The remaking of an American housing bubble: Home prices are up 78 percent since 2000 and 30 percent since 2012.

You have to realize what makes a bubble tick. People get caught up in a deep rooted herd mentality. The absolute blindness that occurred between 2005 and 2007 was incredible. Yet a decade later, people have forgotten many of the reasons why the bubble hit in the first place. Toxic loans were merely a symptom of the bigger issue – and that bigger issue was that stagnant incomes need riskier debt to keep prices moving higher. The system is built on everything moving higher and the Fed lives off of this. Yet somehow, we had an enormous housing collapse. Today, prices are being driven higher by investors and foreign money. In a previous post we discussed how one housing development in Irvine had 80 percent of buyers from China paying all cash – all cash for a median price of $1.16 million. Even a couple of professionals can’t compete with all cash offers. The driver for pushing prices higher today is different but the result is the same – local families need to take on more precarious levels of debt to buy in today’s market. And the homeownership rate shows that many simply can’t compete.

The remaking of a housing bubble

There is now a growing voice of people echoing the views that a new bubble is emerging:

“(HousingWire) Evidence abounds that the bubble is now being re-inflated by these very same culprits:

Fannie Mae and Freddie Mac are once again offering 3% down payment loans, albeit with purported underwriting “safeguards.â€

Janet Yellen has yet to pull the plug on zero-interest rate loans that have only benefitted Wall Street and their congressional “partners,†which means that interest rates will no doubt begin to rise in 2016.

Government debt has climbed from just under $10 trillion in 2008 to more than $18 trillion.

Federal Housing Administration loans have become the “new sub-prime†loans according to many high-profile members of our industry.

There remains significant concern that the recasting HELOC loans will drive delinquencies upward.â€

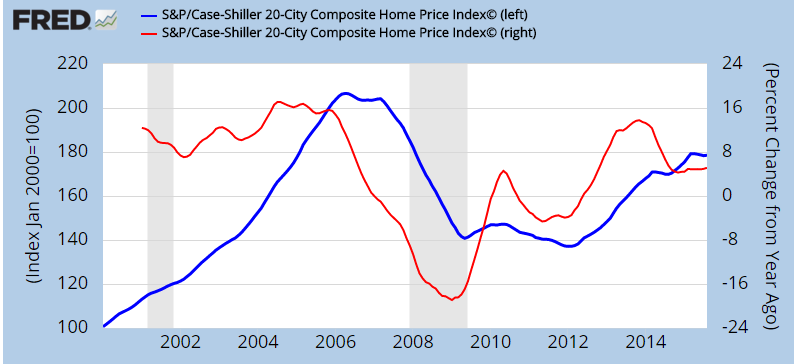

These are all important metrics. And the driver of this is household income is simply not keeping up with inflation in housing. Inflation in housing is being driven by post bailout banking policies, low inventory, investor demand, stock wealth, and foreign money. First, take a look at the Case Shiller Index:

Since 2000, home prices are up 78 percent and up 30 percent alone since 2012. Income has certainly not kept up. In order to keep up, non-investor households are needing to go into deeper debt just to buy a home. In places like California, you already have typical renter households spending 50 percent of their income on rents and for owners, 40 percent on housing payments. You also have house humping people buying homes and busting out kids. Many times, they don’t factor in the big expenses of daycare or the possibility of losing one income for a good duration. Buying a home is a big decision and people really don’t dive into the numbers that carefully (forget about opportunity cost). A minor recession is enough to send prices into reverse. And RealtyTrac is already showing a slight increase in foreclosure activity.

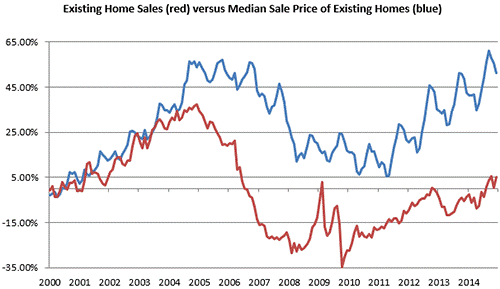

Here is another look at the data but looking at NAR figures:

Home prices are being pushed up on lower sales volume. In places like California with a lack of new home building, NIMBYism, foreign money, and investors are largely pricing out local families. It also feels like a bubble because you get people saying “I missed out since I didn’t buy at the bottom. I could have tons of equity now!â€Â You could have also bought thousands of stocks on discount at the bottom and made bigger profits. This is called speculation. Plus, you don’t take the money until you close escrow and sell. And then what? You either take your large winnings to a lower cost area or you are left chasing the zip code hunters in many markets. Many would rather be Taco Tuesday baby boomers in an expensive zip code eating Purina Dog Chow than taking their lottery ticket elsewhere. Hence, 2.3 million grown adults are living at home in California enjoying Friskies with their parents. Make no mistake, this is massive speculation.

The market is already showing signs of stalling. Price gains are definitely slowing down. Places like San Francisco still have an enormous amount of money flooding in from abroad but there is definitely a start-up bubble as well. Let us finish with an example:

100 W Le Roy Ave,

Arcadia, CA 91007

2 beds, 1 bath – 1,251 square feet

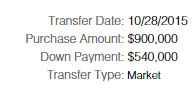

This home sold late in October of this year. Nothing special at all on this property. The home was purchased under an LLC. This is considered a starter home but look at how much was put down:

60 percent down payment on this very basic property. What is interesting is the property has an LLC listed as “100 Le Roy Home LLC†and is public. Feel free to look it up. Even a young professional couple making $150,000 or $200,000 a year is going to have a tough time saving up $540,000. Many times these places are bought up, torn down, and a mega mansion is built up. Take a look at the neighboring property:

$900,000 for this property with a $540,000 down payment. And you wonder why local families are having a tough time? This is a complicated puzzle but there is definitely a smell of speculation in the air.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

131 Responses to “The remaking of an American housing bubble: Home prices are up 78 percent since 2000 and 30 percent since 2012.”

This is basicaly the cost of land. I know in good areas of Bellevue, WA before 2007 one city flat lot was selling between $800,000 – 1,000,000 (at $800,000 it would have sold in less than a week). We know that the bubble was reflated and we know that CA land comands a little bit of premium for the weather.

I agree that prices are insane and we know why, therefore this price does not suprises me.

What I don’t know in detail is how much is the demand in Arcadia, CA vs. Bellevue, WA.

it’s pretty ignorant to think socal is only because of the weather. it’s also because of the economy. California is the largest gdp in the country and almost DOUBLES the next highest gdp state. It is also the 8th largest gdp in the world if you’re comparing it to COUNTRIES. It has almost the same gdp as UK or France. Think about it. THAT’S WHY it’s so expensive to live here.

What about the population? It better have the highest GDP because it has the most population.

What counts is GDP per capita and even more, how is that GDP distributed. If you have few individuals super rich and 40 million poor people around them, that doesn’t make for a good standard of living for most people. If you are at the very top of the “food chain”, good for you. If you are not, I pity you.

Brazil has a very high GDP but very large population. There are few super rich at the top and the rest slums. That is the future of CA.

” California is the largest gdp in the country ”

And it has most population, so irrelevant. GDP per capita is almost irrelevant too as most of income goes to living cost and other mandatory expenses.

So California people actually have less purchasing power than in most other places and GDP is a very poor indicator of that.

Obviously you know it or you wouldn’t use GDP as a measurement of ‘doing well’ for ordinary citizens.

I grew up in Bellevue, but I moved to the East side of the mountains and it is much better here!

It’s all this huge money we’re pulling down. Why, the old Mexican guy who pushed his ice cream cart past the shop here must be making $150k, right?

(In all truth, I bet he’s making more than me.)

