Economic déjà vu from the 1937-38 recession: Lessons from the Great Depression part 30. With financial bailouts and government spending pulling back are we setup for a double-dip?

The U.S. economy is facing some serious challenges ahead. Looking at the current economic climate it feels eerily similar to the 1937-38 recession that occurred during the Great Depression. Some think that the Great Depression occurred overnight on a gloomy day in October of 1929 but we had a decade long build up of rampant speculation and bad investments that led up to the crash. The bottom hit in 1932 and 1933 with unemployment soaring to 25 percent. Yet the story never ended on that date. Throughout the Great Depression even with massive government spending the unemployment rate remained above 15 percent for all of the 1930s. Without a doubt the early success that occurred for the government after 1933 was largely based on government spending. However government spending back then was largely focused on the working class while today most of the stimulus has been shoveled to the financial industry. It is helpful to look at history as a guide since we are facing many similar issues today even though things seem to be stable for the moment.

This is part 30 in our Lessons from the Great Depression series:

25. Reconstruction Finance Corporation II

26. Pecora Commission Where Art Thou?

27. Current Net Worth Drop of $13.8 Trillion Equivalent to 21 Percent Drop.

28. The Gospel of Economic Prosperity

29. New home sales fell 80 percent from 1929 to 1932 and fell 82 percent from 2005 to 2011.

Persistently high unemployment and growth dependent on government spending

Data for 1910-1930 from Christina Romer (1986), Spurious Volatility in Historical Unemployment Data

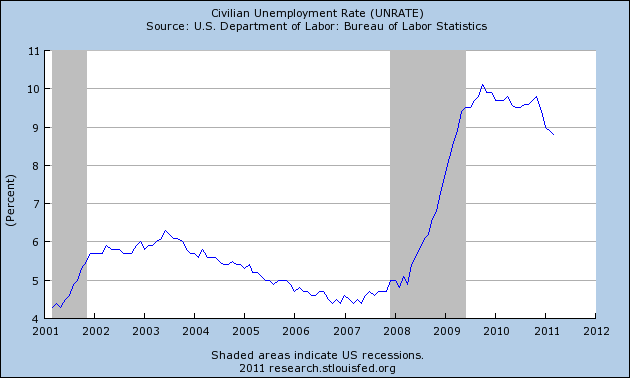

People have unique perspectives regarding the Great Depression and a large part of it stems from deep rooted ideology. The fact is fiscal spending did boost the U.S. economy out of the depths of the recession. This should be obvious. If the government steps in to provide jobs and spends money where the public is not, this will help the bottom line GDP numbers. Yet as the chart above shows the unemployment rate remained stubbornly high for the entire 1930s. The headline unemployment rate has been over 8 percent now going on three years:

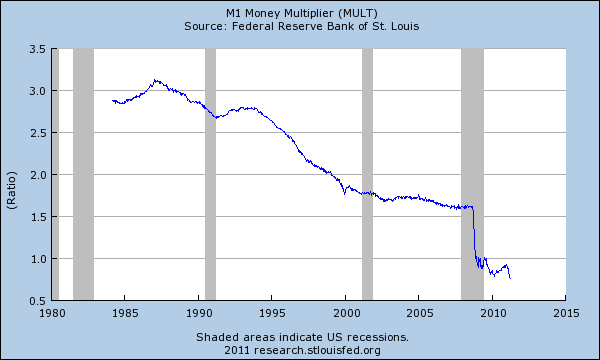

Much of the recent economic stabilization has come from massive government spending. Yet when you inject money like this into an economy you don’t always get the best bang for your buck and that is exactly what we have. In fact, if we actually look at the M1 multiplier you are seeing how ineffective more injections of liquidity have been for the economy:

The ratio is now under 1 which makes any more Fed actions more challenging:

“(Greg Mankiw) Econ prof Bill Seyfried of Rollins College emails me:

Here’s an interesting fact that you may not have seen yet. The M1 money multiplier just slipped below 1. So each $1 increase in reserves (monetary base) results in the money supply increasing by $0.95 (OK, so banks have substantially increased their holding of excess reserves while the M1 money supply hasn’t changed by much).â€

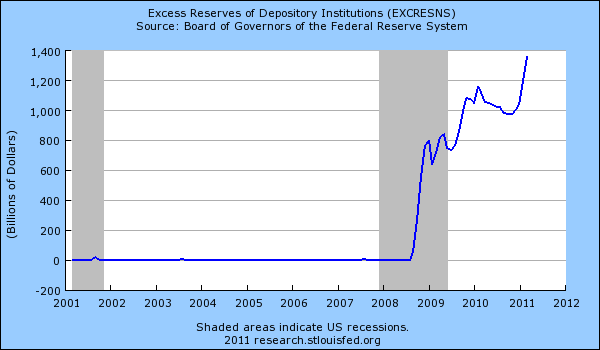

Nothing has changed in the last two years as the chart highlights. Yet Fed policy remains the same and excess reserves continue to grow:

The Federal Reserve pays interest on this by the way:

“(Federal Reserve) The Federal Reserve Banks pay interest on required reserve balances–balances held at Reserve Banks to satisfy reserve requirements–and on excess balances–balances held in excess of required reserve balances and contractual clearing balances. The Board of Governors has prescribed rules governing the payment of interest by Federal Reserve Banks in Regulation D (Reserve Requirements of Depository Institutions, 12 CFR Part 204).â€

This also addresses those questions about massive inflation because of the trillions of dollars in liquidity funneled into the banking system. Much of the money is kept in the hands of banks and isn’t flowing into American households. The actual funds banks do have are used to invest in global markets to chase higher profits. In other words they are not investing back in the American people although the Federal Reserve opened up massive liquidity lines for this specific purpose. Yet with Republicans and Democrats both bringing to the table $4 trillion in proposed cuts, the economy will need to stand on its own two feet. Is it ready?

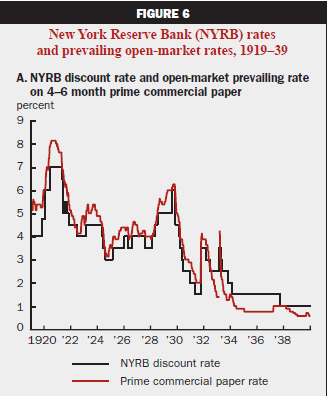

If we look at the Fed funds rate from 1919 to 1939 we realize that rates were also low back then:

Source:Â Cleveland Fed

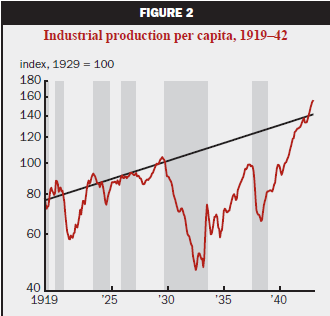

There have been arguments about the Fed ushering in the 1937 to 1938 recession but it certainly wasn’t because of the Fed funds rate which was incredibly low just like it is today. Economists during 1937 largely attribute economic growth because of government spending. Yet fears of an unbalanced budget lead to cuts in spending and guess what happens? The nation falls into another recession in the midst of the Great Depression:

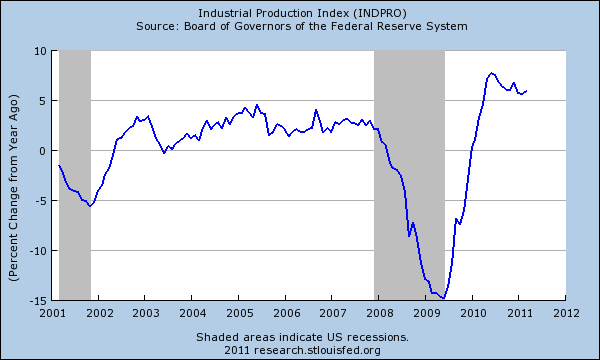

If we look at year-over-year changes in our current industrial production we see that the rate is slowing down significantly:

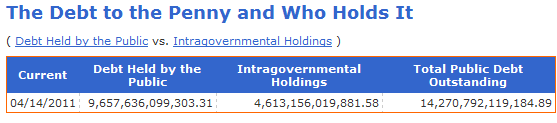

It is clear that we zoomed up from the bottom but how much of this was due to massive trillion dollar bailouts and injections into the financial sector? Just like it happened in the past, massive spending and handouts to the financial industry only cover the current issues and delay the inevitable for a few more years. As many of you know, there will be discussions of raising the debt ceiling shortly. Take a look at this number and see if it does anything for you:

Shortly after the 1937-38 recession the U.S. borrowed money to rebuild its armed forces and manufacturing shoots up to gear up for war. Yet those conditions do not exist today since we are fighting wars with dispersed individuals that use low priced weapons. Where will government spending go? So far it has gone into the already bloated financial sector. If we look at China and their massive spending, you end up with empty cities, shopping malls built for millions with no customers, and over 60 million empty apartments. Simply spending money to build up GDP has a cost in the long-term. What an economy should aim for is sustainable growth through the actual demand by households, not artificial stimulus from the Federal Reserve. We are still stuck on real estate since banks have trillions of dollars of inflated properties on their balance sheets. What we face today is more in line with what Japan faced over their lost two decades. Giant spending and bailing out of the financial sector while allowing banks to keep bad loans in zombie portfolios.

The massive bailouts and stimulus programs are now waning and we are starting to see production pull back which shows us that much of the recent success largely comes from government spending. Yet how much will the real market sustain once this crutch is pulled back? The multiplier already shows us what we already know. The financial industry is largely siphoning money off the productive sectors of the economy in an ever growing fashion. With large contentious battles ahead and both parties aiming to cut large, we can expect a double-dip recession but let us hope that the real economy is strong enough to blunt the force of the massive financial bailouts ending (at least in theory). Ultimately what no politician will tell you is that we have financial pain ahead because we have spent too much and there is no free lunch at the end of the day except for the financial industry with deep pockets and lobbyist that ensure a win-win no matter what happens in the real world. The question revolves around who will suffer the deepest financial pain? Will it be those largely responsible for the financial gambling of our economy or the rest of Americans? So far the brunt has been suffered by working and middle class Americans.

