Financial land of perpetual bubbles – California technology, real estate, and now higher education bubbles. In 1980 the median California household income would have purchased 17 UC bachelor’s degrees. Today it can barely purchase one UC degree.

For a few years I have discussed the potential of a higher education bubble and the fallout it will have on the housing market. Logically you would assume that young adults with back breaking amounts of student loan debt would have a harder time taking on another giant commitment through a 30 year mortgage. At the very least this would stifle home sales from young households given that the vast majority of mortgage originations are now stemming from government backed sources that require income verification. Even with ultra low down payment programs like loans backed by the FHA many people are still struggling with the idea of saddling debt on top of already large piles of debt like a poorly played hand of Jenga. We already know housing was a bubble and we are dealing with the ramifications of the pop back in 2007. Yet the higher education bubble keeps moving higher and higher. I think viewing a chart of California home prices and the University of California tuition over the years might shed a bit of perspective here.

Higher education the next bubble to burst?

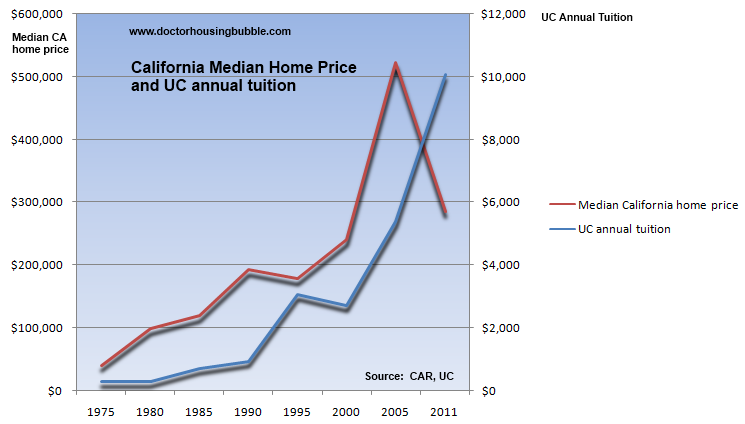

It is hard to put a price on education but this is something that we will try to do. Many young professionals view purchasing a home as their first victory in career success. But when does the cost become too burdensome? I decided to gather a few data points dating back to 1975 and tried to measure the cost of annual tuition to the median cost of a home. Below is a chart showing the median price of a California home versus the cost of attending a University of California (UC) campus for one year:

This chart is simply to show the trajectory of prices. As you can see California had a housing bubble in the late 1980s and early 1990s that led to lower prices in subsequent years. This dip was short lived and home prices entered into the mother of all housing bubbles peaking out in 2006. You notice this early crisis in the 1990s also caused UC fees to rise sharply. Ironically once we entered into the technology bubble UC tuition actually dropped for a few years even though the cost of education was rising. Why save for a rainy day right? Keep in mind that tuition at this time was hovering around $3,000 per year.

Of course the technology bubble burst and left a gaping hole in the California budget. The education system was left scrambling and ever since 2000 tuition has been steadily rising initially in tandem with housing prices. While home prices have cratered tuition continues to move on a steady path upwards.

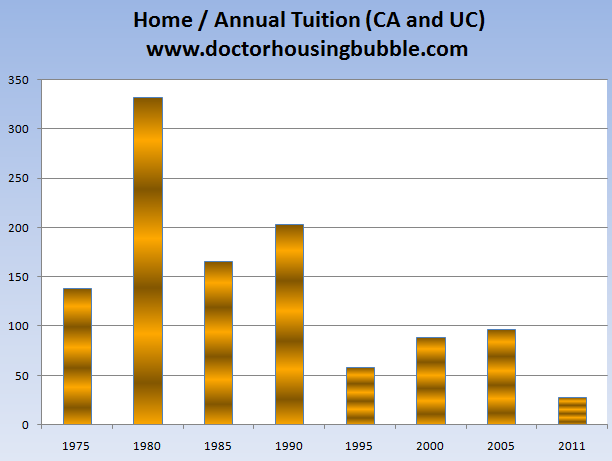

We can look at the above chart in a better way. It is useful to ask at any given point, how many years of UC tuition would it cost to purchase a home? I decided to run this data and this is what was produced:

In 1975 the median priced California home would have gotten you 138 years of tuition at a UC. Education was the cheapest if you want to look at it in relation to housing in 1980 when a median priced California home would have gotten you 331 years of UC tuition (annual UC tuition was $300 at that time).

In 1985 and 1990 the price was still affordable in many ways. Now the typical undergraduate timeline is four years (give or take a year). So if you want to price the home in terms of an actual bachelor’s degree you would have to divide by 4. What this means is that in 1980 the median California home would have purchased 82 UC bachelor’s degrees. Not a bad deal. However today in 2011 it will buy you 7.

Looking at the above charts it is rather clear that housing was in a bubble. Yet a bubble in higher education in the form of a UC degree is not apparent until you compare it to median home prices in the state.

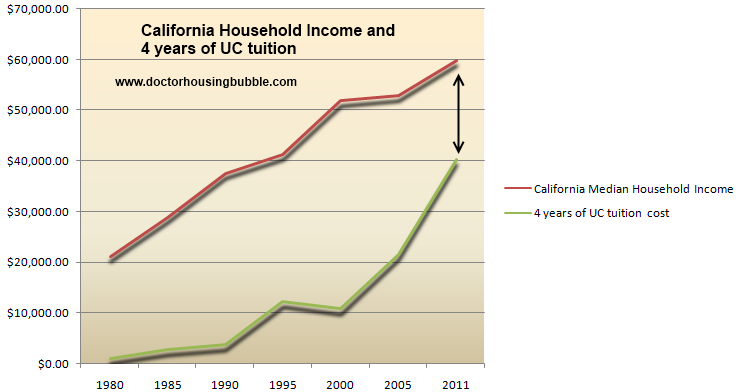

What is more disturbing is when we measure college tuition to the median income of a California family:

This is where the cost of college is really pronounced. In 1980 the typical California household would be able to finance 17 bachelor’s degrees at a UC with one year of household income. In 2000 that number had dropped to 5. Today it is only enough to purchase one bachelor’s degree at the UC system. Now keep in mind we are looking at the cheaper public option partially backed by the state of California. You have other institutions in SoCal like USC that charge over $50,000 per year. Without a doubt higher education is in a bubble more so in the private sector.

Part of the reason for the bubble is similar to what we saw in the housing market. Banks and their government backed supporters work in cahoots to increase liquidity in these markets which helps to create a casino like environment. Initially this starts out slow and ends with option ARMs that have no way of being paid back even though they are made on large ticket items. We now know how the bubble pops with housing but how does it look when it bursts in higher education? The option ARM or subprime equivalent in higher education is the for profit institutions. I’m sure you can find a handful that are strong but many simply operate as a clean setup to extract as much government and private loans from students without producing any measurable results. I know many will say that education is more than just the amount of money you will earn once you graduate. I agree. However, you do not need a multi-million dollar football team to help you read Cicero, Dostoevsky, Kafka, or even Hemingway. You can do that for free at your public library. College in many cases is about making solid contacts and working in a stimulating environment while learning to think critically. What has changed from 1980 to 2011 that has made it so much more expensive? Are professors 20 times better at teaching calculus or derivatives in 2011 than they were in 2008?

