The inflection point has arrived in Southern California real estate: Investors make up smallest percentage of buyers in three years. Inventory continues to grow.

As it turns out, investor buying does have a massive impact on local real estate. Big money is slowly starting to pull away from the real estate market. We are seeing this in dramatic fashion in Arizona and Nevada. It is also happening here in the sunny Golden State. What is interesting in the last housing correction is that prices and sales fell on the outskirts first and slowly made their way inward. The marginal buyer is pushed out first before making its way up the economic food chain. We are seeing similar action happening in places like the Inland Empire and Central Valley where inventory is certainly up and prices are hitting plateaus. The momentum from 2013 is now running on fumes. We also have certain cities being dominated by investors and in many cases money is coming directly from China. Hot money is finding a home in the oddest of places. Yet one thing is certain and that is SoCal real estate is now entering into an inflection point. As this turn unfolds we are going to find out what areas are truly prime and what other areas are all hat with no cattle.

Investors slowly pulling away

After the bust in 2007, many of the investors buying California real estate were of a new breed. These investors were looking for rental properties. The previous boom saw mostly flippers making up the investor category. Flippers only re-entered the game in large numbers in the last couple of years. At this point, as a real estate investor looking for cash flow California is largely unattractive. For flippers, the game is still working but not like it was a couple of years ago. The figures highlight a clear trend. In SoCal for June we had 23 percent of all sales going to investors. While that is still high, this is the lowest number going back to 2011.

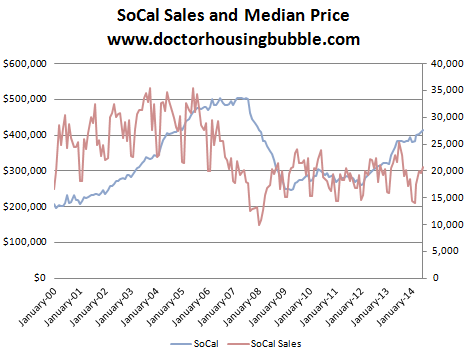

Sales volume also continues to show weakness in spite of all the rhetoric that housing is hot and now is the right time to buy. Take a look at sales and prices going back to 2000:

You will notice that sales volume never recouped the ferocity of what occurred during housing bubble 1.0. The current market is really a market driven by investors and big money. This market is also driven by minimal sales volume. This can be good in pushing prices up in a controlled environment. It can also turn quickly if you suddenly have more sellers accepting lower bids. At least when it comes to those looking to buy, it is a free market. You have a choice in what place you would like to make an offer on. No one is forcing a hand here. No one is forcing anyone to buy or sell here.

The median price for a SoCal home was $415,000 in June. Sales volume in June came in at 20,654. Compare that with the sales volume of 34,454 in June of 2005 when the median price was $465,000. If you are making a full offer on a house sans a mortgage, it is unlikely that this is all the cash you have at your disposal. So you are likely in a good financial position. And something tells me you are not buying these crap shacks that were built before World War II. Slowly, we are seeing sanity enter into the market. The public at large suffers from financial amnesia and thinks real estate is always a safe bet. The last crisis wiped out millions of home owners many right here in California! They couldn’t even hold on. Can you make that $4,000 or $5,000 monthly nut for 30 years? Some people seem to think in our dramatically fast changing economy that the rules of yesterday will apply once again. “Real estate has always gone up!†Sure, so has the price of bread, cars, education, etc. What is your opportunity cost versus other investments? What is the financial cost of being locked into a massive mortgage in a market that is clearly still at the whims of investors? There are many variables to consider. The fact that inventory is up, sales are down, and prices are stalling out suggests that something else is going on. Some are paying outrageous prices for condos that in many cases, are glorified apartments with strict HOAs.

Inventory in Riverside is up well over 100 percent compared to last year. Sacramento has seen a massive increase in inventory as well. We are also seeing inventory increase in L.A. and Orange Counties. The state of California has more people and if it were such a simple decision, why are people not buying in mass? Real estate always goes up right? You have a shrinking middle class and those with money are becoming more hesitant in dumping it into cities with weak underlying economics filled with strip malls and liquor stores trying to justify $600,000 price tags. And that brings us back to the inflection point. I think we all realize that some areas are truly elite: Beverly Hills, Newport Coast, La Jolla, San Marino, etc. All other areas are subject to the whims of the economy. We’ve had a nice run in the stock market and California is heavily dependent on the stock wealth for real estate. Look at tech companies and the Bay Area.

I was grabbing a bite to eat and overheard a mortgage broker talking to the waiter on how hot the market was last year and how now was a great time to buy. This was in an area where starter homes go for $800,000 to $1 million yet the waiter seemed interested in buying in this area. It is also amusing to see California based Tesla mention they are going to come out with an “entry level†car in the low $30,000 range in a couple of years. Isn’t everyone just rolling in the dough in California? Why do we need an entry level Tesla car? At least when it comes to buying cars, Tesla realizes incomes do matter and you need to realize where your customer base is going to come from in the future. Some in the housing industry are merely interested in what happened last week because in reality, housing rarely produces large amounts of jobs especially when you are flipping already built homes. A home doesn’t create a job or pay a homeowner income. I’ve mentioned this in prior posts but I know people living in paid off homes yet continue to have monthly expenses. That million dollar home is not throwing off any cash. In other words, you better have some other sort of income stream to live off of. And for many that buy in this market by stretching their budgets they are foregoing saving for retirement just to squeeze into a home. Forget about the future, look at the next year or two. And these are the people that somehow have the crystal ball 30 years into the future.

Baby boomers came of planning age with the advent of the 401k and how well did that go? They didn’t prepare in large numbers. Even those that bought in California and now have their homes paid off are having a tough time. Many are seeing their grown up kids move back home. The inflection point is happening because local households simply do not have the financial stability to purchase in this market. It isn’t a question of desire as that waiter had a clear and deep hope of buying. If we had those American NINJA loans I’m sure that broker would have signed him up before the appetizers hit the table. The usually hot summer selling season did not materialize this year. We still have some time in July and August to turn this ship around.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

137 Responses to “The inflection point has arrived in Southern California real estate: Investors make up smallest percentage of buyers in three years. Inventory continues to grow.”

“At least when it comes to those looking to buy, it is a free market. You have a choice in what place you would like to make an offer on. No one is forcing a hand here. No one is forcing anyone to buy or sell here.”

BS it is:

Ludicrously tangled and collectivist policies in CA, but ESPECIALLY the urban areas like the bay and LA, utterly choke off any semblance of ‘supply’ to the housing market.

In red states you can buy a parcel and build anything you like to live in and nobody but you has a say. Codes are easy to understand, NIMBYists are escorted out on the nearest rail, and thus there’s always some place in the early 100’s where it’s worth living.

In CA you get to sit on your parcel for 5 years while you beg and bribe a dozen inspection agencies, jump through ludicrous hoops like the “fire sprinklers in your home office because who cares about the 5k in family-room electronics ruined when your kid burns pancakes”, then deal with the lawsuits from 3 or 4 different collectivist organizations. It’s no wonder then that homes are reaching ludicrous ages and entire cities are turning into disgusting ghetto.

This is, of course, if you can find property zoned for new homes, as the “I’ve got mine, screw you” mentality is incredibly strong in the greater bay area, resulting in ludicrous prices while city hall will refuse to run new sewer lines because NIMBY.

