Rental Apocalypse: US homeownership collapses to 48 year low while rental rates continue to climb.

The latest Census figures show a very dismal situation for the housing market. The US homeownership rate has plunged to a 48 year low and the pipeline for future buyers is simply not materializing. We’ve noted that in places like California the big push in prices has come in the form of big investors, foreign money, and the ever present flipper brigade. Yet this trend is not only a coastal phenomenon. Contrary to stucco box sarcophagus loving boomers, the US does not revolve around Southern California. Big shock, I know. Large metro areas around the nation are following a similar path. The next generation of home buyers are priced out and many are viewing homeownership as a lofty if not impossible goal. Rents continue to rise and thanks to the big buy by large investors over the past few years, inventory has been siphoned off the market and regular families have been left in the lurch. We are quickly becoming a nation of renters.

Rental Apocalypse is here to stay

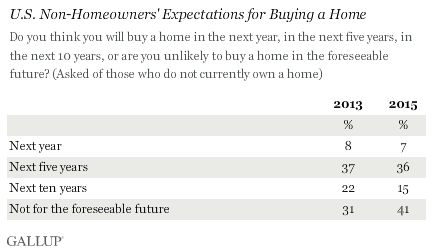

Gallup recently published an interesting survey looking at the expectations of non-homeowners. This is really important because this will drive future home building and buying for years to come. I’m surprised at the speed in which financial amnesia floods California. The booms and busts are like bong hits. One day people are on a good high and the next, the market is imploding. Yet somehow, even recent history like 2007 through 2009 is viewed as some kind anomaly. The 1,000,000+ California households that lost their homes to foreclosure are left to lick their wounds and are ignored by the press. We rather hide that funky part of family history in the attic. We are all about winning even if it means leveraging every penny you have to be owned by your home. Apparently this memo is spreading across the country as seen by non-homeowner expectations:

The most important line here is the “not for the foreseeable future†jumping 10 percent from 2013 to 2015. Isn’t the rising stock market and housing prices being up good for everyone? Apparently not when incomes are not keeping up.  And we put ourselves in a low rate predicament. The entire market is now conditioned to low rates. Even a minor hint of rates going up sends the market into a reality show meltdown with all the subsequent scripted drama that it entails. People are simply seeing homeownership as a more unlikely option. Millions of Millennials are living with mom and dad because they can’t afford to rent, let alone buy.

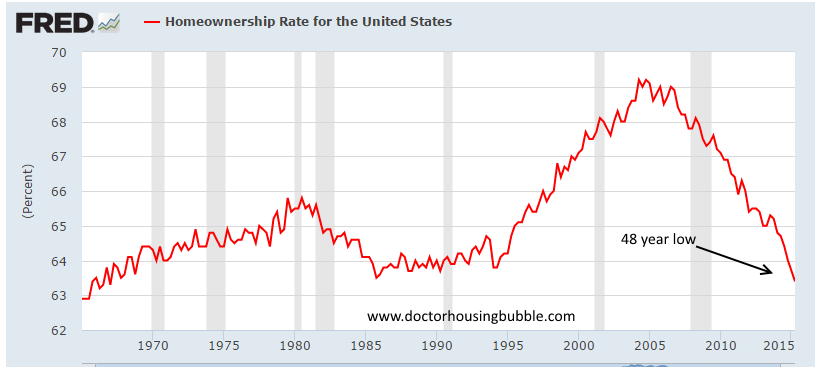

Because of this crushing blow to the middle class, the homeownership rate has hit a 48 year low:

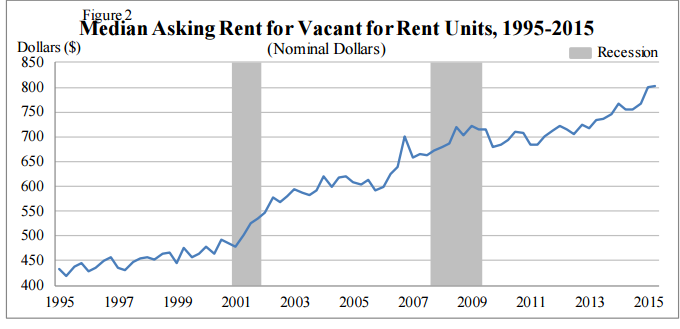

Why this matters is that most Americans are horrible savers. A home is basically a forced savings account. And most Americans that have any sort of wealth have it locked up in housing equity. So with fewer Americans owning, this just means fewer Americans are going to build wealth. And it is going to be harder to build that wealth because rents are soaring upwards:

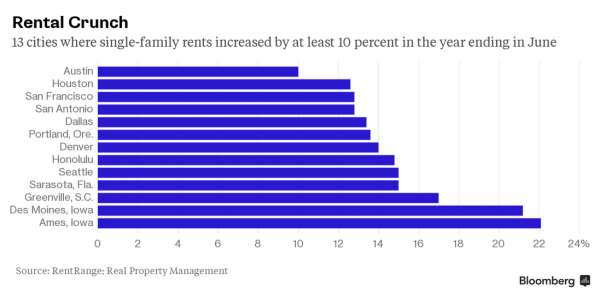

Rents have gone up more than 100 percent over the last 20 years. The general CPI has gone up 56 percent over this period.  In some areas, rents have gone up by double-digits in the last year alone.  Why the big disconnect? First, the CPI looks at the owners’ equivalent of rent that continues to miss any surge in home prices. It also fails to look at wages and is missing out on big items like student debt that is marginally represented in the basket although for many Millennials, is the biggest expense.

