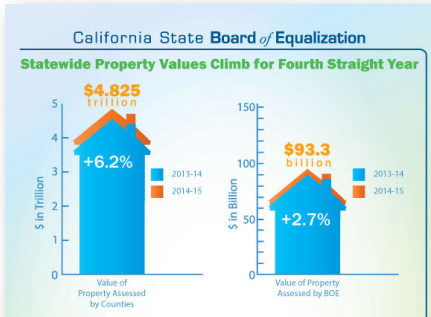

Why California loves taxes, stock bubbles, and housing bubbles: State and county assessed property values up to $4.918 trillion, up 6 percent from last year.

The state of California has a tax structure that is inherently in favor of stock and asset bubbles. The biggest sources of income tax for the state include personal income tax, corporate tax, and sales tax. These sources are completely dependent on the health of the overall economy and can turn on a dime. Compare this to a state like Texas that relies much more heavily on property taxes that tend to remain more stable even in recessionary times. But when times are good, the state of course manages a way to spend the money that is coming in. The current housing market is pushing out the middle class but money is flowing into central coffers so all is good. The Board of Equalization shows the big jump in real estate values across the state. Total state and county assessed property values are up to $4.918 trillion, up 6 percent from last year. By the time it all implodes, “I’ll be gone and you’ll be gone.â€Â How stable are the tax sources for California?

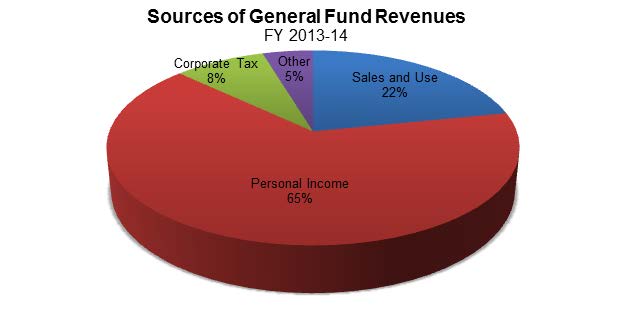

The main sources for tax revenue

The state of California collects taxes on virtually everything. We have a relatively high personal income tax, sales tax, and corporate tax rate compared to other states. Of course we have one of the lowest property tax rates in the entire country with legacy programs like Prop 13 which aid in pushing property values even higher.

Yet the state relies on three main sources for revenues: personal income tax, sales tax, and corporate tax:

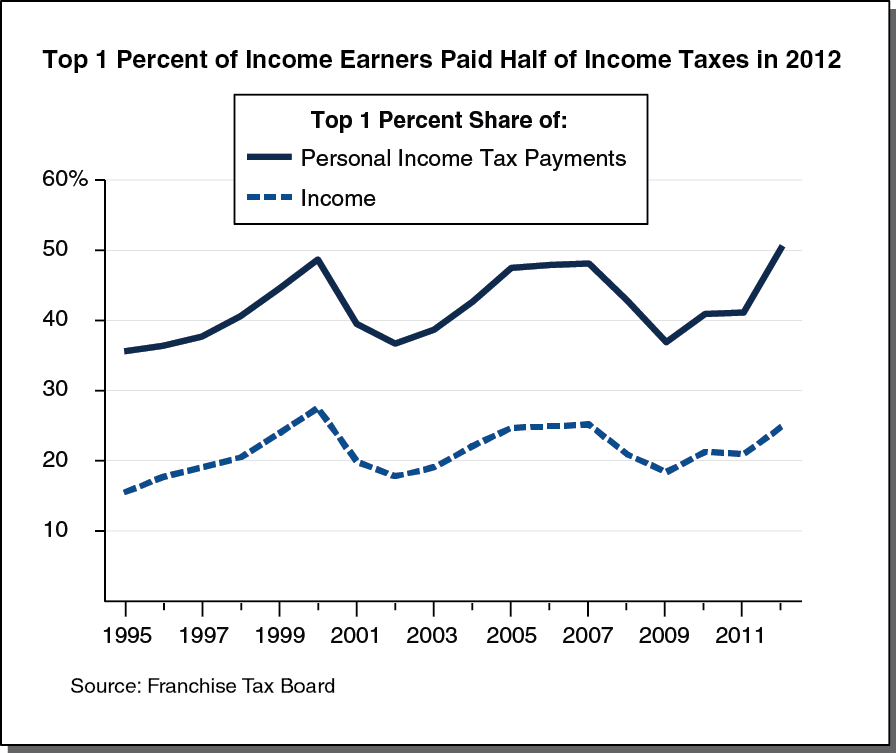

You can see how reliant the state is now on personal income tax. You can thank the many tech executives paying massive tax bills since the top 1 percent in California pay half of all the state income tax:

But of course this is highly dependent on things like the current stock market bull run. Property values tend to follow in tandem. Just look at the Bay Area which can attribute a large part of their mania to the runoff of tech money. We are in year 6 of this major stock run. This year the market has moved sideways. Valuations are massively frothy and venture capital money is running out of “novel†ideas to fund. Large investors have already pulled back in big ways from buying up single family homes.

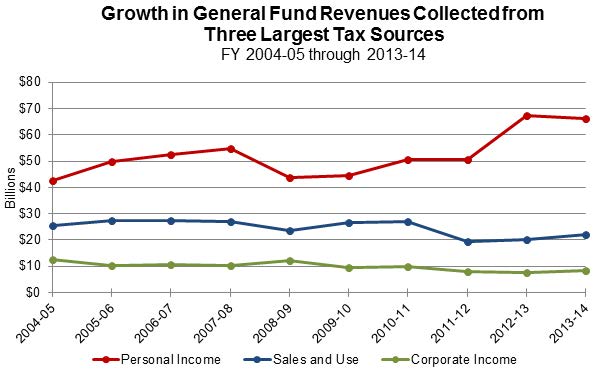

The mantra of California taxes should be things are good until they are not. Planning for a rainy day? Unlikely. The state is now relying much more heavily on individual income taxes to fund its budget, a rather volatile source:

While sales and corporate tax collections remain relatively stable personal income tax has soared since the Great Recession hit. The state is relying more on this as a source of income. And as we noted, the top 1 percent pay half of this tax bill. And where is much of their wealth coming from? The stock market mania. You better hope this stock market bull run continues.

And the localities are already betting on real estate values being high:

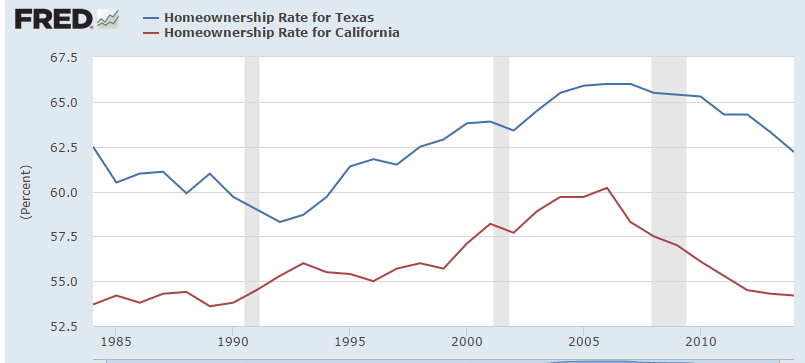

This increase of 6 percent in real estate values means higher property tax assessments. We’ve noted many times when a crap shack with a Prop 13 gift card sells, the new owners usually pay up to 10 times more in property taxes for all of the same services offered to the previous owner. Does that even make sense? This is why a place like Texas where property taxes are high but personal income tax is non-existent also has less volatility in their real estate. It also makes sense to be assessed on property values for what they are in the current market today. This helps to show why the homeownership rate in Texas has fallen at a much slower rate than in California’s rental Armageddon scenario:

In a way, people should be thankful for those new crap shack buyers. They are going to be paying much higher property taxes to help keep the state afloat. And all they need to do is float that 30-year housing payment for a World War II stucco box. Then you wonder why $1 million buys you squat in the Bay Area.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

144 Responses to “Why California loves taxes, stock bubbles, and housing bubbles: State and county assessed property values up to $4.918 trillion, up 6 percent from last year.”

This is all a dream…….

Great observation, when I had my stores in CAL, State Board of Equalization, crazy forms to be filled out, and to be frank nothing equal about it. They take in a huge amount of money but of course roads in front of our stores over 22 years never replaced just patches. Sweep the streets maybe 6 times in 22 years. Underground utilities, lets see sold out after 22 years add been gone from area I think 25 years same old nothing up and down the Blvd. Oh well, can’t fight city hall or the state or fed’s, I will have another cup of Java?