The topper is their policies severely curtail building renewal, and prop 13 causes property taxes for a school district to fail to keep up with inflation, creating sprawling ghettos the longer a fully-developed area exists. Then these people lock their own kids’ new families out rather than let just one of “those people” into their perfect towns, then they call conservatives “racist”.

All of this together is the leftist equivalent of creationism in schools, except creationism doesn’t result in U.S. favellas like this collection of policies does (literally, Moyers did a mini-doc on the favellas in silicon valley because 30% of the populace make less a month than the average rent!).

Outstanding post. Property rights have long ceased to exist in the SF Bay Area. I’ve seen first-hand the stifling nature of bureaucratic fiefdoms, and the bribes required to do anything. Sadly, despite the prevailing mindset that these agencies exist for good reason, they don’t. It’s pure self-centered control, and the current water situation is only going to make it worse.

The “Water Situation” infuriates me even more than the housing codes.

I’ve traveled all up and down the great state of CA and can say authoritatively the punishment of urbanites in the Bay is outrageous.

The water given to the central valley is UTTERLY WASTED at every step in the transport and use process. Drive along highway 5 and you’ll see miles and miles of shallow concrete ditches bringing the water to the farms. When it arrives to the farms, most farmers simply store it in equally shallow ponds. (I’ll note the few who actually store it properly in towers and use soaker hoses instead of irrigation ditches also don’t have “i hate pelosi” signs on their yards).

The combined evaporation from these open ditches and ponds is probably greater than the total usage of the entire bay area.

Rather than punishing people for wanting to shower every day in SF, they should be covering the massive ditches.

Blargh is wrong! The water in the Central Valley canals is not being “given” to farmers in the Central Valley. The water flows mostly to the millions of people living in Southern California and the SF Bay Area who are almost completely dependent on having water shipped in from hundreds of miles away. Farmers are getting almost no water from the Central Valley Project this year:

http://www.sfgate.com/news/article/Drought-Feds-cut-water-to-Central-Valley-farmers-5256131.php

The San Francisco Bay Area is mostly dependent on having fresh water being piped in from the Hetch-Hetchy reservoir in Yosemite. Why aren’t the hypocritical environmentalists in the SF Bay Area demanding that the O’Shaughnessy Dam that created the Hetch Hetchy reservoir be taken down? They seem to want to take down all of the other dams in the state.

Why is it that residents of Sacramento have severe mandatory water restrictions when it has two rivers that flow through it year round but the arrogant elitist residents of Southern California and the SF Bay Area have largely escaped mandatory water restrictions when they are totally dependent on having water shipped to them from hundreds of miles away?

Not really sure why it’s surprising that, the more densely populated an area, the larger the need for rules. That’s the choice one makes living in a city vs. living in out the country.

Indeed, the classic Hamiltonian vs. Jeffersonian arguments. If you live out in the middle of nowhere, nobody cares what you do. When the population gets dense enough that your outhouse fouls my drinking water, then you get government, structure, and rules/restrictions galore. It’s getting to the point of “stop breathing, you’re emitting CO2.”

My condo complex wouldn’t let me have a charcoal BBQ. Not for any government reason, but because the complex’s insurance policy wouldn’t allow it.

+1, GH

What the hayseed conservative Republicans don’t understand is that Democracy is necessary in large, dense urban cities or else they would collapse. These are the same people who would be scared shitless to leave their hotel room in Pasadena without a firearm.

What works in the country doesn’t work in the city.

Please explain to me the “need” to put fire sprinklers into single-family units? They represent an even greater risk of flood damage than they mitigate in fire damage.

Please explain to me why, barring pollution run-off, ANYONE should have ANY SAY AT ALL what someone puts on THEIR LAND.

As you said, there are trade-offs in living in dense regions, one of those is the risk someone may build something you don’t want to see close-by.

who needs zoning laws. in the great red state of texas, fertilizer factories and homes make great neighbors.

And the problem with that is??

For every West Texas there’s a PG&E San Bruno.

Regulations have Diminishing returns, and California is no safer than Texas while their regs have made everything 4 times as expensive.

I’m just not seeing the problem. It’s not like the fertilizer plant is hidden. The people who build and buy those homes know the risks they assume and chose to assume those risks.

They don’t need you or anyone else to be their nannies and take that choice away.

There has been one explosion of a fertilizer plant in the past couple decads in the entire nation. There have also been numerous cases of Jet Airliners crashing and natural gas pipelines rupturing and destroying tracts of housing just as large.

While I have seen increases in inventory in my area (Sacramento outer Eastern suburbs) homes are still being snapped up quickly, and still for more than the last comp sold for.

I walk my dog every day and I know which homes in my neighborhood have sold in the past 3 years. Every single one was bought by someone from the Bay Area. All the cars in the driveways have Bay Area dealer license plate holders.

Whenever I meet someone at my son’s school events, they all state they moved from the Bay Area. Drive around the local shopping centers and same thing: Bay Area license plates.

Since real estate prices in SF area are insane, I figure these people don’t care what they pay.

Sort of like the Chinese buying up anything and everything at any price is So Cal. Pushing out the locals by driving up RE prices.

My question is: what are these Bay Area transplants doing for jobs? Sacramento has a dismal job market….

1. I assume those Bay Area transplants are commuting to SF, the same way so many Inland Empire residents commute to L.A.

2. I’m surprised to hear that Sacramento has a poor job market. I thought that, being a small city that’s also the state capital, it’d have plenty of well-paying, secure-for-life government jobs.

State jobs well paid? I don’t think so. Average CA state worker in Sacramento makes $48,215. Average sale price of houses in my neighborhood = $423,000. Nearly 10 times State worker’s salary.

Commuting to SF from my neighborhood is a MINIMUM 5 hr round trip per day. Possible but unlikely. We are 35 mins (with no traffic/off peak) from Sacramento.

Unless every single new resident of my area is a telecommuter… I have no idea why they are moving to my neighborhood and how they are paying for it. Unless they just cashed out of the Bay Area and paid cash, which they haven’t since some of them I looked up property records at the County Recorder, and they all have mortgages/deeds of trust against them.

As a tech in the bay area, I can illuminate this a little.

Back in 2010 there was a very good article though I couldn’t remember the URL today to save my life.

It essentially said Silicon Valley was drowning in tech talent trying to find problems for their solutions while Sacramento was trying to find solutions for their tech problems. The disconnect is caused by dreams of 150k+ salaries, which, I’m sorry to say, are top-end even on the tech side, and only if you pass the arbitrary hoops they lay out.

The transplants are probably techs who are now experienced, but because most Valley tech firm interviews are essentially an oral CS mid-term, and they’ve spent at least a half a decade out of college, they’ve decided if they’re not going to get those top 10% salaries, they’ll go someplace cheaper.

>State jobs well paid? I don’t think so. Average CA state worker in Sacramento makes >$48,215. Average sale price of houses in my neighborhood = $423,000. Nearly 10 times >State worker’s salary.

Presuming 2 income (trap) household then mortgage payment is doable with todays low interest rates. What are the rents like in Sacramento?

DHB…this is an inflection point but I’m not thinking prices will drop. Prices are high but stable, so while I do not expect to continue up, I don’t see a Jim Taylor “tank hard”. This seems to be the new normal. I still won’t buy in this market but it’s hard to see things going down the way the market is currently rigged…I mean situated.

