Financial timeline of 10 events from the Great Depression and parallels to our current economy: Lessons from the Great Depression Part 31. When government and financial institutions become one.

Our current economy is facing unique circumstances. In no time in our past have we had such a large number of American retiring and living many years post-work. Average life expectancy in 1900 for a male was 46 and today it is up to 73 (for females it is 48 and 79 respectively). The baby boomer generation will draw on retirement plans, pensions, and Social Security. It is also the case that we have never had a housing market like the one we face today. Never had we had such a widespread bubble and we have never had a market where shadow inventory is actually larger than normal inventory. That is actually where we stand on housing as of this moment. It is also the case that we have never gone through such a painful crash without any serious reform to fix the system. Nothing has changed and this is the biggest financial crisis since the Great Depression. Speaking of the Great Depression let us walk through significant events over the 1920s and 1930s and see if we can learn any lessons for our current economic predicament.

This is part 31 in our Lessons from the Great Depression series:

26. Pecora Commission Where Art Thou?

27. Current Net Worth Drop of $13.8 Trillion Equivalent to 21 Percent Drop.

28. The Gospel of Economic Prosperity

29. New home sales fell 80 percent from 1929 to 1932 and fell 82 percent from 2005 to 2011.

30.  Economic déjà vu from the 1937-38 recession

I found a wonderful basic Great Depression timeline here. My background on the Great Depression comes from economics courses on the topic but also reading roughly 20 books and 50 articles/journals on the matter. I’m fascinated by an economic event that touched the lives of all and the stories behind the boom and bust. Let us walk through some key events and relate them to events in our current crisis.

1924

“The stock market begins its spectacular rise. Bears little relation to the rest of the economy.â€

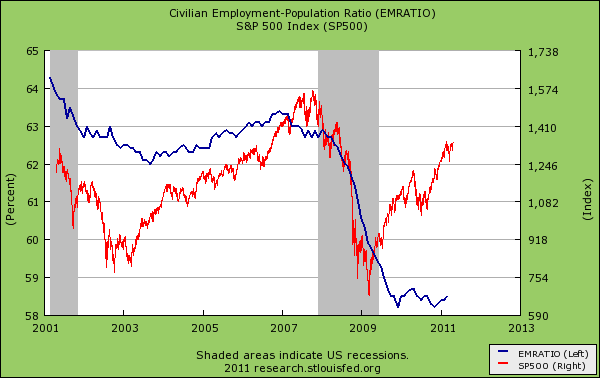

This can apply to the stock market after our current recession:

Most of the jobs lost since the recession are largely still gone even though the recession officially ended in the summer of 2009. Yet the S&P 500 is up over 100 percent from the lows reached on March 2009. What is pushing the market up to these current levels? The push is coming from bank bailouts providing easy access to those with connections to the capital markets and employers cutting wages and shipping jobs overseas to cheaper cost centers. In other words the overall American family is not seeing the benefits at all.

1925

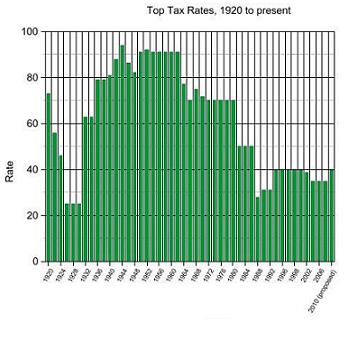

“The top tax rate is lowered to 25 percent – the lowest top rate in the eight decades since World War I.â€

I know some people go nuts when they hear the word taxes. But it is useful to see past experiences in this area to our current rates:

Keep in mind that in 1925 the top rate was lowered to 25 percent and this is currently in one of the proposals being pushed by folks in Congress. The 1920s were one giant speculative party while the majority of Americans simply sat out the bubble. The problem with our tax system isn’t so much the rates but that many people avoid paying what is currently stated thanks to sophisticated loopholes not available to the public. The politics center on scaring the public on the top rate yet rarely is this rate ever paid.

For example, in 1980 the wealthiest in the country paid 34.5 percent on their personal income taxes while in 2008 this fell to 23.3 percent. This rate is even lower than that the speakeasy happy days of the 1920s that led to a mega bubble in market speculation. If anyone is serious about getting our budget balanced or toward that end we have to talk about taxes and spending cuts. The data is rather clear but right now politics cloud the actual conversation with one line slogans.

1928

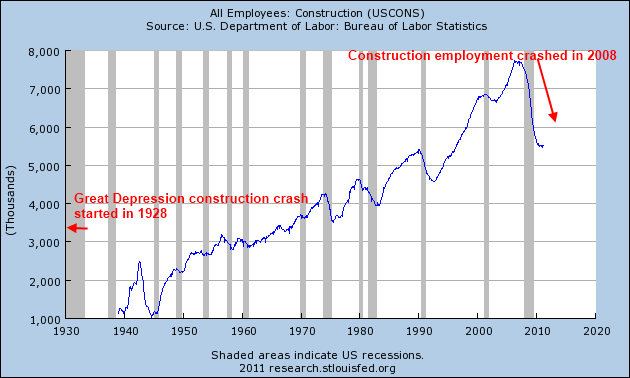

“The construction boom is over.â€

This is one area where we have clear parallels:

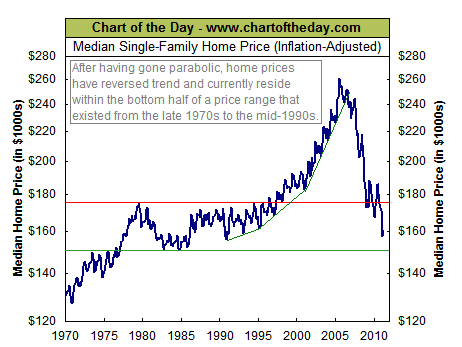

The only time construction has contracted this severely was during the Great Depression and our current Great Recession.   Because of overbuilding and lost wages, the price of housing cratered back during the Great Depression as well. Take a look at the current U.S. median home price:

Now looking at the above chart you would assume that home prices are cheap or near their bottom nationwide. Yet I would argue that we would first need to see wage income growth to justify the above. If we only add lower paying jobs how are home prices going to maintain their current price level? It is clear that the giddy era of the 1920s and that of the happy real estate era of the 2000s led to massive construction booms that burst badly.