I think you hit this on the mark! While I don’t live in Ca. anymore, I read the online papers such as the L.A. Times. There are always articles about woe is me when it comes to how to pay for road repairs decaying water mains, schools, pensions, and on and on! One of the reasons I gave up on California was my assessment of the future … don’t get me wrong … loved the weather but too much congestion, and too many people ignoring all the problems hidden beneath the surface … I didn’t want to be left holding my piece of a broken dream when other shoe finally dropped. Best to have gotten out when people were scrambling to outbid one another for my house!

It’s like pulling a rabbit out of a hat.

Oops – wrong hat!

From the OC Register today,

In Orange County, a renter needs to earn almost $66,000 a year to afford the typical two-bedroom apartment here, housing advocacy groups have reported.

For homebuyers, income requirements are significantly higher. You would have needed just over $141,000 a year to afford a median-priced Orange County house this past spring. That’s up from $92,000 in 2012

http://www.ocregister.com/articles/percent-677635-orange-county.html

SO IF YOU GOT NO MONEY – THEN YOU CAN’T BUY NO HOUSE ???

…. HEY – What happened to my ZERO DOWN LOAN ??

==========================================

08/18/2015

CNBC: ” Why Americans wait longer than ever to buy first homes”

===========================================

http://www.cnbc.com/2015/08/17/why-americans-wait-longer-than-ever-to-buy-first-homes.html

===========================================

” Short of cash and unsettled in their careers, young Americans are waiting longer than ever to buy their first homes. The typical first-timer now rents for six years before buying a home, up from 2.6 years in the early 1970s, according to a new analysis by the real estate data firm Zillow.”

===========================================

FOLLOW LINK FOR REST OF CNBC ARTICLE.

The state of California collects taxes on virtually everything and also imposes fees. But how does Prop 13 push property values even higher? The only people with low property taxes are those that bought years ago. Most of them are dying off or moving on. We bought our house in 2009 for $1.05 million. Our property taxes are about $12K per year which does not include Mello-Roos fees and special district fees. How do these taxes and fees increase property values? They don’t. If anything, these high taxes and fees are a drag on property values.

You inherit the tax rates of prop 13 rate from your parents. Just one more way its better to inherit money than earn it in this country /state.

They want to force the old timers to sell so they can buy for cheaper.

Eliminate prop 13 and then they can starve out the old timers since the new property taxes would not be affordable to them.

That’s the loving theory

Correct. Prop 13 was passed because people were being taxed out of their homes. That’s a “better” idea. Prop 13 is has been a thorn in the side for the statists of CA for 40 years. It’s a straw dog the greedy movers and shakers in Sacramento have been trying to gut since it was voted in.

Schools were getting more money after Prop 13 after just two years of it’s passage even after all the screeching about “the schools are going to die”.

The number of people”inheriting” tax advantages is probably minor as the heirs would rather get the crap shack off their hands than live in it.

Prop 13 was passed as a block to Sacramento’s unbridled and irresponsible spending.

It’s not about “starving” anyone out. It’s about having everybody pay for what they get without others being forced to carry someone else’s load.

“I was here first” is not a sustainable plan.

I don’t think Prop 13 doesn’t do all that much for tax revenue from SFHs. Tax costs figure into the monthly nut and people are so maxed out that prices would have to adjust even further downward to account for the higher taxes. Removing Prop 13 would allow for a raising of the tad rates but on lower assessed values. Sure it would put the squeeze on legacy owners, but they’re such a small portion of the population that it would do little to increase revenue. Prop 13 also has the benefit of forcin increases in income and sales taxes which are felt more broadly and directly by the electorate. Having voters effected equally and directly by taxation is never a bad thing. If you’re gonna vote on taxation you should have maximum skin in the game.

*** THOU SHALT NOT FORSAKE MY GOD GIVEN RIGHT TO ” PROP.-13 “. ***

…….. NOT UNTIL YOU STEAL IT “FROM MY COLD DEAD HANDS” ……………

True. I live in Orange Cty. NY in a “River City” a hour+ commute north of Manhattan. Despite having a deteriorating century old infrastructure, the city’s expense allocation looks like the pie chart only the 8% represents the DPW’s allocation and the 85% represents pensions and healthcare. Heavily dependent on property taxes, the city must raise them 4% a year on average just to keep up with the increase in the latter. If the city were to rely on income tax, individual or corporate, it would be sol. I see a ‘Detroit’ in its future and in many other munis across the country. A beautiful century old Victorian @ 2500 sq.’ with river views can be had for less than 250k. Property taxes…around 14k plus sanitation, water and sewer.

For what it’s worth, Texas is going to regret relying on its property tax base as $40 wti is putting a hurting on its economy. The Houston RE value meme is peaking, imo.

Even you owned the house outright, you still have to pay the property tax as long as the house is in your name.

but the property tax and maintenance on a paid off house is still cheaper than rent

But if you bought your house for $40,000 and today it is worth 850,000 …. you are only paying $800 per year. And if you leave it to your child, they will only pay $800 per year.

Basically put, Prop 13 has a distorting effect on supply but there are a complex set of factors at play that I’ll try to provide my hypotheses for. As the nominal price level outpaces the artificial cap placed on property taxes moving through time, the effective subsidy from later entrants to earlier entrants expands. The value of that subsidy increases over time and provides a growing disincentive to sell relative to other options, thereby constraining supply.

Further to your question and comment, what are some of those other options? Hold and pass down the inheritance chain, convert to income property, convert to second home, hold in place, to name a few. It’s a similar dynamic that happens in a rent control situation whereby tenants hold and don’t turnover due to the economic disincentive of doing so. It can also be considered an outright economic incentive demonstrated by how some rent control tenants will sublet their subsidized rentals and pocket the difference. There then becomes an exponentially self-reinforcing effect whereby each participants’ disincentive begets another participant’s disincentive.

Eventually the imbalance becomes so great that new entrants can no longer afford the increased carrying costs formed by the differential, but this can be delayed by readjustments on the demand side. Reduced cost of borrowing, lowered down payment requirements, creative financing products, re-ammortization through serial re-financing, loosening of rules around non-performance, and so on… Is the degree in which these variables grew their legs in the California market at a certain point after the property tax subsidies began only a coincidence?

Even though the same demand adjustments exist in states where property taxes are uniformly informed by current market pricing for the entire stock of housing, there is not this additional supply constraint. Again, recall where ground zero was for the proliferation of products such as NINJA loans and the like. When the layers are peeled back we could find that Prop 13 has indeed been a contributing factor.

We now have an environment whereby a lot of supply is held-up due to continued household deleveraging from the prior cycle which was in part fueled by the distorting effect of Prop 13 and continues to compound the issue.

Don’t forget to include 1971 moving off the Gold Standard. That set the ball rolling imo.

SIMPLE — KEEP YOUR EYES ON THE OBITUARIES.

Once someone “kicks the bucket” …

…. Race over to the Funeral Home and make an “all Cash offer” to the grieving Widow, and now you’re a Proud Home Owner !!!

Hey – Be industrious .. It’s the American way

Agree, Seismic. SoCal coastal real estate is hot, hot, hot right now. If a person sells his house after 35 years, the new owners pay 1% of the sale price in property taxes, just like the original owner did.

The first owner of a house purchased in 1980 for $135K paid $1350/yr. Fees and other costs like voted indebtedness have the tax bill at $3600/yr after owning the property for 35 years (taxes went up 1% each year plus new fees). The owner sells the house for $1.1 million in 2015. The new tax bill is $11,000.

This is happening all over the place and constantly. That’s what a “hot” market means.

How many “old timers” are still around? The land is turning over constantly, with new tax bills at every sale.

How can anyone say Prop 13 is keeping values up? Unless you mean that the new owners at least know their property taxes will be stable and not launch into the stratosphere on the whim of an assessor.

How can anyone say Prop 13 is keeping values up?

In highly desirable parts of coastal CA, Prop 13 has a huge effect. People will simply stay put in their house because of the low tax base. This limits natural supply and creates much demand for the few houses on the market. This drives up prices or keeps them sticky. It’s pretty common in the beach cities to see older people living in their four bedroom homes they have owned forever. These homes are far from ideal but they won’t sell because of the Prop 13 golden handcuffs. The few houses that come to the market are bid up by families who want to live in the area and need the space. Prop 13 is just another component of the supply/demand imbalance of certain parts of CA.

“How many “old timers†are still around? The land is turning over constantly, with new tax bills at every sale.”

Focusing on “old timers” is a distraction and “land is turning over constantly” is an meaningless oversimplification in the context of this issue.

