Money from China finds a home in U.S. real estate in a big way: California primary target with other states like Texas and New York benefitting. EB-5 Visa program now has multi-year backlog because of China.

The money flowing out of China into global real estate is simply astonishing. In Canada, Vancouver and Toronto are fully inflated thanks to investor funds, house humping locals that are deep in debt, and buyers from China. In the U.S. while domestic buyers are largely being priced out, investors are picking up the slack in big ways. In a previous post we noted how one new community in Irvine was bought out by 80 percent of investors from China. This is causing some dramatic changes in particular areas where money is flowing in. We’ve talked about the money flowing from abroad for a few years now since the housing market was largely propped up by various investor classes. For a few years it was big funds from Wall Street and today it is foreign buyers and flippers. China is by far the biggest foreign buyer of U.S. real estate. Even though the Chinese stock market has gone on a roller coaster ride this year, money is still flowing out of the country in dramatic fashion and finding its way in U.S. real estate.

China money floods U.S. housing

Over the last few days many of you sent over an interesting article from the New York Times covering the money flowing into the U.S. from China:

“This year, Chinese families represented for the first time the largest group of overseas home buyers in the United States. Big spenders on new homes are helping prop up local economies in the Midwest. But in dense areas like San Francisco and Manhattan, they are also affecting the affordability and availability of housing, as demand outpaces supply and bidding wars ensue.

While Chinese purchases make up a small sliver of overall sales in the United States, they have had a disproportionate impact on the market for more expensive properties, buying one in 14 homes sold for more than $1 million. On average, buyers from China, including the mainland, Taiwan and Hong Kong, pay $831,800 for a home, more than three times as much as Americans spend, according to a National Association of Realtors survey.â€

I think this is a very key point that in dense housing markets like San Francisco having an enormous amount of outside money flowing in is causing an insane sort of mania. You’ll also notice that Chinese investors are paying a lot more than domestic buyers – the average price paid from this group is $831,800 versus $229,000 for the median U.S. home price.  And of course, cash is the primary way of closing the deal.

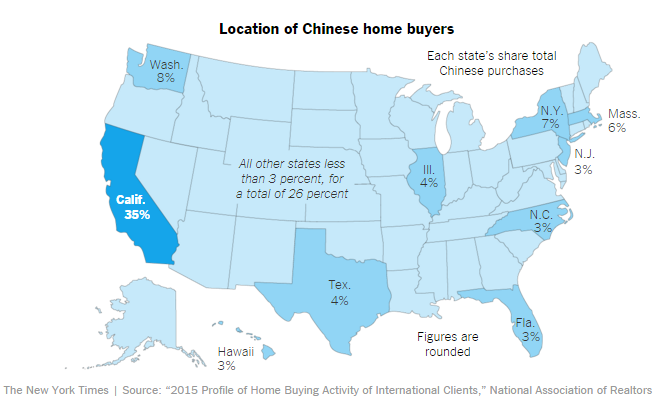

Some think the money is only flowing to California or New York. It is flowing everywhere:

While California leads the way, money from China is finding its home in other areas.

“Some Chinese are buying homes purely as investments, capitalizing on surging rents in many parts of the United States. Others are trying to move their money beyond the reach of the Chinese government.

Many buyers have their children’s education in mind, picking up homes in good school districts or close to universities. At the upper echelon, the wealthy are hoping for green cards, joining with developers to take advantage of a federal program that fast-tracks them for residency.

Eric Du, a management and investment consultant from Beijing, was motivated by the potential for his family and his fortune. Over the last two years, he bought a townhouse — sight unseen — and two single-family homes in Northbrook, Ill., north of Chicago. He paid cash for all of them.

He plans to live in one, to give his children a chance to breathe cleaner air and learn at a better school than he could find in his hometown. He will rent out the other two.â€

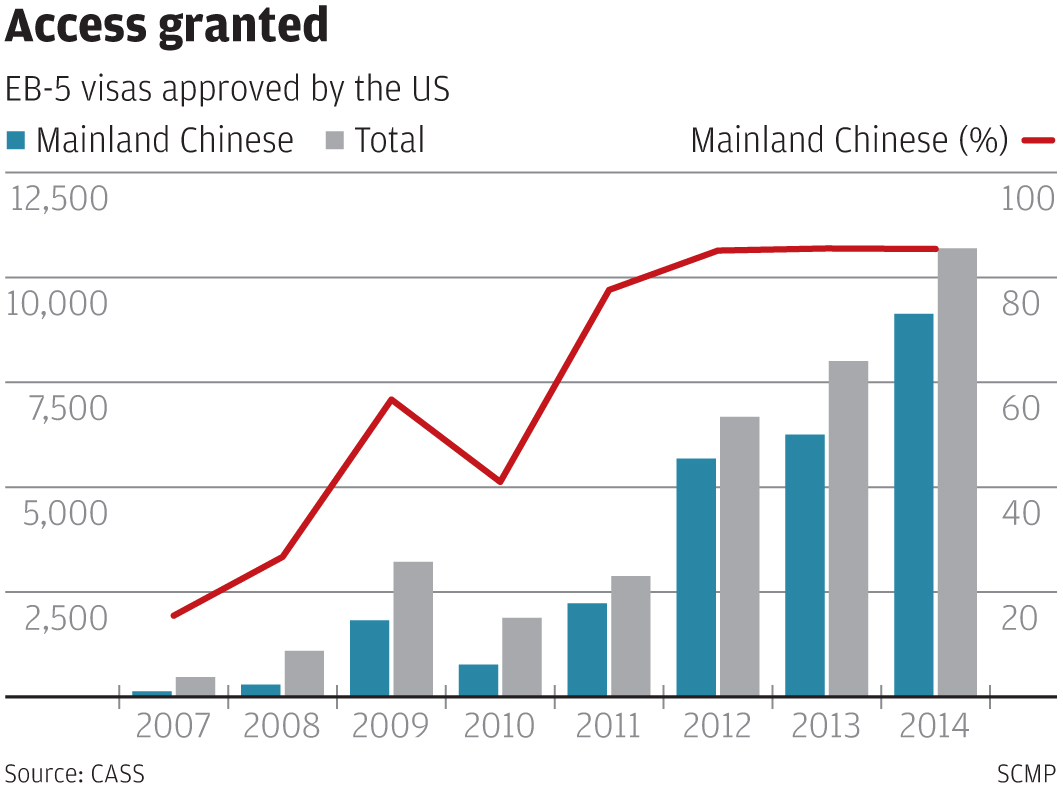

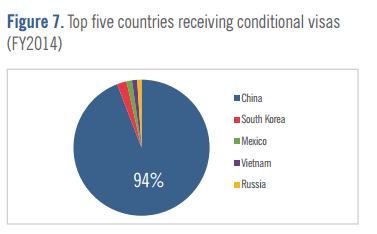

This land rush into the U.S. has also caused a flood into the EB-5 Visa program. This program allows for a fast pass to permanent residency if you have the money to buy in. In 2012 the program gained incredible steam largely from China. Starting in 2012 the flood gates opened:

“(SCMP) More Chinese are expected to apply for the United States’ investor visa this year as people embrace an expanded immigrant quota and promising business opportunities, says a think tank report released yesterday.