And by the way, Friskies is for amateurs. Purina Cat Chow is where it’s at, that and a livestock supplement called Calf Manna. Source: in the starving seventies, I had to be imaginative in my diet sometimes.

I offer the tired old trope “It’s different this time”. Find the answer that best fits below.

A) Housing to go up “foevah”.

B) It’s different this time but will end the same.

C) Free Willy! (sorry)

D) Endless foreign money levitates blight, “foevah”.

E) $15/hr Wal-Mart job will put a floor under housing.

F) Subprime loans are thing of the past. (Although 8 year car loans are now in fashion)

G) Prices are based on solid fundamentals.

*Extra credit to reader Bonzo for submitting new answers!

Wal-Mart’s finished.

H) We are experiencing the gentrification of So Cal.

I) So Cal is becoming an international destination like New York, Paris, and London are.

J) They ain’t making any more land.

K) Surf and ski in the same day (nobody does this)

L) Always amazing climate (forget about droughts, mudslides, fires, floods and the fact that people continue to flock to other cities with subjectively less desirable climates)

M) Diversity (ethnic restaurants)

O) Everyone wants to live here (nothing sets a higher standard of living like crowds and queuing)

P) Prime coastal highly desirable is a sure thing (quick, look over there)

* – Because none of these things existed here in the past when the housing market has turned down

Not really, OC and San Diego have less foreign languages than Houston Texas. LA is a placed for international buyers but OC and Sd are not as much. The Chinese market is dropping in Orange County. Houston Texas and Dallas Texas and Austin are the next international big markets since they are cheaper.

Housing To Tank Hard Soon!

You rock Jim! And @ Booshi, you forgot

E) $15/hr Wal-Mart job will put a floor under housing.

F) Subprime loans are thing of the past. (Although 8 year car loans are now in fashion)

G) Prices are based on solid fundamentals.

I’m actually surprised that the Chinese government has not put a cap or just eliminated foreign investment into U.S. real estate. Seems like they would want to force those with the means to lease (I don’t think they actually buy property there but have like a 70 year lease or something along those lines) more domestically. That would definitely pull the rug out from under.

Cue the ‘foreign investment is so small that if they were to stop buying U.S. property it would barely dent prices’ crowd.

Bonzo, thank you. I’m going to fix it right now! “G” is a doozy and only the truly gifted could say that with a straight face without botching the delivery lol.

It is the lesser of evils. If they close off the outflow of funds then the Domestic housing ponzi gets hit with an avalanche of sellers and zero buyers. Letting the “rats” leave the sinking ship is the preferable choice. In the end, when it all comes crashing down around them, they can blame the ex-pats as disloyal traitors who absconded with the wealth and are to blame for everything. Those in charge are just hoping that no one notices that they were some of the “rats” also when they start pointing fingers.

Home prices are up 30% since 2012, the same time you first began your mantra about housing prices to tank. So now going on 4 years later, you’re still repeating the same thing. Ha. One year you’ll get it right. Maybe 2023…

What you seem to forget is that QE started around that time, if QE had not started and continued through 2014 then Jim’s prediction would have been correct. In 2015 without QE propping up real estate prices have stagnated and in some areas are coming down.

A broken Taylor will be right twice a day.

Doc; I did look up the LLC, but couldn’t find much. Bit of a cheesy showcasing name – from my experience in other parts of the world, choosing the address as company name suggests to me a small time developer/flipper, although that is purely just a guess.

Also, is this information correct (source: Z)… did it first sell on 06/06/14 for $997,000 (?), then coming back to market with an asking price of $1,080,000, before its more recent transaction of $900,000. (?) If so, someone took a slight bit of a bath on it.

http://www.zillow.com/homedetails/100-W-Le-Roy-Ave-Arcadia-CA-91007/20893295_zpid/

https://www.redfin.com/CA/Arcadia/100-W-Le-Roy-Ave-91007/home/7236142

http://www.trulia.com/homes/California/Arcadia/sold/4128619-100-W-Le-Roy-Ave-Arcadia-CA-91007

There’s a couple of rentals on same Ave… a few doors down, number 126 = a 3 bed bungalow-looking type house, asking $3,200/mo.

http://www.zillow.com/homedetails/126-W-Le-Roy-Ave-Arcadia-CA-91007/20893266_zpid/

Quite plush inside (although I will never cease to be amazed on olde-fashioned US kitchen spec.. and they claim it’s a newish kitchen too. It’s ok-ish, but European mid-high end modern kitchens are have all units as flat white/cream surfaces which are easy to wipe down… rather than bevelled doors for grease to get trapped in, and auto-cushioning smooth glide closing, often with no handles at all on unit doors but push-in to reopen.)

And 169, a four-bed, asking $3,300/mo.

http://www.zillow.com/homedetails/169-W-Le-Roy-Ave-Arcadia-CA-91007/20893250_zpid/

Really(?).

Info I’m looking at suggests 126 = Last sold: Nov 2015 for $975,000

And 169 = Last sold: Sept 2015 for $888,000

I wonder when we will see another False Flag attack, like the one in Paris:

https://www.youtube.com/watch?v=V0Zzx7JI_os

When people will oppose war again.

Like the French would kill their own people. Daesh is real and essentially were dealing with something like the nazi werewolves that were active in the last days of WWII and a bit afterward.

sooner than you think in the USA

https://www.youtube.com/watch?v=Uvd91OU_Jbo

possible false flag scenario

If you want to see California’s future, look to Detroit. 90 years ago, Detroit experienced the biggest housing bubble the world had ever seen, up to that point. Tens of thousands of homes were built in the span of a few years to house all the workers flooding into the city to work in the automobile industry. Now the descendants of those workers have moved to the fairly affluent suburbs, leaving the old and crumbling houses from the 1920’s to those who can’t afford anything better. And those houses were built of brick. Imagine what all those plywood McMansions in all the “desirable” zip codes will look like in 90 years. Will suburbs sprout up on the other side of the mountains as hundreds of thousands of migrants move up from the south? I don’t think so. This current housing bubble is merely a blip in a housing story that will soon become about more than down payments and foreign buyers.

Dmsn: I wish that were the case, but I really don’t think that will be the future of California, particularly within 30 miles or so of the coast. California’s economy is exponentially more diverse than that of Detroit’s. Detroit’s economy was predicated almost exclusively on the automotive industry. When much of that industry left, so did Detroit’s economy. There would have to be some really odd event for most of California’s different industries to leave, which will likely never happen, at least anytime within anyone’s lifetime here. Also, as much as everyone wants to dismiss California’s weather as a motivation for people to live here, I feel that the weather is a significant factor keeping people here. It is for me anyway.

One way I think your speculation might come true within our lifetimes is if the total population starts to decline significantly, but I wouldn’t count on that given continual the influx of immigrants.

Nobody is “dismissing” the weather as a motivating factor. What’s primarily in question is its aggregate amount of influence relative to all other factors.

First, nothing goes up forever, not even real estate! It will reset at some point! However, the bigger issue is that California’s real estate situation, simply reflects a new economic reality. Rich Chinese are buying up California real estate because they are now arguably the largest economy in the world! Their wealth has been made at the expense of American jobs, wages, and benefits! Silicone Valley, Silicone Beach, have become exclusive real estate zip codes because technology is the future, thus where the highest skills and highest paid jobs are. But, this has also come at a steep costs … technology has eliminated or reduced the need for workers in almost every discipline! While many scratch their heads wondering how high real estate can go, the current structure is also explainable and scarily one wonders if the fundamentals will ever return to the way they were!

Speaking of Silicon Beach – Phase II residential is nearing completion in Playa Vista, trickling in some 2600 homes to the RE inventory. The timing when these homes come to market will be interesting.