I’ve noticed that the “higher education bubble†meme has now gotten around on the internet:

“(TechCrunch) Instead, for Thiel, the bubble that has taken the place of housing is the higher education bubble. “A true bubble is when something is overvalued and intensely believed,†he says. “Education may be the only thing people still believe in in the United States. To question education is really dangerous. It is the absolute taboo. It’s like telling the world there’s no Santa Claus.â€

Like the housing bubble, the education bubble is about security and insurance against the future. Both whisper a seductive promise into the ears of worried Americans:Â Do this and you will be safe. The excesses of both were always excused by a core national belief that no matter what happens in the world, these were the best investments you could make. Housing prices would always go up, and you will always make more money if you are college educated.

Like any good bubble, this belief– while rooted in truth– gets pushed to unhealthy levels. Thiel talks about consumption masquerading as investment during the housing bubble, as people would take out speculative interest-only loans to get a bigger house with a pool and tell themselves they were being frugal and saving for retirement. Similarly, the idea that attending Harvard is all about learning? Yeah. No one pays a quarter of a million dollars just to read Chaucer. The implicit promise is that you work hard to get there, and then you are set for life. It can lead to an unhealthy sense of entitlement. “It’s what you’ve been told all your life, and it’s how schools rationalize a quarter of a million dollars in debt,†Thiel says.â€

This coming from Peter Thiel, co-founder of PayPal who had some rather good timing on the tech bubble. The Federal Reserve has enabled many to become addicted to this boom and bust bubble culture. I find it interesting that few of the economics or financial courses ever examine historical bubbles or look at the Fed’s hand in creating these bubbles. Most of that knowledge can be gained for free so maybe that is why you will never find it at a for profit school living off student loans from private banks and the Federal government.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

115 Responses to “Financial land of perpetual bubbles – California technology, real estate, and now higher education bubbles. In 1980 the median California household income would have purchased 17 UC bachelor’s degrees. Today it can barely purchase one UC degree.”

The situation may be even worse than what the article shows. Here’s what I’ve seen happen: Kid takes out loans to do a BA, usually in some liberal arts major, takes 5 years to graduate. Can’t find a good job. Decides to go to grad school to improve his or her chances of getting a decent job and dreams of changing the world. Does an MA, PhD, or JD, comes out even deeper in debt. Maybe gets a decent job, maybe not. But definitely deeper in debt, and spent 20’s in school, and maybe early 30’s as well (if went the PhD route).

H

Yes! College is only the beginning of the higher education bubble. Tens of thousands of debt-burdened college graduates fall into the trap of grad school every year, making their situation even worse.

Debt is reason #1 on the 100 reasons NOT to go to grad school blog:

http://100rsns.blogspot.com/

Great post as always, Doctor. It should be noted, however, that there were many boom/bust cycles before the creation of the Fed in 1911. The panic of 1857 was particularly bad and arguably was the economic driver of the Civil War.

I would argue that the Fed perhaps circumvents and delays the necessary corrections that come after a runaway economic boom. While the ending of the current financial crisis has yet to be written, perhaps the Fed’s intervention is going to make this correction much, much worse and last much, much longer than anyone anticipates.

The recent and current Fed members have forgotten the wisdom of an earlier Fed chairman during the Eisenhower Administration:

“The purpose of the Fed is to take away the punch bowl just when the party gets started.”

Whoopsie!

I think the housing bubble and education bubble are related. It’s not so much the cost of tuition at public uni’s that breaks families’ budgets but the cost of living of having to support a student away from home. I started college at the end of the 90’s. At that time, a 2 bedroom place would rent for $1000 – 3 of us shared and usually had plenty of money to buy food, party, and buy our train tickets back home for Christmas. By then end of my college years, you couldn’t even rent a studio for less $1000. I don’t know what caused this huge runup in rent prices but I do think that it is the major culprit in the indebtedness of college students.

Of course they are related. The central theme here with both of these is plentiful cheap credit. The past 20 years has been one credit bubble after another, blown by the Fed.

That’s mostly gone in Housing. Except for the 3% FHA loans that speculators use, which allows them to be underwater in less than a year.

For College though, this credit bubble still hasn’t popped. Like all bubbles, it will. And it will devastate the Higher Educational system. A College degree will no longer be necessary. God help you if you’re employed in that industry and are counting on it for retirement.

You should see the rents in Isla Vista next door to UC Santa Barbara — $3500 and up for barely-habitable 3 bedroom apartments.

So costs are skyrocketing, but I don’t see what is going to diminish the perceived value of a college education unless you get employers to lose their tunnel vision when it comes to hiring.

Ask any capable person without a college degree trying to get hired. In America, credentials still count for too much in bureaucracies and predatory corporate cultures where everyone has to cover their butts, where no-one will “take a chance” on the sharp guy/gal without the sheepskin.

The rents in Isla Vista and Goleta were sky high relative to most people’s means, even when I attended UCSB way back in the 1980’s. It is an expensive school to attend because of the overall desirability of the area and the large number of rich kids attending (whose parents have little problem shelling out thousands of dollars for their darling so that he/she may live on the prestigious Del Playa. )

I came from a family that struggled financially, and who could not help me monetarily. So, I largely earned my own way through UCSB. I worked very hard during the school year and overtime on the breaks. However, i also received some grant/scholarship money over the years and I still needed 20K in loans to make it through the 5 years I took to graduate. Living modestly, sharing small dumps far from any beach view, I barely made it through.

Thank goodness I did though, since it gave me the springboard I needed to vault past my impoverished background. After UCSB, I went on to graduate school with a scholarship, and then went on to work in a scientific industry that wouldn’t even consider hiring someone without at least a Master’s degree (then or now). I have been successful by most people’s measures, and believe that I have made some valuable contributions to society, and it all hinged on affordable education.

I feel for the kids today as costs have only skyrocketed. I fear that my difficult pathway through is not even possible for today’s smart, hard-working, poorer kid – at any of the UC’s, not just in high rent SB. Very depressing to think of all the squandered intellect that won’t be developed, all of those contributions that could be made to our society, if we made higher education possible for all who are intellectually qualified.

Really replying to UCSB Grad:

Isla Vista was very expensive relative to the rest of Santa Barabara/Goleta even in the late 1960s and early 1970s when I was there. In fact, rental prices for (as you so charitably put it) barely habitable apartments, combined with the rental agencies high handed behavior towards students was a contributing factor to the famous IV Riots of 1969-1970 – the only IV businesses besides the Bank of America that were actually targeted by the rioters were the rental agencies (esp. IV Realty) that had the worst reputations.

The employers are the engines pulling this particular train. As long as they demand a bachelor’s degree for work which clearly doesn’t require it (store manager, office assistant, accounting clerk, etc.), the trend will continue.

Ah. . . UCSB. Highest quality poon tang and the keg parties, the LSD, the beach. In 1990 I rented a 2 bedroom in Goleta for $800 and 4 people shared.

Not universally true. Some jobs are ‘resume jobs’. These jobs require a good CV and part of that is a university credential. Other jobs, and many of them very well paying and in growing fields, are ‘portfolio jobs’. To get these gigs you simply need to show that you have a track record of doing good work. Some people generate these portfolios by paying hordes of money to a degree mill, others bootstrap and self teach.