Mainland Chinese received 9,128 EB-5 investor immigrant visas last year, 46 per cent more than in 2013. Among the 10,692 investor visas the US issued last year, mainlanders received 85 per cent of them.

The visa, with no age limits or language requirements, grants US citizenship to foreigners willing to invest at least US$500,000 (HK$3.88 million) and create 10 full-time jobs in the US.â€

China virtually owns the EB-5 Visa program now:

2014 was the first year where the full 10,000 Visas were allocated. 2015 looks to be another record year with a full backlog now in place.

“(LucidText) I-526: FY2015 saw a huge number of I-526 filings – over 14,000 receipts (with 46% filed in the fourth quarter in a surge prior to possible program changes). Assuming that only about 10,000 EB-5 visas can be issued in a year, and an average of 2.2 visas per investor I-526, then this year’s receipts alone will take up over three years-worth of available EB-5 visas. FY2015 ended with over 17,000 petitions pending, which would take up nearly four years of available EB-5 visas. USCIS has shown impressive year-on-year improvements in the number of I-526 petitions processed, up 32% in 2014 and 42% in 2015. USCIS even briefly caught up to the number of receipts in Q3 2015, but then got snowed under again with the blizzard of filings in Q4 2015.â€

This flood of money is not only hitting the U.S. Other places like Hong Kong, Singapore, and Australia have imposed taxes on these deals to curb the flood:

“Outside the United States, the Chinese demand has been so great that some places are trying to temper it.

Hong Kong and Singapore have each imposed 15 percent taxes on nonresident buyers of residential real estate. In Australia, the state government of Victoria, which includes Melbourne, introduced a 3 percent tax on overseas buyers.â€

Welcome to the global economy. Good luck competing with all cash buyers in some markets. In areas where supply is constrained and investors are diving in local buyers are all but priced out. It is really incredible to see but also adds fuel to the declining homeownership rate of regular American families that are already having a tough time competing in this market. Of course people have to wonder how long will this last since the Chinese stock market has taken a big hit recently and no wild mania can go on forever.

Are you seeing any other interesting trends thanks to foreign investors buying up U.S. real estate?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

107 Responses to “Money from China finds a home in U.S. real estate in a big way: California primary target with other states like Texas and New York benefitting. EB-5 Visa program now has multi-year backlog because of China.”

In other words, California is massively exposed to the eventual receding of the tide.

Since there is no official source of data which captures the reasoning behind the Chinese buying sentiment – not that one could be trusted anyway – my instinct remains that it’s mostly pure speculation. The anecdotes of buying for education, family, and so on are coming from the minuscule amount of these buyers that are actually able and willing to talk about it.

https://www.youtube.com/watch?v=YjkkjH0GnfY

If all these Chinese bubble buyers are paying in cash, at least we won’t have to bail out the banks like last time when this run goes bust.

That’s only 50% of the concern (the banks will have to straighten their means, if not already), the other half being the affordability of housing for those of us who live here. These investors only want to “assault” the market and its stability, but it is us working and living in CA who creates this stability and value.

Maybe, but I know quite a few that have paid cash to get the cheapest price and to close the deal quickly.Then once they “move” here, they refi’d the cash back out to put into their EB-5 mandated “business” to “employ” extended family members that they bring with them. Grandma & Grandpa typically watch the kids, and their cousins “work” as consultants for the “company” (really just students that act as caretakers for their RE investment).The program is sham so the Gov gets its money back from buying up worthless mortgages from the banks and it artificially stimulates the RE market “recovery”. Just so millennials will focus on paying off their student loans and deferring another inevitable “crisis” to tank our economy.

The only reason California isn’t a subject state of China is laws against “The Yellow Peril” in the past.

We’d all be extinct (gweilo bones cure bunions!) if it weren’t for the xenophobic good sense of our forebears.

When will we wise up? This is literally an existential threat.

It’s all about capital controls. This is how they move their money out of China to the “safe haven” of ‘Merica (fuck yea!). Expect the flow of Chinese and their money to increase as market turmoil over there increases.

Interesting article, since the percentage of all cash purchases is down after dramatic highs from 3 years ago. Typical all cash buys average around 17%, but had been as high as 40% in Cali. It’s currently around 22% and still dropping

http://www.realtytrac.com/news/foreclosure-trends/realtytrac-june-and-midyear-2015-u-s-home-sales-report/

If the Chinese are only allowed less then $10,000 USD out of China in any one year, how can they pay $1 Million cash for a house?

German Daddy: I don’t know if that $10,000 figure is accurate or not, but assuming it is: well-connected people don’t have to follow the law, just like anywhere else, including the U.S.

You need to have a connection with a Chinese company that imports something from outside China. They over pay for a shipment. The company on the other end gives the cash to the person from China. I imagine they get a substantial fee for this.

The actual value is $50k USD. The Chinese government has been turning a blind eye to this kind of money laundering for a while now. But since their economy has started to falter they began enforcing their capital controls. At this point though it’s too little too late. The amount of money that made it’s way to investments around the world is staggering.

Or the Chinese person goes “gambling” in Macao, and “loses” a large amount at the high-stakes tables. Then someone on the inside of the casino gives the Chinese person a suitcase full of the cash that they lost, taking a small fee in exchange for facilitating this “gambling.”

Housing market is going to tank hard soon

Nicely said 🙂

I agree.

And then you’ll buy, yes?

You can buy in Fontana without the Chinese competitors.

yeah, except that you’re in Fontana

there really is no future in the USSA, this is the worst recession I’ve ever seen in my 25 years in business……..the work just keeps falling off a cliff.

What’s your line of business?

In my own case, e!ectronic surplus just kind of putts along.

35% is a big number, I had to refresh to make sure that was the figure. Avg. of about 4% for the other states listed, I can see that at this time. I don’t really know the future implications for Ca. because of the pure size everything gets wacky there.

As many of us have posted before, CHINESE are emotion driven buyers and have great peer pressure to follow the heard even if it means the fall off the cliff. If and when they fall off will it be a complete dropped to the bottom or just a grab a branch and hold on to help comes. The prices they are paying for these homes and the sheer blindness that they must pay or be left out makes me lean toward a fall to the bottom with no help in sight?

The Chinese that are buying in America are the nouveau riche who worship brand names like rappers. They are draped with logo’ed clothes and ostentatiously flash jewelry, phones, and cars. “American” is just another status luxury brand to them. They are not making wise business or investment choices.

The Japanese did the same thing when the Roaring Eighties reached its peak. They bought up commercial property like Rockefeller Center, penthouse suites, and mansions. Before the ink dried on the contracts, the market crashed and they lost billions. How many Japanese stayed? See many around?

These foreign investors are the canary in the coal mine. It’s time to somewhere they aren’t.

i find most asians to be all hat no cattle. most of them used to be dirt poor a generation or two earlier. most of the asians who come here are smart and ambitious with a little money to afford the airfare, at least the ones that came here after 1965

i’m sure dean would agree with me if he was honest with himself

This EB-5 Program is a wide open ticket to FRAUD. Within the last couple months the SEC and FBI have raided EB-5 offices and frozen assets of numerous EB-5 companies.