Retail consumption this quarter will be weak. Tech and startups are cutting back and getting the squeeze for profits before fed hike. If we have more of the same, China will invest heavily here. But if things turn south, which i’m sure most of us would enjoy, this area will hurt bad. Surrounding towns Westchester, Playa del Rey, Mar Vista are betting the local tech boom is their golden ticket to sell out. If you were in this area around 2002 the vacancy of playa vista was a sad sight. Excessive amount of new homes empty going for a bargain, that was Phase I. Brought down surrounding areas will it. By Spring time of next year will be showtime for the area. I’m afraid that the market again will not be ready.

This. Playa Vista is probably the most visible example of the west side tech bubble’s excesses. My understanding is that a lot of the construction is slated to become rental inventory along with the new units being built nearby at Howard Hughes Center.

Something interesting is that this is also coinciding with a downturn in SFH rental demand in Venice, Mar Vista, Culver City, and Westchester. A plethora of SFH rentals continue to languish on market for the past few to several months with price reductions in lockstep. Up until early this summer, these types of rentals wouldn’t last on the market for more than a few weeks, so something has clearly shifted. There are also examples of asking rents below what are indicated to be previous rent contract prices from ’12-’14.

What I’m also observing is that some these landlords are having trouble getting tenants through self listing channels, so they’ve shifted to listing through brokers with a resultant increase in price. No doubt those brokers are cluelessly representing to the landlord that even in a sea of waning demand, they can pull in a tenant at a higher price due to having special marketing powers.

The significance of this can’t be explained away as “make me move” pricing or “asking prices don’t matter” since vacancies top the list of a landlord’s cash flow killers. It also can’t be simply a seasonal distortion as there are a lot of these rentals which have been on market since summer and the past few fall/winter seasons have seen strong demand.

SFH = Single Family Homes. I had to look it up. I’m used to the term ‘voids’ (for each month a rental property remains untenanted) rather than vacancies, but can roll with both, especially if there really are indications of landlords struggling to find tenants. I hope it is part of a new trend. Yes; voids/vacancies are where it begins to bite on leveraged landlords. Can soon knock the smile from their faces.

Let’s see if those landlords who’ve turned to agents after failing with self-listing get tenants, or whether they just incur more voids, and fees.

__________

The anecdotal is consistent with falling rents, because the rental achieved recently is lower than the rental achieved earlier. However, we can add to the anecdotal because one way to square the circle is to propose that the landlord took all that time because they couldn’t at first accept that they were going to have to accept a lower rent in order for the market to clear. Basically, the market stayed *irrational* longer than they could stay solvent, so eventually they folded and let at a lower price.

It also suggests two tricky questions for landlords. How long do you keep a property void in order to wait for a pinch point in the mismatch between supply and demand to allow you to lock in the rent you want, and how many times does ‘bad luck’ on this score result in landlords wiping out all their profits? On thin margins even a single month void is bad news. The take home message is that a wise landlord with any sense wouldn’t hold the property void for too long. If that meant pulling the rent down sharply then plenty of landlords will do just that, with the earlier entrants able to pull further down without turning cash flows negative. In the teeth of the next recession with all these piss weak late entrant leveraged landlords desperate to avoid voids, rents could fall quite sharply. Sweet. Some late entrant landlords are going to find that a 5% gross yield was just a ticket to an enormous capital loss on an investment with a negative carry. Double sweet.

At least in Bay Area, regular tech wages have plateaued, but asking rents keep going up. A lot of new construction that was banking on higher rents is going to go bankrupt.

In Pasadena, there appears to be an increasing cry for rent control: http://www.pasadenaweekly.com/cms/story/detail/?id=15178

Wise, experienced landlords know that you can’t just buy a property and expect a guaranteed cash flow. Being a landlord is risky.

Among the risks are laws that favor tenants. And the threat of more such laws, because tenant voters outnumber landlord voters.

Curious, what do you consider an acceptable return on your investment as a landlord! I sold the family home in So. Cal in 2014 after my Mom died. The house was 60 years old and had never been updated. I considered moving there in 5 years or so, and would rent it out in the meantime. But it required significant remodeling and after including all those costs amortizing it out, I figured I would get 2% or less return, based on the homes value. I ended up selling, and walked away with a considerable sum of cash that ultimately gives me a lot of flexibility.

a friend’s parents demoed their house in south torrance to the studs and rebuilt a larger more modern home for less than $300,000. my friend is going to inherit it

bonzo: I’m actually surprised that the Chinese government has not put a cap or just eliminated foreign investment into U.S. real estate.

As was mentioned in the previous thread, Chinese government officials ARE the ones investing in U.S. real estate.

You really think it’s possible to become a billionaire, or even a hundred millionaire, in China or Russia, without either being, or being in bed with, top government officials?

You forgot to add the US to that list. Or any country for that matter.

The corruption I see on a daily basis is enabled/condoned by government officials. Government is a fantastic incubator of criminal enterprises.

“Government is a fantastic incubator of criminal enterprises.”

Therefore, elect candidates who are for smaller government. That way you have a smaller criminal enterprise.

This is common in my neighborhood. All the 1500sq ft homes built in the 50’s are bought and demoed and a 3500sq ft house is built on it. Presently prices are between $2.5-$5M for these properties. Who can afford these homes? I find it simply amazing.

Jim – I personally saw in Huntington Beach, those old 1500 sq ft houses being bought, demo’d, and a 4-unit condo being put in. 4X the traffic! 4X the accidents!

Maybe it’s just me but I vision a tenant and 5 to 10 illegals with him living in the property, paying the rent. Unofficially of course as officially these people don’t exist.

So not only 4* more cars, but 10-20 times.

I’m listening to Another Way To Die (Another Way to Die Cameron TSCC (Sarah Connor Chronicles – Summer Glau); YouTube

Doc: Many times these places are bought up, torn down, and a mega mansion is built up. Take a look at the neighboring property:

I see the build next-door as a comparison between the builds and the trend of what has been, (and perhaps still is in the view of others), of tear-downs and swanky rebuilds, in the money-never-runs-out forever higher houses prices glory-profit houses-are-everything worship economeh.

So; Down Payment: $540,000 on Purchase Price $900,000 – if the file-data-source can be relied upon(?). I wonder why they didn’t buy it outright in the flooded with money everywhere economeh.

Look at the pricing history of a house just down the way (on the market). Asking price chasing the market up (moar and moar and moar and moar – can’t get enough of that wonderful stuff ‘+HPI free money fortunes; gimme gimme’ ), but since backing down and down and down.

Motivated seller is ready to move, welcomes all offers!

http://www.zillow.com/homedetails/106-W-Le-Roy-Ave-Arcadia-CA-91007/20893296_zpid/

Now I’m watching/playing ‘R.E.M. – Shiny Happy People ‘ – and doing the dance too, like an idiot; it’s like that in bubble-land for the bubble people. The paradise of real-estate bubble wealth.

http://www.zillow.com/homedetails/106-W-Le-Roy-Ave-Arcadia-CA-91007/20893296_zpid/

___________________________

Depeche Mode; Everything Counts

https://www.youtube.com/watch?v=stOepiohN50

The grabbing hands grab all they can

All for themselves – after all

The grabbing hands grab all they can

All for themselves – after all

It’s a competitive world

Everything counts in large amounts

The graph on the wall

Tells the story of it all

Picture it now, see just how

The lies and deceit gained a little more power

Confidence – taken in

By a suntan and a grin

The grabbing hands grab all they can

All for themselves – after all

The grabbing hands grab all they can

All for themselves – after all

It’s a competitive world

Everything counts in large amounts

The grabbing hands grab all they can

Everything counts in large amounts

Talk about SHAMELESS LIES. Here’s a listing for a house described as situated “in the most coveted Westside location!”

