Home Sweet American Bubble Investing Pie: Lessons from the Great Depression Part XXIII: The Worst Housing Crash in American History.

Americans have a strong love affair with real estate. The idea of private property is deeply ingrained in our investing psyche. For a big part, the latest housing bubble would have never happened if people didn’t have a fertile mental ground in believing sometimes blindly to the myth of real estate. We are now left with the aftermath of a bursting bubble. Yet is this it? What one year ago seemed to be an extreme scenario now seems to be a daily utterance. That is, this is the worst economic collapse since the Great Depression and the historical data backs this idea.

The shocking unemployment report that came out on Friday cemented the notion that this calamity is only accelerating. Market analyst were expecting job losses for November to come in at 350,000 but when the 533,000 number came out, the worst in 34 years the market was initially stunned. Yet the market rallied and ended the day up. Why? The notion going forth is this is simply the effects of the worst which is clearly behind us. I believe to a certain extent that the NBER announcing that the recession started in December of 2007 is a way to try to convince people that we are closer to the end than the beginning. Of course, there are more valid reasons but take a look at the timing. You mean they had to wait until a few days ago to tell us we have been in recession for a full year? As I discussed in detail in a previous article, each subsequent bailout grows exponentially more troublesome and why would we believe that we are closer to the bottom?

Today we are going to examine real estate during the Great Depression and compare it to our current market. This will be a challenging exercise since real estate during that time was very different from our current situation and data is sparse. But we have pocket markets like the Florida boom of the 1920s that can serve as a template for high flying states like California, Nevada, Arizona, and yes even Florida again. If we believe that we can learn something from history, then it is important to look at a time period in our nation’s history and hopefully we can learn lessons that will serve us well today and tomorrow.

This is part XXIII in our Great Depression series:

17. The All Hat and No Cattle Nation

18. Charity for Financial Deviants.

19. The Silent Economic Depression

20. The Four Horsemen of the Economic Apocalypse

21. The Big Change

22. The Infection of Consumerism and Living Fake Lives.

The Boom and the Bust

It is important to note that home building during the Great Depression dropped by 80% between the years 1929 and 1932. It is also the case that many families owned farms which clearly isn’t a factor in today’s market. But we can use current measures and try to determine how deep our current decline is in relation to the past. Keep in mind that when you read 1929 – 1932 you may get a psychological feeling that this was a short timeframe. Remember that in late 1929 we saw the peak of the stock market and the bottom wasn’t reached until the middle of 1932 and it lingered near the lows for a very long time. If we follow a similar timeline with our market peak in October of 2007, then we can expect a bottom in the summer of 2010.

