Bay Area condo madness results in glut: Record number of luxury condos now listed on the market. Is this a sign of the peak for the Bay Area?

The Bay Area housing market epitomizes the word mania. I was listening to a few real estate agents from the Bay Area and what they were saying sounds like absolute insanity. Of course, for people drinking the Kool-Aid it is hard to have any sort of perspective especially when your paycheck is tied to you believing in the mania. Hard evidence tells us that something crazy is happening in San Francisco. The median price peaked in May at a stunning $1,225,000 based on MLS sales figures. That is 65% higher than the previous peak reached and a whopping 104% higher than it was in January 2012. Mania, mania, mania. The price increase is happening so quickly that people are getting gentrified out of the market in epic fashion. You have a large numbers of foreign investors buying properties and many leave the places unoccupied. So not only do you take inventory away from those in the area that would live in these homes but you also take away potential rental property. The rental market in San Francisco is just as crazy. Builders have been building where they can especially with luxury condos. But now, at the apex of prices we now have a record glut of luxury condos. Many of these condos are sitting on the market as we enter the slow fall and winter season. The median condo price is $1,100,000. So where do we go from here?

The condo glut

We’ve talked about the absurd NIMBYism that simply is poor policy for California housing. Sure, you can create a small coastal elite but now we are injecting outside money that is gobbling up inventory. There is this odd sort of tech bubble run-off and VC money is trying to chase ideas that simply have no chance of succeeding all in the hopes of catching those future tech unicorns. But guess what, the market has been blistering hot and now it is cooling off. This is tracking the stock market. It always goes this way.

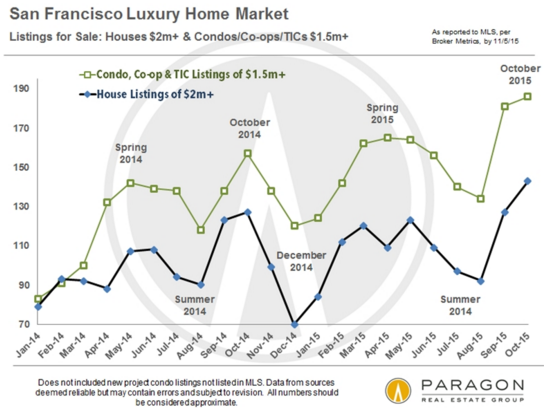

The result is that a large number of luxury condos are coming online at a time when prices are peaking and the appreciation train is slowing down. Take a look at this:

There is now a record number of luxury condo listings in San Francisco. Will there be buyers waiting in the wings to buy these places? Maybe. But think about what you need to make to buy a $1.1 million condo – or a $1.5 million luxury condo. It is funny to think that $1.1 million for a condo isn’t even considered luxury for San Francisco. Seeing real estate agents trying to convince people that a true million dollar crap shack is worth it is a sight to behold. Go ahead and feel free to buy these places. Local high income households are competing with large dark pools of money from abroad. I’ve taken a look at sales data and deeds and it is interesting how some of these people are trying to hide their purchase. They want to hide their names through LLCs and other complicated paperwork. If you take a mortgage, your name is easily accessible and I would imagine even a high income household would need a mortgage for a $1.1 million condo. But if you go all cash you can obscure the money trail easily. For example, you are only supposed to be able to take out $50,000 per year from China but there is an entire cottage industry to get around this.

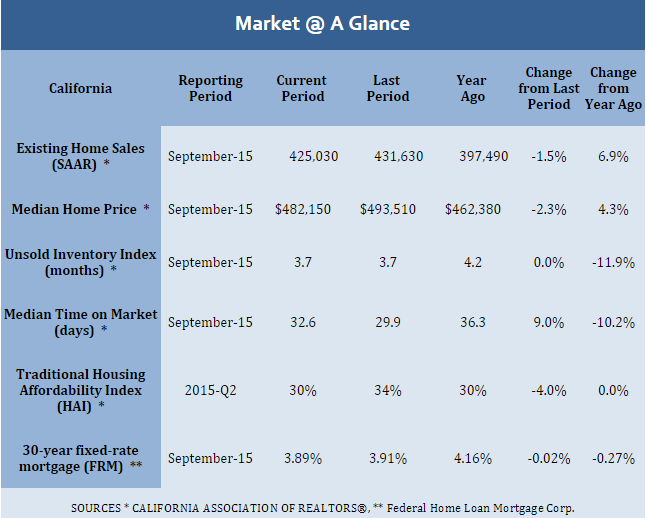

The market in California overall is slowing down:

Prices dipped last month. Sales figures have slowed down. And in San Francisco, sales have dropped year-over-year. Prices are simply getting too frothy. You also have speculators buying for the prospect of appreciation. You also have a good number of new condo construction coming online in San Francisco at a time when things are frothy. Condos tend to be the canary in the coalmine because these are your weakest link in the housing food chain. The same has happened in SoCal and it happened in the last bubble as well as new developments sprang up and some apartment buildings were converted into condos. The same trend is playing out.

“(China Law Blog) Got a call the other day from a United States lawyer with a Chinese client who wanted to buy a very expensive house in that other lawyer’s big city. The lawyer’s Chinese client had said that Chinese law limited them to taking only $50,000 out of China and so this lawyer was calling me to see how they might take out a lot more than that.

We get calls like this fairly often. Sometimes they are from lawyers with Chinese clients. Other times they are from expats or foreign companies that have built up a large stack of illegal earnings in China and want our help to get it out.

Our answer to all of them is always the same. Why would you call a lawyer to ask how you can violate the law? What you are seeking is not legal help, but a way to skirt the law and there is no way we are going to help in that.â€

The above is well worth a read.

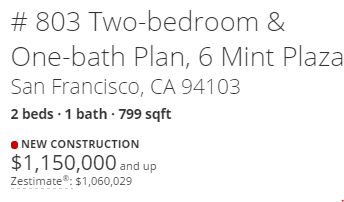

Here is one example of new construction coming online:

$1,150,000 for a 2 bedroom and 1 bath condo. This is for 799 square feet. A good deal? You figure that one out on your own. But if you are a working professional family a large chunk of your income is going to go to housing in San Francisco.  SoCal is home to the $700,000 crap shack while San Francisco is home to the $1 million crap shack. The trendy and artist friendly San Francisco is long gone, many years ago. San Francisco is now a place for elite high earning tech workers and foreign money.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

81 Responses to “Bay Area condo madness results in glut: Record number of luxury condos now listed on the market. Is this a sign of the peak for the Bay Area?”

The fall always has some proportionality to the degree of the run-up.

The worm indeed appears to be turning. Just as it is in the Bay area, albeit to a lesser extent, the tech bubble is a catalyst for the housing bubble in L.A. largely on the west side.

Foreign speculators will probably get spooked once this thing gets going good, fanning the flames, especially the fickle Chinese.

And next year being a presidential election year after a termed out administration, we’ll see if the Fed can keep it together long enough to last through the summer. Last time it didn’t go so well for the incumbent party.

Well, homes in costal California are absurdly expensive, that is a fact. But the question remains if or when the prices will go down. And seeing what happened in Vancouver, Sidney, Melbourne etc I tend to be rather pessimistic. It seems as though foreign capital could inflate the prices, and keep them this way for long periods of time.

The next question is what happens with homes in the inland areas or fly over areas? Homes in the San Joaquin Valley are even cheap in some areas. Are these homes that are maybe around $200-300k going to fall to half or more in comparison to what happens in SF or LA? Should more affordable areas need to follow what happens with these high priced areas? All markets are local.

I don’t think homes in the Central Valley except for maybe Sacramento, Tracy and Manteca will drop as homes in the Bay drop. It is local. Most places are too far for a commute, so they prices mostly reflect local supply and demand. However, interest rate effects are prevalent from what I’ve seen. Places that never saw houses over $300K have homes now going for $600K, which is absurd considering local low income levels. Former college-mates of mine live in the Valley – they’re teachers – and they tell me that student populations are going to start declining in a couple of years. They’re expecting massive school layoffs.

The interesting thing that I’ve seen in the Central Valley is the changing demographics. Most of the Caucausian population is 50’s and older. The younger groups are African-Am, Latino and some Southeast Asian. If it wasn’t for immigration, these places would be empty. I’ve looked at population growth figures from 2000 – 2010 and not much net growth in these areas. It’s been mostly growth in the Latino population that kept the population numbers barely stable. They say the demographics of Mexico are not suitable to keep exporting people to the USA. In a generation, I expect these inland areas of CA to experience significant depopulation.

