The 20 year Japanese bear market in real estate is making its way to the United States. Home prices in the U.S. are now in a double-dip and have gone back 8 years. Lower paying jobs, higher expenses, shadow inventory, and big government spending all align with a path of real estate malaise.

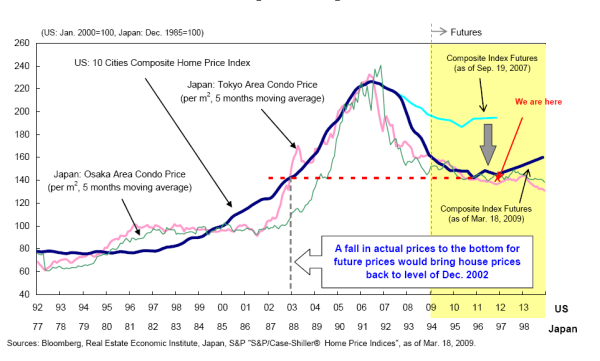

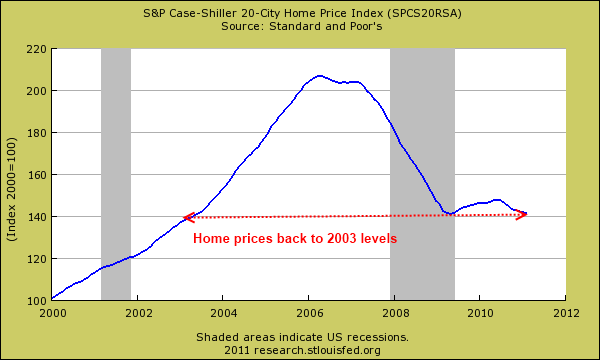

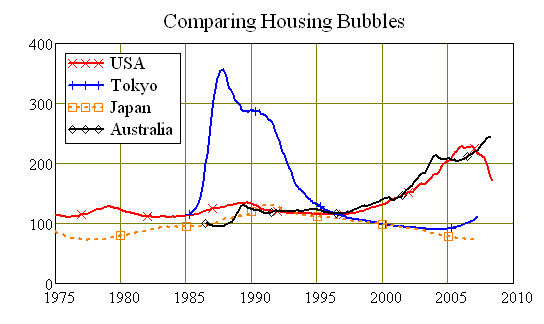

What if real estate prices remain the same for another decade? As I look at economic trends in our nation including the jobs we are adding, it is becoming more apparent that we may be entering a time when low wage jobs dominate and home prices remain sluggish for a decade moving forward. Why would this occur? No one has a crystal ball but looking at the Federal Reserve’s quantitative easing program, growth of lower paying jobs, baby boomers retiring, and the massive amount of excess housing inventory we start to see why Japan’s post-bubble real estate market is very likely to occur in the United States. It is probably useful to mention that the Case-Shiller 20 City Index has already hit the rewind button to 2003 and many metro areas have already surpassed the lost decade mark in prices. This is the aftermath of a bubble. Prices cannot go back to previous peaks because those summits never reflected an economic reality that was sustainable. A chart comparing both Japan and U.S. housing markets would be useful here.

Will the U.S. have 20 years of stagnant home prices?

Source:Â Pragmatic Capitalism

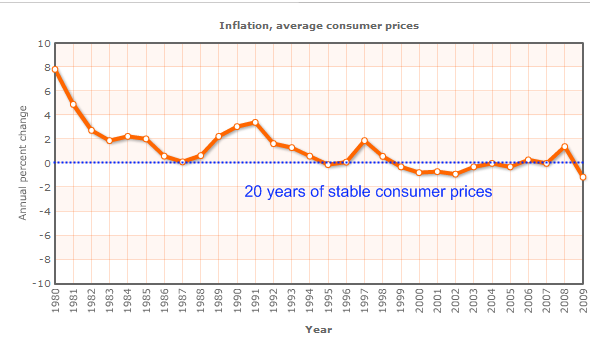

This chart does a simple comparison of Osaka condo and Tokyo condo prices which does not reflect the entirety of the Japanese housing market. Yet the path seems very similar. Large areas with a real estate frenzy that hit high peaks and have struggled ever since. In fact, if we look at nationwide prices we realize that Japan has seen a 20 year bear market in real estate:

Japan urban land prices are back to levels last seen in the 1980s. You have to ask if there are parallels to our current condition. The first point we all have to agree on is that both economies had extraordinarily large real estate bubbles. For the United States the answer to this assumption is a big yes. We can run off a check list of how our real estate markets run similarities:

-Massive real estate bubble (check)

-Central bank bailing out banks (check)

-Bailed out banks keep bad real estate loans on their books at inflated values (check)

-Government taking on higher and higher levels of debt relative to GDP (check)

-Employment situation stabilizes with less secure labor force (check)

-Home prices remain stagnant (check)

Now the similarities are closely aligned in terms of banking policy. Our Federal Reserve followed a more aggressive path than Japan in bailing out our large banks. Yet all this did was make the too big to fail even bigger and exacerbated underlying issues in our economy. Four full years into the crisis and we are still dealing with a massive amount of shadow inventory. Remember the initial days when the talk was about working through the backlog of properties in a clean and efficient manner? Whatever happened to that? Banks operate through balance sheet accounting and it has made more sense to pretend the shadow inventory has somehow maintained peak prices while chasing other financial bubbles in other sectors. Not a hard way to make money when you can borrow from the Fed for virtually zero percent.

Japan and U.S. see real estate as poor investments

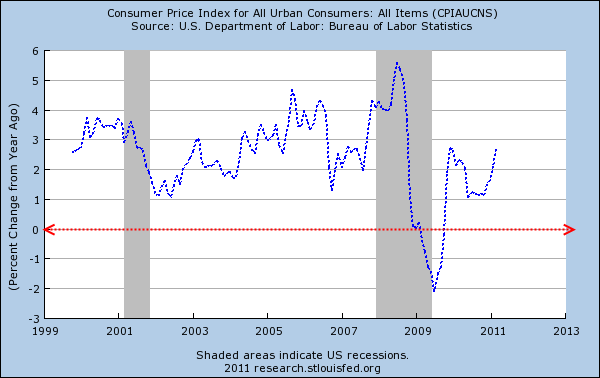

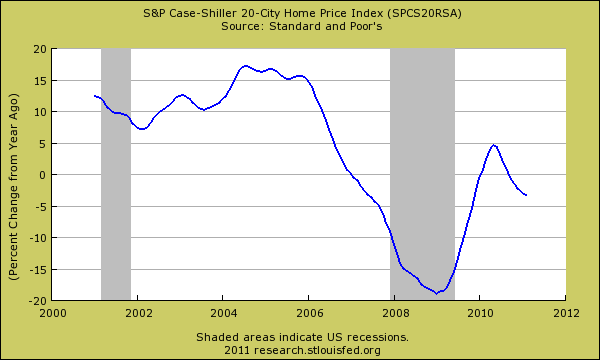

Our earlier assumption about the double-dip real estate recessions has now materialized through home price measures:

The above chart may not seem like a big deal to some but keep in mind the United States had never witnessed a year over year drop in nationwide home prices since the Great Depression. Not only has that been surpassed but home prices are now back to levels last seen 8 years ago. The lost decade is now nipping at our heels but what about two lost decades like Japan?