Lobsang Dargey and Path America EB-5 Regional Center was charged with using investor money to purchase a $2.5 Million home for himself, a luxury Bentley automobile and hundreds of thousands of investor withdrawn by him at casinos. $123 MILLION involved in this alleged fraud scheme!

Lily Zhong and her company EB-5 Asset Manager LLC alledgedly used investor money to purchase a luxury yacht, multiple vehicles and other personal extravagances.

Robert Yang, MD, of Redlands, Calif., and Claudia Kano of nearby Pomona are accused of misappropriating investor funds to pay for other unrelated projects.

These are MULT-IMILLION DOLLAR FRAUDS and the USCIS is the organization charged with oversight, yet this government organization has stated publically that they lack the ability to oversee or have any enforcement authority over EB-5 Regional Centers.

Somehow 56 or so of the Regional Centers (about 8% of them) have now been reported as being under SEC investigation.

It seems that the “Bad Guys” heard clearly that there was a way to recruit investor money that had no oversight!

They seem to have promised investors that the funds would be used for specific projects then they use the money as if it were their own piggy bank so that they can live lavish lifestyles.

What this really implies is that globalization is driving a growing divide between have’s and have not’s. If you expect a sympathetic ear, forget it … the government is raking in money from the Visa fast-track program, county assessors are giddy due to swelling property tax assessment coffers, realtors are pocketing huge commissions, banks are seeing their loan portfolios swell due to rising valuations, REIT’s are raking in profits, and crowdfunding is finding plenty of investors to get in on the action! A perfect money making machine, or a perfect storm when if/when it begins to break! What I would like to know … how come other nations seem more cautious and want to slow the buying out of their countries?

JNS – My speculative answer is that the larger the government, the more corruption there is within that government. And we’ve got a very big government with many employees that are getting their hands greased all along the way. One can easily argue that even when the actions/decisions of people in gov’t aren’t criminal (by definintion) that they at least lack morality/ethics. A select few benefit from these actions while the majority suffer. Just look at pretty much any high-level politician’s net worth before and after serving…

You’re talking about the Chinese govt, right? How exactly does the one-size-fits-all Republican information filter apply to this situation? The “less-governent-is-better” school of “thought” seems rather irrelevant to this discussion.

JR – I’m referring to all of the big governments and all political parties. I have no idea what you mean by “Republican filter”. Want to read up on state-level corruption? Here’s a good article: http://www.nakedcapitalism.com/2015/11/what-are-the-only-3-states-that-score-higher-than-a-d-in-the-corruption-index.html

I’m thinking of zoning silliness from local planning commissions, bribery for trash routes, all the way up to Clinton’s $200k speaking fees and Cheney/Bush/Rumsfeld businesses and their connections to the gov’t. Please don’t tell me that I have to go on. Gov’t and the 0.01% are skimming/taking at the expense of everybody else. Just look at metrics of business profits versus median/mean employee wages over the last 40 years.

Here in the US, I think it’s blatantly obvious that both political parties are now completely beholden to the monied elite.

What can any of us 99 percenters do? My only answer is to go 100% into rental real estate – i.e. to become a member of the rentier class. (not the renter class!)

Jeff just wants small govt for the greater chance of a corrupt chicom official putting money directly into his own hand.

Small govt types would gladly sell your children to a Chinese salt mine so their kids can go to private school.

Excellent post Jeff. Many people on this blog want to fight the system and make things “right.” It should be abundantly clear to everybody here on how the game is played. Acknowledge it and profit from it!

Alex, you are way off base. If you’re trying to make this personal, go ahead. From that perspective, you will be disappointed to know that there have been no people from China as my tenants, nor are any on the horizon, nor is there any reason for me to try to target people of any particular nationality. If you’re bitter because I am doing what little I can to take advantage of this economic climate, I can’t help you.

If you’re going to argue that our gov’t (and China’s) isn’t corrupt to the core, have at it. Or, perhaps you still believe that there is one ‘good’ political party and one ‘bad’ one. If that’s the case, I’d like to hear your argument. Since I’m not in the 0.01%, I don’t see how either party is of any help to me or to the broader economic interests of the majority of people in this country.

I would certainly be in favor of smaller government. That’s spoken from the perspective of somebody that has thought about starting a business in IT but can’t even begin to make heads or tails of what’s necessary to actually employ one person legally. Or for example, I had a big pile of weeds that I wanted to burn in my yard but decided not to once I found out how much government tape was necessary to get a burn permit. Note that I’m in MT, not some dense urban area.

“Many people on this blog want to fight the system and make things “right.†It should be abundantly clear to everybody here on how the game is played. Acknowledge it and profit from it!”

I suppose you mean not buying right now is fighting the system? I think many people on this blog simply are looking for a decent place to live without getting ripped off. If people want to wait, what’s the worst that could happen, they get priced out forever?

With the rules of the game constantly evolving there is a lack of clarity of how playing the game today will result in tomorrow’s outcome. Isn’t that why we’re here?

Nothing wrong with profit motive, but when it’s speculative in nature and looking for a quick buck, that’s where things tend to go off the rails and cloud the picture.

Because the .1% in this country want everything for themselves and nothing for the 99.9%

This. Capitalism wealth pump. Look it up. This.

This reminds me of the Japanese some 20+ years ago – and they lost their collective shirts!

The Japanese lost there shirts in the Commercial market, commercial building prices are not as sticky as SFH’s. The market did not stay distorted too long after the Japanese crash, SFH on the other hand is a sacred cow and the government will not allow to much of a downward adjustment. Since SFH prices are sticky, most people would not sell if they can’t get the price they want and the flippers and Private Equity will swoop in and buy up any houses that are dumped before they hit the market. Unless we get a mass exodus from CA like Detroit, or the government removes the tax benefit from housing the prices are pretty much not going to move.

In other words, this time is different.

“the government will not allow to much of a downward adjustment.”

Much downward adjustment has happened many times before.

“most people would not sell if they can’t get the price they want”

That hasn’t stopped prices from falling before.

“flippers and Private Equity will swoop in and buy up any houses that are dumped before they hit the market.”

That hasn’t always happened before.

“the prices are pretty much not going to move.”

Or you could be wrong.

What goes up, must come down, spinning wheels got to go around

talking about real estate, its a crying sin

keep riding the pink pony let the spinning wheel go around and round..

Seen tops and bottoms and anyone expecting different needs to look up definition of insanity..

Housing is an investment, with wall street, debt/rates, the fed and retail buyers involved you can bet your equity their will come a time when they want to bring pain to longs….

Too funny. Investors will swoop in again even as their own existing portfolio depreciate and they’re already leveraged up to their necks? No redemption on their existing portfolios?

