Tiny homes with big price tags in Pasadena: Inventory grows in Southern California and cash investors continue to pullback from the market.

When you are deep in the euphoria of a mania it is funny what you will come up with to justify shoddy construction, aged properties, and ultimately a profound delusion of value. People are willing to pay outrageous prices because other lemmings are willing to walk alongside them holding their sweaty palms and chanting “real estate only goes up, real estate only goes up, real estate only goes up.†I’ve recently looked at older areas in more desirable cities and you will find older homeowners inching along in a million dollar home yet unable to unlock their equity. Instead of living like a millionaire homeowner, they are counting their pennies for their next gourmet meal of Fancy Feast with a side of Purina Dog Chow. Many do not want to give up their lottery ticket even though they have incredibly out stretched budgets. Some complain about taxes, insurance, and other costs but live in homes with incredibly high assessed values. There is also an interesting movement for minimalist living in parts of this country. However, in California, folks are trying to jump on this bandwagon yet at the same time, maintain the not so tiny price tag which is at the core of the tiny homes movement. California has a big push with this overpaying mentality. You see this with the whole foods movement. I’m all for eating good and healthy and this is absolutely important and critical to your wellbeing. But paying $15 for a tiny bottle of freshly squeeze orange juice? Either eat a freaking orange out right or squeeze the damn thing yourself! Today we’ll take another look at Pasadena and see what the market has to offer us if we went shopping right now.

Tiny homes with big price tags

Part of a market based economy is that you specialize in certain areas. The computer developer is expert at one craft. The doctor a specialist in a section of your body. Part of this has led me to believe that some people have absolutely no freaking clue about crappy construction or even the basics of what constitutes a quality home. Some have never touched a tool in their entire lives yet are primed and ready to hand over their bank account for a 30-year commitment. You have people taking on the biggest purchase of their lives waiving contingencies and walking into money traps just because they have to buy. This sort of mindless delusion is rampant. People don’t run the numbers carefully and don’t bother looking for quality. Buy now or be priced out forever is the war cry again. Forget about the 7,000,000 people that recently suffered foreclosure (many in California) – let us only look at the epic winners and use bro- and sis- science.

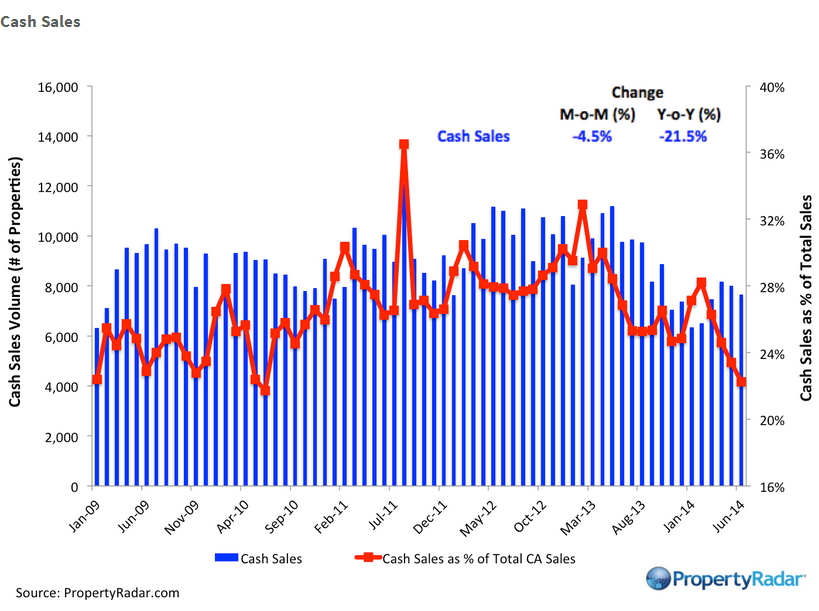

With that said, Pasadena has some interesting homes on the market right now. When I look at these listings, I realize that expectations are through the roof and this is another reason why inventory is rising in the current market. Cash buyers are also pulling back:

If buying in California was such a no-brainer, you would expect this trend to move higher and higher but those with actual cash are starting to run the numbers and they simply don’t make sense short of the greater fool trend continuing. And I should note, a greater fool trend can go on much longer than you can stay rational because there is a large pool of grade ‘A’ house lusting buyers. Yet a large majority have 99 Cents Only Store budgets but would like to shop at Saks Fifth Avenue.

Take a look at this first home:

27 Fair Oaks Dr, Pasadena, CA 91103

2 beds, 1 bath, 676 square feet

This is a nice place, if you were subletting it to your two elementary school kids to live in:

I love the ad on this one:

“Standard Sale” Rehab property 15:00 minutes away from Old Town Pasadena and about 10 minutes from the Rose Bowl.â€

Standard sale? As opposed to what? A fantastic sale? An exceptional sale? This place is listed at 674 square feet and was originally built in 1926. You know what else was going on in the year this place was built? Thomas Edison was saying that Americans prefer silent movies over talkies. Yeah, that is how old this place is.

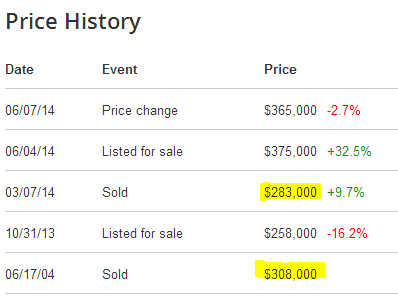

The list price is $365,000 and this is after a recent $10,000 price cut:

It sold for $308,000 back in 2004 in mania 1.0. Sold for $283,000 only back in March. Someone looks to be trying a flip here after 3 months. Initially listed at $92,000 more and looking at the work and it being 676 square feet, unless they refinished the bathroom in solid gold and installed platinum faucets I doubt they added $92,000 in value. Any other lemmings savvy buyers itching to buy this place?

This is how hot the market is. Let us move on to our next home.