Aside from the more important aspects of economic stability, the current path forward is not positive for real estate.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “Economic déjà vu from the 1937-38 recession: Lessons from the Great Depression part 30. With financial bailouts and government spending pulling back are we setup for a double-dip?”

thank you dr hb. an excellent article again. I also think that we are in a terrible aka japanese type of situation, but we haven’t realized it. Unfortunately, this just isn’t obama’s fault, it has been collective over a number of administrations. As you rightly point out, we haven’t grown in jobs or output, and our gdp has been goosed by construction for the last 10 years, we still need to adjust our growth and spending levels to that rate. We have further to fall, and many more cuts ahead….

True is isnt any single individual’s “fault” but our progressive government has the throttle pinned, the pedal to the floor, full steam ahead!! Sheeple vote-in and are suckered by power seekers and sellouts, time after time.

With all due respect, that’s a hijack of avs’s point, and of DHB’s now THIRTY well documented essays on this issue, in addition to the rest of the blog’s five years of data and observation.

The whole point is that politicizing this issue is a diversion, a digression, and, I’m increasingly sensing, the refuge of minds that would rather have partisan whizzing matches than deal with the cold hard numbers. Politics, like profit-chasing, is an excuse to evade the difficult truths of our situation, such as that a clear choice emerged some time ago, and is consistently deferred:

Are we going to continue to let the giant profit-harvesting casino of global banksterism run everything, and let everything else run to weeds and grief?

And if we choose something else, what will it be, and what will be the mechanisms by which that happens? Who will profit, and who will pay? Because in a system where everyone worships profit uber alles, and profits are concentrated while costs are socialized, it’s hard to move off of that, and pinch the delicate toes of those accustomed to having everything free and easy through the miracle of speculative returns and ever more Baller consumerism.

Concurr 100%, affirmation of point.

We are not going to enter a “double dip.” This is what’s coming next:

http://www.heatingoil.com/wp-content/uploads/2010/04/market-crash-graph.jpg

http://www.vectorstock.com/composite/80617/line-graph-growth-and-crash-vector.jpg

It’s called MELTDOWN. Take Chernobyl x 10,000. Fukushima x 1,000,000.

The question is not “if”, it’s “when” the meltdown occurs? This summer, this fall, this winter, early 2012? It can’t be predicted, however, it’s coming.

post after post, A-bomb. This is all we every get from you.. “The Sky is Falling!”

Dr. Housing Bubble,

I have been lurking for 3 years on this blog. A friend of mine worked on a report for the OCBJ in 2006 on housing and rents in OC being out of line with incomes. Your acute analysis has been very calming as a voice of reason in this financial crapstorm.

Will the banks ever clean up their balance sheets? 3.5 years later I still scratch my head at why so much of the fiscal stimulus was dumped on the too big to fail banksters who securitized and sold off the b.s. loans in CDO and MBS form.

Why with market based pricing on accounting can the banks continue to hold on to the vast number of nonperforming loans without serious hits to share price?

I am fine paying taxes for public works and services, but bailing out the system that is broke and not being fixed seems like peeing in the wind.

Thank you for the ongoing economic analysis and historical data.

“Why with market based pricing on accounting can the banks continue to hold on to the vast number of nonperforming loans without serious hits to share price?”

Excuse me, but where have you been? The Banks haven’t used market-to-market for a couple of years now. They’ve used mark-to-model, which allows them to make up any amount in order to cook their books. This is what has allowed them to get away with this housing nonsense, along with generous amounts that you are now on the hook for.

My incorrect wording. Thank your for the correction.

Happy to see that Goldman, Chase, MS, Wells, and Citi all had above analyst expectations on EPS in Q1. Goldman fell short of $5.59 Q1 2010 with $1.56 Q1 2011. Darn.

Those guys sold the securitized mortgage junk off to clients and after liquidating the crap turn around and buy derivative hedges on the same AAA rated tranch effluent and make millions.

They should have been criminally and financially punished instead of given the keys to the financial kingdom. Should have tanked with Lehman and all the heavy leveraged risk party market making and breaking crooks.

When your neighbors who are living free in their homes (0 to 3 years now) are evicted and foreclosed upon,

and when the vacant homes in your neighborhood are sold,

is when the banks will realize their losses at the latest; but they should be forced to mark to market Now based, at least, on probabilities (like 99% dah).

What is the banks required reserve ratio in 2011? Ludicrous leverage ratios for financial instituitions like Bear Stearns and Lehman and there associated AIG credit default swaps destroyed the economy, the taxpayers then shovel billions into the commercial and consumer banks to keep them liquid yet banks still hold on to nonperforming loans and properties instead of taking the write down.

Unbelievable that 1) after 4 years the banks still can’t managed the distressed properties and 2) banks are able to control the markets slow slide by keeping the massive home inventory on their books that currently generates no positive cash flow instead of selling off the properties in a more rapid manner under a more radical price correction scenario.

I have a 20% down, but I am not eager to jump for that dagger of a home price that has been slowly falling for what will be half a decade shortly.

