a degree if you are going to major in an area that offers high remuneration and stability. Engineering is one of those areas. However, I dislike the way you have characterized a liberal arts education as less strenuous and, by extension, less worthwhile. I think it is a tragedy that we live in an economic environment that has devalued these areas to such a degree that it does not make financial sense to pursue them. That doesn’t mean they have no value. It means our society no longer knows how to profit from them.

No, it means the graduates of these programs (on average) are not producing enough value or income to justify the expense of the degreee. The number of people seeking and obtaining these degrees has increased faster than demand. Liberal arts degrees can be quite demanding, or quite undemanding. Easy money for college has lowered the average quality of students seeking degrees. Schools responded by lowering standards. Math is rigorous and grading is rather objective. Most liberal arts programs can subjectively graded. Therefore, the influx of lower quality students was channeled into liberal arts programs were they could be passed along, and the quality of students and rigor of many liberal arts rograms sufferred as a result.

Do they import engineers via H1Bs? That is usually the answer if a field has that low unemployment. It is how they dealt with demand for computer workers back in the day (and still do). It is going on now as well in fields like accounting (they study U.S. accounting all over the world so they can do these jobs). If I was an engineer and experiencing a great job market I think I would keep my trap shut. I really wouldn’t want more and more people to get in the field and flood it (of course that would assume I had taken a *gasp* social science class like economics or two).

Maybe you haven’t noticed, but American Taxpayers aren’t paying for our debts–the rest of the world is in the form of exported inflation. Someday there may be a day of reckoning, but for now we can cook the books and keep the Ponzi scheme going.

I have student loans that total about 12k and I’m almost done with my Associates in Science. I am starting to wonder if it’s even worth it to continue with my Bach when I will be spending almost 12k a YEAR for a regular university.

My fiance has over 40k in student loans. When we went to sign up for a payment plan in the terms and conditions it said that if the loan wasn’t paid by 20 years we wouldn’t have to pay it. I paused and called them, they confirmed it. It’s money he borrowed and it is owed, we should pay it back. It’s good for the individual consumer but bad for the taxpayer which in turn is us anyway.

Well, if the loan was held for 20 years, the total amount repaid with interest would be more than the original loan amount. So the taxpayer would not lose.

I assume that the increase in tuition is due to decreased subsidies from the states, maybe also due to lost revenue from government contracts, although the former obviously doesn’t apply to private institutions. If not, then why raise the tuition so much? What costs do the schools have that have increased so fast? Professors’ salaries? Can’t be. Plain and simple greed? Sure, when you’re talking about the paper mills. But something doesn’t add up here. What am I missing?

yes, the professors salaries have been bid up, particularly in sciences, finance, tech., etc. some are the result of preventing them from leaving. also the school administrators salaries are astounding..they are 500k and up…if this trend doesnt stop, who can go to school anymore.

But colleges have also become more and more picky about who they will hire as a professor. It used to be possible to teach college with a masters degree in the subject. Now PhDs are required for everything but community college teachers and even they prefer a PhD. It’s just another barrier to entry scheme, which basically is how almost everyone protects their income nowdays in a war of all against all. Of course administration costs have been increasing as well.

@Paula:

It’s not that teaching costs have needed to go up. European Universities still manage to cost a reasonable level, similar to the costs from before the Credit Bubble in the U.S..

The problem is, again, with Debt and Credit in the U.S.. Yes, Colleges porked out on Credit, just like the homebuyers of 2006. Under the banner of “staying competitive” to attract students. Harvard almost went bankrupt because of this, and only survived because of a State bailout. This Debt theme should be familiar by now.

Colleges now have to service that Debt. Unfortunately, they also increased their costs, especially Administrator salaries and perks. Those are phenomenal, apparently even including second houses for at least some Chancellors. Among many other things that you almost never see in the Press.

Now, the only Credit available is that via Student Loans. While that lasts, the Colleges can keep their ridiculous expenses. But they can only raise Tuition so much. The limits are imposed now by the maximum amount of money they can extract via Students taking out loans.

This is nothing more than yet another Credit Bubble waiting to be popped. It will eventually happen, as with all bubbles. But don’t look for things getting back to sane levels until it does.

Administration. If you go down to your neighboring UC campus, you will find about 1000 full-time faculty, and about 500 extra part-time folk (who are paid miserably). This number hasn’t changed a whole lot.