The subject of buyer psychology (outside of surface level “house horny”* adage) hasn’t been seriously addressed lately.

All variables aside, the one dominant, recurring psychological aspect re: SoCal RE is when SoCal RE becomes boring (i.e., purchases are absent of the the tug of greed or fear) is really when it’s time to buy for the next inevitable rise up.

An inflection point in a market means nothing without psychology. So, instead of talking about an inflection point in terms of price, what about psychology? Only rising rates, inflation and boredom will bring RE back to historical ratio’s against the national median. But, we’re talking about another 5-7 years from now for boredom to settle in. And, nothing is as boring as years of flat prices.

* House horny is an archaic adage. And, it’s a misnomer. It’s a throw-back to the NINJA loan days. Today’s buyers have strong credit, down payments, access to cash and real jobs. Is Wall Street looking at cap rates being “horny?” Is a foreigner who wants to park their cash into a hard asset where their brood can reside in a country where they believe their family is more secure and has more opportunity being “horny?” Is the 1 percenter with a large income and a down-payment who wants to buy a piece of the American Dream “horny”? Is the professional flipper calculating ROI “horny”? OK, there is now the 10 percenter who is stretching his/her ass off to get into a crap shack in Culver City. But, is that really “horny”? Was Lord B “house horny”?

The new normal? You mean the one where inventory keeps going up because people can’t afford these prices? What do you think happens when inventory goes up? Prices will go down…

It depends on whether inventory is going on the market because of need to sell, or just because asking prices have risen enough to entice potential sellers.

If mostly the former, then yes, the need to sell at some point pushes prices down so the transaction can happen. If mostly the latter then prices won’t move much.

Anecdotally I knew at least a few sellers who are looking to sell now only because the market has finally risen enough to allow them to offer the prospect of not having to short sale to unload a property they’ve been dragging along for years.

I do not know about other places but inventory in San Diego is around 3 months supply at the moment. So although inventory is up on last year it is still at historically low levels.

“What do you think happens when inventory goes up? Prices will go down…”

What happened in SoCal from the late 90’s through about 2006? Did inventory go up? What did prices do?

When cash buyers as a percentage reverse to the mean, it could very likely be the inflection point of the housing market.

Wages do matter but when there are so many cash buyers and limited supply of homes, wages don’t mean a thing at this moment.Regular buyers losing out to cash buyers show strong demand. Sellers have choices for whom to sell to, reflecting high demand. Prices would have already dropped by now if there were less cash buyers willing to pay current prices. Price rejection is what turns markets. Once the supply of cash buyers run out we will see how the market reacts when wages/regular buyers comes back into play. Prices will come back down.

I stopped reading after “When cash buyers…”

RE: What?

Well it is somebody’s cash, just not the actual buyer of the property 😉 All this leverage, greater than in 2007, and the realtards still think we’ll pull of the first soft landing in history. Dumb, dumb as hell…

After spending a year looking for a home to buy from Palos Verdes south to Los Alamitos I have come to the conclusion that renting is the better option. There is nothing worth the price tag here in Southern California. Strongly considering leaving the state. Ca and it’s overpriced Everything is a joke.

For the price you would pay for a Great Depression crap shack in a barrio from SoCal, this is what you can buy in Walla Walla, WA in one of the most expensive areas of the wine country

http://www.wallawallarealestate.com/residential/404coyoteridge/404coyoteridge.html

who wants 2 live where the weather is either light grey, medium grey or dark grey! Plus the water is too cold.

@native cal boy

I agree with you if you have Seattle in mind. Puget Sound is only a small strip west of Cascade Mountains. The rest of WA is sunny and dry like SoCal. The lakes east of Cascades have warm water in the Summer. Water in SoCal, in the ocean, is cold year round. If I want warm ocean I go to Hawaii.

The climate in Walla Walla, WA is as different from Seattle climate like SoCal. It shows the misconception some in SoCal have about WA climate – they think that the whole state has the same climate and nothing is further from the truth.

Walla Walla is a really nice place. The climate is great. (nativeCalboy – like many is ignorant of anything outside his own back yard) Food and wine culture is fabulous. The historical town is neat. I choose to live in S. Cal now, but it is far from the only “paradise” out there. Places like Walla Walla are what many of the so called paradises of California USED to be like.

Yep, we’re renting in a beautiful, upper middle class neighborhood in the Porter Ranch/Northrige area with fantastic schools, and, not only would 20% down require something like $140K for an equivalent house, but my monthly payment would be around $1K more per month than our current rent, so we’re going to keep renting a couple of more years and see what the market does. If it’s still insane, we’ll probably go to the Northwest, since the company I own doesn’t really need to be here. All of our family is in Los Angeles, which is the biggest hurdle.

Your monthly mortgage bill would be $1K more, but does that include taxes and insurance as well? Never mind maintenance and all the wonderful joys and headaches that come with homedebtorship…

cee above comment………………..

You had a small window between mid-2011 and early 2012 to find a steal in Porter Ranch/Northridge/Granada Hills area. Look up some of the sales in that time… They went up 20,30, 40%. We bought in GH in 2011… it was slim pickings at the time. We even could have found a few better bargains had we had more experience. Being first time home buyers it was scary as hell. Shocked by how much homes have rebounded in 3 short years.

We bought in 2011 because of rental parity. My guess is you are renting for about $2000 and that’s exactly what are mortgage is with taxes. Only nearly $600 of it goes to pay down the mortgage every month. So, after tax breaks and adding in maintenance and subtracting out equity payments.. We are paying like $1400 a month for a 4 bedroom pool home. Still, have to agree maintenance is a be-otch.. especially if you bought a fixer like us.

Two modifications, 10 years since purchase, my condo in Lake Forest is *still* not at the same value as 2004 purchase. My children’s wages for laboe are the same as mine was in 1989. Lots of very expensive homes being sold to foreign nationals to shore up the extremely wealthy like Donald Bren. Good luck all.

Coal is the one future determinant if we get a manufacturing base here in the states again. Without coal there is no way we can compete with China. Coal is dirty and unpopular but without it we cannot compete. China is building new coal mines to cut energy costs to continue their dominance in manufacturing.Coal is the only way we can compete with China for manufacturing jobs. Not what anyone wants to hear but it’s the new reality.

You just got another 10 years added to your life sentence without parole…

It’s not about coal. It’s about automation and natural gas.

Well, Lake Forest was hit harder than many places in OC. According to the Irvine housing blog (at the time) it was down over 40%, whereas irvine only ever dropped around 18%. I bought in Lake Forest in 2012 because of the massive discount and great schools. I was expecting that Lake Forest would get some substitution effect from Irvine, but it hasn’t. I think that this may be because there is no substitute for irvine in the mind of a foreign cash buyer.

Come to Kentucky. Home prices will boom because of coal.

You are wrong. Coal mining in KY is down due to the EPA, per 11/13 WSJ Coal’s Decline Hits Hardest in the Mines of Kentucky Mine Closures and Layoffs Are Reshaping Region’s Coalfields

What is also slowing down the market is the difficulty in getting a loan. A brutal experience. Just closed on one last week – reminded me of boot camp.

