Real Homes of Genius – Beverly Hills tipping point? A home in the 90210 for $500,000? Beverly Hills foreclosure selling for $512,000.

As the final days of 2010 come to a slow close, the future of California real estate seems to be pointing to a challenging 2011. By now some thought that loan modifications and tax breaks would have been enough to stick the jumper cables onto the California housing market for a jolt. Gimmicks however only masked over the fragile economy of the state and provided a temporary and expensive boost to sales. Now with much of the fumes burning off California home sales have fallen drastically. Some will argue that this is seasonal and that in fact is true. Fall and winter always provide a slower selling season but the statistics are being measured against previous fall and winters and the picture does not look pretty. The new governor takes office facing a $28 billion deficit and a state unemployment rate of 12.4 percent. For those focused on prime real estate and micro markets the state is facing larger issues and the middle and upper tier of the housing market is already cracking under the pressure. No market is a silo. Today we will look at a $500,000 home in Beverly Hills.

9666 YOAKUM DR, Beverly Hills, CA 90210

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 1

Square feet:Â Â Â Â Â Â 1,052

Beverly Hills will always carry a certain flavor of California celebrity love and many will have flashes of Aaron Spelling when thinking of this zip code. I have alerts setup to notify me when certain areas break thresholds that I think are significant. Of course one home does not make a trend but we all know about the proverbial straw that broke the housing market. To some it was sales collapsing. To others it was the extraordinary graft that occurred with toxic mortgages. To others it was the deliberate orchestration by Wall Street to siphon off as much wealth from Americans and their largest store of wealth before throwing a match into the tinder box of the economy and receiving bailouts before they headed out of Dodge.

This home provides a glimpse at a tipping point. First, let us look at the last sale here:

Sold:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 07/30/2004Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $700,000

This home sold for $700,000 back in 2004. That may seem like a long distant past to many but this was right in the center of the mania in real estate for California. During the bubble days finding a foreclosure in Beverly Hills was similar to enjoying a Big Foot sighting. Why would there be any foreclosures when all you had to do was sell into the glorious momentum? The mania covered years of luck and mistakes. Much of that has now run out. This home only has slightly over a week on the MLS but let us look at the description:

“Bank Owned- Charming Canyon Fixer. Two bedroom and one bath home located on pretty tree lined street in Benedict Canyon- Beverly Hills PO Box area. Living room has hardwood floors and fire place. Dining room looks out to pretty backyard. Laundry room located next to the kitchen. Attached two car garage. Turn this house into your new home.â€

I always like it when my kitchen is next to the laundry:

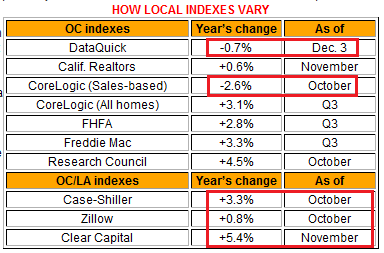

Now I notice that this home already has a lot of interest merely because of the price. It is currently listed at $512,000. That is right, $500,000 for a home in Beverly Hills. It will be interesting to see what happens on this place. This is the reality of the market at the moment. Prime locations and middle tier cities need to price homes competitively or risk chasing the market down even further. With a mixed Congress it is hard to say how things will play out going forward in terms of additional bailouts. Yet the cracks are happening very clearly now. Most metrics are all over the map for California home prices:

Source:Â OC Register

This is why it is important to always keep the bigger picture in perspective. If we look at the above, most sources show a year over year improvement in prices. But if we look deeper we find the following:

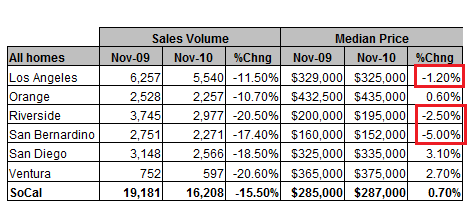

Source:Â Data Quick

Three of six counties in Southern California have already turned negative on a year over year basis if we look at monthly data. What is more crucial for predicting future movements is the absolute collapse in sales. This signifies that 2011 will start off on a slow footing for housing and this does not factor in the more important 23 percent underemployment rate or the $28 billion deficit.  We have a subset of analysts out there that simply have a grasp of real estate in the context of a bubble. That is it. Their entire career has been shaped and molded by a once in a life time real estate mania, one that will not happen again in our generation. For each one of these analysts you probably have 100 people that have heeded their advice. Those 100 depending on their influence also impacted their inner circles. Yet the scales have now tipped and now people are willing to think for themselves so you have seen sales at the upper end grind to a screeching halt in the last few months. These analysts are now pleading for more open lending at the upper end as if this was the problem.

