The Big Change: Lessons from the Great Depression: Part XXI. Challenging Wall Street, Restoring Economic Confidence, and Dealing with the Biggest Financial Challenge since the Great Depression.

The country has spoken and with a loud and convincing voice. Change is demanded. This historic moment in our history is appreciated on so many levels but once again, the market reminded us very quickly that things are not well on the global economic system. President-elect Obama is going to have many challenges waiting for him once he takes office. It should come as no surprise that 6 out of 10 voters mentioned that the economy was the number one issue on their minds.

In today’s article, we are going to look at the early 1900s which saw Theodore Roosevelt take it to Wall Street and later in the 1930s, Franklin Delano Roosevelt taking it to Wall Street once again. It isn’t surprising that during these rough economic times that leaders that expressed a message of change rose to prominence. After all, does anyone think the status quo is working when the system is setup up to reward crony capitalism and we have now implemented the largest bailout ever seen in our world?

The market once again on Wednesday took a brutal lashing as the ADP jobs report came in with weak numbers. The stresses on Wall Street are fully engaged with the fortunes of those on Main Street. As the capital injections go straight to the banks, not much has changed in terms of lending for the average American. Many banks are simply hoarding the money and if they are lending the money, they are still at high rates. One major failure of the bailout proposal is that it forgets to examine the issue of employment. You can give banks trillions of dollars but without a solid employment base no one is going to qualify for a loan.

Today, we are once again at an economic fork in the road. In all frankness, no one really knows where we are going from here. The so-called experts have been proven wrong over and over and a new system is needed to regulate the absurd greed and financial imprudence that plagued us this last decade.

This is part XX in our Great Depression series:

16. Items That Sold in the Credit Bubble.

17. The All Hat and No Cattle Nation

18. Charity for Financial Deviants.

19. The Silent Economic Depression

20. The Four Horsemen of the Economic Apocalypse

In this article, we are going to look at Frederick Lewis Allen’s The Big Change which examines the history of the United States from 1900 to 1950. It is an excellent book and another must read for any history buff.

In the first part, we are going to look at the unlikely taking of the White House by Theodore Roosevelt. It is fascinating that Senator McCain a few times on the stump mentioned that Teddy Roosevelt was one of his heroes. President-elect Obama has referenced Franklin Delano Roosevelt’s New Deal many times. The Roosevelt name seems to garner support from both sides in times of economic collapse:

The Biggest Change

“Indeed as Hanna scanned the skies during the last weeks of 1900 there was only one cloud on the horizon: the man chosen by the Republican National Convention as its candidate for Vice-President, the rambunctious Rough Rider of San Juan Hill, the unpredictable young Governor of New York, Theodore Roosevelt. As Governor this Roosevelt was destined to be in the same office a generation later; but he was independent, he wouldn’t stay tethered, and Hanna distrusted him. “Don’t any of you realize,” Hanna had exploded to another senator at the convention, “that there’s only one life between that madman and the Presidency?”

“What White called “the alliance between government and business for the benefit of business” was an honest love affair to Hanna. He felt that if the path were made easy for the great corporation to do as they pleased, the riches which they accumulated would filter down to the less fortunate, and that any attempt to change the rules of the game except to give the great corporations even more opportunity to prosper would open the way to demagoguery, mob rule, and destruction. With others the alliance was not a matter of emotional affinity or of conviction, but of purchase and sale – the prostitution of government bodies for favors of cash. Big corporations advanced their interests not only by making sizable campaign contributions – often to both parties – but also by subsidizing or bribing legislators and even judges.”

This notion that trickle down economics is new is false. As you can clearly see even in the early part of the 1900s this idea of keeping government out of the corporate structure was well entrenched. The same tactics of lobbyist and buying out politicians is nothing new either. The magnitude at the time was even worse. Yet make no mistake about it that this power held onto by this group will not be relinquished easily. In fact, you can expect epic battles against regulations that are surely going to come given the absolute corruption and poor stewardship of Wall Street. Here is how things operated at that time:

“Railroad companies issued free passes to lawmakers, officials, journalists, and their families. At one state capital after another, corporation lobbyists with well-filled pockets were ready to go into action whenever there was a threat of adverse legislation or a hope of favorable legislation. And as for the United States Senate – whose members were at that time elected, not by the people, but by these amenable state legislatures – it had become the chief citadel for the defense of privilege. Most of the Senators were either rich men or carefully selected allies and messenger boys of the rich; they could deliver orotund speeches about the “full dinner pail” for the workman, but their hearts were with the big stockholder.

