The Canadian housing bubble makes California real estate look sensible: Crash in energy prices will put pressure on home values up north as Canadians go into maximum leverage.

As the year comes to a close, it is useful to put things into perspective. Sure, California has a love affair with real estate and we go through our traditional booms and busts. $700,000 crap shacks now litter the landscape but there are fewer and fewer lemmings taking the plunge. In Canada there was no correction. In fact, households continue to go into deep debt to purchase real estate. The argument goes that mortgage standards are much tighter in Canada so therefore, they are much more enlightened when it comes to financing homes. People forget that the bulk of the 7,000,000 foreclosures in the US came in the form of standard loans. Garbage loans imploded in more dramatic fashion but people lost their homes because the economy shifted. At that point, it merely meant covering the monthly nut. We were housing dependent and that market contracted aggressively. Canada is housing and oil dependent. And oil just got a big kick to the shins.

In Canadian debt we trust

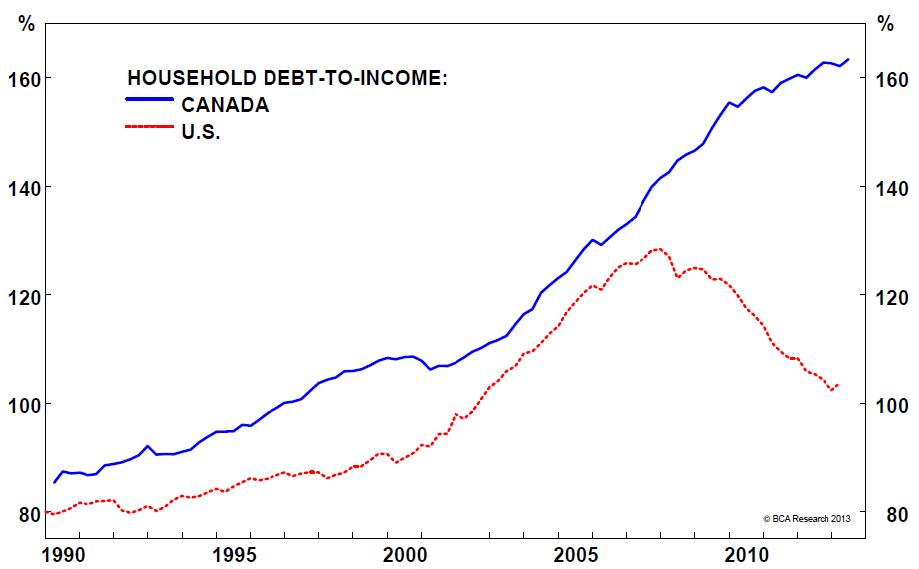

There was an inflexion point for US markets when household debt surpassed household income. People kept saying it was a liquidity crisis initially but it was truly a solvency crisis. People took on too much debt and were walking on a financial tightrope. In the US, this peaked above 120 percent. Canada is well on its way above 160 percent:

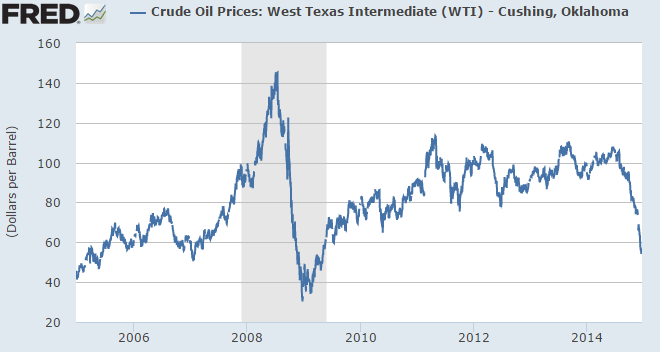

Basically Canadians are deeper in debt relative to their income. And a large part of this debt is housing related. A large part of the economy is also tied to oil and as you may know, oil just took a massive cut:

It was interesting to hear that we would never see oil drop below $100 a barrel. Oil is now trading at $52.84 a barrel. Similar arguments were made about US housing never having one negative year-over-year price drop until we did.

Large part of Canada’s oil is costly to extract               Â

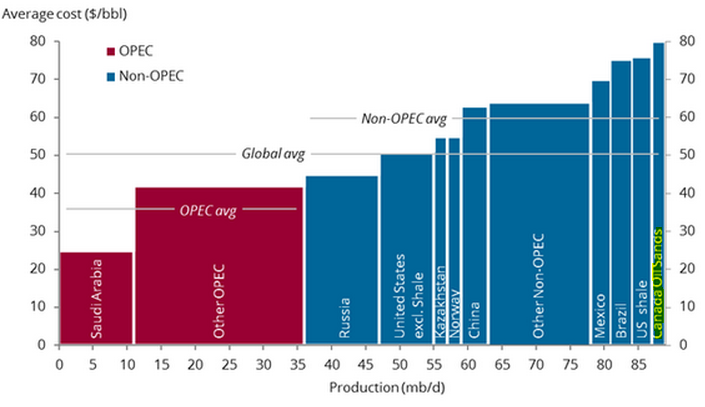

A large portion of Canada’s oil is costly to extract. With oil sands for example oil would need to be at $80 a barrel to make a profit:

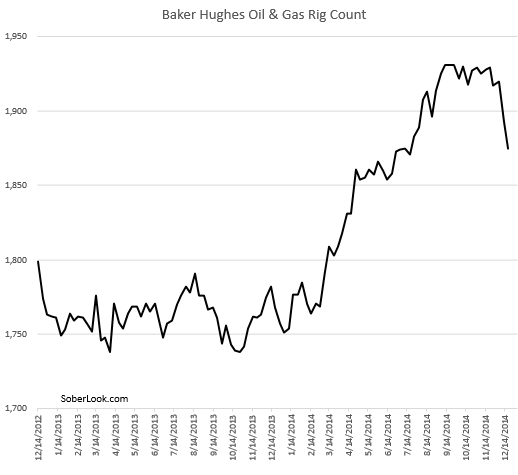

I doubt people want to run money losing operations for a long period of time. So it is no surprise that oil rigs are closing:

Fewer jobs and less money. And for a large part of the Canadian economy, much of this money has been flowing into housing. In Canada, there seems to be a cult belief that housing simply will not correct. They are full on drinking the good old tasting real estate Kool-Aid. In the US, we already lived that correction and understand that yes, housing does go through booms and busts especially when debt is used to supplement a lack of income growth. As the debt to income chart shows, many US households were forced to deleverage via foreclosures and bankruptcies.

