Los Angeles County real estate values overpriced by 30 percent after adjusting for inflation. Data from 2000 to 2010 and looking at Burbank, Pasadena, Culver City, Beverly Hills, and Santa Monica.

The only people surprised about the massive monthly drop in existing home sales are those that naively believe that housing is a good investment in the current climate. The large amounts of toxic mortgages that clog the arteries of the economy are still there. Last week we found out that Southern California home sales plummeted by 21 percent. A handful of delusional pundits who think that only California is in a bubble must have been stunned that nationwide home sales fell by 27 percent. Make no mistake, this is a nationwide housing bubble. Is anyone going to make the absurd argument that housing values in North Dakota are stable and many other low population states so therefore there isn’t a nationwide housing bubble? The housing bubble primarily inflated because of de-regulation in the financial markets. That is the bottom line. This dates back to the early 1980s and guess what happened shortly after that? The S&L Crisis and a smaller version of the California housing bubble. So in 1999 when the Gramm-Leach-Biley Act was passed repealing Glass-Steagall, it was no shocker that the housing bubble took off even before the ink was dry. California is massively overvalued and we’ll take a closer look at certain cities in Southern California and compare their 2000 prices to current 2010 price levels.

First, we should measure the CPI rates from 2000 to 2010:

Source:Â BLS

So over the decade, the consumer price index (CPI) of the state went up by 31 percent. This includes everything from healthcare, energy, food, and housing. Unfortunately the CPI looks at owner’s equivalent of rent so it largely missed the housing bubble. Yet this is the government measure we have so we’ll use it as a baseline. We now know with over a century of data, housing values track the rate of inflation. Some people want to think that just because people live in select cities that this is the reason for prices to be going up. That is absolute nonsense. If we had stronger lending requirements and restraint on our banks, there would be no money to buy speculative real estate. It is that simple. It isn’t like we started living in cities in 2000. If you want to use your own money to flip and sell properties then go for it. But many flippers expect the turnaround seller to jump into their investment with a government insured mortgage! Yes, sure sounds like a free market to me.

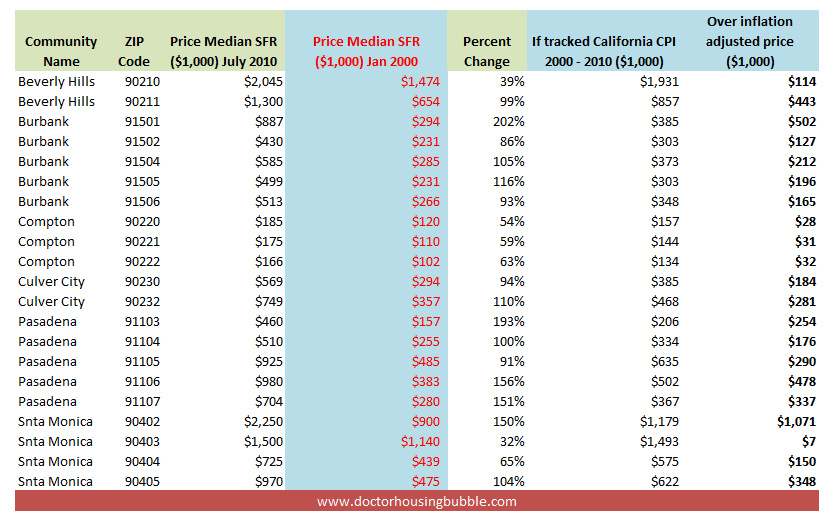

I’ve carefully pulled up data on a few cities that I cover to compare their 2000 median price to the current price. Many of these places are still incredibly overpriced. These areas include Pasadena, Culver City, and Burbank to name a few:

I’ve added a column at the end that shows the median price where it would be if adjusted for the CPI data. Now it can be argued that even in 2000, prices were already inflated but we’ll just go by this decade of data. Interestingly enough, a place like Beverly Hills in the 90210 zip code doesn’t appear to be that off base with the current price (only 5% higher than the rate of inflation). But take a look at a zip code like the 91106 in Pasadena. The current median price is nearly 50% over the inflation adjusted value! Even Beverly Hills doesn’t have this kind of discrepancy (and many more people with truly large incomes).

