Bay Area million dollar shack madness and the forced migration of the middle class: Bay Area real estate mania inspires crap shack documentary.

You know it was only a matter of time that the Bay Area real estate madness was going to be captured in a new documentary. The documentary seeks to highlight the plight the middle class in California is having in affording housing. Forget about buying a home, many are struggling to pay the sky-high rents that plaster the Bay Area market. The tech sector is making the epic gentrification accelerate and with 24/7 media coverage, we are seeing it happen in real-time. The Bay Area is home to the $1.2 million crap shack that is basically the standard piece of junk property. It is interesting to see this story being told through documentary format and it is a counter to all the house-humping TV shows that are out there plastering cable. What is interesting is the documentary looks at how the middle class is getting squeezed right out of the market.

The Bay Area real estate mania

The documentary is aptly called Million Dollar Shack – probably a nicer sounding title than Million Dollar Piece of Crap:

“(SF Gate) Million Dollar Shack aims to share the plight of the Bay Area’s middle class who are slowly being squeezed out by the high-priced cost of living. “The bigger the tech industry gets, the less room there is for families like us,” Michelle says at start of the film.

The message is communicated through a collection of personal anecdotes from Bay Area locals. There’s the story of Deb Follingstad whose San Francisco landlord raised the rent on her home in San Francisco’s Bernal Heights over 300 percent. And there’s the tale of Maryann Creasy Rieger who was forced to commute some 180 miles a day between her home in Fairfield and her job at Yahoo on the Peninsula when CEO Marissa Mayer put an end to telecommuting. Maryann couldn’t afford to move closer to her job.â€

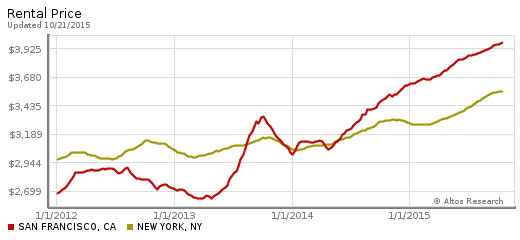

The Bay Area now has a medium home price of $1.2 million and this is for your standard crap shack. San Francisco has an even crazier rental market than that of New York:

This is the Bay Area for you. But the documentary is interesting in highlighting a variety of stories. One of the stories includes a person seeing their rent going up by 300 percent. I bet their income didn’t go up by that much. Then you have the story of a woman now having to commute 180 miles each day since Yahoo changed her work schedule from telecommuting. This is similar to the deal people make by moving to the Inland Empire and then making the ridiculous soul sucking commute into LA or OC.

The story shows your standard crap shack housing:

“Inspecting the crap shack. Â Yup. Â Crap shack confirmed.”

Junk that is ridiculously overpriced. And the core of the issue is all too familiar:

“This is all bad news for middle-class families. A household earning the region’s median income — $86,944 annually — can afford only 12 percent of the homes for sale in San Francisco, Marin and San Mateo counties, as of Sept. 2015, according to real estate website Trulia.â€

Household income for locals is not keeping up. But who cares about locals when hot money from abroad is rushing in like a tidal wave? The Bay Area actually makes the LA/OC market look tame. Ironically the LA/OC market is the most overpriced to rent in based on the actual income-to-rent price ratio – even at insane price levels Bay Area households make more than the very low household income rate for those in SoCal.

There is some deep irony in that the Bay Area, a market that was party central for hippies and counter-cultural artists with little to no money is now becoming yuppie central to the new tech and foreign overlords. These new inhabitants enjoy the Bay Area vibe and culture brought on by these “lower income†folks yet they are gentrifying them out at an alarming pace.

Welcome to the tech revolution. Some people think it is doom and gloom to point out that it is crazy to buy a $1.2 million piece of junk. Be our guest and knock yourself out with that Million Dollar Shack. The state of California will thank you for that nice property tax check you’ll send in each year.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

123 Responses to “Bay Area million dollar shack madness and the forced migration of the middle class: Bay Area real estate mania inspires crap shack documentary.”

it’s all about quality of life. if you can’t your parents neighborhood, move

can’t afford to live in your parents neighborhood? move.

unless you worship money, rather than have peace of mind

I can’t my parents neighborhood. I moved.

If you have kids it is very useful to live near extended family.

Nobody is forcing anybody to live in the bay area. If your rent goes up 300% or you suddenly have to commute 180 miles per day, get the fuck out of Dodge. Unless these people absolutely love living there or have unbreakable family ties, they can likely live much better in flyover country on a Walmart checker’s salary. They could double my salary and offer me a job in Manhattan and I wouldn’t take it because I know my overall quality of life would suffer. This isn’t rocket science here…

@Lord Blankfein wrote: “…better in flyover country…”

Actually, much of non-urban, non-coastal California is in fact “flyover country”.

In Modesto (in the gorgeous, central Valley), 90 miles east of Sunnyvale/Silicon Valley, crap shack SFRs can be had for as little as $70,000 (no that is not a misprint, there are a handful of those in that area). Last week I was looking at a 3 bedroom 1500 square foot Modesto crapshack SFR that was on the market for $90K. (yes that is real California price, and that is true of many non-bubble areas of California).

One word: Subsidence

There are homes in lots of neighborhoods in the Sacramento area that are under $100K. Here’s a home built in 1952 on a corner lot that is $90K that last sold for $245k in 2005 and needs a little TLC:

http://www.zillow.com/homes/for_sale/25815371_zpid/38.528591,-121.410591,38.525758,-121.415848_rect/17_zm/1_fr/

The home has been on the market for over a 100 days. The neighborhood is made up of mostly Section 8 renters and the predominant language spoken is mainly Spanish. The is some gang activity but not as bad as other areas in Sacramento.

That $90k Modesto home is unquestionably in a neighborhood where you dare not take a walk after dark. Unless you send your kids to a private school they should learn Spanish because the overwhelming majority of public school students in the Central Valley speak English as a second language.

Modesto-where they have KKK, and “the gorgeous central valley”SMMFH. That valley is anything but gorgeous. It’s ALL AGRICULTURE. Hey, I guess if you like heat and cockroaches, spend your $90k on a crap shack. It costs $90k because NO ONE wants to live there! The Central Valley is full of prisons and people picking fruit and vegetables. Why don’t you just move to Hinkley? As for myself, I’m content 47 miles from SF in my $179k house now appraised at $330k, because we are in another bubble. My house isn’t a crap shack either.

Agree 100%, Lord B.

Another thing I don’t understand is why tech giants keep such a large presence in CA. The argument that they must stay in CA to lure the “best and brightest” is BS. Many IT workers are non US born, flexible and will move for the right opportunity. We lived in the Midwest for a few years; half my kids friends parents worked in IT and were from Taiwan, India, Indonesia, etc. Ditto for motivated Millenials and realistic, downsized middle aged IT workers; the ones I know would probably relocate almost anywhere in the US for a good FT job w/benefits and an affordable, quality lifestyle.