The $500,000 Beverly Hills home is symbolic just like the $500,000 Real Homes of Genius in low income areas of the Southland. These signified tipping points in the market. Prices have fallen across all market levels. Do you think Congress is going to have any sympathy for folks in Beverly Hills or Newport Coast because they can’t get a low rate jumbo loan? Those that want to buy in these high priced markets now need to back up their talk with cash and adequate income. Mortgage rates are low enough but apparently not too many people are making what the leased foreign cars of the Southland would indicate.

Today we salute you Beverly Hills with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

51 Responses to “Real Homes of Genius – Beverly Hills tipping point? A home in the 90210 for $500,000? Beverly Hills foreclosure selling for $512,000.”

Technically, this home is not in Beverly Hills. It is in what is called the Beverly Hills Post Office area, meaning it gets a 90210 zip code, but no access to the BH schools.

Yes! The Dam Has Broken! At one half a million dollars, this house is OVERPRICED, but it shows that the Housing Insanity is coming to an end. It has to! There is a depression going on. Prices are increasing for gasoline, food and energy. People are losing jobs, and it is very difficult to find a quality job nowadays.

Who could have thought five years ago that a house like this in the 90210 zip code would sell for 1/2 million bucks? And, in my opinion, this is just the beginning of the second phase (downturn). ALL INDICATORS POINT TO HOUSING PRICES HEADING DOWN. I think that looking back in a few years, this home selling for $512K will be selling for half that. Who has jobs? Who has money? Who can get a loan at present? The bond markets are in trouble. Pension plans and retirment funds are in trouble (massively underfunded). Baby Boomers are retiring en masse.

Inflation is the one thing that could halt the slide of home prices. With massive inflation, home prices could increase nominally, but in real terms they would be in reality falling.

Thats whats wrong with California…any idiot that would mortgage their life for a piece of crap like that even for $500,00 needs their head examined. Absolute garbage……You can have California and their retarded cost of living.

Some poeple don’t understand how inflation works. Here are some illustrations from Zimbabwe just a few years ago. In fact, the first note (for 100 Billion Zimbabwe Dollars is dated July 1, 2008).

Here is a 100 Billion Zimbabwe Dollar and what you could buy with it (3 eggs):

http://www.luxuo.com/wp-content/uploads/100-billion-zimbabwean-dollar.jpg

Here is a 100 Trillion Zimbabwe Dollar Note. Note- if each Zim Dollar Represented approximately 1 U.S. Penny, this note would have the value of one Trillion U.S. Dollars. In reality, it was near-worthless.

http://americandigest.org/100-trillion-zimbabwe-note.jpg

Here is a child from Zimbabwe with his arms full of the near-worthless paper money.

http://www.conspiracypenpal.com/images/zimdollar.jpg

According to this article, 100 Trillion Zimbabwe Dollars was worth $30 U.S. Dollars at the time:

http://trendsupdates.com/zimbabwe-z100trillion-us30/

I say all this because severe inflation, should it occur, could really change the real estate “landscape.” Severe inflation could stop the decline (on paper) of housing prices.

Ohmygod, $500K for this sad little shanty! WHAT-somebody actually paid over $700K to live like this? You really have to be a celebrity hound to want to live in that area.

What’s the price of undeveloped land in that neighborhood? That price should be the guideline for pricing shabby little shacks that would be better off being torn down and replaced.

18000 sqft lot.

That is what you are buying for $512K.

You could scrape and build a 5000 sqft house on this lot.

No one behind you.

$500K seems reasonable to me.

What am I missing?

Dude. You’re a moron. The 18000sf is in a freaking canyon. There is probably 2000sf of buildable land. Stick to bumblefuck Colorado.

But of course, you find it reasonable.

What are you missing?

You’re probably missing anything beyond a high school education.

@EconE

Thank you for the erudite response. It was a pleasure having a “conversation” with you. When your mother lets you out of the basement I would be happy to make your acquaintance.