Yes, the comparison is an apt one, the Japanese bubble economy did cause many to lose their shirts- but with one major difference: The Japanese in the 80s were mostly buying big-ticket commercial developments, golf courses etc. This time around, the Chinese are buying single family homes and condos. The effect for the average American family, particularly in Cali and Vancouver (as this blog has been clearly documenting), is becoming devastating. I grew up in San Francisco in a Asian immigrant-heavy neighborhood. My neighbors and schoolmates were mostly hardworking, 1st and second generation immigrants contributing to society and adding their humble light to the Great American Dream. Now, it’s shady millionaires overbidding for anything in sight and planning to send their kids to UC Berkeley on native “resident” tuition. Not only do we have to compete with foreign buyers for a roof over our heads, we have to compete with their kids for a spot in our public schools!

Commercial vs residential is only a differing attribute of the same type of behavior.

“Now, it’s shady millionaires overbidding for anything in sight and planning to send their kids to UC Berkeley on native “resident†tuition. Not only do we have to compete with foreign buyers for a roof over our heads, we have to compete with their kids for a spot in our public schools!”

That’s the popular narrative which is based on anecdotes.

The Chinese are buying more than homes. There is a plan to buy lots of US companies in Renewable energy, biotechnology, aerospace and robotics. There was a want ad for a mandarin speaker banker in to be involved with these transactions. If you read Irvine talk its hard to figure if they are increasing or decreasing since those people live in Irvine and mention about Chinese buyers.

SoCalBaker stated, “Unless we get a mass exodus from CA like Detroit, or the government removes the tax benefit from housing the prices are pretty much not going to move.â€

Do you really think those are the only circumstances which might affect housing prices? What about another stock market crash? What if China bans significant transfers of money to the U.S.? What if an earthquake scares everyone away? There are probably many more scenarios that I can’t think of that might have a big effect on housing prices. Statements like those of SoCalBaker seem to echo those made in 2006.

I agree with Donpelon- it’s unfair that we are pretty much forced to compete with foreigners for property and education. I guess that’s one of many costs of giving them our money for the last 30 years.

Also, what if the exceptional drought gets worse in the coming years? What if people MUST start to leave California, as climate change wreaks havoc?

@responder a stock market crash coupled with a job-loss recession could trigger a crash in home prices, however, I think it is far fetched to think an earthquake itself or drought will cause a crash in home prices. Were there price crashes in LA when the last major quakes hit (1971 Sylmar? 1994 Northridge).. I doubt it.

The underlying message is always that “this time is different.” If our skepticism is wrong, then why waste time on here trying to convince us? Doesn’t make sense.

Dan, Housing was hit hard in 94 without the earthquake

This drought is unlike anything ever seen in California and if it doesn’t rain a lot in 2 years in a row, housing will get hit hard…

why buy a house if you have no water…..godzilla el nino talk is late night news headlines for sheeple….

@ hotel california

I dont understand what this ‘this time is different’ soundbite is all about. I dont recall any poster on this site saying ‘this time is different’. where in my post did I say ‘this time is different’. For those who didnt buy in 2010-2012 who thought that they ‘dead cat bounce’ was imminent had seriously under estimated the demand for homes. Will prices decrease at some point, of course.

http://newsroom.ucla.edu/stories/is-los-angeles-on-the-cusp-of-another-housing-bubble

are the UCLA economists too optimistic? yes, are the bloggers on this site too pessimistic? YES.

Dan, my comment states that this time is different is the “underlying message” which means that it’s the logical conclusion of many arguments being made here. It doesn’t have to be explicitly stated.

By the way, my comment was directed to “Responder”, which I assumed was evident, but I don’t think your comment was visible at the time.

I agree with you. See my post. Americans only have a 10 year memory. Also, so many people are too young to remember. A person would have to be over 45 to have been 18 when that happened in 1989. Most younger people think the history of the human race started when they were in college.

It’s high time for a special tax assessment on foreign buyers. Transfer tax and ongoing assessment.

This. I’d say tighten citizenship criteria too. If you are not originally of European culture, no citizenship for you. Hispanic? Yeah. You’re an American of African descent? You’ve been our guest for hundreds of years, you’re in. Jew just in from Israel? Be my guest! Chinese carpetbagger? Better have a return ticket and don’t let the screen door swat you on the ass on your way out…

Alex: Jew just in from Israel? Be my guest! Chinese carpetbagger? Better have a return ticket and don’t let the screen door swat you on the ass on your way out…

Why differentiate between a Jew “just in from Israel” (i.e., a recent Jew) and a recent Chinese?

* Both Jews and Chinese have resided in the U.S., in significant numbers, since the 1800s.

* Neither Israel or China is in Europe (seeing that makes a difference to you).

Is it because it’s easier to offend Chinese than to offend Jews?

This has nothing to do with ethnicity, it has to do with citizenship. When I say foreign nationals, I mean ALL people who are not currently US citizens.

It comes down to being of western culture, plain and simple. Isaac Asimov, George Washington Carver, these are national treasures. I personally think all Jews in Israel should pick up and move here, pack up the wailing wall etc. why not, the London bridge is here, and leave the sandpit to the 7th century neanderthals. Welcome our civilized brothers and wall off those who would subjucate or enslave us.

In general, people who have been raised in the culture of a command/highly controlled economic and political system like Communist China, Soviet Union and Eastern Block states look at money and possessions in a different way then we do.

Where a black market has thrived and is integrated into daily life as routine (Americas inner cities have a little of this). Where the way to make money and goods is to have and get political influence, and where everything you have earned or own can be taken away without due process and legitimate courts.

People from those cultures see “getting theirs” when the opportunities arises as logical. Only suckers would see it differently. Why should your neighbors get things and you do not?

When you know that your money flow is temporary and ill gotten, and the flow can (and will) stop, and the government can confiscate what you already have. The obvious choice is to cash out (or embezzle/steal ) and get your currently inflated money over to the US/Canada and buy something physical.

What would you rather have during the economic crash, a hand full of worthless paper and a poorly made home in Beijing, or a home in Irvine that may be devalued by eventually, but will still be worth $500K, and your family is here because of the visa programs.

I work with Armenians, and I ask them why many of them (not all) spend a lot of money on Cars, etc… carrying large debt loads. The answer I repeatedly get is, “it all could be gone tomorrow, so why wait?”. Evidently in Armenia under the Soviets they learned to get while the getting was good. Today is what matters/

I apologize for the ramble, but too often we look at this foreign money situation with the eyes of people who grew up in the west. When you look at it with there mind set, you can see the reasoning. Even if it is fundamentally flawed from my American perspective.

Good insight, thanks for that perspective.

Nice. I understand. It is a different mentality. What happens if China goes into a recession? Or the world does? Are the Asians and the bubble they helped create a fact of life now? Can their investments be seized by the US or Chinese governments? If not then why do people think anything will tank hard? All of those people from China, Russia, etc. own most of London and NY — why would anything crash back to earth if that’s the case? I don’t know — that’s why I’m asking.

Frankly I think too much emphasis is placed on cultural differences to try to explain why this time is different. People get greedy and fearful, bottom line.

Because when the house of cards collapses in China, the people who got out will have only the one asset, the real estate they put there money into. The Doctor always says, the money in housing isn’t realized until you sell it (unless you are a large scale land lord).