The same applies for the 90232 zip code in Culver City. The current median price is 37% above the CPI adjusted price. You can run additional numbers above. The bottom line is all zip codes above are overpriced if we use the California CPI as a base measure. But I would argue that even that is only a gauge. Prices will be lower for other reasons including the current economy:

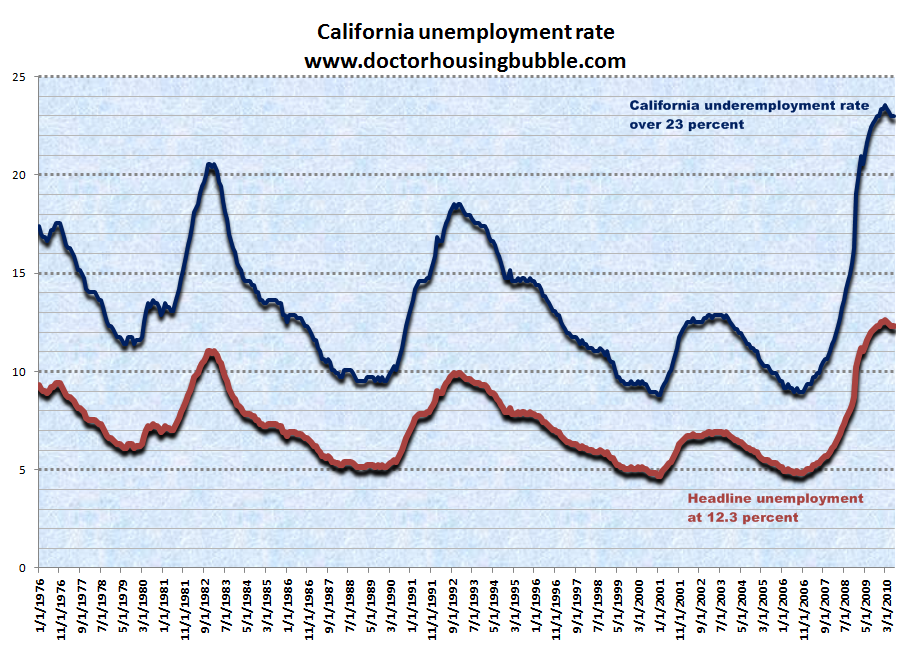

The California unemployment rate held steady at 12.3 percent last month but the underemployment rate is over 23 percent! So even if you work 5 hours as a Wal-Mart greeter but want full-time work, you are still considered fully employed in the U-3 headline number. But any thinking person would realize that this is merely part of the growing working poor. So I value the underemployment number (U-6) much more. And these figures resemble something akin to a minor depression for the state. And yet housing values are going to remain inflated because of what? The amount of delusion in the market is still incredible but it doesn’t surprise me.

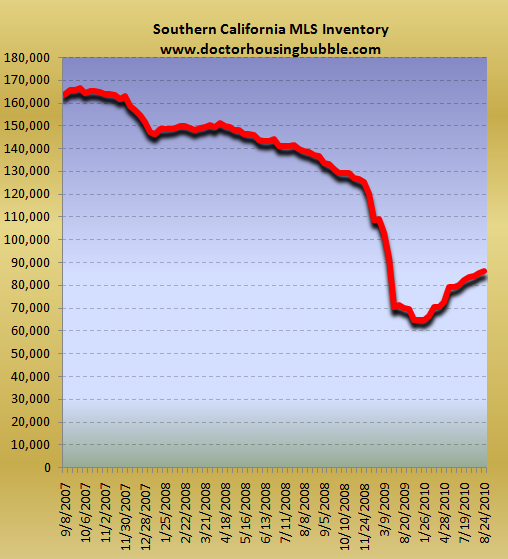

At the same time, you start seeing the actual MLS inventory increase:

With dropping sales and the fall and winter season, we should expect this trend to continue. Plus, we are now hearing about HAMP being merely a foreclosure purgatory. All HAMP did was create the illusion of things being better. And did you realize that 42,000 Californians will be getting up to $1,500 per month if they have no job to pay their mortgage?

“(SacBee) More than 42,000 laid-off California homeowners are about to get a break.

Starting Nov. 1, the government will help them make mortgage payments while they look for another job.