I had a preapproved loan for much more than I needed in 2011/2012 plus enough cash for a large down payment and that did me no good at all, made offers on several houses (all 100% or slightly more) and was ignored in every case as a specuvestor or flipper offered 100% cash…after a year of this retired to the sidelines in disgust and watched Bubble 2.0 inflate. Hope the market has in fact stalled and Bubble 2.0 will pop soon, if so may consider buying again IF it appears that conventional buyers have a reasonable chance of an offer being accepted. I did buy once before and it was relatively easy but that was in a normal market in 1997.

Same situation; couldn’t compete with the flippers/investors. I’m in Vegas. I watch my rental’s estimates (zesty and others) rise every two or three days. I will wait until the fall. If it’s still going higher, I may have to eat it and smile. Rents are very high in Las Vegas.

Same thing happened to us in 2012. We left the San Fernando Valley because we were priced out of Post World War Shacks in Woodland Hills, and we couldn’t get an offer accepted worth crap due to all cash investors. DROVE US NUTS! We bought in Lake Hills(riverside/corona) 10 miles from Anaheim border. Loved the house with a pool and beautiful views, but really wasn’t happy and wanted to get back to the valley. My husband lost his job due to no fault of his own. It pushed us over the edge to sell. We made 95,000 pre all the crap you have to pay(down payment assistant loan, taxes, credit card debt that helped fixed the house.) We had 7 hard offers (two the day before it hit the MLS) and it closed in 27 days. We got 16,000 cash over appraisal and now we are back renting in Woodland Hllls for 500 more a month than our mortgage was. Now we have the cash flow to buy something else and but my husband has to switch jobs. OH how I wish we were able to fanagle the loan market like back in the day, because we are paying more now and have the money to afford a new house indirectly, but we have to rent for now. Sigh…

My wife and I will give it two years out here in Ventura Co. If no decent correction occurs, we are leaving the state for the Mid West.

I moved from Ventura in 2005 to Franklin,TN – a wealthy and lovely city 20 minutes south of Nashville that is BOOMING. I have been very homesick for Ventura, and have tried to move back several times since 2009, I am completely priced out, which is maddening. Can’t afford to live in the place that I was born and raised for 45 years. I’ve got a huge home here on over an acre lot. I couldn’t even get a condo in Ventura for what I paid for this house. I would trade it to be able to come home again, but it’s not currently possible, and all the wishing in the world won’t change it.

Jayne…. I tell people all the time be careful thinking the other 49 states have so much

to offer then CA. there is a trade off to everything.

My wife and I are very lucky in life we can chose where to live and CA didn’t appeal to

us anymore. That said, unless you live in the very best of a state moving from CA just

be trading a lot away?

Big John…. What do you think you going to find in the Mid-West paradise, hardly???

Paradise is in the eye of the beholder.

Personally I enjoy many parts of the midwest.

You see, Southern California is the ONLY place where you can live in “paradise.” That’s why high housing prices are so justified–you’re naturally a more sophisticated, more attractive, smarter person if your ZIP code begins with 90, 91 or 92. After all, everything else is flyover country until you hit either France or Italy.

I’m one of those dumb saps who didn’t appreciate the beauty of California’s public pension system and wealth redistribution strategies, so I stupidly moved to swampland, a.k.a. Florida.

Now, I’m stuck with public school class sizes for my kids that are 18:1. There’s no Franchise Tax Board to help serve the state. And gosh, there sure is a barbaric, red-state tendency where people just don’t understand the importance of making things more “fair” in society through the help of the government.

I just wish I could sell my lakeview home on 1/3 of an acre and go find a nice, comparably priced Culver City condo to call home instead. I’d be such a better person for it, and the quality-of-life/cost-of-living would really be much more of what it should.

KR you are going to have to trade in your dad jeans for skinny jeans if you want to “fit in” with the “up and coming” CC sect…

Hey Robert..I agree! I moved twice from LA after living here for 20 years and both freaking times I was MISERABLE! There is nothing in the world better to me than Cali. That is why my title is wish I wasn’t so obsessed with living here, because if I never knew this place, I might be happy somewhere else where it’s cheaper. It’s a Catch. 22. I am from the east coast and it’s horrible there. I don’t want to offend anybody, but 8 months out of the year it’s MISERABLE weather. Can’t do it.

Big John, funny your considering to move to the Midwest. I have lived in the Midwest all my life, and I would love to trade the cold skin-drying gloomy winters for the traffic and sunshine of So Cal, It is just not feasible — “Crap!” Yup the grass is always greener on the other side I guess ;p LOL

I’m seeing price mark downs and a jump in inventory in most neighborhoods.

Oddly, homes are still selling in my area of $1-$5M homes. Just saw one have the “In Escrow” sign go up last week that has been on and off the market for the last 3 years. That seller bought close to the top in 05, so I know he is happy to be out of there without having to do a short sale.

Regardless of what happens in the next few years, I still think homes will cost more 10-15 years down the road and rents will continue to increase too. Long term, whether you buy in CA or OK, good financial planning includes a paid off home.

Good observation Jim. homes in up to 1.6m are selling at high rates. One reason is when these homes sell I do my research and find many of these sellers took at bath when they sold.

Buyers (high end cash) saw a opportunity and jump on these properties In CA, NEV,AZ, especially.

For the move up buyer or regular buyer the 750k to high 900’s is very weak, they can’t quite qualify them.

Do “move up” buyers still exist?

Some insane renter info.

I live (rent) in Wilshire Center, or North Side of K Town South of Beverly.

I moved into my 3 (2.5) bedroom 1 bath, two level (2nd and 3rd) 1919 built brownstone in 2009, I presantly pay $2300. There are 6 units total in two buildings on the property.

A comparable unit across the courtyard just rented for $3800. Thats right $3800. The couple has a two year old and just moved from San Francisco. So the pricing probaly fells right to them.

Holy Smoke. This neighborhood is on the north end of where the King riots occured in the 90s, some hoeses are still fully barred windows.

My family situation (3 kids under 7) makes moving desirable, but woth the rent and housing prices the way they are I will be staying put for the time being. I feel like I am in some alternate reality at times.

My wife and I have a Gross income of 190K by the way.

My wife and I with one infant daughter currently rent in West LA near Santa Monica paying about $1,800 for a small 2 bed, 2 bath apartment. We saw a house for rent near our place , only a 2 bed, 1 bath, but it had a yard so we decided to call. Rent was $3,800. It seems crazy to me that someone would pay that much for a 2 bed 1 bath place. We are at a similar income to the above poster, but with day care our investing and saving every month would take a serious hit if we had to bump up to $3800.

Same here, my youngest are twins and the care cost is crazy, throw in the after school care and camps for the oldest, oy.

If we wanted to completely quit saving/investing, eat kibble, and never travel we could pay $2500 more a month to “own” (mortgage) a non-desirable home in a marginal neighborhood.

I could always move out to Valencia and never see my kids due to the commute, and rack up additional childcare costs as well!

Renting it shall be.

I agree with a lot of other posters, prices are not coming down much if at all.

It IS different this time! Prop 13 and the the ability to print endless amounts of zero percent money is the cause .

FYI, I don’t own a house.

I have a choice, economic freedom as a renter or be cashed strapped in a 750k fixer.

I choose freedom!