154 N Berkeley Ave, Pasadena, CA 91107

2 beds, 1 bath, 828 square feet

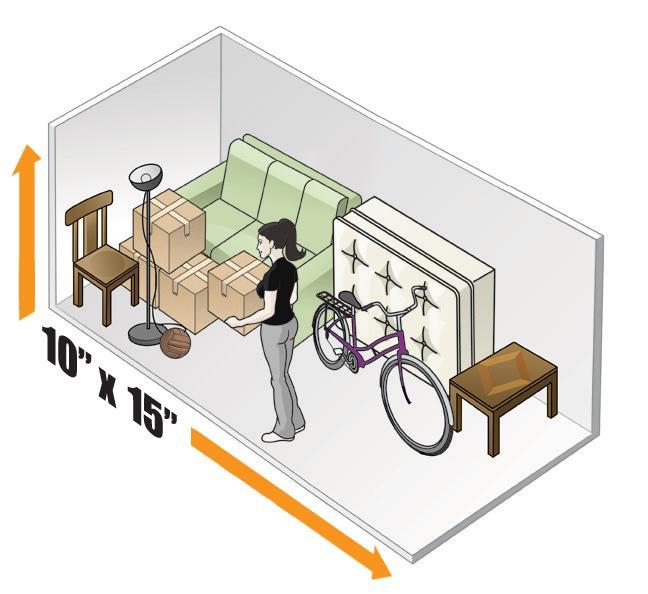

This home is much bigger than the last one since we gain a stunning 152 square feet here. Here is a visual of what you gain:

Not exactly enough room for your new expensive furniture you will be putting into this place unless you plan on having a mattress lined up against the wall. Let us look at some listing information:

“Newly poured concrete driveway extending all the way back to the detached 2 car garage.â€

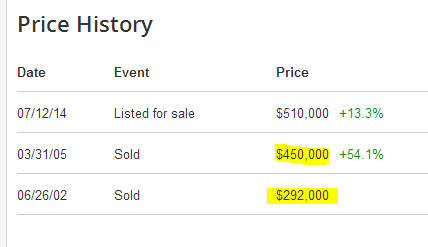

Well that is a plus. At least you know we aren’t living in a developing nation where you will be driving on dirt roads to access your garage. And what do you need to pay for 828 square feet of awesomeness in Pasadena? The current list price is $510,000. Let us look at pricing history here:

This place sold for $292,000 in 2002, then $450,000 in 2005. What is hard to factor in with the California market is that we are in such a boom and bust cycle. You simply can’t take the 2002 price and then apply a CPI smoothing out equation here. That is a poor measure to assign value. So then what? You can look at comparable rents. But then you get the house horny brigade telling you that incomes simply don’t matter. They absolutely matter for cash investors looking to turn these things into rentals and you can already see what they think about the current market. Do you see a wealthy foreign investor buying this place? The rent estimate on this place is $2,100. Not a good deal if you need to shell out $510,000. You’d basically need a 5 percent return to beat this place (and that assumes no maintenance, vacancies, taxes, or insurance which of course you will have).

Next home please.

2647 San Marcos Dr, Pasadena, CA 91107

2 beds, 1 bath, 828 square feet

Another 828 square foot gem here. Let us look at the ad:

“This charming Spanish Home maintains its character with updates and a contemporary feel. The drought resistant yard welcomes you to the entrance and gives privacy to the patio in front.â€

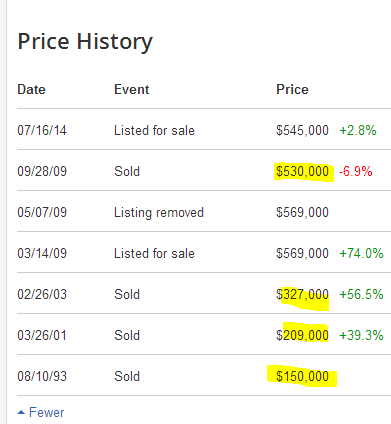

I love how they incorporate the drought resistant yard which at least for California, is making a lot of sense given we are in an epic drought. Nicely done upgrades for what you can squeeze out of 828 square feet. The price tag? $545,000. Let us look at some price history here:

Interesting sales history here. The last sale took place in 2009 for $530,000. With a six percent commission, you are actually looking at barely breaking even here after four years. You have to wonder what the sales motivation is here.

California is definitely in a different sort of housing mania. The latest data on prices and sales came out and we are definitely hitting a plateau during the usually hot summer months. Inventory continues to increase and investors continue to pullback. Boom and bust. After the boom, what comes next?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

96 Responses to “Tiny homes with big price tags in Pasadena: Inventory grows in Southern California and cash investors continue to pullback from the market.”

When looking at the housing cost over time 1992,1997,2003,2008,2012… they are almost always going up over time. So if you buy a home today there is a very good chance it will be worth more in 5, 10, 15, 20, 25 years.

It’s hard to see a bubble when stepping back to look at the long term picture.

“Cost” =/= “worth”. “Price” =/= “value”. Adjust for real rate of inflation and devaluation of dollar and you can be damn sure real estate does NOT always “go up”.

Japan is now 25 years from peak and no where close to what values were then. Values are at the same point they were THIRTY yes THREE-OH years ago.

well, you figure if you’re not owning, you’re probably renting, and rents inflate over time as well. you just have to crunch the numbers and see whether it was all worth it in the end.

Japan is NOT a good example for the course of US real estate for few reasons:

1. You can’t compare the demographics from Japan with those from US

2. Their immigration is almost non existent while US adds millions through immigration (legal and illegal)

3. The natality in US is way higher than Japan

4. Japan doesn’t have as much land as US and because of that the prices went through stratosphere before coming down to earth. In US prices went up during the bubble but never to the same extent as in Japan.

So, yes I agree prices in US are high but still lower than most of the industrialized world. Every time I hear about the Japan example I laugh because the RE conditions in Japan are so much more different than here. You can make a logical argument for lower prices from so many angles but Japan example is a poor one.

Enough with the Japan comparison. If you want to compare Japan then look at the Tokyo prices. Much of CA is like Tokyo. Also Japan has a very low birth rate – CA is exploding with immigrants and births of many new ethnic groups and families who want to take root and own a home.

Even if the first generation is illegal – the kids born here are NOT. And the family have money saved and they will buy the homes for the family to live in. Japan is an entirely different culture and market.

Unless of course you were recommending that we all leave CA and buy homes in Japan? Is that your suggestion?

Exactly Craig. Unfortunately people that born in to inflation have no clue of inflation.

All they see is that interest rates are at historical lows. They don’t understand that housing with inflation are at historical highs!

