Pecora Commission Where Art Thou? Lessons from the Great Depression Part XXVI: Time to put the Bankers and Wall Street on Trial. “Legal chicanery and pitch darkness were the banker’s stoutest allies.”

The Pecora hearings have been making the rounds recently. The United States Senate Committee on Banking and Currency was setup during the Great Depression to examine the causes of the Wall Street Crash of 1929. The initial inquiry started in March 4, 1932 and was heavily politicized. After all, we were talking about the Great Depression here and the public was outraged. The actual investigation itself was launched by a majority-Republican Senate but was criticized by the Democratic Party as an underhanded way of gathering up populist anger. The bottom line was the American public was suffering. The suffering of the vast majority of Americans stood in stark contrast to the high rolling lifestyle of bankers and those on Wall Street. The banking syndicate had brought the U.S. economy to the edge and took it over. At first the initial investigation had very little traction. That is until Ferdinand Pecora, assistant district attorney of New York County was hired to put together and bring forth the final report.

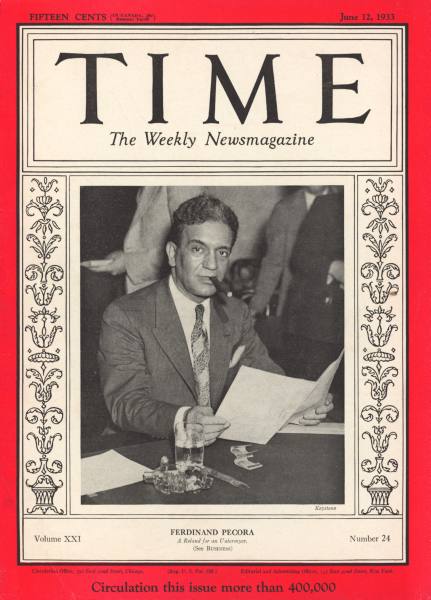

Ferdinand Pecora was appointed Chief Counsel in the last months of the Hoover administration. The banking edifice of the United States was crumbling and even the house of Morgan (read The Lord of Money Speaks) was no longer strong enough to support the economy.

This is what a March 1933 issue of TIME had to say about Mr. Pecora:

“Ferdinand Pecora, most brilliant lawyer of Italian extraction in the U. S., finished public schools at 12. At 18, after loping through his brother’s law books, he was managing clerk of a law firm. Even on the most complex cases (which he, tireless, likes best) he never needs notes, never forgets a word of testimony once it is on the record. One of his most famed convictions was that of former New York State Superintendent of Banks Frank H. Warder for his part in the failure of Manhattan’s City Trust Co. in 1929. At 47, his black eyes flash, his black hair bristles.

Last week, sitting always at Chairman Norbeck’s right, Mr. Pecora put on the show. His the right to question; Mr. Mitchell’s the duty to answer no more no less than suited Mr. Pecora-and Senator Brookhart darkly hinted that a jail cell was ready if the banker balked. Banker Mitchell proceeded to say enough to damn himself to the satisfaction of the Committee, Mr. Pecora and a large part of the U. S. people by the following admissions.”

This is part XXVI in our Lessons from the Great Depression series:

20. The Four Horsemen of the Economic Apocalypse

21. The Big Change

22. The Infection of Consumerism and Living Fake Lives.

23. The Worst Housing Crash in American History.

24. Economic Crises Around the World in Synchronization.

25. Reconstruction Finance Corporation II

Mr. Pecora had an uncanny ability to put together complicated Wall Street jargon into a tangible and understandable argument. Not only did he have this ability, but he understood what the public would be furious about. We need to remember that at this time, it had already been over 3 years since the Crash of 1929. If we want to put a date on our current crash, we can look at August of 2007. If that is the start date, we are not even two years into this crash which is shocking to even think about. So the public in 1933 had already had enough and was on the verge of populist anger. The country ousted Herbert Hoover from office and brought in Franklin D. Roosevelt. Roosevelt being savvy allowed Pecora more time to investigate the shenanigans of Wall Street. So this was a bi-partisan fight. Bill Moyers has an excellent talk which came out last week regarding the Pecora hearings:

The reason this is important is here we are approaching 2 years of being in this crisis and we have yet to see a modern version of a Pecora Commission. Who is going after Wall Street? And I’m not talking about a congressional toungue lashing and then cutting them a check. We’re talking about a deep investigation. These are a few things uncovered by Pecora and his team:

“Pecora’s investigation unearthed evidence of irregular practices in the financial markets that benefited the rich at the expense of ordinary investors, including exposure of Morgan’s “preferred list†by which the bank’s influential friends, including Calvin Coolidge, the former president, and Owen J. Roberts, a justice of Supreme Court of the United States, participated in stock offerings at steeply discounted rates. He also revealed that National City sold off bad loans to Latin American countries by packing them into securities and selling them to unsuspecting investors, Wiggin had shorted Chase shares during the crash, profiting from falling prices and Mitchell and top officers at National City had helped themselves to $2.4 million in interest-free loans from the bank’s coffers.”