Source: Â Debt Watch Blog

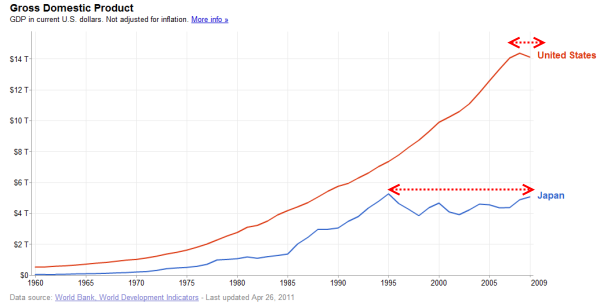

For some this may seem outrageous even to consider. The way I see it is that Japan was quickly catching up U.S. GDP in 1995 and many thought that it would at some point surpass our GDP. This was solidly the number two global economy for many years until China took that place last year. Yet the real estate bust has really been a drag on the economy for years moving forward:

Why has real estate been such a drag on the overall Japanese economy? First, Japan’s unemployment rate stabilized after these bubbles burst but it shifted to a large temporary or contract based employment economy. One third of Japanese workers operate under this new world. Relatively low security with employers and this has spiraled into lower income and money to finance home purchases. The fact that the U.S. has such a large number of part-time workers and many of the new jobs being added are coming in lower paying sectors signifies that our economy is not supportive of the reasons that gave us solid home prices for many decades. I think this is a key point many in the real estate industry fail to emphasize. How can home prices remain inflated if incomes are moving lower?

The question of affordability has always been at the center of this debate. Yet with government mortgages being the only option and banks now actually having to verify income Americans can only afford so much home when the gimmicks are removed like layers on an onion. This is why the double-dip is now fully here:

How much further will home prices fall? It can be that nationwide they fall only slightly more but in the end a lost decade is in the books. Two lost decades might be a real possibility given our demographic trends especially with baby boomers moving forward.

Massive inflation or stagnation moving forward?

One would think that with all the Bank of Japan bailout measures for the banks and government spending that inflation would run rampant in the Japanese economy. That was never the case:

Now it is clear that at least by the above reported data, Japanese inflation has been virtually non-existent for the good part of 20 years. How does this compare with the U.S.?

It is interesting to note that most of our inflation is coming from items ex-housing. As I have discussed the BLS does an interesting measure of home prices via the owner’s equivalent of rent. The reality is the above year over year changes in inflation in the U.S. are not coming from home prices.

Psychological aspects

Watching some of the global news I was seeing many young Japanese workers, some in their late 20s or early 30s, already resigned that they would never buy a home. They asked a young professional if he ever planned to buy a home and his response was (paraphrased):

“I don’t ever plan to buy. I saw my mother and father lose their marriage over trying to pay for the home payment for years. That was many of the big fights in our family. In the end we lost the home and I feel I lost my family. Why would I put pressure on myself for something like that?â€

The millions of people that have lost their home and will lose their home are probably in households with children in many cases. Some may be in college and looking to buy in ten years. The notion that housing is always a great investment runs counter to what they saw in their lives. Will they even want to buy as many baby boomers put their larger homes on the market to downsize? Will they clear out the shadow inventory glut? Now I’m not sure how things are in Japan but many of our young households here are now coming out with massive amounts of student loan debt.

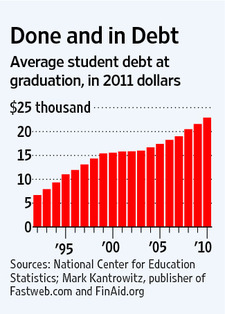

It was interesting to see the Wall Street Journal coming out recently with an article stating that the Class of 2011 will be the most indebted ever:

“(WSJ) The Class of 2011 will graduate this spring from America’s colleges and universities with a dubious distinction: the most indebted ever.

Even as the average U.S. household pares down its debts, the new degree-holders who represent the country’s best hope for future prosperity are headed in the opposite direction. With tuition rising at an annual rate of about 5% and cash-strapped parents less able to help, the mean student-debt burden at graduation will reach nearly $18,000 this year, estimates Mark Kantrowitz, publisher of student-aid websites Fastweb.com and FinAid.org. Together with loans parents take on to finance their children’s college educations — loans that the students often pay themselves – the estimate comes to about $22,900. That’s 8% more than last year and, in inflation-adjusted terms, 47% more than a decade ago.â€

Lower incomes, more debt, and less job security. What this translated to in Japan was stagnant home prices for 20 full years. We are nearing our 10 year bear market anniversary in real estate so another 10 is not impossible. What can change this? Higher median household incomes across the nation but at a time when gas costs $4 a gallon, grocery prices are increasing, college tuition is in a bubble, and the financial system operates with no reform and exploits the bubble of the day, it is hard to see why Americans would be pushing home prices higher.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

87 Responses to “The 20 year Japanese bear market in real estate is making its way to the United States. Home prices in the U.S. are now in a double-dip and have gone back 8 years. Lower paying jobs, higher expenses, shadow inventory, and big government spending all align with a path of real estate malaise.”

Employment levels have to highest correlation to home prices over the last 50 years. At 9% “official” unemployment, we are very far from a home price rally.

I’ve been to Japan several times, and I can personally attest to the fact that the people there have been demoralized by the last two decades. The sense of forward movement that was common in Japan two decades ago has been replaced by a sense of lowered expectations and insecurity. In the US, I remember this demoralization in the early 1990’s, with that weak economy and high crime levels. But then the late 1990’s boom time came and all that was forgotten, and even the early 2000’s recession and 9/11 couldn’t shake the optimism. But now, the sense that things are going downhill seems to be back in the US, especially among the middle class (the moneyed class is doing fine).

I live in San Diego and observed a very interesting phenomenon recently in the local real estate market. It looks like in early 2011, one or more banks sent out a small flood of properties on the market. And these properties sat there for a while and got a few price cuts as it became apparent that the demand was just not there. Eventually most of those properties have disappeared (presumably sold, or maybe delisted). And since then, NOTHING. I mean virtually NOTHING has hit the market recently. I assume that potential sellers and banks saw what happened and have decided not to shake loose any more shadow inventory.

Anyone know if my assumption is correct, or what’s going on?

I can attest to your observation on the tight inventory in San Diego.

It seems a lot of the otherwise sellers hold off selling and banks being very slow releasing REOs. They seem to think market will improve in San Diego in the next few months or later. Many of the ones on the market are so over priced they don’t go anywhere and price reductions are slow to come. There is definitely a stalemate between sellers and buyers in San Diego market.

The realtors are telling them to pull out and wait for a better market if they cannot lower price and there are now a massive number of people in this position. There is this enormous shadow market of negative equity homes that are not on the market because people want to try and ride out the negative equity positions.

When these folks come to the realization that we are taking another huge leg down in home price, the rush for the exits is going to be epic.

“$6.5 Trillion Lost, One House at a Time

Is anyone surprised that housing continues to slide?

American homeowners have lost $6.5 trillion in equity in those 57 months. Here is the data from the Fed Flow of Funds household balance sheet:

Homeowner’s equity:

2006: $12.8 trillion

2011: $6.3 trillion

Net decline: $6.5 trillion

It’s difficult to grasp such large numbers, so let’s look at some actual houses.

1. Recent sale: $820,000

Last sold 2007: $1.172 million

Nominal loss: $355,000

(does not include transaction costs or losses due to inflation)

Even if owner put down 30%, their equity was wiped out.

Nationally, prices have round-tripped to 2003, but that masks the reality that in many locales, prices have returned to 1998 or even lower. ”

http://www.oftwominds.com/blogmay11/6-trillion-lost5-11.html

Well, since wages on average haven’t increased since 1995-1996, why would anyone in their right mind expect long-term housing appreciation to continue?

Besides crackhead flippers and commission swilling real-tards that is…

I know at least 15 of my Qualcom colleagues including me have bought homes with in last 6 months. You can make the conclusion your self from this data.