What you will also find, however, is about 10,000 staff — that’s right, folks, about TEN TIMES as many administraiton and staff as there are teachers and researchers. And this numbers has exploded in the last ten years.

Or go down to your local public high school, for that matter. Twenty years ago you had 1500 students, a bunch of teachers, 1 principal, 1 assistant principal for discipline, 2 or 3 school secretaries, a few janitors, and some clerical people. Now you will find 4 or 5 assistant principals (all $120,000 a year jobs), plus a full-time school psychologist, and her assistant, some office managers and a platoon of secretaries, perhaps a diversity coordinator, ha ha, and a bunch of guidance staff. You’d be fortunate if as much as 50% of the staff at your local public high school actually teach in a classroom.

The same is true up and down the public payroll. We are being overwhelmed by drones.

I’m not sure what campus to which you are referring.

Where I work there are 1000 faculty (plus the part-timer student employees) and 4000 staff. Most of the staff are pretty smart and sharp people working actual functional tasks and paid similar to or less than the private sector (much more experienced and higher performing than the corporate Dilbert nightmare where I used to work).

There is, however, bloat at the self-serving management level, a proliferation of Assistant Vice Chancellors and Chief Whatever Officers making six figures, while our paychecks stagnate. Us working drones aren’t happy about it either.

Paula, what you are missing is the ever-increasing involvement by the federal government in the pricing of education by offering guaranteed student loans to anyone with a pulse, regardless of their field of study. Because anyone can get a large student loan guaranteed by the fedgov, aka the taxpayers, lenders are happy to lend knowing that student debt is not dischargeable in bankruptcy. In other words, the colleges and universities jack up the prices because the student loans are available, thanks to the government intervention and meddling in yet another place where it has no business being! As Ringo once said, “Everything the government touches turns to crap.”

The problem is people getting degrees in majors that don’t translate into jobs that pay enough to pay off the student loans. This demonstrates bad judgment on the part of the student in choosing that major. I would not hire somebody who demonstrated such bad judgment. Like everything else in life, according to Darwin, it is survival of the smartest. The smart ones get degrees in majors that pay well. It is good for the college industry to have the dummies get degrees in majors that are not marketable. It is a taking of resources from the dummies to the college industry(e.g. administrators and professors). The media plays their role in telling everybody that they must get a college degree(from any school) to live the good life.

Art major here, doing just fine…

Agreed…anything outside of the hard sciences, you can teach yourself. If you want a degree in the arts or soft sciences these days, that’s alright, too; however, you should probably look at it like a discretionary purchase rather than career fodder.

Three questions:

When did you graduate?

How much did you school cost?

How much debt did you have at graduation?

Sorry, I think you’re missing the point of what’s going on. What we’re seeing is the turning of critical institutions into trade schools. The places where people should be going to learn critical thinking skills are being trained as glorified janitors. And eventually those janitors will be outsourced, like most janitorial services are today.

A functioning Democracy requires a well educated public. The gutting of all Education today is the gutting of our Democratic Republic. And that, in my opinion, is the entire point of what is going on today.

What you want to hire is a drone. I prefer to hire people who can think.

Our colleges and universities are turining into trade schools because that is the quality of admissions due to all the available money that allows a vast swath of the population to attend college. The tragedy is that these students are not even taught a trade for all their time and expense. Instead they are processed through intelectual (liberal arts) majors that can be subjectively graded. Students are not capable of thinking at a higher order just because they go to college and receive a degree. The points is, many should be in actual trade schools learning to do something use and productive, not poetry, literature, 18th century French Existenlist art, queer studies, etc. The easy money makes it easy to study things you want to study, not things you need to learn. The vast majority of college students are simply wasting their time.

A case in point; my father. He does not have either a high school or college degree – but he does have a medical degree. In his day, obtaining a degree was not required to go to medical school. You simply needed some pre-requisite courses in math and science, pass a entrance exam and screening process by a medical school. In addition, there was no need to even have a medical degree in his state. But you did need to pass a rigorous medical practitioner’s exam. The school was a program to prepare you to pass this exam. Graduation and degree was not required.

The same process applied to law, where you only had to pass the state bar exam. No evidence of degree or education was required.

The result, my father entered medical school at age 18 and started a productive career at a much ealier age, saving a lot of time and money in the process. Now, people are wasting time in college, not learning useful skills, and starting productive careers much later in life but under a terrible and debilitating debt.

