Bank Failure: IndyMac Bank. Lessons from the Great Depression Part XIV. Bank Failures.

Bank failures are not common occurrences. And seeing a large group of people lined up at 7:30AM in a prime Southern California location with distraught faces ready to withdraw their money from the now taken over IndyMac Bank was even more surreal. The idea of a large brick and mortar institution not keeping your money safe is enough to unnerve the strongest of us. Bank failures may seem like part of a distant past associated with the Great Depression or the S & L crisis but certainly not to our current era.

Since 2000, the FDIC has recorded 32 bank failures. I have compiled this list from FDIC data and have also added a column to show the amount of assets taken over. What you’ll find is digging into the data for yourself is much more telling than listening to the media:

So what is the big deal with IndyMac Bank? Take a look at this sobering fact:

IndyMac Bank Total Assets: $32 billion

All Other 31 Combined Bank Failures since 2000: $8.97 billion

Basically IndyMac Bank had about 4 times the amount of assets as all the other 31 bank failures of this decade combined. This is an important contrast since I’ve been seeing the media currently say things such as:

“We won’t have as many bank failures as the past…”

“Only 5 banks have failed this year…”

“We only have 90 banks on our troubled list…”

As you can see from the above, depending on which banks are on the list and their size, having a handful of bank failures the size of IndyMac Bank would be the equivalent of 500 to 1,000 smaller banks failing. It may come as no comfort that IndyMac wasn’t even on the troubled list.

In today’s article we are going to take a look at a few photos of what occurred on Monday. This is part XIV of our Lessons from the Great Depression series:

2. Lessons From the Great Depression: A Letter from a former Banking President Discussing the Bubble.

3. Florida Housing 1920s Redux: History repeating in Florida and Lessons from the Roaring 20s.

5. Business Devours its Young: Lessons from the Great Depression: Part V: Destroying the Working Class.

6. Crash! The Housing Market Free Fall and Client #10 Contagion.

7. Winston Smith and the Bailouts in Oceania: Lessons from the Great Depression Part VII.

8. Sheep Back to the Slaughter: Lessons from the Great Depression Part VIII: All the Change and Bear

9. A Bubble That Broke the World

10. The Sham of our Current Unemployment Numbers

11. Understanding the Impact of Asset Deflation and Consumer Inflation.

12. Is the DOW now Tracking with the California Housing Market?

Photos Then and Now

Reports from all across Southern California discussed the panicked mood of many customers at IndyMac locations all across multiple cities. Eugene Garcia over at the Orange County Register has been kind enough to give us permission to use some of the photos:

*Source: OC Register Eugene Garcia

In this picture you’ll notice a line that according to reports, had approximately 100 people. You’ll also notice that a large number of the customers are nearing or in retirement. Not a good place to be in especially if you are dependent on this money and had over $100,000:

“(LA Times) But an estimated 10,000 IndyMac customers had deposits that exceeded those limits. Among them was 70-year-old Charles Tengeri, a retired teacher from Pasadena, who arrived at IndyMac’s headquarters at 4 a.m. and grabbed one of the first spots in line.

Tengeri had more than $200,000 in five certificate of deposit accounts — his life savings, he said. After waiting five hours, he left with a check for $171,000.

“It’s not 100%, but it’s better than nothing,” said Tengeri, who still has more than $50,000 tied up in the bank. “It’s not fair. . . . I’m praying for it, I’m crossing my fingers for it, but I don’t know.”

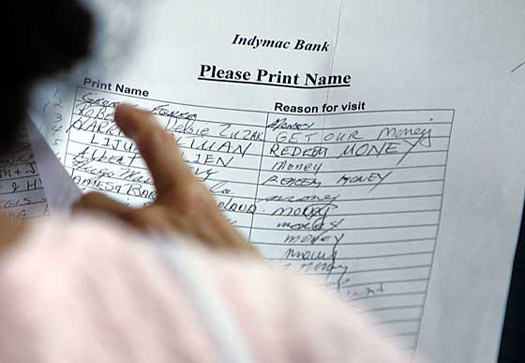

In this case, assuming the total deposit in the bank was $221,000 leaving the bank with $50,000 locked up is a 22% reduction of the original amount. That is a hefty amount given that you are not suppose to lose any of your principal at a bank. According to reports, $1 billion of deposits are beyond the $100,000 FDIC limit. No wonder why folks at a Mission Viejo location had one thing on their minds:

