The oxymoron of Southern California real estate – Two of the most affordable counties in the state are here in Southern California? Acknowledging that household income is the most important driver in stable housing markets. Two lost decades in home prices.

It might come as revelation to some that two counties here in sunny Southern California were labeled as being the most affordable in the state. Of course it wasn’t the overpriced counties of Los Angeles and Orange but those located in the Inland Empire. Riverside and San Bernardino made the list as two of the most affordable regions in the entire state thanks to their crushing price collapse in real estate. In many of these areas you have now found a nominal lost decade in home values. I found the report interesting since it came from the California Association of Realtors and actually used household income and home values as a measure of affordability. I’m curious how they would break down the most unaffordable regions based on household income? It doesn’t seem like they want to burst the bubbles in many inflated areas in the state. Let us exam why the Inland Empire is now viewed as an affordable region.

Going back a decade in home values

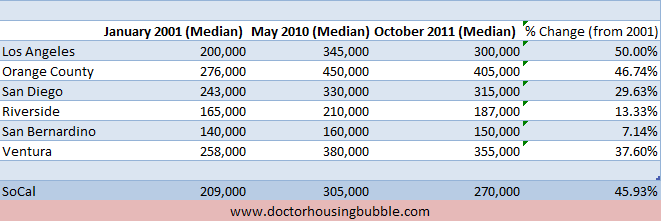

It is always helpful to put prices into perspective. Those that ignore history are bound and destined to repeat it. The Inland Empire is not only already at an inflation adjusted lost decade, but it is inching closer to a nominal lost decade:

Now this is an important trend to exam. Last spring when gimmicks were sloshing all around like a tub full of water in an earthquake, some were calling for a bottom. Well look at how much prices have fallen simply since May of 2010. Orange County is down $45,000 and so is Los Angeles. San Diego dropped $15,000 since then and Ventura fell by $25,000. The Inland Empire also moved lower with Riverside County falling $23,000 and San Bernardino shedding another $10,000. With incredibly low down payment FHA insured loans this is the equivalent of a down payment (or two).

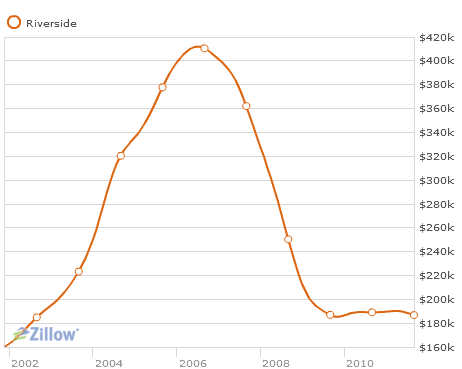

The massive correction becomes more pronounced when we look at home prices back in January of 2001. San Bernardino is only up 7 percent over a period that is longer than a decade and Riverside is up 13 percent. Are prices cheap? This is the only region in SoCal that an argument can be made in this regard. If you look at the rise and fall for Riverside the city, you can get a better picture of a bubble bursting:

What you are seeing is a crash of nearly 60 percent from the inflated peak. Or viewed differently, once the toxic mortgages were removed from the equation not much had really changed in the region to justify those peak prices. Many investors are running out and buying properties out in these regions. The typical all cash purchase was for $200,000 which seems more in line with homes out in Riverside and San Bernardino. This is no small amount of homes since investors last month purchased nearly 30 percent of all SoCal homes with cash.

Here are some figures:

“(PE) Existing homes in Inland Southern California continued to be the most affordable of any region in the state, according to a report this week from the California Association of Realtors. In the third quarter of this year, 69 percent of households in the region that consists of Riverside and San Bernardino counties could afford to buy the median priced existing single family home.

Households needed a minimum annual income of $36,250 to qualify to buy the median priced existing single family home, where half cost more and half less, that sold for $172,090.

Of all the counties in the state, San Bernardino County had the most affordable housing, with 77 percent of households able to afford to buy the median priced existing single family home selling for $133,290. Riverside County came in as the third most affordable county for housing, with 65 percent of residents able to buy the $200,970 median priced house. The county with the second most affordable housing was Solano, where 75 percent of households could afford a median priced house selling for $192,350.â€

You have to dig below the headlines to see what is really going on.