To quote once more from William Allen White’s autobiography, written long years later:

“Senators elected in the days when machines and the ownership of machines were passing into the hands of a class-conscious, organized plutocracy had no obligations to the people of their state…In Kansas, it was the railroads. In western Massachusetts, it was textiles. In eastern Massachusetts, it was the banks. In New York, it was amalgamated industry. In Montana, it was copper. But the power which developed and controlled any state went to New York for its borrowed capital, and New York controlled the United States Senate…The grade of senators, as far as intelligence went, was higher than the grade which the people selected, but on the whole and by and large it was not a representative government. Only a minority of the people of the United States had any control over the United States Senate. And that minority was interested in its own predatory designs.”

This was the status quo at the time. Boom and bust cycles were extremely common in the early history of our country. As Teddy Roosevelt took office, he was expected to keep the line of hands off philosophy but this was quickly challenged:

“It was not until several months had passed that the first signal flare of the new era went up:Â in February, 1902, Roosevelt’s attorney general brought suit for dissolution of the Northern Securities Company under the Sherman Antitrust Act.”

“Morgan was dining at home when the news of the suit came to him by telephone. He was dismayed and indignant. He told his guests that he had supposed Roosevelt to be a gentlemen, but a gentlemen would not have sued; rather he would have asked Morgan privately to reorganize or abolish the Northern Securities Company in order to bring it in line with the government’s wishes. The great banker felt that Roosevelt was treating him, an honorable man, like a common crook. Joseph Pulitzer, publisher of the New York World and a foe of the “trusts,” was overjoyed at Roosevelt’s action and wrote in a letter of instructions to his editor, Frank I. Cobb, that the President had “subjugated Wall Street.” This was considerable of an exaggeration; but at least the battle was joined.”

Now you need to remember that at this time, much of the power was centered in Wall Street. It was seen and regarded by many that politicians in D.C. were largely bought off by lobbyist. They were the mouthpiece of Wall Street concerns. JP Morgan who saw himself as a statesman and protector of the Wall Street structure took a big offense when President Roosevelt brought suit to one of his companies. Of course, Roosevelt wanted to make a statement. The fire however did not last long and did not change things radically:

“This battle between the President and the emerging plutocracy, during the next few years, was destined to be an intermittent and often halfhearted one. The reason was not far to seek. Roosevelt was a Republican President. He could not get too far out of step with his party.”

“Little as these people had in common, they were alike in seeing the nation, not as a place where everybody went his own way regardless of the plight of others, but as a place where people had a common destiny, where their fortunes were interlocked, and where wise planning, wise statesmanship could devise new instruments of satisfaction for all men.”

In 1908 President Taft won the election largely on the popularity of Teddy Roosevelt. He had certified him a true “progressive.” Taft served only one term and lost to Woodrow Wilson, the long-jawed, brilliant, energetic ex-professor. The idealism and anger geared toward Wall Street and a consciousness of a growing plutocracy gave much of the momentum toward electing President Wilson. The desire for service and global good lasted for awhile but then subsided and led to the Roaring 20s where greed and conspicuous consumption exploded. Ideals, which once sounded great like the League of Nations were largely symbolic and without no true political capital. The public got greedy and decided to look to Wall Street for direction, again. The life portrayed in the Great Gatsby dominated the Roaring 20s. This massive speculation of course was one part, which led up to the Great Depression. The parallels are striking to our current time. This past decade was one of the biggest greed plagued periods of our history. The idea of service and investing for the greater good went out the window. What was our patriotic duty again? To go out and spend like drugged up hamsters with no other deeper meaning in life.

Living a life like that does have a cost when the piper comes for his due. What happened after the massive global spending orgy? Let us take a look:

“Let us pause for a second to look at some other figures. During that very year of 1929, according to the subsequent estimates of the very careful and conservative Brookings Institution, only 2.3 per cent of American families had incomes of over $10,000 a year. Only 8 per cent had incomes of over $5,000. No less than 71 per cent had incomes of less than $2,500. Some 60 per cent had incomes of less than $2,000. More than 42 per cent had incomes of less than $1,500. And more than 21 per cent had incomes of less than $1,000 a year.

At 1929 prices, said the Brookings economists, a family income of $2,000 may be regarded as sufficient to supply only basic necessities. One might reasonably interpret this statement to mean that any income below that level represented poverty. Practically 60 per cent of American families were below it – in the golden year of 1929! The Brookings economist added another cautious observation: There has been a tendency, at least during the last decade or so, for the inequality in the distribution of income to be accentuated.”

