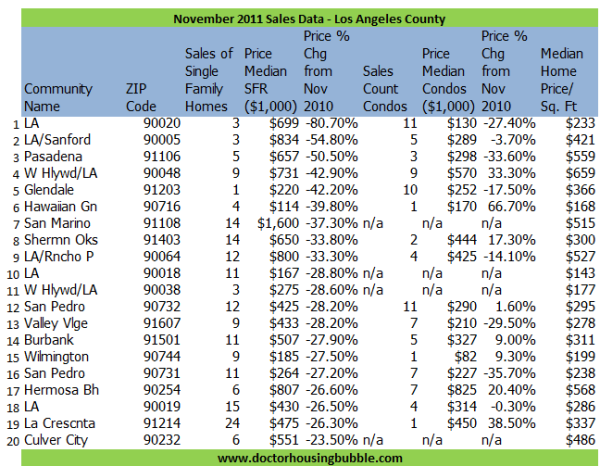

The top 20 zip codes list of price declines for Los Angeles County. If you expect to see poorer areas on the list you will be surprised. 50 percent annual price fall for a zip code in Pasadena? A 37 percent drop for San Marino?

The Los Angeles County median home price is down 6 percent year over year. This in itself fails to highlight the deeper changes occurring in the most populated county in California. If we look back at 2011 we see that it was a year of corrections for the mid-tier and upper-tier segments of the market. This trend is likely to continue with even the most prime locations in Corona del Mar and Beverly Hills showing that they have plenty of shadow inventory to work through in 2012. Los Angeles County is full of cities so the 6 percent drop only tells you very little. If we break out the top declining zip codes the picture is very different today from 2008 and 2009 when low hanging fruit was selling for massive price cuts. Today those price cuts are hitting fully in areas like Culver City, Burbank, and Pasadena which we predicted for a few years based on area household incomes. Let us look at the top 20 falling zip codes for 2011 in Los Angeles County.

The top 20 list of Los Angeles County

What you will notice from the list is that many of the zip codes are in mid-tier to upper-tier markets:

Many of the top zip codes have seen dramatic cuts. Take a look at the 91106 zip code in Pasadena that is now down 54 percent from November of 2010 to November of 2011. San Marino with 14 home sales is down a whopping 37 percent and this is certainly a prime zip code. I remember a few people late in 2009 talking about large chunks of foreign money flowing into this community to keep prices inflated.  Does a 37 percent drop in one year seem like that occurred?

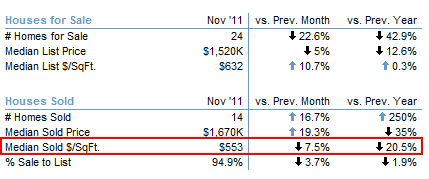

And this is a legitimate drop. Just look at the details for the San Marino market:

Source:Â Redfin

San Marino has a dramatic variance in home styles and price ranges but if we look at the median square foot price, it was down by 20 percent over the year. The number of homes for sale has also plummeted by 42 percent in the last year. This is a continuation of the second phase of the housing correction that is hitting mid-tier and upper-tier markets. Take a look at Sherman Oaks as a mid-tier market. The 91403 zip code in Sherman Oaks saw a 33 percent cut to the median home price. Let us look at this correction in action by using a current duplex on the market for sale:

4970 SEPULVEDA BOULEVARD

Sherman Oaks, CA 91403

3,600 square feet, built in 1956

Take a look at the ad before evaluating this property:

“Location, location, location!!! Charming duplex located in prime area of sherman oaks situated just steps from the sherman oaks galleria and trendy ventura blvd. Unit one (4970 sepulveda) is a one bedroom/one bath and unit two (4972 sepulveda) is a two bedroom/1 bath. Laundry hookups are located inside unit two. Both units have rich hardwood floors that could be touched up and look brand new. New paint throughout. Attached two car garage has been restored back to it’s original use. Terrific investment opportunity for the right buyer!â€

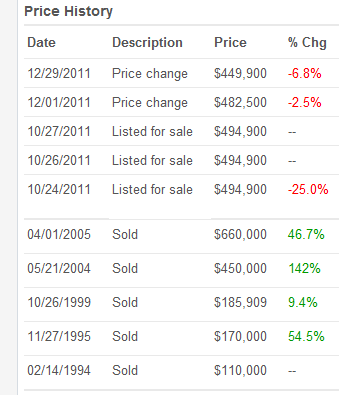

This place seems smaller for a duplex. It is interesting to look at the price history because we start to realize that the bottom is still far away in certain areas. Obviously the price drops that we are showing above are significant and occurring in mid-tier to upper-tier locations. The shadow inventory is immense and will take years to work through the system. A large part of it is in inflated markets where people still haven’t gotten the memo that the housing bubble has burst.