Wednesday, the U.S. Treasury Department added $476.2 million to a $64 million state program that will pay jobless homeowners up to $1,500 a month. The funding represents the newest federal effort to steer Troubled Asset Relief Program funds originally designated to prop up lender balance sheets to homeowners instead.â€

This is flat out discrimination against those that rent. Nearly half the population of California rents. Do those who rent and are unemployed (see above chart) get any help in paying their monthly rental? At this point you have to think that we are in some Alice and Wonderland financial world where failure is rewarded and moral hazard is the economic policy of the day. A few years ago I joked about the government actually paying your mortgage as a policy. Well here we have it. And guess who they are paying? The too big to fail banks. The new oligarchy is the financial system and the current government is merely a henchman for their desired policies. Is it any wonder why the vast majority of Americans are absolutely dissatisfied with both political parties? Three years into the crisis and it is obvious what caused this mess. Yet nothing has changed and you have to ask why.

Going back to the above zip code chart, you need to remember that incomes did not increase in these areas by anything close to the housing appreciation. So these areas are solidly in bubbles. The Federal Reserve is running the biggest Ponzi scheme known to mankind and makes Bernard Madoff look like a walk in the park. You have to keep finding new suckers (aka new home buyers) to keep the party going. Even historically low rates can’t make someone buy a home if they are not secure with their job. Many are finding the cheap rental rates and low commitment liberating. You have mobility (something one third of Americans with mortgages don’t have at the moment). In this tight job market that is a major competitive advantage.

The median L.A. County home is now at $339,000. That is still 26 percent too high above the California CPI. But that is with the underlying assumption that we have a decent economy (we don’t). In fact, we are now a few weeks away from IOUs yet again (does anyone care?). I guess when you have the government paying for your mortgage and banks taking this money, all is well in crony welfare capitalism land. Those who are prudent and responsible are the major losers here and have been all along.

What can you do? Make sure you demand a breakup of the too big to fail banks. Time to enact some real financial leadership and have a real investigation (Pecora Commission style and not some kabuki theatre). I mean who is really the cop on the beat watching over Wall Street? And time to stop the real estate speculation that has led us into this mess. Gear up for those IOUs folks.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Los Angeles County real estate values overpriced by 30 percent after adjusting for inflation. Data from 2000 to 2010 and looking at Burbank, Pasadena, Culver City, Beverly Hills, and Santa Monica.”

Thanks again for the good work. I grew up in the 91105 during the 1970s. I had a dream, well, fantasy is more like it, that I would live there again some day….alas, the dream has died.

I think everyone heard one of Perot’s giant sucking sounds this morning. Everywhere you look things suck. Just like Enron tried to suck the life out of California, Wall Street has been doing it the last 30 years. The patient is on life support and evidently in a coma. The most dynamic state in the hostory of the world gasping for breath. We need a miracle.

We don’t need a miracle…

The people need to rise up and say enough!!! We’re screwed from every angle every day.. I’ve had it..

Right. All the Manhatters have to do is redirect any wrath to the administration, and with a Black president it’s like shooting fish in a barrel. Obviously, Graham tearing down the last wall of protection from our tormenters was the government–but he was just a stooge doing Goldman’s work. How’s that supply-side voodoo economics looking now?

I am still very surprised that the public is not out protesting in mass in the streets on the $10+ trillion bailout of financial industries. We were told that if they did not bail them out, that there would be an economic collapse. Well, here we are 2 years later, and the economy has been steadily dropping ever since. The banks have kept the money, not marked down their bad loans, and are hardly lending these days. Small businesses are terribly hurting while corporate wall street after mass layoffs are awash in bonuses.

Every reader on this blog should not deposit their funds in big banks but rather credit unions.

There is a housing story going around about a guy who lived in a yurt. He loved his yurt. Every year he improved the yurt by adding granite counters, hardwood floors, and solar panels. One day he decided to move and the neighbors were aghasted. They said “Why are you moving? Your yurt is so beautiful and you’ve put so much money into it. His reply was simply “I’ve realized that my yurt is a big waste of money and my neighbors are jackasses, so I decided to fold my cards and move on.” I think we can all learn something from the man in the yurt.

We can’t totally blame the government. As long as morons keep buying at these overly inflated prices, they will continue to supply homes at these outrageous prices. Supply and demand. People are buying. They are stupid and are basically screwing it up for everyone else. Also, the realtors are accomplices to this scam by telling everyone “now is a good time to buy”. They have been saying that for the last 5 years and some people are gullible enough to believe them! Wake up buyers, you are helping to keep these prices high. $650,000 for 1400 square feet in Sherman Oaks? FIXERS in Burbank for $499,OOO? Come on folks, wake up and smell the coffee. Either you are idiots or you love to throw money away…

Amen.