In no other time in history has there been such a wide disparity in income. The United States in terms of income equality ranks very high on the list. According to the Gini coefficient a measure of a country’s income inequality, only a couple of nations have a higher income inequality than the U.S.:

[click for a bigger picture]

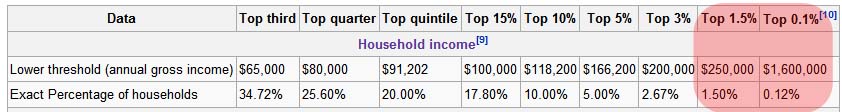

This disparity has only increased since the 1950s. The problem with this divergence is that many of the high paying jobs on Wall Street absolutely robbed Main Street America while they sat behind mahogany desks counting their ill-gotten profits. Once again excessive greed will bring them down like previous times in history. Let us look at the household income breakdown in the United States:

Only 1.5% of all American households even make more than $250,000 a year. 90% of Americans are certain to do better under the Obama tax plan because look above, 90% of households make less than $118,200. And those that fall between $166,200 and $250,000 is only 3.38% and this area will see either a minor gain or no gain at all. This I think is where the campaign had to readjust some of their numbers. That is why the mincing of words between 90% and 95% has gotten a few confused. Bottom line:

90% will do better under the new plan.

3.38% will stay the same between both plans

6.62% would have done better under the Republican plan

To a certain extent, I think most people can understand that. And for the most part I don’t think people have a problem with someone making a profit. What people do have a problem with is when someone makes an outrageous profit creating something that hurts the fundamentals of our economy and comes at the cost of the majority. In this case, CEOs get big compensation checks and we are left bailing out a smoldering pile of junk. You don’t see the public yelling that the CEO of Google is getting paid well. Why? Generally speaking they are producing something that is beneficial to society. Even athletes with outrageous salaries produce a sense of joy when they are on your team and fans have the choice to watch or stay home.

In the case of the financial industry, we had no choice. The prudent Americans were forced into this upside down vortex and by design, they made it hard for anyone to peer in so we really have no idea how bad things are. We have yet to really examine the credit default swap market. Should another major institution go under, we will have a very hard time coping.

Let us reflect on the median income for a family in the United States. That number is $46,326. 50% of Americans make this or less for their entire household. This works out to be about $3,000 a month after taxes. In California, half will probably go into your rent for a modest apartment. Food? Healthcare? Utilities? It adds up quickly. A family with a child and this median income is literally making it tough to live.

We’ve been talking about this for a very long time. This silent depression. A sense that we were inches away from falling into an abyss. The cohesion was debt and more debt. Finally in September and October, the markets literally came unhinged and went on an 8 day prolonged crash.

October is not a good time historically:

“On the morning of October 24, 1929, the towering structure of American prosperity cracked wide open. For many days the prices of stocks on the New York Stock Exchange had been sliding faster and faster downhill; that morning they broke in a wild panic. The leading bankers of New York met at the House of Morgan to form a buying pool to support the market; Richard Whitney, brother of a leading Morgan partner, thereupon crossed the street to the great hall of the Stock Exchange and put in orders to buy United States Steel at 205; and for a time prices rallied. Pierpont Morgan had halted the Panic of 1907. Surely this panic, too, would yield to the organized confidence of the great men of the world of finance.

But within days it was clear that they cold no more stop the flood of selling than Dame Partington could sweep back the Atlantic Ocean. On it went, session after session. On the worst day, October 29, over sixteen million shares of stock were thrown on the market by frantic sellers. And it was not until November 13 that order was restored.

In the course of a few weeks, thirty billion dollars in paper values had vanished into thin air – an amount of money larger than the national debt at that time. The whole credit structure of the American economy had been shaken more severely than anybody then dared guess. The legend of Wall Street leadership had been punctured. And the Great Depression was on its way.”

It is hard to put a number on how much equity evaporated in this crash. Russia came unglued. Iceland went bankrupt. The U.S. Dow is still down 35% from the peak. It is estimated globally that $29.6 trillion in equity was lost. For perspective, the United States GDP is roughly $14 trillion. So globally in this timeframe we lost essentially 2 full years of U.S. GDP. That is shocking. That is the problem with global bubbles. It was clear to any objective observer what was going on. The problem was who is the one to intervene when the punchbowl is being passed around? Someone has to be the adult.