Seeing that your command of the “Engrish” language is somewhat lacking*, I think I’ll keep my dollars in my pocket.

I would however, like to thank all the foreigners (Asians) for catching falling knives.

*”with in” should be within,

“your self” should be yourself,

you need to put “the” before “last six months”

learn to differentiate between “me” and “myself”

http://www.elearnenglishlanguage.com/difficulties/memyself.html

You work for Qualcomm yet you don’t know how to spell your own company’s name? Sure you do, buddy.

Perhaps Qualcomm, Google, Facebook, and Apple can hire the 44 million folks on food stamps so that they can all buy a house in La Jolla.

Yes, I know a bunch of people who have bought in the past year or so. Many are underwater, with housing double dipping and looking like it’s going to drop at least 10% this year. My bet is 10-20% over the next year, nationwide. I don’t know what that says about Qualcomm employees, but I hope you and your friends put at least 20% down.

Otherwise, it looks like you may be joining this sinking ship:

http://www.cnbc.com/id/42957613

“Homeowners Drowning in Negative Equity ”

Frontpage article on CNBC today. I couldn’t believe that a MSM publication would actually publish something negative from Zillow. Most of them aren’t.

And remember:

“Drowning in negative equity” = “drowning in debt.”

Millions of dueschbagz buy cars every year making payments on that depreciating asset, why not make house-payments on a depreciating asset as well?? The teacher asked what is the differrence between the 2? That’s what i say teach, WTF is the difference?

You and your “colleagues” have made a killing from your stock options, that why you’re buying. As would I, if I came into a wind fall…

Add to your list the air pocket created by easy money (leveraged liquidity) leaving the market and looking for easier targets say in commodities for instance or anywhere in the world.

Also add to the list ever increasing energy costs and lack of public transportation in most metropolitan areas (e.g. Kali), which will directly push people out of suburbs/exburbs and back into job/business centric cities.

Perhaps the only buying/flipping opportunities at present are buying pre-gentrification areas of inner cities, although with .gov support of the huddled and entrenched masses, that can be a real gamble…

Great write up Doc! I’m expecting this double dip to continue down down down. I get email updates from redfin on house sales in Laguna Niguel. Houses sold there have dropped dramatically this last month as hardly anything is selling there now. Sellers will have to drop their prices if they expect to sell.

Great essay Doctor Housing Bubble.

My Japanese friends would all say ditto!

thanks doctor. while i agree there is further downside in usa, i think japan has one extra headwind…….the horrible demographic problem. i think that has something to do with the duration of the japanese downturn as well.

Uh…I think the USofA has perhaps a worse “horrible demographic problem” than Japan, only exceeded by Europe.

1> Boomers retiring enmasse over the next ten years, looking to “cash-out” of the RE “investment” and downsize to modest levels

2> Huge pressure on domestic jobs due to 20 years of offshoring (wage arbitration anyone?), outsourcing (many stateside with H1B/L1 Visa treason), out-of-control immigration policies, hostile tax policies et al. — A smart person would want to be mobile, to chase business/employment opportunities, no tied to a boat anchor/deflating asset aka a home.

3> Run-away monetary creation that will create an inflationary environment for everything, including interest rates at some point, but will NOT translate to wages of business profit (see profit margin compression).

Of course, if you’re beneficiary of bailouts for banksters (money from nothin’, chicks for free), you’re probably looking for a place to put your ill-gotten gains and continue to profit from the stupidity of the sheeple, who at this point will mostly have to rent due to inability to obtain mortgages.

The demographic situation is only beginning to unfold…

Throw in ‘Loss of world reserve currency status for the US$’ and we’re in for an interesting next ten years.

I choose to keep a store of wealth in certain tangible assets until the dust settles… housing not being one of those tangible assets.

If we didn’t have food stamps, the Great Depression would look like peanuts, compared to the 40,000,000 now out of work. Get real folks. This RE market is getting worse and has yet to capitulate.

http://www.westsideremeltdown.blogspot.com

I am as double-dip as the next guy and think it will continue downward.

One BIG mistake you make is that Japan is at NEGATIVE population growth (0.1) and the US legal /counted/ seen growth rate is at 1.2.

I think you need to look at how the population is growing. Only 1 group is growing and if you look at the high school and college graduation rates of that group it spells real trouble for our future prosperity as a society. Hopefully at some point they assimilated into our culture, but if they continue with the culture they came from that doesn’t emphasize education then it will only increase our welfare state. These people aren’t going to buy a lot of homes if they can’t graduate from High School and in the end it will mean spend more money on prisons and there will be even less for housing. I’m also curious if they fiasco of the last 20 years has anything to do with why Japan’s birth rate has gotten so low. If you really feel that each generation is going to have to lower their standard of living and your kids would be worse off than you and your parents wouldn’t that impact your decision to have kids at all?

Agreed DG. The problem is that american “capitalism” has reduced education into a mere profit making machine. The Education costs (bubble) kept pace with home prices (bubble) but education prices have not fallen, and to rub salt in your wounds, all education loans are never, ever forgiven.

Add another nail into our society. Education isn’t to raise the cultural level of society, it’s ONLY to get a job. SAD. I suppose Taco Bell and MacDonalds should make prep “colleges” for thier future employees. That way they can work their “education” off and not receive wages. My good God, look at how enslaved we are as a people, yet we still vote against our own benefit. Sad. My $20,000 credit card that was used to try and stay in a over-priced home, I walked from, but if it was used to educate me, I would be bound forever. Anyone see a problem here?

With the way things are going you will have people celebrating murder as a good thing…oops, already there, sorry.

I was listening to a Real Estate Economist on Marketplace this AM 5/9/11. He forecasted stability in home prices within a year and possible upward momentum in two years. Where is this going to happen; Tulsa, OK; Williston, ND; or possibly Detroit, MI? I am not seeing that for the $500-$600K 1300SqFt shanties in OC.

They have been calling for that time-frame since 2008. I really wish there were some accountability with economists, politicians, etc that make these kinds of predictions. It seems to me that they are all trying to, intentionally or just incompetently, by grabbing straws out of thin air, boost the economy by touting nonsensical optimistic predictions to get people to spend and buy houses.

I foresee two rough scenarios, in both, someone who doesn’t really deserve it majorly gets screwed while those who do deserve to be screwed and then locked up, ride into the sunset to rob the world once more when all is forgotten.

Either, home prices will crater below prices long not seen because of an overabundance of housing that exceeded real demand for a decade and organic demand growth cannot absorb quickly enough. Which will lead to long running flat-ish home prices for many many years.

Or, passively intentional inflation through government policy, taxes and market skewing favorable tax structures, government subsidies, etc. will artificially pin housing prices to a new norm, screwing all those who saved and were responsible and all those who saved for retirement. Oh, and it will screw all the young people who will have to pay higher Social Security and Medicare and Medicaid taxes because Baby-boomers are going to be damned if they are going to have to pay the consequences of their failure.

Variables may include; immigration reform that further “grows” our economy through assimilation of ever more people who can make each piece of the pie ever more expensive and buy up the overabundance of housing; and tax and policy structures that are favorable to population growth by making children less costly and even financially rewarding, increasing costs of pregnancy prevention, etc.

We, in America, don’t like to solve problems (assuming we had the capacity to if we wanted); we prefer extending the due date of action by ways that exponentially increase the consequence in exchange for ever shorter extensions.

It’s the same as in personal finance; you know the person, the one that gets a payday-loan for the lapsing payments on homes and cars they can’t afford.

I think most of the grumbling bears in these woods would agree that the housing market will not correct in an efficient manner for many of the reasons Marc listed.

