The Gospel of Economic Prosperity: Lessons from the Great Depression Part XXVIII. Pretend and Spend and Success will Come.

The snow of twenty-nine wasn’t real snow. If you didn’t want it to be snow, you just paid some money.

-F. Scott Fitzgerald

The gospel of infinite prosperity is back in full bloom. Echoing from the television talking heads and radio pundits preach that the economy is on the mend because we have spent our way into prosperity. This recovery, as we are led to believe, is occurring even though jobs are being lost at the rate of 2.5 million a year and this is somehow good (or less bad in their words). We are now led to believe that jobless recoveries are simply part of the new economic landscape. This coming from a group of people that missed the largest recession since the Great Depression (maybe they should avoid predictions for a few years). Since the recession started in December of 2007, a painful 20 months indeed, the U.S. economy has shed 6.9 million jobs. That is the official number. If we dig deeper, we have 26.3 million unemployed and underemployed workers in the economy. For a recession that is the “worst since the Great Depression†we sure got out of it fast.

Getting out of it fast is what we are being led to believe. Yet the public is being fed a bunch of nonsense from the gospel of infinite prosperity. Much of this philosophy was also part of the Roaring 20s. The near religious belief in the big business culture of the U.S. Of course, much of this has influenced the way the crony capitalist have infected Wall Street with their cannibalistic method of destroying wealth for the country for short-term gain. The notion that spending trillions of dollars and giving authority to those that have led us to financial Armageddon is perverse as it is backwards. If anything, it simply demonstrates that Washington and Wall Street are wedded at the hip while ignoring the plight of the average American.

For a country that talks about the “small business owner†the reality is much different. During this economic crisis it is the mighty who are receiving the biggest handouts. You don’t see Jim’s local hardware shop getting a bailout. But Bank of America, Wells Fargo, and JP Morgan all received their piece of the economic handout. And look at all the bank failures. In relative terms, the small are being allowed to implode. In reality, they hold very little of the banking wealth. The U.S. currently has 8,195 banking institutions according to the latest FDIC report. 116 institutions or slightly above 1 percent own and control 77 percent of all banking assets.

And wealth inequality is at record levels once again:

Source:Â William Domhoff

81 percent of all financial wealth is concentrated with the top 10 percent. If you are wondering about another time in history when so much wealth was concentrated in a few hands you can look to the Great Depression. Even though the punditry proclaims to believe in the middle class the data paints a very different picture.

In today’s Lessons from the Great Depression series we are going to examine the Roaring 20s. Much like our economic climate today, much of the “success†was confined to a small group. Sure, many lived up the good times like during our HELOC housing bubble mania but once the tide went out, people learned a quick lesson between wealth and income. Income can be taken away rather quickly as many people are now realizing. Wealth on the other hand has longer sustainability and can impact control including favorable policies enacted by lobbyist to protect the unequally weighted status quo.

This is part XXVIII in our Lessons from the Great Depression series:

22. The Infection of Consumerism and Living Fake Lives.

23. The Worst Housing Crash in American History.

24. Economic Crises Around the World in Synchronization.

25. Reconstruction Finance Corporation II

26. Pecora Commission Where Art Thou?

27. Current Net Worth Drop of $13.8 Trillion Equivalent to 21 Percent Drop.

I’ve studied the Great Depression in great detail. Some of the best books on the topic include:

Only Yesterday by Frederick Lewis Allen

The Great Crash of 1929 by John Kenneth Galbraith

The World in Depression by Charles Kindleberger

Today I’ll be focusing on a few passages from The Year of the Great Crash 1929 by William Klingaman. People think of the Roaring 20s with images from the privileged elite that may come from F. Scott Fitzgerald’s Gatsby like literature. Yet the reality is very different. What we find is a nation that shuns savings, spends on credit, cuts deep in to the working class, and ultimately leads the nation into financial Armageddon:

“Beneath all the sanctimonious probusiness rhetoric, the Coolidge boom was based upon the tremendous expansion in productive capacity of American factories in the 1920s, particularly in such basic industries as iron, steel, petroleum, chemicals, and light metals. Because America’s fundamental transportation and manufacturing systems had been completed before 1914, and because the war had suddenly thrust the United States into an entirely unfamiliar role as a creditor nation possessing a record-breaking stock of European gold, businessmen were free to turn their attention toward refinements in the production and distribution processes. Spurred by military demands during the war, and sustained by the adoption of scientific management techniques in the years immediately afterward, U.S. industrial production nearly doubled between 1919 and 1929. Automobiles production skyrocketed; by 1929, Detroit was turning out nearly five million new cars a year.â€

