The All Hat and No Cattle Nation: Lessons from the Great Depression Part XVII: When Economic Times Cause and Economic Tipping Point.

“Americans, while occasionally willing to be serfs, have always been obstinate about being peasantry.”

– F. Scott Fitzgerald, The Great Gatsby

The Great Gatsby was published in 1925 and chronicles the Jazz Age and captures some of the excess of the roaring 20s. F. Scott Fitzgerald wrote the novel during a time in which there was booming economic prosperity and to a certain extent the novel idolizes riches and glamour yet throughout the book there is a slight discomfort of the unchecked materialism. Even though it is now largely read by most Americans, this book was not popular during its initial publication or subsequent years. A few years later, the Great Depression took hold and many of the themes in the novel simply did not apply to the large majority of Americans. To talk about unrestrained prosperity during the 1930s was absurd. After the Great Depression America had its mind preoccupied with World War II. Only after these major events did this novel garner any large readership.

The idea of the nouveau riche is something that has always been a part of the American spirit. Horatio Alger captured this by his popular rags to riches stories during the 19th century. So this current era of economic boom is nothing new. One of my real estate mentors once told me that, “you Californians have all hat and no cattle. Everyone goes around pretending to own things with money they don’t make.” This was a few years ago and those words ring loud and clear in what is going on today in our current economic collapse.

The idea of “ownership” has morphed in the last few decades. Owning something became more about appearances rather than actually having complete possession of material objects. There is one thing that highlights this point to perfection. The auto lease. Chrysler recently announced that through its financing arm that they will not be offering any additional leases:

“(WSJ) A week ago Chrysler LLC announced its financial arm would stop offering leases on new cars and trucks, effective Friday. For some dealers, the move has sparked a boomlet.

“It has been a frenzy,” said Paul Steel, who runs three dealerships in Michigan, including Southfield Chrysler Jeep outside Detroit. “Everyone is trying to get in now on a three-year lease hoping that Chrysler Financial will get back in the game by the time their lease is done.” Mr. Steel has kept his dealerships open until midnight every night since Monday, and he expects his staff will be working until at least 2 a.m. Friday to process all the orders.”

A friend of mine told me that leasing is a way of “hiding the cheese” of those that actually make a good sum of money. With the current unforeseen spike in fuel prices the large truck market has come to a screeching halt. Many dealers such as Chrysler, Ford, and GM are getting hammered by people bringing back their trucks from short leases and are finding no market for trucks. In addition, the value of each leased truck that is brought back is costing them a sizable amount since it has depreciated significantly due to market conditions. Housing isn’t the only thing that is crashing. With many of these dealers cutting back, we will start seeing who really has the “cheese” and wealth.

This is part XVII in our Great Depression series:

12. Is the DOW now Tracking with the California Housing Market?

14. Bank Failures.

16. Items That Sold in the Credit Bubble.

This phenomena isn’t only a California issue. The entire automotive industry relied on this easy credit decade and played into the “all hat and no cattle” sociological trend. The majority of people thought that by simply leasing a car too expensive for them to own that they somehow were wealthy. What really was unfolding is the same thing as those that purchased homes with Pay Option ARM mortgages and had an artificially low rate. The entire economy was built on people pretending that they actually owned artifacts of the wealthy when the reality of the situation was that their balance sheets were on the verge of becoming insolvent.

I’ve tried to understand the psychology of this and think that as a society, certain constraints were removed that allowed this excess to flow. First, the idea of financial prudence was completely removed. The “greed is good” mentality flowed unchecked. After all, why do an honest hard day of work when you can get a $10,000 commission check for putting someone in a toxic mortgage? Why would hedge funds on Wall Street want to invest in sustainable slow growth companies that add value when they can invest in CDOs and MBS that were yielding rates twice or even three times as much? Instant gratification. There was really no point in looking ten steps ahead when all the wealth was at your door knocking right now.

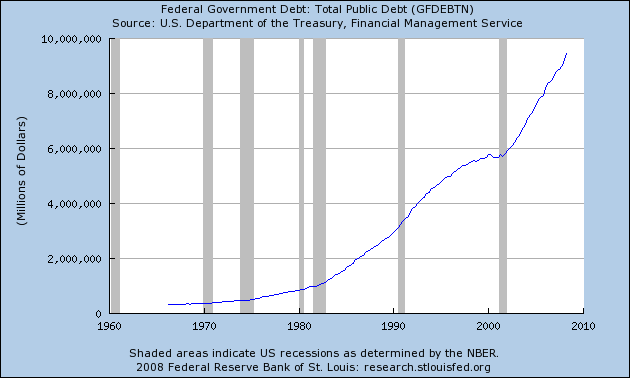

The media fed right into this. It took two to tango. The majority of those in society now labeled as “consumers” were fed by their opposite side the “producers” and all was well. People wanted homes, we will build homes. People wanted huge gas guzzlers, we will build huge gas guzzlers. People want easy credit, we will give them easy credit. The unchecked consumption is what we are now dealing with. That is the problem. All the solutions being thrown around somehow still have nostalgia for going back to this lifestyle. We can’t even if we wanted to because we have reached the tipping point of maximum debt. Take a look at our nation’s debt:

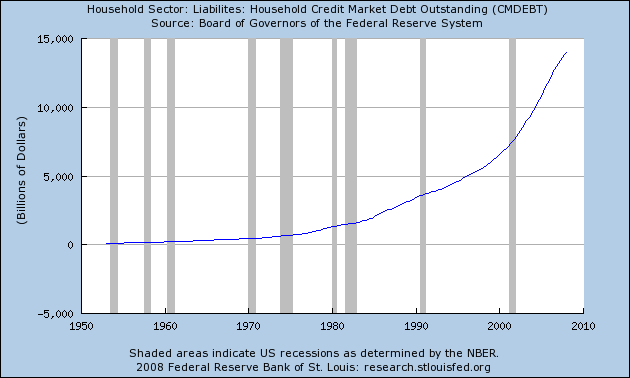

With the backstop to Fannie Mae and Freddie Mac we have virtually guaranteed that the total Federal debt will surpass $10 trillion in the next few months. As distressing as the above figure is, the American consumer has outdone the actual Federal government. Take a look at household debt and liabilities:

The American consumer is on the hook for $13.1 trillion in obligations. This is for mortgage, auto, and consumer debt. The majority of that debt is with mortgages. Now the thing that is occurring is that the underlying assets like McMansions with uranium countertops and civilian tanks with spinning chrome rims are actually losing value as we speak. The debt itself is still valued at the peak price. Welcome to wealth destruction. This is actually deflationary since each foreclosure and each leased truck being dropped off at the dealer is forcing someone to take a loss. The higher prices with fuel and groceries is simply a reflection of our declining dollar.

Given that a large number of people never could really afford a $60,000 SUV or a $600,000 home, prices simply by the law of economics are going to have to come down. They already are. This is how the free market should work. These items are now being valued at their true market rates and not under the decade long Ponzi scheme where the new economic paradigm was, “trade up because it will always go up in value.” Even with the new FHA guidelines people are now going to have to show their actual income and not their brokers made up $250,000 income from working at Target. Those with the cheese, that is good credit and incomes to match, will be able to buy assets at vastly discounted prices. The only reality is this group isn’t as large as many of these companies would like to believe.

Think this isn’t the case? Here are a few examples of people looking to protect their hats:

“(Slate) Along with free trade and the SUV, another ’90s-era icon that seems to be dying is “casual dining.” The Bennigan’s and Steak and Ale chains closed down and will file for Chapter 7 bankruptcy, “the latest casualties in the so-called casual dining sector, considered a cut above fast food,” as the NYT puts it. Technically, only the 150 or so corporate-owned branches-not the roughly equal number of franchisees-are immediately affected, “but the franchisees now find themselves owning a brand with no corporate cousins,” as the Dallas Morning News points out.”

Think Bennigan’s is the only one feeling the pinch? How about a local popular chain P.F. Chang’s:

Over the last 5 years, the company is now down by 45%. I’ve noticed this a couple times during lunch meetings and the foot traffic is demonstrably slower. Or what about the ultimate resilient Starbucks? Everyone needs their latte right?

People are cutting back drastically because they have no other choice. If anything, they are simply trying to realign their balance sheets and now that credit is much more restrictive, it is becoming rather apparent that their spending was all hat. It is time to seek out the cattle if there is any left. Yet it isn’t all bad news. Too early to call a trend but some retailers are actually looking at Great Depression fashion:

“(NY Post) The duds say it all – and it’s depressing.

Taking a cue from the grim economy, this fall’s fashions at Banana Republic, Gap and H&M are featuring a distinctly Depression-era trend of cloche hats, pencil skirts, conductor caps and baggy, vintage-style dresses.

One of the most popular styles appears to hark back to the impish, newsboy getup of the 1930s: baggy trousers, caps, pinstriped vests, oxford lace-up shoes and utilitarian handbags.

“We associate the newsboy look with urban poverty – street kids of the 1930s,” said Daniel James Cole, a professor at the Fashion Institute of Technology.

“Given that we’re in an unstable economy and an uncertain political landscape, it’s possible that a retro style has come back as a way to connect with our heritage.”

