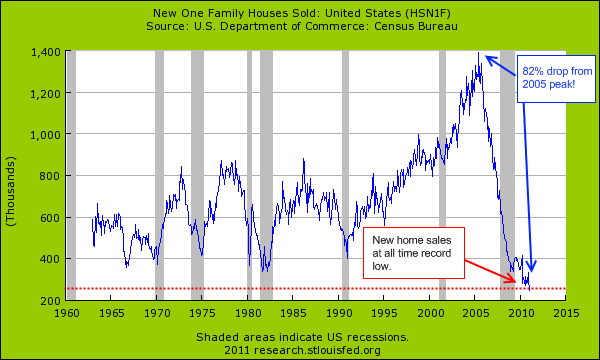

The worst housing crash in history is official: Lesson from the Great Depression Part 29. New home sales fell 80 percent from 1929 to 1932 and fell 82 percent from 2005 to 2011.

This is now officially the worst housing crash since the Great Depression. Putting aside hyperbole new home sales fell 80 percent from 1929 to 1932. Those years, if you know a bit of history were not model years for the U.S. economy. In fact, the economy imploded in spectacular fashion at that time thanks to time honored Wall Street speculation and massive debt leverage. So a fall of new home sales by 80 percent during those years would be expected. Over this duration the Dow Jones Industrial Average fell 89 percent. Now compare this to our current situation. New home sales from their 2005 peak have now fallen by 82 percent! However the Dow Jones is only off by 13 percent from the peak reached in 2007. The big difference in this crisis is that we had a Federal Reserve that bailed out big banking interests under the pretense of saving the housing and consumer market. Yet how can you save a housing market that by definition is too expensive for the immediate population? Going on four years of this crisis I’m sure many now understand the finer points of crony capitalism. Hope Now, HAMP, foreclosure moratoriums, and other methods of saving the housing market were largely cover for a bigger bailout scheme and most of you were not included.

This is part 29 in our Lessons from the Great Depression series:

24. Economic Crises Around the World in Synchronization.

25. Reconstruction Finance Corporation II

26. Pecora Commission Where Art Thou?

27. Current Net Worth Drop of $13.8 Trillion Equivalent to 21 Percent Drop.

28. The Gospel of Economic Prosperity

The record collapse in new home sales

Notice how the shaded area above ends in June of 2009? We’ve been out of a recession for nearly two years folks! Of course that did not stop us from reaching a new trough in new home sales. New home sales have fallen by 82 percent which trumps the drop of 80 percent from 1929 to 1932. This collapse has come with a fury unrivaled in our historical data. New home sales show the health of the “housing industry†because these are properties that are freshly built and employ hundreds of thousands of workers. This is one industry that for reasons of location, cannot be outsourced. So reaching this new low tells us a few things about our economy.

What we can learn from the low in new home sales is that the market is dominated by distressed home sales. People are hungry for low priced homes and these tend to be foreclosure sales. Given the years of inflated home prices and exotic mortgages we now have a healthy pipeline of troubled properties floating out in the market. Why would anyone want to buy a new and more expensive home when you can pick up a relatively new foreclosure for a much lower price? The above chart is merely reflecting the changes in household wealth and investor demand.

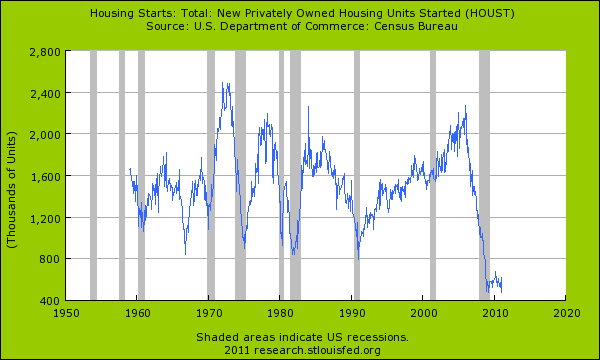

U.S. housing starts show no market turn around

If you want to see the nucleus of a housing turn around you can look at U.S. housing starts. This is the first place that will show any turn around. This too is at a record low. In other words the market is plastered with distressed homes and there is little need for new housing. Many housing analysts point to new demand but fail to account for the contraction in household formation and the fact that many younger families are now entering a workforce with much lower wages (plus we have a surplus of vacant homes). Sure, there is demand for housing but this can be for rentals or for people consolidating households (aka living with parents, friends, etc). Now why would people do this? Because as it turns out the employment situation is still unhealthy:

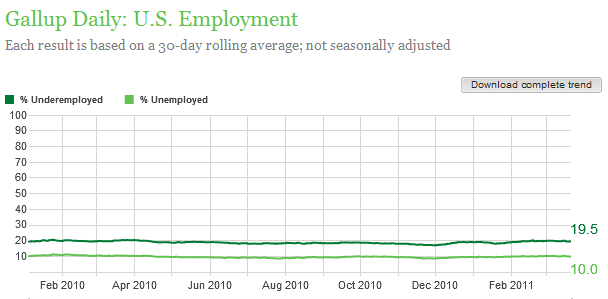

Source:Â Gallup

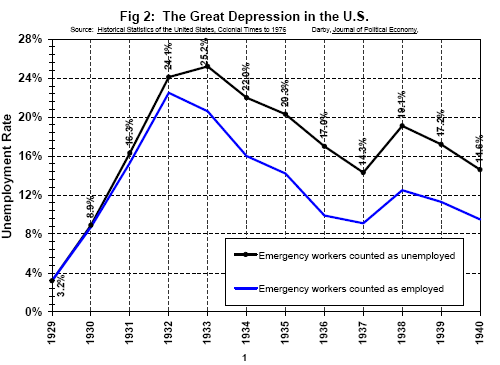

According to Gallup’s daily tracking data the current underemployment rate is 19.5 percent. Working 10 hours a week for a few dollars is not exactly spurring a new segment of demand for high priced McMansions. Even if a person can squeeze into a McMansion can they afford the insanely high cooling and heating bill? An investor in Nevada who bought last summer was surprised his electric bill came in at $300 for the summer. It is hard to increase housing costs when wages are stagnant. I found an older chart of unemployment during the Great Depression:

Depending on how you measure it, if the headline underemployment rate is 17 or 19 percent depending on the data source we are between 1935 and 1936. Keep in mind our giant part-time underemployed sector of our economy. Since the Great Depression the safety net has gotten stronger so that is a big reason why we don’t see anything close to what happened back then. Yet many are a few hundred dollars away from this. 1 out of 6 Americans are on some kind of food assistance and 50 million are receiving Social Security. These are programs that got their start because of the Great Depression. Times are tough and the bailouts have propped up investment banks creating global speculation and a domestic increase in GDP. So by official standards we have been out of a recession since June of 2009 but not in what many think of as a healthy economy. Unemployment is still sky high, the housing market is still crashing, and wages are falling or stagnant. Yet we call this a recovery because trillions of dollars were pumped into the stock market?

The real wealth of households

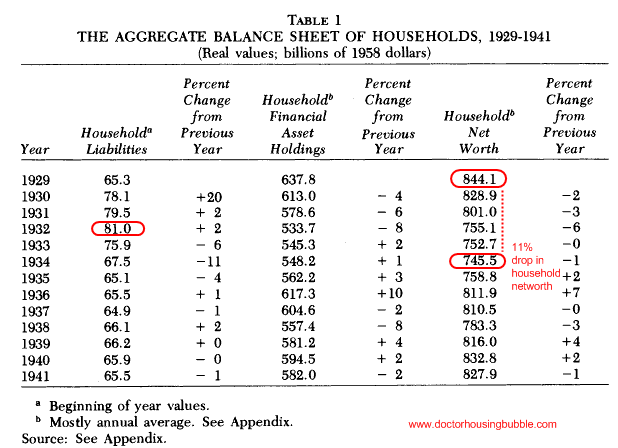

This is an interesting chart. Real household wealth fell by 11 percent during the Great Depression. As of December of 2010 U.S. household net worth is down 13 percent ($8.8 trillion) from the peak reached in 2007. Just trying to put this fantastic recovery in context here.

Part of the challenge moving forward is fixing a system that inherently rewards bad behavior. I was reading a recent article where Bernard Madoff called the U.S. economy one giant Ponzi scheme. The sad fact is he is right. There is no Social Security Trust Fund or “lock box.â€Â It is just a giant accounting gimmick to suck away current payroll taxes for other programs. Money comes in and it goes out to all sorts of government items including giant banking bailouts. This is a cornerstone of a Ponzi scheme right? Those who got in early do fantastic but those at the end well, they usually end up footing the bill or watch the system collapse. Just think of the reward system here:

-Big banks create an environment to speculate on mortgages. Glass-Steagall is repealed so commercial and investment banking now mix. Your local teller who is now a personal loan assistant sells you an option ARM. This option ARM goes to a Wall Street investment banks that sell it off to some fund in Iceland that thinks it is buying a triple-A rated bond. Everyone gets paid along the way during the bubble but look at who pays when it unravels.

