Record number of real estate purchases go to foreign buyers: Canadians target Las Vegas, Detroit Los Angeles, and Florida in General. Chinese targeting Los Angeles, San Francisco, Irvine, Las Vegas, Detroit, and Florida as well.

Investor buying continues to be a major player in the current housing market. Over the last two weeks I’ve had the chance to drive down neighborhoods were international money is flooding in. It does give off reminders of when Japanese buyers were purchasing tons of California and Hawaiian real estate. When it comes to California, there are certain cities where international money is pouring in. This matters when sales margins are razor thin. What struck me about these areas is the marketing is heavily geared towards international buying. After all, when escrow closes there is no loyalty where the cash is coming from. California continues to draw heavy investor money from China alongside their massive boom over the last decade. Apparently buying tons of consumer goods eventually will have a bigger impact and we are simply seeing money repatriating back to other places. While the US is seeing some signs of housing mania, we are nothing compared to the nutty Canadian housing market and what is occurring in some major Chinese cities. Yet a big part of this is speculation and we actually see this via rents. Rentals are more reflective of what local families can pay. It is interesting to see in some highly desirable areas that rents go for $2,500 to $2,700 while homes are selling for $700,000 to $750,000. Foreign money is a big player in the current market and this is also very dependent on foreign economies sustaining their booms.

Chinese investors heavily favor coastal regions

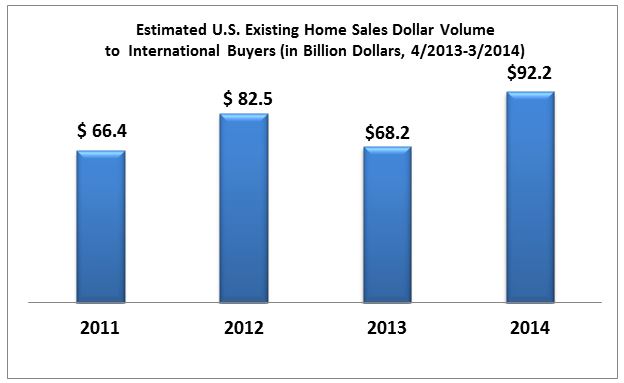

The National Association of Realtors (NAR) recently released data on foreign real estate buyers. What was interesting is that the latest figures show that international buying is at an all-time record high coming in at $92.2 billion dollars of volume. Overall this was 7 percent of the $1.2 trillion in transactions but keep in mind this is highly targeted action. Not much buying in Nebraska, Kansas, Alabama, Kentucky, North Dakota, etc. This is a big deal when it comes to purchasing in a market with low inventory. What I find fascinating is that in these prime areas is that even local area families simply cannot afford to purchase their own home should they compete in today’s market and buy again. These are your lottery holding Fancy Feast eating baby boomers in most cases. In one prime area, you have a home selling for $700,000 and all similar homes around this property sold for $250,000, $300,000, or $150,000 yet there are very few homes for sale in this area. This is similar for other markets where crap shacks are going for $700,000 or more.

In other words, not only are locals being priced out but even professionals in the area are being priced out because of added international competition. Take a look at sales volume:

Source: NAR

This is definitely impacting certain markets:

“(LA Times) That’s driving prices in parts of the region that have long been popular with Chinese buyers. Home values have returned to pre-recession levels in parts of the San Gabriel Valley, for instance. And in Irvine, home to a booming population of young Asian families, new residences are getting scooped up by Chinese buyers.â€

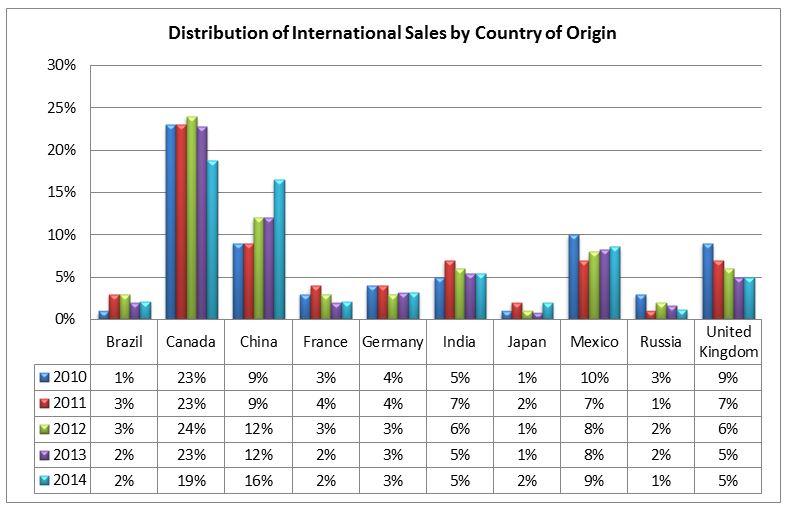

Volume of purchases is still largely driven by Canadians but they are looking at other areas outside of California. Take a look at NAR searches for perspective:

– Canadian Searches: Las Vegas, Detroit, Los Angeles, Ft. Lauderdale, Miami, Orlando, Chicago, Naples.

– Chinese Searches: Los Angeles, San Francisco, Irvine, New York, Las Vegas, Detroit, Seattle, Miami, Orlando, Boston Anderson SC, Chicago, Houston, San Diego

And the boom in China is definitely impacting local markets here in SoCal:

Can you spot which country is booming? And where are Chinese buyers focused? Now as we had mentioned, volume is actually falling in many parts of California and prices are plateauing. You’ll notice that for these investors they are first targeting tier-one areas. I love how some people then try to justify this and say that a certain run-down market is going to experience a new renaissance because all of a sudden they have a Starbucks and a Chipotle. Some crappy stucco box sub-division in L.A. County is not the next Vancouver or La Jolla although people want to push this narrative forward. The figures don’t show this. Look at the top city searches. These are prime locations and places for true low cost investing (i.e., Las Vegas and Detroit). Investors are not looking to flush money down the toilet in a blanket nonsense strategy. If that were the case, inventory would not be rising and prices would be on a more furious path upwards. Yet that is not happening.

Canadians appear to be driving their purchases via avoiding the cold. These snowbirds are looking for cheaper digs to escape the brutal cold months in Canada. With Canadian real estate in an epic bubble, hot money is flowing everywhere and especially to neighbors in the south. While the US did see a correction in housing values, Canada never underwent any sort of correction.