Dave. What you’re missing is most of that is near vertical hillside, so you would be looking at at least 500K worth of excavation engineering, caisson sinking, or one big ass retaining wall, IF the city gives you the variances to do it (probably another 150k). Houses in these parts tend to slide down hills when it rains.

I’m just sayin’…

I lived in this area for about 10 years. Many of these canyon homes in these small, dead-end streets are shanty-grade at best. They front right on a narrow street, have very little parking for guests, and are right up against a steep hill. I liked living in the hills due to the quiet, and it was quite a transition to go home, since it’s more like living in the country than the city; however, I don’t miss the travel time to get to the store (30-45 minute proposition, unless you live close to Bel-Air Circle, Roscomare Market, or Laurel Canyon’s small country store). In any case, the small stores were exactly that; they stocked some items in small sizes at high cost, so if you wanted something else, you were out of luck. Another thing I had to get used to was the fire-insurance problem. Mine was cancelled when I moved there, and it was basically impossible to replace at a decent cost. I look back fondly on living there, but I would probably not move back. More minuses than pluses, especially with the fire problems and mudslides, like what is happening in those areas right now with all the rain.

What are you missing? As another poster noted.. take a look at this street view image. I’m always amazed how people use this freely available tool.

http://maps.google.com/maps?q=9666+YOAKUM+DR,+Beverly+Hills,+CA+90210&safe=on&ie=UTF8&hq=&hnear=9666+Yoakum+Dr,+Beverly+Hills,+Los+Angeles,+California+90210&gl=us&ll=34.113308,-118.429283&spn=0.001483,0.002114&t=h&z=19&layer=c&cbll=34.113349,-118.429192&panoid=-fvzZ_PqK0oby625zfndIw&cbp=12,172.88,,0,3.97

Anyone can spin numbers, it’s the truth that hurts. Declining sales volume and inrceasing inventory (MLS, REO, FSBO, Shadow, or whatever!) are driving prices DOWN. Markets that have not dropped 50% from their peaks, ultimately will. It just takes more time, but when they do, they fall hard. Like rats leaving a ship. It wouldn’t suprise me, to see it overshoot up to 60% off, in some locations.

Look at the history books folks, this ain’t rocket science.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Financing upper tier homes using the 725K GSE upper loan limits ends April 1st. The tipping point clearly will be reached when the government ends this program. The other issue is all the low downpayment loans made using this program are clearly in danger of significant negative equity by the end of 2011.

Ron, thanks for the reminder that this particular piece of FEDGOD “Jumbo Gaming” is still in place. Being that my Bubble Zone (Miami-FtLaud) has virtually NO SFRs (or qualifying duplexes) still levitating in that range (we don’t have Duh Movie Starz cachet), I had forgotten about that corner of .gov/FSE Bizzaro World.

You are also on target about the downrange effect of the foolishly low down payments… market corrupting BASTIGES!… hey, I know, let’s RE-elect them. :rolleyes:

I got excited when I read about the conforming loan limits changing on April 1st, but according to this, they’re staying exactly the same through fiscal year 2011, i.e. through 9/30/2011.

http://www.fhfa.gov/Default.aspx?Page=185

Someone actually paid 700K for that place…that is criminal. Even at today’s reduced 500K price, it’s still too much. Infatuation with Ca RE is like heroin, its addictive power will destroy many lives all for that short term gratification of being a homeowner. I really feel sorry for young families who should be buying their first place, they are contending with unprecedented fraud and manipulation and the true value of real estate is a major unknown due to this.

Spend $150000 on upgrades and this would be a pretty nice $150000 house.

LOL… actually, it’s worth LESS than an empty lot, due to demolition and DISPOSAL costs (AMHIK), not to mention the endless permits and permissions needed in Duh Peoples’ Republik of Kah-LEE-fone-YA. (Attempt at Ah-nold phonetics ;’)

Also, from the limited pics, it looks like one of those EXTREME fire danger “chimney effect” canyons. =:O

Enzo MiMo:

Arnold is no longer our governor.

Jerry Brown was sworn in yesterday.

~Misstrial

Doc, not sure I understand the comparison here; there are many more homes that have experienced a larger drop in 90210 than this one.

In this specific case of 9666 Yoakum I do not think purchase price is the barometer, whatever it sold for in 2004 the most telling stat is that the owner refinanced in December 2006 and pulled out an even $1,000,000 in effect selling it to the bank for no closing costs.