Inland areas of CA to experience significant depopulation? Not as long as big government welfare and entitlements are available for citizens and non-citizens.

Exactly, with this run-up in prices, my real question is “how long can this stay inflated?” With the government using so much influence on the economy, I don’t think things will necessarily play out as anticipated. Not that they ever do, but this distorted economy is something we haven’t really seen. It will definitely be interesting to watch and learn.

Even if these coastal homes drop by 50%, would you be able to buy one? $5 million home 50% off = $2.5 million. Still way out of the price range of mostly everyone here.

Doc: I was listening to a few real estate agents from the Bay Area and what they were saying sounds like absolute insanity. Of course, for people drinking the Kool-Aid it is hard to have any sort of perspective especially when your paycheck is tied to you believing in the mania.

Upton Sinclair: ‘It is difficult to get a man to understand something when his salary depends on his not understanding it.’

Or also as a pal tells me; ‘It is almost impossible to get an eager property-investor/buyer/or older owners to understand something when their ego depends upon not understanding it.’

~ Everyone here says the young are being ******ed over, which they are. But even if there is HPC of -50%, few young people will be able to buy on a zero hours contract – if they even have a job at all.

~ Then we’ll have to have a 90% correction.

——————

Even if few of us could afford to buy coastal prime after a 50% correction, such falls would likely hard affect values lower down the prime scale. You might as well say “let’s see values double to $10m for it makes no difference.” Got to start somewhere and I would welcome any softening.

One thing for certain city and county’s are probably worried about seeing another decline if it happens and will probably be worried about running into the same problems where underwater owners will demand a new appraisal on their property values if prices stay low for considerable amount of time. Tax dollars will keep dwindling for them and the question will be what to do about it with lots of people knocking on their doors asking for tax reductions. -all imo

Homerun, exactly. That’s when we’ll start hearing from Sacramento that Prop 13 is no longer sustainable. It’s going to be a rude awakening.

I think one way Prop 13 could eventually be modified or potentially removed is to offer owners the Prop 13 protection if it is your only residence and no protection if you are an investor for an x amount of years unless you intend to keep the property for more than 5 years or more then you might qualify for Prop 13 protection. Eventually there will be a way to get this adjusted. It may very well create a boost in sales if it were to happen in my opinion.

When high paying jobs start to disappears as they are in Australia and Canada, rest assured the housing markets will ‘deflate’ in Vancouver, Sydney, Melbourne and San Francisco. The last ones to get into the market will be the biggest losers.

I do not agree with Shawn’s opinion. The home prices in places like Vancouver have long been uncoupled from local salaries. Homes are often treated as a safe money storage (not really investment) by foreign capitalists. Many of these homes remain empty and do not bring profit. It is just a way to store money safely. In places like China you can be thrown in jail by party officials for no apparent reason, and all you possess can be confiscated. Owning properties overseas is a way of securing financial safety for the family in case things go wrong. In such case it does not matter how much local people earn – it is only a matter of demand and supply. Paintings of famous masters are absurdly expensive only because there is demand and people want to pay this much. It has nothing to do with the true utilitarian value of such artifacts. Similarly, to some extend, prices of homes in places like Vancouver (where median income is relatively modest) have little to do with their true value. Sadly though, it may take decades to change.

Shawn might be onto something. If prices change enough on the margins due to the local population’s movements, it might make those using the properties as value stores nervous enough to liquidate and transfer the capital to somewhere or something else which would further precipitate price declines.

Shawn – adjusting for inflation, Pan Am baggage handlers were making what would be $70k a year now, back in the 1970s.

Hell, if I’d gone to work for the carpenters’ union, I’d have started at $7 an hour and gone up to $15, in the mid-1980s. I could have bought a house on that.

Now, well, better invest in bunk beds.

With the 10 Yr bond closing in on 2.40%, there is much speculation rates will fall next year to support housing prices and the stock markets. With German 10 Yr bonds at .69% and Japanese bond yields even lower, what do you think the FED will do if there is any deflating of the bubbles?