The point of this is that foreign money is speculating in certain markets in California. If you are buying in the Inland Empire or Central Valley, you probably won’t face much competition from foreign money. But if you are looking at buying in San Marino, Arcadia, or Irvine get ready to face some international competition. In the end however, most locals don’t even have the income to compete even with a 20 percent down payment in some of these markets. For the housing industry, all money is green so as long as your cash or check clears, it is all good.

This idea that foreign money is flooding into crappy neighborhoods and somehow, this is going to make them the next San Francisco is comical. There is no proof of this. What we do have is the data above and it shows that foreign investors just like Wall Street investors are hungry in turning a profit. They are not interested in being the greater fool holding the bag at the end.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

119 Responses to “Record number of real estate purchases go to foreign buyers: Canadians target Las Vegas, Detroit Los Angeles, and Florida in General. Chinese targeting Los Angeles, San Francisco, Irvine, Las Vegas, Detroit, and Florida as well.”

“This idea that foreign money is flooding into crappy neighborhoods and somehow, this is going to make them the next San Francisco is comical”

Don’t mention this to Robert as he believes $400K for McMansion in Rancho Cucamonga will hold it’s value 🙂 It will be amusing as China continues to increase capital controls. That hot money is going to have a LOT harder time leaving the mainland over the next few years. China’s economy is being exposed for the smoke and mirrors it is. The rioting masses there will expect a pound of flesh from the lower level party members. No escape to San Marino for you Mr Oligarch!

The global economy continues to slow down on it’s way to some semblance of market equilibrium. The Central Banks are failing epically at stopping this momentum. Interest are going to rise as that is the only thing that can prevent a total collapse of our monetary system. Mortgage rates will be at 5 or above very shortly putting more squeeze on marginal buyers. People will continue to work less hours for less pay overall and inflation (the real # not the .gov BS) will be a persistent problem as the world scrambles for energy…

And we expect SoCal housing to withstand this onslaught because, Chinese? Because weather? Because…?

400k? You think that is expensive for so cal? Hahahahaha

Whether I perceive it as expensive or not is immaterial. I simply stated that it will not hold that value in a high interest rate environment.

That being said most of the houses with 400K price tags could not rent for mortgage equivalency. So yes they are expensive. If you’re gonna troll, try harder 🙂

I am russian, I am buying in California … wish had a chance to buy few years ago… but wasn’t ready…. plan to stay forever because of weather 🙂

IF you are looking to buy in California please contact me.

I like when Internet bulletin board shlub tells another internet bulletin board shlub that they are right and the other shlub is wrong.

Why would you think high interest rate is a factor? It’s already known that the govt and the fed will now impose manipulated artificially low interest rates for the unforeseeable future. @ $400k with 20% down will cost $2200/month. These houses should rent for that without issue.

Nobody is putting 20% down. It’s a world of FHA 3.5% down loans and sky high mortgage insurance premiums. The FED is projecting 2.5% rate by mid 2016. Leslie Appleton Yong, chief realtwhore in CA peojects 6% mortgage rates by that time.

Unless rates stay at zero+QE the Housing Market must correct. QE is done in just a few months and the market is already at a standstill. When the stock market corrects, as it always does, all that much more faux wealth will disappear. 1982, 1987, the early 90’s, 200/2001, 2007. Math wins out sooner or later. Everytime.

“This idea that foreign money is flooding into crappy neighborhoods ”

…what about Detroit?!!!????… Isn’t Detroit crappy? Most of Florida is crappy, too – with small pocket neighborhoods as an exception.

San Marino AKA Chan Marino

Monterey Park AKA Mandarin Park

Ever notice that Moorpark spelled backwards is Kraproom? Coincidence?

Is there an AKA for Irvine? How is Lee Irvine?

“Borvine”… cuz its OC’s first “Master Planned Community” & so damn cookie cutter!

Some other local OC terms of endearment:

Anacrime= Anaheim

Stabba Anna = Santa Ana

Garbage Grove= Garden Grove

Costa Misery=Costa Mesa

Newps=Newport Beach

HB= Huntington Beach

Guna= Laguna Beach

“It does give off reminders of when Japanese buyers were purchasing tons of California and Hawaiian real estate.â€

Doctor, you cannot compare the two because China did not bomb Pearl Harbor. Chinese inwestor cash monies are completely different than Japanese inwestor cash monies! The main difference is that it is against the law (wink wink) in China to move cash monies overseas and it was less against the law for Japan to move cash monies overseas. This makes all the difference!

Don’t pay attention to the fact that the majority of the “cash monies†from China is from “hot monies†which is debt based by definition. I think the fact that there is debt in the “cash†stream is meaningless and this “cash†is the same as drug dealer cash. Same, same!!!

Ergo, this time is different because all debt created cash monies are different and there are many many Chinese and not so many Japanese!!! Hence, HOUSING TO GO UP 30% 2014!!! This will go FOREVER!!! Chinese peoples never sell and Japanese peoples always sell!!! Did I miss anything?

this is how some of that chinese money washed up on foreign shores legally.

http://www.bloomberg.com/news/2014-07-14/secret-path-revealed-for-chinese-billions-overseas.html

Loopholes for the rich Chinese!! We don’t have that for rich Americans cuz that would not be fair.

Great comment! The only thing I see that you missed, was that all monies are now debt based. All monies, whether it is created through the Federal Reserve, or whether it is created through debt based instruments via fractional reserve banking where there is no fraction even required of actual cash reserves in the central bank. QE is taking care if that. Why use their own Ponzi scheme when it can be funded by taxpayers? Lol and the monies given on those debt based instruments are conjured out of thin air. Yes, out of thin air based on whatever reserves are on deposit w the central bank, but they no longer have fraction reserve requirements! It’s all fraud! If only people understood monetary theory. It would change everything. There is absolutely no need for our US dollar to have to pay interest on every dollar printed. We just need to take control of our money back. The bankers of had control of it for over 100 years now and look what it got us?

It looks like a lot of the QE money is coming back home. We flooded the world with U.S. dollars. So what will you buy if you live in a different country an are stuck with a lot of U.S. dollars. There is not a lot of manufacturing in the U.S. for foreigners holding U.S. dollars to buy gadgets. It is hard to buy a companies because of various regulations so why not by buy hard assets like real estate or land.

“So what will you buy if you live in a different country an are stuck with a lot of U.S. dollars”

Oil. Ultimately that’s what the USD is backed by – full faith and credit is really about the reliability of said backing. As long as there is that backing, someone will trade your dollar in order to buy that form of energy. Now you know why such a big deal is made out of the petrodollar scheme.