This is the true and main reason we are seeing so many foreclosures here in 90210, everyone did this and now it isn’t a question of cannot make the payments but rather “why should I”? So the owner walks off with a $300,000 cash profit and stiffs the bank, we as taxpayers also get stiffed because as well as not paying his mortgage it is a sure bet the owner did not pay his property taxes either. To ice the cake, very often when I get to the front door as a REO agent representing the lender I find a tenant who gave the owner first, last and security deposit a week before the FC sale. This is a gift that keeps on giving for owners with zero money in the property.

When Congress and the media bleat on and on about “keeping these folks in their homes” it kind of makes your teeth itch.

Meanwhile also still in 90210 we have hundreds of properties in foreclosure where the sale is postponed every month and no payment (or prop taxes either) is made by the owner yet we continue to see postponements “by mutual consent”, not BK. Not sure how long we need to play this charade before the banks start to flush the toilet and get tough with these folks but I can tell you this: we can close schools and libraries, let go teachers and firemen all we want but until we start to collect property taxes again on all this shadow inventory we will never close the $28,000,000 budget shortfall.

“$28,000,000 budget shortfall” would be really nice and could be fixed in a minute, but unfortunately it’s 28 Billion and not just $28 Million.

The Tax payer does not really get stiffed because unpaid property taxes are always paid for by the bank after foreclosure when the property is sold to the next buyer. And hefty amounts of interest and penalties are added. The local governments are making large profits on these delayed tax payments!

if the taxing authorities have to wait five years to get paid, then it seems to me taxpayers do get stiffed. budget cuts in the meantime get forced on all of us.

if foreclosures happened in a timely fashion this would be a different story.

Who wants to live in a neighborhood where all your neighbors are assholes?

Obviously you should not ask and I shall not tell.

A friend on a low income rented a trailer in a MHP for senior and even stayed for months on a small boat in Marina Del Ray. What sre people going to do when they are making $ 11 an hour? How about Dr. HB looking into neighborhoods like Inglewood and down town L.A.? What is the rent vs own situation for the 1 BR places? Are the poorest doubling up in there? Just wondering.

It is my personal conviction that people will leave Greater L.A. for the desert towns of the Inland Empire in the next decade. I have a 888 ft SFH on 0.63 acres in escrow. 7175 Scarvan, Yucca Valley. Assessed at $ 137,000 in 2006. Purchase price to close escrow is $ 28,600.

The FT.com has an article on mortgage holders paying only their 2nd mortgage and thus creating an “impediment” for the 1st mortgage holder’s wish to foreclose. The mess is getting bigger, not smaller!

BTW, I am offered 4.25% fixed on a commercial property with 20% down and hardly any loan costs or property taxes in Germany. But there is a 3.5% tax on real estate purchases. And banks limit fixed rate mortgages to 10 years. Banks know, why! I’m really surprised that they are still offering 30 year fixed mortgages in CA!

DTLA is sinking fast, but if you compare it to 10 years ago, it’s up. If you compare to 20 years ago, it’s doing well. Likewise for the areas around downtown, like Pico-Union, Westlake, South Central, USC area. I don’t think the heavy level of gentrification is sustainable given the employment situation, but the gap between gentrification and the previous situation, which was basically an LAPD containment strategy for LA’s “untouchables”, is huge. There’s a lot of social engineering being done by the City.

Chris:

Good news is that Yucca Valley is near the factory stores at Cabazon and you’re near the White Water trout farm. Hadley’s date stand off the 10 is another plus.

Bad news is that you’re near Landers and the main fault-line of the San Andreas that runs through the Coachella.

~Misstrial

http://www.indexpost.com/property-for-sale/california-yucca-valley-92284-7175-scarvan-rd/ not sure why it says $ 48,500 but all I’m paying is $ 28,000 and escrow wants $ 28,600 to close. Thanks to the Doctor for elucidating the murky depths of SoCal property markets! (I keep seeing many properties fall out of escrow or go to auction only to re-emerge on the MLS for much less).

DAMN! $20k (70%!!!) of LYING in sold price! I’m seeing this “false price propping” in So-Fla too! Think about all the powerful interests (incl. the county tax collector) that benefit from this outright market-corrupting LIE! Those NAR lobbying dollars are still hard at “work”!… GRRRrrrr…

Ahem… I’m assuming YOU are the buyer it “sold” to?