If only people did learn real trades, we woul dbe much better off.

@Jim: By your thesis, Europe should be far better off than the U.S.. For that’s exactly what they do, they take the best and shoot the rest by giving them a trade school education. The doors of Higher Education are only open to the elite, instead of the general public.

One look at Europe right now, or indeed its history, ought to disabuse you of the folly of promoting Trade School Education for the majority.

I follow you, I think. You mean like people obtaining JD’s, right? You know, get out of LAw School w 200K debt level and find that you can get $25 per hour doing sweatshop research in a basement in lower Manhattan.

Wake up and think like a Lawyer! This is NOT about worthless degrees. This is about the current global meltdown.

Exactly.

Wrong. People wasting less time and money in college, their own and the taxpayers, will increase the productivity and health of the economy.

Colleges and college student quality are debased today. Marginal students of various types do not belong in college. If anything schools are not only extracting money but also brainwashing, hardly the sort of “critical skills” and surprise geniuses some imagine. Spinning magic words does not make it so.

Having more money at an earlier age will enable people to buy homes and start families, averting or mitigating the demographic disaster of the future, fatal to the economy, that of low human capital of immigrants and dearth of productive workers from lack of children of our previous citizens.

Yeah, you can’t squeeze blood out of a turnip. I doubt the recent announcement by Obama will be the last attempt to liberalize student payment terms either. None the less, someone will pay, and that will further erode the balance sheet of the federal government.

Unfortunately, we are now at the point where everybody is saying, “what’s another trillion dollars”, lol. So I think student loan debt will be vaporized in one of two ways. Either it will be forgiven by legislation or executive action, or the demise of the dollar will inflate it away.

I wonder how much longer they can suppress interest rates. The fiscal position of the Federal Govt. keeps getting worse and worse, and forgiving student debt will just throw more gasoline on the fire. At some point, the fed is going to have to raise rates to contain inflation, at which point housing will take another swan dive.

Once upon a time us lemmings (including myself) actually thought that the bond market was so big the FED could not control long rates, at least that is what Economics 101 would have us believe.

Now that that theory has been blown out of the water, it is up to the market to prove that it has ultimate control of long rates and not the FED.

My best guess is the FED will not allow rates to rise until it sees the economy as strong enough to stand on its own two feet and that could be awhile.

At the end of the day, when you are old and no longer commercially viable, you had better have something a young person needs, wants, or doesn’t have. If you get that, then you understand reality.

wow. Just WOW.

Like…er…what, exactly? A fully operational Zeppelin?

Wow, whoopie, a zeppelin!

I see what Taxee is getting at….he/she is right in that once the perceived value of a person is considered nothing…i.e. a disposable employee… then the chances for meaningful employment are vastly diminished.

I know in my industry (IT) people are chasing after the latest technologies all the time just to stay afloat. Many of us have 20-30-40 years in the industry, carry a wealth of knowledge and yet, when we become unemployed due to budget cuts, we are nothing. Both too highly compensated and too old at the same time.

So, yes, Taxee is right in thinking what he/she does think. Our society is disposable and people are fodder. Its not nice to think that, but it IS what corporate America has become.

How can I buy a Credit Default Swap (“CDS”) on for profit student loan pools with only $100K? Would I need to be an institution? Too bad MF Global went BK. Maybe they would have taken the other side of the trade.

Please end the tired meme, fed to you by extremists and billionaires, that we get the wrong degrees..

I have a degree in (fill-in-the-blank) a worthless field, but the fact that I have the degree from a recognized school has put me ahead in every singe race for a job I entered. Afterof these four years of study, I’m not earning a living in the field I studied, but I’m doing pretty well.

A nation of MBAs is a dreadfully scary thought. That, and the devaluation of humans to the liability column, is largely what has brought us to our current economic situation.

I have one son studying math, and another science. These are graduates we need. They have jobs waiting and little debt. As opposed to the business majors who expect to graduate and have the world handed to them.

The student debt bubble, as well as the banking/housing bubble, were caused by one thing: the corporatization of everything – especially our elections and government. Remove that tax on us all, and these problems will largely go away.

The liberal arts teach people to think. I would not want to live in a world full of engineers and bankers either. Imagine a society lacking art, poetry, music, and the sciences…no thank you! Most of us who went into the arts did it because we had to, not because we wanted to get rich.

