Real Homes of Genius: Today we Salute you Temecula and Culver City. Lower End of Housing Seeing Bottom. Buyers Lining up for Middle to Upper Priced Housing Markets. 1 Percent Discount in Culver City for a 625 Square foot Home or 62 Percent Discount in Temecula for 2,200 Square foot Home?

That smell in the air is housing delusion being pumped out through the clean exhaust of the new vehicles being driven off the dealer lots. You might mistake it for the fall but housing perma-bulls are now coming back out of their journey into the wilderness to proclaim the housing bottom. This climate feels familiar because this is how it was in 2005 and 2006 especially with some of the comments. Some feel secure that the Alt-A and option ARM tsunami is conveniently sitting on the books of banks. Does it bring you confidence that banks will now be landlords or some of the largest property owners in the country? To some this might sit well. But with over 1,000 homes entering distress in California per day, you have to wonder how much of the flood can they take? Either way, those calling the bottom are now out in full force.

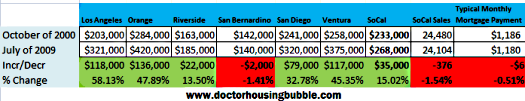

But let me tell you something. There might be a bottom in the bottom of the housing market. Take a look at areas like the Inland Empire:

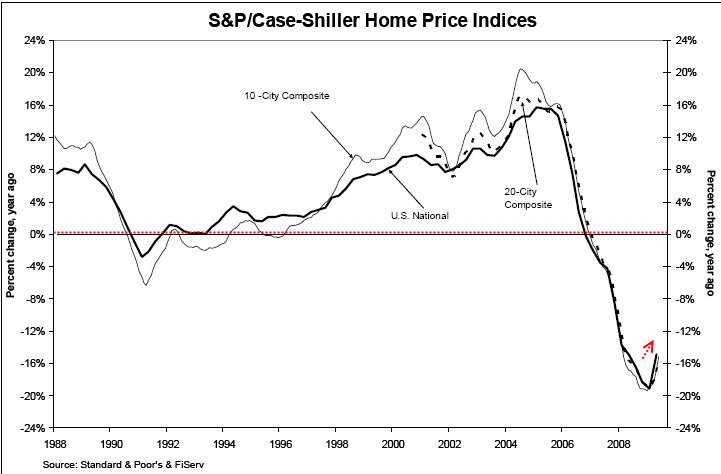

San Bernardino and Riverside Counties are both seeing prices going back nearly a decade. In these areas, you might find some solid bargains. But look at the other counties. People are using the massive drop and correction at the lower rung to justify stagnant or slightly declining prices in more prime locations. And it is clear why we are seeing what we are seeing. The Case Shiller Index has now seen two months of data pointing upward:

Nationwide the housing market has been pummeled. Nationwide from peak to trough the market has fallen 33 percent. The issue was always overpriced homes financed by slick Willy so it is no surprise that with lower prices, homes are selling. Plus, incentives like the homebuyer tax credit have brought people off the sidelines. This is what Calculated Risk had to say about the Case Shiller Data:

“Unlike with the unemployment rate (worse than both scenarios), house prices are performing better (from the perspective of the banks) than the stress test scenarios. I believe there will be further price declines later this year, because I think the Case-Shiller seasonal adjustment is insufficient, and because I expect the first-time home buyer frenzy to slow just as more distressed supply comes on the market – even if an extension to the tax credit is passed.”

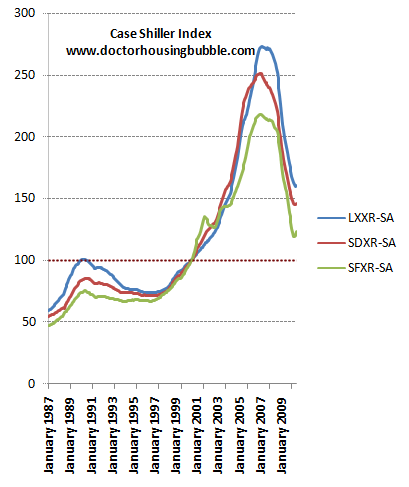

Same thing with cash for clunkers. You get a burst of activity but then what? Also, let us break out the Case-Shiller Data for a few major California MSAs:

The three areas are Los Angeles/Orange, San Francisco, and San Diego. All showed a slight uptick. Does this warrant bottom calling? In terms of sales we probably are there. But the problem is people generalize the overall trend to their little niche markets in Pasadena, Palms, Culver City, and suddenly the bottom is in with these areas even though the major force pulling the trend is lower priced home sales in other areas.