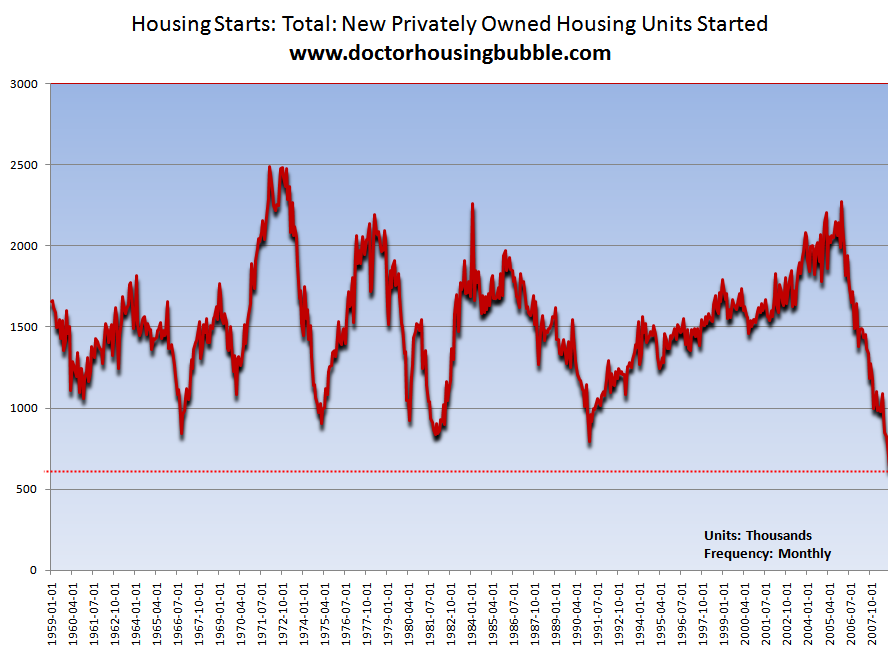

Of course that is simply an observation. The past doesn’t dictate the future. Yet our current real estate bubble is more problematic since it is global. First, let us examine the 80 percent drop during the Great Depression with current housing starts during this bubble:

The housing market, at least measured in housing starts hit a peak in early 2006. We have fallen off a cliff since that time. Keep in mind that housing starts react much quicker to the downside than say real estate values. Why? Well builders have their ears to the ground and are deep in analysis for future building projects. This isn’t an exact science (obviously) yet any significant contraction in starts is a sign that market saturation is starting or profits are no longer to be found. That is why back in 2006 when we saw this decline while prices were going up and the stock market was roaring, we knew we had a leading indicator telling us trouble was ahead.

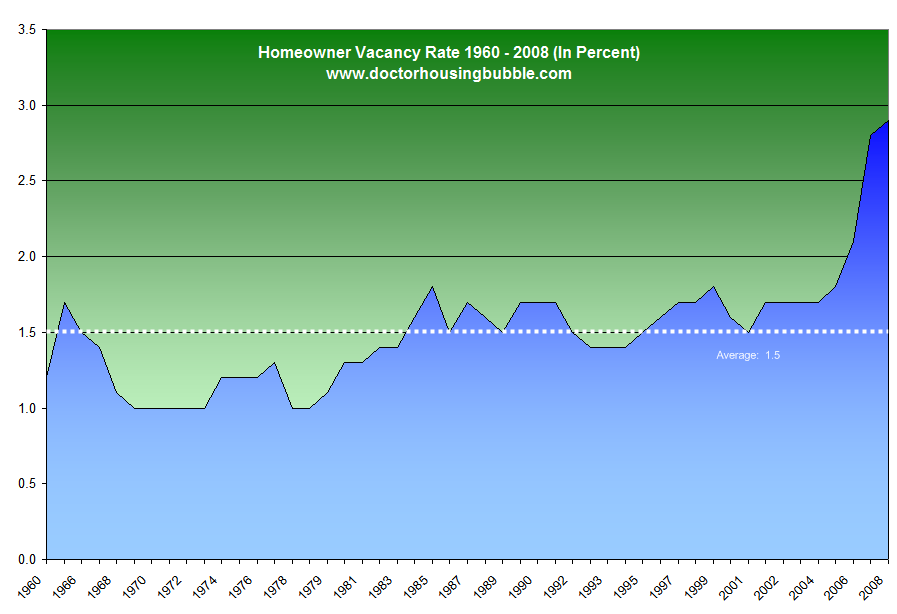

The above chart is telling. Since the peak in housing starts, they have now fallen by a stunning 70% in 2 years. That is on par with the Great Depression figure of 80% from 1929 to 1932. Keep in mind that there are no signs or even reasons for builders to build for the near future since the market is flooded with excess housing units. I have gathered the homeowner vacancy rate for the past 48 years and this chart should be telling:

*Click for sharper image

The current homeowner vacancy rate is the highest ever recorded. It is at 2.8 and has fallen from the peak of 2.9 in the first quarter of 2008. With nearly 5 decades of data, the average vacancy rate stands at 1.5. The current rate is for all intents and purposes at a record high. Now 2.8 percent may seem tiny but we are talking millions of homes here. 2.8 is nearly 80 percent higher than the average rate over the past half century!