Housing TO Tank Hard in 2014!!!!

It is physically impossible for housing to tank with 10 gazillion Chinese! I think we will pass my 30% increase before Christmas!!

Will anyone pay me $2000 to automate Jim Taylor posts. I need to make a mortgage payment.Thanks

It’s been four months since the Ides of March.

2014 is over 54% over.

Still waiting for the Hard Tank.

Basically it looks like locals are priced out of prime and near prime areas, unless they’re bringing mega cash to the table or are dual income surgeons. The door was open a few years ago, and now it has shut. 🙁

Now we buy cheaper houses further inland and pay for private school to avoid gangs.

I can concur on the info stated about Chinese purchasing large amounts of real estate in Irvine Ca. My high school sweetheart moved back to Hong Kong years ago. She has since gotten married. Her husband’s family and friends have been buying a high number of properties in Irvine, and now live there. She told me that over a hundred of there family and friends moved, and continue to purchase land in the area. She stated that they moved there to open up businesses, and raise their families i America. They are well off, and I can see them owning more and more property. As of today, her husband owns 5 pieces of real estate himself.

Does anyone know that in Irvine CA the homeowner does not own the land?

You can own the house but not the land. This applied for all of houses in Irvine. The homeowner pay property tax but does not own the land. The land still owned by Irvine Company.

If the land ownership is “fee simple” the home owner owns the land in Irvine as well.

There is a joke among young college aged people that UCI is not university of California at Irvine but rather university of Chinese immigrants

You may know UCLA also is an acronym for

University of Caucasians Lost among Asians.

Inventory levels in L.A. County continue to move up: http://forums.redfin.com/t5/Los-Angeles/Inventory-levels-in-Los-Angeles-County/td-p/451321/page/4

First post on page 4 shows the past year plus worth of sold, pending, and available inventory levels for all of LA County.

That data is now lagged by 3 1/2 months, as it shows the numbers thru the end of March. What’s happened is not as important as what is occurring and what will occur. Based on the NAR numbers for the last three months, mortgage purchase buying is still declining and the investor segment is fading as well.

Phoenix and Vegas are starting to collapse and SoCal isn’t far behind. That’s where the cracks formed the first time around in 2005…

Dave,,,This is good work on your part, so many on these sites just look at the latest stats, kind of like weather forecast after the disaster hits they tell you what was left behind instead of what was coming.

Data in housing from the past can be very useful in what is coming in the Two or three months ahead. Housing in the three states you mention have seen many sales of grossly underwater houses and desperate sellers sell.

I have pointed out many times my research continues to show property priced right in good locations continue to sit. This is epic buyer- seller standoff, buyers are running around looking to offer below market value this strategy has been a disaster for them,.

Good homes are leaving the market in droves leaving behind bad listings and sour buyers. This can only mean a flood of new listings in Oct. If sellers continue to hold firm on pricing buyers have a choice say uncle or wait till Jan?

I make a daily search and graphs of these trends for many years now. When the 2005-2006 mass increase hit my trend showed in mid 2004 to buy before Dec2004 then watch the flooding of buyers at inflted prices.

By 2007 early I took to several sites stay away from house buying and dump you home now if you are a investor, like this site I got called every name. Forecasting RE is a Two to Five month trend of what may lie ahead. The difference is you see a total collaspe in the future, my trend and take is better seller sense because most are now able to stay in there homes and bank recanted to loan money to losers anymore.

Robert: “buyers are running around looking to offer below market value this strategy has been a disaster for them,”

A “disaster”? That’s a little strong, no?

What’s so disastrous about not getting the house? There are other houses out there. Maybe next time you’ll offer more. Or even get a house for less.

Either way, this emotional — win or lose! — triumph or disaster! — mentality is what fuels bidding wars and buyer’s remorse.

Overpaying for a house is a greater “disaster” than having a bid turned down.

“I have pointed out many times my research continues to show property priced right in good locations continue to sit. This is epic buyer- seller standoff, buyers are running around looking to offer below market value this strategy has been a disaster for them.”

Last I checked, if houses aren’t selling – then they are not “priced right”. They are OVER priced. All this does is causes the motivated sellers to drop prices until the property sells. When this happens, market prices in the surrounding area will drop. Unless your property is special, like everyone in SoCal seems to think, then you might get a premium, but the value will still drop.

When inventory builds and sales drop, that means prices are too high.

“I have pointed out many times my research continues to show property priced right in good locations continue to sit”

Here we go again. Listen up, fool – IF THE PROPERTY IS PRICED RIGHT, IT WILL SELL. If it is not selling at its current list price, IT IS PRICED TOO HIGH AND PRICED WRONG.

NO SALE = PRICE IS WRONG!!!

I have pointed out many times my research continues to show property priced wrong i.e. too high in good locations continues to sit. This is epic buyer- seller standoff, sellers are delusionally sitting around looking to get above market value; this strategy has been a disaster for them.

Good homes are leaving the market in droves leaving behind bad listings and sour sellers. This can only mean a flood of new listings in Oct. If buyers, who set and control the market, continue to hold firm on balk at DSP (Delusional Seller Pricing), sellers have a choice say uncle or wait till they die? Sell now or be priced in forever (forever = when the bank or the government take back the house)

@Dave, worry not about a housing slowdown. There are 700 Million Chinese mega-millionaires waiting in tour buses ready to snap up every vacant house in America. Soon the average starter home will be $30 Million dollars.

Of course $400k in Rancho has to hold value where can you get a modern house for less in So Cal. Rather live in North Hollywood for 1957 shack for $650k or Victoria in Rancho.

BTW found even a better buy over the weekend, 2978 ft three car garage, gated area, for $388k, you probally won’t want to look at it ,a Chinese family owns it???

How do you enjoy your 3 hour plus commute? The 134E and 210 E is a parking lot. And, when it rains, forget it. Yes Rancho is cheap, but the commute will destroy a marriage and it will not be worth it with all the child support and spousal support parents. Buy close to where the jobs are and avoid the stress. Burbank has more jobs than people(100k+). Live in Tune Town and go to Universal every weekend. Burbank has good schools, own police, and courts. Not to mention the airport and trains. Universal has the Red Line sub (Rabbit likes the burrow).