Taxes? Tea partiers won’t pay taxes, social security, medicare… or any other “big government program.” Tax breaks for corporations and the wealthiest equate to freedom and getting the government out of the little guy’s lives. At least that is what the ideologues are shouting.

“Patriot: the person who can holler the loudest without knowing what he is hollering about.â€

-Mark Twain

“Real Estate Economist”

“It is difficult to get a man to understand something when his salary depends on his not understanding it.” Upton Sinclair

Maybe we need to look deeper into economics and value. Does or will economies and values follow laws of physics and life science models like carrying capacities? Will values flat line like the number of life forms able to live in a given environment? It’s well understood that in nature, a given area will only support so many of a certain species.

Also, matter can neither be created or distroyed. Is the same true with wealth? Do we have a finite “pie” of wealth that moves from “family” to “family” over time? Let’s consider a given “life cycle” of family wealth. 2 to 3 generations work to build wealth. 2 to 3 generations maintain that wealth. 2 to 3 generations blow the family fortune…. in general. All of this happening when other “families” are building, some other “family” is blowing it.

Big picture folks. One data point does a trend not make….

The big picture is that the banskters convinced .gov to print money to reload the banks with the anticipation that wages would follow, thus supporting home prices.

It hasn’t materialized, and it won’t until the 30+ year bubble in housing prices is deflated and banks realize their losses.

Of course the meddling of artificial price support has only made matters worse…

http://online.wsj.com/article/SB10001424052748704810504576309532810406782.html?mod=WSJ_hp_LEFTTopStories

“Home values posted the largest decline in the first quarter since late 2008, prompting many economists to push back their estimates of when the housing market will hit a bottom.

Home values fell 3% in the first quarter from the previous quarter and 1.1% in March from the previous month, pushed down by an abundance of foreclosed homes on the market, according to data to be released Monday by real-estate website Zillow.com. Prices have now fallen for 57 consecutive months, according to Zillow.”

As John McClane would say, “Welcome to the party, pal”…

Dr.

Thanks for another fine article with excellent macro graphs.

The truth is California has been living off phony home equity gains for 40 years. Nothing was ever produced to create this money, Nothing. But, they all spent this counterfit cash into the economy like it was real. California has flourished under this scheme of ever increasing Real Estate prices, but the free ride is over. Now they’ll have to learn how to actually produce something to have prosperity.

Take the characters on Real Housewives of OC for example. The bimbos fiananced their fake boobs, spa trips and dining in expensive restaurants by working in industries like selling insurance, selling houses, selling import cars, and selling mortgages and mortgage insurance. I hope their ride is over and their boobs are sagging.

Your correct. Lump into the mix of policies coming out of Sacramento and DC. RE in California is in for another leg down starting this summer. Problem will be even worse if QE is halted by the Fed. Any upward trend in home prices may start happening in the 2015-2020 time frame. The toxic sludge that was the no mortgage down to minimal down is still in the system. As long as that is the case, kiss any correction goodbye.

The end game is upon us. With our aging demographic and continued employment loss, the US will have to maintain a policy of easy money and more QE. This will not bode well for real estate as employment is a key factor for paying a mortgage. The kids coming out of college arent finding good jobs and this will continue. So it’s monetary debasement with rising commodity costs. For as far as the eye can see.

One thing not mentioned that is rather importent is property taxes. In south Florida where I have been looking at condos & townhouses, property tax levies are at 2006/07 valuations. A condos tax bill should be around 2% MAX of an assessed value & most of the ones I’m seeing are 3% min & with maint it’s reaching nearly 10%.

Interestingly the cheepest units seme to have some of the hiest tax levies reaching 15%, but if you go up the price scale the tax levy either stays the same or in most cases drops to less than 1% or at worst 1.5% including maint.

What this means is the person who buys a cheep unit is most likely going to subsidise the purchaser of a more expensive unit by paying a higher percentage of their income in property taxes.

Why are government dependent institutions (i.e. too big to fails and Fannie/Freddie) allowed to just hold homes off the market? They should be required to liquidate REOs within 1 year of foreclosure or suffer some kind of bookkeeping penalty. The value is what the value is, they shouldn’t be allowed to sit on these indefinitely.

If a map were made composed of homes that are 9+ months post foreclosure that are still in the lender’s name and you played that map on a time lapse with black dots representing such homes, it would probably look like a cancer growing over the face of homeownership.

Like the Doctor, I think home prices are resetting to fundamentals. When you lose your equity suddenly you don’t care if prices fall another 30 to 40 percent. With this growing contingent of negative equity homeslaves approaching critical mass you may see the following solution arise to reset home prices so our economy can regain its stability as people will have more money available for other parts of their budget that is now being confiscated for the Too Big To Fails.

So here’s the revolution. We take what’s left of our 401k accounts and crappy CD rates and we create a new non-government mortgage fund called the Freedom Fund.

The Freedom Fund lends money at 95% LTV (yeah I said 95% LTV) to mortgagors under the following lending criteria:

1) 15 year fixed rate mortgages only

2) Full doc underwriting 32/38 debt ratios – you know; old school

3) Primary residence only

4) Terms 6.5% 15 year fully amortized

…and here’s the big one…

5) Ignore walkaways on the credit for those buried by the bankster fraud.

Let me give you number 5 again:

A Walkaway is Okay – A Walkaway is Okay – A Walkaway is Okay!

That chant would make the banksters crawl out on their windowsills.

You see, they’re trying to lock you into a plywood prison by giving you a low modified rate while keeping your balance high – that’s called indentured servitude. Like the Doc says you should always pick a low balance and a higher rate instead of a high balance at a lower rate.

Now think about it. The best borrowers are the ones who are solvent and haven’t defaulted regardless of their submergence and can’t get a short sale approved because they are financially solvent – they were just unfortunate enough to get caught up in the false market created by the banksters. They are the victims of a false market contrived by the banksters by mislabeling sub-junk loans as AAA and sticking them in low risk investment funds around the world. Why would you want to reward them for their fraud by being their slave?

As you may have noticed, HUD issued guidance to treat short sales as foreclosures in underwriting. Fannie and Freddie extend the wait to 7 years if you have a foreclosure. That’s how they are trying to keep you locked in that plywood prison.

Bankster.gov is doing all of the underwriting now and they say if you walk away and try to escape their chains you are going to be a dirty disgusting filthy untouchable renter at best.

The Freedom Fund turns the tables on the banksters by freeing their best slaves. Those slaves go from paying a $700,000 30 year 3% ($2,951.23) interest rate modified Slave Note to a $338,790 15 year 6.5% ($2,951.23) Freedom Loan.

The 5 percent down is not all that risky for fund investors because the quality of the borrowers is high and the fact that the Freedom Note would pay down to $294,557 by only the third year; while with the Slave Note, your balance is $654,809 by the third year. So with the Slave Note, after 3 years your balance has reduced by $45,190 or 6 percent while with the Freedom Note, even though the rate is over twice the Slave Note, it reduces its balance by $44,233 or 13% – yes 13 percent!

The conservative 15 year amortization schedule and 32/38 debt ratio underwriting prevent this loan fund from causing price spikes in the market because it holds down the amount the borrower can qualify for to about 3 times annual earnings.

What CD investor wouldn’t prefer a 5.5 to 6 percent yield over the nothing they get right now?

How much would the economy benefit by redirecting the interest earnings from the banksters to the retirees. The banksters have stolen their proper yield. This corrects that and helps float the economy.

I noticed there are a lot of real estate and lending professionals who comment on this blog. What is your take on the Freedom Fund as a tool of the revolution to cram the market manipulation hangover back down the throats of those who financed it via freeing their best mortgage slaves and resetting the market.