There has been a commercial on the radio for realtors recently. It goes like this: “I’m the golden state and if you want a piece of me, you need help”.

Really it’s hard to argue with that. They meant that you should get a realtors help, but really if you want to buy in CA YOU NEED HELP (as in psychiatric intervention) or at least to make an appointment with Dr Housing Bubble asap.

You loosers better buy something if you can in the next year or so or you will be here complaining for the next 10 years about how realestate prices will come down.

Buy something you can afford and intend to live in and you will have made a great long term investment.

“The time to buy is when there is blood in the streets”

This is the first I have heard about the $1500/month for unemployed homeowners. Would this apply to someone who owns a few rental properties but technically has no job?

NOPE…It is for primary residence only. Actually it is upwards of $50.000 loan for those who are unemployeed and not paying their payments…Now if that aint throwing good money after bad I don’t know what is!

Thanks for the info but perhaps I should have been more clear. Say I own my house and have four rental houses with tenants in them. I am able to live off the positive cash flow from the rentals and therefore do not have an actual job. If I stopped paying the mortgage on my residence, could I collect this stipend for “unemployed” homeowners not paying on their primary residence? BTW, this is not my situation, I am just curious how much fraud will be generated by this program…either from a situation like this or “under-the-table” workers, etc.

I am surprised that many people blame the Wall Street for housing bubble.

It is the Government to blame to. Starting with Clinton

and then aggressively continued by Bush, our Government

was pushing banks to give loans to unfortunate people

(many of them just lazy or moochers),

who could not afford to buy a house to give them loan just for asking,

in order to buy a dream house. They new in the beginning that they

will not be able to pay the mortgage when mortgage will be reset.

Wall stree is the last thing to blame.

Vic, it was Wall Street who “pushed” the government to de-regulate, those creating a massive, highly leveraged, derivative-based mortgage bubble.

Or, it was the lazy moochers.

There is plenty of blame to go around, but I can not in good conscience excuse the actions of licensed professionals, who happen to have a huge lobby in washington which they frequently us to form legislation that paved the way for the crisis. Do you blame Mike for taking the drugs, or the Doc who wrote the prescription. The Doc is currenlty being charged with murder, last I checked.

By the way, I don’t see many of the so called “moochers”, getting any Golden Parachutes. In fact, most of them are much worse off than before. But this is not the case for the banks. We as a nation of hard workers should be outraged, and doing something about it with our collective influence.

No golden parachute for the moochers? As far as I know many of them still live in their mansions for free and drive their expensive cars and have their cool toys. Since they didn’t put much money down, they’re not going to be much worse off than when they started. Living the luxury lifestyle for free for 5-10 years? Only in America!

Vic,

If we learned one thing in the crisis, it’s that the bankers in Manhattan run the government. Paulson, ex GS CEO, wrote blank checks to his crony pals and said the world would come to an end if he didn’t transfer the entire wealth of the United States to Manhattan. Don’t just watch Fox news, read some. Glad you’re here. This place will open your eyes. We transfer trillions to Manhattan and they transfer the guilt to Washington–evil, but brilliant.

Wall Street created this scam with their hedge funds, crooked shorting of the market with no uptick rule. There is NO one who gave a damn for poor people EVER. This was a carefully crafted scam to stip wealth from the economy and put it into the hands of the richest. Bush got rid of the bank regs in 2000 at the behest of Texas R. Phil Grahm. It was planned. The unregulated markets took no time at all to scam us.

Just to everyone know how tough it is to buy a house nowadays. I am in the final stage of buying a $114,000 house in Phoenix. I make a good living (over average) and have a decent savings to easily cover the 20% down payment. And bank is scuntinizing every single transaction on my bank account. It is so difficult to get this loan. I’m actually late on my closing date. Point is, the banks are waking up and realizing that people are overextending themselves. The banks are not allowing them to do it. So it’s either people make more money or the home prices have to go down. If you are planning to buy a house in S. Cal, especially in OC. Hold on to your money! the drop in prices will continue.

wow.. the price of your home is basically the down payment for a house in socal.

Comparing Burbank’s increase to the California CPI is misleading. Location, location.

