Millennials will not save the housing market: 50 percent of Millennials have less than $1,000 in savings. A large number are mired in student debt.

Contrary to anecdotal Taco Tuesday baby boomer nonsense, Millennials are not in any position to save the housing market. Millennials have differing priorities some based on generational trends but some being driven by economic necessity. The vast majority of the $1.3 trillion in student debt is being carried by younger Americans, not older baby boomers who went to college when state schools were nearly free and private institutions were dirt cheap that you could work at a fast food joint and pay for your annual tuition. It was also a time when buying a home wasn’t some giant global speculative gamble. Today we have markets where investors dominate, foreign money is king, and flippers are house humping their way into leased cars and plastic surgery. In California, 2.3 million adults live with their parents. As things improved, some went out and formed new households as renters. Some pundits think that many of these people were saving big bucks living at home with their parents but the latest survey shows the exact opposite. 50 percent of Millennials have less than $1,000 in savings. And these are the people that will buy $700,000 crap shacks that were built during the Great Depression?

Millennials will not save housing

Millennials are not going to save the housing market. Will they buy homes in other parts of the country where the typical home costs something like $230,000? Maybe. But that is a stretch for someone that is barely scraping buy. That is why we are facing rental Armageddon. But in areas where prices are looking very frothy, Millennials have no chance whatsoever to compete against investors and all cash foreign money. The few that have a chance to compete are high earning professionals that still need to leverage into giant mortgages. The idea that these adults are living at home with Taco Tuesday parents to save hundreds of thousands of dollars goes against actual data.

Let us look at the figures:

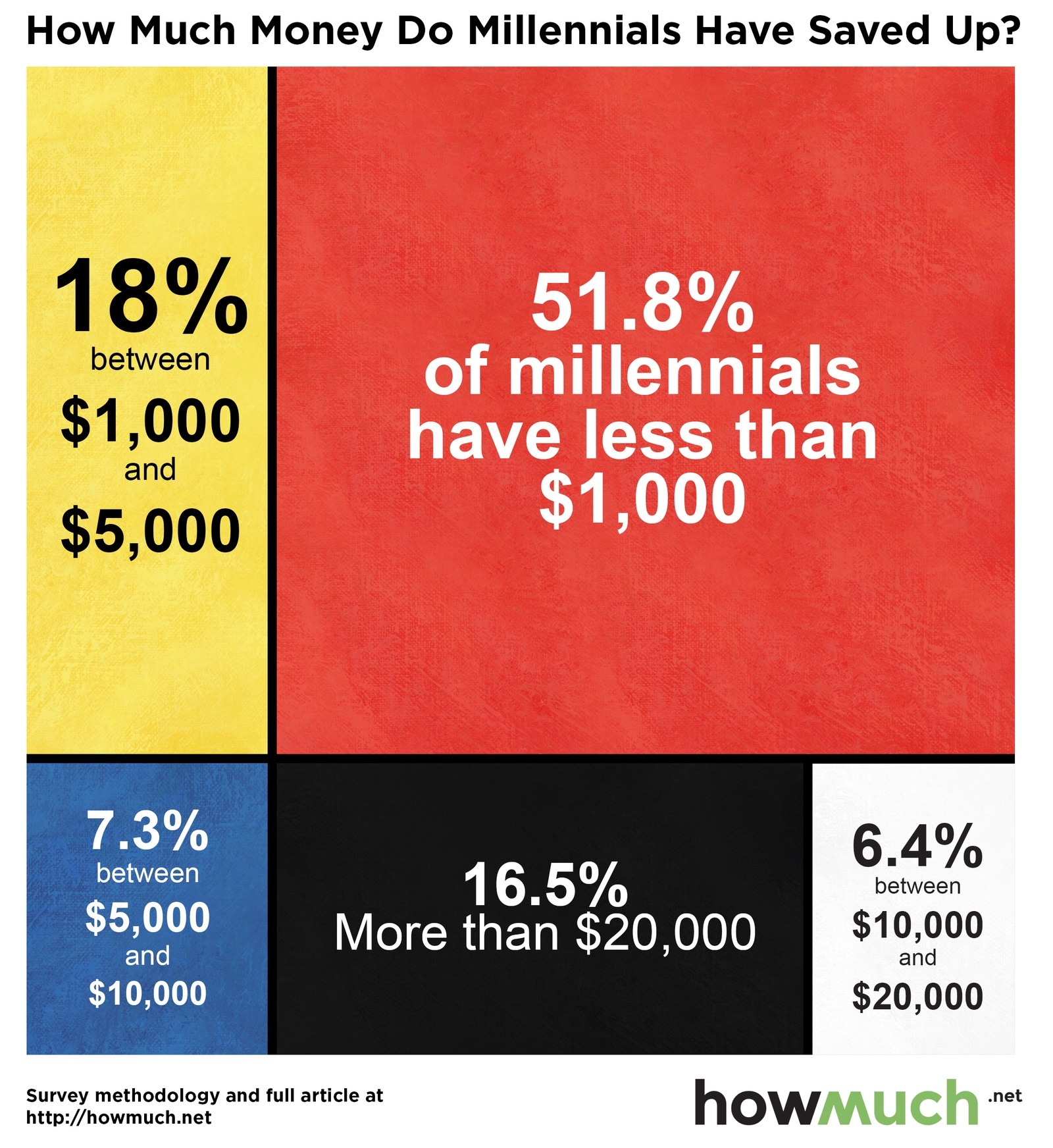

Source: Google Consumer Surveys, Howmuch.net   Â

“For those surveyed, we found that:

- 51.8% of Millennials have less than $1,000 in savings.

- 18% of Millennials have savings of $1,000 to $5,000.

- 7.3% of Millennials have savings of $5,000 to $10,000.

- 6.4% of Millennials have savings of $10,000 to $20,000.

- 16.5% of Millennials have savings of more than $20,000.â€

Half of Millennials don’t even have $1,000. Even more to the point, 83.5 percent have $20,000 or less saved up. Yes, six years into the “recovery†and these Millennials have been living at home saving up “big bucks†to buy that next piece of junk house in the Bay Area or Los Angeles.

Millennials have very different priorities:

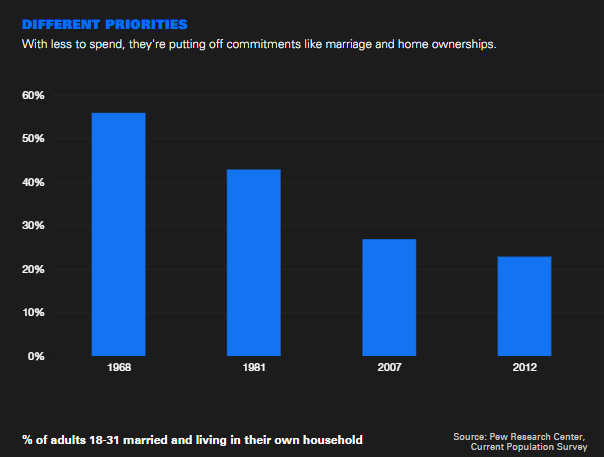

Source:Â Pew Research, Goldman Sachs

In 1968 56 percent of those 18 to 31 were married and living in their own household. Today it is down to 23 percent. That is a massive change. And a large portion of homes being sold in some metro areas where built when house humping couples were having large families and many lived off of one income. Today, most will have smaller families and many don’t even have or want kids. If kids enter the picture, both will need to work and daycare costs are close to adding another mortgage on top of the current mortgage. Some would rather live close to work in people dense areas.