1929

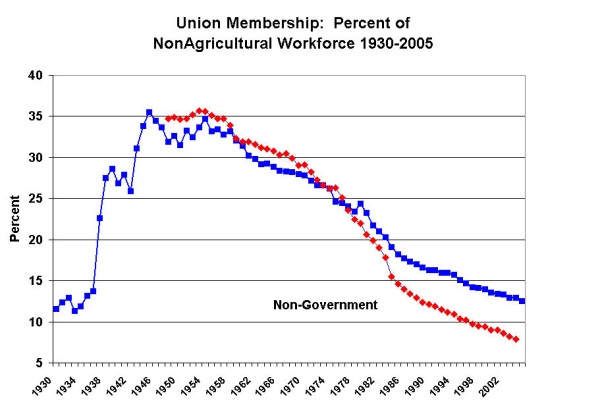

“Organized labor declines throughout the decade. The United Mine Workers Union will see its membership fall from 500,000 in 1920 to 75,000 in 1928. The American Federation of Labor would fall from 5.1 million in 1920 to 3.4 million in 1929.â€

This is a trend that is definitely happening right now:

Source:Â Vote Now

It is a fascinating case of human psychology and consumer behavior dominating the markets and politics. People are voting against their own economic interests in many cases today. It seems like a large portion of our population is okay with having no working protections, no access to reasonable health care, fine with dolling out trillions of dollars to the banking sector, all the while having no tangible results to their own bottom line. Most Americans do not want to get caught up in a race to the bottom. Because of this we are seeing income inequality similar to that of the days that led up to the Great Depression:

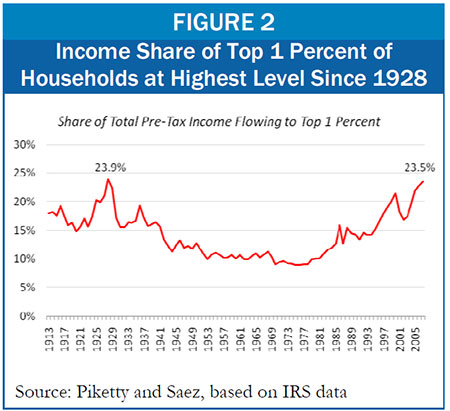

“By 1929, the richest 1 percent will own 40 percent of the nation’s wealth. The bottom 93 percent will have experienced a 4 percent drop in real disposable per-capita income between 1923 and 1929.â€

Today the top one percent holds 42 percent of the nation’s wealth and income inequality is back to the 1920s level:

Now in any economy regardless of politics or economic system you will have income inequality. That is simply a normal process. Some workers are much more productive than others. Most of us accept this reality. We also accept that to live in a modernized society it dose cost money to have certain services (i.e., roads, public safety, schools, military, etc). The problem with our current system is that much of the money is made from the rentier class. That is you have investment banks using Federal Reserve money to speculate in global stock markets that add no value domestically although it is the domestic taxpayer that shoulders the burden through a weaker dollar, higher fuel costs, more expensive health care, and a quality of life that sinks.

While in 1933 the Glass-Steagall Act passed to separate the casino nature of our capital markets today it has gotten stronger with the too big to fail banks getting bigger. So it is hard to say where we are on the timeline because we had our banking collapse brought on by massive speculation and no enforcement or restraint and today we are still there.

Workers rarely see a benefit of this because the rhetoric is “we are broke and there are billions of people around the world who will work for $1 a day†– in other words be happy you have that job at Wal-Mart while we get free handouts at the Federal Reserve:

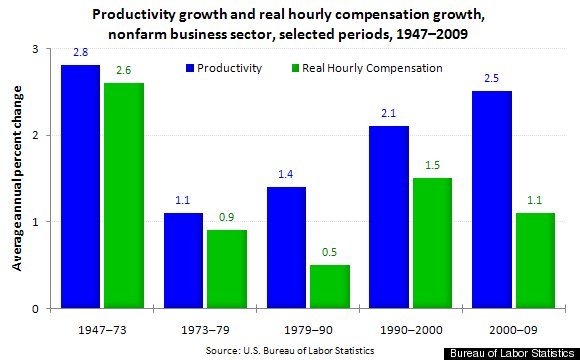

“Individual worker productivity rises an astonishing 43 percent from 1919 to 1929. But the rewards are being funneled to the top: the number of people reporting half-million dollar incomes grows from 156 to 1,489 between 1920 and 1929, a phenomenal rise compared to other decades. But that is still less than 1 percent of all income-earners.â€

This is interesting and also plays along the lines of many Americans voting against their own pocketbook:

Source:Â BLS

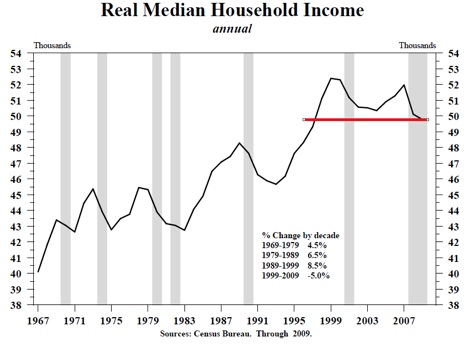

Interestingly enough during a time where real wages have gone stagnant or declined the American worker has become more productive. The reason the S&P 500 is up over 100 percent in a short time is because the profits are flowing all the way to the top. Some will say invest in the stock market but the market is still a casino and most Americans (because of stagnant wages) barely have enough to invest in after they pay their bills. Plus, the system hasn’t changed with flash crashes of 1,000 points (still no solid explanation) and high frequency trading that the typical investors simply becomes chum for the hedge funds who won’t even take your call unless you have $1 million in liquid assets to invest. Take a look at how income has grown over time:

Source:Â Census

Not exactly a promising picture. Add into the mix the massive problems in housing and it is hard to understand how some believe home prices will simply run back up in price. Even during the peak year of 1929 many Americans were merely getting by:

“More than half of all Americans are living below a minimum subsistence level.â€

Today it isn’t as bad certainly but this is thanks to programs like food stamps and unemployment insurance. One out of every seven Americans is receiving food stamps today. This is a large piece of our society in a time where the stock markets are now up 100 percent in a very short time.