“I have a 20% down, but I am not eager to jump for that dagger of a home price that has been slowly falling for what will be half a decade shortly.”

I would advise you to NOT risk your 20% down (unless on a REALLY depressed foreclosure). Instead, “go BankSter”, and use THEIR (our?) low-interest money… LEVERAGE that shyt… then if your value really tanks, and you have to move for a job, can’t rent it, etc., no pain, walk away… “ride it like a Goldman”… lol.

Also, as pointed out for years in this and other well-reasoned sources… THERE IS *NO RUSH*… there will NOT be any “bounce” followed by a rocket-like uptrend. It didn’t happen after the 1989-90 S&L crash–in a much better underlying economy BTW–so it sure as shyt ain’t happening this time. There will be “deals” for YEARS to come.

Thanks. Advice such as the good Dr. provides will continue to be heeded. I am not getting caught up in any RE PR or herd mentality.

Right- – there will be deals, but probably not juicy interest rate nor low down payment opportunities.

And why haven’t the banks evicted and rented out the properties, rather than sat on them collecting nothing year after year?

In the 50’s we had 31% (ranked No. 1) of the total world exports, today we have 19% (ranked number 2 – that is with devalued dollar) after China with 21% (Yuan is still not where it is supposed to be.) Of course, back then there was something else called “National Pride” and “Made in America” and we can all agree that CEO’s back then were not making as much money as they are today.

While in office, President Carter stated in the documentary shown on PBS [paraphrasing: We judge people by what they have and not what they do and stand for.]

Another factor in which Doc indicated is the interest rate and the national debt. Last week in the national news (ABC) they had a segment regarding national debt from 1980’s – current year (1T to currently 14T). By looking at the interest rate, it is clear that interest rate has been decreasing as the national debt increased (It would be nice to see this [National Debt, and interest rate] on a graph along with unemployment/underemployment rate, and inflation from 1980 – present.) To avoid inflation one way may be to increase interest rate, but at the same time the rate of 14T will go up drastically which we are still responsible for.

The main question by the Doc is THE KEY QUESTION.

“The question revolves around who will suffer the deepest financial pain? Will it be those largely responsible for the financial gambling of our economy or the rest of Americans? So far the brunt has been suffered by working and middle class Americans.”

The peolple holding the debt bill will be the lowest common denominator – the largest number of Americans in the lower tax brackets who can least afford to pay for the Wall Street excesses. The double edged sword is that those taxpayers, their children, and grandchildren will have even greater difficulty going forward to purchase a home or attend an institution of higher education and thus move up the socio-economic ladder.

Does anyone see a change coming from this or the next elected U.S. govenment as far as criminal accountability and serious fines levied the most powerful U.S. businesses whose executives have made the most deliterious screw ups in the private sector that will be paid for by the public as part of the national debt for decades?

Lobbyists and elected corporate cronies will protect the corporations from ever paying for their leveraged risks gone south. Spending cuts and new taxes will be the only way forward. In the meantime, the business media waist for a new business sector to cyclically heat up to proclaim the fortunate and well timed CEOs as innovative saviors of the market and bellweathers of economic good times.

Think Wall Street should have been regulated and prosecuted far more harshly? Think Volker as the Fed Cheif would have let the 3 Greenspan bubbles (tech, credit, and housing) occur or would have drawn the interest rate brakes when the economy was going strong?

Helicopter Ben will continue to work hard to appease the banks and Wall Street in the name of “inflation fighting” when the real issue is getting the debt down and continuing to deleverage the too big to fail financial institutions and their smaller but equally important breatheren that comprise a huge percentage of worldwide market capitalization. With all the money that has been printed and loaned below inflationary rates, inflation isn’t an if, but rather when.

A double dip would seem unavoidable, but surely Ben and the inflation fighting fed will spend their last monetarist bullet to avoid it while they are still in charge.

“Does anyone see a change coming from this or the next elected U.S. govenment as far as criminal accountability and serious fines levied…”

No. You’ve bought into the propaganda which they instilled in you in High School.

I’ve said this before. For each election, you get a choice between a Red candidate of the Bankers or a Blue candidate of the Bankers. No other option has a chance.

But it will be a candidate from the Bankers, and that person will do what the Bankers want. This will not change until the To Big To Fail Banks go bankrupt.

How much evidence do you want to ignore before you change your mind?

And if you are banking at one of the TBTF banks, you really are as much a part of the corruption here in the U.S. as are Wall Street and Washington D.C.. Only you’re not getting as much money as they are.

The Fed saved the big banks and Wall Street. That’s about it. The rest of america keeps circling the drain. The govt is the only thing keeping the economy from collapsing. So they’ll have to keep up the ponzi game. And the US$ will continue to erode in value as more and more debt is purchased by money that was not earned by anyone.

Today banks simply do not account for the Shadow Inventory, a non performing loan is still on the books as an ASSET not as a liability as it should and was counted for all of the time leading up to the crash.

So if you are BofA with a million dollar loan in CA, it stays as a mjillion dollar asset even when the homeowner stops paying, for as long as you like. If you foreclose you must write the loan down to what is paid on the courthouse steps, in CA ON AVERAGE that is a %30 hit so you now have a $700,000 liability. If you pretend it is still as asset and do not foreclose you lose about $5,000 a month in payments or 60k a year.

