The housing CPI lottery – How the Bureau of Labor and Statistics helps the Federal Reserve ignore the most important budget item for Americans.

The way housing is measured through the Bureau of Labor and Statistics (BLS) is troubling because it completely understates what is really happening with actual home values. For many years, especially during the bubble I drew attention to this thorn of a fact because many in high places were pointing to the CPI as being stable and actually reflecting reality. The Federal Reserve prides itself with being masters of price stability. But what if you are not measuring what you claim to be measuring? That is what started to happen in 1983 when it came to housing. In 1983 the BLS shifted the way it calculated the housing portion of the CPI by using an owner’s equivalent of rent. In other words, how much would you get if you rent your house out. This flawed methodology has come back to bite us in many ways but was completely intentional. It is no coincidence that only one year before in 1982 the Garn–St. Germain Depository Institutions Act of 1982 was passed and this allowed for adjustable rate mortgages (ARMs) that understated the monthly payment but allowed home prices to inflate. By calculating a rental equivalent the BLS understated inflation for many years, especially during the bubble years. Part of this is cynical in nature to slam those on fixed incomes like Social Security that actually depend on cost of living adjustments. If inflation doesn’t exist, then no cost of living adjustments. The wealthy do not rely on these little items so it is inconsequential but the majority of American families do depend on this data being accurate. Let us take a look at how flawed this measure is.

The BLS measure of housing

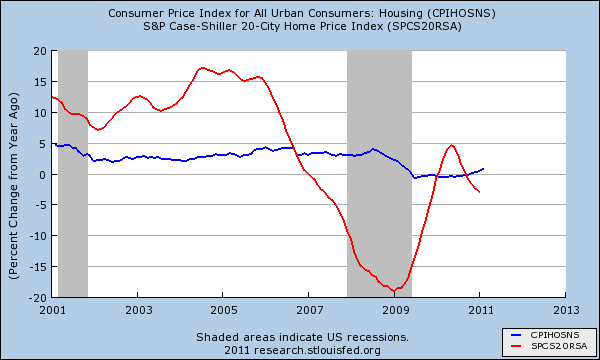

Source:Â The Mess that Greenspan Made

The above chart highlights the massive disconnect between the CPI and actual home values. You see that in the 1980s we did suffer a minor housing bubble which led to the savings and loans crisis. Yet that was small relative to what we faced a decade later starting in 1997. From 1997 to 2007 the CPI completely missed the once in a lifetime housing bubble. How did this happen? Well think about what the owner’s equivalent of rent (OER) measures. It basically measures what you would pay in rent for the home you are living in. Well this completely misses the fact that ARMs in the flavor of option ARMs for example actually allowed people to pay $500,000 for a tiny cardboard box that would rent for $1,000 or less. The real price of the home with a 30 year fixed mortgage actually carries a much higher cost, possibly of $3,000 to $4,000 a month. This is why price-to-rent ratios absolutely matter. If our central bank is going to make decade long monetary changes they should be using metrics that actually measure reality instead of some biased approach.

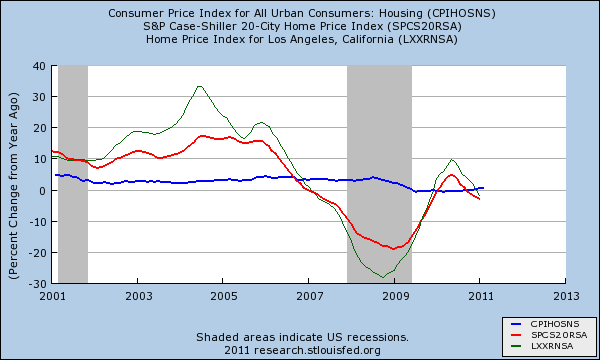

If the CPI understated the housing bubble nationwide you can only imagine what it did in bubble states like California. The year-over-year changes I believe highlight this disconnect clearly:

I decided to breakout the CPI housing component and measure it against the Case-Shiller 20 City Home Price Index. Now keep in mind what each of these items is focusing on. The Case-Shiller Index measures repeat home sales for the same home. This is one of the most accurate ways of measuring home prices in my opinion because you are looking at the same home over time. The blue line looks at the CPI housing component. It is important to note that housing makes up over 40 percent of the index so slight changes here impact the entire weighting of the CPI.