“…apparently not too many people are making what the leased foreign cars of the Southland would indicate.”

This just about sums up most of what is wrong with Southern California. As much as I love it here and I have been here 26 years (more than half my life) the amount of poser rich has increased exponentially!

Sure, we have always had the real and the fake rich, but in the last 10-15 years, the posers have grown exponentially.

Remember, nothing says poser like a leased foreign car. I am not saying everyone who leases one is, but generally posers head over to the car dealership first, even if they can’t make rent or mortgage!

I guess it has a lot to do with the car culture in the Southland. HA!

Just goes to show you that Doc’s article from last week about incomes and prices in the “OC” are right on.

Again, many families do make $150-200K. However, not enough to support the number of homes that are still listed for anywhere from $450-800K in south OC.

Oh well, just squat in the house while driving the Beemer or Benz to work. I guess it is a great gig if you can get it!!!!!

http://www.redfin.com/CA/Upland/1290-Fuchsia-St-91784/home/3879110

I’m not quite sure if this property looks like the gig you mention. It is a short sale and on the market well over 500 days. Only one picture, not much description, increase asking price while market is tanking. Appears this seller is playing with the bank so he/she can live free. The seller will try any excuse to delay showing or denying the offer, just to drag the short sale as long as possible while living free.

Interesting article: “Baby Boomers near 65 with retirements in doubt”. Here, baby boomers admit tat they have been overspending! “Vanetta” was laid off from a $100,000/year job, and decided to take social security at 62 this coming April! If he had the bucks, he would have been smarter and wait until 70, at which time he would receive 70-80% more. He is now divorced and rents an apartment… Like many baby boomers, he figured his house would be a good “investment”, and the bigger the better. In the ’70s and ’80s the average savings were close to 10%. By late 2007, savings had dropped to -1%! Traditional pension plans have dropped from 39% of workers in the private sector having one, has dropped to 15%. 401-K’s have replaced them, but the average 401-K only had about $150,000 in it by the end of 2009. So, what will happen as 10,000 babyboomers / day will turn 65, starting January 1, 2011 FOR THE NEXT 19 YEARS??

http://www.boomerdeathcounter.com

~Misstrial

Get OUT NOW! Get OUT of California!!!!

GET OUT NOW!

GET OUT NOW!

GET OUT NOW!

Ahhhh… The pain in 90210 and everywhere has only just begun. I’m shocked that I haven’t seen anyone mention the massive number of Alt-A and Option ARM resets in this and other medium and high-priced areas in 2011 and 2012. Sure the banks will hold off foreclosure and will hold back inventory but we’re talking MANY years of decline ahead of us. And CA has 58% of all of these loans that written in the US. Fun times ahead… Don’t be fooled by the “analysts” and “banks” who claim that everything will “stabilize” in 2011 or 2012. Those are just comments coming from the scam artists who are desperate to keep things afloat while they continue to rake in record bonuses.

I have literally held off buying my first home since 2005 knowing that the bubble was going to pop. I was scolded at parties for even thinking (let alone mentioning) that housing was going to plummet. I distinctly remember everyone saying that housing will just “peak and then stabilize”. For some reason they just seemed to be happy ignoring that housing is cyclical…

I have been holding off my wife (from us buying our first home since we got married in 2005) by renting new construction condos that couldn’t sell (isn’t that ironic – I guess it was because we weren’t buying!). And, despite the fact that we can afford to buy a decent home in SoCal with about 75% down (ie. $800k-1M home), there’s no way in HELL that I am buying anything for another 3-5 years. At least not until I watch 90210 come down a LOT further! I can’t wait to finally get something at a reasonable price after all of these years! And I’m sure I’m not the only one, which is clearly reflected in the lack of demand in the charts.

In the meantime, I’ll just keep providing hard money loans for the flippers and watch others buy the homes. I feel bad for everyone who was scammed by the system but definitely not for those who were overextending themselves.

And yes – I drive a BMW M3 (I’m a car guy) – but I bought mine cash. So not every one around here leases!

