Since Governor Schwarzenegger took office in October of 2003, he rode in promising no tax hikes and sent a very unpopular vehicle fee out the door along with Gray Davis. He has faced issues with budget delays but nothing like the current short fall. The Governor announced plans for declaring a fiscal emergency in January since the state’s budget deficit has grown from $10 billion to $14 billion:

“SACRAMENTO, Calif. – Gov. Arnold Schwarzenegger said Friday he will declare a “fiscal emergency” in January to reduce an anticipated $14 billion budget deficit, pressuring lawmakers to fast-track spending cuts and other solutions.

The Republican governor has signaled that he wants to cut spending across the board in state programs, while Democratic leaders have said that both spending reductions and tax increases need to be considered.

It will mark the first time the Republican governor has used the “fiscal emergency” authority that he asked voters to approve in a 2004 ballot measure.â€

The deficit is deep enough to cause serious cutbacks and potentially a reneging on his promise of no tax hikes. During the past four years, the California real estate market has been on an incredible appreciation journey. California construction has also been booming and employment in the financial field has provided high paying salaries for people to spend on local commerce. How much of the Governor’s recent success has been skill based and tact and how much was centered on being at the right place at the right time? Sometimes it is important to acknowledge reality. As the famous late night real estate guru Tom Vu once said, “Do you think these girls like me? NO, they like my money!” In fact, it is hard not to like someone when everyone is swimming in a rising golden sea of housing equity.

Yet there are ominous signs now showing through the states economy. The financial and political wizards tried their best to build a fortified wall against the toxic credit pool, but it appears that the damn has now broken and is spilling all over the lands of this country. California, which seemed reluctant until this year to recognize any housing depreciation is now being swept up in the disastrous financial mismanagement of the current decade. It was only a matter of time until the mountain of debt struck the most prosperous state in the nation.

In this article, we will examine the pillars of the California economy and dig deep into the trends that are causing this budget shortfall. We’ll look at automobile sales, construction, and unemployment numbers. The grease of the California economy is drying out and causing the system to come to a screeching halt. The state with a vehicle obsession needs a jump start.

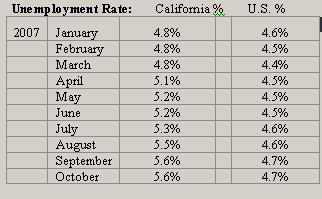

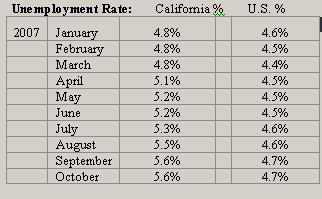

California Unemployment

The current contraction in construction and financial services has hit the golden state particularly hard. Unemployment in the state has increased almost 1 percent since last year going from a low of 4.7% in November of 2006 to our current 5.6% in October of 2007. During this same timeframe, the U.S. unemployment rate has held steady at 4.5% in October of 2006 and is currently running at 4.7%.

Clearly the impact is being faced disproportionately here in the state because of the heavy reliance on the housing and mortgage industries. This will also have an impact on the state’s bottom line since someone that isn’t working will not be paying any state income tax. They will also hold back from purchasing homes.