Dr. B, great post as always. Maybe I missed it, but another point you’ve made in past posts is the lack of jobs for the college grads. And even if they get a decent paying wage, many are in debt right after graduation from their school loans. I don’t see a college grad making $50k/yr while $50k in debt buying a house anytime soon. I think the more affordable alternative has a stigma attached to it. Community colleges are excellent places for students to get a good education and save some money. Unfortunately (like renting) they’re looked upon as education for a second class citizen. I don’t know what the difference between a calculus class at City College vs UC is but I doubt any difference is worth the premium.

The calculus class at the community college is taught by a professor, the UC class is taught by a grad student.

So true…and the professor teaching the class at the CC is moonlighting with a tenured position at the UC or CSU or SC!

I remember paying $250/quarter ($750/year) for “fees” (they didn’t call it tuition back then) at UCLA in 1980, and it was maybe $1200/year total when I left in ’85. $300/year is what everyone else was paying? I got ripped off and I want that money back, with interest!

“… you do not need a multi-million dollar football team to help you read Cicero, Dostoevsky, Kafka, or even Hemingway. You can do that for free at your public library. College in many cases is about making solid contacts and working in a stimulating environment while learning to think critically. What has changed from 1980 to 2011 that has made it so much more expensive? Are professors 20 times better at teaching calculus or derivatives in 2011 than they were in 2008?”

“Harvard is all about learning? Yeah. No one pays a quarter of a million dollars just to read Chaucer. ”

That is some great smart-alik humor right there!! We have to laugh at the prevelant lack of common sense everywhere. Thanks dr HB, I’ve enjoyed your analysis, and sense of humor for years!! Keep it up!

Don’t even ask the question about whether the professors teach the same thing 20 times better today.

The BLS will see that as their opening, say “yes” and immediately add one of their infamous “Hedonics adjustments” then declare that the cost has actually gone down!

The thing you learn about money as you get older is that it is the lack of it among the young that makes the world go round.

I feel that used to be the case as college kids used to fill the low end jobs as waiters and grocery workers; today those jobs are filled by middle age people. The job market is a mess and younger workers can’t find any job.

Schools have no other choice than to loan money to get students. But when they graduate they don’t have jobs to repay the loans. So they get bad credit and it’s a downhill slide from there.

I would not even know what degree to recommend to a college freshman. (Sure a Doctor would be good, but how about for someone who is more average and doesn’t have the funds for 7 years of school.)

And , two threads below, there was a story of a premed student who was sick of all the red tape coming up in the medical industry, and instead became an air condition contractor.

And us old farts can’t retire because we have to keep company sponsored health insurance. Therefore we cannot make way for the younger people to take our jobs.

You’re right, the whole order of things is upside down.

If this pile of crap is worth a million dollars the CIA appraiser’s former carreer must have been in the California real estate industry.

http://www.guardian.co.uk/world/2011/may/04/osama-bin-laden-hideout-worth

Excellent points, especially about the for-profit “university” scam. But why is it that critiques of higher education always trash on the humanities? Humanities faculties are among the lowest paid at most universities and yet those same faculties are the ones most likely to teach valuable skills in reading, writing, and critical thinking. As such recent work as the book _Academically Adrift_ show, it’s the business schools (and others) that dumb down so much that students don’t need to attend class or read books or even write anything. It’s always a humanities student featured in the annual spring sneerfest against higher education, but competent research demonstrates clearly that in the long run humanities students do well. One more thing: if indeed it’s so easy to pick up humanities skills on one’s own, why do so few people read and write well?

Thank you for saying what I was thinking!

+1. IMO, it’s because critical thinking is a threat to the current environment, especially in keeping the present Ponzi going. Most of the popular majors offer nothing but a trade school education, which becomes obsolete quickly. But critical thinking lasts a life time.

And had people been more aware of history in general, they would recognize and understand exactly what we’re going through now, and what the future will bring.

Spot on. The majority of MBAs can’t write their way out of a paper bag. To go further, due to the testing emphasis, a high number recent High School grads cannot write a paragraph, and fewer, a logical essay.

Face it Elizabeth – humaniites (whatever that idiotic term means) are close to worthless. What good is it for us to have 5 to 10 million psychology and other such majors running around psychoanalyzing one another??? What good does it do for our country? Many of these “majors” are worthless leeches, with no productive value to society.

Yes, I am a big proponent of writing, reading and speech skills, however, to have humanities as ones MAJOR is NUTS – they are near worthless degrees in many cases.

America started its descent into mediocrity when colleges and universities started offering so many worthless, non-productive “humanities” majors.

I don’t know about reading and writing, but science is all about critical thinking. What is more, it is about grounded critical thinking.

Yes, but only a limited set. I was referring more to the get-a-job type of majors. Engineering is one example.

And I don’t know how the job market is these days for pure scientists, but it’s always struck me as rather limited at best, or lousy at worst. In fact, I recall a news article from about a year ago of layoffs at Lawrence Livermore Labs IIRC. They targeted the older scientists there, who had worked there all of their lives. That’s got to be hard. It’s not as if they were ever well paid.

That’s why it is worth sacrificing some goodies and send my kids to a school that is tough and they are classically taught. (Socratic method). Public schools are only there to create “worker bees”. Public schools were not created to teach critical thinking…… never.

At my kids school the ones that struggle are encouraged to strive to be the best they can be, and an A is earned, at public school the classroom is alway brought

down to the lowest level and grades are handed out for attendance.

Learning in a “Classical” setting allows each child to achieve and makes them learn to think and act interdependently. Public schools are about social engineering and “group” think. Why? Because the ruling “elite” need (needed) “worker bees” to fill their factories (now fast food restaurants).

I am probably a little too libertarian for most here, but the best thing that could happen is to end all govern-MINT subsidies for education. Start with abolishing the DOE and make parents responsible for the education of there children. It worked well for a long, long time… The cost of an excellent education will drop overnight, just like if the banksters were allowed to fail housing would already be in a recovery.

Defunding public education could never happen now because certain groups of parents in this country have been so divorced from the responsibility for raising their own children that they are now neither motivated nor qualified to do so any more.

Well, the other engineers and I at the university I attended believed that standards were lower in what you would probably call “humanities” classes than they were in engineering classes. At my school, the term was the college of “Arts and Sciences”. They didn’t try to pretend that what other people did was, by implication, less human. But we typically refered to it as the college of “arts and crafts”. Students could suck up to a professor in arts and crafts and get a better grade. Students could take what they surmised to be the professor’s position on some issue in a class in arts and crafts and get a better grade. Students could bull5hit their way through essays and papers and still come out okay in arts and crafts. That stuff didn’t work in engineering.

Mathematics is contained in the Arts and Sciences school at URI.

Industrialization inevitably results in higher overall efficiencies, which in turn results in large numbers of “excess population”, i.e. unneeded workers. I’m not sure what Japan does with theirs, but in USA, we either put them on some form of welfare, or send them to overpriced mediocre “universities”, and THEN put them on some form of welfare (which includes .gov employment). And I doubt Marx was the first to point this out.