Rabbit…You have come late to the party on this site, I don’t live in CA, I lived and bought RE property may times years ago there. That said, I was pointing out that in such a huge state opportunity can be found. I took the Victoria ( Rancho C) location where houses can be bought by CA standards fairly reasonable.

Of course affordability also comes with a price called commute time. I know this very well when Simi Valley was only accessible by the pass a pass road to the SFV.

This has always been a CA issue, live far away to afford a home or risk living with really bad 1950’s houses and locations, unless of course you are people of means you do what you want.

Young people have to make this decision, drive to own or live closer to rent?

Impossible. We all know Chinese hold their property FOREVER! Also priced so low, must be in a barrio or ghetto, no way Chinese buy there! Only 1 million plus shitboxes!

Is the state name being changed to “Chinafornia” yet?

Chinese Searches: …Anderson SC

WTF is in Anderson, South Carolina?

It was identified by CNNMoney as a top rental return area. I was looking too since i got a job offer to move from Sacramento to Greenville, SC which is in the same metro area as Anderson …Here is what i found … MY LORD what 130k will buy out there that will only buy a parking lot space here in california… truly

Another fact of the area is it is rich with engineers from Infor, GE, BMW and a couple other big hitters that have facilities out there. So just another plug for owning rental units.

http://money.cnn.com/2014/07/03/real_estate/rental-markets/

Real Homes of Genius

Hey Doc; here is a real home of genius….

sold 7 months ago for $325K. A little lipstick and some home depot upgrades, perhaps an additional bed and bath added and BINGO. New price $585K. Be the first on this crime ridden neighborhood to pay more than a half million for a home this time around.

And the neighborhood is real homeys of nongenius.

http://www.redfin.com/CA/Los-Angeles/3021-Buckingham-Rd-90016/home/6892517

They should have hired a professional photographer. And a photoshop editor. The rooms are dim. Everything should be GLEAMING.

There isn’t even any grass in the backyard. They should have installed some grass squares and photoshopped it so it so the backyard was amazingly bright green.

Also, they should have painted the front door red. And put in some guitars, block letter signs, a bowl of limes, and a Buddha shrine.

And don’t forget the jars of lemon slices

What a fucking joke. Even the $325K previous sale is crazy.

LOL. They do that in Kansas too. Except they buy the house for $35k. Put in a tile bathroom, tile counters, new carpet and new paint and sell it for $49k. A 30% change in price but probably only $10k in profit.

3 Bedrom, 2 bath, 1 garage and around 1000 Sq feet.

http://www.reeceandnichols.com/homes-for-sale/KS/Kansas-City/66104/3311-N-36TH-Street-125171947

A 2008 report by the People’s Bank of China (PBOC) said that up to 18,000 corrupt officials and employees of state-owned enterprises had fled abroad or gone into hiding since the mid-1990s, and that they were suspected of having taken $123 billion with them. A favored method, according to the PBOC report, involved squirreling cash away with the help of loved ones emigrating abroad. A trial program the PBOC launched about two years ago that allowed a few approved banks, including Bank of China, ICBC and China Citic, to start offering cross-border yuan remittance services for Chinese individuals through their branches in the southern province of Guangdong. The PBOC never publicly announced the program because it intended to carry out the trial quietly, the people familiar with the matter said.

Officials close to the PBOC said on Monday that it isn’t likely that the central bank will withdraw the trial program altogether, as it is in keeping with Beijing’s broader effort to make it easier for funds to move in and out of the mainland and to promote the yuan’s use overseas.

Should the hot Chinese money flow into ultra luxury US real estate stop, watch as New York City double (and triple) digit million duplex and triplex condo plummet in value as the dumb, marginal money is locked out for good.

http://www.zerohedge.com/news/2014-07-14/chinas-secret-money-laundering-story-goes-mainstream-promptly-censored

Funny all this was laughed about in 2006. Check out 18:44 of

http://www.youtube.com/watch?v=BiqEacwADlE

15:40 and 35:20 also reference the Chinese.

Cash is king. We borrowed against our houses. It is no surprise that when we spent the money (borrowed) on frivolous goods and not on capital investments to compete in manufacturing we would end up paying rents. We are now paying the piper. If you don’t like the Chinese then don’t take their money or buy their goods. Although many say this, the US has a government deficit funded largely by Chinese and a trade deficit with China. Giving up some houses seems like the least we can do. It is nice China has capital restrictions, but money always seeks someone to put it into productive use. They wouldn’t have so much except for us and their willingness to produce.

On the bright side, at least they come here. They invest in the US. Maybe this will get our stuff in gear and we can build a new US along with these successful families. Learn from them. There is plenty of land. A few good ideas and investments and that land could be a new prime area. Not long ago Irvine used to be bean fields.

LC…

Flash update: Credit is King.

Just ask Yellen.

&&&

What we’re all looking at is an economy that is being hollowed out by Big Government… the nanny state.

0bama’s antics are just the cherry on top.

&&&

A fulsome corruption of the logical controls side (price and risk signals) of the free markets (by Big Nanny) is something so huge that it boggles the minds of all.

%%%

At any point, the derivatives market can implode.

This is a rigged market/ game — for you have four (maybe five) mega-banks taking all of the action (an oligopoly of underwriting) and the number one bet/ risk being hedged is a rise in interest rates. (!)

There is not a chance in the world that these ‘underwriters’ have the capital to pay off on their ‘policies.’

There is no group taking the other side of this epic one-way bet.

The resultant chaos MUST blow back into the mortgage origination craft — and thereby disrupt the real estate markets — just about everywhere.

&&&

For some reason no-one is much discussing the terminal end game that the Fed has penciled itself into.

In another ninety-days the last of the Syn-CDO boom will have expired. These were 60 month contracts that shoved the risk of systemic defaults back out onto the investment rubes of the nation, to wit: the professional money managers.

After the 2008 debacle, Syn-CDO issuance collapsed. It had become obvious that the risk they entailed was actually very, very high; their payouts, a joke.

(There is some attempt to revive this long con.)

{ Syn-CDO structures permitted the mega-banks to unload risk onto the rubes for peanuts. The true nature of a Syn-CDO is to underwrite risk — investment and credit risks — with the mega-banks paying the premia to the rubes. Such a deal. }

###

The end game for such epic macro-embezzlements is revolution or foreign (financial) intervention. (Think BIS and Weimar Germany.)

The fact that the nanny states are committing macro-embezzlements is nary commented upon.

Like traditional embezzlements, the bleeding comes first, the knowledge, the realization, the pain later.