You can see for yourself that from 2001 the Case-Shiller was showing annual home price changes of 10 to over 15 percent! Yet the CPI never registered an annual increase of higher than 5 percent! In fact in many years it was registering annual changes of 2 or 3 percent which is completely absurd. Yet rents over this time did run sideways because people who pay rent actually use real world wages and in the real world, incomes went stagnant. Plus, why would you rent when anyone can play the housing lottery? Go in with nothing down and see what happens. The only reason the actual price of the home soared was the introduction of toxic mortgages with high leverage, the Federal Reserve artificially holding interest rates low, and a basic sense of graft and speculation throughout the entire country.

Now we already know what happened. But what is interesting is what is now happening. Rents initially started falling as the recession started which is to be expected. But rents seem to be ebbing higher right now even as home prices fall. Why is that?

-1. As more people lose their homes, they are seeking the only option they may have and that is a rental.

-2. Many cannot afford to buy and the only option available is government backed loans that at the very least, look at income which has been stagnant.

-3. You may have people making a more intentional decision to rent instead of buying because of the pain that occurred with the current housing market.

This is temporary in my view but could last a few years until the distressed inventory is worked out. We have never had so many people lose their homes on a nationwide scale. Right now all we are measuring is what someone would pay to rent their own home. For two full decades the entire measure was a sham and all it took was one mega housing bubble to distort the entire measure. The chart above is clear and shows home prices going down and rents slightly moving up on a nationwide basis. Yet other items like energy, food, and healthcare are eating up a larger portion of families’ disposable income. The CPI measure does not accurately reflect what is happening with housing values, even today.

The Federal Reserve prides itself with price stability. If that is the case, it needs to base decisions on metrics that actually measure what is happening in real time. That is, at one point nearly 70 percent of American households owned their home, with a mortgage mind you, yet they were using rental equivalency as a way to value a home? Those in these places will claim economists back these metrics but these are the same economists that missed the technology and housing bubbles and many who are hired by big investment banks. Two for two in that arena and not exactly unbiased.

Yet another point I would like to make is the fact that 30 to 40 percent of all purchases (depending on the market) are being conducted with FHA insured loans. These only require 3.5 percent down and the majority of these buyers are putting that amount down. Yet the real estate industry has pushed policies to keep selling fees up to 5 or 6 percent. In other words, all the tens of thousands of people buying today are starting from a negative equity position. If it costs 5 to 6 percent to sell off the top and you only put 3.5 percent down, you are in a negative equity spot. And what if home prices move lower as they are?

But let us look at another measure of housing for Los Angeles and add it to the graph above:

Look at the Home Price Index (HPI) for L.A. which is conservative but even with that, you can see that in one year the HPI for Los Angeles went up by a mind boggling 30 percent! Yet you can see the blue line CPI just moving sideways like a crab. As they say, don’t believe everything you read or hear.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

36 Responses to “The housing CPI lottery – How the Bureau of Labor and Statistics helps the Federal Reserve ignore the most important budget item for Americans.”

The planet is rebalancing and this gives emerging economies more money to buy the fundamental commodities. That’s why they’re in a cyclical bull market. US housing has so many fundamental problems that it wont be a worthy investment for another few years at least.

Excellent analysis. It’s been obvious for a long time that CPI is inaccurate, and deliberately so. I sometimes look at John Williams’s ShadowStats. That’s a good resource, although I do have some problems with his methodology – I get the feeling he sometimes tries to be controversial just to get more hits and more media exposure. But at least he’s telling it like it (mostly) is.

Henry

Have you looked at MIT’s billion prices project?

http://bpp.mit.edu/

CPI is not a mathmatically pure calculation backed by math but a politically weighted tool. And remeber kids, economics is as much an art and study of human behavior as it is a science. Check the motives and agenda of so-called “experts or economists” who are they? Employees of the state?

The single most ridiculous element of how they calculate the CPI would have to be the “hedonics quality adjustments”. Now, for some things, these adjustments of prices are not outlandish. The laptop on which I’m typing this cost X dollars when I bought it. Just a year later the same model would have much increased speed and memory capabilities. So, if the cost was still X dollars then, one could say that the price for the same features as I got with my purchase had actually gone down. This sort of rationale is not outlandish for some electronic goods.

But if you go over to the BLS site, you’ll find that they have “hedonics quality adjustments” (Their term. Like quantitative easing, if what you’re doing is a joke on its face you have to use opaque terminology) for things like children’s clothing, men’s suits etc. Because the features of that three button single breasted suit you buy this year are so much better than the one you bought last year, right? The pajamas you bought your kids have soooooo many features this year that they didn’t have last year, right?

I didn’t think so.