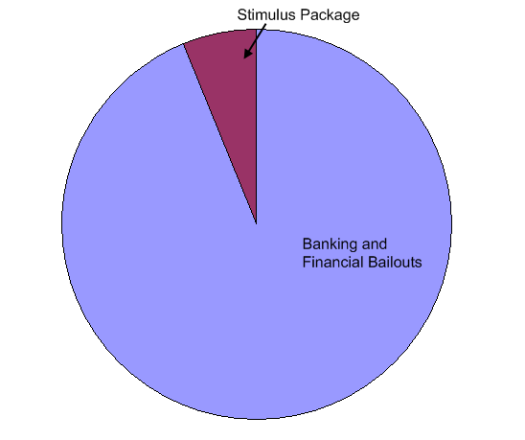

America is anything but a creditor nation. We are a nation full of debt. The green shoot argument was based on spending money we didn’t have. The use of Keynesian philosophy in such a poorly managed way is disturbing. It would be one thing if the bulk of the money was spent on average working Americans but the vast amount of bailout funds went to the top 10 percent while the middle class is seeing the American dream largely disappear. If you want to see a current breakdown of the current bailouts, this is how it would look:

How the stimulus package can garner more heat when we have given the banking and financial sector nearly 20 times more in funds is amazing. The crony capitalist have figured out a way to get the public to focus on smaller shiny things while ignoring the massive exploitation of fraud going on.

To think that suburban sprawl is only a thing from our current housing bubble is incorrect:

“Highway construction (funded primarily by state and local expenditures) provided thousands of new jobs; and as Americans enjoyed the benefits of increased mobility, sprawling networks of suburban development grew up virtually overnight, further fueling the building boom that also provided most of the nation’s cities with brand-new skylines, symbolized by the graceful, unadorned, and ultra-modern brick, cement, and stone skyscrapers that kept soaring higher and higher each year. Utility companies expanded their grids throughout the countryside, bringing the blessings of inexpensive electric light and power to most of rural America for the first time; power consumption in the United States increased at the rate of 15 percent a year during the decade.â€

The perma-growth model was in full force back then as well. But I am certain that we protected the mom and pop shops back then right? I mean that is the story of small business:

“In a never-ending quest for efficiency and greater control over every aspect of their operations, businessmen in the 1920s became obsessed with bigness. Local utility companies merged into mammoth regional empires; nationwide chain stores such as A&P, Piggly-retail shops, and Woolworth’s squeezed out thousands of small, independent retail shops; big-city banks gobbled up defenseless competitors and turned them into branches of multitiered holding companies.â€

Many things are large myths. The Roaring 20s roared for a select few until it all imploded with the Great Depression. Mega organizations ate and swallowed up small businesses like breakfast bars just like gigantic too big to fail banks are eating up smaller banks that are not too big to fail in the current recession. Even in the 1920s, pushing an anti-saving mentality was easy to do in the United States:

“Unfortunately, there was no corresponding expansion of employment or wages to accompany this boom in industrial output – which was, after all, achieved largely by the substitution of machinery for manpower. Without some powerful outside stimulus, production soon would have outpaced consumer capacity. So, to encourage a wider distribution of the mushrooming supply of goods and services, advertising became a major industry in itself. Saving was condemned as hopelessly out of fashion and almost unpatriotic; it was every American’s duty to provide himself with as many wristwatches, electric floor scrubbers, Frigidaires, Kriss-Kross razor blades, ultraviolet sun lamps, exercise machines, and canned peas as humanly possible.â€

Does this sound familiar? Just replace the Frigidaires with Sony plasma TVs and every other consumer good you can squeeze into your Visa card. Only this time, we took it to another level with the home equity ATM because back in the 1920s homeownership was roughly 45 percent while this time we nearly took it to 70 percent. The home became the personal stimulus machine sanction by the U.S. Treasury and Federal Reserve. Once again spending does not equal wealth. But for those at the top, they have to find ways to keep the consumer running on the treadmill faster and faster. The birth of adverting was a good way to get this going:

“Advertising “makes new thoughts, new desires and new actions,†declared Coolidge approvingly in 1926. “It is the most potent influence in adopting and changing the habits and modes of life, affecting what we eat, what we wear, and the work and play of the whole nation.â€Â In preaching the gospel of material abundance, advertisers received an incalculable boost from the invention and popularization of the radio; although the medium had been wholly unknown to most Americans before the war (only one American family in ten thousand owned a radio in 1920), the seemingly unlimited potential of radio captured everyone’s imagination during the twenties and revolutionize the nation’s communications and entertainment industries. The advent of installment purchasing plans provided additional impetus to consumption; all one needed to buy a new washing machine or diamond necklace was a minimal down payment. As the decade progressed, credit terms became even easier, with payment extended over longer and longer periods.â€

Easy credit and media encouraging folks to buy things that are simply beyond their means. Now those in advertising understand basic rules in human psychology. People want to be loved, feel important, and take care of their family. If you can make someone feel inadequate in any of these areas and promise them that your product will take care of the void, you have a good chance of selling it.

Speaking of making someone feel inadequate, remember this wonderful ad for real estate during the boom?

How many people bought a home because of a conversation like this? I would wager that tens of thousands did because they wanted to avoid pain or be loved (both are bad reasons for making the biggest financial purchase of your life).

But the real underlying weakness could only be masked for so long:

“High-powered sales strategies only camouflaged the basic weaknesses in the American economy, however. At one end of the scale there was too much idle capital; at the other end were too many idle workers. Income and purchasing power were dangerously concentrated in the hands of a favored few: government statistics showed that 90 percent of the nation’s wealth was owned by 13 percent of the people. While the number of truly rich Americans kept rising – a study by the Federal Reserve Bank of New York revealed that there were forty thousand millionaires in the United States at the end of 1928, where there had been only seven thousand in 1914 – millions of American families remained locked outside the charmed circle of prosperity. Farm income declined steadily throughout the twenties, and unemployment kept climbing until it neared the four million mark by the end of 1928. The coal and textile industries remained depressed for most of the decade, producing pockets of appalling poverty in the South and especially in Appalachia. Federal surveys revealed that two-thirds of American families were struggling to survive on incomes below $2,500, the official minimum standard for a decent living. Lured into exorbitant installment purchases, workers watched as a growing percentage of their wages was sacrificed every week to meet mounting interest payments.â€

We find ourselves in a similar predicament. All these cash for clunkers and tax credits for purchasing homes are simply a way to get people back into major debt. How many people bought those cars with cash? I would venture to say very few. In fact, many now have 5 to 7 year auto loans that will commit a certain amount of their income to a depreciating asset. Good move. And those buying homes with the tax credit? How many bought in areas where prices will continue to fall? After all, a jobless recovery is in the books and it is hard to make a 30 year mortgage payment with no job. This act of encouraging massive debt purchases in the midst of the deepest recession since the Great Depression is a page out of the Roaring 20s. Wealth does not equal debt! Those in the top 10 percent can tell you that but probably won’t. Anyone that tells you spending more than you earn or can afford is a path to wealth is out of their mind or doesn’t understand the basics of finance.

One group that is on a quick way to financial wealth are those awesome Wall Street CEOs:

CEOs’ pay as a multiple of the average worker’s pay

If this is the reward they get for leading us into economic disaster, can you imagine the pay with green shoots involved?

At a certain point the gig is up:

“In the second half of the decade, as the struggle among producers for customers grew ever more vicious, it became clear that “prosperity†was the exclusive province of big corporations, as the mortality rate among smaller businesses increased inexorably. “The business structure of the United States is undergoing a rigorous process of ‘rationalization,’†explained the managing director of the National Industrial Conference Board in early 1928, “in which many of the smaller companies find it increasingly difficult to compete with the high efficiency standards set by well-managed, large-scale enterprises.â€Â The New York World was less enthusiastic about the trend: “In the intensive competition which is now under way, and which shows no signs of immediate abatement, only the large organizations able to apply the best that science and skill have to offer are showing satisfactory earnings. This goes far to explain what is sometimes called the ‘miracle’ of prosperity and falling prices. When the nature of this prosperity is understood its miraculous features become less evident.â€

History doesn’t repeat but it does bring back stupid financial moves. I know I know, this isn’t the Great Depression. But what industry is going to lead us out of this deep funk? Are we going back to selling houses to one another while Tetris experts sell mortgage backed securities on their Bloomberg terminals on Wall Street to other foreign countries? Is that our idea of a booming economy? Do we think that putting a granite countertop on every home is the idea of a healthy economy while people max out their credit cards? If anything, during the 1920s we did produce and produced a lot. We were a creditor nation and exporter. Now we export debt and U.S. Treasuries while we spend to no end. The fact that we used the $8,000 tax credit to encourage home buying is disturbing because excessive home buying is what led us into this Great Recession!

