Where the Housing Bubble Still Lives – 263 Zip Code Analysis for Los Angeles County. 28 Percent Increase in L.A. CPI from 2001 to 2009 but County Home Prices still up by 70 Percent.

It might be hard for people to believe that large parts of California are still in major housing bubbles. The truth is many California cities are still dwelling in the shadow of the bubble era prices pretending as if they really have corrected. Yet much of this is lost in aggregate data that looks at statewide data or county level prices. Why? The flood of toxic mortgages and lower priced homes in areas like the Inland Empire has caused home sales to go up but at the lower end of the market. What this did was lower the median statewide home price by nearly 50 percent (we’re still swimming at the bottom of the barrel) while many cities still remain in large bubbles like Culver City, Pasadena, and Cerritos. It isn’t enough to show a few basic examples but we will try today to pull inflation, housing, and sales data specific to California and Los Angeles to drill down into the actual trend. What we will find is that many areas are very much elevated to bubble level prices.

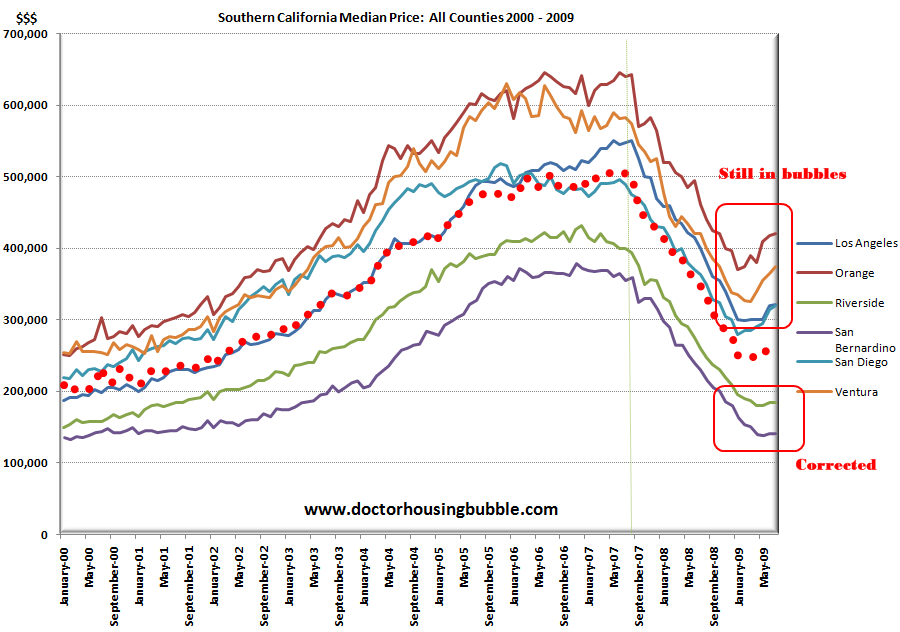

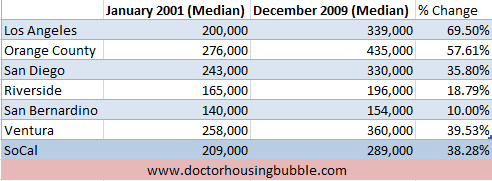

What we will be looking at is data from January of 2001 to December of 2009. I was fortunate enough to dig up median zip code data for 263 zip codes in Los Angeles County from January of 2001. I then compared these zip codes to their latest median price data in December of 2009. This will provide us a better analysis of what is happening in the market over the bubble decade at a very micro level. Keep in mind from 2000 to the summer of 2007 virtually every area in California went up to bubble levels:

What has occurred is the lower end of the market has corrected and as we will see, has now come close to being in line with inflation adjusted levels while certain counties like Los Angeles and Orange remain in elevated levels that have no economic justification aside from being in a bubble. These are the areas with a  large amount of shadow inventory but also Alt-A and option ARM products. Round two of the California housing correction will hit these areas next. In fact, many of the cities in these zip codes have not fully corrected and the overall median price has fallen because of their lower priced zip codes.