Here’s the link to just another way that the government outrageously lies to you and that the lazy press never mentions:

http://www.bls.gov/cpi/cpihqaitem.htm

All of whom missed seeing the crash of 2008 coming. What do you call someone who never saw the biggest event of their career coming? And why do people still listen to them and think they are “experts”?

You know, I’m new to the housing market… and when I look at these graphs, I just can’t seem to think how people could just watch this happen and not know that it was bound to come down. We all know hind site is 20/20. I’m just glad to be a guy looking behind.

Yes, that’s amusing, isn’t it? For kicks, you should see shows about Real Estate at that time. You can still get a whiff of the hopium.

The key thing that one should take away is that it’s hard, if not impossible, to identify a bubble when you’re in it. Less than a year ago we had people all over saying that real estate had bottomed and things were only going to go up. Especially in SF and LA. SF is now down 5% YOY, and LA down 2%. Pity the speculators who bought via FHA with 3% down. They are probably underwater.

Keep in mind that many of these same people lived through the dot-com bubble and the 2006 housing bubble. They never saw those coming, and haven’t learned anything since.

But those who think they are smart now, should ask themselves a simple question. What has changed which will prevent the crash of 2008 from happening again? I see very little, if anything. And I’d argue that we’re in worse shape now if such a thing were to happen.

Given that, IMO it can only be a matter of time before things repeat once more. I sincerely hope people are more prepared next time.

It’s no coincidence that the CPI recast took place during the Reagan administration, when the civil servants were commanded to find ways to substantiate the claims of voodoo economics – the new CPI shows that inflation is under control – which was what the Reaganites were hoping their policies would do. But of course the statistics lie. When government is dishonest we suffer for decades.

The CPI was initially published in 1919. It was revised in 1940, 1951, 1953, 1964 and 1978. Each time it was revised to more accurately reflect the population’s spending patterns. It was revised again in 1983 to remove housing prices and replace them with a more stable “owner’s equivalent rent”, since house prices are volitile and often detached from reality.

You have no idea what you are talking about and are blinded by collectivist BS.

That’s hilarious, Joe. Clearly someone has absolutely no clue of what he’s talking about. And, given the disparity between real prices today, and the excessively low numbers of the CPI, I’d have to say that it’s incredibly obvious that the clueless one is Joe Average.

Talk about being blinded. Try getting out of the house and going to a store sometime.

Questor- Which statement of mine was incorrect? I was not defending or promoting the CPI, only stating facts.

Changes have been made many times. If norcal wants to arbitrarily look at the Reagan years, then in 1983 the BLS decided that rent was a better measure of the cost of living than home prices. Its only a fact, don’t get mad at it.

I believe he was agreeing with you, and referrring to norcal’s ignorance in this case. I still have a tough time accepting that the world is at a minimum, 75% idiots.

Joe: I take issue with your assertion that norcal didn’t know what he was talking about, was blinded, and by consequence that the CPI wasn’t changed to fudge the numbers for convenience of the government. As well as the term “collectivist BS”, and by extension a defence of Reaganomics. Reagan has to take an extremely large part of the blame of the current economic situation, starting at least with his appointment of Greenspan (and arguably earlier). As well as Reagan’s propagation of the nonsensical and disastrous laissez-faire economic view and “trickle-down” economics. Both of which are trotted out to this day by Wall Street shills long after the economic situation has blown up, and the wreckage is still falling around us.

There was a Wall Street Journal article recently which covered what would have happened had the CPI not been changed to use the bogus “owner’s equivalent rent” and what the chart would look like. I posted a link to this in the comments section a couple of DrH articles back. One of the points made there was it would have been clearer that Greenspan was responding too late during the 00’s had the number not been fudged like it is now.

The point remains that there is a large discrepancy between the CPI and what people actually see in the real world. And attempting to use it as an accurate gauge of prices and services is misleading.

It is, however, extremely effectively used to repudiate the costs of Social Security and other debts. That seems to be it’s most useful role these days. Reflecting reality certainly isn’t.

For those people who would like a view of the CPI using older methods of calculations, you can see the difference at:

http://www.shadowstats.com/alternate_data/inflation-charts

Questor- As I said, the CPI had been changed during various administrations: FDR, Truman, Eisenhower, Johnson, Carter, Reagan.

For some reason (it’s up for debate, but I stand by collectivist BS) you and norcal want to arbitrarily look at the change during the Reagan years. Fine, the significant change was replacing housing prices with a rent metric. If you want to discuss the ramifications of that, so be it.