What would you rather have? A $60,000 hit for the year or lose $300,000 overnight?

Correct, extend and pretend because you are bonused off stock price and if you went to sale on all the nice folks paying utilities only your bank would not be solvent. Game over.

ARRGGGH!

Seriously, A million dollar home (2007) loan that is non-performing is an asset? Moreover, that writedown of the book value would effect shareholder equity for the big bath, but the banks still have that 1 million dollar home that will now easily sell for $450-480K.

I still don’t understand the accounting rule that qualifies said non performing loan on a million dollar home as anything but a liability on the Balance Sheet or a loss on the annual report to shareholders.

The accounting practices being used to manipulate the books, make shareholder equity a chimera. At some point the piper will have to be paid. Most of the folks on Dr. HB’s site are scratching their respective heads wondering how long the extend and pretend will last before the government handouts and consumer carrots run out and the true reckoning comes to the financial sector and the economy at large. That double dip might just be extended long enought to be the next recession/depression instead of part of the 2007-Present collapse.

It’s an asset, just one that should be valued at 450-480K (market value) and thus not perhaps a net asset

RentaLurker, here’s the accouting entries (using estimated numbers). My example will show a $350,000 expense, but at no point is a liability involved. Even if an asset falls dramatically in value, it’s still an asset. The process of writing it down generates an expense which counts against revenue when calculating profit.

Original Entry, when loan is made. Cash is given to borrower and receivable is recorded.

– Mortgage receivable (Asset, debit entry (up)) $900,000

– Cash (Asset, credit entry (down)) $900,000

Monthly entries, while the loan is being paid back. Borrower pays $3,100, reduces their loan by $600 and bank generates interest revenue (income) of $2,500.

– Cash (Asset, debit entry (up)) $3,100

– Mortgage receivable (asset, credit entry (down)) $600

– Interest Revenue (revenue, credit entry (up)) $2,500

When the loss must be recognized (either now under mark to market or after foreclosure in mark to myth), the loan is written down. Assuming that the loan was reduced to $800,000 by time the default occurred and the house will sell for a net of $450,000.

– Mortgage receivable (asset, credit entry (down)) $350,000

– Loss on uncollectable receivable (expense, debit entry (up)) $350,000

In the end, the mortgage receivable (or cash once the house is actually sold) will only be for $450,000 and the bank is forced to recognize a loss of $350,000.

1Mil DR asset begin balance sheet asset

To mark to market = realize the loss: CR asset 300k and DR loss 300k on P&L, leaving 700k bal asset. Then when sold, CR 700k asset and DR 700k cash. No liability on the bank’s books.

The homeowner has the liability on their personal balance sheet because they owe the bank $1Mil.

I dare to assume that the asset write down will cause a drop in shareholder equity and associated market cap yet the managers will continue to mysteriously collect bonuses and the shadow inventory will continue.

Thanks for the accounting refresher AL!

It is a joke that the banksters aren’t forced to write down losses on non performing loans in a timely mannen when so many of them haven’t collected a nickle of principal or interest in more that 6 months (and we all know from the good Doc that non payment with no bank recourse can go on much longer.

IMV, christian stevens’s point is exactly correct. What black ink there is in the financial games of the balance sheet caste seems to be equal parts plutocrat poo and squid squeezins.

When overvalued, unsellable, overbuilt crapshacks in unsustainable situations/communities are considered assets–and measured as such by that overvalued price tag–you get the same accounting monkeyshines that let a corporation fire workers, destroying families and communities, call it profit, then reward shareholders with more money. It’s the Ownership Society!

When FDR had his mavens conjure up a way of measuring the nation’s industrial capacity–the GNP–they were trying to measure something real to plot a course out of the Great Depression.

Unfortunately, economists and policymakers have done exactly what the GNP framers said never to do: never to use the GNP as a leading economic indicator.

Not only did they do just that, they have continually morphed it from a meaningful measure of productive capacity to the GDP, which is largely a PR tool for Wall Street. It is an aggregate of “whatever’s goin’ up” factors designed to hide the truth about productive capacity and to instill confidence in the endless seafood buffet in the global casino.

Tip: take your Geiger counter.

Here’s a very sobering reality check:

http://www.zerohedge.com/article/fhfa-re-market-no-upside?

I’ve been saying this for a long time – the housing market is in for major, major trouble, probably 10-20 years of housing depression ahead of us. The artifically high home prices we are seeing now (as in the 2.4 million dollar house in Pasadena) are going to come crashing down.

Here’s another good article….

http://www.dallasnews.com/business/residential-real-estate/20110414-more-u.s.-home-price-declines-ahead-moodys-economist-warns.ece

One has to understand that the only solution to this mess is that we need to implement a wealth tax on the top earners. The top 20% own 80% of the wealth in USA. A simple 14% wealth tax on households with a net worth of more than $50 million would raise trillions of dollars in taxes. I am talking about taxes on houses, boats, cars, airplanes, art, jewelry, etc., not their annual income. This money would pay down the national debt, rebuild infrastructure, and save USA.

