When the housing bubble pops again. California and the 1,700,000 homes with negative equity – 50 percent of Florida homes in negative equity yet bubble markets persist across the country.

Negative equity is a polite way of saying a homeowner is underwater on their overpaid property. This is similar language from the financial industry rewording junk bonds into high yield bonds. Sure sounds better right? Would you rather be broke or income inclined? Mr. Orwell would be proud. Negative equity is now pervasive in our country because home prices continue to make nominal post bubble lows. There is no mystery as to why home prices continue to decline. Home prices are inflated relative to the actual income of American households. As incomes decline further and become eroded by daily living inflation, home prices will come down further as buyers demand lower priced options that meet their household budgets. Zillow recently came out with a report showing that 28 percent of all homeowners with a mortgage are in a negative equity position. In other words, they owe more on their mortgage than what the home is worth. If there is any doubt why the shadow inventory will remain high for years to come, you can look at negative equity as the number one reason. Yet simply saying negative equity is the main reason for such a high number of distressed properties misses the bigger picture. Let us examine the negative equity problems permeating across the country.

Underwater nation

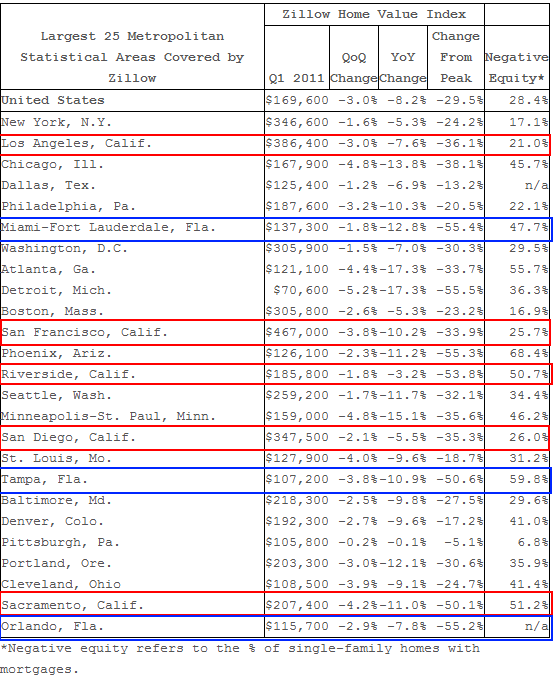

The Zillow report was fascinating and I think one of the main things that were missed from the report was the fact that metro areas still in bubbles actually look healthier than they are:

Source:Â Zillow

Let me explain more carefully what I mean that some areas on the surface appear healthier than others. For example, take a look at Riverside California out in the Inland Empire. The median home price according to Zillow is $185,800 down 53 percent from the peak. Even with this correction 50 percent of current mortgage holders in the area are still underwater. Now measure that up with Los Angeles. Los Angeles has a median price of $386,400 down 36 percent from the peak yet only 21 percent of homes show up as being underwater. What I would argue is that Los Angeles is more poised for a correction moving forward than say Riverside. Why? The negative equity is based on recent sales and the bulk of the sales have not occurred in bubble markets like Culver City and Pasadena. These areas have large numbers of distressed properties that still do not show up on the MLS. Yet they are now trickling out little by little and these are usually properties that push the median price lower. As these homes sell, the median moves down and just by this fact the number of homes in negative equity subsequently gets bigger as comps get adjusted. In other words, we already know Riverside is in bad condition because banks are moving on the shadow inventory at a much faster pace than say homes in Los Angeles.

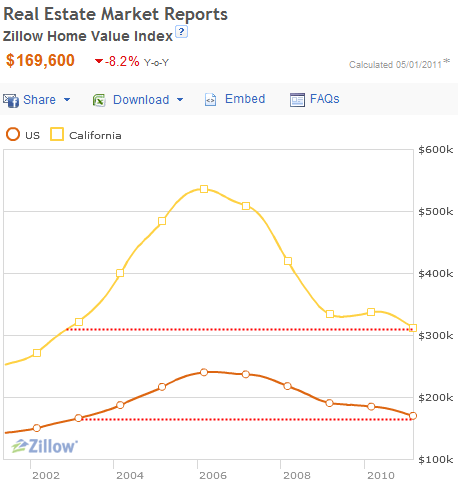

Or look at the blue boxes above that show prices for Florida. Nearly every region has seen 50 percent price drops from the peak and current mortgage holders are underwater by 50 percent, similar to the Inland Empire. Even with the big drop, prices fell by 10 percent or more in the last year! Does that mean things are in better conditions in Los Angeles or San Diego? Absolutely not. What this means is that the bubble is popping in various stages. We still have pockets of markets where you have delusional sellers and buyers thinking that the days of the housing bubble will be back again. Remember that this entire housing bubble was driven by a psychological mania. It was flat out economically irrational. Trying to bring people to sanity is a hard objective especially when many are addicted to the easy credit days. Will home prices soar in California? I doubt it:

According to the above chart, we are making new lows and home prices in California are back to 2002 levels. The lost decade is coming up rather quickly. This is happening because household incomes are not moving up and if you factor in higher education costs, medical care costs rising, fuel, and food you realize that more of the current income is being diverted. Since being underwater is the biggest indicator of future problems, let us break down the entire California market:

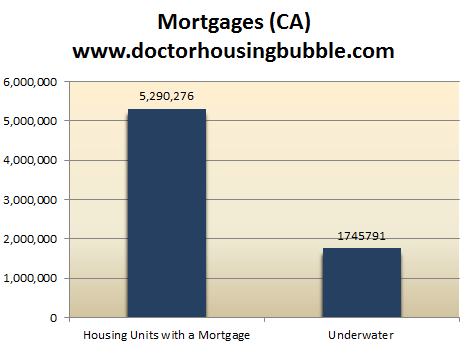

Source:Â Census, Zillow

Over 5,000,000 homes in California have a mortgage. Since the most conservative estimate puts 33 percent of homes underwater in the state we have over 1,700,000 homes that are carrying mortgages higher than the home is actually worth. Keep in mind that this figure is likely to be higher because many bubble markets like Culver City or Pasadena are still inflated and thus make the negative equity position seem healthier.

Nationwide epidemic of negative equity

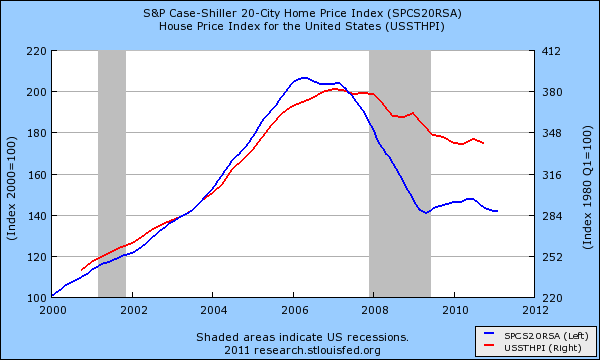

This pattern of new lows is not occurring simply in California but across the country:

According to various reports home prices have fallen by 7 to 8 percent annually across the entire country.  Did we not hit a bottom in 2010 with all the tax credit shenanigans and the Federal Reserve artificially lowering mortgage rates by buying up securities? All this did was sucker more people in and given that in places like California where 30 to 40 percent of all purchases are made with FHA insured loans and a 3.5 percent down payment, we just yanked in more people into the negative equity category. Just run a quick scenario to show how quickly money was flushed down the toilet here:

Purchased in early 2010 California:

Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $250,000

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $8,750

Try to sell today in 2011:

Price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $230,000Â Â Â Â Â Â Â Â Â Â Â Â Â (modest drop of 8 percent)

Commission:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $13,800

Total net:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $216,200

This person is now underwater by $25,000 because people forget that you actually need to pay a commission when you sell your home (this is paid by the seller). And what of the people that jumped into overpriced markets where homes are selling for $500,000 and higher? No wonder why the economy is still stalled and showing signs of weakness. The recent jobs that we are adding are largely in lower paying sectors. How does that keep home prices inflated? We can add 500,000 jobs a month but if these are lower paying jobs home prices will still come down.