Just a haunch, but I’ve long thought that the ultimate irony for the SV could be that technological innovation born there would be its very undoing to some extent. For instance, telecommuting innovations could lead to more plausible options for technical people to arbitrage cheaper CoL whilst remaining employed at SV firms.

Drinks – the only way to have that kind of mobility in the Universe I live in is to be a hot shit tattoo artist, street musician, etc. hyper portable street skills.

Tech continues to start up here because of the VCs and other investors. They’re mainly in the Bay area with some “boots on the ground” in L.A. now. Startups move to the Bay area to be close to potential $$$, and most never leave. A friend’s son has a startup in Venice but is now considering moving to SF to be near the money people for his next rounds of financing.

Drinks – the guy I work for has tried working with circuit board houses that are outside California. It. Does. Not. Work.

It’s like handing critical work over to The Muppets or Beavis And Butt-Head.

He was losing thousands, and hurting his reputation terribly.

I spent 15 minutes on Craig’s List and found a local p!ace, rode over on my bike the next day, essentially interviewed the guy who runs the place, face to face. Their actual shop is walking distance from our shop.

But, and this is important, when I found the place online I filled in an online form, and so the next day when I talked to the guy I said, “I’m the guy who just filled in your response form” and his response was, “We have a response form?”.

They’re an excellent board house. Assembly, layout, hell, package design, they can do it all and they do it well. I’m very impressed with them.

But until we invent an actual Holodeck, business won’t go unless it’s face to face.

And this is why tech is clustered in this expensive place.

“Nobody is forcing anybody to live in the bay area. If your rent goes up 300% or you suddenly have to commute 180 miles per day, get the fuck out of Dodge. Unless these people absolutely love living there or have unbreakable family ties, they can likely live much better in flyover country on a Walmart checker’s salary. They could double my salary and offer me a job in Manhattan and I wouldn’t take it because I know my overall quality of life would suffer. This isn’t rocket science here…”

You dont think that shit doest trickle down to the areas in fairfield, stockton, tracy and even sacramento? You dont think rent prices are going up like crazy here because you think its ok just to say “move”. What at asinine way of thinking. Like it doesnt affect anyone else. It affects everyone, and thats the reason your reading this blog. Because it speaks the truth then you get the mass media BS line that its the economy. When you know for sure its not a normal economy, its a bubble getting ready to blow the hell up all over your right wing agenda, capitalistic thinking. Why should I worry? I got mine, too bad for everyone else. Let them eat cake!

discgman,

You say “its a bubble getting ready to blow the hell up all over your right wing agenda, capitalistic thinking. ”

This is complete nonsense. This manipulated economy by big central government and FED does not have anything to do with free markets which is a condition for having a capitalist economy. Since 1913 when the FED was created we have a bigger and bigger government which controls everything (which I say manipulates). There is nothing capitalistic about it. It is an oligarchy controling everything using the power of a bigger and bigger central government which is an element of socialism which promotes a big government which gets involved more and more in picking winners and losers.

True capitalism implies “laisee fair” markets. What you see in SoCal is the oposite – a very distorted market cause by government interference at all levels. If you like bigger and more powerful central government you will get the same or worse.

What you call “right wing agenda” is people trying to control a monster government which suppress capitalistic business, distorts the free markets through regulations and interference. The “right wing” wants smaller central government to stay withing the limits of the constitution, free markets, lower taxes and individual freedoms – nothing wrong with that if you ask me. Government outside the constitutional limits is not the solution but the problem.

If you can not identify the cause of a problem, you can never find a good solution – on an individual level and also at the country level.

Given the vast wealth achieved by many in business I’d say if our “monster government” is trying to suppress capitalism it isn’t doing a very good job. Perhaps it should try harder?

apolitical: Did you not understand a thing that Flyover said ? It’s not capitalism, it’s government favoring the few over the many: big donors, lobbyists, corporations, letting the Fed manipulate markets. We haven’t seen capitalism in decades, but crony corporatism and until we see people going to jail for their financial chicanery, a proper use of government, we won’t see anything but bubbles and market distortion and more of the same.

The SEC had the case on Bernie Sanders handed to them and did nothing for 10 years. Keating was allowed to loot and scam long after it was discovered what he was doing to Lincoln Savings. Government meddles for special interests and then ignores it’s own laws when things go bust.

“The SEC had the case on Bernie Sanders handed to them and did nothing for 10 years. Keating was allowed to loot and scam long after it was discovered what he was doing to Lincoln Savings. Government meddles for special interests and then ignores it’s own laws when things go bust.”

Of course one could argue that this is a case of too little regulation rather than too much, but what do I know?

Apolitical S.

The oligarchy at the top masquareding as “capitalism” does not have anything to do with free markets. Having a bigger central planned economy by the FED/government is not doing anything to you and me. It just gives more power of control to the cabal from the top.

If you want to call the globalists from the top socialists or fascists, “right wing” or left wing, does not make any diference. The clique from the top does not have anything to do with the traditional american parties. They are hated from the left and from the right.

Do you think that if I am “right wing” I have any sympathy for Bush and Cheyny and their Patriot Act? But now think about: Obama had for 2 years TOTAL control of WH, Senate and the House. Did you see him make any atempt at scraping Patriot Act? No. He didn’t even try. Why? Because he couldn’t? No. He is the same type of globalist like Clinton and Bush, Cheyney, Romney and McCain. These globalist will send all the middle class jobs to China and other countries. They represent the interests of Wall Street, banking cabal and they care less about you and me.

When Obama had for 2 years both the Senate and the House, did you see at least an atempt to prosecute any banker????!!!!….Or maybe you believe all of them were clean like doves for what happened in 2008. I saw lots of prosecutions in Island but none in US.

This march of left, right, left, right just helps to enslave further the whole middle class. If you believe that Sanders or Clinton wants the good of the middle class and they are there to help you or me, I have a bridge to sell you.

From previous posts I understand that you are old enough to understand all of these. I expect these type of reflexes from someone “green” just out of the indoctrination centers called colleges. It takes a while to understand the system and the real life.

@Dweezil I think you meant Bernie Madoff. Bernie Sanders is the socialist running for President …

Lord Blenheim – (yes in fact I am having fun with various mispellings of your name I see here and joining in) the trouble is I’ve lived in flyover country and would actually prefer to live in a ho!e in a hillside here in silly valley than live in flyover country.

Then you have made your choice, and there isn’t any reason for you to be spending so much time on this blog.

Amen.

This blog is not about whether to live in flyover country or not; it’s about the RE bubble, particularly about RE in socal, where I was born and have lived as a very young child, a teen, a young adult, and then as a middle aged adult.

Get it straight: I was born there. I believe the vast majority of you were not.