In the end we have a net increase of 10,000,000 renter households over the last decade while the number of homeowners has gone flat. That is a big shift and it appears to be continuing. With real estate prices now back near peak levels, many people are simply opting not to own.

Here in California, the change is even more dramatic. You have renters living in sardine like atmospheres with multiple roommates. Even tech workers are shacking up with each other in places like San Francisco. The options are simple: buy and over leverage to the max to get a crap shack (if you can), rent, rent with roommates, live with mom and dad, or move out of the state. All the trends are pointing toward this rental apocalypse continuing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

98 Responses to “Rental Apocalypse: US homeownership collapses to 48 year low while rental rates continue to climb.”

Rents in most mid-western states have not risen. I own a rental and charge 15% less then I did 7 years ago. I had to start dropping rent in 2009 and I still do not have pricing power to raise rent. I used to charge $650 for a 3bd (900sq ft) on a 8000 sq ft lot and now rent is $550. Then again the price of the house was appraised at $65k in 2008 and now it appraises at $45k. I bought it in 2002 for $52k. Essentially the price of this house is at 1998 levels. So over the past 10 years I have seen the property tax go from $800 a year to $1100 and property insurance go from $600 to $750. Hard to make a profit as a landlord if you bought a house as a rental investment over the past 10 years. Even with unemployment in the state is at 4.3% there is not any pricing pressure on homes or rent.

So there are places that are not in any type of a bubble. The good thing is that after seeing the price of the house drop for 6 straight years from $65k (2009) to $40k (2014) I have seen the value rise 10% to $45k this year. If it hits $50k (I am using nearby comps) or if interest rates rise then I will be able to raise rent to $600 That is a $45k house with a 30year mortgage will put payments including tax and insurance at about $400 a month. Cheaper to buy then to pay $600 rent which is 50% more than owning. There is over 900 houses in the Kansas City area selling for less than $70k. There are over 1100 houses selling for less than $80k. There are 1300 houses selling for less than 100k. So 10% of current homes for sale are under $100,000

Here is a Kansas city house that is equivalent to a LA crap shack ….but it only cost $69k and a 30 year mortgage of $440 / month. LOL

http://www.reecenichols.com/homes-for-sale/2207-N-9TH-Street-Kansas-City-KS-66101-151938761

I know someone in Dayton, OH, trying to sell his condo for only $20K. No takers.

It appears that more and more, housing prices are tied to climate these days. As extreme weather makes some places horrible to live in, the world wants to live in So. Cal. Throw in the casino component, politicians and lax government, and we have the perfect storm. But even gigantic storms eventually run out of energy.

http://Www.westsideremeltdown.blogspot.com

what kind of person would rent when it’s cheaper to buy??

drifter/methhead?

Uh, someone with a $100K+ down payment?

cara – i was thinking of the KC house example of only $69,000 or your dayton friend for $20,000, but ok

Not eveyone is 1% or 10% with stable guaranteed for 10-20 years employment or a family who can help them out if they get sick and can’t make $$. I guess you don’t know how most people live in the US, they are being forced to become drifters by this economy.

ru82…I can say this only because we lived in CA for 33 years so don’t take this wrong but most people in Ca. would prefer not waking up in KC or Dayton, no matter what the cost difference?

As someone who lived in LA for the past 15 years, I’d agree, when we were talking about somewhat more expensive. Now that we’re talking drastically more expensive, I’m not so sure.

Exactly. I’ve never lived anyplace else. Been here 51 years now!

As someone who was born and grew up on the beaches of So. Cal. and had the opportunity to move back and live near the ocean, I decided it wasn’t worth it. Why? Why spend your income high housing costs, high repair costs, high gasoline, high taxes, high most everything, worsening infrastructure, bad traffic, and trying to communicate with people who don’t speak english? For that same money, I have a nice summer home near a huge lake with mountains, wide open spaces, have a boat, and explore endless hiking and fishing. Then when it starts to get cold, I go back south, or I can spend a couple of months during the winter in Hawaii or some other nice location. It seems a a better trade-off!

JN,

Man you think 100% like me. That is my plan. I’ve been doing that for 10 years now. It works.

Need to factor maintenance and repair costs. $600 security deposit is much cheaper than down payment. No realtor commissions to pay when moving out of a rental.