Let us now discuss 6 characteristics of the Great Depression:

“1. It was a collapse of terrifying proportions and duration. At the middle of the year 1932 – more than two and a half years after the crash of 1929 – American industry as a whole was operating at less than half its maximum 1929 volume. During this year 1932, the total amount of money paid out in wages was 60 per cent less than in 1929. The total of dividends was 57 per cent less; and these dividends represented the earnings of the more fortunate concerns – some might say the more ruthless toward their employees – while American business as a whole was running at a net loss of over five billion dollars.”

We are also on the verge of this. Jobs are being lost. When people look for new work it is very likely their new pay is much lower than their previous job. Think of a real estate agent now looking for work elsewhere. Or a financial worker now out searching for work. The data may not reflect a reduction in their current field but they are now being paid a lot less. Governments are going to be in for a rude awakening come 2009 when they realize how pathetic 2008 is.

California is calling a special session because an expected $3 billion short fall is now looking like a $10 billion short fall. Whoops! When have we heard this story?

“2. The Great Depression was part of a world-wide collapse: what Karl Polanyi has aptly characterized as the collapse of the market economy that had been established during the nineteenth century.”

Decoupling is a myth. September and October have proven that. The Nikkei hit a 26 year low. The Hang Seng has fallen off a cliff. U.S. markets are down nearly 40%. Iceland is essentially done with their market being down almost 80%. Russia? They halted trading on multiple occasions. Latin America is quickly catching the U.S. Europe? Turns out they have a bubble even bigger than our own in certain areas! This is also a global collapse just like then.

“3. It marked millions of people – inwardly – for the rest of their lives. Not only because they or their friends lost jobs, saw careers broken, had to change their whole way of living, were gnawed at by a constant lurking fear of worse things yet, and in all too many cases actually went hungry; but because what was happening to them seemed without rhyme or reason.

Even if they tried to hide their dismay, their children sensed it and were marked by it. The editors of Fortune wrote in 1936: “The present-day college generation is fatalistic…it will not stick its neck out. It keeps its pants buttoned, its chin up, and its mouth shut. If we take the mean average to be the truth, it is a cautious, subdued, unadventurous generation…” As time went on there was a continuing disposition among Americans old and young to look with a cynical eye upon the old Horatio Alger formula for success; to be dubious about taking chances for ambition’s sake; to look with a favorable eye upon a safe if unadventurous job, social insurance plans, pension plans. They had learned from bitter experience to crave security.”

This certainly is the crisis that will mark my generation. Forever I will hold a critical eye to Wall Street. No longer will I view banks as completely safe investments. I am positive that many have this feeling. Things in the past decade have gotten so out of control. It is interesting to note that looking at college occupation fields like accounting and nursing are getting strong interest because of the safety inherent in those fields. It is also the case that companies are still hiring in these fields. I read an article talking about business schools and how students are retooling away from that brass ring at a coveted i-Bank. What i-Bank are you going to work at? Forever this generation will remember this economic collapse. Remember that the peak of unemployment during the Great Depression came 3 years after the crash.

“4. The Great Depression brought the abdication of Wall Street from the commanding position which it had achieved in the late nineteenth century, had consolidated under the personal leadership of Pierpont Morgan, and had institutionalized since his death in 1913. Not only had the big bankers of 1929 failed to stop the Panic, but as time went on the inability of financiers generally to cope with the down trend, their loss of confidence in their own economic convictions, and the downfall of the banking system itself all advertised helplessness.”

Once again we are going to see a shift of power to Washington D.C. This election demonstrates that that majority of the population wants and is open to:

(a)Â Government intervention in healthcare

(b)Â Tax cuts for 90+% of the U.S. population and tax hikes for those at higher brackets

(c)Â Regulation of Wall Street (done by the government)

(d)Â Energy programs with intervention by the government

So once again the throne of power will slowly shift from Wall Street to D.C. Make no mistake that the crony capitalistic model is not going to relinquish power easily.

“5. The Depression sharply lowered the prestige of businessmen. The worst sufferers were the bankers and brokers, who found themselves translated from objects of veneration into objects of public derision and distrust – the distrust being sharply increased by the evidences of financial skullduggery which came out in successive congressional investigations. But even business executives in general sank in the public regard to a point from which it would take them a long time to recover; and it this decline the conscientious and public-spirited suffered along with the predatory.”

Let us do a mental Rorschach test. When I say real estate agent, what comes to mind? When I say mortgage broker, what do you see? Countrywide, IndyMac, and Bear Stearns. Wall Street. Investment bankers. What comes to mind? This is the fall from grace for the finance industry. For an entire generation many Americans will not revere this field. Regulations which are coming down the pipeline will destroy any major profits. People will do well but not like they once did. The prestige is gone for a very long time. And just wait until the echoes of the crash spread even deeper into America. This will be no minor recession. This is the real deal here.