Just to show you that even in 1929, people saw the corruption of the crony capitalist:

“Mitchell is the ideal modern bank executive.”-Carlton A. Shively, Financial Editor of the New York Sun, May 1929.*

“Mitchell more than any 50 men is responsible for this stock crash.”-U. S. Senator Carter Glass, November 1929.”

That is Senator Glass from the Glass-Steagall Act which was passed in large part by the absurdity that was found during the investigations. Of course, the Glass-Steagall Act was repealed in 1999 under President Clinton (D) which was largely rammed down the throat of the public by Senator Phil Gramm (R). Can you believe Phil Gramm was the chairman U.S. Senate Committee on Banking, Housing, and Urban Affairs from 1995 to 2000? Talk about having the fox guarding the henhouse. Yet the point of this all is the de-regulation that setup the massive global debt bubble was supported by both parties. And of course, back in the Pecora investigations the banking community was also vocal about bringing people to justice:

“There rested, over the weekend, the issue of banking morality and responsibility. With one other angle: bankers high & low throughout the land, while not condoning the acts of 1929, loudly proclaimed that last week the greater villains were U. S. Senators who would risk the credit of the U. S. by putting scandal into the headlines when Confidence had already received body-blows at St. Louis (TIME, Jan. 23), New Orleans (TIME, Feb. 13), Michigan (TIME, Feb. 20) and in many another state.

But the Senate Committee had succeeded in getting its man. On Monday morning at 9 a. m. Charles Edwin Mitchell, 66, resigned, and James Handasyd Perkins, 57, was promptly elected chairman of the nation’s second biggest bank. Few hours later the directors of National City Co. accepted the resignation of President Hugh Baker. Mr. Mitchell and Mr. Baker returned to Washington for further grilling.”

Talk about a different time. Here we are 2 years into the crash and instead of looking for our own Pecora investigation, we are actually giving the 19 biggest banks unlimited access to taxpayer money via the Troubled Asset Relief Program (TARP) and also the flawed Public-Private Investment Program (PPIP). In fact, even FDR was quick to bash the banks in his inaugural address!

“Yet our distress comes from no failure of substance. We are stricken by no plague of locusts. Compared with the perils which our forefathers conquered because they believed and were not afraid, we have still much to be thankful for. Nature still offers her bounty and human efforts have multiplied it. Plenty is at our doorstep, but a generous use of it languishes in the very sight of the supply. Primarily this is because the rulers of the exchange of mankind’s goods have failed, through their own stubbornness and their own incompetence, have admitted their failure, and abdicated. Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men.

True they have tried, but their efforts have been cast in the pattern of an outworn tradition. Faced by failure of credit they have proposed only the lending of more money. Stripped of the lure of profit by which to induce our people to follow their false leadership, they have resorted to exhortations, pleading tearfully for restored confidence. They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish.”

I don’t like the false analogy of, “well if your neighbor’s home was on fire, you wouldn’t wait to find out what happened before putting it out right?” Essentially what they are saying is keep throwing $100 bills while you watch Benjamin Franklin disintegrate in the flames. If that doesn’t stop the flames, go buy some of the most expensive wine and start pouring it on the flames until the fire goes out. This is their reasoning. We need someone right now like Ferdinand Pecora who can say, “stop throwing expensive stuff to put out a flame when we can put it out with freaking water!” Is it important to keep current management? No. Is it important to maintain bonuses. Absolutely not. But hey, your banker neighbor’s 20,000 French Chateaux is on fire so let us use your money to put that flame out. We can ask questions later.

As I have pointed out countless times, the majority of Americans are getting pummeled and fleeced while Wall Street and banks make away like bandits. I should also clarify here. We are talking about the investment firms and the top 19 banks. There are hundreds of regional banks that actually operated prudently and have stayed away from toxic assets. Yet these 19 banks make up two-thirds of the entire banking system in the U.S. These banks grew into behemoths thanks to de-regulation which allowed them to be everything and anything. Instead of packaging loans and selling them off to Latin America like some folks did in the Great Depression, people packaged mortgage backed securities and sold them off to anyone and everyone around the world. The banking oligarchy is dictating the economic policy of this country. One simple first step we should take is to start breaking up these gigantic banks and bring back modern regulation that will make banking more like a utility. The riskier side of the business model can be spun off.