*Source: OC Register Eugene Garcia

It is pretty clear what the intention of today’s visit was. The FDIC tried to reassure people that their money was fine but most folks do not want to leave their money in an institution that gambled recklessly in the housing market. Why would they? There are other institutions that are sounder and people now realize that old mantras like “real estate never goes down” are sometimes hard sales pitches. People are looking to protect their money. And if you think people are trusting their government who have recklessly allowed the dollar to plummet and have squandered any semblance of prudence, think again. People are now starting to push the first domino on other institutions:

“(LA Times) Anne Martin, 56, wasn’t taking any chances Monday. She went first to an IndyMac branch in Arcadia to liquidate a certificate of deposit, then planned to go to Downey Savings, where she intended to close another CD amid speculation it would be the next bank to fail.

“I’m going there after this,” she said. “I know they did a lot of loans, and I’m afraid they’re going to be caught up in the same situation.”

At a Downey branch in Arcadia, Doris Crosby of Pasadena was transferring money from another bank, where it hadn’t been insured, into her checking account despite hearing rumors that Downey was in trouble.

“I just have this feeling I’m jumping from one frying pan to another,” Crosby, 82, said. “I just don’t know what to do.”

People are simply not happy about this and rightfully so. Here is a picture from a different angle at the Laguna Woods location:

*Source: OC Register Eugene Garcia

There were reports from long lines at:

Pasadena

Los Angeles

Laguna Woods

Mission Viejo

Long Beach

And I’m sure other locations had similar reactions. Although the housing crisis and credit debacle have been going on for sometime, seeing large banks in trouble and people scrambling for their money will hopefully light a fire with our politicians. Unfortunately they take this as a pass to bailout every nook and cranny of the economy but all we get is corporate welfare for those on Wall Street while middle class Americans, many pictured above struggle to keep enough money for a dignified retirement.

The reason these pictures are so rare is that you would have to go back to the Great Depression to see long lines of people waiting to take their money out of large banking institutions:

If the FDIC is telling us that we have 90 to 150 more troubled banks, how can anyone say with a straight face that we will have a second half recovery? In fact, according to current government measurements we aren’t even in a recession! According to government data, inflation is moderate, unemployment is dandy, and we are following a strong dollar policy. I think people are now realizing the emperor has no clothes and are starting to awake from a decade long financial apathy quelled by debt.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

16 Responses to “Bank Failure: IndyMac Bank. Lessons from the Great Depression Part XIV. Bank Failures.”

There must still be a lot of people doing well. I couldn’t tell if it was a run on the bank or a line for a 3G iphone.

Monday’s trading day marked an important event imo. A huge rally was expected with the fed getting behind Fannie and Freddie and declaring they will not be allowed to fail under any circumstances. Futures were up big and anything less than a few % up would have been a failure. So what happened? A brief rally followed by a sell off by traders. Any confidence the market had in the fed is officially gone. They’ve seen too many executives go on TV to proclaim their company is fine only to go kaput a week later. They finally had enough of Paulson and Bernanke’s jawboning assuring everything’s fine only to do a 180 days later. The big downturn was supposed to be postponed til’ after the elections, but it looks like it will be going on during them.

It think Eric has hit upon an important aspect to this crisis. Confidence. Credibility. There’s none left. Too much spin, too many lies. There will be more runs on banks, maybe from banks that aren’t really in trouble. They will go down anyway because people will pay no heed to any reassurances.

I was going to go with an IMB CD a while back and I am glad I didn’t. Geez I feel terrible for the guy who said, “It’s not 100%, but it’s better than nothing.â€

I have a question for you doc. I have read multiple articles that state that if you double the interest rate on a mortgage that the principle has to be halved in order for the payments to be equal. I made a comment about a Bloomberg article that did this and read it again on an article over at oftwominds. (Got the URL from patrick.net) It reads, “Prices have to fall–recall that a $600,000 mortgage at 6% is equivalent to a $300,000 mortgage at 12%–and buyers will find they cannot find mortgages without hefty origination points.” Now am I the fool or do they have faulty math? My calculations tell me that the $300,000 is much cheaper ($511.46 on a 30 yr fixed.) What do you think?