–Home buyer: most will lose their home to foreclosure if they bought near the peak. In expensive gimmick states like California you have mark-to-market suspension nonsense and banks have been trying to delay for nearly four years now. Prices are not coming back. As we have shown we are now seeing much higher priced foreclosures in mid-tier markets. *Reward: get to live in a home you cannot afford for a set time period.

–Commercial banks: the too big to fail have gotten bigger. In fact, for their ability to sell junk loans many of the big banks were given access to even bigger toxic loan producers like Countrywide Financial and WaMu. The reward for pumping toxic loans is that you get to grow even bigger with government support. *Reward: taxpayer subsidies to grow even bigger and swallow up crappy institutions. Incredibly expensive and pervasive system.

–Wall Street investment banks: probably the biggest winners here. The few politically connected enough to survive on their own were able to eat more of the pie with many of their friends now in the belly of commercial banks (there is really no distinction anymore). Bonus pool goes hog wild since competitors are now out and you are fortified by the Federal Reserve. It pays to have a U.S. Treasury chief as a former CEO. *Reward: giant bonuses for blowing up the world economy.

–Investors that bought these mortgages: If you are not a Wall Street investment bank and are a poor soul like Iceland, you get to pay the bill. As we know there is no free lunch. Ultimately someone in the food chain has to pay. In the end it is investors without the connections for bailout money and prudent domestic taxpayers. It certainly isn’t the home buyer who over leveraged buying a home they cannot afford. Commercial banks? Bwahahahaha! Chase seems to open up a new branch every week on a different corner in Southern California. And all you need to do is look at the bonus pool at investment banks and you realize there is little pain for their destructive financial ways.

Yet the pain is in the housing market still. New home sales have collapsed to levels even below those of the Great Depression. Then again we’ve been in a recovery since the summer of 2009 so why let these 2011 stats get in the way of that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

66 Responses to “The worst housing crash in history is official: Lesson from the Great Depression Part 29. New home sales fell 80 percent from 1929 to 1932 and fell 82 percent from 2005 to 2011.”

It’s possible that this time around (Great Depression 2, maybe even WW3) may make the Great Depression 1 seem like a day at Disneyland.

In the words of BTO, “You ain’t seen nuthin yet!” The Westside has yet to take it’s lumps. A good 20% drop is coming as the area finally starts to capitulate. The housing market continues to disintegrate and is just plain FUGLY.

http://www.westsideremeltdown.blogspot.com

You mention Chase opening up a new bank on every corner. We see this everywhere, how are banks making money opening retail locations?

it seems like a loser to me.

There’s an old truism/strategy in business:

When times are good, you buildup cash, when times are bad, you use that cash to buildup capacity, and bury your surviving competitors.

Chase wants to own half the planet, and they’re making all the preps now (with YOUR money). Also, think how low construction costs are now, compared to say, Peak Bubble, hurricane-ravaged 2005 (when I could NOT hire a tiler or roofer at ANY price… now they’re lined up ’round the block). EXCEPT FOR CHANGING THEIR NAME (a la “Ally” Bank, nee GMAC), Chase is making all the predictable/right moves in this down economy.

I read many of these comments and what most of you fail to realize, is that the 4 major banks are insolvant PERIOD, several times over .. so given they control 60% of all mortgages and nearly 70% of all American Mortages are securitized, making them worthless to the banks, given that the US Bankrupcy judge has ruled pretty much any bank trying to foreclose as a “party not in standing” and therefore cannot sue for foreclosure since they can’y produce the actual note they claim they own.

Basically, anyone’s mortgage that has been securitized is free of payment, but still has to go through court to clear the title.. that makes 70% of all Mortgages not viable as collateral for banks.. as simple forensic audit will determine your mortgage note status..

they all know this, what amazes me, is how slow people are catching on…

I mean BofA threw in the towel in Florida on some 50,000 morgages basically just writing them off… 35,000 more are on the block in MAssechusetts

Another key point is that the vast majority of banks who are NOT “TBTFail” are still going under (from the weight of their toxic RE holdings)–no bailouts for them–and the customers have to go somewhere.

Same as always, they nickle and dime their customers with additional fees and interest.

Chase is after your savings account. (Just like BofA and Wachovia) Automatic transfers from checking to savings every time you use you debit. All kinds of variation on that theme. They give you 1% interest and then turn around and deposit their excess reserves with the Bernank who pays Chase 5%.