First let us look at some economic measures over this time frame:

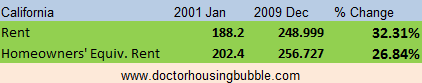

The Bureau of Labor and Statistics (BLS) largely missed the entire housing bubble both in California and nationwide because they focus on a dubious form of home price indicators named owners’ equivalent of rent (OER). As we demonstrated in the Cerritos example, if you focus on the rental value of a home only you will miss the fact that in some markets people will bid homes up to bubble levels. So for the entire decade the measure looked at what you would likely get for renting your own home but this completely missed the decade of housing inflation. As the chart above shows, rents went up by 32 percent and homeowners’ equivalent of rent went up by 26 percent for California. This of course is technically right since mortgages like option ARMs allowed you to pay out a tiny amount per month while allowing people to overpay for the actual home. I remember folks telling me about paying $1,500 per month on a $500,000 pay option ARM teaser mortgage. These homes would have rented for $1,750 to $2,000 in many cases so guess what? The OER missed all of this of course because a 30 year mortgage would yield a housing payment of $3,000 or higher depending on the down payment. But what we can gather from the above is that rents went up by 32 percent.

That is one piece of the puzzle so far. Also keep in mind that in many areas including Los Angeles rents have fallen in the last year because of the massive amounts of inventory but also (more importantly) the troubled economy. But over this time period, how much did the income of families go up?

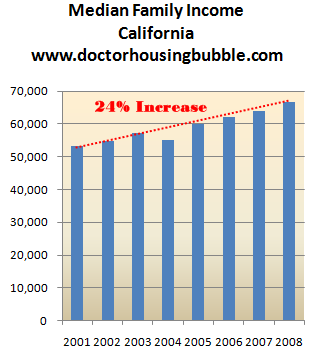

Source:Â Census, Current Population Survey

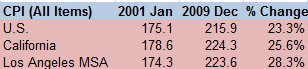

Over this period the median family income in California went up by 24 percent. We don’t have data on 2009 but given California’s underemployment rate hit over 20 percent last year, we can actually assume that income went down last year. So we’re starting to see at least a trend for incomes and rents over this period. The increase of general prices seems to fall between 24 and 32 percent. Let us look at the overall CPI for the U.S., California, and Los Angeles (we’ll be focusing on L.A. primarily in this article):

One thing that is part of the smoke and mirrors of the real estate industry is the argument that home prices and everything else for that matter is always more expensive in California. For the last few decades maybe so, but a flat screen here will probably cost the same as it does in Texas. If it doesn’t you can order it online. What is also not factored into these equations is Californian’s will usually pay less on heating and electricity bills due to the weather. So in a few areas we do pay less. But the one thing the real estate industry harps on is housing prices. The above data is the CPI for all items, housing included. What you’ll see is that even though California prices and L.A. prices went up higher than the nationwide data, it isn’t that big of a difference. Certainly not enough to justify housing values going from $200,000 to $505,000 in Southern California for example from 2000 to 2007. As is the case much of this rise in prices was spurred by toxic mortgages like Alt-A and option ARMs but also the subprime mess. But what you will see is that over this period of time the CPI, family incomes, rents, and OER all went up between 24 and 32 percent with the overall measure for Los Angeles going up 28 percent.

Now this is important because it gives you a sense of where prices should go thanks to the fiat money joy machine of the Federal Reserve. Multiple studies including those from Robert Shiller have shown that over time real estate tracks inflation. So if the general price level went up by 28 percent in Los Angeles you would imagine that home prices would track closely to this trend. They have not:

Now the above is essentially the story of California and the burst of the bubble in some areas. The lower priced areas like Riverside and San Bernardino even though they went up in values exponentially during the bubble as well have now largely corrected to come in line with the general inflation levels of the state. In other words, if you are looking at data from January of 2001 to December of 2009 these areas are actually under the statewide inflation rate. Yet that doesn’t necessarily mean it is a good time to buy since the economy of these areas is mired in unemployment. And these areas have seen the largest volume of home sales (a large bulk of investors). But look at Los Angeles and Orange counties. These areas are still in big bubbles. We have shown the shadow inventory of Los Angeles and Orange in great detail. If these areas are up not because of incomes and certainly not because of the inflation rate then why are they still elevated? Why? They are still showing bubble like metrics because the middle of the market is still harboring mania like behaviors.

The numbers above show that Los Angeles is by far the most over priced county with Orange County right on its back. But this in itself doesn’t tell the entire story. If it did, then the above data on San Diego would seem to be in line with inflation data since San Diego over this period of time went up by 35 percent. But keep in mind where the bulk of the sales are occurring and you start seeing a very familiar pattern. Also, San Diego inflated earlier on so the correction hit first as well. The lower end is skewing the data while the mid to upper tier of the market remains with bubble like valuations.