True, but there’re a lot of things you can’t do in the rental that you can do in own house and no one can throw you out, unless you fail to pay tax for a few years.

pretty good numbers $400 per month for $45k house, keep it

We don’t know anything about the expenses but you’re like oh those numbers look great so keep it.

80% of Americas population lives within 200 miles of the coast. , so even though the center of America is large, it’s really a minority in terms ofpopulation

The Rent is TOO DAMN HIGH!

Rekoveree all the way into 2016 Hitlary elections…

I say buy some raw land. Then buy a shipping container and put on said raw land. Fix up container with plumbing. Your possessions should now include your home and land, your cell phone, your lap top and your paid off car and cans of pepper spray. There ya go. It’s a life.

So…this guy?

http://www.bloomberg.com/news/articles/2015-07-30/wharton-grad-s-got-a-tiny-illegal-solution-to-bay-area-housing

Loved that article, but here’s the thing. Cramming tons of people into apartments and houses in expensive rental markets, has been going on a long time. I lived in London for work from 1990-1991 (23 mths) and this renting out rooms was the norm. And it was the landlord/owner renting them out, not the leaseholder. You didn’t know who you were moving in with BUT luckily they were always the same gender. The landlords were converting dining rooms and even downstairs bathrooms into bedrooms in these old Victorian row houses and cramming in 6-7 girls. It was a hoot… The English are a laugh. Geesh I paid 290 british lbs per month way back then for my room. And I didn’t have to share my room – it was small but it looked out over the back yard (rarity in central London) and was sunny and suited me fine. Wonder how much that room would rent for now in London? Prob thousands per month.

Until either the county fines you 10K for violation or throws you out auctioning your land off, or you die from starvation, as there’re no jobs within 100 miles.

Eww…please do NOT buy shipping container to live in. They’re laden with some very bad pesticides and you’d be getting early death for yoursef.

Money is not an issue for the new wave of wealthy and educated immigrants to Cali.

Move out Americans, San Franciscans to Stockton and Modesto.

Angelinos to Bakersfield and Lancaster.

Stronger Hands are taking over, thanks to our politicians.

Talk with Julian Castro and Otrauma about AFFH and report back from Cali when y’all have time. Yikes!!!

What does this even mean?

@ Cara:

Google – AFFH and report back.

I looked up AFFH. That’s the affirmative action program for housing. Basically to fund Blacks and Mexicans to live in wealthier areas which are usually populated with more Whites.

I’m sure it’s also a way to bust certain districts that vote Republican.

There is always sort of race war going on with Obama.

https://www.redfin.com/CA/Beaumont/864-Targa-Ln-92223/home/22529857#!

Observe this home bought brand new on:

Aug 16, 2013 for $235,500 The builder decided to build this house and made money on it in 2013 for $235,500 or they would not have built it (right??). Now they are selling brand new houses for $299,000.

But this owner of this house is particularly greedy and wants $310,000.

I wonder how low the builders will lower the price when demand slows down as they seem to be able to make a profit selling them for much less than they are now.

Anyone know how how much it actually costs builder to build a house?

There is a lot to consider when building a house. The city is built in determines the soft cost which varies wildely from one city to another or from state to state – sometimes in tens of thousand of dollars.

The building codes varry from state to state and from city to city. That determines the cost of construction. They also change from year to year. One electrical code change in one year can comand 35% increase in labor and materials, depends on the magnitude of the change.

Material cost varies from city to city due to variation in cost of transportation and cost of duing business for suppliers.

Skilled labor cost varies from city to city due to cost of living. It can change significantly from year to year. If a sub didn’t have enough work in 2011, maybe he was charging just enough to keep his employees busy for better time. However, every business exists to make a profit even if the profit is 10%. Without a profit it becomes a not for profit organization. A business can not operate without a profit in perpetuity.

Cost of land is the biggest variable in cost of homes. One lot in Newport Beach cost way more than a lot in Indio.

There are so many variables, that one size doesn’t fit all. It is not so easy to determine why the change in price of home happened. For example, if the builder had the lot bought at fire sale in 2009 and built in 2012 he can ask for less on the house and he still makes a profit. If the new lots he is buying cost more in 2013, then he has to raise the price.

An owner who bought in 2009 a house for one price can not sell it for the same price due to cost of closing and commission. Whatever he is buying next is going to cost more than in 2009, therefore he tries to preserve his purchasing power.

These are basic things easy to understand if the buyer puts himself in the shoes of the seller.

Unless a very hot market exsist buyers could care less about putting themselves in the sellers shoes? If a seller is underwater from 2007 – 2008 they are still in hot water at this present time. As I have posted many times homes are selling in some locations but a quick look at Closings records show sellers are taking a bath to get out of their mistake in 2006. That is why don’t be afraid to offer low on a house you never know what the seller will do to get from under their problem and with rates still at historic lows if you can afford a house go for it. If the sellers don’t take your offer you lost nothing but a few hours of writing a offer? The Fed has to move on rates, yes 5 % or more is coming, but many think it will tank the market not true many buyers will still buy and the folks who qualify for 4% but not 5% or more will be left out again. This holds true for most of USA housing market. CA well it is the old adage drive to buy there, otherwise maybe a move out of state is in order if it makes sense. Housing will get just that more expensive in monthly payments when the rates increase.