The markets are no longer allowed to move based on market forces. The dark side (FED) controls all.

Yes but swaps have flirted with steeper negative recently, leading to some to some market participants to begin. Money has a price, and the deals done can bite when rates fall before floor.

———————

NEW YORK, Nov 6 (Reuters) – A dip in U.S. interest rate swaps that led to negative spreads in recent weeks has raised concerns that other parts of the bond market could be disrupted and raise borrowing costs for the U.S. government.

The decline in swap rates, to below comparable U.S. Treasury yields, was so acute on Thursday that some analysts called it a “flash” event, recalling the U.S. stock market’s “flash crash” in May 2010 when the Dow Jones industrial average plunged and rebounded in just 36 minutes. […] The market for dollar-based interest rate swaps is huge, at an estimated $107 trillion in notional value, according to the Bank of International Settlements. Swaps are used by mortgage lenders and real estate investment trusts guard against rate changes and by hedge funds and speculators to bet on rates.

LOSSES REPORTED

Ellington Residential Mortgage REIT said on Tuesday it had unrealized losses of $18.7 million, or $2.04 a share, on its interest rate hedging portfolio in the third quarter. Its net loss was $4.8 million, or 53 cents a share.

More funds including REITs (real estate investment trusts) and hedge funds with bad swap positions may be forced to liquidate them by year-end, causing possible ripples in other parts of the bond market, analysts said.

http://www.cnbc.com/2015/11/06/reuters-america-record-negative-spreads-roil-us-swaps-market.html

———————-

Comment (from elsewhere): I have seen this happen often before in emerging markets during times of duress. The reasoning is quite clear:

– To earn a fixed rate of return on a bond, you are locked into the credit risk of the lender for the entire term (10 years in this case).

– To earn a fixed rate of return using the swap market, you need to roll your cash over at three month Libor in the interbank market and receive fixed on a swap. Under most ISDAs, the swap is collaterized. You get a chance to review the credit risk of your lending counterparty on your Libor deposit every three months.

The market is telling us that the combined credit risk of the short term deposit plus the collateralized swap is less than the credit risk of the government if the swap spread is negative.

This is a sign that the UST market is in bad shape as the market is now applying the same logic with respect to collateral / short term interbank credit / long term government credit that it historically applied to emerging markets in time of stress.

But you also have to think of risk premiums. If the Fed wants banks to lend more, the rise might start to incentivize more lending as there’s more wiggle room in regards to risk premiums. It could be the opposite of a normal rise in rates in that it expands lending by allowing banks to better price risk.

Jim,

How well did the FED controlled the market in 2008? Or 2008 to 2011? Did they want to control the market in 2008 when the banking system froze? Will they be willing or able to control the market the next time around?

Ask yourself these questions to see how God like power the FED has.

In my opinion this doesn’t look good:

http://www.zerohedge.com/news/2015-11-10/former-bailout-boss-kashkari-replaces-kocherlakota-minneapolis-fed-president

More on the moving of money out of China:

November 2 Bloomberg article: “China’s Money Exodus”

http://www.bloomberg.com/news/features/2015-11-02/china-s-money-exodus

From what I’ve observed, most people who buy houses in SF seem to expect that they will renovate and expand at some point. You can’t expand the square footage of a luxury condo and no matter how you renovate, the next buyer will have his own ideas as to what color the kitchen and baths should be.

The Chinese are famous for buying two adjacent properties and combining them.

This has been long established in Vancouver, British Columbia.

The banks who loan on these properties are complicit in helping the Chinese to break their own country’s laws, even if they do not violate our laws. Which should probably be revised.

It’s surprising that China would allow large heaps of money exit their country. Have their law makers been enticed to look the other way?

If China does set some rules it would deteriorate value of real estate but only slowly. A fed rate hike will help, which may stun some of that tech bubble/VC growth. Investors are loosing or have lost interest. The momentum RE has had, it’s going to take a while for it to turn around. To keep RE low there has to be some catastrophic event. Inventors are just waiting around for that deal, they need to feel some pain.

Tasty – I’ve read elsewhere that for now the Chinese are letting some money slip out as a political safety valve, but I also feel that if China can get its act together, the best place to invest may be China, especially if you are Chinese. I’d not be surprised to see things start to shape up this way in the next decade. China is a huge enough country that they can go along quite well on their own economy.