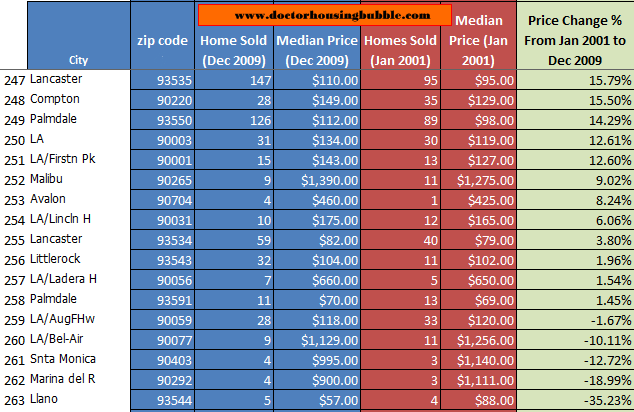

As many long time readers may know, I enjoy digging through the data. I have little room for the “touchy feely†reasons realtors give for why prices are high in some areas. These are the same people that thought putting home buyers into homes with Alt-A and option ARMs was a smart idea. They clearly are the last people you want to go for regarding advice on bigger economic trends. So I managed to dig up data on 263 zip codes in Los Angeles from January of 2001. I decided to line these up with their current valuations as of December of 2009. This is important because it cuts to the core of what is happening in the current market but also exposes which cities are in bubbles. First, let us look at the most over priced zip codes in Los Angeles:

Now what you’ll find are a few usual Real Home of Genius suspects here. We see a handful of Westside zip codes but also areas like Culver City. Now look at those median price changes from January of 2001 to December of 2009 and remember the charts above showing the actual inflation for the area and also income gains. All these zip codes are in bubbles, plain and simple. The 90232 zip code in Culver City went up from $317,000 in 2001 to the current $769,000 mark. This is unsupportable by any metric. Take a look at another area like Arcadia. It went from $312,000 to $770,000 or a price increase of 149 percent. Nothing can justify this price increase. And as we know with areas that have corrected, when there is no economic reason for a price support level values will come down. This bubble ran from 1997 to 2007 in California!  So those thinking a two or three year correction will fix everything have another thing coming their way. The first zip code above in West Hollywood is hard to use since it is only based on 2 home sales for December of 2009. But look at Encino. From $405,000 to $1,287,000 in this time. And December even saw more home sales! All of the above areas are perfect examples of areas that will see prices come down.

Yet in the midst of things, there are also a handful of zip codes in Los Angeles that are actually cheaper both nominally and inflation adjusted from January of 2001:

Now this is an interesting mix of data here. First, take a look at Lancaster and Palmdale. Of the top 15 most over priced areas 156 homes sold in December of 2009. One zip code in Lancaster (93535) almost matched that number by itself (147 homes sold). Palmdale had 126 homes sold. But look at the prices. Now you wouldn’t expect to see Malibu and Bel-Air in the same chart as Lancaster and Palmdale but there it is above. And for an area like Malibu with such few home sales, it is hard to say what is really going on because a few $10 million home sales can suddenly push data into another level. But the pattern is unmistakable. Some areas have fallen and fallen hard. But the majority of areas in Los Angeles have not.

I ran further analysis on the 263 zip codes. The overall Los Angeles inflation increase from January of 2001 to December of 2009 was 28 percent. Now out of 263 zip codes analyzed how many had increases of less than 28 percent? Only 29 fit these criteria. In fact, we have 206 zip codes that are still registering increases of 50 percent or more! Los Angeles is still largely over priced aside from a few exceptions.

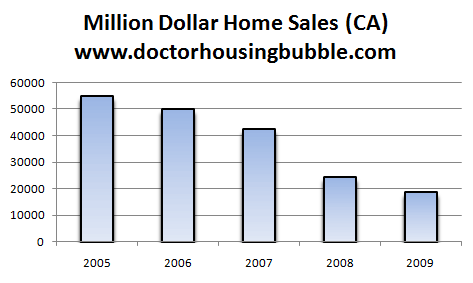

And all this data blends in with the trend in million dollar homes sales:

Now why is this occurring? Because the FHA insured loan market is backing 4 out of 10 mortgages in Southern California and only requires a 3.5% down payment. Is it any wonder the FHA is registering record defaults? The limit is $729,750 for FHA insured loans. So these million dollar home sales are dwindling because the Alt-A market and jumbo loan market is done and many were bought with these absurd loans during the heyday of the bubble. The lower end was saturated with subprime loans. Now the lower end is being dominated by first time buyers and investors. As we have shown, some areas are actually under cutting the inflation rate for the region. But what about the bulk of the mid tier market? This market is now full of delusional folks going after bubble 2.0 with government backed loans. The high-high end of the market is hurting because you need to go the conventional route. But that middle of the road market is still being sustained with government backed loans and folks paying bubble level prices. But just because it is being propped up right now doesn’t mean it will remain that way. The above data clearly shows that the bubble is alive in well in many areas in California especially in Los Angeles County. All bubbles over time will pop and this is no exception.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

32 Responses to “Where the Housing Bubble Still Lives – 263 Zip Code Analysis for Los Angeles County. 28 Percent Increase in L.A. CPI from 2001 to 2009 but County Home Prices still up by 70 Percent.”

Absolutely agree with you. I live in 91107 zip code and a “start-up”, the term used by the realtor describing the house is asking for $564K. The bubble is still with us.

The big question is: How much longer can the government prop up these inflated prices? They are obviously trying to come up with new tricks. Let’s see if they work, and for how long.

DHB– thanks for this excellent analysis. We recently had a seller in 90077 try to tell us their house was worth 1.2x what they overpaid for it in 2004 b/c the market overall in 90077 showed a net increase in prices based on a chart they claimed to have pulled of Zillow….Based on what I see looking around, 90077 is still way over priced, but only the lower-end reasonable properties are selling.

Here is my question: Southern californian homeowners and investors spent millions in the bubble years putting improvements into their homes (whether it’s 2nd stories, new bathrooms, kitchens, etc.) shouldn’t there be some allowance for increase in median home price above inflation if the homes in the neighborhood are materially bigger/better than they were in 2001– or is true that there is a fixed maximum amount people can afford so that the improvements are irrelevant?

Thanks for your thoughts!

Thanks for collecting and presenting all this data!!

Thank you for sharing this information with your readers. Could you provide the 2001/2009 numbers for South Pasadena and La Canada Flintridge? Those numbers would be very helpfull in my LA housing search. Thanks!

All FHA loans should be made recourse so the lenders of the debt, “the tax payer” are guaranteed to get their money back if these loans go into default.

I am so disgusted by these prices. I just want to buy a decent house in a decent area. I am nauseated. how freaking long do I have to wait for sanity to return!!?!?

—Frustrated!

Time to let the FCBs and moneyed elite get what they desire. No middle class! After 30 yrs of living in OC, I’m leaving Cali for good. I wish I could say I was leaving at the top, but I think it’s just the opposite, the bottom! Bye bye all.

You have to keep waiting Steve. I waited over a decade and finally bought in a fringe area where prices had cratered. I plan to move up next year after I pass th cap gains threshhold. The problem is, the truth comes hard for some folks. So long as they have their jobs, they keep pitching money into the mortgage black hole. I’m seeing this with several people I know and it’s sad. Most of these folks are deep in the delusion because they can’t accept that their down payment is gone or that they have built only NEGATIVE equity since their purchase. The mid/upper end markets will be hit hard this year and then we will have capitulation.

California. Still Crazy after all this time… one minor error: Energy is extremely expensive in California. I lived in South OC until 4Q 2008 (degegulated SDGE area) and I routinely paid more air conditioning on a 1 bedroom apt than I pay to run A/C for a HOUSE in Florida. That’s SUMMER… with AC going 24/7. Nevertheless, I’m trying to move back… I (heart) Southern California.

To all my friends in California. I have traveled there for decades. All the while observing “suspended disbelief” of reality by homeowners. The “bigger sucker” theory has ended.

Your choices are. Rent,…….. or Move to Ohio. A comparable home sells for HALF here near Clevland. $100 per foot in excellent schools suburb near the lake. Property Taxes also run about 2% of market value.

We would love to have you here. Great medical ( Cleve Clinic) great colleges ( Case Western Reserve and Ohio State) and great weather ,…. for 9 months! It snows in the winter all the time! Buy a coat!!!!

All FHA loans should be recourse? Woo hoo yet ANOTHER person calling for the victimization of the people raped and pillaged. How about all the mother f’ing BANKS and WALL ST. be RECOURSE and throw them bastards into debtors prison?

Everyone is for personal responsibility until it comes to their masters the banksters, Wall St. and our corrupt politicians. Enough already. John Q. Public cannot GET loans unless approved by the crony system. So crony system gets regulation STRIPPED, crazy unsupportable financing ensues, and the SHEEPLE are expected to be the ones who bear the responsibility?!?!