The income side of the equation is largely what is missed in all the banking bailouts that we have pursued in the last four years. So what if banks have trillions of dollars to lend if you do not have a population with adequate income to service the debt? That is exactly what we are facing. The housing bubble especially in California was a self-feeding machine of delusion. We had job growth in high paying finance and real estate jobs because of the mania so this in turn helped to push home prices further. Home prices went up thus pushing commissions up and creating more funny money. It was one giant Ponzi scheme and everyone was making money doing nothing except trading homes back and forth and pretending that a granite counter top and a bucket of paint suddenly made a home “worth†$50,000 more. When this popped the California economy went down further than many other states. Keep in mind we have had two decades of bubbles. We had the 1990s with the technology bubble followed by the 2000s housing bubble. These created high paying jobs (even if they were bubbles) and thus kept revenues flowing into the state coffers. What other bubble do we have in store to push home prices up?

In the end negative equity simply is reflecting the tide going out and folks realizing that household incomes are actually stagnant for over a decade. Even with low interest rates and home buying coupons people can only afford so much. Banks would rather speculate with taxpayer bailouts on the global stock markets (the returns are better). In 2010 many were chiming in that the housing bubble had reached a bottom in California and failed to miss the artificial support that was propping the market up. Today at new bubble lows, we are moving down again to a new bottom. When will we hit the ultimate trough? Hard to say but not any time soon.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

100 Responses to “When the housing bubble pops again. California and the 1,700,000 homes with negative equity – 50 percent of Florida homes in negative equity yet bubble markets persist across the country.”

Is Zillow fully counting all the HELOCs in their calculations of negative equity? I’ve read that it’s very difficult to actually know what are all the HELOCs out there. I live in SoCal, and I know that there were an absolute ton of HELOCs taken out in 2004-2007. I suspect that one of the reasons that LA and San Diego are showing relatively low negative equity percentages is that many of their HELOCs are not being counted.

Anyone know if that is right?

H

I can’t imagine there is a mechanism for counting HELOC’s. I suppose some metric could be gathered on what banks were giving out in HELOC’s and then use that to offset the underwater percentage in the upward direction. No idea how to get that metric though.

Right. that’s what I’ve always wondered, whether or not these figures include HELOCs. I’m assuming not, which leaves trillions of dollars of bad loans out there floating around and not on the traditional radar. I read recently that one can easily raise the total underwater figure to 50% from 28% if HELOCs were included. Of course, imagine how many would be underwater if they actually stuck a sign on the lawn, all at one time, and tried to sell. hoo boy.

“Equifax reported that in July 2009, the average HELOC balance nationwide for homeowners with prime first mortgages was nearly $125,000. Yet the studies which discuss how many homeowners are underwater have examined only first liens. It’s very difficult to get good data about second liens on a property.”

From:

http://clinvestments.com/wordpress/2011/04/29/strategic-defaults-revisited-this-could-get-very-ugly

Scroll 3/4 down the page for this quote.

~Misstrial

“Remember that this entire housing bubble was driven by a psychological mania.”

As long as suckers believe in the lies, rather than stark reality, there will be victims to see hyper-inflated homes to.

But as incomes and savings are destroyed by .gov meddling, the insanity will become harder and HARDER for the banksters and real-tards to fraudulently induce and anyone that aids in this multigenerational deception is a emotional fool.

“A fool and his money are soon parted” — In this case the emoting morons are FURTHER depleting the assets of the almost extinct middle class through their mistake of volunteering to become another sheeple ENSLAVED to the debt conspiracy.

“If ye love wealth better than liberty, the tranquility of servitude than the animated contest of freedom — go home from us in peace. We ask not your counsels or arms. Crouch down and lick the hands which feed you. May your chains sit lightly upon you, and may posterity forget that you were our countrymen!”

that write-up is all fine and dandy, but if you vote for democrats or republicans, YOU are the problem. The homeowners did *not* vote for the bailout, that was YOUR elected official, stop blaming the victims and start blaming the perps…OUR government. ALL of you that vote for the two parties are the ones guilty of f’ing this country up..ALL OF YOU!

I haven’t participated in the (D) & (R) Free Shit Empire â„¢ since consenting to the coronation of Reagan.

And for the record you’re 100% correct, in that if you voted for either party of the corrupt oligarchy you’re consenting to WHATEVER consequences result:

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness. — That to secure these rights, Governments are instituted among Men, deriving their just POWERS from the CONSENT of the governed, — That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or to abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to effect their Safety and Happiness.

Case Shiller index has a lot of catching up to do with the US House Price Index. They were highly correlated until about 2008. I’m sure the banks holding onto shadow inventory in the large metros has a lot to do with this. The HPI looks like it’ll print below 100 by 2012-13. Look out below, it’s going to get ugly when the the traditionally more active summer period falls flat in sales, and a flood of homes come on the market in late 2011 and early 2012 as sellers panic. Repeat of 2008 with or without QE3.

I’m surprised Las Vegas didn’t make the Zillow top 25 metros. At 80% negative equity, that city is surely the grand prize winner. Has their population reduced that much ?

Surely you don’t think that Zillow might be pulling worst case numbers to appease their RealTard advertisers?

I mean c’mon, you know how expensive it is to maintain a Mercedes and bling-bling wardrobe these days?

Zillow’s gotta lookout for the homeys!

P.S. Don’t listen to NRA cheerleaders telling you it’s raining when they’re pissing on your head….

Just to clarify:

NRA = National Rifle Association

NAR – National Association of Realtors

Normally I wouldn’t nitpick and this isn’t directly solely at your post but I’ve seen this show up 3 times since yesterday so I figure it’s worth mentioning for people that don’t realize this. Regardless of one’s view on firearms and second amendment rights, no rifleman deserves to be slandered like this. 🙂

Houston didn’t make Zillow’s list either and, at roughly 4 million people, it is much larger than most of the cities on the list.

Houston is left off the Case Shiller index too – anyone know why? It has always seemed like a rather large omission to me… Swamp prejudice, perhaps?

Houston is in Case Shiller’s 20 City index, but not in the 10 city. Dallas made the 10 city list.

Don’t think so… Dallas is in the top 20, but not Houston. http://en.wikipedia.org/wiki/Case–Shiller_index#Composite_20_index

There is an UGLY house 5 blocks away from me – UGLY, but looks like a decent place to live. This is in a quiet, pricey California coastal town. The house is bank owned and has been for sale for about 1 year, sitting empty the whole time. The for sale sign blew over in a recent storm into some bushes and is not even visible anymore. I cannot believe that these IDIOTIC BANKS will not get more realistic with their pricing on some of these foreclosures. I’m wondering how long the for-sale sign will be hidden out of view before they fix it. The whole situation is IDIOTIC.

Extend & Pretend, that’s all the banking/re scum have right now, and they’re shouting it from every media outlet that will let them lie on air!

Gotta keep the sheeple grazing on pastures of ignorant bliss, otherwise…OH! OH!

Well if the sign belongs to a Real-Tard, then the dumbass agent should get out there and fix it… and the storm-damaged landscaping.

Yeah, make them “earn” that huge commission…

Why not hook one side of the sign back up. When the realtard drives by, s/he might be inclined to stop the car and hook the other side up so it is straight and level. If not, then you know that the realtard can’t be bothered, which would actually be an interesting fact to know.

What will the people be thinking who buy during the “summer RE season” this year in SoCal? They certainly will not be thinking about incomes and negative equity. All cash buyers who are not worried about a 10-20% near term correction would be my guess for a prime buyer demographic data point. Are there really people out there jumping for the falling knives and listening to RE shill jargon? Yikes.

How long will it be until the rising price of a basket of goods combined with stagnant income cause the residential RE market to find its bottom for real. Get the squatters out and sell off the inventory already.

From what I’m seeing, a lot of the nouveau riche in fast growth places like the PRC are moving their money out and looking for investment properties on the West Coast.

Imagine a state on the verge of being a bankrupt by socialist policies, corrupt backroom deals and public employee looting receiving massive immigration from hardcore communist ideologues!

Should be a lot of fun out there in the ol’ Golden State for those left behind.

Broke because of “socialist” policies ROFLMFAO! Who do you get your info from Rush or Hannity? Take a good long hard look at spending on education, roads, etc.

Good God no wonder corporate america is making BILLIONS of profits while you and I can’t afford homes. You get the numnuts saying the corporations needs more tax breaks and to save money you cut funding to the ones who need it the most. Americans aren’t very bright, but HEY, we assassinated Bin Laden, we rock! Que up the song “Proud to be an american”, and no, we DO NOT mean you indians, you are out, other than naming assassination ops for you.