Sorry, but you cannot teach people to think. That’s like saying you can teach people to be smart or rational or to have common sense or good taste. Cognitive skills and basic discernment is one thing; abstract, critical thinking is quite another.

Meanwhile, what’s even more nauseating than the neocons and billionaires ridiculing liberal arts majors are the liberal arts majors themselves who believe having a BFA validates them as an artist or ensures some kind of eminence in their field. It doesn’t; it doesn’t place you any higher up the scrotum pole than the slob next door who eats drinks and sleeps the same subjects out of his own bent, sans mortar board or deckle-edge certificate. Not trying to rag on your arts degree, but frankly, it’s a luxury item.

My guess it that both you and Rhiannon graduated 20 plus years ago with little or no debt. I don’t think that the issue is that we should all be MBA’s versus art majors. I think the point is that it makes no sense to go into hundreds of thousands of dollars of debt to get a major that will not provide jobs that will allow you to pay off the debt. I am not clear why people keep missing this point. I remember people explaining to me during the dot.com bubble that EPS was no longer a good measure of stock valuation. I also remember people telling me during the housing bubble to by as much house as you can qualify for. Neither was good advice. I think the new mantra is education is always a good thing. I am not clear that this will pan out any better than the prior two.

BA in 1998, then on to grad school. Yes, things were much cheaper then, and I have never intended to buy real estate. I am now 47, happily childfree and debt free.

People in my generation and the ones before me worked their way through college, I never heard of college loans back in the 60’s, even 70’s. Kids now days are too lazy to hold summer jobs and work part time while going to college, or go to a local college and live at home. Instead they have to go in debt, go to a fancy expensive college, live on campus. Much blame is on the parents for allowing this.

I did college in the 1960’s too. Paid for it and received stiepends for excellence in accounting. Apples and lemons comparison. Today, college tuition is jacked way up rising as fast as il-health lack of care. Then there are jobs. In 1960’s there was something to do if you wanted to work, Defense industry etc. Now we got Wal-fart and the creep supervisors it hires. My oldest son worked there for a month. They nearly ruined his back and complained and intimidated him when he needed to take a shit. I would shit on the the store manager’s desk if I’d been working there.

A way out, forget the degree in B.S. and Masters in Masterbation. Get enough training to start a business or free lance and become employee employee of the month every month. One of the benefits of self employment.

A+ on the comedy!!!

The problem is this: College, even state universities, are so expensive that summer jobs and part-time work simply does not cover the costs. Not even close. If you know of summer jobs that pay the $12K that will cover just the fees (no books, no rent, no board) at a UC campus, I hope you will let us all know. The Dr. is right, and “kids are lazy these days” is wrong.

I got out of college roughly 5 years ago. I’ve got a BFA. I worked 2 jobs while going to school full time at a very competitive state school. I did come out of school a little in debt, and I pay those low monthly payments every month. Now I pay taxes, a lot more then I would have otherwise, and because of this everyone here benifits from it. Was my art degree worth it, yes, but I graduated with only $20,000 in debt which is very manageable. Do to the competitiveness of the state school I went to, I really learned how to draw, paint, and market my work very well. I now work in comercial art. Would an art degree be worth $100,000 in debt? Absolutely not. This field is too competitive for work, and getting work can be very difficult.

No One has ever associated the word Lazy with me, and a majority of students I graduated with (thousands of them) all were working just as hard as I was. Perhaps it is different in private schools, but I doubt it.

Heather, I can see that that BFA focused heavily on the artistic side of spelling and grammar as well…

I am just teasing you Heather.

I think there is a place in the world for anyone with a passion for their field. If you choose to go to school, then follow your dream; but realize that the cost might outweigh the benefit.

Student loans were around in the 1960’s. A key part of this mess started back then. You see, back then you could actually default on a Student loan. And that’s exactly what a small percentage (~1 %) did. Mostly people who studied to become Doctors and Lawyers, as those fields required more money than others.

So Congress (around 1967-1968 IIRC) changed the law so that these weren’t dischargeable via bankruptcy.

I have two Master’s and a BS, and paid all of it off myself… don’t see why taxpayers need to bail out those who take on debt they can’t pay off… another form of welfare, subsidizing lack of effort.

But do you have a Masters in B.S.?

MBA – rich people hire me to make them super-rich. I make an Ok living.

Worked and paid my own way through college. Some family that said I mooched off my parents (I guess they fed me) until I was 22. Now, they have Their 28 year olds still living with them, unemployed with old college degrees and a load of college debt.