These views are enough to inflame violence, and if the country (that’s you and I included) doesn’t pull it’s head out of it’s a$$, you just might get people shooting each other over this financial meltdown. The sad fact is, the sheeple will shoot each other and never lift a finger to the masters that CREATED this and fed it.

Personal responsibility is great, having no forgiveness for debt reconciliation would be tantamount to the King issuing a decree. Not smart, but then again, what have I been saying about the majority of us? Do you remember? Yes, that is correct, the majority of america is not only ignorant, but WILLFULLY ignorant, which is flat out stupid and stubborn.

Enjoy the depression, hope you have a government job! And for those whom have fake wealth in equity…can’t wait to see you crying your eyes out when that baby drops 6 figures. Yes indeed, good times are a coming.

Love the first graph, great article today.

With all that is going on in the nation with healthcare, the wars, etc, etc, I do not see how the Feds can keep this over inflated, over weight ballon alfoat. I’m guessing by years end, the mid to high end market will look much different than it does now. Lower prices being the norm, not an increase in asking prices.

There are demographics that do not participate in the general culture and to whom blogs like doctorhousingbubble.com are irrelevant.

If there is confusion and dismay over buyer choices vs. house price trends, you only need to look at who is doing the buying, particularly in Irvine which is still overpriced compared to local wages.

The members of this parallel culture look at what is immediately available and act on that. They can afford to not wait.

Swiller:

Calm down. If buyers do not want recourse loans they can simply save up and pay cash for a home. This way, they aren’t supporting Wall Street or any other “crony system” (your words).

Same thing with credit cards: if you do not like the system, simply pay cash. Pay off your current cc bills and cut up your cards, cancel your account(s) and be done with it.

My grandfather saved up and paid cash for his home during the Great Depression after having lost nearly everything in the stock market crash that began earlier in the year of 1929.

Hi Dr., We really appreciate that you did this by zip code. We are trying to buy a house in Chino Hills, CA (San Bernardino County).It has real good schools that’s why we want to live in this area as our son will be going to kinder garden in 2 years. The median home price here is still $450K. It has dropped from 2006/2007 level. But if it will drop more, we’d rather wait a couple of years. Can you provide the information of 1999 vs 2009 on this city – 91709? Thanks!

How are you swindled if you invest and lose money? Are you stealing if you make money?

YOU ARE NOT A VICTIM. YOU ARE STUPID. YOU MADE A BAD DECISION. I WILL BE DAMNED IF I BAIL YOU OUT.

Sincerely,

A Renter who was unlucky enough to be born in 1974, but smart enough to not to ride a bubble.

I don’t think renting is always the quick answer everyone uses either. You have to run the numbers AND what the entrinsic value of owning means to you.

For example I am a married man with two young boys; 6 and 10. We currenty own a small 2 bed 1 bath house. Its too smal for our growing needs. I am currently in the process of buying a much larger home for our family. Am I “overpaying”? Of course in this market. However would I rather a. Stay in a house that no longer meets my needs b. Pay rent and someone elses mortgage or c. Buy the bigger house at a rock bottem interest rate and live there for the next 20 plus years and never worry about real estate prices again? Ill take c. It makes sense for me financially and emotionaly. At worst in 20 or 30 years ill own 2 homes worth at least a million dollars total and that’s if things stay flat. If thing come back I’m set.

It may not be the best financial path but for those of us with kids etc we have to think beyond the dollar bottom line and get as much of the best of both worlds as possible.

@Madguru: I hope you don’t lose your income or have to move with those two kids depending on you and a mortgage on a house that may be underwater for 20 years. I have two kids too. I’d rather live in a too small place than risk going bankrupt with children to care for. To each his own.

Fantastic article, as usual.

Would you PLEASE consider showing the data for all the zip codes you researched? That would be such a help to all of us in the other areas that you don’t normally cover. Thanks again.

SB123,

This is in fact what I did and what I will do again when I want to move up. I’ll save $1,000,000 over the next decade because of this decision. This will actually improve the US economy(mildly) because I won’t be wasting my money paying banker bonuses and will instead use it in the real economy. What people don’t seem to understand is that massively over-leveraged consumers is what is killing the economy. If everyone walked away from these debts the entire country would be way better off. It would mean that people would pay higher interest rates in the future for housing and probably have to put more money down, but overall this would be good as prices would comes down to levels that area actually affordable. Personally I feel walking away is the patriotic thing to do. Our country was founded on not paying debts(taxes). Sure the excuse was taxes without representation, but now the reason is to save the economy and thus the country.