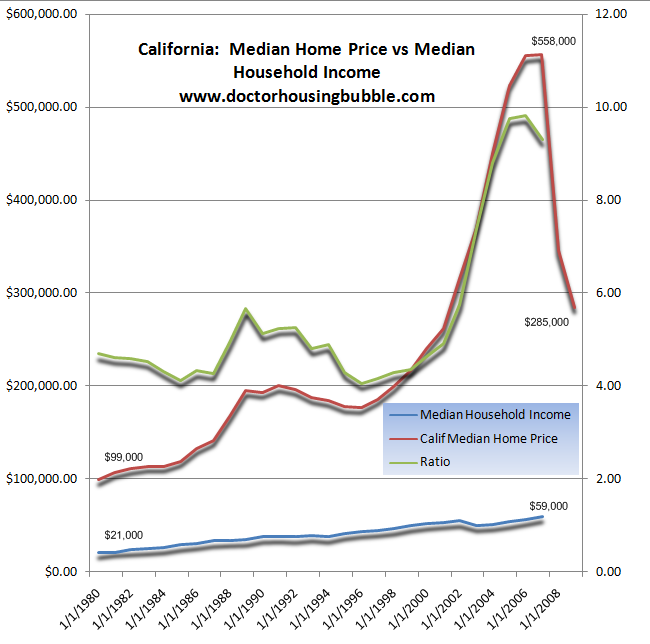

It has been some time since I pulled up this chart but it warrants a look given the current climate:

*Source:Â CAR and Census

You ultimately need a job to buy a home. You need a strong household income to buy in prime areas many that are plagued with Alt-A and option ARM loans. The above chart clearly depicts the housing bubble. You can tell that around 1996 the California home price took off and didn’t look back. More importantly, the price-to-income ratio exploded during this time as well. At the peak, the P/E of California housing was approximately 10! Currently it is closer to 4.76 with statewide data. This is in line with data from 1980 through 2000 where the ratio averaged 4.64. So we are at the bottom then? Not so fast. You need to remember the bulk of the sales have occurred at the lower end (look at the chart above showing the Southern California counties) and you will realize which areas still need to fall lower. This is also why the data looks more in line with historical standards.

I would also argue that California for 20 years has been living in two bubbles. First with technology and now with real estate. That 4.64 might be inflated. Our 11.9 percent unemployment rate is the highest since World War II. California has a stunning budget deficit. The bottom is certainly not in for some regions of the market and California is one of them. Would you like to see an Alt-A example? Let us give you a concrete example of what is going on.

Culver City:Â Mid-tier Over Priced

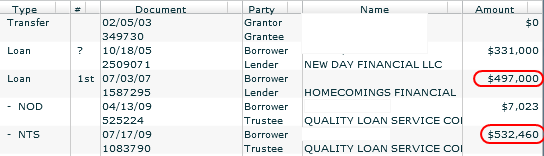

This home is a 2 bedroom and 1 bath home on a stunning 652 square feet of space. Yes, 652 square feet is correct. This home is in an area which is full of Alt-A and option ARM loans, Culver City. When we pull up tax data, it looks like the last recorded sale occurred in 1974 for $14,000. Not a bad deal. But that is the last time this home saw prudence because it was housing ATM time with exotic mortgages:

The last first lien recorded is for $497,000. The current owner had a NOD recorded in April for $7,023 with the NTS filed in July. Now this seems to be a more typical case. 3 months after the NOD a NTS was filed. Assuming the NOD was filed 3 months after the first missed payment (which might be accurate given the lower balance of $7,023) this is a more common path. So this is listed on the MLS as a short sale. Let us see what kind of generous offer the lenders are offering:

List Price: $489,000

Oh really! So let me get this straight, the last recorded first lien is for $497,000 and this home is now being sold for $489,000? Well thank you very much for that 1.6 percent discount in the most gigantic bubble state in the country. See folks, the entire global economy came close to Great Depression 2.0 and all we get is a 1 percent discount in Culver City. It would appear that the housing correction only applied to every other market except the mid-tier. In fact, let us completely forget about the correction and what got us to this point. You would think that some people in California would have learned their lesson but many are ready to jump back in to swim with the housing bubble cult. 652 square feet for almost $500,000. Real Home of Genius style.

Let me show you how the lower tier gets things done. Let us look at Temecula.

Temecula:Â Lower-tier Priced Right

Riverside County has taken it between the eyes with this housing bubble bursting. With employment and housing prices, the Inland Empire is trying to find its footing. This home was built near the peak in 2004 and is 2,204 square feet with 4 bedrooms and 2 baths. A nice sized place as you can see. Let us look at some sales history here:

07/29/2004: Â Â Â Â Â Â $400,500

Sold at peak for $400,500. But let us show you how the lower end gets things done. What is the current list price for the short sale?

List Price: $150,000

Now that is how you move inventory. A 62 percent discount will definitely get your attention. If you are in this area and have a stable job, why not buy a place like this? Might be cheaper than renting with all the money the government is throwing at homebuyers. But the Culver City home?  Over priced for a 652 square foot home in distress. 1 percent discount or 62 percent discount? This is how California is moving inventory.

And that is why this happened last month:

Culver City homes sold: 22

Temecula homes sold:Â Â 209

Today we salute you Culver City and Temecula with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

48 Responses to “Real Homes of Genius: Today we Salute you Temecula and Culver City. Lower End of Housing Seeing Bottom. Buyers Lining up for Middle to Upper Priced Housing Markets. 1 Percent Discount in Culver City for a 625 Square foot Home or 62 Percent Discount in Temecula for 2,200 Square foot Home?”