I firmly believe there are two types of Americans: those who are Californians and those who wish they were.

So anyone who thinks I should not post on a blog devoted to the land of my birth can shut up right now. Go back to Iowa.

Well Lord Blankfein, fitting name by the way, some of these folks have a skill set that really only exists in the Bay area. Not to many high tech, often niche employment, jobs in fly over country. Most of the tech jobs in the middle of nowhere go to the H1B types.

SD….True some people bring to the table a special skill, I doubt as many of these folks really are that special to command salaries only a neuro surgeon or heat doctor should command. When I played ball nobody on my team made it to the big time, you have to have all the tools and than some to play in the Majors and make Thst Lind of money, most never get near it, so I still believe Silicon Valley can’t keep paying minor leaguers major league salries

Robert – you’d not believe how many techies are making $10 – $15 an hour here in Si valley.

This is because tech workers have flocked to metro areas. Tech workers should do well in the middle of no where. The competition is low, H1B only have satisfactory results, you would only hope out there is more american pride.

Tasty – I’ve seen it again and again, companies throwing money into black holes with idea that will save money or come out ahead. H1B workers are the same sort of thing. You have to hire several of them to equal one real programmer.

Look nothing makes sense, the stock market went south almost below 15k, now it is up some 2500 points since then. These swings are crazy and never for the faint of heart tax payer.

The SF housing market is so out of the norm you can only imagine when the cracks appear (not from a EQ) but the sheer common sense tech will dry up to a point where you are not going to play with a computer all day and get paid 500k. This is funny money right now and these so called brilliant people paying $1.2 million for 1350 sq.ft. will run faster than a track star when they lose their huge pay and return to 75k a year salary, it is coming soon to a housing market near you (Austin, Denver, Seattle) especially 2017 loot out folks?

One crazy stat even with the massive price gains in CA since April of 2012

Inventory levels nationally, on monthly annual basis are larger in 2012-2015 than any year from 1999-2005

However, still many people don’t have selling equity because if you work of the affordability index you would need at least 28%-33% equity to sell and move up

Still …. Housing Debt Still Haunts Some Move Up Buyers

Charts here to show why

http://loganmohtashami.com/2015/10/19/housing-debt-still-haunts-some-move-up-buyers/

The hypocrisy seems rather glaring! Liberal, social cause, California, has no place for the poor or middle class!

The mayor of SF proposing to build 100 affordable housing units for teachers.

http://m.sfgate.com/bayarea/article/Mayor-and-SFUSD-have-a-plan-to-help-teachers-keep-6583001.php

This is a good first step but what about all the other important jobs that serve and protect the city? Many of them make as little as the teachers or less. These large swaths of wealthy areas really are going to lose good people and services due to the affordability issue. It is only worth it to commute so far if you make “good money” (not enough to live where you work but more than what you would make living elsewhere).

Long ago in Newport Beach they put in apartments that were restricted to doctors and nurses only, because they needed them at Hoag Hospital.

So this is not a new idea.

They are also forgiving student loans if you become a nurse or a cop or a teacher or something. Public service.

Screaming socialism? Probably.

Probably best to become a teacher, cop….

I’ve a friend who got his Masters degree in Education some 25 years ago, in New York. He wanted a cushy tenured job for some government public school. But he couldn’t find such a job.

He said, “I don’t get it. Everyone says there’s a teacher shortage, but I get a degree in Education and I can’t find a job.”

He eventually settled for a job at one of those for-profit “business career schools” that advertise on NYC subway cars. No tenure. He still works there. After all these years, he only makes about 40k a year, in New York City.

Apparently, it’s harder to find a good teaching job than those PSAs will lead you to believe.

Son – I got boondoggled the same way with electronics. Supposedly there’s a huge demand, on Mars maybe.

Testing, my post went away, or did it. Strange happenigs, maybe the Ca board of Realtors wants me to move on and talk about how a car devalues so fast once you buy it, of course buying a house looks like just as bad investment in Ca.?

We’re seeing the first signs of trouble in San Francisco’s red-hot real-estate market

http://www.businessinsider.com/san-francisco-commercial-real-estate-market-weakness-2015-10

Only a handfull of people actually need a 3000 sq ft or larger home. A 1500 sq ft California Ranch House is just fine for most people who don’t have six kids or throw massive parties every weekend. Mine could use some work, but I keep putting it off for when I retire so I can be more hands on with the contracting. The lot is big enough to satisfy the dogs, and I didn’t take out the grass because I know about the weather cycles in So Cal, and we’re due for lots of rain this year. Calling these houses “crap shacks” is insulting. I’ve seen actual crap shacks in rural California and Oregon, not to mention Baja California (now those are real cago casas).

What is crappy is paying more than $300K for one. Of course the value is in the land, not the house. My neighborhood is selling for $500K to $600K. In Redwood City it might be nearly double that?

“Of course the value is in the land, not the house.”

That’s sort of the whole point with the skepticism involved here. The land value can be fleeting whilst the value of the dwelling is relatively stable. In Los Angeles there are still plenty of undeveloped lots listed for < $100K and they're not flying off the shelf.

I’l bet that there is something undevelopable about them that leads to the low price and nobody wanting them. A residential lot on a busy street out here sold for 250K a couple of years ago.

Joe R: You are probably right. If something is too good to be true, it probably is. For instance, on a corner lot on a semi-busy street, there is a good chance it used to be a gas station. Maybe it was a dry cleaner. Contamination issues abound with either, and a bank will not generally finance land that is contaminated unless you pay to clean it up or unless someone else is in the process of cleaning it up. It’s not like any sane person would want to live on contaminated or “formerly” contaminated land anyway. If there are no contamination or other issues, I would be very surprised to see a clean piece of land in any halfway decent area of L.A. going for $100k.

Check out the plots for sale in N.E. L.A. I should have clarified, mostly unimproved lots.

Regardless, the point remains that if the land is where the value is, and L.A. is supposedly where everyone wants to live, then there would be few limits to what people are willing to do to get their hands on such land. At the very least one could speculate without the intent on improving the lot, but there’s not even enough speculation to get many of these over $100K ask.

Apparently there are limits even in everyone wants to live here L.A.

@Hotel California: most cheap land I’ve seen in any semi-desirable area of L.A. or O.C. (which I researched a bit today after reading your post) is only cheap if it is very difficult/expensive to build on. For instance, if the land is at the bottom of a giant hill or on the slope of a giant hill. Neither option seems like a wise location to live, at least to me. Any other cheap land is way, way out in the boonies, or is in the hood (as in, you stand a 50/50 chance of being shot if you walk through at night). I wish this weren’t the case, since there seem to be some very reasonably-priced modular home options out there (modular: as in built at a factory, but not a mobile home). If I could buy a $100k (or even a $400k) lot in a decent area with good schools, I would probably bite (provided it wasn’t near a cliff).