P.S. We would also have to hold pitchfork and torch rallies around the congressional offices to dissuade them from bailing these F’ers out while we smother them with their own misdeeds.

@The Painester

You have my vote. Sounds like a good sound plan for sustainability. This plan of yours could never work if you intended to steal the wealth of a nation under what ever prominent guise of the decade.

Why are government dependent institutions (i.e. too big to fails and Fannie/Freddie) allowed to just hold homes off the market?

Oh nonsense. That IS NOT HAPPENING – at least not in my 3 county area. This is a smaller area so I can track exactly when things are set for austion and how fast they show back up as REOs.

Now this state has a redemption period where the debtor gets to stay there after the foreclosure auction – 6 months if it is less than 5 acres and 12 months if more than 5 acres.

I can SHOW you the auction notices and the date these properties sold, the date the redemption period ended and when they came back on the market. And they are back on in 4 – 6 weeks after the redemption perdio ended and the lender got possession.

Every one that went to auction (and is less than 5 acres) more than 6 months ago is back on the market.

And these are REOs owned by Chase, BOA, Wells Fargo, regional banks (like PNC and Huntington, local banks and yes VA, FHA and Fannie and Freddie.

This ‘there is a conspiracy to create a shadow inventory’ nonsense is complete silliness and absurd. Some properties take longer to come back on once the lender gets possession beacuse (a) they have to make it presentable and/or (b) the sheer number coming back slowdown the process and/or (c) there may be title problems.

BTW, in this, the VA with its 0 downpayment loans has 1 (yep 1) REO, FHA with its 3 1/2% down had 1 (yep 1 REO), Freddie has 4 REOs and Fannie has 14. The other 50 or 60 REOs are the product of Wall St and securitization. Here it is NOT the government-backed 0 -3 1/2% down loans that are defaulting. Not is it the loans by the community banks – they have only 2 or 3 between the 3 -4 community banks here. What is defaulting are the loans written by the Big Banksters and sahdy otufits like OptionOne, Countrywide etc – most of which those lenders kept and a smaller number they peddled to Fannie/Freddie who are making them take them back.

When TBTFs are allowed to mark to market their securitized assets, they have little to no incentive to liquidate other non-performing assets on their books, including underwater mortgages, notes, etc. Banks are in no rush to offload inventory, as that would simply cause another panic out of their SIVs. And so long as FASB allows mark to model, they will continue to leak out shadow inventory. Sorry, but I don’t buy your premise on iota.

AnnS, your “tri-county area” is undoubtedly flyover/filler state crap. And that’s why the banks are quick to take it back and unload it as soon as possible, because it most likely didn’t run up significantly to begin with thus the losses won’t be steep (and most likely the bulk of these properties were already FHA/VA/FME/FRE backed or will be now). In prime areas the banks are looking at jumbo loan balances that they and they alone are on the hook for the losses – often to the tune of 6 or even 7 figures EACH.

So those are the homes they are holding on to, because these loans were originally jumbo and not government backed, many of these loans are on their own books still, and each one would result in a loss equal to 10 or 20 or more of your hillbilly three county area properties.

Yes Ann, I’m sure the banks are quick to put the mobile home/trailer on 5 acres on the market, given that the original mortgage of $10,000 or so is now only worth $8,000.

Saprtan117

It is NOT a ‘premise’ — it is the actual honest-to-god records in the Registrar of Deeds Office and the REO listings in this area.

“Premise” is the delusion that there is some mass conspiracy to sit on REOs and not get rid of them as fast as possible.

Shall I give you the time frames and % of price cuts done by various lenders in this area to dump the REO’s? They are so ver ver predictable …… 4-6 weeks to first cut of 9.87 -11.11%, another 4 -6 weeks and another cut of antoher 7/5 -10%,….another 6 weeks and now they are 23 -30% of the original list……. ANd they always end up taking offers that are 7 -15% off the list price du jour….

Hey never let real facts get in the way of conspiracy theories on any subject….

Sure, Anns. What area are you referring to? A suburb next to a large metro? Please, do tell us.

Excellent!

Your Freedom Fund sounds interesting! I applaud your positive contribution to this Blog. There has been far too much finger pointing here and your idea is a refreshing read. I’m certainly taking this seriously and will give it some thought, I hope others here will do the same and make this idea work. Real answers, great idea, Well Done!

The problem is that in a normal, non-financially oriented economy, the housing market follows the job market, not vice versa.

Thus, when IT/Nasdaq went bust in ’01-’03 and numerous high paying tech jobs were offshored, why weren’t worker bees concerned with the run up in housing?

I think the above answers the question, the real economy is gone. Everything, including services can be done abroad or in-shored into cheaper markets (see N Carolina, Texas, etc). Thus, this mile high RE market, Boston to DC or San Fran to LA/SD, is simply not sustainable w/o a lot of foreign investors catching the knife in these post-bubble years.

The end result, however, is if folks will eventually need to relocate for work, ie a shale oil field in the Dakotas (FYI, these markets will continue to grow, not services), then there’s no way that that house near South Jersey will stay at $600K without massive stagflation.

Hey, for the treasonous scumbags in the Banking Tribe this was just another opportunity to to be creative in the face of the recently diseased rules the of Glass Steagall Act (Thanks Gramm-Leech & Clinton).

No job, no problem!

Let’s get you 125% LTV on a home that’s already 250% above value, package it up in a nice CDO and sell it to some bloated state pension fund (or perhaps those silly Chinese).

Voila! Instant money creation resulting in big commishes for all the FIRE economy leeches all around!

You say it’s 2006 and the game is up?

No worries, let’s do it until there are no more knife catchers and pass the toxic debt 100 cents on the dollar to ol’ Uncle Sugar!

You see, when you’ve got friends in high places you never have to lose.

Think I’m exaggerating? Just look at what good ol’ boy Ben Bernanke did when we had a 12-15% contraction in GDP for 2008, 2010 and into 2011!

He reloaded the banks with even more capital (up to $4 trillion now) so we could keep the illusion of liquidity up and pump a thinly traded equity market with our secret HFT government approved bullshit programs….

More creativity!

What’s that you say? You’re worried that runaway inflation and destruction of 20-30% of businesses might never return, leading to eventual systemic collapse?

No worries, we bankers are like cockroaches!

We’re already swapping U$D for commodities and having them stored for us offshore!

Who needs a bunch of whingers like those Tea Party morons and their stupid USofA anyways?

HahahaHAhahaHA!

indeed. +1.

Looking for a home, first time buyer and loan approved but feel a bit nervous about it all. Should we wait a while knowing the market may continue to worsen? Will prices lower enough to buy us something a little better/closer to the city we currently live? Low interest rates now, will they go lower? These concerns/worries and more. Is it just first time buyer jitters? Appreciate your input.

Not enough info here. How much will you be putting down? How many months of expenses will you have in the Bank after the home is purchased? This includes all your new expenses, including property taxes and insurance. And why do you want to buy right now?

Take your time! I was in your shoes 6 months ago. I thought I should take advantage of the low interest rates at the time, but since learned lower home price is better than low interest rates. (interest rates and home price are basically inversely proportional) At best, home prices will stay the same through this year. Read this blog, see a ton of homes, learn about housing, loans, the home buying process, curbing your emotions, etc…

We are in a buyers market, and we will be for quite some time. Wait till you get comfortable by learning all you need to know. Then you will know, you know.

The thousands who were displaced during the quake will eventually move to Tokyo.

That will help the Tokyo RE price to go up again.

What the hell, CalAsian? Last time you posted you said all the Japanese quake, tsunami, and nuclear meltdown victims were going to move here bringing suitcases full of cash. WHAH HAPPAH?!?

1) We are not Japan.