1930

“By February, the Federal Reserve has cut the prime interest rate from 6 to 4 percent. Expands the money supply with a major purchase of U.S. securities. However, for the next year and a half, the Fed will add very little money to the shrinking economy. (At no time will it actually pull money out of the system.) Treasury Secretary Andrew Mellon announces that the Fed will stand by as the market works itself out: “Liquidate labor, liquidate stocks, liquidate real estate… values will be adjusted, and enterprising people will pick up the wreck from less-competent people.”

This is where things diverge. The Federal Reserve was slower to act during the Great Depression but it did act. The Fed this time wasted no time and injected money into the banking system. Yet this merely has accelerated the problems that got us here in the first place. The too big to fail are now bigger. Their bank balance sheets are still opaque and hidden from scrutiny even though they are leveraging taxpayer dollars and pushing costs via inflation and other hidden taxes onto the public. The public will pay through inflation that we are now seeing in daily used items.

What it feels like is we gave a golden parachute to the banking and financial companies while the public is still left dealing with the realities of the recession. While the investment banks garner record profits thanks to this easy money and pay no market retribution because of their gambling on housing the public is led to believe the story that they are overpaid, that taxes in every case are bad, and that telling the government to stay out of Bank of America or Goldman Sachs books is good for them. How people believe this argument is illogical but just like during the bubble, herd psychology is very powerful.

1932

“Congress passes the Emergency Banking Bill, the Glass-Steagall Act of 1933, the Farm Credit Act, the National Industrial Recovery Act and the Truth-in-Securities Act.â€

It took three years before any serious action and reform was taken after the 1929 crash. Keep in mind that this happened with the hands off President Hoover who delayed action for a few years. If the market started tanking in 2007 we have surpassed that timeline and what serious reforms do we have? None! It is absolutely amazing how no serious reform has occurred so to think that the system is “fixed†is insane.

In fact we have accelerated the consolidation of financial power even more. This is simply a fact:

Bank of America – swallowed up Countrywide Financial and Merrill Lynch

JP Morgan Chase – swallowed up Washington Mutual and Bear Stearns

Wells Fargo – swallowed up Wachovia

Don’t you think if the issue was too big to fail that we would have split the banks up instead of making them into mega monsters? The Federal Reserve follows the St. Augustine way of dealing with things:

“Lord, Make me chaste, but not yetâ€

1937

“Economists attribute economic growth so far to heavy government spending that is somewhat deficit. Roosevelt, however, fears an unbalanced budget and cuts spending for 1937. That summer, the nation plunges into another recession. Despite this, the yearly GNP rises 5.0 percent, and unemployment falls to 14.3 percent.â€

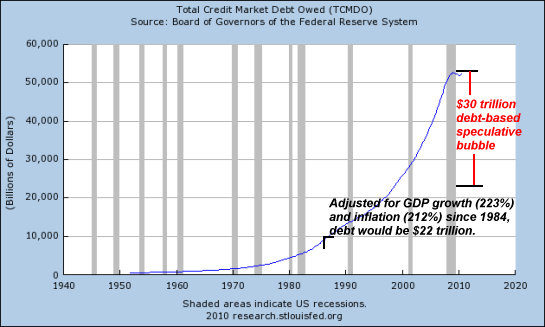

Of course much of the help during the Great Depression came from government spending. The one thing I will say is that millions of people were put to work. The benefits of government spending did largely go to the typical American during this time, even if it was very little. Today the massive bailouts have largely aided those who really don’t need the funds especially the investment banks. And much of this is coming on the back of debt leverage:

Source:Â Of Two Minds

In comparing the two situations, of course very different in many ways, we can conclude that in today’s bailouts and recovery intervention that most of the money and aid was directed to the financial sector. The typical American has seen no wage growth for over a decade and their worker protections are largely being thrown out the window. There is a two story narrative: the financial industry uses corporate welfare and government handouts while chastising the public to deal with survival of the fittest in the free market. The only reason these banks stand with no reform is because of their political connections, not because of success. They were weeks away from being eliminated by the free market because of their massive speculation and bad bets during the bubble. Yet to bail them out is to reward bad behavior so today, are we to expect anything different? There has been no Pecora Commission aside from the FCIC inquiry which came out with excellent findings but no action!

These are interesting times and to think that real estate will recover while most families are seeing no actual income growth is absurd.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “Financial timeline of 10 events from the Great Depression and parallels to our current economy: Lessons from the Great Depression Part 31. When government and financial institutions become one.”

Better watch your step my Good Doctor. To even point out that things are getting better for the rich income wise and tax wise could turn your average reader against you. Well maybe not your average reader but certainly the average American

We must make sure the rich get richer so that they might create a minimum wage job.

I am actually thinking of creating a charity where all the money goes to the rich. Just think of all the jobs that could be created if everyone sent their neighborhood rich guy a dollar!!

Good article. I think you are mostly right.

Don Pitts

In my 62 years, there has never been a time of greater financial uncertainty. Half of America seems happily unaware, and are still buying jewelry, expensive cars, and mega televisions, with 1,000 cable channels.

The other half is wondering where we will be in 2 or 3 years, (irregardless of what party is in the White House.) Real fear about their future, and especially their children, is leaving people paralyzed with inaction, as there is no clear path to prosperity, or where to invest their money.

The baby boomer generation was forever changed by Vietnam, and the social upheaval that ensued.

In 10 years, we may look back, and realize that this time was also a watershed event.

The boomer generation was forever changed by Vietnam?

Oh, please…as the daughter of a Vietnam Vet I can remember my dad coming back to derision and scorn for his service.

Your generation will forever be known for being coddled and shielded from all consequences of your actions and behaviors by the WW2 generation. This immaturity and fantasy ideology directly led to the lending of loans to those who could not afford to repay them.

http://www.generationzeromovie.com

To this very day, boomers are in a perpetual state of adolescence having refused to mentally mature. They are hated by my generation for giving away the nation due to stupid policies based upon their “white guilt.”

Instead of Vietnam, actually what was changed were the futures of the 50M Americans that have been aborted, which right the boomers demanded:

http://cnsnews.com/news/article/nearly-50-million-abortions-have-been-pe

Vietnam? I would say “grow up” but that time has long passed.

~Misstrial

Since you are female, and safe from the draft, you seem to feel that you can heap scorn on Vietnam Vets. An entire generation of men had to plan their life around that war.