Some seemingly decent modular homes I found: http://modularhomeowners.com/two-story-modular-homes-finding-the-perfect-prefab/

I grew up in NE LA. The lot my parents’ house was built on did not connect to the sewer line and we had a cesspool. The sewer line stopped above my folks’ house, so the lot they bought was cheap for a reason. Believe me, it’s better to have a sewer than a cesspool. There are hillsides in NE LA that are moving or have moved during the last 50 years. Irregular corner lots where streets approach at odd angles can be found there, too.

With all this money coming in from China, does any one think its only a matter of time before China tries and puts the brakes on all this capital leaving the their country? It can not be good for the Chinese economy that good capital that could be circulating in their economy is leaving in droves. I just have a feeling they might try and make some policy changes to curb this.

Viper – it’s called capital flight, and there are contries where it’s punishable by death, no kidding.

Chicken or egg? Chinese are taking their gains out in droves because they KNOW the commies can change things tomorrow. In the not-too-distant past, Chinese could not even leave China easily – let alone leave and take money with them.

I believe the Party is allowing the diaspora for the moment as a political release valve. No harm – everyone’s flush right now. But if the clash flow goes south – all bets are off.

I have a haunch that there will be disappointment when it’s discovered that their capital is not as “safe” with our government as they’d hope.

All the hippies and cool bands from the 60’s that put the place on the map could never afford to live there now. Jerry Garcia would spin in his grave.

Jerry Garcia had plenteeee of money…. he just snorted it up his nose, popped it in his mouth or injected it in his veins. San Francisco was a Cultureburg long before the hippies, even before the beatniks. Ambrose Bierce lived there and Jack London was born there. The list of San Francisco artistic luminaries from before World War II is way to long to give here.

As Dr H. Bubble tells us, bubble economies eventually explode or implode. SF is going to be pricy due to the small amount of land and prime location (like Manhattan). But the current out of whack prices cannot last indefinitely, so enjoy them or deplore them while you can.

There are indications that some Chinese investors have been looking for the exit in London UK. Some big changes, what with higher stamp duty at the top end, and perhaps the tax-on-turnover for landlords with mortgages may be spooking them. Guess it could happen US. Markets move at the margin.

http://www.dailymail.co.uk/property/article-3281329/Chinese-investors-London-property-market-begin-cash-gains.html

____________________

CANNONS and TRUMPETS

“There is, of course, the old Rothschild maxim: ‘Buy on the sound of cannons, sell on the sound of trumpets.’

____________________

BANKERS’ MANTRA

“Turnover is vanity, profit is sanity but cash is reality.”

____________________

“The crisis takes a much longer time coming than you think and then it happens much faster than you would have thought.” —-Rudiger Dornbusch.

____________________

This bubble is crazy crazy.

Jed – I haven’t met a poor hippie since I was a kid.

The whole thing with being a hippy was to avoid the draft. Pure and simple. In my 1970s childhood I met plenty, those who didn’t become Canadian geese, ha ha. Some actually were poor, although this was by way of being alienated from their middle class or upped middle class parents.

The working class kids just got drafted and shot at in viet nam.

The hippies of the 1960s got a hair cut as soon as the draft was off, went to work in their father’s corporation, and became the yuppies.

I run into the occasional old hippie when I’m in Santa Cruz, and aint none of those old hypocrites poor.

There was a bit more to the hippie scene than just draft dodging (though that certainly played a part). I knew hippies who dropped out AFTER coming back from Nam – so they certainly didn’t need to worry about the draft.

In any case it always seemed to me that it was a combination of the drugs available at the time (and a certain naivete about their effects), disgust with politics as usual (including the war in Vietnam), the new music that arrived along with the drugs and the political alienation, and a general Peter Pan like desire to stay a child forever, encouraged by the vast glut of resources available to the Baby Boomers as they came into their teens and early 20s.

Of course it all came crashing down in a few years when all the hippies realized that being poor kinda sucked and that irresponsible flower children, while fun at parties, made crappy spouses/parents. As late as the ’90s I’d still see hippie relic street people floating around Berkeley and the City, but they’ve probably all been gentrified into oblivion by now.

Apolitical – yes they can call you back in. After leaving active service, you’re still sort of on call for a few years. It doesn’t happen often now, but it was a thing then in the draft days.

Alex, you’re talking about the inactive reserve. IIRC your in it for 3 years from your separation date unless you did more than 4 years active duty. If they start calling the inactive reserve, we got real trouble going on.

I have to feel partly responsible for this. I make butt loads of cash, I work hard to make these tech companies rich. Profits have been off the charts mostly due to the mobility movement (apps & hardware) over last 6 years. Recently we have seen no momentum, money is still being spent like theres no tomorrow. Our assets are deep and diverse, are we really too big to fail? If the middle class is shrinking the largest consumer base for our products, where is the sustainability in this?

It was mentioned 300k family income is required to own in the bay area. Thats is a big number, even for tech workers. My partner which would be woman, are slim picking in tech and make alot less, making 300k even harder to reach. So I have to be gay in the bay area to not worry about finances…come on lol.

This is obviously happening in West LA (Silicon Beach), just not as fast.

I am guessing what is going on in San Fran is what happened in Manhattan, New York. It is too expansive for the middle class to live in New York.

Sure a lot of tech workers are making tons of money right now who live in the San Jose and San Fran area. In New York is it the high finance type.

I am guessing at some point it will become harder for a start-up company to start-up in the San Fran area as junior level programmers will not be able to afford the cost. I think you are already seeing the migration of some tech jobs to lower cost areas. Like Austin and Denver. Maybe the headquarters will be in San Fran and the the worker bees will be in Austin or Denver. This does not mean the house prices will fall. You still will have thousands of Asians buying real estate in San Fran. Just like rich Europeans and Russians buy property in New York and S. American buy property in Miami.

It’s true that junior programmers can barely afford Bay Area now. Even at $120K gross, the take home is about $6K. You can afford to live on that but the cost of everything in Bay Area is high – from transportation to food. It would take you 10 years to save up enough for a downpayment on a home.

Tasty – the only way you’re making buttloads of cash working for a tech company is by getting their HVAC contract or you’re running a temp agency renting out engineers to them for $10 an hour.

There’s no way you’re making much money handling a soldering iron or even twiddling away on SPICE.

Not sure which is more destructive, the tidal wave coming in or rushing back out.

If i could i would take a pay cut to have middle class neighbors. Hipsters/techies are unsociable hermits, their sense of entitlement is humorous to say the least. It’s more sounding like i need to live somewhere else.

I’m unsure what is effecting the bay area more overseas/investment buyers or tech incomes?

Tasty – I think that’s a large part of the appeal of the TV show King Of The Hill. Just a bunch of regular families who live in regular houses and know each other. They mow their own lawns, their kids play together, etc. Kinda funny that the one obnoxious guy is the techie.