Yeah, when you look at America’s “golden age” the top tax rate was much higher than it was now. I am not saying that we should go back to 91% as it was under Eisenhower, but we need to tax the wealthy more. Everyone else is tapped out. Over the last several decades both corporate and personal income taxes have gone down significantly yet we keep spending, putting ourselves further in the hole. After everything that has gone down recently, it should be clear that the government’s top priority is appeasing Wall Street and the uber-wealthy. This has to change. America won’t last if it keeps moving in the direction of kleptocracy. We must boost the middle class and rebuild our infrastructure.

Tax them so high it isn’t worth it for them to steal. They’ll go back to being socially responsible to get their recognition. That’s how it was in the ’50’s.

While the top marginal rates were indeed very high, the reality is that during those periods, no one with any brains paid those rates. The tax code provided a lot more opportunities to fudge back then. Just read up on the history of the AMT, basically designed after they realized that the majority of top earners were paying next to nothing due to intricate deductions (of course now the AMT has spread down to upper-middle class, from the original target of top 250 earners, since it’s not indexed so this has been a windfall for government over the years). Basically the US lowered rates and made the tax code much more uniform, just look at government tax revenues as a percentage of GDP, during all those different tax paradigms, tax revenues as a percentage largely went unchanged.

Today you have a standard deduction which is large enough to eclipse itemized benefits, including home ownership for a good number of people in this country. What is it this year, 40% of US households pay no income tax or something (saw it the other day)? We already have a system hitting the high income earners. The real issue when you see mega incomes is that a lot of it comes in the form of capital gains and selling companies or other realizations. It’s not like some CEO or founder of a company gets W2 income that high, this is capital gains from equity that are taxed at 15% (low cap gain and div taxes encourage stock ownership and boost the equity markets…). This is why Warren Buffet is complaining that he pays around 17% and his admin assistant pays a higher rate than him. I agree that we need to change this some and capture a higher percentage of these gains.

The current reality is that we as a country have a spending problem and there is no solution except to stop over spending. WSJ had a nice article that taxing any income in this country over $100K at 100% still doesn’t close the current deficit. We have our two favorite parties squabbling over $50bil in cuts. The cold hard truth is that, marginal cuts don’t help anything we are too out of control. Discretionary spending is not the problem (albeit I think we have ridiculous graft , outrageously poor discipline – it’s a problem but not the 800lbs gorilla). Entitlements make up a massive amount of the budget and are expected to skyrocket. Take a look at the budget pie chart, it’s worth it sometime. Quantify entitlements and their expected rate of growth. Then freak out. This government needs to scale itself back and get lean/mean. I don’t mind paying taxes, I like the thought that it helps all of us and those less fortunate than myself. That said, I want to see some ruthless discipline with how our collective money is handled – and I don’t see it at all.

Matt, I agree with your conclusion, but your reasoning leaves room for improvement. You don’t explain why taxing the rich is any more effective than a rise in general taxation. The reason is that annual spending by the rich is little affected by tax increases or reductions (or stock market gains or losses). Thus when tax dollars are taken from the rich and spent, their spending stays roughly the same, thus TOTAL spending over the economy as a whole rises, which means unemployment comes down.

We don’t need to tax ANYONE if you shrink the government. You are assuming the govt is the solution, I assume it is the problem. The founders of America were on my side. You are on who’s side?

Alexander Hamilton was the First Secretary of Treasury and esteemed Founder of America. He vehemently would have disagreed with you and George Washington did not reign him in in these argument back then. Hence some Founders not only disagreed with you with rhetoric their actions set up the National Debt, First Bank of the USA, and the Dollar being the currency of the nation.

The reality is no matter the tax code or policy, taxes revert to around 20% of GDP.

That’s where spending should be.

You want to see the real PROBLEM, look at this comment thread and some of the “ideas”

Asset taxes

Somebody actually thinks the gov’t thought the problem was “solved” in 1937.

Linking to Delong.

These problems will never be solved until the whole sector of resentful, imbeciles in society is corrected. Once society understands to people should be self-sufficient, progress will come.

And a heavier tax on corporations in the financial sector. But that will happen, because the financial lobby will decry the proposal claiming that it will inhibit innovation due to the fact that they wont be able to be able to pay the bonuses for selling junk. Just think of a market without risk lowering innovative financial products like credit default swaps. If the financial corporations paid their fair share of taxes into the infrastructure and to pay down the debt, how would they give their derelict CEOs $150 million golden parachutes every couple of years after they have run their respective companies into the red?

Doc, I think your presentation about 1937 and 1938 has left out a couple fairly large factors that contributed to the economic slump of those years. One was tax hikes. The top rate went from 59% to 75%. Also, the new social security tax was 2% on each employee and the same 2% to be paid by the employer, effectively a new 4% tax on everyone but half hidden. Another factor, to some degree was the Wagner Act and its results which probably included more strikes and higher wages. Of course, higher wages are not bad. But one of the forgotten characteristics of the Hoover administration was a determined effort to keep wages high in the face of economic deterioration. The result was to exacerbate unemployment. Via the Wagner Act, FDR, in part, repeated the same thing.