Bourbon France was destroyed upon the discovery of Louis XVI’s macro-embezzlement. This reality is hidden from modern readers because high school histories dwell upon the human tragedies — never the epic financial and economic crimes that triggered all.

Classical Rome also was torn apart by macro-embezzlements. These were ‘papered over’ (before the paper currency (in the West)) by dipping copper into silver plating solution. The end was nigh.

$$$

Maliki is the fool of the hour: proving how truth comes too late. He’d been running a fake army that collapsed the minute it was pushed. At this time the following Iraqi divisions are gone/ down to remnants:

1st, 2nd, 3rd, 4th, 5th, 7th, …

They evaporated without any significant combat loses.

The same social dynamic awaits the mega-banks… all due to their fantastic derivatives books. They can’t take the first push.

Is it any wonder investment bankers are committing suicide all over?

Their one unifying theme/ MO is a link to the derivatives market.

“Flash update: Credit is King.

Just ask Yellen.â€

No blert, You Love is King.

Just ask Sade.

“What we’re all looking at is an economy that is being hollowed out by Big Government… the nanny state.

0bama’s antics are just the cherry on top.â€

I will leave this to angry old white men to debate…

“A fulsome corruption of the logical controls side (price and risk signals) of the free markets (by Big Nanny) is something so huge that it boggles the minds of all.â€

Nothing is free blert not even markets!!!

“At any point, the derivatives market can implode.

This is a rigged market/ game — for you have four (maybe five) mega-banks taking all of the action (an oligopoly of underwriting) and the number one bet/ risk being hedged is a rise in interest rates. (!)

There is not a chance in the world that these ‘underwriters’ have the capital to pay off on their ‘policies.’

There is no group taking the other side of this epic one-way bet.

The resultant chaos MUST blow back into the mortgage origination craft — and thereby disrupt the real estate markets — just about everywhere.â€

Blert, you are forgetting all the Chinese cash monies! They will buy up all the real estate, banks and derivatives. We are all safe!

“For some reason no-one is much discussing the terminal end game that the Fed has penciled itself into.

In another ninety-days the last of the Syn-CDO boom will have expired. These were 60 month contracts that shoved the risk of systemic defaults back out onto the investment rubes of the nation, to wit: the professional money managers.

After the 2008 debacle, Syn-CDO issuance collapsed. It had become obvious that the risk they entailed was actually very, very high; their payouts, a joke.

(There is some attempt to revive this long con.)

{ Syn-CDO structures permitted the mega-banks to unload risk onto the rubes for peanuts. The true nature of a Syn-CDO is to underwrite risk — investment and credit risks — with the mega-banks paying the premia to the rubes. Such a deal. }â€

I would say that the Fed magic marker’ed themselves into the endgame with emphasis on magic given the synthetic nature of said CDO’s…

“The end game for such epic macro-embezzlements is revolution or foreign (financial) intervention. (Think BIS and Weimar Germany.)

The fact that the nanny states are committing macro-embezzlements is nary commented upon.

Like traditional embezzlements, the bleeding comes first, the knowledge, the realization, the pain later.

Bourbon France was destroyed upon the discovery of Louis XVI’s macro-embezzlement. This reality is hidden from modern readers because high school histories dwell upon the human tragedies — never the epic financial and economic crimes that triggered all.

Classical Rome also was torn apart by macro-embezzlements. These were ‘papered over’ (before the paper currency (in the West)) by dipping copper into silver plating solution. The end was nigh.â€

Speaking of France, has anyone seen my guillotine???

“Maliki is the fool of the hour: proving how truth comes too late. He’d been running a fake army that collapsed the minute it was pushed. At this time the following Iraqi divisions are gone/ down to remnants:

1st, 2nd, 3rd, 4th, 5th, 7th, …

They evaporated without any significant combat loses.

The same social dynamic awaits the mega-banks… all due to their fantastic derivatives books. They can’t take the first push.

Is it any wonder investment bankers are committing suicide all over?

Their one unifying theme/ MO is a link to the derivatives market.â€

I always thought that Maliki looked more like a banker than a Middle East tyrant. Now take a look at Abu Bakr al-Baghdadi, that’s what a Middle East tyrant should look like! Although, bankers do cause more international terrorism than any Middle East despot…

First of all Canada isn’t a bubble. They’re running out of land. And the rich one percenters want a coastal city winter home. They’re competing with the same rich Asians who take over Vancouver.

Problem solved!

http://en.wikipedia.org/wiki/Palm_Islands

God may be out of the land creation business but if you get yourself a few shovels, some large rocks, a heap of sand and 5000 Indians, voila new beach front property!

Places like El Monte, Duarte and La Puente are starting to see an influx of foreign money. Those areas look like they did before this latest bubble started developing, but that could change.

There is one big difference between the Chinese and the Japanese money flowing in: Japanese people never intended to move their families here permanently because they do not consider a life outside Japan to be better than one in Japan. Obviously there are exceptions, but by and large the Japanese bought overseas purely as investments, while the Chinese by all accounts are moving their families here.

No, the difference is that Japan bombed pearl harbor and China did not, America nuked Hiroshima/Nagasaki and America did not nuke Shanghai… That is why the Chinese will hold FOREVER!!! This time is ALWAYS different!!!! This will NEVER end!!!

What? You are so cute when you get worked up…kisses 😉 I love your delusional ways!

Prince C,

Are telling me that we are not living in the “happily ever after”?

Always…

Never…

Forever…

“by all accounts”

Where’s the empirical evidence? Anecdotes abound, but no reliable accounting to prove it.

Hey that’s great news for the recovery! We can have them manufacture all the consume r goods for pennies here in the States!

Sarc/

Yes….We get the toys and they get the real estate… We can play with our toys under some Interstate overpass……..

How else will China get rid of all their excess lead?

You got it sneezy67!

Our corporations, banks and wall street sold out our manufacturing base and commerce to mostly China. Why? Because the petro dollar deal generated by Kissinger in 1972 forced foreign countries to convert their currency to the American dollar in order to purchase oil. Where do you think they get the American dollars? They have to manufacture and sell something that we want or use to get those dollars to buy oil. Hence, our banks, government and Wall Street encouraged our corporations to manufacture goods outside the U.S., it’s still occurring to this day. We’ve been sold out just to prop up the dollar! And guess what? We get absolutely nothing in return but perishable junk! The party is over!!!