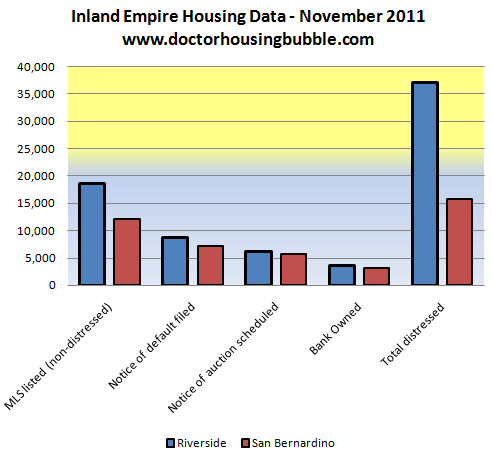

Shadow inventory for the Inland Empire

Even with many investors rushing out to purchase in the Inland Empire because of low prices, we need to explore the reality that prices are low because the economy in this region is struggling deeply. Let us take a quick look at shadow inventory data for both Riverside and San Bernardino counties:

The data highlights the still enormous shadow inventory pipeline that is being worked through. Even with prices reaching deep into the 1990s and investors exhausting the market many people are still facing a tough time covering their mortgage. The above chart shows that the MLS listed properties are dwarfed by the shadow inventory properties still lingering in this market. What this highlights is that even low prices are not enough to revive a stagnant market.

Prices may be cheap for other reasons as well

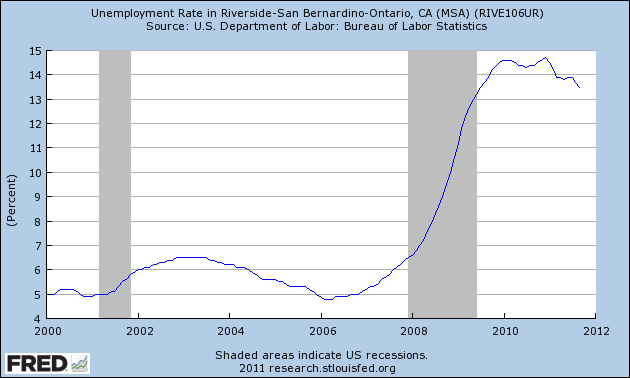

If you are wondering why there isn’t a flood to pickup cheap homes you can look at this:

These regions still have some of the highest unemployment rates in the state. Based on the unemployment data it can be argued that prices should be lower than the 2001 point because at least in 2001, the unemployment rate in the Inland Empire was in the 5 percent range, nearly three times lower than today.

In fact, you are starting to see homes going for two lost decades:

53143 CALLE LOS HERMANOS Coachella, CA 92236

5 bedroom, 3 bathroom, 0 partial bath, 1,402 square feet, SFR

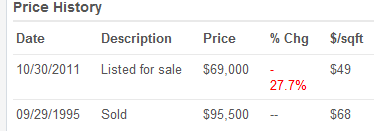

And take a look at the price history here:

This place sold in 1995 for $95,500. Today it is listed at $69,000. This is likely the sale price if it sold in the late 1980s. This place is two hours away from Newport Beach in Orange County yet some folks tend to forget that SoCal has a region that is dealing with the bubble bursting in very difficult ways.

There is general rule that you should not take on a mortgage that is larger than three times your household income. For example, if your household is pulling in $100,000 a year then a $300,000 mortgage would be reasonable. I’m glad the California Association of Realtors looked at household income in determining affordability in various locations because it is all about the income. Or to put it differently, it really is about good paying jobs. Low rates are simply magic dust trying to cover up the reality that the economy is still in deep pain.

Do we have any first time buyers or investors purchasing out in the Inland Empire?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

75 Responses to “The oxymoron of Southern California real estate – Two of the most affordable counties in the state are here in Southern California? Acknowledging that household income is the most important driver in stable housing markets. Two lost decades in home prices.”

In the 1980’s and 90’s the aerospace and defense sectors underwent a massive downsizing in California. When the rug got pulled out from under the mortgage fraud industry there wasn’t any cushion to absorb the shock.

Some downsizing was inevitable but a lot of the non-cut defense work went East to Texas and elsewhere. Senators Fiendsteein and Boxer did nothing to stop it either. Today California gets back 78cents in federal taxes frorn every buck it gives Washington. The problems are now baked in the cake. The unemployed must leave. The empty housing must be knocked down.

“The unemployed must leave. The empty housing must be knocked down”. Maybe, if you only care about housing prices going up. Where in the Constitution does it say that the God of high housing prices must rule our lives? And where are the unemployed to go? Arizona? And where then? Your real name is hidden but your fake name should be “kaimikaze”, or perhaps more simply “village idiot”.

Brian Sheppard

I know prices are lower all over Riverside County, but Coachella is somewhat of an outlier both physically and statistically, don’t you think. Coachella is at the edge of the county, and way out in the desert, on the far side of Palm Springs. It’s not really like the part of Riverside County where most of the people are. One trip to Coachella and you’d probably understand why $69K is probably a fair price for that house under any market conditions.