The avg to build a new house is about $65 to $75 a ft. Of course this is just the home land, permits, utilities, advertisng, commissions, streets, sewers if not already in and paid for must be absorbed by the developer. Most small builders can make a decent profit per house. Big developers buy in large volumes and may also get a break on the developent of land parcels. They can make a nice profit per home if they can squeeze every inch of dollar per sq. ft. and sell a volumne of upgrades and the misleading lot premiums which are just pure profit for them. Small builders have to be careful or they will be strapped if the new home doesn’t sell in a fair amount of time.

These days it is impossible to build at 65-75/sf. Maybe you learned about those numbers a decade ago. They no longer work based on current building codes. For that much maybe you can build a mobile home in Kansas City not a house based on CA buyer’s expectations and CA building codes.

Also, one level homes cost more per square feet than 2 level homes. Also, because the wet areas of the house (kitchen and baths) have the highest price per square foot, the more square feet in the house, the lower, the price per square foot. That should also be taken into cosideration.

Then, did you consider the cost of landscaping in the price per square foot of house or the cost of the land. You can easily spend between 30,000-100,000 in landscaping; depends on size of yard and what landscaping you do.

Now it’d be a minimum of 100 per square foot, in its cheapest version…65/foot is a long gone dream.

Just to add to Builder, the purchaser of the new home may have paid for additional upgrades they want to recoup as well. Plus they have to pay the realtor fees and contribute to closing costs so in reality it may not be as greedy as it looks, and asking isn’t necessarily getting either.

Still on the market today 8/23/2015 and price hasn’t changed on redfin.

Some people have been calling me a Zero Hedge troll, here we go, the Dr. HB is now featured on ZH http://www.zerohedge.com/news/2015-07-30/714-sq-foot-hovel-la-can-be-yours-just-11-million

Troll.

The home ownership rate in Burbank is a low 42%, so what is all the fuss about a ownership rate of 63% nation wide. There are haves and have nots. There are winners and losers, unlike in some schools where everybody is a winner and gets a gold star.

Roger Rabbit: the issue is not the percentage of people who own homes. The issue is that the percentage of people who own homes has been continually shrinking. This is a potentially concerning trend, particularly given the cost of rent, as DHB’s article highlights.

Also, everyone knows there are winners and losers, as you typically can’t have one without the other. However, for the past few decades, the trend has been for there to be fewer and fewer winners while everyone else loses. Unless you’re fortunate enough to be one of the big winners (>1%), it’s not a very fun game.

Example: Depending on the year, my wife and I are in the upper 7-10% of household income earners in the U.S., with no significant debt excluding mortgage (on a rental), reasonable student loan and minimal car loans. We could pay off all debt, but interest rates are so low on everything that it makes little sense to sacrifice the opportunity cost of the capital necessary to do so. In CA, we still feel somewhat poor. Although I’m quite aware this is a first world problem, if we were in the upper 7-10% of earners 40 years ago, our money would likely go much further and we would probably be able to afford something nicer than a 60-year-old crap shack in a questionable area for $700k.

I’m not sure I really understand what you’re saying. People want to buy homes but can’t so they rent. Housing prices and rents are rising. More people as a % are renting than in the last 48 years.

What’s the problem? It’s the same in every part of the world. Australia, Canada, the UK etc.

If anything, as the number of renters grows, this adds to the number of potential future home buyers. When these renters stop buying iPads and start saving for a deposit then you’ll see the home ownership rate increase again.

Dean: One of the problems (in my opinion) is that the rich (via corporate ownership or otherwise) are beginning to own/hoard more and more of the available real estate in So Cal and are renting it to the people who might otherwise be able to afford to buy it. This detracts from available inventory and therefore exacerbates the supply and high pricing issues we currently see in So Cal.

“If anything, as the number of renters grows, this adds to the number of potential future home buyers. When these renters stop buying iPads and start saving for a deposit then you’ll see the home ownership rate increase again.”

I guess places like Mexico are in fantastic shape then, since they have a huge population of poor renters, and therefore they have a huge pool of prospective future home buyers! In all seriousness, I think that view is extremely short sighted, and fails to account for the economic conditions that forced people to be renters to begin with. I don’t think buying ipads is causing people to be renters. I think it’s the exorbitant cost of home ownership causing this.

When you look at median income, and then median house pricing, I think it takes a lot more than staying away from a new iPad to save up for a downpayment in California. Saving $50K-$100K isn’t exactly easy for a lot of people.

“I guess places like Mexico are in fantastic shape then, since they have a huge population of poor renters, and therefore they have a huge pool of prospective future home buyers! In all seriousness, I think that view is extremely short sighted, and fails to account for the economic conditions that forced people to be renters to begin with.”