I am house hunting for a home in N. San Diego county, north of the Asian zone where the open houses are all Asian and the schools which used to be 5% Asian are now pushing 40% Asian and rising. It will be my 4th property. I have yet sell. I love the fence sitter renters because #1 I love a big renter pool and #2 less competition for my next purchase, so thank you frozen people on the sidelines, we need you to stay put! Keep on trying to rationalize the market while prices have in some areas already exceeded peak ’06 values. By the time you finally capitulate and buy or move away I will have most of my next purchase paid off. You are probably frozen on the sidelines of the stock market as well and have missed a massive bull run. I admit I have taken some profits but am still heavy in the market because after 30 yrs of investing I am no longer stupid enough to rely on market timing.

Good luck to all, and again a big thank you to career renters, we need you to keep making us money! Sorry about those rent increases, but baby’s gotta eat!

Wow. Not too often do you get to see someone portray themself as both racist and arrogant in one paragraph. Good luck with your “paper” profits as we all know stock markets and real estate never crash. And savvy investors like you always get out at just the right time.

I heard this BS from so many people back in the boom of 2005-2008.

All of them, every single one, who delighted in telling me I was an idiot for “missing out” and “sitting on the sidelines”, LOST their home to foreclosure because they had been SMART enough to “buy” at the bubble’s inflated prices.

Save it, I’ve heard it all before. It’s like an echo.

You are right, it’s an echo, look at all the liar loans out there today that are driving up prices…

There are a lot of Middle Eastern families moving to Calabasas paying cash for million dollar homes. This area was prominently made up of Jewish families who made their money in the Entertainment Industry. Also, I’ve noticed a huge increase in the India population in the Conejo Valley area also paying cash.

So Dan what is your point? Middle Eastern and Indians came here with funny money and are taking over your hood? don’t think so.

These so called foreigners who many want to blame our economy and inflated house prices don’t. They are hard working family stick together folks, your statement they are moving in smacks of racism and envy?

Next time you folks go to the polls vote the best man or women in not the best reader of a tele-prompter?

Chinese are not racist. We are discriminated at UC because we are over represented for affirmative action purposes. We stick together(e.g. Irvine). You want to call us racist, we don’t care, that only works on white Americans.

Call me nostalgic but this California that all these Foreigners are lining up in droves to buy into is not the same State that anyone over 40 remembers. This is something that cannot be described or put a price on.

(Lee) I’m half Chinese, 52 years old, and have not met a single Chinese relative in my entire life because my mother married a Puerto Rican. While I can certainly say that the Chinese side of my family is rather racist, I couldn’t and wouldn’t say that, as a whole, the Chinese are racist. But by the same token, you can’t say they’re not.

Washington Post, 7/15/14

“The Chinese are coming, and they’d like to buy your house”

http://www.washingtonpost.com/posteverything/wp/2014/07/15/the-chinese-are-coming-and-theyd-like-to-buy-your-house/

“The Chinese are on the move. In 2014, a record number of Chinese, 100 million, are expected to travel abroad, an army roughly

as big as Mexico’s population. They will visit family and friends, and real estate agents as well as tourist sites such as the Great Pyramids, Buckingham Palace, the Eiffel Tower and the Empire State Building — the educated and well-heeled beneficiaries of the biggest economic rocket ride in history. They have money in their wallets, an appetite for the good life and ants in their pants.”

“This month, U.S. real estate Web site Zillow begins publishing its entire U.S. real estate property database in Mandarin on the biggest real estate Web site in China. This means Chinese buyers can surf the Net to find properties near family and friends in their price range. “The fact that Zillow is going there is huge,†says Hall Willkie, president of New York real estate firm Brown Harris Stevens Residential Sales. “The Chinese may just overwhelm the United States with purchases.â€

Okay, okay, I’ll sell! But I damn well better get “twice my asking price” or those Chinese are gonna be outta luck!

I for one, welcome our new Chinese Overlords, and will set out to marry a young, beautiful Chinese girl from a wealthy family.

If ya can’t beat ’em…

Pet bring the Chinese buyer onboard. American buyers still waiting for 2008 to happen again, like waiting for the Beatles reincarnate?

Come to compton!!! We need the influx of new money!

Can anyone lend my daughter and son-in-law a few million dollars? They need a bigger home.

Chinese are hard workers and smart savers.for them to rise above the hardships and their brutal government is amazing.they are doing what we use to do,”the American dream”, to buy homes and investments here in the USA.it is a dream to them compare to what they have back in china and we made it happen buy supporting communism. while here in our country we vote for leaders that make it possible for corporations to beat down the american workers so that china profits and we don’t,the american working family, unless your a bank or wall street. yea, don’t you just hate the Chinese.

nobody: “Chinese are hard workers and smart savers.for them to rise above the hardships and their brutal government is amazing.”

I suspect that most of the Chinese coming to the U.S. with millions to buy a house are not hard workers — they ARE the “brutal government.” That is, they are the officials, cronies, lackeys, and sycophants of the Communist Party.

The hard-working Chinese are still back in China, working long hours, at slave wages, down at the iTablet and iPhone factories.

A buyer is a human folks not a computer set to reason on pricing. If buyers were so smart why did we have a 2008 collaspe, why didn’t they just say no to higher prices of 2005-2007?

Buyers and sellers are the same people. some time in there life they buy and sell, no logic folks, if you have a nice home at the right price and it is not getting showings it is because a stupid buyers agent is giving you advice that will all but assure you never buying a home.

Buyers agent are notorious for stersong buyers to areas were they live to buy inflated prices

The real beauty of this story, of embezzled, printed $$ coming to USA to buy out our real estate, is that when we take it back, we wont have to pay a damn thing for it!

To contiue for steering buyers a illegal practice done everyday, so there locations comp when they sell, I personally have gone out with these folks dozens of times in my life they always drive you around in a circle to keep values up and good priced houses down.

When I use to ask them where they live they always lived within 5 miles of what they were showing me, of course I said go further and the pat answer always, you don’t want to live there?

As I stated before masses of people who buy homes have no idea of the market or location, case in point my ultra dumb cousin from SF, they bought a house in Glendale Az, the first house she showed, told him you know I make a study of RE trends and markets, why did you buy the first house, the women was nice and she said Glendale suited my wife and I’s life style???

I won’t go any further, I just know happens everyday in this country, if you people think buyers are the reason houses will go down you can forget it, buyers buy on media news and what they hear as hot ideas. Sellers wait these people out don’t sell now remove it from the market, let them live in the park, once they awake from the dream houses are collapsing they will buy your house at your price like my dumb cousin did.