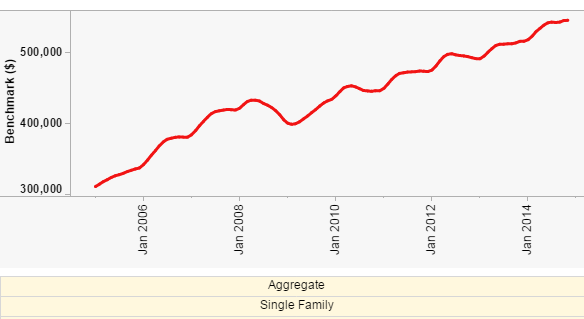

Home prices out of sync

Home prices are fully out of sync with incomes. Take a look at this rise in home values:

Canada has enjoyed many years of the global commodities boom and now finds itself contending with a market full of debt and inflated housing values. Short of oil rising back up to $80 a barrel and higher Canada is likely going to face some short-term pain. The housing market is due for a correction. Those of us in California realize that booms and busts can occur all of a sudden but the events leading up to this are largely foreseeable.

I’m sure many in Canada assume that home values will simply continue to go up and just because banks check incomes doesn’t mean squat. As the above data shows, households are already deep in the quicksand of massive debt. It is all dandy when everything is going up including oil. When oil gets smashed as it did, it came on quickly. Canada has their versions of $700,000 crap shacks usually in the form of condos. Hey, at least with a crap shack you don’t have to share a common wall. When you look at the Canadian housing market it makes the US look like a frugal uncle.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

73 Responses to “The Canadian housing bubble makes California real estate look sensible: Crash in energy prices will put pressure on home values up north as Canadians go into maximum leverage.”

Chinese money did indeed inflate Vancouver housing prices. Canada had a program whereby foreigners could buy Canadian citizenship if they invested enough money — I think it was $500,000 minimum — in Canada, such as by buying real estate.

I think Canada recently ended that program, so Chinese house purchases should slow down.

Don’t know about Canada, but the U.S. has a similar program, a green card in exchange for $500,000 to $1M investments…

http://www.nolo.com/legal-encyclopedia/when-500000-is-enough-get-investment-based-green-card-eb-5.html

First of all, down south, in the USA, Obama refers to the oil sands as tar sands. Yes, Canada is subject to economic laws, no matter how sweet they may appear. There will be foreclosures and etc, and prices will go down, so the Red Chinese can come in and buy up more Vancouver real estate.

Here in Arizona, there have been a large number of Canadian snowbirds buying vacation and retirement homes since the housing downturn. Many Canadians used a home equity line of credit, borrowing against their home in Canada (which were at all-time highs in value) to purchase the property in the United States with cash. It will be interesting to see if how many of those Canadian snowbirds will be forced to sell their Arizona homes if the Canadian economy slows down.

We have the same thing here in the Palm Springs area. With the Loonie so weak, the Canadians will have a double incentive to unload their US 2nd homes. First ones to the exit win. Then look out below for falling RE prices in these markets.

Let them go back North of the border. Have a Canadian neighbor all he does is knock America. This couple bought right in 2009 downturn no problem, but I get sick and tired how the say what fools Americans are and how they the live the good life here with swimming pool and driving year round in a conv.

I told him why hate all the time, he says look at the dummy who went broke and we stole their house, in Canada that can’t happen ,we live within our means.

I hope they sale for their big profit and live within their means in Canada, something tells me they are never going back, it has been 5 years now, I think they are Americanize ie realize they live the good life, and glad they live in stupid USA?

Canadian here. I know exactly what you mean. It’s something that really bothers me about my countryfolk. Many really do think they’re smarter and more enlightened than our southern neighbours. And it’s hard to hold them accountable for that point of view; it’s something that’s been ingrained in most of us since we were children. Those sort of views are really hard to change, despite how wrong and boorish and smug and embarrassing they are.

Housing bubbles around the world are a symptom of a more fundamental bubble. That is the employment bubble. From a technological standpoint, we could shed 80% of today’s jobs without substantially affecting our quality of life. Even seemingly useful jobs such as appliance repair technicians could be redundant if we focused on making appliances reliable and easy for untrained individuals to repair.

I sometimes hear stories in the media of couples who raise children on little or no money. In the US, I hear about Mr Money Moustache who decided to retire at 30 and lives with a wife and child on about $25,000 a year. In Germany, there is Raphael Fellmer and his wife, who went one step further and decided to raise their daughter with no money at all.

There are many people who own houses in places like Vancouver who could retire immediately just by changing their lifestyle. But I’m sure that long before values and attitudes change, change will be forced upon us.

Don’t forget the impact of Robotics and Additive Manufacturing (3D-Printing) within the next 25 years.

As for the whole DYI repair thing, that depends on the mechanical skills of the individual and the incentives, usually economic, to practice them. Depressions and recessions usually bring them to the fore; see back issues of Popular Mechanics from the 30s, particularly the ads, to see what I mean. (Indeed, the popularity of Make magazine and its website probably indicates that we’re already well into an economic slide,)

Just a thought.

Vic3

All the Canadians just move to Arizona and buy cheap(er) places …

They can only stay 6 months

Hey Canadians, come to resurgent Buffalo. Cheap homes, great univsities nearby, great food, great sports, etc….and no fracking crap in NY.

Buffalo? Cheap houses because there are few jobs that pay well and it’s just as cold (or colder) than Canada. Fracking has made fuel cheaper and brought wealth to many Canadians. Arizona is a better option.