If we look at the price history we find that someone over paid in 2005 for this place:

Remember 2005? We are talking about 7 years here yet some people tend to think the correction is already done and each phase is completed. The place sold for $660,000 in 2005 and was then put on the market for $494,900 in October of last year. The price was finally reduced to the current $449,900. This is a 31 percent price decrease from the 2005 sales price so you are getting a live picture of how the correction is hitting mid-tier cities now. A few years ago it was “this will only hit the Inland Empire†and now it is “it will only hit mid-tier markets.â€Â Denial is a very powerful thing.

Is this place a good investment? The 1999 sale price of $185,909 looks like a good deal. What dramatically changed in the last decade to justify such a jump? Household incomes are flat in the state and the Federal Reserve has artificially put interest rates at a low level. Even if we use the 1999 price as a baseline and use the 35 percent California inflation rate from that time the price would be closer to $250,000.

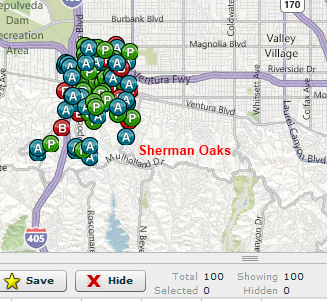

The shadow inventory is still lingering

For this zip code in Sherman Oaks 13 foreclosures are listed but if we pull up the shadow inventory data we find that we have plenty of deals to come online:

100 properties are part of the shadow inventory only in this one zip code of Sherman Oaks.

Other mid-tier areas like Culver City, Burbank, Pasadena, and Rancho Park continue to see prices coming down on the list. Now why is the median price for the county only down by 6 percent then? The answer is because most sales are driven by investor demand or low prices:

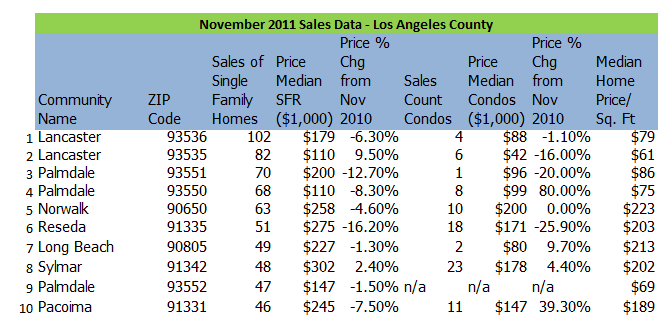

The zip codes with the most sales are happening in low price areas. The top selling zip code is in Lancaster (93536) with 102 homes being sold with a median price of $179,000. The second top selling zip code is also in Lancaster with 82 sales with a median price of $110,000. Even some of these zip codes saw year over year price drops like Reseda with a 16 percent cut from November of 2010 to November of 2011.

So what is the trend? Mid-tier and upper-tier markets are seeing significant declines in median prices while the lower range is seeing strong selling based on very low prices. Price stabilization may be occurring in places like Lancaster or Palmdale but good luck with all the shadow inventory in places like Culver City and Burbank. The numbers above speak rather loud and the trend is obvious. Those that claim these areas will boom never bother to produce household income data for mid-tier zip codes to justify their argument. The trend is rather clear and the data speaks for itself.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

34 Responses to “The top 20 zip codes list of price declines for Los Angeles County. If you expect to see poorer areas on the list you will be surprised. 50 percent annual price fall for a zip code in Pasadena? A 37 percent drop for San Marino?”

Using foreclosureRadar as an indicator for shadow inventory it’s pretty obvious that many areas are in trouble but I don’t see that many in the 90232 area of culver city. Since it was was mentioned, is there other indicators/data I should be looking at?

Thanks Dr. HB for the great info as always. I always quote you to the annoying realtards I have to endure at open houses. I love to get a rise from them. Could you please check out La Verne/San Dimas one of these days. We have been waiting so long to buy a house here. Still so expensive. Hope everyone finds a good and reasonable home in 2012-me included!