Echoing Torabora comments, I grew up in WLA in the 60’s and most of my neighborhood friends fathers worked as janitors all the way up to engineers at Hughes, AiResearch, McDonald Douglas, Northrop, Hughe Helicopter, Hughes electronics, Garrett, TRW, Boeing, the LA Air Force Base (still in El Segundo) Teledyne, Grumman, Quip, General Dynamics, Allied Signal. anyway, most are gone or relocated or bought out and absorbed each other. The point is in the 1960’s someone at the janitor level could afford a house in the Westside.

Those were the daze. and School teachers populated north of Montana and the Pacific Palisades. Now adaze one has to be a Janiter f*&ker and any body else they can fleece to get enough $$$$$$$$$$$$ to make that million dollar mortgage.

wow my brother must have worked for half those companies. He got laid off in 1991 and hasn’t worked since.

Why? was he only able to work for defense companies?

Yeah, he had little or no offense to speak of…

I agree that the problems are baked into the cake. But they are much, much bigger than what you’ve described. As I type this, there’s a big bank run going on across Europe. Zerohedge.com has the best coverage.

Some have claimed that the problems in Europe aren’t going to effect us here in the U.S.. That silly notion was disproven a few weeks ago with the blow-up of MF Global. If you don’t understand the significance of that, I strongly suggest you start learning fast. In short, it has shown many things. One is a disruption in the confidence of the CME (where every day commodities are traded). The second is that brokerage accounts are taking your investments and loaning them out. Tough luck when the brokerage goes belly up; you are screwed, and no promises to you about safety will be kept.

And this is going on with Stock Exchanges across the globe right now, just to prop up the Banks.

I find it amusing to hear people who itching and eager to buy a house. To those people, I strongly suggest you educate yourself as to what’s going on. If any of this causes surprise, you haven’t learned enough. And none of this is good for the current price levels in housing.

Don’t believe in all the media hype about euro zone crisis. The Euro is worth 35% more than US Dollar. Zerohedge has been proven to be a disinformation site by many alternative blogs.

The eurozone crisis is the recognition of problems which are expected to hurt european countries and the value of the euro. To say that the euro has high value right now as disproof of this is meaningless. It would be like pointing to U.S. stock market values in early October 1929 and telling people worried about what will happen that there can’t be a crash because values are high.

The future is not the present.

That’s truly a unique statement. Three sentences, with each one being disinformation in itself.

My suggestion would be to stick to the basic facts. But then that blows up your argument. Were you actually familiar with MF Global, you’d know that it was the European bonds which destroyed it. And this is a company which was a Primary Dealer for the Fed.

Your other statements are equally as silly, and disingenuous.

MF Global losses are about $6 billion out of the $13 trillion euro bond outstanding. Drop in the bucket. Fear mongering by MSM about Euro zone economy is disingenious.

Um, Matt, no man is an island in today’s interconnected banking world. Check this out: http://www.bbc.co.uk/news/business-15748696

And, that doesn’t even take into account all of the CDS bets that are sitting in the shadow banking system like land mines all over the Falklands.

Matt,

You have links to those alternative blogs? I would love to read them.

Thanks.

My favorite websites where I get the real news on the world economies are:

http://bullionbullscanada.com. You have to read Jeff Nielson’s commentaries and responses to daily Bloomberg, AP, CNN, propaganda articles.

http://ttbth.blogspot.com/ Truth Behind the Headlines.

@Matt: Re: “drop in the bucket”

The MF Global bankruptcy is the 8th largest in US history. And you dismiss this as inconsequential.

I’m sorry, sir. But it’s really hard to take you seriously.

Questor,

I still stand by my statement that the $6 billion loss of MF Global in the $13 trillion Euro Bond market is a drop in a bucket. Read it again. I never said MF Global collapse itself was a drop in a bucket.

Read the websites I posted on how devious our media is with their daily propaganda. It will be an eye opener for you!

@Matt: Sorry, but you were trying, rather unsuccessfully, to marginalize the disaster at MF Global with your “drop in the bucket” comparison. If you had said that the Euro losses would impact the the US, that might be one thing. But you claimed that it wouldn’t.

Nice try, though.

I’ll skip the blogs you pointed out, most definitely. They seem to be giving you a number of conclusions that have no bearing whatsoever on reality. Especially the markets, and how they work. Thanks anyway.

And yes, I am short the Euro. Not in paper terms, but in direct holdings. As I pointed out previously, all Brokerages are suspect with their paper trades, now. Wouldn’t touch the Euro futures (or any) with a ten foot pole. The MF Global implosion showed the (expected) mistake in that.