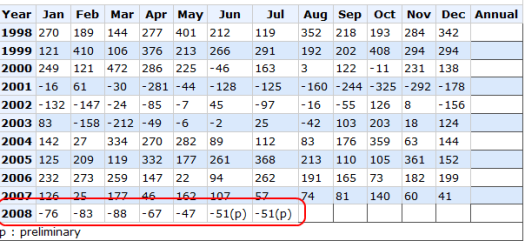

Connect with our heritage? How about connecting with reality. Amazing that all this talk about recession and depression is happening during a stable time according to some politicians. We’ve lost jobs for 7 months in a row:

That is the reality of the situation. What we are learning is much of the cattle that we had was on a short-term lease and now we need to pony up if we want to continue that lifestyle. Hard to continue funding conspicuous consumption when jobs are being lost.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “The All Hat and No Cattle Nation: Lessons from the Great Depression Part XVII: When Economic Times Cause and Economic Tipping Point.”

There was a saying in Orange County that I learned in the 90’s – it’s the land of all flash and no cash. Also – the Thirtythousandaire – you know the guy, driving a Brabus with the numbers removed, tinted windows and bling rims, and what appears to be the leftover grease from his last oil change glistening in his hair.

Unfortunately the response will likely be bad regulation, not good regulation. The housing bill is a debacle, window dressing really, without substantive attention given to addressing the root causes of the bubble- that is, constraining the wall street ba$tards / friends of Hank.

Back when I was a loan officer, I’d counsel prospective first time homebuyers, ask them their budget. Few had done one. I’d always comment on the $2,100 cup of coffee and invariably get a blank look. 2 grande latte’s a day makes 7 bucks times 300 days a year. “Give up my coffee?” They’d ask, incredulous.

No, buy a coffee maker and grind your own. This concept was incomprehensible – adjusting their spending to afford a house. After all – everything was possible! And so Countrywide would get the loan after some scum LO just took numbers and pushed them down the mineshaft. Oh well…

I think I will eat out tonight,

I have a buy one get one free coupon.

The poverty chic offerings of Banana Republic and the Gap are wonderfully ironic: the loss of discretionary income and credit is real, so who do they think will be out buying these new ‘old’ wardrobes?

You’ve heard of dressing for success? No more. The new trend is to dress for depression. “One of the most popular styles appears to hark back to the impish, newsboy getup of the 1930s: baggy trousers, caps, pinstriped vests, oxford lace-up shoes and utilitarian handbags.

“We associate the newsboy look with urban poverty – street kids of the 1930s,†said Daniel James Cole, a professor at the Fashion Institute of Technology.”

Yeah, like I’m gonna rush over to the Gap with my extra cash and buy their cheap flimsy overpriced trash.

One of my all time favorite films is “The Visit” starring Ingrid Bergman and Anthony Quinn. Unfortunately it is not available on DVD. But it should be required viewing. A great cautionary tale about the destructiveness of easy credit.

Come to think of it…maybe that’s why it’s not available on DVD?

Another great article Dr. HB. Keep up the good work!

PF Changs was a little pricey for what you got anyway.

Poverty chic, indeed. Forget about Banana Republic… the place to shop now is Crossroads Trading Co, a nationwide chain of used clothing boutiques, where you can buy, sell, and trade.

The Berkeley, CA company has outlets in Chicago’s trendy Lincoln Park and Wicker Park; and Evanston, IL ; as well as in distinctly untrendy places like Stockton CA. There are 23 stores so far in CA and IL.

I’m hitting the resale and consignment outlets for the barely-used discards of compulsive shoppers to replace stuff that is worn out, and many new used clothing stores are popping up allover the place, while the major chains languish.

I suggest all the women who used their HELOC money to buy shoe wardrobes that would make Imelda Marcos envious, take their stuff over to Crossroads and make a deal. Maybe they can raise enough cash for a parking pad for their RVs they are now living in.

Good stuff.

“The debt itself is still valued at the peak price.”

When I saw this line I thought I’d send you a present.

http://www.professorfekete.com/articles%5CAEFIsOurAccountingSystemFlawed.pdf

I’m actually looking forward to getting rid of my S class M.B., Lexus, kids back to Public school and buying a used Honda Civic. If it brings the family closer together I’m all for it.

Great post Dr. Some of the comments are good too.

I have this strange feeling that we have not seen the worst of it yet. I am thinking we get a miserable Christmas followed by heavy job losses and then real estate enters capitulation hell in early 2009.

Not sure what that housing bill will do, but I know what the fed did by lowering interest rates – made the housing market worse by causing inflation in everything else.