Burbank is unique, it is the media capital of the world. When Mickey is happy, we are all happy. Mickey is happy now.

Comparing Burbank to Santa Monica and Beverly Hills, I have no comment other than those locations are different than Burbank. We have great sun and heat. It is too cold in Santa Monica and Beverly Hills for many folks, not to mention the marine layer and “June gloom.” that has been extending into August.

Just a couple of short years ago, realtors in NYC were saying the same thing “Location, location, location”.

They thought prices couldn’t possibly fall in Manhattan!

What is it about the air or water that makes people crazy in Cali?

I know, I used to live in Santa Barbara, the crazy Real Estate capital of Cali…

Burbank? That’s absurd. You sound like the San Diegans who think the rest of California all want to live here. They’re always going on about how we “have the best climate” and “great beaches” and so on. They are fools. Everyone knows that Irvine is the most desirable place to live. After all, Irvine is truly unique — it is a planned city with good schools and low crime rates…

I look down on Irvine every morning when I go jogging. It is so covered in smog you can barely see it. That is what you consider desirable?

Methinks this is a classic case of “it’s hard to discern sarcasm on the Internet”. Well played, John CPA, MBA.

BURBANK?

You think anyone would willingly choose Burbank over Santa Monica and Beverly Hills? And by the way, the people who work at Disney don’t live in Burbank, with the possible exception of the secretaries. The execs and producers all live on the other side of the hill, in places like (that’s right) Santa Monica and Beverly Hills. The below-the-liners’ and animators’ jobs have moved to Vancouver or Asia, respectively.

I really hope this is sarcasm.

I’ve finally stopped laughing and have cleaned the coffee I spit out off my keyboard. Good one! Burbank…. (giggles)

May be the top people at Disney don’t live in Burbank, but for most of the people at Disney, they can’t afford a $4million Beverly Hills home or a $1.5million Santa Monica home. They also can’t take the commute each way of up to 90minutes to Santa Monica and over an hour to Beverly Hills(via Coldwater Canyon, if the two lane road it not closed). Also, West Hollywood comparable homes are twice as expensive as Burbank for the creative class, so many choose Burbank. As I say, it is location.

Things are not getting better, folks.

Why are they giving $1,500 a month to mortgage holders? There are quite a few people who quit paying their mortgages anyways and are living rent/mortgage free now?

I don’t see that money as a gift to the mortgage holders. It’s more of an effort to give money to banks. If an unemployed mortgage holder is given money by the government to continue paying the bank the bank can hold off a potential foreclosure and loss on it’s balance sheet longer.

It is grotesquely unfair to renters. But hey, the banks win.

“a nationwide housing bubble”???

Absurd! Inconceivable! There has never been a nationwide housing bubble!

–National Association of Realtors, 2006

Just went on Zillow. Everyone is still nuts. Save your cash buy later. Much later.

Obviously, prices are still too high. Until the banks are forced to foreclose, this standoff between buyers and sellers will continue. Buyers, ultimately have the advantage, as they don’t “Have” to buy and can always rent. With the latest housing numbers, prices will start dropping fast again. The market isn’t coming back and banks know it. Look for more short sales and REOS, as the inventory continues to balloon.

Prices are significantly lower now in Santa Monica and dropping.

http://www.santamonicameltdownthe90402.blogspot.com

A note to the writer.

I loved the article. It was very informative, and spot on in many ways. However, the end was lacking. I disagree that we should be looking to end speculation for good. After all, isn’t speculation the very fabric of our great state of California, and our Country as well.

If you want to affect change, it would seem wise to direct the appropriate energy in the correct direction. Moreover, I believe that Wall Street has a much bigger lobby than the “Speculators”. The bigger pockets influence the laws of our nation, which allowed the greatest bank heist in the history of mankind. If we are serious about change, we would get on the same page and go after the actual masterminds who crafted the plot.

I wish you’d cover the 90048 area sometime. We looked at some homes in that neighborhood around 2000 and they were going for around 300,000-350,000. Today those same places go for 1.2 million. Seems quite unreasonable….but what do I know?

There’s a great article on the front page of today’s Los Angeles Times that talks about the decline in home sales. Check it out.