But don’t let this get in the way of the new gospel of prosperity. Everything is fine. Just go out there and spend the money that you don’t have and wealth will magically appear.  The financial elite of the country appreciate your service to their wealth building.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

23 Responses to “The Gospel of Economic Prosperity: Lessons from the Great Depression Part XXVIII. Pretend and Spend and Success will Come.”

Ooh – I *hated* that commercial. I had almost banished it from my memory and now I hate it even more. That actress wins my vote for who gets the role of the next “The Devil Wears Prada” monster-female-boss movie. I sometimes see this blog as providing the answer to her nagging, bullying, emotional-blackmail questions to that poor guy, “What is the point? What? WHAT?!” – “Well, ‘honey’, prices seem really high right now and this would put a big strain on our finances when we can live comparably by renting for less than half! Things are just unhinged from reality and people’s incomes, and I’m skeptical that this is sustainable. What if prices go down? It’s like everyone’s in some kind of mindless frenzy. Remember that tech bubble where we lost all that money in the stock-market, it feels just like that, and I’m worried. And these crazy mortgages we need to make this work – what are we going to do if we can’t refinance? We can’t pay those reset rates! You know – if even the smallest thing goes wrong, we could just be absolutely ruined financially for years to come”.

Meanwhile, “Suzanne” the realtor’s on the line with the counterarguments, “Prices can’t go down, moron.” “Renting is for losers!” “Refinancing is cheap and easy, teaser rates forever!” “You don’t want to get priced out of this market forever” etc…. The next time I see adds like that on TV, I think I’m going to leave the country for a few years.

In recessions of the past, I could name maybe 2 people I know who lost their jobs.

If you asked me that question today, I would have to get a piece of paper, to write down the list.

This would include:

A relative laid off from a city government job-

A friend, computer programmer in the Silicon Valley area, who has NEVER been out of work- now going on 6 months-

A marketing / sales dept. head – now doing part time work-

Computer data base developer- unemployment has run out.

Friend- researcher for large law firm-laid off after 6 years with the firm-

My own former CPA-

I could go on, but you get the idea.These are college graduates, excellant resumes, the people who pay the bulk of the taxes in this country. When these people loose their jobs, and are unable to find new ones, no amount of “happy talk” will hide the downturn that is still getting worse. In the face of that, home prices MUST decline further.

DItto on the job losses. I personally know at least 10 people who have lost their jobs. Again, college educated, great resumes, great fields, all laid off and all have been unemployed for eight months plus!

@ Robert Cramer

Interesting list, but my anecdotal data is completely the opposite of yours. During the last recession (2001 dot com implosion), everybody I knew except for 1 friend was laid off or lost their job. One guy who actually made a several hundred thousand in during the dot com boom was unemployed for 2 years. Eventually, he ended up working at circuit city for a year, so in total he under/unemployed for 3 years. Another guy had to live on my couch for 3 months. My girlfriend at the time was laid off twice in 4 months. Many others I knew had to move back in with their parents. However, in this recession, I know of very few people who actually lost their jobs. In fact, I cannot think of anyone who has lost their job since the recession started. Based on my personal experiences, the recession of 2001 was way more traumatizing than the current “Great Recession.” Of course, because I live in Silicon Valley and most of my friends work in technology, the above anecdotal data makes sense. However, my point is that anecdotal data is not that reliable.

Singhance-

Thanks for your response. I live on the other side of the bay. Your experience in 2001 probably reflects the fact you are young, and most of your friends at the time were 20 somethings.

I am in my 50’s, and nearly all the people that I listed are senior managers,

not younger people. Of course, when companies are downsizing, getting rid of younger people making less does not really have an impact. Getting rid of people making $90,000- $200,000. is where you really can make a difference in your bottom line.

The wealth distribution in this country has become absoultely absurd. Its funny how much flack the President takes for wanting to “spread it around a little more”. What many middle class people don’t account for is that the amount of wealth controlled by so few makes their money worth much less. When some CEO goes out and buys 10 vacations homes that makes it much more difficult for a middle class person to buy one to live in. I hope that pie chart starts becoming more well distributed when this is over.