Money for nothing. Do the math. Its the latest scam courtesy of the Bernank and the Federal Reserve.

My guess is that new home starts will drop further, following new home SALES lower, which appear to be having yet another leg down. This will hurt the employment situation, and the economy.

The fall out from this will be that the Federal Reserve will continue their quantitative easing program beyond the end of June, when QE-2 is scheduled to expire. They seem bound and determined to hold 10 year US Treasury bond yields (interest rates) low.

The problem with this strategy is that it is enabling the Federal Government to continue to run $1.5 trillion deficits annually. It would probably be better to let interest rates rise, and force them to open a national debate as to our spending priorities. However, they can put off this debate only so long. I predict that by the time we approach the next election, in 18 months, things will be coming to a head and the debate will be in the fore front. Could we possibly get a Libertarian President?

No.

Gale is right. The people in this country are too stupid. They only think of the two major parties,dumb &dumber. Far to many people either work for the government or get what they think are free money from our corrupt government.

Yes, WE ABSOLUTELY NEED A LIBERTARIAN for president. Shame on Gael for saying “No” either in absolute resignation or opposition. We HAVE TO SAVE OUR COUNTRY, and frankly, the entire planet. The international bankers are destroying what was a civilized world, mostly based on the rule of law. All of the chaos on the planet right now is caused by them. We need to stand up for freedom, justice and the rule of law. Ron Paul would stop the destruction of America. Ron Paul would save this country, with our support. The economy is NOT going to get better. We are on a road to permanent ruin, unless TRUE changes are made. We don’t need empty words and rhetoric of some clown who says “change you can believe in.”

Libertarians stand for as little government as possible – some have described libertarians as cowardly anarchists… I wouldn’t go that far but the point is made.

A Libertarian would never have approved the bailouts, yes but neither would they tolerate any government controls of the sector. Deregulation of the sort of that is classically Libertarian is what got us in this mess (see DHB’s post on a Debt Built Society for a great chart showing what happened when Glass Steagall was repealed.)

If you truly fear for the planet – elect someone of going to go in and REGULATE these parasites – Not a Libertarian who will deregulate further and let the worst abuses of capitalism flourish unchecked.

Please understand what you’re asking for before you ask for it and then chastising others for expressing opposition to it!

A libertarian president is a pipe dream. Get off the pipe. If we really deregulated and let the banks fail – as per a strict laissez faire policy – the overall availability of credit would contract. Because the economy and money are based on credit, the economy would shrink. This also puts us at a disadvantage, wrt to money, to sane countries that would never elect a rigid laissez faire / libertarian leader.

As much as I love Ron Paul, there is a point there. All the cronies wanted was Glass-Steagall repealed so they could go wild. Just as we need the military protection against an invader, we need someone to defend us against the powerful financial tyrants. Actually, some wars were against the financial tyrants, but they lost. Now their true cause was rewritten by the victors as moral struggles such as slavery. Rational behavior by the few will will destroy the lives of the many.

Some folks here just think a couple more points and we’re back to the races in housing. It may be a generation before things get better. Without WW2, it can be argued, the Depression would not have ended. What is our catalyst now?

Wasn’t it a libertarian that repealed Glass Steagall that lead to the financial crisis? Oh no wait, I think it was Clinton and the democrats and republicans. But I bet you anything that if a libertarian was in charge he/she would have made the situation worse by closing down the Fed, breaking up the credit rating cartel, shutting down fannie and freddie mac, letting the market set interest rates, dissolving the FDIC and making illegal fractional reserve leading. Man just think of the deep shit we’d be in right now if a libertarian were to do all that. These libertarian supporters are complete morons!

@ Chris. Its rare to see someone who identifies Clinton as something other than this fantastic president and I just wanted to commend you on pointing out that it’s his adminstration who is the root cause for this mess. Admittedly, Bush has not done great things, but I have a hard time when fingers consistently point his way as if the Bush administration should shoulder the blame, when it was Clinton that laid the foundation. Not a Bush supporter, nor am I saying that Bush is innocent in any way. It’s just refreshing to hear someone call a spade a spade…

YEPper… and as these mega-facts cannot be denied indefinitely (since not everyone went to bad public skew-els), the interesting socio-psychology CO-story, is how the bankSter-backed, hand-in-glove MainStream Media (MSM) has been diluting and dribbling this news out, for the last year or so.