“How can anyone say Prop 13 is keeping values up? Unless you mean that the new owners at least know their property taxes will be stable and not launch into the stratosphere on the whim of an assessor.”

It’s a constraint on aforementioned turn over because as prices bubble up the effective subsidy becomes exponentially greater even over short periods of time, therefore putting a disincentive on selling due to giving up a large subsidy. Prices bubbling up quickly feeds back into this phenomenon and it becomes self-reinforcing resulting in an additional input into rising prices.

Non-Californians take note: California taxes ALL Capital Gains at Ordinary Income Tax Rates.

THAT is the sole reason why the top 1% have such a huge fraction of the California income tax burden.

Proposition 13 is a blip on the screen compared to the staggering spending coming out of Sacramento.

The other taboo topic: legal or illegal, California’s immigrant population fraction is extreme.

On the whole, immigrants can’t cover their public outlays. They are a net drain on native society. When they become a serious fraction of the whole adult population, their (relatively) poor economic output has a macro-economic impact on the government.

Sacramento is CHOKING on charity.

The outside world is 80 times as populous as America.

We need to help them — where they live. We can’t help them by cramming the freeways of LA and SF, packing the school system and our prisons.

( Immigrants of all stripes are wildly over-represented in the prison population — often by way of murdering their fellow immigrants !

It didn’t take Sherlock Holmes to figure things out, either. The typical immigrant criminal leaves plenty of witnesses. Then, half the time, he makes it back over the border. !)

If only the IRS would follow the FTB and tax the top 1% at 80% + on income and cap gains.

“Proposition 13 is a blip on the screen compared to the staggering spending coming out of Sacramento.”

Therefore demonstrating that Prop 13 and its subordinate measures have been a failure at mitigating the “spending problem” they were purported to help.

Property taxes mostly go to the county and school districts don’t they? Prop 13 was voted in during the 1970s inflation and subsequent increase in assessments. The purpose was twofold. 1) to prevent working class families from seeing their affordable homes become unaffordable (the votes) and 2) to keep rental property owner’s taxes from jumping outside what they could plan for and handle without big losses (the sponsor Jarvis). It may have been sold as a control on Sacramento, but its effects were more local.

Prop 13 DOES mitigate Sacramento… with its primary impact on the elderly.

By the arithmetic, it simply does not ‘cut in’ until you’ve been in a home for many years.

Until such a time, it’s as if it — the law — doesn’t even exist.

The spending blow out in Sacramento is MASSIVELY due to immigration.

Washington controls the borders — and policy; Sacramento has to eat the expenses.

Entire (new) prisons are filled to the brim with criminal immigrants — typically illegal immigrants, to boot.

They bring into California the lawlessness of Mexico’s drug gangs.

A WIDE OPEN southern border means that LEGAL Mexican immigrants can’t get away from Mexican criminal gangs.

One of their favorite hustles is to demand protection monies from (even legal) immigrants lest ” something ” happen to their relatives back home.

This gambit goes on unremarked — even by the MSM. You’d have to ask Mexicans residing in California to get the skinny. It turns out that virtually every one of them knows a victim of such shake downs.

No small amount of Mexican crime in America occurs because it’s the only timely way that a Mexican can pay off the gangsters running the protection rackets.

%%%

Back in Mexico City, the high and mighty Mexican elites are laughing their a$$es off at how they can rake a cut off of this suffering.

Politically, Mexico is virtually a one-party state — with all of the corruption and nastiness one should expect.

Blert, California is partially responsible for its immigration woes. “Sanctuary cities” refuse to cooperate with ICE to deport illegals.

This is not new. I remember this being an issue in the late 1980s, when the City of Los Angeles either had, or proposed, a policy of refusing to turn over immigrants who’d been arrested to the INS.

Then there’s that state driver’s license or I.D. that California gives to illegals.

And are the feds forcing California to grant free college tuition or entitlement benefits to illegals?

“Property taxes mostly go to the county and school districts don’t they?”

“to prevent working class families from seeing their affordable homes become unaffordable (the votes) and 2) to keep rental property owner’s taxes from jumping outside what they could plan for and handle without big losses (the sponsor Jarvis). It may have been sold as a control on Sacramento, but its effects were more local.”

In other words, to save the homeowner from overspending by the recipients which is the same point. It doesn’t matter at what level the money is being spent nor where it’s being spent – those are red herrings. The laws exist at the state level.

“Prop 13 DOES mitigate Sacramento… with its primary impact on the elderly.”

Here we go again back to kicking Grandma out of her house. What was that you mentioned about choking on charity? By the way, Grandma can defer her property taxes in perpetuity and they will then come out of the estate after her death. That’s reasonable. What’s not reasonable is for Grandma’s boy to inherent her decades old tax basis.

“By the arithmetic, it simply does not ‘cut in’ until you’ve been in a home for many years.”

If indeed it were to benefit only slowly over a long time, then we wouldn’t be having this discussion and the cap probably wouldn’t even exist.

The more common and likely scenario is that prices bubble up quickly so the later entrants are subsidizing not only the folks who bought many years prior but also those who bought prior within a small space of time.

“The spending blow out in Sacramento is MASSIVELY due to immigration.”

Still on that hobby horse?

$66k to afford a two bedroom back in of isn’t all that bad, typically that’s a couple making $33k each, not hard to do if you stay away from the computer shit and work in something necessary like wastewater treatment etc and unionized.

Very few make even decent money in tech. I know one guy making $100k or more and that’s the guy I work for. He pays me $15 an hour as a 1099 for about 16 hours a week and lets me love in the building. No running water but at least no rent. We have companies importing Indians in droves, keeping them in dorms, feeding them on rice and beans, and paying them the same wages they’d get in India. The reasoning being that since theyve got a cot and a pot and dhal, they can save theie $300 a month or so….

So the gaggle of Indians getting onto the light rail near eBay etc. may be making less than the average Midwestern teenager and just be happy to be living in the USA for a while. .

What do you mean he let’s you love in the building? Do you mean masturbate?

No I meant LIVE in the building… Thanks to our crappy new technology, we get to bask in typos!

Turn off auto correct. If you’re not going to proof-read your post then spare us the gibberish.

Oh to clarify…. I know tons and tons of people in tech, smart people too, making g about $10k a year like I do.

I am an Indian and work in Tech, real Tech making $200K/year

You won’t find any Indian making $15/hr working in Tech.

A few months ago, two large companies were busted in the Bay Area here, for bringing in Indians and keeping ’em in dorms, paying them $2-something an hour, free rice and dhal I guess. That’s two that got busted, not the 100’s that are actually doing it.

CS majors are making $15 an hour here – although a lot are doing stuff like working for sbux or painting signs…

Yes California loves all the revenues from economic cycles on off. Facebook stock options were part of the Budget when they were about to go public. I am dead serious on that as well.

Here is a great tale of 2 words. The Fed is on the verge of their first rate hike and just take a look at the economic landscape

Corp profits are slowing down and real term wage growth hasn’t really taken off yet. Yet CA and other places have had a Great Financial Asset worth expand and you know the FED

Wealth effect is a economic model. Even if your wages don’t really rise you will spend more. Yet, we are in renting nation cycle this year

FED And The First Rate Hike

http://loganmohtashami.com/2015/08/16/fed-and-the-first-rate-hike/

They have been promising an interest rate increase for at least 20 months. We’re supposed to have one in September. Don’t believe it.

I think we’re in the same doldrums the Japanese have.been in since the 1990s. Super low interest rates and a tanked economy, and every time they try raising the rates even a little, the economy tanks more so they have to lower them again.

Taxes stink no matter how you slice them. Income tax is a larger burden on high wage earners. States like TX that have high property taxes stick it to property owners. Frankly, regardless of which state you live in, the politicians find a way to tax you. In the long run, if you compare the total tax burden from state to state for a family making $100k with an average home, I bet you the total tax burden is within 5% or no big deal.

I have low property taxes due to prop 13.

For those of you bitching about people with low property taxes due to prop 13, keep one thing in mind. Most state property tax increases are typically limited to a 2%-3% increase from the prior year. So a $200k home bought 30 years ago would still have much lower taxes with a 2.5% average annual increase than the home being bought tomorrow for $1.5M with a 1.2% annual tax bill.

Really, what sucks is the 1.2% property tax burden when you buy in CA. That alone would keep me from buying here.

“Most state property tax increases are typically limited to a 2%-3% increase from the prior year. So a $200k home bought 30 years ago would still have much lower taxes with a 2.5% average annual increase than the home being bought tomorrow for $1.5M with a 1.2% annual tax bill.”