So Flyover, from most of what you are saying, you are actually arguing that Japan prices SHOULD be much higher – less available land, less natality. And certainly, they have nigh-zero immigration, but the vast majority of our immigration is of the ultra low skill and ultra low education variety – just low wage overpoppers squirting out more of the same. Not the sort that can either afford or pursue real estate of any sort any time soon, particularly in SoCal.

As for comparing Tokyo directly, sure why not. It’s done MUCH better than raw land and the other cities of Japan, given it’s “ONLY” lost HALF of its value since the 1989-1990 peak. Whoop dee doo, only half! Ok, maybe only 40% for the most prime properties.

CraigLister, please read my comment again. It is true that less land means higher prices. I already said that due to less land prices went to stratosphere and that magnified their bubble way beyond ours – no relationship whatsoever with incomes. Due to less land than us they didn’t have any escape/release “valve” like we have here. Instead of periodic corrections like you saw in CA over the years, they had just one big explosion “Hiroshima style”.

I agree also that low education immigration in US is not going to affect the prices directly. However, there are only so many people you can fit into a room and that is going to push rents higher. Higher rents attracts investors in search of yield. That is what we saw lately and that is what I said before.

We also have high tech legal immigration and higher natality that Japan. Again these are facts.

Saying that, I am not a housing cheerleader and like you I believe that CA prices are in a bubble and they will correct. You can make this argument from many different angles very successful. You just can’t use the Japan angle for the sake of credibility.

My argument focussed strictly to the comparison between US real estate and Japan RE.

I’m sorry, I didn’t realize that only 25 years of recent history is all one needs to place bets on the future.

Unless you are a corporation and plan on living forever … I think 25 years is good time frame to make judgements. Are you still worried about the great depression? Almost everyone who owned a home in 1935 is likely over 100 years old today. So yes, I think a 25 year window forward and back is a good time frame to make decisions as that is the window I am living in.

I don’t advise anyone here to let 25 years pass by in life so they can potentially save 25% on a home purchase.

“Those who cannot learn from history are doomed to repeat it.”

Yes, let’s ignore the hard lessons of the Great Depression, after all it’s a brave new world, apples to oranges, and we have the magic of the FED being extra proactive in helping all us commoner peons now.

That’s a bit of a scarecrow. I’m referring to only using the past 25 years to extrapolate likelihoods on any given future timeframe. Reading comprehension.

“…cost over time 1992 ….”

1992 isn’t a random number here: It’s the lowest point where the bust can go after a 1980s bubble broke in 1990. Try to start from 1989 and use inflation-corrected prices and you don’t any rise, but flat until 2010 or so.

When you start to track your “increase” from lowest point after boom, of course you get “constant rise”, conviniently skipping busts and inflation. On purpose, perhaps?

Not to mention that most houses lost 40% of their value between 1989 and 1992 when bubble burst. There’s a lot of room for correction alone between 1992-1995.

When buying a home one should take a look at maintenance cost too. The current house I live in I bought for $185K in 1999. I can probably sell it for $245. I am up about $60k.

I calculated my maintenance cost during this time. Items include

new carpeting = $8k

painting and wood rot = $9k

new roof = $10k

new siding = $14k

new windows = $3.5k

new wood patio deck = $4k

yard maintenance and landscaping, week control, grass seed = $300 year = $4.5k

New water heater = $1.5k

Plumbing = $1k

Air condition/furnace will need to be replaced next year = $6.5k

All in all the equity I gained via housing appreciation is about the same as my maintenance.

I have heard the same thing from many of my neighbors that they have spent more on their house in maintenance than the value it has appreciated.

These are expense of owning a home beyond the mortgage payment.

Now I thought about buying a maintenance free condo in 2007. The condo was priced at $235k and has a home ownership fee/maintenance of around $600 a month. My fees would total $6.6k a year. The condo was built in 2007. I think the will sell now for $250k. So the condo has appreciated $15k or 7 years but I would have paid $42k in home association fees over those 7 years.

At the end of the day my housing purchase is just forced savings via my mortgage payment. I am guessing my home will appreciate at the same rate as the average cost of yearly maintenance.

I have read some studies that said over a 30 year time frame one would many times be better off renting and investing in the stock market than buying a home. When you buy a home you tend to buy more frivolous items for the home or a more expensive carpet….etc.

Any (and I mean any) SFR purchased in SoCal @ 1999 has doubled or tripled by now.

No question the worm has turned. Now to see if we get that elusive “flattening” of prices, or if, as is usual, the market swings to price declines.

these prices are cheap compared to The City (NYC, aka The Big Apple, the center of the universe).

Yes, yes, just as far out exurbs and ghetto/barrio shitholes are “cheap” relative to prime or even mediocre L.A. Just as I am sure property all throughout most of Africa is dirt cheap. By all means, dive right in!

“these prices are cheap compared to The City (NYC, aka The Big Apple, the center of the universe).”

Everything is relative…What’s your point?

I think he’s pointing out that this problem is pervasive.

People in The City think that their prices are as outrageous as you do the Pasadena prices. This is real estate. Everything is overpriced, but people pay the money. A lot of it is foreign money, in The City, and apparently in Pasadena, it is the same, with the Blacks being displaced.

Center of the Universe? Uh, yeah right. If you like the smell of hot trash and teeming hordes of arrogantf a-holes that think NYC is the Center of the Universe. As soon as the stock market takes a dump, so will NYC RE prices.

Time for another report from the trenches of lily white Eastern Ventura County (where I both own a tiny home and have been looking for a bigger one for *cough* 10 years).

Early this year I reported that the sellers of the sorts of homes I was looking at (typical “move up” home – 3 car garage, ~2500 sq ft) had gotten over-ambitious in their pricing and that such homes priced in the $650-750K range were just sitting on the market. As a consequence of these higher asking prices, though, many more homes had appeared for sale in the neighborhoods I follow than in previous years.

Now that the high season is almost over I can report the consequences of this price boom. While it is surely no longer the mania of 2013 most of these homes did eventually sell (about 80% – the rest were pulled). Those priced toward the high end typically sat for 1-3 months before selling and generally sold for 2-5% under their initial asking prices. A few in this price range, however, did sell for near their asking prices within a few weeks. Much as I hate to give ammo to little robert I would have to say the market did declare these few quickly sold homes to be “priced right”.

Overall it appears that price momentum is pretty much dead. I really haven’t seen any increases in this segment since 2013. That said it seems that buyers, at least around here, appear to be losing this war of nerves and, while waiting a good long while, are eventually capitulating to prices at the current level.