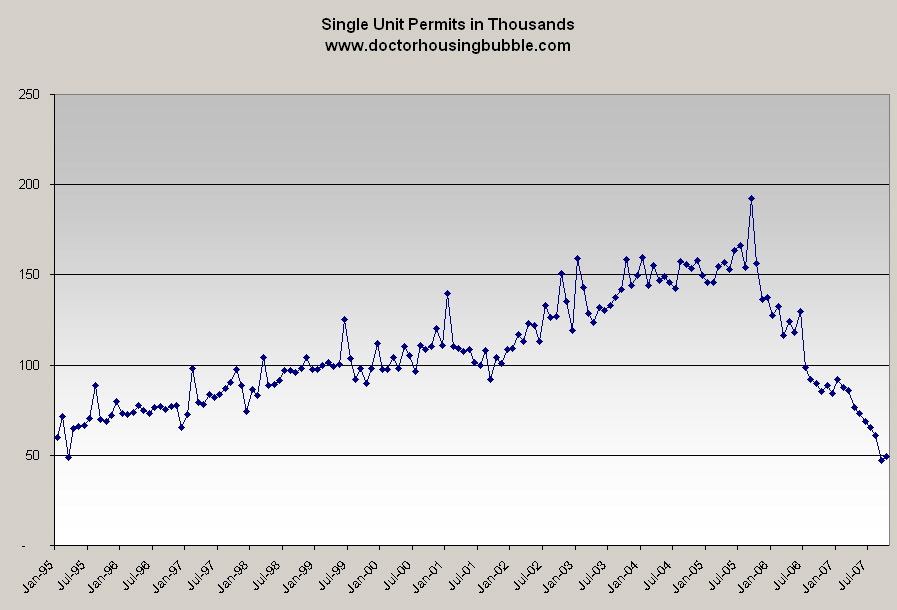

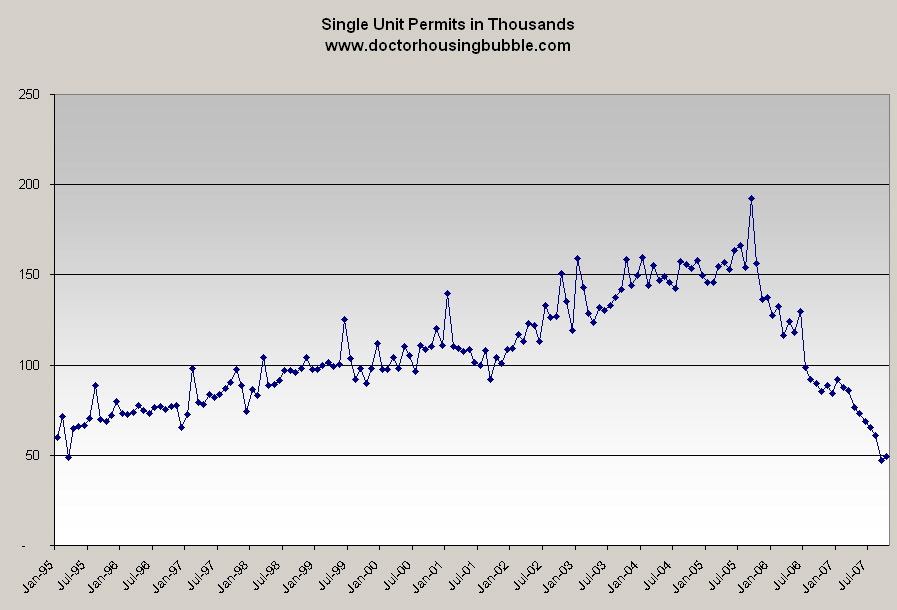

California Construction

Building permits are a good leading indicator because before you build any future homes, you first need approval. The current permit numbers are abysmal in California dropping an astounding 42% from last year for single unit construction. Approval for single unit permits is at a 12 year low.

Keep in mind the last time we had numbers like this we were at the end of a bursting housing bubble in California. With sub-prime resets and the incredible number of option ARM mortgages in the state, we are in for a few tough years. The jobs that are being lost in construction are appearing in the sharp rising unemployment numbers. There is also a direct impact on spending cut backs and loss of a tax base for the state.

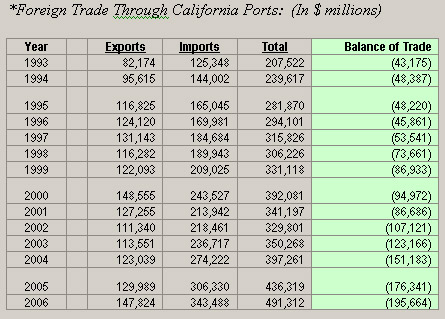

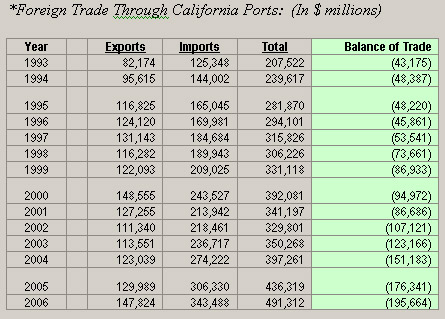

Foreign Trade through California

There was a time in the not too distant past when imports and exports to the state were relatively even. We’ve been running trade imbalances since the 1970s but never has the percentage been so drastic. Take a look at data from 1993-2006:

What these numbers show in a very direct way is what every member of the state already knows. That is, we are spending a lot more than we are producing. Take 1993 for example. In 1993 we were importing 52% more than what we were exporting. In 2006, the imbalance leaped to an astounding 133%. This cannot go on forever and the insatiable consumer appetite will affect our foreign trade partners. For all the talk that a lower dollar will make our goods more lucrative, it doesn’t hold much water since we don’t have that many goods to export and their own growth is very dependent on our spending.

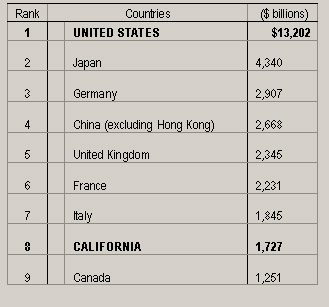

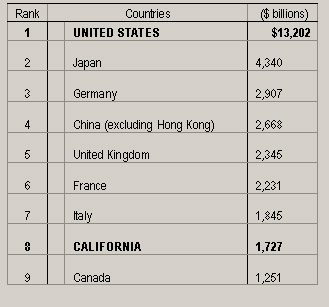

California’s World Ranking

California has the 8th largest Gross Domestic Product in the world:

California represents 13 percent of the U.S. GDP so any impact here will create large shockwaves throughout the nation. With that in mind, California also has the largest nominal amount of any state with sub-prime, interest only, option ARM, and other exotic mortgage products. With a median home price of over $500,000 and the advent of no money and very little money down products, you can imagine how much equity is about to slip away if it hasn’t already. A large portion of our economy revolved around construction and all things real estate so this contraction will hit our bottom line. But looking at the list, many of these places have asset and credit bubbles too. It will be interesting to see how the numbers play out in the next few years.