It’s surprising that China would allow large heaps of money exit their country. Have their law makers been enticed to look the other way?

The law makers ARE the ones siphoning off the money. The Chicoms practice a blend of crony capitalism and crony communism.

As in Eastern Europe, the Communist Party leaders are best in position to rape a country’s assets. Today’s Russian oligarchs and billionaires are former state functionaries. Ditto the rich Chinese. They’re related to state functionaries, well positioned to rape the country and funnel the assets elsewhere.

I think it’s called a kleptocracy.

Son – How long before China gets its equivalent of Putin to put a stop to at least the worst of the shenanigans? Keep in mind that since the USA has decided it’s gonna have Cold War II against the Russkies, Russia and China are better friends now.

Son – How long before China gets its equivalent of Putin to put a stop to at least the worst of the shenanigans? Ha! Your dear leader Putin is in on the shenanigans and is one of the wealthiest leaders in the world.

https://www.washingtonpost.com/news/worldviews/wp/2015/02/20/is-vladimir-putin-hiding-a-200-billion-fortune-and-if-so-does-it-matter/

Don’t you comprehend ?

The very folks moving the money are the officials in charge.

The others are in on the game.

Further, even at the national scale, the CCP realizes that they’ve had their fill of US Treasuries. They want real assets.

All the more reason to be wary of bets riding on housing prices where there is a large amount of exposure to Chinese speculators.

Silicon Valley ‘shack’ in Palo Alto lists for nearly $2 million

http://www.marketwatch.com/story/silicon-valley-shack-in-palo-alto-lists-for-nearly-2-million-2015-11-11

At first I thought it was one of those fake “the onion” postings.

Dr. HBB readers: Please tell me this link isn’t real but a cheap put-on by some realtor who wants to get on the nightly news?

This is housing for the .1%

The average tech worker makes the same $15 an hour I do, or less. There’s no way this can be pinned on techies, which are a few per cent of workers even here.

This is housing for the truly wealthy, inherited money, drug dealers, makers of snuff films, money launderers, etc. You don’t make the kind of money not takes to buy and build on a place like this by working.

Come on Alex, get real. The receptionist at my company’s office in Sunnyvale makes $22/hr. Everybody else makes more than that.

Jeff – so your company is probably a bunch of engineers twiddling away on SPICE, and I don’t doubt your receptionist makes better money than I ever have – my ex-GF works at a hospital and makes $25 or so working in the kitchen. Unions man!

If your company had techs, they’d make $10 or $12 an hour.

Our receptionist also makes in that range, around $40,000/yr which is about $20/hr and she gets benefits. There are actually a lot of jobs that pay more than minimum wage that don’t require THAT much more skill. I’m a liberal progressive and I’m the last person to say that poor people should be blamed for being poor, but I do agree with the idea that we need low paying jobs for entry level people, the minimum wage was never designed to be a living wage, it was a way for people to get introduced into the labor force. We should be focused more on giving people the skills to be able to increase their income rather than arbitrarily increasing the minimum wage. And yes, the government should provide subsidies for that kind of training so that it is accessible for those who want it. The alternative is that you’ll simply incentivize businesses to automate where they can, like the burger making machine, or the touch screen cash register.

I think something is wrong here; I’m at a little more than $87/hour in software development and some signal processing analysis. (I’m salaried, but I still fill out a time card every day). It was painful being a corporate drone in the late 90s, having friends who were instant paper millionaires, but those yearly 2%-4% raises (occasionally zero percent) really add up after 30 years.

You should consider diversifying your skill set. I suggest cryptology and Information Assurance. Software and most other STEM-related subjects inherently require constantly learning.

“….the minimum wage was never designed to be a living wage”

Yea, right. Except since someone invented the concept of minimum wage, ie. forever.

It doesn’t nor hasn’t had any other function than to provide survival-level pay to everybody. And I mean everybody.

Major part of low-paid workforce works on minimum wage tens of years and now someone tries to re-define it to basically slavery. Nice try.

Mofa – Yeah, I should totally get back into the college scam game and get set even further back in life!