And I trust you are short the dollar in paper futures. Is that the case?

@Matt:

And I’d say that promoting the Bankers propaganda is very much disingenuous.Are you one of those which get paid by the post?

Again, let’s stick with the facts. If it were a drop in the bucket, why is it that the CME hasn’t ponied up the money, like they promised, and are legally required to do? Perhaps it’s because they are broke, and can’t?

It’s not a drop in the bucket to the big exchanges, alas. Nor to the people who lost money. Even worst is the confidence that’s been shaken. People now know that you money can be taken, without compensation. Inspite of contracts and promises.

Sort of like what Banks have been promoting.

Sorry, if what you were saying were true, people would’ve been made whole, no problem.

As far as the claim about the news being trivial and propaganda, skip your version of the news. The only news which matters are the markets. Sorry, you Banker boys can’t spin that. And the Bond markets are very clear about it.

The markets are showing a very clear BANK RUN going on in Europe. Thank you for the chance to repeat that. And here, let me take this opportunity to post a link with the charts:

http://www.zerohedge.com/news/european-black-swan-sighted

Actually I’ve been commenting on Doctorhousingblog for years. Also I hate Banksters with a passion!!

Yes there are problems in Europe blah blah but they are greatly exaggerated by our media. ZeroHedge has been constantly bashing Europe and China for past 3 years that both will imminently collapse. If you so believe in the hype, why aren’t you shorting the Euro? Even today with stock market downturns worldwide, Euro remains steady and worth 35% more than US Dollar.

The problem with our media is they are constantly diverting the attention away from the largest problem by far, which is right here in the USA. USA is the world’s largest debtor in history of mankind. We have massive austerity occuring across the country in private and public sectors with layoffs, benefits reduced, part-time only hiring, 50 million on food stamps, destruction of middle class, destruction of unions, tax cuts for the ultra filthy fat cats on top, and continuous Bankster daily welfare. The Federal Reserve has printed 10’s of trillions of dollars out of thin air to try to prop up the economy but it is failing. The true inflation rate is about 10% according to Shadowstats and a hyperinflationary depression is actually imminent in USA. Read what Ron Paul in stating on how truly things are bad here. You want to talk about problems, look no further than good old USA.

I am tired of the constant jumping up and down by the media talking parrots on CNBC, Bloomberg, etc. about “look at Europe, look at China, both will collapse, Euro Crisis, contain the contagion, run for the hills”. As the old saying goes, me thinks the lady protest too much.

Matt,

I have a couple of questions for you. First, what percentage of the US GDP was Lehman? Second, what impact if any did the collapse of Lehman have on the US financial system? I believe these are examples of the infamous straw that broke the camel’s back. I think that Hank Paulson was under the impression that there would be little impact to the financial system if Lehman went under. I believe he may have a different view in hindsight.

As to money supply, I am not convinced that the Fed has been very successful at “increasing†it. I believe Questor made the observation that we are currently in a period of debt destruction. If it is true that the majority of the “money supply†is debt and not printed dollars, then I believe the Fed is simply trying to keep the money supply from contracting during this period of debt destruction.

Just a couple of observations…

@Matt:

You dodged all of my questions, I notice.

And you seem to have conveniently forgotten your original point, which was that Euro losses, in particular Greece, wouldn’t be impacting the U.S.. It already has. And there is a striking example of it.

So you blew that call completely.

Blather on about how things are fine. But I’m sorry, bud. Your interpretation of reality is measurably off. Some would consider that a clue stick.

I never said things are fine. Reread all my posts. I am actually stating that things are so much worse here in USA and problems in Europe are rather greatly exaggerated. I have already proven that Europe is stronger economically than USA. Stock markets and currency trades price in things 6 months in advance. Well known fact. If Euro is about to fail as ZeroHedge has been predicting these past 3 years, it would be worth much less than the US Dollar.

Will you stand by your original post and short the Euro?

Matt,

I am no currency trader, but my understanding is that we are currently in a currency devaluation race to the bottom. In my view the US has been attempting to devalue faster than other currencies in a pathetic attempt to spark exports. The EUR appears to be strong relative to USD and currencies pegged to the USD. This is not due to the strength of the Euro zone rather the different policies of the US Fed and the ECB. I think one issue is that the USD is currently the flight to safety currency which allows the Fed to have very low interest rates and still sell bonds. I think the fact that the market crashed and the treasury yield decreased when the S&P downgraded US treasuries speaks volumes. I believe this is because the current perception is that the Full Faith and Credit of the US is stronger than any other investment. I am not stating that this is a correct perception rather that this allows the US Fed to devalue its currency faster than others. I think this is the real reason the EUR is relatively strong to the USD. I think we may have some interesting news out of the Euro zone over the next couple of months about what to do with the weak members (i.e. breakup of the euro zone).