@Robert Cramer

Yeah, recessions do impact different age and demographic groups differently (and would make for an interesting case study). And you did hit the nail on the head, I was in my 20 somethings during the 2001 recession. But that last recession (of 2001) really did feel like a depression to me, and altered my outlook on the US economy (I expect my generation to be worse off than the previous generation). Even the “boom” years after the last recession simply felt like rampant inflation and that only benefited a lucky few (as this post describes).

i been reading this blog for about a year now, i think everything it says is spot on. kudos to the Dr.

however, sometimes i really get tired of getting fed the endless negativity. the government has chosen to go down that path and it is what it is. Life will go on.

I am small business owner so it’s a major let-down for me when I keep reading about the “supposed” implosion of the US economy. Of course, this blog is giving me a dose of the true reality which I appreciate. However, I cannot live happily with the bad thoughts continually lingering in the back of my mind. Sometimes, it’s nice to have hope.

All I keep thinking as I read these excellent blogs is that we have yet to see the “Great Panic” of 2009/2010. When that scenario unfolds, it will be unlike anything we’ve seen, and it won’t just be about housing either.

Everyone I know is either working extra shifts for the people that got laid off or working scared because they know furloughs or layoffs are lurking around every Friday, or are already laid-off. I know professional people doing painting, odd-jobs, working at Home Depot, Staples, Radio Shack. I think it’s just regional–the areas above sea-level. New Orleans has a bunch of Katrina-Apology money so their UE is low. Mish has 17 states borrowing from Fed because they are out of unemployment funds. Good thing the recession is over–too bad it will likely morph into something worse: The Not-So-Great Depression. Richest guy in our town is a televangelist–how stupid are we? I’d be more satisfied if it were a pro wrestler…at least his wife might call out the criminals in the banking system…

A really first-rate essay; and it expresses many of my feelings. Maybe I was just naive before, but for the first time, I really have no confidence in my government to do anything which will improve my way of life, or those of people like me. And this is not a Democrat vs. Republican issue; it seems that both parties have pretty much conceded that “the business of America is business,” and that if we can just get the credit markets flowing again, everything will be all right. And maybe it will be, but only if we all close our eyes. In January, the president did indeed call this the greatest economic crisis since the Great Depression. And now eight months later, we’re ready for a great recovery? I really do believe that they think that if they keep saying it, they can convince people to start borrowing and spending again…which will of course inevitably lead to a greater economic crisis than this one, in a few short years.

What is most appalling is that there has essentially been a transfer of wealth from the working middle class to the banks and other credit entities. We are of course the ones who are going to be paying for years for these incredible bailouts. None of what is being done now is going to appreciably help middle class people. The rich are already being made richer, while the very poor are being awarded some largesse. But not the middle class. People who stole homes are being allowed to stay in them; banks which greedily lent out money to deadbeats are being given their money back. But savers, frugal homeowners, renters, people who work 40 hours a week and actually pay their taxes, get nothing but platitudes. When the talking heads on CNBC talk about “the economy,” whose economy are they talking about? That of average citizens? Or the economy of Wall Streeters and people who own corporations?

It actually seems that those in charge think that if only people during the Great Depression had been told that everything was all right, and had been allowed to borrow more money that they couldn’t pay back, and to spend it on conspicuous consumption, we would have been back in boom times. Actually, what would have happened in that scenario is that every bank in the country would have eventually failed, and there would have likely been civil insurrection. I shudder to think what is going to happen here in five years if we keep encouraging a culture based on debt, cavalier spending, and the attitude that “if I can’t pay it off, I’ll just walk away, and the government will let me do it all over again.”

eric, you’re right…life will go on. But you know, the good dr. here, is telling it as it is, sad and disapointing as it might be to you. Hope is good…hope is great but it will not change the facts. The “supposed†implosion as you call it, is real and will be here for a while…

Now, bending reality and putting wierd colored glasses on, getting the green shoots rhetoric going, well, that is what you can see/watch on TV, all day long. Good luck to you.

Love the pie chart of Stimulus vs banking and financial bailouts. You should make posters of that and put them all over town to remind people just where all the money went.