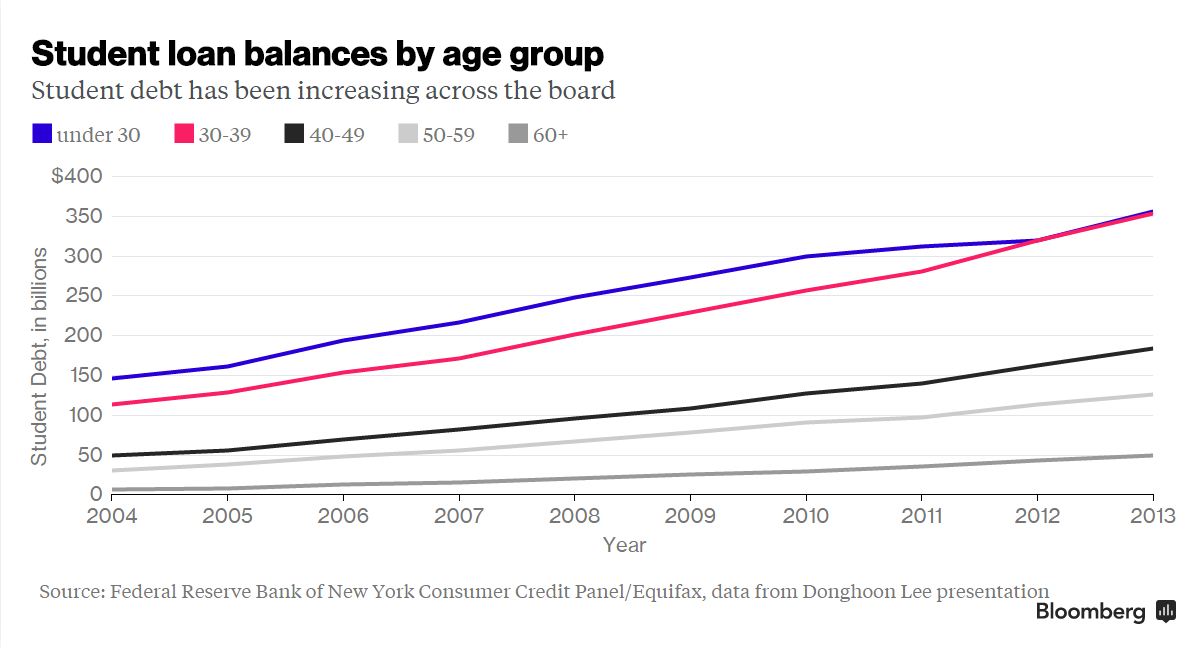

More to the point, many Millennials are already deep into student debt:

Of the $1.3 trillion in outstanding student debt more than half is held by those 39 and younger (your prime first time home buyer demographic). This is also the group that for the most part, has $1,000 saved up. Most probably have a negative net worth when you look at college debt and throw in an auto loan.

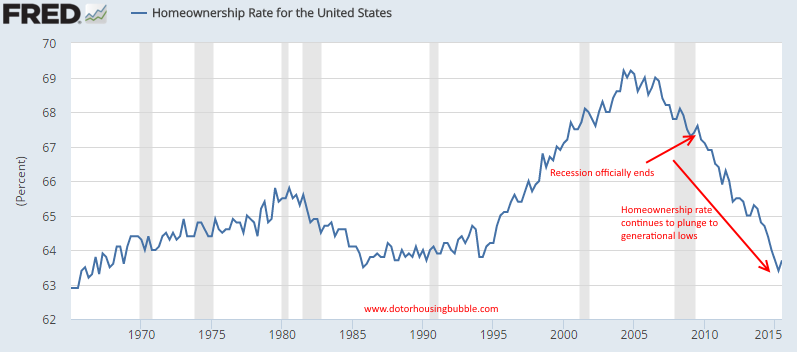

Yes Millennials sure stepped in to boost the homeownership rate in the last six years of recovery:

Yet somehow, these are the future $700,000 crap shack buyers that will take over properties when baby boomers put homes for sale. What is more likely is that some “kids†are going to wait until their parents eat that last taco with Purina Dog Chow toppings before sailing into the halls of housing Valhalla.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

143 Responses to “Millennials will not save the housing market: 50 percent of Millennials have less than $1,000 in savings. A large number are mired in student debt.”

The idea that SoCal is filled with Millennials pulling in 100K+ annual salaries with 100K cash in the bank eager to buy 600K crap shacks is a laughingstock.

The Millennials I know who desire independence are bailing on expensive housing markets and starting adult lives elsewhere. Their idea of success is not becoming a debt slave to an expensive cookie cutter tract house in some bland subdivision. They put far more value on travel, quality food, life experiences, career flexibility and mobility rather than “stuff”. They seem to desire either an urban living experience in diverse communities or dream of older houses with “character” in mid sized towns, raising chickens, growing things, more land, kids, pets, etc. Several Millennials I know love HGTV “Fixer Upper” featuring a couple in Texas who fix up old homes with character that are usually situated on a decent sized piece of property.

In my opinion, if an adult child hasn’t left home by age 30, it’s irrelevant how much cash they have or what they say they’ll do; chances are very slim they will ever move out the family home and/or live independently. They are settled in for the duration.

Funnily enough you have just described my situation nearly to a Tee. I am mid-20’s making over 100k/year and approaching $200k in cash savings intended towards purchasing a roughly $550-600k home in the SoCal area. I would be happy with a 15-20% correction in current prices, though I doubt it will get much worse than that.

I work in a career with around 300 other people in my age range of 25-35 and have the ability to see how often they work extra hours and listen to word going round. I know of only a handful of others in my situation with substantial savings and waiting for a correction. I’m talking 5 or less. This is in a career with an ability to make and save substantial amounts of extra income. So with my small sample size you are quite correct, 2% or less fit into this scripted narrative laid out in the media.

“The Millennials I know who desire independence are bailing on expensive housing markets and starting adult lives elsewhere. Their idea of success is not becoming a debt slave to an expensive cookie cutter tract house in some bland subdivision. They put far more value on travel, quality food, life experiences, career flexibility and mobility rather than “stuffâ€. They seem to desire either an urban living experience in diverse communities or dream of older houses with “character†in mid sized towns, raising chickens, growing things, more land, kids, pets, etc. ”

It is the most obvious smart choice. I did the same thing decades ago when things were way better that they are now. It was the best choice and I never regret it. Today, I have enough to buy most of decent homes in SoCal all in cash. But I don’t, because the market is overpriced and I can do so many things with the money.

If each has a life, why would they choose to live it as slave is beyond me. The borrower is a slave to the lender. In SoCal the borrowing is beyond anything resembling sanity.

Sanity left the housing market in 2009. after that it’s been just another banker fix…

Libor rates, Gold, CDO’s, Oil, Stocks, interest rates.. etc. etc…etc…

Moral Hazard be damned….they fed the rich and chewed up the middle class..

typical banker pigmen action

like yourself people chose to live where they can afford. fortunes are won and lost everyday. one mans bankruptcy is other mans fortune.when one is smart enough to benefit from other mans misfortunes he then can chose to live where ever he desires.

Hubris around everyone wants to live here only counts for so much when overcrowding, pollution, stress, and high-prices begin to make previously basic givens practically unreachable without taking on loads of risk. Hello arrested development.

Drinks – I sure agree. If they’re still at home at age 30, they’ve become limpets. They’re not going anywhere.

Perfectly stated “The Millennials I know who desire independence are bailing on expensive housing markets and starting adult lives elsewhere. Their idea of success is not becoming a debt slave to an expensive cookie cutter tract house in some bland subdivision. They put far more value on travel, quality food, life experiences, career flexibility and mobility rather than “stuffâ€. They seem to desire either an urban living experience in diverse communities or dream of older houses with “character†in mid sized towns, raising chickens, growing things, more land, kids, pets, etc. Several Millennials I know love HGTV “Fixer Upper†featuring a couple in Texas who fix up old homes with character that are usually situated on a decent sized piece of property.”

I bought out of state with more land in a decent city. I have a friend who moved from Santa Barbara to South Carolina for the lower cost of living and cheaper homes once he accepted a job offer. Both of us are millennials, other friends and co workers that are millennials in SoCal all live with their parents or rent small 1 bedroom or studio apartments.

Still here in SoCal but wont be much longer after I transition out, just saving up money and paying the remaining CC debt off. I rent a room btw, to reduce costs. Been doing this for over 5 years… amount time to change it up soon (its starting to get tiring).

The rest of the millennials are not so lucky unfortunately, they got 100k student debt, no house, 7 year subprime car payment, and will be living with their parents or roomates for another 10 years minimum if their lucky.

Interesting, I work in DTLA and just got back from working a week in SF and I always wonder how people dress the way the dress, buy the food they buy, drive the car they drive, pay the rents they pay in both areas making $10 per hour. I do think Southern CA and the Bay Area has so many rich people that a large pct of them can afford their lifestyles but not without sacrificing savings. I think a bigger problem than having almost no savings, is having a lot of debt. You can get by with no savings but when you have debt, the debt collectors come knocking.