When the pipeline of money stops, you will have Chinese who have real estate here who will be forced to sell to get cash to live ( or downgrade into smaller properties to get some cash out), or will abandon the properties.

That is the theory. When most of your paper assets are locked up in China, the physical assets in the US are your safety net, hence why the investment in US real estate.

Great post. Unlike worthless currency, stock certificates, etc…buying a home in coastal CA is a great play for the international rich. It is a great tangible asset. You can bring your family here, get citizenship, live in your house, rent your house, send kids to great public schools, etc. Don’t forget how the Fed, government, banks, PTB love supporting housing at all costs and it seems like a no brainer decision EVEN if the house loses value or is stagnant for the long term.

I am hoping for another dip so I can scoop up another beach close rental. Prices have really taken off lately. Be patient and keep saving.

“Unlike worthless currency, stock certificates, etc…buying a home in coastal CA is a great play for the international rich.”

Or just like with currency and stock trading, international rich can speculate on the basis of others piling into the same coastal CA RE asset class and getting the timing right to exit without getting burned.

“It is a great tangible asset.”

Funny thing is that’s pretty much the exact same argument I often read and hear is a great reason to buy precious metals.

“You can bring your family here, get citizenship, live in your house, rent your house, send kids to great public schools, etc.”

Or you could leave the house sit empty and do none of that.

“Don’t forget how the Fed, government, banks, PTB love supporting housing at all costs and it seems like a no brainer decision EVEN if the house loses value or is stagnant for the long term.

I am hoping for another dip so I can scoop up another beach close rental. Prices have really taken off lately. Be patient and keep saving.”

If it seems like a no brainer, why wait and not buy now?

If you happen to be lucky enough to have come into wealth in China one way or another, it absolutely makes sense to send the money abroad. Same goes for Russia and the basket case Latin American countries. It’s not an accident that places like the US, UK, Singapore and HK are top destinations for foreign money. As much as you guys here like to criticize our system, just try buying real estate or making an investment in virtually any other country in the world. I think you will be shocked at how opaque, complicated, corrupt and unclear the process and the rules are. Any random person can set up an LLC in Delaware in about 10 minutes. Try doing that in China or even Spain. They will make you jump through so many hoops you won’t want to ever do it again. In this country, the concept that the government can just take your property and put you in jail at any time for no reason is not something we ever think about. In many other parts of the world, it happens to rich and well connected people all the time. When you buy real estate in this country, you can run a title search and know exactly who owns the property, you can even buy title insurance to protect your investment on the off chance that there’s something wrong with title, and it’s pretty much certain that your investment will be protected by any claims from third parties or the government. In Greece, good luck, you have to hope the guy who sold you a house really owns it, if not, you’re SOL and good luck trying to get your money back. It is an impossibility that the Yuan will ever be a reserve currency because nearly all of China’s financial reporting, from the government, to Alibaba, all the way down to the average Joe Chen is just made up. No one believes them except idiot mom and pop investors who buy Chinese ADRs because they saw something on “Sqawk Box”. The folks who understand this reality better than anyone else are the wealthy elite in China and they will keep taking money out of there and pumping it into our country for the near future and it will probably accelerate if there is any financial collapse.

That’s a fantastic perspective. Perhaps more Americans should realize that our system is a premium product, and we should start pricing it as such for foreigners interested in buying here.

You have a good point that its easier to buy real estate in the US instead of in their countries. As for Texas I was shocked at some of the recent housing prices. I see prices in the Woodlands a much nicer part of the greater Houston area matching prices in Orange County around 2003 or 2004. I’m not certain if this is all the foreign money or just lots of people from California moving there.

“…and where everything you have earned or own can be taken away without due process and legitimate courts.”

Semi-truth: Get accused of terrorism (whatever that is) and it’s FISA-court and Guantamo for you. No-one knows and needs to be told about this: Basically same system Chile used in 70s: You ‘disappear’ and that’s the end of game for you.

I fail to see any difference to so called eastern block now: No safety to anyone is the name of the game.

Very good observation!

Many got used to say that because we used to live under the rule of law. These days under Patriot Act and the ever changing definition of “terorist” we are prety much like in Chile under Pinochet. A terorist is ANY person a politician or a banker doesn’t like. Hate speech will soon be defined as anything not PC based on the definition of those in power.

As the freedoms and liberties are eroded and the rule of law is bent based on who is in power so the real estate values will go down.

Ms. Smith, I hope you realize that your reference to “Communist China, Soviet Union and Eastern Block states” is in the distant past. The USSR dissolved over 20 years ago. China has been socialist, not communist since 1978. Now it is easier to start a company and get rich in China than it is in America. The middle class is growing every year. The overwhelming majority of Chinese people are happy with their lives. They see they are better off than 10 years ago, and they believe their leaders are making the right decisions.

I am an American who lives in China. You can’t understand what goes on here by reading or watching the American media. Most of it is just bullshit and propaganda. It only took me about 3 days here to realize it.

The Chinese are moving capital from a soon to be useless fiat to a form that they can access and the most stable choice available to them is real estate in CA. They could care less how much they pay for it, that fiat money was an aberration they had a chance to capitalize on.

Whatever they get out of it when they sell, is found money for them.

So paying top yuan and selling for whatever USD they get back is a WIN WIN. However many cents on the dollar recovered depends on politics here in the US.

I think you are wrong about the Yuan. If anything it will have a greater standing going forward and many more countries are using yuan for trade purposes. I think the Chinese are more concerned with their asset/economy bubble and capital controls and thats what we are seeing with money pouring into the west coast which creates bubbles for us. Their air quality right now is hitting record levels of pollution, but its almost always bad. Just about everywhere else has to look like paradise to them.

The money is fleeing from China because the day of reckoning is coming.

When the majority of Chinese citizens, who are dirt poor, have had enough,

Old school, Mao Tse Tung, Red Guard, communism will return along with the firing squads.

Those who are already landed in the US are safe, but their family members back in China will pay for their sins.

It is an interesting theory. If China ISN’T nearing a state of collapse, then why are so many of its wealthy citizens leaving?

And for those of you who point out the horrible pollution: isn’t horrible pollution just a form of environmental collapse?

Or it’s simply a matter of a speculative mania and China ends up rebalancing successfully, albeit along a difficult road.

OK. Some of you people still hoping for bust… You best learn to live your life… CRASH it’s about a lot of money people with power will always do what’s best for them.

Can’t afford a house, they’ll find a way to get you to “afford it” …They just raised the limits HIGHER…

http://www.housingwire.com/articles/35693

I own a place in the City, I still don’t buy into hopium…it’s a drug with long lasting effects

Raising conforming limits means little when DTI, PTI, LTV are the decision engine driver and wages are not helping the party

I fully expect and am prepared for a pullback….it will happen…

http://www.zerohedge.com/news/2015-11-29/its-official-chinese-buyers-have-left-us-housing-market

according to zerohedge the chinese invasion is over

Hello Doc – you state that the last few years housing was ‘propped up’ due to investors…. but who is in those homes that were purchased by investors… people. Doenst that give us an indication of just how strong the demand for housing is, let along construction of residential housing has been extremely low since 2008. does this not tell us that with burgeoning population and influx of hi-tech companies into LA that we may never see a lack of demand in housing (little chance of crash) here in LA, LA, LAnd?