It is a good observation. I believe that US in general and SoCal in special will look more and more like Brazil with every passing year for reasons you state and also because of globalization. US is the biggest promoter of globalization where the middle class is sacrificed for the benefit of the 0.01% at the top.

The US population for one reason or another, for decades now, elects only globalists (some with D and some with R after their name). TPTB make sure that either party nominates ONLY globalists, preferably from the same nest of vipers called CFR.

I think that the real underlying situation that is not being talked about is that America used to be considered a leader or “on top” of most of the world when it came to things like home ownership, economic standing and could represent a strong middle class with less of a distinction between the haves and the have nots for the most part that other parts of the world.

However, due to the long term consequences of globalization, America is now becoming more like the rest of the world in terms of that economic disparity and that disturbs many people. The problem is you can’t have the cheap cell phones and other products that most Americans demand, but they come at a hidden cost that doesn’t show up at the case register. With more of our money being sent abroad, there is less economic output here to support more higher paying jobs and higher tax revenues needed to fund our infrastructure and this same money is being used to buy up property in California and other desirable areas. You can’t have it both ways.

IMHO, this is really about the the “Averaging of America” with respect to the rest of the world; and sliding down that economic scale is always less comfortable than rising up it.

It’s not about winners vs losers. It’s about the complex set of known and unknown consequences that come with fewer of the relative population as stakeholders in their communities through home ownership.

If you look at home ownership rates by country, it clear that the rate is not associated with GDP per capita.

https://en.wikipedia.org/wiki/List_of_countries_by_home_ownership_rate

Unless the populists demand some kind of housing reform, this current “low” rate is likely here to stay.

Here in the UK we have properties that are beyond atrocious for ridiculous sums of money.Central London is a no go area for those of us with a heartbeat and a regular Joe job,yet our Prime Minister,Mr David Cameron,assured many in Singapore that London property would NOT be a method of money laundering for Chinese oligarchs,Ukraine Nazis and so many more-how laudable and laughable!Our restaurants are packed with blood soaked and thieved money(known as hypothecation and re-hypothecation to your US pension funds)and homes,even those you could not swing a cat in,sell to this group.Meanwhile Joe sixpack is excluded from even a crap shack even from renting.When such exclusions are the norm how safe is the investment?Yes we are all assured by our PM that the force of the state is infinite until it isn’t.It will amuse many to see screaming in silence as Chinese and others flee our very hot market as the government of China and margin calls crack the emerging market nut.

If rents are rising, then that kind of justifies higher housing prices. Not excessively higher prices.

But don’t ya wish you kind of saved some money over the years for a home deposit. Don’t worry Apple Inc. saved your money for you.

No. Unlike over on the purchase side, speculators are not renting units to hold or sublease and the U.S. treasury isn’t subsidizing rental contract derivatives. Not yet at least.

Yeah, about those rental contract derivatives, I can’t see that ending well. Under the federal reserve program for large institutional banks, they were allowed to purchase large volumes of foreclosed homes for pennies on the dollar and they must hold those properties as rental units for a minimum of five years they may file to extend that for an additional five years, at which point they must sell. Unless of course the federal reserve changes those rules that applied at the time they began the program. This shut out the average American homeowner from the market where they could’ve actually purchased a home at a reasonable price and kick started the economy. Clearly that was not their intention. Their intention was to steal every underlying asset that backed all the fraudulent mortgage-backed securities. Now they are securitizing the rent rolls. That’s why rents have gone up so quickly. I wonder what will happen to the market when all those homes have reached their maximum time to be used as rental units? And flood the market with homes for sale? If the banks follow the rules that is. That’s almost laughable.

Dean: Why would you assume people aren’t saving for a down payment? There are people here who have a ton of down payment money saved, including me. However, prices are simply too high currently for many people to want to risk the evaporation of their hard-earned money. It’s a waiting game at this point.

Also, even if you don’t have down payment money saved, there are still FHA loans available for 3% down if you’re willing to pay PMI.

The Fall Of Homeownership In America & The Rise Of The Rental Recovery.

My interview with CNBC and 3 charts that show the housing economic reality

Not that the real rate is about 62.2% -62.7% as census counts all delinquent loans as homeowners so with the rental expansion and bailing out of owners that real rate is slightly lower. That rate has always been my target rate for 5 years now and we are almost there just 0.07% off

http://loganmohtashami.com/2015/04/28/the-fall-of-homeownership-in-america/

Higher rents do justify higher prices BUT. I have owned a duplex for 20 years. I purchased it for 10 X the annual rents at that time. Price is closer to 20 X annual rents now. That is pretty crazy considering I have about $20k-$25k in improvements to it.

Sounds like a perfect time to sell to me!

I’m am really sorry to disagree with everyone on this.

I have been renting apartments here in Los Angeles since 1987. Below are the actual real figures taken from my accounting records which I will be glad to show you:

Rents: 2 bedroom one and a half baths 1987: $850, 2014: $1400 = 64.71% increase.