In Los Angeles, any area safe for a white boy starts at about 1.1 million. 800K is gun shots nearby. No different than the bay area, which has a medial in the 600K range, which is about half of the 1.2M claimed in the article.

it – This is why more people are choosing to live in the distal rather than the medial.

When I hear these stories I’m not sure whether to envy or pity my pals in the Bay Area. I could easily have been one of them. PhD from a good school on the Peninsula in the late ’80s just when the tech boom was starting, lots of contacts and job offers in the area, but even then the snob/crowding/money factor made it less appealing and I baled for the mellower climes of Ventura County.

By the mid-90s the internet boom was in full swing and some of my friends were starting to get rich. Even those who didn’t hit the start-up/IPO jackpot generally managed to buy a house somewhere in the area (around the same time I bought my lovely SoCal starter crapshack). As I recall even then prices were somewhat higher on the Peninsula then down in SoCal, so some of them had to stretch a bit. Every one of them is now a real estate millionaire.

Like others on this blog I’m not happy to see the ionospheric pricing of housing in the Bay Area (as opposed to the merely stratospheric pricing down here in the LA area). That said, unless everyone stops using their smartphones and Ipads all of a sudden, the Bay Area is going to be awash in money for a long time and I don’t see prices coming down anytime soon.

My personal perspective: Over the 25+ years since getting my degree I’ve traveled to the Bay Area numerous times for business and personal reasons and every year it becomes it bit more intolerable. Though my net worth might be a few million more if I’d stayed I don’t regret my choice a bit.

Just like the dot com bust, I can see the apps and mobile tech will hit saturation level and once again people will exit the city in droves leaving behind a big mess for the city to clean up. Thank SF Mayor Ed Lee for the tax breaks to all the tech. I am sure the city coffers are full, too bad for the people who have lived there all their lives. How can you tell we are in a bubble? Because a specialized software engineer from a decent school is making more than the president of the united states. Thats when you know things are jacked. How many of these tech companies are actually making a profit? How many will get bought up by Microsoft and Google once they go under. Ive seen it before and will see it again. Greed is good, right Gordon?

I’m with you discg. People are trying to appify everything and its like dot com bomb times, when investors just threw money at any startup that had .com in their name.

SoCal is still viewed as a land of philistines with no culture and no class. A cultural wasteland that we try to avoid ever going to.

News for you. The jet set live in LA, NYC, and London. The bay area is in a lower league

No, I am not in the “jet set”, I am an artist and a bay area land lord. ‘Jet set” people are philistines as well. Being a lord, I can hold court on who is a philistine and who is not. I know what art is.

sure, try getting a membership at Olympic club..

The jet set up here are just not actress or actors in some reality show…they are real money…

cd, Since the 19th century, the contemporary denotation of philistinism, as the behaviour of ‘ignorant, ill-behaved persons lacking in culture or artistic appreciation, and only concerned with materialistic values’ derives from Matthew Arnold’s adaptation to English of the German word Philister.

Ira-“I am an artist and a land lord.” Ha ha ha ha! THAT’S what a Frisco hippie morphed into. Dude, you made my day.

Any area that’s relatively new gets viewed this way. Chicago had this stigma for a while. Socal has the double whammy of being very big and flat and spread out, and being mostly developed after everyone who was anyone was expected to have a car.

There’s tons of culture in socal, you just have to drive an awful lot to see it.

A helluva lot more culture. Bay Area used to have some culture back in the 90’s. It’s long gone now.

It’s supply and demand. It is still cheaper in the Bay Area than Singapore, Hong Kong or London. Just add California land use policies and you have a toxic mix. With the free flow of international money there is little hope for affordable housing. I’m up in Sonoma County where a “Smart Train” to the Bay is coming next year. Guess what’s going to happen to our prices?

Won’t that train only go to the ferry harbor in Marin? Talk about a terrible commute to SF. Car -> train -> ferry -> bus -> walking and in reverse on the way home. It would cost something like $25/day at least. Wow.

Extreme wealth breeds contempt for fellow man in many ways– entitlement, arrogance, and snobbiness. The Bay area is Manhattan-West now, and will never return to middle class affordability unless there’s a massive earthquake or U.S. economic collapse. Stories of $100K/yr GOOG employees living in vans shows that even the average tech worker cannot have a normal life. City/gov planners missed the boat on creating any semblance of housing affordability in the near future, and they won’t wake up until hotel workers, police, and teachers start leaving. I wouldn’t buy into this house of cards– the holding cost is too high, and the higher it goes, the more risk to the buyer.

An argument can be made that real estate prices will stay at lofty levels because of new demographics in play. The current generation, the Millennials don’t want to get married and have kids. So that leaves them with more money to play with. They also want to move into urban areas where other Millennials congregate. They don’t mind paying high prices. Just food for thought.

Perhaps they’re delaying having families due to the terrible house price bubble, and the uncertainties that brings. Oh well, rub your hands together for it locking in these values.

No problem on the kids, the people in Oxnard have plenty. If you want to have a traditional family, come to Oxnard. Not unusual to see a family with five kids(to make up for the Westside people ). We have Taco Tuesday five days a week. Weekends are Captain Morgan time(I do it during the week, since on the weekend I have to work).

I’m a millennial and I am not having kids because I can’t afford to raise them in an area I’d deem safe due to high housing costs. I also don’t want to raise a child in a small apartment but also don’t want to lose my decent paying job in Santa Monica so kids are off the table for now (or ever?).

Economic collapse on the way, FED zero percent is an emergency measure. The boys and girls at the ECB and Japan are devaluing further.

Anyone who thinks that this is going to continue indefinitely have to seriously ask themselves: do you really think that economic cycles no longer exist? Haven’t we seen this all before multiple times, and don’t we all know how it ends? Or does memory end at 3 years? When the money dries up, things will change.

The money keeps flowing into this country from Asia and India, seems to be limitless and is looking for a safe place to land, but only in the prime areas.

The inventory of houses in the Bay ares MLS still is very low, even at todays stupid prices.

I can’t afford a 60 year old crapshack in Hayward.

All I can do is sit back and watch the show, and hope my landlord doesn’t raise the rent.

I think you mean FED cycles.

Murakami – People have such short memories its laughable.

When you’re 18 and just thinking about renting your own place, do you remember what the market was like when you were 15?

When you’re 24 and just out of college do you remember what the economy was doing when you were 21? No, all you remember is having your first beer.

Three years after 9/11 I was encouraging people who did not remember it.

Thus, the boom and crash of economic cycles.

ENCOUNTERING.

I wish people remembered how good the internet was ten years ago. I can’t believe the shit were having to settle for now.