What?,

I agree with your assessment with the situation except one part of the flight to safety to US Dollars. The Feds have printed a total of 20 trillions dollars since late 2008 and loaned it to the Banks and others at 0% interest rate. The Banks then in turn deposit that very same money back to the Federal Reserve and earn interest. Banks then use that interest to prop up their balance sheets. The Feds then in turn have bought most of the treasury bonds (66%) these past 3 years. There is no flight to safety. This is pure money laundering. The flight to safety of private investors are into precious metals, commodities, China, and believe it or not, the Euro.

What our mainstream media have been engaging is a full smear assault on Europe, China, and speculators. I find it interesting that they don’t attack our own failures of our own Federal Reserve printing $20 trillion dollars out of thin air and destroying our dollar. This is the source of the problem. Soon, we will enter into a hyperinflationary depression. This means that food prices will skyrocket. Have you been to the supermarket and seen food prices go up these past 3 years? The Banksters have so utterly destroyed housing that it will not be a safe haven like it was in the 70’s.

Best protection for your wealth is buying silver coins and gold coins. Banksters hate silver and gold and are engaging in a severe attack on it these past 3 months. They will lose as the sheeple are waking up. That is a whole other story for some other time.

Matt,

I have to disagree with your scenario as it does not jive with my understanding nor does it make sense. My understanding is that the banks borrow short-term money from the Fed at zero percent as you describe then they purchase treasuries and earn interest on the treasuries. My understanding is that the Fed has lowered their interest paid to depositors to close to zero and even toyed with the idea of charging interest for depositors. I agree that the fed has purchased treasuries and other debt obligations in an effort to maintain the artificially low interest rate.

I have one question for you if you disagree with the flight to safety hypothesis. Why does the US treasury yield drop every time there is a panic including when the S&P downgraded US treasuries? I am not saying that this makes sense but it appears to have at least a strong correlation to US treasuries being a flight to safety. I am not convinced that the PM market will pan out, as these are not consumable/useable commodities. I would even hazard to guess that we are in a PM bubble. We are definitely in a US treasury bubble if you look at the yield on the 30 year note.

I would suggest seeds and guns versus gold and guns….

I believe we are in a fight against deflation period as I stated earlier. I have previously posted questions on how can we have runaway inflation with a slack labor market. I agree that commodities will go up because we are bidding on a world market with cheaper dollars for them but I do not see how we have runaway price inflation on housing or labor when we have a surplus of both. I believe we may see a time where the majority of our income goes to food and fuel as in many third world counties and crowd out housing and service labor.

Thanks a lot for your very profound comments, Questor. I actually provided you links to read and your response is “I won’t even read them” and “nice try”. Funny, half of the comments on ZeroHedge make fun of the stories on how ridiculous the anti-Euro propaganda is daily. Yet, you believe in them and post it here on doctorhousingbubble like it is fact. I quickly dismissed them and then hurt your feelings. Sorry.

Yes, I have shorted the Dollar and bought Euro’s, Gold, and Silver, and made a fortune these past several years! I did the OPPOSITE what ZeroHedge told everyone to do and I won. I will continue to be very Thankful tomorrow during the feast. Enjoy yours!

Sorry, Matt. You’ve just added to your reputation of not knowing what you are talking about, and being totally full of BS.

First, Zerohedge isn’t even three years old. That you claim to have been following it for so long is absurd.

Also, the Euro was about 1.30 three years ago. It’s now at 1.33. You claim you made a fortune off a move like that? Sorry, but again, you are full of BS.

I just post what the markets are doing. That’s a point you have consistantly ignored. Which, no doubt explains why you have to make up wild stories about your financial success.

A shame they are so easily shot down. But it’s consistent with your track record on your posts here.

And yes, despite your claims to the contrary, I do call you a shill for the Bank

ers. Sorry Bub, but you’ve got it written all over your posts.

Questor:

Now you are resorting to profanity. Nice. I’ve read all my posts and nothing in them are pro-Banker. Zerohedge has been around since early 2009 and has been ever since predicting the demise of the Euro and China. Total propaganda site that spends 70% of their time bashing Europe and China, and the rest bashing USA. It should be the other way around as USA is in much much worse shape economicaly due to the Banksters pillaging and raping our economy. Again, I invite you to read my sources and you will be educated on how media propaganda works.