See the make-work concept of ‘Centrifugal Bumble Puppy’ in Huxley’s ‘Brave New World’ for a tongue-in-cheek treatment of the subject.

I think I need to study up intensely on so-called ‘Third Way’ macroeconomics, ’cause I think it’s already here.

Here’s the “Third Way” in Kali’s Upside Down Nuevo Mundo:

“Roughly 2,000 students have to decide by Sunday whether to accept a spot at Harvard. Here’s some advice: Forget Harvard. If you want to earn big bucks and retire young, you’re better off becoming a California prison guard.

The job might not sound glamorous, but a brochure from the California Department of Corrections and Rehabilitations boasts that it “has been called ‘the greatest entry-level job in California’—and for good reason. Our officers earn a great salary, and a retirement package you just can’t find in private industry. We even pay you to attend our academy.” That’s right—instead of paying more than $200,000 to attend Harvard, you could earn $3,050 a month at cadet academy.

It gets better.

Training only takes four months, and upon graduating you can look forward to a job with great health, dental and vision benefits and a starting base salary between $45,288 and $65,364. By comparison, Harvard grads can expect to earn $49,897 fresh out of college and $124,759 after 20 years.

As a California prison guard, you can make six figures in overtime and bonuses alone. While Harvard-educated lawyers and consultants often have to work long hours with little recompense besides Chinese take-out, prison guards receive time-and-a-half whenever they work more than 40 hours a week. One sergeant with a base salary of $81,683 collected $114,334 in overtime and $8,648 in bonuses last year, and he’s not even the highest paid.”

http://online.wsj.com/article/SB10001424052748704132204576285471510530398.html

I wouldn’t buy a tax enslavement device, fka as a HOME, in Kali if you put a bazooka to my head!

Yeah, I read that article too. They left out the part about being around people all day long who have nothing to lose if they kill you.

It has not been mentioned that once upon a time education was highly subsidized in public universities. Now, it is a lot less so as taxes have been going up less than incomes- so consequently money is funneled away from education to other things that have shortfalls.

“money is funneled away from education to other things that have shortfalls.”

Like criminally convicted Kali publik servants that “deserve” their outrageous pensions:

“A proposal to strip public pensions from city and state officials convicted of misusing taxpayer money died in a state Senate committee on Monday after some lawmakers and employee groups said it is too severe.”

http://latimesblogs.latimes.com/california-politics/2011/05/senate-panel-kills-pension-sanctions-for-those-who-misuse-taxpayer-dollars.html

You just can’t make this stuff up, it’s too whacked-out…

That is so funny…only in California!

WOW… Land of Fruits & Nuts indeed! In FL we sack the pensions of CONVICTED (not accused or indicted) wrong-doers all the time… probably explains our lower taxes and lack of mammoth deficits.

Kali is truly a re-enactment of Duh Fall of Rome.

I agree that a large part of the increase in tuition at UC’s (and CalStates, by the way) is due to less support by the CA government. However, I’m not sure that taxes are going up less than incomes. I think it’s more that governments keep finding creative ways to spend money, and often hide the expenditures (unfunded mandates, unfunded future liabilities, etc).

H

It is also heavily subsidized. So, yeah, you are getting a lot less free stuff, and that undoubtedly is a cost. However, you should pay private university tuition rates and then figure out how much you owe, before getting too upset with the state of california.

I’m going to call you out on that claim. Non-residents pay higher tuition on the basis that their families have not been paying the in-state taxes that have been supporting the universities through their formative years. The obvious corollary, then, would be that whatever difference there is between state-resident and non-resident tuitions would approximately define the ratio of state subsidization, and the latest numbers I’ve seen indicate that non-residents pay 3-4 times what state residents do in tuition, suggesting that the $6000-7000 in tuition is matched by $10,000-$20,000 in state funding.

Well if that’s really the thinking then how do you justify illegal aliens getting in-state tuition subsidies?

Yes, illegals in CA. get tuition subsidies while American citizens from out of state pay more.

That’s CA. reality.

31% of all the welfare paid in the country is paid in CA. even though we have only 13% of the population. And no discussion about THAT is allowed.

Excellent article and charts.

It is said that learning music is harder than learning mathematics. It appears that learning and understanding economy is much harder than learning music because of so many variables!

By observation of the first chart: Median California home price appreciated 4% from 1980 to 2000 which seems to be the norm. However from 2000 to 2006 it was appreciated at a rate of 15% per year.

Assuming a norm of 4% per year, the Median price of California home price should be 350k in 2011, first chart shows 290k.

Of course,

Lawler said it best: “In an economy, …, one can’t hold everything else constant to determine the effect of one variable.”

[Source: http://www.bloomberg.com/news/2011-05-02/housing-s-good-news-is-federal-cash-shortage-commentary-by-caroline-baum.html?source=patrick.net#related_categories_tags_top%5D

Great article. There is a difference between taxpayer subsidized college education and non taxpayer subsidized private sector eduction. Many taxpayers whose children do not go to government subsidized colleges, do not approve of their tax dollars going to subsidize college for children of the rich. They think that the children of the higher income people should pay full cost.

As to the whole myth of the benefits of higher education for the masses in America, Professor in economics, Chang wrote a book, “23 Things they don’t tell you about capitalism.” Thing 17 “More education in itself is not going to make a country richer.”

Germany’s economy is as advanced(or more so) than America’s and they don’t have government subsized college education for the masses like we do in America. Same thing for the Asian miracle economies, according to Professor Chang.

“IMO C means average. Everyones a winner if you can pay!”

Dumbing down of University curriculum in ‘MeriKa is the outgrowth of the K-12 trend to move the herd through the process by lowering the bar to the lowest common denominator…

Those that excel are a threat to the tribe and are usually destroyed socially by thuggery and political correct groupthink before they ever make it to an entrance exam…

Thus the need to import “talent” from abroad.

I am sorry, but that’s a huge load of crap. Germany has 410 Universities and only 71 are private. The remaining 339 are run by the states (some by churches). Fees are between US$200 and US$ 1500 per year and help for low-income families is abundant as are low interest loans.

However, Germans don’t send everybody to college/university. Specialized high schools with focus on e.g. engineering, manufacturing, electronics, telecommunications, tourism, business administration, etc provide a steady source of highly skilled workers.

Sebastian, you misunderstood what I meant, but you do agree with what I meant.

“Germans don’t send everybody to college/university. Specialized high schools with focus on e.g. engineering, manufacturing, electronics, telecommunications, tourism, business administration, etc provide a steady source of highly skilled workers.”

That is my point. In America we should not be sending the masses to college. Why we do this, is to provide jobs for the people involved in the college industry. It is a waste of taxpayer scare resources at a time when grade school budgets are being cut. America and California are no longer the rich country of bygone days. Read Professor Chang’s book.

The European/Asian Educational model is “take the best and shoot the rest”. They don’t really give a d*mn about educating people in general. Just the top ones get access to the educational resources beyond trade school. Everyone else’s role is subservient.

America’s democracy requires a well educated population in order to function properly. You might notice the correlation between the rise of our current Crony Capitalist system and the decline of education since the 1960’s.

And you might also note that both Europe and especially Asia have had significant notable troubles when it comes to a lasting Democratic society.

Excuse me?

the ENTIRE education system in germany is governement sponsored! i have studied 7 years there and i have paid about 150$ per year in tuitions and so has everybody else!