PIMCO said from day one about the “new normal”. Yes government spending has masked some of it, but it will eventually come into full bloom when the music stops. By the way, much of the bank reserves have gone into financing the deficit. Just like musical chairs, with a house of cards trick thrown in. We are in for some very exciting times. As the candidate Obama, he promised changed, and we will certainly have that.

The unemployment rate does not count those who got laid off and started their own failing businesses. If you add those folks in, then we are like the 30’s that our grandparents use to talk about and we thought they were crazy and it would never happen again.

Notice the steep drop in unemployment that subsequently spikes around 1938? This is because the government believed the troubles were over and balanced the budget. The resulting drop in aggregate demand caused a recession. Japan experienced something similar in their two decade fight against deflation.

You stated:

Throughout the Great Depression even with massive government spending the unemployment rate remained above 15 percent for all of the 1930s.

This is incorrect — this happened because most of the people using the unemployment series do not read the footnotes of that employment series. For a more complete explanation of why you are wrong, see

DeLong Smackdown of the Day for June 12, 2010: Robert Waldmann New Deal Unemployment Edition http://delong.typepad.com/sdj/2010/06/delong-smackdown-of-the-day-for-june-12-2010-robert-waldmann-new-deal-unemployment-edition.html

Don’t forget to read the linked sources

Doc, Thanks for the above article and interesting charts etc. But it’s all very pessimistic. You don’t suggest any solutions. I suggest the solutions are simple. In fact I suggest you are only one step away from tumbling to the solution yourself, and for the following reasons.

You say (3rd last para) “What an economy should aim for is sustainable growth through the actual demand by households, not artificial stimulus from the Federal Reserve.â€

Well hang on. You admitted that the 1933 recovery was due to something “artificialâ€, i.e. increased government spending (your first para). Quite right. Then later on you repeat the same message. You say “Much of the recent economic stabilization has come from massive government spending.†So what’s wrong with “artificial†stimulus? This what Keynes recommended, and I agree.

You then make the point that extra government spending can go too far and result in absurdities, like the famous “bridges to nowhere†in Japan, or empty cities in China, to take your example. Quite right.

So the solution is . . . and surely this is blindingly obvious . . . feed stimulus money into household pockets!!!! That way you get what you yourself want, i.e. “actual demand by households†to use your phrase.

The advocates of Modern Monetary Theory have been advocating the latter solution for a long time now. For example Warren Mosler has long advocated a payroll tax reduction. This would feed stimulus money direct into the pockets of every employer and employee in the country, and that would be a big improvement to stuffing the pockets of Wall Street crooks.

That might have worked a couple of years ago; now it’s too late. QE I was stuffing the financial system with $50 Billion a month. QE II has been doing it at the rate of $200 Billion a month. QE III will be interesting, whether it’s direct or virtual.

Re: http://www.zerohedge.com/article/why-fed-has-upped-ante-money-pumps-hint-system-crumbling-la-2008-again

The only way out is debt repudiation; wipe out the bad debts and the fraud. But the only way that’s going to happen is for the big financial firms to fall.

We have that already/now don’t we? 45M on foodstamps, welfare, housing assistance, etc. Handouts, generations on the dole. It’s all good, and stable, folks are fed, housed, and subdued to the point they aren’t robbin you? Problem solved, or is it? Who pays for all this? Answer: Us poor folks who produce & work, you know folks with character who don’t take handouts, who have pride and a work ethic.

We have “successfully” saves the financial institutions from failing. Huge profits, great reserves. They are getting closer to dropping the hammer on the general public. With stronger balance sheets they are in a much better position to stop the ” pretend and extend” method of addressing bad loans. Instead, pushing hard on the middle and lower classes will begin ….. Pay up or get out!!!!! Mr banker is now in a better position to start to realize some losses at the cost to those that saved him …… More stress to families…

Truth of the matter is that defense spending has increased 300% for the past decade. So yes, the Guns ‘n Butter nature of the economy is in fact, the main support beam for the whole thing.

With the above in mind and the trade deficit, how do we build a recovery based upon the consumer? Realize, the consumer needs to be employed by an enterprise which is making revenue. Well, when let’s say a Raytheon (yes, a DoD contractor) starts to cut spending, they order fewer parts (electronics, materials, etc), then that contracting spills over onto those vendors and the servicing industries around those. The net result is job loss and a contraction in overall consumer spending. Without a healthy export economy, there’s no economic recovery at all, as the money isn’t coming in sale of goods.

Thus, in place of worrying about the local economy, the govt/system put its eggs into the financial sectors because that represents the total capital, traded a/o invested around the globe. The *rent* income, from that global spigot is then circulated into the US economy, with the top bankers getting richer, their employees staying middle class, and the rest of the minions in the upper poor.