Yeah, some people are stupid. I knew a ton of people moving from NYC to CA and didn’t know how to find apartments who paid stupid money because it seemed cheap to them. I guess those SF people are the suckers this time around. I’ve seen that trick before where a rental agent lists an apartment in a different, higher wage city just in case someone from there is moving to LA. It seems to work, but tends to raise rents for everyone not just that one idiot.

Definition of ‘Inflection Point’

An event that results in a significant change in the progress of a company, industry, sector, economy or geopolitical situation. An inflection point can be considered a turning point after which a dramatic change, with either positive or negative results, is expected to result. Companies, industries, sectors and economies are dynamic and constantly evolving. Inflection points are more significant than the small day-to-day progress that is made and the effects of the change are often well-known and widespread.

Source: http://www.investopedia.com/terms/i/inflectionpoint.asp

OK, @ Tank Harders, please provide your “event” resulting in a “significant change” that will portend a “turning point” (presumably higher inventories and slower sales) in the “sector” (SoCal housing) which will lead to “negative results” (i.e., dramatically lower prices).

Remember class, it’s “event” in the singular. And, what was the “significant change”?

Don’t forget to show your work on the board for all to see!

DFresh you are smarter than that. You are looking in the wrong place for the “event”. I believe that we have at least 4 major fixed/controlled/contrived markets that are all interrelated (bond, stock, commodity and housing). We could see an oil shock that would ripple through the world economy. The stock buy back bonanza could run its course. The Fed could lose control of the bond market. I think that the next economic shock will start elsewhere and ripple to the housing market not from it… Just a thought…

Easy.

Just look at the current numbers: Sales down significantly, inventory up, prices starting to fall a bit, mortgage apps down, cash sales slipping, economic fundamentals still out of whack and an unsustainable market. If all these indicators don’t makes sense to you, then I would love to sell you my half of the Santa Monica Pier.

All the snow in an avalanche doesn’t fall at once, it starts with a few chunks until the side of the mountain falls off. The few chunks have started to fall. Watch out below….

Bubble, you’re turning your test in early and declaring “how easy” because you didn’t read the question properly.

An inflection point, per the definition provided, is an event (singular).

What? has posited some possibilities of future events, but if indeed the worm has turned for the market (rising inventories and slowing sales), then the event has already happened.

So, what was it?

DF – Oh I see, your rulebook says there needs to be one single event in order to cause a slide. I gave you the answers and you don’t like them.

How about this – we’ll give you all the causes for the price decline and you pick the one you like best?

Oh… you are looking for the reason for the “slow down”. I think the answer is easy. Well, it is not easy if you do not believe in the old religion of Mathematics. The “slow down” is directly related to the change of the rate of change. In this case it would be long term interest rates. I am so glad that we have moved on from the constraints of mathematics!!!

A recession is an inflection point and so would interest rates rising.

Last year interest rates going up by 100 basis points pretty much stalled the real estate market. We’ve been at a plateau every since. If interest rates go higher than an additional 75 basis points that will put a fork in the non-prime SoCal real estate market.

Housing prices have gone down in California after a recession. California GDP has muddled through the last 4 years, averaging slightly above 2% growth. If 2014 California GDP clocks in at 2% then that is just enough economic growth to keep real estate from tanking.

Ernst, if you believe (as I do) that we’re in a global, long-term disinflationary cycle, then rising interest rates aren’t on the table any time soon.

A recession? That’s yesterday’s inflection point. What do you think today’s FED would do in the face of a recession (or looming recession)?

“Ernst, if you believe (as I do) that we’re in a global, long-term disinflationary cycle, then rising interest rates aren’t on the table any time soon.”

This assumes that the cost of money is equal to anticipated inflation. There are other component to the cost of money (i.e. interest rate risk, loan risk and deferred gratification). Of course these are the components of the “natural” interest rate. I believe that we have been lulled into believing that there are no risk components and that once defaults are no longer manageable then rates can rise.

“A recession? That’s yesterday’s inflection point. What do you think today’s FED would do in the face of a recession (or looming recession)?”

I think this is the most important question of all. I have asked myself this for the past five years and am not sure what the next move would be. It would appear the that fed has “shot its load” at this point and has no more bullets but these are some crafty bastards.

I think things like negative nominal interest rates (they are already negative in real terms) or we may see rule changes that allows the fed to directly purchase housing, stocks, commodities, etc. to further manipulate/rescue markets.

The infliction point hasn’t happened according to your definition. What the doc is saying is that inventory is increasing and prices have stabilized/price cuts happening. What you are looking for hasn’t happened, but there are many scenarios in the works that will happen, but i can offer no timetable, been wrong too many times before(F’n Fed). THe Brics bank is a big deal that the MSM is willfully ignoring. Fining BNP Paribas (or whatever, big French Bank, $9 billion) big deal. 3 rd US spy caught in germany, big deal. BIS chairman saying stocks are overvalued another big deal. China re-hypothecation commodities big deal. Portugal bank going insolvent big deal. ANy of these scenarios could cause a black swan event to unfold anytime. This will cause a deflationary cycle on larger items, while affecting suppy-chain causing inflationary response to everyday needs. Then the FED will go crazy and print the dollar to oblivion. Thats my take, not sure if any of this happens this year on the next 5.

I find most older prop 13 winners, are rewarded for not trying to game the system by always trading up. They were simple people with simple needs. They bought their forever house and raised their families,even when their once “nice” neighborhood changed for the better or worse over time. They stayed the course and were rewarded with the great prop 13 tax break.

They are not selling because they see what a great gift prop 13 is. They are keeping their homes for themselves or their kids when they die. This is why boomers are not selling for the appreciation, they keep these homes for the tax base. Prices in other states that are retirement friendly still have property taxes so they are not trading for lower property taxes. They have a golden ticket. It does not matter if housing prices go up or down. They are locked in and not moving.

I don’t worry about boomers eating cat food. They have the choice to sell and move out of state or hang on and eat cat food if they so desire.

I worry about new families and the choices they have now to buy a home and raise a family, with job turn over and flat wages that only complicates the equation. You gotta to be Houdini to get this home buying thing right now. Renting is great for singles but a grind for families. Not everyone wants to wait seven or ten years to buy right. If you have a family that may mean two or three moves while you wait for the right housing market.

Inventory is going up and prices may settle down but prices are still too high for wages. Don’t look for new inventory from the boomer set. They have it made.

I stopped reading after “I find…”

The Prop. 13 squatters I know were house poor when they bought back in the early 1970s and now are reverse-mortgaging their properties to cling on for a few more years. Nothing left for the kiddos. Nice preservation of orange and green wallpaper samples from the era of the Nixon Administration inside. Cat food to be served shortly as they complain from their $1 mil. properties that nobody deserves to make more than $100k/year. (I seriously have heard that from a woman whose Zestimate is 10x+ that.)

Mr What, u knock me off my rocker! Your humor make my belly bounce and your knowledge is enlightening (you are an interesting mad man – Im joking).

If a person’s goal is to attain a desirable home at his price range, situation will create one for him. But if one has no goal or negative thinking, then it will take much longer or they might never attain it.

Mid March 2014 my family was able to purchase a home in College Park Norwalk CA. 100 yard behind Cerritos College for 410k. It was listed at 425k. First cash buyer drop the house, then second cash buyer came and drop house on day of signing escrow due to not liking few things on final inspection.