Next time you post BS on the blog from ZeroHedge of the imminent collapse of Europe I will call you on it.

@Matt: Yes, your posts are simply disinformation and distraction. That’s available to all to see in the marketplace.

Please do “call me on it”, because that’s how one gets to the truth about things, by bringing different views and facts to the table. Alas, in your case though, you just keep getting shot down in flames.

Also, your Math is off, unsurprisingly. 9+2 = 11. Zerhohedge will be three years old next year. Honestly, can’t you even make a serious try at something intelligent?

No wonder your financial view is just way, way off.

Questor. Oops, I was off by 3 months as Zero Hedge started in January 2009. Forgive me.

Anyway, it has been one week and no bank runs in Europe. MF Global is buried news. Your scaremongering and fearmongering are already evident with your original propaganda post. I rest my case.

With gas prices back up at $4 a gallon, inland counties house prices will go down even further.

I’ve been wanting to purchase good rental properties in the IE for a couple of years now – something near UC Riverside that I could rent out to students or people employed by the college.

But it just keeps getting cheaper every day! It is really a conundrum.

Yes, you and everyone else I know. Five years ago, nobody had ambitions to be a landlord like they do today. By all means, follow the herd, insist there isn’t an investment property/multifamily REIT bubble, and go do your part to keep the money-go-round spinning just a few quarters more.

Look Baritone – unless you think rents are going to drop dramatically (20% over the next two or three years), then many properties in the IE are now at compelling valuations for a landlord. And the price keeps kgetting better every day. Sure there are many problems, but you have got to buy while there is blood in the water or you will not get a good deal. In any event, I am almost ready to strike.

I wish the doctor would do an evaluation of possible rental properties and a comparision of same between Westside LA (outragious cap rates) and the IE.

Why are we forgetting that rent is paid with a job? I believe the unemployment rate in the IE is over 12% and rising. I also believe that price of food and fuel is rising as wages for those still employed stagnate. I love how these “inwestors†(misspelled on purpose) catch the falling knive for us. They are like the chum used to catch big fish! Let them price discover all the way to the bottom. I consider it a service! This one’s for you Jay, catcher of the falling knives…

Yes, the battle cry is now to scoop up the “Cheap” homes and become a landlord. As compared to 8 years ago was to flip the homes.

Being a landlord is not for everyone. I know, I tried it several times. The big gamble one takes in this scenario is that home prices keep falling after you buy the home. So you’ll probably be able to rent it out as more and more people become renters and not buyers, but you take a big hit on your capital investment of the home purchase. All the while, you have the happy task of dealing with tenants.

Even with prices at 3 times income, if the income is unstable due to the massive importation of cheap labor from abroad, it would be irresponsible for someone to commit to a 30 or 40 year mortgage. Times are tough today for many people, but I spent 2½ years looking unsuccessfully for work between October, 2001 and December, 2003. Being an independent contractor, I was not eligible for unemployment. Before I finally fot a 3 month contract 100 miles from home, I didn’t know if I would be able to pay the next month’s rent. For the next 7 years I continued doing one short contract after another making 40-60% of my prior rate. I have been lucky to work the last 3 years at a decent rate, but the cheap labor importation lobby never quits and continues to add more cheap foreign labor to the workforce, even at today’s 22% real unemployment rate.

Our government is a disgrace.

http://www.programmersguild.org

http://www.youtube.com/programmersguild

Who would buy a home under these circumstances?

The holiday season is, historically, a great time to blow economies up. Just ask the Mexicans and Argentines. I got a feeling that this year will be a real barn burner.

If I was going to open a crack house, the first place I’d look would be the inland empire.

I was thinking meth lab….

Actually it might not pay off in the end to do either. The Utilities like Jurupa CFD are broke and over built in the boom. They planned on having rate payers from on end of the IE to the other. Dairy cows don’t pay much in hook up fees. They consider that utterly ridiculous to think you should build a new tract house next to a dairy hold out who didn’t have the common sense to sell in 2005 for a million an acre.

Anywho, they are going to have to raise rates for water, sewer and power to cover costs. The meth lab could drown it’s profits in utility bills. I suggest the San Fernando Valley. DWP is still cheaper than the rest for the time being.

All self-respecting meth labs illegally tap into power lines… come to think of it, dig a well and a septic system, put solar panels on the roof and make it a medical marijuana grow room completely off the grid! Would that work? 🙂

No way getting around it, it’s all going to crash and there’s nothing anyone can do to alter this catastrophe. The result we be massive unrest worldwide followed by a war of course. The informed know this, unfortunately, for the rest, they’re to busy in suspended animation watching tv…

except!….buy up some investment properties! USA USA USA USA!!!