Ug. That ad. You know not all wives would do that to their hubby. :o)

I just handed 5 engineers their WARN notice today. I have one more to go; this guy was on travel and I didn’t know he was getting one until this morning. HRs deadline for delivery was today. Mo-fk’n HR.

to William: You said, “When the talking heads on CNBC talk about “the economy,†whose economy are they talking about?”

They’re talking about their own economy. These “talking heads” are all millionaires.

I have lived abroad for twenty years and have become disgusted with America (ok, call me a commie and tell me you are glad I live abroad). While I sympathize with individuals who did not overconsume, refused to drink the Kool-Aid, protested the invasions of Iraq and Afghanistan, are sickened by the Patriot Acts, and want to burn down Wall Street, the nation is overwhelmingly to blame for its own woes.

Apathy, greed, and ignorance are defining traits of the American people. They don’t care about anyone else (unless they are our enemies or messing with our “stuff”). They want it all and they want it now. They have no clue about anything including the rest of the world or how to balance their own checkbooks. Some may argue it is not their fault but the fault of the system. I would argue that Americans made the system they live in so it is damn well their fault.

It’s time to clean house. Arrest, try and execute for treason the perpetrators of the Patriot Acts, the illegal wars, the credit bubble, the real estate bubble, and the ongoing crimes of private insurance. If the best we can do is throw Madoff in prison, and that only because he ripped off rich and powerful people, we are well and truly fucked.

The kids couldn’t even get jobs at McDonald’s for summer vacation; regular middle class men and women are working there now.

Okay, Dr. Bubble, I agree with your take on how much worse our economy and housing market will get…. But, what does a single mother who has sold her home 3 years ago do when she is renting a home and is primarily in cash? What happens when the dollar is worth NOTHING and I don’t have money to pay my rent? If I bought a house now, even if the value goes down, at least I will have a roof over my kid’s head, no? Thoughts?

@Eric

What you say is true. I know something about the underlying issues, but the bottom line is that it is all about distribution of data and methods–resources, productivity and products. The money thing is just a way to keep things somewhat organized. The Khazars know how to keep us in usury bondage. We know how to stay out of it but chose not to. So that’s how it is. I’ve lost a lot over the years worrying about the way things go. As long as the house of cards doesn’t collapse it’s still a roof over your head. Balance the truth with the lies and stay within our circle of concern–what else can we do? A little koolaid now and then might not kill you–just don’t do the Jim Jones thing…

Small biz? I work for a small 3 man shop. The owners have run this shop for 25 years. We are struggling from “paycheck” to “paycheck” and many of our customers either pay late, or are out of business and won’t be paying at all. The only bright side is that most of our competitors are going out of business too (bright side is – we’re getting their customers – it’s not so bright on the part of those businesses).

This economy is terrible and yet the tax men (all of them; local, state, fed) won’t give us a break. While at the same time, the city of Denver is giving tax breaks to Frontier/Southwest airlines. Are they kidding me?

The small biz is about to be a thing of the past in the good ol’ US of A. I hope we’re proud of ourselves.

the only thing worth a shit to invest in, in amerika is the lotteries. if i win big, ill give all my shop equipment ( one tool bought last year for 3100.00, worth, maybe 300.00 this year to someone in the business with a phd and NO common sense) to charity, pack my personal shit, write my landlord a check to fix all the out of code items in his “refied to the hilt” shang ra la, fill the gas tank, drop off a gonzo bag of dog excretia at the local b of a, and be living, INVESTING, and WORKING in canada in one week. maybe i wont make big money, and my taxes will be high, but at least ill be able to live out my life watching this countrys giangitic PONZI SCHEME EX-PLOOOOOODE. cant affect me more there, than hardscrabbeling here in small business to survival basics. always had the idea that we had enemys around the world, never even thought that amerika would turn into a LEGAL self eating watermelon.

We have all seen hard times, and while it’s hard right now – it always seem hardest when your in the thick of it. I rememeber the 80’s recession and there was all this talk about that being the “next great depression” . Yes it was hard BUT that is the nature of economics, we have ups and downs. AND we can’t always ALWAYS always expect it to be “UP”. There spread of doom and gloom everywhere you turn seems to make everything 110% worse then it actually needs to be. I know there are A LOT of people out there who have had a series of bad luck events occur in your life, however, this is the case every other year with or without a ression. The only difference is the everyday people going through hard times when there ISn’T a ression dont get to tell their story on the cover of a national newspaper for everyone to see and relate too…. Get it… GREAT : )

Leave a Reply