It’s very tough to say what this implies going forward. Whether it means we are at a peak (not an “inflection point” as folks who’ve forgotten their math classes insist on calling it) or simply a lull before further increases I have no clue. I do know that I see little benefit in rushing in at this point. The few “bargains” that were to be had in 2011-2012 are long gone, but it doesn’t seem like the deals around now are getting any worse in any kind of hurry.

Does “eastern ventura county” mean TO or SV? I’ve moved from OC to Simi and continue to be shocked at the prices here, considering it is no where near the beach and generally has very uninspiriing neighborhoods. Generally shocked that if prices are this high, they haven’t dropped. Also I’ve noticed that the new construction coming on board is in townhomes that are priced at the low to high 400 range (425k – 475k) so we can at least have a sense for builder profit margin and what prices need to be for them to stay in business.

I’m mostly referring to Moorpark, the location of the neighborhoods I’m tracking, but I’ve lived in the Conejo Valley for over 25 years and am pretty familiar with Simi as well. Years ago Simi, Moorpark and Newbury Park were the poorer stepchildren of Thousand Oaks and Westlake. In the ’90s, though, when T.O. was getting built out some nicer new developments came to Simi (Woodranch, etc) and Newbury Park (Dos Vientos). Over time that’s seemed to flip the old order on it’s head and now many of the more expensive homes in the area are in N.P. while T.O. has more of the older “bargain” homes. Simi is kind of mixed bag. Lots of older homes near the 118 are still semi-affordable, but the nicer developments (Woodranch as previously mentioned and the newer homes north of the 118 on the east end) are just as expensive as everything else in the Conejo.

The one thing we don’t seem to have is a huge influx of Chinese investment (yet). Their are some large immigrant populations (Persians, Indians and others), but these are generally professional classes who’ve put down roots in the community rather than absentee buyers just parking their cash. Perhaps because we aren’t one of those “it” locations prices have merely risen rather than soared around here. It’s no bargain, but dual income professional families can still buy around here (and still appear to be doing so).

To my surprise and dismay this is even true in my neighborhood of 40 year old “starter home” crap shacks of 1100-1500 sq ft. In the last year we’ve had 4 homes in this neighborhood go up for sale in the $500-550K range. 3 sold within a month and 1, priced similarly, just sat for months and was eventually delisted. This is a similar success ratio, but about $150K downmarket, to what I’ve seen in Moorpark – with the cheaper homes in T.O. seeming to move quite a bit quicker, weeks vs. months.

The fact that there have been some failed sales in both locations presumably means that the mania is subdued enough that buyers are at least somewhat price sensitive, and indeed I haven’t seen much of a price increase since late 2013 in either location. That said, there are enough sales still going through that I don’t see much of a motivation developing among potential sellers to cut their asking prices any time soon.

Anyway, I apologize if this seems over-bullish. Nothing would delight me more than to see home prices (including my own) drop considerably. I’m trying to be as data-driven as I can though, and I really don’t see strong evidence pointing to an imminent decline in this area.

Apolitical…thanks for the update. You definitely have the data and history to support your argument. And since I’m not planning on living in this part of SoCal long-term I really don’t care what prices do, but always interested seeing how it pans out.

Let’s all just boil this down. The reality is that the monkey brain in us all is designed to find food while not becoming food, make little monkeys and make sure they get food and do not become food until they become full sized monkeys and nothing more. Synthetic CDO’s, MBS’s, prime housing, pyramid investments, Ponzi schemes, tulip bulbs, crack cocaine, etc. appear to be food to the monkey brain and we can’t stop ourselves even though we conscientiously know that we will become the food in the end.

What?, I can’t decide if you’re the village idiot or crazy like a fox.

I am neither… I am a delivery boy sent by grocery clerks to collect a bill…

“What”, forget the monkey brain race, come to Santa Cruz mountains and leave the monkey world behind. Me and Forest Lady live here in harmony and tranquility. Periodically, I cross the bridge to go to the emerald triangle to give advices to the farmers. Farming is my passion. Get down to the soil, our mother earth.

With electricity and fuel prices at record prolonged high levels, with the price of food rocketing up, and with wages, in our service job nation of growing part-time employment positions, stagnating at best , is now really the best time to pay half a million bucks for an 800 square foot house? I believe it was economist Herb Stein that once said, “If something cannot go on forever, it will stop”. Ya think?

Yes! Why buy a big home. That means more to heat and cool. Food is not rocketing up unless you shop at Whole Foods with the others who have money to burn. Part time employment is an issues but compared to most of the world we are in much better shape.

And a home in CA does not have Heating and Cooling issues. Try living in AZ or the Northeast. When you get a $500-1000 heating bill for your home when it’s -20 deg all winter. You could live in much of CA without heat or A/C.

“You could live in much of CA without heat or A/C.”

WTF? This guy must have never lived or even visited much of CA to believe that you do not need A/C in the summer of 99% of the land mass of this massive state nor heat in the winter… Yes, it actually snows in many parts of the golden state…

Surely you jest?

Do you live in southern cal?

Because of the climate here in southern ca. The older stock of homes, which is the majority, was made with zero insulation any any other type of construction that would reduce heat or cooling loss.

For that reason, and along with higher energy costs, it costs much more than you think to keep cool during the summer and to stay warm during the winters.

I lived in Phoenix for 4 years and overall I actually spent less over the course of a year in Phoenix than San Diego. San Diego , 92116, 4 miles from the ocean as the crow flies.

As far as food costs not rising, obviously you are falling for the old smaller package same price trick.

I am in the LA area in a newer condo. It’s about 1000 sq ft. The heating and cooling is about $50-75 month. 70% of that bill is the service charge and the other 30% is the energy cost.

I could easily live in LA without Heat or A/C. It would not be comfortable on those few 100 degree days or 50 degree night, but I certainly would not die. Friends in SF don’t even have A/C. And they have some space heater for when it gets chilly. San Jose is the same way.

This post was a reply to how energy costs are going to bury us in debt, just saying that’s not going to be the case in CA for a good majority of the population in SF, LA, OC, and SD. I don’t think “What?” actually lives here or he would know that. Or, he has never lived anywhere else and does not know the real meaning of cold winter.

Martin!

Hope that $400k of yours is still resting safely under the mattress!