One big problem is, when you’re young, whatever you’re making, you tend to think that bigger money is in your future, so why save now?

Speaking from my lofty perch of 53, 23-year-old me should have been saving, and on $5 an hour, I could! I had a rented room, OK food, etc. I could live and save. Vanguard funds are a minimum buy in of a grand, bet they were half or a quarter of that then, and I could have easily done it, especially if I’d stayed away from the huge money-suck that is and was college.

In Silicon Valley here, we have a ton of 20-somethings from all over, making good wages in tech, but they don’t understand that once they hit age 40, they’ll be lucky to be stacking shelves somewhere. They have 15 years, approximately, to make their fortune. After that, the smarter ones will get govt jobs, or in utilities, public transit, etc. But for right now, bring on the fancy clothes, expensive food, and Tesla model S.

So true. When your starting wage is $120K, you think it’s just gonna go up from there so it’s ok to spend $3000/month on rent because, after all, the ladder is endless. It’s hard getting hired after you’re 30 at startups. You’re an “old” already. The bigger companies don’t need thousands of programmers, they just need a certain amount of really good ones. I don’t know where all these kids are gonna go. The bust is already starting.

LAer – No friggin’ kidding. At age 53, sure I got decent grades in programming classes in college, C, Pascal, and yes some BASIC – this last invented at my dad’s college.

But nobody’s going to hire a programmer in their fifties. Not even if I turn out to have a knack for it.

Perhaps all the boomers (& some early Gen x’rs) who find themselves in a good housing situation should adopt a few millennials. If we each just take 3 or so it will allow them to save enough to buy our houses in 10 – 20 yrs (?) Problem solved!!

Hey, if those Millennials will agree to wheel us around and wipe our Boomer asses in another 30-40 years I’d take one in right now. Fair exchange. Who needs LTC insurance?

You might as well hand over the keys to these millenials when you are done living there. Home Free!

First, get it through your heads that no one cares! No one is concerned about the long term consequences of any of this. In terms of real estate, there is only how big is my real estate commission now, sellers only care about pocketing profits, and local governments are only focused on their precious property tax revenue. The implication of huge student debt, low overall savings for either emergencies or retirement is an epidemic, and will become the largest socio-political-financial crisis in our history! The longer we kick this can down the road, the more lethal it will be when the bubble bursts!

JNS: I don’t think anyone here asserted that the government, big business, property sellers, or anyone else cared about the welfare of the middle class (or anyone else aside from the .01 percent). Few people are that stupid. This forum is where people seem to come to vent their frustration and float their best guesses on how to best navigate the current housing environment, which really has nothing to do with anyone or any entity caring about ones welfare.

My wife and I millennials, we have a 20% down payment saved up combined yearly income of 175k and very stable careers. We jumped into the housing market this summer and woah…I was floored at what crap $500-600k buys you know compared to late 2013 early 2014 when we last started going to open houses. We have written a lot of offers and been accepted to a few but I am worried. Is it me or has the correction started? Could also be the slow season. I guess we won’t really know until the Spring…thoughts…

IloveLA – Don’t even contemplate buying when the tide’s high. Wait it out and buy when the tide is low again. And keep in mind, if you’re in tech you might be damaged good once you hit 40.

That depends greatly on the company. I work for a big international corporation (17,000+ employees), and just in my small area of the office we have two workers in their 70’s. Most non-tech workers are fresh out of college, but we routinely hire everyone from the incredibly ancient to the cripplingly overweight. No discrimination here. In my department (IS) we only have one developer who is in his 20’s and two in their 30’s. The rest are in their 50’s.

I believe that whether you realize it or not, you’re referring to hipster startups whose founders are barely out of diapers and ageist to begin with. The bay area is overrun with those, and they are the companies to stay away from unless you want to rapidly become undesirable in the real world of consistent profits – any company that is intelligently managed, with stability and good long-term prospects, won’t want anything to do with a techie who had a couple of flash-in-the-pan $170k salaries. They want someone who will be happy with $80-100k, can prove their skills, and will get along with the team, regardless of age or education.

Thankfully I work on tv shows, which has been and should continue to be steady…the question is this high tide or mid tide?

JohnD – Yeah, I think i could learn to tolerate making 8X – 10X what I do now….. I’m sure you have to know someone….

Electronics is such a losing field. What the hell was I thinking about? I am literally hanging my hopes on sign painting (a good solid trade) and saxophone (also a solid wage if halfway competent) these days. Where I work now, I was told I’d eventually make up to $30k a year, but I can see that’s not going to happen. If I can make $30k a year I can live like a king. (A king who lives in a decent rented room, can save up for a Mobil in a 55+ park, eats OK, and has a decent bicycle and trailer.)

Madness to be writing letters, imo, and you ask what the market’s like? Sell on the sound of trumpets, buy on the sound of cannons.

Alex; my family doesn’t need much money for ‘happiness’ either, but I’ll be damned if we’ll pay extreme price for shelter, in a societally destructive idiocy of a market. We refuse to be complicit in it by an act of purchase.

Is there a niche you can find? Electronics. I’m a big fail at physics/sciences, but I recently made a ‘lost-keys’ finder out of a battery powered doorbell. 1 unit the doorbell (small battery) which is the finder device, the other unit the circuitry innards of a 2xAA battery door-bell buzzer. Problem is that is too heavy with 2xAAs for keys. 1xAA would be perfect. I find cell battery gizmos run out of power after 1 day. Not convinced by new types either using modern phones to track down. Not suggesting anything like that, just trying to give you inspiration. Best to look at something you can charge a high premium for. Product or service.

Alex, when you say you work in electronics, you don’t mean that you’re an electrician? One of the building trades, who installs and repairs electrical systems in buildings? I’d read they make good money.

I don’t suppose your IT electronics skills are transferable to becoming a licensed electrician?

Sorry Alex – the closest I come to that field is a FIL who is a retired electrician. I would recommend becoming a plumber if it wasn’t for your health issues.

Have you tried looking in your field in a different area of the country? There’s got to be more demand for your skill somewhere. Vacuum tube audio is back in style.

Galaxy Brain – Everyone’s for the one gadget in mind that will make them rich… Yes there are specialties, like tube audio amps, high end audio in general, things like that and they are possibilities.

However a good sign writer makes bank, no kidding and its far less hassle than electronics, I know, having done both.

Likewise the sax. There’s $100 an hour out there to be made by being competent playing popular music. Steely Dan, Beatles, you get the idea. No soldering iron or 2% precision through hole resistors required, nor pissy customers. Just play and people throw the money. I was hearing $15 an hour as a barely competent trumpeter,and I can tell you its fun. The musicians who are poor tend to be crap,lazy, or went to conservatory but don’t need to use it because they have a trust fund. Or, they’re one of the far too many millions of guitarists we have around here.

I used to work in TV too. The hard part is not when you’re young, it’s when you get a little older. The jobs at the higher end are fewer. There’s a bunch of lower level people in each department, there is only 1 department head. I knew tons of people in their 50’s who went for a few years with no work. Their retirements got depleted, their kids’ college savings too, second mortgages. Save and invest as much as you can because everyone has a dry spell in that industry.

While the decision makers continue to reside in L.A., doesn’t much of TV production now get farmed out to Canada, and other places outside of L.A.? It seems that many cable TV shows, and just about every SyFy Channel movie, is shot in Canada or New Zealand or Australia.

I would love to work in radio; my Roger Ramjet impression is top notch.

If you are going to try and buy now, make sure you right any offers w/ a 20% discount factored in. The market is going to correct again, and potentially play out like all commodities have over the past year. ~50% correction in certain markets by 2017, especially if interest rates rise.

Most Millennials, unless they get the down payment from Daddy, are on the sidelines.

Living in SF East Bay, the houses are bought by young immigrants whose families back home, front them the down payment. I know one such young family from Burma, educated, engineer and IT type.

They got the down payment from older extended family members who are obligated to finance the younger generation. This is their tradition. They in turn, will do the same for their family in 20 years when they become, of well to do means. The newly landed immigrants are the ones that what the “American Dream. It seems to work for the young educated immigrants who pull down good paychecks. They also bring their mom in-law over from Burma to do baby sitting. It’s an idea that works. On my street in Fremont you always see the grand parents of Asian, Indian and Middle eastern famlies pushing around the baby carriages while the younger parents are at work. This doesn’t work for the adverage American.

because the grand parents and their adult kids lack the patience to live with each other.

