3 Reasons Why This Credit Bubble is worse than 1929. Precursors to a Recession: Complicit Fed, Population Involved, and Greater Dependence on Credit

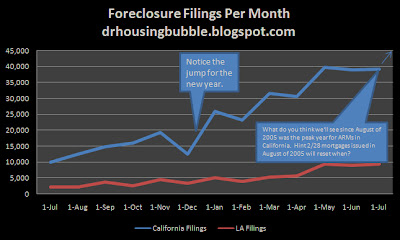

The market seems to have taken well to the liquidity injection by the Federal Reserve. Since the past two weeks of subprime debacles and stock market woes, the market is slowly gaining a foothold. Investors don’t seem to care that each day a few lending companies are collapsing and firing thousands of people. Growing foreclosure numbers, housing prices depreciating, and consumer spending cut backs don’t seem to matter. The sentiment is we will be back to good times in a matter of weeks. Just to give you some idea of how quickly the market is turning take a look at the number of foreclosure filings in California:

This is no small increase. We are up nearly 300 percent in one year. And since the data available does not have the current month of resets (which for California will be the largest) you can easily predict where the next data point will land. So why is the market rallying? There are multiple parallels to the false jump in stock market prices that occurred during March of 1929. At this time, we actually had a Fed that was concerned regarding the booming market. In fact, let us take a look at sentiment at the time:

“The tug-of-war between Washington and Wall Street reached its peak in late March of 1929. The Federal Reserve took steps to limit how much banks could lend for buying stocks. Interest rates doubled, which should have discouraged borrowing, “But people who dreamed of 100 percent profit in a week were not deterred by an interest rate of 20 percent a year,†President Hoover recalled. “When the public becomes mad with greed and is rubbing the Aladdin’s lamp of sudden fortune, no little matter of interest rates is effective.†Borrowing continued. “

This quote from a very brief booked called Six Days in October by Karen Blumenthal, which ironically is for “children over the age of 12†seems like it may provide some insight into the current credit crunch. Many books cover the Great Depression with opposing views and reasons for the decline. But this event happened sufficiently long ago that we can look at it and take lessons from it from an objective stand point. During the last few days in office, Calvin Coolidge was quoted as saying stocks were “cheap at current prices.†Keep in mind that all this speculation ramped up in the last three years of the decade specifically 1927, 1928, and 1929. Sort of like 2004, 2005, and 2006 with the subprime fiasco. Again, the rhetoric during these times was of continued prosperity with little consideration of the massive debt being used to support the current market.

As we hear about certain companies stepping in and the Fed offering support, we are reminded of the big players during the Great Depression that stepped in such as National City offering $25 million to brokers in March preventing a decline at the time. So the market had 7 more months of breathing room. The underlying fact still existed at the time as it does in 2007 that the underlying assets such as U.S. Steel, RCA, Westinghouse, and other companies were incredibly overpriced for what they were selling for. Fundamentals were living in Wonderland. Instead of stocks being over valued we now face massively overpriced houses in 2007. Before I punch my fist through the monitor, yes I do realize that stocks and housing are very different pieces of investments. How many times have we heard, “you can’t live in a stock†as if we were going to run off to the San Gabriel River and fabricate a makeshift home out of Google stock under the freeway overpass. Yet there is comparisons that we can make. Many people speculate through their homes. Need we point out the cadre of players: Flippers, Mortgage Brokers, Agents, Hedge Funds, Banks, Builders, Stock Investors, and pretty much everyone in this country. A stark contrast from 1929; it is estimated that out of 121 million people, just 1.5 million to 3 million of them owned stock during the latter years of the 1920s. How many Americans own their home in 2007? How about 70 percent. How many are living in an overpriced and inflated asset? Probably everyone in most metropolitan areas.