I grew up in So-cal. In 1998, I purcahsed a home and rebuilt it. I then bought and sold 3 homes untill 2007. I was a loan officer at the time and transferring over to daytrading. I had seen a chart of the home appreciation and realized this bubble was about to end. I put our home on the market in Oct, 2007. It sold in one day with 4 offers all over asking price. I moved to Colorado to wait out the impending disaster. I am underwater in my current home, but figured that was probably going to happen. Study any bubble chart over the last 400 years, they all end the same. Nasdaq 1998, Japan 1980’s, Tullips 1624, Real estate 2005. They will bubble up, then overshoot to the downside. I have gotten blind-ass lucky in my decisions over the last 10 years, but I do believe that we need to get to 1996-1998 valuations to bottom out. However, with the current bond bubble (I beleive, the mother of all bubbles brewing now), I think that if you can get a home for about 10-20% below current value and get a loan at todays rate and will live there for at least 10 years, It’s a good time to look at the market. I didn’t say go out and buy the next house you see, just begin to look if you can. Good luck and god bless.

Small wonder there are conspiracy theories, becuase there are so damn many conspiracies…who is legit anymore? Priests? Teachers? Bankers? Brokers? Realtors? Everywhere you turn someone’s trying to screw you…

I keep hearing that deregulation caused the collapse, however my own investigation revealed that over regulation of the banking system caused the massive increase in the issuance of credit to un worthy borrowers. Specifically, in 2001 Andrew Coumo as head of HUD ordered Fannie and Freddie to increase their portfolio of subprime loans to 50%. The GSE’s along with the Community Reinvestment Act were just as big a factors as any.

I concur with you 100%, Jim. This debacle was created by government policies made at the behest of the banking cartel, and because our government policy makers had no way to drive “growth” except through debt creation and asset inflation. When will people realize that 80 years of government involvement in the housing market and government subsidies for housing and home ownership have not only NOT made housing more “affordable” for most Americans, but have driven prices northward, blighted our cities, driven sprawl development, and really made more people badly housed and homeless than ever?

This debacle was created by government policies made at the behest of the banking cartel

So why are you blaming the government? For the past twenty years all we’ve heard is how the government would be better run by business men, so we’ve taken their advice, created a revolving door that has people lobbying then regulating said business, and elected and appointed business savvy personalities. Our societies worship of Wall Street and Greed has subverted the true purpose of government. The goal of trying to provide affordable housing is a noble one that served this country well until the late 80’s. Remove the excessive influence of corporations and wall street from government and maybe they can get back to their job of serving the people.

Laura,

It’s not that simple and does no good to blame the government. The government, as lame as it might be, is the only hope we have to keep the banks from devouring us. The banks don’t answer to us and it should be obvious if you have read much of the doctor’s work, Wall Street syndicates push legislation to enable them to leech the blood of the masses and get a bailout if they get overextended. Turn off Fox news once in a while and do some reading.

@jim Marsh – pretty much yes. Tons of factors here. Monetarily no one wanted to take deflation lumps from the tech bubble and tried to get out of it (didn’t work and made it much worse). Politically the housing expansion and anti-redlining to get votes from low income constituencies alongside feeding the bottom end of the market and increasing demand so all could move up; removing leverage caps on banks to further allow the shadow banking securitization bubble; Basel regulations written to favor securities over the same non-bundled whole loans allowing vastly greater leverage; ratings agencies violating their duties; suppliers of capital willing to visit the crack whore for a few points of extra yield; and let’s not forget the purchasers themselves signing their name to 6+digits with apparently no thought to anything other than a rosy turnout even when the amounts dwarfed their salary let alone discretionary income; move up buyers doubling down into bigger houses never taking a dime of profit off the table or diversifying. Oh yeah – and all those people disguising consumption as investment just spending money on their homes where any comparable sale effectively opened the cash register for everyone in an area to refi and take cash out. I probably missed something in there but that’s pretty close to complete and as unbiased as I can make it because all parties are at fault here.

Honestly the fundamentals stink in short-medium-and long-term (baby boomer divestiture, increasing energy costs etc…). Tempted to give the whole thing the finger and let them know that here is one responsible person who can afford to buy (saw it coming and was renting for years with wife calling me crazy until 2008, she actually listens now) and I’m unwilling to take part in the game. Let everyone rot and when it’s cheaper for me to buy (all in depreciation/updating etc…) than rent, I’ll consider it. I don’t play games rigged to make people lose and this is a sham – it has literally broken countries, states, municipalities, communities and families allowing this thing to blow and then bust. And here we are trying to support it more. There’s just no reason for it (and yeah I know it’s a balance sheet issue for banks and people, irritates me nonetheless ). Basic common sense, mean reversion, independent and critical thinking – you don’t even need to be smart just mildly skeptical and willing to form your own opinion as opposed to take the spoonfeeding media. We are all paying for this idiocy now.