Gee, with enough college, I could make $1 an hour, or maybe because I can’t pay off the loans I’d have to take, $.23 an hour in prison!

Certainly feels like a top now that undesirables are now desirable.

Homeru. – Nobody wants a condo. A condo is something people settle for.

The next tech bust is sure going to hurt folks in SV big time…

Bubble – They’ll just go back to India and China.

Everybody wants a piece of the overpriced pie. These folks are coming late to the dance and will get hurt bad.

Just like everybody wants a BMW, leases everywhere and that is what you should do, because since BMW flooded the market with their over priced cars they bring very little when traded in or sell private party.

Now everybody list their house for a million dollars or more, as if a right of passage, you the buyer must at least start there or just forget about buying a house any house they will regret such a thought or plan to sell, there houses will sit, and sit, and sit, and then they will say UNCLE?

“Just like everybody wants a BMW, leases everywhere and that is what you should do, because since BMW flooded the market with their over priced cars they bring very little when traded in or sell private party.”

Status symbols tend to be like that. The next buyer(s) just wants the car, not the status as AFAIK 10-year-old-car isn’t a status symbol anymore: There has to be a major price reduction at some point.

I have to confess I own a BMW but it’s not leased and it’s an very old 7-series. A high-maintenance car which is very nice to drive. Classified as a hobby as it doesn’t make any economic sense (but it doesn’t really matter with hobbies).

Resale value probably approaches zero and most of the people who are in a market for an used BMW knows that (having owned one earlier), so new ones drop in value really fast, therefore not a good buy.

If a car ever is, hard to tell. But a new car is exceptionally bad investment.

Certainly swimming with Great Whites at the beach, is safer than the feeding frenzy going on in real estate along coastal California! However, one of the problems, it is all relative! To most of us, a couple of million for a property, will never be attainable and seems ridiculous. To some of these foreigners, however, it is a bargain! Unfortunately, money talks … sellers, investors, landlords, realtors, and all the property taxes generated from these inflated assessments, fill pockets, coffers, and bank accounts. There is no motivation to get sensible about real estate, only to work the game until a state of imbalance or instability, forces a reset!

We’re becoming Switzerland, a place for international crooks to park their money.

finally,someone who gets it.

Doc: The result is that a large number of luxury condos are coming online at a time when prices are peaking and the appreciation train is slowing down. Take a look at this: […..]There is now a record number of luxury condo listings in San Francisco. Will there be buyers waiting in the wings to buy these places? Maybe. But think about what you need to make to buy a $1.1 million condo – or a $1.5 million luxury condo.

Wow; that’s quite a steep inventory surge.

It reminds me of what’s been occurring in one part of London, with a huge surge in newbuild supply (see the chart, on the link below). All these key locales, luxury apartments.. does the buying money never run out?!?

http://moneyweek.com/london-new-build-property-uk-house-prices-top-out/

LOL! Supply! That one’s going exponential!

Galaxy – Its simp!e. You just take a regular old condo, install granite countertops and Berber carpeting and now its a luxury condo.

All this is hilarious to the life-long Californian. We who grew up here know the value of real estate based on our personal observations – who can afford what and where. A lot of people from out of state will pay anything to be here and get ripped off by locals as soon as they arrive. Had a friend from NYC who rented a place in SF from 50% over what going prices were just because he didn’t know the local prices. Same thing happens to people moving to LA. My old neighbors in LA paid 60% over what everyone else on the street was paying because they came from NYC too. Student rental housing also gouges people as it plays on parental guilt. The rentals near the DTLA fashion school are ridiculous because parents don’t want to say no to their daughters getting a non-accredited “degree” in fashion. Most people who grew up here have a their grandparents’ empty house, or parent’s house or sibling place to crash while prices stay crazy. When it’s all a massive smoking hole in the ground, the locals buy. Been that way from the beginning. Seriously, why would anyone buy a condo in SF for over a million when you ca get the same thing in NYC which has more diversified, stronger economy?

This will pass, just as the Gold Rush, the LA oil boom, the aerospace boom, tech boom all passed. This current false boom will also pass. Then the exodus of transplants starts and SF is empty again just like it was for a decade after 2000.

HBO has a recent documentary about this. It’s called “San Francisco 2.0” done by Alexandria Pelosi. Worth watching if you have HBO.