The limits that are in place in some other states and individual locales vary greatly in the total effective rate of increase. The devil in in the details.

Your example doesn’t hold much water because many of those programs were put into place far more recently than 30 years ago.

You can characterize it as “bitching” but that doesn’t change the fact that your lifestyle is being subsidized by others. It’s just as easy to label your complaint as bitching.

In NY that 200k house you bought x years ago is re-assessed every year at current market value and that figure is what your property tax is based on. Market value is location relative, so if your neighbor bought for $1.5, your assessment will reflect that inflation. I bought in 2009 and property taxes went up 125% in the first three years while my assessment went from 235k to 135k (bad accounting etc. bs, it was criminal imo). That 2% tax cap is an incentive so school districts get state aid, not law. School taxes are separate from municipal property taxes. As per your 5% tax in the aggregate…add a zero when accounting for fees and other taxes “skimmed” along the way. The fact is we’re paying more while receiving less. Some states are just better than others in hiding their unfunded liabilities. Which, imo, you’ll see the ten year at 1% before you’ll see a fed rate hike beyond a token gesture to save face.

All I can say is, WTF is going on with Zillow. Note the zestimate for this mid-century modern (lovely staging, BTW!) in Woodland Hills. Up 72k in one month?!?! 10 percent gain from July to August? Uh, OK.

http://www.zillow.com/homedetails/5611-Manton-Ave-Woodland-Hills-CA-91367/19879047_zpid/

Despite all of the statement you and your posters make Doctor, people are still tripping over themselves to buy houses in California right? The same can be said here in my home city of Chicago, IL. There is something deep within the American psyche that repels people from frugality and towards lavishness. Also there is this deep rooted need to keep up with the Jonese’s and to follow the herd.

Here is a perfect example. Chicago neighborhoods are gentrifying at an accelerated rate. Houses in the north side of Chicago trendy neighborhoods go for 600K to 2M. Once prices reach that level, then builders, hipsters and yuppies target the next neighborhood in the vicinity.

Now this is the case despite the roads in Chicago being Third World conditions, a school system that is not the greatest and yes property taxes, city vehicle fees and water fees that goes up the wazoo.

Like I said, despite it all, people don’t mind paying more and more. You see, the entire blame can not be placed on the banks, Wall Street, the government, etc. alone. Most of the blame for all of this out of control real estate can be placed directly on the American consumer. The Federal Reserve provides us with the bullets. The banks and big finance provides the gun and ultimately the American consumer pulls the trigger- because he just has to have it. Then this cycle continues and continues.

So people are stupid, and eventually they are going to get burned.

Folks buy Fiat-Chrysler products even though everyday they are recalled for something. Yes many Anericans are not savy, bigger is better to many, that Dodge Ram that gets 12 to a gallon they say gas is cheap now so who cares. I would think buy a 30 mpg and pocket some money. Most Americans don’t think that way They have very little savings the rainy day doesn’t exsist in there plan in life, only impress the brother-in- law mentality ?

Yes Nimesh hate to use stupid buyer but over the weekend a friend of a friend bought a house for $829k , no sewers, well water, dirt road. They fell in love with the rural life ???bought it within two hours, yes buyers are still buying stupid?

Reply to Nimesh: *** SORRY – That is NOT correct.***

” Most of the blame” falls squarely on the CROOKED Real Estate Agents/Brokers who keep promising people “TOP DOLLAR” for houses that cost a FRACTION of the money to actually “Build” ….

…. THIS IS A “COMMISSION” DRIVEN PRICE ESCALATION BY THE R.E. Brokers/Agents

Once all the STUPID MONEY RUNS OUT and the R.E. Market CHOKES, these “same” R.E. Agents/Brokers will DEMAND PRICE CUTS and FORCE SELLERS TO TAKE A LOSS for the SAME PROPERTIES that were PRICED TO THE Stratosphere…

>> What will the R.E. Agents/Brokers say to the Sellers ???

” HEY .. Do you want to sell your P.O.S. Property or NOT ….Well DROP YOUR DAMN PRICE BY $50K or $100K or SHORT-SELL your P.O.S. House …. I NEED MY DAMN COMMISSION NOW … OK .. PAY ME NOW”

** Normal, Innocent People are HONEST, NAIVE and “BORN TO BE VICTIMS” **

(that’s a sad truth)

** Reply to Paul- (not a Realtor)

Paul, it takes to tango. Yes, exorbitant real estate prices don’t make sense. Yes, Americans feel they just gotta have it all and then even some more. It is part of our mentality. But no one is forcing them to behave this way. I honestly thought that after the last worst recession since the Great Depression that finally Americans would alter their behavior. They did, during those very difficult times. They certainly did. But then as the economic landscape improved, they went back to their old ways.

The Fed, Big Banks and other leeches like Realtors will continue to play their games. But if the American consumer decides to leave the play ground then the game is up. But the American consumer has decided to come back to the playground. Like I said in my earlier analogy- The Fed manufacture the bullets, the retailers, realtors, consumer companies, manufacture the gun and then ultimately the American consumer pulls the trigger.

How long will buyers be tripping over themselves in Chicago if employers keep fleeing the state and taking jobs with them? Manufacturers in Illinois have had it with tax hikes after tax hikes coupled with the most costly workers’ compensation setup in the nation. And businesses are voting with their feet. In July, five firms left Illinois for good.

Read more at http://globaleconomicanalysis.blogspot.com/2015/08/get-me-hell-out-of-here.html#DYmFAsoxzchLmXUx.99

Research how Prop 13 changed everything. The effect it had on cities, counties, and the state are huge. The rezoning for commerce and business use alone has cost us many acres of land that could’ve been houses if houses were generating tax revenue — which they stopped doing in any meaningful way with Prop 13.

Huh? Houses are generating property tax revenue–it’s just the Democrats who control this state are spending faster than the revenues that are collected.

1970’s revenue. Prop 13 unintended consequences. Why can’t you do your own research?

http://www.ppic.org/content/pubs/op/OP_998JCOP.pdf

California cities are lowering standards to raise revenue

http://articles.latimes.com/2010/oct/18/business/la-fi-desperate-cities-20101018

How do you get by in the world? You make decisions on incomplete data?

Instead of citing a tired old 2010 propaganda article from the LA Times, why doesn’t tolucatom do some real research? So maybe the only way that tolucatom gets by in the world is to live as an entitlement slave on the Democrat’s bankrupt entitlement plantation? No doubt like most castrated and feminized white males, Tolucatom likes having his decisions made for him by his Democrat masters?

* California has the highest income tax rates in the country and the top income tax rate for upper-income households is 13.3%. The top 1% of income taxpayers in California account for over 40% of income tax revenue.

* California has the highest state-level sales tax rate at 7.5 percent. California has many special taxing jurisdictions (districts), which are funded by a transactions (sales) and use tax rate that is added to the standard statewide rate of 7.50%. The tax rates for these districts range from 0.10% to 2.00% per district. In some areas, there is more than one district tax in effect. Los Angeles has a sales tax rate of 9%.

* California has one of the highest corporate income tax rates in the country. California assesses two corporate level taxes: franchise and income. California also imposes an entity-level tax on non-corporate forms of business, such as limited liability companies and partnerships. California was rated as the worst state to do business in for the 11th straight year based on high taxes and burdensome laws and regulations.

* Californians pay the highest gas taxes in the country at 60.75 cents per gallon. Since January 2014, Californians also pay a global warming (aka climate change) “fee” thanks to the Democrat’s Cap and Trade Program that tacks on an additional 15 to 75 cents a gallon. The money spent out of the cap-and-trade fund supposedly must verifiably help curtail the greenhouses gases that supposedly fuel climate change. However, last year, 25 percent of all “cap-and-tax†cash flowed to communities that just happened to be dominated by Democrat members of the Legislature. It’s a Democrat slush fund that Democrat Gov. Jerry “Moonbeam” Brown wants to tap for his bullet train to nowhere even though construction of the train will increase emissions.

* California came in 17th in a nationwide ranking of property taxes in 2015, but because of higher property values, Californians paid $1,465 per capita in property taxes compared to the national average of $1,388.

* California has some of the most generous welfare benefits in the country and California has almost a third of U.S. welfare cases.

* California provides illegal immigrants with in-state tuition, driver’s licenses, taxpayer funded schooling and healthcare for their children, and there are new rules designed to limit illegal deportations. Democrat Gov. Jerry “Moonbeam” Brown even signed a law that bans the word “alien†from the state’s labor laws. More than half of the new driver’s licenses issued in California during 2015 have gone to illegal immigrants.