Yep, it’s all those darn poor people (code for minorities?) trying to buy expensive homes that caused this mess.. You should read Griftopia by Matt Taibbi and educate yourself on the true diabolical nature of the banking cartel. He even discusses (and refutes) your canard about poor people buying homes as the primary cause of the recession. Deregulation is the biggest culprit, but I suspect it doesn’t fit into your worldview.

“..giving away the nation due to stupid policies based upon their “white guilt.—

Right, civil rights and affirmative action are what’s destroying America… To whom are we giving away the nation, by the way?

Legalized abortion is proof of the Boomer generation’s lack or moral compass or is their some economic impact on home values tied to the aborted fetuses lack of buying power?

You have made some rather swooping generalizations Mistrial. No offence intended, but could your social/moral issues be better voiced on a pro-life/pro-choice Blog?

To assume that greed and lack of regulation is a Boomer problem is spurious and ludicrous. Please review a few footnotes on American greed and corruption: the Grant administration, TeaPot Dome, S&L debacle, and the topic of the above article.

To rant about boomers comes off as a bit unhinged.

I was born in 1970.

I guess your jealous – i don’t blame you – its GREAT being a boomer – HA!

Man, where do I start? You had me agreeing with you in your first two paragraphs, but then you just went off into crazy. Fact of the matter, no matter what you think of abortions personally, it is quintessentially diametrically opposed to what America was said to be when it was founded; a place where people had full domain for their own being and responsibility for their actions. It took a while for that to come to full fruition because of the evil, diabolical, sociopathic, psychotic people standing in the way of liberty for all; who are today the same types, personalities, and even offspring who make up the majority of the Republican party. Abortion is legal because it is no outside party’s real business to decide what a woman should do with her body. As long as a fetus is dependent and contained within her body, it is still her body. Whether you like it or not.

The problem with your defending Vietnam veterans is that we are in a country that lays so much weight upon individual accountability and equal individual reward it also is incumbent upon individuals who joint the military voluntarily, or are part of a society that faces a draft to educate themselves independently, without listening to propagandists, and make a judgement for which they will be held accountable in adequate measure.

If your leader sends you off to fight an illegal and immoral war of aggression and invasion, stop whining that you are not liked for it and get mad at those who sent you after giving them your blind trust. We have an exasperated problem with scuffling with the wrong people in this country. The very reason for this blog is a good example.

The primary perpetrators and beneficiaries of the housing scam committed upon the American people in a treasonous way are overlooked and even given a pass and made excuses for by people (usually Republican bottom feeders) that were victimized. Instead they are given straw men by the criminals and conspirators, e.g., blame fellow dummy Americans who are too stupid to realize they are being used as a vehicle for rich and wealthy (+real estate agents, and ‘Flip This House’ charlatans) to defraud America. The middle and lower class was nothing but the mule for the wealthy to commit their crime, and now the middle and lower classes are pointing fingers to find out which mule is more responsible based on who had their ass stretched the farthest to carry the most defrauded riches to the wealthy.

Something most (pretty much everyone) does not comprehend is that monarchy, dictatorship, America’s “Democracy” is all the same thing. The mindset is and has always been the same; the manipulation of many for the benefit of a few in a fraudulent manner. There is not liberty, justice, equality, freedom, etc. in any country that has inheritance of generational wealth; it’s all the same, just different branding, labeling, etc. If one believed in all the just mentioned positive principles; one would have to demand that everyone, including the children of the wealthy, start at an equal level, where intellect, fortitude, and drive within ones physical abilities are the major indicators of success, not supremacist, racist systems of generational wealth control handed down simply based on a genetic lottery of the most animalistic, primitive kind that even the most simple bacteria partake in.

Why is it that America is that land where you can be anything you want and pursue your American Dreamâ„¢…unless you are the child of a wealthy person or early settler who inherits their American dream and can live off nothing more than the sap (appreciation, inflation, interest) created by all the middle class people striving for an unattainable, ever more fleeting fantasy like the parasites they are.

Viet Vet:

Please go back & reread my post. Never once did I criticize Vietnam Vets, my dad being one.

The object of my derision is the Boomers, go back and read it.

No other age group, having had to face war, has done so with more complaining and whining than the spoiled rotten Boomers.

Maybe its because you idiots were more focused on illicit drug use and free sex.

And then, and then, when you were middle-aged, you drove up the cost of housing to the stratosphere to pad your retirements!

~Misstrial

It’s not just the Boomers. It is human nature. There is corruption and wickedness rampant now and there always has been. More than anything, the boomers learned from Vietnam that America was not the shinging spring of truth and beauty, but just another nation of people manipulated by their leaders. As the doctor points out here, human nature caused the prior depression and this one too. Only now the media is owned by the perpa-traitors so no one is even slapped on the wrist, let alone punished.

yes, those WW2 parents that could spoiled their children, largely in reaction to the horrors of the depression and war that they had known and wanted to compensate and make a wonderful life for us. Unfortunately, that did little for our character.

Another thing was that our generation was the first that was taught that God was not real and that we had to find our truth in science. We were indeed disillusioned and lost, and many just fell into pursuit of materials, in fact the baby boomer mantra is “The one who dies with the most toys wins.” Inside of humor is the truth. We are on a death march and we know it. Most of us go to work, go home and watch TV and drink. I somehow can’t imagine that was the purpose of the universe…

However, I’LL criticize VETS in a heartbeat. Heroes don’t get PAID, mercenaries do. Last I checked, VETS were paid, in some cases for years and years. Add into the fact that these “vets” are coming home with mental illnesses and then joining our Police State of America…well, shootings are way up you know.

Those soldiersin Germany at the extermination camps…yea those guys were VETS too, and followed orders to a “T”. Good soldiers they were, but you have to wonder what kind of human being follows orders like that…oh yea, that’s right, a good SOLDIER.

The WWII generation fought for how many MONTHS in Europe? 18 months. In the Pacific? 3.5 years. We fought in VN for 10 years, led by a pack of corrupt WWII generation generals and politicians. We won every battle but lost the war through inept leadership by YOUR generation of leaders. Much of the current financial crisis was fomented by the likes of Ted Kennedy and Alan Greenspan…neither of them Boomers. Millions of greedy and naive boomers and Gen X, Gen Y…and WWII generation…homebuyers made poor investment decisions and lost their shirts. No generation has a monopoly on greed or naivety.