So, just WHERE is the Westside’s “most coveted location”? The hills of Bel Air? The beaches of Malibu? Hombly Hills? Brentwood? Santa Monica?

No, the Westside’s “most coveted location” is in West L.A. — right beside an exit ramp to the 10 freeway: https://www.redfin.com/CA/Los-Angeles/2940-Selby-Ave-90064/home/6753338

Is this in palms area? I recall when in school there in W. LA that palms was the center of the apartment universe.

It’s on the north side of the 10 freeway, so I think it’s just north of Palms.

Does Palms extend north of the 10?

That’s a pretty good Photoshop job, taking out the inevitable bars on the windows and security company sign on the lawn.

It’s not Palms (apartment hell) but it’s on the border of that and Cheviot Hills. Just south of the Westside Pavillion. Not a bad area, but sort of tucked in an spot with no identity.

I live on the Westside and I can’t for the life of me understand why anyone would be willing to live this close to the 10 freeway, for any price. You are basically begging to get lung cancer.

Dean the air quality in that area is shite anyway, between el Segundo and the airport, besides the 405. I lived in Westchester for a bit and it was amazing how fast things like Windex bottles would turn brown.

I had read that anything close than 500 feet is especially bad because the car exhaust just lingers there. I don’t think you can build a school that close to the freeway for that very reason. It’s totally insane. I’ve gone to see some of those kinds of houses too, the sound of the cars going by is deafening, you can hear it even through double-paned windows. That’s why the open houses for these always have all the doors and windows closed and the air conditioning cranked up to the max.

That is the common sense perspective. You have to look at it from the agent perspective: “Quick and easy access to one of the most traversed freeways in the nation!!!” If you aren’t from the area, you probably picture a fast moving freeway like in the end credits from the first Tron movie. But those of us who have lived here long enough picture the old man on the walker passing up all the cars from the opening credits of Office Space.

Ooooh, memories, my old neighborhood! Nice houses but traffic was dangerous! Almost a mil for a 2 bedroom that close to the freeway? Somehow San Francisco looks cheap in comparison.

Bloody Alameda meeting highlights tenants’ growing ire

http://www.santacruzsentinel.com/business/20151105/bloody-alameda-meeting-highlights-tenants-growing-ire

This is where we currently rent and houses like the one we live in now have doubled in rent since we moved in 1.5 years ago. We couldn’t afford it if our landlords increased the rent to market value, which they could since there is no rent control here. All overflow from people being pushed out of the SF rental market. I just don’t understand who is paying $4000-5000/mo in rent for 1000 sqft 2/1 house…..

BayAreaJH, that’s a good article, thanks for posting it. Demonstrations, violence blood, I hope it makes the TV news.

I was talking to a guy a few days ago who’s an antique furniture restorer. He’s everyone’s go to guy when a patron scratches or scuffs the antique bar in a high end place, and he keeps all the bars and restaurants in this area looking good. He rents a hole in the wall apartment on the Paseo de San Antonio right in downtown San Jose, and the rent is $1800 for a small studio. Hells bells, I could live in a larger and nicer motel room for that.

Now granted, he’s a skilled tradesman, and horray for him. But where do these people who can pay $4000 or $5000 a month rent come from?? The vast majority of people here are struggling, making maybe $15k.

Add LA to the graph and really see how crazy it is. Even if the rest of the country is priced perfectly correctly, you can see the giant bubble LA is in. What are all of these investors going to do with these $500k+ houses in LA’s ghettos?

It seems like most members on this board continue to believe that housing prices will come down and this is not sustainable. Now that is the conclusion that I want and I believe should be. HOWEVER, look at the evidence that is right before your very own eyes and the tip of your nose. The bubble is reinflated and the psychopaths who are at the helm at the central banks, politicians and financial institutions benefit from high asset prices (real estate, stock, etc.) at the expense of us the working class. So why on earth do you think they will allow prices to fall? If your answer is “in the end the free market wins” then you are deluding yourself. There is no free market. The free market exists when the central banks and politicians win. When they lose they simply keep pressing the reset button.

Look, I am just as pissed and angry as the other guy. But there comes a time when you just have to chalk up a defeat as a defeat and just go on with your life.

It is interesting that the three services we need the most; housing, health care and education are all completely rigged.

You admit defeat and ‘get on with your life’ with a mega mortgage if you want to. Or maybe you are cheerleading people into the bubble.

_________

~Apparently, ownership means you can get on with your life, while renting, for some reason, means you are in limbo. Yet even owners seem to move from time to time.

~Are these jumbo mortgage super-high-price house buyers getting always on with their lives? Will they be doing when market turns down?

~The “get on with your life” meme is often another pot of VI bulls*** intended to convince the unwitting to part with their money.

~I live in rented and I’m still working, I’m pushing for promotion. My g/f has found a new job and we were able to move closer to her new work with ease. I can go on holiday if I choose. I don’t understand what part of my life is on hold.

~Of course buying is it’s far from fool-proof as a ‘getting on with life’ strategy’ as millions of people in negative equity or with little equity and stuck on interest only loan have found out – ranging from the most recent generation of FTBs through to people with growing families – there is no ‘ladder’, at the moment at least.

~The other VI bullshit line is that you need to “get on the ladder” / “get on with your life.” We are retired, “getting on with our lives” and happily renting.

~People either give into the pressure of those around them and let them control and dictate their lives, or they don’t. It’s a personal choice. I have no issue with those that feel they need to buy a house in order to have a complete life. They have their priorites and I have mine. It’s no so important to me. And it will cost me less becasue of it.

~Many here rent out of choice and could well afford to buy, even at today’s ridiculous asking prices. But, buying now would be equivalent to paying $75 for a bag of chips, affordable but stupid.

~‘Isn’t the stability with owning a property that you choose when to move whereas with renting you could be forced to move with just a few months notice?’

Lol – Tell that to everyone who goes into negative equity…

World War 3 is the war of government against its own people. Its happening across the globe. Destroy all of a nations institutions – financial, job market, education, healthcare, legal system. Import millions, including criminals and terrorists. Don’t like it? Then you must be racist/sexist/homophobic/judgemental/bitterly clinging to some antiquated notion of sovereignty for the individual and the nation state. Back into the coal mines slave!

Junior, you are describing neoliberalism to a t. It started with Nixon and really got rolling with Reagan.

Nimesh, with all due respect, what do you expect this forum’s users to do? Just stop talking about it and go cry in their soup? I get that your conclusion, and a reasonable one, is that the system is quite rigged against all but the deep pocketed and those connected to the central planning/government types will win while the rest lost. But it is in the discussion of it that people become educated about the exact levers (legislation, tax code, demographic change, whatever) that are directly related to the distortion in prices and markets. If those that are outraged just all turn into a one-tune chorus of “it’s all rigged and we’ve lost” then they risk being taken as conspiracy theorists and sore losers. Credibility is lost. One has to choose a theme to battle upon…and have some fucking faith that ultimately we still live in a democracy. Talk, educate, know the issues–a little feeling sorry for yourself is natural, but taking it to the point where you consider all action, including talking, futile, is, well, just pathetic, isn’t it?

Laura -This is pretty largely a spectator/snark site, have you tried the popcorn? If we keep a few people from buying high and selling low, so much the better.

But we don’t assume we have more weight in the mind of the average prole than the fact that everyone they played football with in high school has a mortgage now and they don’t.

We’re not trying to be The Economist here…. So really, try the popcorn.

Laura, you make some very good valid points. At times I just feel exhausted and just feel like giving up this fight. I live in Chicago and housing prices are going higher and higher. The bubble burst and then all of a sudden we were headed in the right direction and now prices went right back to the peak bubble prices. The only good thing is that prices have now stayed stuck at peak prices and haven’t gone past it. But you never know, with the central planner psychopaths what else will they do next?