* Los Angeles was barely edged out by San Francisco in having the worst roads in the country. According to a D.C. based think tank, the Los Angeles-Long Beach-Santa Ana region has the second-worst roads in the country among major metropolitan areas, with a whopping 73% of the roads in “poor” condition. Democrats in the legislature have diverted gas taxes and vehicle fees from roads and highways to other uses.

BTW, the Public Policy Institute of California (PPIC) claims to be a “nonpartisan” think tank but the Board of Directors and staff are mostly Democrat politicians and attorneys like Phil Isenberg who was a career politician in Democrat politics for decades. Government entities and leftist foundations provide PPIC with most of its funding in the form of grants and sponsorships.

@seismic1 – Typical right wing response. Attack the sexuality of a person. Question that persons manhood. Post a bunch of quotes to support a jaundiced, malformed position — but don’t include links or references.

Think if you can — it’s real simple — Prop 13 locked in tax rates for home owners. Cost of supporting community continues to rise. City can not raise taxes on home owners. Therefore the cities zone for business where they can raise taxes and revenue. Were you able to follow that? That’s the short form. Go back to your Alex Jones podcasts now.

Yes, the Texas Republic has it all right. California is a lost cause for many. Their only alternative is to move to the Promised Land. Why it is heaven in Kerrville, along with Kinky Friedman.

Taxes do not suck if you get fair value for them.

I’ve talked to more than european here in the bay area who’s told me that they thought they were getting away from high taxes by moving to the USA, but then realized that after paying their taxes here and paying for all the stuff their taxes paid for back home, they’re paying MORE.

It’s because we’re supporting a huge military and wars, plain and simple.

I made $10,600 last year. I still had to pay $1300 income tax. The little guy pays a ton of tax in the USA.

On the 2014 1040, the Standard deduction plus personal exemption for a single individual is $10150. You must be counting your Social Security tax which technically isn’t counted as “Income Tax”. CA has a $3992 deduction plus $108 exemption. The tax table says no tax is owed if a single person’s taxable income is under $13242. The social security + medicare rate for employees is 7.65 % and for the self-employed it is 15.3%.You must be counted as self-employed. The employer pays half otherwise. None of that tax you paid went to the military. It went to Grandma’s check and Medicare (in theory?).

You Sir have worked the math.

Yes, what I actually paid went into the social security and Medicare funds. I got a little help through the earned income tax credit.

The federal income tax and social security and medicare taxes go to Obama. The California personal income tax goes to Brown. Obama’s Federal budget is very different than the 50 different state budgets. Also, the County of Los Angeles budget and revenue is different than the City of Santa Monica’s budget and revenue. Don’t forget all the add on taxes to your property tax that funds the local city college districts and the mosquito district and so many other line items things. Take a look at the details of your property tax bill and you will see. Your sales tax goes to the state and the county, and city and other agencies as well. Tax, tax, and tax.

Speaking as a Democrat, I never saw a tax that I did not like.

Haha…military and wars!!! Look at a pie chart of us government expenditures…it’s not that big of a chunk. Look at a pie chart of california expenditures…definitely not a big chunk there.

Prop 13 was ment to keep Grandma and Grandpa in their houses so their SS checks would cover the tax bill. Grandpa is gone and Grandma is in the care facility.

The REAL BENEFICIARIES of prop 13 are CORPERATIONS. and their real estate holdings, commericial buildings ect.

Disneyland is a good example of this, taxed at the 1956 value of their Anaheim acreage.

This was pointed out on the LA, channel 2 news.

That’s why it’s the happiest place on earth!!!

Must be 300 Acres taxed at 1950s land values X 5 for inflation.

Im a beneficiary of Prop 13. Im not a corporation. Im just an average joe who lives in his house just like everyone else in LA. Prop 13 is fantastic. It keeps people in their homes and in their neighborhoods and it creates communities. I and every other home owner and non home owners who will one day own a home will vote against getting rid of prop 13. And, since homeowners typically vote more and way more often than non home owners, good luck getting rid of it. putz.

“Prop 13 is fantastic.”

Subsidy recipients do tend to favor their continued receipt of hand outs.

“It keeps people in their homes and in their neighborhoods”

Indeed it does tend to discourage people from selling which is central to the point that it pushes down on turnover, thereby constraining the supply factor and pushing up on the price level. It should be no wonder that it’s a contributing factor in the many anecdotes of people claiming they couldn’t afford their house at it’s current market valuation, even people who purchased only a few years prior.

“it creates communities.”

No it doesn’t.

“I and every other home owner and non home owners who will one day own a home will vote against getting rid of prop 13. And, since homeowners typically vote more and way more often than non home owners, good luck getting rid of it. putz.”

Seeing how the homeowner cohort is shrinking, good luck with that.

I’m a longtime CA homeowner too, but if given the opportunity I would vote for the repeal of Prop 13 in a heartbeat. Just because I benefit personally from the law doesn’t mean I’m blind to the tremendous unfairness it has spawned.

According to the LA Times, Southland home sales just hit a 9 year high. Prices up 5.5%!! So thank you, I will have “good luck with that”

Home ownership in California continues on a downward trend, your luck isn’t doing so great in terms of hoping the votes will be there when you’ll need them. But if you want to focus on the wrong metric (prices) go ahead and good luck with that, too as you’ll be paying 5% more in price and even more so in taxes should you decide to swap into something else.

I think another tech tank is imminent. The internet is so much worse than it was ten years ago. I’m using a tablet I have for work and a 486 running Windows 3.11 on dialup would run circles around it. I can’t do audio, videos, podcasts etc. I have to stick to text. Internet would cost me $100 a month here. We still have payphones in San Jose. On paper, we have free public WiFi. In reality, we do not, and none of the so called silicon valley cities do.

So now we’re two finger typing out messages full of stupid typos, we’re regressing back to the BBS days.

The soon coming tech crash will certainly affect real estate. At least maybe that means I can buy a mobile home in Costa Mesa or Huntington Beach cheap and draw caricatures for a living on the beach.

Tech bubble part 2 will inevitably burst. The timetable will depend on raising interest rates, whether by the Fed or the bond market. The funny money borrowed by private investors desperate for yields has to be taken out of circulation.

The internet isn’t worse. Just because you reminisce about returning to your dial-up AOL days doesn’t mean any of it is true. Internet and tech is great….AND there’s tons of money in startups at crazy valuations. Things aren’t going to crash because the tech is bad. It’s going to crash because twitter and others aren’t actually worth much.

Internet used to be $15 a month and yeah slow but better than I have now and anyone could afford it. Now it’s literally $100 to $300 a month, be honest with yourselves, and most sites are worse. Yes we have much higher quality screens now but that’s about it.

BTW I agree with your point too, that these companies are simply not worth very much. They don’t produce anything! They don’t produce steel beams or pork chops or wheat. There’s some need for bean counting software and after that it’s just fluff.

I’m paying $55 for 100/10.

Nathan you’re not in San Jose.

Internet here is horrible unless you spend the big bucks.

Once a week I have access to real internet at a friends place the next county over. He spends about $300 a month to have it.

I’m on real internet now and on a real computer … this site is slow as molasses compared to 10 years ago (yes I was visiting it 10 years ago).

Drop the tablet. Go back to a laptop. I’ve used only laptops since the 1993.

I’m now on a Toshiba Tecra with 32 gig RAM. The key is lots of RAM. Lots of RAM will do more to speed your system than a fast CPU or fast connection.

I have standard DSL. Online movies and Google Street View were slow when I had 8 gig RAM, but at 32 gig they’re fast.

Oh yes, and a solid state hard drive is faster than the old spinning hard drive.

See the problem is, I’m living in a building in an industrial area, and internet would cost more than residential, I’m assuming a hundred a month. I have a thin little straw of access through the 4g tablet I’m provided for work.

As soon as I can come up with a justification to spend over 10% of my gross income for internet, I’ll get it anyway. I used to make money on the internet, but this is have changed so drastically that going back to what I did would pay me only two or three dollars an hour if I were lucky.

Alex, no offense, but you’re a sucker for working for 10k/month in once of the most unstable job markets in the country. Move to a city with white collar jobs at stable companies where they actually produce something of value (San Diego, Austin), get a $40-50k full time job doing network support (or do private consulting for small companies), jump ship in two years for $60k, repeat once or twice.

I am not making $10k a month, I’m making $10k a year. Like a lot of techies that no one wants to think about.

Just like everyone who picks up a guitar and learns to sing with a drawl is gonna be a millionaire, rite?

Anyway, my situation is fairly stable because we don’t deal in present tech, which sucks. We deal in surplus, and tech from the 40s to the 70s was actually pretty good. The guy I work for has a mountain of the stuff.