The suppression of safer investments and cheap debt have allowed investors to over-speculate in real estate. In addition, inventory is still being manipulated by financial institutions. Too many dollars chasing too few goods = bubble.

This “strong demand” is based on artificial but unsustainable policies. Those same investors are charging bubble rent rates to cover their purchases. When the financial pyramid becomes too top heavy, the whole foundation will collapse.

Prince, I agree 100%. It’s now only a question of when it will burst and how far things will drop.

Why do you believe this party can’t keep going forever? You can’t fight the Fed. They have a magic printing press. They can print your savings to oblivion.

You can keep your green paper, and build yourself a papier-mâché mud hut with it. I’d rather have a real house. The longer you wait, the more rent you pay as well. How long are you prepared to wait? Until you die? Also, what interest does the Fed have in cutting off easy money, when the US is in trillions of dollars of debt? Why would they want to deflate under this scenario? I’d be more worried about hyperinflation if I were you. Look at the cost of houses 50 years ago. 50 years from now, houses will appear just as cheap at their current prices. There are so many dollars abroad, and when they come home to roost, when the barbarians are at the gates clamoring for something real, I wouldn’t want to be the last one holding the green paper.

In my opinion it would be even more scary to think the FED was the Chinese buyer and we were thought to believe foreign money was fueling the housing game or potentially leaving it.

The NYT article is old news, out of date. Yes, it’s true that Chinese buyers have bought lots of real estate in U.S. with cash since 2012. Today they have pulled back substantially due to the recent Chinese stock market crash. Check out million dollars, unsold inventory in San Gabriel Valley areas. See up-to-date article from the WSJ.

http://www.wsj.com/articles/chinese-pull-back-from-u-s-property-investments-1448649226

Keep hoping, dreaming and praying for a real estate crash. At what point do you accept reality that the federal government, The Fed, big banks, the real estate lobby, etc. will engage in any legal and illegal behavior to keep the bubble inflated?

When you measure all of the interests that are pro-real estate bubble and those who just wish the markets are left to operate on their own, the prior interest group I mentioned wields more power and authority.

Feel free to leverage yourself to the hilt if you think that prices can’t crash. This time, after so many other crashes, must indeed be different.

Dude, you sound depressed. I am pissed and bitter sometimes, but this is about cycles… It’s always a roller coaster…. Thing will change and you can take that to the bank

Nimesh,

You are telling people the truth, if you want them to agree with you, you need to tell them what they want to hear. You talking about how the government has an interest in higher an higher house prices will get you nowhere with this crowd. Most readers here have a sense of fairness and justice, to a fault because they cannot or will not see that the game they are playing is not and will not be fair or just.

A lot of people are going to spend a lot of timing hoping for a crash which may never come, or if it does it wont be enough and they wont get in because they will expect it to get much worse, or it will boomerang to quickly and they will call it a dead cat bounce.

Meanwhile these people’s lives are centrally focused on buying a house to the point where they probably do not truly enjoy most aspects of their lives because they are too worried about what is going to happen.

People want to believe if they do not buy into this market they are not speculators…unfortunately you are a speculator if your decision to buy or not buy has to do with a future price. So those not buying right now because prices are too high and they will wait for a correction of XX% are speculating just like those who buying because they think the price will go up and they are going to cash in.

Neither side knows the truth, what we do know is there is manipulation in the market, how the market will be affected when that manipulation ends (if it ends) is anyone’s GUESS. And assuming there “is no ammunition” is pretty foolish, to me. The FED and the GOV always have ammunition. Who is o say they dont do something else the next time things start to go south.

Am I saying prices will go up forever? NO. I am saying you may end up spending a ton more for a house waiting for prices to crash than if you just buy what you can afford when you can afford it. No, I am not a housing cheerleader. I am a realist and trying to provide perspective to the drum pounded by most on this board that prices will go down being a fact. It just is not the case, they might go down, but they also might stay the same, or go up more. No one knows for sure, and everyone buys for a slightly different reason so in making that decision be sure it makes sense for you why you are doing, not why it makes sense for others, your motives could be completely opposite.

Bryan stated: “You talking about how the government has an interest in higher an (sic) higher house prices will get you nowhere with this crowd. Most readers here have a sense of fairness and justice, to a fault because they cannot or will not see that the game they are playing is not and will not be fair or just.â€

I can’t speak for anyone else, but I never asserted that the government doesn’t have an interest in higher house prices. Of course they do (due to tax revenue, increased interest revenue for the banks who the government works for, etc), and I think any sane person would realize that. Unfortunately, even for the almighty government, there are some things that they are incapable of doing well (actually, they can’t do most things well). Influencing housing prices on a permanent basis is probably one such thing, as was demonstrated by the depressed market between about 2009 and 2012. We’re talking about the same government here.

Also, it’s not that I cannot or will not see that the housing “game†(market) is not fair or just. Of course it’s not fair or just. Nothing is. But fairness and justice have nothing to do with my decision not to buy. It’s that I think prices are out of whack relative to median and mean incomes for almost any given area. And as history has proven multiple times, the market will probably adjust because of that and/or because of any number of other factors. It would be quite peculiar for the market not to adjust given the multiple previous adjustments that have occurred.

“A lot of people are going to spend a lot of timing hoping for a crash which may never come, or if it does it wont be enough and they wont get in because they will expect it to get much worse, or it will boomerang to quickly and they will call it a dead cat bounce.”

For someone who claims to be a realist, you do love to ignore the experiences of past crashes. Have quick price rebounds have been the norm?

“Meanwhile these people’s lives are centrally focused on buying a house to the point where they probably do not truly enjoy most aspects of their lives because they are too worried about what is going to happen.”

Now you’re launching ad hominem attacks. Why would you bother insulting others on a personal level if you yourself didn’t have a personal bias? Voice of reason — I think not.

“Neither side knows the truth, what we do know is there is manipulation in the market, how the market will be affected when that manipulation ends (if it ends) is anyone’s GUESS. And assuming there “is no ammunition†is pretty foolish, to me. The FED and the GOV always have ammunition. Who is o say they dont do something else the next time things start to go south.”

OK, tell us what the Fed and government can do to supplant their current floundering interventions. Be specific.

“I am a realist and trying to provide perspective to the drum pounded by most on this board that prices will go down being a fact. It just is not the case, they might go down, but they also might stay the same, or go up more.”

Ad hominem attacks

Ignores past experiences

Believes the Fed and government to be omnipotent

You give realists a bad name.

Agree, Responder. Government manipulation and unfairness were also a fixture during price resets prior to 2009.

Speculation is about taking on risk in anticipation of gain, not risk and loss avoidance.