Whatever the exact figure is, the point is that higher education in US has been hijacked and turned into an extortion machine by Wall Street. Illegals will take all semi-skilled jobs and if you want to have any chance to claw your way into the shrinking middle class, it is perceived you need a graduate degree from a well-known institution. However, the truly successful often are motivated by the desire to make something of themselves rather than get a big head start and a set of training wheels. It’s not a simple formula.

Germany also has the conspicuous advantage of living under the protective military wing at our expense though, remember? Wonder if that helps their numbers any…

Germany sure does have gov’t subsidized tuition to the nth degree! It’s called taxes and lots of ’em…Public Univ. is pretty much free except for a very small registration fee each year. And Asia…only the top 60-70% are educated in many areas, so the rest of the world gets compared to their top 60%. Education is for the wealthy there.

Tuition inflation must have a strong positive correlation with grade inflation. Harvard average grades for undergrads were C+ range in the 60s. Today they are B+/A-. IMO C means average. Everyones a winner if you can pay!

New meme: education inflation-inflated costs and grades combined with the decreased value to the consumer/student. Is it already on UrbanDictionary? Credit, RE, Tech, Education all bubbled or are still bubbling- what will be destroyed next by Greenspan cum Bernanke frothiness?

You must be an old-timer 🙂 B+ at Harvard/Stanford/Yale/Princeton now means almost failing. They almost ALWAYS get A’s these days.

Massive grade inflation at the Ivy Leagues (and similar schools) is very very deliberate. It’s a way to help Junior get a good job, even if he’s a total idiot. A lot of hiring managers would hire a humanities A student from an Ivy League school instead of a math/science B student from 2nd tier school, despite the fact that the B student probably worked much harder for his grade than the trust-fund kid, and is smarter and doesn’t come with an attitude. Talk to a grad student at an Ivy League school who has to TA the little entitled monsters. (I speak from painful experience).

H

I don’t doubt that. I worked my way through a second tier engineering school and earned A’s, but Frisco Systems wouldn’t even give me an interview. Don’t know about Ivy Leaguers but they sure got a lot of engineers from the Curry League…

Henry – you made me lmao, very much so. You are so right. Many of these Ivy League schools hand out diplomas to rich, spoiled, STUPID KIDS, with good grades on them no less, for no other reason that they come from filthy rich families. Diploma mills for rich, elitist, lazy, worthless kids. By the way Henry, elitists are parasites onto society!

Yes, we now know easy credit made housing available to many who could not afford it and drove up the price of homes for everyone. Basically, straw buyers were welcomed in to the market. And lots of home equity loans were used to pay for exorbitant tuition fees — also having the affect of driving up the cost of tuition for everyone.

When I entered law school the cost at my school was about $21,000 per year, and now it is almost twice that. Have incomes doubled in the past 15 years? At one point salaries for law firm jobs jumped from about $90,000 to $125,000 and that was driven by recent grads drowning in debt and the tech boom. But that’s not double and that is also only salaries for those who want to work for big law firms who do the bidding of major corporations. And that increase was immediately gobbled up by tuition paid back at credit card interest rates. After all, there is now a HUGE market for private loans — whereas when I was there it was very limited.

There is definitely a huge bubble in education. Right now, in my opinion, it can be a rip off — I don’t think most BA degrees are worth $100,000 — even if you had the cash sitting in the bank, much less financing it and paying it over 30 years. Then add grad school and things truly get insane. I have so many classmates that 10+ years later are still drowning in debt with no hope of escaping. I was lucky to pay off my loans with money that I now know was from another bubble (the housing bubble).

I also agree with Elizabeth — the humanities are important and were among my most rewarding classes. We must resist the current push in our society to equate monetary value with actual value. I fear we are losing some of our core values in an attempt to speak to the money culture in terms that they understand.

Great post!

I really couldn’t agree more about this bubble. What amazes me is that we don’t have a higher overall rate of people attaining Bachelor degree’s. What in the world is driving the cost increase? This will end probably even worse than the housing bubble because people can’t walk away from student loan debt. If they can’t make enough money to service the debt will they end up out on the street? This is going to bend up really badly for the country as a whole and possibly create a class of educated indentured servants.

Maybe people are backing away from attaining their degrees because they’ve read too many horror stories of people being destroyed by student loan lenders. Go to http://www.studentloanjustice.org to read countless tales of nightmarish debt from which there is no escape.

The reason we don’t have more people attaining bachelor’s degrees is because most people are properly terrified of assuming massive debt loads for degrees well-known to be of marginal value at best, and often are considered laughable. There’s nothing like running up a $100K or more tab at an online diploma mill just to meet with scorn and derision when you try to market your expensive “skills”, to make you feel suicidal. Believe me, HR people know the difference between the University of IL, or UCLA, and, say, Phoenix University, and the word is out about these places.

The word is out about how very destructive to your health and life college debt can be. Beware: lenders have rights that they do not have with any other debtor. Student loan lenders can, and regularly do, charge borrowers collection fees equal to 25% of the outstanding loan balance for every late payment; raise interest rates at will, call your neighbors, your relatives, your friends, and your employer at any hour of the day or night to hound you and defame you to these people, and charge any other fees they see fit. This is how a loan of, say, $20,000 balloons into a balance of $80,000, or a $150,000 debt becomes $400,000, in a couple of years’ time. The borrower has no rights, no protection, no recourse, and no escape.

Higher education and professional training are very good, and more worth borrowing money for that most other things. But you must weigh the potential lifetime financial value of your education against the staggering difficulty of paying off six-digit debts, especially on the terms of most student loans. Be especially cautious of borrowing to train in “working class” occupations such as chef, nurse’s aid, and other jobs that top out where most professional callings begin.

I did a lot of contract work for one of the well ‘heeled’ schools and they are non-stop new buildings every year, expensive technology, wasted projects. Much of the money comes from the uber-rich in pharmaceuticals but most from the state. The tuitions just go to the fat cats, grant noblemen, whatever…it’s insane. Like a kid can learn more from a power-point presentation on a 65″ LCD than reading from a book? It’s bullshrimp. Expensive technology does not make better graduates–it’s probably worse because they don’t exercise their minds in the natural way–they watch the program on TV rather than engage the subject with the author (although that’s another scam, as Rose mentioned).

I also shared a room with college students–these kids are so buried in debt, and most of them don’t have advanced careers to show for it, many are working retail, food or whatever job they can get. The lucky ones get into some kind of medical. One of the kids committed suicide. It’s not going well.

Fancy LCDs… or books. It’s interesting to see how college textbooks (and their cost) have changed in the past 12 years.

According to an instructor friend who worked in the publishing industry, blue highlighted text costs more than twice as much, per letter, than plain black text. Full color pages? You can imagine.

When I went to school, 13 years ago, most textbooks were still black and white. An occasional reader might have portions in the characteristic blue, but that was about it. The only books in full color were those that needed it for subjects like Art History.

Nowadays, EVERYTHING is in full color and the cost has exploded correspondingly. They just pack on the excesses knowing students will have to buy it. A new Econ textbook, for instance, (I took it for fun) will run you $160. 10 years ago, it might’ve been 40-50. Of course, you could say “well, printing technology has come a long way in 10 years,” sure, but then shouldn’t it also be reflected in the cost?