Seller agent had taken house off listing and put sold for a week (on MLS). I was house shopping (had my loan fully approved) and happen to showed up to look at home (they still had sign) when cash buyer was to sign docs. Cash buyer no show; i use my business man honesty and persuasion and convince seller agent to sell me the house though I only had 5% down but I had FULL approval ready for funding from my bank.

Cash buyer offered 410K for this turn key home (though it needed about 5k to redo lawn and fix shower door). I offered 410K with 5% down and share with seller agent he can sell to me the home,get same commission and go home enjoy feastia with his kids and not worry about having new open house. It work and my agent wrote offer and was accepted next day. Currently there is 30 offers for a corner lot on same block at 440k. My turn key house is 4bd and 2bath 6K plus lot. At closing owner offer to fix 5k worth.

It took about 4 painful rejections and around 1 year before we able to get a home. This is not our first home. I was a flipper before but cashed out (during boom), then bought a mobile home and squander all my money me and my family (youthful ignorance).

This time around it was very stressful to purchase a home due to bank requirements and cash buyer and high price. You need to have a indomitable spirit. If I can do it anyone can.

Believe it or not a simple book call “Rich Dad, Poor Dad,” was my motivation back in 2001.

Look, no matter where a person lands in life there is no utopia, of course I hope heaven is the real utopia if I get in.

And if you don’t get in, you hope it sucks for those who did?

Native Californian here. We just moved from Northern San Diego area. We were paying $1,895 to rent a 900 sq. ft. apt. (water/cable/electricity not included) overlooking a very busy, noisy street. I realize that is still a lot less than others pay in different parts of Cali. Great neighborhood, great schools, very dumpy apartment. It was extremely hard saving up a 20% down payment while paying so much in rent but eventually after several years we were able to do it. Well we moved out of state to Florida last Sept. 2013 into a 2,300 sq. ft house with a mortgage a heck of lot less – $1,750 after a 20% down payment. Since our house purchase here, our house has gone up approximately 80K if you look at comparables of neighbors home sold. We plan to sell here in Florida & used the profit as a down payment on a home in San Diego once the market cools off and remains stable for “a long period of time.” I agree that now is NOT the time to buy. I would just rent there. This coming from a native Californian. I have seen entirely too many booms and busts in my lifetime. I prefer not to be a part affected by the next bust in California because we were too anxious to get a house there.

http://piggington.com/shambling_towards_affordability_housing_valuations_surpass

I think the amount of rent you were paying indicates why house prices in San Diego are pretty stable. Although expensive, rents keep rising. And demand is high. Even Rich Toscano’s site has gone from bubble discussion forum in 2005-7, to house buying advice forum 2011-present. Look at the link above, through the lens of ‘rent to mortgage ratio’ San Diego is not too bad. Just do not expect house prices to keep rising…

It is not going to work. If the CA market is down, then FL market is down, too. What you say sounds good only on paper, not real life.

Agreed. Better watch the Florida market and sell when you can and rent there rather than wait for a CA downturn. The trigger that pulls the floor out of CA RE will likely do the same to FL, and then you’ll be stuck in FL.

Good for you–moved from Northern San Diego County to Collier County myself.

Yeah, I agree with everyone else–don’t toy around and try to time a re-entry into San Diego. Seriously? You miss the Del Mar Fair that much? What are you missing? We moved a bit earlier than you and couldn’t imagine re-entering the rat race that is So. Cal.

Quote”cities with weak underlying economics filled with strip malls and liquor stores trying to justify $600,000 price tags.” You Forgot the proliferation of Payday Loans and TItle Loans on every corner

Yeah if you have to hock your car to pay your electric bill, or get a cash advance on your paycheck to pay your rent, I don’t think a $600,000 home is within your reach.

“Multiplying effect” people. Read up on it. That’s what all the investor buying created in the past four years.

And now that are sharks are gone good luck selling your 50 some % overpriced Cali home! But threre’s a greater fool born every second!

“But threre’s a greater fool born every second!”

Yea, but how do they all become commenters on the DHB site? Is there a greater fool hand book with the URL?

Christie’s post about us Prop 13 winners is spot on. Like her, I worry about my kids being able to buy a decent home In San Diego, as they have no interest in leaving.

I would welcome a 50% crash in values for my kids, but honestly, it would take a huge loss of high paying jobs and an exodus of tens of thousands of families for that to happen in San Diego. How do I know? I well remember all the defense contractors closing down in SD when Clinton was elected and what it did to local values.

I guess if someone can tank the bio tech industry or Qualcomm, it could happen again.

thank god i have no kids

It can happen if someone tanks the middle class. Unfortunately, that seems to be happening. 20% top doing well, 60% middle getting crapped on, 20% bottom being appeased. That is the new model.

I’m convinced that QUALCOMM isn’t going anywhere. But, I’m also convinced that most Carmel Valleyites are just like the rest of San Diego and stretching to get every last appearance of wealth out of that bi-weekly paycheck. The California pension crisis will help take care of that–not to mention, last time I checked, you can get equally smart people in states other than California, so why pay for what you don’t need? Seems like Toyota just recently figured that out. Departure of high-paying jobs + ever-increasing middle class taxes = bad prognosis for San Diego housing.

My wife and I are seriously considering moving out of state. We live in the OC and have a two-year old with another one on the way and are really, really, wanting to get into a house with a yard. It’s so much better for kids, but home prices are just insane and stupid.

My wife stays home with our little one, so we’re living on one income. I make decent money, but it still doesn’t leave much per month after all our expenses (which are relatively low because we have no debt) to save for a down payment. Between income taxes, health insurance, rent, food, electricity, gas, etc., it’s so insanely expensive here that it’s hard to save up a decent down payment. We don’t even have cable because we don’t think it’s worth paying for.

With the average single-family home in a decent neighborhood running around $500,000 to $600,000 in this area, what hope do we have of saving up even a 10% down payment in a reasonable amount of time? We could always come in with less, but then we’re paying a larger mortgage payment and higher mortgage insurance rates. Why be a debt slave to a big mortgage payment for the next 30 years?

I’m born and raised in CA, but tired of how expensive it is here and frustrated that I can’t put a better roof over my family’s head. We’re seriously considering getting out of CA to a cheaper place even though there’s a lot we like about SoCal and we have family here.

Unless one of you earns $150k+ per year, qualifying for a place you would actually want to live in might be tough in OC, not to mention saving for a down payment as you stated. If you move out of state anywhere there is cheap housing, most or all such places have extremely hot and/or cold weather, and/or have little to do. I think I’d rather live in a smaller house in OC and have an enjoyable life than live in a much bigger house elsewhere and be bored or confined to my house half of the year because the weather sucks. My wife and I have considered the Seattle area (some affordable housing in the ‘burbs there), but I’m not sure I could endure the consistent gray weather.

Just like a lot of folks, my wife and I want to buy (we’re renting a place now). We also own a 2-bedroom condo in OC which we rent out, but it’s a little small for us. We only have one very young kid (and that’s all we’re having), so our expenses area minimal as far as kids are concerned, and we don’t need a huge place.

The current market is pretty discouraging. All we really want is a decent-sized 2 or 3 bedroom condo in Newport Beach (if possible). Nothing extravagant or right on the beach or anything, just a decent place somewhat near the beach (within two miles or so) so we can enjoy nicer weather and send our kid to good schools. To get anything halfway decent, we currently need to pay $600k+ (minus 20% down). Although we could technically afford that, it would be in the upper range of our budget and it would be a disaster if one of us lost a job or became ill for any extended period of time. Yeah, we could buy something inland for a bit less, but unless you’re in a small handful of areas (Brea, Y.L., south county, etc), our kid would be attending schools that aren’t exactly, well, good.