Too many guns in AZ

A prolonged oil industry down turn will create economic pain for many regions. In Canada, it is likely in Alberta rather than BC. The oil workers in Alberta know about the booms and bust cycles if they have been around for awhile.

what I do not understand, is when Lehman Brothers collapsed due to be over leveraging of their real estate securities, the United States had a hundred twenty five percent debt to income level at the same time Canada was already at 145 percent debt to income level. I’m sure they’re hawking their notes on Wall Street just like they did here in the US. So any little blip is going to cause a correction because they’re so far out of whack and have been since the United States had their collapse. I guess I was prematurely warning Canadians of this back in 2007 and advised them to sell at their already bloated prices and hang onto their money until the collapse that is surely to come there. So we shall see already been waiting five years and their real estate just continued to go up. Anyone that he heeded my advice lost a good hundred grand or so on their investment. So maybe now? Would be a good time to sell?? Then wait and buy the same property for pennies on the dollar. money never disappears, it only transfers. When we had our collapse here in the United States while millions and millions and millions of people were crying and killing themselves over losing everything those on Wall Street were toasting their good fortune. Always remember that. Your loss when it comes to money, is someone else’s gain.

I think the way the system is set up now, the banking industry profits primarily by taking a fraction of everyone else’s profit. In a bear market, those on Wall Street do not, in aggregate, get rich as a result of the rest of us becoming poor. When the stock market or housing market crashes, the wealth transfer is toward those who sold at the top. Had there not been a bailout, those on Wall Street would have lost the most.

As for buying properties for pennies on the dollar, those types of opportunities arise only when there is a dramatic contraction in the money supply. Today’s central banks are in no mood to allow for such a contraction, so even in the epicenter of the US housing bubble (Las Vegas), the best you could do was buy properties for dimes on the dollar and for no less than three dimes on the dollar to be more exact.

Given the uselessness of work in today’s world, we ought to regard welfare collection as a legitimate profession. I think putting everyone on food stamps wouldn’t be a bad idea. No one should have to starve, right? You’d just have to cut down on the benefit amount to avoid destroying the pricing mechanism of the free market. It would literally have to be just enough to avoid starvation, at least until we find a way to make socialism work, which I am sure is doable.

There is something very honest about being on the dole. Instead of pretending to be doing something useful for society, you just get something without giving anything in return. Now that’s refreshingly honest.

“Today’s central banks are in no mood to allow for such a contraction”

V. Landlord,

Were they in the mood in 2008???!!!!…

How do you increase the money supply if people can’t barrow, or are afraid to borrow due to jobs uncertainty???

Every single dollar in the economy is created through borrowing/debt.

It is true that for now the US government is borrowing over a trillion per year (for few years now). How long can you continue this process without crashing the dollar??….

Lehman Brothers collapsed??? What else did I miss?

Canadians…Well lets say I have a bone to pick with them and if they have to come down to earth great. The homes in Canada are among the most overpriced in the world and with the lousy weather why anybody would or thought they could sustain such prices is vey much beyond me.

Like I said my wife and I were in Las VEGAS and we stop buy a rather nice home development in the Red Rocks area. In comes a couple from Alberta they said, and knock every thing from the upgrade kitchen to the negative edge resort back yard.

This home about 4700 sq. ft. fully upgraded 965k. I asked him what does a place like this go for in your neck of the roads oh about 1.9m but you have Alberta to live in not Vegas? Of course my Italian side came out, I TOLD HIM HOW MANY RESORT BACKYARDS WITH A NEGATIVE EDGE POOL DO HAVE IN ALBERTA, he knew what I meant, none really but who needs this upkeep anyway. Oh I see, this place without a 250k backyard like this home goes for 1.9m in Canada but in America everything is overpriced. My wife whisper let him be, the jealously of this couple has over taken them, let them go back to snow, ice, pot hole streets, grass, two trees, and a wood fence.

We got out of the Canadian house market 3 years ago. I’m a subcontractor and I’ve said for years we are on an unsustainable course. We are over engineered, policy stupid all spurred on by the control of banks and central planners. Though here in BC we have a couple things going for us (at least in the short term) one is water and the other is space where we can go to to find a little peace. It is beyond me to understand how Los Vegas is still developing since they have no real plan to bring enough water to your city.

Yea Albertans,

they piss everyone off with their faux can do attitude (as if they are brilliant for winning the geographic lottery), most are dumber than a bag of hammers.Sounds like a couple who watches too much house porn.

Provincial Government spends like a drunken sailor and little contingency for downturns (such as this, as opposed to Norway which has trillions in reserve)

Hang in there and the fire sales on 2nd homes will hit the southern US.

After seeing the US experience sold the overvalued Vancouver Bung for obscene amount 18 Mo ago (the peak). Now Work is a hobby I can participate IF I want…………………

Common sense ain’t that common…………….

Um, I’m a transplanted American living in Canada’s oil capital. We know full well what is happening here in Canada regarding the price of oil, it was the biggest news story of 2014, we’ve had our own news services reporting on this. I’ve heard about fellow Canadians who are in debt to over 160% of their disposable income. We’ve had other boom-and-bust events over the past 40 years since I moved up here. Alberta alone is facing a shortfall of $6 billion over the next two years if oil prices remain low, as it costs $51 per barrel to produce oil from the oil sands. Hopefully we can hang on and thousands of people will not be losing their jobs, even though that happens from time to time in the oil patch. People are happy to save when they fill ‘er up; but it’s really about the many jobs that are at stake with the corresponding devastating effect on everybody else as well.

I saw a figure of $3 Trillion in high yield debt issued to various petroleum entities and sovereign nations over the past 5 years . As usual , securities buyers and lenders assumed lofty oil prices forever. Madness …. once again fueled by the money printing of the Fed and ZIRP.