It is very possible that we may see that 80 percent fall since builders really have no economically fundamental reason to be building in the current market. On the contrary, next year is expected to have grimmer numbers with more foreclosures flooding the market which will only add more inventory. That is why I have argued that California and other bubble states will not see bottoms well into 2011.

Bubble States

The Florida real estate market during the 1920s witnessed a massive speculation. In terms of bubble states and historical data, we have much information on the bubble during this time. In fact, there are 4 states that had near exact bubble speculation during this current bubble. Those 4 states are California, Florida, Nevada, and Arizona. They have been running up the foreclosure numbers higher for the entire nation. How so? Take a look at this data:

October 2008 foreclosure filings:

Nationwide:Â Â Â Â Â Â Â 279,561

California:Â Â Â Â Â Â Â Â Â Â 56,954*

Florida:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 54,324

Nevada:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 14,483

Arizona:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 17,507

*Recent drop because of SB 1137

So what this means is for the latest data, the 4 states above made up 51% of all nationwide foreclosure filings! Keep in mind that the California number is artificially low because of SB 1137 which is simply bottling up a blast of foreclosures that will hit us in Q1 or Q2 of 2009. If we look at data that is pre-SB 1137 California is in utter free fall:

August of 2008 foreclosure filings:

California:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 101,724Â

The bill was signed into law in July and of course this data was much to soon too reflect those changes.  So has California really seen a drop in foreclosures that amounts to nearly 50% in a few months?  Yes. But the legislation and data is horrifically misleading.  All it does is requires lenders to take a few additional steps to contact and work with borrowers but there is nothing you can do when someone purchased a home for $550,000 (L.A. County median peak) and is now selling for $355,000. All you are doing is wishing. This will only make the numbers look low for the forth quarter of 2008. 2009 we will face the incredible tsunami of option ARM recasts that will flood the state.

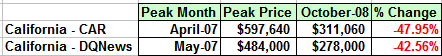

So how far have California prices fallen? Â Take a look at 2 measures for the entire state:

Now I know many readers will see these drops and must think, “wow, a near 50% drop in slightly over one year!  Prices must be near a bottom.” They are not and I have argued this succulently in 10 reasons why California will not face a bottom until May of 2011.

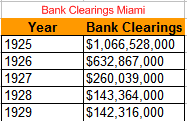

But we need a rubric. Â How bad did prices fall in the 1920 Florida real estate bust? Â Let us look at some records:

Now it is hard to get an accurate figure of price falls.  Some places became worthless because they were built on swamplands and had no intrinsic value beyond the mania.  But the above bank clearings from Miami are stunning. Bank clearings for Miami fell 86% over the above timeframe from 1925 at the peak to 1929. We can use this measure as a good indicator of the fall of interest in a bursting bubble. You will also make note that from 1929 to 1939 the country was in depression and this real estate bust occurred prior to that. So there wasn’t a bottom and then a quick jump up. What it does show is that people can go from one bubble (Florida real estate) to another (stocks in 1929).  This double bubble is as American as apple pie since we went from the technology bubble right into the real estate bubble.

What were some of the reasons during the mania given to people to buy Florida real estate? [from Only Yesterday]

“1. First of all, of course, the climate-Florida’s unanswerable argument.

2. The accessibility of the state to the populous cities of the Northeast-an advantage which Southern California could not well deny.

3. The automobile, which was rapidly making America into a nation of nomads; teaching all manner of men and women to explore their country, and enabling even the small farmer, the summer-boarding-house keeper, and the garage man to pack their families into flivvers and tour southward from auto-camp to auto-camp for a winter of sunny leisure.

4. The abounding confidence engendered by Coolidge Prosperity, which persuaded the four-thousand-dollar-a-year salesman that in some magical way he too might tomorrow be able to buy a fine house and all the good things of earth.