Instead, you rant, trying to convince people that of all the changes made to the CPI over the years, the one made during a Republican administration 30 years ago was a conspiracy to fudge inflation data, rig social security and make people buy things they can’t afford.

I’m a bit new to CPI, and I’m enjoying this (well maintained) thread here. In the effort of seeking truth, I am wondering if any of you in this thread (Joe, Questor, surf) can point to other articles or online sources of the CPI being used or pointed to in politics, housing, economics or other. It seems as if one argument is, “The CPI is BS because it’s been adjusted during Reagan years, and carried on through current politics resulting in our housing market today”. Versus the other argument, “It’s just a number that attempts to outline the state of prices of consumed american stuffs”.

Is the CPI used as a bat – to hit the ball with, or is the CPI a corked bat – something that the gov’t and others use to always hit home runs with?

You’re welcome to try to defend the disasters that Reagan caused Joe. But the arguments get weak when you start looking at all of the facts and results; many of which we face today.

Before you start telling people that they don’t know what they are talking about, be certain that you actually do. Your defense of Reagan’s version of the CPI is extremely weak.

In any case, the bottom line is that you look really silly trying to defend Reagan’s adjustments as something real, when everyone else can just look outside and see that it has little bearing on what people are facing.

That’s a lot of math! Good job. Sadly, no one was listening when it mattered. I never understood why Greenspan and other so called experts didn’t just look outside the window and see what was really happening. I have lost all respect for economics and experts when dealing with money; it’s just a game and fake numbers they invented to keep themselves employed. In they end, they numbers didn’t mean $H!t.

Bernanke’s Failed CNBC Predictions

http://dailybail.com/home/a-movement-by-the-people-to-prevent-the-reappointment-of-the.html

Wow, that is just gold!

You may be right about the conspiracy to keep CPI down, but I think it would sell better if you named names and produced sources (or at least an article or two) documenting the intentional misdirection.

As for CPI measuring owners equivalent of rent, this seems entirely reasonable if you consider who is getting these CPI adjustments and what their circumstances are. Chances are they with bought their house decades ago, in which case current housing prices are irrelevant to them unless they sell, or for tax purposes, or they are renting. I don’t know too many social security recipients who are incurring great costs upsizing their home every few years. If anything, increased home values are a source of wealth, for the time when they sell, not an expense. If you are means testing a population, it seems quite reasonable to me to look at what is really required to live semi comfortably with your expenses trimmed down to minimum comfort zone. I don’t think home ownership (especially home buying) fits anywhere in that lifestyle, unless you are lucky enough to already own a home. Simply put, if you are living off a government financed retirement, home ownership is a privilege afforded to those who saved well while working, not a right. So long as renting is cheaper than buying, I fail to see any justification for including home prices in the CPI.

Can you imagine the economic turmoil if the CPI had included hosing prices? The mind boggles at the tremendous inflation in the first decade of the 21st Century followed by equally tremendous deflation since 2008. The policy responses during those two periods from Washington would have really screwed everything up.

JimmyJoe–I hope that’s dry wit. Otherwise, you are really missing the point.

Consider they changed it when the baby boomers were going wild demographically and grabbing up houses/real assets when interest rates were sky high. They changed the CPI just as interest rates started moving down. This allowed housing values to boom in the mid-late 80s as people could spend more with lower interest and likely they didn’t want to skew the CPI with that move. The ramifications were that CPI didn’t participate in any of the bubbles and wasn’t massively impacted by the draw down. I don’t look at it as a massive conspiracy theory but it’s a notable impact.

That’s a good point of realpolitik, actually. Look at Congress’s (and the SSA, and the VA, and Medicare, and…) inability to handle even a slow-moving CPI.

Still, NO ONE, and I mean NO ONE, can fudge stats like a .gov bureaucrat whose fat paycheck, Mercedes bennies, and Rolls-Royce pension DEPENDS on fudging those selfsame stats! Make sure the publik skew-els keep churning out “grads” who can’t handle anything beyond single-variable linear equations (and who then major in “journalism”) , and your .gov flunky is home safe and dry.

I would like to offer a 4th reason for why rents are trending up.

-4) The average rental unit is housing more people than in previous times.

More roommates, relatives, and families doubling up.

Landlords will accomodate, but they raise the rent to compensate.

Bottom line: People have *less* to spend on rent even though

rents on a per unit basis are trending upward.

Correct, and it would be illustrative to see it plotted alongside rental VACANCIES.