Absolutely no one predicted this Black Swan would land hard in 2015, but here she comes. Energy pricing collapse was the canary in the coal mine for the 2008 recession. A repeat performance got underway at Thanksgiving. Be careful … have a Happy New Year anyway.

I think the black swan has yet to really land. The oil price swoon is a harbinger of a much larger crisis looming – $CDN currency crisis. If oil continues to get smacked (because this is a demand problem, not a supply problem), the market will plumb for a price for a lot lower and a lot lower than most people will care to admit. This will in turn, put immense pressure on the $CDN, and the only thing worse than plummeting oil prices, is a a free falling currency. Ask the Russians. The black swan, in my opinion, will be when the $CDN plumbs new lows and brings on domestic price inflation forcing Poloz to jack rates – hard. This will be the kick in the teeth that the Canadian housing market has yet to experience and it will be here that the black swan lands.

This is just as mad in Australia and New Zealand. It is an illustration of human capacity for self-deception, that the prevailing attitude is, “we’re different” to those Californians and Irish and Spanish, “OUR property really IS worth this much”!!!! We aren’t going to have a crash, this is a new normal, our property markets are finally reflecting the true worth of our magnificent country and the attributes of our sooooo well-planned cities!!!

(Pause for a vomit)

I have learned a lot from reading Phillip J. Anderson, “The Secret History of Real Estate and Banking”. I have been a bear on the property markets in all countries where the fundamentals are as bad as Canada, Australia, NZ, France, Sweden, and many others – this is a global madness. See Jesse Colombo’s “BubbleBubble dot com” site for information on numerous national housing bubbles. But what Phillip J. Anderson teaches me, is that property cycles have an amazingly predictable length that hardly relates to fundamentals at all. The amount of debt built up in overpriced property can significantly affect the severity of a downturn, but it never seems to affect its timing.

What happened in Canada, Australia, NZ and other countries that actually did have the conditions already in 2007/2008 to have a crash following quickly on the heels of California, Ireland and Spain, is that the establishment was not taken by surprise by the crash like California, Ireland and Spain. The cycles did indeed show every sign of having topped in all countries at this time, but in the ones where the full severity of a crash was averted, the establishment did not wait till too late before slashing interest rates, boosting subsidies for house buying, and standing behind financial institutions with artificial liquidity (I believe there has been covert Central Bank buy-up of banks mortgage debt in many countries). The dirtiest of the dirty tricks used to prop the bubbles up (utterly betraying local young people facing obscene housing costs) was the changing of the rules regarding overseas investors and immigrants ownership of local property, along with qualification for citizenship.

So these countries managed to have a 10% or so real downturn in house prices 2008/2009 before their bubbles resumed with a vengeance. Understanding Phillip J. Anderson, the next crash time won’t come around until 2022 – 2025.

But it will be a bloodbath. I don’t think any doomsaying too extreme. Ludwig Von Mises always predicted the eventual “full and final collapse of the system of fiat money”, and I think this will be it.

I hold that the underlying cause of this problem that is really quite unique to our times, is too much regulatory interference in the market on the side of supply of housing. As long as some parts of the USA retain the regulatory freedom to develop housing or even whole new cities just about anywhere, they will be immune to this madness. While many people are saying that it is the globalisation of easy money that is causing this problem everywhere, the other thing that has globalised in our time, is “save the planet” urban planning! And if you gather enough information about housing markets everywhere over the last few decades, the correlation becomes undeniable. Easy money does NOT cause bubbles where there is “easy building”! And there has been serious urban land value volatility without easy money, everywhere that there has been barriers to greenfields supply of housing – eg in the UK since 1947!

Our real estate cycle generally does go in 14-16 year cycles. If you place the top at 2006 then the next top would be 2020-2022. Most areas of the country are still recovering and have yet to start back up in earnest. Only the population growth hotspots are where it seems to have gone back to bubble territory. There is a good reason for this and a good reason for the overall cycle too. Most people can’t see it because we tend to view the our surroundings as somewhat static and unchanging from day to day when the reality is its very dynamic in terms of population growth. A very basic 5% population growth, which many would say is healthy, will double your population in just 14 years. This is what drives the cycle. When you double your population you also need to double your housing stock. In many places they are stifling building while allowing the population to swell like in Southern California with the swarm of immigrants from all corners of the earth. This is why CA has gone back up so fast. I believe it is an error to view the current real estate market as any sort of top. If you recall back when the first stock bubble crashed, real estate did not crash with it, in fact, the party was just about to get started.

For those of you who will insist on taking issue with the 5% growth rate, don’t take it literally for all markets but as a general example to illustrate what is happening and why. A 2% growth rate will double your population in about 30 years. Some cities have more some less but overall there is a big push that is constantly occurring while at the same time building is being artificially restricted which is the big point that Phil comments on a lot. When you see the bigger picture, it’s all really insidious and the younger generation is being steamrolled by the older folks. However, the younger set is not without blame since they all seem to love unrestrained immigration and NIMBYism as well. This is why I left CA. It’s a losing battle.

P.S. For those of you who are genuinely concerned about your prospects I would encourage you to really look closely at the population growth factor. That is the secret to understanding why the cycle happens. The calculation requires some calculus but all you need is the 70 rule. You just divide any growth rate into 70 to see approximately how long it will take to double. (this is because your starting value is constantly growing each year)

Now take a serious look around your area and you can almost see the growth rings of each doubling. In SoCal its kind of scary. Now consider this: Each doubling takes more resources than all the previous doublings combined. If you live in LA, this is where any rational discussion of the issues begins to break down. Instead we just stick our collective heads in the sand and hope it all works out.

Garth Turner’s “Greater Fool” blog is a source of bearish comment on Canada. But the problem for us bears, I have realised, is that cycle length may be far longer than we realise, which will make us look like we were “stopped clocks” that had to be right eventually, when the crash finally does come. And tragically, by that time, ever so many young people will have given up on prices falling, and will have mortgaged themselves up to the eyeballs, probably in “innovative” finance schemes, for “innovative” dog-box “affordable housing”; and will be ruined for life.