The price at La Verne/San Dimas looks pretty good to me. If the price in the area I’m looking to buy were like that, I would laugh out in my dream. BTW, I’m in the Bay area. Good luck to us all.

I too, wish this area would moderate – still too high in comparison to median income.

Such lousy inventory out there………One thing that is happening, I believe, is that people don’t want to settle for just anything simply because it’s in a decent area. People want homes that will work for them for many years, since they know there will be no “moving up” using equity as a funder for many years to come.

Not just no “moving up”, but no moving at all. With no equity growth – or more likely negative equity growth – moving to another area for a job will be impractical and punitive. Buyers need to be certain their jobs are secure and guaranteed (government), or they need to be financially independent.

91105 is the high-end area of Pasadena…

Always fascinating to read your blog. Can you take a close look one day at Montrose and La Crescenta? I’ve been waiting 4 years to buy a house here (small kids in school so I plan to stay put for a LONG time!) and the prices still seem insane to me – $450K+ for a crappy stucco house that has illegal modifications seems to the norm. How long should I wait? I’m dying to get into a permanent home with my kids and not have to worry about landlords (already had to move twice due to landlords losing THEIR homes).

I’m looking in the same area and some others in addition to that as well. For what it’s worth, there’s been a lot of progress towards price reductions in that area over the last 12~18 months. Those same stucco houses were closer to 550~600K then. I’d give it another year and keep up with the pricing trends in the area. I don’t mind paying the premium if the home has good bones and is in a nice area as I’m ok with fixing them up, but not if the premium comes with rapid declines in price. Just waiting until velocity slows down to < 2% decrease on a yearly basis.

Most people will want to buy near the bottom, but some things, you pay for if it's important enough. To me, a home is more of an emotional investment than a financial one. it's just that I don't have a bottomless bank account, but I think everyone has one thing they'll spend more money on simply for the satisfaction it brings to themselves or their family

If one believes Credit Suisse, the option-ARM recasts hit their peak in late ’11 / early ’12 and will wind down quickly this year. Give folks a few more months to exhaust their savings, their parents’ savings and their 401k (unnecessarily!) and then a few months of non-payment before foreclosure and we might see the foreclosure rate bottom out in late ’12, early ’13 perhaps.

http://www.calculatedriskblog.com/2010/03/new-credit-suisse-arm-recast-chart.html

Alas, this is global data a couple years old, so any degree of forecasting for a particular area with it is troublesome. Also, I really have no idea whether foreclosures are principally driven by ARM recasts or just people losing their jobs.

The employment picture is looking better … uh… ish.

http://www.calculatedriskblog.com/2011/12/state-unemployment-rates-generally.html

Of course it is emotional — there was a scientific study done years back where it was determined that no decision, no matter the nature of the thing being decided, could be arrived at without emotional considerations. HOWEVER! If I your emotions lead you to pay a premium that you convince yourself you are okay with today, you might ask yourself ten or twelve years from now whether you were too emotional; especially when you see some young couple buying an equivalent or even better home right across the street from you for half what you paid and enjoying all the disposable income they have left over after housing expenses.

What is the good doctor’s opinion of this?

http://bottomline.msnbc.msn.com/_news/2012/01/09/9614305-as-home-prices-fall-more-borrowers-walk-away?threadId=3315273&pc=25&sp=25#short comment_nav

Yeah, and the doc of housing might want to comment on this too:

http://www.huffingtonpost.com/2011/11/15/fha-bailout_n_1094528.html

Yeah, the FHA is gonna need a bailout soon, as if the good doc didn’t warn the bozos running things…………

God help us all if they stampede

http://www.irvinehousingblog.com/blog/comments/attorneys-criticized-for-advertisement-to-induce-strategic-default/

Dude! Can you not use my handle!!!

Good youtube video

http://www.youtube.com/watch?feature=player_embedded&v=mSedc_J1hME

90048 home prices dropped but condo prices went up? Did people actually buy those horrid places at the Citron?

DHB: “Many of the top zip codes have seen dramatic cuts. ”

Yeah, but many of those only sold 3 houses during the sampling period!!

So, one of them was a dog house or a chicken coop. I think you need a larger sample set to have any degree of confidence these trends are real.