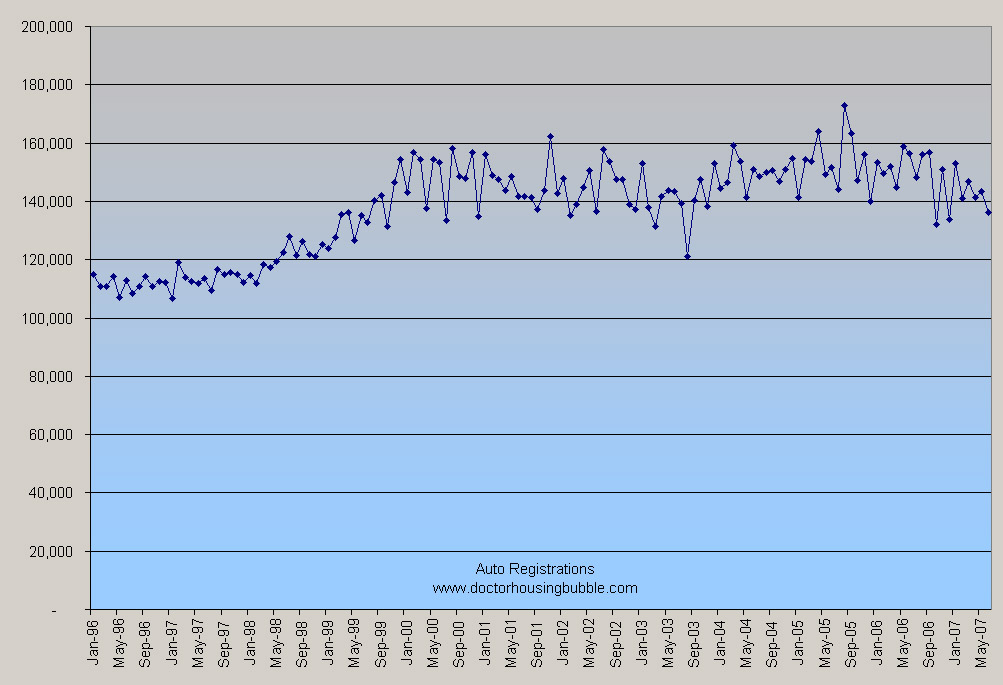

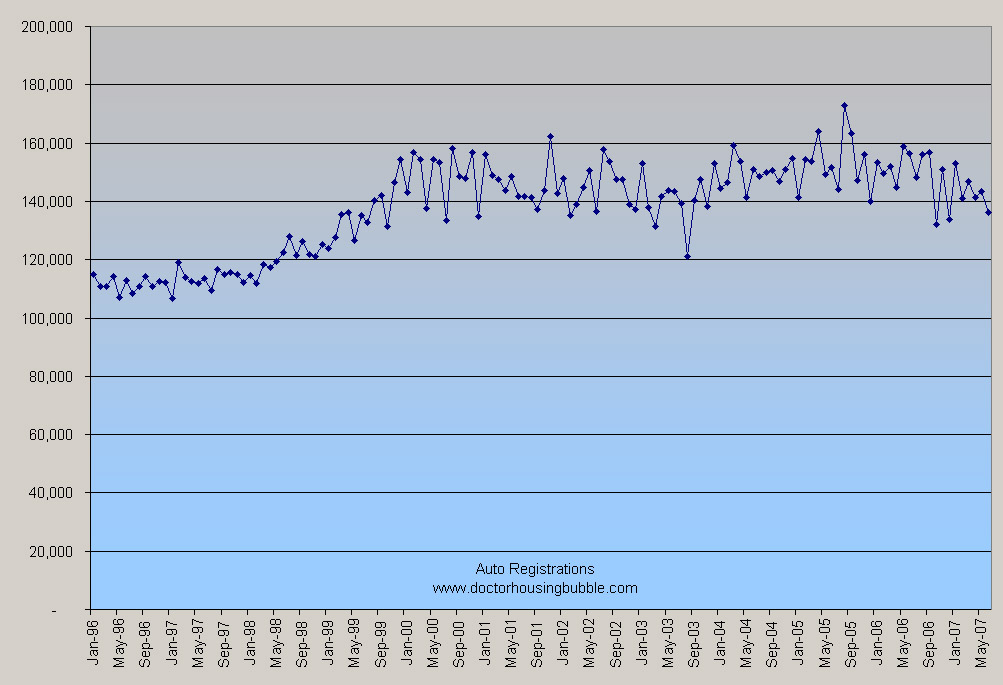

Auto Sales

Auto registrations are a good way to keep track of new automobile sales. I think this will be another casualty of the credit debacle. After all, car dealers wouldn’t survive without financing and financing wouldn’t survive without easy credit. Now that easy credit is slowly going away auto sales are starting to feel the pinch here in the state. Take a look at the trend for auto registrations:

Couple of things to notice. First, you’ll notice the amazing jump starting in 1997. Coinciding with the real estate bubble it appears that we also had an auto bubble. The numbers hold steady from 2000 all the way to 2006. The only difference this year is that the numbers did not have their spring and summer jumps and we are entering the slower selling seasons of fall and winter. What happened to real estate in California is happening to auto sales; I’ve examined this seasonal selling trend for housing before. Aside from all the car commercials about people giving $50,000 cars as Christmas gifts (with a nice monthly payment) December isn’t a hot selling month for cars. You normally see an uptrend during the spring and summer months. This is California and you need the hot rides for the sunny weather. The data only goes up till June of this year so I’ll keep my eyes peeled on this sector since it misses the current credit crunch.