“You could live in much of CA without heat or A/C.â€

Your exact quote is “much of CA†not mine. LA county is less than 1% of the entire state.

“I don’t think “What?†actually lives here or he would know that. Or, he has never lived anywhere else and does not know the real meaning of cold winter.â€

I was born in Santa Monica Hospital in 1964, attended Grant elementary, Roosevelt elementary, Lincoln Jr High, Santa Monica High, Santa Monica College, Cal State Northridge, worked for a big management consulting firm in Downtown LA, lived in Santa Monica, Venice, Mar Vista, Topanga Canyon until 1999. I think I know the area better than you think. I come from an old LA family who arrive in 1860. I moved to Massachusetts and worked two winters in Minnesota, worked one winter in Chicago and another winter in Buffalo New York. I now live in the bay area. I think I both qualify as lives in California and know the real meaning of cold winter. None of this changes my statement that you cannot live without heat and A/C in the majority of the golden state. You are not a very good shill if I do say so myself and this is coming from an aspiring shill…

Dfresh. More like 800k now . I put a tonof money in bac back when it was 5 dollars share, as documented in my posts back in 2011.

I still wouldn’t buy a house with 800k cash down.

Yes, I missed out on a huge run up in housing but there are other places to park wealth besides a house.

Outstanding, Martin! That’s a nice pile.

“What”, I live in the Santa Cruz mountains, under the Redwood Trees, and we don’t use A/C nor the PG and E. We are off all the grids. That is good living. One thing about California, you can always go solar or get a little wind mill. I know that some of my clients in the Emerald Triangle do this. Those folks are really off all of the grids. For heat in the mountains, we can always burn the plant based material(trees(dead of course, don’t believe in killing trees) and other vegetable matter), but we can always get electric heat. These windmills are real wonders. When it comes to living simply in California, me and Forest Lady take the prize. Of course you city folk in the San Jose area would be out of luck when the San Andres turns over.

Not all of California is experiencing the same dip in investor sales. If only the cash sales would decline in Silver Lake, in Los Angeles. Once it was declared the hipster capital of the known world, all cash sales went through the roof – I’ve seen quotes of highs being over 70% of all neighborhood sales. At the same time, historic low inventories have only slightly loosened up. The prices are insanely higher than the previous bubble highs – for the same houses. Four homes on my street were purchased recently by flippers, who quickly turned them over, using questionable updates, each for well over $1 million. Those houses are now standing empty, having been purchased by investors. No new neighbors, and empty homes equal a bad turn for the quality of the neighborhood. One of them is even attempting to rent out for $7K/month,Munich means someone is living in a fantasy world. Very bad, all around.

I bought a foreclosure in October of 2012 and felt like I over paid. I took advantage of Fannie Mae Homepath loan / property and only put down 3.5% and then they ‘gave’ us 3% at closing. 4.25%, no PMI $383k, sold it 18 months late for $627k. (I did $40k of work to it) With the 3%(actually $11k) they ‘gave’ me, the house really cost $372k

Yes, I will pay capital gains….but the government needs the money more thanI do… also because I share some of the beliefs as others on this site do. We now rent one block away. smaller house, smaller property, our rent is more than our mortgage was.

http://www.redfin.com/CA/Los-Angeles/4546-Verdugo-Rd-90065/home/7177420

Nice little place

We are headed for a crash worse than 2007-2009.

…Or not.

Each time I read this blog, it becomes more challenging to keep dreaming of someday of moving my family from the Midwest to groovy Southern California. But I just can’t let go :p

Solid middle class white people have been moving out of LA since the 80’s. Only people moving in are immigrants. Those with a lot of money and those with no money.

There is no middle class Ben. The middle class was assassinated by Ronald Reagan in the middle eighties.

Wrong! Everyone knows that it’s Obama and his corrupt Democrat cronies who are eliminating the middle class and replacing them with slaves dependent on government welfare and handouts paid for by taxpayers. Obama and his corrupt Democrat cronies are also flooding the country with millions of illegals who are poor and dependent on taxpayer benefits.

When Ronald Reagan took over the leadership of the United States in 1981, he inherited an economy that was in terrible shape from Jimmy Carter—the worst American economy, in fact, since the Great Depression of the 1930s. Reagan rescued the economy by reducing government taxes, reducing government spending, and reducing heavy government regulation. The middle class grew and flourished!

Samantha, I voted for Reagan in 1984 (and for Libertarian Ed Clark in 1980, because I thought Reagan was too liberal.)

That said, Reagan did not reduce govt spending. He trimmed taxes, but spending went up. Not entirely his fault. The Democrats controlled the House throughout the 1980s, so whether you hate or love Reagan, both parties must take credit and blame for the 1980s.

Reagan wanted to strengthen the military and reduce entitlements. He couldn’t do both, so he compromised with Democratic House Speaker Tip O’Neil. Reagan got his military spending, the Democrats got their social spending. Taxes went down, but spending went up.

The Big Problem, as I see it, was after the collapse of Communism. The U.S. should have slashed its military by over 50%. Shut down overseas bases. Made friends with Russia just like we’d made friends with Germany and Japan after WW 2. And washed its hands of the Mideast, taking a neutral position regards to Israel and the Arabs.

One constantly repeated rationale for supporting Israel during the Cold War was that the Soviets were supporting the Arabs. Now that rational no longer existed.

Instead, the U.S. stepped up its Mideast interventions, beginning with the Gulf War (a policy that Clinton continued), and treated Russia like a beaten foe instead of reaching out as friends.

Had the U.S. embraced its traditional “isolationist” foreign policy after the collapse of Communism, we wouldn’t have this huge deficit, and 9/11 would never have happened.

Instead, the Democrats and Republicans both pursued imperialism. Madeline Albright famously said, during Clinton’s bombing of the Balkins, “Whats the point of having this huge military if you don’t use it?”

Total Team Red vs Team Blue bullshit Samantha. Obama sucks, but so did Reagan. He TRIPLED THE NATIONAL DEBT! By comparison Obama raising it by over a third aint so bad. He appointed Greenspan who is the Satanfather of America’s current mess.

If people would pull their heads out of their asses and stop believing EITHER party has America’s best interest, we might see some change.

Samantha , You are a victim or stupid, one of the two.

Samantha: Reagan kicked off the full-on de-industrialization of our country.