Nice that parents are taking care of their adult kids – that is what family is all about. Perhaps the house will pass on to kids too, like in Europe. Get your family trusts in order, and funded!

If student loans start to be forgiven on a large scale it will be because the business community has determined that those dollars need to go to goods and services instead of loan payments.

I agree with Socrates also in that true evil is ignorance but our current social perspective of what an education is needs restructured. We have people graduating from college with no earning potential or skills but they have that degree, “education” and debt. Now what?

More vocational schools would be a start. The beginning of a strong building is its foundation. Monies, creativity, and new structure going into the first 12 grades of education seems to make more sense in helping individuals find their interests and true talents and how about teaching how to understand and handle money in those first 12 years!

Steve Jobs or Bill Gates did not finish college. “You do not go to college to get ideas”…….Helen Keller

Love reading this blog. Thank you!

It seems to me that we have become a nation that wants what it can’t afford. A house way beyond one’s means or a student loan that a degree will not provide you with the income to pay back.

Our choices always have consequences. Thank you Dr. Housing Bubble for reminding us of the consequences of our collective choices. It is hard not to see very hard times coming our way.

Without any fanfare, a robotic driver owned by Google has already logged well over 100,000 miles, in traffic, in San Francisco, without an accident. Well, a human driver did hit the robotic vehicle from behind, but nothing that was caused by the robotic car.

In the next two decades, the transportation industry can go completely robotic if they wish to, the same with construction and retail. They have only to crack the ‘vision problem’ and each year they get better and better. Robot drivers don’t drink and drive, do drugs, text message, they can be driving 24/7, so watch out all you taxi drivers, you’re days are numbered. And lawyers and doctors beware. You too are replaceable, especially you lawyers. And we’re not talking about the distant future either….

Think I’m kidding? How many of you knew about Watson before he was jeopardy? It seemed like it happened over night, now they are the smartest machines on the planet, but at some point we will all be surprised when they start taking the jobs in the Service sector. My recommendation? Learn to build robots before they are able to build themselves. Haha.

And no, I’m not Rod Serling, creating a yarn for TV. This is where mankind is heading. and if you think unemployment is high right now, wait till the elites replace us in all different industries and occupations with cheap, robotic-workers, coming to city or town near you. Bwhaahahahaha…..

You make the future sound very bright to me!! More time to surf !! Or we can go bass-ackwards like Oregon, and “save” gas-pumper jobs!!

I agree that more and more blue collar natured jobs will be replaced by automated systems, until all are replaced. This is actually a continuing theme ever since the industrial revolution.

But come on, replacing lawyers and doctors? Although they are pretty much like robots.

Also, Watson is just another engineering trick. It didn’t happen over night, and they of course avoided all vision related problems, which isn’t going to be solved for another century or forever. It’s so easy to say they got better and better each year using whatever “reasonable” metrics they defined. It’s just about research funding, especially defense related.

Similar things have been said since the invention of the spinning jenny. So sure maybe we will have self driving cars, I say great, then all those millions of people will be freed up to do other things. 100 years ago most people were employed clearing fields, chopping down trees with hand axes, animal husbandry and getting in the harvest. Machines have replaced the vast majority of those jobs, and a good thing to, hands up those who want to dig ditches for a living? I have no idea what human beings will be doing to make a living a hundred years from now, but they’ll be doing something.

7B people on the planet and all wanting the same things. Sorry, there’s gonna be a lot of problems that come from this. It’s the paradox of Productivity growth. We have more people than ever and we have less need for them than ever.

It’s a strange thought, but running out of easily gotten oil may actually create a need for all these people. But not in urban environments.

I spent a couple years at Santa Monica College, studying welding and machine shop when a teacher inspired me to get a degree in engineering. I did that while working full time and being in engineering school full time. a student loan never crossed my mind, albeit Cal State LA was about $150 per quarter in the mid 80’s. Then I realized in my senior year that I didnt want to be an engineer and my professors told me not to worry – many companies hire engineers in their sales and marketing departments. I took their advice and have done very well, as a people person with a degree in engineering… working as a sales engineer for many companies before starting my own company. I feel quite lucky that I was able to do all that without any loans. My heart goes out to college kids today but maybe some do what I did – work full time, go to school full time and a Cal State campus tuition is probably within reach without a loan. But no MBA for me (Mediocre But Arrogant 🙂

College debt can not be discharged in bankruptcy. College debt is with you for the rest of your life. With USA economically in by far the worst condition of all Western nations and the higher paying jobs being destroyed by anti-union corporations and local governments, I wonder if one can leave the USA, and move to Canada, Europe, or China, start a new life, get a good paying job, and escape the USA student debt? The Banksters and the Bankster servant politicans have destroyed the American dream and middle class and the future is dead for college graduates since 2008.