Yet who right now is pursuing this avenue? Mr. Pecora was able to do this because he had experience breaking up bucket shops and understood the corrupt structure that had infiltrated Wall Street. He managed to scour the books and present the information to the public in a manner that simply solidified the corruption on Wall Street. Right now, all we get is a high tax rate on bonuses to AIG executives. GM’s CEO has been ousted and the U.S. government is taking a hard stance against the beleguered automaker. What of Bank of America or Citigroup? What of Goldman Sachs? How exactly are they turning a profit in this market? Instead of a hard stance we give them more money!

And if you think Wall Street will allow regulation to come without a fight, this is what Mr. Pecora had to say in his memoir:

“Bitterly hostile was Wall Street to the enactment of the regulatory legislation.” As to disclosure rules, he stated that “Had there been full disclosure of what was being done in furtherance of these schemes, they could not long have survived the fierce light of publicity and criticism. Legal chicanery and pitch darkness were the banker’s stoutest allies.”

I must say that New York Attorney General Andrew Cuomo has put out a strong letter regarding Bank of America’s acquisition of Merrill Lynch. Not only does this put the CEO of one of the country’s biggest banks on the hot seat, but it also puts a big question mark on former U.S. Treasury Secretary Hank Paulson. Ben Bernanke comes up but only as a ghost because the U.S. Treasury and Federal Reserve do everything in the dark. What is clear from the letter is this:

(a)Â Â Â Â Ken Lewis thought he was going to make out like he found a Picasso at a swap meet by buying Merrill Lynch during those epic distressing weekends.

(b)  The deal was arranged. However, after carefully reviewing the books, it turns out Merrill would have deeper losses.

(c)   Lewis wants out. Lewis goes back to Paulson who basically tells Lewis, “Merrill was sold as is buddy!”

(d)Â Â Ken Lewis tries to bluff and the U.S. Treasury and Fed pretty much convey to Lewis he and his buddies will be kicked out on the street if they try to break the deal.

(e)Â Â Â Lewis is told to stay quite.

(f)   Merrill later records a ridiculous loss but the Treasury kicks Lewis down for his troubles. By the way, the Treasury is taxpayer money.

(g)Â Â All is well in crony world!

After reading the letter you will understand that the corruption runs deep here. Is it any wonder that Americans have so little confidence in their banking system? Enough of this. We have plenty of proof and now it is time for investigations. Ferdinand Pecora, where art thou?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

23 Responses to “Pecora Commission Where Art Thou? Lessons from the Great Depression Part XXVI: Time to put the Bankers and Wall Street on Trial. “Legal chicanery and pitch darkness were the banker’s stoutest allies.””

The New York Times had a great article yesterday cataloging Geithner’s Wall Street connection. Just more evidence that the crony capitalists run this country.

My buddy bought a nice condo in Palm Desert 13 months ago for 530K. The builder hired a auction company to wrapped it up and get rid of these things. They have been doing it for 3 months,had a auction blah blah blah. Sunday morning they had 3 left I put a offer in on the last one at the end of the day. 275K was my offer, the only one they had, they said that they will probably take it. The other two that sold that day went for 304K and 295K. They sold from 2003 to 2008 new from the builder for over 500 grand.

First, you imply that Sen. Gramm was somehow responsible for Glass-Steagall Act. You state that the Act “was largely rammed down the throat of the public by Senator Phil Gramm (R).”

Here are the facts: The final version of Glass-Steagall Act was passed in the Senate 90-8 (1 not voting) and in the House: 362-57 (15 not voting). The legislation was signed into law by President Bill Clinton on November 12, 1999.

http://en.wikipedia.org/wiki/Glass-Steagall_Act

Both Republicans and Democrats voted for the bill. Overwhelmingly. The margins are huge.

Second, President Barack Hussein Obama’s financial adviser, Larry Summers had this to say in 1999, about the decision to repeal the Glass-Steagall Act of 1933:

‘Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century,’ Treasury Secretary Lawrence H. Summers said. ‘This historic legislation will better enable American companies to compete in the new economy.’ [New York Times, Nov. 5, 1999]

http://www.nytimes.com/1999/11/05/business…=1&emc=eta1

If you expect Barack H. Obama to do anything about the financial crisis, you are mistaken!

We have him. He’s was compromised by being caught with hookers. Mr. Eliot Spitzer is his name.

Dr.,

As usual, you are spot on.

Obama is a tool, this much we know, since he has not appointed an independent special prosecutor. The moneychangers own him.