There is this talk about negative interest rate policy. So in other words, screw the people who want to save.

I am playing by the rules and I am getting screwed so it at times it does feel disheartening. My health insurance company jacked up my premium and they introduced new rules for next year.

Nimesh: There is this talk about negative interest rate policy. So in other words, screw the people who want to save. I am playing by the rules and I am getting screwed so it at times it does feel disheartening. My health insurance company jacked up my premium and they introduced new rules for next year.

Give up if you want to. What is your alternative? Buy? Fine; do so if you wish/can, but don’t come looking for bailouts with excuses if the market turns down. Talk is talk. And even negative interest rate policy would find out some VIs (REITS ect) on swaps, and affect lending. You won’t be the only one with higher costs to pay (eg health insurance), which means people have less money velocity for rents / housing.

ps: great post by Laura.

I’m sure the evil powers-that-be didn’t want the last gravy train to derail either, but it did. The journey from trough to peak can take a very long time, depending on which wave we’re talking about, and depending on the area. Long enough to be discouraging. The last one took 7+ years to peak, and only 1-2 years to trough again. We’re ~5 years into this increase.

“So why on earth do you think they will allow prices to fall?”

They’ll do everything they can, yes. But as they are borrowing the money to keep the prices up they will eventually run out of people/countries to borrow from.

US internal loans (debt) are only about 40%, the rest is outside money.

The bubble is now blown so large it keeps on only with huge and continuous influx of money. Stop the influx because you can’t loan more and the bubble pops in weeks, not months.

The 80 billions per month from FED is just a small part of the influx.

LA and SF, Only millionaires need apply.

All you poor people go to Hemet, Lancaster, Stockton, Modesto.

Until the rich chi-coms buy up those homes too.

and if you’re not a millionaire you can also forget about such sought after destinations like Livermore, CA, West Covina, Santa Rosa, Sacramento, Santa Ana, and San Pedro/Harbor City!

LA’er

I guess we are packing up and heading for San Berdoo

Only the Chinese nobles can afford OC homes now.

Interesting news clip on the SF CBS news today, The FBI had placed microphones in the court house steps in SF to record defendants in a “investor real estate bid rigging case”.

Gee, I never thought that would happen. Bid Rigging? by honest realtors?

Just an FYI to ‘Bubble readers: acquaintances of mine just renegotiated their mortgage, through a lawyer, because they could no longer afford their monthly payments. The people are in their 60s and have lived large on leverage for years.

The lawyer negotiated a lower rate so they can stay in their dream home — but get this – a 40-year mortgage. 40. Year. Ah-ha-ha-ha.

http://www.theguardian.com/lifeandstyle/2015/nov/14/babies-an-impossible-dream-the-millennials-priced-out-of-parenthood

babies? an impossible dream for working class londoners or in any western nation

All part of Agenda 21. You can google it. It is all about TOTAL CONTROL.

The thing to remember about bubbles in house and stock prices is that THINGS ALWAYS REVERT TO THE MEAN. ALWAYS. It is as dependable as gravity, just not on as reliable a timetable.

Right now, measured by always historical measures, are at an all time high.

Which way will they go next?

History repeating? The Dot com bust/regional collapse in SF may well repeat around 2018/19 as part of the mid cycle bear trap for US house prices. Otherwise full steam ahead till the peak in 2024.

Check out this Redfin LIE — listing this condo as a HOT HOME: https://www.redfin.com/CA/Santa-Monica/1120-24th-St-90403/unit-B/home/6767870

This condo was listed some 40 days ago for $849k. It didn’t sell. So it was taken down and relisted at $845k — a “whooping” $4k reduction.

It was a HOT HOME before, didn’t sell, so after a month it’s relisted as a HOT HOME again, simply because it was relisted.

Furthermore, this home was last sold in 2013 for $610k. Now they’re seeking $849/845k after only 2 years?

Seems like buyers are balking. Good for them. I’m sure the seller can sell for a profit. Just not for an exorbitant profit.

There must be some people trying to flip houses on, who are feeling a slight touch of anxiety.

And in the meantime when they don’t own fully outright, but have leverage, there are repayments to make, and costs to pay.

If you are educated, articulate, capable of understanding compound interest and have some sense of liberty and self-determination you are enemy #1. The psychopaths running the asylum would rather you just go away and leave them to the tending of the lemmings and fleecing of the sheeple.

@ Nimesh who wrote:

“Laura, you make some very good valid points. At times I just feel exhausted and just feel like giving up this fight. I live in Chicago and housing prices are going higher and higher. The bubble burst and then all of a sudden we were headed in the right direction and now prices went right back to the peak bubble prices. The only good thing is that prices have now stayed stuck at peak prices and haven’t gone past it. But you never know, with the central planner psychopaths what else will they do next?

There is this talk about negative interest rate policy. So in other words, screw the people who want to save.

I am playing by the rules and I am getting screwed so it at times it does feel disheartening. My health insurance company jacked up my premium and they introduced new rules for next year.”

Nimesh – just wait til the big ‘ol property tax hike that Mayor Rummy pushed through the City Council without one dissention or floor discussion hits. The thing about this is not only will home owners get hit with on avg. a 900.00 per year increase on a 250k home assessed value – the renters are gonna get hit too not only with the typical annual landlord increase but tack on the increase on property taxes on multi unit buildings and there ya go – Utopia as defined by our buddy Mayor Rummy – the man who just a couple of years ago in wanting to get re-elected said no property tax increase would be part of his admin.

Hitting the road in 8 mos. and leaving this liberal ‘paradise’.

rj Chicago: It makes me wonder why people bother living in Chicago. If you want a high cost of living with taxes and fees galore, you might as well get good weather with it and live in LA/OC.

That comparison is too simplistic. To begin with, the Chicago region’s affordability factor is better than SoCal. Climate is only one consideration out of many factors and to that extent, people tend to focus on the extreme events to the exclusion of the typical and enjoyable events. Conversely, people are prone to overlook the extreme events which occur in SoCal. People in Chicago aren’t putting up with drought/water restrictions, mud/rockslides closing down thoroughfares, fires with resultant smoke/Santa Ana winds, deciding between paying for earthquake insurance or winging-it to hold out hope for a FEMA bail-out, and so on…

They have their problems and we have ours.

I’ve been wondering the same thing, although I keep hearing about the housing boom in downtown Chicago. The city and state are both broke, their finances are even worse than California’s was during the recession. If they are broke now, when the stock market and RE market are at new highs, what is going to happen to Chicago and Illinois budgets when (not if) we enter the next recession? I don’t see any way out of their situation except for massive cuts in services and pensions and massive increases in taxes, especially property taxes. When you raise income taxes, you incentivize high income earners to leave the state. Property owners, on the other hand, are hostages and make easy targets. They are already talking about this. I can’t for the life of me understand why people would be buying real estate in the city if Chicago right now, you are asking to get robbed (both literally and metaphorically from what I hear). Would be interested to hear from people who live there.

I have lived in Chicago for 30 years, and live in a nice middle class neighborhood, West Ridge/ West Rogers Park, which is a “forgotten” neighborhood, with great architecture and conveniences, but is not at this moment “trendy” or “fashionable”, and scored a condo in 2013 for what feels like a gift price. Right now, my area and adjacent neighborhoods like Hollywood Park and Peterson Woods, have incredible deals on houses. Easy drive to rail stops to take the train downtown, a lot of retail in the area, and a huge selection of private schools, and some good public schools- while the CPS system is rated badly overall, there are individual schools that are very highly rated.

Nimesh is speaking of the “prime” neighborhoods downtown and directly outside of it, which have become absurdly valued, and where mansions costing $5M or more are being built, with many over $10M. Downtown, near north, Lincoln Park, Bucktown, Wicker Park, West Town, are all absurdly overpriced, and South Loop, which was the site of a vast number of foreclosures in new high rise towers, is now ramping up, as are Lakeview, Lincoln Square, and Ravenswood.