MARK MY WORDS: “WE’RE GOING TO SEE ANOTHER STOCK MARKET COLLAPSE IN 2011 OR 2012”. You can only pretend that the following issues won’t cause the collapse for so long: Europe, Local/State government debt, Alt-A / Option ARM resets, CRE loan resets in 2011/2012, Federal Budget Crisis, Looming bankrupt Social Security and Medicare. I would love to see someone try to defend the economy and stock market with ALL of these huge dominoes in the midst of falling…

Good luck to everyone. We’ve got MANY more hard years ahead. Stay away from stocks and bonds and lock-in your payments now as we watch deflation in RE and the stock market take hold now that the government is running out of QE money to keep the ship afloat.

512K for 18,000 square feet. That works out to 28.50 per square foot land value. Overpriced but not exceedingly so. Much better than Rosemead or Pasadena.

two points:

1) What year are you using as a baseline?

2) Environmental extremism is highest in CA… you can’t price this as “buildable empty land” until you actually meet someone who has been through the demo and DISPOSAL odyssey in that county and equivalent terrain, e.g. a small custom home builder. It costs more than you think to get rid of a shanty… and G*d forbid it’s been designated “Historical”…

D’OH!… I meant ‘historic’, not historicAL… we’ve already started tippling the bubbly here on the East Coast ;’) … HAPPY NEW YEAR!… oh fudge, who am I kidding… it’s going to be another year of knives in the back for honest folks.

The only real estate I see moving is in the predominately Asian areas like, Temple City, San Marino, Monterey Park, Arcadia, Diamond Bar, Cerritos, etc. They’re paying cash or almost all cash. Of course much of the money they use comes from different sources unlike the locals. They will be driving around in a 8-year-old Honda Accord, but rest assured, their house is paid off or almost paid off!

I’ve been saying that for years. It’s just very hard to prove. Everyone here thinks it’s about income, it’s not. Many Asians live very cheap and have been saving 50-90% of their income for the past 20 years. They have cash in the mattress and a lot of gold.

I know of a lot of people who have 1MM banked and they are currently buying in the areas you mentioned. I would like to get a home in San Marion but I can’t because there are to many cash buyers picking up the low end homes for the school system. They live 2-3 families to a home and they want the best for their kids. Which are usually their kids and aunts and uncles kids too.

Ah Asians. Perfect homeowners wise and frugal and snapping them up. I have looked at two homes here in North SD County with my son owned by Asians. Both were filthy as in no housekeeping whatsoever. One of them even had dog crap all over the carpets despite having a good yard and dog run area. The other had clear water damage from leakage. Both are short sales. Asians are not by definition above the fray.

Frugal yes. However, Asian small business owners are known for “cooking the books.”

When you stiff the IRS of course you’re going to be able to save more money than the rest of the population.

Last year the IRS announced that it will now look at reported income vs home address and property value for small businesses.

~Misstrial

InvestorJ – doctor/lawyer household here in Los Angeles. We are also putting off buying and are accumulating cash until the hope and fraud is wrung out of the real estate system. When there are less jobs than there were in 2000 and cost of living has outpaced wage increases, how can residential real estate trade any higher than the prices in the late-1990s? It can’t, and I think that’s where we are headed. The late 1990s. Finance/Government/Realtors have made this process painfully slow, but the smartest banks and GSEs will liquidate inventory now before losses intensify. The first mover has immense advantage.

Same.

Be aware that Brown is going to raise state taxes and fees significantly.

~Misstrial

Who cares if you are a “doctor/lawyer” household? Who really give a damn? I know many many doctors, and I cannot believe how many of them are sooooo stupid. Many of them are complete robots. They are brainwashed to believe everything they are told in medical school, and they do not use their brains to THINK. They are programmed robots. So anyway, whoop-dee-doo.

Why so much hostility?

This “post” adds nothing to the integrity of the forum.

~Misstrial

It’s funnie how delusional people are. I’m short selling my house in a desirable area Inglewood and I have a buyer. This is my second buyer the first one dropped out because the short sale is taking a long time. The house is going to sell around 300k. What is interesting to me is these people are getting loans and they are only putting 10k down. Then they are asking for closing costs. I put over a 100k down and lost over 200k in value. Silly me…I know I’m an idiot now but then who would have thought. Anyhow, shockingly people are still getting approved for virtually no money down in my opinion on homes that will drop even more in value.

What was your house worth at the peak?

This shack of a house sold for $545,000 early in 2011.

How things have changed?!

I scanned Trulia today and of the 200 single residential houses in Beverly hills, barely 15 are selling for less than a million dollars.

The naysayers and doomesday merchants got it wrong.

Leave a Reply