@ Responder- +1 on this quote “Unfortunately, even for the almighty government, there are some things that they are incapable of doing well (actually, they can’t do most things well). Influencing housing prices on a permanent basis is probably one such thing, as was demonstrated by the depressed market between about 2009 and 2012. We’re talking about the same government here.” To me the one important thing that has changed since the crash is that manipulation of inventory is a new and seemingly viable concept…I am not saying “its different this time,” but that is a new wrinkle that could be used again to keep prices levitated until wages catch up if they start to fall. Also I do agree with you that it could fall for various reasons, my only contention is people who claim that will fall, because while it will fall at some point it could also increase from this point and never fall below this exact point. so while it will fall at some point as we have seen it may never fall below where we are right now…but it also could. My oint remains that we don’t know.

@ Prince – Quick rebounds have not, but 50% flash crashes as seen from 2008-2010 have not been the norm either, but it seems to me that is what people are expecting again…and have been expecting for 3 years now and in that time all that has happened is reduced inventory leading to higher prices. And I do not know that a reduction is as imminent as some are making it seem, which is in some way possibly scary some off of a decision that may be wise for them, depending on the motive for buying.

I am unsure of whom I insulted…I was making a point that people are focusing on house prices which could be leading to stress, anguish, and misery, (as those on this bored have written about) so I am not making it up, nor insulting them. I am pointing out that all the stress takes its toll and distracts people from the life they are living and if things do not go as planned they could be costing themselves the very thing they desire. for some it is solely a monetary decision, but others may have other factors to consider when buying.

Specifically the government can do exactly what it just did and is still doing to provide incentive companies and lenders to keep inventory low and keep distressed property off the market. Also I am not sure what is floundering…prices have simply continued to rise, unless there is a strong price reversal you are seeing that I am not.

The only attack I see is yours on me. Also, the only one making assertions about the future is you, not me only claim I have made is we do not know. If you want to boil down what I said into one sentence it is the following: “Nobody knows what is going to happen for sure in the future, it could go up, down, or stay the same, be sure as a buyer you know why you are buying and don’t let others scare you out of a decision that could be good for you.” I am unsure of who is attacked presenting that statement.

I dont claim the FED and .GOV are omnipotent, I never said that prices wont go down. I just said they might not and that people who are interested in buying a house might be costing themselves money, time, stress, opportunity and other various other things waiting for a crash that may or may not materialize. If the crash does not happen what then? or it if is only 5% instead of 50%? how long can people wait for house prices to crash, how much of their lives will have been spent waiting for something that they may never see?

@ HC – “Speculation is about taking on risk in anticipation of gain, not risk and loss avoidance.” I disagree, simply because the purpose of waiting is to put yourself into the position where you buy in only when you think the asset will gain in value. The opposite of speculation is buying something you want at a given price regardless of its future value, because you want the asset, can afford it, and do not care if it increases or decreases because possession of the asset is your goal, not the value it will eventually return to you.

Brian,

You are wrong on this – you think that the government is God and give the FED/Gov godlike power. They are not God. They are humans making mistakes like everyone else and sometimes they have evil plans. What is a fact is that they don’t represent you and me, they represent their chronies and their own interests. Most of the time, their interests do not line up with yours or mine.

As the history shows, once in a while they get themselves in big truble and they can not levitate the whole economy forever. Soner or later the gravity takes over and they drop the ball. This is not an opinion like yours. History proved many many times that this is a fact.

“I disagree, simply because the purpose of waiting is to put yourself into the position where you buy in only when you think the asset will gain in value. The opposite of speculation is buying something you want at a given price regardless of its future value, because you want the asset, can afford it, and do not care if it increases or decreases because possession of the asset is your goal, not the value it will eventually return to you.”

Brian, I stick with the definition of financial speculation that has been formally defined for ages, otherwise things can quickly become clouded. It seems somewhat curious that on one hand you’re espousing the virtues of not betting on the unknown but on the other hand stating assumptions about the unknown motives of certain commentary made here. The impression I get from most here is not that they are not necessarily profit driven, but simply seeking reasonable value.

@Bryan

“@ Prince – Quick rebounds have not, but 50% flash crashes as seen from 2008-2010 have not been the norm either, but it seems to me that is what people are expecting again…and have been expecting for 3 years now and in that time all that has happened is reduced inventory leading to higher prices. And I do not know that a reduction is as imminent as some are making it seem, which is in some way possibly scary some off of a decision that may be wise for them, depending on the motive for buying.”

The underlying factor behind the crash and the quick rebound was manipulation by the government and the Fed. In the first case, neither entities realized the catastrophe that their policies were creating. In the latter case, both embarked on the largest, ongoing intervention in American history. If the artificially induced recovery was quick, why dismiss the possibility of a downturn of equal magnitude? As always, it is impossible to perfectly predict the timing of a downturn. However, it nearly impossible to deny the historical downside of gouging on far too much debt.

“I am unsure of whom I insulted…I was making a point that people are focusing on house prices which could be leading to stress, anguish, and misery, (as those on this bored have written about) so I am not making it up, nor insulting them. I am pointing out that all the stress takes its toll and distracts people from the life they are living and if things do not go as planned they could be costing themselves the very thing they desire. for some it is solely a monetary decision, but others may have other factors to consider when buying.”

Are you medically trained that you would know how those people on the sidelines feel? Why not bring up the many cases of foreclosures and strategic defaults due to high prices and the ensuing ongoing costs to taxpayers?

“Also, the only one making assertions about the future is you, not me only claim I have made is we do not know. If you want to boil down what I said into one sentence it is the following: “Nobody knows what is going to happen for sure in the future, it could go up, down, or stay the same, be sure as a buyer you know why you are buying and don’t let others scare you out of a decision that could be good for you.†I am unsure of who is attacked presenting that statement.”

Self-contradiction. On one hand you deny knowing what the future holds. On the other hand, you’re assuming that the Fed and government will once again intervene.

“I just said they might not and that people who are interested in buying a house might be costing themselves money, time, stress, opportunity and other various other things waiting for a crash that may or may not materialize. If the crash does not happen what then? or it if is only 5% instead of 50%? how long can people wait for house prices to crash, how much of their lives will have been spent waiting for something that they may never see?”

Like I said, you are bias in presenting only one side of the story. What about the negatives of the lowest RE affordability in decades? Monthly mortgages consume ~40% of incomes in San Francisco and in Los Angeles.

“I dont claim the FED and .GOV are omnipotent, I never said that prices wont go down. I just said they might not and that people who are interested in buying a house might be costing themselves money, time, stress, opportunity and other various other things waiting for a crash that may or may not materialize. If the crash does not happen what then? or it if is only 5% instead of 50%? how long can people wait for house prices to crash, how much of their lives will have been spent waiting for something that they may never see?”

In this case, what’s the worst that could happen? Keep renting? Move to a cheaper part of the country?

Prince, after re-reading the original comments, it seems to me you’re spot-on to take this to task.

—

From Nimesh:

“At what point do you accept reality that the federal government, The Fed, big banks, the real estate lobby, etc. will engage in any legal and illegal behavior to keep the bubble inflated?”

Follow-up by Bryan:

“You are telling people the truth”

“Neither side knows the truth”

—

So people wait and buy later on…

Unless this time is different because they’ll be priced out forever due to TPTB having both total control over everything and reached a decision to keep house prices inflated.