Those $180K homes are being bought by investors to be put on the market as rentals. Many can actually show a positive cash flow. Hence all the sales activity in that price range. Not to mention that Section 8 pays the rent every month like clock work. And there’s plenty of section 8 in those areas. Govt, at your service.

Even though nobody wants to even remotely, seriously consider it, I think the bubble mentality/alchemist premium has been shifted from flipping to buying up rental investments. “Rent is going up! Rents never go down!”

Yes. I follow people like Bruce Norris and other real estate investment groups in Northern and Southern CA. They’re all saying to buy the low end homes and rent them out. Positive cash flow is a rare thing on a newly purchased CA rental home.

But I have heard them praying for home prices to start rising. Being a landlord is one of the more difficult tasks in the real estate business.

“Rent is going up! Rents never go down!â€

Haha. Sounds similar to something the realturds were saying a few years ago.

“The 1999 sale price of $185,909 looks like a good deal. What dramatically changed in the last decade to justify such a jump? Household incomes are flat in the state and the Federal Reserve has artificially put interest rates at a low level. Even if we use the 1999 price as a baseline and use the 35 percent California inflation rate from that time the price would be closer to $250,000.”

I see this logic yet the homes is still for sale for $449K. Is it likely this home will drop another 40-45%. UNLIKELY!

I too would like to see it sell for $250K and let people actually live in a house that does not take every extra cent they have. Maybe with reasonable prices people could paint and fix the yard. But it’s NOT happening. Sales are slow, there are no sellers, and the bank isn’t letting go of the inventory.

But in the past 7- 8 years I have rented an apartment. My life has been miserable in a rental. How much longer before we break and have to cave in to the current prices? I am ready for the last crash to happen – bring it! But I’ve already waited 7 years. I’m not going to live forever to cash in on the best price.

If your life is “miserable” as you state, why in the world would you continue to live in that same situation?

I live in a rental loft in Downtown LA. The building is old, the walls are thick. I love it here. I walk to work, I rarely drive my car during the week. If I want to have dinner out, or go have a drink after work, I literally have 50+ options and don’t need to drive to get there, nor worry about DUI or whatever.

I’m giving up two things….

1.) I’d like a house, yard, etc. But I pay $1600/mo rent and theres no way I’m getting a decent house in a decent neighborhood less than 30 minute rush hour drive from LA for that amount. Maybe Cypress Park or something, but I’m not particularly adept at dodging bullets.

2.) Space. My rental is 850 sq ft. A 2bd/1ba house in a neighborhood I’d consider living in(Burbank, Glendale, etc) will be 900-1400 sq ft. However, all that space would be used for is placing possessions and perhaps a guest room if I have friends over. So this isn’t really giving up much. I figured out something others really haven’t….I don’t need tons of junk/material possesions. Nice furnishings, television, car etc are more than enough.

So again, if you are so miserable renting an apartment, why don’t you move into something you’d like better?

I think it is kinda lame when other people use your handle.

I’m a fan of What? #1. What #2 get a new handle! What #1 is a long time friend of the blog! Rock on What?

“Household incomes are flat in the state ” Why do people like quoting that misinformation? I remember in 1997-8 I made my first six figure salary and Turbotax, at that time, advised me I was in the top 2% of household incomes. *MY* salary has gone up very little since then (aprox 30%) , however, it appears (through other stats I’ve read, since Turbotax no longer tells me) household incomes in my salary range are in the >10%.

Sean,

By buying now, you will be the last of the suckers. I would rather rent in a shithole than be forced to pay for an overpriced box. Overpriced because banks are funded by our government to slowly leak out inventory. They can all go to hell. Not to mention deadbeat owners living in homes that they haven’t made payments on for 3 years. By buying now, you are funding the lifestyle for these crooks. I too would like to see market forces dictate prices, but we’ll have to be patient. Sellers may not want to lower their prices, but let’s see who remains more liquid in the years to come: renters with good credit and plenty of liquidity from years of savings or owners who are so deeply underwater that they eventually are forced to sell or walk away. It’s a war, and I refuse to surrender to these bastards and pay a manipulated price for a product that I know full well is overpriced.

Thanks! I needed that reminder. What is miserable about an apartment is that it does not allow any of the $20K a year I pay to go towards anything. But I guess it’s much better than paying $40K a year and losing $100K in value.