I like the way he throws a fear tactic into us with his PRC comment. “Yah, the Chinese Commies are coming to buy yer houses wit yer money and it’s all cause you people are greedy union workers for the state, a bunch of commie fools ruining our country with union pensions and socialist programs”.

Hey Newsboy, CA went down the tubes cause a) they caved into Bush’s buddy at ENRON with his thieving scheme and b) ran amok with housing schemes thanks to American Capitalist Corporate Banksters.

By the way the Chinese with the $$$$s to buy here are not. They are living like Capitalist pigs in their own country with near slave labor. Why should they trade that for the risk of US increasing taxes on the rich? Especially since our real estate may be headed for a full tanking. It’s not public employees ruining our country or state, it’s corporate greedsters selling out American jobs for maximum profits off that near Chinese slave labor. By the way, the socialist programs here are taxed, as in hard pressed, because Walmart schemes to avoid benefits to their employees and pays so little they can only get Medical.

Hey Newsboy, CA went down the tubes cause a) they caved into Bush’s buddy at ENRON with his thieving scheme and b) ran amok with housing schemes thanks to American Capitalist Corporate Banksters.

I have roots in Klownifornia going back to my family starting the first US bank in Benecia in 1850, so I actually have a firm grip on the history of the Golden State.

The degeneration of Kali is FAR more complicated than some mindless (A) + (B) scenario, but nice try…

“By the way the Chinese with the $$$$s to buy here are not. They are living like Capitalist pigs in their own country with near slave labor. Why should they trade that for the risk of US increasing taxes on the rich?”

Wrong again, this is a well known macro trend, please do try to keep up:

http://www.businessinsider.com/china-is-ageing-and-the-rich-are-fleeing-2011-4

“China Is Ageing, And The Rich Are Fleeing”

“Bain & Co and China Merchant’s Bank Private Wealth Report 2011 found that the so-called high net worth individuals rose 19% in 2010 compared to 2009. Sadly, 60% of them are considering emigration or are already doing so, and 27% of those with 100 million yuan have already emigrated, and 47% of those are considering.”

“There are three major reasons behind rich people’s immigration: a better education for children, safety of personal wealth and a preparation for retirement, the report showed.”

“Safety of personal wealth†is probably the main motivation. The story I have been hearing is this: these folks emigrate to other places and invest in real estate in other places as a form of “political insuranceâ€. Too many of these rich folks got their wealth because of their connections with officials, probably bribery and corruptions, and they don’t see their assets in China being “safe†in a sense that if they get caught, they will have nothing left. So it makes some sense for them to flee before it is too late. “

Renta lurker…I live in CA. I agree with you totally. Our government only wants to tax, to reward the public employee unions so the unions can give them more campaign money, reward illegal aliens because they vote Democratic. They have absolutely NO respect for the private sector who they see as evil business that needs to be taxed.

The Democratic leaders of CA are totally, utterly moronic, you are right.

Give me a break. The illegal aliens don’t vote. They can’t.

The people you see voting are CITIZENS. They have as much right to vote as you or me, and as a decedent of those who came on the Mayflower, I for one am glad they are here. This is an immigrant nation founded by immigrants, built by immigrants and we will continue to enjoy American exceptionalism as long as that remains true. That is because immigrants fight hard to get here, work hard to stay here and don’t for a moment take for granted what is great about our country. They are exactly the people we need to have here. Overbearing, over opinionated xenophobes with an over developed sense of entitlement and an underdeveloped sense of compassion, I’m not so sure we need.

this is one of the Doctor’s very best posts. Does anyone have an opinion about “ultra elite areas” like Malibu, CA? We have a rental house out there that is currently valued at 1.6mm and rents out for almost enough to cover all the costs/mortgage. I’m probably going negative on it $1,000 a month, which I sort of view as an acceptable premium to pay for a huge , leveraged call option on local housing prices marching forward doe to demand from the super rich and lack of space. But I’m just not sure about all that – and from a nationwide / statewide perspective, I agree with the Doctor that more pain is ahead . . .

There is NO shortage of space, but rather a surplus of VACANCIES, and the super-rich are paying cash… at foreclosure auctions. So if you have tenants, better keep them happy… there’s not many more in that price range. (Beware of porn producers, who will rent the swank digs for 2 months, then break lease… bleach will be needed afterwards, lol.)

Enzo – there is a shortage of space in Malibu becaue of zoning restrictions. And there are no vacancies to speak of

Good luck. “Super-rich” looking for a “$1.6 Million” Malibu retreat…..while Beverly Hills has foreclosures galore?

Good luck.

Add the end of the Fed support for Jumbo Loans into the equation:

http://www.nytimes.com/2011/05/11/business/11housing.html?_r=2&hp

“Federal Retreat on Bigger Loans Rattles Housing”

It still amazes me that people come here asking “Should I buy a house now”? Yeah, and I have a bridge for sale too – 25% off, just for you!

With each day that goes by, it looks like my prediction of a 10-20% drop in housing prices nationwide is looking better.

It is interesting that the status quo that preaches confidence is unable to take the necessary steps to ensure confidence.

Lip service, to a notion that has no concrete meaning in the context of the U.S. political and economic system.

2.5 years ago the U.S. could have had real financial reform, forced banks to write off bad debt, started a future that was different from the past.

Instead the status quo circled the wagons, got a blank check, and continued along their merry bonus, sucking the system dry, way.

There is no hope and no change in this system.

There is merely talk of confidence, invoking of MAD at 3 month intervals, and enriching the the top 1% politically-connected crony capitalists and the millions of government employees at the expense of everyone else.

QE et al. is a circling the drain strategy.

Successful Fiscal Looting Needs Federal Reserve Monopoly Policy Lies because fraudulent inflation of global monetary systems cause ALL financial instruments to rise on the floodplain — But once the flood waters recede, only REAL wealth will remain.

“This is happening because household incomes are not moving up and if you factor in higher education costs, medical care costs rising, fuel, and food you realize that more of the current income is being diverted. ”

Might wanna add taxes into that equation too, especialmente in a socialist state like CA, which will have to MASSIVELY hike taxes to meet entitlements, social services and out-of-control pension liabilities – I hope you Californios took note that the CA Senate is trying to empower the Counties to collect income taxes right now!

“The income side of the equation is largely what is missed in all the banking bailouts that we have pursued in the last four years. So what if banks have trillions of dollars to lend if you do not have a population with adequate income to service the debt?”

Matt Taibbi @ Rolling Stone has this to add People v. Goldman Sachs):

“But Goldman, as the Levin report makes clear, remains an ascendant company precisely because it used its canny perception of an upcoming disaster (one which it helped create, incidentally) as an opportunity to enrich itself, not only at the expense of clients but ultimately, through the bailouts and the collateral damage of the wrecked economy, at the expense of society. The bank seemed to count on the unwillingness or inability of federal regulators to stop them — and when called to Washington last year to explain their behavior, Goldman executives brazenly misled Congress, apparently confident that their perjury would carry no serious consequences. Thus, while much of the Levin report describes past history, the Goldman section describes an ongoing? crime — a powerful, well-connected firm, with the ear of the president and the Treasury, that appears to have conquered the entire regulatory structure and stands now on the precipice of officially getting away with one of the biggest financial crimes in history.”

The “banking bailouts” weren’t made to provide “trillions of dollars to lend”, they were made so the Federal Reserve could re-liquidate insolvent criminal enterprises (banks), and receive their toxic RE holdings.

Yes, a portion was invested in a few photo-op make-work projects around the country, (a mere pittance), but the majority of the taxpayer money was given to multi-national banks (e.g. Goldman Sachs), and almost 1/2 immediately went offshore!

God help the USA if the looting doesn’t stop soon!

“When plunder becomes a way of life for a group of men living together in society, they create for themselves in the course of time a legal system that authorizes it and a moral code that glorifies it” ~ Frederic Bastiat.

The root of the problem might be seen as big government tax, instead of the unregulated m’f’ers who make markets at places like G & Sachs.

We either tax the coorporations into the red, or the American populace pays the bill. The American populace doesn’t have a strong legal team so the FIRE TBTF win due to lack of representation and forfeit on the side of the American people.