California Dreaming

California has many challenges facing its economy and the Governor is going to have his work cut out for him. In the October budget highlights the opening paragraph on the economy states:

“The slumping housing sector continued to weigh on the national and California economies in the first eight months of 2007, slowing job growth and dampening retail sales.â€

That is succinct and to the point Governor.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

18 Responses to “California Examined: The Deep Budget Impact of the Mortgage Crises.”

Good points, Doctor. You know, I never really thought about an auto bubble, but it totally makes sense. I just can’t believe how maxed out everyone’s “leverage” is. Monthly payments on the mortgage. Monthly payments on the car lease. Monthly payments for the health insurance. Monthly payments to the gym. Buying that new expensive watch and diamond tennis bracelet on 3 easypay installments via QVC. All new furniture and big screens for 12 months at 0%. Re-financing the house. Flipping the credit cards from one to another for the best teaser rates. Relying on the HELOC when it all gets out of control. It’s just amazing that this amount of risk is normal… in fact almost expected out of the modern American middle class family.

Look at this article for example: http://money.cnn.com/2007/12/12/pf/kids_spending.moneymag/index.htm?postversion=2007121409

It explains as much as any Real Homes of Genius, you know? A family of 5 living in Park City, Utah. He brings in a good 6 figures, she’s an at home mom, and they have 3 kids. You’d think with a money related numbers job, he would instinctually know how to make ends meet. And yet, they are one hiccup away from total disaster. And they smile and shine like they have no worry in the world. THIS is normal and aspirational in America today. Crazy, huh? I feel like I live in upsidedowntown. Just have to convince myself that mistakes are successes that haven’t happened yet, debt is wealth, and war is peace… and then it’ll all be allllllllright. I’m glad at least that my glass is half full… of whisky. *big gulp*

Just one other comment… I just read your last post about your friend in the construction industry. And I got this Twilight Zone image in my head. There was one episode in which a guy could see on a person’s face if they were gonna die. (I think the guy was a gadget seller and he could see the “aura” around the face of a beloved child in his building.) Anyway, I got this sense of you talking to your friend and seeing the aura of what was coming for him around the bend. That must have been really hard for you.

You know, in the big picture, I am just so mad and frustrated with people who should have known better. I feel like wagging my finger in a massive I told you so. But I have 2 sets of friends who bought in Vegas in 2005. And I know for sure that one of them stretched to do it. And they are lovely folk with lovely families who weren’t trying to get anything from anybody. Both are the type of people that help out their communities and are great back-ups if you need a trusted neighbor. They just sold their starter homes, feeling ready to move into bigger nicer places. Movin’ on up a la the Jeffersons… the American property ladder dream. And they were caught in the current of the most massive ponzi scheme ever. I’m cautious by nature with risk, but Doc, it couldv’e just as well been me if I let my guard up for a moment. And although I have done everything right- no debt at all other than an easy fixed 30yr at 4.5% thank god, 6 month emergency savings, retirement savings in a balanced (I hope) portfolio… geez well I just also feel like a little tempting stupid fish morsel swimming with the sharks… like it all doesn’t matter because even if you try to play the game right… you’re still just chum in the end. Sorry for blabbling on… just the story of your friend really brings this back to the personal.

It’s time to raise taxes in California…WHAT??!! With California personal income tax already the highest in the nation at a whopping 9.9%, a taxable GDP larger than the majority of the nations on the planet, and property taxes already based on heavily overinflated property values, there’s plenty of tax revenue to go around. I am left to conclude that Californians’ biggest problem is that they just can’t say “NO” to any good idea…whether that be free health care for the lazy and the undocumented, or free ugly-expensive meds for those with a misbehavior-borne terminal disease in San Francisco. The money is there…it’s clear to me that California is the country’s preeminent model for a complete lack of self-discipline on all fronts. Add to that the long-awaited poke of a pin into the housing and then credit bubbles, and, well, California deserves what’s coming next…and maybe can serve as example for the rest to sit up and notice. Not that the rest will…they’re too busy trying to catch up in the great race to the drain.