I’ve resisted allowing increased occupancies in my rental units (Ft.Laud), even though it has meant going vacant a week or three longer… don’t need the headaches. I’m near a concentration of “BiMeC” (BIo-MEdical-Industrial Complex, aka Hospitals and spinoffs), and am able to draw well-paid healthcare workers.

I’m sure cops are handling more “domestic disturbances” due to the induced crowding… sign of the times.

But I definitely see signs of “doubling up” in larger, corporate-owned multi-family dwellings, i.e. those w/ 10+ units/bldg. e.g. constant overflow parking in bldgs. that used to have plenty of guest spots.

Self-storage units have increasing vacancies too, and I’ve negotiated 2 rent reductions on mine in the past 30 months… heh heh heh…

When people living free in their homes (2-3 years now!) are foreclosed upon, they will have to go out and rent so that may bump-up rents. Hopefully they are saving now what they normally would have shelled-out for their house payment. Some people are just partying with the money. Many of the loans I hear are in control of BofA.

DH – curious what % of people living free in their homes lost jobs, filed BK, have medical bills, divorced or experienced some loss,

vs.

those still working and just refusing to pay their mortgage.

Oh yeah, anybody applies for one of my nice 2/2 or 3/2 rentals, and has a foreclosure on their record (hasn’t happened yet, but it will), and they’re putting down *6 MONTHS* security deposit, minimum!

My thinking is:

a) Anyone that walks away from a mortgage will even more readily skate on a lease;

b) At the glacial rate foreclosures move here in So-Fla, I figure they got 24-39 mortgage payments “saved up”, so that hefty deposit should not be an issue… and if it is, hey, there’s some “Se Habla Espanol” corporate/REIT apts. down the road a-ways…

My wife’s niece rents an apt in NYC with three roommates. They have started renting out the 8 ft sq closet to a guy for 500 a month.

I normally agree with the Dr. but in this case I think this argument is a stretch. It seems reasonable on the surface. However, inflation should measure the change in cost to put a roof over your head on a monthly or annual basis, not the change in the debt load for the homebuyer.

I don’t see why the BLS should not just measure the change in the total of the national rent plus mortgage payments, divided by the number of households. That would be an interesting metric.

Can you imagine people managing their household budget they way these knuckleheads manage our economy. They could forecast insane income growth, lower costs, and go out and spend the future savings with a credit card that’s at the top of it’s limit. Oh, oh, oh, wait it’s our credit card, we’ll just up the limit. Sunshine and roses!

Recently, some learned friend as they say in the British Parliament denied that inflation existed, citing BLS statistics. As a landlord, I just got a $ 210 bill for some obscure health license imposed by the county of San Bernardino. Truth be told, renting out homes is no panacea and on expensive homes, one is not even breaking even. The Dr. HB wants us to think for ourselves and to reevaluate the real estate market. unless rents creep up, there will be many who will fail as landlords, too. Let’s see how the BLS will handle higher rents!

So many govt payments are geared off of CPI that it only made sense that they would try to skew the data towards lower CPI numbers. It also helps that people dont like to see inflation. So it’s a win-win for the govt to produce low CPI numbers.

CPI was changed in 1983 to exclude housing costs and substitute rental equivalent. So was this the right thing to do? Imagine if the change were not made. Housing price increases would have led to a rise in the CPI that would have caused the Fed to raise interest rates to counter the effect. Rising rates would have cooled the housing price rise…hence no bubble…

Consider what is happening now. Housing prices have plummeted. So including housing in the CPI would reflect DEFLATION…not inflation. The Fed response would be to try and lower interest rates to counter this effect. In fact that is what is being done, since Bernanke seems to get it…where Greenspan did not. Of course the side effect of trying to counter the massive drop in housing prices is to create other bubbles, but the only real choice is to let the economy collapse into a Depression.

I understand the academic arguments for using rent equivalent instead of housing price, but the reality is that the methodology of using price vs. rent prior to 1983 would have prevented the housing bubble and would show a clearer picture of our current situation and throw light on what the Fed is doing….also Obama.

We are in for a long slog before the economy recovers from an excessive bubble. Unfortunately, the populace is not patient enough to wait it out. What happens now is the question.

In my opinion, we should go back to including housing prices in the CPI and maybe even stock market prices. Housing is the most important asset in the average person’s portfolio, but stocks now are important as well through 401K’s and IRA’s. Including stock prices in the CPI would have led the Fed to increase interest rates during the dot.com boom of the late 90’s and prevented that bubble as well.

It is a fact of political life that the CPI numbers drive public policy. We can let our leaders ignore housing and other important asset prices to our peril.

Leave a Reply