I have often said that the type of urban planning that actually causes this, might as well have been devised by agents of an enemy power, as a deliberately subversive economic WMD to be insinuated via a long term program commencing with educational institutions, under some pretext such as the environmental one. I don’t say that this is likely, only that it might as well be the case – this is how bad those policies are. I would note though that people with a good grasp of Marxist economic theory on land rent, would be well-endowed with the ability to devise such a concept.

I follow that blog too (Greater Fool) and it’s very good. However.. urggh.. I regularly have housing bulls quote Anderson to me. Can’t believe you’re pushing it/him here. I looked at some of his background.. err.. what qualifications or finance credentials does he have? Where was he pre 2008? You guru Anderson followers deserve all you get! Expect his house price inflation and go in if you really believe it’s year 2022-2025 to the next big house price crash. Go buy the books he publishes or pay the premium to join his site… that’s what he’s really selling imo. He irritates the hell out of me, in videos on YouTube and elsewhere.

Howard Marks, the real billionaire investor/smart guy, in an interview the other day. I am hoping we’re near the correction point.. he goes on how many investors get pulled in to buying at very high prices, because they love paying high prices; then comes a crash.

It will be about the lessons of oil. And one of the lessons that we’re learning again now is how fast things can change in the investment world. There was an economic philosopher, Rudiger Dornbusch, who said it takes a lot longer for things to happen than you think that it can, but then they happen much faster than you thought they would. And that’s the way things go in the investment world.

This was a great snippet from a recent Greater Fool blog entry.

_____

December 11th, 2014

..As you probably know by now, real estate agents are the absolutely last people on the planet to realize when housing is about to blow up. A realtor’s idea of diversifying is to purchase another condo. They believe it’s a great time to buy when prices are rising. And when they’re falling. Or stable. They think liquidity means plumbing. It’s hopeless.

Right until the very moment when America found itself circling the drain of a massive housing crisis, the National Association of Realtors was saying everything was okay. It was a great time to buy. And then, poof. Within two years, real estate nationally had lost 32% of its value and the middle class was done like dinner. Realtors who had told people to ‘buy now or buy never’ were learning how to cook fries.

I thought of that this week as realtors in places like Edmonton, Calgary and Kelowna were telling local reporters that houses there are bullet-proof. They might actually believe it. They’re not inherently evil, just really confused.

_____

House prices set to fall, Calgary real estate consultant warns

Lower oil prices could contribute to a downturn in the market

CBC News Posted: Dec 10, 2014

[..]“There could well be individuals in Calgary in 2015 who find themselves with a house valued at less than what they paid for,†he said.

http://www.cbc.ca/news/canada/calgary/house-prices-set-to-fall-calgary-real-estate-consultant-warns-1.2866966

Also Phil H, about this…

. But the problem for us bears, I have realised, is that cycle length may be far longer than we realise, which will make us look like we were “stopped clocks†that had to be right eventually, when the crash finally does come. And tragically, by that time, ever so many young people will have given up on prices falling, and will have mortgaged themselves up to the eyeballs, probably in “innovative†finance schemes, for “innovative†dog-box “affordable housingâ€; and will be ruined for life.

You can buy into Anderson’s next real estate crash in 2022-25, and how bad it will be because so many people will have paid crazy prices, and be left in a mess….

Well I’m into my 40s now, and don’t hold with Anderson at all. Also, so soon after 2007-09, house prices have been massively reflated in value in low-mid-high prime markets. We had all the rescue policies and moratoriums to protect homeowners who outbid renters in 2008-11. You can stick your sympathy for those who have been paying crazy prices in recent years, to buy houses, where the sun don’t shine. Myself, my brothers, sister, all our renting friends, want much lower house prices. We don’t intend to sacrifice ourselves for those who have been pushing and falling over themselves to pay very high prices in recent years. And here’s you.. expect correction in 2022-25, already planning your sympathy for those who’ve bought house prices at twice the prices of hyperinflated prices today! Where is your sympathy for renter/savers, against house prices in low-mid-high prime today? Those who’ve already been repeatedly punished, with market bailed out by ultra low interest rates and $3.5 Trillion of QE, together with Global QE. It’s not all about the buyers who pay stupid high prices. The best way they can learn, and ensure their children don’t make same mistakes, is via a massive house price crash.

This was a great snippet from a recent Greater Fool blog entry.

_____

December 11th, 2014

..As you probably know by now, real estate agents are the absolutely last people on the planet to realize when housing is about to blow up. A realtor’s idea of diversifying is to purchase another condo. They believe it’s a great time to buy when prices are rising. And when they’re falling. Or stable. They think liquidity means plumbing. It’s hopeless.

Right until the very moment when America found itself circling the drain of a massive housing crisis, the National Association of Realtors was saying everything was okay. It was a great time to buy. And then, poof. Within two years, real estate nationally had lost 32% of its value and the middle class was done like dinner. Realtors who had told people to ‘buy now or buy never’ were learning how to cook fries.

I thought of that this week as realtors in places like Edmonton, Calgary and Kelowna were telling local reporters that houses there are bullet-proof. They might actually believe it. They’re not inherently evil, just really confused.

_____

House prices set to fall, Calgary real estate consultant warns

Lower oil prices could contribute to a downturn in the market

CBC News Posted: Dec 10, 2014

..“There could well be individuals in Calgary in 2015 who find themselves with a house valued at less than what they paid for,†he said.

http://www.cbc.ca/news/canada/calgary/house-prices-set-to-fall-calgary-real-estate-consultant-warns-1.2866966

Brain of England – I absolutely agree with your sentiments; I am horrified at the possibility that Phillip J. Anderson might be right.

My position is that there is no easy way out of this, and no way out of the economic and social Hara-Kiri without restoring some kind of right to develop non-urban land for housing use. The time frame is almost irrelevant; a crash sooner merely means that the cycle is short and we will have bubbles and crashes more often. The trend for cost of land per square foot will continue to rise, though, benefiting the property rentiers. People will spend the same immoral proportion of their income for worse and worse housing of smaller and smaller size and lower and lower quality.