Of course it will change, 2016 will see headwinds and a good stock market correction…no reason 10-15% down move can’t happen in real estate…it happens…

The price history on this Santa Monica condo shows the roulette wheel pricing of the current real estate market: https://www.redfin.com/CA/Santa-Monica/854-18th-St-90403/unit-8/home/6768792

* 1997 — bought for $262,000

* 2010 — bought for $285,500

* June 2015 — bought for $855,000

* Oct 2015 — listed at $1,015,000

The 1997 buyer sold at a loss in 2010, considering inflation. Lost money on real estate in PRIME Santa Monica.

The 2010 buyer made out like a bandit. A Golden Flip.

The June 2015 buyer is gambling on another profit after only FOUR MONTHS. An idiotic and desperate Late Flipper. I hope he gets burned (even if, as likely, he’s gambling with Other People’s Money).

I doubt major banks are on the hook for it.

They are morons picking up nickels in front of a steam roller. Is that a starter motor I hear?

The mechanics of all the leverage and the incentives for the lenders to murder their customers are extraordinary.

Galaxy – there are all kinds of schemes out there, advertised on the radio, to get people into flipping houses. I’m pretty sure the actual business model is to clean people out and move on.

Yes Alex, schemes on schemes on schemes, including seeder/collective funds.

However no one is dragging them into any scheme/flip. Each individual has to take ownership of their own decisions. I only have to look at the asking prices/values in prime market to recoil in horror. If others chose to go into it, their own decisions.

I’m not saying, “Golly, if I can make everyone believe this rubbish, I’ll get a cheap house†…….. I’m actually saying, “This is societally destructive unsustainable idiocy and I refuse to be complicit by an act of commissionâ€.

I can’t stop some herbert property-investors ganging up with a shit bank and using my earnings to pay a landlord-mortgage……… but I can chose not to hand over my savings and sign up for a whacking great repayment mortgage.

It wasn’t too long ago that markets astonished people, by proving they can fall. Not my fault if people are pushing and falling over each other to repeat mistakes, and leave themselves exposed. My position is to rent-save and wait for real value. Not bail out victims.

Short memories and they’ve gone in hard again, to new peaks in prime. There is also outrageous greed that needs to be . I know people with 40+ and 100+ houses on net forums, complaining that UK Gov has unfairly changed the rules, and talking about their own future insolvency. They moved in to capture Generation Rent (Forever), with pure greed, and left themselves fully exposed.

If it is to clean investors who chose to invest in flips at these prices, then it’s deserved. Let smarter money in at much lower prices.

________________

What?

“The people running the con, REITs and flippers have already made their money.â€

Congrats on being one of the few here that actually gets it. Most here make misguided statements like “these investors won’t sell if prices fall†or “interest rates need to go up before these investors will sellâ€. Neither is required. The only requirement is net redemptions. The reason for net redemptions is irrelevant. Assuming that the vast majority of these REIT’s are directly or indirectly held by pension funds and 401k’s, I think there are many scenarios during flat price appreciation and ZIRP that you could see net redemptions in the near future. You don’t have to be a rocket scientist to figure that out. The only real question is does the flavor of the week QE sop up these REITS’s to stop the bleeding. We are in a time where there is no market just central bank policy and all eyes are on the fed not the underlying market fundamentals…

Galaxy – indeed. All we can do is get out the popcorn, sit back, and watch the show, while trying not to make any stupid decisions ourselves.

However, while it’s nice to say the 1997 buyer should have held out and sold in 2005, we should remember that 1997 was a pretty depressed year in socal. I remember 2/3rds of industrial buildings in Santa Ana, it seemed like, being empty. There’s a good possibility some financial calamity caused the owner to sell.

Alex in San jose

October 26, 2015 at 7:50 pm

Galaxy – there are all kinds of schemes out there, advertised on the radio, to get people into flipping houses. I’m pretty sure the actual business model is to clean people out and move on.</em?

——————-

It's always the same thing, but next time, it can't be new bailout. I'm not responsible for keeping people in $1 million+ houses as their entitlement. They're not helping me pay my rent.

Remember this commercial inside GTA San Andreas? (2004 release date – it was obvious to them too… and same for Doc beginning this site at around the same time; the future credit crunch/change/crash – but we bailed them out and kept the rich rich, then made them even richer in real estate… in the name of 'saving the economy'.. 'saving poor people' – what a nonsense.)

____________

https://www.youtube.com/watch?v=aoh4W459oY4

GTA San Andreas (2004) Radio commercial

Woman: Look at that, the Hendersons are getting a new fence.

Man: Who cares?

Woman: I want a new fence.

Man: We just got one two years ago after your parents were killed.

Woman: I want a new fence. That’s it; we’re never having sex again.

Lady voice-over: Need a home loan fast? At the American Bank of Los Santos we’ll help you get the debt you need to make life easier. We’ll show you how to look richer and be poorer. Your home is your equity, what exactly are you saving it for. You need to impress people fast, not in 20 years. It’s only a risk if you get into money troubles or the economy changes, which doesn’t seem likely. We know living in the suburbs is a constant competition where you’re defined by your lawn and your siding. Call American Bank of Los Santos when you need to add a rec-room addition with a jungle swing or a jacuzzi for 8. American Bank of Los Santos. Dreams take money. Why worry about tomorrow when you look inadequate today.

Money doesn’t ‘dry up’, it advances and retreats. There is more or less of it in circulation or available in credit. The retreat phases are bad for those caught out when the tide recedes they are left high and dry …. when they dry up the people they owe get left short….and depending on circumstances eventually a creditor is found that actually can pay the debt out of BK if necessary.

Eventually the taxpayer may decide that enough is enough, but until then the politician will keep buying votes.

When every monetary unit is debt, defaults do indeed destroy the money in circulation. 2008 saw actual money in circulation ‘dry up’ as millions of Alt-A, ARM, and numerous conventional mortgages all defaulted. This monetary system is a type of pyramid scheme. There have to be new loans to keep it semi-stable. More new loans eventually destroy the value of the monetary units. It also destroys the value of the mortgage to the benefit of the borrower. Place your bets wisely…..

A little insight into how easy it was for the boomers, buying houses, and in Prime areas, in the West. In this instance, the UK. So many older owning prime area owners sat on fortunes in equity. And in too many instances, retired and enjoying other people picking up higher taxes for them, with low tiered rates for themselves. It has to change.

_________

Silver Surfer: 23 Jul 2014

I bought my first house in the very early 1980’s. It was three bedroomed terraced house in a decent part of Sheffield, it cost about £10,500 and my pay was about £5,750.

After a couple of years my job took me to London, in price terms I virtually swapped my Sheffield house for a one bedroom flat with an SW1 post code, Sloane Square was less than a five minute walk away and the nearest “off licence” was Berry Brothers & Rudd.

A couple of years after that I paid about £22,000 for a two bedroom flat in Fulham, I think at the time my wages had topped £10,000.

Property costs can’t have been too much of a burden because soon after I bought a Porsche.