“6. Yet the world-wide Depression – though it brought Hitler to power in Germany, and in many other lands seemed to have sounded the death knell of capitalism – brought to the United States nothing approaching a revolution. It brought an epidemic of proposals for economic panaceas – the cult of technocracy, Upton Sinclair’s EPIC, the Townsend Old Age Revolving Pensions Plan, and suchlike; it brought the dictatorlike Huey Long to brief regional power; it brought riots at farmers’ bankruptcy sales, a Communist-led “march” on Washington, and the briefly ominous Bonus Army march of 1932.”Â

This isn’t the end of capitalism. We’ve never been in a full capitalistic system anyways. Look at Social Security, Medicare, education, defense spending, and other areas where the government is involved. We’ve been operating under a quasi-free market system. Yet for the past decade we have left the finance industry run amok and put the entire global system at peril. Now, we are left bailing them out but this bailout comes with many strings attached. Government regulation is going to put some much needed breaks. Just remember this a few years down the road when things start to slowly get better and you start hearing the neo-cronies asking for deregulation. It took 66 years for the Glass-Steagall Act of 1933 to be repealed. We have yet to implement our own and new version of this. I want to leave you with a paragraph talking about Teddy Roosevelt and FDR:

“The long-standing political coolness between the Oyster Bay Roosevelts and the Hyde Park Roosevelts should not blind us to the striking parallels between the approach to public affairs of Franklin Delano Roosevelt and of his wife’s uncle Theodore Roosevelt. Both men had wealth. Both championed the underdog out of conviction, though they were upperdogs themselves. Both were men of abounding energy and captivating charm, though Theodore’s was the more rugged, Franklin’s the more gracious. Both were exuberantly interested in people, people of all sorts and conditions. Neither had a systemic economic philosophy; both, in devising their policies and programs, played by ear; and both though of economic problems as essentially moral problems. Each, in his own time, was curiously fitted to bring change without the ideology or the violence of revolution.”

Economically speaking, we really have to come together because if history is any indication, this is going to be a brutal down turn. One thing is certain and that is doing things via the status quo is no longer a choice. The employment numbers coming out on Friday are going to be stunning and not in a supermodel kind of way either.

We are now going to be forced to put practice into theory. Ben Bernanke a true monetarist from the Friedman school of thought has had a chance to test his Great Depression knowledge. Unfortunately he missed the one aspect of the Great Depression that it was global and we only have control over one aspect of the system. The only way a vision he desires will come to is if the entire global community united under one solid front. That is not going to happen. This is going to be a very challenging road ahead. Whatever does happen, a big change is going to occur.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

20 Responses to “The Big Change: Lessons from the Great Depression: Part XXI. Challenging Wall Street, Restoring Economic Confidence, and Dealing with the Biggest Financial Challenge since the Great Depression.”

Doc, great article but you need to lay off the Obama-Juice because it’s clearly interfering with your critical thinking skills. You said that 90% of people Obama’s tax plan will be better off because they make less than $118,000 a year. In the same article you also say that our economy is going down the tubes. You say that when people are laid off and look for new work they usually are paid less money (i.e. realtors, MB’s and IB). You also said that the big profits from the financial industry will disappear and (athough you didn’t say it) there will probably be caps on CEO pay.

Well the DOC, if a large portion of the high paying jobs disappear who will be left to tax? Well, its pretty clear that Obama will keep moving farther and farther down the income scale.

The thing you’re not seeing is that Obama is the ultimate bread and circus president. He’s told that he’ll give healthcare to the 47 million uninsured, he’ll give tax credits to the working poor, he’ll give larger welfare benefits to the needy, and on and on. We all know that he’s giving away free stuff as pandering for votes. He’ll take it from the ‘rich’ people. And guess what, his plan worked. As long as he can take from someone else who is perceived to have more and give it to someone who has less, he’ll always get their vote. That’s why he’s in office. Redistributing wealth that you and I earn and giving it to the high school drop out Wal-Mart employee isn’t going to help anybody but Obama because he’ll get another (D) vote.

And finally, you keep repeating that trickle down economics doesn’t work. Ok, last time I checked poor people don’t create jobs and poor people don’t start new businesses.