Yes, either we default or have money get worth less and less. But either way, it’s going to be a lowering of living standards for most all of us here in the US.

If you query youtube on Kyle Bass, you can see some enlighting video interviews where he maps it out very persuasively. As he states, “social unrest will get to levels we’ve never seen before in the US.”

Thought Police–“……..it’s all going to crash…”

Yeah, I think so. But I’m curious how it plays out. For example, what if china’s housing bubble is rolling over, just like ours did a few years ago. The Chinese banking system is already on life support from decades of corruption, mismanagement, and lack of proper lending standards.

I’m thinking the Chinese will have no choice but to attempt to sell some of their vast hoard of foreign currency reserves, of which $1.5 trillion are dollar denominated, I believe. I say ‘attempt’ because I don’t know if we would default, right on the spot. More likely, however, Bernanke goes into the computer room and creates a trillion dollars by mouse click (Quantitative Easing, they call it) and exchanges that for the bonds that China wants to unload.

Then, a few months later, when China is forced to sell other bonds, the ECB is forced to do the same. And still, China’s rickety banking structure will be tottering. So at that point the Chinese will sell their Fannie Mae bonds, and Bernanke will have to go to the computer room again. At this point, the state of the Federal Reserve’s balance sheet will be so abysmal, the dollar will be losing its purchasing power by the minute. We will quickly go to an economy where only thing that really matters is the price of food. I would save up 20% for food, not a house, lol.

What do you think the stock market would do under such a scenario? It would explode updward as the nominal value of companies priced in dollars would be forced to “rise” along with everything else of tangible value. And yes, a share of Intel has tangible value.

A share of Intel only has tangible value as fuel (burn the piece of paper) or food (fiber)…

Wow! At 69k that house looks like a great deal. i think the other areas will come to that, before the dust settes.

Yeah, hopefully Reno gets there soon. Good skiing up in the hills nearby.

69K is not cheap. 20k is cheap.

People need to rediscover sticker shock.

I live in Upland which borders LA county. We’ve been trying to buy a house and we keep running into investors paying all cash. It’s frustrating. We’ve got our 20%, we were smart and didn’t buy in the height and are now ready to buy. Houses seem to trickle on to the market two or 3 at a time in our price range, yet I can drive around and see vacant houses, not to mention all the houses that people are living in for free. And when a property does hit the market the investors swoop in.

yes, there is a lot of market manipulation around here – games galore

I’ve been watching neighboring Rancho Cucamonga for the past several years and the houses there just trickle out as well. I have noticed several houses lately that appear to be good (or at least decent) deals that go pending the day that they are listed. I assume that means something is going on behind the scenes in order for that to happen.

Rancho Cucamonga, Upland, and Chino Hills appear to be in mini bubbles still. The prices have come down a bit from the peak but not at the same rate as the rest of the Inland Empire. The major price drops appear to start to the east of those cities.

you would think with everyone and their mother becoming a “landlord” with “investment” properties, the next bubble should be obvious – the rental market?

prime bet for me would be something like the las vegas rental market, once all these 10 000s of houses purchased by investors come back as rentals, who here would not bet on rental market property price collapse, followed by yet another reduction in housing prices as marginal landlords bail out?

everyones landlord calculations omits one key potential problem: what if rental prices collapse?

Also, vacancy!!!! Maybe we should pass this concept on to Jay the inwestor (misspelled on purpose)!

Oh totally see the rent bubble ballooning more & more over time. It’s evidenced in the rises in rent, and reduction of services. People are paying more rent for less space, less amenities, and ads have more “no this” or “no that” than ever before. Until the housing bubble completely deflates, the rent bubble will continue.

Amen! All any investor or potential inventor talks about is rents heading for the sky. What will happen to rents when the shadow inventory is finally unleashed? All the rent chatter sounds just like housing price chatter from 2000-2006.

Yup. A lot of the new landlord geniuses are throwing around numbers that suppose the economy will be back to ’09 and stay there for a while. I don’t think so. Can’t pay a thousand dollars for rent if you have no job. Heard another newbie landlord in a forum say, hey, no worry, military families are a great market. He seems to think that our armies won’t lay anybody off soon as we leave Iraq and Afghanistan and convince the French and British to chip in a bit more, like they did in Libya.

A significant increase in the cost of gasoline will have a corresponding effect on the ability for many people to manage their mortgage payments.

From the Joint Operating Environment of 1020, Department of Defense:

“By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 MBD.”

Google “JOE 2010” to read the document.

That drop in production is greater than the 1974 Arab Oil Embargo drop of 7%. Anybody remember that experience?