Incidentally, I had no student debts and a rock solid final salary pension that subsequently allowed me to retire at 55.

Absolutely none of this is available to my children. They’re fortunate in that I can afford to match for them the benefits that I was lucky enough to enjoy, but anyone from my generation who thinks their own hard work and industry were the keys to their good fortune is just taking nonsense. We were the most privileged generation that has ever lived.

______________

Meanwhile behind the scenes, the major banks have been selling off junk at higher prices and getting themselves sorted out for future trouble. If only a few of the bad things happen, then they can handle an even harder house price crash. Same as in US prime.

_________

BBC News:

16 December 2014

The Bank of England tested the lenders’ resilience to a 35% fall in house prices, and a 30% drop in the value of the pound, among other factors.

Five major banks passed the test.

The results show that the banking system is “significantly more resilient”, said Bank of England governor Mark Carney, and that the “growing confidence in the system is merited”.

“This was a demanding test,” he added.

Stress test scenario

Sterling falls by about 30%

House prices fall by 35%

Bank rate rises to 4.2%

CPI inflation peaks at 6.6%

Unemployment rises to nearly 12%

GDP falls by 3.5%

Share prices fall by 30%

http://www.bbc.co.uk/news/business-30491161

_________

Three Truths for Finance – speech by Mark Carney (Governor of The Bank of England)

Remarks given at the Harvard Club UK Southwark Cathedral dinner, London.

21 September 2015

‘…Moreover, when next time proves no different, the financial intermediaries at the core of the system will be on a substantially stronger footing. Their capital requirements have already increased ten-fold and their liquid assets are up four-fold. Their trading assets are down by a third and intra-bank exposures by two-thirds.’

Like I always said, the boomers are spoiled. Apparently the story is the same across the pond

Couldn’t agree more..

I’m just a few years too young to be a boomer but even in my case, if I’d stayed the hell away from college and learned a trade, I’d probably own a very nice house now. Silver Surfer was making the kind of money I could at a trade, in those years.

Back in 1849 San Francisco had a Gold Rush. Too much money chasing too few goods so most of the mining wealth was ‘inflated away’. Back then it was things like a shovel or pick costing 1/2 ounce of gold or $600 today’s money. Today its housing that is inflating.

The problem is that wages will have to keep up , property values fall or there will be a social collapse. Somebody has to do the unpleasant work. In a city where everyone is a millionaire ( be it from mining gold or writing cellphone apps) and no one is a worker money won’t buy much. The doctor, plumber or garbage man has to live somewhere and if they can’t afford to live in the Bay Area they can’t afford to work there either.

Plumbers do very nicely in Santa Monica — if you can find one. You can’t always get one when you need one.

A few years ago I had a plumber come to my condo. He charged $80 an hour just for labor. Parts extra.

I hear construction work pays less than in the past, due to illegal aliens. But certain skilled tradesmen do make a lot, in certain areas. Right now, there seems to be a plumber shortage on the Westside. They seem to be doing nicely here.

when it comes to services, especially health related, Santa Monica, Malibu, Pacific Palisades are the mecca in terms of fees charged. I had a friend who was a rolfer and he had a practice in Santa Monica and a practice in Westchester area. He charged $30 more an hour in SM for the same work he did in Westchester, simply because he said people seeking healers in SM will pay more just because his office was in SM.

Same with some Acupuncturists and Chiropractors that I have investigated – 20% – 40% higher fees at their SM location.

Trades are hard to get into. You need an “in”. That’s why they’re so hard to find. Artificial scarcity.

Unit – darned right.

And, a generation raised glaring at a screen and pressing buttons can’t plumb and can’t deal with grrreen being grrround.

Maybe this is why the trades are good to go into right now, although I think a large part of it is the current real estate bubble. In hard times, people do teach themselves skills, or hire the guy who will fix their sink in exchange for a place at the dinner table.

http://www.nbcbayarea.com/news/local/Truck-Living-Google-Employee-Explains-HImself–336451901.html

Twenty-three-year-old Brandon (he has not disclosed his last name) quickly became the talk of the town when word broke this week that he was living in a 16′ box truck to avoid paying rent in the Bay Area.

=====

It is possible to live frugally, I commend this young man.

Crowd sourced hard money loans, what could possibly go wrong?

https://patchofland.com/covered-wagon-investments.html

https://www.redfin.com/CA/Arcadia/610-Estrella-Ave-91007/home/7238095

This article is showing that there is life outside the SoCal; not only that but nice quality of life.

http://www.businessinsider.com/ranked-the-50-best-suburbs-in-america-2015-10

High on that list are ultra-wealthy enclaves on the Peninsula like: Atherton, Palo Alto, Los Altos Hills and Hillsborough. These places were unreachably expensive even 30 years ago when I lived in the area – god only knows what it takes to live there now. Of course they have a high quality of life. They’ve gotten rid of poor people and poor people’s problems through economic cleansing.

Economic cleansing….. Hahaha

There’s life outside socal! Just move to another rich enclave!

Nice little 23min video about being well educated, dual income’d, and financially forced out of your home town: “Million Dollar Shack” https://youtu.be/SBjXUBMkkE8

Galaxy Brain,

I agree with you that there is speculation and RE in SoCal is at bubble level. I also agree that there are greedy speculators. However I saw greed in the past from people with less money. Let me give you an example:

In 2011 I saw a condo which sold for $360,000 at the pick. The area was very economicly depressed and the bank foreclosed on it an tryed for months to sell it below their loan amount, for $120,000 for months with no takers. I don’t believe that no one in the area had the money to buy it, but there were no takers. The area was nice and safe but the unit looked dumpy.

I offered the bank $100,000 and they took my offer. I spent a little bit with carpet replacement and painting and 18 months later I sold it for $205,000. I am sure there were many who could have done the same thing but they didn’t for whatever reason – maybe they didn’t want to do the cleaning and painting or maybe there waiting to buy it for an even lower price. When prices are falling, how do you know when is the bottom? Some were waiting for even lower prices. Everyone wants to buy at the absolute bottom and selling at the absolute top but no one knows where those are.

For me, I thought that $100,000 was fair price. At 205k I was happy to sell although prices continued to go higher. Do I regret for leaving about $90k on the table? Not really. Everyone has to make a profit or there is no investment. I was happy with what I made.

In conclusion, when prices will fall, and I agree with you that they will, things will be so tough economicaly (always it must be a reason for prices to drop) that many will not buy and they will wait for prices to go even lower. Even if they do have the money or the ability to borrow, they will be stuck by economic news like a deer in the headlights.

Not everyone can stomach dropping prices. Theoretically, all people know that you have to buy when something is on sale. However, when RE prices are on sale, many are too afraid to make the move or too greedy to buy and wait for the prices to go even lower. That is a fact.