I keep telling myself that the foreign money can’t keep flooding the market and increasing prices forever, but even 0.5% of 1.3 billion Chinese is 65 million people. Not to mention foreign money from India and various other countries. It will be interesting to see how this works out in the next few years. For now, we’re just stashing money away.

“My wife and I have considered the Seattle area (some affordable housing in the ‘burbs there), but I’m not sure I could endure the consistent gray weather.”

Makes me think that someone should do some advanced computer-modeling and project forward to see how global warming will affect us in the next decades. For example, it might turn out that Seattle, or some lesser known area, will evolve to have a beautiful, warm mediterranean climate by 2020. Find that area ASAP and buy now,… or be priced out forever.

Lol have you ever traveled outside your little bubble of OC? There are LOTS of places some very much still affordable where there are just as many things to do or more!!!! I grew up in MO and have lived in CA, CO! I now live in south OC! Guess what we did in winter in MO ….. We put on our ice skates and cleared off the local pond and played ice hockey just about every day we could. I see the type of lifestyle kids live in the OC and it has a lot to be desired. If you are a beach person and like light outdoor activity like hiking overcrowded trails etc. most families are working so much they can’t even afford to enjoy the OC lifestyle. CO was hands down way better place to live than the OC as far as affordability and stuff to do. The weather is great but not everyone likes having 1 season.

Also numbskulls like you living in the most irrigated county in the country are missing the elephant in the room the DROUGHT! All those yards everyone seeks for little jimmy in the OC will be burned out brown patches from now on. There are a lot of thjngs I like about south OC but to say its the best place to live and you’d be bored anywhere else is so utterly stupid and out of touch I had to reply.

If it wasn’t for our high paying jobs that we are stuck in my wife and our two be boys would be gone. We are making the transition up to OR!!! Just driving the roads from Shasta to southern OR makes SoCal feel like a third world crap hole. And up here in the Northwest (vacationing for the week ) Mexicans haven’t taken over every little small town and turned it into a mini tijiuana!!!

Good grief already with the weather hyperbole. A good example of why so many clamor over each other to live here, too fuckin’ weak to handle the idea of a more dynamic climate. You all deserve each other.

I moved my family up to Seattle in 2007. In 2006 I was in grad school in LA and happened to visit a friend up here and decided to apply to UW. During the interview process I had stayed in a friend’s craftsman (a little place), which he rented out most of the year. I asked how much he charged. When he answered 1300, I called my wife and said I think we’re moving to Seattle. Since then we’ve added another daughter so we’ve had to move to a larger house (3 + 2). We pay 2000, which is quite reasonable for here. I’ve had zero regrets. There have been springs that have irritated me when they’ve failed to begin in any fashion that one would consider spring, but overall I’ve adjusted to the gloom. Typically, Seattle natives are out and about in the rain and mist, and don’t seem overly bothered by it. I do come home to visit once or twice a year, and each time my wife and I have a conversation about how we’re happy we made the move. What’s amazing is that Seattle is not a cheap city, but when one compares it to LA, it seems reasonable.

@Conquering fools:

I wasn’t making the assertion that there are no nice places to live other than OC. I know there are such places throughout the country and throughout the world, based on reading and direct experience. You mentioned MO and CO – I’ve been to St Louis and Denver in the winter, and while both were nice, they were too cold for my taste. And OC seems to have more to do. Just my opinion, of course.

My observation has been that most or all places that have a lot to do beyond nature-related activities, are expensive places to live since there’s high demand for housing in those areas (Seattle proper, New York, San Fran, Vancouver, Paris, London, Athens, blah blah blah). I’ve been to multiple cities throughout Alaska, and while the scenery is absolutely beautiful and very serene (possibly the best I’ve experienced anywhere in the world), there’s only so much nature-type stuff I can do. I need a balance- maybe not everyone does, but I do. OC has that balance of stuff to do, nature (beach and mountains are very accessible), and pleasant weather. If you know of another (cheaper) place with those attributes, by all means, please share!

@Tired of the BS:

You make a good point- at 6’ 1†and 170 lbs, I don’t have much fat on me. I’m really not well-equipped or naturally adapted for cold climate living!

Also why are you whining about not being able to afford to live in Newport? It’s a rich area. You’re like most Americans these days in SoCal you want a wine lifestyle on beer money. You snub your nose at other responsible Americans who actually live a beer lifestyle on beer money as if their life is so much less exciting because you live by the beach. You sound like the typical emasculated Orange County make who probably only really lives in a place he can’t afford because his demanding wine money wife says he has to. You’re going to raise your kids in Lido or the Peninsula surrounded by drunk do nothing beach burn outs drinking on their patios from sun up to sun down and with rich snobby elitists? Yeah sounds like they will grow up with a great wordly outlook!

I lived for years in OC, I graduated from CSU Fullerton, I lived for years in Seattle and I didn’t like it anywhere. Too many negatives vs. positives!…

Now I live in Eastern WA and I like it.

@Conquering fools:

I’m quite aware that Newport is a “rich†area. I was not “whining†about not being able to afford to live there. Actually, we can technically afford it. It’s just that we are unwilling to stretch our current budget more than what we’re comfortable with. I was simply stating what we prefer. If we can’t swing it, oh well.

If you consider a household income within the upper 7 or so percent of all households in the US as “beer moneyâ€, I guess you’re certainly entitled to your opinion. You might be right for the time being (at least with respect to OC and LA real estate), but as many folks here seem to believe, that may or may not be the case a few years down the road. As for being responsible, I guess saving/investing 40-50% of take-home earnings is irresponsible? This is news to me! As you are probably aware, wisely investing “beer money†instead of spending it can very feasibly support a “wine lifestyle†a couple of miles down the road.

I don’t snub my nose at anyone based on where they live or how much money they earn. It’s just money. I have friends that earn $40k per year, and some who make many multiples of that. Btw, my wife makes a tad more than I do and is probably more frugal, so there goes your wife theory.

Based on the unnecessary insults in your posts, there is probably little utility in continuing this dialogue. You seem to have an (inaccurate) impression of someone you’ve never met based solely on where that person desires to live. That’s quite ironic (to put it nicely), considering you (wrongfully) accused me of snubbing my nose at other “responsible Americans†because of where they live. Stating an opinion of places I prefer to live clearly does not constitute snubbing my nose at others.

Best of luck to you!

OCNative,

You are not alone. My story is similar to yours. Born and raised here and just want a decent single family home to raise the kids in. It’s sad we live in a time and place where one decent income is not enough to get by. My wife and I still think it is important for her to be home with the kids while they’re young so we sacrifice and live within a tight budget. If you can move out of state it might be something to consider. I work in the entertainment industry so I don’t have that option plus we love the beach too much to leave. I think it’s worth waiting for a bit to see what happens to the market. I have a hard time believing there are so many people though who can afford these overpriced homes. Couples making 200K a year seems almost normal at least here in Cali. Other parts of the U.S. you see statistics with average HH incomes at 60K a year. I guess you have to be rich to live here in the Golden State.