Thanks Alan (FrothyFed) Greenspan, (Helicopter) Ben Bernanke, and SEC Christopher (sux) Cox to name a view of the tactical Maestros.

The answer isn’t taxation, it’s enforcing the Rule of Law.

Of course when you have institutional corruption sold to the highest bidder, not much chance that happening…

http://www.theatlantic.com/magazine/archive/2009/05/the-quiet-coup/7364/

Stop the Looting and Start Prosecuting!

DH

Can you provide a link to the stats on flood effects from the Mississippi River on the floodplains: effects on commercial and residential real estate, farms, and businesses as well as shortfall of gvmt. aid.

How many people might be displaced and what could be the effect on the national housing bubble? I imagine any people displaced would not have jobs and thus would not provide price support.

Will government housing be required? Building in floodplains should be prohibited but I imagine farming is ok.

Near Sacramento, tens of thousands of stucco/tile roof granite countertop homes have been built in a floodplain that reachs up to Marysville. They dyked them with berms and huge electric pumps. Someday a storm will come that will either knock out the power or overwhelm the pumps and these islands of homes will become expensive ponds. It is insane what the politicians have allowed the developers to foist off on gullible home buyers. People are going to drown.

“It is insane what the politicians have allowed the developers to foist off on gullible home buyers.”

Not insane, just sleazy and CORRUPT, i.e. business as usual in RE development. Read the classic American novel ‘Babbit’, by Sinclair Lewis, and remember that it was written (and set) in the 1920s… George Babbit is a RE Broker, and NOTHING has changed.

Also look up H.L. Mencken’s choice quotes on the banality of the made-up word “Realtor”, and the parasitic role of these “used house salesmen”, also from the 1920s… priceless.

Obama admin pushing banks to offer sub-prime mortgages again…

Nice racial/political search engine post. Poser.

Is a personal insult the best you can come up with?

Good grief – get with the program and pen something creative and factual!

~Misstrial

Thank you for the link, Doug.

Its too bad the idiocy goes on. I don’t think most people who live in ghetto/low income areas want to buy there – actually they want to get out.

So, my thinking is that “community activists” are really representing scum property owners who are looking for a foolish buyer to purchase their dilapidated properties.

In the legal field, where I work, its well known that judges and public defenders own these sorts of properties and rentals. I’m thinking there’s a connection going on….

~Misstrial

Make sense, because in my experience with the Federal/State Judiciary there’s definitely a feudalism mindset.

Strict fascismo justice for the serfs, and discretionary justice for the Lords (as long as they don’t make the Elite Tribes look to bad).

‘MeriKa is in a struggle for its very existence, don’t be fooled by puppets and carnival barkers like Rush, Hannity, Huffington, Obama and the Clintons et al. proclaiming their own personal versions of salvation for the nation.

They’re only interested in selling the chattel sheep to the highest bidder…

Ok, well the curt post and notion that this is directly linked to the Obama administration (which I failed to make the connection based on the post) makes me think this is a political SEO post. That’s all. I just can’t see how this will lead to sub-prime lending in large scale again as Doug suggests.

I can see, and do believe that local powers will shift laws in their favor at the detriment to poor and unintelligent. This is sad. What kind of connections are you seeing?

Newsboy:

You’ve got it. And you are not the only one who has noted the unjust nature of the Justice System:

1 Corinthians 6:1–8 (KJV) – “Dare any of you, having a matter against another, go to law before the unjust, and not before the…”

~Misstrial

Great post Dr. HB. “It’s the income stupid” You can’t buy a decent house in West Los Angeles without a decent income. Sooner or later, the Westside is going to get crushed, as the extend and pretend game wears out. As mentioned, there is no reason in sight that will turn this ship around. Look for at least 3-5 more years of pain, before inflation finally catches up to prices dropping.

http://www.westsidermeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Have you sene the MIA/ FLL condo market lately? Holy crap, prices are still way above where they should be. In the city of Aventura alone there are 800 plus condos on the market & 100 plus are over $1,000,000 each & may not sell anytime soon.

I can’t help feeling like the income side of the argument is overblown. If you look at real wages over the last 50 years or so, they don’t change much. They are up some decades and down others, but generally speaking stay roughly the same +-20% or so. Incomes are going down… some… due to unemployment, but it is nothing like the 2x home price increases that occurred in the “naughties”.

My opinion wasn’t changed much. I believe the real story here is that prices went too high over a period. They have largely corrected. They might trend down further… some… for the relatively small comparative declines in real earnings — DHB does have a point — but I’m not looking for California to become another Detroit. The jobs are still here, and so are the people. The homes will still be occupied and someone will own them, even if it is not the occupier. I wouldn’t be surprised to see some particularly unrealistic bedroom communities become Detroit-like, though. The core communities near work will continue to do just fine.

..and quite frankly, living in Sacramento to commute to the Bay Area is just nuts. It should be brought to a stop. If this is how that happens, then why not?

In the end though, it does give one pause about government home ownership programs. It certainly took questionable intelligence and the wisdom of a crack head on the part of the financial industry to do what they did, but at the end of the day, I don’t think the initial sub-prime debacle would have happened on its own without the government stepping in as a buyer for those loans. They are still at it, the largest consumer by far for conforming loans.

It leads me to think that the housing market would be much healthier if other government home ownership programs, principally the mortgage deduction and prop 13 were cancelled (in due time). They are all nonsense. It doesn’t make houses more affordable. Supply and demand just re-equilibrate around a new higher price taking the new glut of money into account. So, you just pay more. It also results in some wealth transfers that I just don’t think are healthy. The tax deduction transfers wealth from government to bank. Prop 13 leads to incredible tax disparities between young and old, on otherwise identical properties — net wealth transfer from young to old. Finally, the simple fact that prices went up causes a wealth transfer from young to old.

I’d like to think that as a result, our older generations would at least be well prepared for retirement, but… apparently not.

Miami-Fort Laud is off-peak by 55.4%, and still plummeting! From the QoQ and YoY figures you can also plot the 2nd derivative, i.e. the rate of ACCELERATION in the downtrend! Looks like the “knee” will be hit THIS year, not 2012… =:O

“We’re #1!…”… in all the wrong things. Banksters and RE-slicksters are scrambling to cut their losses, and foist their shyt onto foreign suckers.

The days when actual incomes in California met the requirements to realistically pay for a typical mortgage in the coastal areas went bye-bye years ago. Its just that the bubble further extended the gap. Home prices were also driven up by several years of exotic lending products. In all reality the true peak of the real estate bubble in CA should have been in 2003, which is when there was a decline in home sales. The introduction of exotic loan products extended the bubble for several more years. That’s important to consider given that prices were already well above and beyond what real incomes could afford by 2003. Thus a decline back to 2002 prices isn’t really all that much of an improvement.

Truth be known the median prices in places like the Bay Area and LA might seem more reasonable than at the peak of the bubble. But the fact is that prices in almost any of the desirable to even semi-desirable areas are still for the most part within striking distance of their all-time highs in 2005-2006. For example, the semi-desirable East Bay neighborhood I live in still has prices set at around $475,000-$500,000 for a typical starter home. The cheapest I’ve seen has been in the upper 300’s for what appears to be a total dump of a home in need of serious structural repair. So while some of the lower income areas have fallen in price dramatically, the upper and middle income areas are still at sky-high levels.

Anecdotally I’ve noticed that homes in my area aren’t really selling when they’re priced at the 500k mark anymore. There are countless homes in my neighborhood that have been for sale forever. One got a price reduced sign stuck on it months ago. On the other hand anything priced at say- the $350k $400k mark seems to sell. Then again the story for those is the same…. ” Investors” paying cash for them.

That brings me to the last point. What exactly do all of these investors paying cash hope to accomplish? A report out this morning indicated that banks have years worth of foreclosures they’re going to gradually release onto the market. Thus its not like these investors are necessarily getting steals. They’re merely buying fodder released from the banks. If anything I would even go as far as to say that today’s “Investors” are merely paying top dollar for what could be tomorrow’s median price because if we’re really and truly going to return to anything resembling a semi-balanced market where real incomes actually support home prices then it goes without saying that what they’re paying for today’s bottom feeder crap is tomorrow’s median home price.

Yeah, I was arguing this the other day.