As I heard a one realtor say to another at an open house down the street in Fremont, some 2 years ago, ” I have 15 chinese clients who I am looking for property for”.

This flood of money seems endless, so keep the party going!

As for the valley feeling the pressure from the Bay Area, It ain’t happening.

Too many forclosures in Manteca,Tracy, Modesto tend to keep prices down. 350K will get you a nice newer home, 60 miles from SF City. But the commute is awful.

Buildable land is the bigger factor. There’s still miles of land west of Tracy between the town and the hills. Land also North, East and South too. It’s cheap too. It’s cheap because it sucks to live there.

The number of empty buildings and the amount of vacant land just in downtown San Jose, and in the greater area, amazes me.

“Perhaps you’ve heard – it’s really expensive to live in San Francisco. A recent report from the real estate website Zillow reveals that San Franciscans spend an average of 47% of their income on rent. Those lucky enough to afford to buy in San Francisco spend 40.6% of their annual salary on mortgage. First-time home buyers planning to put 20% down on their purchase will need to have saved a median average of $153,600.”

http://blog.sfgate.com/stew/2015/11/12/unsurprising-data-reveals-that-sf-residents-spend-47-of-their-income-on-rent/

For those who think prices are too high and they will bust. Think again. In our culture when something is expensive it becomes a status symbol and people gravitate towards it. That goes for cars, watches, clothes and real estate also.

San Francisco is a status symbol and it won’t go away overnight.

In Chicago thirty years ago you couldn’t pay the well off people to come live here. But once it became expensive to live in the downtown area and areas close to it, all of a sudden the high income earners wanted to move to downtown and the neighborhoods close to it.

That is just buyer psychology. Home builders and real estate agents know how to play it like a fiddle.

There’s a difference between a reset and a ruination. The Bay area has experienced significant house price resets before as has L.A. This wouldn’t be the first time people gravitated toward SF for one reason or another.

Dude, nothing last forever. In the 70’s and 80’s buying a home in SF was cheaper than buying a home in Sacramento because SF was a ghetto and everyone wanted the nice, suburban life. And before that, SF was the richest city in the western US. Now it is again. Things change all the time.

It’s impossible that every major city in the world and it’s suburbs + every nice place like Santa Barbara or quaint college town is going to have $1 million+ housing. There aren’t enough rich people for that.

I don’t see any slow down. While currently pursuing rental properties in the Southern part of Riverside County, I’m seeing “highest best” bidding wars for all cash offers, while the properties are going for more then listing. Forget about financing. Those with financed offers aren’t even getting a seat at the table. It’s a feeding frenzy.

Hunan,

That’s insane.

I grew up in Santa Ana and remember the migration of OC folks to Corona, Norco and Riverside in the 80’s because it was so cheap. I can’t believe it is bidding war country now. That level of insanity exists in the Bay area to Livermore, but once you go over the Altamont pass, prices drop like a rock. Yes the CV sucks, but no different from Riverside. hot, dry & smoggy. with long commutes.

The cap rate for most investment properties in very hot neighborhoods is negative. The rents simply don’t even cover the expenses. The investors rely on double digit annual returns to “make up” for the negative yield. Wow, what a sound investment.

In most mediocre neighborhoods the cap rate is a measly 1% to 4%. Hardly worth the trouble.

Nimesh,

True from an investor position. But if you are a Chinese General looking to get your ill-gotten gains out of the country, you don’t care. There are many round eyed realtors here who will help you in that endeavor.

The Chinese General will at some point need to sell in order to free up the capital. The Chinese situation being as unreliable and precarious as it is could easily give rise to some event(s) giving way to the selling of these properties just as quickly as the buying took place.

I disagree. In many cases I see net profit of 5-6% annually. That’s much better then anything you get in the banks. Add in another 5% modest appreciation annually and now you have 10%. That is if the market doesn’t tank. Even if it does, you can collect the rents until it recovers.

Fit for a Chinese General.

https://www.redfin.com/CA/Arcadia/3046-S-8th-Ave-91006/home/7999832

Well, maybe they can collect rents until it recovers.