Temecula definately has some good deals if you are only looking at the purchase prices. But many neighborhoods built in the past five years have very high Mello-Roos, HOAs and/or CFDs (special assessments) which make the monthly payments much higher than expected based on price alone. Speaking from experience, we bought a home in Murrieta in December 2006 for $512,000 and the property taxes alone were just under $10,000 a year. Even if we owned the house outright we would be paying over $800 a month in taxes and nearly $1000 a month if you include insurance.

What is funny to me is that if the home was actually worth $512,000, the effective tax rate would be ~ 2%. But now that the home is worth ~ $250,000, the effective tax rate is closer to 4%. The tax assessor’s office has been slow (deliberately) to reassess properties to realistic values so people in this area are paying taxes on homes assessed at much higher amounts than their actual value.

Additionally, there are very few jobs in the Temecula-Murrieta area which are not service-industry based so anyone considering buying out there would have to be willing to commute at least 45 minutes each way, if not much longer, to a stable job. As bad as the housing market is out there, I feel that it will get considerably worse in the next few years.

It’s all good, but what’s the basis of the claim that “prime areas like Culver City” are “plagued” with Alt-A’s and option ARMs?

This is misleading, because it instills false hope in the hearts of many fence-sitters hoping for a tsunami of foreclosures that rips through desirable prime areas and lands prime properties in good schools at their feet for half price. By prime, I mean top 20% of the real estate in the state. I’m not terribly familiar with LA, but I think that most people would consider Manhattan Beach and Calabasas to be prime. Alt-A’s and option ARMs were at best a mid-tier phenomenon.

Per your own link, the _average_ balance of an Alt-A (at origination?) was 443,000 (and the median balance was probably lower, since the average would be skewed upwards by multimillion dollar loans). At the peak, 443,000 wasn’t enough to buy even a 650 sf house in Culver City. The median in Calabasas was into the seven digits.

Also, could you try to avoid confusing Alt-A’s and option ARMs? All (ok, almost all) option ARMs are Alt-A’s, but not all Alt-A’s are option ARMs. Existing evidence suggests that, by this date, around half of all bubble-era option ARMs have already been foreclosed or short-sold, and perhaps half of the ones still left, aren’t paying. The remaining Alt-A’s (the ones that are not option ARMs) are fairly benign interest-only 5/1’s and 7/1’s which aren’t in that much trouble, especially because their interest rates tend to reset downwards…

Most new buyers (last 5 years) in Culver City are upper-middle-class yupsters (maybe 1-2 kids, usually none) who looked at CC as a “stepping stone” to Santa Monica or at least West L.A.

Then they bought an $900K with no money down, Sandy lost her PR job which paid her $85k/yr to throw parties and rah-rah people, and Carlton can’t make the $6K/mo payments with his $90K/yr job as a Java programmer. Or something like that.

Just makes me sick to these parasites walk away from homes that they couldn’t afford in the first place. I hope their credit is ruined for 10 years, unfortunately I think it’s only a couple years, maybe 5 at the worst.

The realtor’s description is just classic with “cute” and “cozy” and my favorite, “Agents please see PRIVATE REMARKS!” Oh? Nothing makes me super interested in a $750/sqft glorified shed like some secret message only agents can see.

Still, it’s kind of a weird bird. The county assesses it at $202,895 (still $311/sqft!) while Zillow gives it $506,000 with a lower bound of $399,740. Really Zillow? And the other internet appraisal sites are in the same ballpark. Is there gold buried here? Is that what’s in the all-caps “PRIVATE REMARKS”?

Bay Area homes sell for less than $60,000

Condos for $20,000? Single-family homes for under $60,000? What is this, Detroit?

It’s the topsy-turvy world of Bay Area real estate. Despite studies showing prices slowly rising overall, homes at the low end appear to be playing a game of limbo, flaunting prices comparable to what you’d pay for a car.

Sometimes those ultra-low prices are come-ons to spur a bidding war; sometimes they reflect abysmal house conditions. It’s no surprise that the dirt-cheap properties are located smack in the middle of foreclosure hot spots – Pittsburg, Antioch, Vallejo, Richmond, Oakland. They tend to be either bank-owned foreclosures or short sales (selling for less than is owed).

David Lear of Sotheby’s International Realty in Danville is selling a one-bedroom condo in Pittsburg’s Lakeview complex near Los Medanos College for $48,000 as a short sale. The owner purchased it three years ago for $228,000.

“It shows you how dramatically the market has declined,” he said. “We’re not even the lowest-price unit in there; there’s a similar one for $38,000.”

—

Many condos are particularly cheap because of financing issues, said Tim Garton of Coldwell Banker in Vallejo. Government-backed loans, which account for 90 percent of mortgages these days, are not available at complexes where too many residents are behind on their homeowner association dues, or too many units are not owner-occupied.

“These red marks tally up, and suddenly there is no financing available,” he said. “That takes out a huge percentage of the potential buyers. Your pool of potential buyers becomes very small; just the cash buyers. The fewer potential buyers, the more you have to lower the price.”

The Sunday San Francisco Chronicle had a front page story on how prices in the outlying suburbs (Antioch, Pittsburg,etc.) have fallen to $100. a sq.ft.

Not surprisingly, this has triggered a buying frenzy, with multiple bids on a single house.