If prices have fallen to 2003 levels and were inflated, when compared to average income then, and average incomes have actually fallen since 2003, then we haven’t made that much progress and still have a loooong ways to go.

My language is kind of confusing here, but you get my point.

“What exactly do all of these investors paying cash hope to accomplish?”

Why, make more than 1% on their cash, right? After all of the trillions that the Fed has injected into the economy, hoping to pump up the housing market to bubble heights, this is the only result, “investors” with cash burning in their pockets snapping up what they consider very cheap deals churning the market. Some are finding amazing deals, if you look at transactions in Florida – dear lord, how much cheaper can some homes get in places like Cape Coral? And, in a funny way, they may be performing a public service by actually saving these homes from ruin – many Florida homes that have been unoccupied for more than a year or so may have to be destroyed due to mildew problems.

But, who are they? Professional landlords looking at the long term (at least a decade) with decent rental income covering costs and making an OK return? Funds attracting foreign money chasing another bubble in America? (Just think how cheap a Miami condo looks these days to an Aussie with the dollar tanking) Individuals who have left the stock market in the dust, never to return, and are now landlords or flippers in their new life? Maybe all of that. Personally, I think you need a really strong stomach for that kind of thing, or, a greedy, small brain. But, good luck to them. I may be renting from them someday soon.

My opinion is that a lot of “investors” paying cash for homes are still strongly attached to the belief that someday by some miracle we’ll see one more gigantic bubble and since they were so incredibly clever buying at the “bottom” they’ll reap huge rewards. Perhaps that will happen. Who knows? California seems to be the land of bubbles.

That said, there’s a lot of resistance towards the path of having another bubble here.

1: Prices are still too high for incomes. Since there’s no exotic loans, people can’t buy anyway. Not at current prices.

2: California isn’t the “Golden State” any longer. People are now moving to TX. That state might as well be CA circa 1950’s-1970’s: Lots of new economic growth and lots of affordable housing. I just heard a report on California’s population and apparently the state is aging rapidly: Families can’t afford homes so they move and older residents refuse to pay taxes on schools and so forth. You need a healthy middle class for a healthy housing market. With the middle class and now even upper middle class leaving, that seems unlikely. Even so- I’m sure that since so many older residents are comfortably locked into their Prop-13 houses they won’t be thinking of lowering prices either.

3: Boomers are at some point going to retire and probably try and cash-in their overpriced properties. Of course all of them are going to do this all at once- just as they tend to do everything all at once. This will only ad to the still-oozing supply of carefully released foreclosures. I suspect this will cause prices to come down perhaps faster than the bubble collapse.

Either way- What I can’t help but wonder is if you’re investing in foreclosures, exactly how long are you going to have to wait to for the bubble to return? I’ve heard stories of flippers buying houses, slapping on a bucket of paint, and re-selling at a profit. On the other hand My stocks are at the moment doing quiet well. Truth be known, plain old fashioned stocks and 401k’s will get you to a more assured retirement than investing in houses. That’s been a fact for over 100 years and given that my stocks went down and value more than 50% and are now up back to where they were pre-crash with an additional 10% in appreciation on top of that in less than 2 years more than proves this point.

Then again I don’t invest in houses so I’m not an expert. Only time will tell. Its all a gamble and I suppose sometimes gamblers win big.

Wow… US$ to Ausi$ is .94 !!! It was like .76 when I went to school in Australia in 1997.

What do all cash buyers hope to get with their housing purchase?

If you’re a foreigner holding dollars, it is a good place to secure one’s wealth. The dollar is sure to fall in value, with all the printing and “quantitative easing” going on. Precious metals will have big swings both ways and there is a definite holding cost to them. Our housing prices may well fall more but the dollars will fall more over time.

If all else goes to heck, the new owner could even live his house!

Plus, one has to remember, 350,000,000 Americans will need someplace to live.

A prescient investor should realize that we live in a time to be concerned with Return OF Capital, not Return ON Capital…

I can’t wait for the day when moronic paper fortunes are sucked into a black hole.

http://powerfulfigures.files.wordpress.com/2010/11/633564940352646100-sheeple1.jpg

“28% of homeowners with a mortgage are in a negative equity position”

…if you believe Zillow’s “pie in the sky” Zestimates

Buy in 2010, sell in 2011 and lose 8% or more? Dr. are you inferring that “Cash4ClunkerHomes” was a bad idea? If not then I will, it was a joke.

Well said.

Housing prices need to fall more, in some cases a lot more, to be close to what people can realistically afford. The inflated “values” of the bubble were artificial and in some cases fraudulent, driven up by housing and finance industries, and eaten up by gullible home buyers and wannabe investors. We have an overstock of housing now, and it’ll be years and years before prices even stabilize let alone go up. And I do mean “go up” only in the real sense, not another artificial, unsustainable bubble. I don’t doubt that the industry and govt will succeed in blowing air back into the bubble, maybe more than once more yet. But real price appreciation that isn’t followed by more economic busts is just not going to happen. No one can afford those prices and the loans to buy under those circumstances are toxic and doomed to fail within a few years no matter what hype the industry spins. No matter what hype the media repeats at the behest of the industry. It is really a shame that instead of hearing how “housing only goes up,” (a lie by the way), people didn’t hear over and over that the FBI said mortgage fraud, done 80% of the time by the industry itself, was going to take out the economy. Their warnings came in the early 2000’s, even after ordinary people like bloggers, said the same thing. Buy hey, everyone knows the only credible info comes from the tv set, right? Even now the televised news talks of housing being a good deal at these prices, even as prices are falling. They’ve been saying that all along. Please turn off the TV and think, people…housing busts have come and gone before, and this is a stupid industry to base an economy on.

The investor rationalization in CA is now about rental income. Return on investment via rent payments. So a house that costs $400K and can rent for $1800/month is returning 5.4% . And there’s plenty of homes in the Antioch area that sell for $180K and rent for $1400/month. 9% return. While I find the downside to this is that the house prices could easily keep sliding downward, the rents are somewhat stable. But I still cant understand why someone would risk loss of capital over return?

Unemployment in Kali is getting close to Detroit levels, and people are starting to cram in which other to save on rent.

The days of insane rent levels in SoCal are coming to an end, just wait until the mass exodus of businesses fleeing the area to push the UE rates over 30% within the next two years…

Anyone remember when those geniuses from the Kali State Senate went to Austin, TX to find out why businesses are leaving the “Golden” State?

“AUSTIN — Texas Governor Rick Perry constantly talks about how often he goes to California on what he calls “hunting trips” to recruit California businesses to come to Texas.”

http://www.sfgate.com/cgi-bin/blogs/nov05election/detail?entry_id=87103

“Texas pursues Calif. businesses after jobs summit — In a letter obtained Friday by The Associated Press, Texas Gov. Rick Perry urged those businesses to flee California as lawmakers threaten to disincorporate the city of 90 people where the city manager makes more than $211,000 a year.

“As the state of California continues to support legislation that causes undue burden and taxation on companies doing business in the Los Angeles area, I invite you to consider your future in America’s new land of opportunity: the state of Texas,” Perry wrote to nearly 70 businesses in the letter dated Tuesday.”

http://www.fresnobee.com/2011/05/06/2378788/texas-targets-calif-businesses.html

Look for this snowball to gather size and speed as it rolls downhill unabated…

Won’t happen.

Good luck throwing that pitch to the army of wealthy Silicon Valley soccer moms who have grown accustomed to their Palo Alto lifestyle. Good luck uprooting the entire film industry from So Cal. Granted, Austin is nice, but what is there outside of the city? Oh yeah, nothing. You might as well be trying to get them to move to Las Vegas.

As much as I’d like to see a traffic jam straight to Texas, full of overpriced SUVs, driven by people who have multiple uses for silicon, I don’t think it’ll happen anytime soon. There’s simply too much pull from California culture.

Texas has all the same problems in their future as Calif. — their budget problem rivals ours, and their education and social systems are unraveling – it’s not the Mecca so many tout it to be – not to mention the only liveable city is Austin, which is not all that affordable and hotter than hell in the summer, let’s not forget the tornadoes….

no thanks, I’ll take my chances as a fifth generation californian and stay right here

This has already been happening for years. I know quite a few people who work for various tech firms who have been transferred to new offices in Austin. Texas- for all practical purposes- is California as it was in the 50’s-70’s. Tons and tons of growth and tons and tons of rampant, almost out-of-control housing construction.