You don’t need a fancy book for a class like that. A book full of pretty colors will not make you a better student; it won’t make you learn the material. You could get the same thing done in plain old black Times New Roman. It’s pretty sad, really.

Or you could have multitudes of very smart unemployed, extremely frustrated and desperate individuals who start questioning authority and the system. What could that lead to?

DG. They are related and will end badly. You’re right. The reason it’s so expensive is just like what happened in housing – easy credit….lenders expect grads to pay them back. It is definitely a crisis in the making. When lenders stop lending, kids will need to learn a trade to get a job because few have the resources to educate their kids. Going to be a lot of tears.

CA. give grants, (not a loan) of up to $10,000. ayear, to attend a private college.

Shouldn’t this money be going to public colleges?

Yes. It would also help to give it to its citizens, instead of crooks sneaking over the border to scam the system out of everything they can bleed from it.

But Californians have voted to pass out money to everyone with a pulse. Had we kicked out the illegals years ago, our current budget mess would be in the 10’s of Billions (yes, Billions) more positive.

We might’ve even been able to offer cheaper education to our citizens. But we as a State have decided that that isn’t in our best interests.

There is one big difference between the housing and education bubbles, though: you can’t flip a degree.

Can you?

🙂

Not in this economy… Unless you just got hired by Macdonald’s.

Paula left one out over the plate for you…a worse problem with education debt is recourse: the mob got legislation in place so education ransom is unforgivable. A number of viable nations (Germany, for instance) feel that higher education is good for the nation and is thus, free to those who will. We’re so foolish we think we should indenture future generations to make Wall Street more wealthy. We feed our young to the Manhattan Project–the one that will ultimately leave us in a nuclear winter…

Plenty of mathematicians flipping their degrees on Fraud St. – Quants stacking gaming theory and discovering new more complicated ways to deceive the general public.

It’s all about subsidizing the bankster class of parasites, no matter what damage it does to the dwindling middle class.

True that, Robin. It really does come down to the continuous bleeding of our nation to Manhattan, the Vampire Island. NYMEX, Incestment Banking, Advertising, organized crime, media, publishing, …the epicenter of evil.

JR. College is the way to go. No doubt about it. My son is starting at Rio Hondo and getting all of his general courses out of the way a heck of a lot cheaper.

Side note – a while back I was posting that I was looking for a house. Well, reading this site enough finally got the thought thru to me that it would be a foolish thing to do. I ran into a realtor at an open house that was honest enough to say that based on what she is hearing from the banks she would recommend NOT BUYING as prices are projected to take an even bigger drop. When a realtor tells you this is might be a good idea to reconsider!!!! I consider myself lucky that we sold a year ago and decided to rent. I think we are a year out from buying. Thanks to those of you that helped change my way of thinking.

So sad that people delude themselves that the dumbed-down courses of community college with their exams that are true/false or multiple choice and – maybe – one or two 3 pages papers – are the equivalent of any class at a top tier school. They are not. After all the community college has to get every rumdum who is just going for an associates degree in early childhood education (aka babysitting 101) through as well.

My undergrad school is in the top 2% – and incredibly demanding. A student should assume that every course will require 3- 4 research papers 15 -20 pages in length and – gasp – all exams are essay questions. No true/false. No multiple choice. Just writing and writing and critical thinking. ANd then there is the senior thesis which is an original research paper in the student’s major and which is expected to be between 100 -200 pages in length – longer than a Master’s thesis and nearly doctoral length. The thesis is accompanied by an oral exam by 3 members of the department…… and topped off with written exams in the major and all minors. And this is for the BA/BS….

And schools of that caliber D -O N-O-T accept community courses as transfers for credit. Period. The community college classes are regarded as not being sufficently rigorous.

ANd yes it pays off. Certain major companies never interview undergrads and only look for MBAs – except for that undergrad school and the handful like it. Its grads are routinely admitted to the top – very top – graduate schools in the country (think Harvard, Yale, Univ of Pennsylvania); a higher % of its grads obtained graduate degrees than do those of Harvard; and it has 95% and 97% admit rates to medical school and law school for its pre-med and pre-law students.

You need to be honest about what you are buying at the push-’em-through, admit-anyone-breathing community colleges — and it is NOT the academic rigor of the top undergrad schools that allow students to go to the best grad schools or career opportunities. ANd yes- contrary to popular myth, it does matter where you did your undergrad when applying to grad schools. And it will still matter years later in the real world. One day in a casual discussion of some econ data that lead to normal chit chat including where we went to school, I shocked a senior NYT business reporter into an ‘oh migod – you must be brilliant if you went to {that undergrad} ‘ when he ask where I had done my undergrad —- and then he gave a laugh and said ‘ that explains why you breeze through this complicated data like it was elementary school math.’

Sadly while that school’s tuition AND room and board was 33% of the median household income 30 years ago, it is now 100% of the median household income. And therein is the problem of inflating costs but decreasing or flat incomes for the bottom 90% of the US.

My wife took all of her prerequisite courses at a community college in So Cal on the cheap, then transferred to NYU for the last 2 years of her undergrad.

This is the way to properly use CCs, unless you’re strictly looking for a skill set 😉

“So sad that people delude themselves that the dumbed-down courses of community college…”

Not sad for my wife and I, before she finished at NYU we already had a profitable business started that paid off ALL her student debts in under a year after she graduated.

P.S. You sound like a snarky untenured professor that’s afraid your bubble is about to be blown…

Well, good words to come out from a ‘top’ university recruiter who thinks people should put themselves heavily in debt to enjoy the ‘rigorous’ curriculum from that prestigious university.

UC tuition seems to skyrocket right in line with the big public pension giveaway of the late 90s. These people are government employees, after all. The quality of education has risen proportionately, I am sure.

Maybe it’s all a coincidence.

DHB, I think this would be an easier comparison to make for your readers if you compared UC tuition against mortgage payments for a 20% down fixed 30-yr mortgage a median CA home. This would give us something of an Apples to Apples comparison. You could see how many years a person would have to postpone buying a home in order to pay for the schooling. If you want to stretch it out, you could toss in median rents too, as an expense to be borne while paying off UC.

Much of the UC tuition increase has been due to a smaller and smaller share of the operating budget of the University being paid by the tax payers. It is not as if the amount of money the Universities are spending is inflating that fast.

Actually it is the case that the university system in every state, not just CA, is going up way faster than inflation. WAAAYYY faster. Look at actual numbers for your state, not what the university burons say.

Same is true for K-12. Spending for local school districts has seriously outpaced inflation and enrollment for years.

What’s keeping the universities afloat? Foreign students, subsidized by their governments and, I believe, ours.

I really enjoyed this article. Yes- I think the real estate bubble and the education bubble are related, and that techcrunch article nailed it. I’m not originally from the BA, but after having lived here for 10 years it seems apparent to me at least that parents around here do an awful lot of hand-wringing when it comes to their children’s educations. To me some of this perhaps helped inflate the housing bubble simply because parents were so eager to shell out tons of money for a house- any house- that was remotely near a halfway decent public school. This still goes on today and you’ll still pay a high premium for the privilege of buying a home near such a school.