People thinking of buying a home that’s a long commute to work should start thinking about car pooling and gas rationing.

Does anyone remember the mantra from the 90’s that we are now a service based economy (as if that was supposed to be a sustainable economic model)? Some of the same politicians running for office today were champions of the dismantling of America. Well the chickens have come home to roost.

Whelp, “service economy”, means that we’re all a washing the bull sh1t outa each another’s knickers and either plotting the next big scam or fundling our massive home equities for yet one more draw down to keep the opulent life style a going. Meanwhilest China is a sending so many containers to San Pedro that the boats tip over and they are all a fondling thier fat yu-an envelopes after a moderate week of work, Gawd, don’t ya just luv that concept of “Globaliztion” that our Political Fathers shoved down our throats without so much as any debate. Say, where’d that idea come from, could they pleeeeze stand up and defend it now???????

The job market in California is abysmal. Lots of underemployed people of all ages (struck up a conversation last week with a twenty something accountant whose current job was demonstrating a child’s toy; he said this was the only job he could find in SoCal, no future job prospects but had no plan to leave California because he likes it here). Not to mention all the unemployed that have given up, checked out; living on savings, inheritance, etc. Until that changes, there won’t be a real estate recovery. CA is drifting.

Not only is the California job market completely in the crapper, California has its own version of Cap & Trade, that couldn’t get passed on the national level because it would kill the economy further, taking effect here in 2012. Look out when that hits. I have a sister who lives in the Dallas Metroplex who sees something all the time that we never see in California anymore – Help Wanted Signs. We have a whole generation in this state who won’t even know what those are.

The 30-year debt inflation has taught us one thing…some day you have to pay the piper!

You do “get” that the collapse of the world economies was caused by the international Banksters that scammed everyone right? They played with OPM gambling and raked all the fake equity that wasn’t really there on all the over stated assets and then after the bubbles burst they pass along alll the losses to the taxpayers . Whether we are in Italy, Greece, Spain is next, Ireland, Iceland or the corporation of the United States, the taxpayer is getting HOSED!!!!!! Wake up!

I agree if you replace “international Banksters†with the US Fed. I believe this is purely semantics. I believe the true beginning of this catastrophe started with the Fed using interest rates as a lever to stop economies from collapsing versus allowing interest rates to allocate capital efficiently. I think the issue arises when the Fed tries to take their foot off the gas and the entire economy complains that the stock market goes down. I vaguely remember the cover of a magazine with a picture of Greenspan on it with the caption “the end of the business cycle†or something similar. We have the same problem with Keynesian government spending during a downturn. It is politically impossible to reverse the spending increases during a bubble. I believe the “free market†(whatever that means in this day and time) acted accordingly to the environment of free money, accelerating government spending and removal/manipulation of what regulation existed…

I know people in Canyon Lake(Lake Elsinore region in Riverside county) whose property(tax collector concurred) has gone down 50% to $325k. Problem is that the jobs are not in the area to support higher prices. The renters leave these investor owned homes to move closure to L.A. where the jobs are. When the job market recovers, the price of gas will be higher which will also make this Mello Roos(double the rate of property tax) community less desirable.

I know someone in Canyon Lake also, that place is creepy. I guess it is one of the swankiest areas in the IE. No way in hell could you pay me to live there. Like you said, there are NO decent paying jobs anywhere close and the cost of gas and commute time is another no go. You can still rent a decently cheap place near any of the LA/OC job centers and have a quality of life that is orders of magnitude better. As far as future price appreciation in the IE…I don’t see it unless things do a 180 with the economy. Almost everybody I know would move to another state before settling to live in the IE.

Future IE slumlords beware!!!!!

Matt,

I thought Zerohedge was “alternative”, and I would love to read the Zerohedge debunking blogs. Please post links, if the sites exist that is.

My wife and I bought in Chino this past year. I guess we’re technically in the Inland Empire, but our house is in a gated community about a mile from the LA County line. I’m sure we didn’t buy at the bottom of the market, but our new home had lost over $260K from the middle of 2006 to the point at which we bought it. I’m very proud of the house and I don’t have any regrets. I expect to stay there for the next 20-25 years, and we went into the purchase with that mentality. My parents always saw homes as short-term investments and I never really agreed with that line of thinking.

Santa Monica is my home. We thankfully sold our Pacific Palisades home over two years ago, however, the current reality in this still overpriced area is:

Sellers are delusional and unrealistic. Buyers are sophisticated and savvy. The only properties on the market here are distressed or problem properties. Instead of jumping on the band wagon like most, we will happily continue to lease until it makes financial sense to buy, or not.

Leave a Reply