We took a trip to Austin about 2 years ago. Its a nice city. There’s not exactly a lot outside the city, but they’re building new houses there as quick as they can unload the lumber trucks. An un-ending sea of Mcmansions and stucco boxes priced between $120,000-$200,000. Sound familiar? Remember seeing those post WW2 suburban tract home photos- most of them in California? Well now those homes in Cali have $500,000 price tags and nobody can afford them. Hence why TX is getting more domestic immigrants than anyone else.

> Granted, Austin is nice, but what is there outside of the city? Oh yeah, nothing. You

> might as well be trying to get them to move to Las Vegas.

Now, now, it’s not that bad. I spent many years as a kid in Texas. The areas outside the major cities are quite nice. They are a bit like stepping back into the 1950’s (or were at the time) and the old folks have elephantine ears, which is something to gawk at. There’s entertainment there! It’s quite lovely really, and if you were looking for peace and quiet and as a place to get lost for a while, it’s not so bad. The lakes NW of Austin, particularly Marble Falls and Inks can be nice, and peaceful and you can waterski. Austin does try hard to have culture. It has to. However, most /true/ Texans would tell you that that stuff is all liberal hippie (and other swear word) nonsense and should be viewed with great suspicion!

Suspicion and guns. That is, it is best viewed with suspicion down the barrel of a gun. Most keep one in the rack in the rear window of their pick-em-up truck. A gun can fix a lot of liberal, hippie, Yankee (and other swearword) nonsense!

…but, I’m getting carried away. The trouble with Austin is when nice isn’t good enough and you want something spectacular (e.g. Colorado skiing or Mardi Gras). Then you are looking at a 1,000 mi trek. That is a drag. I much prefer living in the redwoods.

“But I still cant understand why someone would risk loss of capital over return?”

This is the heart of the investment world and every business venture. Risk and return are correlated. You don’t get something for nothing. The key is being diversified and sizing it right in your portfolio (idiots don’t get paid extra return for doing dumb things in taking risk). This is where people went wrong with housing, they employed massive leverage on values so far above their income support levels that it exploded them and the entire market. It looked nice for a few years but leverage works both ways and very few even considered it could go against them.

A guy earning $100K a year with reasonable level of savings and investment outside (say $200K) can afford a $250K house and absorb losses if needed. The same income and no savings cannot afford a $600K house and quickly explodes under it if anything goes wrong. The real issue is that everyone thought a $500-600K house is a starter home or base middle class. How many base middle class people have the $200-250K salaries needed to support that? Just crazy stuff but if you watch HGTV and house hunters you start to think it’s normal.

Those rents won’t stay inflated much longer – people need income to pay rent too you know.

Section 8 people are the new target renters. I know someone renting to them and the govt pays on time.

you always have to risk capital for a return. the higher the return, the bigger the risk, typcally. no different with stocks or bonds. If an asset is generating a reliable 9% return, there is no need to ever sell it, but if you did need to, there should theirtically be a ready crop of buyers.

Saving for repairs and maintenance (roof, termite repair, plumbing repairs, earthquake repairs(?)) will eat through a 5.4% return. Capital investments require for the risk about 10-15% return pretax, and after a sinking fund for repairs and maintenance.

Why take such a hugh risk. Think risk-reward. Invest in a diversified real estate fund instead and let the pros handle it but there again wait until real estate valuations start to come up off of some bottom.

I think CA is to unstable to purchase an investment property in. Why not pick a couple up in other states? I have been looking at the Phx market where I can get a prop w/ a tenant already moving in w/ a 2yr lease for $60k, and rent at $900/mo. I think thats a pretty good return.

I own an Underwater home in Riverside County to the tune of $250,000 and I can assure you that the banks are not moving quickly on shadow inventory. I haven’t paid since Dec 2008 and I still somehow own the home. It is getting ready to finally switch over to the bank, but I have done nothing but try to give them back the home for 2 years including short sale and DIL. I wouldn’t describe 2.5 years as the bank moving quickly especially when I have tried to make it so easy. The bank knows the house has been vacant for a full year now and still they lag.

Why aren’t you living in it and enjoying free rent? That’s what I’d do.

I’m amazed that the Banks still employ “realtors.” If they’re worried about every percentage point of money, why don’t they put a few people on min. wage salary in each town and turn them into “realtors?” Then the banks get to keep the commission. I know a LOT of people who would be happy to work for min. wage and benefits if all they have to do is show people around properties and make sure they sign on the dotted line.

I had a sudden epiphany a few weeks ago after looking at homes in a major California city with my brother. After looking at homes in person and on the internet, I realized that many, many homes are SELLING FOR HALF (or less) of what they were in 2005 & 2006. Nice, newer homes! I wondered how many homeowners who are still hanging in there are “underwater” (or close to it) on their homes. I wondered about how many homes are: 1) sitting empty 2) being forclosed on, or 3) have deadbeat “owners” who are not making payments due to their underwater status or their own financial issues.

So here was the eipihany: The banks HAVE TO TRICKLE the homes onto the market (the illusion of scarcity). If all of a sudden they let all of these homes come up for sale it would ABSOLUTELY CAUSE THE COLLAPSE OF THE AMERICAN BANKING EMPIRE! The paper money (“money out of thin air”) empire would come crashing down. Home prices would collapse overnight. It would cause more and more homes to go underwater, thus creating a tsunami of home sales. All the people who have little or no equity would now find themselves underwater. It would be the best thing that ever happened to the American consumers and American working families. It would be the death knell to the evil banking empire.

Exactly what the housing market needs – correction and redistribution.

I agree with you that that is what is happening in California, especially coastal.

But…..I can’t figure out why the banks have acted more traditionally in Vegas and Phoenix. You can choose the very best of REOs in the best neighborhoods. Prices are down 60% easy.

Why are the banks acting in a way you would have expected in Vegas and Phoenix but massive extend and pretend in California?

Just follow the money. First, values in Vegas and Phoenix never got anywhere near those of California. Back around the peak, when a rat shack in the bad sides of OC was still drawing 500,000-600,000 a friend of mine bought a 4 bed, 2 bath, 1800 sq ft house with a pool on an 8000 sq ft lot in a brand new development on the outskirts of the Phoenix metropolitan area and payed just over 200,000 for it. Houses in that neighborhood have subsequently fallen to around 80,000-120,000 for similar houses. Further compounding this is the fact that the Valley of the Sun has around 4 million residents while the Los Angeles county alone has about 10,000,000. Add in OC, Ventura County, and near-lying cities of San Bernadino and Riverside counties, and you’re talking about probably 15,000,000. I would guess that there’s probably 10-20 times more money tied up in the LA metro than there is in the greater Vegas and Phoenix metro’s combined.

It’s actually a really good point. FL is a judicial state and the banks are dragging some but people are still sitting in their houses for 2+ years. Longest timelines to foreclosure are NJ/NY which are something like 900+ days the last I saw…ludicrous. CA is obviously a game of hiding inventory and not killing the sacred cow in the jumbo or higher end.

One thing I can’t help but notice NV/AZ/FL where there has been unmitigated damage vs. NY/NJ/CA where the banks are really taking their time. I’m not a political expert or conspiracy theorist but the best protected states seem to be the heavily democratic ones. An observation anyway, not sure if there’s anything to it. For CA, they certainly don’t want to kill the sacred cow either – incomes out there completely out of line and no magic financing (pretty much game over if there’s any volume brought to market).

I think part of the answer lies in the fact that if you take an upscale fancy sort of house in austin it might cost $1mm , the taxes on it will be close to 20k a year , the same House in Santa Barbara for example might be $2mm and the taxes on it will be anything from $2k to $20k depending on when it was bought due to prop 13 , If and when california gets rid of prop 13 and is forced to run a balanced budget all the people getting away with paying nothing at the moment will be forced to sell and the prices will look similar to austin and the taxes too ….

Thanks to Dr. HB for keeping us informed of the data. Great article, as usual – thanks!