Rents: 1 bedroom one bath 1987: $495, 2014: $900 = 81.81% increase.

**********************************************************

Cost to buy the house next door: 1987: $100,000., 2014: $630,000. = 530% increase.

Cost to buy 30 gal. 6 year water heater: 1987: $89., 2014: $450. = 405.61% increase.

Day Labor: 1987: $40/day, 2014: $125/day = 212.5% increase.

1 gallon of paint: 1987: $5/gal., 2014: $25/gallon = 400% increase.

1987: No SECP fees, no sewer fees and various other fees courtesy of your local and state government. Think all the new regulations and building codes and fees don’t add to the cost of new apartments?

Comparatively, rents have not gone up anywhere near the cost of mostly all other things including taxes. Wages are feeling the effects of 45 years of policy changes which have affected the economy here in the U.S. If the Fed has it’s way with 2% inflation targets, homeowners will just have to get used to the fact that they can no longer live in a beautiful home for free anymore by increasing their selling price to cover the cost of their home ownership expenses while they were living in the home. Homeowners will have to start paying for what you’re getting, mostly to the banks, because the buyers can’t afford to come in and bail you out anymore. Interest rates are at zero and wages are not increasing very much. Sounds like a top to me if you get what I’m saying. Add that fact to the freedom of renting, and that is what you are seeing today. My renters are all very happy active people. They don’t grumble about the rent. They’re having a blast. I see them! I am beginning to think that no matter what stage of life we’re in, that a new reality is around the corner, because our current system is definitely not sustainable, we all know it even if we hate to admit it, and it’s going to change and this may be part of that change. Didn’t mean to burst your bubble. IMHO 🙂

I’m one of those happy renters who pays a tiny fraction of his income to rent and enjoys the freedom to go out and do things and travel rather than maintain a stucco shoebox. Home ownership does have its positives of course and I’m a former homeowner who sold in the bubble middle of last decade. With the situation in housing and the economy now I’m thinking it might be preferable to rent if you can find a decent place at a decent price and just sock away money, then move/retire outside of the metro areas and buy a place in a nice cheap location with all the cash you’ve been saving – no loan. Or, continued to rent and move around the country/world, taking in new experiences. But with prices where they are a whole lot of stuff has to go right for you if you buy relatively young, and I just think the risks are far too great.

What part of Los Angeles can you rent a 1 bedroom apartment for $900 per month today? Will you need a Kevlar vest?

exactly….

Same could be said for the urban pioneers buying flips in the ghetto. The $900 place is probably one of his rental units but it doesn’t matter because you just scale his example to fit the neighborhood with something like a $1,200 monthly 1 bedroom rental with a $900,000 house next door that was $200,000 in 1987. It’s a rough example but the point stands.

Now, now boys…you need an attitude adjustment. Save the kevlar for riding those twisties like I do, and enjoy this big beautitful world class city we live in. There’s a lot of single girls living in some of those cheap apartments and they aren’t scared and like I said, they’re happy. 😉

Hilarious there’s tons of poon everywhere and you don’t have to venture to the ghetto for it!

A glorified closet over a dirty bookstore in West Hollywood in 2010.

No need to be sorry as it’s what most of us here already know. You’re a landlord with actual experience and personal historical evidence unlike some first time home owner desperate to justify their submission to debt by saying everything the opposite of what they were saying before the last bubble burst.

Hello Doc

for those of us who grew up in LA, we remember what a scuzzy, crime ridden, concrete jungle downtown LA was…

this article focuses on the surge in luxury rentals popping up all over downtown.

http://www.globest.com/news/12_1165/losangeles/multifamily/DTLA-Luxury-Living-Sees-Leasing-Surge-360155-1.html?ET=globest:e47132:858291a:&st=email&s=&cmp=gst:California_AM_20150730:editorial

Not surprised to see this after seeing previously owned apartment complexes being bought up by these large property management companies. They upgrade all the units and then give the place a new theme as “luxury living”. Also rather interesting how they put large price ranges on these rentals now. Starting around $1000-$5500! Almost seems like they are creating the sense there is going to be big money coming to rentals. I wonder if AFFH has anything to do with this or just this time now?

Much of downtown LA is still scuzzy and crime ridden!

http://www.ladowntownnews.com/opinion/crime-concerns-in-downtown/article_df2d6c10-a103-11e4-8300-9fc6e98127e4.html

Rents are ridiculous here on the Monterey Peninsula. I can verify the YOY rent increase promoted in the graph above. To rent the same 2 bd 2 ba condo unit I rented last August for $2,200 a month it will now cost me $2,500 on the open market.

Good bless you greedy bastid landlords. Enjoy that Mexico cruise you took on that healthy rent increase last year. Enjoy the Mediterranean cruise you’ll take next year on the coming increase. Meanwhile us renters will be working overtime so you can enjoy the shipboard gambling sessions and parasailing excursions. Say hi to the captains and don’t choke on the baked Alaska!