As the Dr. as pointed out repeatedly,

1.The housing market is self correcting

2. There is nothing wrong with a house that a low price can’t correct.

great post! on the front page of union tribune this morning it says we are on the way back up! it made me want to hurry up and buy. it is to bad they do not know about the job market.

here in coronado it is the same as culver city, they still think houses are worth so much more. same size house in coronado would be about $700 to 800 thousand! dr. hb take a look at the housing market here, it can be your next real home genius.

We all know where the majority of jobs are, so some of the disparity is warranted. There are folks who dont mind comuting from Temecula to Culver City. Burning gasoline and 20+ hours a week sitting in a car doesnt suit me, so as Dr HB aptly caveats, if you can score a good job out there in the desert, snatch this up!!

Dear Dr. Housing Bubble,

I have been enjoying your blog for months now. As a realtor I find daily truths. For example the house you selected in Culver City is around the corner from me. According to the MLS it was built in 1923. It is small, in need of major work, and has a pitiful yard. There is value if it were set at the correct price. It has been on the market 165 days. Obviously the buyers out there who are craving Culver City are smarter than the market.

Great comparison Dr. HB. It is impossible to lump all the homes together in a state the size of California without looking at individual markets. The Westside is quite different than the Inland Empire. It is all about affordability and jobs now. With speculation gone on the Westside, the only ones buying are uber-rich or totally uninformed. The bulk of buyers can afford to wait it out, as renting is much cheaper than owning, while prices continue to drop.

We conducted a poll on the price of a starter house in Culver City at the bottom. That would be a 2+1 in an average park area of the city. The results came in at $300K – $325K. That’s quite a drop from $550K – $600K now.

We still have a long way to go on the Westside.

http://www.westsideremeltdown.blogspot.com

I have been getting daily updated listings on the “low end” areas in Temecula

and I continue to see price decreases, not increases. I also see many homes being put back on the market after they had been “sold” and removed from the listings.

That does not seem to be the bottom if prices continue to drop or if the same

property has to be relisted multiple times to get one “sale”.

Dr. I have been following your post, but the recent stories makes me re thingk about should I wati or should I buy now

http://finance.yahoo.com/news/July-new-US-home-sales-up-96-apf-2930955123.html?x=0&sec=topStories&pos=main&asset=&ccode=

We have to remember that most bubbles are symmetrical in nature. The housing bubble started roughly around 1998 and peaked around 06-07′ in CA; therefore, it took about 8-9 years to blow up and it should take about the same time to come back to a sustainable and affordable level.

I think we should be looking to 2014-2015 for a real bottom in housing for CA including the mid and high tiers. There are many more triggers on the horizon for lower prices: morgage resets/recast peaking in mid-2011, eventually interest rates will rise = lower prices, increasing unemployment, banks releasing shadow inventory, higher foreclosure rates, etc.

The banks and government actions including foreclosure moratoriums, ineffective mortgage modifications, slow short sale and foreclosure processing, maintaining large shadow inventory, low downpayment loans, etc. are SLOWING the housing correction.

Your dream home will be affordable in 4-5 years, save up as much money as possible and buy then. Now is a terrible time to buy. We may experience a double dip recession once monetary easing is pulled back and who wants a mortgage when your job is in jeopardy?

Wow, looks like the trolls have become emboldened by all of the “sucess” our Peoples’ Republic has had over the past month or so and are starting to come out of the woodwork! Well, then, welcome and riddle me this: have any of the fundemental realities (income, jobs, affordability etc.) of our lives truly improved or even changed much over the past year or so, particularly here in Cali?

–

I wouldn’t characterize Dr. HB and those who frequent this blog as pessimistic, but rather waiting to be optimistic for the RIGHT reasons and skeptical of anything less. In the meantime, all I can do is shake my head chuckle at those who claim our gubbermint’s efforts to avoid dealing with bad debt have made things all better now.

It’s the old case of supply and demand. Even in tuff times like these, areas like Culver City, Santa Monica, etc. won’t budge too much. Sure, there are a few idiots out there that leveraged the crap out of their homes and they will probably lose their property. But in limited or smaller populated desirable cities where everybody in the world would like to live, drops will be minimal. Places like Corona, Valencia, Temecula, etc. where there is plenty of space to build more corporate packaged developments and malls will surely have quite a way to bottom out. The wild card will be the burgeoning middle class from overseas spending cheap dollars on desirable properties here. They will most likely dictate prices in the future re: the desirable areas. Like the Dr. states, job losses will be with us for several years. Folks from other countries are not concerned with our problem and don’t have to wait around for years.

The Culver City case may relate to a situation I recently saw on the HGTV program Real Estate Intervention. BTW HGTV has become the “slow motion train wreck” TV station with programs such as 2007 victims of House Hunters. Anyway, on this episode this poor single woman had a frankly disheveled house in suburban Washington, D.C. She had been sucked into the deepest part of the mortgage loan vortex with a negative amortization loan. OMG! Anyway, she was up to her eyeballs in it. Further, her mother had just been diagnosed with terminal cancer. Anyway, to make a long story short, she went to her mortgage lender on her knees begging for permission to short sell. Apparently, her request was granted on a “humantiarian” basis. According to the laws in Maryland (I believe) she was forced to list the house at the actual outstanding mortgage amount due, even though there was not a snowballs chance that the house would sell for that amount. Suffice it to say that she would continue to live on a strict expense budget until the lender was satisfied that due diligence had been exerted to sell the house at a more favorable price. What may be happening with the Culver City property is something similar, i.e. the bank looking for the last remaining “Greater Fool” to come along and pay that ridiculous price. Eventually, though the “owners” will be forced to deal with the fact of depressed housing prices and the sales price will drop to a market clearing level.