This entire exchange in reaction to Michael’s compassionate view of the dreadful situation he sees (and many of us do, and DHB writes about with such clarity and tenacity) typifies another layer of why our society is so paralyzed, rather than mobilized to repair the damage and reset our sails.

There are some generational truths in what Miss Trial says, but apparently feels compelled to vent anonymously in a tone of scorn and generational exceptionalism. Nobody is as good at being Generational Victims as Gen Xers and Millennials.

I we can restrain our Internet frothing for a moment, I think it has become clear–including from Doc’s numbers above–that all the bling and speculation and Monopoly money and bubblicious riches that the Baby Boomers lived for ARE GONE. They have been sucked upwards to the plutocratic caste. So let it go, Miss Trial. The Baby Boomers in the main played a rigged game–one to which they contributed, but it’s not letting them off easy.

And here the rest of us sit, throwing hand grenades at each other. How convenient for the plutocrats, union busters, and lords of debt.

As for Miss Trial, I’d say you have to get out more. My father was WWII, Navy, PTO. There is no way you are qualified to speak for me. Demographers consider me Baby Boom, but I am in fact a punk of the Generation Jones cohort. You know, the ones who were going to get in positions of power then change the world.

http://www.philly.com/philly/blogs/attytood/Along_came_Jones_Why_my_generation_isnt_saving_the_world.html

I will note that the night Reagan got elected, I couldn’t afford to get drunk. I was working as a sandblaster on the riverfront of our city, down among the refineries, and every penny I made was going either into food and housing, or my S&L savings account. I was trying to hold body and soul together not just for myself, but for family members.

Two years later through an accident of fate and the intervention of several old WWII generation teachers, I was in an Ivy League Ph.D. program. Where I’d always belonged, but my family was poor and destined to be used up and discarded.

“The Sixties” in our Rust Belt city were not the suburban idyll Miss Trial suggests, and apparently got from her readings on the Internet. They were a time of rampant societal and economic disorder, of race riots (“white guilt”? that’s a luxury for those of you who are white, and in the majority where they live), maiming and death in Vietnam (we didn’t get college deferments and couldn’t afford to blow town for Canada, plus we had family obligations), poverty, dislocation, structural unemployment, and for those lucky enough to have had jobs since World War II, death from willfully caused industrial mayhem. (It’s cheaper to kill off workers, you see. Then you don’t have to pay them pensions in old age.)

See what Dark Ages has to say immediately below.

I just finished reading “Griftopia” by Matt Taibbi.

My anger is again explosive in regards to Wall St.

The fact that nothing has been done makes me fear for this country.

Obama turned out to be just as dirty as Bush.

Makes a person wonder who really is calling the shots in America? Could it be that the Office of President is just a puppet on strings? I want to know who really is at the top of the strings?

Same people that own the rest of the politicians. The top 1% via their lobbyists. The best government money can buy.

George Soros and cronies is who is in charge here. BO is a puppet. The progressive movement whose goal is to devalue our currency and install their new world order.

George Soros is largely responsible for these games in formrer Czechoslovakia , and broke the bank of England before they told him to leave. He is here now doing what he did there. Glen Beck talks about him frequently.

mlimberg, the nation was set on this path when pulled out of the economic system we were founded for and into the old European fiat currency banking order.

Do some reading on the Federal Reserve Act, on the shady way the US was pulled into the central banking system, and our currency changed from a sovereign national scrip to the private currency of European banksters which we rent at vast, and crippling, cost.

Yes, toster, we should be listening to Glenn Beck for the real truth. It’s not like he’s a charlatan whose influence is based entirely on ignorance and dumbshit hyperbole. He’s trustworthy!

I bet you think we should all be buying gold, GOLD, GOOOOOOOLLLLD!

Agreed. This is the observation which should be plainly obvious to everyone by now. The really big decisions that both political parties make are strikingly similar. What we really have is a one party system with two factions. Obama has the same Wall Street crooks who were there under Bush and Clinton. His health care “reform” helps out the insurance companies more than it helps anyone else. He has given away tons of money (with virtually no strings attached) to the super-rich. And people still call him a socialist. This is how far political discourse has degenerated in America.

The average American has gotten no help since the crash of 2008 and no help is on the horizon. And this is exactly why the housing market will continue its downward slide.

Real estate will not be recovering anytime soon. The fundamentals are plain horrible and good incomes are disappearing at an alarming rate. It’s hard to buy a house with only service jobs. Even the prime of most prime housing markets are now witnessing foreclosures. North of Montana, in Santa Monica 90402 has REOs along with everybody else now.

http://www.santamonicameltdownthe90402.blogspot.com

http://www.westsideremeltdown.blogspot.com

Aw Doc you disappoint me as you are a FAR better analysis of statistical patterns than implied by this nonsense of “Average life expectancy in 1900 for a male was 46 and today it is up to 73 (for females it is 48 and 79 respectively). ”

(1) “Average” is a meaningless number when comparing life spans as far far far more died in infancy or childhood until post-WWII with the advent of antibiotics and vaccines for things like polio.

Take my grandfather and his 8 brothers – 9 children in all. They were all born between 1906 and 1919. The “average” life span of the 9 brothers was 61 years.

Of course that is heavily skewed by the fact the 2 of the brothers (twins) died before they were 1 year old. The remaining 7 brothers who lived to adulthood had an average life span of 78+ years. One of the 7 brothers who lived to adulthood was killed in a traffic accident at the age of 40. The remaining 6 brothers had an ‘average’ life span of 84 1/2 years.

And yes those who made it to adulthood were all young adults or late teens in 1934.

(2) My other grandfather was born in 1901 and lived to be 93 1/2 . Of course the ‘average’ life span for his siblings and him looks to be far less as 2 of his 3 siblings died from typhoid in 1903 when they were less than 8 years old.

Really Doc, you are better than such superficial nonsense. In fact the lifespan of those who lived to adulthood has increased only by 2 or 3 years as compared to the 1930s. And the group whose longer lives have increased by the average or more are the upper 10% who have gained 7 -10 years in longevity. The bottom 90% have barely gained a year or so.

It is NOT that people are “living longer” ie: living to 85 instead of 46 – it is that more are surviving infancy and childhood so more of each generation born are surviving and growing up and working and then getting old. Those who survive infancy are living about the same time as those who survived infancy in the 1900s, 1910s, 1920s etc.