IMO two things were done to create the tuition bubble.

1) The debt was made non-dischargable in bankruptcy

2) Explicit government guarantees

All this made lending money to students for a college education risk free, at least as perceived by bankers.

All the old notions of risk pricing, actuarial assessments went out the window and debt was offered to anyone with a pulse and a desire to get that degree. You wanna study 18th century Japanese poetry? The rise of feminism in the 1960’s? The mating habits of the great spotted waddler toad (OK I made that up) well no problem, nice Mr. Banker will give you $50,000, just sign here.

And what happens when leverage is offered to all and sundry, tied to a particular asset class? (in this case a perceived asset in reality a consumer service) Why demand for that particular thing shoots to the moon. And what happens when demand jumps but supply remains static? Well if my old economics prof was right the supply demand curves will settle into a new equilibrium of a much higher price. Cheap credit ALWAYS leads to price inflation.

One fly in the ointment, because the old actuarial standards have been thrown out of the window, and hundreds of thousands of people have gotten loans they can never pay back or even service, cash flow into this debt pile will eventually dry up, in fact I think that’s already beginning.

What’s next? Well I imagine rampant price deflation, which is going to really suck for the colleges. And like all price deflation (which is a GOOD thing for most ordinary people) it will be fought tooth and nail by the elites with the old standbys of bailouts and government subsidy.

Let’s all get something straight here. Producing more engineers (or other such professions) to “meet demand” is an exercise in deception. The last trime my utility advertised an electrical engineering position, we received 110 resumes. What does that tell you??

Everyonre wants to stay real comforetable in their little worldview that students have borrowed tens of thousands of dollors for “worthless” career paths in while in college. Think again! This is not a recession of Sociology majors. This is a depression of all skill sets.

I am surprised that instead of having deflational pressures due to recession people keep talking about inflation over and over again. Where is inflation? We need inflation right now not deflation to counter balance sheet debt.

http://krugman.blogs.nytimes.com/2011/11/26/mysterious-europe/

http://krugman.blogs.nytimes.com/2010/10/25/sam-janet-and-fiscal-policy/

Government needs to subsidize education so that the poor can have a chance for higher education. All these foreign graduates get engineering degrees for pennies compared to American education. They are doing good with par with americans. So whey is American education so expensive?? Good facilities may be. But there should be second tier universities which charge way less like community colleges, so that higher education is available for more people. Subjects like math and based on mostly theory should not cost as much and should be cheaper than subjects that need more labs and research etc. Math, languages, etc should not cost much. Higher cost only keep more people away from education and illeterate masses and electorate.

It’s not that simple. There are cross-currents. Collapsing bubbles, currency destruction, China hoarding commodities, stocks stuck in multi-year trading range forcing extraction from the 401ks of the cattle, global debt unwinding. Technology coming down. Inflation numbers being understated. Most Americans too stupid to realize how bad their financial situation really is. Demographic consumption deterioration. It’s not like Econ 101 where you can put some scalar index on inflation.

Unless there is a nominal increase in wages, helicopter Ben can’t inflate away 200 Trillion in debt. There is no mathematical algorithm to fix this, particularly since we haven’t even begun to address the issue. If they stop the heroin now with all the derivatives, civilization will destabilize. This is not your grandfather’s depression.

Krugman is either a glorified fool or a shill for bankers, I suspect the latter.

Why is University education so expensive? Because of freely available credit given to people who in normal circumstances would never qualify. This has massively increased demand for college, allowing administrators to ramp up tuition fees. Why has credit become so widely available? Because of government intervention, changes to the legal code and explicit backstops.

You want to make college affordable again? Then get rid of the leverage. Krugman doesn’t want that, he wants EVEN MORE government intervention and even bigger backstops. Fortunately we’ve reached the end of the line, there is no more free cheese to dole out. Deflation should be hthe normal state of affairs, as productivity increases prices fall. It’s only through the actions of our self serving elites that inflation has been allowed to run rampant through manipulation of the credit money system. And it’s those self same elites who benefit enormously from that inflation as they get to use money before anyone else.