2) See note #1.

It’s apples and oranges. Japan’s stock market did not bounce back, the US market is almost there. We have a wealth of resources and a country full of people willing to work. Sure we may need to have a slightly lower standard of living, but we live in an extremely comfortable time.

Sure, drama sells as it’s exciting. But the reality is that people can sit it out in there homes. Banks can hold these assets for 10 years as the government bailed them out.

What everyone better realize is that inflation is coming. Bookmark this and quote me on it. We will have inflation. And that is going to push prices up. So that cash you have in your pocket will be worth less in the future and that is going to drive the cost of everything up. Including homes.

Also: Banks aren’t stupid! They would not hold on to these homes if they didn’t have a reason. And they have the funds and life is not passing a bank by as they wait to sell. The bank will be 200 years old when there is nothing left of us. It’s hard to lose when you have endless time on your hands.

Show me full employment (or more) and rising incomes, then we can talk inflation. Until then, the inflation story is completely unconvincing.

Our stock market never actually bounced back. Subtract out the POMO (Permanent Open Market Operations) money from the Fed propping up the market and what would you have? A hell of a lot less market rebound than we appear to have had. It was rigged.

+1. Anyone who thinks the stock market has bounced back from anything other than the Fed putting money into it, shouldn’t be in the stock market at all. It’s unbelievable the general ignorance of many Americans.

And supposedly QE2 is going to end. Hmmm. What does that mean for the stock market, if it’s true?

We have stagflation: inflation plus deflation equals stagflation!

You’re hypothesis requires people able to pay higher prices in general, and on homes in particular. Who are these people, where are their jobs? As interest rises homes become less affordable. Prices go down. I could go on and on about what’s wrong with that post.

Anyway have at it. Maybe you can be the next Donald Sterling.

BTW who is going to maintain these empty homes waiting for the rising tide of inflation that convince people to buy them?

High unemployment and high inflation will have negative impact on home prices IMO – it is coming. Will the fed fight Stagflation like Paul Volker fed did with high fed fund rates? Will supply and demand market forces wrest the shadow inventory from the bankers in the next 5 years or will the supply chain remained clogged with squatters and inflated balance sheets?

inflation plus deflation does not equal stagflation. Stagflation is a macroeconomics term. Read up.

The definition of stagflation is (Inflation + Stagnant economy). In other words, the prices of goods go up, but employment/wages go down or stay flat. Agreed, we definitely appear to be in stagflation.

http://en.wikipedia.org/wiki/Stagflation

Here’s a question for you, Sean. What has changed since the Fall of 2008 to prevent that crash from happening again? All I see is the Banks gambling even more, since they have no other way to make money. Plus, they have learned that the U.S. will cover their gambling losses.

If nothing has changed, then why are you under the impression that it won’t happen again? Because if it does, the continuing deflation in the money supply will accelerate even worse. And that’s not good for the housing market.

You know, the housing bulls are really rather funny. They will never, ever answer the above question.

They’ll spend tens of thousands on a down payment. Go in debt to the order of hundreds of thousands. Or stay in their sinking real estate while shelling out thousands every month that they could be saving. But they’ll never give my question any serious brainpower and at least think through the consequences before committing themselves to eternal debt peonage.

It just goes to show how delusional they are.

So come on, you housing bulls! Take your best stab at answering the question! The alternative is to face up to the reality that housing has only begun to sink, and that there is are no fundamentals to support upwards price pressure on housing.

For the housing bears here, feel free to use this same question whenever you want to shut up a housing bull. It’s always effective. 🙂

Slam dunky kudos to The Doctor…who quickly answered his own question, “How can home prices remain inflated if incomes are moving lower?”

Debt, my man, debt. In the rush to FIRE economy how could anything be better than DEBT? Particularly if you get the debtors to re-contract for that debt, and more, every so many months, resetting the terms of their interest payback to the beginning of the curve each time? As Ron said, this was all Monopoly money…that people agreed to pretend was real. The problem with speculation is that once you have more than a few people dancing atop the Milk the Suckers ponzi pyramid, it ceases to be a pyramid shape….

There was never anything under this but FIRE, so of course we’re all either toast or smelling it. I have to reach way back to the memory of that shining Camelotian time when everyone on Wall St. and in the culture of Bigg Bidness was looking to the East and Japan in particular as the absolute model of what we should remake the US economy into.

Japan might still be ahead of China with its GDP had they resisted the temptation to go all funny money on themselves….

But here’s what’s been bothering me the most lately: the wholesale move not back to productivity, as Ron points out (and DHB has on many occasions, and other readers/commenters as well).

What bothers me is the wholesale move in our nation/economy in the US, and particularly CA and probably the Left Coast in general, is toward the license-and-rent economy, which at bottom is serfdom. In this system you rent your very right to exist. Not only do you have to pay for the basic sustenances of food and housing, but also water, and quiet, and movement necessary to do your job to get your cash to pay for everything you can no longer make yourself. You buy your house, then forever have to rent a place to put it from your municipality/county, just like at a trailer park. Ownership? Good heavens, all you own, someday, maybe, is the title to what sits atop the soil.

Even health “insurance” is nothing more than renting your right to have a place in line to MAYBE get health care if something happens to you, but don’t bet on it.

Doc, I think that when many people react strongly against renting their dwellings, they have some element of this concern in their overall palette of concerns: at what point does life become nothing but laboring away, hoping to be able to rent yourself a tiny space in the increasing number of for-profit queues people are forced to stand in.

Re: LateSummer’s example of food stamps:

Food programs are widely considered welfare to the people using them. In fact they are welfare to the food industry: it is a direct transfer of government (tax) bling to the pockets of General Mills, General Foods, Cargill, ADM, Monsanto, and the other Big Food/Big Pharma companies. It is tax bling to the grocers as well. These companies can keep marking up food for profit, squeezing those who pay money for it AND pay taxes so those who can’t afford the food can give Munchy Bucks to their local food vendor, and those dollars are credited to the food industry.

And think of Wal-Mart, which touts itself/is celebrated as a model of competitive enterprise…but could not exist if it weren’t one of the biggest recipients of welfare (its workers can’t afford to live on their WM wages):

http://ufcw.blogspot.com/2009/09/walmart-tops-state-assistance-rolls-in.html

Sorry this is all over the place, but there are multiple converging streams here. And as DHB constantly reminds us, there is absolutely no reason to believe that in an economy built on gambling, scamming, and computer automated profit skimming, ANYTHING is going to accrue bubble-type benefits to just you and me, anytime soon. Least of all your house.

True Rose-

The pain of the masses and yet Wal-Mart and Exxon continue to use their monopoly power to extort the nation for bragging rights to see which corporation and have the biggest 11-digit profit in one quarter. You might think even Rush and Kudlow would take pause that perhaps unfettered capitalism may not be the self-correcting, perpetual-motion answer to all humanity—but no, once a fool has his mind made up, no amount of evidence will change it.

As the doctor demonstrates, all people follow predictable, repeating mathematical subroutines. There is no financial method to correct these simple facts:

1) People care most about themselves and passing their genes into the future, whether they realize or admit it.

2) People care about their family and will sacrifice all others to save their own; hence, commit rational behavior—the knowing destruction of others to improve their own situation.

3) The accumulation of wealth as sport, at the expense of others. I personally feel that Bill Gates has learned the most important lesson in life—it is more blessed to give that to receive.

Dark Ages is not a silly username—it is a compelling fear that we are repeating the mistakes of all great civilizations, with arrogance that we can merely crush nations that will not continue to take our paper for their tangible goods. I don’t know whether folks dismiss this ranting as nonsense or actually are concerned that this is where we are headed. I cannot imagine a rainbow behind this cloud, although I was in North Carolina recently and saw a beautiful rainbow to the east, while death and destruction were occurring underneath that storm.