Your explanation leaves out abortion. since the early 1970’s approximately half of all pregnancies ended in abortion.

http://cnsnews.com/news/article/nearly-50-million-abortions-have-been-pe

~Misstrial

Misstrial, your claim that others misread your post is negated by the fact it’s quite clear you don’t understand the article you are linking to… We don’t have 50% abortions in the US. It’s 50 Million WORLDWIDE. I’d point out, that number dropped under progressive sex education funding and is creeping back up due to the misinformation provided by “abstinence education” – Now let’s get back on topic with something we can agree about: the housing market isn’t done adjusting.

Thank goodness…

btw, Boomers are dying of at the current rate of one every 33.6 seconds. This is according to actuarial calcs. This death rate is sure to increase with greater frequency in the near term:

You can watch the progress on:

http://www.boomerdeathcounter.com

~Misstrial

GO pedal your wacko fundamentalism elsewhere.

Average ‘LIFE’ span is based upon how long someone lives after being born alive. Still births aren’t counted in calucalating lifespan.

ANd BTW, you claim of 50% of pregnancies being terminated is WRONG! More lies.

There is nothing like a GenXer or Millennial with an Internet connection for getting facts and figures dead wrong in the service of some ideological assertion or other.

From ZeroHedge: http://www.zerohedge.com/article/guest-post-few-dollars-more-part-1

“Boomers Come of Age

“If those in charge of our society – politicians, corporate executives, and owners of press and television – can dominate our ideas, they will be secure in their power. They will not need soldiers patrolling the streets. We will control ourselves.†– Howard Zinn

Whenever I direct any blame for our economic woes towards the Baby Boom generation they react as expected. They blame the GI Generation for creating the welfare state. They declare that Generation X and the Millenials are just as greedy and self centered as the Boomers. Boomers are great at blaming, ridiculing and acting pompously, while taking no responsibility for their actions and more importantly their inaction. This generation cannot avoid their responsibility for the state of affairs. They like to take credit for their stand against the Vietnam War and their protests against the man during the 1960s. They don’t like to take credit for turning into materialistic, greedy, selfish, short-term focused bastards. When a generation of 76 million people decides to go in a particular direction, the country will go in that direction. While blaming FDR and the GIs who stormed the beaches of Normandy for creating the unfunded Social Security and Medicare liabilities, the Boomers have been voting since the mid-1960s and have been in control of corporate America and the levers of government since the early 1980s.

The U.S. Congress is dominated by Baby Boomers today and has been dominated by this generation since the 1990s. The Senate has 60 Boomers out of 100, while the House of Representatives has 254 Boomers out of 435 members. Boomers occupied the White House from 1992 through 2008. They have had the political power and control of the agenda for two decades and have failed miserably. Rather than do what was best for the country for the long-term, they took the expedient, easy, vote getting route. Promise more than you could ever deliver and let future generations worry about the consequences. Not one true noble statesman has arisen from this generation of myopic, self centered “Me Generation†political hacks. Even as the country nears the precipice, they continue to address the great issues of the day with talking points supplied by other Baby Boomer PR maggots from Park Avenue. These weasels care not for the country, but worry only about poll numbers and the next election cycle. An apathetic public, dominated by the Baby Boom generation, has the attention span of a gnat. As long as they can make the lease payment on their Escalade, use one of their 15 credit cards at the Mall, be entertained by 600 cable TV stations, play with the latest iSomething, live in their McMansion for two years without making a mortgage payment and consume massive quantities of fast food, then any thoughts of future generations or civic duty are unnecessary. Live for today has been the rallying cry for the Boomer generation. Pot was their drug during the 1960s. Debt has been their drug since 1980.

The drug (debt) dealer for the Baby Boom generation has been the Wall Street mega-banks, coincidentally, run by Boomers. The entire corrupt financial industry is being run by Boomers. The CEOs, CFOs, and the thousands of Harvard MBA VPs that created the fraudulent derivative scheme to bilk billions from clueless municipalities, pension funds and American taxpayers are all Boomers. It is no coincidence that the great debt delusion began in the early 1980’s. Jim Kunstler captured the essence of Boomer transformation:

“The Baby Boomers came back from the land, clipped their pony tails, discovered venture capital, real estate investment trusts, securitization of “consumer†debt, and the Hamptons. Greed was good.â€

The Boomer CEO hall of scam has been built on the brilliance and financial acumen of Lloyd (god’s work) Blankfein, Charlie (keep dancing) Prince, Jamie (friend of Obama) Dimon, and the king of the Boomers, Hank (the system is sound) Paulson. These mainstays of crony capitalism led the Boomer charge of greed, greed and more greed. The Baby Boomer generation has been the proverbial pig in a python working its way through the decades as presented below. By 1985, Boomers had entered the work force in full force with the entire generation between the ages of 25 and 42. It will be a great day when the python craps this pig of a generation out the other end.”

and wouldn’t the world be a better place with 50 million extra people who were unwanted and unloved as children

Ann, I would like to add one more factor to your life expectancy rate. One factor which commonly skews the scale is the infant and child mortality rate. Those who survive childhood generally made it to old age. There really needs to be a scale showing the average life expectancy for those over, say, six years of age. As prenatal and infant care improve in countries the life expectancy increases dramatically.

And lest our dear Misstrial jump upon the high infant mortality rate eras or countries, your abortion fears are of no consequence. I do hope you find peace.

Ann,

While you are correct in how the statistical averages and life expectancy are contextually different now I think the doc’s statement about “In no time in our past have we had such a large number of American retiring and living many years post-work” is still correct borne through just the sheer force of demographics. Good job on a well picked nit, though.

The average American has gotten no help since the crash of 2008 and no help is on the horizon.

What do you call living rent/mortgage free for one to three years. That is a HUGE bailout and a huge amount of cash for the “average” american. America has slipped into a world of moral hazard that is going to prove very difficult to recover from.

Let them all fail: Wall Street/ Banks/ underwater “free-loaders”. From that point there will be a moral ground to rebuild on.