So you see, this is a bimodal economy, govt/defense on one end, finance/trading on the other. With this in mind, economists need to re-visit all their assumptions on how the economy actually works.

http://abcnews.go.com/WNT/video/american-flags-made-american-hands-13399912?tab=9482930§ion=1206853&playlist=1363488

One good solution is the above link and ABC is absolutely correct. Buy more and more Made in America because,

1. It just feels better;

2. It is just the right thing to do;

3. Unemployment will come down at a much faster pace and our family, and friends will have jobs and when they are happy, we will be happier;

4. CEO’s will not be able to make 300-500 times the salary of average worker anymore;

5. National debt will be paid for in few years so our children and grandchildren will be able to enjoy their life more;

6. It seems like back in the 30’s people would have only bought Made in America;

7. Many more trickle down effect to make our economy healthier;

8.

9.

What do you think?

Good idea, but rather naive. There are no televisions built in America. About 40% of

“American” cars are built in Mexico, Canada, or Korea. No clothing made in America.

The only things made in America anymore are video games.

It is naive to think it is naive. If televisions were made in the U.S. before, why the mysterious disappearance; and why the grumpy attitude about jobs leaving but never returning? Things, for example, like unfair trade, currency pegging, and wage arbitrage don’t have to be forever. At the margin tending to buy American made products could only help U.S. employment and send the signal that things like offshoring jobs and low grade forms of wage slavery may not be the future key to CEO success in the country. Finally, why bother to comment if you think it is completely hopeless?

Your comment tells me it is you who is truely naive. Again, if you really believe that the die is cast and we are powerless, then why comment and call others naive for suggesting something they can do that, although small in its absolute impact, may collectively help the situation? The situation is dire and will likely get worse, but I for one think that there are simple common sense things that will help if not turn things around and calling one of them naive is not helping now or in the future as the SHTF more than now.

http://dealbook.nytimes.com/2011/04/18/goldman-spins-away-from-success/?ref=business

More insight on GS both contributor to and beneficiary of the credit cum housing collapse.

Punish and Tax.

It’s dire folks. Housing is falling like a rock….

http://www.bloomberg.com/news/2011-04-19/americans-shun-most-affordable-homes-in-generation-as-owning-loses-appeal.html

On another note – this guy makes some incredible videos from Arizona (on You Tube). This video shows an (almost) new 4 bedroom, 2.5 bathroom home in Arizona for $76,500!!! Gorgeous little home – but you have to deal with the fact that it’s in Arizona, in the middle of the desert. He has other videos that show homes for about $55,000. Seeing this home for $76.5K makes me think “What the hell is wrong with California.” Where I live in California, it’s hard to buy doggie doo (an old, old fixer-upper) for $400K. No joke. Anyway, enjoy the video.

http://www.youtube.com/user/ArizonaPublic#p/u/49/4zuOLYimESo

If you don’t live in So. Cal. it sounds like its a good time to buy

We can’t have our financial system fail! The ways to prevent that are not always pretty and they have and will be corrupted, but that’s what our government needs to do.

Yes, the weight will fall on the home owner as prices correct and on the tax payer but what is our alternative? Should BofA, Wells-Fargo, CitiCorp all go out of business? We’d be royally screwed then.

And yes, this is a political question – we can’t avoid it since it sure beats pistols or bombs. Spending HAS to be brought under control – Keynes was wrong is so many ways.

Right now, those banks are leeches, insolvent leeches sucking money out of the rest of the economy. Why shouldn’t they go down? In the early 90’s the Swedes took over a couple of their biggest banks, put them into receivership, replaced all the management, reorganized them and then set them going again. And life still went on in Sweden. Life still seems to be going on in Iceland as well.

The management of those banks should all have been fired, 5hitcanned on the spot in 2008 after they needed to take dime one from the U.S. taxpayer to remain officially (though we all suspect not actually) solvent. Take over all of them, make that many much smaller banks with no or almost no remaining non-performing assets.

Regarding Chart 1: What year did WW2 start? And might that have been a factor in taking Unemployment down from +15% to 5%. And if WW2 was a factor, what will happen this time around if we get a double-dip on Housing and Unemployment (U6, not the BS U3 measure) goes back above 17%?

Just wondering…

DJI up 187 today. What’s the problem?

Today’s financial mess is the result of failed MBA’s.

MBA’s which are short sighted, make your incentive-based-salaries-and-run and damn the mother who wrought you.

If any new MBA received any foresightedness and long-term planning strategies/sustainabilities training in their education, that has been quashed by the old boy network of banksters and wall streeters. These latter who’ve been running a Ponzi scheme for a long time as evidenced by the typically decennial “corrections” known as recessions.

Get in, make your money in ten years, and bail out.

Leave everyone still on the boat holding the bag on a sinking ship of their making.

Too bad.

I think the American public is waking up and non-cooperating.

This recovery will be long and difficult.

When those with money and big houses dare not go out of their estates as the majority of neighborhoods become crime ridden due to lack of adequate police.

The upcoming generation fueled by the babies of illegal immigrants will not be earning as much as their educations will have been impacted by the education cut backs, subsequently for every decent paid Federal, State, local, and sales tax payer today, it may take two or three in the future. These are the same workers who will not be able to qualify for- and afford inflated home prices.

Great job you MBA’s that have been produced in the last twenty years have done.

Leave a Reply