Slim, ya freakin’ nailed it. Beautiful assessment of the whole g*ddam mess. I might only add that an overall decline in social morals regarding personal responsibility probly had something to do with the current state of the decline of the American Empire (cue sound of toilet flushing). Face it: the American Century is over.

Today’s Burbank Leader’s headline: “Local housing market better than most ,Glendale and Burbank are among the best-performing cities in a slumping regional real estate market, according to figures released Tuesday…”

http://www.burbankleader.com/news/tn-gnp-taxes-20100824,0,7727359.story

@Jim M RE: regulation and the big government push to give loans to those can can’t afford loans…this video has been around for a while, but just in case somebody hasn’t seen it…

http://www.youtube.com/watch?v=hxMInSfanqg

But ask who has incentives to drive the government this way. All we hear are populist excusesfor policy–not the drivers of that policy and the true intent, which was to provide a structured vehicle for generating CDO’s and the CDS’s that made Manhattan wealthy beyond anyone’s wildest dreams, at the expense of the rest of us. They just expanded from sub-prime to prime-time, with the Alt-A-Jumbo-Negative-Amatorizating death star.

Dr.,

You always make the same mistake when talking about Beverly hills, 90210. It actually is two discinct areas: Bev. Hills and Bev Hills PO. This obscures the #’s as BHPO sells >300 sq ft less per foot

The most ABSURD real estate bubbles have been going on in India and China for the past 20-30 years, where homes have appreciated about a THOUSAND times. A one thousand US dollar investment in India’s metro real estate in the 1970s is now worth more than a million US dollars. Home owners in India and China are unbelievably rich and are far more wealthy than their Western counterparts. Despite the ABSURD appreciation in the past 30 years, the mentality in India and China is that real estate is the easiest and best form of investment, with values doubling every 2-3 years. Note that these so called homes in India and China are small, with little features, very low quality, have no good infrastructure and so filthy that no sensible person would spend even a 100 bucks on, yet are being sold and bought for millions of dollars each in the greatest PONZI game ever played. Note also that the median income in these places is still just a few thousand dollars per year, yet the median home prices are about a million dollars. This PONZI game has created inflation, which then fuels the PONZI game even more and you get the idea. Compare all of this to the United States. Homes have hardly even tripled in value in the last 30 years, and yet, we are quick to point this out as a bubble. We are playing the reverse PONZI here, where we want to destroy absolutely fabulous homes to complete worthlessness. A regular 2000 sqft 4-BR American home would cost several million dollars everywhere in the world except in the USA, where it costs a measly USD 200000. Yep, Americans want everything for free. If it is not free, it has to be a bubble.

You’re funny Rob. You should do standup.

The article is written in great detail and he makes some very good point, however being so negative and saying that real estate does not worth anything is way over exaggeration. Real Estate has always been a great investment and will always be if you are willing to do your homework and purchase a property within your means. What I mean by that is not buying what you can’t afford like so many millions of people did. People are saying that today Real Estate is in the gutter, on a contrary I disagree. This is the best time to buy Real Estate if you ask me and become a homeowner. When Real Estate prices tripled, everyone got on there horses and start buying what they could not afford, now that it’s actually affordable, people say it’s not a good time to buy. That’s really amusing to me. Its not that Real Estate is a bad investment, it’s that the economy has to turn around and more people need to work. That’s it. Simple as that. So I don’t really agree that people indicate that Real Estate is a bad choice and it’s not worth owning your own home. We all know that R/E is a long term investment and you have to keep that in mind. If you keep it long enough you will be rewarded. By the way, I personally bought 2 rental properties in Vegas when the Real Estate was booming. Now it’s worth half of what I paid, but I’m not worried. Like anything else, you need to be patient. Mark my words, we will see Real Estate prices doubling again, I believe within 5 to 7 years, and when it does people today that though R/E its worth nothing, are going to feel awfully stupid that they did not invest today when they should have.