I speak from experience, But Americans did live that up to WWII.

It was for econimic survival.

Inexorable decline – that’s the future of the US.

It’s very true what you say about young immigrants and their extended families making it work (living together, grandparents helping with childcare) to get into the housing market and be financially solvent. I personally think it’s smart to set yourself up this way. The days of the American nuclear family are coming to an end. It’s just not affordable anymore even though a lot of people are still trying to live this American Dream. There needs to be a culture shift for it to become the new normal for extended families to live together again. I’m 34 and husband is 39 so not really millennials- we have a couple hundred K saved up for down payment and make about 200K/year combined but are currently sitting on the sidelines hoping for an implosion of the housing market here in the Bay Area. What we could afford without over-extending and without a ridiculous commute is a very sad proposition at this time. I just don’t want the crap shack bad enough! I wish my parents would jump in and sell their home and buy a larger house with us. I have the patience to live with my parents who are boomers but they wouldn’t give up their lifestyle for that kind of change. Yes they love their grandkids but they love their freedom more and would never sign up as a regular babysitter during their retirement years. I think this is par for the course for most of the boomers. I can’t say I blame them, but it does make me sad. If we don’t see a price correction in the next 2 years, we’ve already decided to move somewhere more affordable.

BayAreaJh: My wife’s parents are baby sitters for two brats (their grandkids), and their life seems less than desirable because of it. Although no one, young or old, knows how much time they have left, they are wasting many of the limited years they have left caring for two brats. Neither the parents nor the brats are appreciative in any way for the parents’ service. I can’t say I blame your parents in the least for not wanting to play baby sitter to your kids; in fact, I commend them. They should enjoy the limited years they have left on their own accord. Your kids, your responsibility; there shouldn’t really be anything to be sad about. Another thing to think about in a multi-generational household is being a caregiver for your parents in their twilight years whenever you are at home- do you really want to do that, have a full time job, and/or take care of your kids at the same time? Do you want your kids having to take care of your parents? That sounds exhausting and potentially unfair to your kids. I’d rather hire a caregiver for my parents (but visit frequently), enjoy my freedom, and let my child be a child without having to play caregiver to a grandparent.

BayAreaJh

I echo your sentiments completely. We are about same the age as your and your spouse and are on the sidelines. I also have retired parents in San Jose who sadly cannot quite sympathize enough with the next generations’ plight in housing affordability to take action, be it to find a way to buy together or to rennovate their place to make space for us. We are the first to give them grandkids of my siblings. They love their grandchildren, but do not seem willing to take on any of their care burden. I mainly believe they dont want to admit that their children have less chances (home affordability and job stability wise) than they did and still hope that we are just going to make it. Denial is a powerful force…sadly even so much as to prevent families from protecting their own.

Also, I wonder if this new runaway home, health, and school cost trend happened so suddenly, as in last 5 years, that the boomer generation isnt processing it yet.

But I am with you…it is sad. If a boomer cannot take pity on their own child, how can they possibly feel beholden to the younger generation of americans in general? They have turned their eyes to cruises, vacations, home remodeling, and generally enjoying their harvest years. Lastly, many boomers probably feel quite entitled and proud of the mere fact that they have spared their children the obligation to care for them in final years of life. i know that is my mother’s sense…that she did us the favor of “earning” her retirement so as to never depend financially upon us. Again all pointing to an general culture of each nuclear family fending for for itself…kids flu the coop, rinse and repeat. The more that I think about it, the part played by consumer marketing must be huge…the market chasing the disposable income of retired boomers is too rich with opportunity to allow this family solidarity thing to encroach upon it…

Not sure if the tide will change there… certainly not without some dire circumstance to shake people awake as to their priorities…

sorry for the stream of conscience;)

We gave our Millennial Daughter and her Husband about 1/3 of the money they used in buying their current house. At its 2015 value, they have about 50% equity (based on houses that sold recently on their street). They own a nice North Orange Co place with 2600 sq ft and 4 bedrooms. The payment is affordable on one salary, and my Daughter quit her job to stay home with the kids. We aren’t rich and neither are they. I know of several other middle class families around here that helped their kids buy here in Orange Co. Are we just the last bastion of old fashioned American family values?

No, you’re the last bastion of the local entrenched-class who won the generational lottery which enabled you to enter the market when wages to prices were reasonable and continue to have your property taxes massively subsidized by the majority of other tax payers.

It’s fitting that some of those savings would be put toward further fueling the imbalance from which one benefits.

Where in hell do you get the money to do that? Drug dealing? Human trafficking? Snuff films? You dont get that kind of money by working.

You’ve helped pump up the bubble imo.

This woman helped her daughter buy earlier this year in London, and in my opinion, had a bit of superior attitude about it.

Since then, UK Gov has announced shock new tax-grabs. The market is set to fall in my view, possibly plunge.

We’ll see who is left in position in a couple of years.

__________________________

My daughter and her partner bought their first house about 3 1/2 years ago. We did offer help, to enable them to go for something a bit further up the scale, but they were adamant about doing it on their own. They were newly back in UK after quite a while overseas, and I did suggest renting for a while, because I thought prices surely HAD to come down soon. Instead of which, the house – an ex council house – they bought for £205K – they have spent less than £10K on it – went on the market again recently for £290K and they have accepted an offer of £285K. They have a new baby and with primary schools in mind they now want to move to a slightly ‘better’ area. They have found a house they like, which does need modernisation, and because it’s quite a bit more, and there is very little at any sort of affordable level, we have offered help which they are accepting this time.

I did briefly suggest waiting for a bit in case prices do start coming down, but my daughter is worried about them moving even further out of reach. They are in an expensive part of the country anyway, and given what happened last time I suggested waiting, I didn’t mention it again. Like you, they would plan to stay in the house long term and will improve it considerably. Our future son in law is very capable with any sort of DIY. If the house were already done up, it would almost certainly be out of their reach now.

I am well aware that BOMAD (Bank Of Mom And Dad) is very unfair on those who can’t expect any help, but sadly life never was fair, and most parents like to help if they can. Of course I wish prices had come down to realistic levels – I would not give a toss if the value of our own house halved tomorrow. But at best all I can see now is dribs and drabs, and maybe not even much of that, at least not in expensive areas.

Old Fashioned American Values = Screw You, I’ve Got Mine.

Don’t worry, my whole family works that way. It’s the Anglo way. We deserve to be overrun.

I agree with the other posters, you presumably benefited from 20-30 years of relative sanity in median wage / house price ratio of 1:3, and if invested right, were able to have incredible gains in the stock market in the 90’s, and again from 2001-2008, or 2009-2014. Everyone needs to realize we are circling the drain, and the span between each recession is shorter, and the recovery weaker.

On a side note, Prop 13 will eventually need to get overturned, and interest rates will eventually need to rise for everyone’s benefit whether they like it or not.

We got the extra money the old fashioned way. We inherited it when older relatives died with paid off houses. The total amount put into the house wasn’t more than 250K, and the 2/3rds was saved by my Daughter and her husband from government employment. I have saved more than that in IRAs and 401ks over my working life. I’ve never made 6 figures per year in my life. Slow and steady wins the race you losers!!

Escape from LA and OC. I bought a condo in riverside for right around 230k. 4 bedrooms and 2 baths backyard for the dog and no mello roos. No longer in the OC rat race for houses. For most people unless you inherit money home ownership in the OC is not going to happen so it is time to move to greener pastures or stay and complain about how affordable housing is in your neighborhood it is your choice.

Bought a condo in Riverside for around 230k: Different strokes for different folks. Glad you like it in Riverside. I’d rather live in jail, but that’s just me. Just kidding (sort of). You don’t need an inheritance to live in OC. In fact, with two working professionals, a condo in Newport is very feasible.

I can’t speak for everyone, but for me, buying a place I’d want to live in isn’t really a matter of affordability. I can technically afford what I want. It’s more a matter of not wanting to pay the current ridiculous prices, and trying to gauge when prices might come back to some semblance of sane.

Ok we can agree that 99% of the millennials ain’t shit. But the housing prices, continue to rise.

So then what exactly is driving the rising market? Inflation, global demand, etc.? And how much longer will this continue. Aye, what does your eye see in your crystal ball?