Robert: “Sellers wait these people out don’t sell now remove it from the market,”

Not all sellers can “wait these people out.” Some sellers are going through a divorce, or a job relocation. Or they’re under some other financial pressure. Some sellers HAVE to accept the current best offer, even if it’s way below what they want.

Notice how Yellen said today “we are afraid to lower standard for buyers to get loans.

The Fed’s know buyers are not in the know, if Wed morning the mortgage business was

to slacken loan qualifications houses would sell like crazy again, count on it

This slow down is based on the following not prices?

Foreclosures and short sales dried up

grossly underwater houses sold at record rates very few remain

sellers can afford to make payments so they are pulling houses off market

sellers may not relist or list at all so low numbers in listed properties in coming

months will cause shortages and price inflation

Buyers have seen up to 10% price reductions they still are talked into waiting, this is

dangerous as houses will either remain at present level with buyers on the sidelines or

up again when inventory lessens.

If you are waiting for 2008 revival, you have more of a chance China becomes a

in this century?

Democracy in this century?

This million dollar house has some of the ugliest interior decor I’ve yet seen. The bedroom looks like a parody of a 1970s swinger’s pad: http://www.redfin.com/CA/Santa-Monica/1724-Maple-St-90405/home/6766846

Looks like the sort of place that Steve Martin and Dan Akroyd’s “two wild and crazy guys” would own.

One of the tricks of the trade is for the listing broker to delete all the prior purchase history. I dont know how it is done, but they do this in order to make the house appear more appealing and not being a money making scheme. In this case, in looking at the price history, it appears to have last sold in 1993 for $450K. From this, my guess is that the owner is going to jump on this 8%-9% price increase YOY (according to recent news from Dataquick).

If the owner was not in need of money, or job relocation or downsizing, they would not sell to then overpay for another house in the same area.

And yes, the purple bathroom wallpaper and the living room looks like a set from a Dan Akroyd movie : ) but at least no trash cans in the photos like we so often see.

Can you believe those bathrooms? Or ANY of it?

However, I would never have gotten past the exterior. One look at a tiny house painted 2 shades of bright blue, and I would have just stomped the gas pedal and kept going, especially at nearly $1M.

You sure this really isn’t a 70’s porno house in Van Nuys?

We buy goods at a low cost from China(they do not have environmental laws and labor laws) and I spend the money on Corona beer and watermelon. Now those dollars are coming back to America. That is the cycle. Even this Bubba understands that. If you rich goobers don’t understand this, then you are really as dumb as a box of rocks. What does it matter to you if they are Chinese who move in or Chinese absentee landlords? Why in the south, they would call us racist if we would complain about Blacks moving in. The Chinese built your railroad and were discriminated against by law in California, like Blacks were in the south. It is so funny to read this blog about all these liberal racists.

Ahh the good ole days…back when the USA created jobs and millionaires in the mother country. Now we export all of those economic opportunities elsewhere. Not only does the average worker have less income, but he/she also has higher cost of living. What used to be Apple Pie is now an economic Shit Sandwich.

And the cherry on top, is for millionaire foreigners to move into (what used to be) middle class neighborhoods and drive up the price of homes, making them even more unaffordable to the average American…a proverbial slap in the face.

I don’t know folks,

China 7.5% goods increase excellent 2qtr numbers

Consumer debt falls to record level in America

Home builder sales and consumer confidence up

Mortgages to remain in low 4% range

Dow at over 17,100

This is heart of summer laid back and numbers are either steady or better then expected

Does this translate to a fall collapse of housing prices and sales in this country?

I don’t know folks,

The stranger with candy says he can give you a ride home. The candy sure looks good and he says you can trust him.

Should you get into the car?

Shotgun!!!

BS..I do appreciate your post on me ( the candy man is the worse man), read my for post for the record. I want people to know that yes this market is not for the most people to buy in. You have to be very sharp and really research if a home purchase makes sense 7 or 8 years down the road.

I should definitely have realize that many people are on the fence because they don’t want to fall off again like 2008.

Today’s America is troublesome, the rich ( 1 to 2%) continue to ride the wave, the rest of the country can’t even afford the paddle to get to the wave, I realize that and should take that in account when directing folks to RE investing.

So… since I already called shotgun, you will have to sit bitch if you want to go for a ride with the candy man…

For those that say there’s a housing bubble, based on gold, some properties are actually undervalued.

Take a look at this property in Irvine:

https://www.redfin.com/CA/Irvine/5406-Amalfi-Dr-92603/home/4739605

It just sold for $1.85M on 6/19/2014.

It last sold for 803k on 9/2/1993, or approximately 21 years ago.

Well, according to goldprice.org, gold per ounce in 1993 was approximately $350/oz, and today is $1296.9 per ounce. If that home appreciated at the same rate as gold, it’d be worth 803k * ($1296/350) = $2.97M. Based on that valuation, $1.85M seems to be a pretty dam good deal.

Any thoughts?

Jason there are couple homes right now in non-mello roos Orange County Trabuco Cyn. homes can be a good buy in that area if you watch it very carefully. This is what I mean, while all are in a doom and gloom houses that are good buys sit, because everybody thinks every house is overpriced so they pass on it, bad decision when the fall hits.

ah… little robbie… Jason specifically asked for our thoughts on the Fed’s talky, talk, talk. WTF does “non-mello roos Orange County Trabuco Cyn. homes” have to do with Janet’s favorite flavor of Kool Aid?

Speaking about the Fed Chair’s latest talky, talk, talk, it just occurred to me that we have had the federal reserve bank for over a hundred years (assuming my math is correct, one never knows these days) and they just now decide to break out the good stuff!?!? This whole QE thingy seems to me to be like cocaine induced unprotected sex on steroids with no negative consequences/side effects/shrinkage/etc. Why would the Fed not break this QE whatchamacallit out on day one? I feel really bad for all those poor soles who worked their whole life to live and died when the Fed could have just printed them to prosperity…

Build a house out of actual gold and your theory might make sense.

I hate to break it to you but we have been off the gold standard for like ever! You need to build your house out of debt, MBS’s, synthetic CDO’s, hypothecation, rich Chinese, etc. you know… the new gold standard…

I would say with gold you do not pay:

1) property taxes

2) HOAs

3) Mello Roos

4) maintenance cost

Factor all this in especially in the super expensive Callifornia coastal…and that house does not look a bargain to me

Look for the record, I’m pointing out and cheery picking homes because lets face it the days of shopping for a home was kind of fun and very exciting when you bought, now you have to look very hard to find a decent home.