I am trying to imagine what a 649 square foot house would look like inside. I am trying to conceive of who would want to buy such a house for $480,000. But people will do what they will do. If there are enough idiots out there to start buying still overpriced houses on the Westside, then they will be bought. But I doubt that there will be another wave of buyers to later take the houses off the hands of this group. And I can only hope that the banks are requiring 20% on mortgages, so that the buyers cannot do what the first wave are doing; blithely sitting in the house until foreclosure, or just walking away, since they had no skin in the game to begin with.

I continue to believe that the government statements and policies which attempt to prop up or inflate the housing market, or which continue to talk about “keeping homewners in their homes,” are creating an ethos in which would-be buyers have in the back of their minds that if they buy a house now, and later they go underwater, the government will help them or save them. In other words, there isn’t all that much risk. I think they are wrong; there is never going to be another bailout like this one; they are going to be losing substantial down payment equity. But if they are willing to start buying in a markets which won’t appreciate for ten years, there is not much that we more logical people can do about it.

This uptick of Case-Shiller is the ultimate misleading indicator where the RE market is heading. Not because of the index itself, but because of the lack of perspective to the issue of today’s housing. The recession of 1990 lasted less than 2 years, but the lasting direct damage to the consumer confidence and indirectly to the RE in California went for 6 more years. The early rush then of delusional buyers to the market produced similar uptick in the housing in 1993. (Only if they could learn the lesson of the 80s bubble? ) When this last straw was lost to disparity of the economic conditions, market continued silently sliding for 3 more years until 1996, where it really hit cyclic bottom. What I am saying today’s uptick someday may be considered midpoint in this debacle. One more point is that people are not learning from mistakes, at least the big majority, so the history repeat itself. Remember LA riots 1994? That was after the desperation that there is a meaningful recovery 4 years after he much smaller resection.

So, the house in Culver City is selling for a little shy of $800 per sq ft? Hell, I’d be afraid to put a $1500 couch on $10K of floor space.

“but in limited or smaller populated desirable cities where everybody in the world would like to live, drops will be minimal.”

D1 (and others), how do you explain the early 90s? North of Montana, Manhattan Beach, Malibu all suffered huge decline. They were as desirable then, as they are now. There were rich people then; there are rich people now. Look at the historical Case Shiller for Los Angeles, or see the link below (from a lender, no less) about what happened to million dollar properties last bubble.

Am I the oldest person on this blog? Could some westside bubble-deflation-denier please convince me why “this time is different?”

http://www.firstrepublic.com/lend/residential/prestigeindex/losangeles.html

Comment by SD Scientist:

Banks are mostly lending to people with excellent credit, 25% down, at a 30 year fixed. In order to buy a 1000 square foot shack in Culver City, on a 5000 square foot lot, built in 1950’s, is still $700K. Very few are selling as someone needs to make a $250K salary to pay for the place. It is a battle between seller and buyers and the buyers will win Inevitably, Culver City, and west side will go down regardless of foreclosures, due to stringent loan requirements.

Jason,

I agree with a lot of what you write. If you are going to talk that westside drop stuff, you are correct. People paid unconscionable high dreamy prices for property over there. But now that doesn’t mean the properties are going to drop off a cliff from now on in those areas. I know foreign cash buyers are there ready to roll. People with cash want a good deal. It’s much different NOW than the 90’s. As our middle class shrinks, foreign middle class is rising fast. It’s just a tuff reality that we have not experienced before. My friend bought a tear down house in Huntington Beach (2nd st.) on a double lot in 1993 for $400K. People laughed at the price he paid, thinking things were going to drop further. The bank scandal was a prominent issue at the time. The property did drop about 50K a year later. In 2002 he built (2) small three story houses after splitting the property at a cost of about 650K. The houses peaked at 1.7M a piece. Now, there worth about 1.2M a piece. Not bad, he’s still ahead and retired at 48 with his smart purchase. He could have bought a mansion/ranch with all the b/s in Chino Hills for the same price back then and we all know where those prices are going. It’s all about area. Although, if things get so bad that you can buy a house in Culver City for 200K, who in hell would want to live here?

BUT THE ZERO INTEREST RATE POLICY OF THE FED WILL BLEED ALL THE SAVERS ACCOUNTS A DRIP AT A TIME AND THEIR INVESTMENT WITH THE FED THAT CHANGED THE INFLATION CALCULATION METHODS TO NOT INCLUDE HOUSING HAS LOST 90 PERCENT OF ITS PURCHACE POWER OVER 9 YEARS IN RELATION TO HOUSING AND WILL NOT AT EVEN 30 PERCENT FALLEN PRICES BREAK EVEN……CONSPIRACY THEORIST?