Read Chomsky’s ‘Manufacturing Consent’, and watch it play out in front of your very eyes… Mr. Bill! =:O

you all know what is really STUPID in all this, the housing market is not collapsing, the US dollar is, and everyone is oblivious…. the “house” is a tangible asset, it servess a purpose and you can trade it for food or any other comodity, but the dollar only has as much value as you yourself place in it… It is useless

a house is not worth more or less than it was 100 years ago.. but the dollar, now that is another story..

imagine brainwashing on a global scale and that’s you…

The precipitous drop in new home sales always seemed a bit inevitable. The housing market is suffering not only from the general state of the economy but also from having cannibalized future buyers for old sales by offering ridiculous financing options. Buyers who would have had to save to make a purchase (and thus wait longer) were able to buy with no money down and other ridiculous terms. This led to a glut of short term buying and concomitant reduction in the supply of available buyers. Cut that further by re-imposing lending standards, and the available pool of new buyers shrinks even more. This is quite similar to the automotive industry. Offering really attractive financing and reduced pricing brings in additional buyers this year, but costs you those additional buyers out of next year’s sales.

In my little neighborhood ‘Sandy’ (retired CEO of Citibank) generously donated 12 million notes to the music center at SSU – you remember Sandy? Originated sub prime mortgages, got a fed bail out (with US $$)? Our city is nearly bankrupt, has closed 2 elementary schools, houses sit vacate, at the county there is talk of laying off 500 folks this summer, and the beat goes on

Actuallly “Sandy” did not originate them … Wells Fargo (hsbc) (planning started for this in 1994, creation of MERS stared 1998 with help and funding from MIcrosoft, Bill gates, and Warren Buffet) did, and made itself the “Master Servicer” for nearly all mortgages from 2003 to 2008 , they would pay any loan originator a fee, then arrange financing, then select a servicer(chase, BofA, citi etc) to collect the monthly check. then turn around and sell the loan though MERS to a trust they controled for 150% of value, then then destroy the original note and create a security based on the monthly payments for the mortgages.

If yo all really knew how (for want of a bteer word) conspiracy, there is not a banker or politician (both sides) who would not be hanging from a tree right now.. but they also control the media.. so you never get all the facts.. but the ral documents and proof are out there all published, just takes work to compile

Where do you get the 150% and why would ANYONE destroy proof of their underlying security – the mortgage and rights??

Sure we need spending reforms, but no one will touch the only real place to get any kind of meaningful savings – the Military budget. This dog and pony show from the Republicans and Tea Partiers in regards to discretionary spending cuts is fantasy at the best, there’s not much to trim there even if you wanted to cut every needed or beneficial program completely out.

Revenue needs to be a part of any viable solution, but god forbid the crony banksters have to go back to a tax rate that isn’t the lowest in decades! Won’t happen, their friends in the government will never let that happen and will place the burden on the backs of the middle class prolonging the decline of our economy wile shoveling all the wealth left into their own pockets.

Your ignorance is boundless. Military is around 20% of govt spending. MOST of those dollars pay for PEOPLE (military salaries and benefits) if you had a brain, you’d suggest cutting the entitlements & foreign aid which are the other 80% of SPENDING. The solution is SPEND less as you point out, but you are barking up the wrong tree. Sounds like the idiotic rules we have here in CA for low flush toilets (i flush twice, on principle) and shower heads: Target residents who use 10% of CA’s water>> 90% is used for farming, and industry. Wake-up!!

20% is a HUGE number mr ignorant.

You flush twice out of spite and call him ignorant? As to your comments on where the spending goes could you please show us a link to where we can see that information. What I have in my head on military spending is 50%. I know it got there many years ago in a former deficit time in America. I think it was the 80’s. I do know that we have troops in scores of countries. I ask myself how really essential is this to our defense. Not that I want to drag this into a discussion of politics. You name entitlements and I have to consider the money given to farming and oil and mining and big business across the board – somewhere else on the web today I saw that GE pays no taxes. GE? How many industries are they in? They have recently had the mantle GM had in the past. As GE goes so goes the economy. And no taxes? So many things are wrong in government and business. Unless these are fixed we will continue to suffer and slide into wage slavery whether housing declines to affordability or it doesn’t.

@wydeeyed

I agree that this thread is deeply misguided, but here’s a link:

http://en.wikipedia.org/wiki/United_States_federal_budget

There’s a nice little pie chart as well.

Keep in mind that there’s $14 Trillion in debt to be serviced; with another $10+ Trillion in guarantees. And this doesn’t even cover the off balance sheet items, (like Social Security in full). Altogether, our debt is over $70 Trillion.