Today it is fraught with danger, will you qualify, even if you do will the value hold, will the gov’t come up with a new programs you could have taken advantage of. the whole thing is worrisome for most lookers.

My point of finding these homes is for the person who is ready to buy, a nice down payment, good job, money behind them, this of course is the dream buyer very few out there.

Please don’t ever buy anything in life because you are told the sky is falling, make every decision on your stake in life and what really is best for your future.

I wish I had better news for you folks on the edge of buying a home, overall the market is really for the well healed or the buyer who will in turn get a poorly built 1950’s shack that frankly was never intended to last 25 years let alone 50 or more.

The American dream of every citizen having a shot at ownership is long gone and yes I’m afraid that most of you are priced out.

So who is going to buy if most are priced out?

I’ll tell you a nice story…here in coastal Cali the chinese are buying…well most of them do not know about property taxes…eheheh….they are going to get the bad news later…some of them they already complain about the HOAs…..kkind of fun when they are going to receive the sticker price on that one million carton box they bought.

In China there is no property tax and though some chinese bought to immediately live in…many bought for the future not knowing that in the time being they have to pay a truck load of expenses.

Now knowing pretty well the Chinese mentality some will keep it….some will sell…and when the voice spreads (and in the Chinese community it spreads very fast) you will see the Chinese not willing to pay these prices anymore. It is a matter of time.

Now lets take a nice example: Irvine

12/13 1/14 2/14 3/14 4/14 5/14 6/14

Price Reductions 88 875 118 191 186 198 230

New Listings 128 276 272 365 363 370 403

Sold/Expired 245 297 300 377 332 360 327

Inventory is at 822 houses for sale (77% higher than a year a go 7% higher than a month ago)

I do not want to rain on your dreams but the problem in Cali is not even the house price…are the property taxes, mello roos, hoas etc. to keep the 1M$ carton box.

That is a much bigger problem than coming with a 50% down on the 1M$ which I have already.

So… you are saying that now is a great time to buy. Right?!?!

Actually the opposite….inventory is creeping up a lot…if it keeps like this there will be some substantial price movement in the coming months

If you look at the price reductions they are going up substantially.

If you make the difference between new listing and sold/expired is pretty much positive in the last 3 months and july is going to be even more positive which will make the inventory going up substantially.

So I would wait because IMO price have only one way to go and that is down.

This is a policy shift. Mrs Yellen has admitted that the Fed misjudged the pace of jobs recovery. The staff did not expect unemployment to fall this low until late next year. The inflexion point has come 15 months early. Yet she has undoubtedly changed gear. She no longer dismissed rising inflation (1.8pc) as “noise”. She said share prices for biotech and social media companies were overheating, and that junk bonds were frothy. “Valuations appear stretched. We are closely monitoring developments in the leveraged loan market,” she said. The BRICS, the mini-BRICS and much of global finance have taken out a colossal short position on the US dollar. Mrs Yellen has just issued the first margin call.

Interest rates are going up, dollar is going up, housing to tank. Edward Smith, what do you suggest? Fall into the life boats?

First time posting here. Like the intelligence of the forum very much.

Here is some fresh data from Malibu for you – off topic but might be interesting. We just got our house refied into a 4.5%, 30 year fixed costing 4500 per month. Property taxes are 1500 per month. We rented it out at market for $6,750 per month which more or less covers the basic expenses after landscaping, pool service, etc.

The “conservative” value from the bank we used for the refi (which is in fairness known for being extremely conservative) was 1.7mm.

Does it make any rational sense for a home valued at 1.7mm to have a rental value of 6,750?? That is an annualized price multiple of 21. But it seems to just keep going up every year so I see little risk now to just holding since the rent is covering the basics.

Thoughts?

我ä¸èªªè‹±èªž

Wǒ bù shuŠyīngyǔ

Here’s another example of RealTard desperation and delusion: A house sold in our neighborhood after 2 price drops totaling $25,000, and 11 wks on the market. Sale price: $375,000. Said property was 1,905 sq ,ft

2 days ago a home 4 doors down from above property hit the market. 1,445 sq ft, needs a complete remodel and has some fugly ghetto “sunroom” stuck to the back of it. House backs up to a open lot which I know has been approved for a 3 story Hampton Inn Hotel (of course the RealTard knows nothing about this).

Guess what this idiot listed it for? $399,900. So $276 p. sq ft vs. best comp of $196.

Does that make any sense whatsoever? Does this RealTard really expect people are so stupid they will pay anything? The place is a dump to boot, straight out of the 90’s. I checked out the RealTard’s “webpage”. It’s the only listing he has. Guess he was desperate enough for a listing to BS the poor owner into believing “I can get you this much”.

This place will be lucky to appraise at $290,000…. Insanity.

Hello CalGirl

There are a lot of ‘weekend warrior’ realtors out there; they have a day job and are realtors on the weekends. They hope to represent their sister or their cousin on a home purchase but usually (even with comps in hand) are not very good at setting listing prices, so when they get lucky enough to get a listing, they list the property at a higher price than last, in hopes of pleasing the seller. Could also be an out-of-town realtor who knows nothing about the nuances or zoning or development projects in the area. But in all cases ‘buyer beware’. 🙂

Here’s a house in the Palms district: http://www.redfin.com/CA/Los-Angeles/3445-S-Bentley-Ave-90034/home/6751418

Two blocks from the 405, with a backyard that borders a CVS across the alley, and they’re asking for $1,200,000.

Yeah, it’s got a pool. You can lie in the water as you listen to all the cars coming and going to CVS.

I would be careful about the Canadian nationals. I can imagine many of them are originally Chinese as well. I cannot imagine that there could be a really meaningfull number of Canadians buying down in California (even though I know some). Chinese are the sharks of the market, they are pouring their money to the real estate over the world. This is probably why there is a growth despite the housing prices.

There are many warnings in good financial journals that 2008 will probably be repeated in the near future. The basic cause of the 2008 crisis has not been fixed. Also, some of the perpetrators of the collapse are now in key positions of government. None of them suffered the fate of Berny Madoff, although – just as guilty.

Canada is is no bubble it just a lot higher than it used to be. Wages are higher and rents are cheaper.

But shootings do not happen everyday like in Ca.

Leave a Reply