The issue occurs with the credit leverage of what has been going on. Let us highlight a brief example. Say Bill and Susie public decided to buy a starter home in Southern California for $400,000 in 2004. Bill and Susie figured that they would flip this house in 1 or 2 years so it didn’t make sense to take on a 30 year mortgage. They talk with their mortgage broker Jane, and she offers them a 2/28 mortgage with zero down. Bill and Susie seemed shocked that they can control a $400,000 piece of real estate for nothing. They purchase their home, live a comfortable life, and after 2 fantastic seasons of American Idol decide to sell their property. Amazingly, Joe and Cindy public want to buy this same home for $600,000 in 2006. After speaking with Jane the broker, Joe and Cindy plan on flipping the home in 1 or 2 years so they decide on going with a 2/28 mortgage as well. Bill and Susie leave with a nice chunk of change after selling fees and since this is sunny California, they will not pay any capital gains taxes because they lived in the home for two years. Sweet deal. Now Joe and Cindy are licking their chops and “know†they’ll be able to sell the home in 2 years for $1 million at the current rate of appreciation. However, they start hearing rumblings of a crashing market. They get an appraiser to their home in summer of 2007 and find out their home is only worth $550,000. They realize that they will not be able to make the payment once it resets since it will amortize over 28 years with a higher rate and will jump a whopping 75 percent. So who made money here?

Bill and Susie: Approximately $200,000 profit. Return on Investment? Over 100 percent since they didn’t put down one penny.

Joe and Cindy: They are down over $50,000. Return on Investment? Nothing and in fact, they will owe a lot more money than if they had rented.

Broker Jane: Nice kick backs on each loan.

Agents: Nice cuts from each sale (and purchase) of the home.

Wall Street: Amazing returns in Real Estate and Mortgage Backed Securities.

Government: Great returns on higher assessed property taxes and sales receipts.

Consumer Outlets: Amazing sales with mortgage equity withdrawals and the wealth effect making every American spending happy.

So it seems we only have one loser when the game of musical chairs is over. And that is the current owner of the property. However, if what we are hearing from Fed and other central banks is true, this market has a little bit more steam in it because so many players are involved in making money from continually perpetuating this bubble. Forget fundamentals and true asset values. Who cares when everyone is making money. This is why from a policy perspective, this credit bubble is much more widespread than the time just before October of 1929.

Complicit Fed

The Fed has already cut the discount rate and has done a few symbolic injections of liquidity into the market. Yet they are still cautious. As I was watching Senator Dodd talk about the bail out, he constantly mentioned that he was “pleased†that the Fed is willing to use any tools necessary to help this market. However, he wasn’t “pleased” that the Treasury wasn’t so Pollyanna and didn’t want to lift certain caps for government secured mortgages. As we’ve talked about, the Fed in the year leading up to the Great Depression radically increased rates to put a stop on the market. In this case, we actually have a Fed that is willing to continue this market speculation. We also have symbolic buys from certain large banks stepping in trying to assure the market that everything will be okay. Seems familiar. Yet looking at the raw numbers and looking at the fundamentals, no one is talking about a housing bubble. Am I the only one wanting to drop kick the morning newscaster like Chuck Norris when they say, “the problem with this market is the subprime debacle.†At this moment I pull out my megaphone, turn it on high and scream, “IT IS THE RIDICULOUS HOUSING PRICES YOU MORON†while dogs and birds scurry off my property. Everyone suddenly wants to blame the mortgage company and lenders as the soul reason for this entire mess. Since 2000, we’ve had countless players [see above] that made out like bandits in this market. Why would they want to see a different market?

The Fed is an independent agency. At least that is what they would like us to believe. Senator Dodd kept emphasizing this while giving the public an implicit wink that the Fed will do whatever the politicians tell it to do. Can it be that someone wants to buoy this market up at least until the election is over in November of 2008? Sadly, I’m not sure what could be done. Thankfully the Treasury at the moment seems to be standing its ground. I wouldn’t be surprised if in a month or so we turn on the television and see printing presses hand delivered to each lending institution. This may seem far fetched but just a few months ago, you literally had an ATM machine attached to your home (if you owned it) and could create money out of thin air simply by writing a check to yourself. $50,000 made out to me. Yes!