As I always say, they should all be killed, and I am totally serious. These guys are a cancer on the world, they suck the life out of us and bleed us by usury. It still shocks me that they can be so evil and above the law.

Until something is done, there will be no confidence in the system.

I see that Ron Paul is calling for an audit of the FED.

Good luck with that. I’m surprised they let him live.

The reason that there will never be a “commision” is because of what you stated- BOTH parties participated in engineering this financal mess. Since neither party can make the other look “bad”, nothing is going to happen on this front.

I am still amazed that most people think this is a normal recession, and we are on the upswing. Someone I know is thinking about buying a pet bakery franchise, for $300,000. The realtors in our area are still saying that housing prices are not going to go down further in our city, because we are too desirable.

Meanwhile, my neighbors, in an upper middle class area, are getting laid off, left and right, often after 20 plus years, with the same (Fortune 500) employers.

But the people who point these things out, are “too negative”, and dismissed as

“doom and gloom”. Most Americans still want to hear “happy talk”, not the reality of the freight train that is about to hit their financial vehicle, which is parked on the train tracks.

Nice article, DHB. Deflation followed by rampant inflation followed by who knows what? It’s good that there are people like you out there crying for a champion to come out for the people, and I’m sure all of your readers appreciate your dedication… but I’m not holding my breath. What I am doing is gathering money and resources and squirreling them away and reading your blog daily for tips and hints to get through all of this nonsense. Thanks again for your service.

It is interesting (sadly) how much of our history we ignore, pay the price, and then repeat the process and then surprised at the results.

Your articles are a constant look in our rear view mirror.

It’ll be interesting if anyone is prosecuted over this mess.

It doesn’t matter if the Dems or Repubs are in power. Both sides are owned by crony capitalism. I think the US is probably an oligarchy. When you add up all the politicians, CEOs, Union bosses, Think Tanks, lobbyists… it really is a small segment (probably less than 1% of the population) that has all the power in the US.

Dr HB and all – What do you think of these two items:

1004 MC form:

http://www.dailybulletin.com/business/ci_12228714

CA Foreclosure Prevention Act, I’ve read it’s kind of like SB1137 and starts in July:

http://www.leginfo.ca.gov/pub/09-10/bill/sen/sb_0001-0050/sbx2_7_bill_20090220_chaptered.html

I don’t know, if people think this mess is simply a breakdown in regulation and purely the fault of Wall Street, I’m not sure we are learning the right lessons.

There can be no truth commission until the party of “No” can’t stand in the way.

They have put their political party (the party that deregulated everything, failing repeatedly) ahead of the interests of finding out what went wrong.

That’s because this party’s fingerprints are all over the crime scene.

That’s why they are quaking in fear today as Arlen Specter changes parties.

Also, they will try to deny the people of Minnesota representation so they can filibuster anything and everything.

This political party really should be investigated under the RICO laws…it’s a criminal organization.

Andy, hopefully for your sake, they won’t accept because in Cal-y-fawn-ya prices will continue to shoot down hard.

I think SB 7 (posted by Wincompetent above) really sucks as all they are doing is further prolonging the tough times that need to come to pass.

WHAT A DRAAAAAAAG!!! (No pun intended)

yo, Fraud Detector — I’m not saying republicans didn’t share in the responsibility here, but it’s very important to realize that responsibility was shared. For instance, on the Gramm-Leach-Bliley act that overturned the Glass-Steagall act (which having passed under a republic congress is claimed to be a republican move that democrats did not want), 84% of Senate democrats and 75% of House democrats voted yes. Bill Clinton happily passed it into law. In fact, Barney Frank, the current democrat chairman of the house financial services committee, had this to say in ’05 as the bubble was inflating:

–

“Those who argue that housing prices are now at a point of a bubble seem to me to be missing a very important point. Unlike previous examples we have had when substantial excessive inflation of prices later caused problems we are talking here about an entity, home ownership, homes where there is not the degree of leverage where we have seen elsewhere. This is not the dot-com situation. We had problems with people having invested in business plans of which there was no reality; people building fiber optic cables for which there was no need. Homes that are occupied may see an ebb and flow in the price at a certain percentage level. But you’re not going to see the collapse that you see when people talk about a bubble and so those of us on our committee in particular will continue to push for home ownership.”

–

And if you want to be truly disgusted, take a look at the list that was compiled several weeks ago of the the top recipients of Freddie Mac and Fannie Mae campaign contributions over the last 20 years. The top 5 are all democrats. Sen. Dodd is #1. Barack Obama is #3. Clinton is #4. 16 of the top 25 are democrats. If you look at who holds power in the committees responsible for regulating financial affairs in the current democrat-controlled congress, you’ll most likely find their name on that list.