I know I’m repeating what others said, but I would be very interested in the prognosis for 91042 and 91040, or even better, the data from all the zip codes you researched. I’d even be willing to pay a small amount for the info.

Economists at mortgage insurer PMI Group say Orange County’s chances of further home-price declines is as high as Top 50 U.S. market. The latest housing risk assessment from PMI, based largely on third quarter stats, shows …

http://lansner.freedomblogging.com/2010/02/04/oc-housing-risk-tops-in-us/54847/

It’s funny. Many of the things I have typed have been posted by the good Doc here, I just say it in a manner to invoke emotion, because damnit, I see what is happening to the country while the sheeple point fingers at each other just like the gov/Wall St/banksters want. They DO NOT want to be exposed to the light by the people, and with some of the responses I have read here, no worries, they won’t.

After all, it’s foolish to buy at all when the market is controlled and propped up by the system. And good for you RENTER, I’m still living in my home even though it is upside down big time. Goodbye 20% downpayment! Perhaps me LOSING $100,000 of SKIN, allows me a bit more of a voice than renters who sat on the sidelines.

I agree with DG’s post. I think defaulting on your FRAUDULENTLY PRICE FIXED home is PATRIOTIC. Look for that in the future from me if there is another collapse (and I hope there will be for more MIDDLE CLASS people to be able to afford homes for their families).

The banks will still get the money no matter what…

http://finance.yahoo.com/news/Mortgage-lenders-pursue-cnnm-3107909798.html?x=0

Weren’t there “debtors prisons” in our history?

And the creeple sheeple will go back to BAU because the MSM has told them everything will be okay.

I think I see the ocean level getting down before the second tsunami hits…. the prices in San Diego (which has been the canary in the real estate gold mine for the last 2 down turns – remember 1990?) are falling down again, Las Vegas and Phoenix are going down since December too. Even with areas in LA metro, which seams to be already corrected like Riverside and San Bernardino, they will follow the downfall too, because the potential difference of the low prices in AZ and NE on one side and CA on other, will drain population outside CA. This gravity is huge for essentially the same type of population – blue-collar working class. This in order will create even bigger disconnect for the prices in Westside from the rest of the areas. Grab something strong the wild ride will go on some more.

Josh Kammerer, every dollar of bailout money is aimed at padding losses on the financial industry side. The fact that a few underwater homeowners get a leg up because of it in completely unintentional. Please direct you fervor to where it’s deserved: Our bankers.

DAN

Well put. I have tried to articulate the same thing. I am one of those people, sitting on 600K cash refusing to buy a 600K dump when I know I can move to Phoenix and buy in the best neighbor hood of Phoenix a sprawling cream puff 3500sq foot house, built in the 50’s, on a 20,000 sq foot lot with a swimming pool and guest cottage for the same price of a San Diego Dump.

I will wait another couple years as a renter here in San Diego , if prices don’t come back to reality rather than uying a 600K dump I will choose the 600K sprawling beauty in the best school district of Phoenix.

Martin, way to go!!! I admire your patience and persistence. I am in the same boat. I know some people who bought in the past two years because “oh gosh it was such a bargain” and now they are sorry. I am going to wait. Wait for a real estate decline and then buy. I really don’t know what is the hurry with some people. But if they want to go ahead and buy more power to them.

When you are ready to ‘walk’ away from the crazy prices in SoCA, walk east to AZ. I did and am glad. Try the Tucson area if you want a cooler climate then Phoenix. We have some great homes here too. Check out the prices on Realtor.com.

Okay we have sat in our ever shrinking two bedroom long enough, and after everyone from friends family boss realtor’s screaming Now is the time to buy. We have decided to be brave and Rent. Although rents have come down some it is still outrageously expensive to rent is a nice area , and I am not talking Beverly Hills I mean the San Fernando Valley. A three bedroom in reasonable condition is on the low end 2800 a month. If we wanted Sherman oaks or studio city it would be over 3000. I see as rentals some of the houses that were for sale last year and what is depressing is our monthly payment with an FHA 3.5% loan would be lower, and I would not have to live with dirty carpet and some one else’s idea that burnt orange walls is style. Although I do believe that renting is the right decision in the long run I completely understand why many people in our position would just buy even with the uncertainty. So if anyone knows where to find a good priced rental or can tell me what coordinates with burnt orange I would appreciate it.

Leave a Reply to Josh Kammerer