“So then what exactly is driving the rising market? Inflation, global demand, etc.? ”

I believe (based on extensive knowledge and experience) that the main driver is inflation – 3 types:

1. Land price inflation (in highly sought area close to employment) is the main one due to scarcity of buildable land comparative with the demand – all people from inland empire would like to live closer to their jobs and closer to the ocean where the climate is more pleasant.

2. Materials and SKILLED labor inflation. In desirable areas where is very crowded, skilled labor demands higher wages than in midwest. Materials also cost more because all suppliers have higher business cost to operate.

3. Higher and higher development fees, building permit fees, hook up fees which can add up to more than 25% of the construction cost (without land).

Due to these 3 drivers of cost, many builders can not make a profit on building. That creates scarcity built over many many years which drive price higher which is also a cause for even higher construction costs, therefore we see a vicious circle.

I know that many will not agree with this, but it is a reality regardless if you accept it or not. At the root of it all are the policies of the FED.

The demand based on history is very low even if you include all the Chinese buyers. The purchasing power for most people is decreasing. The middle class which used to buy homes in SoCal is a minority today. However, the supply is even lower. Where the supply is not so low, there are not too many jobs.

What do you think would cause prices to drop?

I think either the FED raising interest rates (which they won’t do because of all the debt)

and/or

building houses becomes much cheaper due to new revolutionary technology. (such as houses being 3D printed or whatever). But that still does not alleviate the constraints of supplies and land.

In the long run, the dollar will just keep shedding buying power. Sure, there might be small drops here and there in the housing market, but holding green paper long term is a losing position.

That just leaves the question, why did housing prices ever fall before?

I guess this can be explained by the FED either raising interest rates; or the equivalent occurring, which was the credit crunch. Whether the credit tightening occurs upstream or downstream doesn’t really matter so long as it occurs upstream to the masses. Tightening and relaxing credit is done from time to time so insiders can profit off of volatility; buy low, sell high, repeat.

It doesn’t really require much skill to control the market when you have a magic printing press.

Also, if prices do drop due to increasing interest rates, that just means the sellers of houses make less and the banks make more (due to charging higher interest). It will still be a net change of zero for the buyer (unless they intend to not take out a loan at all, and just buy all cash; which isn’t really that smart because you don’t get as many tax breaks, nor can you benefit from inflation eating away at the debt).

Good observation, FiatValue

In OC and LA county out of the price for a new house about 2/3 of cost are in land and soft cost (all fees charged by the county/city). In some areas it can be more. The materials and labor are about 1/3. In a normal balanced market the cost of land is about 25%.

That gives the bloggers who do not work in construction a good idea as to what they buy with those high prices.

The demographics are going to be changing very soon. Millennials are not marrying and having children as is pointed out. The future of this country lies in the hands of those in the majority and that means those who are multiplying faster. In the not too distant future, Millennials are going to find themselves in a minority in the country that their parents were the majority. In some ways that has already happened. Real Estate will be a small issue when that happens…

Do you mean white people? Are we talking about white people? Because it totally sounds like you’re talking about white people….

Having been around a lot of white people and seeing the kind of dog-eat-dog culture they have, where everyone is competing with everyone for crumbs, where family members even treat each as The Competition, to be given no aid or quarter, I’ll take my chances with the Mexicans.

Are you an ethnic tolerant (Ha!) type or just have a self loathing anglophobe? Signed in just to spit your way.

“Do you mean white people? Are we talking about white people? Because it totally sounds like you’re talking about white people….”

Haha. Love it. Thanks for calling a spade a spade. This “not gonna say what I mean directly” nonsense needs to be called out. I think he meant white people too!

Serious question: If most Millennials can’t afford homes, and Gen X is stretched beyond belief, who/what is driving all the demand? Are investors buying up all this real estate and causing the prices to be so high? Are buyers just stretching their affordability to “get in” no matter what? I mean, I see people at stores arguing with the clerk about a 50 cent coupon, while nobody seems to bat an eye at purchasing 1/2 million dollar home. Thoughts?

As the cliche says, foreigners with suitcases full of cash.

If most Millennials can’t afford homes, and Gen X is stretched beyond belief, who/what is driving all the demand?

Inventory of nice houses, in nice neighborhoods, is limited. And there are just enough Angelinos (Millennials, Xers and Boomers) with money to overbid and buy that limited inventory.

Most Angelinos might not have enough money to participate. But you don’t need that many Angelinos to drive up prices for nice houses, in nice neighborhoods.

It’s a sort of generational crowding going on. 30 years ago, a lot of the over 60 crowd would have already been dead. Medicine has advanced so much that people are living longer.

If you take 1955 as the midpoint for Boomers, that puts 2020 that most will be over 65. Right now, they still have a lot of buying power due to saved equity, good careers, investments and retirement income. Since they haven’t moved into retirement homes yet, there isn’t enough inventory that in previous generations would be on the market. You have to remember that the Boomer generation is huge. They’re also the biggest group buying luxury urban condos. Something bad’s gonna happen in that market pretty soon.

local govt should provide fair housing to older n young worker…..if we can built great campus of uc during 60s in ca, why not let local govt built housing for the needed??there going to be big supply shocks in ca housing….unless some move out or dead …the deficit is greater??

I lived in SF and went to school there in the early 70’s. Granted rent and tuition was a lot less then but even allowing for that life was cheaper for a young adult. You didn’t have cellphones, ISP or cable bills for one thing. Broadcast TV gave you quite a few channels with sports, movies, music/entertainment and it was free. A single landline would serve a house full of roommates. Electronic gadgetry was limited to a stereo. I lived at Post and Taylor in a studio for $160/month two blocks up from Union Square and I was making $1200/month at Bank of America’s data processing center on Market St so I mostly walked to work. Aspirational things were a nice car ( or even a house. It was all doable back then on a single income if that was what you wanted to do. What the hell went wrong!

Sangell – It started with Reagan.

@sangell What the hell went wrong!

Greed! Offshoring! Why pay U.S. based labor costs when offshoring to various 3rd world nations is cheaper and returns greater profit to the shareholders!

Here is where I believe we were all led astray by the lies of globalization and how it would make our lives better by making the crap we buy at Walmart cheaper!

$120 for a studio with a salary of $1200?!? So, for a 40hr a week job 4wks per month, you were making $7.50p/h. After rent and a few bills, you were probably saving 90% of your income? A lot of people in the Bay are not making much more than per month that now! Excluding inflated tech salaries that skew the income curve, the majority of jobs out there are service, tourism and retail. Paying, if you’re lucky $15 p/h -after taxes this might end up as $1700 take home pay. Except that a studio, even in a crap, ghetto neighborhood (I live in one) is going to be $2000 minimum! How can our economy survive if 80-90% of the population does not even have disposable income?!?

I live in a finished office (130 sq. ft.) in a building zoned storage. I only pay $40-$60 a month for electric. No rent. I was looking around on Craig’s list and found plenty of jobs I could probably talk my way into for $15 or so. I can find a crappy studio for $1200 without too much trouble around here. So its do-able. But the kind of jobs I can walk onto require being in decent physical shape as well as being sharp mentally. And I don’t want to work full time right now.

Two people can live in a studio. So you’re both making $15-$17 or even $15-$12. and the numbers get a lot better. If at least one is a decent cook, you can eat quite well on a “food stamp” budget.

This is all assumed on jobs like Costco, home depot, auto parts delivery, things like that.

A lot of us shop at Ross too. I just got a Columbia fleece pullover for $10 that was originally $60. My $150 Doc Martens low quarters made in England cost me $50 at Black And Brown.

So a lot of us are making it work….

The U.S. will use immigration to make up the difference left by millennials.

CSV – This is because many immigrants think this is the same land of milk and honey it was in the 1950s. They come here young and full of energy and work their guts out and only realize they’ve been conned when they reach my age. Then, fifty fifty odds they go back to the old country to retire, so the US doesn’t have to support them when they’re old.

Even in my case, even though my race is strongly disliked there, if I’d stayed I’d own a house in Manoa Valley now. Not everyone there hates haoles, and in fact it made us stick up for each other a bit more. The real security and money is in something that has to be done, like water treatment and its the kind of job a haole can get, because it’s stinky.

Who cares what the Millennials can’t buy. There is huge demand and people all over the world are buying Nice houses at astronomical prices. The recovery occurred. Let’s move on….