The bottom line is that all of this debt can’t and won’t be repaid. We’ll be seeing cuts in all areas, including the military and entitlements, either through cutbacks or outright defaults.

Not only is there no avoiding it, but this is how these situations have always been handled historically. And no, this time really isn’t different.

Now imagine how the world will be without our military to protect our oil supply.

Surfaddicts comments and arguments are obnoxious but he’s got some of the numbers right if you classify social security and medicare/medicaid as “entitlements.” Here’s a chart: http://en.wikipedia.org/wiki/File:Fy2010_spending_by_category.jpg

Here’s what he (?) gets wrong… even with SS and health programs, “entitlements” are less than 50% of the budget and foreign aid is a paltry 1% of total government spending so don’t even go there…

And dude, every little bit helps so stop flushing the toilet twice – that’s just pathetic…

Here is a great graphic from the NY Times. It shows graphically where the federal government spends its money.

http://www.nytimes.com/interactive/2010/02/01/us/budget.html

You can also look at discretionary vs. total. That is a really eye opening feature.

Yes military is now about 1/6th of the total.

Military spending is a fraction of defense spending, which seems to float at around 50% of Federal spending. I’m never sure if this includes things like defense research and foreign aid; the former is sometimes like scientific research, and the latter is often just a government subsidy for weapons makers (welfare for weapons, for countries too poor to buy our armaments).

In all probability, we cannot cut spending significantly. There are the obvious political considerations, such as the fact that old people vote in higher numbers than other age groups, so forget about cutting social security.

The main reason why we cannot cut spending, however, is economic, not political. The USA GDP (the size of the economy on an annual basis) is about $15 trillion. The federal budget deficit is $1.5 trillion, which is 10% of our whole economy. So if we balanced the budget without raising taxes, we would cut spending by $1.5 trillion, which would reduce the size of the economy by 10%. Well, the economy contracted by a little more than half that amount in 2008 and look what happened. Anybody wanting to take credit for inflicting DOUBLE that much pain?

There is only one way out, and that is to call a 2nd constitutional convention, declare the dollar null and void, abolish the fed, and start over with some sort of system that won’t permit the government to run deficits.

Take a look at the Social Security number (hey that’s already as big as defense right there). Now start adding up welfare/unemployment, then Medicare and medicaid. Now consider that these are expected to skyrocket over the coming years. Defense is big but it’s not even on my radar of problems. Entitlements are the elephant in the room, you can cut defense in half and all you do is buy a bit of time. Any budget that does not address the broad entitelemtn promises is not sustainable and living in denial. So far no one has the guts to face reality but we all know it’s the problem.

To diminish the power, opression, and control the govt has over you, the supposedly free individual, REDUCE their budget, give them LESS money, not more!! Cut ALL of it, let’s start with 10% across the board!! Those LARGE roles of “benefit recipients” are nothing more than “Dependants” You like being dependant? Like an infant? What a bunch of woosies!! Yes i am obnoxious, but if i had the wimpy on the dole, attitude i wouldnt catch any waves, id get run over, and if that didnt take me out, the ocean will!! Be strong, the moment you Rely on “the govt” you give up your freewill and soverignty, God didn’t put you on earth to be on the dole, that is the devil at work!!

Excellent article Doctor. Thankyou.

One of your all time best articles Doc.

I was at a bank function yesterday and am being told by major lenders that it may be time to “ramp up” the foreclosure pipeline again, everything that has been attempted for the most part has failed. Banks will try short sales but some folks living inside a free home with shot credit just don’t answer the bell and take action to avoid foreclosure.

BTW all the Chase branches aren’t opening; the signs are going up on old Wamu branches and only the name is changing, remember, these include all the old Home Savings branches in prime locations so are very noticeable.

In my area (Ventura County) they replaced all of the old Wamu signs well over a year ago. In the last couple of months I have seen several new Chase branches open up (where the previous business was not a bank).

I too live in the good ol VC and have seen the same. I can name at least 3 new Chase locations that have replaced non bank business locations just in the city of Thousand Oaks alone…

Check this link:

http://www.latimes.com/business/la-fi-edd-audit-20110325,0,1902644.story

New payroll tax could automatically kick in if these loans from the Bubble State are not repaid. More bad news that will affect housing !!!!