In those years there were lots of houses nice ones, on 2-3 acres in places like Gilroy and Morgan hill to be had for a quarter mil. Now prices have shot up again.

People need to get real jobs instead of speculation in real estate and flipping houses, imo; although I realise US mindset is very . As my Dad once told me; ‘If you shake hands with someone from finance brokerage on Wall Street – check to see you’re not missing any fingers.’ I want a crash and to wipe out flippers/landlords.

This (below) is not a dig at you personally Flyover. You saw your opportunity and took it, but you were assisted by a massive system reflation with interest rates floored and QE and so many other schemes – overriding markets for to support chosen positions (and not renter-savers). It’s ridiculous, imo, all this speculation on house prices.

Selection of posts made be other on net, that I’ve logged.

_______________

~The private individual property investors are puppets of the crap banks and finance houses, and are the reason why we don’t have a well run private rental sector. They are the dumb money. They have bid prices to a point where the smart money is staying away.

~The property investors ability to bid is predicated equity release or/and on crap reflated banks which bankrupted themselves enabling ‘property-investors’ to bid these stupid prices. …It should be about ‘ensuring market participants bear consequences of their decisions without any artificial fiddling that makes the final reckoning much harder and destroying the standards of living of large swathes of the populace along the whole process’.

~People talk about capitalism, but all I see is a game of, “I was here first so you can ****** off.”

~Landlords and flippers; Amoral chancers disrupting other people’s lives by making a daft and unsustainable pact with a bunch of banks that are so crap that not so long ago nearly put themselves out of business.

~This tendency of some property-investors and lnandlords to run behind the idea of their ‘gains’, like a child runs behind its mother’s legs. There is only so much simplistic explaining one can do.

~I think that a lot of landlords and property-investors infer personal animosity because their limited self-worth is wrapped up in your ‘property gains’, so they misinterpret an attack on their thinking as an attack on themselves. That’s just an error of reasoning.

~I can just post a link to this conversation and others can make up their own minds about the credibility and motivations of posters who go for. “Shut your mouth and look at my wad gains”. Basically, you are way, way out of your league, pal. This is men against boys shit here.

~They’re all the same, can’t even keep up a part time act. Trouble is there’s thousands of property investors, landlords and flippers out there who’ll think they’ve made money on housing, and to them, that’s all that **** counts.

~You are doubtless right that for the older homeowners, landlords and property investors in the wild, all that matters is the mad gainz, and many of them, maybe most, are so dumb that the leverage causes them not a moment of disquiet. I think that the property-investors we get here are self-selecting, by two possible mechanisms. Firstly, they may be the ones for whom the gains are not enough. They need to parade the gains. Secondly, the ones posting on housing forums and blogs may be the ones who’ve got a tiny sub-conscious inkling that they may be the mug being taken for a ride by the bank.

Flyover, as for the second part of your posting (not the part you talk about buying and flipping for profit) – if only people could see their way to not treating housing market as they do; a speculative mad-gainz on a resource of shelter that people need to live in – and rather for some investment in something more productive.)

A wider deleveraging could see REIT investments unwind, imo, in the scramble for cash.

I will adapt as the market plays out. Last time Fed stepped in with heavy QE (and rates floored). I am not after ‘best value’. We each have our buying price, for homes. I agree when sentiment changes people can be like deer in headlights. However the last ‘crash’ was followed in prime areas by remarkably fast ‘price recovery’ and also new peaks. QE fuelled. I doubt there will be as much urgency to time it for a quick window, like last time, but that prime values will fall, and remaining buyers can take more time. Also I suggest buyers become more choosy/picky when they’re not under pressure of a ballooning-price property market. One reason that buyers are willing to buy crap shacks at crazy high prices, in the frenzy.

________________________

Re UK Prime/Mid-Prime Areas

Poster 1: Everyone here says the young are being ******ed over, which they are. But even if there is HPC of -50%, few young people will be able to buy on a zero hours contract – if they even have a job at all.

Poster 2 (chartered accountant): Then we’ll have to have a 90% correction.

Doc; one house-price source I am highly influenced by, wrote and released a short book this Summer, called ‘A Goodbye To All That Buy To Let’.

Buy To Let = Property Investing/Real Estate Investing. Why, how.. and the end.

OK it is mainly UK focused, but much of it applies to the US and US Prime real estate as well.

About the author: I spent way too much time and energy on an education I probably didn’t need, ending up with degrees in philosophy, physics and mathematics. At some point in between the first and second degree I worked as an auditor in the financial services sector and qualified as a chartered accountant.

He is smart. You might find it very interesting reading, to flick through..

He has released it for free here:

http://agoodbyetoallthatbuytolet.blogspot.co.uk/

Or, for the minimum fee he could charge (the Amazon system apparently makes it so a fee has to be charged), for Kindle release.

http://www.amazon.co.uk/goodbye-all-that-buy—let-ebook/dp/B014N2E9H0/

If in the end there is a housing correction or something back to a normal housing market what year would you pick? 2002.. 1996.. 1982.. 1971 or ……..?

What should we expect to happen if prices stay low for a long time?

At one point were counties doing well financially before this housing mania?

If prices do fall to a new norm would this change perception over Prop 13?

Oh dear oh dear oh dear. Dearie dearie dearie me.

_____

[…]It is unclear whether swap spreads would remain negative even if corporate bond supply slows ahead of the U.S. Federal Reserve’s next policy meeting in mid-December.

LOSSES REPORTED

Ellington Residential Mortgage REIT said on Tuesday it had unrealized losses of $18.7 million, or $2.04 a share, on its interest rate hedging portfolio in the third quarter. Its net loss was $4.8 million, or 53 cents a share.

More funds including REITs (real estate investment trusts) and hedge funds with bad swap positions may be forced to liquidate them by year-end, causing possible ripples in other parts of the bond market, analysts said.

“We believe moves in spreads should be viewed as symptomatic of deeper problems in the Treasury market,” J.P. Morgan Securities strategist wrote in a research note on Friday.

in full

http://www.cnbc.com/2015/11/06/reuters-america-record-negative-spreads-roil-us-swaps-market.html

_____

What?

“The people running the con, REITs and flippers have already made their money.â€

Congrats on being one of the few here that actually gets it. Most here make misguided statements like “these investors won’t sell if prices fall†or “interest rates need to go up before these investors will sellâ€. Neither is required. The only requirement is net redemptions. The reason for net redemptions is irrelevant. Assuming that the vast majority of these REIT’s are directly or indirectly held by pension funds and 401k’s, I think there are many scenarios during flat price appreciation and ZIRP that you could see net redemptions in the near future. You don’t have to be a rocket scientist to figure that out. The only real question is does the flavor of the week QE sop up these REITS’s to stop the bleeding. We are in a time where there is no market just central bank policy and all eyes are on the fed not the underlying market fundamentals…

Leave a Reply