Lowest American home ownership rate in decades. But you claim that it’s a recovery?

Oh BTW, it’s the sell side that claim that millennials are going to jump in since the corporations and the foreign buyers are pulling out of the market. Don’t throw millennials under the bus since the government desperately wants them to take out low down payment loans.

It doesn’t matter, real estate prices will be manipulated anyways!

No matter what facts you throw out Dr. Housing Bubble, you forget the elephant in the room; the central banks and government/politicians will just make up the rules to engineer another bubble.

It’s sort of like when you are about to win in a game of checkers. The other side is cornered and no matter what next decision they make, they will lose. The options are few and the end result is inevitable. But then the losing team just makes up more checker board spaces out of thin air. That is what they did with the next housing bust and that is what they will do with the next housing bust. Their trump card is negative interest rate policy.

Nimesh: that doesn’t mean you can’t strike while the other side is cornered (like in 2009-2011). It was a narrow window, but it was very doable to get a reasonably-priced house during that period. I’m just waiting for the next such opportunity. And yes, I did take advantage of it (but I only bought one; I should have bought two).

Responder – During that window, houses on 3-5 acres were available all day in Gilroy and Morgan hill for a quarter mil all day. Morgan hill has a surprising amount of tech. On land that size, you can keep livestock, a horse for your kids to ride, etc. Now it’s bubblesville again.

Nimesh that’s a pretty cool visual.

Millennial here. There are fixes to this problem. They will never be implemented. First, zirp cause this problem. Money seeking a return poured into housing. Next china caused it, they see it as an escape plan and a way to hide money. Finally, poor tax policies such as prop 1 keep it going. It is easier to just leave and get on with life rather than wait for things to change here. I make 90k as an engineer in social and rent a 2 bedroom that isn’t particularly special. The rest of my money is going into low risk 401k or other savings at the moment. I refuse to buy a house, ever, at these prices.

Raise interest rates to 4%, mod prop 1 so that second homes get prop tax at 4%, third homes at 6, 4 and up at 8. Foreign owners should pay at least 4% unless they live there as a primary residence.

RenterForLife: Great points; one thing I would add is that maybe non-citizens shouldn’t be permitted to own houses here at all. Also, even though house prices are ridiculous, throwing away rent money every month adds up after a few years, especially given likely rent increases. At some point, it might make sense to buy despite the high prices. I don’t blame you for waiting to buy, though; I’m patiently waiting as well.

Non – citizens not being allowed to own here is just common sense. Also, no more citizenship by birth, no more anchor babies. Citizenship by birth only when both parents are citizens.

non-citizens shouldn’t be permitted to own houses here at all.

That’s not necessarily good for all Americans. It’s good for Americans who don’t already own homes. It’s bad for Americans who already own homes.

If you’re an American home-owner, you want as many rich people, foreign or not, bidding for your home.

@RenterForLife: YES! My sentiments exactly! We’re also on the sidelines renting and saving at least $3k every month from 2 salaries. The house we’re renting is cheaper on a monthly basis than it would be to buy a similar house in the same hood.

Sure, I’m “wasting” equity on rent. But at least my rent is going into another person’s pocket, to use as he desires rather than paying a jumbo mortgage to some faceless, multinational corporation that doesn’t give a damn about people.

But as long as crap shacks are priced as if they were turn key ready and needed no renovations (which most are not), we REFUSE to pay today’s insane prices.

How about only allowing 1 house per person? And no corporation or business can own a house. That would solve the whole enchilada. Give the current unhappy “investors” 2 years to liquidate their “assets” into a deflating market.

How about only allowing 1 house per person? And no corporation or business can own a house. That would solve the whole enchilada.

That’s a great way to TANK the home construction industry. Put LOTS of people out of work — contractors, builders, inspectors, carpenters, electricians, plumbers, loggers, concrete mixers, etc.

BTW, the East European Communists had similar programs. Limiting home ownership or occupancy. (Often the state owned the homes or apartment blocs, and people were merely assigned to those buildings, subject to removal by the state at any time.)

On paper, the Communist ruling elite owned no more houses than anyone else. In reality, the elite were given many houses and mansions. But since the state owned these mansions, the elite remained “modestly-paid workers,” merely using the mansions to do the work of the people.

Kinda like how the pigs in Animal Farm merely used Farmer Jones’s house and beds.

Son – Fine, you side with the oligarchs and we’ll side with The People.

I agree with SOL.

Depriving the public of rights will only lead to further power concentration within the privileged and connected. Those who can afford to will circumvent the law like they do now.

Sounds like we have some people with good jobs and good savings on here. My best advice don’t just wish for a 15% correction to buy with a 20% downpayment. Wait for the epic collapse when HOUSING TO TANK HARD IN 2016 happens you can buy it outright for your downpayment now.

I’m only truly familiar with how things are here in Orange Co. I do think that we could see a 20% correction soon which would make $700K houses drop to $560K and $500K houses drop to $400K. But 2016 is an election year, and BO and JY have a vested interest in keeping the White House in Dem. hands. They will do what ever is necessary to keep a boom market housing collapse from happening on their watch. It was 2014, then 2015, now 2016. We are seeing asset prices up and commodity prices down due to what the fed is up to. A slight rise in interest rate this month will stabilize the dollar against the awful foreign currencies, stabilizing assets and hammering commodities again in my opinion. we’re just the best house in a crappy neighborhood (the World).

I too have only been looking in OC. I must admit though I have seen some price reductions in the cities I have been following (mission viejo and ladera ranch).

Wondering if those listings were indeed grossly over priced at initial listing; or, if the demand pull back is real?

Totally agree that an incumbent party will do its best to hold up the tent poles until election time. It will be interesting to find out how successful they will be. It didn’t work out so well for Bush Jr and the Republicans in 2008.

They can keep prices inflated for a bit, more so with any inflation signs…but it will back down 20-30% in time…give it 2 years…

they can only keep prices up for so long, 3 card monte tricks are always figured out and no one will play with that player….

anyone saying prices will not come down is too young, naive or just plain old equity stupid….People talk about equity at parties, break rooms, bars, eateries etc. the issue is you have none until you sell…

RE agents always tell me about my 450K in equity and I laugh at their folly…

Ok I will put everything on RED!

Jim, you promised a HARD TANK by the Ides of March — of 2014.

People are house horny. They’re tired of waiting.

Go, Jim go! I want to see the real estate market collapse but I doubt it will.

Sorry Jim, If houses were that cheap, I would get a half dozen of them, and I would be in line ahead of you. People on this board will call me a knife catcher again, just like last time Housing Tanked Hard 5 years ago.

@Hotel California

Nor the Democrats in 2000…

Fed intervention can only go so far.

I know some Millennials who are buying their first house. They only needed 3.5% down payment. This is after they had a crappy FICO score. They went to a lawyer to get that fixed and then FHA helped them get a 3.5% loan. Not that hard.

Who said that subprime loans are no longer an issue?

When small investors invest in conventional investments like stocks, bonds and commodities (like gold), their one way to do well generally is to take advantage of dollar cost averaging; buying fixed dollar amounts over the long term. When prices are down, you buy more, when prices are up you buy less. The only way to do exactly that in Real Estate would be to buy stock in a REIT over time. i guess you could think of a mortgage payment as a form of dollar cost averaging, but it really isn’t exactly that. Market timing is a bitch in both stocks and real estate. My experience says that real estate is good to have if you hold it long term. That may not work for the new generation, but I wouldn’t bet that way given History (which often repeats itself but may not do it in a cycle that does you any good!).

ru82: Those millennials you know will enjoy paying PMI for the entire duration of the loan. With only 3.5% down, PMI isn’t cheap. And if they can only afford 3.5% down, I doubt they will be in a position to refinance anytime soon to rid themselves of PMI.

Currently, the upfront PMI premium is 1.75% of the loan amount (which can be financed lol); the remainder of the PMI amount is an annual premium of 0.85% of the loan amount. Fun stuff!

Source: http://www.bankrate.com/finance/mortgages/7-crucial-facts-about-fha-loans-6.aspx

When I read and hear enough anecdotes of people with a history of bad financial decision making purchasing homes, especially the ones who have previously foreclosed, it sticks in the back of my mind as an ominous sign. Just like the properties with a history of speculative pricing and foreclosure, they tend to come back into the picture about when you’d expect them to.