He removed our government’s protections for domestic industry and middle-class workers while our economic rivals continued to cheat. In the short term it was the mace-economic equivalent of running up a credit card: apparent prosperity, but with a piper to pay, as we we were killing the geese to get one more golden egg sooner.

While leaders on both sides of the aisle were complicit in allowing this prisoner’s dilemma to play out rather than saying “no” to the globalist agenda, Reagan was the inventor of this trend, and thus bears the majority of the blame.

Now we’re in the end-game: The golden eggs are gone, and the geese who laid them are dead. The companies who padded their quarterlies through ponzi-scheming are now noticing the “great unwashed masses” they thought they didn’t need are unable to feed their balance sheets. Panic is starting to set in.

Curtis states: “We are headed for a crash worse than 2007-2009”.

So what is going to cause that to happen Curtis? Argentina defaulting? Unrest in the Ukraine? The Fed bumping up rates and then dropping them to 0 when the economy faulters? The demise of the USD, as Asia, the Bricks and Russia quit using the dollar for trade? I mean when is this going to happen, so I can short everything?

Just curious.

” I mean when is this going to happen…”

NEVER!!!!

This will go FOREVER!!!

This is the NEW normal!!!

The Fed can print FOREVER and asset prices will continue to rise exponentially while wages stagnate. This will NEVER end!!!

War….. pure and simple

Between Israel and her neighbors

@ Jim

There are many good signs in the market. With aprox 50% of all home sales being all cash [or at last 20% down] and; lowest foreclosure starts in Calif since 2005; and Calif home affordability index at +/- 30% [crashes happen when affordability index drops to below 20%]; and boomers not selling their homes.

That being said, most people seem take lack of wage growth as the ‘silver bullet’ that will cause the next crash. If there is a crash, you will be looking at 2010 prices again or for a worse-then-previous-crash perhaps 2000-2002 prices.

“That being said, most people seem take lack of wage growth as the ‘silver bullet’ that will cause the next crash.”

Au Contraire! None of the resident bears have proposed any such silver bullet. But, it would be interesting reading…

One thing I’ve noticed with inventory is that there is actually a lot of it. There is a price point above which homes sit on the market and that is what is growing the inventory. Anything that remotely resembles a ‘deal’ (within a ‘normal’ person’s budget, or offers actual potential value to an investor) sells quickly. The rest just sit on the market. All these flippers are trying to sell their tarted up shacks and nobody can buy them. $500K is a lot to ask for a place that is basically an old house in the ghetto (even if it is an ‘up and coming’ ghetto).

On a recent open house excursion I visited a house that was $350K, literally 30 feet from train tracks and the (loud/ghetto) neighbor’s house might as well have been attached to the side of the place. It was the least expensive house for sale in the area. It was old, ugly, had no landscaping whatsoever and no garage. It was on a narrow street with no parking. Nothing had been done to upgrade this house and it had no charm to speak of. $2000+ per month to live there? I think not!

Apolitical Scientist – What are your thoughts on the Westlake Village, Oak Park, Agoura neighborhoods? I seem to get redfin updates every day with new properties for sale or price drops. I maybe get a few sales a week. Seems like at least a 5 to 1 ratio of listings vs closings? What do you think the market cost should be for a 2,200 SF home?

Really?

Jason…If I may, about 400ft starting point for these locations, expect to pay at least 850k and up for over 2000ft. Also be well qualified, or you will be wasting your time?

Dear Tired of the BS:

When you say something is a bit of a scarecrow, do you mean it’s a straw man argument…? Vocabulary comprehension.

Having lived in Tokyo there is nothing about it that even remotely resembles CA. Also RE is based on speculation. Thats what caused the 2008 collapse and that’s what’s causing these inflated bubble prices. In 2008 a 7 billion dollar loss caused Lehman to go under since money is created via debt instruments and they over sold and did not have enough real assets to back all that money they sucked out of the system. Now the investors are sueing the banks for not selling according to the pooling and servicing agreements for 250 billion. Bond holders and shareholders get paid first, depositors are last. When you put your money in the bank you become a creditor and if the bank has to pay what they don’t have guess who loses? Depositors. It already happened in Cypress last year. Keep a close eye out as to what happens with this lawsuit. Also, our deposits are supposed to be FDIC insured, however there is only 47 billion in that trust, not enough to cover the 250 billion being sought by defrauded investors in the biggest MBS Ponzi scheme in our history.

“Also, our deposits are supposed to be FDIC insured, however there is only 47 billion in that trust, not enough to cover the 250 billion…”

Let me see 250 – 47 = 203. The Fed will make a couple of key strokes and voila! Problem solved! You are acting as if money costs something. Money is free…

Lynn, you’ve taken the first step, but the rabbit hole goes much deeper. Keep digging. Lehman could have easily been bailed out. Why weren’t they? I can only speculate. Just keep in mind there are paper assets and hard assets. One comes from old money and doesn’t just blow away…

I love reading this blog, and all the responses. The doctor is so smart and prolific, and really does his homework. I don’t know how he cranks out the kind of volume and quality that he does. It makes me nervous though when lately I see more and more mockery of the current prices from him, and less charts pointing to why we have to be at a turning point.

I drove by some land that was going for $500K yesterday, hoping that maybe somehow I could get in at some sort of sane price and build on the pay-as-you-go plan. After driving out into the boonies, I found the land, which had no pictures on Zillow, but pictures of ‘land like it’, and found that it was a steep ravine. Like almost a cliff down to a seasonal creek and a cliff back up the other side. I think about all you could build on that land would be a little bridge from one side to the other. That’s what $500K buys you near where I live nowadays.

I think the posters here should give the poor Tokyo analogy a break. I think the primary point of bringing that up is to say that real estate doesn’t always go up. In fact, in a country suffering from an extreme bout of irrational exuberance and suffering a subsequent fallout, whose nature is always difficult to predict before it happens, as our will be, real estate can go down… for 30 YEARS. Are their fundamentals so different than ours? They took a Keynesian approach to recovery and printed money aggressively and brought interest rates to 0. That served only to stretch out their pain, leave toxic debt on the books, create ‘zombie’ companies and buy them several ‘lost decades’. We’re taking the same approach. They have an aging population and we have our enormous baby boomer generation just now starting to leave the workforce. There are differences, but I think that the original point is well taken that when the jig is finally up for a country’s economic tom-foolery, all options are on the table for the long term direction of a once-over-inflated real estate market, and results are hard to predict.