Just be ready to stick to your bearish position even if the crash that people like us are promising keeps not materialising. The 2022 – 2025 possibility means: if it has not happened by around the middle of 2021, definitely assume it WILL happen in the next year or 3. Most people without this knowledge will simply have given up that it ever will.

My position is still to advocate urgent reform of the land-planning racket to restore the stability that was the norm during the era of automobile based urban growth. It was only a norm during that period. 1930 and all the cycles before it, had urban land heavily implicated in them. By the way, I am the author of THIS comment:

http://www.voxeu.org/comment/105237#comment-105237

Also called, escalator up, elevator down

Really hope it finally implodes up there. Then maybe I can move to Canada finally. Hate being a US Citizen.

Canada is nowhere as free as the U.S. when it comes to speech. Stricter libel and “hate speech” laws, which can cover all manner of legitimate criticism. Then there are their draconian anti-gun laws. And don’t even think about trying to use force to protect yourself against a criminal.

Canada is an Orwellian nanny state. Everyone is super nice and smiley, until you say or do something politically incorrect (which is taken far more seriously than in the U.S.)

OTOH, Canada is a great place if you hate even the few freedoms we have left in the U.S.

Awww, c’mon DG, for a thinking, logical, rational human being, is the cognitive dissonance of this place called Amerikkka kicking in? It is for me, and I too, look to move to another country, possibly Mexico, or Costa Rica, which will be the N. American version of Switzerland.

The Canadian banks had limited exposure to the dangerous leveraged derivatives market, got rid of their name down payment mortgages for much more stringent guidelines in 2007 and the conservative government was running a surplus budget. That will explain why our housing market did not collapse at the same time as us. It would take something much larger, like a deep dollar devaluation coupled with many other eroding factors.

Housing prices in Canada have been melting for the past year and a half, the result of the CMHC pulling back its subprime mortgage financing activity. So no ‘event’ was required other than a reduction in credit availability.

The banks aren’t exposed …………the taxpayer sure is! (VIA CMH) Current 600B outstanding on the books. Not Good. primarily as a result of goosing the economy by 5%/ 40 yr amortization scheme which quickly blew up and was recinded. But lots of sketchy 5% ers still getting mortgages by crafty bankers who have NO skin in the game.

The deck of cards is crumbling across the country with only parts of Van and Toronto hanging on.

Stick a fork in it………..its done

Oil is just the first wave folks. All commodity prices have crashed, meaning there is no demand. Real estate, stocks, bonds, it’s all coming down in 2015. And not in a nice controlled manner so you can pick up a home at a discount. This is the last bubble, the everything bubble, and it’s popping right now.

Good points about commodities.

China has been reporting GDP growth of +7%, yet China’s energy usage is way down year-over year. This is impossible. The U.S. is reporting GDP growth of +3%, yet energy usage is also down year-over-year. This is also not possible.

Between energy usage being down year-over-year, and commodity prices tanking, the numbers printed by the Red Chinese and U.S. governments do not pass the smell test.

Seeing some of the contagion to the rapid collapsing oil and commodity prices. Eg: This company provides accommodation for rent to oil workers / commodity workers etc in Canada and around the world.

“which operates mainly in the Canadian oil sands and Australian resource sectors… said occupancy rate for rooms contracted in Canada has plunged to 35 to 40 percent in 2015 from more than 75 percent this year. In Australia, the rate has also dropped to 35 to 40 percent from more than 55 percent at the start of the year.”

Back in June 2014, shareholders might have been patting themselves on the back, holding shares valued at $23.25. The reports suggest some shareholders have been seeking the company pay higher yield to shareholders back when share price still very high. Now shareholders finding their shares only worth around $4.11, with a 50% drop just in one day the other week.

http://www.bloomberg.com/news/2014-12-30/civeo-cuts-spending-closes-energy-man-camps-on-commodity-drop.html

and/or http://www.marketwatch.com/story/civeo-shares-crater-as-oil-price-rout-takes-its-toll-2014-12-30

How things can change, so quickly, so unexpectedly, for the forever paradise ‘it only goes up’ or ‘it can’t lose value’ market participants.

Mick,

Yes deflation is coming. Oil is the canary.

Deflation is typically good for gold, and Canada is home to most of the world’s gold mining companies, or at least their administrative headquarters.

Once had a snowboarding vacation in Banff, Alberta, Canada. We stayed there on the cheap, in the YWCA (“Young Women’s Christian Association” – they took males guest too… cheaper than hotels.)

I see visitor numbers are still quite impressive, but it now looks like authorities trying to protect revenues for hotels etc, with a crackdown on holiday home lettings.

22 Aug 2014. The Town of Banff is cracking down on homeowners who illegally rent out their homes to tourists. Parks Canada’s eligible residency regulations for the townsite prohibit homeowners from using their residences as second homes and leasing them to recreational users.

Canada needs a big house price crash. The loonie/canadian dollar, began weakening mid 2014… down around 8% against the US dollar over 2014.

A couple of basic differences between the US and Canadian housing/mortgage markets:

1. You need a significant down payment (20-25%)

2. Mortgage interest isn’t deductible

3. Canadian banks generally don’t do 30 year fixed – they basically do 5/1 ARMS

4. Mortgage debt isn’t in it’s own category, i.e. in Canada if you default, you don’t just lose the house, you lose *everything*…. so people don’t/can’t just walk away.

So what’s really missing is the “stupid” factor – the NINJA loans, and people just walking away… so if housing does collapse, there is likely to be so much *real* pain that the government will step in and help – because that’s what socialist governments do…

Canada can also cheapen its currency and increase exports, so that’s how things will stay propped up… it’s a cycle….

1. Not true. Subprime credit is ubiquitously available in Canada through the CMHC.

2. True. It wasn’t fully deductible in the US though due to AMT and the structure of itemized deductions in the most bubbly cities. Didn’t stop the bubble from imploding.