Agree Rose-

All of the welfare is wealth transfer from the many to ultimately the few causing multiple layers of damage:

1) Taxing the middle class to pay for the food stamp

2) Millions of abuser drive prices of food up

3) Working pay higher food prices

4) Disincentive to work hard when others get free ride.

5) Middlemen and ‘investors’ use subsidized profits to bribe officials for more subsidies and moral hazard.

Great rant – Why I love getting my mental health care at Dr. HB’s!

Interesting shifts here in Europe. Here is an article that is apropos. Mr. Soini is right in tune with Dr. HB.

http://online.wsj.com/article/SB10001424052748703864204576310851503980120.html?mod=WSJ_hp_us_mostpop_read

He says no bailouts because all they do is benefit the banks as a way of shoring up weak governments. Sure feels like that right here at home.

Sean, inflation-will-solve-the-problem theorists always fail to point

out that housing will be the asset that will not go along for the ride

when everything else adjust itself to maintain value. That’s how

we will someday be able to meet your inflated asking price. You’ll

receive a nominally identically but deflated cash value. By then,

you’ll also be very happy to take it. It will be the best offer you can

hope for. You see, the gap in affordability will never go away until housing

gives back its bubble value. Twist and turn the argument as much as

you like, the game is over. You’ve lost the money. Sorry.

“Banks aren’t stupid!”

actually , banks are really stupid

see the 2005-2007 when they gave 0 down loans to as many people w/ bad credit as they could , and then maybe a few more for good measure

“banks are really stupid”

Oh really?

Are we talking about the same banksters that passed off their toxic debt onto the US taxpayer?

Are we talking about banksters like Angelo Mozilo, who cashed out is living like a king offshore?

Are we talking about the same banksters that are buying out-of-control US debt from the Treasury and immediately flipping it back to the Fed for a nice vig?

No, banksters are not stupid at all.

The electorate my muets petit mouton are the ones that are truly stupid.

Keep voting for the (D) & (R) oligarchy for change you can bleed (or was it bleet?) in…

buying a home under the illusion that home prices always rises was an essential element in the RE easy money game but now that assumption is no longer considered a universal truth as a result the easy money RE game has now developed some serious air pockets in housing prices. Inventory levels,jobs and income levels all play vital parts in creating home prices but at the end of the day if you are not convinced that the home will increase in value (price) over time then the buying decision becomes more complex and everyone impacted by the buying decision generally will not want to lose money! even the wife!!!!!!

Seeing this real estate swindler was just sickening to me – look at his video and listen to the guile of his deception/con job. He is trying to tell potential home buyers that “there is no such thing as a bargain” and that you have to pay the full rip-off price for a house at the current over-inflated valuations.

http://www.youtube.com/watch?v=OXRzGzSTz-A

Listen to him say….”THESE ARE THE FACTS.” This video is very entertaining and very informative. It shows you how much of a shyster these real estate agents can be. He says “there’s a whole bunch of us (realtors) out there who know real estate – it’s what we do for a living. We’re licensed and WE HAVE TO TELL YOU THE TRUTH, BY LAW. Boy, what a shyster.

Well Danny – let me tell you something. There are many, many other people out there who are intelligent and REFUSE TO BE TAKEN TO THE CLEANERS. Real estate is WAY overpriced in many areas, so if you say that we basically “need to pay at least 97% of the asking price,” I say you are the epitome of an UN-professional. You do not have the best interests of you buyers at heart. You only have your own selfish interests in mind.

http://www.marketwatch.com/story/housing-crash-is-getting-worse-2011-05-09?

All the underwater home owners are hoping for a hyperinflation so they will have a chance to erase the debt, not much different from the federal government.

All those dollar bills Uncle Ben and the gang printed got to work their way into the circulation eventually. But with 9% unemployment there won’t be any wage pressure any time soon. Dream on homeowners.

Uncle Sugar and his bro’ Ben the Bernank aren’t printing dollar bills, they’re issuing T-Bills that are just zeros in the computerized banking system and unpayable by the US Gov.

The tax receipts are imploding, and jobs won’t be recovered due to collapse of industries outsourced or vaporized by technology.

For the moment TBTF is kicking the can, but eventually it’ll be the *END GAME*…

When that happens, THEN you’ll get currency collapse and hyperinflation, until then its business as usual (fake inflation via debt creation).

Enjoy the good times while they last, because things aren’t even *BAD*, yet.

Who the hell is buying 3 month T-Bills? Maybe TIPS? What garbage…

Monetarist can kicking back and forth with TBTF – a game for the hedgefunds to protect the uber wealthy and corporations to keep up buisness as usual.

It isn’t a R or D issue, it is a monetary/fiscal policy issue combined with deregulation such as the above poster mentioned with calamitous policy decsision to repeal Glass-Steagle and other interests driven forward by financial industry lobbyists.

From: Somis Guy

To the Doc and all who use this site…, The time has come. Our Land Lord wants us out within the next three months. They have been more than fair and resonable…Â

We live on the western side of Ventura County and for many reasons we would like to stay in V.C. Or close to… However the inventory and quality of rentals has fallen to an all time low while the price of homes for sale is far too high. There are very few decent homes listed in our range.Â

We hope to buy a 2,000 sq., Ft., or larger single story, move in ready, single family residence with Good Bones and plenty of yard ( acres ) with privacy, (no Tracts or busy streets) and must be quiet area. We want to live modestly and without the cost and hassles of Mella Roos, HOAs or the many City ordinances. A ranch or farm land preferred. We hope to move once and to stay for at least 10 to 15 years before we retire, then move out of the area for good.

I feel that the market is at it’s worst as far as the quailty of available homes at “Fair” prices – we realize that we will lose money, that’s a fact! Also, the sale will unfortunatly bolster the false values of the market. As the Doc’s readers know far too well, the stars have aligned and the wave is comming soon, prices will move further downward to a point of equalibrium with incomes, inventory, supply and demand. It looks like the banks will fight the whole way down delaying a natural correction. Folks have far too much debt into thier properties to make Short sales, preforclosers, forclosures sales work and finding folks who’ve lived many years in the same home with a good amount of equity to negociate with are very rare and thier homes are seldom Gems.Â

I guess I may be answering my own questions. Sorry people, I hate to give in, but renting here is – at this moment – not an option.Â

Any ideas? I know by following this Blog that you all are the best Informed, well educated ( street smart ) and practical! I’m open to any thoughts in or outside the box.Â

For the sake of helping others, we will be posting any ideas that help and those that do not. Stay strong Folks  – we wish you all the best. Peace, love, health and Happiness!

Semper Fi

Move to Landers. You can get what you want for $25K today. Kinda hot there though…

Hello all

I must be missing something here. I am a first time buyer, interested in Culver City (LA).

When I look at this link and scroll down I see trends that do not purport a falling market. Avg time on market for a house has decreased, median prices increasing now.

Is this all smoke n mirrors or is this an example of a micro market that is trending upward? Is this the quiet before the storm (downward)?

http://www.movoto.com/statistics/ca/culver-city.htm

Sincere comments appreciated

Knife Catchers…the SoCal meme “It’s different here” will soon be replaced with “WTF was I thinking”.