Let’s count exactly now many new businesses the recipients of Obama’s redistributions create. Lets see if they take their extra $5k a year and invest in the future….or if they use the money to upgrade their cell phone plan … I work in a law firm and my bosses are gonig to get whacked under the new tax plans. Let’s see how many new employees they hire next year. My guess is Zero. Obama is redistributing the new employee’s money to the parking lot attendant.

Doctor,

Do you think that our currency is in danger of collapse? Peter Schiff says that the dollar is so debased at this point that it is going to fall, and that we will be facing hyperinflation.

What say you?

Holy smokes! Once again doc you articulate so well what I’ve been predicting for many years. This is the most serious article you have presented ever, you know how I conclude that? Only ONE wise-crack in the entire thing!!

When comparing salary inequalites, keep in mind that the chart is a static slice of the economy at a moment in time. Over one’s life, most wage earners start in the 1st or 2nd quintile and rise to the 4th or 5th quintile, dropping back down 1 or 2 quintiles at retirement. Examining wage data of individuals over time presents a different perspective than the static slice approach. Still, I do not dispute the out of whack and inappropriate salaries of CEOs and financial wizards (who turned out to be fairly stupid actually). Companies argue that it costs a lot to hire “talent” but then they mostly hire idiotic self serving managers who destroy their own firms.

“we all know that he’s giving away free stuff as pandering for votes. He’ll take it from the ‘rich’ people. And guess what, his plan worked. As long as he can take from someone else who is perceived to have more and give it to someone who has less, he’ll always get their vote.”

yea, it’s all about these voters. It has nothing to do with the fact that the Rs ran a doddering old man who might die in office and a complete incompetent as vice president to take over if he does. Or that 8 years of them have trashed this country in every possible way. You think those massive Bush deficits won’t require higher taxes someday? So yea you can have a healthcare plan and lower taxes but taxes will have to go up eventually for it, you can’t defer that baby indefinitely. Doesn’t mean Obama is not the better choice.

As for Schiff, he may be right eventually, the problem is you could go broke in the meantime listening to him (foreign stocks – ack!), listen to him and you’d have lost 25-50% of your portfolio. The market can stay irrational longer than you can stay solvent. But for the extreme long run maybe.

TO: whowhatwhenwherewhy – That trickle you keep hoping for is just the wealthy pissing on the rest of us. We need a new-new deal! Doc is right, we’ve not been purely capitalistic and effective regulation with progressive taxation is where we are headed. THAT IS THE REALITY. Is it good or bad? How about examining these examples: Western Europe (high taxes, regulation of corporations, national health/welfare and democracy) or Russia-China-Mexico (Oligarchy with massive pollution & poverty for the average person). The choice is ours: which direction do we choose? Obama’s election makes it pretty clear that the VAST majority of Americans choose a version closer to European values than the alternative!

Doc,

I appreciate your educated insight on the housing crisis, but it doesn’t exaclty take a genius to see how these corruptocrats worked. Rahm Emanuel, president elect Obama’s new chief of staff is a former Freddi Mac employee. Can you say more of the same? Nothing will change in Washington or on wall street until we start holding our politicians responsible and make room for them in prison. Instead we elect the best liars and for personal gain we look the other way as they commit crimes that would send you or me to prison. If you have money in the market you should have removed it when President Bush used a scare mongering tactic to pass the bailout bill and crash our dollar. Will the dollar colapse? That doesn’t take a genius either. Remember these are men who are surrounded by the best educated the world has to offer. They aren’t stupid. Incedible evil and corrupt, but not stupid. The dollar has to inflate to maintain our huge debt. If it crashes it will be replaced. I believe they already have a plan. If you loved what NAFTA (supported by McLame, Obama, Bush, Emanuel and all are other elected crooks) you will love the new ameropeso.

Doc — AWESOME article. Is there any chance you could do a post on the Laffer curve and whether it’s something that could be affected by increased taxes on the wealthy. I saw Dr. Laffer on some news show this week giving a doomsday take on higher taxes with Obama.

I was also wondering if you have ever done an overlay of income levels and taxes paid (including the big buckets like: fed and state income, social security, sales, property). It would be very interesting to see these data in a format similar to your household income breakdown above.

Fascinating stuff!

Ben

Re whowhatwhenwherewhy:

Poor people may not start businesses, but they do spend money at businesses, which helps the economy. Right now everyone’s too scared to invest, so if you give money to businesses it will just sit in T-bills — it won’t trickle anywhere.

Obama will change nothing and his election was easily predictable, already the Treasury secretary is slated to be a member of the FED. The rich voted with thier money Wednesday and will simply go sit on the beach and find new taxshelters. The US will be forced to default on it’s debt before Obama leaves office.