3. True. Which makes it even more dangerous in Canada. Worst price collapses in the USA occurred in areas characterized with large amount of ARM lending.

4. Untrue. Most US states are full recourse, just like Canada. True non-recourse loans were relatively rare in the US as most either refinanced, or purchased with “80/20” packages during the bubble. Personal bankruptcy on both sides of the border eliminates the debt.

Also, debt deflation is very hard to combat and will push up the Canadian dollar once the shock and awe initially wears off. So don’t expect a low Canadian dollar to “save” Canadian RE.

Not true. In Canada, if you put down a significant down payment, then you do not need to take out mortgage insurance via CMHC. The minimum is 20%.

Many in Canada routinely buy property with 5% and get mortgage insurance. The banks are happy to provide these loans given they are insured by CMHC so the banks get paid in case of default.

Anecdotal evidence in Canada suggests that high risk borrowers also tend to “find” the initial 5% down payment through a credit card cash advance, line of credit, lender cashback, etc. In other words, there are people with virtually no money in Canada who are buying properties they can ill afford — and this is perfectly legal and encouraged.

https://www.cmhc-schl.gc.ca/en/co/moloin/moloin_003.cfm

Canadians have also bought vacation rentals in Hawaii and may be exiting those in the near future due to fewer travelers to the islands..

As long as the Sheeple keep believing everything is o.k., and the U.S. keeps juicing their phony economy with unlimited printing of money, things will keep carrying on as usual. The U.S. is the most indebted nation in the world. Over 120 trillion in unfunded liabilities. So remember, fundamentals don’t even come into the equation any longer. Just keep printing your money , and keep buying our products , oil, lumber,etc. and we’ll be just fine. House prices can go up a long way yet.In Zimbabwe, it took $100 billion dollars to buy a pound of rice.

@minitru

In practice, Canadian buyers need only 5% down with CMHC insurance. Pretty well everyone qualifies for this federal government sponsored insurance. Until recently, several banks had 5% “cashback” promotions, where if you had the 5% down payment (or could find someone to temporarily loan it to you -Shhhh!), the bank would give you the 5% back in cash upon mortgage approval.

Essentially, you needed zero down.

Regarding point 3, you have to remember that the banks in Canada enjoy an oligopoly and that Canadians have been brainwashed to accept ARMS as normal. In fact, most Canadians are blissfully unaware that right next door, Americans have access to a fixed rate for the life of their mortgage.

Canadian housing bulls dismiss the 5%/0% requirement and ARMS, saying that the Canadian housing market is “different”.

The oil price crash could be the nudge that starts the Great Canadian Housing Correction.

The province of Alberta especially depends on oil sands (tar sands) revenue, which unfortunately, have the highest cost of oil production on the planet. Sustained low oil prices will ripple through Alberta’s economy and result in huge job losses.

Real estate values will plummet. The contagion could easily spread to other parts of Canada, as the Alberta housing crash will be well people are clearly shown what can happen to house prices.

In Canada you can still get mortgages with 5% down, it’s just CMHC insured, still can be done.

You can still get a 30/35 year mortgage, you just need to have 20% or more down, but again can still be done.

Technically you can “walk away”, yes it’s harder, but it can be done.

What most Canadians don’t understand about the CMHC is that the insurance they provide is for the banks and not the borrowers.

just another data point: all my friends that work for the builders (like lennar) are looking to buy or upgrade their homes right now

take that to mean what you will, or don’t, since this is a bear site

Your friends who work for Lennar’s (a building company, it would be nice if you would clarify that in your post instead of assuming readers magically know this) are basing their desicions to upgrade their homes, or to go buy a bigger home, on income they made in the recent past. Good, so they had good income in the past couple of years. That certainly does not mean the builder they work for is guaranteed to make good money in the next few years. Duh.

no amount of explaining my comment will ever reach you

good luck steve

Nix.

Collapsing oil pricing will put the hurt on. Most of the gold and silver that was easy to get has already been pulled out of the ground in Canada.

Immigrants may have driven the price of RE up but don’t ignore the subsidies for tech and film production. Those are the primary drivers in the Vancouver market. The studios will just pack up and move elsewhere. And many of the folks that moved there, got their outsourced jobs back, and drove up the market will pack up and leave as well.

Not to feel sorry for them. Nice Canadians is a myth. Warm and fuzzy in person but stick the knife in when you’re not looking.

It seems our Canadian relatives are just as caught up in living foolishly as many Americans! Rationalize and make excuses all we want about the economy or our plight, but chasing overpriced real estate, taking on huge mortgages, and always trying to keep up with the ‘Joneses’, isn’t getting ahead … it’s becoming enslaved!

As a Canadian who has been warning others about the susceptibility of our housing market to an American-like correction for the past two years, I can assure you that the mythical ‘this-time-is-different’ mantra is alive and well. There is a widespread belief that our banks are stronger, our regulations better, and our economy invincible. It will be a black swan event for many when things finally go sideways in the great white north.

I dont think you can blame the Canadian people. They have never seen a real estate bust. I am sure there are speculators but there are also people that want a place to live. It is hard to stand on the side lines for years watching those who dive in the pool first “get rich.”

You would think the cycle would have ended here in the SF bay area with the last bust. Nope. Memories are short.

Aww another softheart, “They’ve never seen a real estate crash..” and “You can’t blame buyers for paying Midas-Looks-Poor greedy fortunes” for houses because “they just wanted a home.” “Their debt should be your debt – bail them out – protect them.”

They need to experience a house price crash that will echo down centuries into the future to prevent future greed and hubris and complacency. They need to experience a house price crash that will open up proper opportunity for younger generations and those who rented and waited for much better value. Stop with the soft-heart pathetic excuses for overpayers.

Each time I hear it I’m like Khan/Cumberbatch in Star Trek Into The Darkness… thinking saying, “I will walk over your cold dead corpses” (after a house price crash).