The magnified degree of the breakdown in California is as much about communities running out of fiscal control as it is about individuals…the State of California is run too much like Californians run their own lives, and it’s a bloody awful mess. And it’s a mess that can’t be waved away with a quick “mea culpa” and a call to a personal injury lawyer. This one’s gonna stick, and it’s gonna hurt.

Wow Bob, way to miss the boat. Prop 13 has reduced property taxes that even Warren Buffett comments that his pad in Malibu pays less property taxes than his mansion in Florida. The money from property taxes is not there.

True, California deserves what it’s going to get (disclaimer: born, lived, raised and die-hard Californian). That is the consequence of having a very democratic state constitution that allows the citizens to make things like Prop 13 into law. Every bond float for something or another can be moved onto the ballot for the people to decide on So, yes, it is actually very true that the State of California is run like Californians run their lives.

The result is a constitution that pre-allots – 40% of the budget iirc – before the state houses get ahold of it. Having a senate and house is another reason The Governator is more restricted than most. In the end, Prop 13 and property tax law is the sacred cow of California. We covet our low property tax, we are oblivious to how little we pay – even on 700K homes; and we’ll likely take it on the chin many other ways before we give up our “right to have low property tax”. =\

Darin, your understanding of the mechanics and impacts of Prop 13 are so poor I am not even inclined to correct your misapprehensions. Rather than be a bully and self appointed know-it-all how about first you provide evidence of; “Prop 13 has reduced property taxes”* or identify the Buffet “Malibu” pad (not Malibu) and/or why a pad shouldn’t pay less property taxes than a mansion. Too tough? How about evidence of Prop 13 being a “citizens initiative.” An easier one? Explain how a bicameral legislature is in the minority of states as you assert.

* Yes, the passage of Prop 13 “rolled back” some massive increases but at no time did it cause a reduction of revenues.

Taxes are high. Yes the state income tax is nearly 10% with SDI, and it’s more flat than progressive. At around 43k (not a particularly high income in L.A.) you reach the max tax bracket.

As I have no deductions other than the standard one (mostly because I can’t AFFORD even a condo!), this 10% gets added right on top of my federal income tax bracket of 25%.

With fica and everything, for every extra dollar I earn I’m paying nearly half in taxes. I ask myself how can that be that I am “rich” enough to pay nearly 50% of my marginal income in taxes and at the same time I am “poor” enough not to be able to afford a condo? I don’t think most of america faces this predicament!

And then there is the sales tax. In L.A. it’s currently 8.75%. Wow, I just thank heaven it’s not charged on food.

As for property taxes, I don’t really know, it’s not a tax I pay directly, as I rent.

So much for voters rejecting the “Live Within Our Means Act.” Along with no new taxes (republican pre-requisite for being elected time and time again), California is once again on budget quicksand. And it looks as though the $43Billion in infrastructure bonds hasn’t stimulated the economy enough after all. During the boom times, where as 15% to 20% of Cali’s private sector was employed in the real estate industry; no one paid down debt or saved for the future. So we had a boom based on easy money and shrinking credit standards, and California went into “debt ape-shit†and now what? They expect to keep spending money they do not have. The housing bubble has now popped but the consequences have only begun.

Ahnold TRIED to cut spending before, but the PEOPLE SPOKE: “Give us big spending, big government, we want it all, paid for by the savings of foreign countries, and loaned back to us to lull us into these ridiculous lifestyles.”

Time to pay the piper, folks! First it will be the banks, state and local governements, and the Federal government, all bankrupt. No retirement, no nothing. The Greater Depression!

Sounds like the auto peak season is tax refund time-like me.

Great article. The numbers really don’t lie, and it helps to see the physical charts and graphs.

Every place I ever lived, and I’ve lived in a few, wherever taxes were high, the standard of living was high, and where taxes were lowest, so was the standard of living. I really think that the problem in this country is that for about 30 years now, everything has risen steadily, except wages. To distract the victims from this fact, the ruling class has hired an army of cheerleaders – professional liars, you know who they are – to bitch all the time about how everyone would be well off if only they didn’t pay such high taxes. When this “tax relief” gets the government too poor to enforce the laws, these people win. I myself wish I paid about $4,000,000 a year in taxes.