Nearly “Nearly eight-in-ten (77 percent) workers report that they live paycheck to paycheck to make ends meet”, no more so than in ol’ Sunny Kali.

http://www.declineoftheempire.com/2010/09/living-paycheck-to-paycheck.html

Enjoy the ride down, it’s gonna be one for the history books…

I don’t visit moveto much so can’t say anything about the accuracy of their numbers BUT I will say that both zillow and redfin’s numbers suggest a declining market in Culver City.

http://www.zillow.com/local-info/CA-Culver-City-home-value/r_51617/#{scid=mor-site-topnavlocalsub}

http://www.redfin.com/city/4557/CA/Culver-City

Culver City has always been squirrlly maybe because it’s so diverse… You have expensive neighborhoods and decrepit ones… a bit like SM but more so… I think you have to look at specific zip codes to get a better sense of what’s going in the specific neighborhoods you are interested in…

Select and read several Dr. HB articles on employment and shadow inventory data dating back 7-8 quarters, if that doesn’t give you a different lens through which to view the market then BUY, BUY, BUY!

Maybe you can knuckle down a bank foreclosure with an all cash deal that will not kill you as the market drops and then flattens over the next decade.

It might help to actually read some of the comments here. See mine above about housing bulls, and answer my questions first. Otherwise, you look just plain silly, and you’re about to make a serious mistake if you buy a house.

DHB has done several an article on Culver City and the surrounding areas. Don’t doubt that the RE spring summer season will want the affluent-esque Culver RE participant to push this area up during this time. If you can wait, do so. Don’t get mixed up in with the buying season this year. I would think we’ll see some interesting price drops in the still bubble areas this fall/winter. Of course I’m a guy stashing away money in a rent free place just watching, reading, learning and waiting.

good article, Doc. It kind of reminds me of a point Mish made a while back about exponential functions and the dangers of apparently small imbalances over time. Basically, if wages are increase slightly slower than inflation (which is bound to happen when the CPI is as cooked as it has been for several decades), the effects will become massive over time. For instance, if real inflation was 4.5% while median wages increase, let’s say, 3.5% per year in the same time, most people will say it’s not a big deal. Just a penny on a dollar. But if this is consistently the case for 25 years running, that $25,000/year job would now be pulling in about $59,000 but the $75,000 house purchase back then would now be demanding about $225,000. The d-to-i ration to maintain the same household on the same job, then, moved from 2.4 to over 3.0. Another 5 years down the road and it’ll up to 3.2. But if those 5 years are between 2008 and 2013, the chances of maintaining any momentum in wages is slim. Adjusted for inflation, everyone I know working the private sector is actually losing ground versus inflation, even with the rare down year factored in. I won’t pronounce it dead just yet, but the American dream certainly is taking a pounding.

The Gary Shilling prediction for housing is troubling. I’m wondering if people can weigh in on an investment decision I’m considering. I think Gary is wrong about not investing in real estate—if you take into account 20% down mortgage using cheap money locked in for 30 years . . . .

I’m considering buying a house (jumbo loan; 20% down; good metro-NY area with easy commute to city–so likely to hold its value; really low interest rate for a jumbo; 30-year fixed loan; good debt-to-income ratio).

Ignoring the obvious benefits of living in the house, and ONLY looking at it from an investment perspective, I STILL think it is probably one of the best investments I can make.

Here are my assumptions:

1. Agree with Gary that global recession is a higher probability than most financial cheerleaders out there contemplate.

2. BUT, due to unfunded private and public sector unfunded obligations explosion and pending debt bomb, as well as the likely global recession with occasional bouts of mediocre growth, the only tool our weak politicians and Fed will likely resort to is the printing press.

3. So, even with huge, current deflationary pressures, we will likely create sustained and relatively high inflation in the medium term to eat away at the substantial debt burden and try and to inflate our economy.

4. I don’t know whether G. Shilling is right or not on deflation. I think he is right on the economic slowdown, but not necessarily on the inflation piece (can have slowdown AND inflation). But, I’ll give it the following probabilities: 20% chance of another decade or so of Japan-like deflation; 80% chance of sustained, lasting inflation for decades (sustained bouts of stagflation).

5. Historically, housing has generally kept up with inflation (whereas stocks have generally performed negatively in real terms—which takes into account inflation). For example, look at the negative real returns on stocks during the 70’s; compare that to real value of housing that stayed flat during the 70’s (housing prices moved up in line with inflation).

6. I’ve assumed NO appreciation on my house.

7. The low interest rates that I can actually obtain right now will not be around much longer. With inflation and growing lack of confidence in US, interest rates will rise. This assumes the 80% scenario of inflation. It is possible Gary is right and we stay in low interest environment for a couple more years, but it is still likely to go up, along with inflation, at some point in the not too distant future.

8. I don’t mind having a house for the long-term (e.g., 30-year loan). Even if we move, I will easily be able to rent it out.

The practical question is, is my down payment on a house a better investment than the alternatives. I think it is for either the 20% deflation scenario or the 80% inflation scenario. Here is why:

1. The cheap money won’t be here much longer. Would like to use it while I can (am lucky that I can get approval for). Gary might argue that low interest rates will last a lot longer . . . and maybe go lower. . .

2. Assuming NO appreciation on the house, and ignoring my monthly home payments (only looking at initial deposit (investment) and my ending house value 30 years from now), I get approximately 5% real return in almost every scenario on the initial deposit. Varying inflation from 0% to 10% annually has wide impacts on nominal rates and final house values (assuming house keeps up with inflation), but the real value stays almost 5% annually in most case.

3. Even if I assume a 10% or 20% immediate reduction in value in the home (immediate after purchase), my annual return on my deposit is still not too far from 5% (4.8% and 4.4% respectively).

4. While 5% real annual return doesn’t seem like much, it is a highly stable and secure return. How would stocks fair in that same time frame? Taking into account a 2% annual inflation rate, you would need a 7% nominal annual return on stocks to keep up with a 5% real return on a house. What if inflation goes to 4% or higher? Can you imagine a sustained nominal return on stocks of 9% or higher (to achieve a 5% real return on stocks)??

But the above analysis only looks at the beginning investment (deposit) and ending value (30 years from now). The real value kicks in for the “fee for services†for the benefits of living in the home.

1. Assume I am paying a good (not overpaying) “fee for service†(mortgage payment = rent proxy) on day one. Every day we will use the house “service†at the FIXED loan payment amount (cost)—for the next 30 years. But, the government will conveniently print money and inflate its way out of debt—allowing me to gain the increasing nominal value for my house service as it goes up, while I continue to pay the same fixed monthly fee (cost). Over the years, the value compared to my fixed cost sky rockets (and in this case, the nominal value for the service is what matters). NOTE: I’m assuming I have to pay a fee for my living accommodations no matter what, so am not taking the stream of fees (mortgage payments) into account in the previous investment NPV/FV calculations.

2. Should I choose to move and rent, the growing differential (between value and cost) becomes my growing rental income year in year out. And, this rental income goes up even if there is NO appreciation in the house’s value (the house, and rent the house can generate, merely moves up and keeps up with inflation; the real values stay flat). If I were to add the likely stream of increasing amounts on rental payments to my previous return calculation, I would get well over 5% annual returns previously mentioned.

So, I’m struggling with Gary Shilling’s analysis because I think that he misses the real investment value we will obtain from real estate from:

1. The benefits of 20% down using cheap money locked in for 30 years.

2. The likelihood that we will get socked with substantial inflation when the government fights off what Gary predicts, as well as how it deals with debt bomb.

3. The value of real estate as it compares to alternative investments in a sustained inflation environment.

Yes, maybe real estate does go down 20% and maybe I should market-time for that. But, if he is wrong and I miss the cheap money opportunity, then when interest rates do spike, will I wonder if I had foregone a good investment in real estate???

Thoughts?????

I totally agree, i have been saving up a deposit, time to buy, just missed interest bottom thou

Luckily, your forcast didn’t play out.

Leave a Reply