Well, I can remember when Wicker Park, just for one sorry example, was a ragged slum, and still sort of looks like it, while many “unfashionable” nabes like West Ridge, Portage Park, Saganash Park, Edison Park, and Jefferson Park are loaded with fine housing stock at reasonable prices. These are solid areas with low crime and access to rapid transportation, as well as other urban amenities. There is no way you could touch this Hollywood Park home for less than $3M ANYWHERE in the Los Angeles area:

http://www.realtor.com/realestateandhomes-detail/3520-W-Thorndale-Ave_Chicago_IL_60659_M84533-54185?row=8

Beautiful, huge house with great architecture in nabe stuffed with similar homes, in quiet area close to METRA and retail. It’s been on the market a long time. Note it’s a foreclosure and they can be difficult to close, which is probably the problem. I think someone with a big down stroke could knock $100K off the price at this point, and I’d try it.

Here’s one in adjacent North Park, which is the quietest, dullest, most low-crime nabe in Chicago. You have to drive to retail, but what a nice house for the money:

http://www.realtor.com/realestateandhomes-detail/6112-N-Central-Park-Ave_Chicago_IL_60659_M83057-08447?row=15

A description of West Rogers Park – West Ridge for strangers:

https://en.wikipedia.org/wiki/West_Ridge,_Chicago

That first home is great, hardly see those type of homes in LA/OC, some in Sherman Oaks and Encino. They would costs 1.1 Mil though ha

“If they are broke now, when the stock market and RE market are at new highs, what is going to happen to Chicago and Illinois budgets when (not if) we enter the next recession?”

That’s going to be more of a problem for California than Illinois.

“Nimesh is speaking of the “prime†neighborhoods downtown and directly outside of it”

Spot-on observation, Laura. As you have mentioned, in the Chicago area the likelihood of finding a relatively affordable home to purchase in a nice livable neighborhood without being forced to succumb to a soul sucking commute is still a reasonable expectation.

Not so much in SoCal. Even the ghetto is unreasonably overpriced in SoCal. Yes, I know they are all gentrifying and we will no longer have any ghettos along with the world peace which should be coming along soon.

The exception available to the masses is to move way out into the 909 and 661 areas. I know some people like those areas, but I don’t think that’s the greener grass you’ll find envisioned by starry eyed new arrivals coming from Illinois. They’d be just as well if not better off exiting the Interstate with their U-Haul in Las Vegas or Phoenix.

@Hotel California, why would you say that CA has a bigger budgetary problem than IL? We are currently running a surplus and IL is still running larger and larger deficits even as tax revenues have increased. I’m sure in the next recession, CA will also fall back into a budgetary deficit, but at least there is a rainy day fund that is being set aside now, what will happen to IL?

Dean, thats not the claim I’m making. Fact is, we can only speculate as to what the future holds for either state. What is known right now is that California has a greater level of exposure to cap gains and bubble sector fluctuations than Illinois.

It’s true that California currently has a budget surplus. What it also has a surplus of is deferred problems.

California budget surpluses are meaningless, because whenever there’s a surplus, the govt employees’ unions demand the surplus be spent on raises and increased benefits.

Raises and benefits which are never “given back” in hard economic times, but remain a perpetual financial burden.

When there’s a surplus — “Now that there’s money, you can afford to give us raises.”

When there’s a deficit — “In these hard economic times, you need to pump more money into the economy via good pay for state workers.”

Son of a Landlord writes:

“California budget surpluses are meaningless, because whenever there’s a surplus, the govt employees’ unions demand the surplus be spent on raises and increased benefits.

Raises and benefits which are never “given back†in hard economic times, but remain a perpetual financial burden.

When there’s a surplus — “Now that there’s money, you can afford to give us raises.â€

When there’s a deficit — “In these hard economic times, you need to pump more money into the economy via good pay for state workers.†”

Whereas Democrats argue that when the budget is controlled by “conservatives”:

Budget Surpluses result in demands to cut taxes because clearly government is being too greedy.

While,

Budget Deficits result in demands to cut public benefits because we clearly can’t afford them.

Pick your poison. Both dogmatic descriptions of “the other side” have elements of truth but are overly simplistic – which is part of why this scientist tries to be apolitical.

Apolitical writes:

“Raises and benefits which are never “given back†in hard economic times, but remain a perpetual financial burden.

When there’s a surplus — ‘Now that there’s money, you can afford to give us raises.'”

Not really, when the recession hit, any teacher in LAUSD hired after 2004 was let go.

Teachers’ pay was cut for four years in the form of furlough days – up to 10 per year.

The amount that teachers received in a recent pay increase is far less than COLA – which they do not receive.

@Dean, Hotel California is correct about California being at greater exposure than Chicago or Illinois in the next recession.

California papered over its debts (issued lots of bonds) whereas Chicago/Illinois picked a different solution. So California sacrificed the future (issued lots of bonds i.e. loans) to pay the post-2008 deficits. Also, California is deeply tied to the stock markets. The exploding home prices in Silicon Valley and the desirable parts of SoCal is a direct reflection of this. Margin debt (loans) are at an all time high. Margin loans are what people with stock portfolios use to avoid selling their stocks. The billionaire Larry Ellison of Oracle is the most notable person who uses his stock holdings as collateral for loans to buy very expensive real estate.

@Dean, also California has a higher level of debt on a per capita and a GDP basis than Illinois. On a total debt basis, California completely eclipses everyone else.

So if the Federal Reserve starts pushing up interest rates, those of us in the more expensive parts of California will need to put on our hard hats and watch out for the sh*t storm that is going to hit.

ernst, I assumed it was common knowledge that California has a large exposure to cap gain volatility.

It’s good sport these days to mock Chicago and Illinois, but I find it very peculiar when it comes from interests in California. Illinois is being forced to swallow its medicine which is a good thing in the long run. Better now than later.

Dr. Housing Bubble is always citing these million dollar properties as evidence of over valued/bubbled real estate. Here in Sacramento, I just checked the comps on my 3 BR 1 Ba, good area, 60’s house on one acre, 10 minutes to downtown and from the Capitol building, and I’d be lucky to get $200K for it. So it makes me think the rarefied atmosphere of Southern California and the Bay Area are hardly good examples of the general state of the real estate market in California.

Brian Richards: considering So Cal (LA to SD) and the Bay Area are the two major population centers in California, the example properties cited by DHB are often quite relevant. Perhaps some are exaggerated examples, but they are relevant examples nonetheless.

It wouldn’t really make much sense to frequently provide examples from Eureka and Ridgecrest, since those aren’t places where most people live. I would posit that Sacramento is more of a “rarified atmosphereâ€, since more people live in So Cal and the Bay Area.

When you’re looking at properties for sale, check out the kid’s rooms. Nine times out of ten you’ll see a kid’s bed in one room, and a crib in the other.

Families hit that point where they can’t afford day care for two kids and make that house payment, even with both parents working, and they can’t afford to have mom quit her job, because dad can’t make the house payment on his own.

It’s a Catch-22 that these panicked buyers never take into account. It’s always, “we’ll figure it out later”, then they get trapped.

Shoeguy: that’s a big reason why I don’t want to buy in the current market even though I can technically “afford†to do so (well that, and the current prices are just flat out ridiculous to me relative to median and average incomes for any given area). What happens if we take out the maximum mortgage we qualify for, and then my wife and/or I lose our job and can’t find an equivalent-paying one? We might stand a good chance of losing the house once we burn through our savings. I ideally want to buy a place that we can afford on only one of our incomes so that we are not totally screwed in case an unforeseen event occurs. I am definitely not someone to throw caution to the wind and “figure it out later†as you noted. And I only have one kid!