@ Debbie

Your comment reminded me of the 6th sense.. “I see dead people”…

The reality is that most people are financially illiterate. How many people do you know that really understand markets / bubbles / ARMs / yields / etc.?

Even Helicopter Ben needed educated on SIVs..

Part of the natural cycle is that financial instruments become so complex and people become so trusting that they end up in devastating financial accidents.

Like a paralyzing car accident, but instead of you being confined to wheel chair for 10 years, your checkbook is.

Maybe instead of I lost my house/car/boat/401k, people could say “I had a horrible financial accident, recovery is slow, but I’m taking it one day at a time”

In my mind it really is a just a huge accident where multiple variables work against you. Like driving too fast on ice, around a blind corner where the “slow down” sign fell off the post and a logging truck is coming the other way, but you don’t hear the truck because your favorite song is cranked up on the radio.

Does any sell insurance for “financial accidents”? AFLAC!!

Here comes the government bailouts:

“Dec. 17 (Bloomberg) — Treasury Secretary Henry Paulson said Fannie Mae and Freddie Mac, the largest sources of finance for American mortgages, may help “jump start” the market for the largest home loans.

Paulson said in an interview today that he favors temporarily allowing the two companies to purchase so-called jumbo loans, which exceed $417,000. He said the proposal should be part of a package of legislative changes governing the two government chartered companies. ”

“Bernanke indicated in a Nov. 8 hearing that he favored letting Fannie Mae and Freddie Mac buy mortgages of up to $1 million. He noted that it was up to Congress to determine the amount.”

Why not allow the government to buy back every stinking loan out there and be done with it? Everyone that thought the Hope Now Alliance was it was sorely mistaken. The door was slightly opened and now they are barging in:

http://www.bloomberg.com/apps/news?pid=20601087&sid=arYAUdPhQtvc&refer=home

RE: the Car Bubble

OK, I figure that 85% of all Cadillac Escalades, Chevy Tahoes and Lincoln Navigators (aka The Rolling Embarassment: it just screams Look at Me! I’m Nouveau Riche!) were paid for from re-fi’s and HELOCs.

So, those are goners. They might as well just put those models on hold for a few years.

the biggest problem about taxes is not whether they are too”high” or “low”, but whether they are regressive or progressive; and whether they are providing the govt the revenues/funds it needs to provide the services that its constituents all need. CA-like just about every state in USA-has adopted a more regressive/less progressive tax structure since the 1960s. this is the greatest legacy of conservatism-not that they “cut” taxes-but instead they made taxes more regressive. taxes are regressive when they fail to take one’s income into account. sales/excise taxes & property taxes are the most regressive. income & estate/inheritance taxes are the most progressive.

might i make some suggestions on taxes:

Individual Income Tax-1. get rid of as many itemized credits, deductions & exemptions as possible. use the $$$ saved from this to double the standard deduction & exemption. allow taxpayers to deduct charitable contributions, local property taxes on their homes, mortgage interest on principle homes on top of the standard deduction & exemption.

2. tax earned income(wages, salaries & net income from biz) at half the rate dollar for dollar that u would tax unearned income (interest, dividends, capital gains, gambling, lottery, royalties, etc.)

SDI Tax: 1. take cap off of wage base

2. split the tax burden between employees & employers equally-like soc. security & medicare.

doing these things will allow the worker’s tax to drop dramatically w/out reducing benefits.

Sales & Use Tax 1. cap rate @ 5.0% statewide. 3.75% state, 1.25% local (bradley-burns)

2. tax articles of clothing only after their cost is more than $175

Vehicle License Fee a.k.a. “Car Tax”

1. give all vehicles subject to the vlf a standard exemption equal to the median book value of vehicles in CA. what this means is if the median value is lets say $10,000 then the first $10,000 of each vehicle is exempt from the tax. half of all vehicles will not pay ANY car tax.