You have a point, however, most of us weren’t anticipating living rent free 2-3 years. We figured 6 months and we’d be out. The people who are “free-loading” are requested by the banks to continue occupying the property. When you move out before they foreclose they get very angry with you. They also start charging the people who own the loans $3000 a month for insurance that normally costs $600 a month when occupied. Most of the “free-loaders” would really just like to move on with their lives, but the banks aren’t allowing them to. I might add this country was founded on not paying debts supposedly owed and we have never had debtors prisons or punished people severely for going into debt. The banks would love to change that, but it would fundamentally change all principles this country was founded on.

Wow. Great piece of information. I guess occupants (i.e. non-payers of mortgages) are better than paying property managers to manage distressed (shadow) inventory the banks can’t.

I would take it a step further and say this will end worse than the great depression. Once people finally wake up to what has happened it will be class warfare that will make whats gone on in Libya and Egypt look mild. There aren’t 100 million people with guns in those countries. I do find it humorous that the same people who advocate giving more and more money to the wealthy also want to make sure everyone has guns. This is going to end really badly for us all.

I sold my house last year and have been stacking gold and silver ever since.

From one bubble to the next. Buy high in housing and sell low, then buy at a high point in silver and gold.

Are precious metals looking like a pump-and-dump scam, too?

No, Precious Metals are nothing close to a pump-n-dump. This very evening, some of the biggest shops are completely out of the main product. Silver Eagles as well as Maple Leafs! They are quoting 2-4 week deliveries. Plus Apmex just sent out email saying that they’ll buy any decent legit product at $3 over spot!

There are a number of games being played in the silver market, but pump-n-dump isn’t one of them. JPM keeps trying to hammer it down, but it keeps going up. They’ll probably hammer it down for options expiry this week. After that, it’ll be off to the races again.

My silver has doubled in less than 6 months. I took profit recently, but will be back in shortly; and it will be up at least 20-40% by the end of June.

I would think that anything that looks unusually high should be looked at with caution. It’s all a psychological game, with the real value by the numbers being secondary.

I’m currently reading “Extraordinary Popular Delusions & the Madness of Crowds”, and history always seem to repeat itself.

@Enough:

That is a superb book! Everyone should read it. As it applies to Silver though, we’ll be in a bubble when you have it far more widespread. Right now, how many people do you know who actually own a coin made out of bullion? Or even know how to buy one?

I’ve said before that it is hard for most people to see a bubble when they’re inside one. But it’s not impossible. In contrast to the other main bubbles, this one is not only not being blown by the Fed, but they are fighting a battle to suppress the price. One which they are losing, as more people wise up to dollar destruction.

It is hard to say where we stand with gold and silver. Silver, in particular, is a very small universe. I have read that there are about 1 billion ounces of above ground, pure silver. At a recent price of $45/oz, that would place the present value of the total hoard at $45 billion.

Obviously, just a few billionaires could corner the supply, and put the price into orbit. If their agenda is to acquire silver, however, it would far wiser for them to methodically buy silver, trying as best they can not to push up the price against themselves.

What is particularly amazing is how the Japanese and Europeans seem to be powerless to weaken their currencies against the US dollar. When you consider what is happening in Japan, with their debt problem and the earthquake/tsunami problem, and Euro area problem with the PIIGS sovereign debt problem, the dollar should be gaining ground, not losing ground.

I’m hanging on to my silver.

There’s nothing like shopping to ease the fear of a Depression, eh?

Doc, I think you’re repeating a stereotype of Hoover that’s just not true. Read Murray Rothbard’s book America’s Great Depression. Hoover was very very far from having a hands off attitude toward the economy. He talked a laissez faire game but he intervened on a scale that hadn’t been seen till that time. The problem was that most of what Hoover did turned out to be counter productive. The biggest example was Hoover’s fixation with the idea that wages should be kept high. Through various means including browbeating business owners at many turns, wages did stay relatively high and resulted in helping produce an explosion of unemployment. He also signed the Smoot Hawley tariff and at just about every turn bungled the banking situation. Again, I urge anyone interested in seeing if the thumbnail sketch of Hoover they probably got in school bears any resemblance to reality to read Rothbard’s book.

I’m with James in disagreeing with DHB on his Great Depression analysis. The 20s were a period of HUGE productivity gains in our economy – very economic growth occurred.

Hoover and the Federal Reserve Bank turned a typical business cycle correction into a huge mess that FDR made even worst. I’d recommend Amity Schales’ “Forgotten Man” and Milton Freedman’s work as two books that offer a more cogent view of our economic history.

We currently have bubbles bursting all around us but the Obama administration’s responses have been counterproductive. I’m with Andrew Mellon – “Liquidate, liquidate, liquidate!”

Sorry, but any analysis based upon Freedman’s work is just simply discredited. Completely. The only ones who believe that nonsense are the Economists who failed to see the Crash of 2008 coming. And who are botching up the current economy.

The “productivity gains” you refer to were an artifact of FDR assembling his brain trust and deciding to re-measure things as productivity that previously weren’t measured, then to re-organize the nation’s economy so that it followed only those highly measured and profit-defined activities.

I could redefine an inch as a foot and measure my wang, and call it a surge in manliness. That doesn’t make it so.

I think what you both are missing is that recounting of stuff to make it sound like it’s going up–which was the crux of the GNP’s creation by FDR, and is the crux of the management of today’s GDP derived from it–is NO LONGER WORKING.

You don’t seem to understand that just recounting stuff and shoving stuff from one column to the next DOESN’T WORK ANYMORE. It never did, and did so only in limited ways in an era such as the 1930s, where you could look forward to decades of ecoclysm, hemoclysm, and nuclear brinksmanship to shop and spend your way out of what Wilson and the Fed wrought in the ’20s.

It is not an option open to us. At least not for anybody who wants to be living on this planet in another 30 years.

The whole point here is that recounting things, and assigning them to little categories like “productivity”–then redefining “productivity” as “whatever is going up,” then pfutzing with the economic indicators till they measure what is going up–this is the toxic path our economy has been on since 1913.

It serves only the monarchial/oligarchic/plutocratic elites globally. Period.

Yes, things are following the 30’s Depression script. But look on the bright side. Look at all the wonderful government programs and regulations we got from the 30’s. That is the other shoe that will fall. Unfortunately, Obama is no Roosevelt. He will not get elected next year. If the Dems were smart, they would get somebody else. Otherwise, their next chance will be 2016, the year that China surpasses the USA.