Yeap, housing, retirement, kids, taxes and medical expenses. Very few people can afford them all. Ya have to pick 2 or 3.

The US Fed will keep rates low for as long as it takes. There is no viable alternative to the dollar despite all its flaws and our soon to be 20 trillion debt so they are free to set the rules as they wish. They reinflated the stock market and housing and will not back down. China’s yuan? Not ready to supplant the dollar for at least another decade or two. Yes the housing market is distorted but I don’t see the Fed backing down. Higher asset/housing prices is the desired goal.

“Higher asset/housing prices is the desired goal.”

Were they the desired goal in 2007-2009? You can answer the question to yourself in all honesty.

Many market participants on the owner side are smug with such a view. Others on the high price buying side are gambling that’s Fed . My own view is that the Fed is positioning the banks to ride out a correction followed by fresh profitable lending on prime.

Prime bubble, and young people up against it vs those prices and putting anything away towards retirement.

Also I feel for all these younger people who are not only massively priced out of housing, but also putting very little aside toward a pension. You can’t live on fresh air in older age, which comes around too quickly. I pushed my sister into going into her company scheme about 18 months ago, and she’s now got a pitiful $7611 (approx) in her pension pot, aged 34. Her employer doesn’t offer a very good scheme; something like a 3% match. She puts in 3% of wage a month and they match it to 3% max. At least I talked my brother-in-law into taking his up the offer from his new company when he joined some 18 months ago. Good scheme with something like a 6% match, or maybe even better than that.. maybe it was he puts in 3% and they put in 6%.

____________

Nov 28, 2014. A survey conducted this year by Harris Poll for Wells Fargo found that middle-class U.S. residents aged 25 to 75 have set aside a median of only $20,000 for their retirement. One-third of them reported they are not contributing at all to a 401(k), an IRA or any other retirement plan. Of those who are saving, the median amount reported was $125 a month.

http://www.seattletimes.com/business/boeing-will-freeze-pensions-for-68000-nonunion-employees/

As with the early 2000’s bubble, higher asset prices is only a means to an end. The goal of robust, sustaining economic growth has failed once again.

I’m just curious, and I hope you will entertain my question. Those of you who are priced out of Los Angeles and the immediate surrounding areas, are you considering purchasing in other areas of Southern California? If so where?

I’m not sure I would say I am “priced out†necessarily, but there is no way I am going to pay the current inflated prices for real estate. The net result is the same, I suppose (I’m not buying anytime soon).

To answer your question, I am not really considering anywhere other than coastal OC. Most affordable places in So Cal that I know of are all inland (such as Riverside, San Bernardino, Palmdale, etc), have ridiculously hot weather, lesser job prospects, and do not have good schools.

Regarding schools: I guess you could send your kid to private school to circumvent bad public schools, but at $700-$1000+ per month for private school (which increases every year), you might as well just apply that $700-$1000+ per month to a mortgage and live in a nicer place with good public schools.

@Hunan: No, we will not be telling you the next great cheap area for your chinese money to destroy.

Good one. You got me. (sarcasm)

Remember, small-minded people can only excel on a small level if ever.

those making 75k?? else we need new section to discuss rv or van parking in so cal??

“The US Fed will keep rates low for as long as it takes”

It is going to be bad either way:

1. If they raise the rates even 0.25% they will be blamed for blowing up an already colapsing economy. The blame will be right at their feet. The question is – will they want that close to elections????!!!….

2. If they don’t raise the rate, they lose all credibility for 2 reasons:

a) How can you justify the zero rate after 7 years of “recovery”??? The “recovery” will be questioned even by the most gulible market participants.

b) They said that they will raise the rate for so long that nobody listens to them anymore – the credibility of the FED is lost.

If they don’t do anything it is still bad because of very high risk in the market, the participants not knowing which way to go. High risk means high volatility. It is only so much the “plunging team” can do to defy gravity.

The only possible course of action will be a raise of 0.25% followed by another QE. After so many QEs the strategy has a diminishing effect. No real impact. I am just talking about the psychological impact.

“Since 2000, home prices are up 78 percent and up 30 percent alone since 2012.”

is that asking price or selling price? ’cause where I am zillow is ticking up “home values” every single week, but if you look at what actually sells it’s about 2/3 of what zillow says.

heh. got one house near where I live been for sale for six months, decent place, has a sign out front “no credit check required!” for the last three. oh yeah, now THAT’s a good sign ….

hey look at fillmore in east ventura county, north of simi valley, a few years ago it was a sleepy backwater little town, now ventura home sales are up and a one bedroom stye is rentng for $1100. absolutely unbelievable to me.

Santa Paula, Fillmore, Piru have been the last frontier for Ventura County development ever since T.O., Moorpark and Simi approached build out. I’ve seen the new development too, but dread the thought of living there while having to commute anywhere else. Access is pretty much only along 126 – which already jammed up years ago when those towns along the Santa Clara River were less populated.

It sounds like a fantasy now, but I have a friend who bought a 300 acre ranch / lemon orchard in Fillmore back in the mid-’90s – for $500K. Probably sell for 10 times that now. Oh well.

thats EXACTLY what i was talking about how it was a sleepy little town back in the mid to late 90s i looked a property originally built in the 1930s or 50s i dont recall but i was a solid house, this mustve been 97-2000 period exactly in fillmore, and the house was nice, white wood frame, no one had lived in it for years, the furniture inside was period, i think it was a 3 bed 2 bath deal, on the grounds it had an orange orchid, field, if thats what you call it, it was large at least 3 acres, orange grove thats it, plus it had an open garage work area, it was a lot of land and property and oranges on that property, i mean you could sell the oranges, all for 300k or 330k if i recall, now? i bet you anything its at least 1.3 million, i recall meeting an indian (from india) father and his son back then on the adjacent property, they had a very young avocado field, maybe an acre or two, they were at least 3 years from fruit.

man i wished so much i had bought that orange grove house or had an avocado farm right now.

side note about the growth of simi (which you cant pay me to live there because of the SSFL radiation), its grown a lot, and its beocme the place 2nd tier celeberties go who cant afford malibu/agoura/etc, like i drove hulk hogans wife home from malibu one day and she lived somewherein simi valley, what stuck in my memory was her mansion, and specifically, her drive way, it was built on a ridge leading up to the house, it must ve cost 1ooK easliy just for that drive way.. that might have somethingto do with property values going up, interesting comps anyway.

Has anyone here ever bought on lease land? I hadn’t thought about it before but there are a couple properties listed that I may look at but they are on leased land. It’s at least 1k per month for the lease plus HOA and mortgage but still way under rental parity in the area.

No, I have never bought anything on leased land, and I probably never will unless the improvement I was buying was practically free. Reason being that the owner might decide to raise the lease amount (sometimes substantially), and there’s often not much you can do about it except watch the value of your “investment†plummet. Then, your choice is to sell at a substantial loss or pay the exorbitant increase in monthly lease fee. Two fantastically sh!tty choices!

Here’s one such example: a condo complex on leased land in Santa Ana, CA (shady Hollow) had ±$42-$44 per month lease fees, fixed for 30 years. After that 30 year period, the landlord decided to jack up the lease fee to ±$1,100-$1,200 per month. Condo owners lost a lengthy court battle to the landlord, and witnessed the value of their condos plummet from ±$400k at the peak to less than $60k (I actually remember some of these listed at $40k to $50k circa 2011). Fun stuff!