2. double the tax rate to make up for lost revenue-so it is revenue neutral & doesnt screw local govts.

this essentially makes this tax a “luxury tax” which i think is what excise taxes are. the vlf is an excise tax to me because cars depreciate in value-like say tvs & clothing-but unlike real estate, at least most of the time.

Property Taxes

1. adopt a classified rate system like most other states do. for instance

Residential Property 1.0% of assessed value

Commercial & Industrial 2.5%

2. adopt a circuit breaker/rebate program for principal residences-whether rented or owned. once the occupant of a principal residence pays a certain portion of their income in property taxes-they dont pay any more, the state makes up the difference. if they have paid more, they receive a refund.

3. allow elected officials to set tax rates & make decisions again on operating budgets w/out having to hold referendums. if it is so bad let voters vote the bumbs/elected officials out.

Gasoline/Fuel Taxes

1. index taxes to inflation-rather than what the federal tax is.

2. repeal sales tax on gasoline, it is in my opinion double dipping.

well…i think ive gone on WAY too long. ive just felt this way for a LONG time and wanted to take the opportunity this blog/forum has provided me to let people know what i think

It’s not clear to me that there is any link between the automobile registrations and the housing bubble. We see a bump in the late 90s and then it levels off. That is not a “bubble”. If auto sales had been increasing every year that would be a different story.

In recent years there are also much wider fluctuations in the number of registrations. I would be interested to know whether there might have been a change in the method of collecting this data. In 2003 we see a massive drop back down to late 90s levels. How can this be explained by the housing bubble overflow treatise?

All I can see are two different charts that don’t seem to have any significant correlation whatsoever. I’m uncertain why we got a sudden bump at the end of the 90s, but the current increase might be attributable just to population growth.

I really think the inclusion of the auto registrations chart hurts your argument more than helps it.

Prop 13 has caused a huge transfer of wealth from young people to old people. We are now in the absurd position where a young couple who scraped together enough money to buy a house may be paying $1000 per month on property tax, while their next door neighbors, members of the “great generation” – the richest generation in history – are paying $100 per month or less. The taxes paid by the new homeowners are subsidizing the homeowners who are paying next to nothing because they have owned the house since Prop 13 was passed.

When it first appeared, Prop 13 was a benign seeming law that prevented unexpected (and unbudgeted) increases in tax expenses. It has turned into a monster. We have young people sholdering most of the property tax burden for the state.

John,

Your proposal to put a 2.5% tax on industrial and commercial property would backfire. I am a commercial realtor. Most of the leases for commercial and industrial property have clauses allowing tax increases to be passed through to the tenant. An additional 1.5% tax on assessed value could be comparable to a 15+% rent increase on the business operating at the property, which would be a big hit to businesses at a time when the economy is slowing. If a tenant can’t pay that bill, it could throw the owner into default on his or her loan, if the tax increase is more than the cash flow.

Here’s a different idea: CUT SPENDING!!! State spending has increased by nearly $40 billion since the Governator took office. Cutting half of that back, and freezing spending until the economy recovers, is the best solution to the budget mess.

All car owners should pay a minimum fee, which represents the costs of the DMV bureacracy keeping track of their car and driver’s license.

Employers never pay payroll taxes. The employee does, in the form of lower wages. An employee’s productivity must cover all costs of employment, including taxes. If that productivity falls short, the employee’s pink slip will be in the mail, right behind the foreclosure papers.

Lastly, having a differential rate for “unearned” income like dividends, interest, and cap gains, massively increases the double tax on investment income, and will play havoc with savers. Some will abandon the state entirely, costing Sacramento billions. All dividend income is already taxed at the corporate level, in the form of taxes on corporate profits. To tax dividends at all is double-dipping. To tax them at a rate higher than wage and salary income is economic suicide. If interest is subjected to such a punitive tax, lenders will have to make it up by charging higher rates — just what CA’s wallopped housing market needs. Moreover, to call such income “unearned” is an insult, because to get my dividends, I had to save money after paying taxes, instead of spending it all and borrowing more. Dividend income is deferred earnings — the fruits of being responsible and saving money.

Leave a Reply