This seller surely would appreciate a wealthy Chinese General to come along soon.

https://www.redfin.com/CA/Arcadia/1645-Elevado-Ave-91006/home/7230047

Just came in across mission blvd here in Fremont. There are realtor signs at practically every street corner. Much more inventory than a year ago. Something is different.

I was a Realtor in CT in the heady Eighties. The first sign we had of the whole real estate boom coming to an end was a lengthening of DOM, Days On Market. It’s on every MLS listing. Everything fell apart. Prices dropped over 50% in some cases, and took ten years to regain their losses.

10 years.

Sounds fun, let do it again!

I don’t wish bad on people but for some reason I am hoping this flipper gets burned (even though I won’t care if he doesn’t)

https://www.redfin.com/CA/Anaheim/219-E-Alberta-St-92805/home/3200337

http://www.zillow.com/homedetails/219-E-Alberta-St-Anaheim-CA-92805/25126392_zpid/

Reality hasn’t set in for this one, they buy it, flip it and it doesn’t sell for 6 months, one would think they would just drop it more but NO, they hire a new Agent and relist for the same price that it didn’t sell for in the first place. Maybe I am being a hater oh well!

Some properties have a knack for signaling a top. In this case, late to the game last time, late again.

A similar example, although the seller on this one clearly realizes time is quickly running out. Not a cherry pick as there are hoards of similar examples throughout the region which are easy enough to discover on one’s own time.

https://www.redfin.com/CA/Hawthorne/3827-W-134th-Pl-90250/home/6510511

Purchased at $400K, began list at $550K and so far has rode the wave down to $486K. 22% aggregate reduction in 3.5 months.

If this place was purchased on a hard money loan, as many flips are, considering typical costs of such loans, factoring rehab costs/eventual closing costs/taxes, this flipper will be lucky to get out of this one with much to show for it.

Asking prices do matter as this example demonstrates. This seller is not floating a “make me move” price. The product was put on the shelf with a profit motive from the start and the pricing has clearly been out of whack with expectations. It also can’t be solely blamed on seasonal factors as it was first listed in the summer.

On a so-called rental parity basis, it doesn’t make cents (pun intended) to purchase this property outside of speculating on real price appreciation. Similar rentals in its vicinity cost less even after factoring MI and property tax deductions at maximum potential. Even the lowest down available mortgage on this place won’t come anywhere near close to parity with the upfront cost of a rental deposit. In fact, many rentals in the vicinity are showing price reductions in their listings as well. The closest one would get is by utilizing a low income downpayment assistance program, but even with that possibility, on the margins of the ghetto, it’s still not selling.

More nearby madness.

https://www.redfin.com/CA/Lawndale/4430-Marine-Ave-90260/home/6565846

Who is going to look at the price history and be the next to grab on to this bag? It’s commercially zoned on the edges of the ghetto abutting a busy street, how fun would that be to live in?

Nothing about it justifies a 65% increase in price from one year ago. FFS, the lister couldn’t even be bothered to add more than the one photo of the front door.

What a California dream…or nightmare.

Here is another example of what you two are talking about, but with an extra twist.

Sold in March, flip listed in August, but it continuously cycles in a list, delist, relist, delist, relist….

Flipper might be getting anxious, but the price never changes.

https://www.redfin.com/CA/Inglewood/926-E-Brett-St-90302/home/6430062

Hmmmm, nothing says class like cyclone fencing and a cement yard. Your own little piece of falluja!

They should sell houses with high paying jobs. I would totally go for something ridiculous expensive…oh wells.

Because mobile homes are befitting of 380% markups, too.

https://www.redfin.com/CA/Newport-Beach/87-Yorktown-92660/home/45377051

Hotel if I’d done something smart in life like work for the post office or the water treatment plant, and was ready to retire with a mil in the bank, I’d buy that. I’m familiar with the area and its very nice. Play sailboats, scull around Newport harbor in the morning, ride a bike out to the Wedge and watch the crazy bodysurfers, eat crab at Charlie’s, etc the place has it all. Lots of fond memories of that area here. Plus that is a very nice trailer.

We can observe exponential markups on flips in undesirable areas as well so the point here is not if the area is worth the price. There are several other mobile homes in that neighborhood which represent a better relative value. The flipper in this case has given no where near 380% of additional value, which is especially outrageous in a land lease scenario.

Leave a Reply