Having said that though, I could definitely see the opposite Argentina scenario where the money printing spirals even more out of control, in response to the greater debt payment obligations and public outcry for the Fed to ‘do something’ about an economy falling deeper in crisis, and that house prices as a result go up from here to the moon and never look back. In that scenario, what we are seeing now would be just the very first stages of the decimation of the middle and even upper middle class, in which houses, along with other basic necessities, become out of reach for all but the uber-wealthy, who snatch them all up and rent them out to the new serfs of America. That’s the scenario I’m getting more worried about lately.

The point of all these arguments is that prices can go really high from now on or they can crash. It depends on so many variables that nobody can prove for sure one direction or another.

The FED is one powerful variable but not the only one; they can tighten or keep the loose money policy in place. They also look for other variables in the global market and how those affect their power, interest and wealth.

The global bond market is a bigger force than the FED and that is also influenced by the actions of so many players.

The system is so complex that there is not one single small group of people affecting it.

The RE prices can go in either direction for both immediate future or long term. Everyone can make an argument, correct in itself if they look ONLY at 2 variables, all other things being equal. The BIG problem is that “all other things” are NEVER staying constant.

Jeff, good comment. I tend to think the second scenario in play. I think people in the 80-90% income bracket are under great pressure and are worried about falling out of the middle class. Think about that for a moment: those in the 80-90% bracket. There are many ways to fall off, including job loss and income reductions, but being overextended financially, especially through a mortgage, has got to be at the top of the list.

I’m getting really, really, really, REALLY tired of people calling QE “keynesian”.

QE is 100% supply-side: The printed money is given only to those who already control billions in investment capital. (Even the Obama stimulus was supply-side: giving tax breaks to families who still have jobs doesn’t buoy demand from families who have NOTHING)

Keynesian tools are characterized by the assurance of spending money to those who are (or are under imminent threat of being) dispossessed by whatever economic shock is being countered. It’s a Short-Term policy designed to avert a Non-Structural crash by buoying demand long enough for a failing large firm’s competitors to step up and take their place. Keynesian policies haven’t been used since the 1930’s, and they only work if firms are NOT bailed out.

Our economic problems are structural and a result of political corruption: Our politicians refuse to counter the macro-level interventions of places like china to foster our domestic industry through carefully crafted Tariffs and Subsidies. The result has been the destruction of our industry through “dumping”, unfair competition via foreign subsidies and oppression of peasants. (see the US steel industry and our decaying rust belts). The corruption has reached treasonous levels as it’s eroded our national security: we would not be able to win a prolonged global war anymore because the chips in our smart weapons are now manufactured by our geopolitical rivals.

We have been under sustained macroeconomic assault for decades, and our leaders have been handing out drinks and maps to them as they charge up our beaches. I dare say we no longer have a nation, since the tools of economic sovereignty are now being maligned by the propagandists chanting “free market, free market” when foreign players have ALWAYS been intervening.

I chuckle every time I read the various reasons purported why the Japanese and the US real estate markets are not comparable. The fallacy of any comparisons of the two countries misses the actual cause of inflated asset pricing.

It could be argued that Japanese regulators artificially lowered interest rates to increase capital investment to give Japanese firms a competitive advantage over other firms.

It could be argued that US regulators relaxed regulations to make US financial firms more competitive.

In the end both actions increased liquidity. The result of increased liquidity was that any excess liquidity that was not sopped up for the original purpose found its way into asset speculation.

The world central bankers now seem to be no different than the mid evil healers that believed that bloodletting was the cure for all ills. The Fed believes that more liquidity will solve all financial problems and have flooded the world market with excess liquidity. The sea of asset bubbles across the planet is a side effect of excess liquidity and nothing else. All cultural, demographic, resource, etc. differences have been made irrelevant. Free money changes everything…

But what do I know? I am just the village idiot…

“But what do I know? I am just the village idiot….” No, you’re just mid-evil. LOL.

In previous posts where some bloggers were bringing the argument for higher prices (bubble prices) due to excess liquidity, you were trying to make the point that the higher liquidity provided to the banks is not making its way to main street, therefore the prices will go down not up.

Now you bring the argument in the opposite direction attacking what you just supported before.

“In previous posts where some bloggers were bringing the argument for higher prices (bubble prices) due to excess liquidity, you were trying to make the point that the higher liquidity provided to the banks is not making its way to main street, therefore the prices will go down not up.

Now you bring the argument in the opposite direction attacking what you just supported before.â€

Is that you Janet? Hey everyone! blert was not so delusional!!!

Higher liquidity is NOT making its way to main street as my previous post suggested simply look at the different measures of M0, M1, M2, M3, etc. I thought we all knew this Janet. The excess liquidity has had minimal impact on GDP. Trading existing assets for every increasing prices has a very small impact on GDP. Banks and fund managers with access to the free money are buying up these assets and securitizing them. Janet you were in the meetings when this plan was hatched. How come you are acting like you don’t know the game? Banks are “investing†the excess liquidity in various markets. Fortune 500 companies are taking the excess liquidity and purchasing their own stock (buy backs) at heavily inflated prices. I know, I know Janet, you see no bubbles. Janet I think the real question is can this all be sustained forever? There has never been a time in history where you have a boom that is not followed by a bust. This is a law of nature not an economic theory. I believe I have not contradicted myself rather supported myself. Janet, this is called connecting the dots. You created the dots and I am just connecting them…

@what

“Higher liquidity is NOT making its way to main street as my previous post suggested”

I have to agree in regards to housing. I live in a flyover state. In good neighborhoods with good schools where households are in the top 20% income percentile have seen the price of there home rise above the peak 2007 price.

Just 10 miles away in low income areas I see houses that are still 20% to 30% below peak 2007 prices and are not going up at all. I would say these house are sitting at 2000 or 2001 prices.

What? The village idiot? You said it. Be sure to get the last word, you never disappoint!

Yup

This is what you have to ask yourself…is this a bubble like the many housing bubbles that California has experienced before? In that case you wait for the bubble to pop and buy. Or is this bubble part of a larger bubble that will affect your way of life moving forward?