The same attitude goes for college. It seems like a lot of parents here want their kids to go to the absolute best colleges and what’s more- they’re going to pay every penny of the cost.

Its sort of shocking to me to see just how much college has gone up. I graduated in 2000 and even then the costs were rising dramatically. I paid a total of about $8,000 for my education. By the time I graduated the tuition at the school I attended had gone up 30%. If I were 10 years younger there would be no way I could afford to go to that school.

In the baby-boomer generation, you see the most successful people went to college. So they give college the credit for their success. What they don’t take into account is that people from that generation that went to college usually came from affluent families and already had a leg up. But because the credit was given to college education many people have decided if their children go to college, their children will be successful, this has created an abundant supply of college graduated and lack in supply of skilled workers. So we have an issue with supply and demand. I think everyone here knows what happens when there is too much supply and not enough demand.

I went to UC from 1980 to 1984. $212/quarter. And now it’s around $3,300. I would say that the price has out-paced inflation by quite a lot.

Back in those days a liberal arts degree could still get you in the door of someplace that offered a career path. I dont think that exists today. Or at least not nearly to the same extent as it did back then. As more and more people move into their 30’s that never saw a return of their educational investment, it will get a bad reputation as a way to further one’s economic position in life.

I graduated from CSUN in 1983 — in the midst of what was (until then) the biggest recession/depression since the `30s. I had a degree in Management Information Systems, but when i went to on-campus interviews, there were very few companies recruiting — in my major, 3, to be exact. I got a job with one of those, and on the whole, my career has been fairly successful, but — my buddies in high school who didn’t go to college, and became firemen, policemen, plumbers and carpenters all did just as well (if not better)

Sure, they had more ups & downs in their income, but on the whole (because they were just as smart as us college bound kids) did just as well as we did.

If I had kids and were to offer advice, I’d say go into a trade (plumbing or carpentry, for example) and build a business — but I’m glad I don’t have kids. I am not optimistic about the future, and worry about my nieces & nephews.

I think the real crime is that student loans–unlike virtually every other debt–cannot be forgiven through bankruptcy. And I’m a poster-child for leaving school (after three degrees) with enough student debt to preclude me from buying a home for the foreseeable future, e.g. forever?

You need to take a look at the history of student loans. Back in the 60’s, when these were new, there was a high percentage of people (especially lawyers) who would take the loans and then default. I suppose it made economic sense to scam the system. But that’s where the recourse to student loans came from.

So, if you make them no-recourse, you’ll see the same thing happen, but on a much larger scale, given the magnitude of the debt.

The only (and I do mean only) viable solution is to eliminate student loans altogether. Spare me the whining about how it can’t be done. It can. Yes, the Educational system will take a hit. It’s going to anyway, as there’s no way out here. The only question is “when”? That’s how credit bubbles work.

Unsustainable debt/credit always implodes. It has to. Get used to it. In the long term, we’ll be better off.

College is a complete scam, and everyone knows it.

But… businesses need a filter for jobs. College is one of those filters.

I challenged a senior member of a previous employer about this idea. I’ll never forget his response:

“We need a filter, because not everyone can be a executive… if not college, than what should it be?”

I didn’t have a good response for him then, and I don’t now.

This was one of my better employers… it didn’t really matter where the degree was from, although Ivy league seemed to make promotion rack faster.

Honestly the filter should be work ethic and track record demonstratable on a resume and through discussion/letter. If this is about becoming an executive, the time is warranted. I cannot tell you the number of ‘high levels’ who are unable/unwilling to do any real critical evaluation/thinking about new hires. Even in the investment world where finding the diamond in the rough is the holy grail and purpose in life, most of these guys don’t do crap when it comes to hiring right into their own firm which is arguably more impactful than any single investment they will make.

The issue is this – our society has produced a bunch of lemmings who can’t think for themselves and therefore have to play averages as they have no ability to identify such a desirable traits in someone else. This is the sad reality of it and there are precious few exceptions.

That’s an incredibly silly response. Apparently, that executive never ever considered competence as a filter? That speaks volumes, doesn’t it?

I see a similar thing with MBA’s. What a nearly useless degree. Yet it’s effective in masking complete incompetence with paper. I have yet to see a good engineering manager who had an MBA. The most outstanding ones never had them. They new what needed doing, how to get the best from their people and how to get the job done. I’ve never, ever seen that from anyone who had an MBA. But hey, it looks good on paper.

So what’s an American to do? Obviously, we can’t rack up a million dollars worth of non-dischargable education debt to get a BA, MA, and PHd while learning a second language up into your mid thirties, then leave the country for a job in another country (possibly the country for which you learned the second langugage) and then tell all your American creditors to “go F’ yourselves.”

That would be almost as immoral as colleges raising tuition and fees 500% for an education over the course of a decade. What kind of lesson are we teaching our children? If the education system (Colleges, banks, and governement) screws you, it is okay to screw them back? I for one cannot condone these actions. We must encourage our young people and the education system to be fair, just and responsible to themselves, their families, their communities, and their country.

You sound like a pensioneer or a wannabe pensioneer , sorry the kiddos are not going to buy your growth stock , or ticky tacky mchouse , or pay for you to eat jello and piss on yourself for decades. In a little over a decade 2 our of 3 americans are going to be on SSI of some sort , public assistance , or employed in the public sector. Not sustainable , the best and brightest are going to bail or find a way to get by without supporting an onerous parasite class of citizens. If i was young I would bail on 500 k worth of debt in a new york minute , the elders can default on their unsecured debt and mortgages .

Massive student debt, lack of Rule of Law, rampant financial fraud, undealt-with war crimes, legislative corruption, legalized torture, dwindling Constitutional & Civil Rights, a pay-to-play judiciary system, an ineffectual & captured Executive Branch, institutionalized transfer of wealth from savers to speculators; the United States of America is a CLUSTERF@CK of IRRESOLVABLE problems that mutually impede & interfere with each other.

WHY the F@CK should I spend my hard-earned money to buy a property in this SINKING SHIP when I’ll most probably need it to EMIGRATE instead?

The Assembly passed legislation today to allow illegal immigrants to receive college scholarships. We can’t even fund grade school, yet we give college scholarships to illegal immigrants. It is a mad house here.

More Centrifugal Bumble Puppy… in other words, once you get on the INflation train, it’s very hard to get off… and when the DEflation train is spotted gaining on the caboose, expect outright panic! ;’)

Their parents are paying taxes in California, so why shouldn’t they get the benefits?

as I dad, I’m really starting to think twice about sending my kids to college. Here’s the top 4 reasons I landed on:

http://www.savvydaddy.com/content/site/blog/004504/college-still-worth-it

50,000 Starbucks lattes. That’s how many a college grad has to make to pay for a median-range college education.

Thank God for Junior College. I went to PCC, and put myself through school as a waiter. I graduated with zero debt, and a nursing degree. Now even in a good healthcare labor market, new grad nurses are having to wait a year or more to get hired. Many of them are in debt with prestigious nursing school degrees. When they do get hired the starting pay is in the mid $20 an hour range, and it takes years to work their way up the scale. Then try and raise a family and buy a house. We have screwed the younger generation big time. Hell, I can’t afford a home in Burbank, and I make top RN wage.