DOW down 1,000 points in 2 days? So now you know how the business feels about an Obama presidency….

Rahm Emmanuel as chief of staff? He’s my congressman and he’s an ass*ole. Change? ahahahaha! Rahm worked in the white house for the clintons. SOunds like more of the same to me. hahahah! sounds like you obamabots were sold a lemon….and an expensive one too. how long before you have buyer’s remorse?

Another thing you guys forget to mention is that america’s debt is only 50% of GDP. Japan is currently at 100%. After WWII the US was at over 100%. The most debt an EU country can have is 120% of GDP. Italy squeeks by every year! There’s no way we’ll default on our debt. We’ll just turn into Europe and die a slow death. You know, perpertually high unemployment, it will be difficult to find a job because no one wants to hire an employee for life. We’ll have socialized medicine but it will be slow and mediocre at best (have you ever been to a hospital in Europe with socialized medicine?? I have!! IT SUCKS! My family visited europe died there because the care is subpar at best!) Be careful what you wish for because you might actually get it.

I’m only 30 but I look around at the rest of the youthful obamabots and it scares the hell out of me. They’re the laziest son’sabitches the world has ever seen. They’ve never fought a war, half of them still live at home with their parents, they graduate from lame state colleges and they have little work ethic. like my fricken lazy ass 23 year old paralegal. works no more than 35 hours a week, plays in a band, lives in his parent’s basement… they think europe is hip and cool (but don’t look in the suburbs where the disaffected poverty ridden outsiders live). Of course they want socialized medicine and mo’ free stuff from the gov. Anyone who has more than they do is considered ‘rich’ and is a target for redistribution. Obama sold them a bill of goods hook,line and sinker. God help America.

Respectfully, whowhatwhenwherewhy, your ungrammatical anecdotes and superficial knowledge of the diverse and complex continent of Europe do not mark you out as someone with insight.

Doc, I’ve been a loyal reader for 1.5 years, and by far, this is the best entry you have done. The comparisons to the past are always spot on, and they prove the George Santayana quote: “those who forget history are doomed to repeat it.”

Doc,

“Bar Stool Economics”

Suppose that every day, ten men go out for beer and the bill for all ten comes to $100. If they paid their bill the way we pay our taxes, it would go something like this:

The first four men (the poorest) would pay nothing.

The fifth would pay $1.

The sixth would pay $3.

The seventh would pay $7.

The eighth would pay $12.

The ninth would pay $18.

The tenth man (the richest) would pay $59.

So, that’s what they decided to do. The ten men drank in the bar every day and seemed quite happy with the arrangement, until one day, the owner threw them a curve. ‘Since you are all such good customers, he said, ‘I’m going to reduce the cost of your daily beer by $20. Drinks for the ten now cost just $80.

The group still wanted to pay their bill the way we pay our taxes so the first four men were unaffected. They would still drink for free. What happens to the other six men – the paying customers? How could they divide the $20 windfall so that everyone would get his ‘fair share?’ They realized that $20 divided by six is $3.33. But if they subtracted that from everybody’s share, then the fifth man and the sixth man would each end up being paid to drink his beer. So, the bar owner suggested that it would be fair to reduce each man’s bill by roughly the same amount, and he proceeded to work out the amounts each should pay.

And so:

The fifth man, like the first four, now paid nothing (100% savings).

The sixth now paid $2 instead of $3 (33% savings).

The seventh now pay $5 instead of $7 (28% savings).

The eighth now paid $9 instead of $12 (25% savings).

The ninth now paid $14 instead of $18 (22% savings).

The tenth now paid $49 instead of $59 (16% savings).

Each of the six was better off than before. And the first four continued to drink for free. But once outside the restaurant, the men began to compare their savings.

‘I only got a dollar out of the $20,’ declared the sixth man. He pointed to the tenth man, ‘But he got $10!’

‘Yeah, that’s right,’ exclaimed the fifth man. ‘I only saved a dollar, too. It’s unfair that he got ten times more than I!’

‘That’s true!!’ shouted the seventh man. ‘Why should he get $10 back when I got only two? The wealthy get all the breaks!’

‘Wait a minute,’ yelled the first four men in unison. ‘We didn’t get anything at all. The system exploits the poor!’

The nine men surrounded the tenth and beat him up.

The next night the tenth man didn’t show up for drinks, so the nine sat down and had beers without him. But when it came time to pay the bill, they discovered something important.

They didn’t have enough money between all of them for even half of the bill!