5. A paradoxical, widespread, but only half-acknowledged revolt against the very urbanization and industrialization of the country, the very concentration upon work, the very routine and smoke and congestion and twentieth- century standardization of living upon which Coolidge Prosperity was based. These things might bring the American businessman money, but to spend it he longed to escape from them-into the free sunshine of the remembered countryside, into the easy-going life and beauty of the European past, into some never-never land which combined American sport and comfort with Latin glamour-a Venice equipped with bathtubs and electric iceboxes, a Seville provided with three eighteen-hole golf courses.

6. The example of Southern California, which had advertised its climate at the top of its lungs and had prospered by so doing: why, argued the Floridians, couldn’t Florida do likewise?

7. And finally, another result of Coolidge Prosperity: not only did John Jones expect that presently he might be able to afford a house at Boca Raton and a vacation-time of tarpon-fishing or polo, but he also was fed on stories of bold business enterprise and sudden wealth until he was ready to believe that the craziest real-estate development might be the gold-mine which would work this miracle for him.

Crazy real-estate developments? But were they crazy? By 1925 few of them looked so any longer. The men whose fantastic projects had seemed in 1923 to be evidences of megalomania were now coining millions: by the pragmatic test they were not madmen but-as the advertisements put it- inspired dreamers. Coral Gables, Hollywood-by-the-Sea, Miami Beach, Davis Islands-there they stood: mere patterns on a blue-print no longer, but actual cities of brick and concrete and stucco; unfinished, to be sure, but growing with amazing speed, while prospects stood in line to buy and every square foot within their limits leaped in price.”

We have been here before. This seems like a template of how things will play out in bubble states. What occurred during this bubble is people forgot the lessons taught to us during the Great Depression and here we are repeating them. I am struck by this notion being thrown around that we should put a bottom on housing prices. Why would we want to legislate unaffordable housing to Americans? That is what will happen. In fact, people took on riskier and riskier loans because of higher prices. Either way, the idea is absurd and is part of the dumb and dumber bailout model we are currently living through.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

21 Responses to “Home Sweet American Bubble Investing Pie: Lessons from the Great Depression Part XXIII: The Worst Housing Crash in American History.”

It is like helping a drug addict by giving him unlimited supply of drug so he would go through withdrawal. A lot people have faith the US will bounce back soon; I am not sure the US economy will even be the same……………..

The definition of INSANITY is doing the same thing over and over again and expecting different results. Here we are again. History repeating itself. Unfortunately, we have politicians trying to save the institutions that got us into this mess. That is the irony of it all. They’re in their last days of robbing and stealing taxpayer dollars. Who knows, if there will be anything left to actually fix things. They need to yank the &*%$#@! credit card.. Prepare for the %$^@#$ to hit the fan in 2009. Real estate in bubble markets that havent corrected by at least 50%, will get hit the hardest, and with increasing velocity. Often times, they overshoot, as they are the last card to fall, among the panic. Sales volumes in some of the Westside’s Prime areas dropped over 50% during November. It gets worse from here.

http://www.westsideremeltdown.blogspot.com

DR HB , your last point is so simple, how can talking heads and politicians even get away with saying such asinine things? The answer must be most folks are really dumb! To see how really silly the suggestion is, just insert/replace ANY item for “house”. I.e Mr Congressman suggest to save car companies, no car should be priced below $85,000…or OPEC say “$75 a barrel” is good price…for who? THEM and their cartel families you retards!!! If we have any resemblance of a free market economy the buyer (market) should always dictate the price.

“With nearly 5 decades of data, the average vacancy rate stands at 1.5. … 2.8 is nearly 50 percent higher than the average rate over the past half century!”

Actually 2.8 is about 87% higher than 1.5.