–

This mess is definitely not one-sided.

Here is one of the guys most responsible for the Housing Crisis today…

http://www.youtube.com/watch?v=iW5qKYfqALE

National City bank and Mitchell were were at the virtual epicenter of the banking collapse in 1929. J.K Galbraith talks extensively about this in his book, “The crash of 1929”. What is really interesting, is that National City Bank did, in fact, survive and eventually morphed into today’s CitiBank. They went back to their old tricks, with a few new wrinkles, but the effect is now the same of worse.

You cannot change the stripes of a leopard. There is a distinct class of people that are the masters of the world: financial, legal, political, medical, media, advertising, retail, etc. They don’t consider the rest of us human. They enslave us with usury. That’s why they bail out wall street and throw GM and their suppliers out in the street. There is a bird that does this–the Cowbird, which lays it’s eggs in another’s nest, the parents feed the cow-chick, send him off to Harvard where he ends up at an investment bank and steals regular people’s nest eggs. We willingly go into hyper debt to live a few years in perceived wealth. There is nothing new under the sun…

Wow so much for accountability. This was a great history lesson, things I would have never known without coming to your blog.. As simple as these points were, it is amazing that not more people throughout the country are screaming the same thing.. We all know there was a lot of decisions that led up to the current situation we find ourselves in. And I am sure many of those were done behind closed doors, to pad someone’s pockets? I don’t know if any of you see it, but I relate it to the rich guy down the street who doesn’t really want to be a dad, and doesn’t know what to do with his kids.. SO, what does he do? He throws enough money at them so they will go away. What happens 99% of the time, they all end up being dead beats and the father years later wonders what happened.. Its almost like Uncle Sam thinks if they throw enough money at it, it will go away.. ???????

Comrades,

Here are my seven reasons why we haven’t addressed this issue in a meaningful way yet (feel free to add on):

1) Big Corporations whose business model is to deceive the public and regulators into believing that they are acting on their behalf. The shining example of this is the motto “what’s good for GM is good for America”. This model arose out of necessity from the damage caused by the Great Depression no doubt. We’ve been lulled into this con like some kind of narcotic. When the drug finally wears off, we can get around to the investigations.

2) A White House that doesn’t want to look back- maybe because some of the insiders (Geithner/Summers) might somehow get snared in the dragnet if this goes too deep. When Obama lets Volker out of his box, maybe we can get progress.

3) A Congress also enmeshed in the money system and more focused on posture than policy. Do you think the lobbying industry has shrunk with the rest of the economy? You’d be wrong.

4) A Justice Department that has its hands full with Crimes Against Humanity investigations such as torture and other human rights abuses as well as a potential cover up. Until the dysfunction of this department caused by the previous administration get cleaned up, they will not be able to tackle this issue on top of their workload.

5) A complex financial system that goes far beyond banking to include the insurance industry, ratings agencies and hedge funds where financial products such as derivatives are not well understood even by the MBAs who bought and sold them.

6) A complacent and uneducated public that can barely balance their own checkbooks much less understand the complexities described above. Doctor Housing Bubble of course is but one solution to enlightenment.

7) Finally, an ingrained culture of greed and imprudence. We would rather steal the future from our children for our own material benefit that provide a better life for them. If we don’t reverse this one, we’ll perish as a society. I’m not sure a trial or two will do the trick but it will at least demonstrate that there’s a high price to be paid for one’s bad deeds.

Dr. Bubble:

I’m disappointed that you didn’t go after the Federal Reserve and instead continue to pretend like it is just the wall st./banker crowd that is responsible. Can’t you see the obvious that without the Federal Reserve price fixing (which is what it is when they set the overnight rate target), that there would be much more transparency in the market.

The whole idea of overnight lending is that fellow bankers have the best feel for the financial solvency of the other banks. Without the fed price fixing, the true price of intra-bank lending would be based on the assessment of other banks. If they don’t lend, you go under.

Everyone in this time should read the excellent book “The Panic of 1819” to understand how government is the PROBLEM not the SOLUTION. It is available as a freebie PDF (209 pages), http://mises.org/rothbard/panic1819.pdf, or you can order the print version.

Thank you Doctor for sharing your knowledge!

All, please research Jekyll Island and the Federal Reserve (along with Martin Armstrong & the circumstances of his incarceration). The internet has allowed us access to lots of information… if we stay mindful as we sift through it, the truth is there.

http://www.frugalfun.com/jekylisland.html

Yeah, some folks here know what’s up.

Read “Web of Debt” by Ellen Brown. She exposes the FED for what it is…a revenue stream of usury that buys worldwide influence…

Leave a Reply to Spencer Janke