And that, boys and girls, journalists and college professors, is how our tax system works. The people who pay the highest taxes get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up anymore. In fact, they might start drinking overseas where the atmosphere is somewhat friendlier.

///////////////////

P.S. It would be a good idea to pass this around. And have a little section where your visitors can be educated about how the real economy works. 🙂

@ john and his beer economics: don’t forget that the tenth man owns the bar, so if the other nine men don’t come to drink, he makes ZERO. Why do those at the top pay the most taxes, because they own the MOST!!! and don’t go to the “because they are smarter” because we all know where that argument can go.

@ John’s tired tale: Tell #10 not to let the door hit him on the ass on the way out. Most other ‘overseas’ countries where the taxes are lower than the US don’t have the basic infrastructure to give the rich saftey or opportunity to make their riches in the first place. Ironically it’s the 7th, 8th and 9th (middle class) that end up screwed the most in the transaction as #10’s money is taxed at lower cap gains rates, wrapped up in land/property, or sheltered from taxes in one of the many ways those with access to tax lawyers can do.

I’m also tired of the old canard that people on the low end of the income scale “don’t pay taxes.” They don’t pay *federal income tax*, but they do pay social security payroll taxes, state and local sales taxes, and often state income taxes.

Unbelievable. People actually believe in this benevolent government concept? How “hard working”, “self sacrificing”, “all knowing” and altruistic government officials ride in and save the day…I have news and it aint good my friends and foes. People who want more government are going to get more and THEN they’ll realize the true purpose of government which is to smash and destroy. How petty,power obsessed,corrupt, unintelligent, unaccountable and deniable government can be. Get ready for many “riddles wrapped in enigmas” as far as assessing the blame, “not my fault” is going to be the newest government agency . Get ready for civill,class,racial, theological and gender warfare as political opportunists pit one faction against the other “lookin for the bad guy”.

The systems organisation is whats the problem. Fiat money plus fractional reserve banking equals credit bubble and credit bust with major misallocations needing to be reallocated via deflation.

Its hard to believe, but the market is TRYING to work and correct the mistakes that “cheap money” and prolific credit creation. The problem is very uncomfortable, because EVERYONE OF US has been engaged in UNPRODUCTIVE or marginally productive true wealth creation based on this damn PHONY economy. Now DEAL WITH IT PEOPLE!! Don’t be so willing to completely forgoe your hard faught freedoms for this “pie in the sky” promises made by a “Kennedyescke” pied piper, if you believe in anybody believe in yourselves and you ability to survive this on your own. Re-establish mutual aid societies, church organisations, local neighborhood get togethers and “barn raising” concepts. Figure out how to take responsibilty on a local level for your friends/family,neighborhood,city,county,state and if your still so inclined federal obligations ( which should be the LEAST of your efforts.)

Its gut check time folks, and we’re staring into the abyss from the abyss. If you don’t back responsible freedom, that is freedom to make a decision AND most importantly at this point to TAKE RESPONSIBILITY for that decision all is lost.

Let these damn banks fail FOR CHRIST SAKES!! Let the automakers fail, let the airlines fail, let the state governments fail, let the insurance companies fail. Out of these ashes that were justifiably made will arise a new structure built on FREEDOM and RESPONSIBILITY. Right now every day capital and credit are being destroyed by these misallocations that continue fester and put off the inevitable.

Get back to sound money and full reserve banking. Limit government spending on EVERYTHING except locall militia defense and soup kitchens (tongue in cheek statement, but not totatlly). Take risks with deregulations of industries to fuel experimentation. Let privately funded “popular mechanic” concepts have free rein to innovate and creat a real expansion. Stop coaching all are kids to be company workers instead of entreprenuers. To be lawyers instead of inventors. Civil servants instead of mavericks. We need more Thomas Edisons and less Barack Obamas. More Henry Fords and less Henry Paulsons.

It took us a little less than 3 generations to burn through all the real wealth creation that our forefathers built for us. We need to make sure we set the bedrock of a new economic expansion based on freedom,sound money,non-interverntion in foreign affairs, full reserve banking, market rate interest rates, drastically pared back government and unfortunately everything that is being proposed to be done.

In short. Take away the governments ability to regulate and you stick a stake in the heart of chrony capitalism. Trust yourselves with freedom and be prepared to take the heat for failure. The road ahead is going to be very rough, but the eventual outcome will be either annihilation of our species or unleashed human potential,which path we take will determine our fate as an ongoing concern.

That pretty much shut everyone up. Excellent post.

Leave a Reply to Robin Thomas