By the way, being a doctor is worse than ever for the young. They are looking at mid 40’s to begin to amass any sort of wealth.

I keep thinking something has to give but the middle class just keeps breaking their backs and accepting the new normal. Ugh!

I went to PCC too, great school! When were you there?

87-91

I started the year you finished…

Doctor – your thoughts here are downright silly. There is a difference between price and cost. As the price at UC increases (and it is still well below what it costs to educate a student) a couple of things happen. First, graduation rates improve. (and look at the data for the confirmation) Second, the elements of rent seeking in the old low tuition model are reduced. Those things on themselves are fundamentally positive. But third as you might expect of any bureaucracy they reduced the number of available spaces. The correlations here while interesting are not very dispositive of anything.

Silly?

This is not some hypothetical what-if scenario. It’s stating the obvious. There are dozens of sources the re-emphasize the basic points here. We all know actual people who are actually engulfed in college debt, many of whom could not find a job and have gon back for graduate degrees.

The price is not a function of the inpuyt cost, but how much the market will bear. If fools take the bait, the get loans, creating inflated demand. Housing, education, commodities–prices are driven by debt-enabled ‘buyers’. It’s subprime, alt-a all over again. And if you don’t know that, you either have a dog in the fight or dr stands for dufus-retard. I doubt that’s the case so I lean to the former. What’s your disclosure?

Is I’ve observed with my own eyes, working at multiple universities around the country the last 10 years, they build numerous giant buildings. Way more than are needed. But they fill them up with students and their giant loans. I lived with the students and saw how much they spent on apple junk, organic foods, new cars, all kinds of stuff because they had that loan money and they were going to make so much money in the future it didn’t matter. One worked at clothing store, one at Panera, one a bead-shop, one was a cook (not a chef, just worked in the kitchen of some OK restaurant). One was a bartender. One hung himself. Two went on to get graduate degrees. One became a missionary…and I know a lot more.

drtax–I think you might be missing the forest for the trees. I think the point is that we aren’t going to need all that many college grads in the coming decade. We’ve been importing the rest of the world’s stuff, and sending them US Treasury Bonds, which are basically worthless. And of course we are masters of financial engineering, which is rapidly falling out of favor. As this becomes understood as fact, our ability run budget deficits and trade deficits will vanish.

Starting in a couple of years, if we want to import stuff, we will have to export stuff. What we are going to need is factory workers, as we slowly rebuild our manufacturing sector. Maybe they can convert half of UC and Cal State campuses to trade schools…………

Today on KMPC or KMPR whatever FM 86.9 or something like that they said UC universities can not afford to accept California citizens because they make more money accepting “out of state” students or “foreign” students.

California is broke.

Did they make a terminator 4 movie? If CA doesn’t get a bailout, they will certainly default. There is no way they can float that much debt. Funny, I just heard Sacramento is getting a new arena for the Kings (who didn’t make the playoffs). Until they fix the systematic expansion of government and municipal debt, the whole system is on a Titanic-sized trip to the bottom of the sea. “California can’t sink!”, “She’s made of iron, I assure you she can and she will”. Ironic (no pun intended) that SS California picked up the survivors of the Titanic.

This subject is very popular judged by the number of responses. Time to leave the failed state of California and move to Texas. Saddle up and move them on out. Good bye.

This subject is very popular judged by the number of responses. Time to leave the failed state of California and move to Texas. Saddle up and move them on out. Good bye.

When mexico morphs from failing to failed state status. How do you think Texass is going to handle a million + refugees a month for years ?

Recomend something edutardation wise ? I would say some sort of military deal . Things are being put in place so just about everyone gets a two year degree . Punmp out online courses and army education courses . Then screw off for 6 years on unemployment and the GI bill and fluff your college pedigree on the taxpayers dime.

Or in worst case scenario as in the system goes crash. At least you will be in a compound with state of the art weapons , food , water and friends . )

The time to move out too the country and build a community , with a self sufficient lifestyle was late 2000. Come out to the country today and you will end up as a serf , concubine or hog chow. Plugged in kool aid zombies can go take their normalcy bias and choke on it .

Sounds like you’ve given up on your fellow countrymen. I can just imagine the Founding Fathers looking down upon you from beyond the grave: This is what we fought for? A nation of whiners who just give up on their country, on their children, on their fellow American because things are hard.”

Sorry, you have to fight for good governance, you have to fight to leave this country better for your children, you have to fight to make sure you and your fellow Americans have a better life. The problem is people don’t realize our government is a tool in this fight. A government of the People, by the People, for the People.

As someone who is facing over $120K in student loan debt…I really don’t have anything witty to add. The more I educate myself and my parents on student loan debt the more I’m convinced I made a bad decision to go to grad school. Damn I’m depressed now…

DHB– great content as always. I agree that there is likely a bubble in education currently; I believe that the deflator will be demographic as the children of boomers are exiting college while the number of colleges increases. However, I am not sure that the measure of the cost of education is really the best. I think a better analysis might be college-high school wage differential. Per the following paper http://www.economics.harvard.edu/faculty/goldin/files/GoldinKatz_Brookings.pdf, that differential has increase by >50% since 1980. That difference may not justify the increased cost of education entirely. Another trend in education that we have observed elsewhere in the economy is globalization– more foreign students come to the US to study than did in 1980 (http://www.iie.org/en/Who-We-Are/News-and-Events/Press-Center/Press-Releases/2010/2010-11-15-Open-Doors-International-Students-In-The-US) because the perceived value of a US college education outside the US is greater than even what we see in the US (I only have anecdotal experiences here).

I’ve just returned home to the US after 12 years in Asia (Singapore, Hong Kong and the ROK). These states have always been home to wandering Americans who are escaping something or the other, but increasingly, they’re home to Americans who are escaping debt. They take their degrees and leave, forever forgetting about their debts. They’re making the rational decision.

When I think about something called a bubble, I think in terms of an item that gets terribly overpriced, and then the price crashes down again. This is the situation with housing today. But when and how is the cost of a college education going to crash back down to the levels that I encountered when I started at Cal, Berkeley in 1959? At that time, tuition was $73 per semester with two semesters per year, or $146 per year. Just for the record, full room and board at a well-run University dormitory cost my parents $130 per month. A $15 textbook was thought to be expensive. So once again, can I ask when college costs will start to head downwards? And by how much? Or am I misinterpreting the concept of a “bubble”? There’s no reason for universities to lower their costs as long as wealthy students from the USA and abroad can afford to pay $50,000 per year for an education in the USA. Perhaps the “bubble” is seen in the relative numbers of UNITED STATES CITIZENS who can afford a college education without totally disabling themselves with debt? In that case, why should our tax dollars be used to subsidize “public” educational institutions that are so heavily biased against US citizens? This kind of taxpayer revolt is already taking place here in California where the proportion of tax dollars in the University of California’s budget is shrinking drastically every year. Thus the two vital bubble curves in higher education could be 1) The percentage of US citizens in the student bodies of our universities, and 2) the percentage of US tax dollars in the budgets of these universities. I wonder what these curves would look like? I think I already know, and in these terms, the bubble has already burst. Or am I thinking incorrectly here? Feedback, please!

I blame these problems on the movie “animal house”

Leave a Reply