Average HH incomes in LA/Cali are less than $60K as well – you just don’t see them in the circles you run in, as do most upper middle folks. But all those homes and apartments in the less desirable areas and even in the semi and some desirable areas are full of people making shit in earnings.

@Dan wrote: “…Couples making 200K a year seems almost normal at least here in Cali…”

Uh, maybe in Silicon Valley, San Marino, Manhattan Beach, Rancho Palos Verdes that is somewhat true. But here in SoCal median household income is $58K per year, and that includes Orange County. If you count just Los Angeles-Glendale-Long Beach then median household income drops to $53K per year.

Here someting to worry about, I followed 27 homes 45 days ago, 11 went off market, of that number 7 of these homes are now relisted as bank owned?

To worry about? Sounds great to me!

nathan118…don’t get to excited. I failed to mention all the bank owns homes are listed at the original MLS, no discount (yet).

@robert, banks can withhold foreclosures from the market for a period of up to ten years. With ZIRP, these homes may not see the light of day until the year 2024.

Thanks ernst you are right, that is why banks rarely lose they wait, they still make a nice profit when the time is right to list the property even waiting 10 years.

Guys,

C’mon didn’t someone just win a nobel prize showing the over 200 year link of real estate prices to wages? Wages ain’t going anywhere good. And, does none of this seem like a Ponzi scheme to you? One buyer selling his overinflated house to buy another overinflated house and seeing nothing wrong? Problem is when you try to introduce the bottom rung to this pyramid scheme, and as you see, there are very few first time buyers. It will eventually crumble. Housing is priced at the margin, and while it hasn’t historically been subject to wide swings, the last 2 decades certainly show that it can go up and down.

Also, the inflection point isn’t an abstract concept. Positive feedback of ever-increasing prices make people willing to offer even more for prices. Fear of stagnating or decreasing prices freeze buyers and panic sellers. I think this is already starting to happen in Phoenix.

“link of real estate prices to wages”

What is the link of RE prices to wages? and does this correlation hold for London, Sydney, Toronto, Hong Kong, Tokyo, Shanghai, New York?

Why not?

This time is different. Come on ak, get with the program…

“Problem is when you try to introduce the bottom rung to this pyramid scheme, and as you see, there are very few first time buyers.”

Ding, ding, ding, we have a winner.

NAR has slowly but surely been floating the idea of the price level being too high. When the FIRE cartel HQ is packing the message in with the propaganda, you know there’s a real issue. The primary concern for the cartel is sales and turnover – pricing is secondary.

The persistently low number of first time buyers is a big deal.

That’s why we keep hearing bullshit about how incomes don’t matter anymore and specu- oops, I mean “investors” are in it for the long haul, so don’t worry. A big fucking distraction.

Doc: Even those that bought in California and now have their homes paid off are having a tough time. Many are seeing their grown up kids move back home. The inflection point is happening because local households simply do not have the financial stability to purchase in this market.

____

Can’t say I’ve got any sympathy for outright-owners in the $500,000+ range. They have options.

Perhaps you can explain some of it to Yellen, who finds it a total mystery, why we’re not buying. Financial stability, and for me at least, repulsed by the zany high asking prices. The Global QE $multi-trillions has not helped me, whatsoever.

_____

“I have to say that I’m somewhat surprised,†Yellen said of the weakness of the housing market in a hearing in the House last week. “Frankly, it continues to be sluggish. And I can’t give you a precise reason why that’s occurred,†she admitted.

http://washingtonexaminer.com/yellen-admits-she-doesnt-know-why-this-economic-sector-is-doing-so-poorly/article/2551057

Janet has just started to read the comments on Doctor Housing Bubble. Give her some time to absorb all the new data…

Nice. +1

The RE salespeople are everywhere these days claiming “now is the time to buy”.

https://www.yahoo.com/homes/news/5-reasons-to-buy-a-house-in-the-next-5-months-192327266.html

Cranky… Although a RE agent always has a dog in the fight there is no reading between the lines:

Interest rates will rise, 2015

Houses will sell, 2015

The dream of a total collapse will be that, only a dream. 2015

https://homes.yahoo.com/news/5-reasons-to-buy-a-house-in-the-next-5-months-192327266.html

I can sum up the entire article this way: buy now or miss the boat!

Basically, the same pitch back in 2005 and 2006 – and we all know what happened then.

Terri Rae Elmer just read a news story on KABC-AM saying that government reports show the housing market is in a “strong recovery.”

I don’t suppose Elmer did any original investigative reporting. All most journalists do these days is read press releases.

All is quiet on the western front, too. And Obamacare is a roaring success, haven’t you heard?

http://www.housingwire.com/articles/30745-fitch-housing-market-getting-ready-to-grow

Just today I had lunch with some colleagues, smart people too. They were telling me I am a fool to wait to buy because PRICES ARE ONLY GOING UP.

I asked them “so why do you think prices are going up”? They said I don’t know they just are.

Not an ounce of thought as to the forces pushing those prices up forever.

I am amazed at how many people think this. I hear it all the time.

Inflection, infection, inflatuation “what ever” cycles repeat so ” what difference does it make”

Dear Doctor Housing Bubble, Now that you have reached an even hundred comments, you should stop approving any new comments. I like nice even numbers like:

Housing to go up 30%

Dow 20000

S&P 3000

GDP 10% growth

etc…

Up up and away! What a joke…

http://wallstcheatsheet.com/business/buyers-beware-home-prices-continue-their-relentless-rise.html/?ref=YF

U.S. home resales rose in June to their fastest pace in eight months, a signal that the housing market was pulling out of a slump.

The National Association of Realtors said on Tuesday existing home sales increased 2.6 percent to an annual rate of 5.04 million units.

That was above analysts’ expectations and marked the third straight month the pace of home resales accelerated.

Not in S CA. Sales flat from May/June this year and pendings down 2% in OC according to MLS stats. Sales and pendings down about 6% from last June. This market is running out of steam

…yet resales are well below last years levels, despite increased inventory. Try harder.

http://2.bp.blogspot.com/-Z8L5Qeczquw/U85wOqp0yWI/AAAAAAAAfzA/s27wBX-YmYk/s1600/EHSJune2014.jpg

I talked with a very sound investor couple days ago, it seems folks are going to enter buying earlier then before ( the fall season) so mid August may see more traffic plus transactions then before (West and Midwest) could be the beneficiary?

robert, are you typing on a smart phone? Your statement is convoluted. I took me several reads before I could decipher what I think you’re trying to say.

You’re saying that sales will increase this Fall, but only in the West and Midwest?

And why would this be the case, instead of the usual spring/summer sales season?

Sales historically peak in Summer. How is Fall “earlier”?

Also, he is wrong. http://seekingalpha.com/article/2327385-mortgage-applications-and-housing-starts-leave-little-doubt-about-the-housing-market

Prices are dropping nationally, and it is JULY. Good luck with your August spike. http://www.deptofnumbers.com/asking-prices/us/

And why would they do that? Or are we relying on proverbial investor/realtor magic beans?

Came across this blog, seems legit. Author talks about how bad debts get amortized. Pretty interesting, it’s about China but he touches on US policy as well. Basically, we’re in for a tough slog for the next generation, and how GDP rates can be manipulated.

http://blog.mpettis.com/2014/07/bad-debt-cannot-simply-be-socialized/

Leave a Reply to ben