Read the article. As a CA employer, that’s a scary thought. =:-0

The ultra wealthy have pillaged and looted the middle class. 80% of us own 20% of the wealth in this Country. The only way to save the economy is by imposing a wealth tax of 14% a year on those whose net worth is over $100 million. This would raise trillions of dollars to Federal and State goverments. The money than can be used to rebuild infrastructure, pay off debt, pay off the national debt, and give homeowners 0% loans to purchase properties.

Who needs more than 3 Million, tax households over 3 Million.

Who needs more than 1 Million, tax households over 1 Million.

You realize the logical end to the slipping down that particular slope is taxing everyone over the median wage, somewhere in the mid-50-thousand range, right?

How about a two’fer…every war has been financed with special taxes. So as long as we have 2 and a third war going on, plus the wars against drugs, etc. lets start taxing incomes above 3 million to protect those with the wealth.

I think anyone calling a housing bottom is absolutely nuts or just clueless. There are so many reasons why housing will continue to decline in price. It’s very said that millons of people got sucked into overpriced homes, and are now losing their homes, or owe more on their homes than they are worth. Stories are everwhere of homes sitting empty in Florida, Nevada, California and other places. It’s both sad and scary. But the bottom line is that housing is nowhere close to finding a stable bottom is prices.

I talked to my tax guy yesterday, He is like many of that ilk always playing the flute, do what we do, follow us. But wow, he said it openly, this summer will show the trend that will be, He thinks that there will be a glob of inventory to lower pricing to cause: startegic default mania. He said that a majority of his clients asked questions about next years taxes if they default this year, hmmm.

I recall reading a Deutschebank real estate analysis a couple years ago projecting that 1 in 2 mortgagees would be underwater by 2013 in the US. I remember thinking that number must be either a typo or just a wild guess.

Since we’re now at 1 in 3 for this category, seems he could be spot on.

I see good news. The new home builders have hit a bottom. When will used homes hit their bottom? I think that it is clear. BE A RENTER. There are so many good reasons to be a renter. If you want a home and a family go to Texas, the promised land. California has not been the promised land for sometime(except for illegals and those who come here for MEDI-CAL or MEDICAID, and SSI for their rich parents and siblings, you know who you are). People need to realize, now is the time to get out. The state’s budget crunch is upon us. There is no future in California. LEAVE now before you get trapped.

Well Said John CPA. You may very well be right. There may be no future in California, except for illegal immigrants and the very rich. California may very well try to “sqeeze blood from a stone” and tax the hell out of real estate and all workers in order to finance it’s massive bankrupt welfare state.

http://www.youtube.com/watch?v=qLezXLuvNgc

Well said John! By the way John, are you bailing out? Jumping overboard?

http://www.believeallthings.com/wp-content/uploads/2009/11/Greetings_from_the_Welfare_State.jpg

To the above pic I say “Greeting from the welfare state, now give us your blood.”

One other item, Doc (and again, I do love your blog), there are a lot of homeowners who, while leveraged 60, maybe 70%, have seen their entire equity wiped out before any bank would take a hoit…I know, I am one of them having lost $500k in my property in San Francisco (I now live in New York), so I don;t believe it’s entirely fair to say “It certainly isn’t the home buyer who over leveraged buying a home they cannot afford.”….Thanks! Vny

our neighbors to the north are in a huge housing bubble and they are in massive denial. i went looking for blogs and articles on the canadian housing bubble and readers’ comments sounded like the masses in denial here before the bubble finally burst. their problem is actually bigger than ours. when our bubble burst median income was around $47k and median home price was around $230k nationwide. in canada those numbers are $44k and $350k. i’ve done some searching about a similar situation in australia but it’s not easy to find. i think the big question that needs to be asked is what are all these governments up to? housing bubbles, massive debt, unrest in the middle east, consolidation of wealth with a few uber rich, etc. it seems like those in charge have something in store for us, and it’s not good news for us.

Australia’s housing bubble is alive and well.

Median is some 450k ( 1 USD=1 AUD) and the Median wage is 50k

9X !!

We have a resources boom on Chinas back ..

Watch this one burst!

Glenn Beck just had Griffin on his show, and they talked about “The Creature from Jekyll Island.” This was on prime time television folks.

It’s clear to me at this point that everybody knows about the FED.

So, the question is what’s to be done about it?

Griffin even came right out and said that they (the money men) own the media and own the politicians, and also said that as long as this is the case no true reform can ever happen.

I’m afraid that this is true.

Excellent post, sir. I sure like seeing today’s numbers in context. Showing new home sales and new home starts since ’60 sure puts to bed any discussion about ‘improving.’