In my experience, investors (I am one of them, although I very diversified far beyond real estate – RE + ATMs, factoring, short-term business bridge loans, cash flowing websites, equipment leasing, etc, etc) are now waking up to the realities that price declines in SoCal are actually accelerating during a season in which they would normally have the most support. For example, I know a number of “flippers” who are very conservative and yet who are now facing the prospect on losing money on flips they purchased in Oct-Dec. Seeing losses on their horizon, these flippers are now becoming extremely hesitant to continue buying in 2011 due to their pending losses (and that’s once they sell, which is very, very difficult right now). As such, price declines are starting to accelerate because investors are stepping aside and the only investor purchase support now seems to be coming from those who plan on buying and holding, which is really only a consideration in the lowest priced markets (ie. Inland Empire). While I do not invest in CA due to the low yields (I have always invested out of state), most of the buy/hold scenarios I see that are being purchased now are in the 6-8% range in the low-priced areas.

For those focused on the 1.5% number for a savings account these days (if you’re lucky) – it’s imperative you read this paragraph. Here’s the major problem with 6-8% these days: TRUE inflation is running at 8-10% based on non-adjusted charts using the pre-1982 inflation basket. That means that, as an investor, you can’t afford to earn less than 8-10% if you want to simply break-even on inflation! That’s the reality – not what the media would have you believe. So, to an ultra-conservative investor like me, trying to catch a falling knife on a 6-8% yield today makes NO sense whatsoever and today’s investors will be burned. I, for one, CANNOT wait until 2017/2018, when we’ll probably finally see some stabilization and a serious investing opportunity. But, until then, I’m not planning on trying to catch any falling knives myself, certainly not for 6-8%.

With true inflation running at 8-10%, if you’re not earning an 8-10% yield then you’re falling behind in real terms. With that in mind, I don’t feel so asking for (and earning) 15% on my real estate loans, 17% on my factoring, etc, as it’s really not putting me that much ahead of inflation! If you’re trying to protect your wealth then you need to keep this in mind the next time you’re considering something that yields 5-8% and you think it’s good enough. It’s crazy but true…

We’re clearly in for a long ride down – all you have to do is take a look a chart of Japanese real estate prices from 1989 to 2003 and you’ll see how our curve will look (hint – it’s not pretty!). All I can say is that investors who try to catch a falling knife will clearly be hurt – and many of them are now stepping aside to let the knife land, which will lead to much lower prices by the end of the year. Be very, very careful right now if you’re considering buying and if you care about losing equity!

Good Luck To All,

Investor J

http://www.meetup.com/investing-363/

http://www.meetup.com/FIBICashFlowInvestors/

Excellent posting. Thanks for your observations. A couple of other points. First, don’t forget the Realtors commission. If the buyers bring an agent, tack on 3% to that 8-10% which you need to make.

Second, money earning 0% is a superb investment if it’s for buying a house, when housing is going down 10-20% per year. 🙂

True inflation at 8 to 10 percent? Of course housing deflation for the last 5 years is part of the “true” inflation. I just bought some clothes and electronics the other day and the “true” inflation of these products has actually deflated tremendously in the last twenty years. A 27 inch Apple LCD monitor at $999…in 1992 my awesome 14 inch sanyo tube monitor cost over $1,500. At JC Penny I can’t even find a nice shirt for more than 30 bucks. 20 years ago nice shirts were easily 60 or 70 bucks. The core CPI reflects all products and services, not just commodities.

I don’t mean to sound rude but you might want to rethink your focus on Core CPI, as it is a fallacy. If you look at how Core CPI is measured and how it changed in 1982 then you would see that if you use the pre-1982 method of calculating core CPI then it is actually running at 8%, while true inflation is running 10%. They changed the calculation in 1982 to conveniently make things look more stable. In fact, part of the change was to substitute housing prices for rent prices, as rent prices tend to increase steadily, on average, over time, while house prices are more volatile. That doesn’t mean that it’s more accurate – it just means that it’s more convenient for the government to use. I am not making this up – I am just passing along the facts.

As a full-time investor, if I don’t focus on the facts and what’s coming up then I am dead in the water in the long-term, just like middle-class America is being eroded away. And yes – prices for some goods have decreased over time, as technology and lower production costs, as well as globalization, enables that. For every example you can point to of items becoming cheaper there are more examples of items, especially for which consumers spend a larger part of their income, that have increased, some dramatically like education, health care, and cars. A decade-over-decade comparison is particularly useful, as household incomes have actually DECREASED over the past decade while prices for all of the categories I mentioned above have increase, some by over 100%!

And Core CPI does NOT include food or energy, 2 things we clearly aren’t paying for on a daily basis according to the government 🙂 5 of our 6 previous recessions dating back to 1970 were correlated to energy prices that caused consumers to spend less on everything else. But that doesn’t matter because Core CPI doesn’t count it, which is hilarious!

Good Luck To Everyone,

Investor J

http://www.meetup.com/investing-363/events/17426353/

http://www.meetup.com/FIBICashFlowInvestors/events/17426967/

Interesting on the political front. When gas was $2.78 per gallon the last administration was trashed as being in with big oil. Now its approaching $4.50 per gallon in the SF area and there’s hardly an outcry. Amazing! I’ve even seen some spin about how this is a good thing. Fact is, many people are struggling with current prices everywhere. The people in Washington seem to be non pulsed. When are people going to demand more from their elected leaders? This current group is even more disconnected than the last one, if that’s possible. We desperately need some real leadership; not the amateurs we now have. The whole economic situation is and has been deteriorating. More taxes will break the back of this already weak economy. We need change and some new hope, and the sooner the better.

I think the supporters of the current administration would rather see focus in untangling the housing problem and jobs growth. Oil is seen to them as a sideshow to the main issues. Despite it being used to ‘transport goods’, business will actually do a fair amount to protect consumers from price increases to remain competitive (2% cpi in goods seen … that’s a very low inflation number despite the high cost of oil. The fed would love to see it at 3 … remember they need inflation!).

We know oil prices are driven by the speculation that prices will go up because of trouble with production/increased risk/etc. caused by the instability in the region of oil producers. It is pre-building in a price increase due to investors believing it will happen. Seems unfair, but sometimes markets are. Vote with your dollar and buy as little of the overpriced stuff as you can, or buy less of something else.

The opponents of the current administration seem that they would rather focus on birth certificates, deflecting credit of Bin Laden’s death, and which rapper/poet is being brought to the white house this week. They would rather attack Obama than Obama’s politics. It’s a much simpler attack to make, one that the basest of their base can follow. It is sad that they don’t use oil as a topic for discussion. I wonder if they don’t attack the administration over oil for fear they might themselves get tangled up in their own involvement in it. Doesn’t the GOP hold more contacts and political ties with oil than the Dems?

And as far as taxes go, we just paid one of the lowest federal tax rates in the history of the country. This is especially so if you are in the top income bracket (ie ‘rich’ … which I am not).

I believe we need higher interest rates and higher taxes, adjusting the tax burden up on the top couple income brackets, bringing all these things back into more historic norms. It will feel bad to begin with, but it will actually bring growth and faith to a market which people know is mostly just digital/paper and not derived from real substance.

Until then, the stock market will keep going up, and investors and banks will get loaded up with dollars. It is too bad it doesn’t really bring them any faith in the economy, or their situation, to hold all that though, isn’t it? I think it is a game of continuing to pretend is better than facing up to reality.

Whichever administration, current or future, is forced to face up to reality … they will last one term, be extremely un-popular, but probably very healthy for the country. Unless Obama, knowing he cannot run again, decides he should do it in his second term. I wouldn’t put that past him. 🙂

He would need the support of Congress, which I doubt he will enjoy again to the degree he did for 2008-2010.

@Curt

It’s not that simple. Everyone with an IQ over 27 knows that the prices are driven by the futures markets, and hot money is causing a commodities bubble–hedge funds, pension funds, billions of fake dollars chasing options with ZERO chance of taking delivery. Wasn’t there a campaign promise about this? Indeed both parties are either powerless or in bed with big oil. However, if we did force fair trade in oil:

@Curt

It’s not that simple. Everyone with an IQ over 27 knows that the prices are driven by the futures markets, and hot money is causing a commodities bubble–hedge funds, pension funds, billions of fake dollars chasing options with ZERO chance of taking delivery. Wasn’t there a campaign promise about this? Indeed both parties are either powerless or in bed with big oil. However, if we did force fair trade in oil:

Pensions might collapse faster than they certainly will anyway (Ponzi scheme)

The dollar will collapse because the petrodollar props up the fiat dollar

Oil profits in US (third largest world producer)are propping up some of the economy, while devastating the rest.