I just need to ride this out, but I really want the last straw to break the housing bubbles back soon!

There 90232 homes being sold in Culver City for 550K are in the Clarkdale/Tellefson Park neighborhood. These are primary 800 to 1000 square foot homes on 1/2 size lots or smaller (i.e. the lot sizes are not advertised because if they were most potential buyers would not bother looking). These houses are located in areas where its zoned for a mix of low density apartments, duplexes, townhouses, condos and SFRs. So if you like the idea of having a three story condo complex on one side and a two story apartment building on the other side towering over your 800 square foot single story SFR in Culver City, Clarkdale/Tellefson Park is the place to be.

The nicer houses in CC 90232 are in Culver Crest and around Culver City High School. Those are listed on the MLS at $700K to $1MM but they aren’t selling.

This is about investors AGAIN. It’s so frustrating that these faceless people can snap up all the reasonably priced homes, keep the prices inflated just so they can rent them back to those that would’ve bought them in the first place, pocketing extraneous profits. I’m supposed to buy into this capitalistic free for all when all I want is for my family, husband and two small children, is to have a house (no condo please) to call our own. (something i never had as a child) We have $100K down, but a yearly income of only 60K since I stay home, I want to live somewhere safe in the Southbay. It’s impossible and incredibly frustrating! The simple truth is that if you want to live this area of CA, and own a place you have to be very wealthy or you will always be at the mercy of the landLORDS. Sadly this eventually will cause the deterioration of quality of life here, those who rent simply don’t care about the longevity of the property and landlords rarely make improvements they arnt going to enjoy. Its a sad shame. And NO I won’t move, I love the community and the mindset here. Us thirty something’s who missed the boat seem perpetually screwed.

I understand about market dynamics not being fair and probably illegal right now, but you sound pretty entitled here. You stay home and expect to be able to buy a nice house in a good neighborhood on the $60k that your husband brings home? I don’t know your situation and why you have to stay home (illness, etc), but life’s not fair and what you want doesn’t matter to anyone else.

Everyone is fighting for jobs and working their butts off for the home you want dropped on your lap. It’s like the people who bought thinking they were going to see appreciation because they listened to an agent or family member who thought they knew better. They’re just asking the government for their money back or a reduction because the market’s not fair. Be glad you have $100k in the bank and enjoy it.

Take a downer Dude!

It seems to me she is making a comment more about the FED than to the Republican battle call…….”I am entitled”.

Not too many years ago, a person could get 5% risk free for their hard earned cash. And you should receive a reward, a return, for the lending of your hard earned cash. Instead, two Republican Federal Reserve Governors have seen fit to dwindle that “return” to just about zero over the last 10 years so that people are forced to do WHATEVER they can.

One of the best ways (or so it is sold that way) is to buy a 300K house and rent it out for 1500 to 2500 a month and as long as it all works out as planned (good luck) you will yield the 5%.

Here in San Diego because of what rentals command, investors can get a 5% return on rentals that cost up to 500K. Yes, this all works out as long as realestate remains stable.

So, yes, investors are the problem again with real estate, investors being led by the nose, by B.S. Bernanke.

Let’s all hope for a Fed Governor like Democrat Paul Volker, who was appointed by a Democrat. Under his style, the risk takers were punished with high rates to thwart undue risk and savers were highly rewarded by being smart enough to save.

OK we all agree this is a frustrating game. Yes we are being screwed by banks who are freely funded by the government to sell to inside investors. Let’s remember that the frenzy to buy at any price is gone. That investors can’t manage all the properties as rentals that they are snapping up. That investors will get burned by price declines as they flip. That banks will capitulate as the population has lost it’s tolerance of bailouts. That California is in a world of financial hurt, and even with such a diverse business climate, unemployment is one of the highest of the states. This all equals much more downward pressure on prices no matter what the Pollyannas of real-estate say. Burbank is seeing significant drops, in house prices. You could actually live here now if you made under a million a year. (LOL)

I’m a realtard as the above mentioned refers to those in RE, new to the business! Double Whammy! I’ve been reading your blog for quite sometime. I agree with you completely. My question for you…Where is all the inventory going in OC ( Newport Beach, Cornona Del MAr), not any fresh sellers? Will it all be replaced with distressed only?

Leave a Reply