Mike – You’re welcome. I feel no guilt in raising rates if I see that the demand is there to do so. I’m not running a charity. My rentals are a business and I will treat them as such. Anything else will be foolhardy.

From my limited landlord experience thus far, I’ve found that pricing below market is a winning proposition for all involved. I get longer-term tenants who generally take good care of the place because they don’t want to risk losing a good thing. And the tenants get a very reasonably-priced place to live.

It should be obvious, but turnover is a huge expense. It takes many months of raised rents to compensate for even one month of vacancy. Not to mention cleaning, flooring replacement, etc in between tenants. So over the course of 10 years, it’s much less hassle and arguably cheaper to have 2 tenants at lower rates than 5 or more tenants at higher rates. Just my opinion, of course.

Even if I make a few bucks less with my method, I’m perfectly ok with that. I don’t like being taken advantage of, and therefore I try not to take advantage of others. Golden rule and all that.

Mike,

Who stops you from becoming a landlord? Go in debt like a landlord, answer all the emergency calls like a landlord and enjoy the privilages of a landlord. You just have to work hard for a long time, live very frugal for a long time, take the risk and headache associated with being a landlord and make sure you ask for rent ONLY $100/month so your renters will be happy renters. Aren’t landlords supposed to live just to make the renters happy????….

My goodness Flyover, a little bitter and angry?

Steve, I am not bitter or angry. Why should I be? Life is good; at least for me it is very good. Nothing to complain about. Happy with my business, happy with my family and happy with where I live:-))))

Here is some Bay Area physiology with regard to renting vs buying for tech workers who I might add are also getting squeezed because salaries are not increasing anywhere near as fast as rents or housing prices. I have a couple of friends, well sort of friends, both with families, renting, as of 2013/2014 in Redwood City and Santa Clara, respectively. Both cites are not under rent control, so their rents increased from 2 grand to just over 3 grand in a very short period of time and still climbing. Their response? Buy crap shacks (3 bed 1 bath) in good school districts for outrageous sums of money 1.2 mil and 900K in Sunnyvale and San Jose (both 30 year fixed), respectively. It is a considerable risk given how shaky the south bay economy is; get laid-off, which does happen to tech workers and miss three mortgage payments and say hello to foreclosure proceedings with your bank.

Everyone has different reasons to rent.

In my case, I’m divorced a few yrs back, got back on my feet, have zero debt and have $85,000 in the bank in cash. I rent a really nice 3/2 house for about 65% of what it would cost me to buy and carry the same floorplan in the same neighborhood. Now that I’m in a good place to buy, I do not want to as I will not buy at the top of the market. The past 3 yrs I’ve lived in this neighborhood I’ve seen the same houses sell (or should I say you couldn’t given them away) in 2012 for $235,000… now selling for $420,000. What has justified this rise in prices in just under 3 yrs? I’m in the CA Central Valley. Nobody around here has had a pay raise for years. The fools that are buying now are leveraging themselves to the hilt to “get in” because “you must buy now”. NO THANKS. I’ll wait for the next bust lol.

Ha! There are first time home buyers here that will have you believe the justification is that those prices are once in a lifetime opportunity! As if they have experience buying and selling over the decades.

There’s a social cost when you have a population of mainly renters. There’s no incentive to put down roots in the community, there’s little or no sense of civic involvement. It’s too easy to move on when and if things go bad. Consequently, things *do* go South in a hurry, eventually bottoming out and collapsing into a Section 8 hellhole. Add to the mix “Diversity” and you end up with a Detroit or even a Haiti or Calcutta.

Just a thought.

VicB3

it’s always the very poor who can’t afford to move out

like what happened in detroit

VICB3,

Haiti has a very nice weather, sits on a tropical island surounded by the blue waters of the Gulf of Mexico. The bad part is that is occupied by people who think like children, believe all the lies spewed by the politicians and expect the government to take care of them. Another problem is that the politicians they elect are lieing all the time and are thieves.

In the direction the US is going all we need is Hilary for 8 more years and US will look like Haiti.

But at least SoCal has good weather, same like Haiti.

Flyover: sounds like the US right now.

181ch,

Don’t know what part of the C.V. you are in, but there are still plenty of good 3&2’s for 250-350 K. from Sacramento to Bakersfield

Because there are still so many foreclosures in the valley the prices have not climbed like the LA or Bay area.

Not too many good paying jobs either.

Zero debt and renting is smart. Screw the realturds and anyone who says renting is throwing away money.

I got caught in the frenzy in the mid 90’s, and ate it on my Cali home.

I wish I had rented then. Not always a smart investment, timing is everything.

The Sacramento area was hit hard by the housing bust and most of the foreclosures were bought at bargain basement prices by investors who paid cash. There are a few 3&2’s in the $250-350K price range but more than likely those homes will be in lousy school districts surrounded by poorly maintained section 8 rentals with people whose first language is not English.

Exactly. Renting is not “throwing money away”. It’s putting a roof over one’s head and buying the use of that space.