Big Q: ” …worker protections are largely being thrown out the window. ” What protections are you refferring to? Who/what protects anything, anyone from anything? Are you endorsing a worker state? The 40 hr workweek, child labor laws, etc, are what, about a 100 yrs old now? Who is ignoring them, Walmart? China and India are non-compliant, I’m sure, is that what you mean? We are choking on our own rules, aren’t we? In m MY world, there are no “protections” or guarantees: I do my job, I get paid, i dont, I get fired, if i don’t like it, I find another job. The “protection” is built into the free market. I shop around. WTF am i missing here?

I’m with you bud. Couldn’t agree more.

You are unaware of the need for worker protections? Oh, OK, go deep into a mine that hasn’t been checked for safety standards in five years and is owned by the Koch brothers. Work in the Big Agriculture business, in a slaughterhouse, and of course you’ll see there’s no need for safety regulations! Be a bus driver but let’s throw away speed limits and laws against drunk driving…I mean, geez, isn’t that the regulation that is choking us also? I can give you countless examples where there is need for worker protections. Why don’t you go take a shower where Halliburton did the work?? Paper cuts aren’t the only type of hazard in work…I don’t know about YOUR world but certainly do know the world is bigger than your individual experience.

Contrary to what you believe, regulation is not PURE EVIL. Myself, I like clean air, water, food, safe highways, safe airports, dependable medication, an economy not based on a casino system, clean rivers and oceans (which we don’t have), etc.

Seems to me you’re missing a lot.

You “find another job”?

What planet are you living on? Must be the imaginary one where the U6 employment isn’t somewhere between 20 and 25%.

Maybe you’re just more valuable than the rest of us. A bean counter, or a lawyer for corporations or rich folks.

Protection is built in to a “free market.” Protection to foment innovation and entrepreneurship. However, if you work for someone and are in a position to get fired – be careful what you wish for. You don’t need to be incompetent to be fired. You can be replaced with cheaper labor in a free market. Even skilled engineers, architects, etc. can be outsourced to India or other skilled labor markets in a true “free market.”

Of course in a Friedman/Hayek free market economy taxpayer money doesn’t support out of work labor looking for that new job, nor does it bailout financial institutions to support a system.

But as a free marketer who can just find a new job anytime, you can fearlessly embrace complete deregulation and the implementation of economic “shock therapy” as advocated by Friedman.

If you don’t like the system and can’t change it – go feral as any surf addict should and get the goods in backcountry outer island Indo. Not sure you’ll find the government there any more to your likeing than our “welfare state.” You certainly won’t have to worry as much about rules and protections.

“What am I missing?”

Obviously not Fox News. There is no free market–only a government sponsored one. I know a lot of smart, talented, hard-working folks who are out of work, partially working, or working way into their retirement years. Meanwhile Rush-lites think everything is just fine and we should be happy US military uses >10% of the world’s oil and that banks perform virtual war crimes against humanity and are yet rewarded by their cronies in gov’t…Keep some company with Kudlow. Everything will be just fine if you keep going to meetings and going on and on about some useless power-point presentation…I bet you got a 50″ LCD to watch Hannity…

Yeah, the Libertarian free market idiots always seem to overlook the fact that they were the one’s who caused this economic disaster in the first place. The repeal of the Glass-Steagal act in particular, along with their banner boy Greenspan at the helm.

One question.

Are the people who bought in the spring 2010 better or worse off now? I am asking because I was very very close to having bought a house last spring and I am not sure if I made the right decision or not. Now I am facing the same situation – on the cusp of buying a house again. And yet not sure if I should or not.

I almost bought last spring, but I kept reading the Dr.

I have watched the South OC neighborhoods where I was going to buy all drop another 10% of listing and 15% foof actual sale since last summer.

I am glad to be safely on the sidelines for 2-3 more years if necessary.

What you’re missing is the fact that the super rich have government/taxpayer backup, while the rest of us eat shit.

Robin, the rich have always run the place throughout history. This is nothing new. Always was, always will be. The key to life is to make the best of it under the circumstances. Texas is the promised land, not here in the failed state of California. Saddle up and head east while there is still time to get out. .

It feels like it has been real close a few times now where the politicians have asked the people to eat cake instead of bread… I’m waiting for that day to come..

It will be 1789 all over again.

Doc says he reads 20 books and 50 articles on the Depression. you read one source and now that one is the gospel. The truth is very hard to get at, but it is there.

One theory that should be obvious any time one pulls into the gas station or trys to buy a house is that the prices of commodities are driven by hot money. I’m not rich but I have way more money than I need to survive. People with lots of money get into speculation–they drive the cost of housing and fuel up by speculation–via futures for oil and hedge funds and REITs for housing.

Our zero-interest policy of exporting inflation is destabilizing the entire world, in case no one noticed. People don’t start revolutions because they want ‘freedom’. They do it as a result of financial oppression-survival. Our fiat money is starving the rest of the world, but we don’t care–we just want some house price to drop so we can live the fantasy world of HGTV 2006–good luck with that.

http://www.marketskeptics.com/2011/04/federal-reserve-is-selling-default-insurance-put-options-on-treasury-bonds-to-drive-down-yields.html

“The only reason these banks stand with no reform is because of their political connections, not because of success. They were weeks away from being eliminated by the free market because of their massive speculation and bad bets during the bubble. Yet to bail them out is to reward bad behavior so today, are we to expect anything different?”

This summary of the systemic conflict of interest for politicos who live and die at the corporate trough illustrates exactly why no politician or business school intellectual cum shill, who has the ear of or is a federal policy maker, will ever be the initiator of systemic change. Nor will it be one of the bellicose tea party reformers. It is doubtful that the rhetorical clammouring of the tea partiers will survive the withering onslaught of lobbyists or the self interest to remain in power. I am not sure if any of the tea party incumbents or candidates have the political or managerial skills to effect regulatory change, even if it were on the agenda.

Another fine article on some of the parallels with the collapse 80 years ago. Thank you Good Dr.

And Yet the Planet survives… Do what you can, be thankfull for what you have and where you live. Carry only the things you need to survive. Sounds like Camping when I was a kid, needing very little more than my family and nature to put a smile on my face. Is it so great to have so much or does it occupy to much of your mind? So much anger at so many people, laws, regulations, over crowding, politics, noise, pollution, wealth… You don’t have to look far for something to blame for your misery.

My perscription, Take a Hike!

Semper Fi People

Leave a Reply