Hello Dr. HB,

Could you comment on what you think of the approach to GSE’s in this article?

http://www.ft.com/cms/s/0/93f0da74-5269-11dd-9ba7-000077b07658.html

Thanks,

I noticed something today as I was driving home past a couple of godawful housing projects still under construction. Formerly banks used to place a sign with their logo proudly pointing out they were providing the financing for the project. No sign of a bank sign here because I was curious who would finance such crap. One prjoject was townhomes ( from the $390’s) 150 feet from the interstate on one side and a heavy equipment repair shop on the other. You can only make a right turn to nowhere from the entrance because it is at the end of a freeway overpass with a divided 4 land aterial road that is very heavily used all day to get the big mall so even a ‘right turn’ will be difficult. The project only has the first section of townhomes complete ( maybe a dozen or so) and the rest is barren land. I can’t imagine anyone paying that much money for such a hideous location. Anyway has anyone else noticed that banks are no longer displaying their relationship to such developments or is this just a local phenomenom. I’d really like to know who the lender is for this abomination.

While some of the people sweating it out (literally!) in those long lines at IndyMac yesterday and today were worried because their account balances were greater than the FDIC insurance caps, there were others who didn’t need to stand in line. On the news this morning I saw a woman saying that she waited in line for 7 1/2 hours to get a check for $60! This kind of panic is contagious, but for many of us it’s unwarranted. I don’t even have $100,000 to my name, not even in my 401(k)! My accounts are at Washington Mutual, and I’m not worried. Unless FDIC fails, or the entire U.S. government fails, people need to stop being so jittery! And if our government falls apart, we’ll have a lot more to worry about than just the banks.

It’s my understanding that if your bank fails and the FDIC has to come in, that it can be awhile before you get access to your cash, although you will get it eventually. If you don’t have a lot of money to begin with, you may well need access to that cash.

The entire U.S. government failing, hmm, well it is bailing out Fannie and Freddie ….

I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.

Thomas Jefferson, Letter to the Secretary of the Treasury Albert Gallatin (1802)

3rd president of US (1743 – 1826)

The rallies that you are seeing now are known as “sucker ralleys” a term dating back to the Great D.

Jason

Read all you can about the New World Order, the Illuminati, the Pilgrims Society, the Free Masons, and the small percent that owns the assets of the worlds economy. etc. etc. It’s not fiction folks. There is so much written on it and it is not speculation. Our own government is behind it. We are moving toward a one world government. It was foretold even in the bible, for the end times. My faith is in the Lord, not in man or government. Even if things get better for a while, it will not last. If this country doesn’t repent, and if our citizens do not start “getting it”, we will lose this country. We are well on the way. We are imploding because we have lost our way, and forgotten the Lord. People call evil good, and good evil, just as it is written. Not paranoid, just know what the Word says. Research it for yourselves. Expect negative comments from those involved.

Looking at the lineup photo of people in their 60s and up, I have to wonder how many of them realized THEY voted for this when they voted for Reagan, and considered him the savior of everything. Rather than seeing that the almost-end-game of neoliberalism and globalization is precisely this: privatize everything, transfer all you can upwards, leave everyone else in bread (or bank run) lines.

I know, they all thought THEY would get rich, and to hell with everyone else.

This situation is also a moral reckoning for the US.

Just because a bank loans out $100.00 does not mean they have $100.00 in the safe or in liquid assets. Its more like $10.00 on the banks books in some form for every $100.00 loaned out.

So for all your money they are paying you 1, 2, maybe 3% interest on, they are turning around and charging 5 to 20% interest ten times over. Pretty slick deal for the banks, until the market turns against them and suddenly “poof” everybody’s money disappears.

For a very good explanation of how our banking system works check out http://www.scamorbam/bankingscams.html

Umm, the FDIC only has $5 billion in assets, guaranteeing $6 trillion in deposits.

Even a monkey can figure out that it could all be over in a flash if 100 banks failed this year. Of course they’re projecting as many as 350, which is undoubtledly a number fully massaged just like unemployment and any other number the government puts out.

Guns, ammo, and beer…stock up NOW

More on the IndyMac fraud from a whistleblower:

http://wcvarones.blogspot.com/2008/07/massive-fraud-and-corruption-at-indymac.html

can anyone tell me if you used your bank to buy treasury notes or municipal

bonds are these financial instruments treated as part of the 100000 dollar

coverage or do you own them outright and they will not be lost if the bank fails.

Leave a Reply