Population Involved

The parallels are very different this time as well. A large part of the country is involved in this bubble. Consumer sales will be hit when the market turns south. If your business depends on people buying discretionary products from you, the oncoming recession will hurt you. Anyone that worked for a subprime outfit is definitely at risk (if not gone already). Construction and building is on the decline. After all, why would you buy a depreciating asset at least in the short-term? Financial institutions are having trouble. Borrowing has gotten more expensive. 70 percent of the U.S. population owns their home. When I say own, I mean that that many are on the deed or title as owner. Some estimates point out that 30+ percent of Americans own their home straight out. But for those that don’t, equity as a percentage of the value of the home has been on the decline. This is a sobering fact considering that in no time in our country’s recorded history have housing prices risen so drastically. Can it be that many folks turned on the spigots and let the equity drain out of their homes? Maybe.

Even those in the public sector will be hurt since local governments and municipalities depend largely on sales and property tax receipts. The State Controller of California in August reported a projected short-fall of $787 million in total tax receipts; a big adjustment considering the projections were only issued in May of this year. These are things that haven’t hit the mainstream media but will in the near future.

Great Dependence on Credit

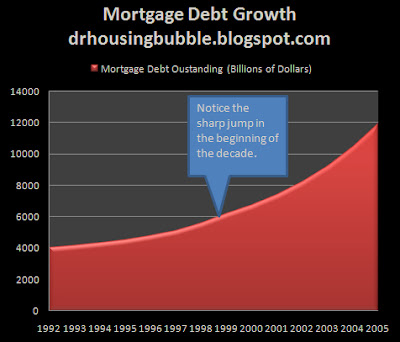

Think this country doesn’t have much mortgage debt outstanding? Take a look at this chart I put together showing the increase of debt over the last 15 years:

We’ve nearly tripled the mortgage debt in 15 years. Again this is as much a credit bubble as it is a housing bubble. At the peak of this mayhem, in August of 2005 over 70+ percent of all loans in California were adjustable rate mortgages. Of course this includes negative amortization, option ARMs, 2/28, interest only, and every other exotic mortgage product floating out in the market. Our dependence on credit is amazing. This partially comes from the fact that we as a nation have a negative savings rate. I imagine it is hard to spend something you do not have but many credit card companies during this massive boom were more than willing to lend you the credit. Where does this end? I think we are already seeing the end. I know we are in a bubble like no other when I get credit offers and refinancing offers from companies that no longer are in operation! Maybe they should contact their direct mailers and let them know that they are no longer offering 0 percent for 12 months or 5 percent Home Equity lines.

The parallels to the Great Depression are many. I’ve highlighted two letters one from a lawyer dealing with the fallout and another from a banker giving his opinion on the market. Yet it doesn’t seem like we are willing to learn from the past. In fact, it appears that from every branch of government we are more than willing to keep this thing going. Don’t you find it ironic that big banks can go to Fed and get a discount while you can’t? How does this liquidity help Joe and Cindy who are upside down by tens of thousands of dollars? I guess in the end, someone needs to carry out the garbage.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

6 Responses to “3 Reasons Why This Credit Bubble is worse than 1929. Precursors to a Recession: Complicit Fed, Population Involved, and Greater Dependence on Credit”

Great Article!

The thing that doesn’t make sense to me, I guess, is that Bernanke has studied the Great Depression extensively. Check out his remarks in 2004. Being that we have a Fed Chief who doesn’t pander to Wall St. and who has a vested interest in the health of the economy, I find it hard to believe that we would dip into a massive depression like that of 1929.

Why would the politicians running for election want the market to stay up right now?

Seems they would want it to crash now so they can come in and “fix things” and blame their predecessors.

Too risky to have it crash on their watch – a la Hoover.

To try answering my own question, if the market were to crash now, I guess it could potentially taint all politicians, not just the White House, but Congress too.