@ Flyover- I am not sure what most of what you typed has to do with what I said that I did not address already. I do not think the gov. or FED is God, and I agree they do not represent what is best for the citizens. We do not differ in result, we differ in timing. My point being the inevitability of the next crash that people on here are so dead set on may not be as soon as would be needed to make not buying at this time the best choice. It may be tomorrow, nobody knows.

@ Hotel California – The Quoted portion you are attributing to me saying Nimesh is telling the “truth” is not accurate, it was the part of his statement that had to do with no one knowing the timing of the future market.

@ Prince of Heck – I would know how those who are in that situation feel because I was in both of those situations. Foreclosed and looking to buy as prices rose quickly, so I know the feelings involved. I dont do any asserting at all except that no one knows what will happen. All the assertions are coming from others here, not me. The worst that can happen in waiting is that good down payment money gets spent on rent and that the prices we have today are the same prices going forward for several years before a down turn.

Again let me spell out my point…people should not assume that a down turn is imminent, because no one knows. And people need to be aware that if they believe the opinions on this board are fact, they may be costing themselves a buying opportunity that would have actually been better than one that may occur later on in the future.

This generalized no one knows the future rhetoric is overstating the obvious. It begs to be pointed out in the moment when especially egregious but a false emphasis is being placed on the unknown to cover for an underlying fear of missing out bias. Based on the statistics pointing to the trend favoring renting, seems as if many people are getting on with their lives without buying now.

We already know anything is possible so what we’re debating is probability. The few commenters here that claim to have a crystal ball are the exception and not the rule.

@Hotel California

My thoughts exactly. It seems that Bryan is rushing from end of the RE-related emotional spectrum to the next.

@Bryan

You do realize that many people have the patience to wait out the current echo bubble like they did previously with the original bubble. It seems that your RE-related insecurities are overcoming financial common sense.

At this point, buying presents few benefits, if any, to renting. First, tying down so much money (~100K) as down payment when prices are already at nose bleed levels is worrisome enough. Second, that down payment could alternatively invested in a portfolio that historically appreciates faster than RE could.

In Chicago the Chinese investors are being taken to the cleaners. In Chinatown and Bridgeport there is a lot of heavy investment from Chinese investors. The so called Chinese “investors” don’t have a freaking clue. They will pay 500K to 800K for a property when they can pay that same amount in BETTER NEIGHBORHOODS.

I can somewhat understand the prices in Chinatown, since it has been a Chinese enclave for over 100 years,and Chinese social and business life is centered there. These people will pay a premium to be in a community where their languages are spoken, and they know almost everyone. It’s a very intimate, cozy neighborhood where everyone knows everyone else, where families have lived 3 generations or more, and it has the private schools and the local Chinese institutions that the residents depend on. Moreover, the development of the adjacent South Loop area has helped it tremendously- it is no longer a little island lost in a sea of post-industrial blight, but part of a thriving and attractive new neighborhood.

What I do NOT understand is how nabes like Bucktown, Wicker Park, and other west town nabes became as valuable, on a cost-per-square foot basis, as the beautiful near north side. I remember when Buck Town and Wicker Park were absolute slums, without a single shard of decent architecture, and WP still has a rough-edged semi-slum feel to it. Even 20 years ago, when the area was inhabited mostly by artists looking for dirt cheap rent, you could rent a shabby 4 bedroom apt for something like $500 a month. I had many artist friends over there. But they, like all the other artists, had to vacate when the affluent “hippoisie”, lured by the major art scene that had developed there, came along and ran the prices up to levels of the near north side.

“He paid cash for all of them.”

And, as we know, it’s legal to transfer about $50k out from China.

So the chinese criminal class is buying their way into US. Nice.

As if the US didn’t have those enough already.

No one really knows how heavily manipulated the yuan currency is. You can be sure the Chinese elite have a good idea of its true value and may be in bed with the parties that are turning the yuan dial.

So if all these westernized countries are trading there considered more stable currency for hypothetically questionable currency. Who do you think gets hurt? It’s smart for the Chinese elite to obtain overseas assets, they aren’t confident in their own currency. But if the source of currency you are purchasing these assets with have been manipulated and laundered why would it be not treated like any other crime. Drug money for example and also confiscated. Unfortunately the scale is so large you have to assume US corruption is involved (like drug money).

In my opinion in the grand scheme of things cities will rise and fall based on how well they can maintain their infrastructure (bridges, water and sewer, crime, etc. ) with what it’s locals can afford to pay. If home are affordable most probably won’t complain much about what their tax bill will be. However, if homes spike out of reach for most of the locals then you have essentially caused an anomaly which by its very nature is going to trigger more spending by your local government without considering the consequences of their actions. This has to stop right here. Also assessments based on increasing home values in the long run is a failed system. If homes values increase 100% over 10 years how in the world are businesses going to be able to continue to function in these cities if wages don’t keep up with inflation. Small businesses would likely only be able to survive with the owners running it. It’s a ponzi plain and simple. Either way all cities will eventually revert back all that it has created regardless of what you do to prevent the inevitable.

if I have 5m in cash….why choose to be American??

if u put your money in hk or Singapore the dividend tax is none and no capitol gain if asset is outside above 2 locations[ wall street]….

by saving dividend tax and FATCA tax, I pay full price at Berkeley or westwood U??

ochuhu, seems to me that you’re asking the wrong group considering most everybody here is in the US. But it’s an interesting question. If you get an answer from elsewhere, please share here.

Having to figure out where to stash your money or what country do you want to choose as your primary location to live is really up to the individuals risk assessment and life choice. If you think you would be better served living in a county that is a bit more stable or has their financials under control maybe that is for you. However, I am pretty sure all these individuals that have lots of cash have probably spread themselves out into different currencies, have multiple places to live as well as an updated Passport to pretty much go where they need to go. That in my opinion is the best way to live in this environment.

https://www.washingtonpost.com/realestate/by-not-downsizing-baby-boomers-help-clog-up-the-real-estate-pipeline/2015/12/01/ec88299e-978f-11e5-b499-76cbec161973_story.html

baby boomers are not selling to millennials

I’m still waiting for the POP. And seriously, homes are being sold LEFT AND RIGHT even at these inflated prices here in Garbage Grove.

And to think, I COULD HAVE bought a home in Cypress for $499k just 2 years ago. I thought that was expensive.

But guess what the going rate is for the crap shacks in Garden Grove. Yep, $550k….

I’ve seen a few homes nearby being bought and none of them were “Red Chinese”. Almost all of the are Vietnamese Americans however.

There is this one Caucasian family that just purchased a $600k home near my parents house. Very nice house but way overpriced. Especially since the backyard it right next to an ally and behind that ally is a Goodwill. Where trucks drive by and make all types of noises.

I wouldn’t pay $600k for that. I’ll just wait and live with my parents for now.

In 2014, Canada was the LARGEST buyer of US Real Estate. Funny how no one talks about this.

I guess because they look “white” they blend in?

Canada with 26% and China with only 10%.

http://www.cbre.com/about/media-center/2015/02/04/canadian-investment-in-us

Leave a Reply to Andrew