Living in the building, I’m avoiding about a grand a month in rent, so in a way I’m “making” more like $22K a year, which is good money in the Valley.

People don’t realize how many are sleeping 3 and 4 to a room, living with the parents or grandparents, etc.

They’re only thinking about the top 1% of tech workers, the Zuckerbergs and so on, but there are tons of people who’d have been better off learning to weave baskets.

Go to http://www.rabb1t.com – here’s an example of someone who was literally wired from shortly after birth to be into computers – he literally isn’t capable of doing anything else. This is how some kids are being raised; computers computers, tech and computers. So in their mid-20s if they’re very very lucky and know/are related to the right people, they MIGHT get one of those $100k+ jobs, and keep it for the 15 years they’re considered viable. Most are gonna make $30k at best, and when they realize what a shit sandwich tech is, well, they’re literally not capable of doing anything else, so they’ll settle for their $30k at best a year, tell fibs about how much they’re making, and live with the parents or 3-4 to a room.

Sorry, I meant /year. I’m saying you’re probably worth more than that elsewhere, and elsewhere it’s also easier to climb the ladder. I don’t try to match wits or resumes with the 170 IQ guys, which means the bay area is off limits to me.

And no, you probably won’t ever make $100k+ unless you’re one of those low-empathy people who are really effective at being managers because they don’t mind stepping on others.

P.S. Tech from the 40’s to the 70’s was pure art, but I can’t imagine the career possibilities going anywhere but down, right?

John D. – With an IQ of 163, I’m not that far behind the 170 crowd, but you have to know people – you don’t just “get” a job, you “network” for a job. I work for a guy who’s one of the 170 crowd, but he’s struggling himself.

You’re right about having low empathy. They’re probably administrating the Voight-Kampf test at the big tech companies, if you pass, you don’t get hired. Tech is very very low empathy. The guy I work for is an outlier in that he’s actually human. Sure he wants to talk about neutron absorption cross-sections all day, but there’s a heart in there. Most people in tech are cold-hearted mofos who’d screw over their own mothers for a new wii or something. Maybe just for the science of it.

Not sure what the Author of this blog suggests you should do in Southern California, where rents are climbing even faster than home prices. You have to live somewhere . If your friends, family and job are here, moving out of state will trash your quality of life. Who wants to be lonely in a huge, gorgeous house?

Even with all the bubble talk, I’m now in escrow, buying a house because rent costs in this area (LA – South Bay) are now about the same as a mortgage payment (property tax & maintenance costs are offset by the income tax savings of owning over renting). And landlords these days don’t upgrade anything, they rent houses “as is”, so renters are stuck with 1970s kitchens and bathrooms forever.

I don’t feel good about my purchase, it’s in a bad school district, is certainly no dream house, and no doubt it’ll lose value with the next dip of our roller coaster market; but at least I won’t have to worry once a year that I’ll have to move again.

Bubble and bust cycles are the norm in California, and most of us do not have the luxury of waiting to time the market. We buy a house to live in, and we buy it when our age, salary and emotions say we are can. Sometimes that just doesn’t match the SCal market’s hormones.

It sounds like you’re desperate to rationalize your recent purchase at current elevated prices. Plenty of posters here have felt vindicated by their decision to move out of CA.

Are you sure your deductions will cover the maintenance, property taxes, and insurance costs? Here’s the other side of the argument: the money (down payment + monthly) saved by renting can be invested in a portfolio that produces higher yields than the rate of mortgage interest.

Even if you don’t feel good about your decision, there’s no need to drag others down because they have chosen a different economic lifestyle.

@Prince Of Heck stated: “…the money (down payment + monthly) saved by renting can be invested in a portfolio that produces higher yields than the rate of mortgage interest.â€

I don’t know if I believe that. Where, specifically, can a layperson earn a >4% ROI in a relatively safe investment? If you’re referring to a portfolio that includes securities such as stocks/futures, then you could very easily lose a substantial portion of your investment in the event of a 2009-style crash (which very well could happen). That’s not a very smart risk if you need your money for a down payment in the near term.

Every time someone asserts that you can make 4-5%+ safely investing your money, I always ask how/where, and the answers always are always pretty foggy and non-specific (big surprise there). The best safe investment I’ve found is a CD at a credit union making a little over 2%.

I’m not asserting that buying a house now is a good use of $100k or $200k or whatever, but I also don’t think that a typical person could otherwise safely earn 4-5%+ ROI on that money.

@Responder

No investment in this artificial economic environment is safe. Real estate, bonds, and stocks have all benefited from Fed and economic policies to re-inflate asset values through cheap money. Hence, a RE crash will most likely accompany a stock market or securities crash as so many investment properties were purchased by financial institutions through low-interest loans.

The benefits of an investment portfolio are 1) dividends 2) diversity 3) liquidity and 4) higher returns. These are risk management avenues that RE simply does not afford.

@Prince Of Heck:

You are obviously correct that in the long term, investing in stocks, bonds etc. is the way to go to realize good returns on your money, though many people have alternatively done very well in real estate. For instance, I’m likely going to invest a sizable sum of money in one or more oil ETFs to try to capitalize (long term) on the current extraordinarily low oil prices.

However, I would certainly not invest any of my down payment money in any investment vehicle that has exposure to the market. Because, exactly as you stated, a RE estate crash will likely accompany a stock market crash, and that’s exactly when I will need my down payment money.

@Responder

As with any investments, buying at the right price is critical. For stocks and RE, 5-6 years ago would have been ideal. Right now, both are hopelessly overvalued. So no, I wouldn’t recommend depositing the equivalent of a house down payment for either at this time.

Even the stock market offers ways to benefit from a equities or RE downturn. Couldn’t say the same about a RE investment.

This is quoted from you message “Who wants to be lonely in a huge, gorgeous house?”. Sounds like a personal problem, if in fact you are in such a state of loneliness. I must say you would also be lonely in a small bungalow. Ah but I digress from your rather thin justification for buying at prices that are ridiculous and potentially ruinous to your future financial well being. Good luck to you as you are going against the well thought out advice of this site.

where are you buying??? LA or SouthBay?

Congratulations…

Some people are still kicking themselves for not buying in 2009… instead of moving on based on simple rental parity math.

My entire family (both my side and my wife’s side) lives in LA, as well as most of my friends, and we happily made the move out of state last year. Granted, my job allows me to live anywhere, but, in many parts of the country, you could get a job that only pays half as much as your Cali job, and you’ll still end up better off.

Now we’re “stuck” with new friends, a great school system, and a house that would be easily $1.5m in LA. Our friends and family visit us all the time, and Facetime/Skype really keeps everyone close. You just have to rip the band aid off.

We’re already dreading visiting LA for the holidays. We don’t miss it at all.

Do you mind saying where you moved? (sorry if I already asked in a different thread)

EZ…I agree with your “hate to visit” CA. especially LA county for sure. I’m glad you make enough to live where you want. I disagree with respect in that you can make half as much and still enjoy a nice life in another location. In my travels I find many area are cheap in some ways and make up for it in others. Example, I know of a very nice area of gated homes and nice schools. When out of state buyers moved in they were thrilled of nice homes for 300 to 400k and fair taxes. What they didn’t know was the development roads, water, police-fire contacts were just that contracts that ran out. Now homeowners pay $200 a month water pumping upcharge, $1,000 a year police and fire tax, and a road repair charge of $ 45.00 dollars a month. In addition to HOA dues that were $119 month, now three years later $275 a month. Homeowners and auto insurance also a issue. Many homes on the market and a whole lot of disgruntled HOA meetings with security in attendance it gets so crazy. most don’t make enough because they lost CA pay to absorb these expenses? I say just be careful folks, yes the grass may look be greener in other states ( CA is turning brown), but take a closer look, it may be artificial or about to be, so is many of the economy in these so call quality of life places.

It came down to Indianapolis (I grew an hour away from there,) Denver and Portland. After spending a lot of time in these places, we ended up in Portland, and we love it here. Portland makes sense for the type of people we are, but there are dozens of great cities all across the country that offer quite a bit, depending on what’s important to you.

Portland works for us because:

– we wanted to live close-in in the city

– we wanted to walk/bike to a lot of places (or drive easily)

– lots of parks and things to do for the kids

– lots of nature options

– lots of arts/entertainment/food options

– it’s about as unreligious as a city gets

– we like cool/wet weather (although it’s unfortunately been unusually dry and hot)

– while not cheap, it’s noticeably cheaper than LA

– great public schools in our area

– only 90 minutes from the Ocean, even less from skiing Mt. Hood.