Nope…

If you think we are in another standard California bubble without inflation risk, buy when bubble pops. If you think we are heading towards inflation or hyper-inflation, read this blog post:

http://gonzalolira.blogspot.com/2011/02/inflation-hyperinflation-and-real.html

Gonzalo Lira is making a reasonable argument (with some logical flaws) using the eternal 2 variables “all other things being equal”. In real world there are far more than 2 variables and all of them feed into each other – try something like 300 variables all feeding into each other. The system is too complex for any human being, even with a super computer, to predict the outcome with accuracy. Maybe someone is lucky to guess the direction correctly; that would be a major accomplishment. Trying to guess the amplitude of that direction is impossible.

The flaw in Gonzalo’s argument: he says that in a hyperinflation most sellers will not put their homes on the market (that is correct). Then, he says that few left with a house listed will sell it for almost nothing. However, low supply means higher NOMINAL prices even if real price will be lower. Lets assume that demand drops 80%. If the supply drops 95%, you might make the case for a higher NOMINAL price.

You see, in real life things are not so simple or black and white. Most of the time you see different shades of gray. For more fallacies in Gonzalo’s argument you may browse through some of the comments under his post.

They come and they go here in CA but they still come here, new residential starts have been down for a while and eventually demand will outpace supply “mid to late seventies”, “lotto lines”, “yup double escrows” and don’t forget land contract sales. History is sure to repeat and like Kenny says “you got to know when to hold and know when to fold” I love CA real estate.

I am on second…

Irvine as of today has an inventory of 831 hiuses +8% respect to a month ago and +79% respect to one year ago. If the trends contunues we will be at 1000 house before we know it.

some flippers do seem now bag holders….they cannot get out and they are trying to lease (at some crazy price) and they cannot even lease.

Interesting times ahead.

Here’s a flip that didn’t work out: http://www.redfin.com/CA/North-Hollywood/12414-Laurel-Terrace-Dr-91604/home/5248718

House in Studio City. Asking $819k. Then lowers to $799k. Then to $779k for a long time. Then delisted, relisted, and sold for $739k.

I visited this house while it was at $799k a few months ago. I stayed for an hour because the realtor kept talking to me. Wouldn’t stop. I was the only person at the open house. He was very talkative and overly-friendly, in a nervous kind of way.

He told me the house had been bought by a company that specializes in flipping. I’m not sure he was supposed to say that. He also said it was a difficult sell because it wasn’t a good house for a family, since it was only 2/1 and had no backyard.

Yes, there’s a “yard,” but it’s steep. Not much you can do with it.

Yes, there’s a Buddha shrine in the yard. And a vintage movie camera desk lamp (this being Studio City). So it was nicely staged.

Realtor called me a few times afterward, giving me heads up on the coming price drops.

Anyway, I didn’t make an offer. The air conditioner atop the roof look very old. And a newly installed air vent in a wall was bent and didn’t quite fit right. It made me wonder about the quality of the refurbishing.

Yes, there was a brand new granite-top kitchen.

Odd thing, the Redfin listing says it was last sold in 2005 for $707k, yet the realtor spoke as if it was only recently bought by the flipping company, so I wonder if there’s a previous sale not publicly listed?

Landlord….typical RE agent who probally knows very little other then the owner lost on this sale. BTW pending at 739k, most likely they took less and with commission and cost they like so many selling now are in the red.

$707k looks like the public records price of 2005, you can exempt a properties sold price from MLS, but never from public records.

Robert, FWIW, the Bureau of Labor Statistics inflation calculator – http://www.bls.gov/data/inflation_calculator.htm – says that $707k in 2005 is the equivalent of over $861k today.

So they’d have had to sell that house at $861k just to keep up with inflation.

Of course, Blert says that BLS online calculator underestimates the rate of inflation.

“But then you get the house horny brigade telling you that incomes simply don’t matter.”

I’m not house horny and I’m telling you median incomes don’t matter in SoCal like they do for the rest of the country. Median incomes in SoCal are barely more than the rest of the country, yet homes cost twice as much. So, you’re right, median incomes don’t matter (like they do for the rest of the country).

You do realize that the real homes of genius series just illustrates to prove that point?

Let’s see:

-The first place is just down the street from 2 drug rehab centers. What a great neighborhood!

-The second place is close by a piercing parlor and PCC. Can you say “Sex and Drugs and Rock and Roll?” I’m surprised the the listing doesn’t tout all the “Recreational Opportunities” available

-And the third place? Well, on the plus side via Zillow, they really have done a fine job of rehabbing the place, The backyard looks great, the staging looks nice, and so forth. Quiet street too.

That said, no amount of wide angle shots can get around the fact that this place is tiny. That and the Garage has been turned into a sort of 2nd living room/bedroom, meaning that you get to leave your car outside to bake in the sun and smog. Oh, and let’s not forget the drug rehab place about 1000 feet away.

Add the smog and summer heat in Pasadena, and…. Well, you get the idea.

Just a thought.

VicB

Question for posters: flippers are first and foremost concerned with turning a quick profit. But in determining the right place to buy and flip, is part of the analysis looking at the “price stability of the neighborhood”? In other words are they really concerned with what prices have historically performed because they know they can get a return in a particular neighborhood? Or is the analysis strictly around recent housing and activity and what will move the fastest? I have my own assumptions but curious what others think.

My guess is that the average flipper does what he/she knows over and over again until it no longer works. They may gain some knowledge over time but I think we have seen over and over again during bull runs how everyone thinks they are a genius when something makes money. I knew a lot of day traders back in the day who would explain to me how smart they were until they weren’t…

Hahaha, a brand new show on HGTV called “Flipping Moms” is on now.

Description reads, “business-savvy mothers who are also best friends, want to flip a home in Southern California and earn a profit.”

I can’t wait to see how this premiere show ends.

They are VERY LATE to the game…

Bad news, they sold the home for a profit, declared they have great new careers, and are going on to their next flip. Oy!

What’s striking about these properties is that ANYONE would throw even more good money after bad: They should’ve been torn down.

They are NOT suitable for a flip.

One of the costs of home ownership is opportunity. For example, there are some high paying jobs in N. and S. Dakota right now, courtesy of the Bakken oil field. There are also opportunities there to set up a business to profit from these well-paid oilmen. So, if you are renting and the job market isn’t so good, heading to the oilfield is relatively easy and painless. If you own an anchor in California, it’s a lot harder and more expensive to go to the current land of opportunity.

Leave a Reply