I never understood why people needed to include “clothes” into a

monthly budget… How do you manage to spend money on new

clothes every month? What… can’t wash what you have?

Since I don’t care for “what’s in” or “what’s out” in fashion I guess

I don’t mind wearing my jeans for more than a month.

Who am I kidding – I don’t mind wearing them until they fall apart..

I feel for Starbucks employees… I have got one right next to my

business. We don’t compete with each other although I do sell coffee.

What I sell is a honest cup of Joe and we haven’t increased prices on

coffee in ages… (it’s still just 1.49 for the 24 oz. cup). Of course it’s just

plain coffee not fresh ground arabica beans but then again this is why

we don’t compete – my customers are the locals and their customers

are the rich tourists? Don’t know… don’t care.

No, they aren’t closing the Starbucks next door, probably because

there is only one in town. But I get the question at least once a day…

I need a new car and have decided to wait until’ this December to buy. Dealers are desperate now and I can’t imagine what it will be like during the slowest season of the year. I also stopped by a Dillard’s to pick up a polo shirt since they were having an additional 40% of 50% sale and there were four sizes (never tried on) of the shirt I wanted. Guess it doesn’t matter how cheap something is if you don’t have any cash or credit.

If its so bad why is obesity a sign of poverty?

Those of us who saved, rented rather than bought, and didn’t buy boats, can now enjoy life rather nicely. I have a brand-new Corvette, can easily pay for the gas, dine out on Miami Beach, and can afford all the new clothes I want. Why, because I never bought into the “logic” of purchasing a condo for $3k a month that I could rent for $1350. The assessment for my unit is nearly $700. Let someone else pay for it while I enjoy my dinners and new car! Dr. HB was always correct, along with Dean Baker, Robert Shiller and Nouriel Roubini. The

“nays” finally have it. We got the last laugh. We were right all along. Now we watch as Rome burns. And eat our lobster.

After the embers subside, we can take our modest savings and purchase $500k Miami Beach condos for under $200k. And still get the best loans because our credit scores are intact. Those who listened to Dr. HB will enjoy the next few years immensely, those who did not will wish they did and suffer like Job these next few years. It will be very ugly out there according to Nouriel.

But, back to the lobster.

Manny

Andy,

Let me explane, when poverty hits the first thing to go are foods that are high in nutrition & low in fat. Fruits, vegies & fruit juices are often substituted for fast food, sodas,cookies & chips because they are cheeper by the unit. These prosses foods are loted with corn sweetner, wich MAY lead to weight gane.

If you read the labels on packaging look for “HIGH FROOKTOSE CORN SIRUP”, most packaged foods have it, very few people know it is even there. I herd on radio that HFCS is a byproduct of ethanol production & is not a natural substance. When the ethanol makers had to get rid of this stuff, the food companies used it because it was cheeper than sucrose. Now 25 years later the nation is overwelmed with health issues, namely do to eccessive weight gane from junk food.

There is a book that explanes this better than I can, called “Fast Food Nation.” You can also see the movie “Supersise Me” as well.

Isn’t most of this caused by our “instant news” and craving for the bad news? I recently heard two economist speak on this. Here’s a link to their speech

notes.

http://www.capitallistings.com/focus-bad-news-creates-problems-markets

Those newsboy caps and baggy dresses were everywhere last fall. This year: gone. No one is wearing those things now. That commentator, those stores, and that article are behind the fashion times, if not the economic times.

Lately it’s a return to the early eighties. Wish the newsboy look had had legs, because I am not dressing like Flashdance. I live in the east village, so what you see on the streets here turns up on the runways a year later, and in the stores mentioned after that.

Maybe fashion indicates a rally?

Andy — you are right. Worldwide, poverty and emaciation go together. In the US it’s poverty and obesity.

And whoever blames it on high fructose corn syrup is wrong. High fructose corn syrup is in virtually everything that Americans eat. Check the labels at the supermarket — it’s as ubiquitous now as transfats were until recently.

Therefore, not only the ‘poor’ are consuming it. So, it is not the cause of the obesity epedemic that is mainly among the poor.

Additionally — fast food per meal has roughly the same calories as the average entree at a restaurant. Orange Peel chicken at P.F. Chang’s is a little higher in calories than a Big Mac and fries. So those paying more to eat out are not eating less and quite likely are not eating any more vegetables.

My personal opinion is that obesity among the poor is linked to depression. Food is a drug. Eating triggers all sorts of physical reactions that affect brain chemistry. Overeating and drinking are a form of self-medicating.

And remember — getting fat is not possible without consuming more calories than you burn. The poor don’t get fat because they’re poor or because they eat at Taco Bell. They get fat because they eat more calories than they use.

Leave a Reply