– we have a couple of friends here

Just about everyday, my wife and I look at each other and praise this city, especially compared to LA. We’re so glad we moved here last year.

Thanks for the reply, EZ.

We made the mistake of moving from LA to Portland which did not work for us because:

– Portland has an artificial urban growth boundary and onerous limits on new building. The result is real estate prices are very high and people are crammed into the city.

– Portland is a dreary, dark, depressing city with too much rain for months on end.

– Portland is full of radical leftists and anarchists who are always spouting off about white privilege and micro-aggressions.

– Portland is full of radical environmentalists whose religion is climate change and who want to eliminate people from the planet.

– Portland has lots of homeless and transients who live in the parks and do drugs.

– Portland’s cost of living is high.

– Portland’s traffic is horrendous and the roads are in terrible shape.

– While Portland not too far from the Ocean or Mt. Hood, getting to those areas is difficult because of all the traffic.

– Portland’s public transportation is crowded and filled with gangster thugs and the homeless.

– Portland’s schools are Marxist indoctrination camps where teacher’s unions rule.

Just about everyday we lived in Portland, we looked at each other thought we did the hell did we move there. We’re so glad we when we finally fled Portland last year.

@ore-gone:

So it sounds like Portland is a lot like L.A., the exception being the dreary weather. That and you must allow creepy attendants to pump your gas (oddly, one of the reasons I would not live in Portland). I guess I’ll continue to stay in O.C. for now…

Oregon in general and Portland in special is so liberal, they lost all common sense. In east part of Oregon you drive through the most boring stretch of freeway at 55 mph. Everything flat and straight, no cars and you can barely move unless you are ready for stiff fines. On similar stretch of highways in Idaho and Utah you can drive 80-85 mph legaly.

But the Oregon liberals have to condition the whole population to submit to their whims.

Without too much liking for liberals and “progressives”, at least those in Seattle and Washington have more common sense than those in Oregon and Portland.

What about if all your family think like you – “I can’t move out of CA because of family”?….

Maybe if more family memebers band together, they can move out. Your standard of living will increase enourmously and your stress level will plumet.

I talk from experience. I used to live in SoCal. Now I live in Pacific NW and all my family lives here. It was the obvious choice.

However, if you want to live with a mill stone around your neck and be a slave to a bank, then it is your choice and yours only. You can’t blame anyone later for your poor choices except yourself. There are 10 times more people living outside CA than in CA.

There was no rent parity in home prices in the SF bayarea in 2009.

Gosh I can remember those Jarvis-Gann debates about prop13 like it was yesterday. The opponents warned of a disaster to the state in the year 2010 or so based on future calculations and data back then. Most of course said 2010 is light years away nobody really knows, in the mean time retires and folks moving here need a guarantee of low taxes no matter how long they stay in there homes. Jarvis use to say most Americans move every 7 years so don’t worry about the vast majority staying in there homes 40 or 50 years. They want the equity and profit out and won’t care if they lose prop 13 thus the 2010 scenario is not in play in the future it will all balance out in the state budget years from now. All I know is our family and friends have stayed in their CA bungalows and 1500 sq. ft. homes ever since they received the prop 13 gift and for that reason they never have moved even though their neighborhoods are like war zones.

Just don’t know, if they can repeal it how many won’t be able to afford the new tax but then again, the state is desperate for these property tax revenues. Glad I don’t ever make that call?

Proposition 13 passed in 1978, but you still have family and friends that have stayed in their CA bungalows and 1500 sq. ft. homes even though their neighborhoods are like war zones? They all must be really old and their properties must not be worth much if their neighborhoods are like war zones?

seismic…Yes very old folks now. West Van Nuys with iron around property, North Hollywood, Fontana. These are not garden spots but the taxes are dirt cheap and kids and grandkids will make a nice profit when sold. Most of these homes were bought in the 40k to 60k range.

What’s “iron around” property? Does it stick up like a button, so when you’re ironing the shirt you have to iron around it?

Tech is so great now it’s making us all illiterate.

I’m on a connection that’s scarily fast and yet this page is S-L-O-W.

The 1970s were when we changed over from a high mobility society to one where social class and what your parents set up for you, or didnt, dwarf individual effort. So of course people are going to hang onto their houses for 40 years. They want to give their kids a fighting chance.

What’s wrong with a 1,500 sq ft home? I live in a 690 sq ft condo.

I can understand families with 2 or 3 kids wanting 1,500 sq ft. But I don’t understand people who must have a 2,500 to 3,500 McMansion to feel happy. Unless you’re the Brady Bunch, why do you need so much space? What, you need a separate room for every activity?

son of a landlord.. Nothing wrong with 1500 sq. ft. it is all about where that 1500 ft. home is located, Watts has 1500 ft. homes so does Santa Clarita Valley where do you think the best investment is? As far as larger homes , if you can do it who the heck are you impressing nobody really, but then again I don’t think people who live frugal are any smarter either, just means they can live without, some folks need the fix of bigger is better, see my Dodge Ram earlier comment.

You must have grown up in California if you think 2500 sq ft is any kind of mansion. I grew up in a 3600 sq ft home (counting the basement) in the Midwest, and it was of average size in my neighborhood. I’m currently married with one child, and we find 2000 sq ft or so to be acceptable.

Either way, I think the point is that Califronia has upper middle class families packing into pre-war houses designed for low income families 90 years ago.

Total state and county assessed property values are up to $4.918 trillion, up 6 percent from last year. By the time it all implodes, “I’ll be gone and you’ll be gone.â€

That’s just $2.5 trillion less than all of United Kingdom – including London. Yet, what does this mean? Gone? This is just the pain-barrier before some healing correction. Only new debt, written in volume, can defeat structural debt. I’ve always thought Doc as being on the side of honest economics and of fair opportunity.

“I say just be careful folks, yes the grass may look be greener in other states ( CA is turning brown), but take a closer look, it may be artificial or about to be, so is many of the economy in these so call quality of life places.”

robert,

That is a good advise for any real estate purchased anywhere. However, the fact is that while prices in SoCal, SF and Denver went through the roof, in most US cities the prices are still half or a third less than they were in 2006. Historically there is a correlation between the prices. Historically SoCal comands about 50% premium for weather but not 300%.

Other areas in US have more stable RE prices – increase 5% during boom and drop 5% in a downward economy. SoCal has major ups and downs. If someone sells a house in SoCal now for double what he paid in 2009-2011, he can bennefit tremendously from the differential.

If they sell in a down market they may lose 50% (i.e IE) and benefit 5% buying somewhere else where the markets are not highly speculated.

Flyover Thanks good points, but again it always comes down to location and paying jobs. Large paying jobs in the US account for the price discrepancy as of course you would expect. Every town has its so called Nob Hill if it is followed by a SF zip code or Dodge City Kan. zip makes the difference. As far as 300% it is all relative, Simi Valley 1960 new home 19k same home today 550k. That home in SF-San Jose 1960 60k today $1.2 million and up, the difference pay, in Simi 1960 was about 32k today 80k, pay in bay area 65k, today folks make upward of 250k. Silicon-SF is not Simi-Moorpark. Banks value property by income levels, locations, ability to pay back loans. The simple truth sub-prime was fraud across the board, Dodge City wanted CA. prices in 2005-06 CA never going to have Dodge City prices in any era. Gas 25 cents a gallon when it hit 1.00 the sky was falling, many CA gas is 4.00 a gallon. Today many folks are left behind, to make 250k a year or more you have to produce and invent new ideas for companies and have a PHD etc. Many people want to be taken care of by the Gov. they got use to a monthly check or working for a Lockheed or Big Three type company everything taken care of, health care, pension, and hire family members those days are long gone, and it left many wondering what happen.

The 21st century is what happen, new world order, make big money, spend big money, if you live in the towns that are players, many towns in the US you can get by and let the world maybe go up in flames as you watch but to me not really, it all catches up, if you go broke in Middle America no difference than going broke in CA. just a different place you wake up to?

Thank you…. +1

No matter where you go, rent and property prices are PEGGED to MEDIAN INCOME. That’s why it’s not affordable to live virtually anywhere but in your (respective) parents’ basement. There are no new jobs out there that pay above median income for any market. If you’re a Sr. skilled employee, you’re lucky to get Jr pay.