I’ll stick to my guns in thinking that the risks are weighted more towards stagflation than to deflation. We’re more likely to re-run the 70s than the 30s IMO.

Dems looking to unseat GWB have plenty of ammo already, thank you very much. No one wants to spend his or her two terms in office trying to dig out from under a big crash that happened in 2008. It’s in their interest to appear to save the day while blaming GWB for creating the problem in the first place.

Bernanke and Paulson have some wiggle room and I suspect they’ll use it. The Fed could lower the funds rate to 5% without significant damage to the dollar, which is gonna sink anyway no matter what they do. Arguably the rate is already too high. The fed’s problem all along has been that they really needed long term rates to go up so that the yield curve is more reflective of inflation and currency risk, and yet they can only directly set short-term rates. They’re like a guy trying to reposition a garden sprinker by wiggling the hose at the end connected to the tap. As for treasury, I don’t see much harm in bumping the jumbo level to 600k to increase liquidity, as long as credit quality metrics don’t change. If you’re holding 1000s of mortgages what’s the difference between 3x 400k mortgages and 2x 600k, if owner equity, DTI, FICO, etc. are the same.

As bad as things are, the majority of mortgages are eventually going to be repaid, and most of the rest will be harvested at some large fraction of their face value. I’ll bet smart money players are going to snap these instruments up at cents on the dollar and then look like geniuses a few years from now, just like buyers of junk bonds did in the 80s.

The great disconnect.. You can’t look at the stock market or any other macro economic indicators at this point. They reality plug has been pulled out, for now.

Joe and Susie are now the prime indicator. It’s all on their backs.

We have folks in the bubble and those that are out of the bubble. For the last 10 years people have been drawn into the bubble, and now they are being thrown out, literally.

Become debt free and get a non-bubblicious job and you are out of the bubble. The majority of folks that are smart are already outside of the bubble. Those that are left on the inside are the rubes and those trying to squeeze the last few dollars from the rubes.

Amazing how stories I’ve considered “well, duh” for years now start to be published.

http://www.msnbc.msn.com/id/20393984/

The full ramifications of the so-called housing boom have yet to really be discussed by the media experts or even here for that matter. The effects on our society are myriad, catastrophic and sad. There are plenty of hidden prices to be paid.

First, the huge change was from the days of private local builders, the sorts of small companies (by today’s standards) that build early suburbs in my day or the inner historical parts of our cities, to publicly-traded mega companies whose primary duty was to return shareholders’ equity and turn out more and more product, faster and faster.

Rather than build what was truly needed (higher density, low cost housing in central areas as Dr. HB has many times pointed out), these companies (Toll, Beazer (sleazer), etc) spent the last decade creating immense sprawl of cookie cutter condos and McMansions nationwide.

The construction quality on even the $1 million McMansions was so clearly shoddy compared to historical standards, these things would never make it to the next century. It was so OBVIOUS.

To keep shareholders happy, what do you think they did?

This massive sprawl has:

1) created gigantic infrastructure problems to maintain highways, sewers, utilities, etc, etc. in an ever-increasing dispersed manner. These are paid by us, the middle-class taxpayers, not Tony Mozilo or the Toll Brothers.

2) taken out of production, forever, valuable agricultural land, especially in places like the Central Valley and coastal California (where do you think your orange juice comes from)

3) destroyed huge swathes of wildland driving many plant and animal species closer to extinction (again, especially true in complex biological coastal zones of various states)

4) As these neighborhoods crash in value, provide little tax revenue, they will have to be maintained by more and more tax monies from productive sectors

5) Some of these suburban neighborhoods will rapidly turn into gang-infested Section 8 “new” slums, with shoddy construction feeding upon itself — national blight.

If you think this all extreme, just travel to some of the already new ghost towns in the Inland Empire of southern California, or the high desert or Stockton or fill in the blank.

It’s all very sad and was for nothing. So people could “flip” 3, 4, 6, 20 houses? That doesn’t build neighborhoods, communities or societies.

Leave a Reply