As someone who bought near peak pretty close to Temecula the 62% might be on the low side. You showed the value in 2004, but the market out here didn’t peak until 2006 (when I bought). That $400,000 2200 square foot was going for closer to 460k in 2006. The guy who was talking about HOA and special assessments is right on the nose. Water/Sewer is also really expensive out here ($120-140 a month) for a small yard. The county is actually doing a good job this year of fixing the assessments. They dropped mine by 50% which was a lot better than the 5% drop they gave me last year. I didn’t even apply this year and they gave 50%… its too bad the $6000 tax bill last year is what through my house into default. Even if i was staying in my house I’d pay around $4200 a year in property tax(after the reassessment) on a $150k house . Also anyone who buys out here be prepared for 1/4 of the houses near you to be abandoned over the next 2 years. How many people do you think will stay in their homes that they bought in 2004-2006 for $400-500k when their neighbor is getting deals like this. The foreclosures in this area haven’t even come close to peaking yet.

Price to income ratio of 4.64 in recent history is a bit high for someone like me who is not from California. I’m sorry, but you can keep your sunshine and warm weather. Why would you want to be house poor?

Speaking of Californian, I’ve been seen lots of California license plates around our town more than the usual. Most of them are equity locust (think Lexus SUV) or GMC construction trucks looking for their next gig.

BTW, if you think the $150,000 Inland Empire house is a bargain, wait a few years when jobs even harder to find.

Cinch

We’ve been warned: FDIC regulator Bair says too-big-to-fail banks putting taxpayer money at risk

http://www.bigbuilderonline.com/industry-news.asp?sectionID=363&articleID=1051121

people, westside is great place to live: sun, beach, not to hot, golf, etc. but with prices staying sky high in places like CC, I am starting to think that west LA might not be the place for me in the long run. it makes more sense to SAVE for the next several yrs and then move to a more affordable city like portland or seattle.

there’s just way too many ppl with money out here. I make 150k/yr, and that’s just not enough to buy a very modest 3/2 starter home in CC. I used to get angy bc I couldn’t afford buying out here, but that’s just the way it is. there are other places to live. Plus, I am not in the industry so living in LA is not a must. Beach is cool, but I only go a dozen times a year at most. Plus, a city with better air wouldn’t hurt either.

Why buy that home in Culver City when you can rent a larger place than that for in the same area for 1500 a month? My place is twice the size! I know people who bought homes in the area want desperately to believe it is worth the inflated price they think it is, but it isn’t. So while they are house poor and living in cramped quarters I’ve got a sweet pad and the ability to actually save money.

Dear “When”

If you are thinking about moving to Portland or Seattle(I’ve lived in both)

you will not be making $150K there. Similar jobs would probably pay $70-80K, if you are lucky.

Most of the people in those areas are natives, and will not move for any reason. Employers take advantage of that, and pay low wages with poor benefits. The only way you can “move up” is when someone retires, or dies.

Also, both of those areas are “boom or bust” economies, with dramatic roller coaster rides for employees. It got so bad in the early 80’s, that Oregon’s total population dropped- there were NO jobs. My next door neighbor,(a PHD) ended up starting a landscaping business. The neighbor down the street,

(an engineer) ended up working for a sewer installation business for 3 years, until things finally bottomed out.

Ah yes, the old “but you make more here” BS.

The wages here are only SLIGHTLY, very slightly higher in SOCA, but the unemployment rate is the nations’ highest.

Real estate is not on the rebound. No way.

ROBERT CRAMER.

I think you are exaggerating about Oregon and Washinton.

The early 80’s were exceptionally bad in the North West but it was bad just about everywhere back then. Once the economy recovered things were fine until the recession of the early 90s where there was a minor softening of the Oregon economy while there was a major recession in most parts of the country. Things have been fine in Oregon until lately and is on a par with California but there foreclosure problem is not even close.

It is true prior to 1984 or 1985 Oregon and Washington were very susceptible to booms and busts, Oregon due to its heavy reliance on lumber and Washington on it heavy reliance on aerospace. Both places have diversified their economies.

Market fluctuations are a reality of this industry. Ride them out and the market absolutely will self correct. It’s all part of the job.

The Fed has me in a PICKLE HOLD.

My 600K is producing 6K a year in interest, meanwhile I am forking over 27K a year in rent. In two years my 600K will drop to about 560K.

I can see someone who has to borrow the money waiting to buy a house for more price falls but can anyone logically argue that a cash buyer ought to hold off?

In economics 101 I was brainwashed into believeing the market set interest rates and that is absalutely true, until the FED wants to set rates. The FED clearly can control rates and it will for much longer than people think.

Yes because there’s absolutely nowhere better to live than southern CA. Never mind the 10% sales tax we have in L.A. now. Never mind the 10% income tax we have statewide now. Never mind the 12% unemployment. And the state is STILL bankrupt (which means more taxes and layoffs and cut backs in vital services ahead and that will get UGLY). Never mind the absolutely unaffordable housing (although the high unemployment has to lower that eventually).

Besides if the plan is to SAVE MONEY for a house then you can take advantage of earning a higher income now to pile up cash and then move somewhere cheaper.

Foreign buyers are hot here in Silicon Valley. While county unemployment is listed at 12.4%, it doesn’t seem that bad.