Thanks for mentioning Denver. A previous commenter mentioned Portland, Denver, and Indianapolis as possibilities. The truth is, for the money, I personally would rather live in Portland (I live in Denver now…) or another small/mid size city in the PNW or Southwest regions (namely NM or ID). I am astounded as to what $300k will buy you near central Denver vs. a place like Santa Fe, ABQ, or Boise. Sure, those cities have their issues but living in Denver (and all along the front range) is becoming harder to justify. The traffic is becoming very bad here and it’s only going to get worse, as our infrastructure is still pretty outdated, despite improvements.

I read the median sale price in Denver in 2009 was $145k and now it is roughly $300k. This means houses are selling around $280 per sq ft. Denver is getting close to California sq ft prices?

I guess it must be the weather?

@RU82 yes, it’s the weather, our “quality of life” (my commute time has more than doubled in one year), 300 days of sunshine, “low” taxes, etc. etc. What no one will tell you is that our winters can be brutal: Try commuting from an affordable area to downtown with 6 inches of snow and ice on the roads in your front-wheel drive car (not uncommon for the entire front range; it’s much worse in the foothills.) FUN!

And yes, home prices as well as median rents continue to go up.

Don’t forget how dry it is in Denver. On my last visit I’d wake up gasping for moisture. For that reason alone I couldn’t live there.

Repealing provisions of Prop 13 relating to SFH’s is a matter of time. Angry youngsters with a place to focus. Capital gains on the sale and higher property taxes after that for the state. It has no lobbyists like commercial real estate does.

Tech is going to take a hit. That’s a sobering admission from the front lines. Going to have to make up for it somehow.

The last correction never completed. This next one will likely be the stuff infamy is made of.

Tech is already dead. Raising or decreasing property taxes isn’t going to fix anything. I discovered personally that the ONLY reason why we have unemployment in CA is so that you can afford to pay your property taxes… the state gives you money so that you can pay the tax so that they don’t take your home for being unemployed.

CA prop tax has NOTHING on TX prop tax. You want to sell your home in Los Angeles and move to Austin? Fine. Go ahead. What’s that? You want to avoid income tax and move to TX? Great!

Wait a second… 2.9% property tax in unincorporated Austin? You mean… my new $700k Toll Brothers home has a ~$21k annual tax bill? And I need to pay that shit in order to fucking close escrow? Fuck me!

God Bless Prop 13.

It’s funny how people don’t appreciate California until they leave it. Most other places have a higher sales tax, much higher. In Arizona depending on where they are, the sales tax can be over 12%. And they tax everything, even food. Yes they will tax your banana. The only place better than California in this respect is Hawaii where its 4%, always has been, and like California they don’t tax food.

Most other places feature horrible weather, no jobs, having to own a car and drive tons, different tires for different seasons, half the people you know having a picture of the towns famous klan parade on the wall, and a rent to pay ratio that’s worse than it is in California.

Man, you’re way off base, Alex. California is in the top 10 of sales tax states in the country, so there many other states with more favorable sales tax rates. I moved to Oregon last year, where there is no sales tax at all, and I don’t miss California one bit.

Moving to just about any good city in the Midwest is going to give you a much higher pay to rent ratio than California, and they’re not any different than California when it comes to “Klan Parade” pictures that you speak of. Whether in California, Oregon or Indiana, the cities are full of diversity, and that tends to go away the further you get outside of town.

To be honest, most medium-to-big cities in America are pretty similar, these days. You could go work retail in the Midwest and live a better life than you’re living making $10,600 per year in San Jose.

“Most other places feature horrible weather, no jobs, having to own a car and drive tons, different tires for different seasons, half the people you know having a picture of the towns famous klan parade on the wall, and a rent to pay ratio that’s worse than it is in California.”

You just described the situation in many parts of California.

Some of my husband’s family lives in a a beautiful small town in the Midwest. It is frequently on the “best places to live” lists. People walk everywhere; it is very affordable. There’s a quiet little downtown area, beautiful libraries, parks, summer festivals, and the public schools are actually very good. Sure the weather is a trade-off, but there is plenty to do there. And an added bonus: I have never seen a photo of Klan parades anywhere. For 200k you can buy what most people would consider a very nice home in a good, quiet area.

EZ – No, I could move to the Midwest and be homeless and freeze to death because I don’t know people there. You have to know people. College or no college, skills or no skills (although it does help to have some knowledge, be a good worker, honest etc) it’s all in who you know. Unless I somehow get to know some bosom friends in the Midwest, that way would lead to cold and starvation for me.

The only way to swing it, as huge a move as that, would be to develop some skill that’s universal – become a really good singer, stand-up comic, tattoo artist, caricaturist, etc. Some skill where you can land naked and afraid just about anywhere, and make it.

Hotel California — Look at a map of California – it’s huge. Almost all of the state is, indeed, a desolate wasteland as far as making a living goes. I lived in Gilroy for a bit, which is just at the edge of Santa Clara County, and there was zero work. I lived at a place for free in exchange for chores, and occasionally would get $20 for helping load a truck or something. I made some money as a “picker” for the antique stores there, and just got good at living on very little. I think one year I made about $1500 for all year.

So yes, yours is an astute observation.

imfromcolorado – it sounds heavenly. However, if I were to hop on a Greyhound and show up there, the chance of my getting a job for more than min. wage is tiny. My knowledge of electronic surplus or of tech in general would be useless. And I’d know no one there which is key – you get jobs by knowing people.

I doubt they’ll have a need for a 52-year-old Baskin Robbins ice cream scooper, supermarket floor mopper, etc. Moving to that heavenly little town would mean homelessness for me. It’s probably a great place to live if your great grandparents came over in the early 1900s and your family has known those of the mayor, one of the major churches, the car dealership, etc. That’s how towns work.

The only way to break out of that paradigm is to have some skill that’s so out of the ordinary that people are happy you came to their town.

Yes, God Bless having other people foot the bill. Where you save in property taxes, yourself and others disproportionally are making up for it in other fees and taxes.

Either somebody has to pay to make up the difference or we’re left with worse off infrastructure or in the case of California, both.

You can’t compare a 700k house in Texas to a 700k house in Southern California. That 700k house in Austin is most likely a 4000 square foot house on a giant lot. A 700k house in Los Angeles would land you in the Valley or San Pedro and only 1500 square feet.

If you want to make a fair comparison, buy the same house not the same price and you will see the taxes are probably equivalent. I don’t know what the school system is like in Austin but in Los Angeles you’re either in a million dollar neighborhood or you’re in the ghetto.

Exactly. People kept telling me about high property taxes before we moved to Oregon, where there also happens to be no sales tax. Well, when you consider that fact that equivalent homes are a third of the prices of the homes in LA, you still pay less in property taxes, despite the higher rate. Plus, the median income in Portland is slightly higher than in LA.

I’d only stay in LA if I made $300K+ per year, or if I wanted to “make it” in entertainment. If not, there are zillions of other great cities across the country to live in.

Having lived in different parts of usa, I can speak from experience that CA is over stated and is really very very expensive.

I am still in san diego because I have a cushy job though no family. I emigrated to USA 15 years back.

The boom n bust cycle in CA is normal and the bust is coming. No one knows when though..

I don’t get all this vitriol against people who live or want to stay in CA. It sounds a lot like sour grapes. What it’s to you if people want to put up with the BS of living here? The reality is, there are pros and cons to living anywhere and people have different situations. I’m Asian-American, there is no f’ing way I moving to some place where there is zero diversity. I have a friend who lives just outside Atlanta in a huge McMansion that cost something like $500,000. She and her husband are Taiwanese. Every time she goes to a nice restaurant, people approach her and ask her why they’ve been waiting so long for service. She gets attitude from folks all time at normal, chain retail stores. For all the crap we have to deal with in this state including the sorry state of housing affordability, there are plenty of other downsides to living in other areas of this country.

No vitriol from me. I’m just trying to help those who question their situation in LA, but don’t think there are other options.

Either way, just about every major city has diversity, although I’m certainly not saying the South is necessarily a great choice, in your case. Even Seattle, while not cheap, is more affordable than LA, and it has a strong Asian-American population.

This is anther factor people are afraid to look at but should. Diversity or lack thereof. Being a minority sucks. I grew up in Hawaii where I caught hell all the time for being white. So I got the hell out of there and will not return unless I get something going that both pays me enough money to be able to insulate myself from many of the realities of the place, and gets me some “social reward” where, like Jim Nabors, the attitude of the locals will be “Well, he’s white but he’s one of the ones we like”.

Now, where I am in California, I blend right in. I’m what I call “brown paper bag white”. I came up with this when I noticed that if I’m carrying a brown paper bag, the color’s the exact same as my hand, which looks weird, like someone in the color department got lazy and used the same shade.

The result is, I can hang out most anywhere in California, even gang-y Hispanic areas, and I’m A-OK.