The comparisons of today’s numbers to those from the G.D. for unemployment rate, new home sales, and household net worth are enlightening.

I remain steadfastly on the sidelines, renting here in La Jolla, and will do so for a number of years.

America was rushing headlong into peak debt, driven by excessive borrowing and a dangerous addiction to credit. To this observer it appears bizarre to borrow ever greater sums simply to bid against other for the same group of housing assets. All countries should at some point hit a maximum credit limit. The timeframe for approaching the limit hard to know but clearly we are at the limit America!

Peak Debt Blog http://australianpropertyforum.com/blog/main/3192297

it’s about history of home values” You guys need to watch

Utube

Glenn Beck Housing Market Graph

Thanks for a good researched article.

In 1929, when the stock market crashed, our nation was in a very different place from today. Our currency was backed with gold, we were the world’s largest lending nation and an emerging mfg economy. Now, it is the opposite, and I think we are facing much worse. Yes, there are some social safety nets that were not present in the Great Depression, but we have some leaders who want to destroy all the rights of workers and eliminate the middle class completely. WI & MI are only a couple of examples, but every week, some state passes another anti-labor law, and all spending cuts are focused on the most vulnerable in our society.

I don’t buy the notion that reigning in public employee unions has a lot to do with being anti-labor or anti-middle class. Their clout has grown out of proportion to their numbers or their significance to the economy and the current conditions don’t support it. Never did, really…it’s just more noticeable now.

Of course all of the spending cuts are focused on the most vulnerable in our society. They are on the receiving end of government payments. That is how it works, some pay, some receive. Spending cuts affect those that receive.

Amen sister! Workers should not have any rights unless (and only if) they join the union. And all union members are in fact tax payers too, so I just don’t see why tax payers are against increasing taxes to pay for us union folks. Yes I understand that we’re in the worst economic period since the Great Depression and a lot of people don’t have jobs, but that doesn’t mean that they should get a break on taxes causing me to lose my job too! After all, we do this for the kids and your safety. That should be evident when we cut programs and services (instead of our benefits) as our budgets are decreased.

Excellent and well researched and corroborated work by the Doctor HB!

I think in order for things to turn around, the complete shadow inventory needs to be liquidated. Banks will be weak, but after the operation, they will be rid of the cancer.

Fannie, Freddie & Ginnie and FHA – any attempts to mess with the all powerful MARKET will turn out expensive and doomed from the start.

There will be higher rates, tougher requirements when it comes to down payments and prices have a long way to go South… But it’s darkest before the dawn and the banks need to have a giant bowel movement soon. Let’s see what happens. With the shadow inventory remaining as it is for years to come, that would be a true national catastrophe!

Do you guys know who owns the FED? Hint, it’s not the Federal government!

kf6vci–The average rube believes that the ‘Federal Reserve Bank’ is part of the federal govt., but most of the people that read Dr. Housing know that private banks own it. It might have mattered a few years ago, but now it really doesn’t matter, since the fed is now insolvent.

Here’s the key piece of information on the ‘fed’. They and the US Treasury are engaged in a check kiting scheme, as has been explained quite eloquently by Antal Fekete. (google his name plus ‘check kiting’)

Briefly, the fed creates ‘dollars’ out of thin air, and uses them to buy US Treasury bonds. The US Treasury, which just sold the bonds to the fed, now has those dollars from the completed sale to the fed. So we have the curious situation where the Treasury bonds sold by the USA govt. are redeemable in dollars, and at the fed, the dollars they created are backed by the bonds they purchased. In other words, a daisy chain that begins and ends with something created out of nothing.

Alan Greenspan said that the fed would manage this ‘money from nothing’ scheme, just as if we were on the gold standard, being very careful not to increase the amount of dollars too fast, just like the supply of above ground gold is not increased very fast, due to the latter’s rarity. But Alan said those words before a full blown financial implosion put his theory to a test. His protege, Bernanke, is having to create gargantuan wads of new dollars frequently to prop up zombie banks, and to monetize the $1.5 Trillion deficit.

Actually our system mirrors that of Weimar Germany — exactly.

They also used the two-step scheme.

At the end they’d destroyed their currency and put Hitler in the national spotlight.

At bottom, Rubin, Gorelick and Clinton permitted the Money Trust to re-congeal around MERS.

It is with supreme irony: Karl Marx’s first writings were a direct consequence of the Money Trust screwing up France in the 1830’s. In many ways he was as paranoid about the Money Trust as Andrew Jackson.

Both 1837 and 1873 were

Leave a Reply