You’re right on one thing though, most people have no understanding of simple exponential principles, basic arithmetic a not so bright ten year old should understand. And by most people I include the POTUS and most politicians.

Actually education basically is ALREADY pretty affordable at the community colleges and Cal State schools (even UC isn’t that bad but it is getting there). The problem is classes are being cut back. I mean if you are looking at private school tuition and complaining it’s unaffordable without a scholarship, well of course it is.

Ahh, Paul Krugman. The guy who told Alan Greenspan that we needed a Housing bubble to offset the dot-com bust:

http://articles.businessinsider.com/2009-06-17/wall_street/30063851_1_interest-rates-housing-bubble-policy-makers

“Actually, Krugman Was A Huge Advocate Of The Housing Boom”

If you think we haven’t had price inflation in food prices, you must not be buying the food in your family.

Krugman is a nut. We need inflation like a hole in the head, all that does its devalue the currency and force those that are working to be even poorer by the end of the day. What we need is for Americans to buy AMERICAN MADE PRODUCTS = JOBS!

Without a stable manufacturing sector, of adequately priced goods, we will have no financial recovery. And no degree is going to fix the employement issues when there is no work.

I myself worked my way through college. I went part time at night to class, and worked full time during the day. It took me nearly 10 years to finish my degree because I got a technical degree (certificate) before I went to a local community college to finish my AAS. What I found was nearly all the universities and colleges at that time were geared towards the full-time day student who was going to complete the degree program in 4 years – working students were just not wanted.

What you have now is a 5 year degree, because you can’t get the upper level classes sometimes they offer them only one semester, so you are sometimes stuck with waiting another year to get the required credits. And the tuition has climbed an astounding amount in the last ten years so its not possible work and go to school and make you rent, utilities and whatever else you need even if you live modestly and live in a depressed area, like Ohio.

I graduated with no debt, but it was very hard getting there, I often felt like it was a game to get a piece of paper. Most of what I learned in college did not apply to the working world. I graduated in 1990.

check shadow stats .com for inflation, currently at 10%

Dr. H.

Retail comp sales up 7% – how much of that 7% could be due to people living free in their homes awaiting foreclosure.

How much due to higher number of occupants per household resulting in lower standard of housing, but higher discretionary spending.

The Occupy Wallstreet movement is not without cause–Manhattan is inflating education. I personally know four experienced Electrical Engineers that have been out of work for years. (One worked at Radio Shack and another at Staples). I only have stayed working because I can write software too. Education alone won’t guarantee a good job. Still, the kids think 400k for a house is normal and paying down loans is just part of the deal.

There is a race of beings in Manhattan that consider infidels (not a Muslim term, by the way) to be completely expendable. We are just cattle to them. It’s a game-they already have everything they want, they just toy with us to keep score.

No problem, we can all get high paying jobs as real estate agents and spend our days putting videos up on youtube:

http://www.youtube.com/watch?v=bSslVb3LPqU

Right?

I’ve addressed this situation in several ways to fix it.

Firstly, you should all agree that those part-time teachers are terribly overpaid. Full-time teachers are all part-time when you find out how much they really work over a 12-month period.

College is being over-emphasized. High schools are not doing a good enough job and I propose a streamlined approach to this on http://tlextras.blogspot.com and in my book “God Gave You a Brain; Use It!”

Here’s the bottom-line: Boycott colleges. Boycotting does work but rarely instituted these days. Think of the high salaries of sports players these days-if people grouped together and boycotted, you’d see their salaries fall. Companies need to be pressured to do their several hour to several week training to HIGH SCHOOL LEVEL persons to FULLY equip them in performing proficiently in their jobs. It does not take 4-6 years to count pills as a pharmacist, it does not take 4 years to figure out how to do accounts payable, nor does it take more than a few weeks training to even be a scientist if a very capable person bothered to provide all the relevant information without all the inefficient stuff that college pushes.

High college costs will do exactly what is seen in third-world countries: separate the rich from the poor even more.

College does not make one qualified – that’s up to the individual, yet today, with brainless personnel in human resource positions, they don’t want to take the effort to find out who’d make a great employee, but instead they rely on a flimsy paper certificate as if it really meant something, yet it does not.