Diane Feinstein rationalized her position on the Senate floor by saying that even though she had received emails and phone calls that registered an 86% rate AGAINST any bailout for banks she knew better than her constituents what should be done. So she voted for the bailout. My congressman, Sam Farr, must have had nearly the same ratio and he voted for the bailout. I imagine they are both still doing so.

So much for representative gov’t in the USA. Both of the above are multi-millionairs so I guess they were voting their interests instead of ours. Is that the definition of an Oligarchy? Let’s see…Bush’s, Clinton’s, Kennedy’s…yep, an oligarchy to herd us sheep through the Great Bush Depression. Sux to be us.

Got these prices for San Diego from a thesis paper. he used 95% of selling prices from ads in the newspaper.

1/1927 5200

6/1927 4682

2/28 4750

6/1928 4789

2/1929 5389

5/1929 5599

1/1930 5093

5/1930 4450

1/1931 4391

5/1931 4000

1/1932 3500

6/1932 3050

1/1933 2800

6/1933 3050

1/1934 2300

6/1934 2500

1/1935 4150

6/1935 4000

proces started to fall again till year 1940 to 3250.

Great insight, but I believe you cannot forecast a specific month, May 2011, as the turnaround date. I agree that it will not be intil 2011, but there are many factors that need watching to even be certain 2011 will start to see things turning around.

Also another small point…climate. I don’t think Florida even has the climate, as it has excessive humidity in the Summer, items such as hurricanes,etc. This, coupled with the changing needs of the boomer generation, namely active lifestyle, such things as mountain-biking, cross-country skiing,etc., are making Florida very undesirable, I believe.

Did anyone read the article entitled “Chinese Tourists’ Hot Souvenir: U.S. Homes? I’m wondering what impact this activity will have on the housing market.

Dr. HB,

Thanks as always! However, what do you predict will happen if Obamarama does actually push and get congress to allow homeowners facing foreclosure to have their loan balances reduced by the banks. Will prices still fall until 2011 or will prices stablize and start rising again sooner?

Well if I was retiring California would definitely be much less desirable to me than Florida. One reason: taxes. If you are pulling money out of a say a DEFERRED tax account (the standard 401k) do you want to do so in a state with 10% income taxes (California) or in a state with zero income taxes (Florida)? Oh and CA sales taxes are going to keep going up too.

Wash, rinse, repeat…

Human follly is cyclical and so are markets. By the way, how did smart investors who didn’t like shorting profit during the great depression? BUYING GOLD STOCKS.

See the links for more info:

http://goldversuspaper.blogspot.com/2008/12/gold-stocks-back-to-basics.html

http://goldversuspaper.blogspot.com/2008/10/swinging-pendulum-in-history.html

Thanks for another insightful report, doc.

The “kick-the-can-down-the-road” metaphor is so appropriate. Nobody wants to take responsibility. These are smart people–they know what’s happening and they keep trying to put a bandage on a festering infection because capitalism by nature kills the party pooper every time. Many fortunes have been made by blatant criminals but nobody goes to jail. Some say WT7 was files on tech bubble crimes with SEC that were destroyed by taking out the whole building. What is far-fetched anymore? Who knows…

Another good post doctor; thanks.

>

I am a capitalist by nature but I have to wonder; what the United States could have done with a massive government effort to direct those 7 trillion dollars to say, renewable energy?

Reading through this great site on a regular basis it just frustrates me to see that the government is in denial and literarly painting a picture to deceive the American public injecting trillions into the stock market and trying to maintain housing prices.