I bid on a REO, 4 bd/3bath, 1700 sq ft, across the street from a freeway sound wall in San Jose. Good schools though. The listing price was $460k. I bid the outstanding loan amount of $512k with my FHA pre-approval. It went for $550+k with 50% down.

Wahhhaaa.

I lost a smaller short sale listed at $512k and my bid was $535k. Same neightborhood but away from the freeway and across from an elementary school. The wife thought we were overbidding. The bank declined our offer and said they would just keep renting it and so, supposedly, withdrew it from the market.

These are what I call “lower middle tier” homes. Just basic, chean, middle class housing. So when this tidal wave of upper middle tier homes come crashing onto the market, is the lower middle tier going to fall too or will the spread just compress? Still lots of $600 to $700k houses listed.

@martin,

It’s always a gamble. Perhaps you should consider honestly the worst-case scenario: If I pay 600k for a house and the value drops to 300k, do I care? I still have the house with the intrinsic value, which as not changed, but the phychological realization that I just lost 300k of perceived value. If you really want the house and aren’t concerned with the potential loss, maybe you should put in an offer. I’ll bet cash is king right now more than ever and if you put in an offer, you could get a far better deal that others.

The trouble might start if your neighbor’s liar loans and reverse-equity recasts turn your street into a danger zone. Doc makes a great case for housing falling further, but the wildcard here is the corrupt financial system and the odd distribution of rewarding the wicked and punishing the just. Maybe they can prop this mess up another year, another five years, maybe not. With the stupid run-up in the stock market, another black-swan event may be right around the corner. September, October and November have seen some of the most wicked market corrections in history, and housing and stocks seldom move in different directions for long. Irrational exuberance and panic selling are features of both.

A big part of the problem now is taxes keep going up while wages and employment keep going down. I like living here, but if I lost my job I’d leave in a heartbeat for a job somewhere else. A few people seem to be doing well for themselves, but CA is effectively destroying its middle class. If a large number of us tax-paying middle class citizens move out of the state its going to get real ugly for those that are left. The state needs to find a way to cut costs and attract some private sector jobs. All these special tax assessments on homes need to be looked at as well. Paying 1/3 of your mortgage payment as property taxes is pretty harsh.

Cash for clunkers and RHG’s is similar to what the auto companies did at the start of the decade. They used promotions with 0% interest loans to prime the pump, but instead of the sales flowing on, the produced a future expectation of 0% and the promotion became the norm. Wonder how car sales did the rest of the week. But Monday was will and Tuesday was Tombstone Territory…I just saw Guinness for $10 a six in the walmarx. I guess the dollar is crashing because the domestic stuff looked about the same. Maybe they can inflate the debt away. Remember Dan Aykroyd on SNL (of course you don’t) “Don’t you want to smoke an $8000 dollar cigar? Don’t you want to drive a $250,000 car? I know I do”.

Hope that some of you who know WLA/CC area well can provide some color here. Who are these folks living in the 650k-700k 3/2 modest starter homes in CC/Mar Vista? Are there really that many tens of thousands of ppl who have a combined income of 200-250k who want to live in a very modest, middle class neighborhood? It is very hard for me to imagine a family making 200-250k+ settling for a modest starter home in Culver City. I know a couple who just bought a 700k condo in Brentwood, and when I asked whether they’d consider buying a house for that prices in CC, they asked me is CC safe? I know there are some fancy neighborhoods in CC, but I am not talking about those. I am more focused on the neighborhoods with the 650-700k modest starter homes. Look forward to hearing what you guys think.

When,

I’m sure that some folks will whip out the median income statistic for Culver City (CC) and open up a can of whopass on me, but I do see a lot of families in the 250K range who are desperate to move into a small home in CC. Now, I am totally generalizing- however, I am one of those families and we have spent a little over a year looking at houses with friends. CC was an funky Westside alternative to Venice, AND it has its own school district (not great, but much better than LA).

Culver city has attracted a lot of young, funky couples who make relatively decent incomes, and who do not want to live in Silver Lake (too far east) but cannot afford Venice.

I am by no means suggesting that CC is a good deal. It is a horrible deal! I am embarrassed that I choose to live there, and I paid about 600/sq ft for my place. A lot of the other 30somethings like me had parents help too.

It is a sad thing, but I would do it again. I am a native Angelino, and I have lived in NY, IN, OR and a couple of brief stints in NoCal. It is a disease, I know, but it is totally infectious and there are a LOT of out of state people who bought into CC b/c it is a “known” destination, like Venice or SM. West LA is really not know and, no offense to anyone, way too bland for many of the hipsters living in CC/Venice. SM is too expensive and, sadly, full of ex-Beverly Hills families.

I’m tired of hearing about these young funky super couples that supposedly drive the westside pricing. I’ve lived in and around this area my whole life and while I know of (some) young couples pulling in 150k (combined), any higher than that and the number drops precipitously. There definitely aren’t enough to support bubble pricing in places like CC, Venice etc. I suspect many of these legendary super funky couples had bubble jobs anyway that today must pay much less, if they have them at all. Without going back to the days of real “funky” exotic financing, these funky young folks will have to forget about living in the west side for the time being. I am more convinced that foreign money from Iran and Asia have pumped the westside much more than these funky couples ever did. I am also more worried that a new infusion of foreign money will keep all the good Southern California properties from getting all the way down to the level where the local incomes would justify them.