This is true; but, they MUST qualify based on income (debt to income ratio).

Trying buying a home in s decent neighborhood with a FHA 3.5% down payment. The payment is ridiculous. in the IE, your looking at a payment well above $2k monthly. It’s easy to get in but that doesn’t mean people can pay it. Factor in HOAs and taxes and it becomes a finnicail death trap. My wife and I are under 30 and all we are told by sellers is get in now, invest everything, your guaranteed to make money. We are saving and have 20% to put down and we are staying out. the fact that the only way my generation can buy is this route should tell you that they can’t afford it. We want nothing to do with a market propped up by low interest rates, investors and FHA buyers just wanting to get in before it’s too late.

Michael – It’s almost like they’re trying to sell you something, huh?

The house they are buying is in flyover land. It is a brand new 4 bedroom, 3 bath, 3 car garage, 2400sq ft for about $300k

The house is similar to this.

http://www.homefinder.com/MO/Lees-Summit/1058-SW-Conch-Way-121617027d

Dan – The Husband is in sales. They really do not have any debt as they have been trying to clear up the FICO score the past few years. The husband will make over $100k this year as he is having a great year. Prior to this year he probably never made over $75k and the wife does not work.

Responder: The PMI is not that big of a deal. They are going to get a 3.5% 30 year loan. That is .5% under the normal market rate of 4.0% for someone with excellent credit history. Since they do not have excellent credit this low 3.5% loan rate makes the extra .85% PMI a wash. I would have to guess with a non-FHA loan they would be paying 4.5% to 5% for a 30 year loan do their their past credit history. Thus the FHO w/PMI is better than having a conventional loan and 20% down and no PMI in their case. Crazy as that sounds.

And if the economy goes sour they only lose their 3.5% down or about $11k dollars.

Anyway if you go to bankrate.com and use the “how much can I afford” calculator it says they can afford a $400k house on a 30 year loan @ 4% interest. Crazy and a pretty good deal if you have a poor credit history.

I

Absolutely. When $625,500 is the FHA and conforming loan limit, it’s obvious there’s a problem.

But their mortgage payment must be huge. Default is baked into the cake on that one.

FHA 3.5 % down is not wise, u should save 20% or more for down payment and try 15 years fix rate!!!

Definition of “Crap Shack”, built during the Great Depression, 1930-1945. Before 1930, they are now known as “vintage”, built during the 1920’s when the stock market gave people plenty of money to build in style. Post 1945, the “cracker box”(not to be confused with the “crap shack”, were cheap construction, built up in big developments for the returning GI’s. Of course, crap shacks and the cracker boxes did not have lath and plaster, but the cheaper plaster board that will not stop a 9mm. This is a good selling point currently. You feel safer in a “vintage home” during these troubling times.

Ira – nice urban dictionary and great points! I’m in a 1921 now and am very drawn to homes built in that decade. Now I appreciate how difficult it can be just to hang nails for the art!

That “cheap construction” post 1945 came from economies of scale. These houses are still providing shelter. Just because they’re “cracker boxes” doesn’t mean they weren’t well built.

They’ve survived quakes when newer, “better” housing and luxury condos and apartments didn’t.

And I owned one: built in 1947, 946 sq ft. 2 BR, 1 BA. Huge lot. It was well constructed in a development, one of the earliest in the suburban building boom in the Valley.

The property horny snobs will sneer because it wasn’t a 4000 square ft McMansion with granite and an open floor plan. Let them. I loved that house. I bought it to live in, not speculate.

Compare these modern expectations to those of 1947. These met a ready market as their was a housing shortage at the end of the war. People raised families in them. And with only 1 bathroom ! The suffering.

I really doubt that all those houses going up en mass in the previous bubble period were that well constructed. We’ll see in a couple decades. The crap shack of tomorrow is here today.

I would bloody well take a smaller house that had withstood time and quakes that needed some work, over some half assed speculative first time flipper’s idea of a rehab.

Will your 1947 stop a 9mm like a 1926? Living in the San Fernando valley, that is a pertinent question with MS13 around.

You can always reinforce your crap shack, with bricks then make it a decorative shelf etc. Even stacks of national geographics will do it.

The printed money prosperity mirage can be found in the outrageous amounts companies like yahoo! pay to acquire zombie companies nobody wants — except friends of friends – “Yahoo bought Polyvore in July for $230 million. Polyvore, a social commerce site that lets users make artistic collages of clothes and accessories, was founded by three Yahoo alums, including Jess Lee, whose relationship with Mayer dates back to Lee’s days as a Google APM more than a decade ago. It’s not acceptable to pay $230M for zombie companies run by former APM members,” he says, pointing out that Polyvore had raised $22 million in VC funding, was eight years old and had gone through multiple pivots. For all intents and purposes, it looked like a goner until Yahoo bought it. http://www.businessinsider.com/eric-jackson-slams-yahoo-for-polyvore-acquisition-2015-12

3 out of 5 of the best housing markets in US to be in since the bottom (2010-2012) happen to be in Californication (SF, SJ, Anaheim) while LA is one of the worst for renters. Housing, renting stats correlate well with job growth.

http://www.marketwatch.com/story/10-housing-markets-that-have-fared-well-since-2012-2015-12-11

I’m friends with at least a dozen millennials. Some live on their own, with several roommates. Some used to have their own places, but moved back home with parents. And others are renting homes and have not expressed any desire to own.

One thing they all have in common is that they love to go bar crawling every weekend and spend most of their disposable income on the bars, restaurants and going on weekend trips to do the same things, just in different cities.

This is not the generation the housing recovery will be built on.

The 40-something manchild son of my boss is like this. Get all interested in buying a bicycle and I help him find a nice used one on Craig’s List (Trek 520) and he can’t come up with the $400 or so to buy it. He works, but the bars and restaurants get most of his pay – he’s even a member of a wine club and gets wine mailed to him regularly.

cool story bro

I don’t have much concern that 20-somethings aren’t buying, because when I was that age, I didn’t care at all about that stuff. Even though I’m a Gen-Xer, I “trend” just like a Millennial. Back in my 20s I only wanted for adventure and experience, skool of hard knocks style. Worked my way through college, traveled, had very low standards, tons of roommates, and the adventures of a lifetime. Hit career strides in me 30s and bought my first property in 2012 in LA in my mid-40s. Seems normal to me.

It could matter when it comes time to move.

Passing, that sounds like a lot of us, but I am guessing that when you were having a great time in your 20’s, you weren’t carrying massive educational debt. Maybe Millennials do so much bar-hopping because they know they are never going to crawl out from under that load.

Nope – no student debt, although I was a film student in the early nineties and we shot on film and I spent tens and tens of thousands funding my major, so I worked 30 hours a week in a restaurant and paid my way through, getting a BS at the age of 27 as a result (also took time off to travel on the cheap). All the tech gadgets that are normal today didn’t exist, I typed my papers on a typewriter and used whiteout to correct mistakes. I watched my older siblings get trapped into 80s-style credit card debt, the cc companies were on campus giving away cards. I saw them getting trapped by credit and cocaine. I actually have been working since I was a teen starting with a paper route at age 13, it’s just that I didn’t care about saving or security til I was a working stiff. Now it’s all I care about!

Incidentally my “buy low” in 2012 was in a central LA in a transitional neighborhood and I want so bad to upgrade, so here I am dealing with the “sell high” option but then where the eff do I go??? I pay way less than rental parity for a studio!

If buying in your mid-40s is the new normal, that is a huge economic shift and is precisely what home builders and overpayers fear.

Long term it has little affect, but short term the implicarions would be huge.

These high prices not backed by income habe something like 8 million different ways to die, you don’t have to predict any 1 exact reason why LA prices will crash.

This New York Times article is a MUST READ: http://www.nytimes.com/2015/12/15/us/shell-company-bel-air-mansion.html?_r=0

It’s about uber-rich foreigners buying up Los Angeles. Names names. Sons and daughters of corrupt foreign tyrants from Russia, China, Indonesia, Nigeria, Uzbekistan, and more.

Lots of money quotes:

Allan Alexander, a former Beverly Hills mayor who now practices real estate law, said he, too, had seen a steep increase in foreign buyers, especially from China.