Ever seen the relationship between oil and recessions? One of the surest determinants is an oil spike. Double-dip is already baked in. And everyone knows how well housing fares in a recession. Bring out your dead…

It is funny to read all the Texas supporters here and wonder if any of you even own a home over in TX? First of all, proportionally, their budget deficit is worse or about the same as ours and they are scrambling to fix it. Real estate taxes are much higher and now with prices in non prime areas cratering here, you will pay a ton in taxes. It works out the same and who would live in TX where there is no freedom-the state prohibits an atheist from running for office-which is contrary to our constitution. Then there is the whole intelligent design /creationism thingie which they want to feed our kids-last thing we need more Jehadists instead of scientists and then the state repub party has in its platform that they want to get into people’s bedroom and throw people in prison if they happen to be gay. No thanks, I will stick in CA and I have relatives in TX.

Klownifornia isn’t the only Tax & Spend State about to see an exodus of PRODUCTIVE citizenry:

“ALBANY – Escape from New York is not just a movie – it’s also a state of mind.

A new Marist College poll shows that 36% of New Yorkers under the age of 30 are planning to leave New York within the next five years – and more than a quarter of all adults are planning to bolt the Empire State.

The New York City suburbs, with their high property values and taxes, are leading the exodus, the poll found.

Of those preparing to leave, 62% cite economic reasons like cost of living, taxes – and a lack of jobs.

“A lot of people are questioning the affordability of the state,” said Lee Miringoff, director of the Marist College Institute for Public Opinion.

An additional 38% cite climate, quality of life, overcrowding, a desire to be closer to family, retirement or schools.

The latest census showed New York’s overall population actually increased, though parts of upstate shed population and jobs.”

http://www.nydailynews.com/ny_local/2011/05/13/2011-05-13_new_yorkers_under_30_plan_to_flee_city_says_new_poll_cite_high_taxes_few_jobs_as.html#ixzz1MFCU6bjV

Really loved this poignant comment:

“This is completely unfair, I think this should be illegal! People can’t just leave, by being residents, they have made a commitment to the social wellbeing of their neighbors! This is just like Boeing trying to build a new plant in South Carolina, and the Obama administration has said that, that is illegal. We can not allow the resources that we require to maintain our attempt at a social utopia to leave. They must be stopped!”

If you read past that posted comment, you will find that the commenter added:

“/sarcasm” at the end of the post.

[QUOTE]

Mashman

10:15 AM

May 13, 2011

This is completely unfair, I think this should be illegal! People can’t just leave, by being residents, they have made a commitment to the social wellbeing of their neighbors! This is just like Boeing trying to build a new plant in South Carolina, and the Obama administration has said that, that is illegal. We can not allow the resources that we require to maintain our attempt at a social utopia to leave. They must be stopped!

Mashman

10:17 AM

May 13, 2011

My prior post had an “/sarcasm” at the end, but I’m guessing it was removed because it looked like HTML. But yes, that past was sarcastic. [UNQUOTE]

~Misstrial

Lower income taxes, intelligent design, and no gays – sounds like a tea party rally. Home school and dirt roads yeehah!

The housing bubble was started and encouraged by the Banks. The Government was also in favor because it gave a temporary impression that the economy was going good. It should not be forgotten that the responsibility of buying a property is up to the individual. If the purchaser has little or no knowledge of history, economics he or she is mostlikely the victim of their own lack of wisdom. While I feel sorry for those who have been sucked into this disaster, The people in trouble have no one to blame but themselves. They felt that the prices of houses will go up and up forever. Well, they were wrong.

First they bundled mortgages, then they bundled families…

Survey: 85% of New College Grads Move Back in with Mom and Dad

The kids are coming home to roost.

Surprise, surprise: Thanks to a high unemployment rate for new grads, many of those with diplomas fresh off the press are making a return to Mom and Dad’s place. In fact, according to a poll conducted by consulting firm Twentysomething Inc., some 85% of graduates will soon remember what Mom’s cooking tastes like.

Times are undeniably tough. Reports have placed the unemployment rate for the under-25 group as high as 54%. Many of these unemployed graduates are choosing to go into higher education in an attempt to wait out the job market, while others are going anywhere — and doing anything — for work. Meanwhile, moving back home helps with expenses and paying off student loans.

…reducing demand for both real estate AND rentals.

since we are talking about long term sustainability relative to income, can someone explain why the safe and/or sustainable property-value-to-income is 3 or 2.5x? Why isnt it 2x or 3.5x or some otherl number?

Sigh…. that 3 or 2.5 that is bandied about is the DUMBED DOWN and SIMPLISTIC estimate that is rough, rough rough……

Bottom line is that you should not spend more than 28% of gross income on housing aka rent or principal + interest + taxes + insurance. And you are better off if you keep it at or below 25% of income.

That income times (whatever) multiplier changes based upon interest rates and property taxes.

Using the property tax rates here and assuming that the taxable value is the price divided by 2 divided by 1000 x the millage, and assuming property insurance is $75 a month

(1) With a 10% interest rate on a $100,000 loan (and the purchase price to keep it simple) the monthly payment would be $877 for principal and interest (PI) + $145 in property tax ($35 millage per 1000 of taxable value) + $75 insurance = $1107 per month. If that is 28% of income, you need a gross income of $47, 500 a year. The house costs 2.1 times income.

Now we know that the max you can afford is $1107 a month with $877 going to principal and interest.

(2) Interest rate is 5% and $877 a month covers $802 in principal, interest and taxes. If borrowing $100000 gives a PI of $536 and the taxes on a $100000 house are $145 month (a total of $681 for PIT), then that $802 for PIT covers a $118,000 house. And that is 2.48 (2.5) times income.

ANd this will change depending on property taxes and insurance. Move just outside our city with its $35 per 1000 taxes and buy in the township. Now taxes are only $19 per 1000. ANd when you run the numbers again on that 5% loan, you have a monthly PIT of $536 PI and $83 in taxes for every $100,000 of house. So take that $802 and divide by $619 and it covers a $130,000 house —– and that is 2.75 times that $47,500 gross income.

When you start trying to pay 3 or more times income for a house, you are pushing up to committing 31% or more of your income to housing — a dangerous risk if anything at all happens (job loss, car repairs, illness, divorce, kids, house repairs…..)

The best way to decide how much you can spend on housing (mortgage or rent) is to work backwards. Take your expenses and put the ‘must pay’ first. This would be things like utilities, car insurance, student loans, health insurance etc. Then come the ‘should pay or can reduce’. This would be things like the level and type of cable/ISP; cell phones; and the car your drive.

Now look at what is left. Put it into 3 groups: savings (and yeah, you need that with a house for when the water heater blows up and floods the basement); discretionary spending (some fun or you will go nuts) and then housing.

Housing is the biggest expense in your budget – and thus the area you can cut the most. You may end up living below what ‘they’ say you should and in a much simpler more modest place but your budget is real world – not maxed out.

There is what realtards cay you can afford then there is what the lender says you an afford (less than what realtards push) and then there is what you really can afford (even far less than the lender syas you can.)

whoops – hit the calculator key.

In the 2nd and 3rd example, the amount left for the house after property insurance should be $1032 for Principal, interest and taxes — not $802.

So in the 2nd example, with that 5% money and $35 per 1000 taxable value in taxes, you can afford a $151,000 house – or 3.157 x income.

And in the 3rd example, with that 5% money and $19 per 1000 taxable value, you can afford a $167,000 house – or 3.51 x income.

Now keep in mind that the average interest rate for the past 25 years has been around 7 – 7 1/2% (check Doc’s old posts for the exact number.) And for every 1% interest goes up, the price you can sell that house for goes down 10%. THink long and hard before jumping because of ‘low interest rates’. AVerage buyer stays in a house 7 years – not 30. Can you take a hit of losing 20% or more of what you paid for it?

People are stupid. It’s pretty simple – spend less than you earn and don’t buy things you can’t afford. Save your money and put down 20% on a home. Get a 15 year mortgage. It’s painful to hear but a new car, new dining set and boat bought on a credit card aren’t going to help you buy a home. America has a lot of temptations, and unfortunately many people simply can’t resist.