I am from the midwest and have read your column for over a year. While California’s troubles exceed other states with a couple of exceptions (Florida, Nevada). I don’t see any answers or solutions to the problems. Or, how to take advantage of the situation. Basicially, your doom and gloom forecasts (which I think are well thought out and logical) say that we have 3-5 years before these markets stablize and that banks especially those with mortgages on their books are in trouble.

Your thoughts!

Comment by Kid Charlemagne

Thanks for taking the time to respond.

In a word…BINGO!

I am well aware that Sept and Oct are nasty months for the markets. Given the stock market is way over valued at a time like this it ought to be pretty nasty this fall and if so the housing market should change due to the loss of wealth.

On the other hand, if the FED can prevent a collapse in the stock market this fall then their power is more than I can comprehend and I will plunge into the housing market, if the FED can’t, I will bide my time.

I recall someone wondering why the banks are holding on to this shadow inventory and I have a theory that I had thought might be ridiculous – I’m no economist, not that they have better insight.

I had wondered if banks were keeping the houses off the market and on their books so that they could secretly transfer the property to foreign creditors, like China, who wants to dump their US debt for hard assets.

I read this on kitco.com today:

“The FDIC has responded in two ways. They have opened the door for foreign financial firms to rescue the growing list of insolvent US banks, taking equity in exchange for infused funds as capital. This is unprecedented. Could this be due to the general insolvency of the great majority of big US banks?”

If this statement is true, and foreign financial firms can take equity in banks, then wouldn’t they acquire these properties? The public would be unaware that the empty homes in their neighborhood were owned by foreign investors? I guess they would own them anyway if they bought the loans…

I don’t know…dumb theory, I suppose. I guess it shows I know too little about the way things work.

Re: When,

Guess i’d fall into that catagory, living in cc, 250k+ income, bought in the range you mention. Did it because CC was the only area that met my critera of what I wanted:

– House (not condo)

– Central to my job (SM) and my wife’s (Mid City)

– Walkable to well, anything.

– Within my price range

Ultimately would I have rather lived in another area? Sure, I’d love to be in Rancho Park or Beverly/3rd or something like that but I also wasnt willing to spend the $1MM+ it would have cost at the time to live there and I wasn’t willing to give myself an hour commute each day. There are lots of areas of CC that aren’t so great and there are some that area, ultimately I think it’s got the best combo of what I wanted. Hope that answers your question.

For those of you sitting on the fence waiting to buy in Silicon Valley, just quit sitting on that fence, and don’t EVER buy.

I’d rather have $XXX,XXX in cash and solid investments than a house made of spit and toilet paper. The bay area is never coming back to it’s boom times. It will even out, but forget about ever seeing anything like the dot.com mania or the housing mania. Here, it’s just going to be long, ongoing pain.

There is so much rental property here, it’s nuts. In my apartment complex of 64 units, more than 10 sit empty and I pay $1200 a month for 1000 square feet. I feel no obligation to buy a place here, when I have enough money to pick up, go back to the Central NY where I grew up, buy a house for cash, and settle into any job that is just enough to pay rent and taxes.

I can do a partial retirement, I can rent and continue accumulating money, or I can buy a small tiny place here and become a wage slave. Hmmm. what to do…

I have been in the Temecula Valley (Murietta, Lake Elsinore, Temecula) for over 5 years. I would not choose to live here. The only way we survive is my work from home situation. There are NO JOBS! The weather is extreme with very view good 70s weather. The local mountains don’t allow us to benefit from the beach. I would not invest here! There is a development next door with streets and no houses being built on it. If you do want to have employment, your only option is to drive the crowded freeways 2-4 hours (possibly each way). The jobs are far more plentiful in Los Angeles/ Culver City! So what if you have a big new house – if you are never there or too tired to enjoy it! Been there and done that!! This area is going to be depressed for a long time. When my Father In-law passes away, I am getting the hell out of here! Even at a loss.

ive lived in temecula since 1985 ive seen it grow and this is the second ecomomic downfall its gone through. This is bad for temecula. All the rich people who lived in the wine country are selling. You dont see many of thoughs people here anymore. I used to take care of tyreese gibsons dogs at the vet clinic I worked at. There are NOOOOOOOOOOOOO jobs here so beware. Its a commuting down. what JP said is true. Alot commute to san diego also, there are lots of jobs in san diego but this makes the freeway Packed. you spend about 4 hours on the freeway to get to your 9 am starting job. which should only be an hour and 30 on weekends. Big companys and small bussiness are going out of bussines. Everyone seems to be struggling here. the plus side is that it is a good place to raise kids. Low crime . Dont get me started on the city gov here. They spent 50 thousand dollers on fireworks. YEs fireworks. Everyone told them not to do it cause the other citys cut there budgets to survive the recession. But they didnt. STUPID STUPID STUPID anways yea been here since 1985 grew up here.

All the people making it here are living with there familys so you have familys of generations living together to pay for there house.

Leave a Reply