“A lot of them are buying because of the safety of the investment here, and they don’t care about the price so much because, candidly, they want to get their funds in a safe place,†he said.

As I’ve been saying, they DO NOT CARE if housing TANKS HARD. Better to lose 20%, even 50% in a HARD TANK, than to lose 100% of their ill-gotten gains to their own corrupt governments.

And yes, these ARE the government officials, coming here with their ill-gotten gains.

And how about this money quote:

While the prices are high — $20 million, $50 million, $100 million — people in real estate say that in terms of square footage, Los Angeles is actually a deal.

“L.A., it’s the cheapest real estate in the world,†Mr. Hadid said, sipping tea during the interview at Le Belvédère, the 48,000-square-foot mansion where he lives in Bel Air. “London is more, New York is more.â€

I guess to these people, Barstow and Biloxi and Cleveland don’t qualify as being “in the world.”

Not sure what the takeaway on these sort of reports are supposed to be. Buy now in Los Angeles or be priced out forever thanks to foreign interests of ill repute? Then again, the media is often behind the curve of market sentiment.

If the scope and depth of this is true, it is a red flag for a normal owner occupant looking to buy in Los Angeles today, and those looking to sell down the road.

A suddenly large influx of volatile and externally exposed interests speculating on our back yard can go as quickly as they come.

Indeed, if these buyers don’t care about a 20-50% loss against the backdrop of alternative total loss, they surely also won’t mind cutting those losses.

The rest of us that actually live here making a living have more at stake than a speculative hedging strategy and the leveraged among us can’t cut negative loss.

It’s for good reason that there are plenty of old sayings warning against the tying of one’s interests to those which are at odds. It’s an age old problem and this time is never different in that regard.

Name the names, note the addresses, publish the mug shots, and we’ll lock and load. Can’t outrun a .308 and we’ll be doing the nation a favor. It’s coming.

Your post is noted by the NSA as an advocate of taking unlawful action. Why in Kerrville, me and Kinky would never advocate using a gun like that. You being in no guns California are probably in big trouble from the radical leftists in the Democrat party. California people don’t have the mentality to be trusted with guns like the open carry state of Texas. Trump says no Muslims, in Kerrville, we say no crazy Californians, the fruits and nuts.

Big TexMex – look up the NRA national champs in pistol, rifle, shotgun. The vast majority of them are Californians and also the Californian state champs.

Fine if the money launderers don’t care that RE tanks hard. Market prices will be set by those who need to sell. BTW, should anyone really believe that money laundering could be a safe and constant source of RE purchases? After all, if RE were to tank, you could assume that the economy, as well as the source for those ill-gotten gains, would have declined dramatically.

Housing will tank very hard. Millennials don’t care much about housing, they understand its way out of reach and question the benefit of purchasing a house…you cant shop for the best job which often requires moving & you are not flexible when economic situations change. Others here said it before, Millennials rather spend their time & money for fun activities. Previous generations saved their little money for down payments and many lost their house during crisis. Millennials are smarter than that and don’t rush into buying a place. The fears of previous generations of being priced out and missing out on appreciation don’t apply to Millennials. Rather than worrying about that BS they enjoy craft-beers. It wont get boring as every month a new microbrewery pops up that needs to be explored.

This is why houses in flyover country are cheap. For me, it’s a matter of stay where I am in weather that won’t kill me rifnt away, where I have a few different ways of making money, have personal connections with people who probably won’t let me starve or die of exposure, or move to flyover country and make $5 a month and be homeless.

I am a millennial and I want to purchase a home. However, I do not want to purchase a house that it outside what I can truly afford based on my budget. The bank agreed to loan us (husband and I – on a combined income) an insane amount of money to buy a house (about 6 times our combined annual salary before taxes). The amount they agreed to loan us would have been “doable,” but would come at the expense of a lot of other things: saving for retirement, saving for a rainy day, saving for our child’s education. The herd mentality that exists when it comes to purchasing a home is actually quite astounding. Many of our friends have purchased homes in very expensive and trendy neighborhoods, which is fine and I am happy for them. But in my mind, the trade-offs are significant. If one purchases a home at the top (or close to it,) it can limit options for later in life. If you lose your job, those mortgage payments still come due every month.

I also wonder how many people my age factor in the cost of childcare, which is a significant and in some cases prohibitively expensive budget item.

I want to buy a home that is small and simple. Pay it off and live in it long-term, or rent it out. Less is more. Simpler is better. The problem is that many of these smaller homes are still overpriced. It would be nice to see a moderation or at least a correction in housing.

I hope housing tanks. It has to doesn’t it? I rent and don’t want to move, but my landlord wants to sell soon. I’m older and wasted many years of my life, but I can’t change the past. Just wanted to say that I’ve recently been checking out your blog and it has been a great source of entertainment and knowledge. Thanks. Look at this place very near where I currently rent in Pasadena. The price appreciation is ridiculous and so is the now 2nd foreclosure.

http://www.zillow.com/homes/for_sale/fsba_lt/house,condo,townhouse_type/20874710_zpid/0-100000_price/0-374_mp/featured_sort/34.151847,-118.103254,34.150353,-118.106132_rect/18_zm/0_mmm/

That is a really ugly house.

Holy shit that looks like every public bathroom ever where I grew up.

Ugly?

According to the (shamelessly hyperbolic) listing description: “This is the most desirable single-family house in Pasadena.”

Why do desirable? Among its other attributes, “It’s very easy to access to I-210 Freeway.”

Yup. Right near the freeway. What more could you want?

“This is the most desirable single-family house in Pasadena.”

Cut the price in half and that might be true.

Considering that in real estate circles the word “desirable” is as thoughtlessly tossed around as is “racism” in a safe space, the label is meaningless.

Just got news from the wife that our daycare for our Baby is going to run about $1600 and change per month ha. I think it is safe to say that if we didn’t buy high this past year, we sure as heck won’t be buying high next year.

If we had two babies, well we would be better off if I quit and work under the table or try to qualify for government subsidies.

My grandfather’s generation was upper middle class, my father’s was middle class, my own generation got a little taste of being middle class – having lots of books around, being expected to behave well and have a work ethic – and by our teens we were in the lumpenproletariat.

None of us have children. None of us could envision bringing children into the world, knowing that if the trend continues, they’d be digging in the trash to find something to eat. But people who do not care so much about this are having children and God bless them for doing so. Here are revolutionary armies supposed to come from otherwise?

Seriously Alex?

Welcome to the club, FutureBuyer. It would be really nice (for your baby) if your wife could stay home at least 6-9 months or so. At 0-6 months, they are so fragile and helpless, it would be really tough to trust someone else to take care of him/her the way s/he deserves. In the long run, you will probably be glad you did it, and will likely not miss the money from that relatively short period.

Thanks Responder for the input. My wife had a tough recovery and she actually stayed with the baby for about 7 months, so it worked out in some ways. He will be in daycare at 18 months. The money comes and goes and you are right about that, right now we are blessed to both have good jobs but she definitely makes more than me so it would be tough for her to stay home longer than a year and still own a decent home in South CA.

Ol’ Yeller did it. The Fed is going to do the thing we’ve read many times over the past few years from some in these comments that couldn’t and would never happen.

Is this the same “can’t” which “can’t see” prices in SoCal experiencing a major correction?

Can’t and never. Famous last words.

Ol’ Yeller done dood it. I’ll stick by the radio to see or hear the results.

If there so e thing the past decade has taught me, its that I don’t know shit about economics. We’re heading for cheap-ass oil and I’d never have forecast that. I saw a guy lose $200k at least betting on silver up close, and now he’s a (pot farmer) sharecropper.

Watch the wooden nickels? I dunno. My evening lacks sax.

From what it sounds like it is not affecting the mortgage market but short term loans and I guess credit cards. -all imo

I house just in front of my parents is up for sale. Over $600k! LOL

That is true. Mortgage rates are generally tied to the 10-year treasury bond yield. Since the feds increased the interest rate .25% it does not mean the mortgage rates automatically go up .25%. Most likely the mortgage rates will go up gradually over the next year. Since many people don’t know or understand this, there will be a huge rush to lock in mortgage rates and close escrows in the short term after this announcement by the feds.

There are indirect consequences for the housing market as a result. It’s a milestone act in the Fed’s change of sentiment that impacts many decisions which beget many other decisions.

Leave a Reply to Alex in San jose