What did almost each adult individual resident in Alberta do with their 2006 Prosperity Bonus? Each given a check for $400. (This represented $1.4 billion (20%) of the $6.8 billion surplus.) Time to realize it is not ‘forever prosperity’.

I am finding myself in agreement with a U.S position against a pipeline from Canada down into, and through, the US. Especially when domestically US has vastly improved its own stocks. Why do the Canadian companies too many favors to help lower their costs selling on global markets.

_____

..it would save Canadian oil companies and the Canadian oil industry an enormous amount of money if they could simply pipe it through the United States and all the way down to the Gulf. Once that oil gets to Gulf, it is then entering into the world market and it would be sold all around the world.

..The United States will get a couple of thousand temporary jobs, and a great deal of environmental risk out of the construction of the pipeline.

http://www.politicususa.com/2014/12/19/obama-sends-strong-signal-veto-bill-authorizing-keystone-xl-construction.html

Obama’s decision to withhold approval of the Keystone XL pipeline was huge benefit for one of his largest supporters – Warren Buffett. Buffett invested in the Burlington Northern Santa Fe railroad (BNSF) one year after Obama was elected. BNSF essentially invented the business of carrying crude oil by rail and rail shipments have surged from fewer than 100,000 barrels a day in 2010 to 800,000 barrels a day last October. Three years of State Department environmental impact studies found “no significant impacts†and an oil pipeline poses a far smaller environmental risk than moving oil by train.

http://www.theblaze.com/contributions/did-warren-buffett-railroad-president-obama/

“You are the kindest country in the world. You are like a really nice apartment over a meth lab.” Robin Williams

Doc, you may already know, but the Greater Fool (Canada) has referred to your analysis, in this, your latest entry re Canada, and possible implications for much of their very high priced real estate.

http://www.greaterfool.ca/2015/01/02/defiance/

I guess he values having your external, rational analysis and excellent insight, which you have shared with readers here since 2006 (and probably long before in private with friends and family)… whilst most other housing-economy experts were having a party in belief of forever boom, and those experts today all claiming ‘no one could see it coming’. (I was working and saving like an idiot in 2006 and years before, towards buying, in expectation low-mid-high prime market would correct).

http://www.doctorhousingbubble.com/how-i-learned-to-love-socal-and-forget-the-bubble/

Sorry about ragging on our great friends and neighbors to the North, but America has always had a two fold problem neighbors to the North and South.

The Northern neighbor has a beautiful country with suspect weather, and chip on their shoulder, they don’t won’t to identfied with England and have a built in problem being a little brother to America. They sound like they would like to go it alone in this world, but of course they realize where their bread is buttered.

To the South a really beautiful country with climate, they never seek or wants identities with England or USA. They send us their poor across the border, they punish us for stealing Cal and Texas, they don’t want to join us in limmited wars around the globe.

They like Canada are a huge trading partner, but I can’t remember the last time I saw a rich Mexico family buy in our development during the housing crisis, rich Mexicans seem happy in their country. Yes, for goodness sake who in the heck is going to do your paver driveway, cut your lawns, tile your bath rooms, Canadian’s, startingng to think who really are the better neighbors.

Canada: The HOME of PC coercion and ‘Africa for Africans, Asia for Asians, White Countries for Everyone!!

Enough. I hate this parasitic, manipulative government.

Part of Canada’s problem is that they have no National Identity — and it bothers them. Their self-image is all borrowed pieces from Britain, France, and the U.S. (which managed to forge its own National Identify despite its colonial origins).

So Canadians try SO HARD to invent an identity that is Uniquely Canadian. SCTV’s “The Great North” comedy skit satirized this Canadian insecurity.

I read a dreadful book by a Canadian sci-fi writer, Robert Sawyer, and saw in the front part that the book benefited from an Ontario arts grants. And sure enough, the book is full of pointless references to Canadian products and TV Channels (e.g.Much Music), which have nothing to do with the book’s plot.

In Winnipeg a few years ago, I read a Canadian columnist who was praising immigration to Canada. He actually said, “Immigration is who we are.”

I call that “trying too hard.” Surely, even if immigration is an aspect of Canada, it’s not so central as to be “who we are.”

Especially ironic was that he was poaching from America’s longtime National Identity as “a nation of immigrants.”

Even when Canucks try to cobble together a uniquely Canadian identity, they end up borrowing from someone else’s. They should be satisfied to claim Mounties, ice hockey, and maple syrup — and leave it at that.

you obviously haven’t experienced the pleasure of Canadian cuisine.

Oh, wait…

Real Canadians don’t read crap produced by the parasitic artistic class that subsists on arts grants.

And anything written by a Canadian columnist is as representative of what Canadians think as anything on CNN or MSNBC is as representative of what Americans think.

I suggest you look at the Canadian conservative blogosphere to find out who we really are.

We know who we are.

For instance, we have a Prime Minister who calls terrorism for what it is.

You have a President who calls terrorism workplace violence.

In Canada there is no such thing as a 30 year fixed rate either. The lone you get today will automatically reset in 5 years. That means there will be a major correction in affordability when the rates rise. The days of a $750 3+2 for an older home in Calgarywill change. It’s not just the economy that can change the situation up there. There are two factors that kept Canada from having the crash in 2008. 1. Their lending laws have always been more strict. 2. The Oil and Gas industry was booming and creating high paying jobs. I’ve talked with friends in the lending industry and many believe the U.S. lenders with begin a big push to get away from the long term fixed rate loans, before rates go up. You will likely see a similar system here, where you lock in for a 5 year rate and renegotiate at the end of the term to whatever the current conditions are. It’s different from a standard variable loan but the consequences are similar.See the Greenlight “Light 5” loan here. https://www.greenlightloans.com/lp/camp/loan?sub=MSNSB&loan_purpose=refi-loan&userguid=440c15fd-9f71-45e6-8997-647235e1b609&mm_campaign=B5FC34156C2C0E66DAE6298505C37971&keyword=mortgage+loan+rates&mkwid=811614613

It’s already starting.

Leave a Reply