1)As we assume the bubble will last longer – what impacts will the 4.5% 30- year fix have, why are some areas affected so much more than others; eg. as Corona/Santa Ana versus Yorba linda/ Anaheim Hills/ Villa Park in recent periods, etc…

2)How in the world is the market showing positive gains recently with negative news and grim sales numbers covering the news headlines – do they really think this is a bottom. Amazingly, talking with family and friends during the holidays over 75% were either working less hours, going through lean cuts, and not traveling to perform their jobs… people are hurting much more than reported

@Surfaddict:

+

Actually, there’s a lot of people who have proposed a price floor on oil prices. And there’s lots of good reasons for one. The biggest reason is that we are running out of oil, and we need to move to alternative fuels. But as long as gas is cheap, there’s no incentive to move away from them. So by having low gas prices, we’re remaining addicted to a fuel supply that is running out. If we kept gas prices at the pump around $2.50 or $3.00, it would discourage people from buying big ass SUVs who don’t need them, it would discourage people from sitting in their cars at drive-thrus, it would discourage people from driving like a-holes as they speed up to red lights, etc.,.

+

At the same time it would discourage wasteful practices, it would encourage auto manufacturers to move away toward polluting, gass sucking vehicles toward electric vehicles, by giving them the consumer demand they need to make the switch profitable.

+

But you know… to understand why you might want to institute price floors takes someone who isn’t retarded…

@BK

+

You don’t read this site very often do you? One of Dr. HB’s biggest points is that people don’t earn enough money to support the price of houses. The only way that housing prices can rise again is for people to start earning more money so that they can afford the higher prices. Because people can’t afford the current prices, and people are being laid off left and right, and companies as big as the Chicago Tribune (owner of the Cubs and Wrigley Field) are going bankrupt — we have a long, long, long time to go before people will be able to afford higher prices.

And it goes a lot further stevej. Does capitalism only work during bubbles? Uber-wealthy don’t usually invest–they speculate because it’s play money. It’s a game–they don’t’ care about collateral damage, obviously. The frightening thing is that we as humans are not getting more intelligent–just more arrogant. Like we all stayed at Hol Inn Express and think we’re friggin masters of all things economic. No, we are becoming less intelligent, less motivated, and more irresponsible. This Depression will possibly provide some motivation to get back to understanding our interdependence.

As has been said here before, what’s the point in propping up housing prices when they’re too expensive to begin with? Nobody will buy except, perhaps, the Chinese who come here now on property-buying junkets.

~

A just-finished eight-unit condo project here has its 950 SF units asking $450K! $470 per SF? What a joke!

I got out of the crock market back in 2002 and got a fed gov job. All my assests are in FDIC accounts, treasury notes, gold and silver coins and ammo. Yep, I got cash on hand too as well as food, water, etc. I”m ready for my neighbors to turn into animals. And I’ve got Italian relatives to back me/us up. We died getting to Amerika and we will die to stay here as well.

Jason

stevejust

I disagree, there is NEVER a “good” reason to have price fixing on ANYHTHING.

Just cuzz YOU don’t like me smoking the tires in my 67 Camaro, and sitting at lights in my Crew Cab Dually doesnt mean I dont like it. Your artificial pricing works for you, but not for me!! I might be a bit delusional and idealist as far as free market economy goes, but i believe the little guy always gets the best product for the best price if you leave the market to function freely. I’ll buy a car that gets a million miles per gallon, if they build it. It’ll get built cuzz ill buy it. Why punish me in meantime? If you really wanted us “off” oil, wouldnt you encourage us burnnning more so we run-out sooner? I dont wanna hear the polution argument either, when was the last time any of us rode our bikes to work?

>>Actually, there’s a lot of people who have proposed a price floor on oil prices. And there’s lots of good reasons for one.<<

The best reason for a price floor on oil prices is that price floors tend to operate as price caps. For example, if we set a price floor of $80 per barrel on crude oil, producers will know that they have a ready market at that price and will make long-term investments that they otherwise would not make.

Remember, twice in the past 20 years crude prices have dropped below $20 per barrel, forcing many producers out of business and forcing the capping of many producing wells. This oil production is often lost forever and the wells can’t just be uncapped. A price floor of $80 would likely increase production enough over the next 15 years to forestall major shortages. A floor of $100 would likely cause such a glut there would be no place to store all the oil.

Leave a Reply