Far more legitimate use of one’s money than staying in debt because the price of the funds is so low and claiming phantom opportunity costs makes one sound like a financial whiz.

Debt is not your friend.

This blog does have a lot of good statistical info, What is does not have is the right forecast. The DR has been saying the recovery could not happen and look what home prices have done in his market, So Cal. Totally missed the boat. Huge returns have been made.

This chart is also misleading, really we just have mean reversion and are getting back to historical ownership rates +-62% prior to the Clinton years when he mandated getting that number up. That was achieved through relaxed lending standards and targeted loans. It sounded like a favorable program to get people into homes however history has proved that this is not attainable and we are back to the mean.

Pretty close to the mean as far as national home price to income ratio also. Every market is unique.

Pretty sure the DR doesn’t make forecasts so whatever you’re reading into the information provided is on you.

Check out this flipper just 5 grand away from original cost. Dumb dumb dumb https://www.redfin.com/CA/Long-Beach/1077-Martin-Luther-King-Jr-Ave-90813/home/21924147

Ideal lot for a 1000 sq ft single wide. But at least the house has granite countertops

First rule of Finance… Assets are variable, Debts are fixed.

“California households that lost their homes to foreclosure are left to lick their wounds and are ignored by the press”

48 months of rent free living though, so……..

Don’t worry 15 bucks an hour minimum wage will fix that!

Long as they don’t get taxed on it!

Some interesting unintended consequences of the $15/hr minimum wage hike:

“Some workers across the city are left telling bosses to give them fewer hours at the higher wage because a full week’s earnings now puts them past the threshold for some welfare payments such as food stamps and assistance with rent.”

http://www.breitbart.com/big-government/2015/07/24/seattle-sees-unexpected-fallout-from-15-per-hour-min-wage/

You think the cost of living in LALA Land is high now? Wait till $15 an hour minimum wage kicks in. The cost of everything will increase once the people who stock the shelves, prepare & deliver food, clean the toilets, park the cars, run the register, etc. get a huge pay increase. I foresee a mass increase for unemployment and a huge decrease in customer service as businesses streamline their workforce and cut jobs wherever possible to keep their profits from falling. Increases in fuel prices and food will drive middle-class families further inland and away from LA.

I’m trying to help out a relative who lives in SoCal and figure out a few things for her. She is renting in — it’s called the Marina but close to edge of Venice. She has rent control or rent stabilization. She needs to move but is being told by friends not to move because of what I understand is a rental hosing shortage. I don’t live in California and do not understand the market out there. She sent me this article. But I am still confused. Does anyone know of a reliable source that I could access to determine what a fair market value for a rental property would be? There are pluses and minuses to her particular house. I am trying to offer advice from across the country. However, it is difficult without knowing how to asses ‘fair market value’ given her situation. Any help? Or can anyone point to a web site or any type of direction? Thanks.

Item 1) There is nothing “fair” about the value of anything when fiat money is infinite.

Item 2) Get her specs for what she wants and where and search on Craiglist. That will give you the ballpark for supply and cost. Not much supply and cost is high. Why do you think you see all these new websites (rent.com/apartment.com/etc…) advertising all over the mass media. They don’t pay Jeff Goldblum to be a pitchman if there is no market.

Item 3) Why does she have to move? So Cal is about commuting, the start point and end point are always moving goalposts. No place in SoCal covers are the bases.

Item 4) Congratulate her on not taking the advice of someone who lives in Venice.

Item 5) Have her take in a roommate. She should try to find a gold digger who can pounce on all the recently divorced “professional” men who relocate to the Marina after getting the heave-hoe out of Brentwood/Beverly.

Mortgage backed securities(watch the movie “margin call”). Then you have real estate agents who you’d never find working at there local pharmacy garnering their 3-5%. Who artificially inflated the homes by stating “Location, location, location.” Then you had the appraisers…oh my the kickbacks because the comps weren’t high enough. Then you had the infamous buyer, the speculator with triple “A” credit, who spec’d out their 3rd, 4th, 5th home, sucked the equity right out of them then defaulted. Problem is you at 63-million babies murdered since Roe v Wade. There is or was your economy murdered. Because the elitists think it better to have 1-billion people in this world than 7b. Population is getting older not younger. Then you have the Fed and its fiat money. The banksters. The biggest ponzi scheme around.

and those not able to buy at pennies on the dollar of last highest sold price because of front running brokers or insider zero percent interest borrowers and pay by borrowing from the fractional reserve bank system that prints up on average 38 debt dollars for every dollar borrowed that compete equally with every dollar of savings in the neighborhood and destroy their value and make prices and taxes high enough to force people out of neighborhoods they created and destroy any community of enough strength to turn against the rulers who write the goon enforced rules each collecting inflation adjusted wages while creating inflation….yehaw war……………….suckers money for the rulers……what of the interest income buyers in masses looking for renters too

been in teal esrate in the so cal IE area…real estate is good..a lot of young people purchasing with 10k down…..many investors purchasing properties….

Leave a Reply