Victor – for real estate to go up incomes need to go up and by that I mean we need to get all the jobs back that were lost, people need to have massive increases in their incomes, and all the equity that was wiped out would need to be rebuilt. You forget how we got to those prices before – rediculously poor underwriting, overleveraged financial institutions, and delusional buyers. That’s very hard to recreate. Typically bubbles, real estate or stock or tulips, end the same way and they don’t reinflate for at least a couple generations. The only thing that might help would be some serious inflation but at this point that would only serve to put a floor under pricing that is still too high and what typically happens is that necessities inflate more than luxuries which isn’t going to help housing other than the lower end becoming more solid as discretionary income craters.

slim, don’t you recognize the NAR handbook talking points?

I agree with your conclusion, but it would be more accurate to look at incomes, not CPI. Though the two track closely, incomes go up faster than inflation due to productivity gains in a strong economy. Also, looking at equivalent mortgage payment rather than house price would be more accurate because the former takes into account the interest rate change. Because you don’t adjust for the currently very low rates (at least 1.5% lower than at the market peak), you exaggerate the overpricing by a substantial amount.

I bought this spring & after the Federal Tax Credit paid under $500K for a lovely house, pool & gardens next door to the West Burbank/Toluca Lake neighborhoods. This is a great area & many people do actually work at the studios including Disney.

We got a conventional mortgage with 20 % down.

I moved here to Los Angeles in 2007 & was looking to buy but saw that prices were to high & followed this site & others. However, at 40 years old my wife & I were fed up with apartment living & at the beginning of this year started to look for a house. We considered renting a house in a good location but taking everything into consideration it didn’t make sense for us to continue rent.

Of course I think California real estate is over priced & like most people here I don’t care much for real estate agents including the one we used. At the beginning of this article the good Doctor uses the word houses & investments together. A house is a place to live & I could sit on the sidelines waiting to buy for another two years & pay out $2,000 month in rent to live in an apartment or for a little bit more enjoy the life I am enjoying now even if this house depreciates in value. If it dropped another 10% that is still the same amount we would have paid to a landlord.

Everybody’s needs are different but I think if you can afford a better quality of living then go for it. A lot worse can happen to you while your sitting around waiting to buy than a drop in the price of your home.

The future may hold lower prices but good Los Angeles neighborhoods are not returning to 200-300K . Gas was around a dollar ten years ago or so & it is never returning to that price.

Your last sentence sounds like good old fashioned wishful thinking. Good luck with that and your overpriced home.

Gas is different-China and India consume it in huge quantities and supply is limited. Housing on the other hand is dependant on speculation to some extant and the overall economy. In the overall economy, China and India are creating all the jobs. I just read Citibank and three other firms created 30,000 jobs in india. In prior recession cycles, those 30,000 jobs would have been created here-not anymore.

I really do not know what we are staring at in the future.

Staring into the abyss perhaps? The Manhattan Trench.

House prices even without a bubble don’t necessarily correlate to inflation, just as computer prices, gold prices and college education prices don’t necessarily correlate to inflation. Inflation is one factor in the price movement (in an inflatable currency) of a thing you want to buy. Someone in my wife’s family bought a house in North Dakota in the late ’80s for $500. They bought it to use as a cabin to camp out in on vacations. (They were from ND and thought of it as a good vacation destination.) I think they were probably better off for buying it than most people who buy timeshares. Dr Bubble is right that the price of houses has to be sustained by demand at a given price. When the price goes above what the demand will sustain, the price MUST drop. Again, when a location suddenly has a lot of money show up in the form of a new industry that offers good paying jobs, etc., one can expect prices to go up beyond the rate of inflation. But where in CA is there a new industry moving in with more good paying jobs?

There is some money coming in to very upscale neighborhoods in CA from abroad. People with dollars from businesses in growing economies need to hedge against a decline in the dollar which may come about from the massive deficits. Think of purchasing high end California real estate as a form of money laundering for very rich people. Even if the prices go down, it may benefit the new owners by reducing the exposure to the US buck. But those neighborhoods are a tiny fraction of the market. It just means that cash savers will NEVER be able to afford the elite neighborhoods on a middle class salary, no matter how much more bad news comes along for the RE market as a whole.

can you please tell us what you see in south bay area? torrance, PV, Redondo, hermosa, manhattan beach? people all keep wondering this would be immune since it’s right next to the beach and wonderful suburban area.

thank you!!!

bobby

Leave a Reply