Sources:

http://abc7.com/archive/8525002/

http://www.nbclosangeles.com/news/local/OC-Homeowners-Claim-Landlord-is-Unfairly-Hiking-Fees-135628543.html

There’s nothing wrong per se with buying real estate on a ground lease. All you need to know is the rental rate and how much term you have on the lease. You have to compare that with the cash flow you can generate from leasing out the building or otherwise utilizing the building for your own purposes. If you can do arithmetic, you will be able to back into the value of the ground lease. If you can’t figure that out, then you shouldn’t be buying real estate. The only financial difference between fee simple ownership and a ground lease is the term, in fee simple, you can use the land for perpetuity. If a ground lease is long enough, you can emulate the same kind of returns because a discounted cash flow gives less and less value to cash coming in way into the future. If you run a simple cash flow on excel, you can see how this is just projecting the income further and further out, at some point, it will start to have very little impact on your analysis.

Dean stated: “If you can do arithmetic, you will be able to back into the value of the ground lease. If you can’t figure that out, then you shouldn’t be buying real estate.â€

In my opinion, it’s not that simple. A dwelling on leased land might have a term with a set fee (or a fee with minimal increases) for 20 years. As that 20 year mark nears, the value of your dwelling will diminish, maybe significantly, because of the unknown future land lease fee. The real estate market is already pretty unpredictable in California. Add in the volatility of a land lease term expiration, and that is a recipe for a huge headache.

There is no way that you can predict, with any reasonable degree of accuracy, the long term value of a dwelling on leased land. It’s impossible, since the fee amount is the land owner’s decision in the long run, and he can charge whatever he wants. Obviously, the foregoing statement applies to the period after the current land lease term expires. I even provided a real example of this in my post above. There are probably many more examples that don’t make the news.

I guess if you had a 100-year+ term on the lease or something, that might be an exception of sorts. But in general, since 100-year+ land leases don’t exist or are extraordinarily rare in California, the long term value of a dwelling on leased land is always going to be a much bigger gamble than a dwelling on fee-simple land. That’s why I wouldn’t bother buying a dwelling on leased land unless it was practically free.

Btw, Dean, it appears @FutureBuyer was contemplating a land lease dwelling for himself, not for use as a rental property. Your latter part of your post, since it is somewhat unclear and confusing to me, seems to be more relevant to a rental property than to a primary residence.

I also wanted to add that, even though the monthly cost to own a house on leased land might be less than the monthly cost of a rental, you are probably still going to have a fair amount of your own money (down payment) locked up in the house, which could evaporate after the lease expiration. You will also probably have to pay closing costs, etc. Overall, it’s generally not worth it imo, even if the monthly cost of renting costs a little more.

I don’t think there is anything wrong per se with purchasing on leased land, as long as you know what your getting into. As a investment it’s a horrible idea, but for a primary residence it may have it’s advantages. Leased land options often exist in places where the average person can not afford to purchase the same land. Therefore if your wish is to live on multiple acres in Solvang, CA, but can’t afford to buy a traditional property for one million plus, there are leased land deals with large beautiful homes that are more affordable. But don’t expect to get any appreciation or even be able to sell the house in the future.

lolhu the Chinese r not tobe blame on housing…. most house in la to sd r own by white….btw not all of us paid cash too…

i brought my oc dream “shack” during oc bancrupucy for 200k n now this shitshack might worth 1.5m…. thus i would strongly recommend ppl buy south oc before another 8 folds happened??

ochuhu: Maybe you could proofread your drivel prior to posting it. As it stands now, it is barely comprehensible and filled to the rafters with spelling, punctuation and other grammatical errors.

Beyond the above, your message is absolutely preposterous. Buy in south OC because south OC will be valued at 8 times what it is now in 20 years? Ha ha ha ha.

It’s about 10 years after the peak of 2006, and prices are struggling to even reach 2006 levels in south OC. One little hiccup in the economy, and prices are almost guaranteed to decrease (maybe significantly) from where they are now.

Irvine Company continues to build new neighborhoods nonstop because they know this is their chance to cash out on all the land they own down in south OC. All that inventory is keeping a lid on prices, it’s just supply and demand. You have a different situation in SF, LA and coastal areas because there is no more room to add inventory, infill housing is much harder to build.

hey I am not English major…. btw Chinese is new English??…. plez focus on housing bubble not my English….what my point is we may go up another 8 folds from here, it seems that there r 2 types of ppl ?? spenter n saver…..for saver they can jack up prices !!!! I was lucky buying auction property of the county in npb…

ppl making 300k r buying before hi rate!!?

folks we ought to study why houses might double n double not chi- com buyer?? else we should study where to park our van or rv for free in so cal?? coz I am thinking todo that ….

The Wire; Season 4 Episode 4

____________________

Marlo: That’s my money.

Omar: Man money ain’t got no owners. Only spenders.

https://www.youtube.com/watch?v=AtoM9x-Bfu8

ochuhu,

I find it hard to believe your a real foreigner, more likely a troll looking for a laugh.

8 folds is impossible from current home speculated values. Whatever advisor that has been feeding you this information please do share, we would enjoy the entertainment. I understand Chinese do have a heard mentality and investing in real estate is their current trend. But as accessible information is I find it hard to believe Chinese are that ignorant of how our economy works and its cycles. If blind investing is your moto then prepared to get burned.

Laura Louzader is correct in that there are many neighborhoods in Chicago that are affordable. Plus there are many suburbs with good schools that are affordable. There are many places to choose from. There is a little bit of everything for everybody.

My chiropractor is from L.A. He bought a four bedroom, two bath, 1600 square foot, two car garage house in Skokie, IL for 250K. Skokie is a good middle class suburb with good schools.

But like many parts of the country, prices are back to 2006 levels in the downtown area and neighborhoods close to downtown.

What I object to and am sick and tired of is the corporate cronyism. The banks are still letting out foreclosures and short sales from five to eight years ago. At the same time home owners are not in a hurry to sell because they believe prices are headed even higher. So far what we have seen in Chicago is a huge run up in prices from 2001-2006. Then 2007-2011 prices crashed. 2011-2015 prices went back to 2006 levels. So in the end who made out like bandits? The banks did, mortgage companies did, real estate agents did, flippers did, renovation companies did. Home buyers did not. Prices just have stayed at the same levels from 2003-2006 here in the Chicago area.

dont forget hedgefunds and wallstreet rentiers, they bought and sold the orginal MBS and then now aafter the home owner occupants had to sell or were foreclosed on (using MERS and robo signing), they now are renting those same home BACK to the previously expelled home owners, THATS how fed up this is, and some people saw this NEOFEUDALISM coming, i knew this shit was gonna happen, that the banks would ultimately make their bouses, ferraris, harvard-westlake, and braces for thier kids, on the backs of …well,,,,fraud…..here is bloomberg: Blackstone has led hedge funds, private-equity firms and real estate investment trusts raising about $20 billion to purchase as many as 200,000 rental units…blah blah blah……

People forget about the water shortage. If we are in a mega drought which has happened in california before. 25-50 years no rain well I think so. cal. will run out of water in 10-15 years. then everyone’s stucco box will go to zero.

Here’s another Late Flip: https://www.redfin.com/CA/Los-Angeles/1911-S-Ridgeley-Dr-90016/home/6901131

Bought last July for $500k.

Listed again in November for $689k.

I know that during those four months it’s been fully refurbished — granite kitchen, hardwood floors, etc. But does this neighborhood justify $689k?

Tellingly, the realtor photos do NOT provide an exterior photo of the house. Google Streetview does — and yes, the window had (has?) bars.

In one of the realtor photos, you can see the neighbor’s window, and it too has bars.

http://sf.curbed.com/archives/2015/11/19/most_of_the_bay_areas_allcash_buyers_dont_work_in_tech.php

most of the all cash buyers are not in tech nor overseas money

75% increase in 15 years is about 4% increase annually

Is that surprising?

Leave a Reply to Responder