Questor and others,

When there was a recession in 2001, the right thing to do was to cut the interest rates. Mr. Alan Greenspan continued to keeping interest rates low until 2005 or 6 until there was full blown housing bubble. It need not be like that. Krugman also talked about dangers of low interest rates for a long time from 2001 which was not necessary.

It does not matter how much money is printed by the Fed, if the prices are falling that is called deflation not inflation. In Japan, instead of all the excess paper money, prices are still falling, wages are falling, home prices are falling. Where is inflation? When prices fall it is deflation not inflation. A big hole is created due to falling home prices on the bank balance sheet, all the fed did is to fill that hole. Right now, there is no demand and people do not have money to make new investments. Corporates do not want to invest with no one to purchase. Where will new jobs come if there is no investments either by the Corporates or by the government????? We are going the Japan way of deflation and all this talk of inflation and hyperinflation is just not happening. It happens only on Fox news.

A hyperinflationary depression is when food and material prices skyrocket and wages collapse. Haven’t you read the papers, commodity prices are skyrocketing these past 11 years and much more so rapidly since 2008, due to the Federal Reserve massive relentless money printing.

http://krugman.blogs.nytimes.com/2011/10/07/commodity-prices-redux/

Where is hyperinflation??? Only food grains were going up due to ethanol production from corn and climate change issues and demand in developing countries. There is no hyperinflation in commodities. Commodities are highly volatile instruments and temporarily blip should not be used to create panic. One should look at long term atleast one year graph to see if there is any inflation. Clearly from the graph there is none. It only happens on Fox news, unreal hyperinflation.

This has been a fascinating discussion. Thank you, everyone who answered my question about why college costs have gone up so much so fast.

I have to agree with Mr. Blankenhorn to some degree (no pun intended). In these days where there is so much information presented so well outside of the educational system (see the Khan Academy, http://www.khanacademy.org/, for example), you don’t have to go to school in order to learn important and valuable skills. Sure, it helps to have some guidance from people who know what they’re doing, but there’s a lot a self-starter can do on his or her own. And even if the “brainless personnel in human resource positions” don’t recognize a qualified applicant when they see one, these self-starters can succeed–by going around hirers. It’s not easy to run your own business, but it can be done successfully, and I see no reason that bright, motivated people can’t build great businesses, either on their own or by collaborating.

I work for UC as one of those overpaid staff.

First, I just wanted to point out that tuition has increased largely as the result of drastically decreased state funding. (In the early 90’s, the state paid over 75% of the costs per student; they now pay less than half. On my campus, state funds account for less than 10% of the campus’ budget, with a bit more coming from student fees, and the vast majority coming from grant funding).

That said, I do believe that rampant loan availaiblity has enabled the state to cut funding, which has led to fee hikes.

http://budget.universityofcalifornia.edu/?page_id=5

Second, much is made of the 60k average household income and how kids from those families are shut out or end up with massive loans, but students from families earning under 80k adjusted gross income pay no fees or tuition to attend UC. zero. What really happens is the under 80k folks go for free, the wealthy families get an affordable education (as compared to private schools), and the rest in the middle class can’t afford to go and/or end up taking out a crapload of loans.

http://www.universityofcalifornia.edu/admissions/paying-for-uc/financial-aid/grants/blue-gold/index.html

I am a retired electrician. 250,000 home, current value, paid for. Everything I have is new and paid for with money in the bank. In my opinion an education is useless until applied. If when applied it produces nothing real or tangible it is still useless. Book larnin is great but it is hard to eat it. To many people think getting dirty and sweaty is for low life’s. I guess I am a low life and glad of it.

The student debt figures are worse than people realize. Bond traders sell these risk-free debts assuming a ~40% lifetime default rate, excluding the very real possibility of a Euro collapse:

http://online.wsj.com/article/SB10001424052970204224604577030562170562088.html

Of course they have an effect on the housing market. They’re only 5% or so of the national debt stock, but they have a disproportionate effect on the 75% of mortgages and the associated sectors of construction, etc.

Once again, public money has been used to build private fortunes for bankers, university administrators and trustees, and the government, who profits from defaulted loans just like the rest of this predatory pack.

These toxic debts are unpayable. They should be cancelled and there needs to be much more investment in public education in all levels. That’s a helluva lot cheaper solution that the current useless system of subsidizing the financial sector, with at least $16 trillion in secret loans since 2008, according to government reports. The country has fallen behind its rivals.

Leave a Reply